How can we help?

- 19 December 2022

- Commercial Real Estate

Commercial Rent Deposits – A brief overview

What is a rent deposit.

A rent deposit is money provided by a tenant to its landlord as security for payment of the rent and performance of the tenant’s covenants contained in the lease. A rent deposit deed will specify the circumstances in which the landlord can draw on this money and the conditions that must be satisfied for the deposit to be repaid to the tenant.

Landlords like rent deposits because they are easily accessible sources of money that can be drawn upon as soon as the tenant is in breach of a relevant covenant in the lease. Court action is not required to recover the debt or enforce performance of the obligation. Tenants are not generally too keen on rent deposits as they lock up capital, often for a lengthy period.

When will a rent deposit be taken?

A rent deposit will be put in place on the grant of a lease or on assignment of an existing lease. If the landlord does require a rent deposit it will usually be for one of the following reasons;-

- The tenant’s covenant is weak and therefore unsatisfactory to the landlord without some additional comfort

- The tenant may be an overseas company with few, if any, UK assets

- The tenant is a new business and so is unable to provide evidence of its past good behaviour as a tenant.

As many tenants will not want to lock up the capital required to fund it, the possible alternatives include;-

- A bank guarantee or bond

- A parent company guarantee

- A guarantee from a director

- A letter of credit from a bank

All of these alternatives have potential disadvantages, for example both the bank guarantee or bond and a letter of credit will require a payment to the bank from the tenant to secure the payment and the value of a guarantee will depend upon the strength of the party providing the guarantee.

Points to be considered when negotiating a rent deposit deed

How much should the landlord require .

There is no prescribed level and no statutory constraints on the size of the sum. However, the amount put down usually reflects the rent payable under the lease, the likely period that it would take for the landlord to re-let the property and the landlord’s perception of the risk that the tenant poses.

Rent deposits are generally equivalent to between 6 & 12 months’ rent due under the lease. The amount is usually related to the yearly rent payable but may also include insurance rent and service charges.

VAT on rent deposits is often a contentious point a deposit in respect of the sum representing the amount of VAT that will be payable is often a contentious point. The parties may not consider VAT when negotiating the amount. VAT is not payable on the sum deposited with the landlord as a supply is not being made at that time, but once the landlord draws on deposit as a result of tenant’s default and if the landlord has exercised the option to tax, VAT will be payable on the amount drawn down.

Accordingly, where the landlord has exercised the option to tax or is likely to do so, the negotiated deposit should be an amount that includes a sum equivalent to the VAT that will be payable if the tenant is in default.

Simon Ralphs

View profile

Email Simon

+44 20 7539 8049

A rent deposit is money provided by a tenant to its landlord as security for payment of the rent and performance of the tenant’s covenants contained in the lease.

When will the rent deposit be returned to the tenant?

It will generally be returnable in the following circumstances;-

- Assignment under the lease in accordance with the lease. (On such an occasion the landlord may, if appropriate, want to require a new rent deposit from the assignee.)

- Expiry of the lease term without any holding over under the landlord and tenant Act 1954

- Early termination of the lease by agreement (such as by way of surrender or exercise of an option to break). Early termination by agreement would exclude forfeiture and disclaimer

The landlord may also agree to return the rent deposit if the tenant demonstrates that its financial position has sufficiently improved to render the rent deposit unnecessary to reassure the landlord that it will meet its financial obligations under the lease. Examples of this trigger are the “net profit” test where the net profits of the tenant are shown to equal or exceed a multiple (usually 3 times) of the rents reserved by the lease for up to 3 years and the “net assets” test where the net assets of the tenant are equal to a multiple (often 5 times) of the rents reserved by the lease.

Tax on rent deposits

Sdlt on the rent deposit.

In the past, rent deposits did not form part of the “consideration” on the grant or assignment of a lease so no SDLT was charged on. However, the Finance (No.2) Act 2005 contains provisions to enable SDLT to be charged on premiums that are disguised as rent deposits.

Under these statutory provisions, rent deposits are held to be “consideration” for the purpose of the grant or assignment of a lease (and therefore potentially liable for SDLT) unless the rent deposit is less than twice the highest amount of annual rent payable in any 12 month period in the first 5 years of the term or, in the case of an assignment, in the first 5 years of the term remaining outstanding at the date of the assignment.

It is argued by some advisors that these provisions only apply to the type of the rent deposit structure where the tenant actually transfers ownership of the deposit monies to the landlord. However, most rent deposits are drafted to provide that the money is held by the landlord but owned by the tenant.

VAT ON RENT DEPOSIT MONIES

Where a landlord has opted to pay VAT, VAT is payable on the annual rent. As mentioned above, it is therefore usual where the option has been exercised, for the landlord to ask that the money deposited incorporates a figure equivalent to the VAT on the rent deposit to ensure that the landlord will be able to claim the full amount due if the tenant fails to pay rent.

VAT is not actually payable when the money is put on deposit, since the landlord is making no supply at that date. It is only if and when the Landlord makes a deduction from the deposit monies that a taxable supply is made that is liable to VAT.

No VAT invoice is required when a rent deposit deed is entered into if a sum equivalent to VAT is paid.

Further information

This article contains some initial points to be considered in relation to rent deposit deeds. These documents are often drafted in a complex way and questions will arise on each form of rent deposit deed used for example whether a landlord can draw against a rent deposit if a corporate tenant becomes insolvent, and what happens when the landlord sells its interest in the property.

If you have any queries on any of these points or the point referred in this note or any other matters relating to rent deposit deeds please contact our Commercial Real Estate team.

About this article

- Subject Commercial Rent Deposits – A brief overview

- Author Simon Ralphs

- Expertise Commercial Real Estate

- Published 19 December 2022

Disclaimer This information is for guidance purposes only and should not be regarded as a substitute for taking legal advice. Please refer to the full General Notices on our website.

Read, listen and watch our latest insights

- 26 April 2024

Prime Minister Proposes Changes to Fit Notes

The Prime Minister recently announced a raft of changes, to be implemented in the next parliament, aimed at reducing the number of people who are economically inactive due to illness.

Amanda Glover comments on ‘flexible contracts’ for HR Magazine

In HR magazine, Amanda Glover, Associate at Clarkslegal comments on why some workers voluntarily opt for flexible contracts while others are given no choice.

- 10 May 2024

New duty on employers to prevent sexual harassment – coming October 2024

The Worker Protection (Amendment of Equality Act 2010) Act 2023 is due to come into force in October 2024.

- 09 May 2024

Labour Party Employment Law Proposals – Promises of further consultations and a softer approach

- Corporate and M&A

Navigating corporate transparency: ECCTA reforms series – part 1

The Economic Crime and Corporate Transparency Act 2023 (ECCTA) received Royal Assent in October 2023 and marked a pivotal moment in corporate governance and transparency.

- 07 May 2024

Changes to TUPE rules from 1 July 2024

The Transfer of Undertakings (Protection of Employment) Regulations 2006 (‘TUPE’) aim to safeguard employees’ rights on the transfer of a business or on the change of a service.

Home » News & publications » Latest news » Why commercial rent deposits are not quite so simple

Why commercial rent deposits are not quite so simple

Posted: 28/08/2019

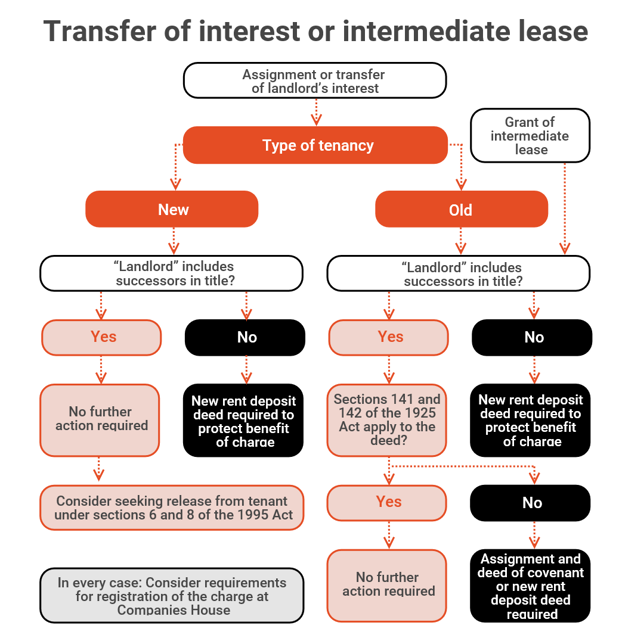

In today’s insecure commercial lettings market, it is becoming increasingly common for landlords to take a significant rent deposit when granting a new lease and to enforce their rights under the rent deposit deed. This is putting the drafting and enforcement of rent deposit deeds under scrutiny. How do the parties to a rent deposit deed protect their positions when the landlord assigns the reversion to the lease? In this article, we assume that the rent deposit account is in the landlord’s name and that the tenant’s interest in the account - and the monies in it - are charged to the landlord.

