- GLOBAL SEARCH

- WEB SUPPORT

16 Entrepreneurs Explain What Work Means to Them

25 Entrepreneurs Share Essential Skills One Needs to be a CEO

22 Entrepreneurs Share How They Incorporate Health and Fitness into Their Day

8 Entrepreneurs Reveal How Much They Work In a Week

11 Entrepreneurs Reveal Their Why/Motivation

12 Entrepreneurs Share Views on Whether Entrepreneurs are Born or Made

7 Entrepreneurs Share Essential Skills One Needs to be a CEO

30 Entrepreneurs Share Essential Skills One Needs to be a CEO

15 Entrepreneurs Explain The Misconceptions Around Entrepreneurship & Business

- Wordpress 4 CEOs

How to Create a Google Business Profile / Tips to Optimize Google Business Profile

How to Get Your Product Into Walmart- {Infographic}

Make Money using Facebook – Make Great Posts

2 Interesting Updates from WordPress 4.8 Evans

How To Know If Your Business Idea Will Succeed

This is How to Write a Converting Email Autoresponder Series

15 Entrepreneurs Explain What They Love And/Or Hate About WordPress

6 Updates That I’m Paying Attention to with WordPress 4.7 – Vaughan

Download Our Free Guide

5 Entrepreneurs Share Their Favorite Business Books

18 Entrepreneurs and Business Owners Reveal Their Best Leadership Tips

30 Entrepreneurs Share Their Thoughts On the Role of Middle Management Within Organizations

30 Entrepreneurs Reveal The Future Trends They Anticipate in Entrepreneurship

27 Entrepreneurs Reveal The Future Trends They Anticipate in Entrepreneurship

12 Entrepreneurs Explain What Hustle Means To Them

7 Entrepreneurs Reveal Their Business Goals for 2024

27 Entrepreneurs List Their Favorite Business Books

14 Entrepreneurs Describe Their Leadership Style

30 Entrepreneurs Define The Term Disruption

25 Entrepreneurs Define Innovation And Disruption

16 Entrepreneurs Define The Term Disruption

15 Entrepreneurs Define Innovation And Disruption

- GUEST POSTS

- WEBSITE SUPPORT SERVICES

- FREE CBNation Buzz Newsletter

- Premium CEO Hack Buzz Newsletter

Business Plan 101: Critical Risks and Problems

When starting a business, it is understood that there are risks and problems associated with development. The business plan should contain some assumptions about these factors. If your investors discover some unstated negative factors associated with your company or its product, then this can cause some serious questions about the credibility of your company and question the monetary investment. If you are up front about identifying and discussing the risks that the company is undertaking, then this demonstrates the experience and skill of the management team and increase the credibility that you have with your investors. It is never a good idea to try to hide any information that you have in terms of risks and problems.

Identifying the problems and risks that must be dealt with during the development and growth of the company is expected in the business plan. These risks may include any risk related to the industry, risk related to the company, and risk related to its employees. The company should also take into consideration the market appeal of the company, the timing of the product or development, and how the financing of the initial operations is going to occur. Some things that you may want to discuss in your plan includes: how cutting costs can affect you, any unfavorable industry trends, sales projections that do not meet the target, costs exceeding estimates, and other potential risks and problems. The list should be tailored to your company and product. It is a good idea to include an idea of how you will react to these problems so your investors see that you have a plan.

Related Posts

Business Plan 101: Overall Schedule

Business plan 101: personal financial statement.

This Teach a CEO focuses on Google Business Profile formerly Google My Business. List your business on Google with a...

How can you get your products into Walmart? Many entrepreneurs struggle with the lack of ideas on where exactly they...

As we know that ‘Content is the King’, therefore, you must have an ability to write and share good quality...

WordPress 4.8 is named "Evans" in honor of jazz pianist and composer William John “Bill” Evans. There's not a log of...

Business Plan 101: Financial History

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Privacy Policy Agreement * I agree to the Terms & Conditions and Privacy Policy .

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Join CBNation Buzz

Our Latest CBNation Content:

- IAM2098 – Brand Messaging Strategist Helps Businesses and Brands Distill Their Complex Work Into Stories

- IAM2097 – CEO and Founder Connects Local Amenities to Short-Term Rental Through a Hospitality Platform

- IAM2096 – Founder and Coach Specializes in Business Development Empowering Entrepreneurs

- IAM2095 – Life Coach Helps People Break Through Their Limited Beliefs

- IAM2094 – Best-Selling Author and Speaker Helps Entrepreneurs Write, Self-Publish and Tell Their Stories

- Physician and Founder Empowers High-Achieving Women Through Sleep

Our Sponsors

Join thousands of subscribers & be the first to get new freebies.

What is CBNation?

We're like a global business chamber but with content... lots of it.

CBNation includes a library of blogs, podcasts, videos and more helping CEOs, entrepreneurs and business owners level up

CBNation is a community of niche sites for CEOs, entrepreneurs and business owners through blogs, podcasts and video content. Started in much the same way as most small businesses, CBNation captures the essence of entrepreneurship by allowing entrepreneurs and business owners to have a voice.

CBNation curates content and provides news, information, events and even startup business tips for entrepreneurs, startups and business owners to succeed.

+ Mission: Increasing the success rate of CEOs, entrepreneurs and business owners.

+ Vision: The media of choice for CEOs, entrepreneurs and business owners.

+ Philosophy: We love CEOs, entrepreneurs and business owners and everything we do is driven by that. We highlight, capture and support entrepreneurship and start-ups through our niche blog sites.

Our Latest Content:

- HR Consultant Helps Businesses Excel in Managing their Human Resources

- IAM2093 – Nutritional Chef Creates Healthy Dishes with a Modern Twist

- IAM2092 – Founder Shares His Journey on Building His Media Empire from Sports Cards

- IAM2091 – CEO Shares on How to Empower Entrepreneurs and How to Bridge the Communication Gap

Privacy Overview

- Teach A CEO

Share on Mastodon

This free Notion document contains the best 100+ resources you need for building a successful startup, divided in 4 categories: Fundraising, People, Product, and Growth.

This free eBook goes over the 10 slides every startup pitch deck has to include, based on what we learned from analyzing 500+ pitch decks, including those from Airbnb, Uber and Spotify.

This free sheet contains 100 accelerators and incubators you can apply to today, along with information about the industries they generally invest in.

This free sheet contains 100 VC firms, with information about the countries, cities, stages, and industries they invest in, as well as their contact details.

This free sheet contains all the information about the top 100 unicorns, including their valuation, HQ's location, founded year, name of founders, funding amount and number of employees.

12 Types of Business Risks and How to Manage Them

Description

Everything you need to raise funding for your startup, including 3,500+ investors, 7 tools, 18 templates and 3 learning resources.

Information about the countries, cities, stages, and industries they invest in, as well as their contact details.

List of 250 startup investors in the AI and Machine Learning industries, along with their Twitter, LinkedIn, and email addresses.

List of startup investors in the BioTech, Health, and Medicine industries, along with their Twitter, LinkedIn, and email addresses.

List of startup investors in the FinTech industry, along with their Twitter, LinkedIn, and email addresses.

90% of startups fail .

Thanks to the explosion of the digital economy, business founders have plenty of opportunities that they can tap into to build a winning business.

Unfortunately, there is a myriad of challenges your new business has to navigate through. These risks are inevitable, and they are a part of life in the business world.

However, without the right plan, strategy, and instruments, your business might be drowned by these challenges.

Therefore, we have created this guide to show you how can your business utilize risk management to succeed in 2022.

There are many types of startup and business risks that entrepreneurs can expect to encounter in 2022. Most of these threats are prevalent in the infancy stages of a business.

To know what you’ll be up against, here is a breakdown of the 12 most common threats.

12 Business Risks to Plan For

1) economic risks.

Failure to acquire adequate funding for your business can damage the chances of your business succeeding.

Before a new business starts making profits, it needs to be kept afloat with money. Bills will pile up, suppliers will need payments, and your employees will be expecting their salaries.

To avoid running into financial problems sooner or later, you need to acquire enough funds to shore up your business until it can support itself.

On the side, world and business country's economic situation can change either positively or negatively, leading to a boom in purchases and opportunities or to a reduction in sales and growth.

If your business is up and running, a great way to limit the effect of negative economic changes is to maintain steady cash flow and operate under the lean business method.

Here's an article from a founder explaining how he set up a lean budget on his $400k/year online business.

2) Market Risks

Misjudging market demand is one of the primary reasons businesses fail .

To avoid falling into this trap, conduct detailed research to understand whether you will find a ready market for what you want to sell at the price you have set.

Ensure your business has a unique selling point, and make sure what you offer brings value to the buyers.

To know whether your product will suit the market, do a survey, or get opinions from friends and potential customers.

Building a Minimum Viable Product of that business idea you've had is the recommendations made by most entrepreneurs.

This site, for example, was built in just 3 weeks and launched into the market to see if there was any interest in the type of content we offered.

The site was ugly, had little content and lacked many features. Yet, +7,700 users visited it within the first week, which made us realize we should keep working on this.

90% of startups fail. Learn how to not to with our weekly guides and stories. Join 40,000+ founders.

3) Competitive Risks

Competition is a major business killer that you should be wary of.

Before you even start planning, ask yourself whether you are venturing into an oversaturated market.

Are there gaps in the market that you can exploit and make good money?

If you have an idea that can give you an edge, register it. This will prevent others from copying your product, re-innovating it, and locking you out of what you started.

Competitive risks are also those actions made by competitors that prevent a business from earning more revenue or having higher margins.

4) Execution Risks

Having an idea, a business plan, and an eager market isn’t enough to make your startup successful.

Most new companies put a lot of effort into the initial preparation and forget that the execution phase is equally important.

First, test whether you can develop your products within budget and on time. Also, check whether your product will function as intended and whether it’s possible to distribute it without taking losses.

5) Strategic Risks

Business strategies can lead to the growth or decline of a company.

Every strategy involves some risk, as time & resources are generally involved to put them into practice.

Strategic risk in the chance that an implemented strategy, therefore, results in losses.

If, for example, the Marketing Department of a company implements a content marketing strategy and a lot of months, time & money later the business doesn't see any ROI, this becomes a strategic risk.

6) Compliance Risks

Compliance risks are those losses and penalties that a business suffers for not complying with countries' and states' regulations & laws.

There are some industries that are highly-regulated so the compliance risks of businesses within them are super high.

For example, in May 2018, the EU Commission implemented the General Data Protection Regulation (GDPR), a law in privacy and data protection in the EU, which affected millions of websites.

Those websites that weren't adapted to comply with this new rule, were fined.

7) Operational Risks

Operational risks arise when the day-to-day running of a company fail to perform.

When processes fail or are insufficient, businesses lose customers and revenue and their reputation gets ruined.

One example can be customer service processes. Customers are becoming every day less willing to wait for support (not to mention, receive bad quality one).

If a business customer service team fails or delays to solve customer's issues, these might find their solution in the business competitors.

8) Reputational Risks

Reputational risks arise when a business acts in an immoral and discourteous way.

This led to customer complaints and distrust towards the business, which means for the company a big loss of sales and revenue.

With the rise of social networks, reputational risks have become one of the main concerns for businesses.

Virality is super easy among Twitter so a simple unhappy customer can lead to a huge bad press movement for the company.

A recent example is the Away issue with their toxic work environment, as a former employee reported in The Verge .

The issue brought lots of critics within social networks which eventually led the CEO, Steph Korey, to step aside from the startup ( she seems to be back, anyway 🤷♂️! ).

9) Country Risks

When a business invests in a new country, there is a high probability it won't work.

A product that is successful in one market won't necessarily be in another one, especially when people within them are so different in cultures, climates, tastes backgrounds, etc.

Country risk is the existing failure probability businesses investing in new countries have to deal with.

Changes in exchange rates, unstable economic situations and moving politics are three factors that make these country risks be even more delicate.

10) Quality Risks

When a business develops a product or service that fails to meet customers' needs and quality expectations, the chance these customers will ever buy again is low.

In this way, the business loses future sales and revenue. Not to mention that some customers will ask for refunds, increasing business costs, as well as publicly criticize the company's products, leading to bad reputation (and a viral cycle that means even less $$ for the business).

11) Human Risk

Hiring has its benefits but also its risks.

Employees themselves involve a huge risk for a business, as they become to represent the company through how they work, mistakes committed, the public says and interactions with customers & suppliers,

A way to deal with human risk is to train employees and keep a motivated workforce. Yet, the risk will continue to exist.

12) Technology Risk

Security attacks, power outrage, discontinued hardware, and software, among other technology issues, are the events that form part of the technology risk.

These issues can lead to a loss of money, time and data, which has many connections with the previously mentioned risks.

Back-ups, antivirus, control processes, and data breach plans are some of the ways to deal with this risk.

How Businesses Can Use Risk Management To Grow Business

To mitigate any future threats, you need to prepare a comprehensive risk management plan.

This plan should detail the strategy you will use to deal with the specific challenges your business will encounter. Here’s what to do.

1) Identify Risks

Every business encounters a different set of challenges.

Before mapping the risks, analyze your business and note down its key components such as critical resources, important services or products, and top talent.

2) Record Risks

Once risks have been identified, you need to assess and document the threats that can affect each component.

Identify any warning signs or triggers of that recorded risk, also.

3) Anticipate

The best way to beat a threat is to detect and prepare for it in advance.

Once you know your business can be affected by a certain scenario, develop steps that you will take to stop the risk or to blunt its effects.

4) Prioritize Risks

Not all types of business risk have the same effect. Some can bring your startup to its knees, while others will only cause minimal effects.

To keep your business alive, start by putting in place measures that protect the vital functions from the most severe and most probable risks.

5) Have a Backup Plan

For every risk scenario, have at least two plans for countering the threat before it arrives.

The strategy you put in place should be in line with the current technology and trends.

Ensure your communicate these measures with all your team members.

6) Assign Responsibilities

When communicating measures with the team, assign responsibilities for each member in case any of the recorded risks affect the business.

These members should also be responsible for controlling the risks every certain time and maintaining records about them.

What is a Business Risk?

The term "business risk" refers to the exposure businesses have to factors that can prevent them from achieving their set financial goals.

This exposure can come from a variety of situations, but they can be classified into two:

- Internal factors: The risk comes from sources within the company, and they tend to be related to human, technological, physical or operational factors, among others.

- External factors: The risk comes from regulations/changes affecting the whole country/economy.

Any of these factors led to the business being unable to return investors and stakeholders the adequate amounts.

What Is Risk Management?

Risk management is a practice where an entrepreneur looks for potential risks that their business may face, analyzes them, and takes action to counter them.

The steps you take can eliminate the threat, control it, or limit the effects.

A risk is any scenario that harms your business. Risks can emanate from a wide variety of sources such as financial problems, management errors, lawsuits, data loss, cyber-attacks, natural calamities, and theft.

The risk landscape changes constantly, therefore you need to know the latest threats.

By setting up a risk management plan, your business can save money and time, which in some cases can be the determinant to keep your startup in business.

Not to mention, on the side, that risk management plans tend to make managers feel more confident to carry out business decisions, especially the risky ones, which can put their startups in a huge competitive advantage.

Wrapping Up

Becoming your own boss is one of the most rewarding things you can do.

However, launching a business is not a walk in the park; risks and challenges lurk around every corner.

If you are planning to establish a new business come 2022, make sure you secure its future by creating a broad risk management plan.

90% of startups fail. Learn how not to with our weekly guides and stories. Join +40,000 other startup founders!

An all-in-one newsletter for startup founders, ruled by one philosophy: there's more to learn from failures than from successes.

100+ resources you need for building a successful startup, divided into 4 categories: Fundraising, People, Product, and Growth.

6 Critical Risks in a Business Plan

Business plan risks analysis, problem, challenging factors and mitigation strategies.

What is a major example of critical risk in a business plan? Every business is prone to facing certain business risks, which might appear very critical in the real world.

As a business person, you must be able to spend sufficient time in drafting your business plan so that it is capable of addressing the critical risks and assumptions that your business might face.

You should be able to envision and determine, in your business plan, critical risks in a restaurant business plan that might pose a threat to the overall success of your business. When you do not pay enough attention to these risks, it could cause your readers – most important of which are potential investors and bankers – to negatively evaluate your business plan.

Below are some critical business risks and contingencies in a business plan that you must ensure to properly handle before they pose a threat to the success of your business.

Conducting Business Plan Risk Assessment – Business Plan Risk Factors

• Risk of Overestimated Figures

The number one critical business risk that might land your business into problem by getting too much negative attention has to do with figures that have been overestimated. We are talking about high sales profit that seem too optimistic; salaries that appear to be too high or outrageous for a business of its age; and profitability. These three, if you overestimate the figures, will inadvertently pose as a serious business risk.

For salaries, it will be wise for you to go for the minimum as a startup business, together with any additional incomes that come in the form of profits.

For sales and profits, it will be wise of you to always give figures that appear to be more likely, not figures that seem to match your optimism. Your business’ profitability largely depends on your ability to meet sales projections, and your ability to be able to operate in the confines of your costs. • Risk of Indecisive Conversion Rates

Conversion rate (also hit rate) has to do with the percentage of people, out of the total number of people you approached, that purchased or patronized your product or services. Conversion rate could be best tested through test marketing or pre-selling.

When you test market, it simply means you offer the sales of your product within a particular limited area, for a particular period of time. Usually, you would offer incentives to buyers to encourage them help you outline your actual target customers for your business.

When you pre-sell, you are making introduction of your products or services to prospective customers, and even accepting orders for deliveries.

Your goal is to accurately know the conversion rate such that a reader may be able to take your projected market size, apply the conversion rate, and be able to deduce what the total sales estimate might be. • Risk of Ignored Competition

Here is another critical business risk that many entrepreneurs fail to curtail. As an entrepreneur, you are the master and captain of your game. You are to take charge and seize your market. How do you do that? You are to know every competitor in the industry of your business. Yes, it is an obligation you can never overlook.

Many entrepreneurs feel they know their competitors very well, when in actually reality, they have no real clue as to who their major competitors are. You must ensure you have adequate knowledge of your immediate competitors, as well as substitutes and potential or latent competitors.

If you want to prove your long-term vision for your business, you must always keep abreast with the latest development regarding your competitors. You should even envision businesses that, in later years, might stand as competitors.

• Financial Risk

Most businesses today fold up as a result of financial difficulties. Lack of adequate financial resources is a very critical business risk that might make a business to close.

In most cases, the business runs out of enough money; many customers are taking too long to pay up; unforeseen expenses and too much miscellaneous; accidents and costly financial mistakes could pose a very critical business risk to the business, and even lead to the eventual folding up if the business does not have enough money saved for rainy days to handle such problems.

In your business plan, you should demonstrate that you have adequate financial strength to operate your business until break-even and even after that. Provide the amount of needed investments and loans you will obtain to start and even run the business successfully – even if you are sure your sales volume will generate as much needed money to run the business.

• Risk of Inadequate Payback

When drafting your business plan, it is pertinent to always think about what the readers of your business plan will be expecting. For most people, it is how you intend to pay back the loan or investment you obtained, or the line of credit you hope to obtain from external sources such as banks.

For bankers, they would analyze the business plan critically to understand how exactly you have made plans to settle up the loans or line of credit you want to obtain from the bank. Your cash flows and your collateral issues are highly significant.

In the case of investors, the growth rates and profit margins of the business are highly critical because these are the factors that will actually determine how much they would earn.

For very vital employees, analyzing the business plan helps them have a good grasp of the business’ operation; this in turn would help them envision their future with the business. • Strategic Risk

Another critical business risk factor to your business plan is the strategic risk. Sometimes, your best well-laid business plan might very quickly, actually look so obsolete.

The strategic risk is the business risk that your business strategy might actually become too rigid and no longer efficient in shooting your business to its desired level; your business then starts struggling in order to achieve its business goals.

This business risk could be as a result of a very powerful new competitor in the industry; technological advancement; a shift in the demand of customers; or even a rise in the cost of raw materials or other market changes.

You should take out time to write your business plan such that whenever you face a strategic risk, you should be able to easily tweak your business strategy and adapt, and be able to come up with a viable solution.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Business Plan Risk Analysis - What You Need to Know

The business plan risk analysis is a crucial and often overlooked part of a robust business plan. In the ever-changing world of business knowing potential pitfalls and how to mitigate them could be the difference between success and failure. A well-crafted business plan acts as a guiding star for every venture, be it a startup finding its footing or a multinational corporation planning an expansion. However, amidst financial forecasts, marketing strategies, and operational logistics, the element of risk analysis frequently gets relegated to the back burner. In this blog, we will dissect the anatomy of the risk analysis section, show you exactly why it is important and provide you with guidelines and tips. We will also delve into real-life case studies to bring to life your learning your learning.

Table of Contents

- Risk Analysis - What is it?

- Types of Risks

- Components of Risk Analysis

- Real-Life Case Studies

- Tips & Best Practices

- Final Thoughts

Business Plan Risk Analysis - What Exactly Is It?

Risk analysis is like the radar system of a ship, scanning the unseen waters ahead for potential obstacles. It can forecast possible challenges that may occur in the business landscape and plan for their eventuality. Ignoring this can be equivalent to sailing blind into a storm. The business plan risk analysis section is a strategic tool used in business planning to identify and assess potential threats that could negatively impact the organisation's operations or assets. Taking the time to properly think about the risks your business faces or may face in the future will enable you to identify strategies to mitigate these issues.

Types of Business Risks

There are various types of risks that a business may face, which can be categorised into some broader groups:

- Operational Risks: These risks involve loss due to inadequate or failed internal processes, people, or systems. Examples could include equipment failure, theft, or employee misconduct.

- Financial Risks: These risks are associated with the financial structure of the company, transactions the company makes, and the company's ability to meet its financial obligations. For instance, currency fluctuations, increase in costs, or a decline in cash flow.

- Market Risks: These risks are external to the company and involve changes in the market. For example, new competitors entering the market changes in customer preferences, or regulatory changes.

- Strategic Risks: These risks relate to the strategic decisions made by the management team. Examples include the entry into a new market, the launch of a new product, or mergers and acquisitions.

- Compliance Risks: These risks occur when a company must comply with laws and regulations to stay in operation. They could involve changes in laws and regulations or non-compliance with existing ones.

The business risk analysis section is not a crystal ball predicting the future with absolute certainty, but it provides a foresighted approach that enables businesses to navigate a world full of uncertainties with informed confidence. In the next section, we will dissect the integral components of risk analysis in a business plan.

Components of a Risk Analysis Section

Risk analysis, while a critical component of a business plan, is not a one-size-fits-all approach. Each business has unique risks tied to its operations, industry, market, and even geographical location. A thorough risk analysis process, however, typically involves four main steps:

- Identification of Potential Risks: The first step in risk analysis is to identify potential risks that your business may face. This process should be exhaustive, including risks from various categories mentioned in the section above. You might use brainstorming sessions, expert consultations, industry research, or tools like a SWOT analysis to help identify these risks.

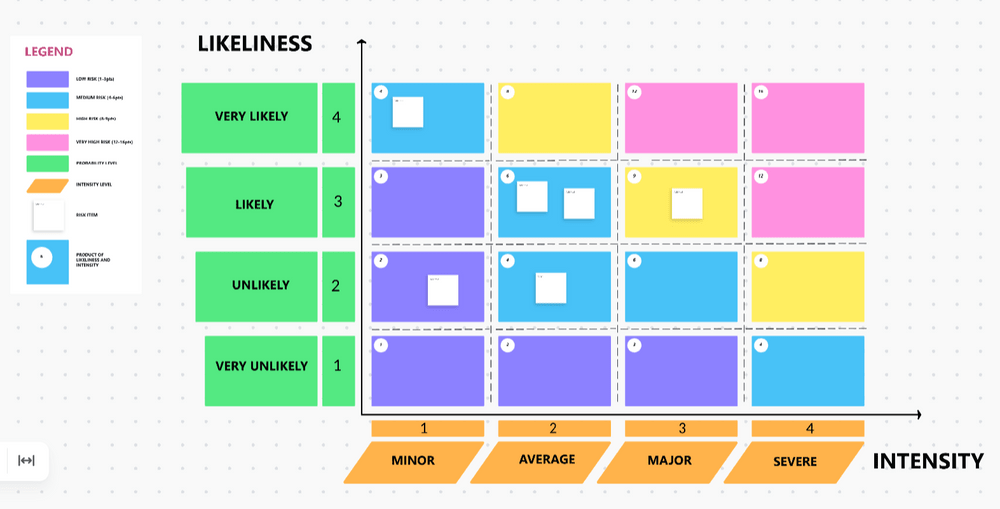

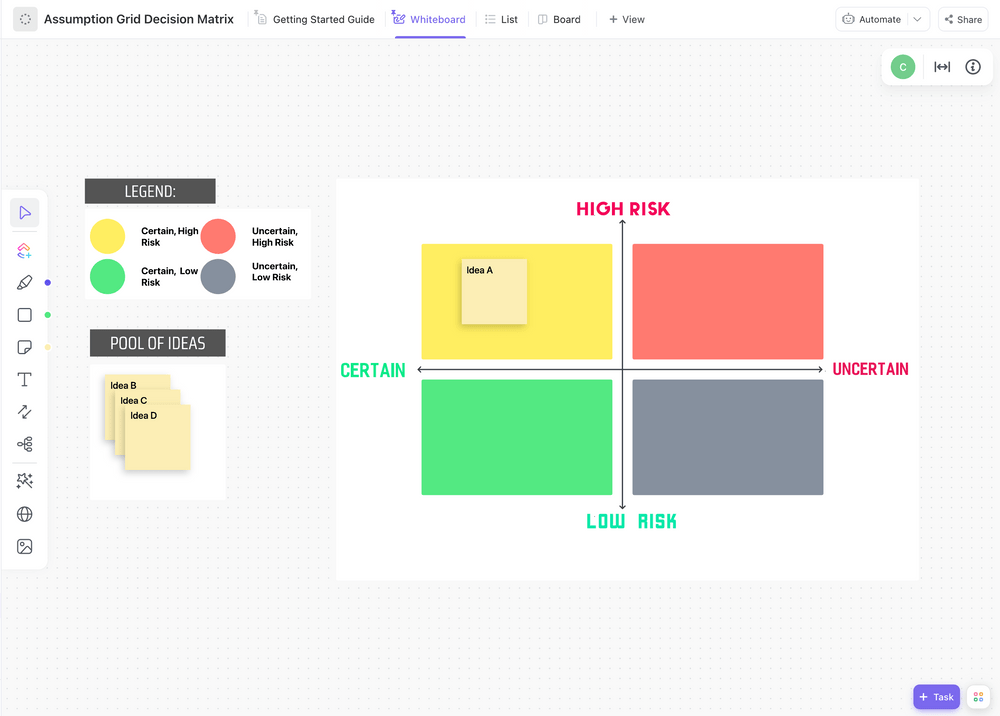

- Risk Assessment: Once you've identified potential risks, the next step is to assess them. This involves evaluating the likelihood of each risk occurring and the potential impact it could have on your business. Some risks might be unlikely but would have a significant impact if they did occur, while others might be likely but with a minor impact. Tools like a risk matrix can be helpful here to visualise and prioritise your risks.

- Risk Mitigation Strategies: After assessing the risks, you need to develop strategies to manage them. This could involve preventing the risk, reducing the impact or likelihood of the risk, transferring the risk, or accepting the risk and developing a contingency plan. Your strategies will be highly dependent on the nature of the risk and your business's ability to absorb or mitigate it.

- Monitoring and Review: Risk analysis is not a one-time task, but an ongoing process. The business landscape is dynamic, and new risks can emerge while old ones can change or even disappear. Regular monitoring and review of your risks and the effectiveness of your mitigation strategies is crucial. This should be an integral part of your business planning process.

Through these four steps, you can create a risk analysis section in your business plan that not only identifies and assesses potential threats but also outlines clear strategies to manage and mitigate these risks. This will demonstrate to stakeholders that your business is prepared and resilient, able to handle whatever challenges come its way.

Business Plan Risk Analysis - Real-Life Examples

To fully grasp the importance of risk analysis, it can be beneficial to examine some real-life scenarios. The following are two contrasting case studies - one demonstrating a successful risk analysis and another highlighting the repercussions when risk analysis fails.

Case Study 1: Google's Strategic Risk Mitigation

Consider Google's entry into the mobile operating system market with Android. Google identified a strategic risk : the growth of mobile internet use might outpace traditional desktop use, and if they didn't have a presence in the mobile market, they risked losing out on search traffic. They also recognised the risk of being too dependent on another company's (Apple's) platform for mobile traffic. Google mitigated this risk by developing and distributing its mobile operating system, Android. They offered it as an open-source platform, which encouraged adoption by various smartphone manufacturers and quickly expanded their mobile presence. This risk mitigation strategy helped Google maintain its dominance in the search market as internet usage shifted towards mobile.

Case Study 2: The Fallout of Lehman Brothers

On the flip side, Lehman Brothers, a global financial services firm, failed to adequately analyse and manage its risks, leading to its downfall during the 2008 financial crisis. The company had significant exposure to subprime mortgages and had failed to recognise the potential risk these risky loans posed. When the housing market collapsed, the value of these subprime mortgages plummeted, leading to significant financial losses. The company's failure to conduct a robust risk analysis and develop appropriate risk mitigation strategies eventually led to its bankruptcy. The takeaway from these case studies is clear - effective risk analysis can serve as an essential tool to navigate through uncertainty and secure a competitive advantage, while failure to analyse and mitigate potential risks can have dire consequences. As we move forward, we'll share some valuable tips and best practices to ensure your risk analysis is comprehensive and effective.

