- Contact sales

Start free trial

Project Cost Estimation: How to Estimate Project Cost

Good cost estimation is essential for project management success. Many costs can appear over the project management life cycle, and an accurate project cost estimation method can be the difference between a successful plan and a failed one. Project cost estimating, however, is easier said than done. Projects bring risks, and risks bring unexpected costs and cost management issues.

What Is Project Cost Estimation?

Project cost estimation is the process that takes direct costs, indirect costs and other types of project costs into account and calculates a budget that meets the financial commitment necessary for a successful project. To do this, project managers and project estimators use a cost breakdown structure to determine all the costs in a project.

Project cost estimation is critical for any type of project , from building a bridge to developing that new killer app. Everything costs money, so the clearer you are on the amount required, the more likely you and your project team will achieve your objective.

Project cost estimating is a critical step during the project planning phase because it helps project managers create a project budget that covers the project costs that are needed to achieve the goals and objectives of the project set forth by executives and project stakeholders.

Get your free

Project Estimate Template

Use this free Project Estimate Template for Excel to manage your projects better.

What Is a Project Estimate?

A project estimate is the process of accurately forecasting the time, cost and resources required for a project. This is done by looking at historical data, getting information from the client and itemizing each resource and its duration of use in the project.

To create a project estimate, you should first define your project scope and then create a project cost breakdown structure, which allows you to pinpoint all of your different project costs for each stage of the project life cycle.

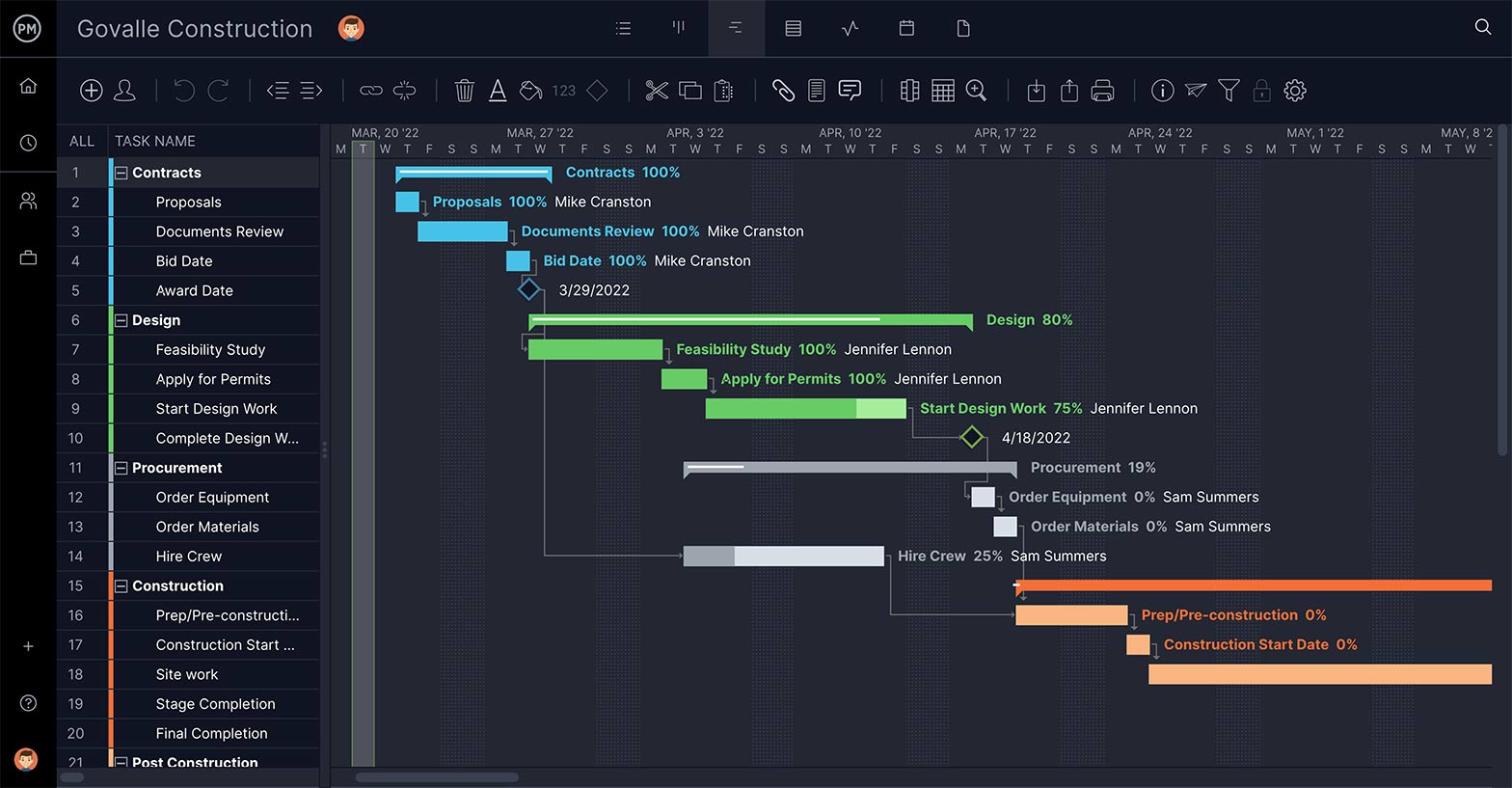

Project cost estimation is simplified with the help of project management software like ProjectManager . Add project budgets and planned costs for specific tasks and include labor rates for your team. When you build your plan on our Gantt chart, your estimated project costs will calculate automatically. Plus, as the project unfolds, you can track your costs in real time on our automated dashboard. Try it for free today.

What Is a Project Cost Breakdown Structure?

A cost breakdown structure (CBS) is a very important project costing tool that details the individual costs of a project on a document. Similar to a work breakdown structure (WBS) , it’s a hierarchical chart where each row represents a type of cost or item. This is done at the task level, which is called a bottom-up analysis.

Creating a cost breakdown structure might be time-consuming, but one that’s worth the effort in that the result is a more accurate estimate of costs than you’d get with a top-down approach, such as basing all your estimates on the costs of previous, similar projects.

Using a cost breakdown structure is an essential part of project cost management and resource management . By zeroing in on costs at the task level early during the project planning phase, you’re less likely to miss hidden costs that could come up later during the project execution stage and throw your project budget off.

Types of Project Costs

There are five main types of costs that make up your total project cost. Here’s a quick overview of these types of project costs and how to measure them.

- Direct costs: Direct costs are those that occur in a project and are attached to specific activities. These are generally costs that are easier to accurately estimate. They include raw materials, labor, supplies, etc.

- Indirect costs: Indirect costs in a project are those that are in support of the project, such as administrative fees. These can include everything from rent to salaries of the administrative staff to utilities, etc.

- Fixed costs: Fixed costs, as the name suggests, are those that don’t change throughout the life cycle of a project . Some examples of fixed costs include setup costs, rental costs, insurance premiums, property taxes, etc.

- Variable costs: Variable costs are costs that change due to the amount of work that’s done in the project and are variable in nature. These costs can include hourly labor wages, materials, fuel costs and so on.

- Sunk costs: In project cost estimating, when an investment has already been incurred and can’t be recovered it’s called a sunk cost or retrospective cost. Some examples of sunk costs include marketing, research, installation of new software, etc.

What Does a Project Estimator Do?

The project estimator or cost estimator, is tasked with figuring out the duration of the project in order to deliver it successfully. This includes determining the resources needed, including labor, materials, etc., which informs the project budget .

In order to do this, a project estimator must understand the project and its phases and be able to research the historical data of projects that were similar and executed in the past. Cost estimators also need to have a firm grasp of mathematical concepts.

Unlike a project manager , who’s responsible for the delivery and oversight of the project, a project estimator is focused on the direct and indirect costs associated with the project. Project estimators work closely with contractual professionals to develop accurate estimates, which are presented to project leaders.

Project Cost Estimation Techniques

All of these factors impact project cost estimation, making it difficult to come up with precise estimates. Luckily, there are cost estimating techniques that can help with developing a more accurate cost estimation.

Analogous Estimating

Seek the help of experts who have experience in similar projects, or use your own historical data. If you have access to relevant historical data, try analogous estimating, which can show precedents that help define what your future costs will be in the early stages of the project.

Parametric Estimating

There’s statistical modeling or parametric estimating , another cost estimation method that also uses historical data of key cost drivers and then calculates what those costs would be if the duration or another of the project is changed.

Bottom-Up Estimating

A more granular approach is bottom-up estimating, which uses estimates of individual tasks and then adds those up to determine the overall cost of the project. This cost-estimating method is even more detailed than parametric estimating and is used in complex projects with many variables such as software development or construction projects.

Three-Point Estimate

Another approach is the three-point estimate, which comes up with three scenarios: most likely, optimistic and pessimistic ranges. These are then put into an equation to develop an estimation.

Reserve Analysis

Reserve analysis determines how much contingency reserve must be allocated. This cost estimation method tries to wrangle uncertainty.

Cost of Quality

Cost of quality uses money spent during the project to avoid failures and money applied after the project to address failures. This can help fine-tune your overall project cost estimation. Plus, comparing bids from vendors can also help figure out costs.

Dynamic Project Costing Tools

Whenever you’re estimating costs, it helps to use online software to collect all of your project information. Project management software can be used in Congress with many of these techniques to help facilitate the process. Use online software to define your project teams, tasks and goals. Even manage your vendors and track costs as the project unfolds. We’ll show you how.

Free Project Cost Estimation Template

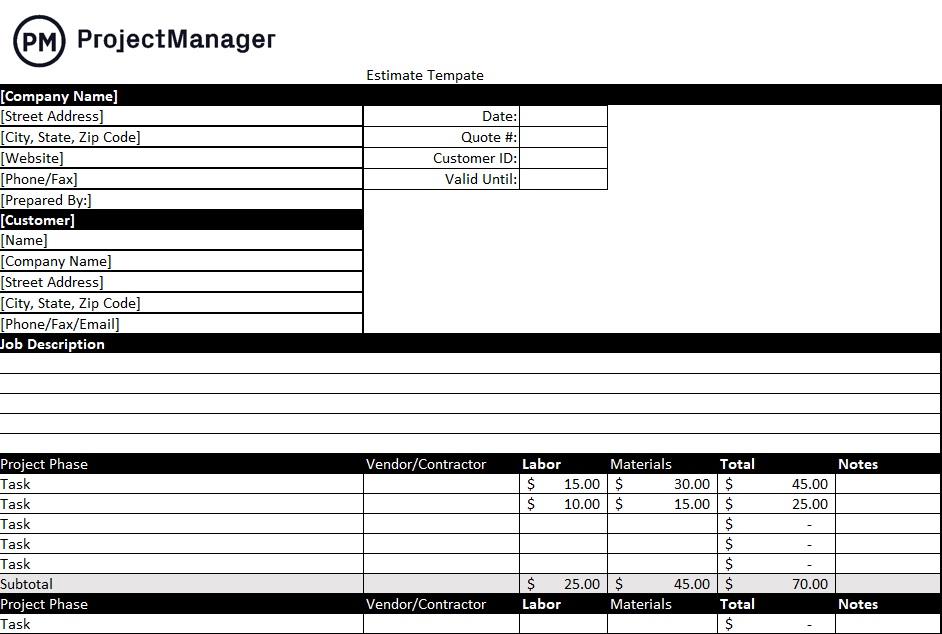

ProjectManager has free templates for every aspect of managing a project, including a free cost estimate template for Excel. It can be used for any project by simply replacing the items in the description column with those items that are relevant to your project.

This free cost estimate template has all the fields you’d need to fill in when estimating project costs. For example, there’s the description column followed by the vendor or subcontractor column and then there are columns to capture the labor and raw materials costs. These can be added together by line and then a total project cost can be calculated by the template.

Naturally, a cost estimate template is a static document. It’s handy in terms of collecting all your project costs and tracking them over the life cycle of the project. However, all that data must be manually added, which takes time and effort—two things that you don’t have in abundance when managing a project. Once you’re ready to streamline the cost estimate process you’ll find that there are many project management software solutions that can build budgets and track them in real time to keep you from overspending.

How to Estimate Project Costs in 10 Steps

The U.S. government has identified a 10-step process that results in reliable and valid cost estimates for project management . Those steps are outlined below.

- Define the cost estimate’s purpose: Determine the purpose of the cost estimate, the level of detail that is required, who receives the estimate and the overall scope of the estimate.

- Develop an estimating plan: Assemble a cost-estimating team and outline their estimation techniques. Develop a timeline , and determine who will do the independent cost estimate. Finally, create the team’s schedule.

- Define characteristics: Create a baseline description of the purpose, system and performance characteristics. This includes any technology implications, system configurations, schedules, strategies and relations to existing systems. Don’t forget support, security, risk items, testing and production, deployment and maintenance and any similar legacy systems.

- Determine cost estimating techniques: Define a work breakdown structure (WBS) and choose an estimating method that’s best suited for each element in the WBS. Cross-check for cost and schedule drivers; then create a checklist.

- Identify rules, assumptions and obtain data: Clearly define what’s included and excluded from the estimate and identify specific assumptions.

- Develop a point estimate: Develop a cost model by estimating each WBS element.

- Conduct a sensitivity analysis: Test the sensitivity of costs to changes in estimating input values and key assumptions, and determine key cost drivers.

- Conduct risk and uncertainty analysis: Determine the cost, schedule and technical risks inherent with each item on the WBS and how to manage them.

- Document the estimate and present it to management: Having documentation for each step in the cost estimate process keeps everyone on the same page with the cost estimate. Then you can brief the project stakeholders on cost estimates to get their approval.

- Update the cost estimate: Any changes to the cost estimate must be updated and reported . Also, perform a postmortem where you can document lessons learned.

Project Cost Estimation Example

Let’s take a moment to create a hypothetical project and run through a general cost estimate example to see how this process works. Construction cost estimation is straightforward so we’ll use a construction estimate example. This construction project will focus on the general requirements for cost estimation in project management.

Related: Construction Estimate Template

First, you’ll want to have a list describing the various elements needed to build your construction project. Gather all your construction project management documents such as plans, designs and specifications, blueprints and permits to find out cost data. In your documents, you’ll find administrative costs, financing costs, legal fees, engineering fees, insurance and other cost items.

Now it’s time to use a work breakdown structure (WBS) to identify all your construction project activities. Identify the labor costs, direct costs and indirect costs associated with every activity in your project schedule. There are various cost estimating techniques such as bottom-up estimating which allow contractors to estimate costs for each construction activity to create accurate proposals for the construction bidding process.

These costs are then added together for a line total, and those line totals are added together to determine your total project cost. Having a cost estimation template is a good tool to collect and track this information.

ProjectManager Helps With Project Cost Estimation

ProjectManager is a project management software that has features to help create a more accurate project cost estimate. Our Gantt chart can be used to help you track costs and expenditures for projects and tasks.

Estimate Costs of Specific Tasks

When estimating individual tasks, costs can also be collected and tracked on our online Gantt chart. Here you can add a column for the estimated costs, baseline cost and the actual costs to help you keep the project on budget once it’s been executed.

Our online Gantt chart can not only track tasks, but you can set it up to track materials and fixed costs associated with each project task and monitor the difference between budget and actual costs. All of this data is collected on one page.

Start by creating a project and then go to the Gantt view on ProjectManager. If you already have data, you can import it by clicking on the import button on the top right-hand side of the page. Or you can use this online Gantt chart to collect the data. It can be easily shared with team members and stakeholders when you’re ready to get input or approval.

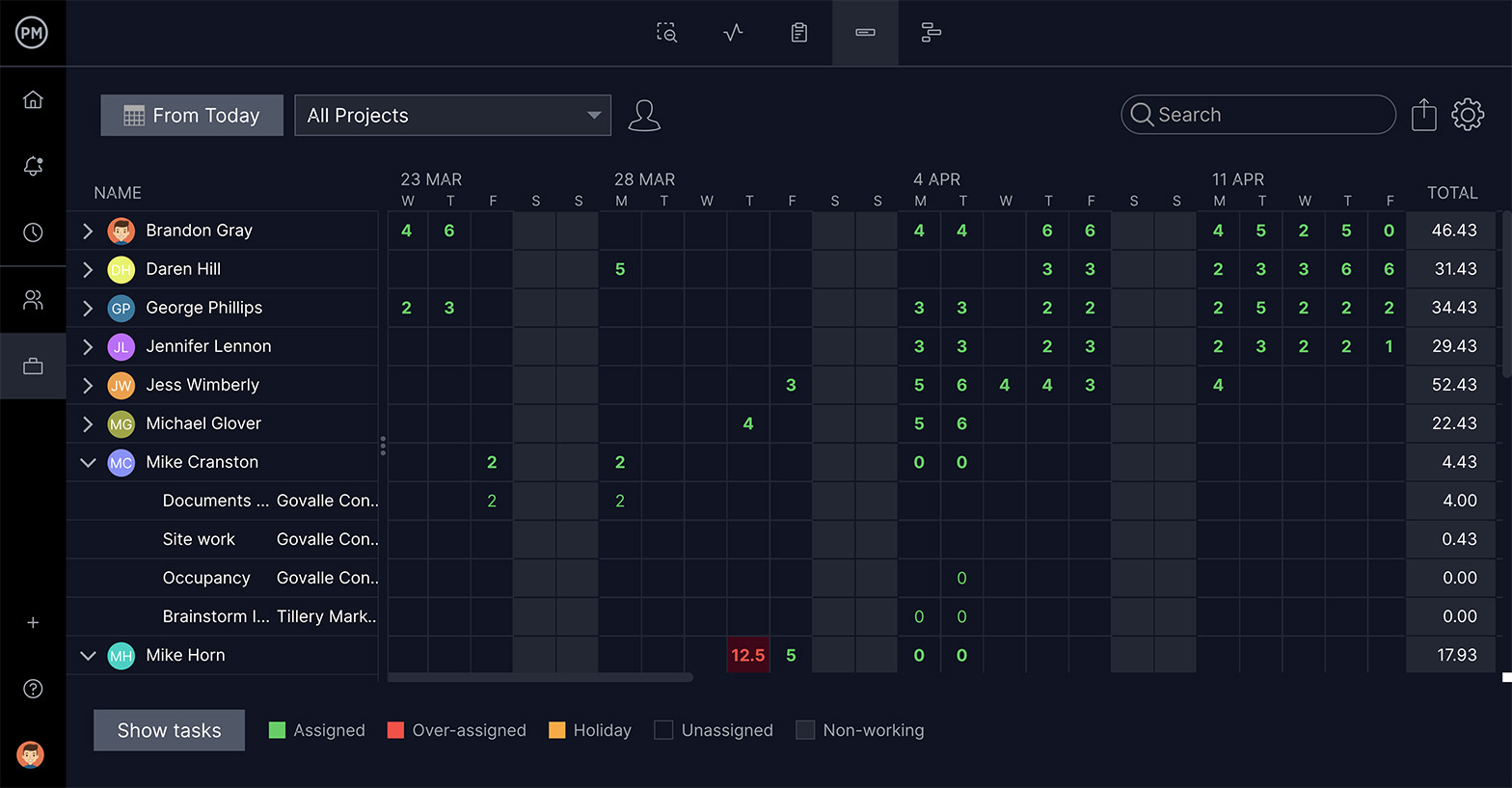

Estimate Costs of Resources

The resource management feature on ProjectManager is another tool that can help you achieve a more accurate project cost estimate. It offers a way to look at your costs through the workload across tasks and projects.

