Stop the War. Support Ukraine. Make a donation to United24 program. Support Ukraine

- Pitch Deck Consulting Services

Business Plan

- Investment Teaser & One pager

- Startup Financial Model

- Investor Targeting and Outreach

- Due Diligence Consulting

- Post-Investment Reporting and Communication

- Pre-seed funding services

- Seed funding for startups

- Series A funding advisory

- Industry Analysis Services

- Executive Summary Consulting

- Company Overview

- Financial Performance Analysis

- Growth Opportunities and Projections

- Management and Organizational Structure

- Business Valuation Services

- Market Research Services

- Market Entry Strategy Analysis

- Pitch Deck Design Services

- Product Demo Presentation

- Event Deck Design Services

- Digital Health

- Pharmaceuticals

- Cannabis Wellness

- Cannabis Biotech

- Cannabis Products

- Psychedelics

- Social Commerce

- Mobile Commerce

- E-commerce Marketplaces

- P2P Marketplaces

- Smart Watches

- Digital Banking

- Financial Exchanges

- Personal Finance

- Flexible Workspace

- Green Building

- Clean Energy

- Solar Energy

- Wind Energy

- Animal Health

- Vertical Farming

- Mobility Tech

- Travel and Tourism

- Renewable Energy Tech

- Energy Efficiency Tech

- ClimateTech

- Car Sharing

- Ride Sharing

- Gig Economy

- P2P Finance

- Smart Government & GovTech

- Smart Building

- Smart Mobility

- Edutainment

- Video Games

- Console Games

- Online Gaming

- Mobile Gaming

- Fantasy Sports

- Online Gambling

- Event Management

- Creator Economy

- Meeting Software

- Social Networks

- Business Intelligence

- Machine Learning

- Predictive Analytics

- Generative AI

- Nanotechnology

- 3D Printing

- Augmented Reality

- Virtual Reality

- Internet of Things

- Cybersecurity

- Remote Work

- Digital Marketing

- Sales Automation

- Crypto Exchange

- Crypto Wallets

- Metaverse Economy

- Success stories

5-minute test to check your chances of raising funding in 2024

Home / Blog / Pitch Deck vs. Business Plan: What is the Difference?

Pitch Deck vs. Business Plan: What is the Difference?

- Core knowledge

- Fundraising

Want to learn more?

More growth and fundraising hacks at your fingertips

Thank you, your sign-up request was successful!

Deciding between a pitch deck and a business plan for your next fundraiser? In reality, both documents play an important part in your fight for the next round.

- Research shows that a clear, concise pitch deck can increase the chances of securing an initial meeting with investors by up to 72% .

- A business plan reduces internal confusion by 25% by clearly outlining the goals, strategies, and financial projections, leading to a 30% increase in team collaboration .

Both documents require heavy research and are designed to convince investors to back your venture. However, they accomplish it in different ways.

Having raised over $505M in 2023 for startups with our pitch decks and business plans , we’ll walk you through a detailed Pitch deck vs. Business plan comparison and their role in the fundraising game.

What is the pitch deck?

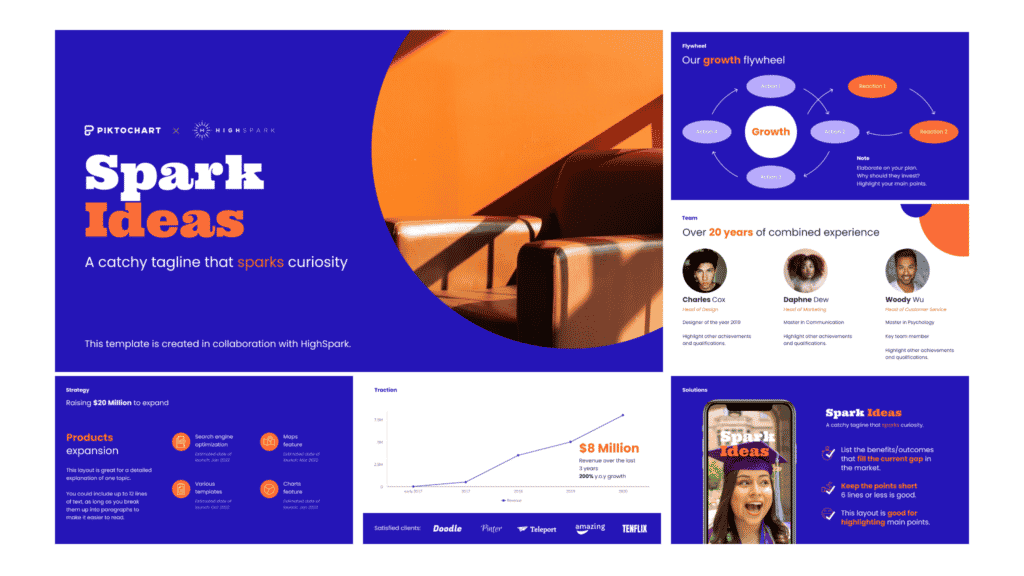

A pitch deck is a 10-20-slide presentation showcasing the potential of your business idea and startup to investors. Briefly and compellingly, it introduces your company, product, market, business model and overall strategy.

An effective must showcase your market research, traction to date, and a roadmap to where you want to get. No one-sized pitch deck exists, so you can even pitch someone in the elevator .

Think of it as an introductory sales document designed to pique investor interest and encourage further dialogue.

Components of a pitch deck:

- Introduction: Brief overview of your company and its purpose.

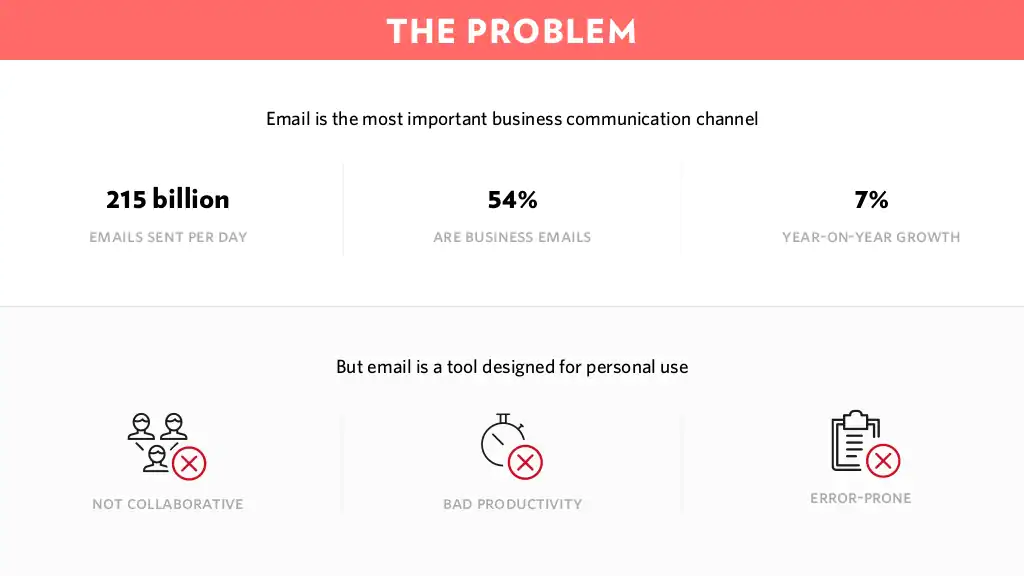

- Problem Statement: Clearly define the problem your product or service solves.

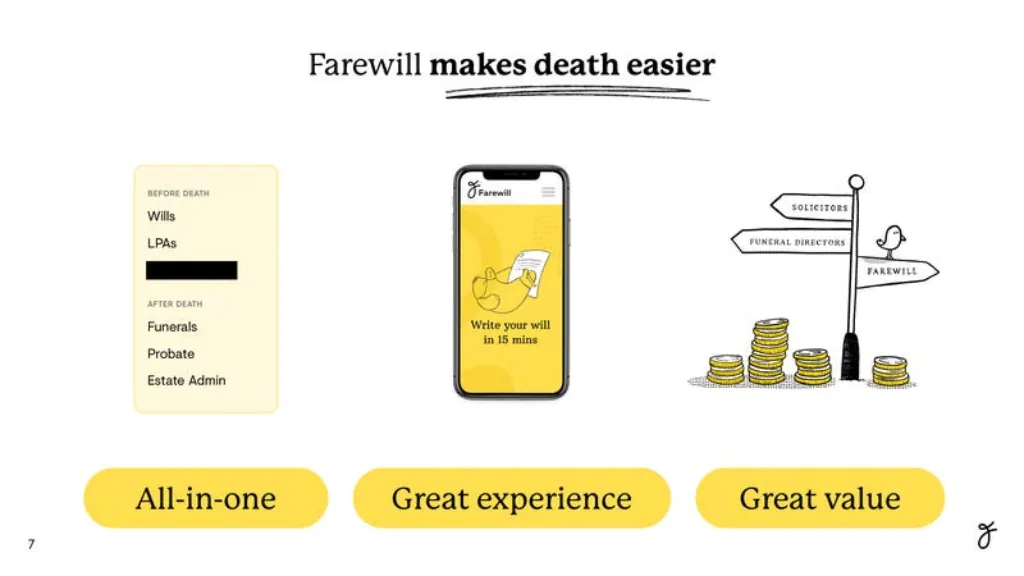

- Solution: Describe your product or service and how it addresses the problem.

