How To Make a Crypto Trading Plan

Previously, we dove into how to plan ahead and optimise your trading in 2023. In this article, we take a closer look at trading plans and the steps to go through before entering a trade.

Table of Contents

What makes a good trading plan good, step 1: analysing and identifying a setup, step 2: calculating your position size, step 3: checking all the boxes, assessing emotional state, step 4: executing the trade.

So how does that translate into a single trading plan, and how do I plan for a trade?

A great trading plan prepares you for multiple outcomes. While not exhaustive, great traders prepare themselves by following the steps below:

- Conducting their analysis (according to their trading strategy)

- Identifying a trading setup that matches that strategy (identifying SL and TP)

- Calculating the position size, checking all boxes, and even checking their own emotional state before entering the trade.

Let’s get to work!

This gives us a better look at the chart and can help us identify a trading setup that matches the trading strategy described in our 2023 trading plan.

This brings us to the following setup that matches everything we described in the example 2023 trading plan.

Naturally, it is important to perform your analysis in a way that matches what you personally wrote down in your plan for 2023, rather than the simple examples we used above. Of course, there will be moments where your analysis does not immediately present a clear trade. This is fine, trading is as much about patience as it is about analysis. Use the tools you know best and wait for these tools to present an opportunity.

That gives us the following information:

With this information, we can calculate position size as follows:

This is where you put your trading plan to the test, and check if it matches the criteria outlined in your 2023 plan. This will take time at first, but once you have burned the criteria in your head, it will only take a split second. You will just know.

This is also a good time to assess your emotional state. Ask yourself questions such as: am I able to think clearly? Are there any personal issues ongoing that can cloud my judgement? How am I feeling? Asking these questions will help you understand if you are in the right headspace to trade.

If your trading plan is still sound after the first three stages, that means you have a solid trading plan! Time to execute! Creating this plan is essential to having a consistent trading performance. Planning ahead eliminates improvisation and allows you to trade more clinically.

You can now enter the trade, knowing that you are prepared for any outcome. Let the trade run its course, whether it approaches your take profit area, or stop loss. I hope your trades play out the same way as the example trade:

Sticking to your trading plan requires discipline and patience. Don't get discouraged if you encounter setbacks – just stay focused and continue your journey to trading success.

Writer’s Disclaimer: This article is based on my limited knowledge and experience. It has been written for educational purposes. It should not be construed as advice in any shape or form. Please do your own research.

CryptoJelleNL

I'm an entrepreneur with a wide range of interests.

Related Articles

Join the thousands already learning crypto!

Join our free newsletter for daily crypto updates!

ssr content

How to Create a Cryptocurrency Trading Plan

Grab up to 5,000 usdt in rewards.

Get a 20 USDT Coupon instantly & earn more bonuses when you sign up today.

Be the first to get critical insights and analysis of the crypto world: subscribe now to our newsletter.

© 2018-2024 Bybit.com. All rights reserved.

The Complete Guide to Crypto Business Ideas

There are endless opportunities to make money in the crypto world. This in-depth guide will provide you with tips and strategies for profitable crypto business ideas.

Why Crypto Business Ideas Are So Important

Cryptocurrencies and blockchain technology have been around for more than a decade. But it still feels like we’re at the tip of the iceberg of crypto’s long-term potential. As an entrepreneur interested in starting a crypto business, you can still become a first-mover in this space.

Crypto is gaining traction worldwide. User adoption rates are increasing, businesses are more often accepting crypto as payment, and organizations are keeping crypto on their balance sheets.

What does this mean for you? There are dozens of potential crypto business ideas and plenty of ways to make money in crypto for the foreseeable future.

Whether you’re looking for a small side hustle or a full-scale crypto business, there’s no shortage of ideas to consider. As crypto adoption rates continue to rise in the coming years, you can scale your venture and turn limitless profits.

Quick Tips For Crypto Business Ideas

Making money in crypto all starts with the right idea. Below we’ll highlight some of the top crypto business ideas that you can start right now. These business ideas are poised for growth in the foreseeable future.

Day Trading With Crypto

To be clear, this is an extremely risky business idea. So don’t put your life savings on the line here, and only trade with money that you’d be comfortable losing, as with any risky investment strategy.

But the great part about becoming a crypto day trader is that anyone can do it, and you can start with very low amounts of money. It’s an excellent opportunity for people who want to make money with crypto as a side hustle.

Getting started is easy. You just need to sign up for a cryptocurrency trading platform.

If you plan on trading long-term, then you’ll likely want to open accounts with multiple exchanges. But for beginners, Coinbase is a great option to start with.

More than 56+ million users across 100+ countries rely on Coinbase for crypto trading. You can sign up in a matter of minutes by creating an account and linking your bank account—then you can start buying and selling crypto right away.

Another cool aspect of Coinbase is the information they offer about crypto and the crypto market. They have tips, tutorials, crypto basics, and other valuable insights for new cryptocurrency day traders.

Like most crypto exchanges, Coinbase charges transactional fees when you buy and trade crypto. The rates vary from transaction to transaction, so just take this into consideration when you’re executing trades.

Start a Cryptocurrency Exchange

For those of you with big aspirations, you can create your own crypto exchange business where people can buy and sell crypto through your platform. You’ll generate revenue through transactional fees for deposits, withdrawals, trades, and transfers.

There are several different types of cryptocurrency exchange platforms on the market. So you’ll need to do some research to determine which option works best for your business.

Examples include:

- Decentralized exchanges

- Centralized exchanges

- Hybrid exchanges

- Binary options exchanges

- Clone script-based crypto exchanges

- Ads-based exchanges

- Oder book exchanges

- White label crypto exchanges

Getting started with this type of venture is a bit more complex compared to other crypto ideas. You’ll need to find an exchange software provider and payment processor in addition to raising capital and going through all the other steps required to start a crypto business.

Start a Crypto Payment Gateway

As cryptocurrency adoption rates continue to rise worldwide, there’s an increasing demand for businesses to accept crypto.

Similar to credit card processing, businesses need to go through a third-party provider to accept these alternative payment methods. That’s where you can step in and fulfill this growing need.

Whenever a customer pays using crypto through an online payment gateway, the gateway is responsible for converting that payment into fiat currency (government-issued currency not backed by a commodity) to stabilize the value. From there, the gateway routes the transaction to the issuing bank before it gets approved, settled, and ultimately routed to the merchant.

This type of crypto business makes money through transactional fees, account setup fees, and subscriptions for providing merchant services to clients.

Offer Crypto Asset Management Services

If you’ve already mastered crypto trading and developed your own strategy for success, you can use your knowledge to manage crypto portfolios for other people.

This business operates like any other financial management service with traditional investing.

Clients come to your business with money they want to put into the crypto market. You’ll determine a risk tolerance for the client based on their goals and customize a portfolio based on their unique needs.

You can offer crypto financial planning services, crypto investment advice, and financial analysis services to clients. Like many other fiat financial advisors, you can also offer cryptocurrency coaching services, providing insights to people who want to learn more about crypto investments.

If you offer these services remotely online, you can get started with little to no overhead. This sets you up to turn higher profits once your business scales.

Sell Physical Things for Cryptocurrencies Online

Lots of cryptocurrency users want their assets to be more than an investment. They want to use crypto to buy everyday products and services. The problem is that the vast majority of businesses haven’t adopted crypto as a mainstream payment method.

You can target these buyers by selling goods online in exchange for crypto. It’s possible to do this with essentially any type of product.

Start an ecommerce website and use dropshipping to avoid holding inventory or handling shipping. With this business model, the products ship directly from the manufacturer or wholesale warehouse to the customer. We’ve even compiled a list of the best dropshipping companies for you to consider.

All you need is an online exchange to facilitate these transactions. Coinbase Commerce makes this process really easy for merchants.

The platform integrates with Shopify and WooCommerce as well—both of which have solutions for ecommerce dropshipping.

More than 8,000 merchants are already using Coinbase Commerce to accept crypto for physical goods and services. You can sign up and get started in less than five minutes.

There are no merchant fees to accept crypto using this platform. But you’ll be charged transaction fees to convert your crypto into fiat currency.

Offer Legal or Accounting Services to Crypto Investors

This crypto business idea is only for entrepreneurs who fall into specific categories. In short, it’s for attorneys and accountants.

As a crypto legal specialist or a CPA specializing in crypto, you can charge significantly higher rates for your services. That’s because you are filling a niche category that not every lawyer or every accountant can serve.

For example, as a crypto CPA, you can offer tax advice to crypto investors or handle bookkeeping services for crypto day traders. Crypto attorneys can help their clients navigate the waters of the ever-changing laws and regulations surrounding cryptocurrencies.

It’s safe to assume any prospective client seeking these types of services has deep pockets. So you won’t be dealing with crypto beginners with a $500 balance in their exchange accounts. Instead, you’ll be helping top investors look for ways to save tens of thousands of dollars—meaning you can charge premium prices for your expertise.

Cryptocurrency ATMs

As crypto grows in popularity, there’s an increasing demand for people who want to withdraw crypto for cash.