What happens when:

- The landlord transfers or assigns its interest?

- The landlord grants an intermediate lease?

Transfer or assignment: new tenancies

A rent deposit deed that relates to a “new” tenancy is a “collateral agreement” to the tenancy, as defined in section 28(1) of the Landlord and Tenant (Covenants) Act 1995 (the 1995 Act). Covenants contained in collateral agreements are “covenants” for the purposes of the 1995 Act.

Section 3(3) of the 1995 Act says that, where a landlord transfers or assigns its interest, the transferee or assignee will become bound by the landlord’s covenants whether they are covenants contained in the tenancy or in the rent deposit deed (except where they are stipulated to be personal) and will become entitled to the benefit of the tenant’s covenants. This is a statutory exception to the established principle that the burden of a contract cannot be assigned. In these circumstances, the covenants contained in the rent deposit deed are enforceable by and against the new landlord.

Transferring the charge

The charge on the rent deposit account does not fall within the definition of a “covenant” under the 1995 Act. A charge is not a “term, condition or obligation”; it is an encumbrance on the asset that is subject to the charge and gives the landlord the right to appropriate the charged property.

The fact that the benefit and burden of the rent deposit deed covenants have transferred to the landlord’s successor by virtue of the 1995 Act does not mean that the benefit of the charge has also been transferred. If the parties do not take further action, the beneficiary of the charge may be the old landlord even though he is no longer able to enforce the covenants under the deed.

Defining the “landlord”

If the deed is personal to the named landlord, a new rent deposit deed containing a new charge is required. A new charge will create a chargee/chargor relationship between the new landlord and the tenant. Without a new charge, although the new landlord can enforce the tenant’s covenants in the deed, it will be an unsecured creditor with no priority in a tenant insolvency.

The central purpose of a rent deposit deed is to protect the landlord in the case of tenant insolvency. In a worst-case scenario, a new landlord may find that the deposit is entirely swallowed up by the creditors ranking above it, resulting in the total loss of its security.

It is common for rent deposit deeds to define the “landlord” to include successors in title, so that the tenant’s charge of its interest in the deposit account is to the current and all future landlords. The benefit of the charge will automatically transfer when the landlord transfers or assigns its interest.

Release under the 1995 Act

Under section 6 of the 1995 Act, the outgoing landlord will remain liable for the landlord’s covenants in the rent deposit deed until it obtains a release from the tenant.

The landlord is released if it serves notice on the tenant telling the tenant of the proposed assignment and requesting that it is released from the landlord’s covenants and:

- the tenant does not serve a written notice objecting to the release within four weeks of service of the landlord’s notice;

- the tenant serves such a notice but the court makes a declaration that it is reasonable for the covenants to be released; or

- the tenant serves written notice consenting to the release (and withdrawing any prior notice objecting to it, if applicable).

If this procedure is not followed, a landlord remains liable for the performance of the landlord covenants. However, owing to complications arising if some (but not all) tenants release the landlord, it may not be appropriate in every case to seek such a release.

If a rent deposit deed to a “new” tenancy incorporates the landlord’s successors in title, no action needs to be taken. Where appropriate, a landlord should consider following the procedure in section 8 of the 1995 Act to release its liability to the tenant.

If the deed does not incorporate successors in title, a new rent deposit deed will need to be entered into between the tenant and the landlord’s successor. The covenants will be extinguished and the successor will offer new covenants.

Transfer or assignment: old tenancies

One of two different sets of rules will govern:

Sections 141 and 142 of the Law of Property Act 1925

If the lease and/or the rent deposit deed define covenants given in the rent deposit deed as lease covenants, then sections 141 and 142 of the Law of Property Act 1925 (the 1925 Act) apply. As lease covenants they are enforceable by and against the landlord’s successor in title automatically. To pass on the benefit of the charge automatically, the charge must be drafted to refer to successors in title.

Common law rules

If the covenants in the rent deposit deed are not lease covenants, the common law rules for the assignment of contractual obligations and privity of contract apply.

The benefit of a contract may be assigned. The assignment must be absolute, in writing and signed by the assignor, and notice of the assignment must be given to the tenant.

The burdens of a contract may not be assigned. When the rent deposit deed relates to an “old” tenancy, the parties must create privity of contract between the new landlord and the tenant. Two methods are available:

- Assignment from old landlord to new landlord and deed of covenant from new landlord to tenant: The assignment can be completed within the suite of sale documents, and the deed of covenant can be entered into unilaterally by the new landlord on completion. If the deed does not incorporate successors within the definition of the “landlord”, the benefit of the charge will not transfer.

- Novation of the rent deposit deed: The new landlord and the tenant enter into a new rent deposit deed on identical terms to the previous deed. This could be dealt with as a condition subsequent, so as not to interfere with time pressures or confidentiality obligations relating to a sale. Consideration should be given as to whether the tenant may not comply or may delay and to which party should bear the tenant’s costs. A prudent landlord should ensure that the tenant is in a financial position to give the new charge before completing the new deed.

Grant of an intermediate lease

The 1995 Act does not apply where the landlord grants an intermediate lease of the property. The granting of a new lease is not an “assignment” and the intermediate tenant is not treated as stepping into the landlord’s shoes.

The grant of an intermediate lease may qualify as a disposition of the reversionary estate immediately expectant on the determination of the term of the lease to which the rent deposit deed relates. The provisions of sections 141 and 142 of the 1925 Act may apply as above and, if they do not, the common law rules apply.

Registration

Charges created by companies on or before 5 April 2013 had to be registered at Companies House within 21 days of the date of execution or they are void. If the charge created by a rent deposit deed is not registered, a tenant’s insolvency practitioner will assert that the charge is void and the landlord is an unsecured creditor.

The landlord has two options:

- Argue that the charge did not require registration at Companies House.

- Enter into a new rent deposit deed with the tenant.

Charges created on or after 6 April 2013 are not required to be registered at Companies House.

In summary, rent deposit deeds should be given appropriate consideration both during the drafting process and during due diligence relating to the disposition of the landlord’s interest.

This article was first published in Estates Gazette in June 2019.

Giorgia Mayes

Email Giorgia +44 (0)1223 465425

Related expertise

- Real estate litigation

- Real estate investors

- Property entrepreneurs

Share the article

Useful links

- Legal notice

- Privacy policy

- Cookie policy

- Accessibility

- Complaints procedure

- Quality statement

- Modern slavery statement

- Environmental statement

Contact an office

- London (Head office) +44 (0)20 7457 3000

- Basingstoke +44 (0)1256 407100

- Birmingham +44 (0)121 312 2560

- Cambridge +44 (0)1223 465465

- Guildford +44 (0)1483 791800

- Oxford +44 (0)1865 722106

- Reading +44 (0)118 982 2640

- Madrid +34 91 781 6670

- Paris +33 1 44 34 24 80

- Piraeus +30 210 361 4840

- Singapore +65 6438 4497

- Aviation and aerospace

- Energy and natural resources

- Financial services

- Insurance and reinsurance

- Life sciences

- Media and creative industries

- Private wealth

- Real estate

- Sustainability

Services for Business

- Banking and finance

- Commercial dispute resolution

- Construction and infrastructure

- Data protection and privacy

- Immigration

- Intellectual property

- International trade

- IT and telecommunications

- Marine, trade and energy

- Regulatory compliance

- Restructuring and insolvency

Services for Individuals

- Clinical negligence

- Contentious probate and trust disputes

- Court of Protection and deputyships

- Holiday accident claims

- Personal injury

- Private client and tax

- Residential property and conveyancing

© 2024 Penningtons Manches Cooper LLP. All rights reserved. Website design by Frontmedia / Dynamic Pear

Penningtons Manches Cooper LLP

Penningtons Manches Cooper LLP is a limited liability partnership registered in England and Wales with registered number OC311575 and is authorised and regulated by the Solicitors Regulation Authority under number 419867.