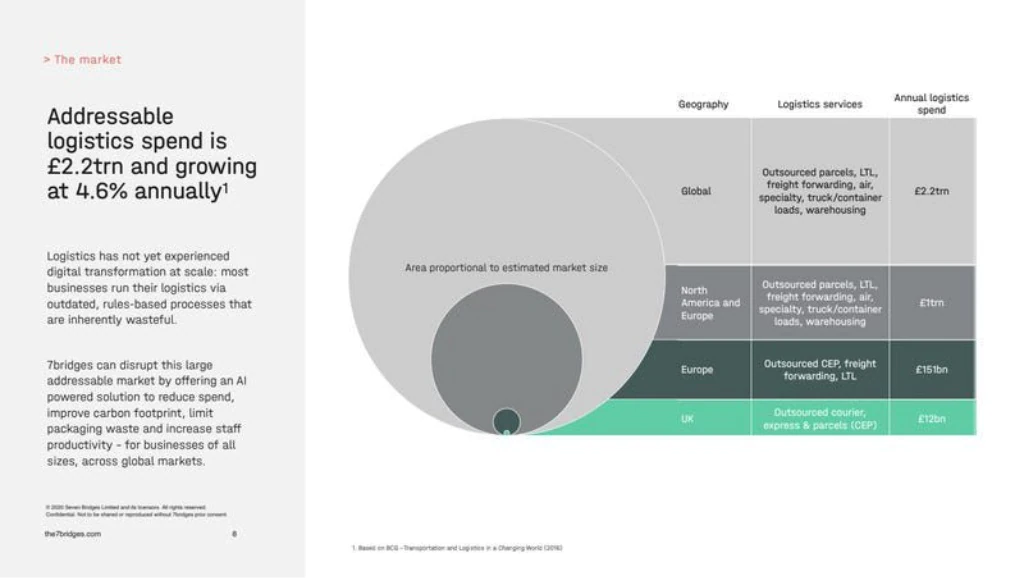

- Market Opportunity: Showcase the potential market size and target audience.

- Business Model: Explain how your company plans to generate revenue.

- Traction: Highlight any milestones, achievements, or user statistics.

- Market Strategies: Outline your marketing and sales approaches.

- Competitive Analysis: Identify and analyze your competitors.

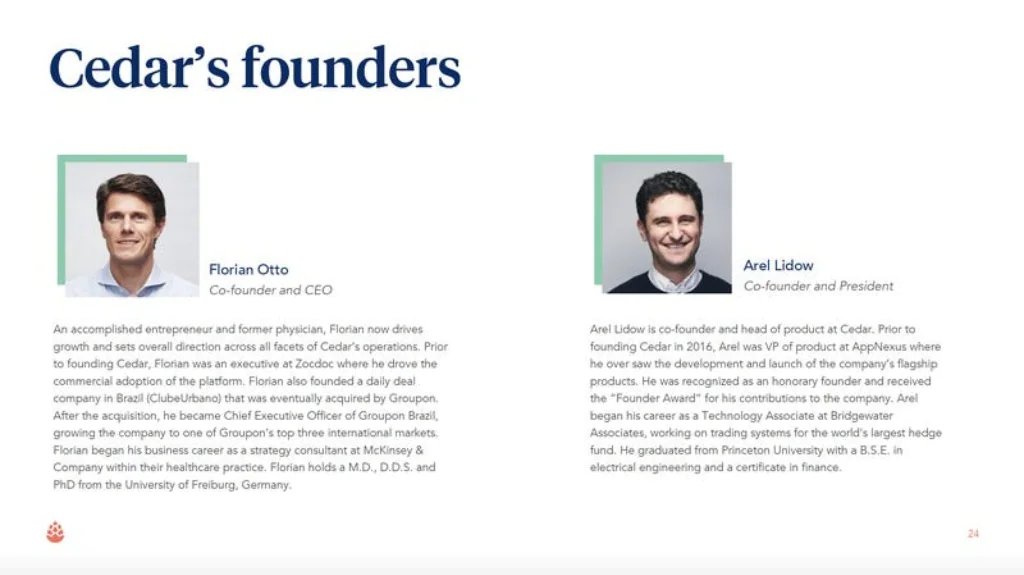

- Team: Introduce key team members and their roles.

- Financial Projections: Present forecasts for revenue, expenses, and profitability.

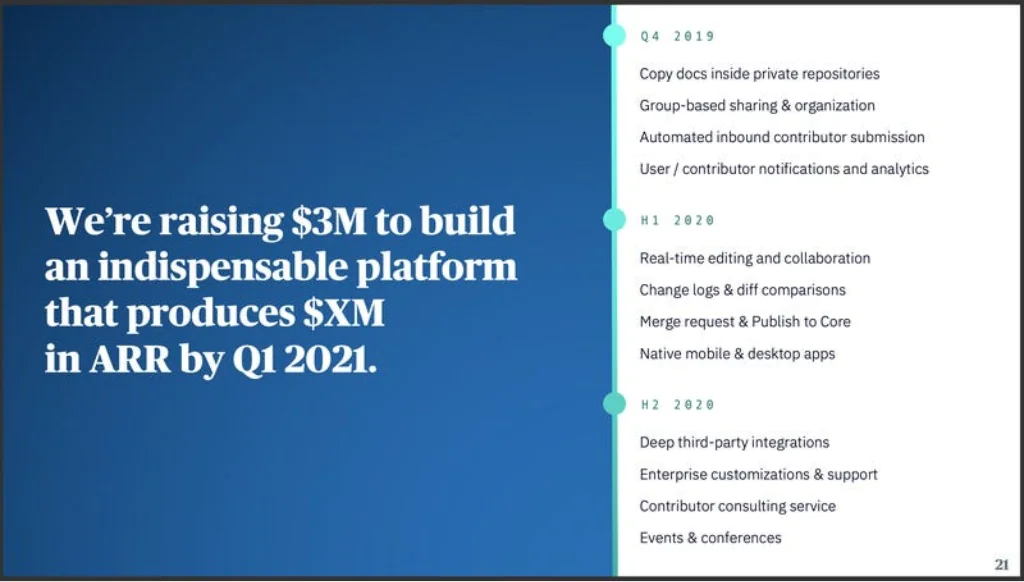

- Ask/Investment: Clearly state what you’re seeking from potential investors.

What is a business plan?

A business plan is a 30-100-page document showcasing an in-depth analysis of your business idea to potential investors to convince them to invest. It elaborates on things like:

- Your sales, marketing, and operational plans for growth

- Where your company will be in the next 1,3 or 5 years

- A step-by-step plan of how you’ll get there.

The business plan is the first part of the investor’s due diligence process before finalizing the deal. It lays out more detailed research on your industry and competitors, contains many charts, graphs, and pictures, and is very text-heavy.

Think of it as a comprehensive blueprint of your venture designed to persuade interested investors to pull the trigger and invest.

Components of a business plan:

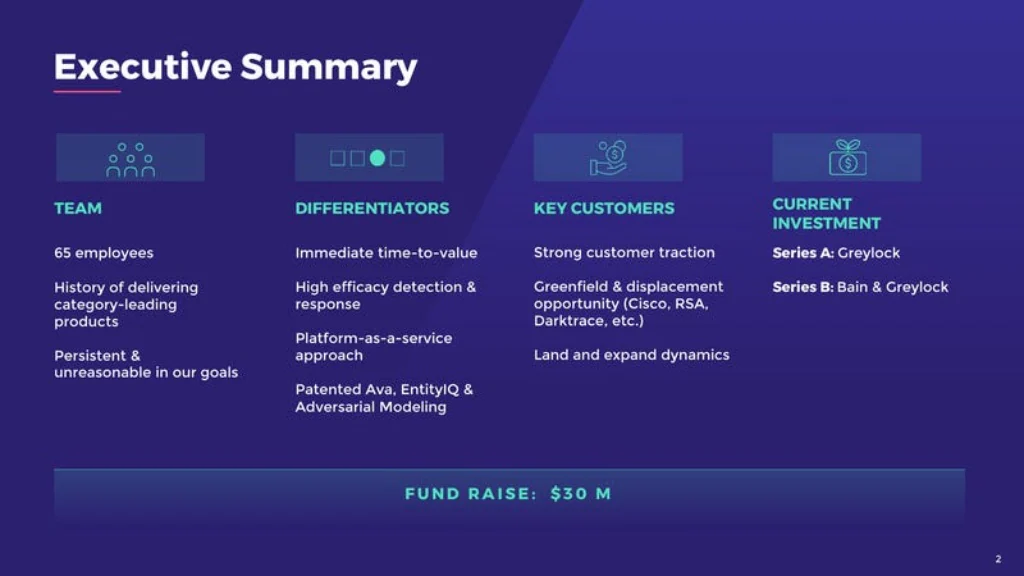

- Executive Summary: A brief business overview, goals, and plans.

- Company Description: Details about your business, mission, vision, and structure.

- Market Analysis: Research your industry, market, and competitors.

- Organization and Management: Information about your team, structure, and key personnel.

- Product or Service Line: Description of your offer and its benefits.

- Marketing and Sales: Your strategies for promoting and selling your product or service.

- Funding Request: If you seek funding, outline your financial needs.

- Financial Projections: Projected financial statements, like income statements and balance sheets.

- Appendix: Additional supporting documents, charts, graphs, etc.

