Dictionary of International Trade

Presenting bank.

In bank collections, the collecting bank that deals directly with the drawee ; usually is the drawee ´s bank of the account.

Related entries

- T/T Telegraphic transfer

- Vostro account

- Usance draft

Search Terms

- Banking (206)

- Contracts & Law (190)

- Customs (130)

- Documentation (111)

- Economics (173)

- Insurance (54)

- Logistics (401)

- Marketing (139)

Practical Guide to Incoterms

- Contracts & Law

- Documentation

- International Contracts

- Chinese Contracts

- Country Guides

- Business Letters

- Trade Documents

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

How to Make a “Good” Presentation “Great”

- Guy Kawasaki

Remember: Less is more.

A strong presentation is so much more than information pasted onto a series of slides with fancy backgrounds. Whether you’re pitching an idea, reporting market research, or sharing something else, a great presentation can give you a competitive advantage, and be a powerful tool when aiming to persuade, educate, or inspire others. Here are some unique elements that make a presentation stand out.

- Fonts: Sans Serif fonts such as Helvetica or Arial are preferred for their clean lines, which make them easy to digest at various sizes and distances. Limit the number of font styles to two: one for headings and another for body text, to avoid visual confusion or distractions.

- Colors: Colors can evoke emotions and highlight critical points, but their overuse can lead to a cluttered and confusing presentation. A limited palette of two to three main colors, complemented by a simple background, can help you draw attention to key elements without overwhelming the audience.

- Pictures: Pictures can communicate complex ideas quickly and memorably but choosing the right images is key. Images or pictures should be big (perhaps 20-25% of the page), bold, and have a clear purpose that complements the slide’s text.

- Layout: Don’t overcrowd your slides with too much information. When in doubt, adhere to the principle of simplicity, and aim for a clean and uncluttered layout with plenty of white space around text and images. Think phrases and bullets, not sentences.

As an intern or early career professional, chances are that you’ll be tasked with making or giving a presentation in the near future. Whether you’re pitching an idea, reporting market research, or sharing something else, a great presentation can give you a competitive advantage, and be a powerful tool when aiming to persuade, educate, or inspire others.

- Guy Kawasaki is the chief evangelist at Canva and was the former chief evangelist at Apple. Guy is the author of 16 books including Think Remarkable : 9 Paths to Transform Your Life and Make a Difference.

Partner Center

Join 307,012+ Monthly Readers

Get Free and Instant Access To The Banker Blueprint : 57 Pages Of Career Boosting Advice Already Downloaded By 115,341+ Industry Peers.

- Break Into Investment Banking

- Write A Resume or Cover Letter

- Win Investment Banking Interviews

- Ace Your Investment Banking Interviews

- Win Investment Banking Internships

- Master Financial Modeling

- Get Into Private Equity

- Get A Job At A Hedge Fund

- Recent Posts

- Articles By Category

Investment Banking Pitch Books: Design, Examples & Templates

If you're new here, please click here to get my FREE 57-page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking . Thanks for visiting!

Bankers like to complain about almost everything, but near the top of the complaint list is “investment banking pitch books.”

Some Analysts claim that you’ll devote all your waking hours to creating these documents, while others say they’re time-consuming but not that terrible to create.

Some senior bankers swear by pitch book presentations, claiming that they help to win and close deals, while others think they’re over-hyped.

We’ll look at all those points and more in this article, including downloadable pitch book examples and templates for you to use.

Table Of Contents:

- What Is An Investment Banking Pitch Book?

How to Create a Pitch Book

Pitch book presentation, part 1: pitching your team as the advisor of choice, pitch book presentation, part 2: providing background and context, pitch book presentation, part 3: choose your own adventure, sell-side pitch books for sell-side mandates, buy-side pitch book examples, equity pitch book and debt pitch book examples for financing mandates, other types of pitch books, why do you spend so much time on investment banking pitch books as a junior banker, what do you need to know about pitch books as an intern or new hire, what is an investment banking pitch book.

Pitch Book Definition: In investment banking, pitch books refer to sales presentations that a bank uses to persuade a client or potential client to take action and pay for the bank’s services. Pitch books typically contain sections on the merits of the transaction; analysis of potential buyers or sellers; pricing and valuation information; as well as key risks to mitigate.

That is the classic definition, but in practice, people use the term “pitch book” to refer to almost any presentation created by a bank.

We’re going to focus on presentations to potential clients here because they tend to be the most time-consuming ones, and they generate the most horror stories as well.

There’s no way to “measure” how much pitch books matter, but it’s safe to say that they’re less important than the time spent on them implies.

Bankers win deals primarily because of relationships cultivated over a long time ; a pretty presentation right before a company goes public means little compared with the 5-10 years of meeting the CEO and CFO before that point.

Pitch books matter to you as an investment banking analyst or associate primarily because you’ll spend a good amount of time creating them – and you can’t screw up if you want a good bonus .

Almost all investment banking pitch books use a structure similar to the following:

- Situation, 0r “Current State”: Your prospective client is looking for growth.

- Complication, or “Problem”: The potential client’s growth rate has been slowing down.

- Hypothesis, or “Solution”: Acquiring a growing company can meet the potential client’s need for growth.

Then, you go into detail showing why the hypothesis might be true – including why your team is qualified to lead this transaction, similar transactions you’ve led before, and the valuation this company can expect to receive.

Investment Banking Pitch Book Sample PPT and PDF Files and Downloadable Templates

Here are a number of example pitch books in editable Powerpoint (PPT, PPTX) and PDF versions, drawn from some of the case studies within our investment banking courses :

- Jazz Pharmaceuticals – Valuation and Sell-Side M&A Pitch Book (PPT)

- Jazz Pharmaceuticals – Valuation and Sell-Side M&A Pitch Book (PDF)

- KeyBank and First Niagara – FIG M&A Pitch Book (PPT)

- KeyBank and First Niagara – FIG M&A Pitch Book (PDF)

- Netflix – Equity, Debt, and Convertible Bond Financing Pitch Book (PPT)

- Netflix – Equity, Debt, and Convertible Bond Financing Pitch Book (PDF)

Here’s what you can expect in the first few parts of any pitch book, including many examples from actual bank presentations:

The first section of investment banking pitch books introduces your firm’s platform, recent transactions, and team.

You might include stats on your firm’s position in the league tables , or explain its growth story and how it’s different from its competitors. Here are a couple of examples:

You might also write about distribution partnerships and other strategic developments here.

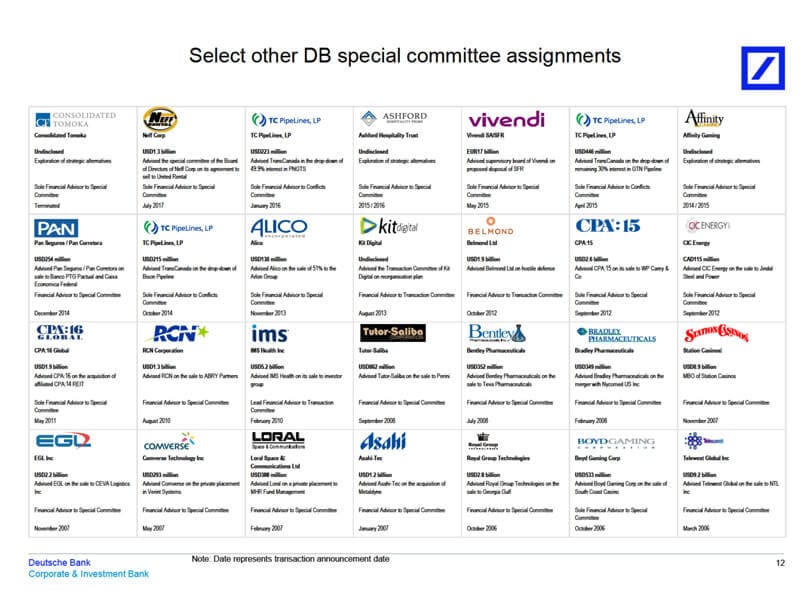

The next section consists of credentials , which include similar transactions your team has completed. Since turnover at banks is high, these lists often include transactions completed by team members when they were at other banks.

Here are a few examples:

These pages look simple, but they can be time-consuming to put together because you need to find the most relevant deals and rearrange elements from other presentations.

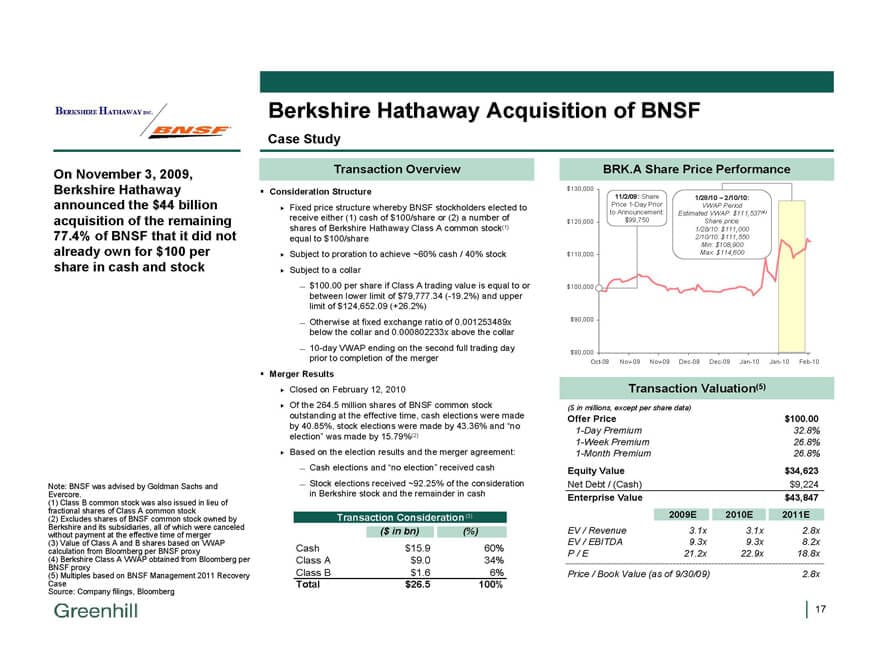

You may also go into more detail on a few deals and devote entire pages to them.

Banks often call these 1-page descriptions “ case studies ,” and you can see a few examples below:

Finally, this section will include a team biography , including previous firms, relevant deals/clients, and education for each member:

Before you move into the specific situation of the company you’re meeting, you’ll usually share some updates on the industry as a whole and recent deal activity in the sector.

Unlike the first part, which was about your team ’s experience, this one is more about general trends that affect everyone.

For example, if a tech startup is considering an initial public offering , you’ll review tech IPOs from the past 6-12 months, explain how they’ve performed, and discuss the types of companies that tend to go public.

Here are a few examples of industry updates:

And here are a few examples of deal/transaction updates:

After these first few sections, which are similar in any pitch book, the structure and content start to differ based on what the bank is pitching.

We’ll look at three broad categories here:

- Sell-side mandates (i.e., convince a company to sell itself)

- Buy-side mandates (convince a company to acquire another company)

- Financing mandates (raise debt or equity).

You’ll start by including a few slides on how your bank would position the company and make it attractive to potential buyers.

For example, if the firm is a traditional services provider with a growing online presence, you might attempt to spin it as a “SaaS” (Software-as-a-Service) company – within reason.

If you’re pitching a large company on a divestiture, you might explain how you’ll make the division sound like more of a standalone entity – meaning that buyers won’t have to spend as much time and money integrating it.

Next, you’ll lay out the company’s valuation and the price it might expect to receive in a sale.

This valuation section might be only 1-2 slides in a short pitch book or 20+ slides in a longer one.

Common elements include the valuation football field , output of a DCF model , comparable public companies , and precedent transactions .

The “football field,” or summary valuation, pages range from simple to more interesting to so complicated they could be eye charts .

Here are a few examples of other valuation-related slides:

It is unusual to include a Contribution Analysis or any M&A analysis in this section unless the deal is highly targeted or has advanced quite far.

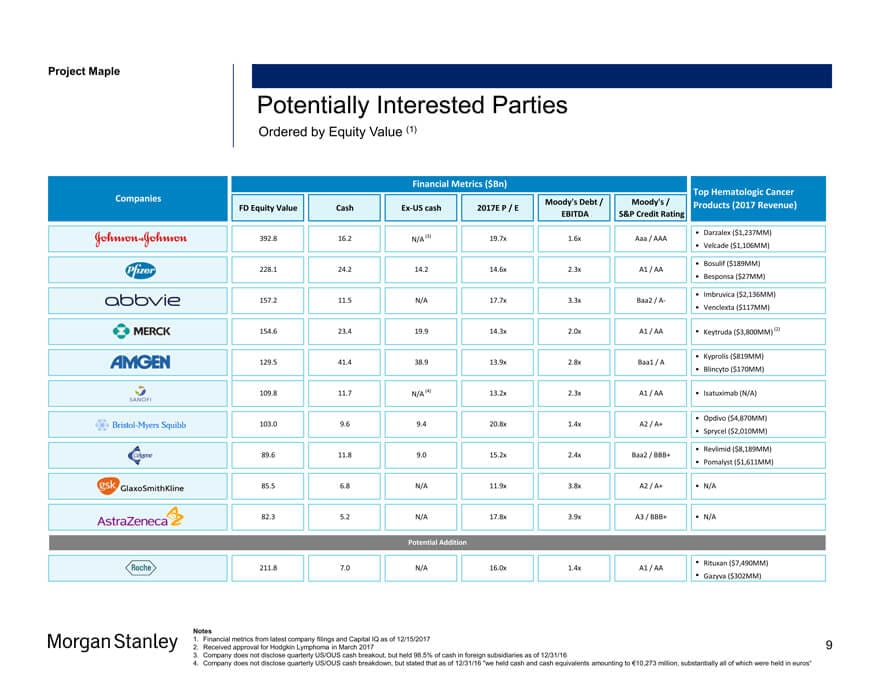

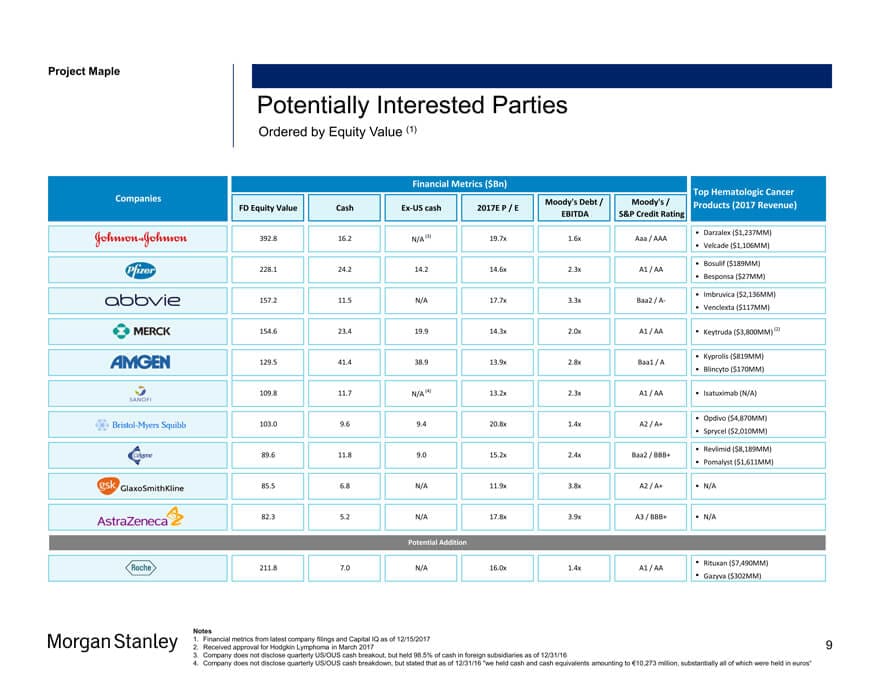

After the valuation section, you’ll discuss “potential buyers,” a list that is sometimes the longest and most time-consuming section of the entire pitch book.

Short summaries aren’t too bad, but if a senior banker wants a full page on each acquirer, you can look forward to a lot of monotonous work gathering the information.

Here are a few shorter examples:

You’ll conclude the pitch book with a summary of your recommendations and the company’s next steps.

For example, you might suggest that the company pursue a targeted sale process with the 5-10 best buyers and aim to complete a deal within 12 months.

These slides tend to be generic ones, used across multiple presentations:

Finally, in longer investment banking pitch books, there is often an Appendix with more detailed models and data, and sometimes even longer lists of potential acquirers.

No one reads this section, but bankers enjoy spending time on unnecessary work (read: evidence of effort).

Investment banking pitch books for buy-side M&A deals follow a similar structure, with a few key differences:

- The “Positioning” part in the beginning might be more about the types of acquisitions the company should pursue and how your bank will help close these deals.

- There may be valuation information, but the purpose will be different: in buy-side deals, you value the buyer to estimate how much a stock issuance to fund the deal might be worth. You might also include quick valuations of potential targets.

- Instead of profiling potential acquirers, you’ll profile potential targets . This list is often longer than the list of potential buyers because a large company could, in theory, choose from hundreds or thousands of potential targets to acquire.

Buy-side M&A pitch books are often shorter than sell-side ones, but they can be more tedious to create due to the longer profile lists.

As a junior banker, you won’t have much input into the acquisition targets that are profiled in these presentations, but senior bankers try to present ideas that:

- Maintain or exceed the firm’s cost of capital.

- Maintain the firm’s competitive advantage.

- Enhance the firm’s ability to serve clients.

- Help the firm expand into high-growth geographies or industries.

Large companies often meet with dozens of bankers per month, so originality can be important as well; many investment banks pitch the same set of acquisition targets repeatedly.

If you present an idea the company has seen 100 times before, they’re unlikely to be excited – but if you find a company they haven’t considered, or you have some exclusive insight, you’ll capture their attention.

It’s tough to find real investment banking pitch books for these transactions because most buy-side M&A deals never close, so the banks do not disclose any of the documents.

But here are a few company profile and associated commentary slides similar to the ones found in buy-side pitch books:

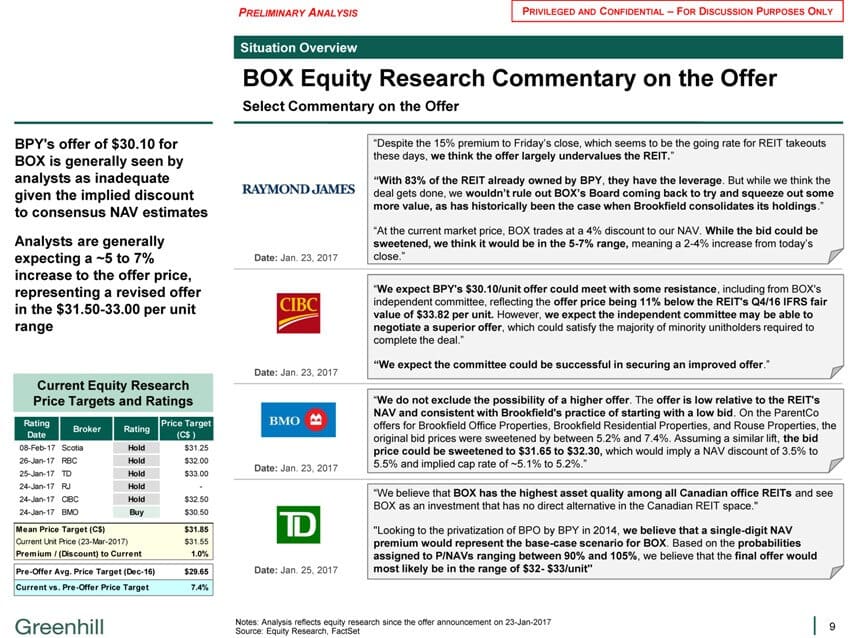

- Brookfield Canada Office Properties by Greenhill

- Banco Santander S.A. by Goldman Sachs

- Side-by-Side Comparison of Buyer and Seller by JP Morgan

- Equity Research Commentary on Buyer’s Offer for Seller by Greenhill

In financing mandates – for equity, debt, and even restructuring deals – there are a few major differences compared with the investment banking pitch books described above:

- No Profiles – You are simply pitching the company on raising capital or restructuring its capital, so there is no need to discuss potential buyers or sellers.

- Financing Models Instead of / or In Addition to Valuation – Valuation still matters for equity and restructuring deals, but you will also have to present additional analyses that are relevant to the deal.

For example, if you’re pitching an IPO, you might show the range of multiples at which the company could go public, the range of proceeds it might receive, and how its value might change after the deal.

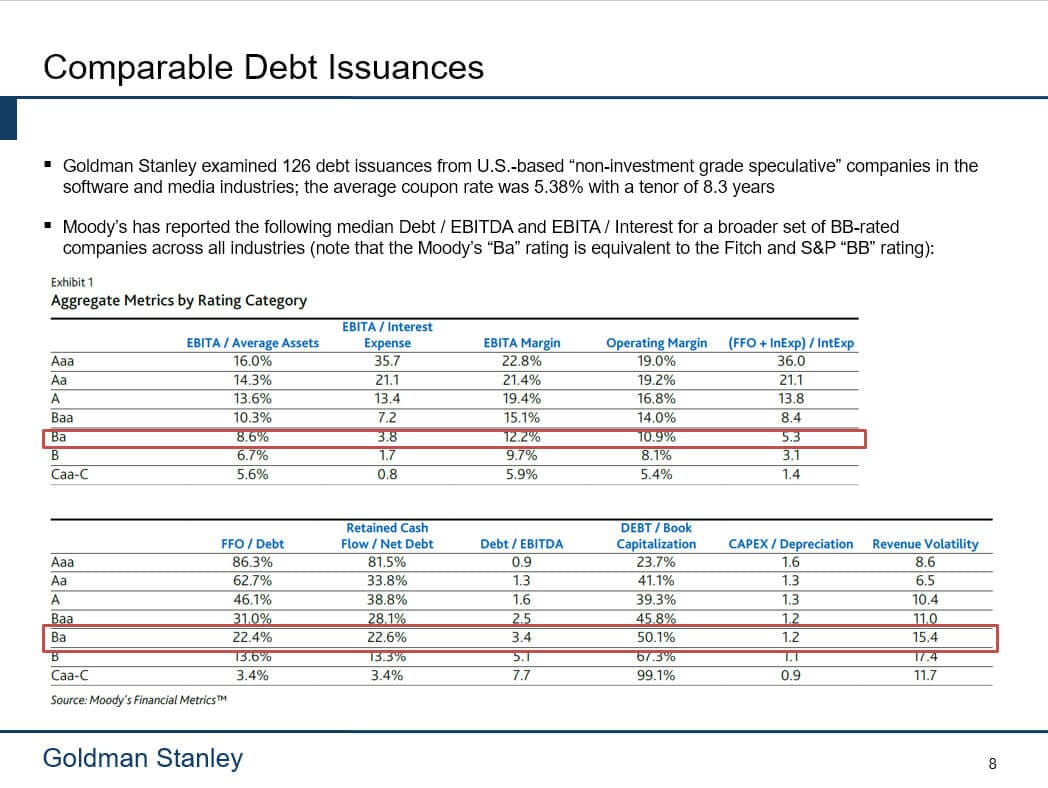

In a debt deal, you’ll show the credit stats and ratios for the company under different scenarios, such as Term Loans vs. Subordinated Notes, and explain which one is best based on that.

For more examples, please see the articles on ECM , DCM , and Restructuring .

Also, see our coverage of IPO valuation models and debt vs. equity analysis :

Many other presentations get labeled “pitch books” even if banks pitching their own services do not create them.

For example, management presentations for pitching clients to potential buyers are often labeled “pitch books.”

However, they’re just extended versions of the Confidential Information Memorandum (CIM) .

And in the EMEA region, they’re the same thing because CIMs tend to be more like presentations than written documents.

Banks also create presentations to deliver Fairness Opinions , update clients on recent buyer or seller activity, and update clients on the status of M&A deal negotiations.

None of these is a pitch book according to the classic definition, but the slides often look similar, and there may be some common elements, such as the valuation section.

Not all pitch books take days or weeks to complete – shorter ones might require only a few hours of work.

But they can easily spiral into never-ending projects that require all-nighters and extraordinary effort to finish, resulting in those legendary investment banking hours .

That’s because of:

- Attention to Detail – You’ll spend a lot of time making sure your punctuation is consistent, that all the footnotes are in the right spots, and that the dates are correct.

- Dozens of Revisions – Senior bankers love to make changes well past the point of diminishing returns. It’s not uncommon to see “v44” at the end of file names.

- Conflicting Changes – The Associate wants one thing, the VP wants another, and the MD wants something else. And if you implement the MD’s version based on seniority, the others may fight back.

- Random Graphic Design Work – This one is more of an issue at boutique firms that lack presentations departments, but sometimes you’ll have to spend time creating fancy visual elements on slides – which end up being useless once your MD changes his mind and rips out those slides.

If you’re new to the industry, you should familiarize yourself with the layout and design elements of pitch books, but you do not need to be an expert on the creation process.

Different banks use different tools and methods, so it might be counterproductive to learn too much in advance.

You should also learn the key PowerPoint shortcuts very well, including how to customize PowerPoint to make it more efficient (see our tutorial on PowerPoint Shortcuts in Investment Banking below):

Everyone knows that Excel is important in finance, but people tend to underestimate PowerPoint – even though most junior bankers spend more time in PowerPoint than Excel.

To learn those efficiently, check out our PowerPoint Pro course , which covers the fundamentals of presentation creation, including how to set up PowerPoint properly in the first place, alignment and formatting tricks, slide organization, pasting in Excel data, and applying the “finishing touches.”

There are also practice exercises for creating deal and company profiles and fixing slides with formatting problems.

If you learn all that and understand the structure and layout of investment banking pitch books, you won’t have much to complain about – even as the other interns and analysts around you are whining.

You might be interested in a detailed tutorial on investment banking PowerPoint shortcuts or this article titled Stock Pitch Guide: How to Pitch a Stock in Interviews and Win Offers .

About the Author

Brian DeChesare is the Founder of Mergers & Inquisitions and Breaking Into Wall Street . In his spare time, he enjoys lifting weights, running, traveling, obsessively watching TV shows, and defeating Sauron.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Read below or Add a comment

10 thoughts on “ Investment Banking Pitch Books: Design, Examples & Templates ”

Hi Brian. Thank you for valuable information!

I’m currently interning. After sitting in a client presentation. What questions should I ask my supervisor regarding the presentation. As we’re going to have a follow up call

I’m not sure I understand your question. The questions you ask are completely dependent on the presentation, so I can’t really answer this without knowing the contents of the presentation.

Its a great article. Appreciate if you also have a link or article for new PE firm Pitch Deck (presenting to investment banks or FIGs), please. Thanks

Sorry, don’t have anything there.

Great article! The information is very helpful and informative. Where and how can I find other examples of sell-side pitchbooks similar to the ones mentioned in this article?

Thanks, Ryan

Thanks. Unfortunately, sell-side pitch books are hard to find because they’re not disclosed publicly. You can find presentations for recently announced deals by Googling the deal’s name and limiting the search to the sec.gov site and going through those results.

Is an information memorandum informally called a teaser or is this something else?

A teaser is a much shorter document, such as a 1-2-page summary of the company’s key benefits, financials, growth opportunities, etc.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Perfect Your PowerPoint Skills

The BIWS PowerPoint Pro course gives you everything you need to complete pitch books and presentations in half the time and move straight to the front of the "top tier bonus" line.

Banking Pitch Deck Guide 2024 Insights (Template + Examples Included)

January 9, 2024

Presentation and Pitch Expert. Ex Advertising.

$100mill In Funding. Bald Since 2010.

Ladies and gentlemen, buckle up for an exhilarating journey through the thrilling world of banking! Now, you may be thinking, “Did he just say ‘thrilling’ and ‘banking’ in the same sentence?” Yes, indeed.

This guide is crafted for banking professionals like you, who understand the importance of a compelling pitch. With insights drawn from industry experts and successful case studies, we’ll navigate you through the nuances of creating a persuasive and effective banking pitch deck.

What’s up! I’m Viktor, a pitch deck expert , presentation expert , and crazy about burgers. I’ve been a pitch deck expert for 10+ years and helped clients raise millions and win pitches, with my unique approach to creating pitch decks.

Whether you’re a startup seeking funding or an established bank pitching a new product, the key to success lies in your ability to captivate your audience. Let’s see what a pitch deck guide for the banking industry is.

Book a free personalized pitch deck consultation and save over 20 hours of your time.

Join hundreds of successful entrepreneurs who’ve transformed their pitch decks with my help.

Let me develop an investor ready deck by using my hands-off approach, which includes: market research, copy, design, financials, narrative and strategy.

One week turnaround time.

The least you will get is 10 actionable tips & strategies to own that next presentation, worth $599, for free.

Crafting a Compelling Narrative: A Central Element of Your Banking Pitch Deck

Varo money pitch deck, what is a banking pitch deck.

A banking pitch deck is a presentation that banking institutions or financial startups use to provide an overview of their services, highlight their unique selling propositions, and demonstrate how they can add value to potential clients or investors.

Just like pitch decks in other industries, a banking pitch deck typically includes sections such as

1. Company Overview: Brief introduction to the bank or financial institution. 2. Mission and Vision: The bank’s purpose and long-term goals. 3. Services: Detailed description of the bank’s services or products. 4. Market Analysis: Overview of the current market and potential opportunities. 5. Competitive Advantage: Unique features that set the bank apart from its competitors. 6. Business Model: How the bank generates revenue. 7. Team : Profiles of key team members. 8. Financials : Key financial data and projections. 9. Ask : What the bank is seeking from potential clients or investors, like partnerships or investments?

The goal is to convince the audience that the bank’s services or products are valuable, differentiated, and worth investing in or using.

How to Create a Banking Pitch Deck Presentation?

Creating an effective banking pitch deck involves several steps. It’s important to remember that the goal is to engage and persuade your audience, whether they’re potential investors, clients, or partners. Here’s a step-by-step guide:

- Understand Your Audience: Knowing who you are pitching to will help tailor the presentation to their interests and concerns.

- Set a Clear Objective : Define what you want to achieve with the pitch. Are you seeking investment, partnerships, or new clients?

- Outline Your Deck: Plan the sections you’ll include, based on the information you need to convey. The typical sections might include an introduction, problem statement, solution, market analysis, competitive analysis, business model, marketing and sales strategy, team, financial projections, and your “ask.”

- Start with a compelling story that introduces the problem you’re solving.

- Clearly explain your solution and why it’s unique.

- Use data to support your points in the market and competitive analysis sections.

- Highlight the qualifications of your team.

- Provide realistic financial projections.

- Keep the design clean and professional.

- Use visuals like charts and infographics to represent data.

- Keep text to a minimum, use bullet points for clarity.

- Stick to a consistent color scheme that aligns with your brand.

- Practice Your Presentation: The delivery of your pitch is as important as the content. Practice until you can present confidently and answer potential questions.

- Incorporate Feedback: If possible, do a few practice runs with trusted colleagues or mentors and make adjustments based on their feedback.

- Prepare for Questions: Anticipate questions you might get and be prepared to answer them clearly and confidently.

Remember, a successful banking pitch deck isn’t just about sharing information; it’s about persuasion. It needs to showcase why your bank or financial institution is a worthy investment or the right solution for potential clients.

The Exact Banking Pitch Deck Structure You Can Steal And Use

If you’re looking to create a banking pitch deck, here’s a tried-and-true slide structure you can follow:

- Company name, logo, tagline

- Contact information

- Description of the problem in the current market

- Statistics and facts to back it up

- Your product/service and how it addresses the problem

- Key features and benefits

- Description of the target market and its size

- Market trends and growth potential

- Screenshots, mockups, or videos of your product/service

- Detailed explanation of how it works

- How you plan to make money

- Pricing strategy and revenue streams

- How you plan to attract and retain customers

- Marketing and distribution strategy

- Overview of competitors and their strengths/weaknesses

- Your unique selling propositions (USPs) and how you differentiate

- Current users/customers, revenue, partnerships, etc.

- Key milestones and achievements

- Revenue and expense projections for the next 3-5 years

- Key assumptions behind your projections

- Key team members and their qualifications

- Advisory board members if any

- How much money you’re raising and what it will be used for

- Equity offered in return

- Potential exit strategies for investors

- Comparable exits in your industry

- Clearly state what you want from investors

- Thank investors for their time

- Provide contact information for further questions

Remember to keep each slide clear and concise, with a focus on visuals to keep your audience engaged. Each slide should serve a purpose and help build your overall story.

Get My Template That Helped Companies Win Millions in Funding

An impressive pitch deck is crucial for catching the attention of potential buyers and investors when presenting a Banking startup.

However, the process of creating an effective deck can seem overwhelming. The good news is that it doesn’t have to be. The key is to know which slides to include. Although templates are readily available on websites like Canva, Slidesgo, and Google Slides, they may not be consistent with your brand.

As a result, you may need to spend countless hours personalizing them to match your brand guidelines. Fortunately, there is a better solution.

My clients have achieved success by utilizing my written template structure, which enables them to create exceptional banking pitch decks in half the time. With this template, they were able to design a deck that accurately reflected their brand.

Why is it important to understand your audience when creating a banking pitch deck?

Understanding your audience is crucial when creating a banking pitch deck for several reasons:

- Tailored Content: Each audience has different needs, concerns, and interests. Investors might be interested in your financial projections and growth strategy, while potential clients might be more concerned with your services and customer experience. By understanding your audience, you can tailor your content to address their specific interests.

- Relevant Language: The level of financial knowledge can vary greatly between audiences. For example, a pitch to industry experts or investors may include more technical jargon, while a pitch to potential clients or the general public should use simpler, more accessible language.

- Effective Persuasion: Knowing your audience allows you to appeal to their motivations, fears, and desires, which can make your pitch more persuasive. For example, if you know your audience values sustainability, you could highlight your bank’s commitment to environmentally friendly practices.

- Engagement : Understanding your audience helps you craft a presentation that resonates with them and keeps them engaged. This includes the use of appropriate humor, stories, and examples.

- Preparedness : Anticipating the questions or concerns your audience might have allows you to prepare suitable responses and incorporate answers into your presentation where appropriate.

In short, understanding your audience is essential for creating a pitch deck that effectively communicates your message and achieves your goals.

Why is it important to craft a compelling story when creating a banking pitch deck?

Crafting a compelling story is essential when creating a banking pitch deck because:

- Engagement : Storytelling is a powerful tool for engaging your audience. Instead of a dry presentation filled with facts and figures, a story can captivate the audience, making your pitch memorable.

- Emotional Connection: Stories often evoke emotions, which can make your pitch more impactful. An emotional connection can make your audience more receptive to your message and more likely to act in your favor.

- Simplicity : A well-crafted story simplifies complex ideas, making them easier for your audience to understand. This is particularly important in banking, where concepts can be complicated.

- Context : A story provides a context for your data, making it more meaningful. For example, instead of just stating that your bank has grown by X%, a story could explain how your team’s hard work and innovative ideas led to that growth.

- Differentiation : A unique story can set your bank apart from competitors. It can highlight your unique journey, values, and vision, showing why your bank is special.

Remember, your story should be relevant and authentic, aligning with your bank’s brand and values. It should weave through your entire pitch deck, providing a coherent narrative that ties all your points together.

How important are design and visuals when creating a banking pitch deck?

Design and visuals are incredibly important when creating a banking pitch deck for several reasons:

- Simplicity and Clarity: A well-designed pitch deck with clear visuals helps simplify complex information. Graphs, charts, and infographics can make data easier to understand and more memorable.

- Engagement : Visually appealing slides can grab attention and keep your audience engaged throughout the presentation. Good design can also enhance the storytelling aspect of your pitch, making it more impactful.

- Professionalism : High-quality design and visuals project a sense of professionalism and credibility. They show that you’ve invested time and effort into your presentation, which can create a positive impression.

- Branding : Design elements like color schemes, fonts, and logos help reinforce your brand identity throughout the presentation.

- Memory and Recall: People generally remember visuals better than text. By including relevant images, diagrams, or charts, you increase the chance that your audience will remember key points from your presentation.

Hold on. You might want to check my list on the best presentation books. Why?

It’s 1O crucial books that will help you improve the design and structure of your presentations, besides improving its delivery. Check it out below.

However, it’s crucial to avoid overloading your slides with too many visuals or design elements, as this can distract from your message. The key is to use design and visuals to enhance your message, not overshadow it.

How to prepare for questions and objections when presenting a banking pitch deck?

Preparing for questions and objections is essential when presenting a banking pitch deck. Here are some tips to help you be prepared:

- Anticipate Possible Questions: Consider your audience and what questions they might have based on the information you present. This could include questions about your financial projections, competition, regulatory issues, or anything else relevant to your pitch.

- Research and Gather Data: Be ready to back up your answers with data and research. This shows that you’ve done your homework and increases your credibility.

- Practice Q&A Sessions: Do a practice run with colleagues or mentors, and ask them to play devil’s advocate. This will help you refine your answers and feel more confident when facing questions.

- Be Honest and Transparent: If you don’t know the answer to a question, don’t try to fake it. Instead, admit that you don’t know but will follow up with a response later. Honesty and transparency build trust with your audience.

- Stay Calm and Confident: Be confident in your pitch and your ability to answer questions. Even if you face a challenging question or objection, stay calm and composed. Take a deep breath, listen carefully to the question, and respond thoughtfully.

- Reinforce Your Key Messages: Use questions and objections as an opportunity to reinforce your key messages. For example, if someone questions your business model, use the opportunity to reiterate why it’s effective.

By preparing for questions and objections, you demonstrate that you’re thoughtful and knowledgeable about your bank’s services and products. This can help build trust with your audience and increase your chances of success.

What nobody will tell you: Crucial considerations to keep in mind when developing your restaurant pitch deck and business

10 insights. These are things no advisor, startup event organizer or coach will tell you for free. We’ve done the research and combined it with our experience to give you these insights with no strings attached.

Market Analysis and Trends in Banking: Key Insights for Your Pitch Deck

Importance in Pitch Deck Development: In the fast-paced world of banking, a pitch deck must not only demonstrate your business’s value proposition but also reflect a deep understanding of the current market landscape. Incorporating market analysis and trends in your pitch deck serves multiple purposes:

- Establishes Credibility: Showcases your knowledge of the banking sector, which builds trust with your audience.

- Highlights Opportunities: Identifies gaps or emerging trends that your business can capitalize on.

- Guides Strategy: Informs your strategic direction, ensuring it aligns with the market realities.

Research-Based Insights: Recent studies and reports indicate several key trends in the banking sector:

- Digital Transformation: The rapid shift towards digital banking solutions, driven by customer demand for convenience and efficiency.

- Regulatory Changes: Ongoing adaptations to comply with evolving global financial regulations.

- Sustainable Banking: Increasing focus on sustainable practices and ESG (Environmental, Social, and Governance) factors in investment.

Actionable Steps:

- Conduct In-Depth Market Research: Gather data on current banking trends, customer behaviors, and competitor strategies. Utilize reputable sources like industry reports, financial news, and market analysis studies.

- Analyze Customer Demographics and Preferences: Understand the changing needs and preferences of banking customers, focusing on how digital innovations are reshaping customer expectations.

- Identify Emerging Opportunities: Look for gaps in the market that your business can address. For instance, are there underserved customer segments or unmet needs in digital banking?

- Evaluate the Impact of Regulations: Assess how recent regulatory changes affect your business model and how you can turn compliance into a competitive advantage.

- Incorporate Sustainability: Discuss how your banking solutions align with sustainable practices, catering to the growing demand for responsible banking.

- Use Data to Tell a Story: Present this analysis in your pitch deck through compelling data visualizations and narratives that connect these trends to your business proposition.

- Forecast Future Trends: Offer a forward-looking perspective, predicting how these trends might evolve and how your business is poised to adapt.

By integrating a thorough market analysis and banking trends into your pitch deck, you can demonstrate a sophisticated understanding of the industry, which is crucial for attracting investors, partners, or clients in the banking sector. This approach not only showcases your business acumen but also positions your proposition as both relevant and forward-thinking in the dynamic world of banking.

Understanding Financial Regulations: Essential Insights for Your Banking Pitch Deck

Significance in Crafting a Banking Pitch Deck: In the banking industry, navigating the complex landscape of financial regulations is not just about compliance; it’s a strategic imperative. Incorporating a clear understanding of financial regulations into your banking pitch deck demonstrates to your stakeholders – be it investors, partners, or regulators – that you are committed to operating within the legal framework and are mindful of the risks and obligations involved. This aspect is crucial for:

- Building Trust and Credibility: Shows your commitment to legal and ethical banking practices.

- Risk Mitigation: Highlights your proactive approach to managing regulatory risks.

- Strategic Decision Making: Ensures your business strategies are aligned with regulatory requirements and anticipates changes in the legal landscape.

Research-Backed Insights: Key regulatory trends and considerations in the banking sector include:

- Global Regulatory Frameworks: Understanding the Basel III and IV frameworks, which set global standards for bank capital adequacy, stress testing, and liquidity risks.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations: Increased emphasis on combating financial crime and ensuring customer due diligence.

- Data Protection and Privacy Laws: Compliance with regulations like GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act) in handling customer data.

- Comprehensive Regulatory Analysis: Research and document the specific regulatory requirements relevant to your banking niche. Utilize authoritative sources like government publications, legal analysis, and industry reports.

- Integrate Regulatory Compliance into Business Strategy: Clearly articulate in your pitch deck how your banking services or products comply with existing regulations and how you plan to adapt to upcoming changes.

- Risk Assessment and Management: Include a section in your pitch deck on how you identify, assess, and manage regulatory risks. This can involve compliance checks, internal audits, and regular monitoring.

- Showcase Compliance as a Competitive Advantage: Turn regulatory compliance into a unique selling proposition (USP), especially if your solutions offer innovative ways to meet these regulations more effectively or efficiently than competitors.

- Prepare for Future Regulatory Changes: Demonstrate foresight by discussing potential future regulatory changes and how your business plans to stay ahead. This could involve engaging with regulatory bodies or investing in compliance technology.

- Data Security and Privacy Measures: Detail your approach to protecting customer data, aligning with privacy laws and building customer trust.

- Visual Representation of Compliance Pathways: Use infographics or flowcharts in your pitch deck to visually represent your compliance roadmap and how it integrates with your overall business strategy.

Incorporating a detailed understanding of financial regulations into your banking pitch deck reinforces the message that your business is not only compliant but also resilient and forward-thinking in a regulatory landscape that is constantly evolving. This approach can significantly elevate the perceived value and credibility of your banking proposition.

Technology Integration in Banking Services: Strategic Insights for Your Pitch Deck

Relevance in Banking Pitch Deck Development: Incorporating technology integration into your banking pitch deck is critical, as it demonstrates your understanding of the digital transformation in the banking sector. In today’s tech-driven world, banks and financial institutions are expected to offer innovative, secure, and user-friendly digital services. Showcasing how your proposal leverages technology effectively can:

- Differentiate Your Offering: Highlights your innovative approach in a market where digital services are increasingly valued.

- Enhance Customer Experience: Indicates your commitment to providing seamless and efficient banking experiences.

- Showcase Efficiency and Security: Demonstrates how technology improves operational efficiency and enhances security measures.

Research-Backed Insights: Recent trends and technological advancements in banking include:

- Digital Banking and Mobile Solutions: A surge in demand for digital banking services, especially mobile banking apps.

- Blockchain Technology: Implementation of blockchain for secure and transparent transactions.

- Artificial Intelligence and Machine Learning: AI-driven solutions for personalized banking experiences and improved risk management.

- Cybersecurity Enhancements: Advanced cybersecurity measures to protect sensitive financial data.

- Detail Specific Technologies Used: Explain the specific technologies you plan to integrate, such as AI, blockchain, or cloud computing. Show how these technologies address specific banking challenges or customer needs.

- Highlight Benefits of Tech Integration: In your pitch deck, clearly articulate the benefits of technology integration, such as improved customer service, enhanced security, or operational efficiency.

- Showcase User Experience (UX) Design: Present the design and functionality of your digital banking interfaces, emphasizing ease of use and accessibility.

- Data-Driven Decision Making: Illustrate how the use of technology enables better data analysis and decision-making processes in banking operations.

- Compliance and Security Measures: Detail the security protocols and compliance measures in place, especially when implementing new technologies.

- Innovative Use Cases: Provide examples or case studies where technology integration has led to tangible improvements in banking services.

- Future Tech Roadmap: Outline your future plans for technology adoption and innovation, showing you are prepared for ongoing digital transformation in the banking industry.

By focusing on technology integration in your banking pitch deck, you effectively communicate your commitment to innovation and modernization in the banking sector. This approach not only aligns with current industry trends but also positions your offering as a forward-thinking solution in a highly competitive market.

Customer Experience and Engagement Strategies: Elevating Your Banking Pitch Deck

Importance in Banking Pitch Deck Development: In the banking sector, where products and services are often complex and highly regulated, customer experience (CX) and engagement become crucial differentiators. Integrating a clear strategy for CX and engagement in your pitch deck can significantly elevate your proposition by:

- Differentiating Your Brand: Demonstrating a customer-centric approach sets you apart in a crowded market.

- Building Customer Loyalty: Good CX leads to higher customer satisfaction and loyalty, which is key for long-term success.

- Driving Revenue Growth: Enhanced customer experience can directly impact revenue, as satisfied customers are more likely to use additional services.

Research-Based Insights: Key findings in banking CX include:

- Personalization: Customers expect banking services tailored to their individual needs.

- Omnichannel Experience: Seamless experience across digital and physical channels is highly valued.

- Tech-Driven Service Models: Adoption of technologies like AI for personalized recommendations and automated customer service.

- Map Customer Journeys: Detail the customer journey for your banking services, identifying touchpoints where experience can be enhanced.

- Implement Personalization: Explain how your services can be tailored to individual customer needs, using data analytics for personalized product offerings.

- Omnichannel Integration: Show how your banking services provide a cohesive experience across multiple channels (online, mobile, in-branch).

- Leverage AI and Automation: Describe how AI and automation technologies are used to improve customer service and operational efficiency.

- Focus on User Interface (UI) and User Experience (UX): Highlight the design and usability of your digital banking platforms, ensuring they are intuitive and user-friendly.

- Customer Feedback Loops: Incorporate mechanisms for regularly gathering and acting on customer feedback to continuously improve CX.

- Training and Development: Outline training programs for staff to ensure high-quality customer interactions at every touchpoint.

- Measure and Showcase CX Metrics: Use metrics like Net Promoter Score (NPS) or Customer Satisfaction (CSAT) scores in your pitch deck to demonstrate the effectiveness of your CX strategies.

- Case Studies or Testimonials: Include real-life examples or customer testimonials to illustrate the success of your CX initiatives.

By focusing on customer experience and engagement strategies in your banking pitch deck, you emphasize your commitment to meeting and exceeding customer expectations. This approach not only showcases a customer-first mentality but also indicates that your banking services are designed with the end user’s needs and satisfaction as a top priority.

Risk Management and Mitigation Strategies: Core Elements for Your Banking Pitch Deck

Criticality in Banking Pitch Deck Creation: In the banking industry, effective risk management is not just a regulatory requirement but a strategic asset. Showcasing robust risk management and mitigation strategies in your pitch deck signals to stakeholders that your bank is capable of identifying, assessing, and managing potential risks. This is vital for:

- Building Stakeholder Confidence: Demonstrates to investors, regulators, and clients that you are prepared to handle uncertainties effectively.

- Ensuring Sustainable Growth: Effective risk management is key to the long-term stability and growth of the bank.

- Compliance and Resilience: Highlights your bank’s commitment to compliance and its resilience against financial shocks.

Research-Based Insights: Key focus areas in banking risk management include:

- Credit Risk Assessment: Innovations in credit scoring and risk assessment techniques.

- Market and Liquidity Risk: Tools and strategies for managing market fluctuations and liquidity challenges.

- Operational Risk Management: Addressing risks arising from internal processes, systems, and people.

- Cybersecurity Threats: Evolving strategies to combat increasing cyber threats in the digital banking landscape.

- Risk Identification and Assessment: Clearly articulate in your pitch deck how your bank identifies and assesses various types of risks, using state-of-the-art tools and methodologies.

- Risk Mitigation Strategies: Detail the specific strategies and tools your bank employs to mitigate identified risks, such as diversification, hedging, or insurance.

- Technology Integration in Risk Management: Explain how technology, like AI and machine learning, is used in risk prediction and management.

- Training and Awareness Programs: Highlight programs aimed at increasing risk awareness and management skills among your staff.

- Regulatory Compliance: Showcase how your risk management strategies align with regulatory requirements, emphasizing your commitment to compliance.

- Real-Time Monitoring and Reporting: Describe systems in place for continuous monitoring and reporting of risk exposures.

- Scenario Analysis and Stress Testing: Detail how your bank conducts scenario analyses and stress tests to prepare for potential adverse events.

- Cybersecurity Measures: Elaborate on the cybersecurity protocols and measures implemented to protect against digital threats.

- Case Studies or Examples: Provide examples where your risk management strategies successfully mitigated risks, underscoring their effectiveness.

By focusing on risk management and mitigation strategies in your banking pitch deck, you effectively communicate your bank’s capability to handle the complex risk environment of the financial sector. This approach reassures stakeholders of your bank’s stability, resilience, and forward-thinking mindset, which are essential in today’s dynamic financial landscape.

Sustainable and Ethical Banking Practices: Enhancing Your Banking Pitch Deck

Relevance in Banking Pitch Deck Presentation: Incorporating sustainable and ethical banking practices into your pitch deck is crucial in today’s socially conscious market. It demonstrates to investors, clients, and regulators that your bank is not only focused on financial success but also committed to positive social and environmental impacts. This approach is essential for:

- Aligning with Global Trends: Reflecting a growing global emphasis on sustainability in the financial sector.

- Building Trust and Reputation: Showcasing ethical practices builds trust with customers and strengthens your brand reputation.

- Attracting Socially Conscious Investments: Appealing to a growing segment of investors who prioritize environmental, social, and governance (ESG) criteria.

Research-Based Insights: Emerging trends and key areas in sustainable and ethical banking include:

- Green Financing: Providing loans and funds for environmentally friendly projects.

- Social Responsibility Initiatives: Programs focused on social welfare, community development, and financial inclusion.

- Governance and Transparency: Adhering to high standards of corporate governance and transparency in operations.

- Detail Sustainable Banking Products: Include in your pitch deck specific products and services that support environmental sustainability, such as green bonds or sustainable investment funds.

- Showcase Social Responsibility Efforts: Highlight initiatives or programs that demonstrate your bank’s commitment to social responsibility, community engagement, and financial inclusion.

- Emphasize Ethical Practices: Explain your bank’s approach to ethical decision-making, fair lending practices, and avoidance of financing harmful industries.

- Incorporate ESG Criteria: Discuss how your bank integrates Environmental, Social, and Governance (ESG) criteria into its operations and decision-making processes.

- Demonstrate Compliance with Sustainable Regulations: Show your adherence to any relevant sustainable banking regulations or guidelines, both local and international.

- Sustainability Reporting: Include sustainability reports or metrics in your pitch deck to quantify your bank’s impact on environmental and social factors.

- Leverage Technology for Sustainability: Highlight how digital banking solutions contribute to reduced environmental impact, such as paperless operations or energy-efficient data centers.

- Community Engagement and Partnerships: Describe partnerships with NGOs or community organizations to enhance your social impact.

- Case Studies or Success Stories: Provide examples of successful sustainable banking initiatives or projects your bank has undertaken.

By emphasizing sustainable and ethical banking practices in your pitch deck, you communicate a forward-thinking and responsible approach. This not only aligns with current trends and customer expectations but also positions your bank as a leader in the movement towards a more sustainable and equitable financial sector.

Effective Financial Forecasting and Modeling: A Key Component of Your Banking Pitch Deck

Significance in Banking Pitch Deck Development: Effective financial forecasting and modeling are fundamental in a banking pitch deck, as they provide a quantifiable and realistic projection of your bank’s financial future. This is critical for:

- Demonstrating Financial Viability: Convincingly projecting the bank’s growth, profitability, and stability.

- Informing Strategy: Guiding strategic decisions based on forecasted financial outcomes.

- Building Investor Confidence: Giving potential investors a clear view of expected returns and financial health.

Research-Based Insights: Financial forecasting in banking typically involves:

- Advanced Analytical Tools: Utilization of sophisticated software for more accurate and detailed financial projections.

- Scenario Analysis: Considering various economic scenarios to understand potential impacts on the bank’s finances.

- Regulatory Impact Assessment: Evaluating how regulatory changes could affect future financial performance.

- Utilize Robust Forecasting Tools: Employ advanced financial modeling software to ensure accuracy and depth in your forecasts.

- Incorporate Realistic Assumptions: Base your financial forecasts on realistic and well-researched assumptions about market conditions, interest rates, and regulatory environments.

- Present Multiple Scenarios: Include best-case, worst-case, and most-likely scenarios in your financial models to demonstrate preparedness for various market conditions.

- Align Forecasts with Business Strategy: Ensure that your financial projections align with your overall business strategy and objectives.

- Regularly Update Financial Models: Reflect changes in the market, economy, and regulatory environment to keep your forecasts relevant.

- Detail Revenue Streams and Cost Structures: Clearly outline your bank’s revenue streams and cost structures to provide a comprehensive understanding of your financial model.

- Include Key Financial Metrics: Highlight important financial metrics such as Return on Equity (ROE), Net Interest Margin (NIM), and Loan-to-Deposit ratio in your pitch deck.

- Sensitivity Analysis: Perform sensitivity analyses to understand how changes in key variables impact your financial forecasts.

- Graphical Representations: Use charts and graphs to visually represent financial data, making it easier to comprehend and more impactful.

- Expert Validation: Consider having your financial models reviewed or validated by financial experts to add credibility.

By focusing on effective financial forecasting and modeling in your banking pitch deck, you effectively communicate a well-founded, strategic, and financially sound vision of your bank. This approach not only adds credibility to your pitch but also demonstrates a thorough understanding of the financial dynamics and drivers of success in the banking industry.

Competitive Analysis in the Banking Sector: Enhancing Your Pitch Deck’s Impact

Importance in Banking Pitch Deck Creation: A comprehensive competitive analysis is a cornerstone of a successful banking pitch deck. It demonstrates an understanding of your bank’s position in the market and helps in identifying unique selling points and areas for improvement. This analysis is crucial for:

- Strategic Positioning: Understanding where your bank stands in relation to competitors helps in crafting a distinctive market position.

- Identifying Market Gaps: Spotting opportunities that competitors haven’t capitalized on.

- Tailoring Products and Services: Aligning your offerings more closely with customer needs, especially where competitors fall short.

Research-Based Insights: In competitive analysis for the banking sector, consider:

- Market Share Analysis: Understanding the distribution of market share among competitors.

- Service Offerings Comparison: Evaluating how your products and services stack up against those of your competitors.

- Technology Utilization: Assessing how competitors are leveraging technology to enhance customer experience and operational efficiency.

- Customer Service Strategies: Comparing approaches to customer service and relationship management.

- Identify Key Competitors: List your primary competitors, including both traditional banks and emerging fintech companies.

- Analyze Competitor Strengths and Weaknesses: Conduct a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) for each competitor, focusing on areas such as financial performance, product offerings, technological adoption, customer service, and brand reputation.

- Benchmark Your Bank: Compare your bank’s performance against competitors in key areas such as interest rates, fees, service quality, digital banking capabilities, and customer satisfaction.

- Customer Feedback and Reviews: Analyze customer feedback and reviews of competitors to identify their pain points and areas where your bank can excel.

- Monitor Competitor Movements: Keep track of any new product launches, marketing campaigns, or strategic moves by competitors.

- Assess Market Trends: Understand broader market trends and how competitors are responding to these trends.

- Highlight Unique Differentiators: Use this analysis to pinpoint and emphasize your bank’s unique selling propositions in your pitch deck.

- Visual Data Representation: Incorporate charts, graphs, and tables to visually compare and contrast your bank with competitors.

- Include Actionable Insights: Based on your analysis, propose specific strategies or initiatives that your bank can undertake to gain a competitive edge.

- Regular Updates: Continuously update your competitive analysis to reflect the latest market developments and shifts in competitive dynamics.

By integrating a thorough competitive analysis into your banking pitch deck, you provide evidence of a strategic, well-informed approach to your bank’s market positioning. This not only reinforces the credibility of your pitch but also showcases your proactive stance in navigating the competitive landscape of the banking sector.

Investor Relations and Fundraising Strategies: Key Focus for Your Banking Pitch Deck

Critical Importance in Banking Pitch Deck Development: In the banking sector, effective investor relations and fundraising strategies are vital components of a pitch deck. They demonstrate your bank’s ability to not only attract but also maintain fruitful relationships with investors. This is essential for:

- Securing Capital: Essential for growth, expansion, or launching new initiatives.

- Building Investor Confidence: Showing potential investors that you have a clear, viable plan for using and managing their funds.

- Long-Term Relationship Building: Establishing and maintaining ongoing relationships with investors, crucial for future funding rounds.

Research-Based Insights: Key areas to focus on include:

- Investment Attraction: Strategies to make your bank appealing to investors.

- Effective Communication: Best practices for transparent and regular communication with investors.

- Return on Investment (ROI): Demonstrating a clear path to profitability and ROI for investors.

- Define Your Value Proposition: Clearly articulate what makes your bank a valuable investment opportunity. Highlight unique aspects like innovative banking services, technology adoption, or strong market positioning.

- Develop a Clear Funding Plan: Outline how you intend to use the raised capital. Be specific about how the funding will contribute to growth, product development, or market expansion.

- Showcase Financial Health: Include detailed financial statements and projections to provide a clear picture of your bank’s financial health and growth potential.

- Investor Targeting: Identify and target potential investors who have a history of investing in the banking sector or show interest in your specific banking niche.

- Communication Strategy: Develop a strategy for regular and transparent communication with investors, including updates on progress, challenges, and market changes.

- ROI Projections: Offer realistic projections of return on investment, supported by data and market analysis.

- Demonstrate Compliance and Stability: Highlight your bank’s compliance with financial regulations and stability in the face of market fluctuations, as these are key concerns for investors.

- Use of Technology in Investor Relations: Utilize digital tools and platforms for efficient investor communications and updates.

- Leverage Success Stories: Share past successes or case studies where investment led to significant growth or innovation in your bank.

- Engage with Investor Feedback: Encourage and incorporate feedback from potential investors to refine your approach and offerings.

Incorporating these investor relations and fundraising strategies into your banking pitch deck will demonstrate to potential investors that your bank is not only a viable investment opportunity but also committed to maintaining strong, transparent, and mutually beneficial relationships with its investors. This approach is crucial in securing the trust and capital necessary to drive your bank’s success and growth.

Significance in Banking Pitch Deck Design: Crafting a compelling narrative in your banking pitch deck goes beyond presenting facts and figures; it involves telling a story that resonates with your audience. This is critical because:

- Engaging Your Audience: A compelling narrative captures and retains the attention of investors or stakeholders.

- Emotional Connection: Stories create an emotional connection, making your pitch more memorable and impactful.

- Simplifying Complex Information: A good narrative can make complex banking concepts more understandable and relatable.

Research-Based Insights: Studies in marketing and communication suggest that storytelling is a powerful tool for persuasion and engagement. In the context of banking, this involves:

- Customer Success Stories: Illustrating how your services have positively impacted customers.

- Historical Milestones: Sharing your bank’s journey, challenges overcome, and successes achieved.

- Vision and Future Goals: Painting a picture of where your bank is headed and the impact it aims to make.

- Start with Your ‘Why’: Begin your narrative by explaining why your bank exists. What problem are you solving? What is your mission?

- Personalize Your Story: Include personal anecdotes or stories from team members or clients that give a human face to your bank.

- Create a Clear Story Arc: Structure your presentation like a story, with a beginning (where you started or what you saw as a market need), a middle (how you’re meeting that need), and an end (where you see your bank in the future).

- Use Visual Storytelling: Enhance your narrative with visuals, such as charts, graphs, and images, that complement and reinforce your story.

- Highlight Customer Testimonials: Incorporate testimonials or case studies that showcase how your bank has made a difference.

- Be Authentic: Ensure your story is genuine and reflects your bank’s values and culture.

- Link Narrative to Data: While storytelling is key, back up your narrative with data and statistics that add credibility.

- Address Challenges and Solutions: Discuss challenges your bank has faced and how you’ve overcome them, showing resilience and problem-solving capabilities.

- Future Vision: Conclude with a compelling vision of the future, outlining how your bank will continue to innovate and grow.

- Practice and Refine: Rehearse your pitch to ensure that the narrative flows smoothly and resonates with your audience.

By weaving a compelling narrative throughout your banking pitch deck, you engage your audience on a deeper level, making your presentation not just informative but also memorable. This approach helps to differentiate your bank in a competitive market and can be a decisive factor in winning the support and investment you seek.

Use these insights and make a winning pitch. If you want to talk about them, reach out to me and book a call.

How to creatively pitch your banking startup? 27 ways

Pitching a banking startup pitch deck creatively requires a blend of innovation, surprise, and engagement. Here are some novel and slightly unconventional ideas to make a memorable impression on stage:

- Augmented Reality Presentation: Use augmented reality (AR) technology to bring elements of your pitch deck to life. As you talk about your banking startup’s features, AR can visually demonstrate these in real-time, creating an immersive experience for your audience.