Rent deposits | Practical Law

Rent deposits

Practical law uk practice note overview 2-200-0304 (approx. 40 pages).

This website uses cookies. Your interaction and usage of this website is subject to the points outlined within our privacy policy .

Rent Deposit Deeds – Trusts or Charge?

Nathan Mee , Commercial Property Team Lawson West Solicitors, Leicester

As detailed in our previous article “ Rent Deposit Deeds – What are they and do we need one ?”, one of the details that a Rent Deposit Deed will set out is how the Landlord will hold the deposit.

There is no “one size fits all” when it comes to Rent Deposit Deeds and in fact there are a number of rent deposit structures available however, the two main routes, which are similar, are:-

Deposit held on Trust; and

Deposit held by charge..

Held on Trust

Where the deposit is to be held on Trust, the Tenant will pay the deposit to the Landlord and the Landlord will become the legal owner of the deposit. The Tenant will retain a beneficial interest over the deposit.

The Landlord must place the deposit is a separate bank account from their other funds. However, the Landlord will be bound by the terms of the trust as detailed in the Rent Deposit Deed which will outline how and when the Landlord can deduct from the deposit and how and when the deposit is to be returned to the Tenant.

Deposit Held by Charge

There are two options in which the deposit can be by way of a charge, the first of which is the most common option.

1. Firstly, the deposit can be held by the Landlord but owned by the Tenant but the Tenant charges the deposit in favour of the Landlord. As with the deposit being held on Trust, the Landlord is to place the deposit in a separate account, but depending on the drafting the Rent Deposit Deed may specify the name on the account the Landlord places the funds in. The Tenant then creates what is called a fixed equitable charge in favour of the Landlord as security for performance of their obligations under the Lease.

Care must be taken when negotiating the wording of the charge and Rent Deposit Deed. The parties must again comply with the terms of the Rent Deposit Deed (for more information on Rent Deposit Deeds); and

2. The second option with a charge rent deposit is that the Tenant retains the deposit and instead places it in a separate account at their own bank . The Tenant then places a fixed equitable charge over the deposit in favour of the Landlord though it is rather uncommon for Landlords to accept this structure.

Our Commercial Property Department at Lawson-West can assist with the preparation (Landlord) and negotiation (Tenant) of Rent Deposit Deeds. Please contact Nathan Mee on 0116 212 1117 should you require any assistance.

This article is a brief introduction into Rent Deposit Deeds and is not intended to be legal advice and cannot be relied upon or applied to any set of circumstances. For further guidance, please contact Lawson West Solicitors Limited.

Lawson West Solicitors Limited is registered in England and Wales (registered number 7514625). Registered office: 4 Dominus Way, Meridian Business Park, Leicester, LE19 1RP. A list of Directors is available for inspection at this address.

Lawson West Solicitors Limited is authorised and regulated by the Solicitors Regulation Authority. SRA number: 557518. You can obtain a copy of the rules and the principles that we are subject to by clicking on the link: http://www.sra.org.uk/

Our Complaints Procedure can be viewed here . Data protection, GDPR and Privacy Policy here .

Websters Solicitors was incorporated into Lawson West Solicitors on 1 April 2022. Lawson-West Solicitors is a trading name of Lawson West Solicitors Limited. Employment Claims UK is a trading name of Lawson West Solicitors Limited.

© 2023 Copyright Lawson-West Solicitors Limited, all rights reserved.

*Please note this will be kept in strictest confidence and is required solely to ensure we do not have a conflict of interest according to SRA regulations. Information re other party (where applicable) is needed before we contact you. It will either be name and DOB of your ex-partner if it’s a family matter, or employer name if it’s an employment issue. The party *WILL NOT be contacted* by Lawson West.

The information we collect and store when you submit this form is covered by our Privacy Policy here and retention of cookies information here .

Request a Callback

- Client login

How can we help you?

Rent deposit deeds: let battle commence.

21 March 2017

By Andrew Williams

It is not uncommon for landlords to request a rent deposit from an incoming tenant or assignee where there are doubts about its financial covenant strength and/or its ability not just to pay the rent, but also comply with its other covenants under the lease.

The preferred starting position for many landlords is a rent deposit paid to them absolutely on completion of the lease so that the funds are readily available if they need to be drawn upon. The document will usually contain a promise from the landlord to return the deposit balance to the tenant either at the end of the term or on an earlier event (such as a lawful assignment) provided there are no outstanding costs or tenant breaches.

However, it is becoming increasingly common that tenants are pushing back on this structure; usually citing risks about the landlord's solvency and therefore the tenant's ability to recover its rent deposit were the landlord to become insolvent.

Whilst this may be less contentious where the landlord is a UK incorporated company or fund –referring the tenant to the landlord's financial position at Companies House or reputation in the commercial property market may do the trick – the issue can still lead to prolonged negotiations.

What does the tenant want?

What happens if the tenant will not pay the rent deposit outright to the landlord? There are two alternative structures that we tend to see – one being the rent deposit is held by the landlord on trust for the tenant and the other that the rent deposit is expressed to remain the tenant's money, but is held by and 'charged' to the landlord. Whilst both may give the tenant comfort if the landlord becomes insolvent, there may be issues for the landlord.

The trust structure - albeit recommended by the Lease Code 2007 – may not only have unexpected tax consequences, it may also create unintended fiduciary duties (inherent in a trust structure) for the landlord unless expressly dealt with in the drafting of the deed. With the second option, uncertainty as to what the landlord is actually taking security over could raise questions about the validity of the charge (one approach is for the tenant to charge its ability to recover any deposit balance) - changes to registration of charges at Companies House (so that rent deposit deeds cannot be registered from 6 April 2013) have not helped either.

What is the alternative?

So how to get the deal over the line if this becomes a sticking point? One potential option is for the deposit to be held by a third party as stakeholder, perhaps a managing agent regulated by RICS or a firm of solicitors regulated by the SRA. Although this option may involve additional cost to the landlord – the stakeholder usually charging a fee for this service – knowledge that the stakeholder owes mutual duties to both parties, may be attractive and dispenses with the charging issue.

When negotiating a rent deposit, it is important to remember the overriding principle as to why the landlord has asked for a rent deposit in the first place! The alternative of personal or bank guarantees may be less palatable to a tenant.

To reduce the risk of a deal stalling, the structure of a rent deposit should be discussed at the outset and agreed at the heads of terms stage. Asking for legal input at this point may prevent unwelcomed additional time and costs being incurred during the legal process.

Andrew Williams

Professional Support Lawyer

Related Sectors

Related services.

- Practical Law

Standard documents and drafting notes: Property

Practical law uk help and information notes 3-200-9460 (approx. 44 pages), boilerplate.

- Boilerplate agreement

- Boilerplate clauses

- Execution formalities

Title matters

Commercial property standard enquiries, other sets of pre-contract enquiries.

- Construction enquiries before contract

- Additional enquiries on CRC issues: which to select

Epitome of title

Certificate of title, reports on title.

)

- CLLS Short Form Report on Title (4th Edition) . This is the report on title produced by the CLLS.

Declarations of trust

- Declaration of trust by individuals as tenants in common (floating shares)

- Declaration of trust by individuals as tenants in common (fixed shares)

- Declaration of trust by individuals to change tenancy in common to joint tenancy

- Declaration of trust where third party has beneficial interest

- Gift of property by declaration of trust: one adult beneficiary (one settlor)

Lease summary

Long form lease reports.

- Long form lease report which has not been pre-populated. This is so that it can be adapted for use in relation to any commercial lease.

- Long form lease report based on Lease of part: office

- Long form lease report based on Lease of whole: office

- Long form lease report based on Lease of part: office (complies with Lease Code 2020)

- Long form lease report based on Lease of whole: office (shorter form)

- Long form lease report based on Lease of part: office (shorter form)

- Long form lease report based on Lease of part: retail unit in a shopping centre

- Long form lease report based on Lease of whole: high street shop

- Long form lease report based on Lease of part: high street shop

- Long form lease report based on Lease of whole: high street shop (shorter form)

- Long form lease report based on Lease of whole: high street shop (complies with Lease Code 2020) (shorter form)

- Long form lease report based on Lease of part: high street shop (shorter form)

- Long form lease report based on Lease of part: retail unit on an estate

- Long form lease report based on Lease of whole: retail unit on an estate

- Long form lease report based on Pop-up lease of part: retail unit in shopping centre (inclusive rent)

- Long form lease report based on Lease of part: industrial unit warehouse on an estate

- Long form lease report based on Lease of whole: industrial unit warehouse on an estate

- Long form lease report based on lease of whole: industrial unit warehouse (not on an estate)

Severing joint tenancy and advising on co-ownership

- Letter severing a joint tenancy

- Letter of advice on co-ownership

Statutory declarations to support claims for adverse possession

- Statutory declaration to support an application for adverse possession (registered land)

- Statutory declaration to support a SECOND application for adverse possession (registered land)

- Statutory declaration to support an application for adverse possession (unregistered land/registered land transitional provisions)

- Statutory declaration to support an application for registration of title where the title deeds have been lost or destroyed

Power of attorney

)

Pre-contract

Residential property client guides.

- Freehold and leasehold ownership: client guide .

- Selling a house or flat: client guide .

- Buying a house or flat: client guide .

- Extending the lease of a flat (LRHUDA 1993): client guide .

- Collective enfranchisement (LRHUDA 1993): client guide .

- Tenants' right of first refusal (LTA 1987): client guide .

Heads of terms

)

Exclusivity agreements

)

Confidentiality agreements

- Confidentiality agreement (property)

)

Licences for access to land

- Licence for access to land for environmental site investigations

Contracts for sale of commercial property

Sale of land with leaseback.

- Contract for the sale of freehold land with leaseback

Sale of land with vacant possession

Contracts incorporating third edition of the scpc (2018 revision).

)

- Contract for the sale of leasehold land with vacant possession (incorporating the Standard Commercial Property Conditions (Third Edition – 2018 Revision))

- Contract for the exchange of bare land with vacant possession

Contracts incorporating Second Edition of the SCPC

)

Sale of land subject to leases

- Contract for the sale of freehold land subject to lease (incorporating the Standard Commercial Property Conditions (Third Edition – 2018 Revision))

- Contract for the sale of leasehold land subject to lease (incorporating the Standard Commercial Property Conditions (Third Edition – 2018 Revision))

)

Conditional sale contracts

- Contract for the sale of freehold land with vacant possession conditional on planning permission

Portfolio sale contracts

- Contract for the sale of a portfolio of commercial properties subject to lease

- Contract for the sale of a portfolio of commercial properties with vacant possession

- Contract for the sale of a portfolio of commercial properties (mixed portfolio of properties with vacant possession and properties subject to lease)

Sale of a hotel

- Contract for the sale of a hotel

Capital allowances

- Capital allowances fixtures election

- Standard document, Structures and buildings allowances: allowance statement

- Structures and buildings capital allowances: clause requiring the seller to provide an allowance statement

Contracts for the sale of residential property

Contracts incorporating the standard conditions of sale (fifth edition).

- Contract for the sale of part (plot sale contract)

)

- Contract for the sale of residential freehold property by a mortgagee

- Contract for the sale of residential freehold property by a Trustee in Bankruptcy

Contracts for sale incorporating the Standard Conditions of Sale (Fourth Edition)

- Contract for the sale of residential freehold land with vacant possession (incorporating the Standard Conditions of Sale (Fourth Edition))

- Special conditions of sale for residential freehold land (vacant possession) (incorporating the Standard Conditions of Sale (Fourth Edition))

- Contract for the sale of residential leasehold land with vacant possession (incorporating the Standard Conditions of Sale (Fourth Edition))

Letters advising on aspects of conveyancing

- Letter to buyer of residential property advising on financial aspects of conveyancing transactions

- Letter to buyer of leasehold residential property advising on the Building Safety Act 2022

Completion documents

Assent of an equitable interest in land.

- Standard document, Probate: assent of equitable interest in land

Stock transfer form

Completion statement, notices to complete (commercial).

)

Notices to complete (residential)

- Notice to complete for residential sale contracts

- Supplemental agreement to vary the completion date .

- Transfers of part: clauses for TP1 (residential plot transfer of new-build property on housing estate) .

- Transfers of part: clauses for TP1 (plot on a commercial estate) .

Undertakings

- Undertaking to be given by the seller's solicitors to the seller's bank (or seller's bank's solicitors) (recipient) confirming that they are holding the DS1 to the recipient's order and following completion will transfer the completion monies to the recipient.

- Undertaking to be given by the seller's solicitors to the buyer's solicitors and (if appropriate) the buyer's bank's solicitors confirming (amongst other things) that they are holding the release documents executed by the bank and will hold the completion monies to the order of the buyer's solicitors until completion.

- Undertaking to hold completion monies. An undertaking from a borrower’s solicitors, addressed to a lender, to hold completion monies to a lender's order, for example on a commercial property or share purchase transaction likely to complete outside banking hours.

- Undertaking to hold title deeds . An undertaking from a law firm acting for a lender to hold title deeds to the lender's order.

- Deed of assignment of arrears

Contracts and deeds clauses

Deeds of assignment.

- Deed of assignment of equitable interest in land .

- Deed of assignment of benefit of a contract for sale of property .

- Deed of assignment of the benefit of an option .

- LRHUDA 1993: deed of assignment of benefit of lease extension claim .

- LRA 1967: deed of assignment of benefit of claim for the freehold or an extended lease .

Deed of rectification

- Deed of rectification .

Clauses for TP1

Granting leases: preliminary matters.

)

Exclusivity agreement

)

Confidentiality

)

Agreements for leases and underleases

Agreement for lease.

)

- Agreement for lease with landlord's refurbishment works (incorporating the Standard Commercial Property Conditions (Second Edition))

- Agreement for lease with landlord's refurbishment works (incorporating the Standard Commercial Property Conditions (Third Edition – 2018 Revision))

- Agreement for lease with landlord's refurbishment works and early access for tenant's fitting out works (incorporating the Standard Commercial Property Conditions (Second Edition))

- Agreement for lease with landlord's refurbishment works and early access for tenant's fitting out works (incorporating the Standard Commercial Property Conditions (Third Edition – 2018 Revision))

- Agreement for lease with landlord's works (new build) and early access for tenant's fitting out works conditional on the landlord obtaining planning permission (Second Edition)

- Agreement for lease with landlord's works (new build) and early access for tenant's fitting out works conditional on the landlord obtaining planning permission (incorporating the Standard Commercial Property Conditions (Third Edition – 2018 Revision))

- Agreement for long lease of flat (off-plan)

- Agreement for underlease

Leases of commercial property

Office leases.