Many bitcoin ATMs also allow users to buy bitcoin and other cryptocurrencies using cash or debit cards though the machine. This feature works well for those of you who are also starting a crypto exchange.

The biggest difference between a bitcoin cash kiosk and a traditional ATM is that the crypto kiosks don’t connect to bank accounts. Instead, they connect users directly with a crypto exchange platform.

Crypto ATM transaction fees range anywhere from 5% to 25%. So there’s plenty of money to be made in this space.

Crypto Freelance Writing

Here’s an indirect way to make money in the crypto industry for people who don’t want to risk their money buying or selling virtual coins. You can use your research and writing skills to publish crypto-related content on the web.

There are tons of potential opportunities to make money in this space.

First, you can write for existing online publications looking for crypto news articles, crypto blogs, and more. You can also help those sites with crypto SEO, crypto marketing content, crypto email newsletters, and anything else to help drive traffic to their websites.

Alternatively, you can start your own crypto blog and generate money through ads, affiliate marketing, and more. You could also write and sell ebooks online about the crypto space.

You can make a lot of money as a crypto writer, especially if you’re comfortable writing technical copy like tutorials and whitepapers. Since many laypeople don’t fully understand cryptocurrencies, there is always a need for great writers who can break down and explain these topics to the masses.

Sell Online Crypto Courses

People are searching the web every day for crypto information. This holds true for beginners and experienced crypto investors alike.

You can answer these questions by creating a crypto website and offering online courses to visitors. Courses can be delivered as live webinars, pre-recorded training videos, or a combination of the two. You can also offer written resources, like a knowledge base.

This business idea is great for those who already have a basic foundational understanding of how crypto works. But really, anyone can start this type of crypto business by conducting research and repurposing that research into an online course.

If you’re pre-recording courses and selling them online, the potential profits are essentially limitless. You’ll only be paying for the fees associated with running a website, plus your time to create the courses.

Long-Term Strategies For Crypto Business Ideas

Beyond the initial idea, there are a few big-picture strategic factors you need to keep in mind as you’re launching a crypto business. These require a bit more time and effort to see the payoff.

Narrow Your Focus to a Specific Target Market

Trying to form a business that meets the needs of any crypto user isn’t realistic. There are high school students buying and selling crypto for $20 to $50, and there are investors with millions in the crypto market.

So do your research and decide who you want to target and why.

There’s nothing wrong with targeting crypto beginners. While these users might not be investing or trading as much, there will be a ton of prospects in the coming years as crypto adoption rates rise worldwide.

Alternatively, you can focus on a specific niche within the larger crypto market. Look back to the example of BearTax that we discussed earlier. That business specifically targets crypto traders who need help with tax documents.

Your target market might change over time. So this is something that you’ll need to keep an eye on as crypto trends evolve in the future.

Be Prepared and Set Realistic Expectations

Every business has risks. But crypto businesses can be significantly riskier than others.

This is especially true if your business is directly involved in the exchange of crypto in any way, shape, or form.

You need to prepare yourself for considerable swings in the market and set limits for yourself. What will you do if there’s a 50% plunge in the coin you’re holding? How will you handle crypto bear markets?

Just look at Bitcoin—it was trading for nearly $20,000 in December 2017 before dipping to less than $4,000 just one year later in December 2018. Bitcoin was worth over $60,000 in the spring of 2021 before dropping close to $30,000 just months later.

Have contingency plans in place and limit your risk just as you would with traditional investing.

If you’re expecting to launch a crypto business today and retire on the profits next month, this business probably isn’t for you. Plan for the long-term, and prepare yourself for big swings on the path to success.

Once you’ve settled on a crypto business idea that you want to pursue, you’ll need to consult with an attorney before you get started. A lawyer will help you assess the risk associated with your venture and ensure you set things up in a way to limit your liability.

Check out our guide on the best online legal services for assistance here. Many of these platforms also offer business formation services, so you can use them to officially launch your crypto business.

Launching a website for your crypto business needs to be high on your to-do list as well. Our in-depth reviews on the best website builders will steer you in the right direction.

Make your website better. Instantly.

Keep reading about operations.

How to Set Up a Virtual Phone System in 15 Minutes or Less

Setting up a virtual phone system is easy—it takes just three steps and less than 15 minutes. You don’t need to waste time comparing providers…

NimbleWork Review

Finding a management system that integrates smoothly with your company’s workflow can be a daunting task. With so many options available, how do you know…

ONLYOFFICE Review

Working on the cloud has many advantages, but you may prefer having all your software housed under your own servers. That way, you have total…

Oyster Review

Hiring top talent is hard enough on its own. Doing it across borders can seem downright impossible. Navigating complex legal requirements, tax regulations, and labor…

Best Virtual Mailboxes Compared

Among the six virtual mailbox brands we reviewed, iPostal1 and Anytime Mailbox are our favorite virtual mailbox companies. Although we like iPostal1 or AnyTimeMailbox for…

Best PEO Companies

PEO services take a lot of the burden of HR, employee and benefits administration, and more off of your organization’s plate. We looked into many…

Funding Circle Review

Funding Circle is a lending platform that aims to help small businesses secure the finances they need. The service offers several perks that attract entrepreneurs,…

Replicon Review

Whether you’re a new business with a small workforce or a large enterprise with thousands of employees, there’s one common, underlying necessity for teams of…

Best Business Checking Accounts

Over the years, we’ve started dozens of businesses spanning numerous industries and business models. While each is unique, there’s one common thread among them all—they…

Looka Review

Making a good first impression on customers is crucial, so your company’s branding needs to be spot-on. Looka helps you do this by harnessing the…

Best Online Business Banking Compared

It’s no secret that people have no time to visit the bank. With online banking, you get the same services and convenience as a traditional…

Best Email Hosting Providers Compared

Just like a website, emails need hosting too. Most hosting plans come with email hosting baked in, but that’s not always the case. Furthermore, where…

Xoxoday Review

Happy employees equal happy customers, and happy customers equal business success. To help you cultivate happy employees, Xoxoday offers a trio of innovative employee engagement…

KnowledgeOwl Review

What if you had a digital library of helpful content that was easily accessible from anywhere, at any time? KnowledgeOwl offers this, functioning like a…

Traqq Review

Tracking your team’s work hours and monitoring their activities takes a lot of time. Filling out spreadsheets and calculating payroll manually is even more difficult…

Over 300,000 websites use Crazy Egg to improve what's working, fix what isn't and test new ideas.

How to Create a Cryptocurrency Trading Plan

Getting into crypto trading? Don't start crypto trading without a proper plan!

Successful cryptocurrency traders usually follow a set of routines in carrying out their trades. These routines are according to their structured plans that have been fine-tuned until reliable. You need such structures to get consistent results in crypto trading, which is why you need a crypto trading plan.

What Is a Crypto Trading Plan?

A trading plan is a written structure that serves as a roadmap for your trades. It helps you identify and execute trade opportunities. The plan accounts for different conditions like how to look for trade opportunities, what variables to consider before buying or selling a crypto token, what cryptos are to be traded, how much risk you are willing to take per trade, and how to manage your positions.

With a trading plan, you can manage trading risks better and get more consistent results.

3 Reasons You Should Have a Trading Plan

There are many reasons to have a crypto trading plan, not least the extra support it gives you.

1. Trading Becomes Simpler

Having a written plan makes it easy for you to trade. A detailed plan includes your trade entry conditions, the risks you desire to take per position, your risk-to-rewards ratio, the trades to avoid, and many more. Having all these in place also helps you reduce stress and make more rational decisions.

2. Performance Gauging

Since your trading plan includes different technical tools and strategies and fundamental metrics that you intend to include in your trading decisions, it can assist you in gauging which strategies work best and in what conditions.

Following your plan and documenting it in your trading journal will also help you evaluate your trading decisions and refine them to improve.

3. Trading Discipline and Precision

Following a trading plan makes you more focused and helps you execute trades with better precision. In addition, following your rules will save you from making impulsive trades and gambles.

Since you have conditions for entering and exiting trades, you will also take less emotion-driven trades.

How to Create Your Trading Plan

Below are some of the activities you need to carry out in creating your trading plan

Define Your Trading Goals and Approach

Your trading goal must be specific, measurable, and realistic. For example, the goal could be to increase the value of your portfolio by 6% in the next six months. Having such in mind will help you define your approach to trading.

You can use your trading goals to determine conditions like how much time you are willing to commit to trading, if you can combine trading with regular work activities, how to keep yourself constantly updated on market happenings, and more.

Define Your Trading Strategy

A proper trading plan should include your trading strategy. For example, you should determine if you want to trade as a scalper, day trader, swing trader, or long-term investor. Defining your strategy should also include the tools and technical indicators you intend to use and the factors and variables to consider when using them.

Some trading strategies require more trading time than others. Therefore, your daily activities and lifestyle should be considered when considering your strategy.