- Interactive Data Visualization: Turn complex financial data into an interactive experience. Allow audience members to engage with live data visualizations through touch screens or mobile devices, making them part of the presentation.

- ‘Day in the Life’ Simulation: Create a short simulation or role-play scenario that takes the audience through a ‘day in the life’ of your typical customer before and after using your banking services. This can highlight pain points and your solutions in a relatable way.

- Flash Mob or Theatrical Performance: Begin with a surprise flash mob or a short theatrical skit that metaphorically represents the problem your startup is solving. This unexpected start can be a great conversation starter and attention-grabber.

- Personal Storytelling with a Twist: Share a personal story that’s relevant to your startup, but add a twist – perhaps it’s told in reverse, starts in the middle, or is interspersed with audience questions.

- Virtual Reality Demo: If your banking startup involves a unique user interface or experience, let audience members try it firsthand through a VR demonstration. This immersive experience can be far more impactful than simply talking about it.

- Gamification of Your Pitch: Turn your pitch into a game where audience members participate. For example, use a quiz format where each correct answer reveals a new aspect of your startup.

- ‘Choose Your Own Adventure’ Scenario: Let the audience choose what they want to learn about next through live polling. This interactive approach makes the presentation dynamic and audience-centric.

- Unexpected Props or Costumes: Use props or costumes that align with your startup’s theme. For example, if your startup focuses on saving time, use a giant clock or hourglass on stage.

- Live Customer Testimonials: Bring in a real customer to share their experience. A genuine, unscripted testimonial can be incredibly powerful.

- Music or Song Integration: If you’re musically inclined, turn part of your pitch into a song or integrate background music that aligns with your message.

- Problem-Solving Workshop: Turn part of your pitch into an interactive workshop where the audience helps ‘solve’ a problem that your startup addresses.

- Time Capsule Concept: Present a “time capsule” to the audience, filled with items that represent the future of banking as envisioned by your startup. Reveal each item during your pitch to symbolically demonstrate your vision and innovations.

- Reverse Pitch: Start your presentation by outlining common problems in the banking industry, then invite the audience to suggest solutions. Gradually reveal how your startup addresses these issues much more effectively, turning the audience’s ideas into a lead-in for your own solutions.

- Interactive Storybook: Create a digital or physical storybook that illustrates your startup’s journey or the customer journey. Turn the pages as your pitch progresses, using storytelling to engage the audience.

- Banking Fashion Show: If your startup has a unique brand or aesthetic, showcase it through a brief, thematic fashion show. For instance, models could represent different customer personas or banking services in a stylized manner.

- ‘A Day Without Our Service’ Exhibit: Set up a small, interactive exhibit that simulates the inconveniences or challenges of traditional banking, contrasting this with the ease and efficiency of your service.

- Escape Room Challenge: Design a mini escape room experience that metaphorically represents navigating the complexities of traditional banking. Show how your startup simplifies this ‘escape.’

- Silent Disco with a Twist: Give the audience wireless headphones that play different narratives or aspects of your pitch. This could symbolize personalized banking experiences or different customer journeys.

- Live Art Installation: Have an artist create a live painting or sculpture during your pitch that encapsulates the essence of your startup. This evolving artwork can serve as a powerful metaphor for innovation and growth.

- Banking Delivered: Mimic a delivery service during your pitch. “Deliver” packages to audience members that contain samples, brochures, or gadgets representing your services.

- Mock News Broadcast: Create a mock live news segment reporting on the ‘future’ success of your startup, complete with interviews, customer feedback, and expert opinions.

- Interactive Holograms: Use holographic displays to showcase your banking technology, allowing audience members to interact with the holograms for a futuristic feel.

- Mobile App Scavenger Hunt: If your startup has a mobile app, create a scavenger hunt that attendees can play on their phones, leading them through the features of your app.

- Personalized Banking Journey Maps: Create individualized journey maps for audience members, showing how your startup could specifically benefit them in various banking scenarios.

- Food for Thought: Cater the event with themed snacks or drinks that tie into your banking startup’s unique selling points or brand identity.

- Incorporate Magic Tricks: Use sleight-of-hand or other magic tricks to metaphorically demonstrate how your startup solves banking problems as if by magic.

Remember, while creativity is key, it’s also important to ensure that these ideas align with your brand and message. The goal is to be memorable but also to clearly communicate your startup’s value proposition.

What are the best practices when creating a banking pitch deck?

Here are some best practices to follow when creating a banking pitch deck:

- Know Your Audience: Understand your audience and tailor your presentation to their interests and needs.

- Tell a Compelling Story: Create a narrative that ties all your points together, engages your audience, and makes your pitch memorable. If you want to enhance your storytelling skills, take a look at this compilation of best books for pitching . These authors have earned billions of dollars by crafting compelling narratives during their pitches and are now revealing their techniques to you.

- Keep It Simple: Use simple language, clear visuals, and concise messaging to ensure your audience can easily understand your points.

- Show Your Unique Value Proposition: Highlight what sets your bank apart from competitors and demonstrate how your services or products add value.

- Provide Evidence: Use data and research to back up your claims and demonstrate the potential of your business.

- Be Professional: Use a consistent design and branding, and ensure your presentation is free of errors or distractions.

- Practice and Prepare: Practice your pitch, anticipate questions and objections, and be ready to back up your points with data and research.

- Focus on Benefits: Emphasize the benefits of your bank’s services or products rather than just the features.

- Be Authentic: Be true to your bank’s values, brand, and culture throughout your pitch.

- Close Strong: End your pitch with a strong call to action, whether that’s a request for investment, partnership, or simply to use your services.

By following these best practices, you can create a banking pitch deck that effectively communicates your message, engages your audience, and increases your chances of success.

Banking Pitch Deck Examples From Successful Businesses

Here are a few examples of banking pitch decks that you can use as a reference:

Nubank Pitch Deck

Nubank is a Brazilian fintech startup that provides digital banking services. Their pitch deck focuses on how they’re disrupting the traditional banking industry and showcases their unique business model.

Simple Pitch Deck

Simple is a digital banking platform that offers a range of financial services. Their pitch deck highlights their customer-centric approach, their unique value proposition, and their commitment to transparency.

Alipay Pitch Deck

Alipay is a mobile payment platform based in China. Their pitch deck emphasizes their position as a market leader in the digital payments space and how they’re tapping into China’s rapidly growing consumer base.

Revolut Pitch Deck

Revolut is a UK-based fintech startup that offers digital banking services. Their pitch deck highlights their user growth, their unique features, and their focus on innovation.

Varo Money is a US-based fintech startup that offers mobile banking services. Their pitch deck emphasizes their mission to help people improve their financial well-being and their commitment to providing a seamless user experience.

Note that these examples are just a starting point and should be adapted to fit your bank’s unique value proposition, brand, and goals.

Questions That Investors Ask Banking Pitch Deck Owners:

Investors may ask a wide range of questions during a banking pitch deck presentation. Here are some common questions that investors may ask:

- What is your unique value proposition? Investors want to know what sets your bank apart from competitors and why customers would choose your services.

- How big is the market opportunity? Investors want to understand the size of the market opportunity and the potential for growth.

- What is your business model? Investors want to know how your bank makes money and how it plans to generate revenue in the future.

- What is your go-to-market strategy? Investors want to understand how your bank plans to acquire and retain customers.

- Who is your target customer? Investors want to understand the demographics of your target customers and how your bank plans to reach them.

- What is your team’s experience and qualifications? Investors want to know that your team has the necessary experience and qualifications to execute on your business plan.

- What is your financial performance to date? Investors want to understand your bank’s financials, including revenue, profit, and customer acquisition costs.

- What are your growth projections? Investors want to understand your bank’s projected growth trajectory and potential return on investment.

- What are your key risks and challenges? Investors want to understand the potential risks and challenges facing your bank and how you plan to mitigate them.

- What is your timeline for achieving key milestones? Investors want to understand your bank’s timeline for achieving key milestones and how you plan to measure success.

Preparing answers to these and other potential questions can help you better communicate your bank’s value proposition and increase your chances of securing investment.

So there you have it, folks! A comprehensive guide to creating a banking pitch deck that will knock the socks off of your audience (hopefully not literally, because that might be a bit awkward).

Remember, creating a successful pitch deck is about more than just sharing information. It’s about persuasion, storytelling, and engaging your audience. By following the best practices we’ve outlined, you can create a pitch deck that effectively communicates your message and increases your chances of success.

So go forth, create your masterpiece, and remember to practice, practice, practice! And if all else fails, just remember the wise words of Benjamin Franklin: “If you fail to prepare, you are preparing to fail.”

You got this!

But if you don’t got it :

Let me develop an investor ready deck by using my hands-off approach , which includes: market research, copy, design, financials, narrative and strategy.

More Resources

Check my cornerstone guide on pitch decks that helped my clients win millions in funding: