- français

- BAHÁNDÌAN Home

- College of Law

- Juris Doctor

The feasibility of reducing personal income tax in the Philippines: Its implications to National Internal Revenue Code and National Revenue

Thesis Adviser

Defense panel chair, share , description, suggested citation, shelf location, physical description, collections.

- Juris Doctor [144]

The following license files are associated with this item:

- Creative Commons

CPU Henry Luce III Library

EXTERNAL LINKS DISCLAIMER

This link is being provided as a convenience and for informational purposes only. Central Philippine University bears no responsibility for the accuracy, legality or content of the external site or for that of subsequent links. Contact the external site for answers to questions regarding its content.

If you come across any external links that don't work, we would be grateful if you could report them to the repository administrators .

Click DOWNLOAD to open/view the file. Chat Bertha to inform us in case the link we provided don't work.

- Asia Briefing

- China Briefing

- ASEAN Briefing

- India Briefing

- Vietnam Briefing

- Silk Road Briefing

- Russia Briefing

- Middle East Briefing

- Asia Investment Research

A Guide to Taxation in the Philippines

The taxation policy in the Philippines is chiefly governed by the following Republic Acts:

- The Corporate Recovery and Tax Incentives for Enterprises Act (CREATE Act)

- Tax Reform for Acceleration and Inclusion (TRAIN) Law

- Article VI, Section 28 of the Constitution;

- The National Internal Revenue Code; and

- Local Government Code of 1991.

Tax structure

The country imposes a territorial tax system, meaning only Philippine-sourced income is subject to Philippine taxes.

Corporate income tax

From July 2020 to 2022, foreign companies will be eligible for a reduced corporate income tax (CIT) rate of 25 percent, down from the regular rate of 30 percent. The reduction in the headline CIT rate was passed by the CREATE Act, which also stipulates the further reduction of the CIT rate by one percent per year to finally reach 20 percent in 2027 for foreign companies.

Domestic micro, small, and medium-sized companies will directly benefit from a preferential rate of 20 percent (businesses with taxable income of up to PHP 5 million (US$89,270) and not exceeding PHP 100 million (US$1.7 million).

The CIT of 25 percent is levied on net income on all sources. Non-resident companies are taxed only on their Philippine-sourced income. Domestic companies are taxed on their worldwide income.

Minimum corporate income tax

A minimum corporate income tax (MCIT) of two percent is imposed on the gross income of both domestic and resident foreign corporations, on an annual basis. It is imposed from the beginning of the fourth taxable year immediately following the commencement of the business operations of the corporation. The MCIT is imposed when the standard 20 percent CIT is lower than the two percent MCIT on the company’s gross income. Any excess of the MCIT over the normal tax may be carried forward and credited against the normal tax for the three immediately succeeding taxable years.

Withholding tax

Dividends distributed by a resident company are subject to withholding tax at 25 percent; those distributed to non-residents are taxed at 15 percent, provided the country of the non-resident recipient allows a tax credit of 15 percent. The withholding tax may be reduced under an applicable tax treaty.

Interest paid to a non-resident is subject to a 20 percent withholding tax unless otherwise stipulated under a tax treaty.

Royalty payments made to a domestic or resident company are subject to a final withholding tax of 20 percent. A 25 percent withholding tax is levied on royalty payments to non-residents.

Fringe benefits tax

Fringe benefits granted to supervisory and managerial employees are subject to a 35 percent tax on the grossed-up monetary value of the fringe benefit. Under new income tax regulations, fringe benefits mean any good, service, or other benefit granted in cash or in kind, other than the basic compensation, by an employer to an individual employee.

The benefits include, but are not limited to: housing, expense accounts, vehicles, household personnel, interest on loans at below market rate, club membership fees, expenses for foreign travel, holiday and vacation expenses, education assistance, and life or health insurance and other non-life insurance premiums.

Fringe benefits tax, however, is not imposed when the fringe benefits are deemed necessary to the nature of your business.

Branch profit remittance tax

Branches of foreign companies in the Philippines, except those registered with the Philippine Economic Zone Authority, are subject to income tax at the rate of 30 percent of their income derived within the Philippines. A 15 percent branch profit remittance tax (BPRT) is levied on the after-tax profits remitted by a branch to its head office. After-tax profits remitted by a branch do not include income items that are not effectively

connected with the conduct of its trade or business in the Philippines. Such income items include interests, dividends, rents, royalties, including remuneration for technical services, salaries, wages, premiums, annuities, emoluments or other fixed or determinable annual, periodic, or casual gains, profits, income, and capital gains received during each taxable year from all sources within the Philippines.

Improperly accumulated earnings tax

Income accumulated by closely held corporations with the purpose of avoiding tax attracts an improperly accumulated earnings tax (IAET) of 10 percent. The closely held corporation may refer to companies wherein at least 50 percent of the capital stock or voting power is owned directly or indirectly by not more than 20 individuals.

The criteria to determine the liability for the IAET is the purpose of the accumulation of the income and not the consequences of the accumulation. That is, if a company allows its earnings or profits to accumulate within its reasonable needs, then it would not be subject to the tax unless proven to the contrary.

Webinar – Unveiling Southeast Asia’s Opportunities: 2023 Achievements and 2024 Prospects

February 29, 2023, | 9:00 AM Los Angeles / 12:00 PM New York / 6:00 PM Brussels

Join us in this data-driven webinar as Kyle Freeman, Partner and Head of the North American Client Services Desk in Asia, shares insights on Southeast Asia’s 2023 economic indicators and provides an overview of what to expect in 2024. The focus will be on trade and investment trends, noteworthy developments affecting businesses, and opportunities for foreign companies.

Join us in this free webinar.

Register Now

Personal income tax

The Philippines implements a progressive personal income tax rate of up to 35 percent. The TRAIN Act, which was passed at the end of 2017, stipulated provisions to reduce personal income tax on all taxpayers except those in the highest income bracket. Taxpayers in all income brackets below PHP 8 million (US$142,900) will therefore see between a two and five percent reduction in personal income tax rate from January 1, 2023, onwards.

Value-added tax

The 12 percent value-added tax (VAT) rate is imposed on most goods and services that have achieved actual gross sales of over PHP 3 million (US$53,562).

VAT exemption for exporters of local purchases

The Philippines issued a value-added tax (VAT) exemption for registered exporters on their local purchases of goods and services through Revenue Regulations (RR) No. 21-2021.

The VAT privilege covers the sale of equipment, supplies, packaging materials, and goods, among others, for a maximum period of up to 17 years.

What services are subject to VAT exemption?

The services performed by a VAT-registered person that is subject to VAT exemption are as follows:

- Sale of raw materials, packaging materials, supplies, inventories, and goods, to a registered enterprise and used in its registered activity;

- Sale of services, including the provision of basic infrastructure, maintenance, utilities, and repair of equipment, to a registered enterprise;

- Services rendered to persons engaged in air transport operations or international shipping, including leases of property, provided that these services are exclusively used for air transport operations or international shipping;

- The transport of passengers and cargo by domestic air or sea vessels from the Philippines to a foreign country;

- Sales to persons or entities who are exempted from direct and indirect taxes under special international agreements to which the Philippines is a signatory;

- The manufacturing, processing, or repacking of goods for persons or entity that is doing business outside of the Philippines, and the said goods are subsequently exported and paid for by foreign currency; and

- The sale of power is generated through renewable resources such as geothermal and steam, hydropower, biomass, solar, and wind, among others.

New registered export enterprises under CREATE can enjoy the VAT exemption for a maximum of 17 years starting from the date of registration. Meanwhile existing registered export companies located inside freeport zones and ecozones, the VAT exemption shall be until the expiration of the transitory period.

A registered export enterprise is a corporation, partnership, or other entity established under Philippine laws and registered with an Investment Promotion Agency (IPA). They must also engage in manufacturing, assembling, or processing activities that result in the direct exportation of manufactured or processed products.

ASEAN Briefing is produced by Dezan Shira & Associates . The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore , Hanoi , Ho Chi Minh City , and Da Nang in Vietnam, in addition to Jakarta , in Indonesia. We also have partner firms in Malaysia , the Philippines , and Thailand as well as our practices in China and India . Please contact us at [email protected] or visit our website at www.dezshira.com .