Document Your Risk Management Approach

You should define how much of your capital you wish to risk. It is wise to define your risk limit and follow it strictly. As much as we cannot give a definite risk management rule, we do not advise that you risk more than 5% of your capital on a single trade, especially when trading crypto futures .

Your risk management approach should also include a risk-to-reward ratio. Before entering any trade, you should define your profit target. Traders typically use a profit target of 1:1.5 to 1:5, and some even target more. Suppose you risk $25 on a trade and expect to get $75 as profit at the end of the trade. In that case, the potential risk-to-reward ratio is 1:3. Your profit target should be based on your trading strategy and market conditions and not necessarily your desire.

Define the Markets or Conditions You Want to Trade in

You can't trade all the crypto markets. Apart from it being impossible, each one behaves differently from another. So, trying to get involved in many markets at the same time could leave you confused.

You can specify the market you want to trade by choosing specific cryptocurrencies you want to concentrate on or having a market setup you want to trade consistently. Whichever one it is, keep in mind that the secret to having a successful trading plan is to follow the routines consistently.

Document Your Trades

Have a trading journal where you document all your trades, the motivation behind them, the strategies you used, and the results. If you execute a trade outside your trading plan, you should also note why you did that and the result. Proper documentation will always help you make your crypto trading plan better.

Don't Trade Crypto Without a Plan

There is no strict pattern to creating your trading plan. However, you should only create one based on your trading goals—you cannot copy someone else's! Your trading plan could be a lengthy and detailed note that has a step-by-step approach to trading. It could also be a little note that covers the cryptocurrencies you want to invest in, the conditions for investing in them, and how much you are willing to invest. Whichever one you go for depends on your needs; only make sure you don't trade without a plan.

A trading plan is a work in progress. As much as we do not encourage altering your plan regularly, we also understand that adjustments would be needed from time to time. The crypto market is dynamic, and you must adjust your plans based on market conditions. Likewise, a change in your financial goals may also necessitate a change of plan.

The information on this website does not constitute financial advice, investment advice, or trading advice, and should not be considered as such. MakeUseOf does not advise on any trading or investing matters and does not advise that any cryptocurrency should be bought or sold, ever. Always conduct your own due diligence and consult a licensed financial adviser for investment advice.

Crypto Business Plan Sample

With lower fees and more efficient transactions, cryptocurrencies are leading the way towards a global shift to a decentralized and open digital economy. With widespread adoption by institutions worldwide, now is the best time for you to enter the crypto space. Our crypto business plan writers at Black Sheep Business Consulting will help you write a winning business plan. This will be useful when you pitch your company and your services to crypto investors and partners. A crypto business plan sample has been included below:

1.0 Executive Summary

“Coinerica Limited” (herein also referred to as “Coinerica” or “the company”) was incorporated in the State of Illinois on April 5, 2019 by Founder and Chief Executive Officer, Mr. Paulson. Coinerica is a crypto currency exchange and trading platform currently applying for a bank account with Brakewell Securities.

2.0 Business Overview

Currently, Chaseville Moving is a one truck company that is primarily operated by Owner, Pat Steele. Mr. Steele utilizes contractors on a case by case basis depending on the demand of the job. The business operates in the area, and is involved in the moving industry.

A Brief History

In recent years, the crypto currency exchange market has grown thanks to strong consumer interest in the digital asset space, decentralized digital currencies, and blockchain technology. The most well known, and largest, crypto currency, Bitcoin was conceived in 2008 and the overall market is projected to gain value over the next five years. While it will be at a slower pace than in recent years, the technology continues to mature and become more established in the market aiding growth.

Looking Ahead

Today, the crypto market remains alive and well in spite of recent macroeconomic events. The underlying technology has emerged from the 2008 financial crisis to provide an alternative means to centralized currencies, as well as for investors seeking to put their capital into the digital asset space. The market is projected to grow at a 7% compound annual growth rate (CAGR) to 2027, while the total crypto market capitalization easily exceeds $1 trillion. As new coins emerge and investors flock to this financial market, Coinerica is positioned to cater to the B2C segment’s wallet and trading needs.

Introducing Coinerica

The company aims to disrupt the exchange market with an innovative wallet services and trading platform. The management team brings years of experience in technology, blockchain, and product development to create a unique offering for the B2C crypto currency exchange segment. Coinerica is currently pre-revenue, but seeking to obtain account approval through Brakewell Securities in order to launch the platform.

The deep subject matter expertise and experience of the team in building scalable products for enterprise-level clients provides a tangible differentiator to competing platforms. This ensures the product is secure and brings a level of sophistication to the B2C market, which is commonly lacking from other players. Additionally, due to this experience, security is top of mind, which is a primary reason many exchanges fail. Fraud, theft, or cyberattacks can crush a business, particularly one reliant on financial transactions. Coinerica has the know-how, capacity, and capabilities to ensure risks are mitigated for each customer. Keeping data secure and ensuring a seamless customer experience are at the forefront of all operations.

Thanks to a heightened standard of competency and experience in the blockchain and platform development space, Coinerica aims to break even within three months for crypto-fiat. With approval for a business bank account, the company seeks to create value internally, for platform users and Brakewell Securities.

Coinerica is a Canadian Financial Transactions and Reports Analysis Centre of Canada (FINTRAC)-registered crypto currency exchange that launched in March 2022. The exchange offers over 170+ crypto currencies on its platform in addition to wallet services for users. The goal of Coinerica is to enable tens of thousands of people to buy and sell digital currencies without worrying about security concerns or hefty withdrawal fees.

Solving Common Crypto Problems

The company is fulfilling this objective by allowing its customers to trade several types of digital currencies safely and quickly. Coinerica aims to increase the freedom for users on the platform to trade crypto currency while maintaining strict security protocols. Customer’s data is secured and an accessible means is provided to trade easily for new, intermediate, and advanced crypto currency enthusiasts. The company intends to reduce common frustrations with exchanges by incorporating enhanced security, high performing systems, transparency, traceability, fast deposits and withdrawals, competitive trading fees, a wide arrange of asset collections, and 24/7 customer support.

2.1 Mission Statement

Our mission is to increase the freedom associated with trading crypto currency and provide users with unparalleled security. With our trusted, and user-friendly platform, we will enable tens of thousands of people to trade cryptocurrencies safely; therefore, making the crypto-economy more accessible.

2.2 Vision Statement

Our vision is a global marketplace that leads the blockchain revolution; providing an advanced platform to trade a wide variety of crypto currencies in the most trusted and secure manner possible.

2.3 Core Values

Coinerica’s core values encompass a range of ethics that sit at the heart of our business.

Transparency: Live order books are available for reviewing the current market. Additionally every transaction detail is recorded in our system. They are traceable and available without a set date limit. Users also have the ability to generate statements from transaction history for any reporting purpose.

Trust: Coinerica is a FINTRAC-registered Money Services Business (MSB) in Canada.

Security: Employ highly sophisticated methods to encrypt users’ personal data as greater than 95% of the assets are stored safely offline.

Let's Get Started!

- Your Name *

- Email Address *

- Phone Number

3.0 Market Analysis

Coinerica performed a market analysis to gain an in-depth understanding of the crypto currency exchange market. Additionally, the assessment included other factors impacting the ability to successfully conduct business, and develop accurate financial projections.

Global Cryptocurrency Exchange Platform – Market Analysis

The global cryptocurrency exchange platform market is expected to witness significant growth over the coming decade. The market growth can be attributed to the high demand for the platform to facilitate the trading of cryptocurrencies for fiat money. Cryptocurrency exchange platforms act as intermediaries between the buyer and seller and earn money through transaction fees and commissions. According to statistics provided by CoinMarketCap, a publishing company, cryptocurrency exchanges have reached 419 globally in October 2021 with a total 24-hour trading volume of USD 112 billion.

Various fintech companies are partnering with cryptocurrency companies to improve their offerings and customer experience. For instance, in July 2021, Visa announced its partnership with 50 crypto companies, including Coinerica and FTX. Through this partnership, Visa allows its clients to spend and convert digital currencies through its card program. Additionally, in August 2021, PNC Bank announced its partnership with Coinerica, a cryptocurrency platform provider. Through this partnership, the bank offers crypto solutions to its clients.

Moreover, the increasing penetration of smartphones across the world is also one of the major factors creating opportunities for market growth. This is because smartphones enable customers to leverage the capabilities of cryptocurrency exchange platforms. Many platform providers are focused on offering their services through mobile phones to efficiently meet the needs of their customers. For instance, in June 2021, Kraken, a cryptocurrency exchange platform provider, announced the launch of its cryptocurrency exchange mobile application in the U.S. This application enables Kraken’s customers to buy and sell crypto tokens through mobile phones.

The market growth is highly influenced by the increasing number of crypto users worldwide. According to statistics provided by Crypto.com, a cryptocurrency exchange platform provider, the number of global crypto users reached 106 million in January 2021. This can be attributed to the rising adoption of DeFi, growing number of crypto service providers, and rapid adoption of cryptocurrencies by financial institutions. Furthermore, in March 2021, Morgan Stanley started offering its wealth management clients access to bitcoin funds. This helped the company to strengthen its offerings and enhance its customer experience.