)

- Lease of part: office (complies with Lease Code 2020)

- Lease of whole: office (shorter form)

- Lease of part: office (shorter form)

- Underlease of part: office

- Underlease of whole: office

)

Retail leases

- Lease of whole: high street shop

- Lease of part: high street shop

- Lease of whole: high street shop (shorter form)

- Lease of whole: high street shop (complies with Lease Code 2020) (shorter form)

- Lease of part: high street shop (shorter form)

- Lease of whole: retail unit on an estate

- Lease of part: retail unit on an estate

- Lease of part: retail unit in shopping centre

- Pop-up lease of part: retail unit in shopping centre (inclusive rent)

- Short term lease of retail unit in shopping centre (inclusive rent)

)

- Short term lease of a shop (turnover rent)

Industrial/warehouse leases

- Lease of whole: industrial unit/warehouse (not on an estate)

- Lease of whole: industrial unit/warehouse on an estate

- Lease of part: industrial unit/warehouse on an estate

- Short term lease of industrial unit/warehouse (inclusive rent)

Long leases

- Long lease of a whole commercial property

- Very long lease of a whole commercial property

- Lease of wind turbine site

Telecommunications lease

- 2017 Electronic Communications Code Lease

Lease of car parking space

- Short term lease of car parking space

- Lease of bare land

- Tenancy at will

Leases by reference

- Renewal lease by reference to an existing lease

- Lease of an additional property by reference to an existing lease

- Underlease of whole by reference to superior lease with prescribed clauses

Overriding leases

- Overriding lease

Leases of residential property

Long leases of flats.

- LRHUDA 1993 (lease extension): new lease of a flat complying with section 56

- Residential long lease of a flat in a block of flats

- Lease of a flat in a block (where tenants' management company becomes landlord)

- Residential long lease of a flat in a building converted for use as flats

- Residential long lease of a flat above a commercial unit

Long leases of houses

- Residential long lease of a whole house (landlord insures and reinstates)

- Residential long lease of a whole house (tenant insures and reinstates)

Assured shortholds

)

- Letter to landlord client enclosing draft assured shorthold tenancy

- Prior notice to assured shorthold tenant of grounds for possession

Common law tenancy

- Common law tenancy agreement

Lease management

Authorised guarantee agreement.

)

Costs undertaking

- Undertaking to pay costs in connection with tenant's licence

Licences to assign, underlet, alter, change use and charge

- Licence to underlet whole

- Licence to underlet part

- Licence to underlet whole and change use

- Licence to sub-underlet

- Licence to assign: new lease with AGA and guarantee

- Licence to assign: old lease with guarantee

- Licence to assign and change use: new lease with AGA and guarantee

- Licence to assign and change use: old lease with guarantee

- Licence to assign underlease: with AGA and guarantee

)

- Licence to carry out works (consent only)

- Licence to carry out works including installing plant and equipment outside the demise

- Licence to charge

)

- Retrospective licence for alterations

Deeds of variation

)

- Deed of variation of a lease plan

- Deed of variation to add a right to install plant and equipment outside the demise

- Deed of surrender of part and deed of variation

Deed of assignment

- Deed of assignment of rent deposit(s)

)

Deed of release

- Deed of release of tenant's guarantor

)

- Letter from landlord's solicitors confirming receipt of keys, original lease and surrender by operation of law

- Statement of truth to support application to Land Registry on surrender of lease by operation of law

Rent deposits

)

Rent review memorandum

)

- Rent review notice

- Rent review counter notice

- Landlord's break notice

- Tenant's break notice

- Notice to quit: residential dwelling

)

- Notice of forfeiture

)

Rent payment letters

)

- Rent concession letter

- COVID-19: rent concession letter

- COVID-19: rent deferral letter

Dilapidations

- Letter serving an interim schedule of dilapidations near the end of the lease term

- Letter serving a terminal schedule of dilapidations at the end of the lease

- Schedule of dilapidations (see Annex C of the Property Litigation Association Dilapidations Protocol)

Notices under Landlord and Tenant (Covenants) Act 1995

)

- Landlord's notice applying for release from landlord covenants of a tenancy on assignment of whole of reversion (sections 6 and 8, Landlord and Tenant (Covenants) Act 1995) (Form 3)

- Landlord's notice applying for release from landlord covenants of a tenancy on assignment of part of reversion (section 6 and 8, Landlord and Tenant (Covenants) Act 1995) (Form 4)

- Former landlord's notice applying for release from landlord covenants of a tenancy (sections 7 and 8, Landlord and Tenant (Covenants) Act 1995) (Form 5)

- Former landlord's notice applying for release from landlord covenants of a tenancy (former landlord having assigned part of reversion) (sections 7 and 8, Landlord and Tenant (Covenants) Act 1995) (Form 6)

- Joint notice by tenant and assignee for binding apportionment of liability under non-attributable tenant covenants of a tenancy on assignment or part of property (sections 9 and 10, Landlord and Tenant (Covenants) Act 1995) (Form 7)

- Joint notice by landlord and assignee for binding apportionment of liability under non-attributable landlord covenants of a tenancy on assignment of part of reversion (sections 9 and 10, Landlord and Tenant (Covenants) Act 1995) (Form 8)

Options to renew

- Option to renew a lease

- See Lease summary

Lease report

- See Long form lease reports

Deed of covenant

- Deed of covenant by assignee of residential lease (old tenancy)

- Deed of covenant by assignee of residential lease with landlord and management company (old tenancy)

Lease extension and enfranchisement

Leasehold reform act 1967.

- LRA 1967: Tenant's notice of claim to acquire the freehold or an extended lease

- LRA 1967: Landlord's notice in reply to tenant's notice of claim for right to enfranchise

- LRA 1967: Landlord's notice of request for details of rights of way and restrictive covenants required by tenant

- LRA 1967: Tenant's notice of request for details of rights of way and restrictive covenants required by landlord

- LRA 1967: Landlord's request for deduction of title and particulars of occupation

- LRA 1967: Tenant's notice of request for deduction of landlord's title

- LRA 1967: Statutory declaration by tenant as evidence of its right to enfranchise

- LRA 1967: Tenant's notice that it will not proceed with the enfranchisement claim

- LRA 1967: Tenant's notice that it wishes to deal directly with the other landlord

- LRA 1967: Notice that Landlord other than the reversioner to deal with Tenant direct

- LRA 1967: Reversioner's notice of request to tenant to double time limit

- LRA 1967: Landlord's notice of default

- LRA 1967: Tenant's notice of default

- LRA 1967: Landlord's notice to complete

- LRA 1967: Tenant's notice to complete

- LRA 1967: agreement to assign the benefit of a claim for the freehold (or extended lease) served before exchange

- LRA 1967: agreement to serve and assign the benefit of a claim for the freehold or extended lease

- LRA 1967: assignment of benefit of a notice of claim for the freehold or extended lease (clauses for transfer)

- LRA 1967: deed of assignment of benefit of claim for the freehold or an extended lease

Leasehold Reform, Housing and Urban Development Act 1993

- Extending the lease of a flat (LRHUDA 1993): client guide . This is an introductory guide, designed to be given by a lawyer to a client who is considering extending their lease of a flat.

- Collective enfranchisement (LRHUDA 1993): client guide . This is an introductory guide, designed to be given by a lawyer to a client who is enquiring about collective enfranchisement.

- New lease of a flat under the Leasehold Reform, Housing and Urban Development Act 1993

- LRHUDA 1993: tenant's notice requiring information from the immediate landlord or the landlord's agent

- Tenant's notice requiring information from the freeholder

- LRHUDA 1993: Tenant's notice requiring information from a superior landlord other than the freeholder

- Tenant's notice of claim to exercise right to acquire new lease of a flat

- Landlord's counter notice admitting claim for a lease extension of a flat

- Notice by landlord claiming deposit from a tenant who has requested a lease extension

- Notice by landlord requiring a tenant who has requested a lease extension to deduce title

- Notice to tenant that the right to a new lease is suspended due to an application for leasehold enfranchisement

- LRHUDA 1993: agreement to assign the benefit of a lease extension claim served before exchange

- LRHUDA 1993: agreement to serve and assign the benefit of a lease extension claim

- LRHUDA 1993: assignment of benefit of a notice of lease extension claim (clauses for transfer)

- LRHUDA 1993: deed of assignment of benefit of lease extension claim

Tenants' rights of first refusal under the Landlord and Tenant Act 1987

- Tenants' right of first refusal (LTA 1987): client guide . This is an introductory guide designed for a lawyer to give a client that has received a section 5A notice.

- LTA 1987: section 5A offer notice .

- LTA 1987: section 5B offer notice .

- LTA 1987: section 5C offer notice .

- LTA 1987: section 5D offer notice .