When planning a project with our resource management tool , you can account for employee schedules, equipment rentals, holidays and office space, among other factors that’ll impact your budget. Distributing project resources is one way to balance a budget.

Create a resource plan by scheduling the dates for planned resources, how long you’ll need them and the people who will be involved. That includes any equipment or site rentals. Break that down into the number of resources needed for each activity on a daily basis and you’ll be able to create a schedule with detailed resources, including duration and estimated costs.

FAQs About Project Cost Estimation

Here are some of the most frequently asked questions about project cost estimation online.

What Is Project Cost Analysis?

A project cost analysis is used to determine the costs and benefits associated with a project. It’s a process used to determine if the project is feasible.

What Is a Project Cost Breakdown?

A project cost breakdown is the process by which a project manager estimates what will need to be spent in order to deliver a project. A cost breakdown structure is used during the project cost estimating process to ensure all costs are accounted for.

Why Is Project Cost Estimation Important?

Cost estimation and cost management are an essential part of project management. The project manager is responsible for making the most accurate project budget possible by using a cost breakdown structure and project estimating techniques.

The project budget collects indirect costs and direct costs as it estimates the overall cost of delivering the project on time and meeting quality expectations. That means, whatever you’re going to need to make the project a success will be thought through during the cost estimation process.

Related Content

- Project Estimation Techniques: A Quick Guide

- Time Estimation in Project Management: Tips & Techniques

- Calculating Estimate at Completion (EAC)

- Parametric Estimating In Project Management

- What Is Job Costing? When to Use a Costing Sheet (Example Included)

When estimating costs on a project, you want to have the best tools to help you calculate a more accurate budget. ProjectManager is online project management software with online Gantt charts and resource management features that give you control over your project costs. See how ProjectManager can assist with your project cost estimation by taking this free 30-day trial today.

Deliver your projects on time and under budget

Start planning your projects.

Estimating Cost of a Project: Techniques and Examples

Estimating cost is an important process in project management as it is the basis for determining and controlling the project budget. Costs are estimated for the first time at the beginning of a project or even before a project has started. Subsequently, the (re-)estimation of the project cost is repeated on an ongoing basis to account for more detailed information or changes to the scope or timeline.

For instance, if the earned value management measures that are used for controlling project cost indicate significant variances from the budget, a re-estimation of the cost and schedule and a revisiting of the overall budget can be inevitable.

The methods introduced in this article are tools and techniques of the “Estimate Costs” process that is part of PMI’s Knowledge Area “Project Cost Management” (see PMBOK®, 6 th edition, ch. 7.2).

What Is a Cost Estimate?

Rough order of magnitude vs. definitive estimate, estimate to complete (etc) and estimate at completion (eac), when are cost estimated, why is cost estimation important in project management, comparison of estimation techniques, expert judgment , analogous estimating , parametric estimating, bottom-up estimating, three-point estimating.

A Cost estimate is a quantified expectation of how many resources are required to complete a project or parts of a project.

Such cost estimates are often expressed in currency units. However, other units such as man-days can also be used if the currency amounts are not applicable or irrelevant.

There are different types of cost estimates. The Project Management Body of Knowledge lists the rough order of magnitude (ROM) and the definitive estimate. Both types differ in respect of their accuracy, the project phases in which they are used as well as the available tools and techniques. Some projects use additional, sometimes industry-specific types of estimates.

Cost estimating involves different tools and techniques which typically include

- Expert judgment,

- Analogous estimating,

- Parametric estimating,

- Bottom-up estimating,

- Three-point estimating, and

- Cost of quality.

Read on to learn the details of these techniques, supplemented with examples and practical considerations.

What Are the Types of Cost Estimates?

According to the PMBOK®, there are 2 types of cost estimates:

- Rough order of magnitude (ROM) with an accuracy of -25% to + 75% (other frameworks quote a range of +/-50%) and

- Definitive estimate with an accuracy range of -5% to +10%.

Some sources also list so-called preliminary estimates and budget estimates as further gradations of estimate types. There are also industry-specific types of estimates such as design and bid estimates in construction projects ( source ). However, the current PMI project management framework only refers to the 2 above-mentioned types.

If the budget has to be revisited part way through a project, a so-called estimate to complete (ETC) is determined.

The obvious difference between these 2 types of estimates is the accuracy: the ROM is rather inaccurate with a broad range of possible outcomes. It is therefore typically used in project initiation phases where a ballpark figure is sufficient to get a project started.

The definitive estimate is determined in the course of the project when more information and resources for accurate estimates are available.

Read this article for more details on the ROM and the differences between ROM and definitive estimate .

If partway in a project it turns out that the budget baseline (based on previous estimates) cannot be met, a re-estimation of the project cost is required.

This is done by determining an estimate to complete (ETC) which is used to calculate a new estimate at completion (EAC) that replaces the initial budget at completion and thus becomes the new cost baseline of a project.

Costs are estimated at different points in time throughout the project. The PMBOK states that the process is performed “periodically throughout the project as needed” (source: PMBOK®, 6 th edition, ch. 7.2).

The first point to estimate cost is during the initiation phase, e.g. when the project business case or the project charter is created. For these documents, a project manager has to determine the amount of resources that is required to complete the project.

As the information that is available at that point is usually not very detailed, the project manager will likely end up producing a rough order of magnitude estimate rather than a definitive estimate. Later in the project when more information is available, this order of magnitude estimate will be replaced with a definitive estimate.

After the project initiation phase, the cost will be re-assessed during the planning phase, using the techniques introduced in this article.

In subsequent phases, costs are typically (re-)estimated if relevant new information and details become known or if changes to the project scope or timeline occur. One of the common reasons for re-estimating cost is, for instance, when the indicators of the project controlling suggest that the original budget baseline cannot be met.

Estimating costs is one of the core activities of project management and planning. This is because a project is defined as being subject to at least three fundamental constraints : scope , budget and time. Cost estimates are obviously addressing the budget constraint; hence they are highly relevant for the management of a project. The initial rough cost estimate is usually included in the project charter as well as in the business case of a project.

The estimation of costs is also necessary to compute the project budget which is subject to the approval of the project sponsor(s). In fact, the process “determine budget” uses a technique called “cost aggregation” which directly refers to the outputs of the “estimate cost” process.

Cost estimates are the basis for allocating budget to work packages and deliverables which can be politically sensitive within a project as well as among its stakeholders. Therefore, budget determination and assignment require some stakeholder involvement, communication and, in many cases, their approval.

In addition, cost estimates are input parameters for the earned value and variance analyses as well as forecasting of project costs .

Tools and Techniques for Estimating Project Cost

This section provides an overview of the tools and techniques for estimating project costs. These methods refer to chapter 7.2.2 of PMI’s Project Management Body of Knowledge .

Click on the links to the detailed articles on these techniques to find further explanations and practical examples.

This table compares the approaches to estimating project costs and highlights the differences between these techniques.

This technique is suggested by the PMBOK (ch. 4.1.2.1) as a way to produce a cost estimate.

If you or your team have experience with the kind of work that is in the scope of a project, you can use expert judgment to produce an estimate. This requires a certain level of familiarity with the subject of a project and its environments such as the industry and the organization.

Expert judgment can be applied to both bottom-up and top-down estimating. Its accuracy depends greatly on the number and experience of the experts involved, the clarity of the planned activities and steps as well as the type of the project.

Two examples of expert judgment are:

- Estimating the rough order of magnitude at the beginning of a project. At that time, estimates are often performed top-down due to a lack of team members. more accurate estimation techniques (such as parametric estimating) may also not be available due to a lack of data.

- (Re-)estimating the efforts needed to generate the deliverables of a work breakdown structure (WBS) by asking those responsible for work packages and activities to estimate their resource requirements. This type of expert judgment can lead to comparatively accurate results.

Besides being an estimation technique on its own, expert judgment is also inherent to the other estimation techniques. For instance, if the comparability of previous work and the current project is assessed or adjustments to parametric estimates are determined.

Analogous estimating refers to the use of observed cost figures and related values in previous projects (or portions of a project). In order to be accurate, the type and nature of these reference activities must be comparable with the current project.

“Analogous estimating, also called top-down estimating, is a form of expert judgment.” Source: Heldman, Kim. PMP: Project Management Professional Exam Study

This technique uses historical data in the form of values and parameters to determine the expected resource requirements of a current project. The historic values are adopted for the current work and can be adjusted for differences in scope or complexity. Analogous estimating is categorized as a gross value estimating approach.

In general, analogous estimates are used if a project has access to historical data on similar types of work while the details and resources for more accurate estimates in the current project, such as parametric or bottom-up estimating, are not available.

Parametric estimating is a statistical approach to determine the expected resource requirements. It is based on the assumed or proven relationship of parameters and values. Simple examples are the building cost per square foot in construction projects or the implementation cost per data field in IT projects.

If, for instance, the cost of implementing a new data field in an IT system were $20,000 according to historical data, and a project required 15 new data fields, the total cost of this part of the project would be 15 x $20,000 = $300,000.

The input data can be obtained from previous projects or external data sources such as industry benchmarks or publicly available statistics.

In practice, this technique is employed with a broad variety of sophistication and accuracy. It can be used with a simple ‘rule of three’ calculation but also in conjunction with a complex statistical or algorithmic model that may consider multiple quantitative and qualitative parameters for detailed regression analyses.

In projects that do not use an explicit statistical correlation analysis, some expert judgment is required to assess whether it would be reasonable to apply the historic parameters to the current project. Complexities of projects and activities vary and may therefore require certain adjustments.

For instance, building a highway in a mountainous region likely produces a higher cost per mile than in a flat area. IT development projects in complex IT architectures or systems tend to require more resources than a less complex environment.

Another consideration concerns the expertise and experience of the project team. If a previous project was delivered by highly skilled and experienced resources while the current team is just at the beginning of its learning curve, using unadjusted historic data may understate the estimated cost.

Similar to analogous estimates, adjustments can be made to adapt the parametric estimates to the current project.

Depending on the quality of the input data and its applicability to the current type of work, the parametric estimation technique can produce very accurate figures. However, the higher the accuracy desired the more resources are needed to perform the data gathering and statistical analyses.

Bottom-up estimation refers to a technique that involves estimating the cost at a granular level of work units. The estimates for all components of a project are then aggregated in order to determine the overall project cost estimate.

In practice, these estimates are often performed at the lowest level of the work breakdown structure (WBS), e.g. for work packages or even activities.

While there is no clear rule on who should be performing this estimation, it seems to be a good practice in project management: asking those project team members who are operationally in charge of the respective work packages or activities to estimate there on work.

Thus, this approach to estimating costs often comes with significantly higher accuracy than top-down estimations. However, obtaining and aggregating these granular estimates normally requires some resources and can potentially become a political challenge, especially in large or complex projects.

Three-point estimating is a technique that usually leverages on bottom-up estimates, analogous or expert estimates. The concept requires three different points of estimates: the optimistic (best case), pessimistic (worst case) and the most likely cost estimate.

Based on these 3 points, a weighted average cost estimate is determined that overweighs the “most likely” point. This can be done by assuming a triangular distribution, a PERT or beta distribution.

Read this article for further explanation and examples of this technique.

In this article, we have discussed the techniques of cost estimating as suggested by the PMBOK. Note that the level of detail and granularity of the estimates usually increases throughout the project.

In the initiation phase, the rough order of magnitude (ROM) is often the only type of estimate that can be obtained. Definitive estimates will usually require techniques such as analogous, bottom-up and parametric estimating that may only become available in later stages of a project.

Parametric and bottom-up estimates are usually the techniques that provide the most accurate cost projections. They are commonly used if the budget needs to be revisited and replaced with a new estimate at completion.

When a budget is determined and approved, earned value analysis and variance analysis help project managers control the cost and value generated in a project. You will find more details on the measures and the techniques in this article .

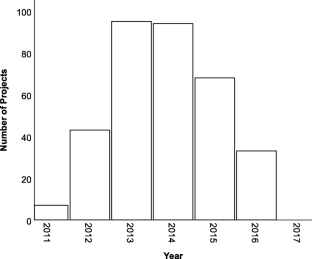

An empirical study on a single company’s cost estimations of 338 software projects

- Published: 25 November 2022

- Volume 28 , article number 11 , ( 2023 )

Cite this article

- Christian Schürhoff 1 ,

- Stefan Hanenberg ORCID: orcid.org/0000-0001-5936-2143 1 &

- Volker Gruhn 1

355 Accesses

10 Altmetric

Explore all metrics

A recurring statement in the literature is that cost estimations in software projects are problematic, but the evidence for such a statement is often unclear. In this paper, we analyze a project repository consisting of 338 software projects from the German software company adesso where for each project the original estimation is available in addition to the actual and estimated remaining costs at different points in time. The results revealed that there is an underestimation of costs in the repository (12.6%), but this underestimation is not significant: the hypothesis \(\mu (\frac {estimatedCosts}{averageCosts})=1\) (respectively the hypothesis on the log-transformed ratios \(\mu (log(\frac {estimatedCosts}{averageCosts}))=0\) ) could not be rejected. However, we found a significant underestimation in the largest 20% of projects. And finally, we found a strong correlation between the estimated costs after 50% project duration and the final costs.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

Analysis of the Software Project Estimation Process: A Case Study

A Proposal to Improve the Earned Value Management Technique Using Quality Data in Software Projects

Review of Current Software Estimation Techniques

https://www.adesso.de/

We considered only software development projects, because, for example, maintenance projects in the repository do not necessarily describe software maintenance projects, i.e. the other kinds of projects in the repository could be pure consulting projects without the goal to write any software.

Note: The data set provided with this paper does not permit to reconstruct the absolute human days per project or per year. The reasons for this is the need to protect the company’s data and to not give others the opportunity to check what projects played what role in the company’s balance sheet.

We use here the previously used terminology of BAC to describe the initially estimated costs.

Note: We give these numbers in order to get an impression of the data underlying this study. The raw data provided with this paper does not contain absolute numbers, i.e., it is not possible to compute from the raw data provided with this paper the number of human days per project.

Due to the uncleanliness of the repository not all ETCs are set to 0, i.e., the computation of the global CPI requires to consider the ETCs of each project as well.

This number cannot be computed from the repository delivered with this paper, because the computation requires the concrete ACs, BACs, and ETCs.

In order to ease the reading of the paper, we directly state at the hypotheses, whether or not they were rejected.

Throughout this paper, we used SPSS v27 for the statistical analysis.

There is one project in the dataset with CPI = 0 (which cannot be log transformed). For this rather small project (total number of human days less than 10), the final BAC and ETC where equal, i.e. it is one of those project, where we assume that the ETCs (and ACs) were finally not added to the repository. As a consequence, we decided to remove the project for the comparison of log-transformed CPIs.

In order to have a comparable basis, we applied the t-test to the same 337 projects.

The original reference refers to the ratio \(\frac {BAC}{AC}\) which is at the end of the project the CPI.

Since not all projects had ETC = 0 in the end, we added the remaining planned estimates to complete to the actual costs before the analysis.

We intentionally do not describe the concrete values on the x-axis, because such concrete value would contradict the confidality of adesso’s data.

Actually, the sets of AC and the BAC determined upper 20% projects just differ by 6 projects.

Just to make sure that the used 20% are not the main drivers that no difference to CPI = 0 on all projects was identified in Section 4.3 , we tested the difference to 0 on the smallest 20% of projects as well as on the resulting 80% of projects. In all cases, no significant difference from μ ( l o g ( C P I )) L a r g e s t 20 % = 0 was detected (p >.5).

We define the 0% quantile as the very first CPI for a project.

Addison T, Vallabh S (2002) Controlling software project risks: an empirical study of methods used by experienced project managers. In: Proceedings of the 2002 annual research conference of the South African Institute of Computer Scientists and Information Technologists on enablement through technology, SAICSIT ’02. South African Institute for Computer Scientists and Information Technologists, Republic of South Africa, pp 128–140

Albrecht A J (1979) Measuring application development productivity. In: Proceedings of joint share, guide, and IBM application development symposium

Aranda J, Easterbrook S (2005) Anchoring and adjustment in software estimation. In: Proceedings of the 10th European software engineering conference held jointly with 13th ACM SIGSOFT international symposium on foundations of software engineering, ESEC/FSE-13. ACM, New York, pp 346–355

Bergeron F, St-Arnaud J-Y (1992) Estimation of information systems development efforts: a pilot study. Inf Manag 22(4):239–254

Article Google Scholar

Boehm B W (2017) Software cost estimation meets software diversity. In: 2017 IEEE/ACM 39th international conference on software engineering companion (ICSE-c), IEEE, pp 495–496

Boehm B W (1981) Software engineering economics. Prentice-hall advances in computing science and technology series. Prentice-Hall

Boehm B, Abts C, Chulani S (2000a) Software development cost estimation approaches—a survey. Ann Softw Eng 10(1–4):177–205

Article MATH Google Scholar

Boehm B W, Clark B K, Horowitz E, Brown A W, Reifer D J, Chulani S, Madachy R, Steece B (2000b) Software cost estimation with Cocomo II with Cdrom, 1st edn. Prentice Hall PTR, Upper Saddle River

Google Scholar

Britto R, Freitas V, Mendes E, Usman M (2014) Effort estimation in global software development: a systematic literature review

Brooks FP Jr (1995) The mythical man-month (anniversary Ed.) Addison-Wesley Longman Publishing Co., Inc., Boston

Emam K E, Koru A G (2008) A replicated survey of it software project failures. IEEE Softw 25(5):84–90

Garousi V, Coskuncay A, Betin-Can A, Demirors O (2014) A survey of software engineering practices in Turkey. J Syst Softw 108:148–177

Glass R L (2006) The standish report: does it really describe a software crisis? Commun ACM 49(8):15–16

Grimstad S, Jørgensen M (2007) Inconsistency of expert judgment-based estimates of software development effort. J Syst Softw 80(11):1770–1777

Grimstad S, Jørgensen M (2008) A preliminary study of sequence effects in judgment-based software development work-effort estimation. In: Proceedings of the 12th international conference on evaluation and assessment in software engineering, EASE’08. BCS Learning & Development Ltd, Swindon, pp 129–135

Halkjelsvik T, Jørgensen M (2012) From origami to software development: a review of studies on judgment-based predictions of performance time. Psychol Bull 138(2):238–271

Hill J, Thomas L C, Allen D E (2000) Experts’ estimates of task durations in software development projects. Int J Proj Manag 18(1):13–21

Jenkins A M, Naumann J D, Wetherbe J C (1984) Empirical investigation of systems development practices and results. Inf Manag 7(2):73–82

Jørgensen M (2004) Regression models of software development effort estimation accuracy and bias. Empir Softw Eng 9(4):297–314

Jørgensen M, Shepperd M (2007) A systematic review of software development cost estimation studies. IEEE Trans Softw Eng 33(1):33–53

Jørgensen M, Grimstad S (2010) Software development effort estimation—demystifying and improving expert estimation. Springer, Berlin, pp 381–403

Jørgensen M, Halkjelsvik T, Kitchenham B (2012) How does project size affect cost estimation error? Statistical artifacts and methodological challenges. Int J Proj Manag 30:839–849

Kitchenham B, Pfleeger S L, McColl B, Eagan S (2002) An empirical study of maintenance and development estimation accuracy. J Syst Softw 64(1):57–77

Kwak Y, Anbari F (2012) History, practices, and future of earned value management in government: perspectives from nasa. Project Manag J 43:77–90

Langdon W B, Dolado J, Sarro F, Harman M (2016) Exact mean absolute error of baseline predictor, marp0. Inf Softw Technol 73:16–18

Larman C, Basili V R (2003) Iterative and incremental developments. A brief history. Computer 36(6):47–56

Larman C (2004) Agile and iterative development: a manager’s guide. Addison-Wesley

Lederer A L, Mirani R, Neo B S, Pollard C, Prasad J, Ramamurthy K (1990) Information system cost estimating: a management perspective. MIS Q 14(2):159–176

Lo B, Gao X (1997) Assessing software cost estimation models: criteria for accuracy, consistency and regression. Australas J Inf Syst 5(1):11

Møloekken K, Jørgensen M (2003) A review of software surveys on software effort estimation. In: 2003 International symposium on empirical software engineering. ISESE 2003. Proceedings, pp 223–230

Møloekken-Østvold K, Jørgensen M, Tanilkan SS, Gallis H, Lien AC, Hove SW (2004) A survey on software estimation in the Norwegian industry. In: 10th International symposium on software metrics. Proceedings, pp 208–219

Moløkken K, Jørgensen M (2003) Software effort estimation: unstructured group discussion as a method to reduce individual biasis. In: Proceedings of the 15th annual workshop of the psychology of programming interest group, PPIG 2003, Keele, UK, April 8–10, 2003, p 4

Phan D, Vogel D, Nunamaker J (1988) The search for perfect project management. Computerworld 22(39):95–100

Putnam L (1978) A general empirical solution to the macro software sizing and estimating problem. IEEE Trans Softw Eng 4(04):345–361

Sarro F, Petrozziello A, Harman M (2016) Multi-objective software effort estimation. In: Dillon LK, Visser W, Williams LA (eds) Proceedings of the 38th international conference on software engineering, ICSE 2016, Austin, TX, USA, May 14–22, 2016. ACM, pp 619–630

Sauer C, Cuthbertson C (2003) The state of it project management in the UK 2002–2003. Computer Weekly

Shepperd M J (2014) Cost prediction and software project management. In: Ruhe G, Wohlin C (eds) Software project management in a changing world. Springer, pp 51–71

Shepperd M J, Macdonell SG (2012) Evaluating prediction systems in software project estimation. Inf Softw Technol 54(8):820–827

Shepperd M, Schofield C, Kitchenham B (1996) Effort estimation using analogy. In: Proceedings of the 18th international conference on software engineering, ICSE ’96. IEEE Computer Society, Washington, DC, pp 170–178

Vicinanza S S, Mukhopadhyay T, Prietula M J (1991) Software-effort estimation: an exploratory study of expert performance. Info Sys Res 2 (4):243–262

Whitfield D (2007) Cost overruns, delays and terminations in 105 outsourced public sector ict contracts. In: ESSU Research report no. 3. The European services strategy unit

Wohlin C, Runeson P, Höst M, Ohlsson M C, Regnell B, Wesslén A (2000) Experimentation in software engineering: an introduction. Kluwer Academic Publishers, Norwell

Book MATH Google Scholar

Zhu X, Zhou B (2010) An earned-value approach to assess and monitor software project uncertainty: a case study in software test execution. Inf Technol J 9:0

Yang D, Wang Q, Li M, Yang Y, Ye K, Du J (2008) A survey on software cost estimation in the chinese software industry. In: Proceedings of the second ACM-IEEE international symposium on empirical software engineering and measurement, ESEM ’08. ACM, New York, pp 253–262

Yourdon E (1997) Death march: the complete software developer’s guide to surviving mission impossible projects. Prentice Hall PTR, Upper Saddle River

Download references

Author information

Authors and affiliations.

Paluno – The Ruhr Institute for Software Technology, University of Duisburg–Essen, Essen, Germany

Christian Schürhoff, Stefan Hanenberg & Volker Gruhn

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Stefan Hanenberg .

Ethics declarations

Volker Gruhn co-founded adesso in 1997 and is currently chairman of adesso’s supervisory board.

Additional information

Communicated by: Dietmar Pfahl

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

Reprints and permissions

About this article

Schürhoff, C., Hanenberg, S. & Gruhn, V. An empirical study on a single company’s cost estimations of 338 software projects. Empir Software Eng 28 , 11 (2023). https://doi.org/10.1007/s10664-022-10245-z

Download citation

Accepted : 20 September 2022

Published : 25 November 2022

DOI : https://doi.org/10.1007/s10664-022-10245-z

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Software development projects

- Cost estimation

- Find a journal

- Publish with us

- Track your research

Project Cost Estimation: Examples and Techniques

Fahad Usmani, PMP

August 7, 2022

To be successful, a project must be finished on schedule and under budget while also satisfying the standards outlined for its scope. To accomplish the goals of this project, it is necessary to perform effective project cost estimation, planning, and control.

Estimating project costs allows you to more accurately establish the total cost of the project, as well as your budget and the cost baseline.

Estimating costs in project management is extremely important, even though many organizations cannot carry it out accurately. As per PMI’s Pulse of the Profession Report, 28% of project deviates due to faulty cost estimates. Though this report is not available on the site, the screenshot can be seen below:

The cost estimation is not difficult; it only requires knowledge of some simple tools and dedication.

Estimating the costs of a project is an important step, and if you make any mistakes in this step, it could result in an inaccurate project budget, which could impact the project’s goals.

Let’s look at a real-world example of an incorrect project estimation before we examine the project’s cost estimation.

A local authority requested proposals for a multi-year contract to build multiple metro train stations. A large number of contractors submitted bids, and the one with the lowest total won the project.

As a result of inaccurate cost estimation, the project’s cost and schedule deviated significantly from the baselines during the execution period. After several years, the distance between them got so great that the project had to be scrapped.

This is just one example of wrong project cost estimations that were not reflective of actual costs . Low data quality, lack of data, or no refinement can all lead to incorrect estimations.

Longer projects can have shifting requirements; you need to factor them in and update the baseline. In the beginning, you might factor assumptions and constraints incorrectly, so you just go back and validate them.

A Few Cases of Erroneous Project Cost Estimating

- In 1914, the Panama Canal ran 23 million USD over budget compared to the 1907 plans.

- In 1995, the Denver International airport opened 16 months late with extra spending of 2.7 billion USD.

- In 1993, the London Stock Exchange abandoned the Taurus Program after more than ten years of development. Taurus was 11 years late and 13,200 percent over budget, with no viable solution.

What went wrong with these cost estimations?

Estimators lacked information and failed to revise costs and schedules as the project progressed.

Proper estimations help determine a project’s feasibility by weighing the benefits against the costs involved.

What is the Project Cost Estimation?

Project cost estimating process estimate the project cost by accurately identifying the scope of work, tasks, duration, and resources required to complete the project.

The creation of a project baseline and the prevention of scope creep in the later stages of the project can both be aided by an accurate project estimation process.

Estimating the costs of a project is not a one-time task. It is an ongoing process that is performed whenever there is any new information available, the scope of the work changes, or any identified risk occurs and affects the project’s goals.

You will be able to improve your estimation and arrive at a more precise number as the project moves forward and the scope becomes more apparent. This feature is known as progressive elaboration.

Project cost estimating techniques can also help find resources, effort, duration, probability, the impact of risks, etc. It can help you analyze:

- Contingency reserve

- Management reserve

- Organizational budget and estimation

- Vendor bid and analysis

- Make or buy analysis

- Risk probability, impact, urgency, and detectability analysis

- Complexity scenario analysis

- Organizational change management analysis

- Capacity and capability demand estimation

- Benefit definition

- Success criteria definitions

- Stakeholder management planning

Estimation can be simplified using project documentation that includes assumptions and constraints, risks, levels of information, ranges, and confidence levels. The information that is readily available to you on market dynamics, stakeholders, rules, organizational capabilities, risk exposure, and complexity all impact the level of confidence you can have in your estimation.

Importance of Cost Estimation in Project Management

Cost baseline is one of three project baselines, and completing the project within budget is a key project objective.

To develop a cost baseline, you must estimate project costs and determine the budget.

The cost of the project is estimated collaboratively by the project manager and the project management team. It is an effective tool for communication that can be used to display the progress of the project to stakeholders and compare the actual progress to the projected progress.

When the project sponsor wants to know the budget to choose whether or not to move forward with the project, cost estimating is also helpful in the feasibility study.

How to Estimate the Cost of the Project?

In traditional project management, if you have a well-defined scope of work , you will calculate the cost of all elements and add them to get the project cost. However, if you do not have detailed information, you can go for analogous or parametric estimation techniques .

The estimate includes the cost of quality , along with direct and indirect costs .

The scope is defined at a high level in agile project management; this high-level definition is called epics or features. A “user story breaking” process is performed on the epics or features that will be worked on during the sprint before it even begins.

Then, estimates are calculated based on the stories using various estimation techniques, e.g., playing a poker game.

During the sprint planning meeting, the project manager will decide the total number of user stories that will be delivered.

Estimates for every project aspect include assumptions, restrictions, uncertainty, and risk perceptions; these aspects should be incorporated and modified when new information is obtained.

For example, in the initial phase of the project lifecycle, you may have a rough order of magnitude (ROM) estimate between -25% to 75% . However, progressive elaboration can narrow the accuracy from -5% to 10%.

Estimating the project’s cost (definitive estimate) is a long process; you will need to create a WBS, break it down to the activity level, etc.

The following steps will clarify cost estimating in detail.

- Create the Work Breakdown Structure

- Break the Work Packages to the Activity Level

- Compile Activities, and Assign Resource

- Find the Duration and the Cost of Activities

- Roll them Up to Get the Project Cost

#1. Create the Work Breakdown Structure

If you want an accurate cost or time estimate for the project, you need to build a Work Breakdown Structure. It is a useful communication tool in addition to having a hierarchical framework for the project’s work.

An example of a work breakdown structure for a school building is shown below.

#2. Break the Work Packages to the Activity Level

The work package represents the very final level of the WBS. To compute the cost of the project, you must first disassemble the work packages into their respective activity levels. It is imperative that the activity level be one level lower than the work package level.

#3. Compile Activities, and Assign Resource

Compile the list of all activities, sequence them and find the task dependencies. This will help you identify the resources required to complete the project. Now you can add resources to each activity.

#4. Find the Duration and the Cost of Activities

After assigning resources to activities, you can easily find the duration and cost of each activity.

#5. Roll them Up to Get the Project Cost

You have a cost estimation for all project activities. You can now add them and get the total project cost.

Examples of Estimating Costs in Project Management

Here we will discuss two examples using analogous estimating and bottom-up estimating.

Example of Estimating Cost in Project Management Using Analogous Estimating

In this approach, you will compare your project to any previous projects that were comparable to it, locate the cost of the previous project, and then, based on this knowledge, you will make an educated prediction as to how much your current project will cost.

You can utilize this method if you need an estimation quickly or if there is insufficient time to create a full scope of work.

The degree of resemblance between the projects being estimated by analogy is directly proportional to the accuracy of the results. The budget would be more accurate if the project for which you need to estimate the costs and the project that you just completed were extremely comparable in terms of size, scope, and technical complexity.

For instance, you are given a project to construct a school building that would have 20 rooms, and you are tasked with immediately estimating how much money this project will cost.

You look into your organizational process assets and find a similar project where your organization builds a school with 40 classrooms. The cost of this project was 200,000 USD.

Based on this information, you guessed your project cost as 100,000 USD.

Example of Estimating Cost in Project Management Using Bottom-Up Estimating

This is the most time-consuming process to estimate costs in project management. In this method, you create the WBS, break it down to the activity level and find the cost of each activity; then, you add the cost of each activity and roll them up to get the total project cost.

Free Project Cost Estimation Template

You can use the following free template to estimate the cost of your project.

Roles of Stakeholders in Project Cost Estimations

- Project Sponsor: authorizes the budget and lays out a high-level schedule.

- Project Manager: responsible for the estimate, but not necessarily for estimating. The team helps them determine the project estimation.

- Portfolio and/or Program Managers: aggregate the project cost estimation across the projects within the portfolio or program.

- Estimators and Subject Matter Experts: responsible for estimating a specific activity in the project. Estimators and SMEs can be individuals or team members of the organization.

- Analysts: support the project team.

- Senior Management: high-level stakeholders who review and approve the project estimates.

Project Cost Estimation Techniques

You can divide cost estimation techniques into three groups:

- Quantitative

- Qualitative

#1. Quantitative Project Cost Estimation Techniques

These methods involve analyzing data to produce an estimate of costs. When you don’t have enough information, don’t have enough experience, or are pressed for time, you can’t apply these strategies.

Analogous Estimation: you can use an analogous technique when you have limited information, but the project is similar to a previous one. This is useful, and management needs a quick estimation for a feasibility study.

Parametric Estimation: based on historical information of a similar project but uses mathematical equations, like the cost of painting per square foot.

Bottom-Up Estimation: provides the most accurate result, but you can only use this method when all project details are available. Here, you calculate every component and add them up to get a final estimate. The bottom-up estimates technique takes the longest time and resources.

#2. Relative Project Cost Estimation

Instead of being implemented at the level of the sprint backlog, this method is applied at the product backlog level.

When you don’t have much experience, data, or time to work with, the relative method of project cost estimation is the one to turn to. The ability of humans to compare things is utilized in this method of high-level estimation.

In this section, the members of the team compare the amount of effort that is required for the new tasks to the amount of effort that was required for the task that was just finished.

Affinity Grouping: In this technique, similar items are grouped. T-shirt sizing is the most commonly used. A specific item is estimated to be of size small, and it is compared to the next item. If larger, you will group it as medium-sized.

Planning Poker: This method is frequently employed in adaptive and agile estimations. It does this by applying a Fibonacci sequence to the process of determining the point value of an epic, feature, user story, or backlog item. Each user narrative will have its own set of cards, which will be accessible to all team members.

If there are any estimation deviations from multiple team members, the user story is re-discussed till they reach an agreement.

#3. Qualitative Project Cost Estimation Techniques

Some project elements are difficult to quantify. Qualitative estimates rely on understanding processes, behaviors, and conditions as individuals or groups perceive. This technique can be used along with quantitative methods when perceptions are crucial.

Expert Judgement: This is a judgment based on expertise in an application area, knowledge area, discipline, or industry.

Observation: Estimations sometimes can be based on observations (tacit knowledge).

Interviews: A formal or informal approach to extracting information from stakeholders can be used in estimations.

Surveys: A set of written questions designed to capture information from many respondents. This data is then used to formulate a common understanding of the estimates.

Estimating the costs of a project is an important step that will ultimately supply you with the project’s cost. The precision of this method is contingent upon the requisite conditions as well as the information that is at hand. Estimates of costs are regularly improved through iterative and adaptive approaches as the work on the project moves forward.

I am Mohammad Fahad Usmani, B.E. PMP, PMI-RMP. I have been blogging on project management topics since 2011. To date, thousands of professionals have passed the PMP exam using my resources.

PMP Question Bank

This is the most popular Question Bank for the PMP Exam. To date, it has helped over 10,000 PMP aspirants prepare for the exam.

PMP Training Program

This is a PMI-approved 35 contact hours training program and it is based on the latest exam content outline applicable in 2024.

Similar Posts

Contingency Plan Vs Fallback Plan

This is one of those concepts that makes professionals scratch their heads. I was a victim of it myself. During my initial days of PMP exam preparation, I had difficulty understanding the difference between the contingency plan and the fallback plan.

I used to think that the contingency plan was used to manage identified risks and the fallback plan was for unidentified risks. This was wrong. Contingency and fallback plans help manage identified risks.

However, since both plans are used to manage risks, you may wonder which you should follow if any identified risk occurs as both deal with identified risks?

Since I have passed the PMP and PMI-RMP exams and understand these concepts well, I am writing this blog post and hope after reading it you will be able to differentiate the contingency and fallback plan.

What is a Creative Brief? Definition, Examples & Templates

Today, we will discuss the creative brief, its definition, and examples and provide you with a few templates and more. To successfully manage and complete a project, all stakeholders must know the project objectives and strategies and be on the same page from the beginning. The creative brief helps you achieve this goal. This document…

Bill of Materials (BOM): Definition, Examples & Types

Calculating a Bill of Materials (BOM) is a key process in project management and manufacturing industries. A BOM is also known as an assembly ingredient list, a product structure, a bill of quantity, a product blueprint, etc. BOM is also useful in supply chain procedures. For example, materials requirement planning, stock management, forecasting, product pricing,…

Bottom-Up Estimation Technique in Project Management

The bottom-up estimation technique helps project managers estimate the project cost or the duration. This quantitative estimation technique provides the most accurate estimation. Let me give you an example of a bottom-up estimating technique. The government has floated a contract to construct a building and provided a detailed scope of work. However, the contract must…

Estimate to Complete (ETC): Definition, Formula, Example & Calculation

You will often want to know how much more money you need to complete a remaining task.

In your personal matters, you can go with a guess, but in your professional life you must adopt a professional approach and use proven techniques to reach a decision.

In project management one such technique is the Estimate to Complete (ETC), which is another forecasting technique used along with the estimate at completion.

This technique gives you an approximate idea of how much money will be required to complete the remaining balance of work.

Since this is a very important forecasting technique, I will explain this topic with three simple examples in three different scenarios, so you can understand it properly and then we will move on to mathematical examples.

This topic is very important for the PMP exam. You may see a few questions from this topic on your exam.

Okay, let’s get started.

Project Network Diagram In Project Management: Definitions and Examples

A project network diagram is a vital concept in project management, as it is the basis of your schedule and helps you allocate resources. If you are involved in project management, you must understand project network diagrams, their types, and their usage. I will cover this concept in detail in today’s blog post, and I…

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

CONCEPTUAL COST ESTIMATION FRAMEWORK FOR MODULAR PROJECTS: A CASE STUDY ON PETROCHEMICAL PLANT CONSTRUCTION

- Department of Civil and Environmental Engineering

Research output : Contribution to journal › Article › peer-review

Modularization, which allows for pre-assembly away from a construction site, has been known to be more cost-effective than stick-built; however, contractors have difficulty ascertaining the benefits and adopting it. Calculating the benefits and costs of adopting modularization precedes decision making. However, modular cost estimation is challenging since relevant information in the early stages of a project and historical data about industrial modularization both have limited availability. To solve this problem, this study developed a conceptual cost estimation framework for industrial modular projects by converting stick-built project information. The framework is composed of eight steps based on two approaches. This study conducted a case study to demonstrate the applicability of the framework, which compared the project cost of modularization scenarios 1 and 2 with that of the stick-built version of the ongoing project. In addition, the estimated modular cost was compared with the engineers’ estimation to verify the accuracy of the framework. The contributions of this study are in identifying and quantifying the factors influencing the differences in cost between the modularization and stick-built versions, and developing the conceptual cost estimation framework for an industrial modular project. This framework is expected to support deciding on adopting modularization, budgeting, and project viability.

Bibliographical note

All science journal classification (asjc) codes.

- Civil and Structural Engineering

- Strategy and Management

Access to Document

- 10.3846/jcem.2022.16234

Other files and links

- Link to publication in Scopus

Fingerprint

- Modularization Computer Science 100%

- Cost Estimation Computer Science 66%

- Case Study Computer Science 33%

- Decision-Making Computer Science 16%

- Relevant Information Computer Science 16%

- Construction Site Computer Science 16%

- Availability Computer Science 16%

- Influencing Factor Computer Science 16%

T1 - CONCEPTUAL COST ESTIMATION FRAMEWORK FOR MODULAR PROJECTS

T2 - A CASE STUDY ON PETROCHEMICAL PLANT CONSTRUCTION

AU - Choi, Younguk

AU - Park, Chan Young

AU - Lee, Changjun

AU - Yun, Sungmin

AU - Han, Seung Heon

N1 - Publisher Copyright: © 2022 The Author(s).

PY - 2022/1/14

Y1 - 2022/1/14

N2 - Modularization, which allows for pre-assembly away from a construction site, has been known to be more cost-effective than stick-built; however, contractors have difficulty ascertaining the benefits and adopting it. Calculating the benefits and costs of adopting modularization precedes decision making. However, modular cost estimation is challenging since relevant information in the early stages of a project and historical data about industrial modularization both have limited availability. To solve this problem, this study developed a conceptual cost estimation framework for industrial modular projects by converting stick-built project information. The framework is composed of eight steps based on two approaches. This study conducted a case study to demonstrate the applicability of the framework, which compared the project cost of modularization scenarios 1 and 2 with that of the stick-built version of the ongoing project. In addition, the estimated modular cost was compared with the engineers’ estimation to verify the accuracy of the framework. The contributions of this study are in identifying and quantifying the factors influencing the differences in cost between the modularization and stick-built versions, and developing the conceptual cost estimation framework for an industrial modular project. This framework is expected to support deciding on adopting modularization, budgeting, and project viability.

AB - Modularization, which allows for pre-assembly away from a construction site, has been known to be more cost-effective than stick-built; however, contractors have difficulty ascertaining the benefits and adopting it. Calculating the benefits and costs of adopting modularization precedes decision making. However, modular cost estimation is challenging since relevant information in the early stages of a project and historical data about industrial modularization both have limited availability. To solve this problem, this study developed a conceptual cost estimation framework for industrial modular projects by converting stick-built project information. The framework is composed of eight steps based on two approaches. This study conducted a case study to demonstrate the applicability of the framework, which compared the project cost of modularization scenarios 1 and 2 with that of the stick-built version of the ongoing project. In addition, the estimated modular cost was compared with the engineers’ estimation to verify the accuracy of the framework. The contributions of this study are in identifying and quantifying the factors influencing the differences in cost between the modularization and stick-built versions, and developing the conceptual cost estimation framework for an industrial modular project. This framework is expected to support deciding on adopting modularization, budgeting, and project viability.

UR - http://www.scopus.com/inward/record.url?scp=85125044148&partnerID=8YFLogxK

UR - http://www.scopus.com/inward/citedby.url?scp=85125044148&partnerID=8YFLogxK

U2 - 10.3846/jcem.2022.16234

DO - 10.3846/jcem.2022.16234

M3 - Article

AN - SCOPUS:85125044148

SN - 1392-3730

JO - Journal of Civil Engineering and Management

JF - Journal of Civil Engineering and Management

Jyväskylän yliopisto | JYX-julkaisuarkisto

- Opinnäytteet

- Pro gradu -tutkielmat

- Näytä aineisto

Challenges in software project cost estimation : a comparative case study

Tekijät

Päivämäärä, tekijänoikeudet.

http://urn.fi/URN:NBN:fi:jyu-202105172945

- Pro gradu -tutkielmat [28117]

Samankaltainen aineisto

Näytetään aineistoja, joilla on samankaltainen nimeke tai asiasanat.

Why do software development projects fail? : emphasising the supplier's perspective and the project start-up

Individuals at the heart of educational change : local level administrators' views on the development of the organization of language education through top-down projects, bottom-up reorganization, and cooperation and communication , requirements engineering failure factors in software projects , developing it project management model which affects customer satisfaction : case study of government ict centre valtori , work‐from‐home impacts on software project : a global study on software development practices and stakeholder perceptions .

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

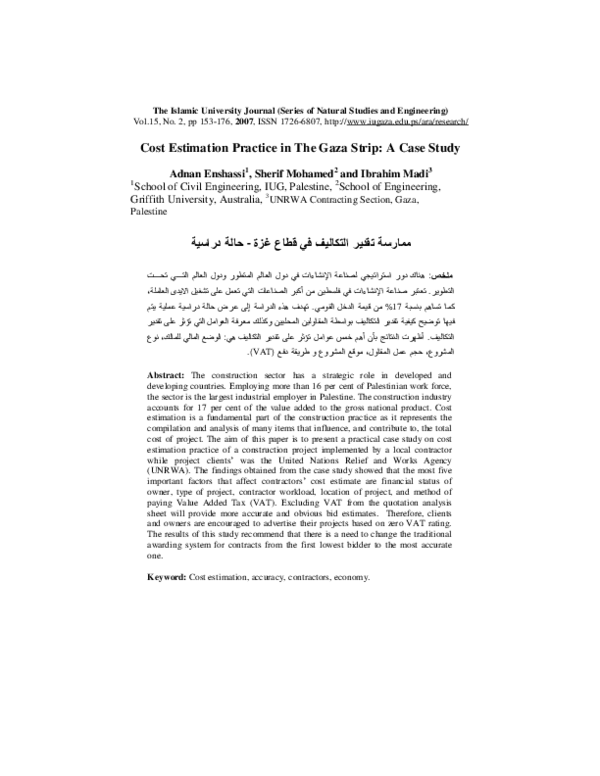

Cost Estimation Practice in The Gaza Strip: A Case Study

Related Papers

Jordan Journal of Civil Engineering

Adnan Enshassi

Journal of Financial Management of Property and Construction

Sherif Mohamed

Estimating is a fundamental part of the construction industry. The success or failure of a project is dependent on the accuracy of several estimates through‐out the course of the project. Construction estimating is the compilation and analysis of many items that influence and contribute to the cost of a project. Estimating which is done before the physical performance of the work requires a detailed study and careful analysis of the bidding documents, in order to achieve the most accurate estimate possible of the probable cost consistent with the bidding time available and the accuracy and completeness of the information submitted. Overestimated or underestimated cost has the potential to cause loss to local contracting companies. The objective of this paper is to identify the essential factors and their relative importance that affect accuracy of cost estimation of building contracts in the Gaza strip. The results of analyzing fifty one factors considered in a questionnaire survey ...

IJAERS Journal , Ira Wiraningsih

The government in Bali Province, Indonesia offers a limited number of projects, even during 2018-2020 it has decreased by 32% annually. The limited number of projects makes contractors compete to submit low-value bids. That phenomenon raises a question of what the optimal construction bidding for contractors is. A bid could be defined as optimum when it provides both of winning opportunity and the expected profit. Optimum bid analysis was carried out using the Friedman method, where it was discovered that the optimum value of construction bidding is in the range of 1%-9% markup or bidding at 76.21%-82.25% of the owner's estimate. Based on a review of projects throughout 2021, only 19% of projects were won with an optimum value but the quality and quantity of the results remained good according to the agreed contract and was acceptable to the owner. The contractor needs to formulate efforts to maintain the targeted profit margin from the bid value that has been submitted. The factor analysis method is used to find the main factors that affect the profit margins expected by the contractor, where it is found that the Financial-Coordination Factor is the main factors that must be considered. The semi-structured interview method is also used to obtain the right implementation strategy in order to strengthen indicators related to Finance-Coordination factor, such as: smooth payment processing from the owner, good internal communication, safe environment, skilled workforce, proper site conditions, cooperation with suppliers, and good response from the community.

The South African Journal of Industrial Engineering

Leon Pretorius

Munther Abdelhadi

MATEC Web of Conferences

godwin uche

Contractor selection is an important step in ensuring the success of any construction project. Failing to adequately select the winning contractor may lead to problems in the project delivery phase such as bad quality and delay in the expected project duration; which ultimately results in cost overruns. This paper reviewed the strength of existing studies on the link between contractor selection strategy and project outcomes, with a view of proposing an approach on how one might try to examine this relationship moving forward. There are research that try to establish a direct relationship between contractor selection strategy and the outcome of the construction project. There are also decision support tools such as AHP or ANP that help clients prioritise various factors when selecting contractors. However the majority of these research and tools are informed by self-perception questionnaires and surveys that makes it difficult to gauge the strength of the relationship between contra...

Engineering, Technology & Applied Science Research

Ibrahim Mahamid

The purpose of this study is to identify and rank the factors influencing the bid/no-bid decision according to their relative importance from the perspective of the contractors in the West Bank in Palestine. To achieve the study objectives, a questionnaire survey was conducted. The survey covered a randomly selected sample of 64 contractors involved in the construction industry in the West Bank. The questionnaire’s structure is based on the related literature, the pilot study, and the feedback from local experts in the construction industry. A total of 32 factors that might influence the bid/no-bid decision were identified and considered. Then, the targeted population was asked to rank these factors according to their relative importance. The results indicate that the top five factors affecting a contractor’s decision to bid or not include the financial stability of the client, the identity and reputation of the client in the industry, the promptness of the client in the payment pro...

Adam Yahuza

RELATED PAPERS

IZA Journal of Labor Policy

Michihito Ando

ECS Transactions

njoku chima

Revista Tempo do Mundo

Luis Kubota

Elvis Mujkic

Review of Business Management

Eduardo Murro

Proceedings of the National Academy of Sciences

Subramanian Sankaranarayanan

Indian Journal of Experimental Biology

Madhavi Indap

IMPURITY TYPE INFLUENCE ON SHAPE OF INTERLAYER NANOSTRUCTURES IN BISMUTH CHALCOGENIDES

Samir Gahramanov

Sudarnoto Abdul Hakim

Industrial & Engineering Chemistry Research

Kumaresan Loganathan

International Frontier Science Letters

shahnaz bathul

Vanessa Arellano Fabian

Direktorat Jenderal Pendidikan Anak Usia DIni, Pendidikan Dasar dan Menengah eBooks

Yudha Permana

Revista Juridica Universidad Autonoma De Madrid

Fernando Martinez-Perez

Ciência Rural

Eduardo Aguiar

Arabian Journal of Chemistry

Ahtaram Bibi

Eduard Jose-Cunilleras

Historia Y Politica

Isaías Barreñada

Journal of Applied Animal Welfare Science

Chatchote Thitaram

Richard J. Golsan

Proceedings of the American Society for Composites: Thirty-First Technical Conference

El guergui Ahmed

Sasi Arunachalam

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript.

- View all journals

- My Account Login

- Explore content

- About the journal

- Publish with us

- Sign up for alerts

- Open access

- Published: 17 April 2024

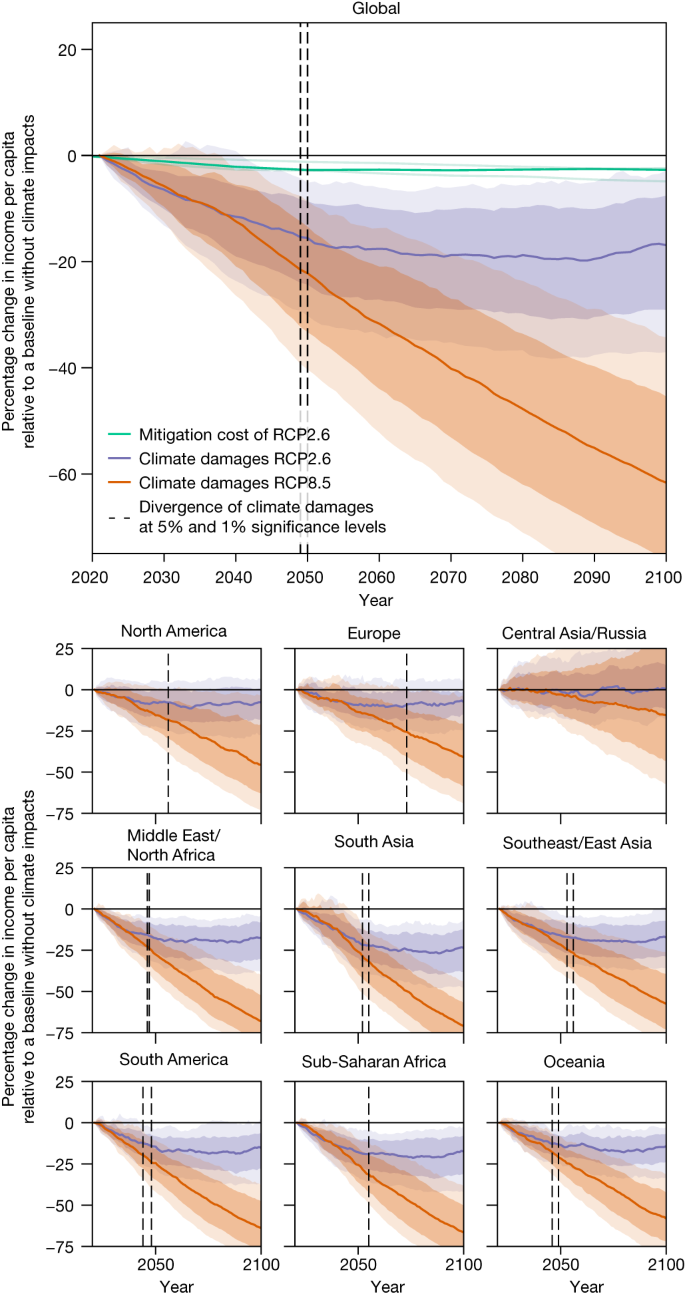

The economic commitment of climate change

- Maximilian Kotz ORCID: orcid.org/0000-0003-2564-5043 1 , 2 ,

- Anders Levermann ORCID: orcid.org/0000-0003-4432-4704 1 , 2 &

- Leonie Wenz ORCID: orcid.org/0000-0002-8500-1568 1 , 3

Nature volume 628 , pages 551–557 ( 2024 ) Cite this article

57k Accesses

3393 Altmetric

Metrics details

- Environmental economics

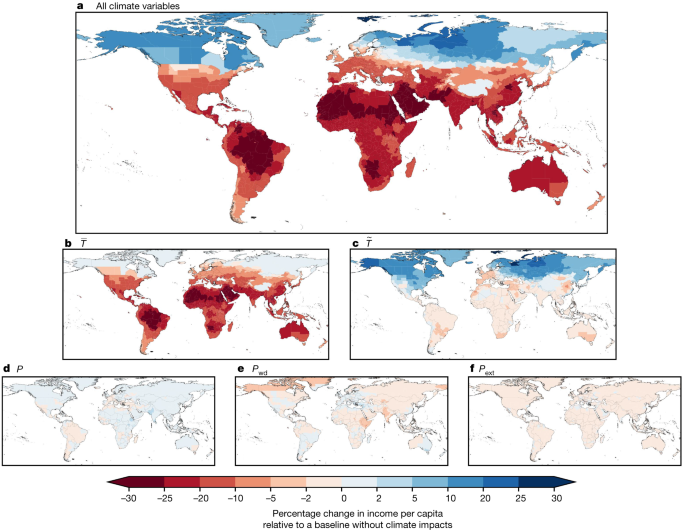

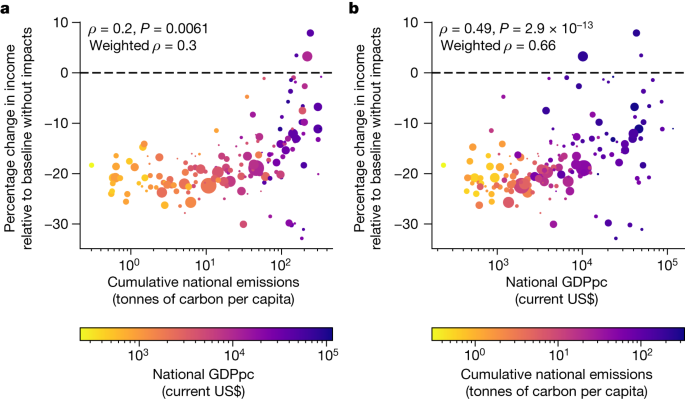

- Environmental health