Significant funds raised by venture capital firms in Cryptocurrency Exchange Platform companies offer lucrative opportunities for market growth. CoinSwitch Kuber, a cryptocurrency exchange platform provider, raised more than USD 260 million in funds. The funding was raised by investors such as Andreessen Horowitz and Coinerica Ventures, which the company uses to increase its revenue and strengthen its offerings.

Key players in the market include BlockFi, Coinmama, eToro, Coinerica, Binance, Kraken, Bitstamp, Coincheck, FTX, and AirSwap. These companies focus on strategies such as partnerships and product developments to expand their offerings. In September 2021, Crypto.com announced its partnership with Fnatic, an esports organization. Through this partnership, the former company aims to expand its portfolio of partners in addition to adding cryptocurrency payment options to Fnatic fans.

3.1 Government Regulations

The Government of Canada’s agency responsible for crypto currency transactions is the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). It is a financial intelligence unit charged with a mandate to facilitate the detection, prevention and deterrence of money laundering and the financing of terrorist activities, while ensuring the protection of personal information under its control.

Compliance is an Evolving Landscape

Additionally, banks in Canada are overseen by multiple layers of regulation; it is therefore vital for Coinerica to stay on top of emerging trends as the regulatory environment stays fluid. While the major crypto currency regulator is FINTRAC, it coordinates with other Canadian government agencies as needed. The regulatory landscape for crypto currency is nascent as digital coins have only emerged in a little over a decade. Compliance officers at other financial institutions are frequently informed of the new laws that may affect their industry. Coinerica is also considered a Money Services Business (MSB) under Canadian law. This means it must abide by certain Anti-Money Laundering (AML) and Know-Your-Customer (KYC) regulations. This is further detailed in the specific obligations and regulations required by the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA).

Canada’s Advantage in the Market

According to Julie Mansi, a partner at Borden Ladner Garvais who has experience in securities regulation, the Canadian crypto currency market has “a robust regulatory review that looks at facets that I don’t think are looked at globally, whether it’s counterparty risk, custodians, internal control, [or] cybersecurity.” [1] Officials in other jurisdictions are still deciding the right structure whereas Canada has reviewed risks with platforms, offerings, and created a robust path to registration. In March 2021, the Ontario Securities Commission, the largest of Canada’s provincial securities regulators, notified crypto trading platforms they needed to register with the Investment Industry Regulatory Organization of Canada (IIROC). Other provinces soon followed. The robustness of Canada’s regulation of the crypto currency market has made it inherently attractive to dealers, portfolio managers, and fund managers active in this asset class.

FINTRAC’s Terrorist Financing (TF) and Money Laundering (MF) for Crypto

In response to growing demand for crypto currency, FINTRAC released a list of indicators for TF and MF in crypto transactions. Coinerica aims to follow this guidance for ensuring transactions are compliant.

3.2 Market Trends

Every day new digital coins are launched and offered worldwide. Additionally, by 2026 the crypto currency market is expected to reach $2.2 billion. In 2021, the market sat at $1.6 billion for a CAGR of 7.1%. [1] Greater awareness and knowledge of digital currencies will allow for more players in the market. Furthermore, the total crypto currency market capitalization is currently at over $1 trillion while Bitcoin and Etherum are the largest digital tokens, respectively.

Growing as a Currency

Crypto currencies continue to grow as a means of payment and could replace domestic currencies unofficially. Web3.0 and crypto currency appear to be gaining traction globally as more people have access to the Internet in emerging markets. The underlying technology of bitcoin, ethereum, and other digital currencies is blockchain. In this context, it is a decentralized ledger of transactions over a peer-to-peer network facilitating trades. Individuals participating in transactions can provide confirmation without the need for a central authority. The shared ledger is built on top of cryptographic keys which ensures that it remains permanent, transparent, and unalterable.

3.3 Key Competitors

4.0 products and services.

This section details the product and service offerings of Coinerica. The company aims to leverage fees per transaction unit as the primary means of collecting revenue. Additionally, as the company grows, it will increase its product offerings to the B2B SaaS segment with node as a service, explorer as a service, wallet as a service, and exchange as a service.

4.1 Pricing Model

Coinerica’s pricing strategy is based on industry standards which charge per transaction. The company will charge $.005 per trade value. Beginning in year 2, there will be additional product offerings for B2B software as a service (SaaS). This includes Node as a Service ($15 per unit), Explorer as a Service ($50 per unit), and Wallet as a Service ($100 per unit). For year 3, Exchange as a Service will be added at $2,000 per unit.

4.2 Competitive Advantages

Coinerica aims to be the crypto currency exchange of choice for the B2C Canadian market. The company offers a fast, reliable exchange that targets a specific customer segment. Additionally, the user experience is simple and intuitive aimed at emerging crypto currency investors. Whether beginner or experienced, the Coinerica platform is reliable and intuitive enough for any investor. The company has four key competitive advantages:

- Security: Security and compliance are top of mind for Coinerica and the company invests heavily into talent, process, and systems that ensure the platform is protected at all times from theft, cyber attack, or fraud.

- Asset Diversity: With over 170+ crypto currencies available to this B2C Canadian market segment the company seeks to become specialized meanwhile exploring avenues for scalability and growth.

- Management Team Experience: Coinerica brings a level of experience unmatched in the market thanks to the management team’s past background in technology, product development, and blockchain.

4.3 Goals and Objectives

Coinerica has several stated top company goals including:

- Always stay updated with regulatory compliance changes

- Fastest, unlimited scalability and the most advanced trading platform

- Increase the customer base

- Increase market share

- Increase trading volume

- Increase the variety of crypto currencies that can be offered

- Bring new and advanced features to the platform

- Best in class customer service

- Cover wider jurisdictions

- Increase community outreach

4.4 Key Success Factors

Key Success Factors (KSFs) are a function of a company’s top goals and objectives. Coinerica aims to accomplish its goals and objectives by establishing performance baselines while tracking against them. The two primary goals of the company are:

- Increase the Platform User Base

The company has established its domain and is on its way to developing its user base. The account with Luminous Financial will provide the necessary next steps in order to fulfill this objective. Additionally, once the user base grows then further hires can be made to continue to create a safe and powerful platform for customers. Within the first year the company expects to grow its user base and revenues to $928K. By year five, the company conservatively projects a minimum of $9.7M in gross revenues per annum.

- Support a Secure and Powerful Trading Platform

Security and reliability are the cornerstones of the Coinerica platform. The platform must be operable 24/7 with customer support staff available to answer any questions or issues that may arise. As previously mentioned, there are several federal and provincial agencies in Canada that are involved with the regulation of crypto currency. Therefore, to ensure that Coinerica meets its own operational standards as well as those of the Canadian government, the company intends to invest heavily in security and compliance.

KSFs bring clarity to the overall vision, mission, and goals for a company. Coinerica aims to be strategic with its goals adjusting them at least annually to ensure the company is on top of changing macro and micro trends.

5.0 Sales and Marketing Plan

A concerted sales and marketing initiative is essential to the success of Coinerica. The company plans to invest heavily in areas such as social media, SEO, and Google Ads meanwhile projecting adding positions for marketing professionals as well as strategists in the future.

5.1 Target Customer

B2C Clients within allowable jurisdictions

- Above the legal age of 18 years old

- Employed professionals

- Knowledge of the fintech space

- Knowledge of crypto currencies

- Currently on at least 1 exchange

- Clean background check

- No political or risk exposure

5.2 Key Channels

Digital channels will be the most effective way to reach customers for Coinerica. The company plans to invest heavily in SEO and other digital marketing campaigns to ensure we reach the target audience. Most sales will come from inbound marketing and ads as the target customer is a B2C user base. Therefore, there will be limited outbound selling.

Common Crypto Currencies

As part of its marketing, Coinerica will highlight the fact it offers over 170+ crypto currencies. As a reference, here are some of the top coins that users can buy on the platform:

5.3 Key Performance Indicators

Coinerica aims to track several Key Performance Indicators (KPIs) in order to grow its business. First, its gross revenue target is $928K by the end of FY23 and to support this growth the company will hire at least 12 employees. Additionally, there will be a concerted effort to ensure the marketing budget and campaigns will reach the ideal client profile (ICP).

An Inbound Approach

Coinerica will set pipeline and sufficiency targets to ensure that the bookings per quarter are within a tolerable range. Nonetheless, without a traditional sales force the company will rely on marketing KPIs such as organic reach, email outreach, and social media engagement to determine the pulse of the market. Also, with customer service being key, the Net Promoter Score (NPS) should be above an industry standard of 75. These KPIs are the essential components for tracking success and will enable Coinerica to achieve its growth targets.

5.4 SWOT Analysis

Coinerica performed a Strengths, Weaknesses, Opportunities, and Threats (SWOT) analysis to assist with the strategic planning process for developing its crypto currency exchange business.

Have Questions? Looking To Get Started?

6.0 operational plan.