- LTA 1987: tenants' acceptance notice under section 6

- LTA 1987: tenants' notice of nominated person under section 6(5)

- LTA 1987: landlord's notice of withdrawal under section 8(3)(a) or section 9B(1)

- LTA 1987: nominated person's notice of withdrawal under section 8A(4)(a) or section 9A(1)

- LTA 1987: nominated person's notice of election under section 8B for sale by auction

- LTA 1987: nominated person's notice of acceptance of contract under section 8B for sale by auction

- LTA 1987: tenants' notice of election under section 8C

- LTA 1987: landlord's notice under section 8E: obtaining consent of a third party

- LTA 1987: nominated person's notice of withdrawal under section 9A(2) LTA 1987

- LTA 1987: landlord's lapse of offer notice under section 10

- LTA 1987: tenants' information notice under section 11A

- LTA 1987: tenants' election to take benefit of contract under section 12A

- LTA 1987: tenants' purchase notice under section 12B

- LTA 1987: tenants' notice to compel grant of new tenancy by superior landlord under section 12C

- LTA 1987: nominated person's notice of withdrawal under section 14(1)

- LTA 1987: nominated person's notice of withdrawal under section 14(2)

- LTA 1987: default notice under section 19(2)

Business tenancies and Landlord and Tenant Act 1954

Excluding security of tenure.

)

Terminating a protected tenancy

)

- LTA 1954: Details of claim to be included in a landlord's claim form for an unopposed lease renewal

- LTA 1954: Details of claim to be included in a tenant's claim form for an unopposed lease renewal

- Section 27 notice: tenant's notice to terminate

)

- LTA 1954: case management directions for unopposed renewal

- LTA 1954: landlord's acknowledgment of service of a tenant's claim for an unopposed lease renewal

- LTA 1954: tenant's acknowledgment of service of a landlord's claim for an unopposed lease renewal

- LTA 1954: Landlord’s particulars of claim in opposed lease renewal proceedings

- Application for interim rent under the Landlord and Tenant Act 1954

Agreement to surrender a protected tenancy

)

Landlord and tenant enforcement

- Prescribed form of notice requiring possession under section 21 of the Housing Act 1988 (England)

- Notice requiring possession under section 21 of the Housing Act 1988 (Wales)

- Notice seeking possession under section 8 of the Housing Act 1988 (England)

- Notice seeking possession under section 8 of the Housing Act 1988 (Wales)

- N5: Claim form for possession of property

- N121: Particulars of claim for possession (trespassers)

- N130: Application for possession including application for interim possession order

- Letter from landlord demanding possession of property following expiry of a contracted out lease

- Letter from landlord to former tenant delaying possession proceedings

- Particulars of claim against trespass

- Particulars of claim for possession at the end of a commercial tenancy

- Particulars of claim for possession of rented residential property

Breach of covenant

)

- Statutory demand for unpaid rent

)

- Particulars of claim for relief against forfeiture (commercial premises)

- Particulars of claim for forfeiture for non-payment of rent (commercial premises)

- Particulars of claim for forfeiture for a breach other than non-payment of rent (commercial premises)

Easements, covenants and third party rights

- Deed of easement (right of way)

- Deed of easement for overhead service media

- Deed of easement for underground service media

- Deed of easement: general rights

- Deed of release and grant (of a right of way)

- Deed of release of rights of light

- Deed of release of an easement

Licence to use a route

- Licence to use a route over land

- Statutory declaration confirming use of a right of way over a private road

Preventing acquisition of right of way by prescription

- Acknowledgement to prevent acquisition of right of way by prescription

- Car parking licence

Permissive Path

- Permissive path agreement

- Walkway agreement

- Deed of covenant and indemnity (flying freehold covenants)

- Deed of mutual covenant and grant

- Deed of release of restrictive covenant

Licences to occupy

)

- Sitting-out Licence

Lodger agreement

- Lodger Agreement

Service occupancy

- Service occupancy agreement

- Hairdresser's chair rental agreement

Terminating a licence to occupy

- Notice to determine licence to occupy commercial premises

Wayleave agreement

- Wayleave Agreement

- 2017 Electronic Communications Code wayleave agreement

- Venue hire agreement

Corporate support

Asset purchase and share purchase.

- An asset purchase agreement.

- A share purchase agreement.

Assignment of goodwill

- Assignment of intellectual property rights and goodwill (for use with asset purchase agreement)

Bribery Act 2010

- Bribery Act 2010: sample statement of ethics

- Memorandum to board of directors on the Bribery Act 2010

Development and construction

Development agreement.

- Landowner's development agreement

Put and call option agreement

- Put and call option agreement over land

Promotion agreement

- Land Promotion Agreement

Collaboration agreement

- Land collaboration agreement

Clauses for development and construction

Assignment and novation.

- CLLS Standard Form Novation Agreement

- Assignment of construction documents

Agreement for lease with works

- Agreement for lease with landlord's refurbishment works

- Agreement for lease with landlord's works (new build) and early access for tenant's fitting out works conditional on the landlord obtaining planning permission

- Agreement for lease with landlord's refurbishment works and early access for tenant's fitting out works

Crane oversailing

- Crane oversailing licence

Scaffolding

- Scaffolding Licence

The Party Wall etc. Act 1996 (PWA 1996)

- PWA 1996: line of junction notice (new wall astride the boundary)

- PWA 1996: line of junction notice (new wall astride the boundary): adjoining owner response

- PWA 1996: line of junction notice (new wall wholly on own land)

- PWA 1996: line of junction notice (new wall wholly on own land): adjoining owner response

- PWA 1996: party structure notice

- PWA 1996: party structure notice: adjoining owner responds positively

- PWA 1996: party structure notice: adjoining owner responds negatively

- PWA 1996: three or six metres notice (adjacent excavations)

- PWA 1996: three or six metres notice: adjoining owner responds positively

- PWA 1996: three or six metres notice: adjoining owner responds negatively

Options, right of pre-emption and overage

Option agreements.

- Standard document, Call option agreement (shorter form, without planning obligations) (incorporating the Standard Commercial Property Conditions (Third Edition – 2018 Revision))

- Standard document, Developer's option agreement (incorporating the Standard Commercial Property Conditions (Third Edition – 2018 Revision))

- Standard document, Landowner's option agreement (incorporating the Standard Commercial Property Conditions (Third Edition – 2018 Revision))

- Standard document, Put and call option agreement over land

Pre-emption agreements

- Standard document, Pre-emption agreement (incorporating the Standard Commercial Property Conditions (Third Edition - 2018 Revision))

Overage and clawback

- Positive overage covenant with restriction: overage payable on earlier of implementation of planning permission and disposal of property with benefit of planning permission

- Positive overage covenant with restriction: overage payable on disposal of property with benefit of planning permission

- Positive overage covenant with restriction: overage payable on grant of planning permission

- Positive overage covenant with restriction: overage payable on implementation of planning permission

- Positive overage covenant with restriction: sales overage (overage based on proceeds from sales of part of a completed residential development)

- Positive overage covenant with restriction: turn overage (overage payable on disposal)

- Deed of covenant (overage obligations)

Mortgages and security

Legal mortgages.

- Occupier's consent to mortgage

- Third party legal mortgage over property from a company securing specific liabilities

- Legal mortgage over property from a company securing specific monies (own liabilities)

- Mortgage agreement with individual borrower: residential property, not by way of business

Clauses for mortgages and security

- Deed of substituted security

Etridge letter

- Etridge letter confirming independent advice about mortgage

Letter of non-crystallisation of floating charge

)

- Appointment of fixed charge or LPA receiver

- Acknowledgment of appointment by fixed charge or LPA receiver

Sale by an LPA receiver

- Contract for the sale of freehold land by an LPA receiver

- Contract for the sale of leasehold land by an LPA receiver

Sale by company in administration

- Contract for the sale of freehold land by a company in administration

- Contract for the sale of leasehold land by a company in administration

Sale by company in liquidation

- Contract for the sale of freehold land by a company in liquidation

- Contract for the sale of leasehold land by a company in liquidation

Sale by mortgagee in possession

- Contract for the sale of freehold land by a mortgagee in possession

Sale by trustee in bankruptcy

Residential tenancies, articles of association for property management companies.