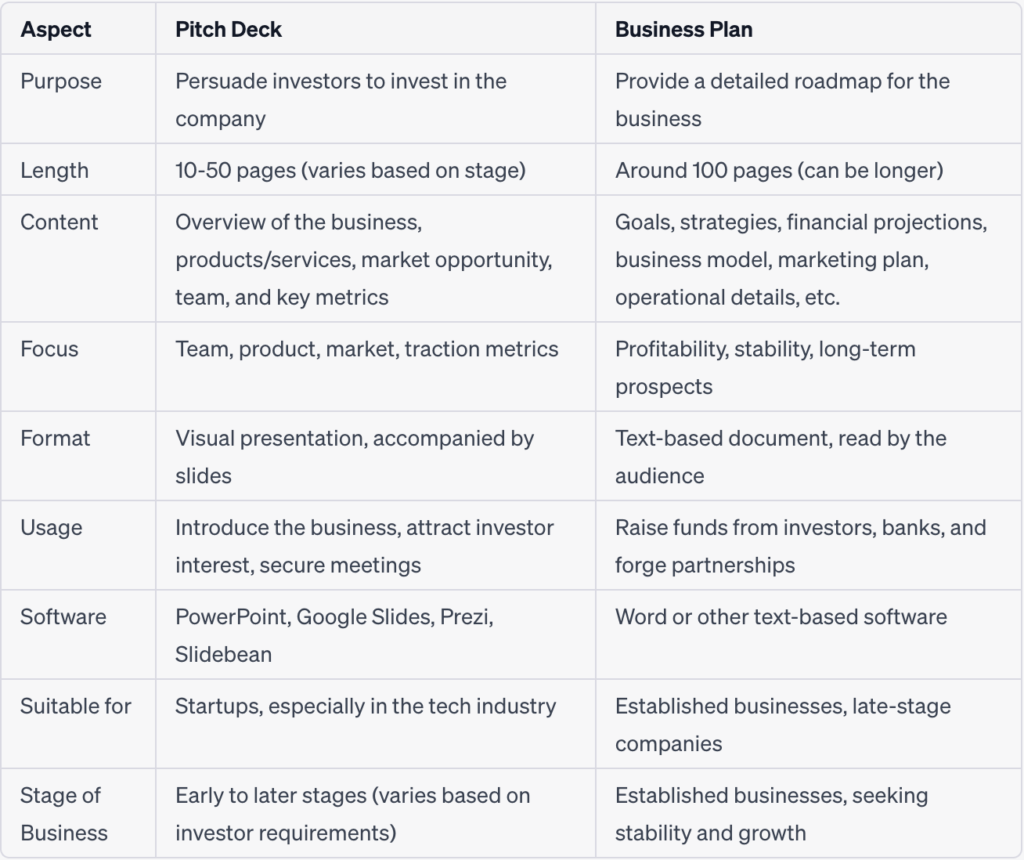

What are the differences between a pitch deck and a business plan?

While the business plan and pitch deck give a view of your venture, they serve different goals, reach different audiences, and build the story differently. These distinctions manifest in the length, format, target audiences, and funding stages.

Length and Format

- Pitch Deck:

Brief and eye-catching 10-20 slides with engaging visuals, like images, charts, and minimal text. Generally highlights critical points, like product or service, target market, business model, and future potential.

- Business Plan:

Detailed 30-100 page text-heavy document armed with visuals like charts and graphs. It typically emphasizes projected revenue, expenses, and profitability through financial statements and forecasts. The document details strategies for sales, marketing, operations, and human resources, along with a description of team members’ expertise, experience, contributions to the company’s success, etc.

Raise money with the free pitch deck template from Waveup

Why startups love our template:

- Investor-proof narrative & design

- Best practices from $3B+ raised

- Powerpoint + Keynote

Success. We just sent the Pitch Deck Template from Waveup to your inbox.

Targeted Audience

- Pitch Deck: Investors (initial stages)

- Business Plan: Investors (due diligence), internal team

Stages and Objectives

- Pitch Deck: 1. Shines in early stages: Pre-seed, seed, Series A. 2. Captivates investors: Concisely delivers the problem, solution, market, and team.

- Business Plan: 1. Dominates later stages: Series B and beyond. 2. Secures substantial funding: Demonstrates viability and potential return on investment (ROI).

Frequency of use

- Pitch Deck: 1. High Frequency: Used frequently and repeatedly throughout the fundraising process. You might prepare several variations tailored to different investors or stages of funding. Examples: Initial investor meetings, pitch competitions, and conferences seeking investment opportunities.

- Business Plan: 1. Lower Frequency: Typically used once during the later fundraising stages, specifically during due diligence. 2. Focus: Providing detailed information for investors to thoroughly assess your business’s viability.

Pros and cons: Pitch Deck vs. Business Plan

Advantages:

- Comprehensive: This thoroughness is crucial for investors, lenders, and internal stakeholders.

- Strategically complete: Aids decision-making, resource allocation, and risk management.

- Supportive fundraising: Studies suggest that companies with a well-crafted business plan are 18% more likely to secure funding than those without one.

Disadvantages:

- Time-consuming: Requires potential expertise in areas like financial modelling and market research.

- Outdated quickly: Market dynamics and business strategies can evolve rapidly, necessitating regular updates to the plan to maintain its accuracy and relevance.

- It may not be read: Lack of time and poorly structured info can push away the potential investor.

- Concise and engaging: Studies reveal that audiences lose focus after 10-20 minutes of presentations. Pitch delivers a clear and quick message.

- Easy to adapt and share: Adapting the pitch deck for various audiences and situations is simpler due to its brevity.

- This can lead to meetings: Engaging presentations foster positive connections with potential partners and lay the groundwork for long-lasting collaborations.

- Sometimes limited information: By definition, it does not provide the in-depth financial analysis, operational details, and market research needed for comprehensive due diligence.

- Less suitable for later stages: As funding requirements and investor expectations increase, a pitch deck alone may not be sufficient for securing more significant investments.

Which is more important, the pitch deck or the business plan?

There is no one-size answer; in most cases, you need both. The importance of each depends on your industry and fundraising stage. The pitch deck is crucial early on , but investors scrutinise the business plan for details as you progress .

The pitch deck is vital for visibility. Without it, you may miss opportunities with investors and hinder connections with mentors and partners essential for your startup’s success.

On the other hand, the business plan is crucial to validate everything you’ve outlined in your pitch deck. Investors can quickly spot unprepared founders or unrealistic propositions. While a compelling pitch may secure a meeting, a thorough plan will convince investors to back your venture.

Important: A well-crafted pitch deck often stems from a strong business plan.

When to use a business plan and not a pitch deck

- If you seek debt financing: Banks rely on business plans, emphasizing their importance for loan applications.

- If you fundraise above $500k: Careful planning is crucial for substantial fundraising. Investors will scrutinize your venture, so be thoroughly prepared.

- If you have cooperative ownership planning: A written plan is essential for co-owners to navigate challenges together, staying true to the initial vision while embracing necessary changes.

When to use a pitch deck and not a business plan

- When attracting equity investment: A concise pitch deck is essential to secure funds from venture capitalists, angel investors, or knowledgeable friends and family.

- When looking for networking with potential investors: Crafting a positive initial impression is paramount.

- For pitching opportunities for founders: Explore pitch competitions in the startup community, seizing opportunities for exposure and honing your pitching abilities with a solid pitch deck.

- When seeking co-founders: If you’re looking for cofounders, there is no better way to convey your concept and the value you can bring to the table than through a pitch deck.

- When applying to accelerator programs: A well-crafted pitch deck is typically required. It is a critical asset in the assessment process for entry into the accelerator’s next cohort.

You need both

Need to grab attention and lock connections? Use a pitch deck. Need to showcase in-depth details and long-term potential? Use a business plan. Both tools are paramount in navigating your fundraising journey effectively.

Want to know how to craft pitch decks that secure investor interest? Check our pitch deck hub to learn all about it straight from the trenches.

CONTENT WRITER

Hey there! I'm Anastasiia, a Content Writer at Waveup. With my marketing expertise and storytelling magic, I turn complex data and industry insights into your startup playbook, making the business world a breeze for you! At Waveup, I work with brilliant folks who make insights a never-ending flow. So, join, read, and enjoy!

Related Posts

Startup funding stages guide: from pre-seed to ipo [2024], top-11 market validation methods, mistakes & slide examples.

- Financial model

6 pro tips for building superior startup KPI dashboard

How to value your startup: pre-seed to series a guidebook, how to calculate the cost of revenue: startup cheat-sheet, how to prove to investors you have product-market fit, a complete rundown of pitch deck mistakes and how to avoid them, startup operating expenses: what should they include, startup math: the key performance indicators you need to track, top 10 vc firms in germany, top 10 venture capital firms in atlanta, top 10 venture capital firms in seattle.

Leave your information below and one of our experts will be in touch to schedule a call.

Case Studies

Resource Hub

Featured post

What is a Pitch Deck: The Definitive Guide for Entrepreneurs

Explore our latest posts

Leveraging Emotional Intelligence for Startup Leadership: Enhancing Team Dynamics and Decision-Making

Navigating the Challenges and Opportunities in Green Tech Startups

Navigating the Gig Economy: Strategies for Startups to Leverage Freelance Talent

The Entrepreneur's Arsenal: Pitch Deck vs. Business Plan

Learn the differences between a business plan and a pitch deck and when to use each one. Discover the pros and cons of both and how to create a winning pitch deck or compelling business plan.

November 20, 2023

Pitch deck vs. business plan: which one do you need for your business, and when? As a businessman or entrepreneur, do you sometimes wonder why your potential investors aren't responding after you've sent them a long and detailed business plan or a catchy pitch deck? This could be due to the minimal information provided in the pitch deck or the lengthy, boring, and irrelevant details in the business plan that repelled them from reaching back to you. However, you should also know how to send pitch decks to investors. Therefore, it's crucial for an entrepreneur to understand which approach is best for their venture. Before seeking out investors, one should be very well aware of the difference between a pitch deck and a business plan. Luckily, we have all the information you need. Check out our resource on how to send a pitch deck to investors.

Pitch Deck vs Business Plan

What are pitch decks and business plans, and how do you write them? Let’s find out.

A business plan identifies, describes, and analyzes a business opportunity and/or an existing business. It focuses on the technical, financial, and economic viability of the idea, and explains in detail the plans your company has for the next 1, 3, and 5 years. This document is used as a reference point by potential investors when deciding whether or not to invest in your company. Furthermore, it's frequently used in a due diligence step in the funding process. A pitch deck, on the other hand, is a much more summarized version of a business plan that aims to excite investors about a company, to set up a second meeting and the possibility of an investment discussion. It is a pitch presentation used by business owners or entrepreneurs to give potential investors, like venture capitalists or angel investors, a concise but informative overview of their startup or company. Investors can use it to see where your business stands and where it is going, and decide whether they want to support it in getting there. It is purposefully sent to potential investors in order to set up a face-to-face meeting or used as a visual aid during a live presentation to potential investors.

Included Information

A business plan contains the research you have conducted on your industry and competitors as well as your company's operational, marketing, and sales strategies. It also includes financial analysis, growth, success projections, and a road map of where your business will be in the future and how it will get there. These nine sections are combined in a traditional business plan design in one way or another:

- Executive summary

- Business description

- Market research

- Operational plan and management

- Service or line of goods

- Sales and marketing

- Money request

- Financial estimates

If you want a professional business plan, it is highly recommended to use a business plan consultant. On the other hand, a pitch deck usually covers the following sections:

- Introduction

- Target market

- Marketing and sales strategy

- Pitch Deck Competition Slide

- Funding request

- Financial Strength

You can find all the details in our Pitch Deck Outline article. Another element of information that should be included in a pitch deck is how much money the company intends to raise, for what amount of equity, and how the money will be spent. Therefore, it must contain expected financials and a pre-money company valuation. You can also include a timeline of significant events in the company's history, which will help convince investors to approve the funding.

The business plan is a lengthy, in-depth document that typically has 10–100 pages and is created in Word. It is primarily text-based. On the other hand, the pitch deck's length ranges between 10 and 20 pages and is produced using PowerPoint with the intention of using visual aids such as pictures, graphs, tables to convey as much of the critical information as quickly as possible.

Situations Where a Business Plan Is Needed

- Obtaining Debt Financing from Conventional Banks: If you want to obtain any type of loan from a bank, you will need to submit a business plan, as they still review them.

- Company Having Multiple Co-Founders and Co-Owners: A business plan is quite helpful in managing a bigger board of seniors in the company. It ensures that everyone sticks to the company's core values and carries out the intended plans to achieve long-term goals. This should be a dynamic document that is continually updated as circumstances warrant.

- Fundraising over $500K: If you are raising a large amount of cash, you better have a strategy in place for how you are going to use it. Be ready for due diligence from investors.

For an in-depth guide on startup business models , click here.

Situations Where a Pitch Deck is Needed

- Meeting or Starting a Conversation with an Investor: A pitch deck is a conversation starter that encourages investors to get in touch with you. You can email a PDF file or send a printed copy to start building a relationship with investors.

- Pitching in a Competition: The startup community organizes many pitch competitions and events that provide business founders the opportunity to practice pitching their business and gain exposure. In these competitions, a pitch deck is a must-have document that effectively communicates the startup plan.

- Seeking Equity Funding: If you are seeking funding from venture capitalists, angel investors, or knowledgeable friends and family, you need a clear pitch deck.

What to Write First - Business Plan vs Pitch Deck?

At the initial phase of a business, a fundamental document called a business plan is written. This plan is updated as the business develops and as needs and goals change over time. The lengthy document can serve a variety of purposes, including internal use within the company or in banks that still require business plans for loan applications today. Additionally, the business plan document can be very useful in creating a compelling pitch deck. In the eyes of professionals, the pitch deck is considered a child of the business plan. Having a prepared business plan makes it much easier to get depth and length in your plans, which eventually results in more clarity and strong points that you could include in a pitch deck. Research is already completed when writing a business plan, which allows the pitch deck to focus on composing the already-existing information in such a manner that encourages the investor to approve the funding you need.

The Pros and Cons of a Business Plan vs. a Pitch Deck

Both business plans and pitch decks have their advantages and disadvantages. Let's take a closer look at the pros and cons of each.

Business Plan Pros

- Comprehensive: A business plan is a comprehensive document that covers all aspects of your business, from your market research to your financial projections. It may be helpful to seek assistance from a financial modelling agency when creating your financial projections.. It provides potential investors with a detailed understanding of your business and its potential for success.

- Strategic: A business plan helps you to think strategically about your business. By analyzing your industry, your competitors, and your own strengths and weaknesses, you can create a plan that maximizes your chances of success.

- Useful for fundraising: A well-written business plan can be an effective tool for raising funds from investors. It provides potential investors with the information they need to make an informed decision about whether to invest in your business.

Business Plan Cons

- Time-consuming: Writing a comprehensive business plan can be a time-consuming process. It requires a significant amount of research, analysis, and writing.

- Outdated quickly: Business plans can quickly become outdated as your business evolves and circumstances change. This means that you may need to update your business plan regularly to ensure that it remains relevant.

- May not be read: Some investors may not have the time or patience to read a lengthy business plan. This means that your hard work may go to waste if your plan is not read by the right people.

Pitch Deck Pros

- Concise: A pitch deck is a concise document that provides potential investors with a quick overview of your business. It is designed to be easy to read and understand, which makes it more likely that it will be read by potential investors.

- Engaging: A well-designed pitch deck can be an engaging and memorable way to present your business to potential investors. It can help you to stand out from the competition and make a strong impression.

- Can lead to meetings: A pitch deck is often used to secure meetings with potential investors. If your pitch deck is well-received, it can lead to a face-to-face meeting where you can provide more detailed information about your business.

Pitch Deck Cons

- Limited information: A pitch deck provides only a limited amount of information about your business. This means that potential investors may not have a complete understanding of your business and its potential.

- Not suitable for all businesses: A pitch deck is not suitable for all businesses. If your business is complex or requires a significant amount of explanation, a pitch deck may not be sufficient.

- Not as useful for fundraising: While a pitch deck can be used to secure meetings with potential investors, it may not be as effective as a business plan for actually raising funds.

Ultimately, the decision to use a business plan or a pitch deck will depend on the specific needs of your business and the goals you hope to achieve. It's important to understand the pros and cons of each and use them appropriately to effectively communicate your ideas to potential investors.

How to Create a Winning Pitch Deck

Creating a pitch deck that stands out can be a challenging task, but it's essential if you want to attract investors to your business. Here are some tips to help you create a winning pitch deck:

1. Start with a Strong Introduction

Your introduction slide should grab investors' attention and make them want to learn more about your company. Use a catchy tagline, a powerful image, or a compelling statistic to draw them in.

2. Focus on the Problem You're Solving

Your pitch deck should explain the problem you're solving and why it matters. Use real-world examples and statistics to illustrate the problem and show why it's important.

3. Explain Your Solution

After you've described the problem, explain how your product or service solves it. Be clear and concise, and focus on the benefits of your solution.

4. Show Traction

Investors want to see that your company is gaining traction and making progress. Include data on customer acquisition, revenue, and growth to show that your business is on the right track.

5. Describe Your Marketing and Sales Strategy

Your pitch deck should explain how you plan to market and sell your product or service, including specifics on your target market, your marketing channels, your sales process, and any startup market research services you may use to gain insights into your target audience and industry.

6. Highlight Your Competitive Advantage

Investors want to know what sets your business apart from the competition. Explain your competitive advantage and show how it gives you an edge in the market.

7. Be Realistic About Financial Projections

Your pitch deck should include financial projections, but they should be realistic. Don't exaggerate your projections or make unrealistic promises. Instead, focus on achievable goals and realistic timelines.

8. Keep It Simple and Visual

Your pitch deck should be simple and easy to follow. Use visuals, such as graphs, charts, and images, to convey your message and make your presentation more engaging.

9. Practice, Practice, Practice

Finally, practice your pitch deck until you're comfortable delivering it. Practice in front of friends, family, or colleagues, and ask for feedback. Refine your presentation until it's polished and persuasive.

By following these tips, you can create a winning pitch deck that will help you attract investors and grow your business. Remember to start with a strong introduction, focus on the problem you're solving, explain your solution, show traction, describe your marketing and sales strategy, highlight your competitive advantage, be realistic about financial projections, keep it simple and visual, and practice, practice, practice.

Tips for Writing a Compelling Business Plan

Writing a business plan can be a daunting task, but it's an essential step in securing funding for your business. Here are some tips to help you write a compelling business plan:

1. Know Your Audience

Before you start writing your business plan, it's essential to know your audience. Who will be reading your plan? What are their goals and objectives? What information do they need to make a decision? By understanding your audience, you can tailor your plan to their needs and increase your chances of success.

2. Keep It Concise

While a business plan is a detailed document, it's essential to keep it concise. Avoid using jargon or technical terms that your audience may not understand. Instead, use short sentences and simple language to convey your message. Use bullet points and headings to break up the text and make it easier to read.

3. Focus on Your Unique Value Proposition

Your unique value proposition is what sets your business apart from the competition. It's essential to focus on this in your business plan. Explain why your product or service is better than what's already available in the market. Show how you plan to differentiate yourself and capture market share.

4. Be Realistic

When writing your business plan, it's essential to be realistic. Don't exaggerate your projections or make unrealistic promises. Instead, focus on achievable goals and realistic timelines. Provide evidence to back up your claims and show that you've done your research.

5. Include Financial Projections

Financial projections are a crucial part of any business plan. They show how you plan to make money and when you expect to become profitable. Include projected income statements, balance sheets, and cash flow statements. Be sure to explain your assumptions and include a sensitivity analysis to show how your projections could change under different scenarios.

6. Get Feedback

Before submitting your business plan, get feedback from others. Ask friends, family, or colleagues to review your plan and provide feedback. Consider working with a business coach or mentor who can provide guidance and support.

By following these tips, you can write a compelling business plan that will help you secure funding and grow your business. Remember to tailor your plan to your audience, keep it concise, focus on your unique value proposition, be realistic, include financial projections, and get feedback.

Key Components of a Business Plan and a Pitch Deck

A business plan and pitch deck have different components that are essential to the success of your company. Here are the key components of each:

Business Plan

- Executive Summary: This section provides an overview of your entire business plan. It should be concise and highlight key points about your company, such as the problem you're solving, your target market, and your competitive advantage.

- Business Description: This section describes your company in more detail, including your mission, vision, and values. It also includes information about your team, your product or service, your target market, and your business model.

- Market Analysis: This section analyzes your industry and your competitors. It includes information about your target market, your competition, your marketing strategy, and your sales strategy.

- Operational Plan and Management: This section explains how your company will operate on a day-to-day basis. It includes information about your organizational structure, your management team, and your operational processes.

- Service or Line of Goods: This section describes your product or service in detail. It includes information about the features and benefits of your product or service, as well as any intellectual property you've developed.

- Sales and Marketing: This section explains how you plan to sell your product or service. It includes information about your sales strategy, your marketing strategy, and your pricing strategy.

- Money Request: This section explains how much money you're raising and how you plan to use it. It includes information about your funding needs, your use of funds, and your financial projections.

- Financial Estimates: This section includes your financial statements, such as your income statement, balance sheet, and cash flow statement. It also includes any other financial information that investors may need to make a decision.

- Introduction: This slide includes your company name, logo, and tagline. It's the first thing investors will see, so it should be attention-grabbing.

- Problem: This slide explains the problem your company is solving. It should be concise and clearly explain why your product or service is needed in the market.

- Target Market: This slide describes your target market. It should include information about your ideal customer, such as their demographics, psychographics, and buying behavior.

- Solution: This slide explains how your product or service solves the problem you identified earlier. It should be concise and clearly explain the benefits of your product or service.

- Traction: This slide describes any traction your company has gained so far. It should include information about your customer acquisition, revenue, and growth.

- Marketing and Sales Strategy: This slide explains how you plan to market and sell your product or service. It should include information about your marketing channels, your sales process, and your pricing strategy.

- Competition: This slide describes your competition. It should include information about your competitors' strengths and weaknesses, as well as how your product or service is different.

- Funding Request: This slide explains how much money you're raising and how you plan to use it. It should be concise and clearly explain why you need the money.

- Financial Strength: This slide includes your financial projections. It should include your revenue, expenses, and profit margins.

- Team: This slide describes your team. It should include information about your management team, your advisors, and any other key team members.

Keep in mind that these are just the basic components of a business plan and pitch deck. Depending on your industry and your company's unique needs, you may need to include additional information.

Both a pitch deck and a business plan are essential tools for entrepreneurs seeking funding for their ventures. While a business plan provides a comprehensive overview of a company's operations and financial projections, a pitch deck is a more concise and visually appealing document that seeks to excite potential investors about a company's potential. Understanding the differences and appropriate use cases for each document can greatly increase an entrepreneur's chances of securing funding and growing their business. By following the tips outlined in this article, entrepreneurs can create compelling pitch decks and business plans that effectively communicate their vision and attract potential investors.

Key Takeaways

A business plan analyzes a business opportunity and/or an existing business, while a pitch deck aims to excite investors about a company and set up a meeting for an investment discussion.

A business plan is a lengthy, text-based document, while a pitch deck is a concise document that uses visuals to convey critical information as quickly as possible.

A business plan is helpful for obtaining debt financing from conventional banks, managing a bigger board of seniors in the company, and fundraising over $500k, while a pitch deck is useful for starting a conversation with an investor, pitching in a competition, and seeking equity funding.

A business plan is comprehensive and strategic, while a pitch deck is concise and engaging.

Both business plans and pitch decks have their advantages and disadvantages, so it's essential to understand the pros and cons of each and use them appropriately to communicate your ideas effectively.

.webp)

Table Of Content

Explore Our Services

Explore our top-notch pitch deck service

We help discerning startups and growing businesses create powerful pitch decks that attract investors and secure big deals.

Subscribe to our newsletter and keep in touch with us

An error has occurred somewhere and it is not possible to submit the form. Please try again later.

Only available to newsletter subscribers!

Answers, To The Most Asked Questions

What is the difference between a business plan and a pitch deck, when should i use a business plan, when should i use a pitch deck, what are the pros and cons of a business plan, what are the pros and cons of a pitch deck, you may like.

10 Best Cyber Security Startup Ideas

Discover the most promising cybersecurity startup ideas for 2023. Drive innovation, meet market demands, and elevate digital safety. Start your journey now!

Read Article

10 Best Software Startup Ideas

Discover the hottest software startup ideas for 2023. Dive into trends, market potentials, and launch strategies to kickstart your entrepreneurial journey!

10 Pros and Cons of Venture Capital You Should Know

Explore the dynamics of venture capital. Dive into its benefits, potential pitfalls, and learn how it can shape startup trajectories. Make informed decisions with our guide.

10 Unique Clothing Business Ideas

Discover groundbreaking fashion business concepts for 2023! From sustainability to tech trends, master the art of differentiating your brand. Dive in now!

discover the menu

Get Ready For Funding

Pitch Deck Service

Pitch Training

Financial Modeling

Investor Outreach

Fundraising Consultant

We normally respond within 24 hours

View all our blog articles

AI Presentation Maker

Pitch deck vs business plan: differences and which to use

Table of Contents

Have you ever spent time deciding between creating a pitch deck vs business plan? For startups and new business owners, where every minute counts, it’s crucial to concentrate on activities that deliver the most significant impact.

This blog article demystifies the pitch deck vs business plan, whether you aim to attract investors, secure a loan, or win over partners and clients. We’ll start with pitch decks, followed by business plans, with the goal of helping you choose wisely – so you can spend less time on paperwork and more time building your business.

1. What is a pitch deck?

A pitch deck is a slideshow that concisely conveys your business idea, market opportunity, and value proposition in a presentation format. Also known as a business or investor deck, they are used to quickly present business ideas, products, or services in 10 to 20 slides.

Purpose of a pitch deck

The purpose of a pitch deck is similar to that of an elevator pitch: tell a compelling story to grab the attention of potential investors, partners, or clients.

The goal isn’t to seal a deal on the spot but to spark sufficient interest to secure follow-up meetings and negotiate potential funding.

How long should a pitch deck be?

Your pitch deck should pack a punch, not bore your investors. Aim for 10-20 impactful slides . For complex ideas or specific industries, slightly more might be okay.

The 10/20/30 rule is your friend: make a 10-slide deck that grabs attention. Investors see hundreds of pitch decks a year. Choose quality over quantity – make each slide count!

💡 Related article: How many slides do you need for a 10-minute presentation?

What should be in a pitch deck

Most successful pitch decks follow a similar flow to keep investors hooked. The tried-and-tested 10-slide pitch deck format is a great starting point but be prepared to adjust or add slides for emphasis.

These are the 10 core slides for a pitch deck based on Guy Kawasaki’s 10/20/30 rule:

- Problem slide

- Solution slide

- Market size and opportunity

- Product/service

- Business model

- Competition

- Financials and key metrics

- Ask (funding needs)

Here are additional slides you may include based on specific business and investor preferences:

- Introduction

- Go-to-market (GTM) slide

- Sales and marketing strategy

- Use of funds

- Exit strategy

💡 Learn more about the 10/20/30 rule: How to create a pitch deck (and the 10 slides you need)

Pitch deck examples

Curious how some tech unicorns have pitched their ideas in the early stages? Here are two examples that have proven successful.

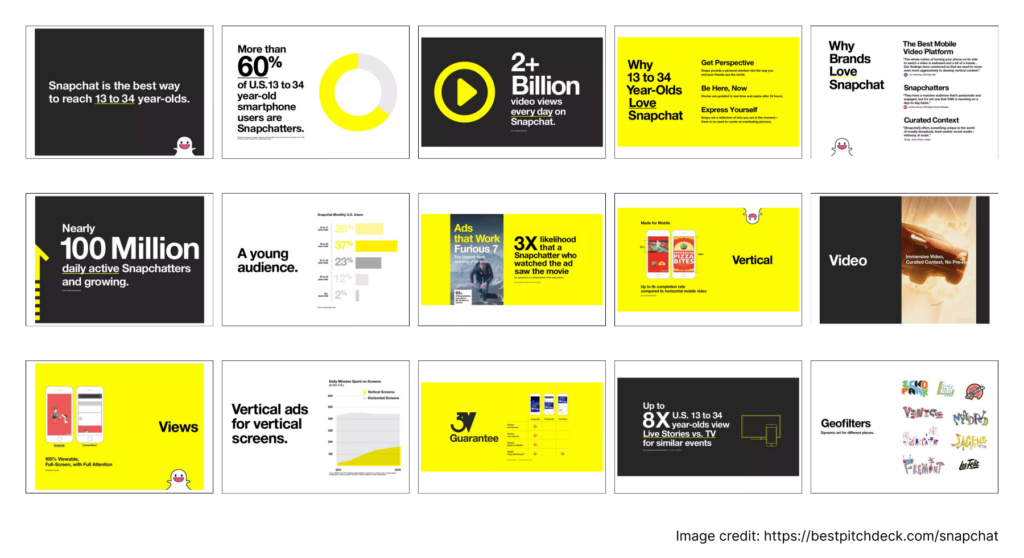

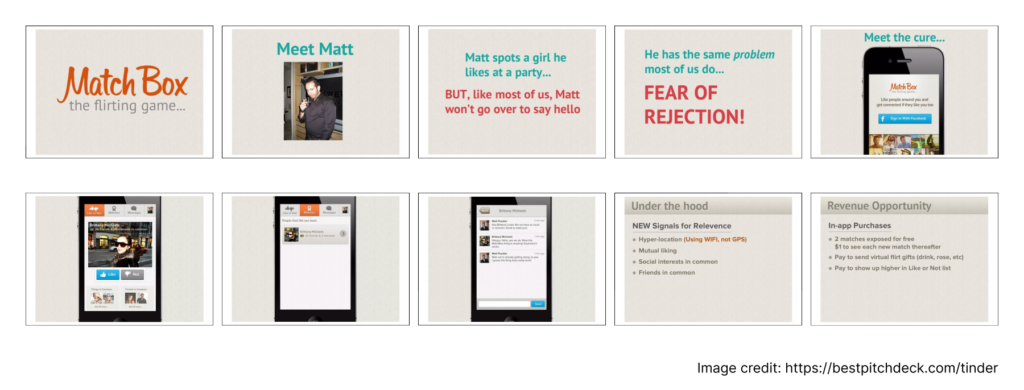

✅ Snapchat pitch deck (2013, Pre-seed)

✅ Tinder pitch deck (2016, Seed)

Examples from Best Pitch Decks

2. What is a business plan?

A business plan is a written document with detailed information that acts as a roadmap for your business. A traditional business plan is a formal document that outlines all aspects of your business, including its goals, strategies, market analysis, operational structure, and financial forecasts for the next 3 to 5 years. Most business plans are created in a Word document or report format, ranging from 10 to hundreds of pages long.