Business Plan Risk Analysis Tips and Best Practices

While the concept of risk analysis can seem overwhelming, following these tips and best practices can streamline the process and ensure that your risk management plan is both comprehensive and effective.

- Be Thorough: When identifying potential risks, aim to be as thorough as possible. It’s crucial not to ignore risk because it seems minor or unlikely; even small risks can have significant impacts if not managed properly.

- Involve the Right People: Diverse perspectives can help identify potential risks that might otherwise be overlooked. Include people from different departments or areas of expertise in your risk identification and assessment process. They will bring different perspectives and insights, leading to a more comprehensive risk analysis.

- Keep it Dynamic: The business environment is continually changing, and so are the risks. Hence, risk analysis should be an ongoing process, not a one-time event. Regularly review and update your risk analysis to account for new risks and changes in previously identified risks.

- Be Proactive, Not Reactive: Use your risk analysis to develop mitigation strategies in advance, rather than reacting to crises as they occur. Proactive risk management can help prevent crises, reduce their impact, and ensure that you're prepared when they do occur.

- Quantify When Possible: Wherever possible, use statistical analysis and financial projections to evaluate the potential impact of a risk. While not all risks can be quantified, putting numbers to the potential costs can provide a clearer picture of the risk and help prioritise your mitigation efforts.

Implementing these tips and best practices will strengthen your risk analysis, providing a more accurate picture of the potential risks and more effective strategies to manage them. Remember, the goal of risk analysis isn't to eliminate all risks—that's impossible—but to understand them better so you can manage them effectively and build a more resilient business.

In the ever-changing landscape of business, where uncertainty is a constant companion, the risk analysis section of a business plan serves as a guiding compass, illuminating potential threats and charting a course toward success. Throughout this blog, we have explored the critical role of risk analysis and the key components involved in its implementation. We learned that risk analysis is not just about identifying risks but also about assessing their potential impact and likelihood. It involves developing proactive strategies to manage and mitigate those risks, thereby safeguarding the business against potential pitfalls. In conclusion, a well-crafted business plan risk analysis section is not just a formality but a strategic asset that empowers your business to thrive in an unpredictable world. As you finalise your business plan, keep in mind that risk analysis is not a one-time task but an ongoing practice. Revisit and update your risk analysis regularly to stay ahead of changing business conditions. By embracing risk with a thoughtful and proactive approach, you will position your business for growth, resilience, and success in an increasingly dynamic and competitive landscape. Want more help with your business plan? Check out our Learning Zone for more in-depth guides on each specific section of your plan.

How to Highlight Risks in Your Business Plan

Tallat Mahmood

5 min. read

Updated October 25, 2023

One of the areas constantly dismissed by business owners in their business plan is an articulation of the risks in the business.

This either suggests you don’t believe there to be any risks in your business (not true), or are intentionally avoiding disclosing them.

Either way, it is not the best start to have with a potential funding partner. In fact, by dismissing the risks in your business, you actually make the job of a lender or investor that much more difficult.

Why a funder needs to understand your business’s risks:

Funding businesses is all about risk and reward.

Whether it’s a lender or an investor, their key concern will be trying to balance the risks inherent in your business, versus the likelihood of a reward, typically increasing business value. An imbalance occurs when entrepreneurs talk extensively about the opportunities inherent in their business, but ignore the risks.

The fact is, all funders understand that risks exist in every business. This is just a fact of running a business. There are risks that exist with your products, customers, suppliers, and your team. From a funder’s perspective, it is important to understand the nature and size of risks that exist.

- There are two main reasons why funders want to understand business risks:

Firstly, they want to understand whether or not the key risks in your business are so fundamental to the investment proposition that it would prevent them from funding you.

Some businesses are not at the right stage to receive external funding and placate funder concerns. These businesses are best off dealing with key risk factors prior to seeking funding.

The second reason why lenders and investors want to understand the risk in your business is so that they can structure a funding package that works best overall, despite the risk.

In my experience, this is an opportunity that many business owners are wasting, as they are not giving funders an opportunity to structure deals suitable for them.

Here’s an example:

Assume your business is seeking equity funding, but has a key management role that needs to be filled. This could be a key business risk for a funder.

Highlighting this risk shows that you are aware of the appointment need, and are putting plans in place to help with this key recruit. An investor may reasonably decide to proceed with funding, but the funding will be released in stages. Some will be released immediately and the remainder will be after the key position has been filled.

The benefit of highlighting your risks is that it demonstrates to investors that you understand the danger the risks pose to your company, and are aware that it needs to be dealt with. This allows for a frank discussion to take place, which is more difficult to do if you don’t acknowledge this as a problem in the first place.

Ultimately, the starting point for most funders is that they want to invest in you, and want to validate their initial interest in you.

Highlighting your business risks will allow the funder to get to the nub of the problem, and give them a better idea of how they may structure their investment in order to make it work for both parties. If they are unsure of the risks or cannot get clear explanations from the team, it is unlikely they will be forthcoming when it comes to finding ways to make a potential deal work.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- The right way to address business risks:

The main reason many business owners don’t talk about business risks with potential funders is because they don’t want to highlight the weaknesses in their business.

This is a fair concern to have. However, there is a right way to address business risk with funders, without turning lenders and investors off.

The solution is to focus on how you mitigate the risks.

In other words, what are the steps you are taking in your business as a direct reaction to the risks that you have identified? This is very powerful in easing funder fears, and in positioning you as someone who has a handle on their business.

For example, if a business risk you had identified was a high level of customer concentration, then a suitable mitigation plan would be to market your products or services targeting new clients, as opposed to focusing all efforts on one client.

Having net profit margins that are lower than average for your market would raise eyebrows and be considered a risk. In this instance, you could demonstrate to funders the steps you are putting in place over a period of time to help increase those margins to at least market norms for your niche.

The process of highlighting risks—and, more importantly, outlining key mitigating actions—not only demonstrates honesty, but also a leadership quality in solving the problems in your business. Lenders and investors want to see both traits.

- The impact on your credibility:

Any lender or investor backs the leadership team of a business first, and the business itself second.

This is because they realize that it is you, the management team, who will ultimately deliver value and grow the business for the benefit for all. As such, it is imperative that they have the right impression about you.

The consequence of highlighting business risks in your business plan with mitigations is that it provides funders a real insight into you as a business leader. It demonstrates that not only do you have an understanding of their need to understand risk in your business, but you also appreciate that minimizing that risk is your job.

This will have a massive impact on your credibility as a business owner and management team. This impact is more acute when compared to the hundreds of businesses they will meet that omit discussing the risks in their business.

The fact is, funders have seen enough businesses and business plans in all sectors to instinctively know what risks to expect. It’s just more telling if they hear it from you first.

- What does this mean for you going forward?

Funders rely on you to deliver on your inherent promise to add value to your business for all stakeholders. The weight of this promise becomes much stronger if they can believe in the character of the team, and that comes from your credibility.

A business plan that discusses business risks and mitigations is a much more complete plan, and will increase your chances of securing funding.

Not only that, but highlighting the risks your business faces also has a long-term impact on your character and credibility as a business leader.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Tallat Mahmood is founder of The Smart Business Plan Academy, his flagship online course on building powerful business plans for small and medium-sized businesses to help them grow and raise capital. Tallat has worked for over 10 years as a small and medium-sized business advisor and investor, and in this period has helped dozens of businesses raise hundreds of millions of dollars for growth. He has also worked as an investor and sat on boards of companies.

Table of Contents

- Why a funder needs to understand your business’s risks:

Related Articles

5 Min. Read

9 Common Mistakes with Business Financial Projections

3 Min. Read

What Is a Break-Even Analysis?

8 Min. Read

How to Forecast Personnel Costs in 3 Steps

How to Improve the Accuracy of Financial Forecasts

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

- Our Approach

- Our Programs

- Group Locations

- Member Success Stories

- Become a Member

- Vistage Events

- Vistage CEO Climb Events

- Vistage Webinars

- Research & Insights Articles

- Leadership Resource & PDF Center

- A Life of Climb: The CEO’s Journey Podcast

- Perspectives Magazine

- Vistage CEO Confidence Index

- What is Vistage?

- 7 Laws of Leadership

- The CEO’s Climb

- Coaching Qualifications

- Chair Academy

- Apply to be a Vistage Chair

Research & Insights

- Talent Management

- Customer Engagement

- Business Operations

- Personal Development

Business Growth & Strategy

Strategic planning: managing assumptions, risks and impediments

Share this:

- Click to share on LinkedIn (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on X (Opens in new window)

While no one likes the idea of having one foot on the brake while doing strategic planning, there are very good reasons to take the time required to be cautious. We are speaking to the undeniable link between the business assumptions we make and the risks we introduce to the organization during strategic planning. In fact, the assumptions we base strategies upon can mushroom into grave risks and show-stopper impediments down the line – appearing out of nowhere when the business attempts to execute to a seemingly well-laid plan. Twelve to eighteen months into strategy implementation is too late to go back and ask, “What were we assuming…?” Given that time will always be of the essence, what kind of strategic assumption vetting and risk management is warranted? How much is enough?

Assumptions Introduce Risk

At a minimum, the planning process must involve an evaluation of the impacts that the strategy will have on the business to determine if it will actually help accomplish the outcomes intended. That is the absolute minimum requirement.

The strategic planing process is the one key point to get in front of idle supposition and truly manage assumptions, risks and impediments. When strategy is well developed, there will be an actual plan for implementation associated with the strategy. A holistic plan defines goals that support the strategy and addresses the operational tactics that will accomplish the goals. No business possesses a crystal ball to know exactly what will happen in the economy, financial markets or competitors next bold moves. That means that business assumptions are a necessary evil.

Given that we must rely upon certain assumptions to put strategic plans together and that risk will always be present (as will natural impediments to execution of strategy), the following sections will explore each of these factors at the planning level…beginning with a definition of terms and ending with approaches to better manage process.

What is an assumption in strategic planning?

The dictionary defines an assumption as follows: “ something taken for granted; a supposition ”.

Assumptions form the basis of strategies, and those underlying assumptions must all be fully vetted. Testing strategic assumptions requires allowing those involved with planning to back away from the “givens” and challenge them to ensure the team is not assuming the rosiest of scenarios on which to base strategy.

Considering that the synonyms for the word “assumption” includes words like “hypothesis”, “conjecture”, “guess”, “postulate” and “theory” the concept takes on a more weighty meaning in the strategic planning process. Yes, assumptions are beliefs we take for granted, but they can be no better than guesses in many cases.

Assumptions are not always justifiable. Defending an assumption may be difficult, as facts are not always available to support the belief. That does not mean that they are incorrect, but it does underscore the challenge assumptions present in planning. In fact, assumptions are particularly difficult to even identify because they are usually unconscious beliefs.

An assumption about assumptions:

One can safely assume that if an assumption is sound, the inferences and conclusions associated with the assumption will also be sound. Unfortunately, the reverse is also safe to assume.

What is a risk in strategic planning?

As a noun, risk means something that may cause injury or harm or the chance of loss or the perils to the subject matter. As a transitive verb, risk means to “expose to hazard or danger” or “to incur the risk or danger of”.

In strategic planning, the definitions applying to both the noun and the transitive verb usage are relevant. A risk might be an event or condition that might occur in the future. Likewise, we may risk financial losses if we bet on an assumption that is incorrect.

An unmitigated risk can become an impediment, so risks must be evaluated in terms of the likelihood they will occur and the impact they will have if they do occur. If the impact/likelihood of a risk is high “enough”, we should identify a mitigation path – as an unmitigated risk can become an impediment later on.

All risk can never be removed from a strategic plan, therefore business planning teams must approach risk management from a Cost / Benefit perspective. Business risk mitigation in planning can cost speed, but if risks are addressed early the organization can avoid future impediments.

What is an impediment in strategic planning?

An impediment is something that makes movement or progress difficult. It differs from being a risk in that risks are future-based and an impediment is something that is occurring now.

During the strategic planning process, impediments might be grouped into macro or micro categories. Macro impediments might include: poor culture, business process inefficiencies, lack of job descriptions, no performance metrics and many other general types of issues. Micro impediments might include: core competency gaps, having people in the wrong roles, lack of sufficient tools to support business functions and technology / infrastructure issues.

Knowing business impediments and factoring them into the planning process adds realism to the strategy being developed and the operational tactics needed to implement it.

How should risks, assumptions and impediments be identified?

Identification of assumptions.

Strategic planning is a team sport, so working in teams is a great way to approach the identification of assumptions. In small groups, conduct a “round robin” to identify the assumptions within each strategic theme of the plan. Review the assumptions compiled by each team and discuss. This same approach can be used to identify impediments and risks.

The following are questions that assist to identify assumptions:

- Is there anything being taken for granted?

- Are there beliefs that we are ignoring that we shouldn’t?

- What beliefs are leading us to this conclusion?

- What is… (this project, strategy, explanation) assuming?

- Why are we assuming…?

Identification of Risks

Risks are about events that, when triggered, cause problems. Hence, risk identification can start with the source of problems, or with the problem itself. Remember, risk sources may be internal or external to the organization. Examples of risk sources are: external stakeholders, employees, finance, political and even weather.

Risks are related to the identified threats from SWOT analysis, so that is another valuable reference during the identification process. For example: the threat of losing money, the threat of a major planned product launch being delayed or the threat of a labor strike disrupting critical manufacturing operations. The threats may exist with various entities, most importantly with shareholders, customers and legislative bodies such as the government.

When either source or problem is known, the events that a source may trigger or the events that can lead to a problem can be investigated. For example: banks withdrawing funding support for expansion; confidential information may be stolen by employees; weather delaying construction projects, etc.

Additionally, other methods of risk identification may be applied, dependent upon culture, industry practice and compliance. For instance, objectives-based risk identification can focus on any potential threats to achieving strategic objectives. Any event that may endanger achieving an objective partly or completely can be identified as risk. Scenario-based risk identification – In scenario analysis different scenarios are created. The scenarios may be the alternative ways to achieve an objective, or an analysis of the interaction of forces in, for example, a market or battle. Any event that triggers an undesired scenario alternative is identified as risk. As a final example, a taxonomy-based risk identification can be utilized, where the taxonomy is a breakdown of possible risk sources. Based on the taxonomy and knowledge of best practices, a questionnaire can be compiled and the answers to the questions used to reveal risks.

How should risks, assumptions and impediments be dealt with?

Dealing with identified assumptions essentially becomes a task of translating the assumption to a risk. Once all risks have been identified, they must then be assessed as to their potential severity of impact (generally a negative impact, such as damage or loss) and to the probability of occurrence.

The assessment of risk is critical to make the best educated decisions in order to mitigate known risks properly. Once risks have been identified and assessed, the strategies to manage them typically include transferring the risk to another party, avoiding the risk, reducing the negative effect or probability of the risk, or even accepting some or all of the potential or actual consequences of a particular risk.

Taking the time and caution to identify, asses and deal with the risks and other factors will always be a worthy investment, even when time is of the essence. The vetting of these factors will pay off in smooth implementation of the strategic plan down the line. Your plan can proceed, free of the potholes and other roadblocks that, with a little planning, might well have derailed the best-laid plans.

Related articles:

Grow from a position of strength (Video)

Four innovation strategies to take your company from complacent to competitive

Category: Business Growth & Strategy

Tags: risk management , Strategic Planning

Since 2006, Joe Evans has been President & CEO of Method Frameworks, one of the world's leading strategy and operational planning management consultancies. The firm provides services for a diverse field of clients, ranging …

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Gain deeper insights when you join Vistage

Take advantage of peer advisory group advice, 1-to-1 executive coaching, industry networks, exclusive events and more.

Privacy Policy

Your contact and business information will be used to fulfill this request and to share other Vistage services.

See Vistage's Privacy Policy for details.

Privacy Overview

Necessary cookies are absolutely essential for the website to function properly. This category only includes cookies that ensures basic functionalities and security features of the website. These cookies do not store any personal information.

Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. It is mandatory to procure user consent prior to running these cookies on your website.

Financial Assumptions and Your Business Plan

Written by Dave Lavinsky

Financial assumptions are an integral part of a well-written business plan. You can’t accurately forecast the future without them. Invest the time to write solid assumptions so you have a good foundation for your financial forecast.

Download our Ultimate Business Plan Template here

What are Financial Assumptions?

Financial assumptions are the guidelines you give your business plan to follow. They can range from financial forecasts about costs, revenue, return on investment, and operating and startup expenses. Basically, financial assumptions serve as a forecast of what your business will do in the future. You need to include them so that anyone reading your plan will have some idea of how accurate its projections may be.

Of course, your financial assumptions should accurately reflect the information you’ve given in your business plan and they should be reasonably accurate. You need to keep this in mind when you make them because if you make outlandish claims, it will make people less likely to believe any part of your business plan including other financial projections that may be accurate.

That’s why you always want to err on the side of caution when it comes to financial assumptions for your business plan. The more conservative your assumptions are the more likely you’ll be able to hit them, and the less likely you’ll be off by so much that people will ignore everything in your plan.

Why are Financial Assumptions Important?

Many investors skip straight to the financial section of your business plan. It is critical that your assumptions and projections in this section be realistic. Plans that show penetration, operating margin, and revenues per employee figures that are poorly reasoned; internally inconsistent, or simply unrealistic greatly damage the credibility of the entire business plan. In contrast, sober, well-reasoned financial assumptions and projections communicate operational maturity and credibility.

For instance, if the company is categorized as a networking infrastructure firm, and the business plan projects 80% operating margins, investors will raise a red flag. This is because investors can readily access the operating margins of publicly-traded networking infrastructure firms and find that none have operating margins this high.

As much as possible, the financial assumptions should be based on actual results from your or other firms. As the example above indicates, it is fairly easy to look at a public company’s operating margins and use these margins to approximate your own. Likewise, the business plan should base revenue growth on other firms.

Many firms find this impossible, since they believe they have a breakthrough product in their market, and no other company compares. In such a case, base revenue growth on companies in other industries that have had breakthrough products. If you expect to grow even faster than they did (maybe because of new technologies that those firms weren’t able to employ), you can include more aggressive assumptions in your business plan as long as you explain them in the text.

The financial assumptions can either enhance or significantly harm your business plan’s chances of assisting you in the capital-raising process. By doing the research to develop realistic assumptions, based on actual results of your or other companies, the financials can bolster your firm’s chances of winning investors. As importantly, the more realistic financials will also provide a better roadmap for your company’s success.

Finish Your Business Plan Today!

Financial assumptions vs projections.

Financial Assumptions – Estimates of future financial results that are based on historical data, an understanding of the business, and a company’s operational strategy.

Financial Projections – Estimates of future financial results that are calculated from the assumptions factored into the financial model.

The assumptions are your best guesses of what the future holds; the financial projections are numerical versions of those assumptions.

Key Assumptions By Financial Statement

Below you will find a list of the key business assumptions by the financial statement:

Income Statement

The income statement assumptions should include revenue, cost of goods sold, operating expenses, and depreciation/amortization, as well as any other line items that will impact the income statement.

When you are projecting future operating expenses, you should project these figures based on historical information and then adjust them as necessary with the intent to optimize and/or minimize them.

Balance Sheet

The balance sheet assumptions should include assets, liabilities, and owner’s equity, as well as any other line items that will impact the balance sheet. One of the most common mistakes is not including all cash inflows and outflows.

Cash Flow Statement

Cash flow assumptions should be made, but they do not impact the balance sheet or income statement until actually received or paid. You can include the cumulative cash flow assumption on the financial model to be sure it is included with each year’s projections.

The cumulative cash flow assumption is useful for showing your investors and potential investors how you will spend the money raised. This line item indicates how much of the initial investment will be spent each year, which allows you to control your spending over time.

Notes to Financial Statements

The notes to financial statements should explain assumptions made by management regarding accounting policies, carrying value of long-lived assets, goodwill impairment testing, contingencies, and income taxes. It is important not only to list these items within the notes but also to provide a brief explanation.

What are the Assumptions Needed in Preparing a Financial Model?

In our article on “ How to Create Financial Projections for Your Business Plan ,” we list the 25+ most common assumptions to include in your financial model. Below are a few of them:

For EACH key product or service you offer:

- What is the number of units you expect to sell each month?

- What is your expected monthly sales growth rate?

For EACH subscription/membership you offer:

- What is the monthly/quarterly/annual price of your membership?

- How many members do you have now or how many members do you expect to gain in the first month/quarter/year?

Cost Assumptions

- What is your monthly salary? What is the annual growth rate in your salary?

- What is your monthly salary for the rest of your team? What is the expected annual growth rate in your team’s salaries?

- What is your initial monthly marketing expense? What is the expected annual growth rate in your marketing expense?

Assumptions related to Capital Expenditures, Funding, Tax and Balance Sheet Items

- How much money do you need for capital expenditures in your first year (to buy computers, desks, equipment, space build-out, etc.)

- How much other funding do you need right now?

- What is the number of years in which your debt (loan) must be paid back

Properly Preparing Your Financial Assumptions

So how do you prepare your financial assumptions? It’s recommended that you use a spreadsheet program like Microsoft Excel. You’ll need to create separate columns for each line item and then fill in the cells with the example information described below.

Part 1 – Current Financials

Year to date (YTD) units sold and units forecast for next year. This is the same as YTD revenue, but you divide by the number of days in the period to get an average daily amount. If your plan includes a pro forma financial section, your financial assumptions will be projections that are consistent with the pro forma numbers.

Part 2 – Financial Assumptions

Estimated sales forecasts for next year by product or service line, along with the associated margin. List all major items in this section, not just products. For instance, you might include “Professional Services” as a separate item, with revenue and margin information.

List the number of employees needed to support this level of business, including yourself or key managers, along with your cost assumptions for compensation, equipment leasing (if applicable), professional services (accounting/legal/consultants), and other line items.

Part 3 – Projected Cash Flow Statement and Balance Sheet

List all key assumptions like: sources and uses of cash, capital expenditures, Planned and Unplanned D&A (depreciation & amortization), changes in operating assets and liabilities, along with those for investing activities. For example, you might list the assumptions as follows:

- Increases in accounts receivable from customers based on assumed sales levels

- Decreases in inventory due to increased sales

- Increases in accounts payable due to higher expenses for the year

- Decrease in unearned revenue as evidenced by billings received compared with those projected (if there is no change, enter 0)

- Increase/decrease in other current assets due to changes in business conditions

- Increase/decrease in other current liabilities due to changes in business conditions

- Increases in long term debt (if necessary)

- Cash acquired from financing activities (interest expense, dividends paid, etc.)

You make many of these assumptions based on your own experience. It is also helpful to look at the numbers for public companies and use those as a benchmark.

Part 4 – Future Financials

This section is for more aggressive financial projections that can be part of your plan, but which you cannot necessarily prove at the present time. This could include:

- A projection of earnings per share (EPS) using the assumptions above and additional information such as new products, new customer acquisition, expansion into new markets

- New product lines or services to be added in the second year. List the projected amount of revenue and margin associated with these items

- A change in your gross margins due to a specific initiative you are planning, such as moving from a high volume/low margin business to a low volume/high margin business

Part 5 – Calculations

Calculate all critical financial numbers like:

- Cash flow from operating activities (CFO)

- Operating income or loss (EBITDA) (earnings before interest, taxes, depreciation, and amortization)

- EBITDA margin (gross profits divided by revenue less cost of goods sold)

- Adjusted EBITDA (CFO plus other cash changes like capital expenditure, deferred taxes, non-cash stock compensation, and other items)

- Net income or loss before tax (EBT)

- Cash from financing activities (increase/decrease in debt and equity)

Part 6 – Sensitivity Analysis

If your assumptions are reasonably accurate, you will have a column for “base case” and a column for “worst case.” If you have a lot of variables with different possible outcomes, just list the potential range in one cell.

Calculate both EBITDA margins and EPS ranges at each level.

Part 7 – Section Highlights

Just list the two or three key points you want to make. If it is hard to distill them down, you need to go back and work on Part 3 until it makes sense.

Part 8 – Financial Summary

Include all the key numbers from your assumptions, section highlights, and calculations. In one place, you can add up CFO, EPS at different levels, and EBITDA margins under both base case and worst-case scenarios to give a complete range for each assumption.

The key to a successful business plan is being able to clearly communicate your financial assumptions. Be sure to include your assumptions in the narrative of your plan so you can clearly explain why you are making them. If you are using the business plan for financing or other purposes, it may also be helpful to include a separate “financials” section so people unfamiliar with your industry can quickly find and understand key information.

How to Finish Your Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan and financial projections?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

It includes a full financial model. It lists all the key financial assumptions and you simply need to plug in answers to the assumptions and your complete financial projections (income statement, balance sheet, cash flow statement, charts and graphs) are automatically generated!

Click here to see how Growthink’s professional business plan consulting services can create your business plan for you.

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success.

Click here to see how our professional business plan writers can create your business plan for you.

If you just need a financial model for your business plan, learn more about our financial modeling services .

Other Resources for Writing Your Business Plan

- How to Write an Executive Summary

- How to Expertly Write the Company Description in Your Business Plan

- How to Write the Market Analysis Section of a Business Plan

- The Customer Analysis Section of Your Business Plan

- Completing the Competitive Analysis Section of Your Business Plan

- How to Write the Management Team Section of a Business Plan + Examples

- How to Create Financial Projections for Your Business Plan

- Everything You Need to Know about the Business Plan Appendix

- Business Plan Conclusion: Summary & Recap

Other Helpful Business Plan Articles & Templates

- Link to Follow us on Twitter

- Link to Like us on Facebook

- Link to Connect with us on LinkedIn

Ivey Business Journal

Strategic assumptions: the essential (and missing) element of your strategic plan.

- Share on LinkedIn

- Share on googlePlus

- Share on facebook

- Share on twitter

- Share by email

Stakeholders often approve a strategic plan without scrutinizing the strategic assumptions, the very foundation on which the plan has been built (Sound familiar? As in, “…the value of this derivative, which we call a Collaterized Debt Obligation, is built on the value of the underlying securities.” (which we have looked at…but uh..not very closely). This author sees an inherent danger in such a practice and states that stakeholders need to start scrutinizing the strategic assumptions that underlie the very plan they are being asked to approve.

In the field of strategy, the admission that assumptions are being made in the preparation of strategic plans needs to be acknowledged. Moreover, transparency and discussion surrounding these assumptions need to be viewed as key elements and the responsibility of the strategy creators.

In doing so, the practitioners themselves – be they CEOs, consultants, Chief Strategy Officers, or employees in the Strategy Management Office – will be forced to elevate both their own performance standards and the rigor of the strategy process to a level comparable to that exercised in the fields of science, economics and finance, where the publication and debate of assumptions are the norm. This will pave the way for strategy creators to gain greater credibility and build a stronger voice on executive teams. Finally, it will provide them with the opportunity to increase their contributions in determining direction and forecasting the future performance of the organization.

The reality is that strategic assumptions form an identical, underlying foundation for the strategic plan. They underpin everything contained therein – and hence reflect the vision, strategic map, performance targets and project portfolio which subsequently follow. The problem is that in the field of strategic planning, the assumptions that have been made are almost never clearly documented or highlighted. As a consequence, they are rarely scrutinized or challenged as they should be.

Too often, shareholders, employees and other major stakeholders unnecessarily invest time, money and energy in supporting an organization’s vision and strategic plan, not recognizing that the vision and plan were doomed to fail from the day they were conceived.

This article posits that the identification and in-depth analysis of an organization’s strategic assumptions need to become an integral part of the strategic planning process, and that the presentation of these underlying strategic assumptions should become an implied and required part of any written strategic plan.

The rationale for preparing a set of strategic assumptions

Financial analysts examining a set of projections insist on seeing a complete and detailed set of financial assumptions. These assumptions represent the raw material — the opinions, beliefs and more often, the hopes, of the management team — on which the projections are based. They usually receive very close scrutiny, especially since financial projections are only as valid as the assumptions upon which they are based. If the assumptions are deemed unrealistic or otherwise questionable, so are the projections. Analysts also understand that while financial projections can be manipulated, clearly presented financial assumptions cannot.

It is not just in the realm of finance that stakeholders demand to see assumptions. In almost all other fields, be they marketing and sales, or even engineering, science and economics, the assumptions used for future predictions are the first element to be examined and rigorously challenged.

Generally, this is not due to management duplicity – although in certain cases that cannot be ruled out. After all, it is easier to defend a set of financial projections when the financial assumptions are not attached; that is the reason financial analysts insist on receiving them. Likewise, it is easier to defend a strategy, business model, value proposition, value chain network, etc. when interlocutors are not aware of the underlying assumptions.

A major reason for the absence of a set of strategic assumptions is that often senior management does not recognize that assumptions are, indeed, being made. They genuinely believe that future markets, competition, customer needs, etc. will evolve exactly as they are expected to. The resulting “group think” – valid and well-founded or not – is therefore not viewed as a set of assumptions at all. It is viewed as fact, the most dangerous assumption of all!

Given today’s shift towards greater transparency, tighter governance, greater accountability for board members, and most importantly, the high levels of uncertainty about tomorrow, next quarter or next year, the business community requires a new paradigm for preparing and certifying a plan as “strategic.” Quite clearly, the moment has come to recognize that the content of any organization’s strategic plan is incomplete unless a complete set of strategic assumptions are included.

Preparing a set of strategic assumptions

The contents of an organization’s business plan often reflect the difficult choices made by management during the strategic planning process. The identification and discussion of the key issues are not intended to generate right or wrong “answers;” rather, they represent choices and shared points-of-view about what the team believes will happen. Together, they form a set of approximately 12-15 strategic assumptions upon which management intends to build its strategic plan and business.