- Articles of association for a tenants' management company limited by guarantee (where company becomes landlord)

Prescribed form notices

- Prescribed form of notice requiring possession under section 21 of the Housing Act 1988

Rural and agricultural land

Contract for sale.

- Contract for the sale of freehold agricultural land with vacant possession

- Grazing licence

Grazing tenancy

- Tenancy agreement for grazing horses

Agricultural farm business tenancies

- Landlord's notice under section 6 of the Agricultural Tenancies Act 1995

- Long form agricultural farm business tenancy

- Notice under section 1(4) of the Agricultural Tenancies Act 1995

- Notice under section 5 of the Agricultural Tenancies Act 1995

- Short form agricultural farm business tenancy: bare land

- Short form agricultural farm business tenancy: bare land (Wales)

- Tenant's notice under section 6 of the Agricultural Tenancies Act 1995

Farming partnership agreement

- Family farming partnership agreement

Agriculture and rural land standard enquiries

Sporting rights.

- Lease of fishing rights

- Lease of shooting rights

- Fishing licence

Planning obligations

)

- Supplemental agreement under section 106A of the Town and Country Planning Act 1990

- Unilateral undertaking under section 106 of the Town and Country Planning Act 1990

Compulsory purchase orders and appropriation

- Compulsory purchase orders: indemnity agreement

- Compulsory purchase orders: draft order

- Compulsory purchase orders: statement of reasons

- Compulsory purchase orders: statement of case

Enforcement of breach of planning condition

- Breach of condition notice

- Enforcement notice: failure to comply with a condition attached to a planning permission

- Enforcement notice: material change of use without planning permission

- Enforcement notice: operational development without planning permission

- Planning contravention notice

- Section 215 maintenance notice (building repairs)

- Section 215 maintenance notice (clearance of demolition materials)

- Tree replacement notice

Building preservation

- Building Preservation Notice

Pedestrianisation

- Notice of a pedestrianisation order made under section 249 of the TCPA 1990

- Draft pedestrianisation order made under section 249 of the TCPA 1990

- Notice of a proposal to make a pedestrianisation order under section 249 of the TCPA 1990

Stopping up

- Draft stopping up order made under section 247 of the Town and Country Planning Act 1990

- Draft stopping up or diversion order made under section 257 of the Town and Country Planning Act 1990

- Notice of a proposal to make a stopping up order under section 247 of the Town and Country Planning Act 1990

- Notice of a stopping up order made under section 247 of the Town and Country Planning Act 1990

- Notice of a stopping up or diversion order confirmed under section 257 of the Town and Country Planning Act 1990

- Notice of a stopping up or diversion order made under section 257 of the Town and Country Planning Act 1990

- Notice of intention to apply for a stopping up order under section 116 of the Highways Act 1980

- Model stop notice

Diversion order

- Notice of intention to apply for a diversion order under section 116 of the Highways Act 1980

Section 278 agreement

- Section 278 highways agreement

- Section 278 agreement: default notice

Section 31 Highways Act 1980

- Landowner's statement pursuant to section 31(6) of the Highways Act 1980, where the land is in Wales

- Landowner's statutory declaration pursuant to section 31(6) of the Highways Act 1980, where the land is in Wales

Consents and orders

- Section 179 consent to build under a street

- Draft court order under section 116 of the Highways Act 1980

- Counter notice admitting liability to maintain a highway under section 56(4) of the Highways Act 1980

Notices under Road Traffic Regulation Act 1984

- Notice of a proposal to make a traffic regulation order under section 1 or section 6 of the Road Traffic Regulation Act 1984

- Notice of a proposal to make a temporary traffic regulation order under section 14(1) of the Road Traffic Regulation Act 1984

- Notice of a traffic regulation order made under section 1 or section 6 of the Road Traffic Regulation Act 1984

- Notice of a temporary traffic regulation order made under section 14(1) of the Road Traffic Regulation Act 1984

- Draft traffic regulation order made under section 1 or section 6 of the Road Traffic Regulation Act 1984

- Draft temporary traffic regulation order made under section 14(1) of the Road Traffic Regulation Act 1984

- Draft special events temporary traffic regulation order made under section 16A of the Road Traffic Regulation Act 1984

- Draft special events temporary traffic regulation order made under section 21 of the Town Police Clauses Act 1847

- Notice of the making of a special events temporary traffic regulation order under section 16A of the Road Traffic Regulation Act 1984

- Notice of a proposal to make a special events temporary traffic regulation order under section 16A of the Road Traffic Regulation Act 1984

- Notice of the making of a special events temporary traffic regulation order under section 21 of the Town Police Clauses Act 1847

Professional conduct

Money laundering.

- Anti-money laundering compliance: presentation materials

Capital Gains Tax

- Capital gains tax: principal private residence relief: main residence nomination

Using Property standard documents

- Maintained and constantly updated by the Practical Law Property Professional Support team . Amendments are recorded in a Resource history, which can be accessed from the Actions box for the relevant document.

- in a separate document (drafting note) that can be readily accessed by clicking on the "Drafting note" link in the abstract at the top of the document; or

- in integrated drafting notes, which are integrated into the web view of the standard documents.

- Available in Microsoft Word format . Select the Word tab that appears in the Actions box. You can then save a copy of the standard document to your computer. How you do this depends on your internet browser (for example, Internet Explorer or Mozilla Firefox), but you will usually need to select "Save As" from the File menu. Most Word documents on the service use a sophisticated template (see How do I use the Practical Law Word template? , which explains how to deal with automated numbering and tables of contents.) Practical Law has developed an application, called Firmstyle , which enables standard documents to be downloaded in a subscriber's own house style, so saving substantial time for fee-earners and secretaries. For further information, see Firmstyle .

)

What is the liability of an outgoing tenant under an 'old' lease following assignment? Is a landlord obliged to pursue the current tenant for any arrears before pursuing a former tenant or guarantor to a former tenant?

Article summary, access this content for free with a 7 day trial of lexisnexis and benefit from:.

- Instant clarification on points of law

- Smart search

- Workflow tools

- 41 practice areas

** Trials are provided to all LexisNexis content, excluding Practice Compliance, Practice Management and Risk and Compliance, subscription packages are tailored to your specific needs. To discuss trialling these LexisNexis services please email customer service via our online form. Free trials are only available to individuals based in the UK, Ireland and selected UK overseas territories and Caribbean countries. We may terminate this trial at any time or decide not to give a trial, for any reason. Trial includes one question to LexisAsk during the length of the trial.

Get your quote today and take step closer to being able to benefit from:

- 36 practice areas

Get a LexisNexis quote

* denotes a required field

To view the latest version of this document and thousands of others like it, sign-in with LexisNexis or register for a free trial.

Existing user? Sign-in CONTINUE READING GET A QUOTE

Related legal acts:

- Land Registration Act 2002 (2002 c 9)

- Landlord and Tenant (Covenants) Act 1995 (1995 c 30)

- Landlord and Tenant Act 1954 (1954 c 56)

- Law of Property Act 1925 (1925 c 20)

Key definition:

Tenant definition, what does tenant mean.

A person to whom a lease is granted.

Popular documents

What is the liability of an outgoing tenant under an 'old' lease following assignment is a landlord.