There are other types of less formal business plans used by startups or for internal alignment:

- Lean startup plan/Lean canvas: Summarizes the value proposition and business model into a single page, with a focus on the problem-solution fit.

- One-page business plan: Fits the essential information of a business into one page. Great for quickly testing an idea’s viability or getting immediate feedback.

- Internal business plan: Less formal, designed for use within an organization — for example, a feasibility business plan, operations plan, strategic, or expansion plan.

Purpose of a business plan

Business plans aren’t just for paperwork – they drive action and results. Think of your business plan as a multi-purpose tool that serves several vital functions:

- Attract investors

- Fundraising or securing loans

- Map your strategy

- Provide a strategic roadmap

- Track business progress or provide a performance benchmark

- Win over partners, talents, and potential hires

Components of a business plan

Business plans don’t have a right or wrong format; only different situations call for other formats. You can mix different plan types to prioritize components that directly support your objectives.

What to include in a traditional business plan:

- Executive summary: A concise overview of your entire business plan, highlighting the most critical points.

- Company description: What your business does, the problem it solves, your target market, and competitive advantages.

- Market analysis: Research data like market size, trends, competitors, and customer demographics.

- Organization and management: The business structure, roles, and experience of key team members.

- Products or services: Details on your offer, including features, benefits, pricing, and any intellectual property considerations.

- Sales and marketing strategy: How you plan to reach your target customers (market) and tactics to promote and drive sales.

- Financial projections: Forecasts of your income, expenses, cash flow, and profitability for the next 1 to 5 years.

- Funding request: If you are fundraising, state the amount, how it will be used, and the terms you offer investors.

- Appendix: Include any supplemental information and documents.

💡 Pro tip: Customize your plan! Add, remove, or rearrange sections to achieve your goals.

How long should a business plan be?

Think about your reader and your goal. Need a detailed plan for a bank loan? That might be 15-25 pages. Want a quick internal roadmap? A one-page Lean Canvas could work. Consider your industry, who’s reading it, and what you need the plan to do.

💡 Pro tip: Choose quality over quantity. Focus on clarity, regardless of length.

How long does it take to write a business plan?

It can take anything from 20 minutes to 20 weeks. The whole process of creating a business plan can be time-consuming (if opting for a long format), and it can also be quick (for example, the Lean Canvas).

The general advice is: Don’t overthink your first business plan. Start simple, move fast, and build as you grow. Business plans aren’t static, so be prepared to refine and expand your plan as the business evolves.

💡 Pro tip: It’s not uncommon to uncover some challenging sections while writing the plan – the key is to show awareness of these issues and ways to overcome them.

Business plan templates

Not sure where to start? Use these example plans and templates from these reputable sources to get you started:

- SBA.gov: Write your business plan – Has the traditional business plan and lean startup business plan templates

- SCORE.org – Has business plan templates for a startup , an established business , and the Business Model Canvas

- Bplans has over 550 business plan examples across multiple industries, which you can use for inspiration.

3. Pitch deck vs business plan: the differences

Now that you understand pitch decks and business plans, let’s dive into their key differences.

- Pitch decks are short and punchy, designed to grab investors’ attention and get you that crucial meeting.

- Business plans are thorough and detailed documents, perfect for in-depth analysis or large funding requests.

💡 Think of it this way: Pitch decks are the attention-grabbing movie trailers that sell the whole project. Business plans are your complete blueprint.

Both documents can serve you, but understanding their differences helps you select the best tool for attracting investment or charting your company’s path.

4. Do you need a pitch deck or a business plan?

In the past, business plans were the standard document to present a business idea to investors. However, simple business plans and pitch decks are increasingly popular, especially in startups.

Here’s how to choose the right tool for the job:

🎯 Pitches and investor meetings

Pitch decks provide a snapshot of your business or idea’s potential to spark interest and secure future investor meetings.

🎯 Early stages or for idea validation

Use a simple business plan or Lean Canvas, as the format forces you to focus on the core problem you’re solving and the solution.

🎯 Internal roadmap and planning

Formal business plans will aid in longer-term strategic planning, or they can be shorter since they are for internal use.

🎯 Complex business model

Create a thorough business plan with intricate details; short plans and pitch decks wouldn’t cut it for specific industries or complicated business models.

🎯 Fundraising, loans, or traditional financing

Banks, investors, and government-funded grant applications often require a detailed business plan. Whether you seek debt or equity funding, angel investors, VCs, and banks need compelling reasons to support your venture.

💡 Pro tip: You’ll still need a traditional business plan for detailed strategy or significant funding!

5. Conclusion

Pitch decks and business plans aren’t simply documents – they’re essential tools for driving your business forward. Now that you know the difference, consider your current needs. Ready to capture investor attention? Start crafting a compelling pitch deck. Need a detailed roadmap? Begin writing a winning business plan. Use the resources in this guide to get started and put your business on the right track toward success!

When should you write a business plan?

According to research by Harvard Business Review , between six and 12 months after deciding to start a business. For various reasons, crafting a comprehensive business plan either earlier or later doesn’t necessarily impact business success:

- Most startups pivot from their original ideas and plans.

- The time needed to create a thorough plan is better spent on other business activities (at least initially).

- Creating an elaborate plan may distract entrepreneurs from seeing opportunities in real time and responding to real customers’ needs.

Planning is valuable, and entrepreneurs who plan are more likely to start a successful business. However, you don’t need a complex business plan to begin working on your business. It’s okay to create a plan early on but remember; it’s more about being strategic with your time than trying to forecast the future from the start.

What’s the difference between a business plan and a canvas?

They differ in complexity and length. Business plans are longer and more detailed and are typically used to secure funding from investors or financial institutes.

A canvas, Lean Canvas , or business plan canvas, is a 1-page business plan. The Lean Canvas template helps you deconstruct your idea and focus on finding customer problems worth solving without a significant time investment.

It is popular as a direct replacement for traditional business plans within startups. The canvas can be used for quick and efficient brainstorming of multiple business models in a few hours or less.

How do I turn a business plan into a pitch deck?

Once you’ve done the groundwork of creating a business plan, you can reuse some of the insights, data, and information for a pitch deck.

- First, extract the core details from the business plan, such as the problem you solve, the solution, the size of the market, team strengths, and financials.

- Translate that information into your chosen pitch deck template (for example, the 10-slide pitch deck ) or use an AI presentation generator tool such as SlidesAI to structure your slides.

- Add and emphasize visuals. Replace some text with charts, diagrams, and graphs whenever applicable.

- Edit and keep the pitch deck focused and clear. Quality over quantity!

- Get feedback, practice your pitch, and then iterate on the deck until you are ready to show it to investors.

💡 Related article: 5 best free AI pitch deck generators 2024

Is a pitch deck only for investors?

No, while the primary purpose of a pitch deck is to attract funding, it can be adapted for various audiences and goals, such as partnerships, customers (especially enterprise customers), grant applications, startup or pitch competitions, or even for internal alignment within your team.

Save Time and Effortlessly Create Presentations with SlidesAI

Pitch Deck vs Business Plan — Which One Do You Need?

Uncover the differences between a pitch deck and a business plan and discover which is essential for your startup. Learn and create with PitchBob.

In this dynamic world, where ideas can spark revolutions and dreams become realities, two essential companions await your journey: the pitch deck and the business plan. These tools aren’t just documents but the wind beneath your entrepreneurial wings. Let’s set sail into the world of pitch decks and business plans, unraveling their magic and discovering when to wield their power.

Imagine standing at the helm of a ship, gazing at the uncharted waters ahead. Your startup is that ship, and at your disposal, you have instruments that can guide it through the unpredictable currents of the market. These instruments are the pitch deck and the business plan — crafted to impress and chart your course with purpose and strategy.

What is a Pitch Deck?

A pitch deck isn’t just a collection of slides; it’s the vibrant tapestry that weaves your startup’s narrative. Visuals, text, and passion converge to create a captivating story. Think of it as your startup’s cinematic trailer, offering a sneak peek into the adventure you’re embarking upon. It’s not just about presenting facts; it’s about evoking emotions and igniting curiosity.

When you’re at a startup event surrounded by potential investors and decision-makers, it is your chance to condense your startup’s essence into a visually striking, emotionally resonant package. The pitch deck shines brightest in scenarios where time is short, attention spans are fleeting, and impact is paramount.

What is a Business Plan?

Now, let’s steer our ship toward a different horizon. Imagine a comprehensive map that not only outlines your journey but also details every landmark, every challenge, and every resource needed. This map is your business plan — a strategic document that transcends mere ideas and dives deep into strategy, operations, and financial projections. It’s the blueprint that guides your ship through uncharted waters.

Where your startup has gained some traction, you’re no longer just presenting an idea. You’re showcasing a vision backed by research and planning. This is where the business plan takes center stage. The business plan becomes your guiding star when seeking substantial investments, forging partnerships, or outlining your startup’s long-term trajectory. The document demonstrates your commitment, knowledge, and foresight to potential investors and stakeholders.

Main Differences Between Business Plan and Pitch Deck

Let’s pull out our magnifying glass and explore the nuances that set these two powerhouses apart:

1. Purpose and Usage:

- Pitch Deck: The pitch deck is akin to your startup’s captivating movie trailer — a visual and concise introduction that sparks curiosity, leaving the audience eager to learn more about your venture. It’s your chance to pique interest and create a memorable initial impression that lingers.

- Business Plan: In contrast, the business plan is your startup’s comprehensive screenplay. It delves deep into the plot, character development (or market analysis), and intricate details of your venture’s journey. This document captures attention and provides a comprehensive roadmap for potential investors, partners, and your internal team.

- Pitch Deck: Like a thrilling teaser, the pitch deck is succinct, comprising a carefully curated collection of 10-15 impactful slides. Each slide is a trailer frame, revealing essential plot points of your startup’s story.

- Business Plan: In-depth, the business plan reigns supreme. It stretches across 20 to 50 pages, meticulously laying out every scene of your startup narrative. Your comprehensive manuscript covers everything from your startup’s origin story to its grand finale — the financial projections.

3. Audience Focus:

- Pitch Deck: The pitch deck is tailored to a bustling audience, including potential investors and partners. They have limited time, seeking a snapshot of your startup’s possible and unique selling points. The deck’s visuals and succinct content aim to capture their attention swiftly.

- Business Plan: Here’s where you zoom in. The business plan caters to investors, potential partners, and your internal team. It invites them to explore the finer nuances of your startup universe — the market analysis, the competitive landscape, and the intricate strategies that will propel your venture forward.

4. Creation Process:

- Pitch Deck: Crafting a pitch deck is a delicate dance of creativity and strategy. It’s about weaving compelling visuals, impactful messaging, and the right balance of information. Each slide should be visually appealing, grabbing attention and guiding the audience through the story.

- Business Plan: Assembling a business plan is akin to preparing an epic saga. It requires meticulous research, strategic planning, and attention to detail. Your business plan showcases your commitment to realizing your startup’s potential, demanding a systematic approach to ensure each detail is accurate and well-structured.

Pitch Deck vs. Business Plan — At What Stage Will You Need Them?

As you journey through the startup landscape, timing is everything. Knowing when to whip up your pitch deck and business plan is essential for a delectable startup recipe, just as a chef adds ingredients at precisely the right moments. Let’s break it down, shall we?

When Do You Need a Pitch Deck?

Imagine you’re at the starting line of a grand marathon. The gunshot goes off, and you sprint to capture attention, make connections, and spark interest in your startup. This is where the pitch deck becomes your secret weapon. In the early stages of your venture, when your idea is ripe with excitement and potential, your pitch deck steps into the limelight. Think of it as your startup’s dazzling overture — a concise yet impactful introduction that beckons investors, partners, and decision-makers to notice.

You’ll want your pitch deck ready when you’re:

- Introducing your startup idea at networking events, pitch competitions, or investor meet-ups.

- Seeking initial funding to transform your idea into a reality.

- Elevating your startup’s visibility and attracting potential collaborators.

When Do You Need a Business Plan?

Now, picture your startup as a mighty oak tree. It began as a tiny seed, and now it’s growing tall and strong, casting its shadow across the industry. But as it grows, it requires a well-thought-out plan to sustain and nurture its growth. Enter the business plan. When your startup has evolved beyond the ideation phase and is gearing up for significant growth, that’s the cue for your business plan to take center stage. It’s not just about capturing interest; it’s about showcasing your startup’s depth, potential, and strategic prowess.

It’s time to unleash your business plan when you’re:

- Seeking substantial funding from investors who want a comprehensive view of your venture’s future.

- Navigating partnerships and collaborations that require a detailed roadmap.

- Planning the subsequent phases of your startup’s growth and expansion.

How Can PitchBob Help to Create Pitch Deck and Business Plan?

Hold on to your compass because we’re introducing you to a game-changer — PitchBob! Imagine a platform where creating pitch decks and business plans is efficient and creative. PitchBob empowers you with customizable templates, user-friendly tools, and the freedom to infuse your unique voice into your documents. Whether you’re aiming for elegance or innovation, PitchBob has you covered.

In a world where startups rise like constellations, your pitch deck and business plan are the guiding stars that illuminate your path. They’re not just documents^; they’re your dynamic ensemble, your tag team. The pitch deck takes the stage, captivating hearts, and minds, while the business plan works backstage, ensuring your startup’s strategy is solid and future-proof.

As you navigate the waves of uncertainty and opportunity, remember that you’re armed with these potent tools. Whether stepping onto a stage bathed in the spotlight or sitting across the table from investors in a boardroom, your startup’s journey is powered by the fusion of innovation, strategy, and vision. May your pitch be as compelling as your plan is meticulous, and may your startup voyage be filled with discovery, triumphs, and the realization of your dreams.

Disruptive Partners OÜ Harju maakond, Tallinn, Kesklinna linnaosa, Tornimäe tn 3 / 5 / 7, 10145

PitchBob, Inc 2261 Market Street #10281 San Francisco, CA 94114

How do business plans differ from pitch decks?

If you are a new entrepreneur you might get confused with some of the business terminology and have trouble understanding what type of document an investor or other stakeholders may require from you.

Differentiating between business plans and pitch decks in particular is a well known struggle. Whilst they may feel like similar documents that can help you raise capital, a pitch deck varies significantly from a business plan in the way it is created, structured, and used.

Luckily for you, this guide covers what each of the documents are, how they differ, how they are used and what tools businesses can use to create them.

In this guide:

What is a business plan?

What is a pitch deck, business plan vs. pitch deck: what do they have in common, business plan vs. pitch deck: what are the differences, what tools can you use to write a business plan, what tools can you use to create a pitch deck.

A business plan is a document providing detailed information about your business and its objectives for the years to come (usually 3-5 years).

To keep it short and simple, a business plan consists of two parts:

- A financial forecast which provides information about the expected growth and profitability of your business, your potential funding requirements, and cash flow projections.

- A written part which provides the context and details needed to assess the relevance of the forecast: company overview, description of products and services, market analysis, strategy, operations, etc.

Formal business plans are usually written: to secure financing, to get buy-in from stakeholders (board members, investors, business partners) on the plan of action for the coming years, to convince suppliers to do business with the company, or to communicate the company's vision to staff members.

Financial savvy businesses regularly track their actual financial performance against the forecast included in their business plan and re-assess their progress against what was planned, and update their plans as needed.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

Strictly speaking, a pitch deck is just a generic term to design a document format: a pitch deck consists of slides and can refer to any type of presentation given to stakeholders.

For example, you can use pitch decks to:

- Pitch an investment opportunity to an investor: example pitch deck from Buffer

- Pitch a product to a prospective buyer: example sales pitch deck for Office 365

- Pitch an agency's capabilities: example agency pitch deck from ANL Creative

- Pitch new business ideas internally

Pitch decks are used everywhere, for the rest of this guide however, we will focus specifically on pitch decks designed to help secure new funding from investors.

Business plans and pitch deck share similarities between them, let's have a look at some of them.

Help secure funding for business

Both documents are used when trying to secure funding from investors for a business.

Typically, a pitch deck summarizes key information from the business plan and is used to pitch the highlights to investors before sending them your fully fledged business plan.

Visual elements

While a pitch deck may rely more on visuals, considering it is designed to be a presentation, both items use visual elements.

A business plan, just like a pitch deck, may contain graphs, charts, and pictures to illustrate information, especially in the market analysis section.

Financial information

Since both are intended to provide information to stakeholders regarding the business, both a pitch deck and a business plan will likely contain projected financial information.

Since a pitch deck is more of an introductory pitch, it is likely to not go into as much detail as a business plan does.

Strategy and decision-making

Because both introduce potential investors to the business, a pitch deck and a business plan discuss business strategy.

They typically reflect how a business plans to operate and generate income, showing investors why it makes for a worthwhile investment.

As a result, both are used as decision-making tools regarding investing in the business.

While they boast some similarities, pitch decks and business plans vary significantly in many ways. Some of these differences include:

Means of delivery

The way a pitch deck is presented is very different from a business plan - Being a visual presentation, it contains a series of slides with information about the business.

Pitch decks are not standalone items and are accompanied by a senior manager or partner providing commentary. The contents of the slides also typically do not go into much detail, simply highlighting key messages instead.

While the aim of the pitch deck is to draw investors to the business idea, the business plan provides more in-depth information to help them make a final decision about whether to invest or not.

Business plans carefully detail the business, its strategies, future goals and are written as formal documents that can be read and understood on their own.

Given the different modes of delivery, the format of both documents also differ. As mentioned previously, pitch decks use slides to convey information to the reader, and each slide is likely to hold limited information written in large(r) font.

Pitch decks are also likely to contain far more graphical elements such as charts, images, drawings and graphs. Business plans are often not as visually appealing but richer in substance and more formal.

The length of the two documents can vary but as a general rule, business plans tend to be longer than pitch decks.

A pitch deck will typically consist of about 10 to 15 slides (one slide usually takes 1-2 minutes to be presented), though further appendices may be added to answer specific investor questions.

A business plan usually spans between 20 and 30 pages and contains a lot more information, whilst also including appendices at the end of the document.

Amount of financial information

Both business plans and pitch decks contain financial information but the quantity and type usually differ.

Pitch decks usually have no more than one slide dedicated to financials and prefer to zoom in on key figures.

Business plans, however, include a detailed balance sheet, a profit and loss account, and a cash flow forecast.

Order of creation

In terms of presentation, a pitch deck is offered to investors first as an introduction to the business.

However, it can only be created once the business plan has already been produced, as the pitch deck summarizes the information presented in the plan.

Frequency of use

A pitch deck is typically created for one-off use. Once the financing round is complete and you’ve met with all the potential investors, you’re unlikely to need the same document again.

However, you will need to refer to your business plan down the line to ensure that the business is on track to achieve its forecasted financials and goals (and adjust as needed).

Need inspiration for your business plan?

The Business Plan Shop has dozens of business plan templates that you can use to get a clear idea of what a complete business plan looks like.

In this section, we will review three solutions for writing a professional business plan:

- Using Word and Excel

- Hiring a consultant to write your business plan

- Utilizing an online business plan software

Create your business plan using Word or Excel

Writing a business plan using Word or Excel has both pros and cons. On the one hand, using either of these two programs is cheap and easy to learn.

However, using Word means starting from scratch and formatting the document yourself once written - a process that can be quite tedious. There are also no templates or examples to guide you through each section.

Creating an accurate financial forecast with Excel is also impossible for a business owner without expertise in accounting and financial modeling. As a result, investors and lenders are unlikely to trust the accuracy of a forecast created on Excel.

Ultimately, it's up to you to decide which program is right for you and whether you have the expertise or resources needed to make Excel work.

Hire a consultant to write your business plan

Outsourcing a business plan to a consultant or accountant is another potential solution.

Consultants are used to writing business plans, and accountants are good at creating financial forecasts without errors.

This means that they will be able to create an effective business plan with accurate financial estimates without much effort.

However, accountants often lack the industry expertise to accurately forecast sales. And hiring consultants or accountants will be an expensive endeavour: budget at least £1.5k ($2.0k) for a complete business plan, more if you need to make changes after the initial version (which happens frequently after the initial meetings with investors).

For these reasons, outsourcing your business plan to a consultant or accountant should be considered carefully, weighing both the advantages and disadvantages of hiring outside help.

Ultimately, it may be the right decision for some businesses, while others may find it beneficial to write their own business plan using an online software.

Use an online business plan software for your business plan

Another alternative is to use online business plan software . There are several advantages to using specialized software:

- You are guided through the writing process by detailed instructions and examples for each part of the plan

- You can be inspired by already written business plan templates

- You can easily make your financial forecast by letting the software take care of the financial calculations for you without errors

- You get a professional document, formatted and ready to be sent to your bank

- The software will enable you to easily track your actual financial performance against your forecast and update your forecast as time goes by

If you're interested in using this type of solution, you can try our software for free by signing up here .

A pitch deck is presented as a series of slides and so applications such as Microsoft Powerpoint, Google Slides and Prezi are ideal to create the presentation.

Pitch decks are notoriously time consuming and tedious to produce: designing and correctly alligning elements in order to make the slides "look good" is a real time sink - especially for entrepreneurs who aren't expert at PowerPoint.

Therefore, the polishing of pitch decks is often outsourced to graphic designers or freelancers that specialize in creating presentations in order to save time and get a document that looks professional.

We hope that this guide helped you get a better understanding of the differences between pitch decks vs. business plans. don't hesitate to contact our team if you have any questions left unanswered.

Also on The Business Plan Shop

- Business plan steps: everything you need to know

- Business plan vs business case: what's the difference?

Know someone in need of a little guidance in making a business plan? Share this article and help them out!

Founder & CEO at The Business Plan Shop Ltd

Guillaume Le Brouster is a seasoned entrepreneur and financier.

Guillaume has been an entrepreneur for more than a decade and has first-hand experience of starting, running, and growing a successful business.

Prior to being a business owner, Guillaume worked in investment banking and private equity, where he spent most of his time creating complex financial forecasts, writing business plans, and analysing financial statements to make financing and investment decisions.

Guillaume holds a Master's Degree in Finance from ESCP Business School and a Bachelor of Science in Business & Management from Paris Dauphine University.

Create a convincing business plan

Assess the profitability of your business idea and create a persuasive business plan to pitch to investors

500,000+ entrepreneurs have already tried our solution - why not join them?

Not ready to try our on-line tool ? Learn more about our solution here

Need some inspiration for your business plan?

Subscribe to The Business Plan Shop and gain access to our business plan template library.

Need a professional business plan? Discover our solution

Write your business plan with ease!

It's easy to create a professional business plan with The Business Plan Shop

Want to find out more before you try? Learn more about our solution here

Revenue vs Earnings: Understanding Financial Metrics

CoinLoan vs BlockFi: Crypto Lending Platforms

Nexo vs Voyager: Crypto Interest Account Showdown

Trending tags.

- profile picture

- music production tool

- image editing tool

- image editing platform

- eyewear industry

- Digital avatars

Pitch Deck vs Business Plan: Understanding the Differences for Startup Success

Have you ever wondered what sets successful startups apart from the rest? While many factors contribute to their success, one crucial distinction lies in the way they present their ideas and plans to potential investors. Pitch decks and business plans are two commonly used tools in the startup world, each serving a unique purpose. In this article, we will dive deep into the world of pitch decks and business plans, understanding their differences and exploring how they can lead to startup success.

What is a Pitch Deck?

A pitch deck is a concise and visually appealing presentation that outlines the key aspects of a startup’s business plan. Unlike a traditional business plan, which is typically a detailed document, a pitch deck focuses on capturing the attention and interest of potential investors in a short amount of time. It is designed to be presented in person or virtually, usually accompanied by a verbal pitch. Picture it as a teaser trailer for your startup, where you have just a few slides to captivate your audience and make them eager to learn more.

The Power of Visual Storytelling

One of the key elements that differentiate a pitch deck from a business plan is its emphasis on visual storytelling. While a business plan relies heavily on words and numbers, a pitch deck incorporates compelling visuals to communicate the startup’s vision, market opportunity, product or service, business model, and team. By using eye-catching images, charts, and graphs, a pitch deck can effectively convey complex ideas and data in a visually appealing and easily digestible format.

What is a Business Plan?

A business plan, on the other hand, is a comprehensive document that provides an in-depth analysis of a startup’s business model, market research, financial projections, and operational strategies. It serves as a roadmap that outlines the company’s goals, target market, competitive landscape, marketing and sales strategies, and much more. A well-crafted business plan demonstrates a startup’s understanding of its industry and showcases its long-term vision and potential for growth.

The Art of Detailed Planning

Unlike a pitch deck, which focuses on capturing attention through visuals and concise messaging, a business plan delves into the nitty-gritty details. It requires thorough research and analysis, presenting a comprehensive overview of the startup’s market, competition, and financial projections. A business plan provides potential investors with a deeper understanding of the startup’s operations, strategies, and potential risks. It acts as a blueprint that guides the startup’s growth trajectory and helps align the team on a shared vision.

When to Use a Pitch Deck?

Now that we have a basic understanding of what a pitch deck and a business plan entail, let’s explore when it is most appropriate to use a pitch deck. Generally, a pitch deck is the preferred tool for initial investor engagements, such as introductory meetings, networking events, or pitching competitions. Its concise format allows for a quick overview of the startup’s key value proposition, market opportunity, and growth potential. A well-designed pitch deck can leave a lasting impression, leading to further discussions and potential investment opportunities.

The Art of Captivating Investors

When creating a pitch deck, it is essential to strike a balance between providing enough information to pique the interest of potential investors and not overwhelming them with too much detail. The key is to craft a compelling narrative that highlights the startup’s unique selling points, demonstrates market demand, and convinces investors of its growth potential. By focusing on telling a captivating story, a pitch deck can make a strong impact and generate investor excitement.

When to Use a Business Plan?

While a pitch deck is ideal for initial investor engagements, a business plan comes into play as discussions progress and potential investors express deeper interest. A business plan provides a more detailed and comprehensive understanding of the startup’s operations, strategies, and financial projections. It acts as a reference document that potential investors can review at their own pace. Additionally, a business plan is often required when seeking larger investments or securing bank loans.

The Blueprint for Long-Term Success

A business plan serves as a roadmap that guides the startup’s growth and operations. It helps align the team on the company’s goals, strategies, and milestones. A well-crafted business plan demonstrates a startup’s understanding of its industry, target market, and competitive landscape. It provides clarity on the startup’s revenue streams, cost structures, and financial projections. By developing a comprehensive business plan, startups establish a solid foundation for long-term success and growth.

Final Thoughts

In summary, both pitch decks and business plans play crucial roles in startup success. While a pitch deck acts as a visually appealing and concise tool for capturing attention and generating investor interest, a business plan dives deep into the details, outlining the startup’s operations, market strategies, and financial projections. Understanding the differences between these two tools and knowing when to use them can significantly impact a startup’s ability to attract investors and pave the way for long-term success. So, whether you’re preparing for a pitch competition or seeking funding for your startup, make sure you have a compelling pitch deck and a comprehensive business plan ready to showcase your vision and potential to the world.

References:

- Business plan on Wikipedia

- Pitch deck on Wikipedia

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Previous Post

TradeKing vs Scottrade vs E-Trade: A Comparison of Brokerages

Leveraging Chatbots for Customer Service: Enhancing Support and Efficiency

Related posts.

500+ business plans and financial models

Startup Business Plan vs. Pitch Deck: Which One Should You Prepare?

- February 17, 2022

- Fundraising