- Previous Article ASEAN Economic Outlook 2023

- Next Article Singapore and South Korea Sign Digital Trade Agreement

Our free webinars are packed full of useful information for doing business in ASEAN.

DEZAN SHIRA & ASSOCIATES

Meet the firm behind our content. Visit their website to see how their services can help your business succeed.

Want the Latest Sent to Your Inbox?

Subscribing grants you this, plus free access to our articles and magazines.

Get free access to our subscriptions and publications

Subscribe to receive weekly ASEAN Briefing news updates, our latest doing business publications, and access to our Asia archives.

Your trusted source for India business, regulatory and economy news, since 1999.

Subscribe now to receive our weekly ASEAN Edition newsletter. Its free with no strings attached.

Not convinced? Click here to see our last week's issue.

Search our guides, media and news archives

Type keyword to begin searching...

Home — Essay Samples — Economics — Taxation — Importance of Taxation in the Philippines: the Republic Act and the Corporate Recovery

Importance of Taxation in The Philippines: The Republic Act and The Corporate Recovery

- Categories: Philippine Government Tax Taxation

About this sample

Words: 1254 |

Published: Feb 11, 2023

Words: 1254 | Pages: 3 | 7 min read

Cite this Essay

Let us write you an essay from scratch

- 450+ experts on 30 subjects ready to help

- Custom essay delivered in as few as 3 hours

Get high-quality help

Verified writer

- Expert in: Government & Politics Business Economics

+ 120 experts online

By clicking “Check Writers’ Offers”, you agree to our terms of service and privacy policy . We’ll occasionally send you promo and account related email

No need to pay just yet!

Related Essays

1 pages / 468 words

2 pages / 919 words

4 pages / 1620 words

2 pages / 1193 words

Remember! This is just a sample.

You can get your custom paper by one of our expert writers.

121 writers online

Still can’t find what you need?

Browse our vast selection of original essay samples, each expertly formatted and styled

Related Essays on Taxation

Cornelsen, L., Green, R., Dangour, A., & Smith, R. (2014). Why fat taxes won't make us thin. Journal of public health, 37(1), 18-23.Doshi, V. (2016, July 20).Tax on Junk food in Kerala leaves Indians with a bitter taste. The [...]

Taxes are a fundamental aspect of modern society, serving as a primary source of revenue for governments at all levels. They are essential for funding public services, infrastructure, and social programs that benefit the entire [...]

World Health Organization. (2018). Obesity and Overweight. Retrieved from https://www.theguardian.com/society/2012/may/16/fat-tax-unhealthy-food-effect

Government of Canada. (2006). The Health Risks of Obesity. Health Canada.Government of Canada. (2018). Obesity in Canada: A Whole-of-Society Approach for a Healthier Canada. Public Health Agency of Canada.Government of Canada. [...]

The globe is in panic as a result of the pandemic, a pandemic that has ravished and caused a lot of harm generally. The United States of America was at the receiving end of the pandemic, it was left unguided and the resultant [...]

You and your friends are playing the game of who can build the most houses in a set amount of time. The rules are simple: Everyone starts out with the same amount of given money. With that given money you can buy supplies to [...]

Related Topics

By clicking “Send”, you agree to our Terms of service and Privacy statement . We will occasionally send you account related emails.

Where do you want us to send this sample?

By clicking “Continue”, you agree to our terms of service and privacy policy.

Be careful. This essay is not unique

This essay was donated by a student and is likely to have been used and submitted before

Download this Sample

Free samples may contain mistakes and not unique parts

Sorry, we could not paraphrase this essay. Our professional writers can rewrite it and get you a unique paper.

Please check your inbox.

We can write you a custom essay that will follow your exact instructions and meet the deadlines. Let's fix your grades together!

Get Your Personalized Essay in 3 Hours or Less!

We use cookies to personalyze your web-site experience. By continuing we’ll assume you board with our cookie policy .

- Instructions Followed To The Letter

- Deadlines Met At Every Stage

- Unique And Plagiarism Free

- Subscribe Now

The problem with our tax system and how it affects us

Already have Rappler+? Sign in to listen to groundbreaking journalism.

This is AI generated summarization, which may have errors. For context, always refer to the full article.

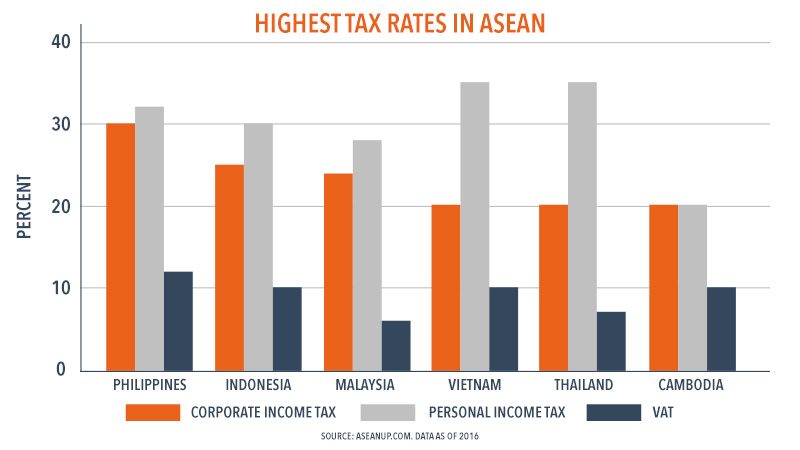

President Duterte’s plan to overhaul our tax system is arguably his most highly-anticipated and consequential policy thus far into his term. The plan, originally crafted by the Department of Finance, aims for a “simpler, fairer, and more efficient” tax system that will promote investments, create jobs, and reduce poverty. Many sectors have expressed support for it, including a group of former DOF and NEDA secretaries . But some lawmakers have branded the tax proposal as “heartless” and “anti-poor” because of, say, the planned increase on fuel taxes. Others have also questioned certain spending items in the General Appropriations Act of 2017 that do not merit the additional revenues that tax reform will yield. In this article, we step back from the politics of it all and look at the current state of the Philippines tax system. We focus on 5 issues which, to our mind, demonstrate best the present deficiencies (or “structural weaknesses”) of our tax system. In each, we show how the current state of things deviates from well-known principles of taxation. 1. We have some of the highest income tax rates in the region. Principle of taxation : High income taxes could discourage firms from producing more goods or employees from working more hours. Hence, a good tax system makes sure that income tax rates are not too high so as to discourage economic activity. The problem : The Philippine tax system currently has some of the highest income tax rates in this region. Compared to our major ASEAN counterparts, our corporate income tax is the highest at 30%, a rate that “turns off” foreign investors who prefer to do business in our low-tax neighbors.

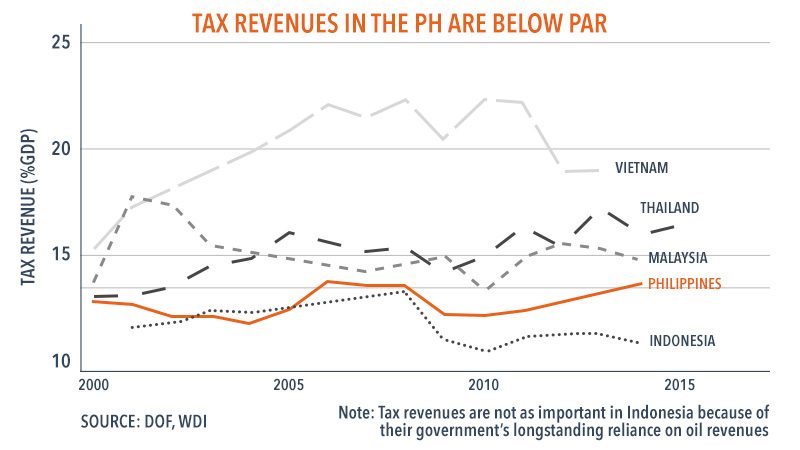

2. Too many goods and services are not being taxed. Principle of taxation : A good way to reduce high tax rates is to expand the tax base, or the set of goods and services which are taxed. The same (or even a larger) tax revenue can be collected as before by imposing a lower tax rate on as many goods and services as possible. The problem : In the Philippines, too many goods and services are exempted from taxes. For instance, our value-added tax (VAT) law has 59 lines of exemptions – more compared with the VAT laws of our neighbors. The plethora of exemptions partly explains the relatively low tax revenues we get. If only fewer goods were exempted – or if only the exemptions were limited to essential goods like raw food and medicines – then the government could boost its revenues.

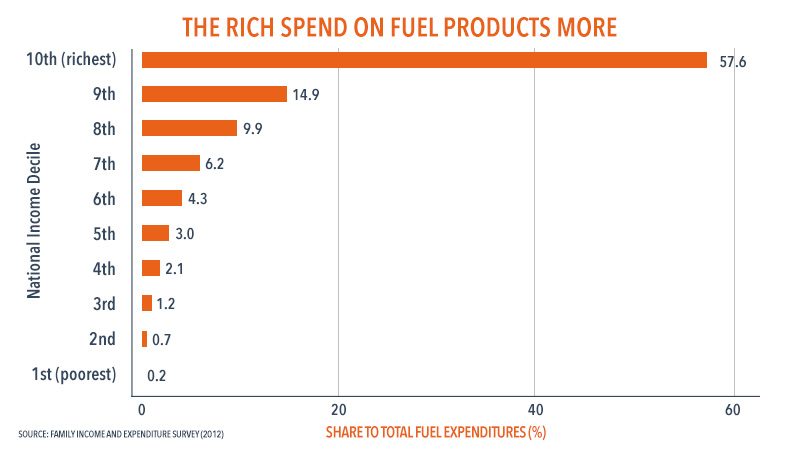

5. Rich Filipinos are not paying their fair share of taxes. Principle of taxation : Finally, a good tax system levies more taxes to people who can afford to pay more. One way to do this is to make the rich pay for a larger fraction of their income than the poor; that is, by making the tax system “progressive.” The problem : The Philippine tax system is only “mildly” progressive, and even borderline “regressive” – in many instances, poor Filipinos effectively pay a larger fraction of their income in taxes. For example, tax rates on dividends and other forms of capital incomes (which are earned mostly by the rich) are so low compared to the tax rates of ordinary workers. Increasing these capital income tax rates will certainly help make the rich pay more in taxes. Also, taxes on petroleum products have been constant for many years. Aside from being a lost opportunity to combat pollution and congestion, it’s also a lost opportunity to tax the rich who consume petroleum products more.

Conclusion: The time is ripe for tax reform Tax policy is essentially a balancing act between efficiency and equity. We want to impose progressive taxes to make society a fairer place to live in. But at the same time, we want to make sure that such taxes do not reduce economic activity so much. Unfortunately, the Philippine tax system is currently deficient in both respects. Not only do our taxes disproportionately burden the poor and benefit the rich, but they also yield too little revenue given the distortions they create. Needless to say, both problems need to be resolved soon. Comprehensive tax reform in the country is long overdue.

Add a comment

Please abide by Rappler's commenting guidelines .

There are no comments yet. Add your comment to start the conversation.

How does this make you feel?

Related Topics

JC Punongbayan

Recommended stories, {{ item.sitename }}, {{ item.title }}.

Checking your Rappler+ subscription...

Upgrade to Rappler+ for exclusive content and unlimited access.

Why is it important to subscribe? Learn more

You are subscribed to Rappler+

Get our daily tax nugget here! Sign up

What are Taxes & Taxation: A Guide to Understanding Taxes with Your Tax Tita

Quick Tax Info Box: Philippines Edition

Taxation in a Nutshell: – The process where the government collects money (taxes) from people and businesses to fund public services. Key Nature of Taxation: – Comprehensive and plenary, giving the government full authority to impose taxes for national needs. Taxes Defined: – Mandatory contributions by individuals and businesses, based on income or property value, to support government functions and public services..

Let’s Talk About Taxes and Taxation

Hey, there!

First off, a big virtual hug to everyone navigating the labyrinth of Philippine taxation.

Trust me, adulting is hard, and understanding taxes? Even harder.

But as your Tax Tita, I’m here to sprinkle some clarity amidst the cloud of confusion.

Let’s deep-dive, shall we?

Definition of Taxation (because, let’s get our terms straight!):

“Taxation is the act of levying a tax. It is the process or means by which the sovereign, through its law-making body, raises revenue to defray the necessary expenses of the government.”

Unpacking The Jargon: Taxation 101

1. “the act of levying a tax”:.

This is basically the government saying, “Hey, we need some funds, so we’re setting this particular tax.” Think of it like being charged an extra fee for a VIP concert ticket. It’s the cost of enjoying the show!

Imagine going shopping in one of our countless malls, and you see that adorable top or those killer heels with an added amount on the price tag. That’s kind of like how our government “adds” or sets a specific tax amount on certain goods or our incomes.

For the Titas in Training: It’s like that extra 20% you pay on top of your spa day. Only, this 20% goes to the government.

Another Example: Our beloved Philippines might decide that for us to have cleaner streets, there’s a need for a tiny environmental tax on certain products. So, next time you see a slightly higher price tag on a plastic bottle, remember: it’s for Mother Earth!

2. “The process or means”:

Okay, so now that the tax is set, how do we get it from your wallets to the government’s coffers? This is the method or way they do it.

It’s not just slapping on an extra amount. There’s a whole system behind it! This talks about how the government collects this amount.

Life Analogy: Think of it as your BFF borrowing money. She doesn’t just take it; there’s a promise (or a Pinky Swear ) to return it, maybe through monthly brunch treats!

Example: Remember that time you got your first salary and wondered why a chunk was missing? Yep, that’s our friend, the withholding tax. Straight from your paycheck to the government!

3. “By which the sovereign, through its law-making body”:

When we say “sovereign” , picture the Philippines as a person. She’s the boss, the queen, the main character. And her trusty sidekicks? The lawmakers in our Congress and Senate . They decide the tax rules.

Example: It’s like our very own Philippine version of a K-drama where Congress and The Senate writes the script, and we, the citizens, act it out. Cue dramatic music.

4. “Raises revenue”:

Raises Revenue is a fancy word for collecting money. This is basically our government’s version of a paycheck. In simple terms? It’s all about collecting that money. And trust me, in a country of islands as beautiful as ours, there are a lot of expenses to cover.

Chika Time: It’s like pooling funds for that epic barkada beach trip—only this is for roads, schools, and hospitals.

Example: Ever been to Luneta Park and marveled at its beauty? The maintenance, the events, the lovely lights during holidays—all funded by our tax pesos.

5. “To defray the necessary expenses of the government”:

All this collected money? It’s not for a wild party.

It’s for the essential stuff —hospitals, roads, schools, and all the things that make our Philippines run smoothly.

Imagine having a huge group potluck. Everyone chips in, brings a dish (or cash for the lazy ones like me ), and at the end of the day, we all get to enjoy a grand feast.

Example: From the school in your barangay, the public hospital in your city, to the bridge being constructed nearby—all these are our tax pesos at work!

Nature and Scope of the Power of Taxation

We chatted about what taxation is above.

Now, let’s dive into its nature and scope.

Sounds fancy, right? But just like that 10-step skincare routine we all tried last summer (guilty ), each element has its role.

Let’s decode!

Nature and Scope of the Power of Taxation:

“The power of taxation is comprehensive, plenary, unlimited, and supreme. It is essentially legislative in character and is inherent in the state.”

1.”Comprehensive”:

This basically means our government’s taxing power covers a LOT. From that cute pair of shoes you bought online to the income of big tech companies, they can potentially tax it all.

Example: Remember the time you decided to start a small online business during the lockdown and realized you had to register it? Yep, the government’s reach is pretty much everywhere.

2.”Plenary”:

This is just a fancy term meaning ‘full and complete’. When it comes to deciding what, how, and when to tax, the Philippines is pretty much its own boss.

Example: If the government suddenly wanted to impose a tax on specifically our favorite milk tea (oh, the horror! ) for health reasons, it has the full power to do so.

3. “Unlimited and supreme”:

These two words emphasize just how dominant the power of taxation is. There’s no putting a leash on it! It’s like how your favorite teleserye lead has ultimate sway in the plotline.

Example: The government can decide to adjust tax rates or introduce new ones based on what it deems necessary. Remember the TRAIN law? That’s the government flexing its unlimited power.

4.”Essentially legislative in character”:

This means the big decisions regarding taxes are made by our lawmakers. Yep, those guys and gals in fancy suits we voted into office!(I just sincerely hope they understand what the lifeblood doctrine is!)

Example: Before any tax reform becomes law, it has to pass through both houses of Congress and the Senate and get the president’s approval. So, it’s a whole team effort!

5.”Inherent in the state”:

This simply means that the power to tax is a natural part of being a government. Like how posting OOTDs is inherent to being a fashion blogger, taxation is innate to governance.

Example: Just as rice is a staple in every Pinoy meal, taxation is an essential part of how every country operates.

Definition of Taxes :

“Enforced proportional contributions levied by the state’s law-making body by virtue of its sovereignty upon the persons or properties within its jurisdiction for the support of the government and all its public needs.”

Demystifying Taxes: Let’s Dive Deeper!

1.”enforced proportional contributions”:.

At its core, taxes aren’t voluntary donations. They’re mandated, but they’re based on a certain proportion or scale. It’s like when our barkada decides on a fixed contribution for a beach trip. The more luxury you want, the more you contribute.

Example: If Juan earns more than Pedro, Juan will pay a higher amount of income tax, because it’s proportional to his earnings.

2.”Levied by the state’s law-making body”:

This emphasizes that our taxes are set by official bodies – think Congress or the Senate. It’s not just any Juan (pun intended) deciding the amounts!

Example: When the TRAIN law was passed, it was our elected officials in the Congress and Senate who discussed, debated, and decided its provisions.

3.”By virtue of its sovereignty”:

This means that because our Philippines is an independent and sovereign state, it has the full right to set and collect taxes.

Example: It’s like when you’re the queen bee of your squad. You decide the theme for your birthday bash because, well, it’s your party!

4.”Upon the persons or properties within its jurisdiction”:

Basically, if you’re living, working, or owning property here, expect the taxman’s knock. Our islands, our rules!

Example: If you bought a condo unit in Makati or opened a sari-sari store in Cebu, you’re within the Philippine jurisdiction and will need to abide by our tax regulations.

5.”For the support of the government and all its public needs”:

This is the WHY . We pay taxes so that our government can run smoothly and provide us with public services.

Example: Every time you drive on NLEX or see a public school being built, know that our tax pesos are hard at work!

To Wrap Up Taxes and Taxation Jargon:

Are taxes and taxation complicated.

Taxes might sound complicated, like trying to understand the ending of a Filipino telenovela, but it’s all about the communal spirit.

We contribute a bit, and in return, we get roads to drive on, schools to learn in, and hospitals for when we eat one too many chicharons.

Think of taxes like the membership fee to the exclusive club that is the Philippines.

We all chip in, and in return, we get to enjoy the amenities, services, and beauty of our home country. And while we might grumble about those deductions now and then, just remember: Every peso has the potential to make our nation even more fabulous.

Got thoughts or just want to share your latest “I survived tax season” selfie? Hit me up below! Remember, the best way to navigate adulting is to do it together, one tax query at a time.

And as Your Tax Tita always says:

“In the world of taxes, just like in love, every contribution matters – small or big, it’s all about giving your share to build something beautiful together. #TaxHugotWithYourTaxTita Your Tax tita

Marie is the knowledgeable voice behind Tax Maven Ph, a trusted Philippine blog simplifying tax matters for individuals and businesses. As a Certified Public Accountant with extensive experience at the country's premier tax collecting agency, Marie shares her expertise on various tax topics, demystifying tax laws and helping readers navigate the tax system with confidence. Stay informed and gain valuable insights by connecting with Marie through Tax Maven Ph, your go-to resource for navigating the complexities of the Philippine tax system.

- Skip to primary navigation

- Skip to main content

- Skip to footer

Taxes in the Philippines [Taxation Guide for 2024]

Last Updated – Oct 23, 2023 @ 1:35 pm

Every year, millions of people in the Philippines face the same annual task – staying on top of their taxes. After all, only two things are certain in life: death and taxes.

Whether you’re an employee or running your own business , missing tax deadlines can lead to detrimental consequences.

As we step into a new year (in a couple of months!), we’ll let you in on some tax planning strategies to help you avoid any potential issues with the Bureau of Internal Revenue.

The goal of this guide is to help you understand the basics of taxation, provide practical advice to ensure compliance, and help you minimize any tax-related headaches.

But before you start learning about the tax landscape in the country, you must first be aware of the key republic acts governing taxation policies in the Philippines. This includes:

- The Corporate Recovery and Tax Incentives for Enterprises Act ( CREATE Act )

- Tax Reform for Acceleration and Inclusion ( TRAIN ) Law

- Article VI, Section 28 of the Constitution

- The National Internal Revenue Code of 1997 ( Republic Act No. 8424 ), also known as the Tax Reform Act of 1997, as amended

- Republic Act No. 1937 , the Tariff and Customs Code of the Philippines (as amended)

- Republic Act 7160 , also known as the Local Government Code of 1991, as amended

These serve as the foundation of our tax system, encompassing both national and local taxes.

National taxes are those we pay to the government through the Bureau of Internal Revenue, while local government taxation is based on the powers granted to local government units under the Local Government Code of 1991.

Tax Structure in the Philippines

The Philippines follows a territorial tax system. This means that only income generated within the Philippines or from Philippine sources is subject to taxes.

Income earned from foreign sources is generally not taxed in the Philippines, with some exceptions for certain types of income.

The Role of BIR

The Bureau of Internal Revenue or BIR is the primary agency responsible for the assessment, collection, and enforcement of internal revenue taxes and other related charges within the Philippines.

Here’s a more detailed breakdown of the BIR’s key functions:

Tax Assessment

The BIR has the power to assess taxes on individuals and businesses based on their income, transactions, financial activities, or other taxable transactions.

The assessment process involves reviewing the taxpayer’s records and financial statements to determine the amount of tax owed.

Tax collection

This involves sending notices to taxpayers informing them of their tax obligations.

The BIR also has the authority to impose penalties for late or non-payment of taxes, as well as to seize assets or initiate legal action against delinquent taxpayers.

Assistance and education

To help ensure everyone is in the loop about taxes, BIR offers information on tax filing procedures and tax regulations. The agency also provides guidance on how to avoid common tax-related issues.

Auditing and investigation

If there are suspicions of tax evasion, fraud, or non-compliance, the BIR may conduct an audit or investigation into the taxpayer’s financial activities .

This includes reviewing their accounts and gathering evidence to determine if any violations have been committed.

If violations are found, the BIR may impose penalties, fines, or even criminal charges.

Tax clearance and certificate issuance

The BIR also provides tax clearance and certificate issuance services to individuals and businesses. A tax clearance certificate is a document that certifies that a taxpayer has no outstanding tax liabilities or has paid all taxes due and is up to date with their tax obligations.

This certificate is required for various transactions such as registering a new business , renewing business permits, applying for travel visas , and more.

Policy and regulation

The agency has a key role in developing tax policies and regulations. They also work with other government agencies to make sure that tax laws and regulations are clear, consistent, and fair.

Enforcement and legal action

When necessary, the BIR has the power to enforce tax laws and regulations by taking legal action against individuals and businesses who do not comply with tax requirements.

This can include imposing fines, penalties, and even imprisonment in extreme cases of tax evasion or fraud.

What is Taxable Income?

Taxable income refers to the portion of your total income that is subject to taxation by the government. In simpler terms, it’s the money you earn on which you have to pay taxes.

This income can come from various sources, such as your job , business , investments , or any other financial activities.

Types of Taxes in the Philippines

To understand taxation, it’s essential to know the different types of taxes imposed by the government.

Direct taxes

This type of tax is directly levied on an individual or business, and the burden of paying it falls on the same person or entity. Here are the different types of direct taxes.

Income tax is imposed on the yearly profits or earnings that individuals and businesses generate from various sources, such as property, professions, trades, or offices.

Individual or personal income tax rates

Individual income tax follows a progressive tax rate structure, where the tax rate increases as income levels rise.

Corporate income tax

Corporate income tax is a tax imposed on the net income or profits of corporations, partnerships, and other entities engaged in trade or business within the Philippines. It is based on a fixed rate.

Philippine corporations are taxed on their total global income. However, non-resident corporations are only taxed on income they generate in the Philippines.

Meanwhile, a foreign corporation with a branch in the Philippines is subject to taxation on the income generated in the country. Branch taxable income is calculated in the same way as subsidiary taxable income.

Effective from July 1, 2020, Philippine corporations are taxed at a rate of 25% (from 30%). This doesn’t include corporations who have a net taxable revenue of less than PHP5 million and total assets of less than PHP100 million, which is taxed at a rate of 20%.

Withholding tax

The following are the different withholding taxes you should know.

When a resident company distributes dividends, they are liable to the following taxes.

For individuals:

For corporations:

For interest payments made to non-residents, a 20% withholding tax applies, unless a tax treaty specifies otherwise.

In the case of royalty payments, domestic or resident companies are subject to a final withholding tax of 20%. However, a 25% withholding tax rate is applied to royalty payments made to non-residents.

Fringe Benefit Tax

The FBT rate is set at 35% of the grossed-up monetary value of the fringe benefit.

This tax is imposed on non-wage benefits that employees receive as part of their basic compensation package. This includes goods, services, or other benefits granted in cash or in kind.

The benefits include, but are not limited to the following:

- Expense accounts

- Household personnel

- Interest on loans at below market rate

- Club membership fees

- Expenses for foreign travel

- Holiday and vacation expenses

- Education assistance

- Life or health insurance and other non-life insurance premiums

Keep in mind that this tax is not imposed when the fringe benefits are considered necessary to the nature of your business.

Capital Gains Tax

This is levied on the profit (capital gains) earned from the sale or disposal of certain types of assets, such as real estate , stocks , bonds , mutual funds , and other investments.

It is typically imposed when an individual or entity realizes a gain by selling an asset for a higher price than the original purchase price.

This is levied on the right of a deceased person to transfer their estate to their lawful heirs and beneficiaries upon their death.

It is imposed on the total value of the assets and properties left behind by the deceased individual, and it is calculated based on a graduated schedule of tax rates.

This tax is also applicable to certain transfers that are considered equivalent to testamentary dispositions, such as certain gifts made shortly before the individual’s death.

Related: How to Write a Last Will and Testament

Donor’s Tax

Donor’s tax in the Philippines is a tax imposed on the act of giving property as a gift while the giver (also called donor) is still alive.

This tax applies when someone transfers property to another person or entity out of generosity, without expecting much in return, and without being legally obligated to do so.

Whether the donor is a resident or non-resident of the Philippines, this tax is imposed on the privilege of making such a gift.

Keep in mind that this is different from estate tax, which is levied on the transfer of property upon a person’s death.

Indirect taxes

The opposite of direct taxes, this tax is imposed on goods and services at the point of consumption.

Value Added Tax

Also called VAT, this tax is imposed on the sale of goods and services. It is levied on the value added to a product or service at each stage in its production or distribution and ultimately passed on to the final consumer.

Excise tax is a type of indirect tax that is levied on specific goods, such as alcohol, tobacco products, petroleum products, and automobiles.

This tax is imposed on the manufacturer or importer of these goods, but the cost is ultimately passed on to the end consumer.

Check out this page for the updated table.

Documentary Stamp Tax

This is for a variety of legal and commercial documents. These include deeds, contracts, and other instruments that relate to the transfer or conveyance of property rights or financial obligations.

Local Taxes

Here are some additional local taxes you should account for.

Real Property Tax

This tax is for immovable properties such as land, buildings, machinery, and other improvements that are permanently attached to the land.

This tax is imposed on the privilege of owning or holding real estate within the jurisdiction of a local government unit (LGU), such as a city or municipality.

It is a significant source of revenue for LGUs and is used to fund local public services and infrastructure development.

Business Tax

This is enforced by LGUs on businesses operating within their jurisdiction. It is based on the gross sales or gross receipts of a business for the previous fiscal year.

The rate varies depending on the location of the business but should not exceed 3% of the gross sales or gross receipts.

Tax on Transfer of Real Property Ownership

This tax is imposed when real property is sold, donated, bartered, or transferred to another owner.

Tax on Business of Printing and Publication

This is for businesses engaged in printing and publishing materials like books, posters, pamphlets, and the like that are subject to this tax.

Franchise Tax

Businesses with franchises are taxed at a rate not exceeding 50% of 1% of their gross annual receipts from the previous year within their jurisdiction.

Tax on Sand, Gravel, and Quarry Resources

This tax applies to resources like stones, sand, gravel, and earth extracted from public lands, waters, or riverbeds within the local government’s jurisdiction.

Professional Tax

Professionals who are required to pass government exams are obligated to pay an annual professional tax.

Amusement Tax

The proprietors of entertainment venues, including theaters and concert halls, are required to collect this tax from patrons.

Annual Fixed Tax for Delivery Vehicles

Manufacturers, wholesalers, dealers, or retailers using delivery vehicles for products like liquors, soft drinks, and tobacco pay this annual fixed tax.

Tax on Business

Businesses must pay this tax to secure a business license or permit to start operations. This is what businesses pay to get a Business Mayor’s Permit. Rates may vary among cities and municipalities.

Fees for Sealing and Licensing of Weights and Measures

Charges for certifying and licensing weighing and measuring equipment are determined by the local government.

Fishery Rentals, Fees, and Charges

Fees are imposed on individuals granted fishery privileges in municipal or city waters.

Community Tax

Levied on individuals 18 years and older engaged in work, business, or owning property with a certain assessed value.

Corporations doing business in the Philippines are also subject to this tax.

Barangay Taxes on Stores or Retailers

This is for businesses with gross sales of receipts of the preceding calendar year of P50,000.00 or less for cities, and P30,000.00 or less for municipalities.

The rate should not exceed 1% on such gross sales or receipts.

Service Fees or Charges

Barangays can collect fees for services related to the use of barangay-owned properties or facilities.

Barangay Clearance

A reasonable fee is collected for issuing a barangay clearance. This is usually required for various government transactions.

Tax Incentives and Exemptions in the Philippines

The government offers many tax incentives and exemptions to help promote economic growth, attract investments, and support various sectors.

1. Special Economic Zones and their tax benefits

Special Economic Zones (SEZs) are designated areas in the Philippines that enjoy unique tax privileges and incentives to encourage investments and economic activities.

These zones are typically established in strategic locations to spur development and job creation.

Some of the tax benefits associated with SEZs include income tax holidays, as well as duty-free importation to decrease production costs.

2. Tax holidays and other incentives for businesses

Export-focused businesses can enjoy a tax break called the Income Tax Holiday or ITH for 4 to 7 years and choose between a low Special Corporate Income Tax (SCIT) rate of 5% or extra tax deductions for 10 years.

Meanwhile, companies targeting the local market can also get an ITH for 4 to 7 years and opt for enhanced deductions for 5 years.

3. Exemptions for certain individuals and entities

The Philippine tax system also provides exemptions for specific individuals and entities such as:

Senior Citizen and Persons with Disabilities (PWD) Exemptions

Senior citizens and PWDs may be eligible for income tax exemptions, as well as VAT exemptions or discounts on specific goods and services.

Exemptions for Cooperatives

Cooperatives engaged in certain activities may benefit from exemptions on income tax, as well as VAT privileges.

Nonprofit and Charitable Organizations

Non-profit entities engaged in charitable, religious, cultural, or educational activities may enjoy tax exemptions and incentives.

Tips for Effective Tax Planning in the Philippines

Take a look at some of the best practices for effective tax planning in the Philippines:

1. Income Splitting

As stated above, the Philippines has a progressive tax system which means higher incomes are subject to higher tax rates.

By distributing income among family members, you can potentially reduce the overall tax liability on that income.

Furthermore, some individuals or entities may be eligible for tax credits to offset their tax liability. Income splitting allows you to allocate income to individuals with available tax credits, therefore reducing the overall tax burden.

Income splitting can also be a strategy for those with huge estates who want to actualize an estate planning strategy.

By transferring income or assets, the size of your estate can be reduced. This helps facilitate the smooth transfer of wealth to the next generation.

2. Timing of income and expenses

This tip involves the deliberate deferral or acceleration of income and deductions to optimize an individual or business tax situation.

Managing capital gains, utilizing carryovers, meeting income thresholds, and aligning with business planning are all part of the possibilities with this strategy.

By following this tip, you can manage your tax rate effectively by choosing when to recognize income or incur expenses.

Smoothing your tax liability over multiple years is also possible if you want to avoid sudden spikes in tax payments.

Moreover, you can reduce your taxable income for the current year by deferring income and accelerating deductions to lower your tax liability.

This strategy also maximizes the utilization of available deductions and exemptions.

Keep in mind that timing should always adhere to tax laws and be based on legitimate financial and business decisions.

3. Utilizing tax credits and deductions

It is recommended to take full advantage of available tax credits and deductions to reduce your overall tax liability.

Tax credits are direct reductions in the amount of tax you owe. Ensure that you claim all eligible tax credits you qualify for.

For example, if you donate to a BIR-accredited charity, you can claim a tax credit for the donated amount.

4. Investing in Tax-Advantages accounts

Utilizing the following tax-advantaged and tax-efficient accounts can help you grow your wealth and secure your financial future while minimizing the impact of taxes.

Pag-IBIG HDMF (Home Development Mutual Fund) – MP2

Consider investing in this tax-free savings account, offering attractive dividend rates (usually 5-7%) and a 5-year maturity period.

The earnings from MP2 are tax-free, allowing your savings to grow faster.

SSS ( Social Security System ) Flexi and Peso Funds

For Overseas Filipino Workers (OFWs), the Flexi Fund is an option that invests in 91-day T-bills, while the Peso Fund is invested in 5-year T-bonds and 365 T-bills.

Contributions and interest in these funds are not subject to tax.

PERA (Personal Equity Retirement Account)

With PERA , you can enjoy a 5% tax credit on annual contributions. Moreover, the income and withdrawals after retirement (usually at age 55) are tax-exempt.

This account offers a tax-efficient way to save for retirement.

Tax-Efficient Investment Accounts

Consider low-cost index funds under ETFs and Mutual Funds , as they minimize trading activity and offer lower taxation.

ETFs in particular are very tax-efficient since you will be only taxed when you sell your shares. This helps you enjoy tax deferral.

Tax-Managed Fund

Some mutual funds are specifically designed to minimize tax burdens for investors.

While they may come with higher costs due to specialized services, they can be worthwhile if you have a higher income and are in a higher tax bracket.

Real Estate Investment Trusts ( REITs ) and REIT-ETFs

These investment options provide tax-efficient exposure to the real estate market.

Non-Taxable Income Sources

Certain income sources and services are exempt from taxation, such as insurance proceeds (in most cases), riders for disability and critical illness, employer-provided insurance (life/health), municipal bonds (with tax-free interest earnings), tax-exempt money market funds (for parking cash), and Health Savings Accounts (HSAs) for medical expenses with tax-free compounding.

5. Tax incentives and exemptions

Most tax incentives and exemptions provide opportunities to minimize tax liabilities and promote economic growth at the same time.

As stated above, availing Special Economic Zone (SEZ) Benefits gives you substantial tax benefits if you operate in these designated zones.

For example, your business will be exempt from paying income tax for a specific period. You may even enjoy duty-free importation of essential equipment and streamlined customs procedures.

The Philippine government even offers various tax holidays and incentives designed to stimulate business growth.

Meanwhile, Research and Development tax incentives provide deductions and exemptions for R&D-related expenses to encourage innovation. Export-oriented businesses can also benefit from VAT zero-rating and exemptions on export earnings.

Also, the Alternative Modes of Compliance (AMoC) allow businesses to choose the most tax-efficient treatment applicable to their industry.

Finally, exemptions are available for specific individuals and entities. By understanding and capitalizing on these incentives, businesses can optimize their tax positions.

6. Considerations for Business Owners

For business owners in the Philippines, there are several strategies that can help minimize taxes.

One crucial decision is choosing the right business structure , such as a sole proprietorship, partnership, or corporation.

Each structure has its own tax implications, and selecting the one that aligns with your business goals and financial circumstances is essential for tax efficiency.

Proper documentation and record-keeping are also equally important. It should be your priority to have accurate records of income, expenses, and transactions that allow you to claim legitimate deductions and credits while staying compliant with tax regulations.

This practice not only minimizes the risk of audits and penalties but also ensures you’re making the most of available tax benefits.

Deducting business expenses and capital allowances is another vital strategy. Business owners can deduct various expenses related to their operations, such as rent, salaries, utilities, and interest on business loans .

Additionally, capital allowances can be claimed for asset depreciation.

Lastly, regularly assess your business activities for opportunities to optimize tax efficiency. This step includes identifying tax credits and incentives.

7. Real estate and capital gains

When selling real estate or other capital assets, you may incur significant capital gains tax. To minimize this tax, consider the following tips:

Hold for the long term

Holding your property for at least one year before selling it can result in lower capital gains tax rates. The longer you hold, the lower the tax rate becomes.

Utilize the Family Home Exemption

Individuals who sell real property in the Philippines are subject to a tax rate of 6% based on either the property’s selling price or its fair market value, whichever amount is higher.

However, there is an exception to this rule when the property being sold is the individual’s principal residence and the proceeds from the sale are used to purchase or build a new principal residence.

This exemption can be used once every 10 years.

Offset Gains with Losses

If you have incurred capital losses from other investments, you can offset these against your capital gains to reduce your overall tax liability.

Understand your property tax implications

Taxpayers in the Philippines should also have a thorough understanding of real property tax implications.

This is imposed on land, buildings, and improvements in the Philippines. To navigate this tax efficiently, keep these tips in mind:

- Know Your Property Classification: Properties are classified into different categories, each with its own tax rates. Ensure that your property is correctly classified to avoid overpaying.

- Keep Updated Records: Keeping accurate records of payments and deadlines can help you manage your tax obligations effectively.

- Check for Exemptions: Certain properties may qualify for exemptions or reduced tax rates, such as agricultural land or properties used for low-cost housing.

- Consider Tax Amnesty Programs: The Philippine government periodically offers tax amnesty programs that allow property owners to settle arrears at reduced rates. Participating in such programs can provide relief from overdue taxes.

- Review Property Valuations: Real property tax is based on assessed property values. Regularly review the valuation of your property to ensure it accurately reflects its market value and avoid over assessment.

8. Estate Planning and Donor’s Tax

Take a look at the following tips to help you reduce estate tax liability through strategic gifting:

Exempt Gift

Certain gifts are entirely exempt from donor’s tax, including those made to the government or charitable institutions. By directing your gifts toward these exemptions, you can minimize tax liability.

Gradual Wealth Transfer

Plan to gradually transfer assets to heirs over time rather than waiting until later stages of life to spread out potential tax liabilities.

Setting Up Trusts and Other Estate Planning Tools

Trusts and estate planning tools can be effective in minimizing estate tax liability and ensuring the smooth transfer of assets:

- Irrevocable Trusts: Transferring assets into an irrevocable trust can remove them from your taxable estate.

- Life Insurance: Consider using life insurance policies to provide tax-free benefits to beneficiaries. The proceeds are typically not subject to estate tax, making it a useful tool for wealth transfer.

- Family Corporations: Some families opt to establish family corporations to manage assets and facilitate their transfer to heirs more efficiently.

9. Seeking professional advice

Tax professionals and accountants are experts in taxes. Their deep knowledge and experience allow them to uncover deductions, credits, and exemptions you might overlook.

Remember that Philippine tax laws change frequently and it is the job of these professionals to stay up-to-date with these shifts and understand how they impact taxpayers.

Furthermore, they are helpful in assessing your financial situation, business activities, and goals to create customized tax strategies that consider factors like income sources, investments, deductions, and exemptions.

Related: Top Accounting Firms in the Philippines

When it comes to audit or tax disputes, tax professionals also provide valuable assistance and can represent you before tax authorities, address questions, and ensure your tax records are well-prepared and compliant with laws.

This decreases the stress and potential financial impact of audits.

10. Using digital tools and software

Using digital tools and software can greatly simplify the tax filing process and help you stay organized.

For example, tax software will take the bulk of the hassle out of tax planning and filing. This not only saves you time but also reduces the chances of errors in your tax returns.

In many ways, going digital with record-keeping can also be a game-changer. This involves storing your financial documents, receipts, and transaction records electronically. They’re also less likely to get lost or damaged.

A tax software will also do the math for you, therefore reducing manual data entry and keeping you informed about tax changes in real-time.

Most tax software providers also come with strong security features to protect your financial data, plus they are compliant with government regulations and guidelines.

Lastly, digital tools let you manage your taxes from anywhere with an internet connection. This flexibility is particularly useful for professionals who are always on the go or have multiple businesses to manage.

Check out our in-depth guide on finance apps to know the best personal finance online tools for taxes in the Philippines.

About MJ de Castro

MJ de Castro is the lead personal finance columnist at Grit PH.

MJ started her career as a writer for her local government’s City Information Office. Later on, she became a news anchor on PTV Davao del Norte.

Wanting to break free from the shackles of her 9-to-5 career to live by the beach, she pursued remote work. Over the years, she has developed a wide specialization on health, financial literacy, entrepreneurship, branding, and travel.

Now, she juggles writing professionally, her business centering on women’s menstrual health, and surfing.

Education: Ateneo de Davao University (AB Mass Communication) Focus: Personal Finance, Personal Development, Entrepreneurship, & Marketing

Reader Interactions

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

We need your help!

Our team is currently conducting research for an upcoming guide focusing on starting a business in the Philippines . We would greatly appreciate your contribution, which should only require a few seconds of your time.

Thank you in advance!

- Digital Marketing

- Search Engine Optimization (SEO)

- Digital PR & Link Building

- Social Media Marketing

- Digital Advertising (PPC & Social)

- Content Marketing

- Copywriting

- Email Marketing

- Conversion Optimization

- Web/App Development

- Ecommerce Development

Please enable JavaScript in your browser to complete this form. Name * Location of Business * Number of Employees * 1 - 10 11 -50 51 - 100 100 - 500 500+ Phone Number * Email * Insurance Company Standard Insurance AXA Philippines BDO AIG Submit

Please enable JavaScript in your browser to complete this form. Full Name * Company Name * Mobile Number * Email Address * Submit

Please enable JavaScript in your browser to complete this form. Name * Contact Number * Email Address * Target Location Preferred Developer * Ayala Land SM Prime Megaworld Alveo Land DMCI Homes Federal Land Robinsons Land Corp Vista Land and Lifescapes Filinvest Land Shang Properties Century Properties Empire East Rockwell Land Phone Submit

Disclosure: Your personal details will not be shared with any third-party companies. We’ll just need your contact details so our resident real estate agents can reach you to provide you with the details for any of the listed property developments you’re interested to invest in.

Please enable JavaScript in your browser to complete this form. Name * Age * Location* Phone Number * Email Address * Insurance Company Sun Life Financial Pru Life U.K. AXA Philippines AIA Philippines Manulife Insular Life BPI-AIA BDO Life Etiqa FWD Insurance Allianz PNB Life Comment Get a Quote

Disclosure: Your personal details will not be shared with any third-party companies. We’ll just need your contact details so our resident financial advisors can reach you to provide you with the details for any of the listed insurance company you’re interested in.

Tax Controversy 2023

Philippines, law and practice.

SyCip Salazar Hernandez & Gatmaitan is a full-service law firm and one of the largest in the Philippines. The firm’s tax department consists of 34 lawyers (14 partners, one of counsel, one special counsel and 18 associates), a half of whom are certified public accountants, and is headed by Ms Carina C. Laforteza, who is a partner and a certified public accountant. SyCipLaw’s tax department provides the entire range of tax services, from advising on, and structuring, the tax aspects of corporate transactions to administrative and judicial litigation in relation to tax refunds and defending clients against assessments for national and local taxes and customs duties, including in respect of safeguarding measures cases before the Department of Trade and Industry and the Tariff Commission. The firm also assists its corporate clients in obtaining rulings and with compliance requirements.

1. Tax Controversies

1.1 tax controversies in this jurisdiction.

The Philippines practises self-assessment, wherein the taxpayer determines the tax liability, files the tax returns and pays the taxes due. Proper tax administration, however, cannot rely on voluntary compliance alone. Thus, several measures are in place to facilitate the taxpayer’s compliance with the tax laws, such as the extensive investigatory powers granted to tax authorities. To check the correctness of taxes remitted to the government, tax authorities are authorised to examine the taxpayer’s returns and related documents.

Tax controversies in the Philippines are generally the result of regular tax audits/investigations conducted by:

- the Bureau of Internal Revenue (BIR) for national taxes under the National Internal Revenue Code of 1997, as amended (Tax Code);

- the Bureau of Customs (BOC) for tariff and customs duties; and

- local government units (LGUs) for local taxes, which include local business taxes and real property taxes (RPT).

A tax controversy arises when the authorities issue an assessment for tax deficiencies and the taxpayer disputes that assessment.

Tax controversies may also arise from the following:

- premature issuance of warrants that authorise the BIR to attach the taxpayer’s real and personal properties, even if the tax assessment is not yet final;

- assessments for customs duties and taxes arising from the tariff classification and valuation of imported products;

- claims for refund by the taxpayer involving erroneously or illegally collected taxes, excess creditable taxes withheld, and excess unutilised input taxes;

- requests for a ruling on the tax implications of a certain transaction (eg, tax treaty relief applications and requests for tax-free exchange rulings);

- court decisions, which finally resolve and confirm the taxability of certain transactions – these may lead to tax audits of taxpayers with similar transactions, or of those belonging to the same industry or industries where such transactions are common;

- complaints, confidential information filed by informers, or referrals from other government agencies, which may result in the investigation and prosecution of criminal tax cases under the BIR’s Run After Tax Evaders (RATE) programme; and

- petitions filed by taxpayers to assail the validity of a tax statute, local tax ordinance of LGUs or regulations issued by the BIR or BOC.

1.2 Causes of Tax Controversies

For national taxes, most tax controversies involve corporate income tax, withholding tax and value-added tax (VAT). This is due mainly to the taxpayer’s poor tax compliance system and inadequate documentation or lack of supporting records. Deficiency assessments on corporate income tax usually come from conflicting interpretations of law or tax regulations or differing tax positions on a complex transaction. Withholding tax deficiencies are commonly due to differences of opinion on the applicable withholding tax rates and discrepancies over the amount of certain expenses reported in the financial statements (FS) or tax returns as against the alphabetical list of income payees (which contains the amounts paid to these payees and the taxes withheld). VAT controversies normally arise from non-compliance with the proper invoicing requirements for VAT zero-rated sales.

For local taxes, the typical tax controversy involves RPT, where there is a dispute over the property classification and assessment level. Some LGUs also continue to impose local taxes on export-oriented companies and other companies entitled to tax incentives.

1.3 Avoidance of Tax Controversies

A controversy involving national taxes is mitigated by securing a confirmatory ruling from the BIR regarding the tax implications of a transaction.

Other ways to mitigate tax controversies include:

- seeking tax advice or opinion on a transaction, especially when it involves a novel tax issue, difficult interpretation of tax laws or conflicting positions due to its complexity;

- engaging an external adviser to conduct tax due diligence; and

- maintaining a robust tax compliance system.

1.4 Efforts to Combat Tax Avoidance

The Philippines has not fully adopted the Organisation for Economic Co-operation and Development (OECD)’s Base Erosion and Profit Shifting (BEPS) Recommendations, nor the European Union (EU)’s recent measures to combat tax avoidance.

1.5 Additional Tax Assessments

When the BIR assesses a taxpayer for tax deficiencies, it will issue a final assessment notice/formal letter of demand (FAN/FLD), requiring the taxpayer to pay the assessed taxes within 30 days from the date of demand. If the taxpayer agrees, it can immediately pay the assessed taxes. However, if the taxpayer disagrees with the assessment, the taxpayer must file a protest within 30 days from receipt of the demand. The protest must contain the taxpayer’s factual and legal bases for disputing the tax assessment, together with supporting documents. The taxpayer is not required to pay the amount of deficient taxes due while the tax assessment is under protest. However, interest on the tax deficiency tax will continue to accumulate until the full amount of tax is paid.

Generally, the CIR’s decision or inaction on the protest may be elevated to the Court of Tax Appeals (CTA) without payment of the disputed tax. Nonetheless, the BIR may still enforce collection against the taxpayer, unless collection is suspended by the CTA.

The rule is different in the case of RPT (a local tax) because the taxpayer must pay the RPT due before filing a protest.

Under the Customs Modernisation and Tariff Act (CMTA), the BOC shall assess the duties and taxes on imported goods. If the importer disputes the assessment, such shall be completed upon either final readjustment based on the tariff ruling in the case of a classification dispute, or final resolution of the protest case involving valuation, rules of origin, and other customs issues. In the absence of fraud and when the goods have been finally assessed and released, the assessment shall be conclusive three years from the date of final payment of duties and taxes, or upon completion of the post-clearance audit. Decisions of the BOC Commissioner may be appealed to the CTA.

2. Tax Audits

2.1 main rules determining tax audits.

Revenue Memorandum Order (RMO) 19-2015, as amended by RMO 64-2016, prescribes the procedures to be observed during a tax audit. It classifies those that are subject to tax audits as follows:

- mandatory cases including claims for tax refund, tax clearance and estate tax returns;

- priority taxpayers/industries such as taxpayers with zero-rated sales, taxpayers enjoying tax exemptions/incentives and those whose compliance is below the established benchmark rate; and

- other priority audits identified by the BIR.

RMO 19-2015 also provides that taxpayers who have not been audited but have been in operation for more than three years are subject to a mandatory tax audit. Meanwhile, those that have been subject to a tax audit for two successive taxable years will no longer be subject to tax audit, unless there is a presumption of a tax fraud (ie, understatement of sales/income, or overstatement of expenses/deductions by at least 30%).

2.2 Initiation and Duration of a Tax Audit

Under the Tax Code, the BIR has the authority to assess internal revenue taxes within three years after the last day prescribed by law for the filing of the return or the actual date of filing, whichever is later. In exceptional cases (ie, false/fraudulent return with intent to evade tax or failure to file a return), the BIR may assess the taxpayer at any time within ten years after discovery of the falsity, fraud or omission.

While the law does not limit the duration of the tax audit, as long as it is conducted within the three-year prescriptive period, RMO 19-2015 requires the BIR examiners to strictly comply with the prescribed periods for completion of their audits. BIR examiners are given an internal deadline of 180 days (for non-large taxpayers) or 240 days (for large taxpayers) from the issuance of the letter of authority (LOA) to submit their report.

Generally, tax audits do not suspend the prescriptive period except for the following instances:

- when the BIR is prohibited from making the assessment and for 60 days thereafter;

- when the taxpayer requests a reinvestigation which is granted by the CIR;

- when the taxpayer cannot be located at the address given in the tax return filed, upon which a tax is being assessed/collected; and

- when the taxpayer is out of the Philippines.

The prescriptive period is also suspended when the taxpayer agrees, in writing, to waive such period.

Meanwhile, the BOC may conduct an audit examination, inspection, verification, and investigation of records pertaining to any goods declaration for the purpose of ascertaining the correctness of that goods declaration and determining the liability of the importer for duties, taxes and other charges, including any fine or penalty, within three years from the final payment date of duties and taxes or customs clearance.

2.3 Location and Procedure of Tax Audits

Generally, tax audits are conducted in the business premises of the taxpayer during business hours. The BIR examiners usually request copies of tax returns, invoices and official receipts, journal vouchers, ledgers and other accounting books and records. Tax returns, invoices and official receipts are based on printed documents, while books of accounts and accounting records can be made available electronically or in a spreadsheet format.

2.4 Areas of Special Attention in Tax Audits

Tax auditors should check the authority of the assigned BIR examiners and the validity of the LOA issued to the taxpayer. A taxpayer may validly refuse a request for examination by any revenue officer not mentioned in the LOA. Tax auditors must ensure that the BIR examiners’ power to conduct the tax audit has not lapsed or does not go beyond the scope of the LOA.

The BIR typically examines the completeness and timeliness of a taxpayer’s filings; furthermore, it is likely that the BIR will compare the FS, tax returns and other documents to spot discrepancies between the amounts reported/disclosed (eg, sales in the FS as opposed to sales reported in the alphabetical list). The discrepancies noted will become the basis of any tax deficiency assessment.

2.5 Impact of Rules Concerning Cross-Border Exchanges of Information and Mutual Assistance Between Tax Authorities on Tax Audits

The prevalence of rules concerning cross-border exchanges of information and mutual assistance between tax authorities has contributed to an increase, though not a significant one yet, in tax audits in the Philippines.

Republic Act No 10021 (the Exchange of Information on Tax Matters Act) allows the exchange of information by the BIR on tax matters according to internationally agreed tax standards. Under the law, the CIR is authorised to inquire into the taxpayer’s bank deposits and other related information held by financial institutions, and to respond to a request from a foreign tax authority, pursuant to a tax treaty to which the Philippines is a party. Furthermore, income tax returns of the taxpayer subject of an exchange of information request shall be open to inspection, upon the order of the President of the Philippines.

We have not experienced, or are not aware of, any joint tax audits conducted by the BIR with the tax authority of another state.

2.6 Strategic Points for Consideration During Tax Audits

Familiarity With the Tax Treatments of Accounts and Transactions

Taxpayers should be familiar with the tax treatment of all their material accounts, entries and transactions. It would be helpful if these tax treatments were documented through company policies or supported by the opinion of a tax expert.

Prepare Tax Documents and Other Supporting Documents in Advance

In tax audits, the tax authorities will request all relevant tax returns, accounting records and other documents. Since the BIR usually requests the same set of documents, the taxpayer can prepare the documents for a given year in anticipation of a tax audit. Having complete documents not only gives the impression that the taxpayer is prima facie compliant with all its tax filings and reporting obligations, but also facilitates the conduct of the audit. It is also helpful if the taxpayer can provide a reconciliation of the usual discrepancies the BIR examiners note in their findings. Accordingly, the taxpayer can easily explain the reason for any discrepancies thereby preventing the discrepancy from giving rise to a deficiency assessment.

Designate a Contact Person for the Tax Authorities

To ensure a smooth audit, the taxpayer should designate a responsible employee to co-ordinate with the tax authorities on their document requests and to handle the overall conduct of the tax audit.

Engage an External Tax Adviser

It is prudent to engage an external tax adviser to handle the tax audit who can help prepare the factual and legal arguments and ensure that the rights of the taxpayer are adequately protected. An external adviser may also be consulted on major legal issues and possible questions from the tax examiner during the audit.

3. Administrative Litigation

3.1 administrative claim phase.

When attempting to refute or protest an assessment by the tax authorities, the administrative phase is mandatory and must be concluded before proceeding to the judicial phase.

Letter of Authority (LOA)

The issuance of an LOA signifies the start of a tax assessment. The LOA is issued to authorise a BIR examiner to conduct a tax audit. It must specify the type of taxes that will be examined and the taxable year subject of the audit.

Tax Audit Proper

After the issuance of the LOA, the BIR examiners can request and examine the tax returns, books of accounts and accounting records, official receipts, invoices, and other relevant documents necessary for the tax audit.

Notice of Discrepancy (NOD)

Upon audit, the BIR examiners will submit their initial report containing findings of discrepancies. Based on the report, the taxpayer shall be informed in writing of the discrepancies for the discussion of discrepancy (Discussion).

The taxpayer may present its side and explain the discrepancy during the Discussion, which must not extend beyond 30 days from receipt of the NOD. The taxpayer must also submit all the necessary supporting documents within the 30-day period. Failure by the taxpayer to appear without prior notice is tantamount to a waiver of its right to a Discussion. If the taxpayer does not agree with the BIR’s findings, or if the BIR finds that the taxpayer is still liable for tax deficiencies, the case will be endorsed for issuance of a PAN within ten days from the conclusion of the Discussion.

Preliminary Assessment Notice (PAN)

The PAN contains the proposed deficiency tax assessment along with its factual and legal bases. The taxpayer may file a reply to the PAN within 15 days from receipt, containing the taxpayer’s factual and legal bases in disputing the PAN, and supporting documents.

Final Assessment Notice and Formal Letter of Demand (FAN/FLD)

The BIR will review the taxpayer’s reply to the PAN. If the BIR does not accept the taxpayer’s explanation, it will issue the FAN/FLD, which must be done within the three-year prescriptive period, and in exceptional cases, within ten years. Otherwise, the BIR’s right to assess will be barred by prescription. Usually, the FAN/FLD is only a reiteration of the findings in the PAN with adjustments on the amount of interest.