What is the liability of an outgoing tenant under an 'old' lease following assignment? Is a landlord obliged to pursue the current tenant for any arrears before pursuing a former tenant or guarantor to a former tenant?Obligations of an assignor tenant under an old leaseThe general rule is that where

Commercial rent arrears recovery (CRAR)

Commercial rent arrears recovery (CRAR)Right to recover rentThe commercial rent arrears recovery (CRAR) regime allows landlords to seize a tenant’s goods from the demised premises in order to recover unpaid rent. It replaced the old common law right to levy distress, and is more strictly regulated

Quick guide to landlord’s remedies for breach of lease

Quick guide to landlord’s remedies for breach of leaseThis Practice Note provides a summary of the remedies available to a landlord when faced with a tenant’s breach of lease, including forfeiture, service of a statutory demand, court proceedings to recover rent or damages, or for an injunction,

Accepting rental payments from third parties—landlord’s considerations

Accepting rental payments from third parties—landlord’s considerationsThis Practice Note explains the various potential implications for a landlord to consider before accepting rental payments from third parties, including arguments that rent paid by a third party has given rise to a surrender by

0330 161 1234

- International Sales(Includes Middle East)

- Latin America and the Caribbean

- Netherlands

- New Zealand

- Philippines

- South Africa

- Switzerland

- United States

Popular Links

- Supplier Payment Terms

- Partner Alliance Programme

HELP & SUPPORT

- Legal Help and Support

- Tolley Tax Help and Support

LEGAL SOLUTIONS

- Compliance and Risk

- Forms and Documents

- Legal Drafting

- Legal Research

- Magazines and Journals

- News and Media Analysis

- Practice Management

- Privacy Policy

- Cookie Settings

- Terms & Conditions

- Data Protection Inquiry

- Protecting Human Rights: Our Modern Slavery Agreement

- All Properties

- 1415 S Hawthorne – 1 Bedroom

- 1415 S Hawthorne – 2 Bedrooms

- 1499 S Hawthorne Drive

- Lauder Avenue – 1 Bedroom

- Lauder Avenue – 2 Bedrooms

- Taylor Avenue 1 Bedroom

- Taylor Avenue 2 Bedroom

- Main Street

- 215 E Henley St – 1 Bedroom

- 215 E Henley St – 2 Bedroom

- 6th Street & Jefferson

- Lilley – 1 Bedroom Apartments

- Lilley – 2 Bedroom Apartments

- Adams Street Duplex

- Oakridge Apartments

- Current Availability

- Pricing & Future Availability

- Start Application Process

- Tenant Portal

- Rules and Policies

- Fair Housing Resources

- Pricing & Availability

Pricing & Future Availability

To see vacancies opening in the next 30 days see current availability.

Application fees are non-refundable. Contact the Hill Rental Properties office for availability prior to filling out an application.

Download Full Property Description Packet

Packet includes maps, photos, and general floor plans for all 1 & 2 bedroom apartments managed by Hill Rental Properties.

Rent includes water, sewer, and garbage.

The last month’s rent and security deposit are due at the time of lease signing. the first month’s rent is pro-rated and due on the first day of the lease., one bedroom apartments.

Pets are not permitted. Hill Rental Properties will make accommodation for service/support animals. Contact the office for more information. Security Deposit is $300

Two Bedroom Apartments

Three bedroom apartments.

- N & S Lilley Street

- Henley Street

- Taylor Avenue

- Lauder Avenue

- 1415 S Hawthorne Drive

Community Links

- Avista Utilities

- Smart Transit

- City of Moscow

- Post Office

- Vandal Athletic Center

- Farmers Market

- Moscow Co-op

- Exploring the Palouse

- Palouse Bicycle Collective

- Moscow Recycling

Office Hours

Monday – Friday

8:00am – 12:00pm & 1:00pm – 4:30pm

Hill Rental Properties, LLC

1218 S Main Street

Moscow, ID 83843

Phone (208) 882-3224

IMAGES

VIDEO

COMMENTS

A deed for use when acting on the sale of a reversionary interest in a property subject to occupational leases, where a tenant (or more than one) has entered into a Rent Deposit Deed. To access this resource, sign in below or register for a free, no-obligation trial.

by Practical Law Property. Maintained • , England, Wales. A deed for use when acting on the sale of a reversionary interest in a property subject to occupational leases, where a tenant (or more than one) has entered into a Rent Deposit Deed.

We have published a new Standard document, Deed of assignment and covenant in relation to Rent Deposit Deeds. The deed is for use when selling a reversionary interest in a property which is subject to occupational leases, where one or more tenant has entered into a Rent Deposit Deed.

A rent deposit deed will specify the circumstances in which the landlord can draw on this money and the conditions that must be satisfied for the deposit to be repaid to the tenant. ... Assignment under the lease in accordance with the lease. (On such an occasion the landlord may, if appropriate, want to require a new rent deposit from the ...

Practical Law UK Standard Document 4-200-0303 (Approx. 20 pages) Rent deposit deed: trust. A rent deposit deed where the deposit is held by the Landlord on trust for the Tenant, subject to the terms of the rent deposit deed. This standard document assumes that both the Landlord and the Tenant are both corporate entities and that the rent ...

A rent deposit is a sum of money (usually equalling between 6 and 12 months' gross rent) paid by the tenant and accessible by the landlord in circumstances agreed between the parties. The circumstances are usually non-payment of rent or breach of tenant covenants. The document setting out the rent deposit agreement is usually a rent deposit deed.

A rent deposit is a sum of money that is deposited by a tenant when it takes a lease of premises as security against the non-payment of rent and other breaches of the lease. The money is held on the terms of the rent deposit deed. Rent deposit agreements usually cover 'any' default or breach by the tenant, and not just rent arrears.

Transfer or assignment: new tenancies. A rent deposit deed that relates to a "new" tenancy is a "collateral agreement" to the tenancy, as defined in section 28(1) of the Landlord and Tenant (Covenants) Act 1995 (the 1995 Act). Covenants contained in collateral agreements are "covenants" for the purposes of the 1995 Act.

Transfer or assignment: new tenancies. A rent deposit deed that relates to a "new" tenancy is a "collateral agreement" to the tenancy, as defined in section 28(1) of the Landlord and ...

A Rent Deposit Deed is a document which is supplemental to the Lease and is something a Landlord may require so that they have an advance payment of the rent (usually between 3 and 12 months) to protect the Landlord in situations where the Tenant fails to pay rent or breaches other conditions in the Lease.

A rent deposit deed where the deposit is held by the landlord but, subject to the terms of the deed, it remains the property of the tenant, and is charged to the landlord. Both the landlord and tenant are assumed to be corporate entities and the rent deposit deed is assumed to be supplemental to a "new" lease for the purposes of the Landlord and Tenant (Covenants) Act 1995.

A practice note on rent deposits and the various ways in which they can be structured.

Many rent deposit deeds will contain provisions dealing with a change of landlord. Such provisions will typically allow the landlord to assign the benefit of the deed to the buyer on a sale of the landlord's reversionary interest, subject to the buyer covenanting with the tenant (with effect from the date of the assignment of the reversion) to:

The parties must again comply with the terms of the Rent Deposit Deed (for more information on Rent Deposit Deeds); and . 2. The second option with a charge rent deposit is that the Tenant retains the deposit and instead places it in a separate account at their own bank. The Tenant then places a fixed equitable charge over the deposit in favour ...

The preferred starting position for many landlords is a rent deposit paid to them absolutely on completion of the lease so that the funds are readily available if they need to be drawn upon. The document will usually contain a promise from the landlord to return the deposit balance to the tenant either at the end of the term or on an earlier ...

PLC Property hosts the CPSE, which are prepared by members of the London Property Support Lawyers Group and are endorsed by the British Property Federation. The suite of documents includes guidance notes and historic versions of the individual sets of queries. ... Deed of assignment of rent deposit(s)

Article Summary This q and a discusses the liability of an outgoing tenant under an 'old' lease following assignment, and whether a landlord is obliged to pursue the current tenant for any arrears before pursuing a former tenant or guarantor. It explains that generally, the original tenant remains liable for tenant covenants throughout the term of an old lease, even after assignment.

Government activity Departments. Fields, agencies and public bodies. News. News history, speeches, letters and notices. Guidance and regulation

1x1 C. 1 Bed / 1 Bath — 474 sq. ft. See More Details. Pricing and availability are subject to change. Rent is based on monthly frequency. SQFT listed is an approximate value for each floor plan. Republic on Main Apartment Rentals.

The last month's rent and security deposit are due at the time of lease signing. The first month's rent is pro-rated and due on the first day of the lease. One Bedroom Apartments. Address 11.5 Month Lease 10 Month Lease Laundry Dishwasher 2024 Availability; 1415 S Hawthorne: $640: $704: Coin-op: Yes: No Availability: Taylor Avenue: $640: