- Startup of the week

Cred Case Study: The Successful Story of a Fintech Startup

| 4 minutes read

An Indian Fintech Startup, Cred, entered the unicorn club on April 6 th, 2021. CRED had shown a strong footprint and became one of the most successful startups in recent times. Bengaluru, India Based Startup, made its name big, but it has its true story starting from Zero to billions. Although the road was not easy, they made the impossible possible and showed the strength of the Indian startup .

The company was established in 2018 and had a valuation of approximately $2.2 billion. Many other startups like Flipkart and OYO took more than ten years to reach a similar valuation level.

What is their Business model?

The startup is based on the “Hole and hook model”. It is a common problem that many credit card users don’t pay their credit card bill on time. So the business model of Cred encourages holders to complete payments on time by providing some exclusive rewards including 100% cashback.

The company found the ‘hole’ (flaw) in the credit card payment system and provided a ‘hook’ in rewards. They offer attractive rewards to their customers, which makes their product a brag-worthy proposition.

About the founder

Kunal Shah was also the co-founder of ‘freecharge’. Coming from a Gujarati family and a non-tech background, he is currently the founder of two big tech companies. He was motivated to start CRED after research and understanding the loophole in the overall credit card payment system. He is also the current CEO of the company Cred.

Also Read: Startup Case Study: How Byju’s is Disruption the Indian Edu-tech Sector?

What is their marketing strategy.

The marketing campaign of CRED is universal. They have implemented an aggressive marketing strategy to improve the value of their product. Surabhi Capoor is the brand and product marketing head at CRED.

The company’s marketing department came up with unique advertising ideas that made the brand larger than life. For example, the latest ad featured Kapil Dev (Former Cricketer) acting like a Ranveer Singh that pulled viewers because no one had seen him in this avatar before. Apart from this, during IPL (Indian Premier League), Cred starts to increase its awareness before the beginning of the IPL like the way Vodafone used to do by introducing Zoozoo (character).

Further, the company was marketed through various other celebrities on social media platforms . Meme marketing also worked for the company, and thus the awareness of the brand is on the rise.

What services do they provide?

The company started with just credit card payment services, but now it is expanding its reach in different sectors. The CRED app has more than 60 lakh users, and the number is increasing.

Listing the services provided in the app.

- It allows you to manage all your credit card payments in one place.

- The app notifies your regular payment details and due dates.

- It offers rewards and cashback for new users.

- The company provides CRED points on the completion of payment, and these points can be used to avail various vouchers and cashback.

- The payment method is hassle-free.

- They have started providing services for rent, loans, and insurance.

How Credible are they?

The company assures total privacy to the customers (claimed by the company). They deal with the valuable financial data of the customers, and they offer complete privacy on it. With such attractive rewards and enhanced security, it is trusted by its users. In just 2 years, they have successfully reached a million consumer base, and their number is ever increasing.

What is their Mission?

The mission of the company is understood by everyone. They want to improve and enhance the credit card payment system. Despite not making any profit in 2019 and 2020, they have eventually gained the trust of their users. They used the “reward and punishment tendency” effectively to attract and establish the customers base.

CRED & their Vision

CRED’s business model is futuristic. They want to develop themselves in diversified sectors like insurance, rent, shopping, loans, and realty payments. The company also focuses on a futuristic revenue model.

It aims to generate revenue through merchandising, commission and consulting. They can also use this vast customer base for sales pitching and generate good fortune from it.

How are they Funded?

CRED is one of those legendary startups that got funding right before its execution. This was made possible by the brilliant execution of the founder Kunal Shah. The company has made a loss of 63.90 crores and 378.89 crores in 2019 and 2020, respectively. Despite these losses, the company is trusted by its investors.

The company has around 28 investors and 7 lead investors. The lead investors are listed below:

- Dragoneer Investment Group.

- Tiger Global Management.

- Sofina.

- DST Global.

- Coatue.

- Falcon Edge Capital.

- Insight Partners.

The company has raised funding of around $471.3 million from investors. The company’s other investors are Ribbit Capital, Gemini investments, Sequoia Capital India, and Rainmatter Capital.

Who are the Brand Partners?

The company offers different rewards and vouchers for customers. It has successfully bagged many reputed brands as its partner. Some of the esteemed brand partners are:

The story behind their Struggle and Success

Kunal Shah faced a serious dilemma before starting the company. He was offered to become an investing partner in Sequoia Capital of India. But the entrepreneur chose to start a company rather than become an investor.

The company has also registered itself as an IPL sponsor and has started building some revenue. Despite making losses in the first two years, it has continued to provide valuable services to its users. The company has a futuristic revenue model, and thus it is trusted by its investors.

Born in the family of entrepreneurs and have inherited the same. Started building applications in order to pay for my tuition. Later founded a tech company, marketing agency , and media outlets.

About the author

Related posts.

Feb 20, 2024 | Analysis , Investments

How to invest in the stock market: a guide for beginners.

Nov 13, 2023 | Marketing , Sales

The advantages of personalised tote bags featuring your brand logo.

Nov 13, 2023 | Marketing

Local seo for real estate: dominating your local market.

Aug 14, 2023 | Investments

Top reasons for investing in gold, get updates to your inbox.

Thanks for subscribing! Please check your email for further instructions.

Recent Tweets

Cred Marketing Strategy: A lesson on customer acquisition strategy

Learn about cred's iconic marketing strategy and advertising campaigns. read how cred aces the 4ps of marketing mix - product, price, promotion & placement..

- overview#goto" data-overview-topic-param="cred">What is Cred?

- overview#goto" data-overview-topic-param="background">Cred's Background

- overview#goto" data-overview-topic-param="business">Cred's Business Model

- overview#goto" data-overview-topic-param="strategies">Cred's Marketing Strategies

- overview#goto" data-overview-topic-param="noteworthy">Noteworthy Marketing Campaigns

- overview#goto" data-overview-topic-param="key">Key Takeaways

As India's purchase power increases, people are looking for apps that offer rewards and discounts to spend more. But loyalty-based platforms are a common business model - so how can a company stand out from the competition and attract this growing wide base of customers?

In this article, we will dive deeper into Cred marketing strategy that enabled them to attract a diffused target audience.

What is Cred app?

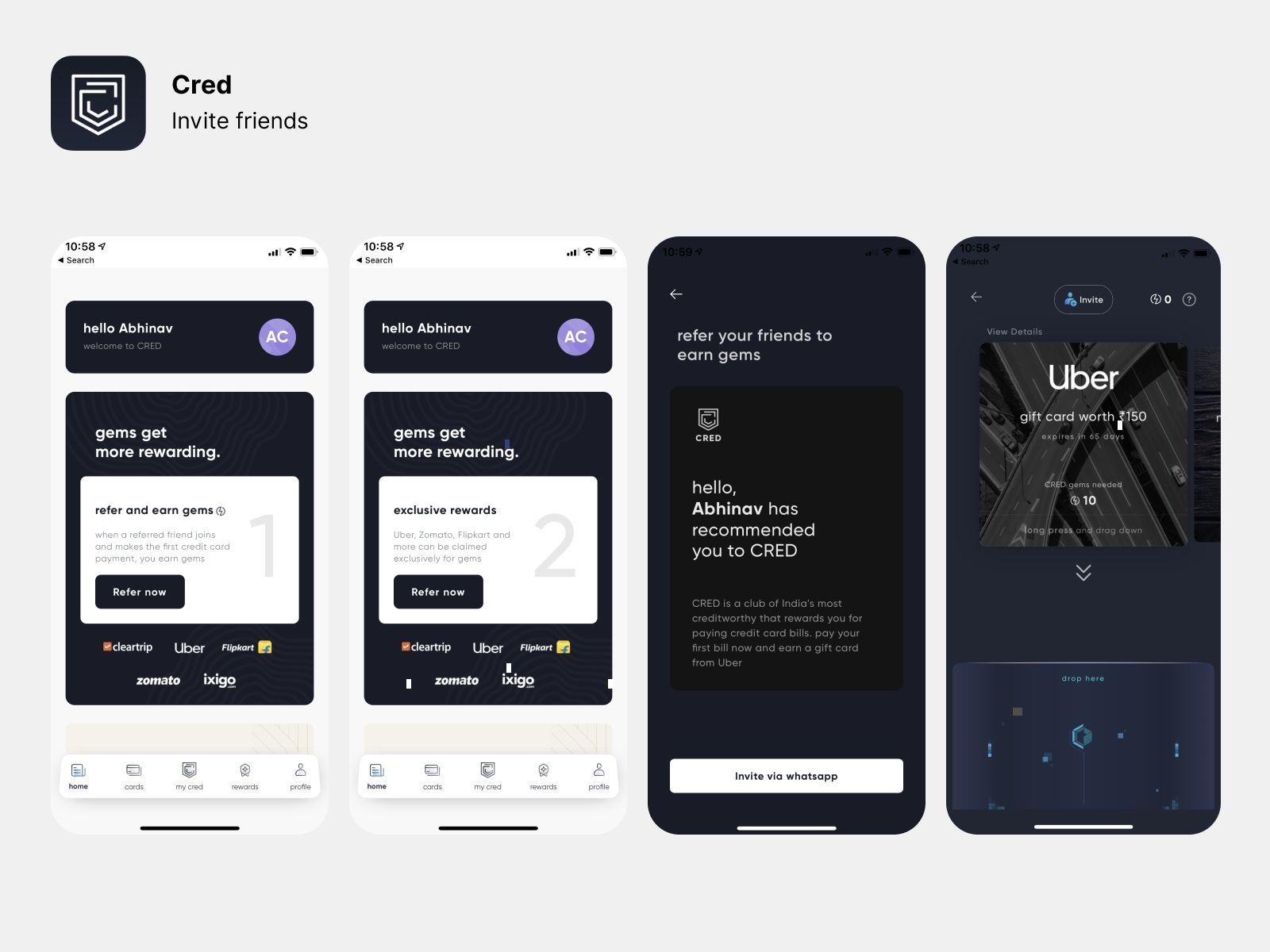

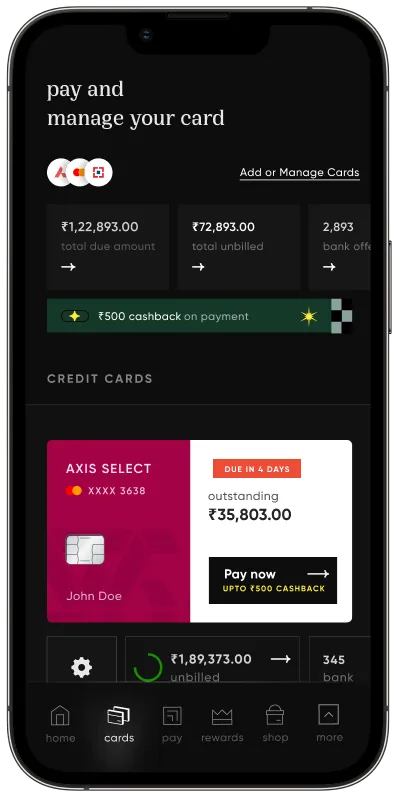

Cred is an Indian startup that has launched a mobile app to provide its customers with services facilitating credit card transactions. Cred attempted to create an industry niche for credit card holders. Its tagline is Pay your Credit Card Bill – Receive Rewards. It enables cred users to control credit cards in one place.

Cred app enables its users to pay credit card bills instantly and get reward points as a result. Cred also provides its users with personalized spending insights, credit health advisement, and financial monitoring services. It also allows its customers to save money by tracking debt levels across different cards.

Image source: screenshot from Appstore

The main feature which makes the app stand out from traditional mobile banking services is that it rewards users for timely bill payments. For every bill paid using Cred, you get reward points in the form of cash back or gift vouchers.

Image source: Forbes India

Cred's Background

Cred is an Indian startup company founded by a popular entrepreneur in the startup community - Kunal Shah, a former founder of FreeCharge. He has a strong personal brand - which has also helped with Cred's marketing. Even today, he works on his personal branding via Twitter with content that appeals to Cred's target customers.

Since its inception in 2018, CRED has established itself as a leading provider of financial services for businesses and individuals.

As with the US credit-dependent economy, the goal of finding this startup was to automate day-to-day transactions and start the credit revolution. Cred was launched to expand the number of young credit card users in India due to the nation's burgeoning middle class.

The Cred app exists to facilitate credit card payments for its users and rewards them with Cred Coins, which can then be redeemed for discounts and cashback within the app. For paying credit card bills, Cred rewards its users.

In addition, Cred offers services such as Cred Stash, which gives its users a credit line, and Cred Rentpay, which lets them pay rent with a credit card.

By paying their credit bills on time and improving their credit score, its founder aspires to make India a creditworthy country.

Business model of Cred

Use case of cred app.

In this fast-paced world, there are so many monthly payments to make, especially credit cards or EMI on a new car, house, or maybe a new mobile phone purchased with a credit card.

Missing such deadlines can result in very hefty late payments charges by the bank. Even so, a credit card company's major source of income are those very hefty fines it charges for late payments. That's where Cred comes in - making credit card users easy and convenient to pay their credit card bills.

Target audience of Cred app

Initially, Cred targeted wealthy individuals and created the Cred Club community to serve this niche. Cred is a business that specializes in credit card users. Today, anyone with a credit score over 750 points can benefit from Cred's facilities and become a member of its club.

For now, it is focusing on Generation Y, i.e. people aged 25 to 40, especially those over 30 years old. Cred's marketing efforts are geared towards capturing the attention of Generation Y.

That's why Rahul Dravid, Javagal Srinath and Venkatesh Prasad appear in their ads rather than Virat Kohli or Hardik Pandya. Madhuri Dixit, Anil Kapoor and Kumar Sanu also appear - but not Alia Bhatt or Varun Dhawan.

Cred's Business of credit card bills

The business model of Cred Cred is somewhat speculative. In fact, it does not charge any entry fees to its users. Nor has it teased them with any memberships. In exchange for giving them a space on the CRED App, they have partnered with several brands for whom they charge commissions on sales.

Image source: Cred's app

Cred recently launched Cred Stash with IDFC First Bank to provide loans to customers. It’s currently fully focused on targeting its niche by aggressive marketing tactics and reward offerings such as cash backs and deep discounts.

The success of Cred’s business model can be determined once it reaches maturity over time, just like what Jio, Zomato, and Paytm did in their growth stage. Giving hefty discounts nowadays is how many companies build a loyal customer base.

Cred app marketing strategies

Some of Cred's marketing strategies are viral, while others are as simple as releasing simple finance blogs and rewarding users with cashback and discounts.

However, every strategy has two things in common: uniqueness and the ability to create brand recognition.

We have already covered Cred app as a product and its business model, so let us understand the rest of the marketing strategy via 4P analysis:

Under the new scheme, customers can avail of certain credit card offers at a discounted price. For instance, they can get 5% cashback on all purchases made using their CRED card.

This move is in line with CRED's philosophy of customer centricity. The company hopes to enhance its marketing strategy and create long-term loyalty among its users by offering such discounts.

Cred has conducted many brand-related promotional activities. Let's have a look at them for a better understanding.

The CRED Digital Marketing Strategy

One of its most successful marketing campaigns was the "Rahul Dravid" social media campaign, which featured the Indian cricket legend endorsing the company.

Image source: ForbesIndia

The campaign was very well received by the public and helped Cred increase its customer base significantly.

Content marketing strategy of cred

Despite the fact that few people understand finance topics and how the credit system works, it is a responsible brand that educates Indians about financial topics through content marketing Cred.

To achieve this, Cred curates blogs related to credit cards, personal finance, and fintech on its website to help make Indians financially literate.

With its CRED – On The Money series, it Cred launched finance-related content on YouTube. As a curious man, Kunal Shah interviews experts and entrepreneurs to produce podcast-like content about money, startups, and trends under his CRED–Curious series.

Also, The Cred YouTube channel 'On the Money' explains topics like how IPL earns money.

Sponsorship and Collaboration

The Indian Premier League (IPL) has partnered with Cred for three seasons as an associate sponsor, and Cred's marketing activities are also conducted during the IPL season. In order to gain more exposure and trust among the public, they organize various social media contests, marketing campaigns, and advertisements.

Viral marketing moves

By sending cakes Cred utilizes customer acquisition. For example, of you are a cred user and just sitting on your boring day shift job, you receive a cake out of nowhere.

Yes, this happened in 2019 when Cred practiced this customer acquisition strategy which was in fact focused on colleagues of existing users.

Image source: Twitter

Additionally, Cred offers house rent payment alternatives, short-term credit lines, and Cred Mint, a platform where cred targets lenders to lend their idle money at interest rates of roughly 9% to borrowers with good credit ratings.

Platform marketing strategy of Cred app

As a result of CRED's active social media presence, the brand has been able to reach more consumers through Twitter marketing. There are a number of marketing tactics, including engaging with other brands' tweets after the viral 'Indiranagar Ka Gunda' Ad, using celebrities to share and retweet their ads, etc.

Image source: Youtube

Image source: Hindustan Times

Cred's noteworthy Marketing Campaigns

Cred has conducted several notable advertising campaigns and promotions over the years, including:

The Mega Jackpot Week campaign

During the IPL 2021, Cred launched Mega Jackpot. From iPhones for a decade to Bitcoin, this campaign had it all. Users who participated in this campaign had a chance to win jackpots.

As the name implies, Cred's Mega Jackpot Week offered seven various prizes, including gold, Harley Davidson Fat Boys, iPhones for ten years, five years of free flights, a TATA Safari car, a total home renovation, and a Bitcoin.

image source: Economic Times

Cred's campaign, like many of its other campaigns, generated a lot of buzz on news channels and social media. Cred had also capitalized on the bitcoin trend, as this campaign launched when bitcoin was trading at its all-time high and was all the rage around the world.

Cred Powerplay Campaign

Cred organized the Cred Power Play campaign during the IPL 2021 just like the Mega Jackpot campaign. The winner also stood a chance to be featured on the virtual fan box if they paid during the powerplay overs of the IPL game.

Key Takeaways from Cred marketing strategy for entrepreneurs

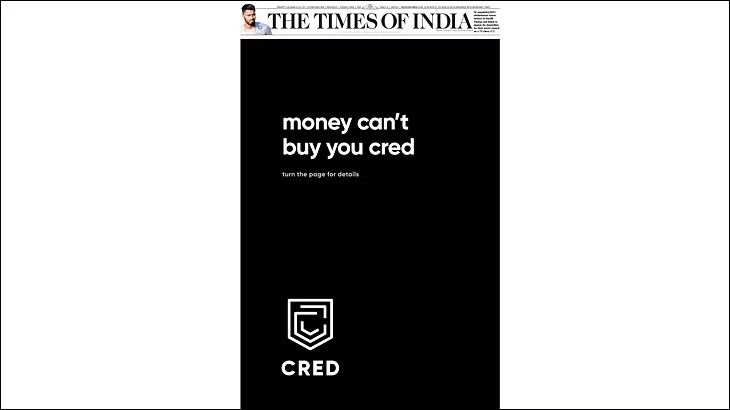

Image source: Time of India

Form partnerships

Cred marketing strategy involves partnership with many brands to provide discounts and loans. It embraces partnership marketing strategy to the fullest.

Appeal to target audience

Cred is a brand that is clear about what its target users crave. Cred's marketing strategy focuses on creating a simple and convenient way for cred users to manage and pay credit card bills. And this could be anyone as such. But Cred's target audience is narrowed to Gen-Y and aligns accordingly.

Embrace exclusivity

Cred app is designed on exclusivity terms. It's campaign 'Not everyone gets it' signifies how only credit card holders can access the app.

A similar strategy was used by Clubhouse and Facebook for grabbing early users. But in Cred's case, its a part of the business model, making exclusivity a moat.

Explore gamification

Cred's famous lucky user based games are very popular. It showcases a slot machine where users get various discounts available. It has many 'one lucky user' campaigns running every now and then too in partnership with brands.

Cred's marketing strategy is incredibly successful in India, with the app seeing impressive growth and adoption. The company has effectively tap into the wallets of young, middle-class Indians looking for an easy and convenient way to manage their credit payments.

What has been most impressive about Cred's marketing strategy is its focus on creating a trusted and credible brand to manage such payments. In a country with low financial literacy and many scams, Cred has positioned itself as a reliable and safe option. Today it focuses to generate revenue by exploring lending. This has been achieved through solid Cred's effective marketing strategy which has been backed by positive customer reviews and word-of-mouth.

You can explore more marketing mix case studies for your own business- check out Costco marketing strategy and Nintendo marketing strategy .

- popover#mouseOver mouseout->popover#mouseOut" data-popover-translate-x="-25%" , data-popover-translate-y="-220%"> Copy link

- bottom-bar#toggleTagsSection"> popover#mouseOver mouseout->popover#mouseOut" data-popover-translate-x="-25%" , data-popover-translate-y="-220%"> Copy Link

- bottom-bar#toggleTagsSection">

"Must read for every entrepreneur"

"The best part is it's written by real entrepreneurs"

"My favorite newsletter on the web"

You'll love these articles too!

Co-founder & CEO at Flexiple ($3mn+ revenue, bootstrapped) & buildd.co | Helping Startup...

Monster Energy Marketing Strategy: How Monster become a market leader by 'Unleashing the Beast'?

Learn about Monster's iconic marketing strategy and advertising campaigns. Read how Monster aces the 4Ps of marketing mix - Product, Price, Promotion & Placement.

Co-founder at Flexiple, buildd & Remote Tools ($3 million revenue, bootstrapped)

Breaking Down The Maruti Suzuki Marketing Strategy: How they became a brand that rules India's automobile market

Learn about Maruti Suzuki's iconic marketing strategy and advertising campaigns. Read how Maruti Suzuki's aces the 4Ps of marketing mix - Product, Price, Promotion & Placement.

Clinical Research | Data Analytics

Partner at Deloitte | Banking & Capital Markets | Cloud Strategy | FinOps Offering Leader | Board...

Swiggy Business Model: How the Company is Building a Brand That's Hard to Resist

Explore the innovative business strategies behind Swiggy's success, including the company's approach to building a strong brand and delivering unbeatable customer experiences. Learn how Swiggy is disrupting the food delivery industry and solidifying its place as a leader in the market.

How CRED partnered with Pepper Content to scale their product listings that drove app conversions

This case study delves into the collaborative journey of CRED, a prominent fintech and credit card bill payment platform, and Pepper Content, a leading content creation platform.

Faster Content Production

Confidence in Deliverables

Customer Satisfaction

Company Type

In this story

Founded in 2018 by Kunal Shah, Cred has emerged as a leading credit card bill payment platform, offering a range of financial management tools and benefits to its extensive user base of 7.5 million members. The platform not only enables seamless bill payments but also provides users with curated product offerings and access to quick credit options.

For the past few years, the fintech industry has witnessed remarkable growth, including more people using fintech services, the number of fintech startups, and increased investments. Looking ahead, the global fintech market is poised to hit a staggering $9.24 trillion in revenue by the end of 2027.

India, in particular, has emerged as a leader in the fintech industry. With a market size of $50 billion in 2021, the Indian fintech industry is projected to reach an estimated $150 billion by 2025. A significant part of this surge can be due to the digital payments sector, which is anticipated to see a user base of around 5.48 billion by 2027.

In this flourishing fintech landscape, CRED has emerged as a leader with their exclusive rewards and experiences from premium brands for timely bill settlements. This robust growth indicates a dynamic and thriving fintech landscape, both globally and within India's rapidly evolving market.

Cred's members have exceptional credit scores, often surpassing 750 according to Experian. This entitles them to exclusive rewards and experiences from premium brands based on their timely credit card bill settlements.

CRED offers the CRED Store, an in-app e-commerce platform where members can explore products from renowned brands like Myntra, Diesel, Cure.fit , Olive Bar and Kitchen, and more. They also have access to enticing offers for domestic and international travel. The CRED Store has partnerships with over 1800 brands, including prestigious direct-to-consumer labels like Starbucks, Neeman's, and Bombay Trooper.

By partnering with Pepper Content, CRED aims to enhance its content creation capabilities. This collaboration will allow CRED to generate high-quality content efficiently, freeing up resources for innovation and strategic growth.

Speaking on the importance of content, Rohan Ralli from the creative team at CRED adds, "Our app is a sort of super-app. It's more than just rewards and payments, and for this reason, the number of creatives required is very high."

Meeting the Demand for Diverse Content Types: As a multifaceted app with a wide array of offerings, CRED needed a versatile range of content types, including blogs, app content, and more. However, sourcing, hiring, and onboarding the right talent for such a diverse content pool proved to be a time-consuming and intricate process.

Catering to a Diverse and Extensive Audience: With a user base spanning both domestic and international audiences, CRED faced the challenge of linguistic barriers. It was necessary to create content that resonated with this diverse demographic, requiring a nuanced approach to language and cultural differences.

Ensuring Optimal Content Management: Before partnering with Pepper Content, CRED's in-house team was heavily involved in the content management process, particularly in quality checks. This time-consuming workflow left little room for focus on other critical tasks.

Necessity for Highly Optimized Product Listings: For a platform like CRED, where user engagement plays a crucial role in conversions, ensuring that product listings are not only abundant but also highly optimized was a significant challenge.

Addressing Long-Term Growth Opportunities for In-House Writers: Recognizing the importance of sustaining long-term growth opportunities for their in-house writers, CRED's creative team sought a solution to enhance content creation capabilities without the need to expand their internal team continually. This required a strategic partnership with an organization that could consistently deliver quality content, thereby freeing up internal bandwidth for more specialized tasks.

The collaboration with Pepper Content proved to be a game-changer for CRED:

1. Leveraging Pepper Content's Extensive Creator Network

With a network of over 65,000 content creators, Pepper Content offered CRED a seamless solution to meet their ever-growing content needs. This extensive pool of vetted and highly qualified creators ensured a steady flow of high-quality content.

2. Strategic Content Planning and Implementation

CRED adopted a forward-looking approach by planning content requirements in structured sprints for 2-3 months. This proactive strategy allowed them to align content production with their evolving business needs and marketing objectives.

3. Agile Response to Surging Content Demands

After collaborating with Pepper Content, CRED gained the confidence to tackle instances of surging content demands effectively. They could swiftly respond to high-demand scenarios, a feat that would have been challenging to achieve with an in-house team alone.

The partnership with Pepper Content yielded significant outcomes, leaving a notable impact on CRED's content strategy and operational efficiency.

Accelerated Content Production: The strategic partnership with Pepper Content resulted in a 5x increase in content production speed for CRED. This surge in content creation efficiency empowered CRED to meet its content requirements with agility and precision.

Enhanced Confidence in Deliverables: CRED's confidence in the quality and timeliness of content deliverables soared, reaching an impressive 100%. This newfound assurance was a testament to the effectiveness of the partnership in meeting and exceeding content creation expectations.

Elevated Satisfaction Levels: The partnership with Pepper Content led to a 200% surge in satisfaction levels for CRED.

By collaborating with Pepper Content, CRED not only resolved its content creation challenges but also achieved remarkable results in terms of accelerated content production, heightened confidence in deliverables, and elevated satisfaction levels.

This strategic partnership played a major role in driving CRED's content strategy, ultimately strengthening its foothold in the dynamic fintech market.

In the future, CRED is interested in exploring a deeper partnership where they collaborate with Pepper to improve content performance and explore other cutting-edge elements of the platform, such as the Peppertype AI writing tool, design services, and more.

Through their combined efforts, CRED and Pepper Content are poised to continue setting new benchmarks in the dynamic landscape of fintech and content creation.

More Customer Stories

How Apollo 24/7, achieved a 15% MOM revenue growth through organic content marketing

How Adani built the largest and most ambitious "Adani Travel Super-App" through a content-led growth engine

Ready to grow your funnel with pepper.

8502-002-002

- Current Batch - 28 May

- Upcoming Batch - 22 June

A Case Study on Cred Marketing Strategy – Detailed Analysis

Home > Blog > A Case Study on Cred Marketing Strategy – Detailed Analysis

- Last updated on August 28, 2023

Cred is an Indian fintech company. The company gained popularity in India due to its innovative marketing strategies. If you want to know about those strategies then read this cred marketing strategy guide till the end.

Generally, people face trust issues while using fintech apps. To solve these issues, Cred started launching innovative marketing campaigns and by 2021, they have gained 5.9 million users on the app.

Cred has mainly focused on digital marketing over traditional. We have done in-depth research and listed all their marketing strategies. If you are an entrepreneur, you can also apply these strategies to your business.

Kunal Shah is the man behind Cred. But the whole credit goes to the marketing team of Cred. They have done an excellent job in planning & implementing these strategies. So let’s begin our Cred marketing strategy guide.

About the Company

Cred was started in 2018 by a famous entrepreneur Kunal Shah . Before Cred, Kunal founded Freecharge which was a successful startup. In 2018, Cred was started to make the life of credit card users easy.

Cred became a popular name in India because of its outstanding marketing strategies. Their marketing strategies are also an inspiration for other startups as well. Do you want to know how Cred works? Know below.

How Does Cred Work? Business Model of Cred

Cred rewards its members when they pay credit card bills on time. Cred is an RBI-approved app with millions of active downloads. 20% of Indian credit card payments are done through cred. When someone pays a credit card bill on time, Cred gives them rewards.

Now the question arises how does Cred earn money? Cred has multiple sources of income. They earn by selling ad space to businesses. The company has a huge chunk of credit card users’ data, they also generate revenue by selling this data to financial organizations like Banks.

Cred Marketing Strategy

Cred follows various marketing strategies. Below in this article, you will also know about the few popular ad campaigns of Cred.

1) Rahul Dravid’s “Indiranagar Ka Gunda” Ad

This is the most popular ad campaign of Cred. Featuring Rahul Dravid in the ad was a marketing strategy of Cred. They knew that this ad is going to viral. Indiranagar is a crowded place in Bangalore. The head quarter of Cred is also situated in Indiranagar.

People know Rahul Dravid as a very cool & calm personality but in this ad, he seems to be very angry. India is filled with cricket fans and everyone got crazy when they saw this side of Rahul Dravid.

This campaign was a marketing success for Cred. They have gained a lot of users after this ad. Other popular brands like Zomato and Amul also used this moment to share some viral tweets.

2) Old T.V. Commercials

This is another great marketing strategy by Cred where they targeted 90s people. Everybody misses those old ads featuring Annu Kapoor & Renuka Shahne.

Cred recreated these ads where they are playing “Cred Antakshari” . This was a successful ad campaign by Cred. Banking or Finance apps work on trust. These ad build trust among consumers.

Cred marketing doesn’t seem like marketing. People really enjoyed watching these ads. Now let’s move towards another Cred marketing strategy.

3) Free Giveaways

This year, 2022 Cred became the official partner of IPL. They have launched Cred Bounty. Cred was giving free Apple products and travel trips to its Bounty winners. Cred users pay bills on time and earn rewards. Only one person in a day can win a big reward.

This was a successful Cred marketing strategy. It helped their large market share at a small cost.

4) Personal Branding of Kunal Shah

Kunal Shah is a successful Indian entrepreneur. He is also an inspiration for many young entrepreneurs. Kunal is known for its “Delta 4” theory. According to him, if you found a Delta 4 product, you don’t need or need less marketing.

He has 724K followers on Twitter and 173K followers on Instagram. Like Elon Musk, he also follows personal branding strategies for Cred. He regularly uploads content on Instagram and Twitter. You can also watch him in podcasts on YouTube. This is Kunal Shah’s cred marketing strategy.

5) Sending Cakes to Users

Cred marketing strategy involves many innovative & crazy ideas. One idea was sending cakes to the customer’s office who paid the bill on time. When some of his colleagues ask, who sent this cake? The answer will be Cred.

This is a great marketing strategy used by Cred to acquire new customers. This also improves the customer relationship. When a few people got cakes at the office, they shared the photos on social media. This message frequently spreads on the Internet. And again, it has given a boost to Cred users.

Popular Ad Campaigns of Cred

Cred launched many popular ad campaigns so far. We have shortlisted some of the popular ad campaigns below.

Cred PowerPlay Campaign

This campaign was started in IPL 2021. When a user pays a bill during the powerplay over of IPL. They can get 100% cash back on the credit card payment. The winner will also be listed on the virtual T.V. during IPL.

The cost of Cred was very less. As they were paying for just one payment but they are getting enough value from that.

My Two Cents

It is a popular marketing campaign of Cred where they feature some of the top personalities and ask them about their financial management. You can see Sunil Grover, Anand Gandhi, and other big personalities talking about what they think about money. This helps the audience know the financial mindset of their audience.

Great For the Good

This is one of the longest-running ad campaigns of Cred. They have created multiple videos where Jim Sarbh explains why you should pay bills through Cred. Every person who pays a credit card bill through cred earns a Cred coin which can be redeemed to earn rewards.

They have explained this scenario in different situations. People loved it and Cred’s marketing strategy wins the game.

About Quibus Trainings

Quibus Trainings Institute offers the best Digital Marketing course in Jaipur with 100% placement assistance. The founder of Quibus trainings and the course instructor, Mr. Paramveer Singh has an experience of more than 10 years in this field. He has taught 3000+ students and helped them in building a successful careers in Digital Marketing.

The modules covered in the Digital marketing mastery course are SEO, PPC, Google Analytics, Social Media Marketing, Email Marketing, and Blogging. In addition, you will also receive 10+ certificates from Facebook, Google, Hubspot, etc. So, join our 4-month Digital marketing mastery course and become job ready.

So here we end the Cred marketing strategy guide. We have shared almost all strategies that Cred uses for its marketing purpose. Cred is an innovative brand. They regularly come up with new marketing strategies. We will update our guide as soon as we found new marketing strategies. Thanks for reading.

Parmveer Singh Sandhu

Speak To A Counsellor

CRED Case Study – Business Mode, How CRED APP Works

Aryan jalan.

- May 10, 2024

Introduction

CRED is India’s first application that rewards its users for paying their credit card bills on time. It was founded by Kunal Shah, former founder of Freecharge in April, 2018.

Kunal Shah started CRED with a vision to create an exclusive community for India’s most trustworthy and creditworthy individuals.

It helps to manage and pay all your credit cards in one place. It also reminds us about payments, offers on our credit card, and also monitors your spending’s.

CRED Tagline: pay your credit card bills & earn rewards.

How CRED APP was started?

After selling Freecharge in 2015, Kunal Shah was researching another idea to make people’s life better. While researching, he found that so many things are automated in the developed nations like super markets with no cashiers, petrol pumps with no attendant, etc but there’s no such trustworthy system that helps the individuals to pay the right amount of credit card bills on time with zero additional charges.

According to one Kunal Shah’s interview with Yourstory , There are over 30 hidden charges and exorbitant interest costs that haunt you even if you pay a single rupee less than your full bill. The current model thrives on you making an error. It wants you to faulter. The system has taken the good guys for granted for far too long. Creditworthy individuals deserve better.

But the problem was, why would people pay their credit card bills through their APP, then the idea came to reward the trustworthy credit card users, who pay their credit card bills on time. With this strategy to attract users, CRED was started in April, 2018.

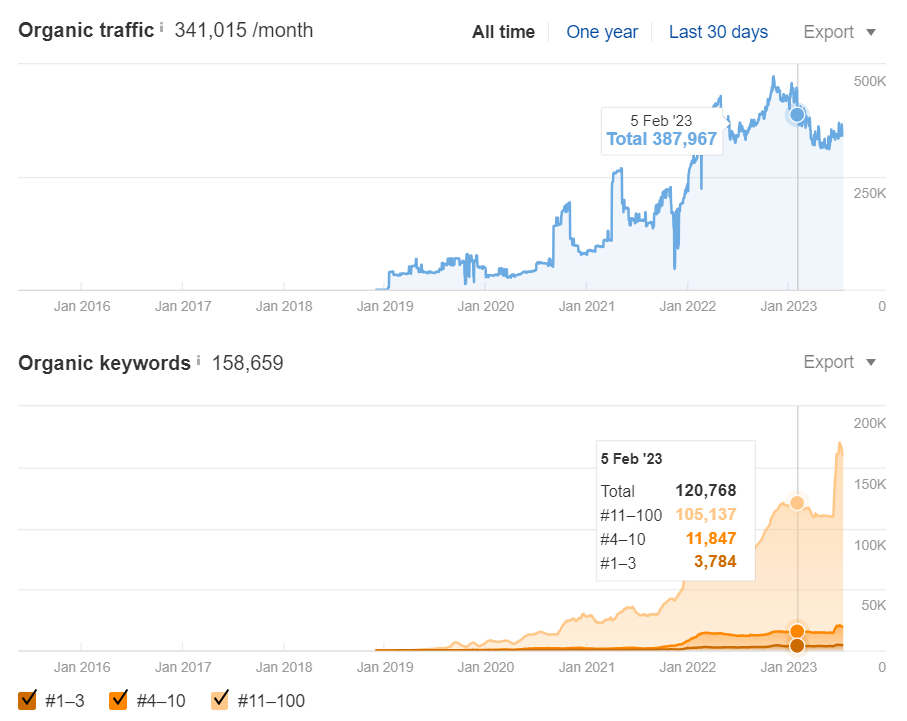

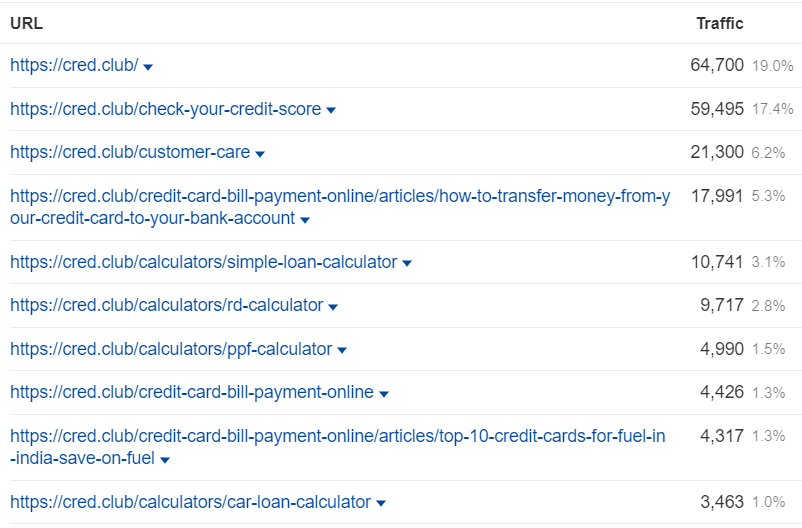

Now, Cred is getting almost 341 thousand traffic per month organically with more than 3 thousand backlinks to their 690+ pages. (As per Ahrefs.com )

Here is the organic traffic growth chart of Cred since January 2019.

Top Performing Pages of Cred in July 2023.

CRED APP Features

CRED offers you to manage all your credit cards at one place.

Whenever you pay your credit card bills you’ll get some CRED Coins that you can use to get discounts on various brands partnered with CRED.

It analyzes your total spending, hidden charges, and tracks credit limits and reminds you about all these to avoid such additional charges.

Apart from all these, few more amazing features of CRED,

CRED Protect – CRED protect is the feature of the app that reads the statements from the email and gives information about- balance, due date, bank charges, and expense bifurcation.

Smart Statements – This feature helps the user to streamline their expenses by analyzing the CREDit card statements.

CRED Powerplay – It is the new feature of CRED after it has become the official partner of IPL 2020. It enables 100% cashback on the entire bill provided the bill is paid in the first six overs of both the innings. Also, the winner gets an exclusive spot in the virtual fan box.

CRED Funding Rounds

Cred app business model.

Currently there is no business model of CRED. Currently, CRED is focused on expanding its user base and not focuses on making any profit. Though the primary vision is to create a trustworthy community and company will further build their business model.

Various sources say they’re earning money from listing the brands in their CRED Coin redemption but it’s a conflict but CRED might use this in the future.

There’s a prediction that it will use their data to monetize their business. Currently, the app creates a database of users based on the bank details, bill payment history, rewards used, and interests but not share this data with any 3rd party. Therefore they can do multiple uses of users’ data in the future and can make a profitable business model around it.

Also check out 👉🏻 Khatabook Business Model

How CRED APP Works?

Step 1. Download the CRED App and register with your mobile no.

Step 2. Once the account is set up, the app scans the credit cards linked to the registered phone number.

Step 3. Users get access to the app if the credit score is higher than 750, otherwise the user went to their waitlist.

Step 4. If you get the access, then CRED app requires access to the mail id to read and scan your credit card transactions like due dates, statements from the applicable services, etc.

Step 5. And then you can earn CRED coins after paying your every credit card bill. One CRED coin equals Rs 1. These coins can then be used to claim rewards.

Step 6. Users can also choose to burn the coins to win cashback and then the cashback is directly credited to your credit card.

Most Asked FAQ’s

Q. who is the founder of cred.

Ans. Kunal Shah is the founder of CRED.

Q. How to contact CRED?

Ans. There’s no official contact number. Users can drop a mail on the email id – [email protected]

Q. Is CRED app safe?

Ans. The app is trustworthy as the records of the founder are intact. Also, it does not ask for any critical information such as the date of expiry or CVV.

- Swiggy Case Study

- Udaan Business Model

- Unicorn Startups In India

- Top E-commerce Companies in India

Latest Post —

Top e-commerce companies in india 2024, travel triangle success story – business model, competitors, easemytrip success story – business model, how they started & much more, featured post —, swiggy story – how swiggy stared | business model of swiggy.

Our Newsletter

Get the latest insights directly to your inbox!

Related Post —

Aryan Jalan App

Cred Success Story - How It Made Credit Card Payments Effective and Rewarding

Anik Banerjee , Manisha Mishra

Company Profile is an initiative by StartupTalky to publish verified information on different startups and organizations.

The concept of credit is something that is not new. People have been opting for credit since time immemorial. Credit is crucial when our capital cannot support certain investments, and credit cards had certainly made them easy to avail. However, paying the credit card bills is a priority and equally difficult to manage. This is why Cred decided to come forth with the unique idea of a platform that will help Indians pay their credit card bills on time and also offer them instant offers and rewards for the same.

Cred is a fintech company headquartered in Bengaluru, which allows its users to make credit card payments through its app and get exclusive offers and other benefits online. Furthermore, Cred has also introduced house rent payment options, Rent Pay; flexible credit lines, Cred Cash; and Cred Mint, with which the lenders can lend their idle money to borrowers who exhibit decent credit scores at interests of around 9% per annum.

Learn more about Cred, its startup story, founder, tagline, logo, business model, revenue model, funding, competitors, and more.

Cred - Company Highlights

Cred - About Cred - Startup Story Cred - Founder and Team Cred - Tagline and Logo Cred - Business Model Cred - Revenue Model Cred - Funding and Investors Cred - Acquisitions Cred - Growth and Revenue Cred - Products and Features Cred - Partnerships Cred - Competitors

Cred - About

CRED allows credit card users to pay their credit card bills through its platform and extends rewards for each transaction. The fintech platform also lets the users make their house rent payments, and also avail all the benefits of the short-term credit lines that the app now offers. The Cred headquarters is in Bangalore .

The company takes utmost care in protecting the data and the information of the users. Hence, the app is completely safe and secure. Kunal Shah is the founder of Cred. He founded the company in 2018 and often describes Cred as a TrustTech company and not a Fintech. This is because his initial motivation to start Cred came from solving trust issues in the Indian society, which according to him, is the key to economic prosperity. The Cred founder Kunal Shah is a well-known face in the startup ecosystem who has already funded numerous startups .

Cred - Startup Story

The goal was very simple. It was to create a platform where life could be made better and systematic. Kunal Shah wanted to offer more privileges and benefits to the people having good credit scores. And therefore, creating a flywheel effect for more people was important to improve the scores.