Without sound operations, no strategy cannot be implemented. Therefore a robust operational plan was created to incorporate the tactical coordination needed in order to accomplish the company’s goals. The main strategic advantage of Coinerica is in security, the 24/7 platform, and focus in the Canadian B2C crypto currency market. Also, the company aims to establish processes, technology, and people to make this a reality.

6.1 Operational Process

Operational processes are vital for the organization to ensure complex security and technology protocols are effective. These may include standard operating procedures, policies, and robust processes.

Industry Standards

The company leverages and maximizes industry standards in order to stay compliant, as well as competitive with security regulations. Additionally, Coinerica ensures efficiencies through standard operating procedures in all aspects of the company from sales, marketing, product, customer service, and other areas. Although this is a new company, as the company grows it will create and implement further rigor to match.

6.2 Health & Safety

The business is not engaged in the manufacturing sector, or tangible goods, therefore it does not necessarily have the same safety requirements as other companies.

Customer Safety a Priority

Nonetheless, it does abide by the rules and regulations as set forth by the federal and provincial governments. The primary safety concern to the company is its infrastructure and vulnerability to any kind of theft, cyberattack, or other sort of fraud. It has planned for a robust security team that secures its platform and the architecture is scalable as well.

6.3 Equipment & Inventory

The company has minimal equipment and inventory costs as it is an online platform.

Low Inventory Advantage

Much of its IT infrastructure is managed on the cloud by Microsoft Azure, so there will be fewer costs associated with maintaining its own on-premise environment. As the company grows, Coinerica may consider office space for its employees but the majority of the work will be conducted remotely. This aids the business as it reinvests the majority of profits back into projects that help the platform become faster, more secure, and easier to use.

6.4 Risk Analysis

For any crypto currency exchange, risk of compliance and security are paramount. Coinerica aims to develop robust policies, procedures, standard operating procedures, and processes to create a culture of compliance.

- Security Risk: The first is security as exchanges are prone to theft, cyber attack, and fraud. This creates compliance and legal risk as well for users. The company seeks to mitigate this risk with its strong background in security, product development, and enterprise software. Additionally, further hires are planned to bolster security as the platform matures.

- Macroeconomic Risk: Additionally, Coinerica faces risks in the general macroeconomic environment. Crypto currency is still relatively new having only been around for a little over the past decade. Price volatility has played a major role in the last year as confidence in the crypto currency markets has been debated. Some argue that it is an asset, while others maintain it is a form of payment. Sitting between both, it has experienced volatility greater than that of more stable currencies.

Risk Mitigation Planning

Nonetheless, with any new financial asset there is bound to be risk. This is especially true in crypto currencies where confidence in the platform is essential. Many exchanges have failed by not putting in the proper protocols or procedures. Therefore, Coinerica aims to offer an array of product offerings to customers to ensure that they can make an informed decision on trading. All securities have some level of risk and there is no possibility to completely eliminate it.

Quadriga: A Cautionary Tale

The company also plans to learn from other failed crypto currency exchanges such as Quadriga. In this case, the founder of the company, Gerald Cotten, suddenly died in 2019 leaving C$180M in the lurch from investors. Quadriga even mentioned customer feedback that Canada was seen as a safe place to store and trade their assets. [1] Nonetheless, this tale, and countless others, illustrates the need for reliable safe trading platforms for crypto currencies.

7.0 Management Team

One of Coinerica’s major advantages is its management team with years of experience in enterprise software, technology, and blockchain areas. Many crypto exchanges lack the experience and expertise to run a sophisticated organization, which can handle immense trading volumes.

Mr. Paulson

Founder, CEO, CCO

Mr. Paulson is an expert in the technology, blockchain, and product development fields. He has over 18 years of experience working in technical and cross-functional environments, meanwhile maximizing his understanding of product design and development to create the Coinerica platform. His background includes a variety of technology competencies such as .NET, C#, Web APIs, Azure Compute & Architecture, Angular, MongoDB, SQL Server, and Business Central. This wealth of experience helps guide the Coinerica management team toward success to the vision of becoming a $1B crypto currency exchange. The technical competencies aid in providing leadership and oversight of the platform upgrades ensuring it stays a market leader for the B2C crypto currency investor segment. Mr. Paulson’s technology background and business acumen merge to create a vision backed by deep subject matter expertise. Coinerica is the emergence of a prior interest in crypto currency combined with the technology skills developed while working on Microsoft products.

7.1 Key Personnel

Mr. Paulson is supported by a roster of ten active team members, who all withhold specific expertise and specializations in their given roles.

8.0 Financial Plan

8.1 Capital Requirements

8.2 Income Statements

8.3 Cash Flow Statements

8.4 Balance Sheet

How can we help you?

Get in touch with us or visit our office

We earn commissions if you shop through the links below. Read more

Cryptocurrency Business

Back to All Business Ideas

How to Start a Cryptocurrency Business

Written by: Natalie Fell

Natalie is a business writer with experience in operations, HR, and training & development within the software, healthcare, and financial services sectors.

Edited by: David Lepeska

David has been writing and learning about business, finance and globalization for a quarter-century, starting with a small New York consulting firm in the 1990s.

Published on June 14, 2022 Updated on March 13, 2024

Investment range

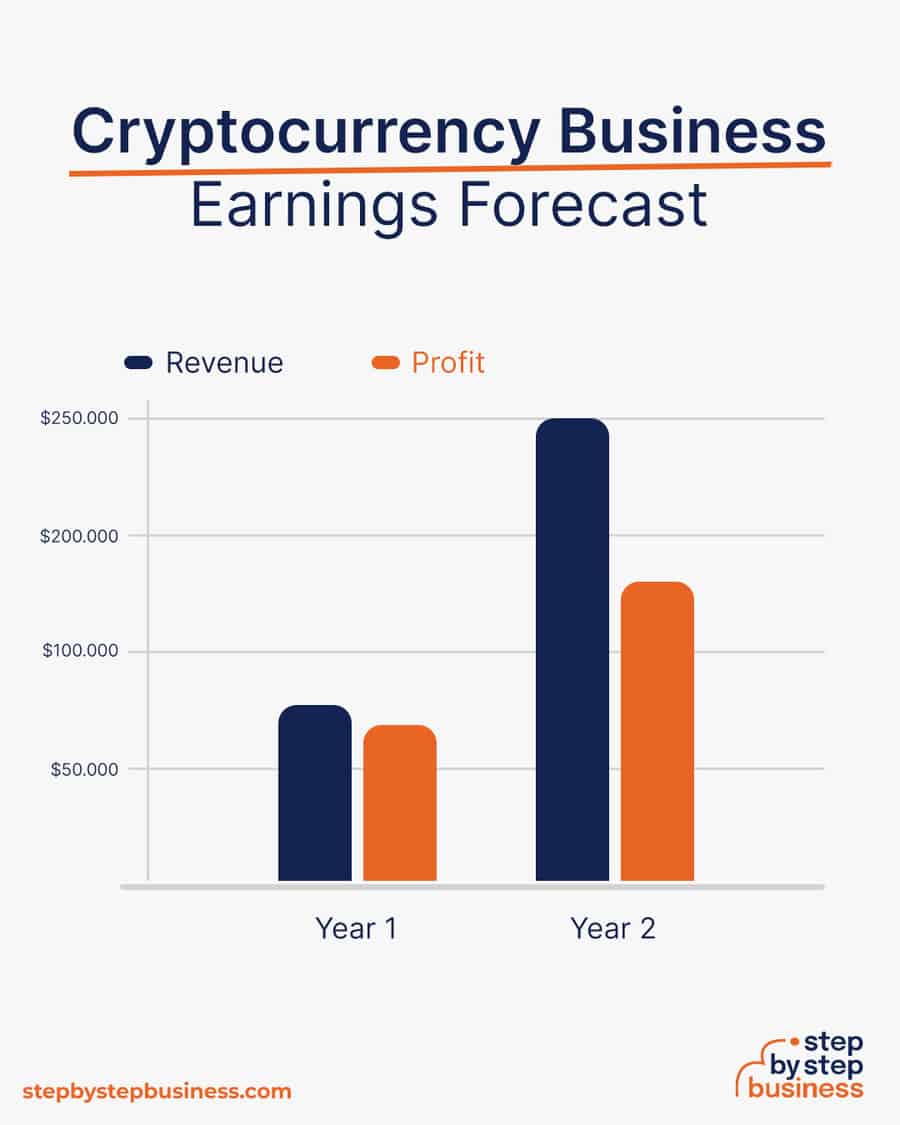

$8,000 - $20,200

Revenue potential

$75,000 - $250,000 p.a.

Time to build

0 - 3 months

Profit potential

$68,000 - $163,000 p.a.

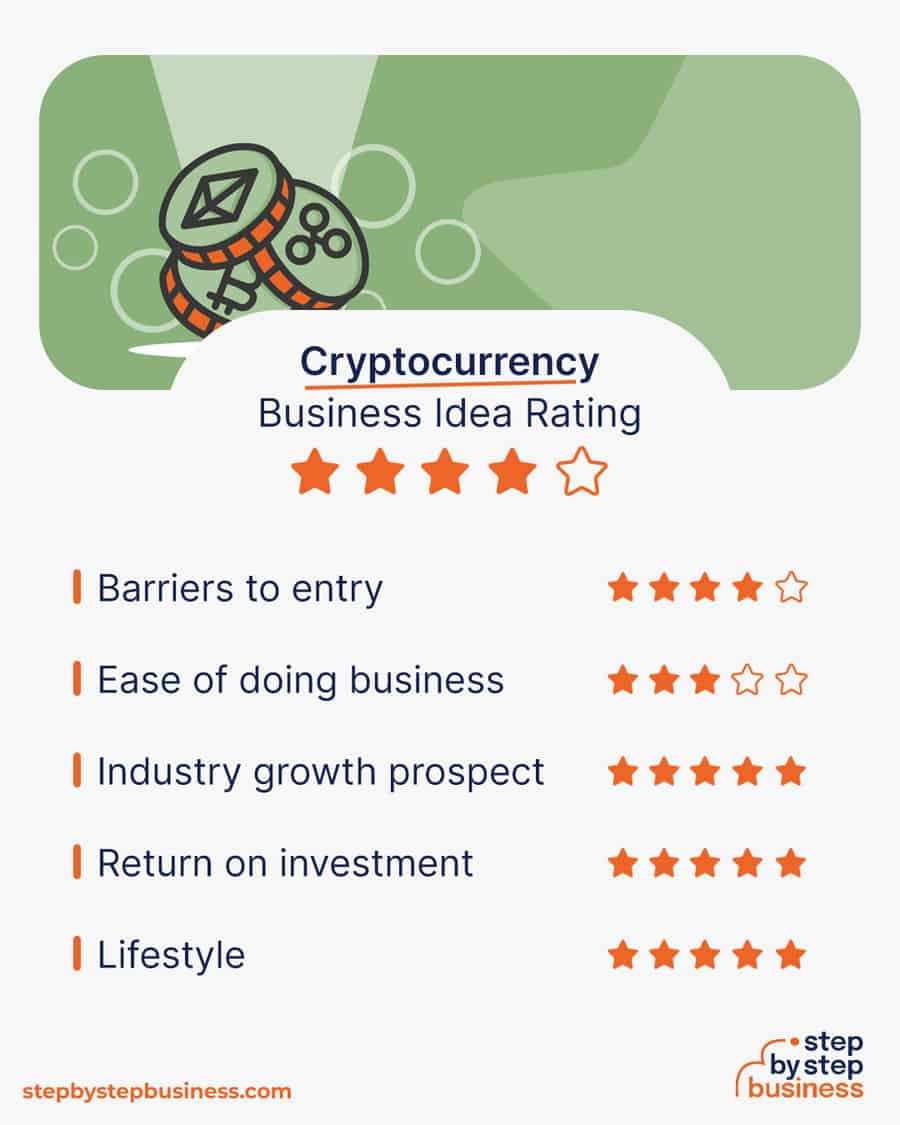

Industry trend

Cryptocurrency is everywhere these days. What started as a fad is now drawing in the world’s largest financial institutions and becoming a mainstream method of payment.

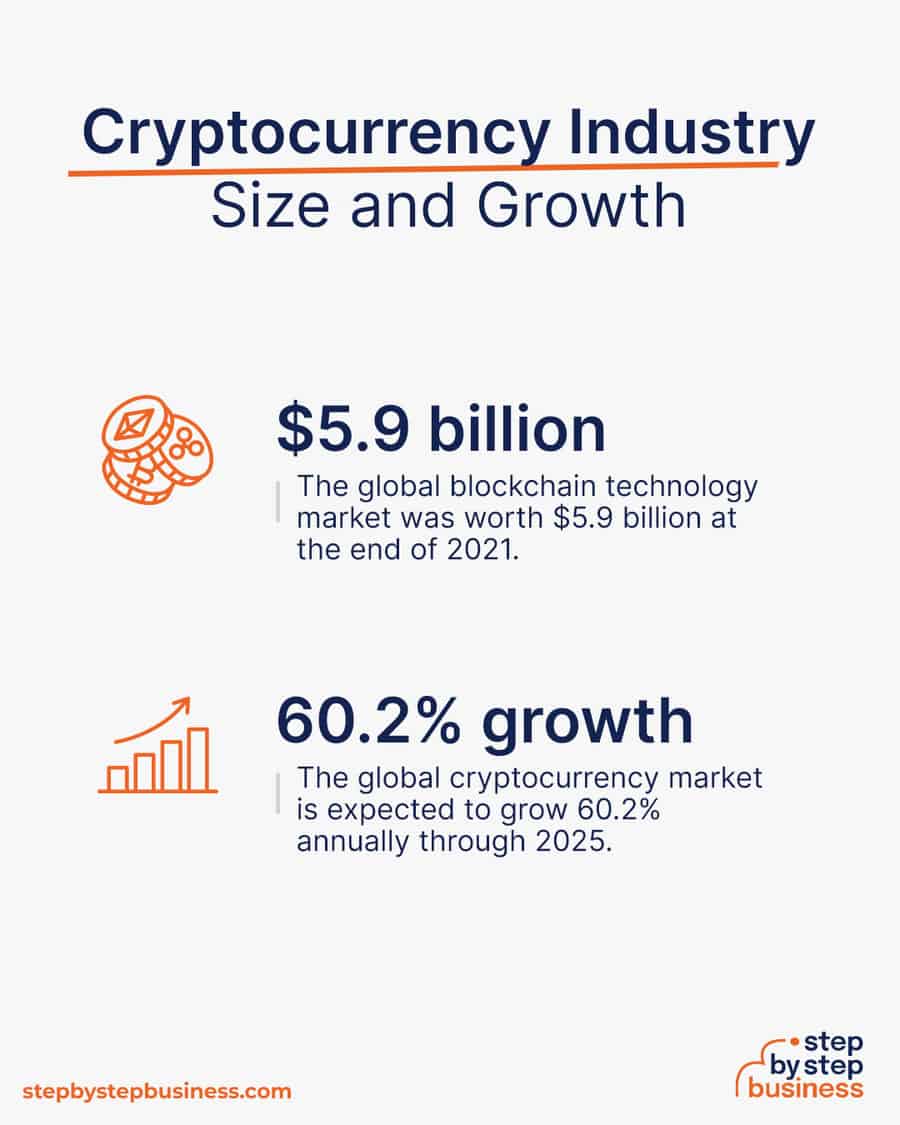

As a result, the global crypto market expects lightning-fast 60% annual growth through 2025. This means an entrepreneur has many options, from creating coins to gaming platforms and more.

But before you dive into the blockchain, you’ll need to learn what it takes to launch a business. Fortunately, this step-by-step guide has the insight and information you need to get your new cryptocurrency business up and running.

Looking to register your business? A limited liability company (LLC) is the best legal structure for new businesses because it is fast and simple.

Form your business immediately using ZenBusiness LLC formation service or hire one of the Best LLC Services .

Step 1: Decide if the Business Is Right for You

Pros and cons.

Before starting a cryptocurrency business, it’s important to consider the pros and cons.

- Flexibility – Work from anywhere in the world

- Good Money – Raise big money with an ICO (initial coin offering)

- Cutting-Edge Work – Help build the future of currency!

- Skills Required – Expert-level finance and tech skills needed

- Stiff Competition – Compete with other crypto businesses

Cryptocurrency industry trends

Industry size and growth.

- Industry size and past growth – The global blockchain technology market was worth $5.9 billion at the end of 2021 . (( https://www.grandviewresearch.com/industry-analysis/blockchain-technology-market ))

- Growth forecast – The global cryptocurrency market is expected to grow 60.2% annually through 2025.(( https://www.mordorintelligence.com/industry-reports/cryptocurrency-market ))

Trends and challenges

Trends within the cryptocurrency industry include:

- The skepticism around cryptocurrency is easing as processing companies like PayPal and Venmo allow crypto transactions on their platforms.

- Non-fungible tokens, or NFTs, are a new type of digital currency that’s on the rise. NFTs represent physical or digital artwork, domain names, and collectibles and are traded like other cryptocurrencies.

Challenges within the cryptocurrency industry include:

- Cryptocurrency platforms are under increased scrutiny due to a lack of regulation. Regulators are most concerned about a lack of consumer protection and insufficient guards against money laundering.

- Although crypto is becoming more mainstream, the currency itself is still a volatile investment.

How much does it cost to start a cryptocurrency business?

Startup costs for a cryptocurrency business range from $8,800 to $20,200. The main costs include a computer outfitted with the latest hardware and software, as well as legal fees, marketing expenses, and app development.

Legal consultation isn’t required, but is highly recommended to make sure you’re ready for ICO and other future regulatory requirements. If you are a skilled programmer, you can save costs by doing app development yourself.

How much can you earn from a cryptocurrency business?

New cryptocurrencies work to raise capital prior to their ICO. This can take time and extensive networking to find investors, so companies often look for other ways to generate revenue.

Some crypto firms develop platforms where users can trade currencies and play games to earn coins. They typically charge users a one-time fee or an annual subscription for access. If you’re working out of your home, your profit margin should be somewhere around 90%.

In your first year or two, you could attract 750 users to your platform and charge them each a $100 annual subscription fee, bringing in $75,000 in annual revenue. This would mean $68,000 in profit, assuming that 90% margin.

As your brand gains recognition, you could attract 2,000 users per year and increase your annual fee to $125. At this stage, you’d hire additional staff and rent an office, reducing your profit margin to around 65%. With annual revenue of $250,000, you’d make a handsome profit of $163,000.

What barriers to entry are there?

There are a few barriers to entry when it comes to starting a cryptocurrency business. Your biggest hurdles will be:

- Raising capital for your ICO

- Competition with established crypto players

Related Business Ideas

How to Start a Software Company

How to Start a Live Scan Fingerprinting Business

How to Start a 3D Printing Business

Step by Step Business values real-life experience above all. Through our Entrepreneur Spotlight Series , we interview business leaders from diverse industries, providing readers with firsthand insights.

Discover the innovative world of cryptocurrency taxation with Carl Gärdsell in our interview with him .

Step 2: Hone Your Idea

Now that you know what’s involved in starting a cryptocurrency business, it’s a good idea to hone your concept in preparation to enter a competitive market.

Market research will give you the upper hand, even if you’re already positive that you have a perfect product or service. Conducting market research is important, because it can help you understand your customers better, who your competitors are, and your business landscape.

Why? Identify an opportunity

Research cryptocurrency businesses in your area to examine their offerings, current value, and customer reviews. You’re looking for a market gap to fill. For instance, maybe the local market is missing a cryptocurrency business with a focus on real estate.

You might consider targeting a niche market by specializing in a certain aspect of your industry, such as gaming or NFTs.

This could jumpstart your word-of-mouth marketing and attract customers and investors right away.

What? Determine your products or services

You’ll be creating your own cryptocurrency and offering it to a target community within the niche you choose. Many cryptocurrency businesses also create games and virtual worlds where people can earn coins. You could also start a crypto YouTube channel or blog, grow your audience, and monetize your platform to bring in additional revenue.

How much should you charge for cryptocurrency?

Cryptocurrency firms typically make most of their money from an ICO, which is similar to a standard company’s initial public offering (IPO), in which its stocks are made available for purchase on the market. An average starting price for new coins is around 10 cents, but you can set any price you choose. Once a coin hits the open market, the price will fluctuate.

Many cryptocurrency businesses also charge fees to access their platforms and use their software and play games. These fees are typically charged on a one-time basis or annually and will depend on the services you provide. Your ongoing costs will be very low, so expect a profit margin of around 90%.

Once you know your costs, you can use our profit margin calculator to determine your mark-up and final price points. Remember, the prices you use at launch should be subject to change if warranted by the market.

Who? Identify your target market

Your target market will be the cryptocurrency investor community. Crypto investors range in age, but most are under 40. Focus your marketing efforts on social media platforms like TikTok, Instagram, and Facebook, and on crypto-related news outlets like cointelegraph.

Where? Choose your business premises

In the early stages, you may want to run your business from home to keep costs low. But as your business grows, you’ll likely need to hire workers for various roles and may need to rent out an office. You can find commercial space to rent in your area on sites such as Craigslist , Crexi , and Instant Offices .

When choosing a commercial space, you may want to follow these rules of thumb:

- Central location accessible via public transport

- Ventilated and spacious, with good natural light

- Flexible lease that can be extended as your business grows

- Ready-to-use space with no major renovations or repairs needed

Step 3: Brainstorm a Crypto Business Name

Your business name is your business identity, so choose one that encapsulates your objectives, services, and mission in just a few words. You probably want a name that’s short and easy to remember, since much of your business, and your initial business in particular, will come from word-of-mouth referrals.

Here are some ideas for brainstorming your business name:

- Short, unique, and catchy names tend to stand out

- Names that are easy to say and spell tend to do better

- Name should be relevant to your product or service offerings

- Ask around — family, friends, colleagues, social media — for suggestions

- Including keywords, such as “coin” or “crypto”, boosts SEO

- Name should allow for expansion, for ex: “The Crypto Collective” over “Ethereum Investments LLC” or “Bitcoin Trading Co.”

- Avoid location-based names that might hinder future expansion

Discover over 220 unique cryptocurrency business name ideas here . If you want your business name to include specific keywords, you can also use our cryptocurrency business name generator. Just type in a few keywords and hit “generate” and you’ll have dozens of suggestions at your fingertips.

Once you’ve got a list of potential names, visit the website of the US Patent and Trademark Office to make sure they are available for registration and check the availability of related domain names using our Domain Name Search tool. Using “.com” or “.org” sharply increases credibility, so it’s best to focus on these.

Find a Domain

Powered by GoDaddy.com

Finally, make your choice among the names that pass this screening and go ahead with domain registration and social media account creation. Your business name is one of the key differentiators that sets your business apart. Once you pick your company name, and start with the branding, it is hard to change the business name. Therefore, it’s important to carefully consider your choice before you start a business entity.

Step 4: Create a Cryptocurrency Business Plan

Every business needs a plan. This will function as a guidebook to take your startup through the launch process and maintain focus on your key goals. A business plan also enables potential partners and investors to better understand your company and its vision:

- Executive Summary: A brief overview of the cryptocurrency business, summarizing its goals, mission, and key highlights.

- Business Overview: A detailed description of the cryptocurrency business, including its industry, target market, and unique value proposition.

- Product and Services: Clear delineation of the specific cryptocurrency products and services offered, emphasizing their features and benefits.

- Market Analysis: Examination of the target market for the cryptocurrency, identifying trends, opportunities, and potential challenges.

- Competitive Analysis: Evaluation of competitors in the cryptocurrency market, highlighting strengths, weaknesses, and strategies for differentiation.

- Sales and Marketing: Strategies for promoting and selling the cryptocurrency, encompassing marketing channels, sales tactics, and customer acquisition plans.

- Management Team: Introduction to the key individuals involved in the cryptocurrency business, emphasizing their skills, experience, and roles.

- Operations Plan: Explanation of the day-to-day processes and activities required to run the cryptocurrency business successfully.

- Financial Plan: A comprehensive overview of the financial aspects, including revenue projections, expense forecasts, and funding requirements.

- Appendix: Supplementary information such as charts, graphs, and additional details supporting the various components of the cryptocurrency business plan.

If you’ve never created a business plan, it can be an intimidating task. You might consider hiring a business plan specialist to create a top-notch business plan for you.

Step 5: Register Your Business

Registering your business is an absolutely crucial step — it’s the prerequisite to paying taxes, raising capital, opening a bank account, and other guideposts on the road to getting a business up and running.

Plus, registration is exciting because it makes the entire process official. Once it’s complete, you’ll have your own business!

Choose where to register your company

Your business location is important because it can affect taxes, legal requirements, and revenue. Most people will register their business in the state where they live, but if you are planning to expand, you might consider looking elsewhere, as some states could offer real advantages when it comes to cryptocurrency.

If you’re willing to move, you could really maximize your business! Keep in mind, it’s relatively easy to transfer your business to another state.

Choose your business structure

Business entities come in several varieties, each with its pros and cons. The legal structure you choose for your cryptocurrency business will shape your taxes, personal liability, and business registration requirements, so choose wisely.

Here are the main options:

- Sole Proprietorship – The most common structure for small businesses makes no legal distinction between company and owner. All income goes to the owner, who’s also liable for any debts, losses, or liabilities incurred by the business. The owner pays taxes on business income on his or her personal tax return.

- General Partnership – Similar to a sole proprietorship, but for two or more people. Again, owners keep the profits and are liable for losses. The partners pay taxes on their share of business income on their personal tax returns.

- Limited Liability Company (LLC) – Combines the characteristics of corporations with those of sole proprietorships or partnerships. Again, the owners are not personally liable for debts.

- C Corp – Under this structure, the business is a distinct legal entity and the owner or owners are not personally liable for its debts. Owners take profits through shareholder dividends, rather than directly. The corporation pays taxes, and owners pay taxes on their dividends, which is sometimes referred to as double taxation.

- S Corp – An S-Corporation refers to the tax classification of the business but is not a business entity. An S-Corp can be either a corporation or an LLC , which just need to elect to be an S-Corp for tax status. In an S-Corp, income is passed through directly to shareholders, who pay taxes on their share of business income on their personal tax returns.

We recommend that new business owners choose LLC as it offers liability protection and pass-through taxation while being simpler to form than a corporation. You can form an LLC in as little as five minutes using an online LLC formation service. They will check that your business name is available before filing, submit your articles of organization , and answer any questions you might have.

Form Your LLC

Choose Your State

We recommend ZenBusiness as the Best LLC Service for 2024

Step 6: Register for Taxes

The final step before you’re able to pay taxes is getting an Employer Identification Number , or EIN. You can file for your EIN online or by mail or fax: visit the IRS website to learn more. Keep in mind, if you’ve chosen to be a sole proprietorship you can simply use your social security number as your EIN.

Once you have your EIN, you’ll need to choose your tax year. Financially speaking, your business will operate in a calendar year (January–December) or a fiscal year, a 12-month period that can start in any month. This will determine your tax cycle, while your business structure will determine which taxes you’ll pay.

The IRS website also offers a tax-payers checklist , and taxes can be filed online.

It is important to consult an accountant or other professional to help you with your taxes to ensure you are completing them correctly.

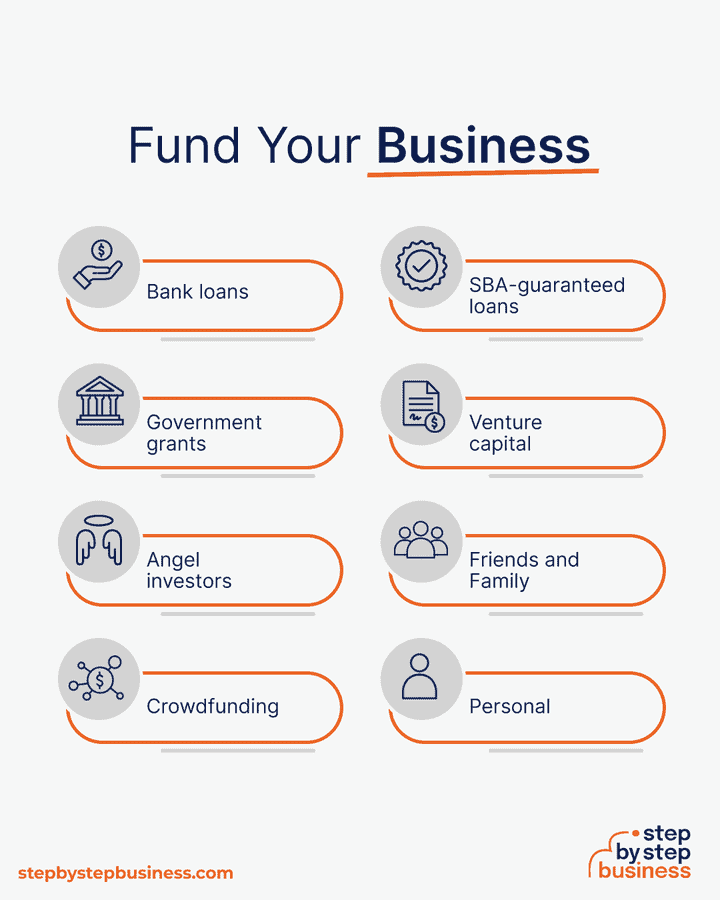

Step 7: Fund your Business

Securing financing is your next step and there are plenty of ways to raise capital:

- Bank loans: This is the most common method but getting approved requires a rock-solid business plan and strong credit history.

- SBA-guaranteed loans: The Small Business Administration can act as guarantor, helping gain that elusive bank approval via an SBA-guaranteed loan .

- Government grants: A handful of financial assistance programs help fund entrepreneurs. Visit Grants.gov to learn which might work for you.

- Venture capital: Venture capital investors take an ownership stake in exchange for funds, so keep in mind that you’d be sacrificing some control over your business. This is generally only available for businesses with high growth potential.

- Angel investors: Reach out to your entire network in search of people interested in investing in early-stage startups in exchange for a stake. Established angel investors are always looking for good opportunities.

- Friends and Family: Reach out to friends and family to provide a business loan or investment in your concept. It’s a good idea to have legal advice when doing so because SEC regulations apply.

- Crowdfunding: Websites like Kickstarter and Indiegogo offer an increasingly popular low-risk option, in which donors fund your vision. Entrepreneurial crowdfunding sites like Fundable and WeFunder enable multiple investors to fund your business.

- Personal: Self-fund your business via your savings or the sale of property or other assets.

Bank and SBA loans are probably the best option, other than friends and family, for funding a cryptocurrency business. Many successful cryptocurrencies also receive funding from venture capitalists and angel investors. You might also try crowdfunding if you have an innovative concept.

Step 8: Apply for Licenses/Permits

Starting a crypto business requires obtaining a number of licenses and permits from local, state, and federal governments.

Federal regulations, licenses, and permits associated with starting your business include doing business as (DBA), health licenses and permits from the Occupational Safety and Health Administration ( OSHA ), trademarks, copyrights, patents, and other intellectual properties, as well as industry-specific licenses and permits.

You may also need state-level and local county or city-based licenses and permits. The license requirements and how to obtain them vary, so check the websites of your state, city, and county governments or contact the appropriate person to learn more.

You could also check this SBA guide for your state’s requirements, but we recommend using MyCorporation’s Business License Compliance Package . They will research the exact forms you need for your business and state and provide them to ensure you’re fully compliant.

This is not a step to be taken lightly, as failing to comply with legal requirements can result in hefty penalties.

If you feel overwhelmed by this step or don’t know how to begin, it might be a good idea to hire a professional to help you check all the legal boxes.

Step 9: Open a Business Bank Account

Before you start making money, you’ll need a place to keep it, and that requires opening a bank account .

Keeping your business finances separate from your personal account makes it easy to file taxes and track your company’s income, so it’s worth doing even if you’re running your cryptocurrency business as a sole proprietorship. Opening a business bank account is quite simple, and similar to opening a personal one. Most major banks offer accounts tailored for businesses — just inquire at your preferred bank to learn about their rates and features.

Banks vary in terms of offerings, so it’s a good idea to examine your options and select the best plan for you. Once you choose your bank, bring in your EIN (or Social Security Number if you decide on a sole proprietorship), articles of incorporation, and other legal documents and open your new account.

Step 10: Get Business Insurance

Business insurance is an area that often gets overlooked yet it can be vital to your success as an entrepreneur. Insurance protects you from unexpected events that can have a devastating impact on your business.

Here are some types of insurance to consider:

- General liability: The most comprehensive type of insurance, acting as a catch-all for many business elements that require coverage. If you get just one kind of insurance, this is it. It even protects against bodily injury and property damage.

- Business Property: Provides coverage for your equipment and supplies.

- Equipment Breakdown Insurance: Covers the cost of replacing or repairing equipment that has broken due to mechanical issues.

- Worker’s compensation: Provides compensation to employees injured on the job.

- Property: Covers your physical space, whether it is a cart, storefront, or office.

- Commercial auto: Protection for your company-owned vehicle.

- Professional liability: Protects against claims from a client who says they suffered a loss due to an error or omission in your work.

- Business owner’s policy (BOP): This is an insurance plan that acts as an all-in-one insurance policy, a combination of the above insurance types.

Step 11: Prepare to Launch

As opening day nears, prepare for launch by reviewing and improving some key elements of your business.

Essential software and tools

Being an entrepreneur often means wearing many hats, from marketing to sales to accounting, which can be overwhelming. Fortunately, many websites and digital tools are available to help simplify many business tasks.

You may want to use industry-specific software, such as OpenDAX , Tatum , or HollaEx to build a crypto exchange, integrate payment gateways, and develop custom apps.

- Popular web-based accounting programs for smaller businesses include Quickbooks , Freshbooks , and Xero .

- If you’re unfamiliar with basic accounting, you may want to hire a professional, especially as you begin. The consequences for filing incorrect tax documents can be harsh, so accuracy is crucial.

Develop your website

Website development is crucial because your site is your online presence and needs to convince prospective clients of your expertise and professionalism.

You can create your own website using website builders . This route is very affordable, but figuring out how to build a website can be time-consuming. If you lack tech-savvy, you can hire a web designer or developer to create a custom website for your business.

They are unlikely to find your website, however, unless you follow Search Engine Optimization ( SEO ) practices. These are steps that help pages rank higher in the results of top search engines like Google.

For your cryptocurrency business, whether it’s a trading platform, a consultancy, or a tech development firm, the marketing strategy should focus on highlighting your expertise in the field, the security and user-friendliness of your services, and your commitment to staying at the forefront of blockchain technology. Emphasize trustworthiness, innovation, and customer support to attract both crypto-savvy users and newcomers to the space. Here are some powerful marketing strategies for your future business:

Kickstart Marketing

- Professional Branding : Your branding should convey innovation, security, and reliability – critical factors in the crypto industry. This includes everything from your logo to your website design and marketing materials.

- Direct Outreach : Engage with potential clients and partners through industry networking events, crypto meetups, and conferences.

Digital Presence and Online Marketing

- Professional Website and SEO : Develop a comprehensive website that explains your services, offers educational resources on cryptocurrency, and highlights your platform’s features or consultancy strengths. Use SEO best practices to optimize for search terms related to cryptocurrency, blockchain technology, and digital finance.

- Social Media Engagement : Utilize platforms like Twitter, LinkedIn, and Reddit to share industry news, provide crypto insights, and engage with the community. Platforms like Telegram or Discord can also be valuable for real-time discussions.

Content Marketing and Engagement