Everybody, starting from the startups to the government, has focused on the masses. The founder of the company wanted to focus specifically on the people, the responsible citizens who pay taxes timely. He felt that nobody had solved their problems earlier.

'If you look at history, nobody has been rewarded for paying back on time. We want to fix that.'

Therefore, Cred was founded primarily to solve the problems of the taxpayers and reward them with attractive rewards in return.

Cred - Founder and Team

Kunal Shah is the founder and CEO of Cred. He is an Indian entrepreneur , who is credited for launching new ventures for a second time. Kunal was a Philosophy graduate from Wilson College and later went on to pursue MBA from the Narsee Monjee Institute of Management Studies, but he dropped the course midway to chase his dreams as an entrepreneur.

Kunal started his entrepreneurial journey with PaisaBack, a website for cashback, coupons, and other offers for the users along with Sandeep Tandon . However, he eventually shut down its operations in order to found FreeCharge, which the duo founded in 2010.

FreeCharge was acquired by Snapdeal in April 2015 but the company still continued as an independent entity led by Shah. Cred was founded in 2018 and successfully turned unicorn on April 6, 2021. FreeCharge, on the other hand, was acquired by Axis Bank in July 2017. Here's looking at the FreeCharge business model and how it makes money through it .

Kunal Shah was born in Mumbai in 1983. His hobbies include playing chess and poker. He loves munching on chips and guacamole. He loves the ideology of Socrates and the plays of G.B Shaw.

Cred's employee strength is over 1600+.

Flaunt your startup with StartupTalky

800+ stories, thousands of founders, and millions of visitors. Want to be the next?

StartupTalky is where founders, entrepreneurs, startups and businesses hang out and look up to for inspiration. If you have the means, we have the medium! Inviting founders and startups who are building sustainable solutions from ground zero! Startups who run the show, StartupTalky will let the world know!

Cred - Tagline and Logo

Cred's tagline is ' Suraksha Aur Bharosa Dono '.

Cred - Business Model

The business model of Cred consists of four parts :

Cred app - The Cred app is a neat-looking, beautifully designed app, which the users can visit if they want to go through the offers that are available after they pay their credit card bills. They can easily sign up on the app and view all the offers that they can avail of.

Businesses that provide offers on the app - The users of Cred can also find a wide range of offers from numerous businesses. For this, Cred brings businesses on board and collaborates with them. Along with benefitting Cred and its customers, who can avail of the exclusive offers provided by the businesses, it is also a win-win situation for the businesses. This is because they are also hugely benefited from the visibility they get.

Users who pay their credit card bills - Cred also serves as a smooth and rewarding platform for the users who use it to pay their credit card bills. In comparison to banking or other apps, the end-users can choose Cred as an app to pay their credit card bills and get numerous offers and benefits. On the other hand, the users who like the app also share Cred with their family and friends.

Cred Mint - Cred disclosed its new feature, Cred Mint on August 20, 2021, which is designed as a peer-to-peer lending platform help that will help Cred users lend their idle money to creditworthy members. It is a rather transparent process that only allows the trustworthy Cred members boasting of a minimal credit score of 750 or higher to be the borrowers. Furthermore, the lenders can also withdraw their money whenever they want with the interest that they have accumulated for the period.

Cred - Revenue Model

There are 2 prominent ways via which Cred makes money,

Listing products and offers - Cred, as we know, lists an array of products and offers that benefit its users from a range of businesses. These businesses, in turn, pay Cred a fee for their visibility. Every time a user avails of the offers, Cred generates an income through it.

Using the financial data of the users - Cred accumulates the financial data from the users who use the platform for paying their bills and more. Along with providing Cred with the opportunity to introduce more offers to their users using these data, Cred also has other banks and financial institutions who pay them a fee for accessing these data. These companies, banks, and financial institutions would eventually approach the potential customers with their own set of products aligned to their tastes.

Cred has revealed that it does not charge any fees for the credit card payment options that it offers via its app. The company instead earns its revenues from the ancillary services it provides with the help of its technology and distribution platform.

Cred - Funding and Investors

Cred has raised a total amount of $1+ billion in funding over the 10 funding rounds that the brand has witnessed. Cred has last received $80 million in funding on June 9, 2022, via its Series F funding round led by GIC, and followed by Sofina Ventures, Alpha Wave Ventures, and DF International.

Here's a look at the Cred funding rounds:

Cred is funded by 33 investors in total, as of June 9, 2022, with the recent investors being GIC, Sofina, Alpha Wave and DF International

Cred - Acquisitions

Cred has acquired five companies to date, Hipbar, Happay, smallcase, and Spenny. The recent acquisition is of Spenny on June 23, 2023.

Cred - Growth and Revenue

Cred has shown steady growth throughout the years. Being a startup that was founded in 2018, it successfully joined the unicorn club on April 6, 2021, closing its Series D round where the company had mopped up $215 million. Cred controls "22% of all credit card payments in India on a monthly basis,” said Kunal Shah in his statement released in April 2021. Cred's valuation reached $6.5 billion in 2022 after a $200 million funding round.

Kunal Shah further took to his LinkedIn profile on July 10, 2021, and shared highlights of the milestones reached by Cred in the month of June:

Cred Financials

Cred operating revenue has increased from Rs 393.5 crore in FY22 to Rs 1,400.6 crore in FY23. In terms of profit and loss, company losses increased from Rs 1,279.5 crore in FY22 to Rs 1,347 crore in FY23.

Cred Expenses Breakdown

The company's total expenses rose from Rs 1,702 crore in FY22 to Rs 2,832 crore in FY23.

Below is the breakdown of expenses for FY21-FY22:

With a huge increase in EBITDA margin from -299.24% in FY22 to -86.42% in FY23, the company showed remarkable financial improvement. The ROCE increased from -42.66% in FY22 to -31.95%in FY23, demonstrating good improvement. These adjustments imply that the company's financial performance is on the upswing.

Cred - Products and Features

Cred introduced Cred Mint on August 20, 2021, which will serve as a peer-to-peer lending feature that can be used by the customers of Cred. Cred Mint has been launched by Cred in collaboration with RBI-approved P2P Non-Banking Financial Company (NBFC), Liquiloans.

Cred launched Cred Cash, a flexible credit line, in 2020. Cred Cash considers its members pre-approved for an active credit line of up to Rs 5 lakhs, without any documents, phone calls, forms, or physical visits.

Cred launched Rent Pay in April 2020, which enables users to pay their monthly rent via credit cards.

Cred launched Cred Store, an eCommerce platform , which is deemed as a haven for customers with over 500 premium brands across a wide range of categories to shop from.

Cred, which was famous as a credit card bill manager, is now up with some more offerings including mobile, DTH, and FASTtag recharge options. As per the latest reports dated April 1, 2022, the Kunal Shah-led company has launched its utility bill payments segment, with the help of which the users can now pay their utility bills including the electricity, water bills, and municipal tax via the Cred app.

Tap to Pay Feature

With Tap to Pay feature android users with NFC capabilities can pay without physical cards or wallets by tapping their smartphones on merchant terminals. Cred launched this feature in February, 2022.

BidBlast is a thrilling bidding game that CRED members can only play and it was launch in December 2022. This will give the cred members the excitement of bidding without using actual money by using CRED coins.

Cred has launched cred flash in February 2023 with this launch customers can make payments using BNPL product within the app and across more than 500 partner merchants.

Cred Escapes

With the launch of Cred Escapes in March 2023, it will provide a painstakingly designed platform with premium privileges, exclusive events, and lodging. This is consistent with CRED's cutting-edge strategy, which offers members benefits like spa credits, hotel upgrades, and theme park admission.

P2P Payments

Cred launch P2P payment feature in April, 2023. With this feature customers of CRED will be able to send money to other users via UPI IDs or contact numbers using the P2P payment.

RuPay Credit card - based payments

Cred in collaboration with NPCI in August 2023, has launched Rupay credit card-based payment and now customers can make UPI payments using their credit cards. This partnership benefits banks and merchants by increasing spending and increasing credit sector inclusion.

Fourth Edition of AWP programme

CRED launched its fourth version of the AWP (Accelerated Wealth Program) giving staff members the opportunity to purchase more ESOPs (Employee Stock Ownership Plans) with a quicker vesting period.

According to a March 15, 2024 report, this program gives employees the option to choose to have up to 50% of their pay come from special grant ESOPs. With this initiative, CRED hopes to encourage employee ownership and alignment with the company's long-term growth trajectory while also rewarding and incentivizing staff members.

Cred - Partnerships

Cred partners with luxury and premier brands to extend the best experience to the users at the end of the bill payment cycles.

Some other partnerships of Cred are as follows:

- Cred launched Cred Mint, in partnership with the P2P non-bank LiquiLoans, which helps the users invest their savings in a capital pool.

- Cred launched Cred Pay by partnering with Razorpay. This tool helps the users to make payments using their CRED coins and experience a seamless checkout.

- Cred has partnered with Gokwik and with this partnership they aim to improve the online shopping experience and create trust for Direct-to-Consumer (D2C) merchants.

- Shopify and cred partnerships to give merchants on its platform access to the latter's payment methods.

Cred - Competitors

Cred's top competitors are Paytm , PhonePe , Google Pay , Amazon Pay, Freecharge, and MobiKwik .

- Paytm is the top competitor of Cred. It is a fintech app and payments platform that is headquartered in Noida, Uttar Pradesh, India and was founded in 2010.

- PhonePe is another notable competitor of Cred. It is also a digital payment and financial services platform headquartered in Bangalore, India, which was founded in 2015. This app has the largest market share of 50% as of December 2022.

- Being a UPI platform that is a mass volume player, Google Pay is another competitor of Cred. This digital payments platform is developed by the Search engine giant Google itself.

- Amazon Pay is also a rival of Cred, which is now all set to provide diverse payment options. The online payments processing app is launched by Amazon and founded in 2007.

- MobiKwik is yet another fintech company , which supports digital payment options and is a rival of Cred at the same time. It is headquartered in Gurugram, Haryana, India, and was founded in 2009.

- Freecharge is also a company that Cred competes with, after the launch of its mobile bills and utility bill payment services. Originally founded by Kunal Shah and Sandeep Tandon, Freecharge now stands acquired by Axis Bank.

Is Cred a startup

Yes, Cred is a fintech startup founded by Kunal Shah in 2018.

In which year was Cred started?

Kunal Shah founded Cred in 2018.

What is Cred company?

Cred is a fintech company based in Bangalore that provides rewards on paying credit cards.

Is Cred a fintech company

Yes, Cred is a fintech company founded by Kunal Shah headquartered in Bangalore .

Is Cred an Indian company

Yes, Cred is an Indian fintech company.

Where are the CRED headquarters?

The CRED headquarters is in Bengaluru.

How does Cred make money?

Cred earns money from listing fees that businesses pay to display their products and offers on its app - Cred collects your financial data as you use the app and continues to pay your bills to offer you better offers in the future. To gain access to this data, banks and credit card companies pay Cred.

Is Cred profitable?

The company has witnessed a massive growth in its revenue from Rs 88.6 crore in FY21 to Rs 393.6 crore in FY22. However, the company hasn't seen profits to date, while the losses of the company have been registered at Rs 1,280 crore in FY22.

How much is CRED revenue?

Cred has seen massive growth in its operational revenue to Rs 393.6 crore in FY22 from Rs 88.6 crore in FY21.

Must have tools for startups - Recommended by StartupTalky

- Manage your business smoothly- Google Workspace

Transforming Customer Experiences: A Guide to Implementing Conversational AI

This article has been contributed by Abhinandan Jain, Chief Growth Officer, Startek. Conversational AI, the technology powering chatbots and virtual assistants, is rapidly reshaping customer interactions. Imagine a tireless AI assistant, available 24/7, that personalizes the customer journey, answers questions with ease, and even streamlines lead generation. Studies show

The Transformative Role of Artificial Intelligence in Education: Applications and Impacts

This article has been contributed by Vivek K Singh, Co-founder and CEO, Careerera. Before delving into Ai’s role in the education sector, let’s begin by defining this technology. Artificial Intelligence or AI enables machines to execute tasks typically associated with human cognition. AI-powered systems have the capability to

How to Network Effectively as an Intern: Building Connections and Expanding Opportunities

This article has been contributed by Sonica Aron, Founder, Marching Sheep. Internships are a very special time in any young professional’s life. Not only do they as act as a passage from them being carefree students to responsible and accountable contributors, but for many aspiring professionals this is when

Revolutionising Corporate Wellness: How FITPASS is Addressing India's Sedentary Workforce Challenge

This article has been contributed by Mr. Akshay Verma, Co-founder of FITPASS. In today's digitally-driven society, India's workforce is grappling with a pressing challenge: the sedentary lifestyle prevalent in corporate environments. Recognising the severe implications of this inactive lifestyle, which experts globally equate to be as detrimental as smoking, FITPASS

Location Set your Location

Popular Cities

Learn Digital Marketing Training from the Best Tutors

Book a Free Demo

- Digital Marketing Blog

CASE STUDY ON CRED: STORY OF FAILURE TO ENTER UNICORN STARTUP!

An Indian Origin Fintech Startup entered the unicorn club as none other than CRED. CRED is now the most successful Indian fintech startup in recent years. Bengaluru Based Startup made its name big but it has its true story of struggle and failure. Let’s see what made this Fintech Startup such a huge success.

The company was established in 2018 and has a valuation of around $2.2 billion. Many reputed startups like Flipkart and OYO took approximately 10 years to reach a similar valuation. The head office is located in Bengaluru, Karnataka.

What is their Business model?

The entire startup is based on the “hole and hook model”. many credit card users don’t complete their payments on time. cred provides benefits to users who complete their payments on time. the benefits are offered in the form of valuable rewards. .

The company founded the 'hole' in the credit card payment system and provided a 'hook' in rewards. They offer rewards to their customers, which makes their product a brag-worthy proposition.

About the founder

Kunal Shah is a high-profile entrepreneur who was also the co-founder of 'freecharge'. Coming from a Gujarati family and a non-tech background, he is currently the founder of two big tech companies. He was motivated to start CRED after observing and understanding the loophole in the credit card payment system. He is also the current CEO of the company.

What is their Marketing Strategy?

The marketing campaign of CRED is universal. They have implemented the perfect marketing strategy to enhance the value of their product. Surabhi Capoor is the brand and product marketing head at CRED.

The marketing department of the company came up with great advertising ideas to enhance the brand value. CRED has increased its awareness before this IPL season. They successfully created two viral advertisements that included stars like Rahul Dravid, Govinda, Madhuri Dixit, Anil Kapoor, and Bappi Lahiri. These creative advertisements have successfully gained attraction from people.

Further, the company was marketed through various other celebrities on social media platforms. Meme marketing also worked for the company, and thus the awareness of the brand is on the rise.

What services do they provide?

The company started with just credit card payment services, but now it is expanding its reach in different sectors. The CRED app has more than 60 lakh users, and the number is increasing.

Let’s take a look at the services provided in the app.

- It allows you to manage all your credit card payments in one place.

- The app provides you with regular notifications regarding your payment details and due dates.

- It offers rewards and cashback for new users.

- The company provides CRED points on the completion of payment, and these points can be used to avail various vouchers.

- The payment method is hassle-free and is liked by its users.

- They have started providing services for rent, loans, and insurance.

How Credible are they?

The company assures total privacy to the customers. They deal with the valuable financial data of the customers, and they offer complete privacy on it. With rewards and enhanced security, it is trusted by its users. In just 2 years, they have successfully reached a vast consumer base, and their number is ever increasing.

What is their Mission?

The mission of the company is quite clear. They want to improve the credit card payment system. Despite not making any profit in 2019 and 2020, they have eventually gained the trust of their users. They used the "reward and punishment tendency" effectively to attract customers.

CRED & their Vision

CRED’s business model is futuristic. They want to develop themselves in diversified sectors like insurance, loans, rent, shopping, and realty payments. The company also focuses on a futuristic revenue model.

It aims to generate revenue through merchandising, commission, and consulting. They can also use this vast customer base for sales pitching and generate a good fortune from it.

How are they Funded?

CRED is one of those legendary startups that got funding right before its execution. This was made possible by the brilliance of Kunal Shah. The company has made a loss of 63.90 crores and 378.89 crores in 2019 and 2020, respectively. Despite these losses, the company is trusted by its investors.

The company has around 28 investors and 7 lead investors. The lead investors are listed below:

- Dragoneer Investment Group.

- Tiger Global Management.

- DST Global.

- Falcon Edge Capital.

- Insight Partners.

The company has raised funding of around $471.2 million from the investors. The other investors of the company are Ribbit Capital, Gemini investments, Sequoia Capital India, and Rainmatter Capital.

Who are the Brand Partners?

The company offers different rewards and vouchers for customers. It has successfully bagged many reputed brands as its partner. Some of the esteemed brand partners are:

Their Awards and Recognition

Well, it is impossible for the best Indian fintech startup not to win any award. The CRED app has won the best UI/UX design award for its simple and useful design. The application is highly rated by users on the Google play store. The startup has also bagged recognition from the National startup awards, 2020.

The story behind their Struggle and Success

Kunal Shah faced a serious dilemma before starting the company. He was offered to become an investing partner in Sequoia Capital of India. But the entrepreneur chose to start a company rather than becoming an investor.

The company has recently registered itself as an IPL sponsor and has started building some revenue. Despite making losses in the first two years, it has continued to provide valuable services to its users. The company has a futuristic revenue model, and thus it is trusted by its investors.

How to Contact them?

You can contact the company by using the contact us page on their website. You can also reach the support team through email.

Email: [email protected]

For More...

You can visit i-Strategist to get more informative blogs like this. The institute publishes a series of educational and informational blogs on its website.

i-Strategist is one of the best digital marketing institutes in Mumbai. It has two centers in Kandivali and Andheri. It was established in 2018 by Rushant Pragwat. He has vast experience in digital marketing, and he is also a trainer in the institute.

The institute is an ISO-certified institute and provides 100% job assistance to the students. They also offer corporate training and career counseling along with the courses. The trainers of the institute are highly experienced and industry experts.

Please Enter a comment

Other Lessons for You

Nikul Patel

Nimmakayala J.

Ravinder Singh Bassan

Shailesh B.

Digital Prostudy

Find Digital Marketing Training near you

- Digital Marketing Training in Delhi

- Digital Marketing Training in Bangalore

- Digital Marketing Training in Hyderabad

- Digital Marketing Training in Mumbai

- Digital Marketing Training in Pune

- Digital Marketing Training in Chennai

- Digital Marketing Training in Noida

- Digital Marketing Training in Kolkata

- Digital Marketing Training in Gurgaon

- Digital Marketing Training in Jaipur

Looking for Digital Marketing Training ?

Learn from Best Tutors on UrbanPro.

Are you a Tutor or Training Institute?

Digital Marketing Training Questions

By signing up, you agree to our Terms of Use and Privacy Policy .

Already a member?

Looking for Digital Marketing Training Classes?

The best tutors for Digital Marketing Training Classes are on UrbanPro

- Select the best Tutor

- Book & Attend a Free Demo

- Pay and start Learning

Learn Digital Marketing Training with the Best Tutors

The best Tutors for Digital Marketing Training Classes are on UrbanPro

This website uses cookies

We use cookies to improve user experience. Choose what cookies you allow us to use. You can read more about our Cookie Policy in our Privacy Policy

- About UrbanPro.com

- Terms of Use

- Privacy Policy

UrbanPro.com is India's largest network of most trusted tutors and institutes. Over 55 lakh students rely on UrbanPro.com, to fulfill their learning requirements across 1,000+ categories. Using UrbanPro.com, parents, and students can compare multiple Tutors and Institutes and choose the one that best suits their requirements. More than 7.5 lakh verified Tutors and Institutes are helping millions of students every day and growing their tutoring business on UrbanPro.com. Whether you are looking for a tutor to learn mathematics, a German language trainer to brush up your German language skills or an institute to upgrade your IT skills, we have got the best selection of Tutors and Training Institutes for you. Read more

IMAGES

VIDEO

COMMENTS

The concept behind this advertising campaign was to highlight the use case of the Cred app and the rewards that one gets on paying credit card bills. It released six different commercials which featured Bollywood celebrities such as Anil Kapoor, Madhuri Dixit, Govinda, Bappi Lahiri, Udit Narayan and Alka Yagnik.

CRED — Business Case Study. Introduction: Seizing the Opportunity in a Changing Market. In the landscape of India's rapidly evolving digital finance sector, a visionary entrepreneur, Kunal ...

CRED is one of the most fascinating design case studies in the Indian Fintech ecosystem. It extensively works on altering the behavioral design of society and its anticipation makes it a billion-dollar company. ... In CRED, payments being the heart of app experience. The payment experience is reimagined using Assisted Best Actions framework ...

The CRED app has more than 60 lakh users, and the number is increasing. Listing the services provided in the app. It allows you to manage all your credit card payments in one place. The app notifies your regular payment details and due dates. It offers rewards and cashback for new users.

Cred app is designed on exclusivity terms. It's campaign 'Not everyone gets it' signifies how only credit card holders can access the app. A similar strategy was used by Clubhouse and Facebook for grabbing early users. But in Cred's case, its a part of the business model, making exclusivity a moat. Explore gamification

This case study delves into the collaborative journey of CRED, a prominent fintech and credit card bill payment platform, and Pepper Content, a leading content creation platform. ... Rohan Ralli from the creative team at CRED adds, "Our app is a sort of super-app. It's more than just rewards and payments, and for this reason, the number of ...

During IPL 2020, videos of celebrities getting auditioned for Cred ads went viral. They were thoughtfully made to propel views. As we told earlier, Cred is a members only app. They kicked " Not everyone gets it " as their tagline. The ads showcased celebrities dancing and singing weird dance numbers to get selected.

Cred was started by Kunal Shah in 2018 to change the way people use credit cards in India.He built a company named Freecharge and sold it to Snapdeal for a s...

CRED App Design. CRED is a members-only app that rewards the user with exclusive rewards for paying credit card bills. The app's design is clean, minimalistic, and intuitive. It employs neumorphism; a trend that's taken over the interface design. ... A UI design case study to redesign an example user interface using logical rules or guidelines.

4 Takeaways From CRED's Marketing Strategy. CRED's marketing strategies were a game changer. The brand's solid yet consistent comeback took the company's status from a loss maker to a unicorn startup. From TV to Twitter, there was a massive buzz about CRED among people. Let's check out what steps CRED followed to reach the current stage.

1) Rahul Dravid's "Indiranagar Ka Gunda" Ad. This is the most popular ad campaign of Cred. Featuring Rahul Dravid in the ad was a marketing strategy of Cred. They knew that this ad is going to viral. Indiranagar is a crowded place in Bangalore. The head quarter of Cred is also situated in Indiranagar.

As per App Annie, a global provider of mobile data and analytics, the daily downloads of the CRED App increased by over eight times when compared with the pre-IPL time period (18 days prior to IPL).

Cred App encourages its users to pay their credit cards on time by throwing reminders. It rewards its users with offers from premium brands for every payment through the app. It comes with other product offerings- ... In our case study, we focus on individual card users. Credit card users can be classified as individual and business credit card ...

CRED Case Study - Business Mode, How CRED APP Works. Aryan Jalan May 10, 2024; Introduction. CRED is India's first application that rewards its users for paying their credit card bills on time. It was founded by Kunal Shah, former founder of Freecharge in April, 2018.

1. Since its inception, CRED has always been in the news. Obviously for good reasons and one of them being the jaw dropping design of the CRED application. This HelloMeets event was all about designing CRED, the philosophy and the motivation behind that. And who else other than Harish Sivaramakrishnan would be suitable to tell the story.

Indian fintech unicorn CRED has introduced a Unified Payments Interface (UPI) payment feature, 'Scan & Pay', on its app for its members. Features of CRED Pay. The service, which will be limited to CRED members, will also allow users to make peer-to-peer (P2P) transactions from their bank accounts linked to the CRED app.

Cred - Tagline and Logo. Cred's tagline is 'Suraksha Aur Bharosa Dono'. Cred Logo Cred - Business Model. The business model of Cred consists of four parts :. Cred app - The Cred app is a neat-looking, beautifully designed app, which the users can visit if they want to go through the offers that are available after they pay their credit card bills. They can easily sign up on the app and view ...

Apr 10, 2022. --. 2. New UI of Cred app (Apr 2022) Cred is an exclusive members-only app that rewards you for paying credit card bills. Over the time, Cred has grown and has implemented several payment and finance related features within the app. Widely known for its in-cred-ible design, Cred recently shifted to a new design system and revamped ...

CRED - Case Studies - LottieFiles. Learn how CRED transforms the payment experience by incorporating Lottie animations and delightful storytelling into their app.

The CRED app has more than 60 lakh users, and the number is increasing. ... MOMO ACROSS INDIA, A CASE STUDY May 13, 2021 HOW DOES DMART EMPLOY THEIR "DAILY SAVINGS, DAILY DISCOUNTS May 12, 2021 ...

This is where the curious case of CRED communications becomes clearer. If CRED needs more data, it needs more installs. For more installs, it needs more awareness. For more awareness, it needed to create share-worthy communications. In the world of new age digital first brand building, share-worthiness is critical.

CRED is an Indian fintech company, based in Bangalore. [2] [3] [4] Founded in 2018 by Kunal Shah, [5] [6] it is a reward-based credit card payments app. [7] Cred also lets users make house rent payments [8] and provides short-term credit lines. [9] Cred has received criticism for being overvalued and lacking a sound monetization strategy.

The CRED app has more than 60 lakh users, and the number is increasing. Let's take a look at the services provided in the app. It allows you to manage all your credit card payments in one place. The app provides you with regular notifications regarding your payment details and due dates. It offers rewards and cashback for new users.

Elon Musk's brain-chip company Neuralink is looking to enroll three participants to evaluate its implant in a study that could last more than five years. Neuralink is seeking three paralyzed ...

Earlier studies reported short mean incubation pe-riod estimates of 9.0 days (7) and 7.6 days (95% cred - ible interval [CrI] 6.5-9.9 days) (10), extended to 9.5 days (95% CrI 7.4-12.3 days) when accounting for right truncation (10). Estimation of the incubation period of mpox pres - ents several difficulties. One challenge arises from the