Cost of Having a Baby Calculator

- The baby's expenses from birth 'til adulthood

How much does it cost to have a baby - the essentials?

Keeping the expenses low, how does the cost of having a baby calculator work.

Are you planning on having a baby? Then this cost of having a baby calculator is just for you! It estimates the average cost to raise a child, meaning all the necessary expenses you need to cover to support your newborn just after they come home. Check the date with the due date calculator .

The results include all of the most essential one-time purchases. In the article below, you'll find money-saving tips and baby must-haves.

The baby's expenses from birth 'til adulthood

The average cost to raise a child is quite a scary topic for those who don't have a kid yet - and one too well understood by those already with a baby. Why so? A child is an ongoing expense for the next 18 years at least . They cost even more when they go to school (take a look at our back to school calculator ), when they are teenagers (and eat a lot!), and when they finally get their car, or maybe just get put on your insurance. Finally, after all of that, there's college, flat rental, and helping them start their own lives. You may also want to save up some money every month to secure their future. If so, check out the savings calculator .

The average cost to raise a child mostly depends on whether the family is single or dual-parent . The second factor that influences the cost is the family's income; the average spending on a child from a low-income family is more than half that of a high-income family. While they still spend roughly the same on essential items, this disparity is brought about by money spent on leisure, hobbies, electronics, etc.

Are you interested in similar calculators to help you get through those early days as a new parent? Our diaper calculator is just what you need.

Let's be clear - you don't need to buy everything in advance . In this tool, we focus on the items that are crucial from the very first days. Why? First of all, small babies grow so fast that they'll outgrow most of their clothes in the first weeks. Second of all, it's better to try out different brands at the beginning, so you can find out exactly what you need in, say, a baby monitor. Finally, only buy the things you'll need in the first few months, not years. There's no need to get the coolest bicycle or cute high-chairs at that moment - the right time will come soon.

So, what are the basics? Below are all of the items included in this cost of having a baby calculator:

First, nursery-related things , such as a crib or a bassinet. A co-sleeper for the parents who want the child close, without the fear of rolling on top of it at night or having to leave the bed when the baby wakes up every other hour. Then, some essential bedding and blankets. A changing table could also be helpful, especially if it comes with a cupboard, where you could keep all of the baby's clothes. The last thing, which is life, and sleep, the saver is baby monitors. The most modern ones come with a camera, so you can not only hear the baby crying in the other room but also see what's happening in real time.

If you decide to breastfeed , which is the best option for feeding the baby unless there's any contraindication, all you need are comfortable nursing bras and a pillow. Maybe add a bib if you don't want to change after each feeding. On the other hand, if direct breastfeeding is not possible, e.g., you go to work, you'll need a pump (either manual or electric), a storage bag, and a couple of bottles and brushes. There's no need to buy these things immediately, but only if you decide to express milk.

Bathtime! There are a couple of things you'll need for their first baths, such as a baby bath, a couple of comfy towels with a hood, and fluffy washcloths.

Not every family will need a car seat, but they'll sure use a stroller . It should be stable and safe, possibly with a place for a cute diaper bag; you'll never know when you'll need it! For those who prefer closer, skin-to-skin contact, a sling or carrier can be used.

The last, but certainly not least, is a pacifier .

Did we forget about something? If so, you can add your other expenses at the end.

So, how much does it cost to have a baby? Quite a lot. But there are some tricks that will surely help lessen the strain. Take a look at the paragraph below . 👇

As mentioned at the beginning, the budget estimated with our cost of having a baby calculator includes only the first and one-time costs. There are also diapers, clothes, food, toys, etc. Supposing you don't make your money on YouTube and therefore don't get any free gadgets to promote, how can you reduce the expenses?

Try buying those items second-hand . Search for some Facebook groups where parents exchange or give away baby stuff. Kids grow fast, and in a blink of an eye, your crib will be too small. The only thing which should be new is car seats; used ones may not guarantee safety due to their overuse in the past or deterioration of the materials over time.

It's effortless. First, choose whether you'll be calculating for one baby or twins. In the case of twins, some of the items cost double. Next to those, there's a (2x) sign .

If you're from the US or Poland, the default average price is already provided in the calculator . Otherwise, it's set to zero. However, if you know the exact costs of the things you buy, feel free to change it. By choosing show me the price range option, an estimated price range shows up at the end of the section for each item above. Note that some of the items have a wide range of costs, e.g., you may find cribs for both 120 or 800 USD. It depends on the materials used, additional features, and the brand.

At the end of the expense calculator, you'll get the total cost and also the sums of each section . On the pie chart, there's a graphical explanation of how the expenses are distributed between the parts.

Coffee kick

Harry potter currency, mm to ring size converter.

- Biology (100)

- Chemistry (100)

- Construction (144)

- Conversion (295)

- Ecology (30)

- Everyday life (262)

- Finance (570)

- Health (440)

- Physics (510)

- Sports (105)

- Statistics (182)

- Other (182)

- Discover Omni (40)

First Year Baby Cost Calculator

This Resource Will

Help you estimate the costs of a baby in the first year

BONUS: Estimate possible tax benefits for having a baby

When planning a baby's first year, you may be surprised by which items you'll need to have and which items are just nice to have! This Baby Cost Calculator will help you decide which is which, and give you an idea of how much you'll need to spend. As a bonus, it will also help you estimate possible tax savings!

Related Articles

Can we make this official?

Join our monthly newsletter designed to keep your future on track through unplanned pregnancy.

Yay! Welcome to our Community.

How Much Does It Cost to Have a Baby?

Fact-checking standards, latest update:.

Fact-checked to ensure accuracy.

How much does it cost to give birth?

Recommended reading, how much does it cost to have a baby, essential baby costs, baby monitor, a safe place to put your baby, diaper costs, baby food, formula and breastfeeding accessories costs, nursery furniture and décor costs, child care costs , clothing and other miscellaneous costs, how to start saving for baby expenses.

First-year costs can add up quickly, but planning and saving can help. And if you're still unsure about certain expenses or how to make the whole baby budget thing work, pick the brain of a family member or friend with young kids. Chances are they'll be happy to share some insight into their spending habits — and hopefully, reassure you that the money aspect of new parenthood is always manageable.

Updates history

Trending on what to expect, how to keep your house clean and healthy for your baby and your family, spacing your kids: the pros & cons of every age gap, ⚠️ you can't see this cool content because you have ad block enabled., how to make — and keep — a family budget, different types of parenting styles, how to earn money as a stay-at-home mom.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Baby Calculator: How Much You’ll Spend in Year 1

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Whether you're thinking about becoming a parent or already have a little one relying on you, chances are you've thought quite a bit about the cost of raising a baby.

We've tallied typical costs for a variety of goods and services to give you a sense of roughly how much you might spend in the first year of your baby's life. Use our baby calculator to guide you through the general expenses of Year 1:

To estimate the total cost of raising a baby in the first year of life, we added all annual totals in the following categories:

Source: U.S. Bureau of Labor Statistics Consumer Expenditure Survey, 2015

Amount: Difference between mean housing expenses for a married couple only and married couple with children

Metro area differences: Bureau of Labor Statistics data, 2015

Source: Official U.S. Department of Agriculture Food Plans, December 2016

Amount: Monthly cost of food for 1-year-old on “thrifty” or “liberal” plan, multiplied by 12

Transportation:

Amount: Difference between mean transportation expenses for a married couple only and married couple with children

Child care:

Source: Child Care Aware, Parents and the High Cost of Child Care, 2016

Amount: Average of state-by-state data for full-time, center-based infant care (“simple”) or for nanny care (“deluxe”) assuming 12 weeks of parental leave

Out-of-pocket health care costs:

Source: Health Care Cost Institute, Children’s Health Spending 2010-2014

Amount: Per capita, annual health care spending for children 0-3

Health insurance:

Source: The Henry J. Kaiser Family Foundation, 2015 Employer-Based Health Insurance Premiums

Amount: Employee share of premiums for employer-based coverage; difference between national average prices for family coverage versus “employee plus one” coverage

Cost of starting a college savings account:

Source: Financial Industry Regulatory Authority College Savings Calculator

Amount: Used calculator’s default settings to arrive at typical annual savings rate

Life insurance:

Source: NerdWallet life insurance tool

Amount: One 20-year, $1 million policy each for a healthy 30-year-old man and woman

Toys, clothes and other miscellaneous costs:

Source: NerdWallet Baby Checklist

Using the NerdWallet Baby Checklist, we built a database of thrifty options purchased online, then used a multiplier to determine how much a household with greater income would spend

Diaper estimates were obtained from the Diaper Bank Network

» MORE: A new parent’s guide to life insurance

On a similar note...

Get expert advice delivered straight to your inbox.

How Much Does It Cost to Have a Baby?

8 Min Read | May 31, 2023

Are you looking to the future and thinking to yourself, How much does it cost to have a baby anyway? Well, the quick answer is an average of $18,865 (or $2,854 with insurance). 1

Yeah, that sweet little bundle of joy can come with a big bundle of bills. But of course it’s worth it! So, what all does that big number include? Let’s break it down so you can start planning ahead.

How Much Does It Cost to Have a Baby

So, the average $18,865 cost we just mentioned covers pregnancy, hospital childbirth and postpartum care. Insurance typically covers $16,011 of that, leaving you with an out-of-pocket average of $2,854. 2

But your exact cost depends on a whole list of things. So. Many. Things. Here are a few of those:

Type of Birth

The average cost of a traditional delivery is $14,768 ($2,655 out of pocket). But a C-section is more like $26,280 ($3,214 out of pocket). 3

Where You Give Birth

The “where” here means a few things. First, if you go the hospital route, that’s where those average numbers we’ve already mentioned come in.

A home birth is generally much cheaper at $4,650 for the midwife costs and everything else involved with pre- and postnatal care. 4

Of course these days you’ve got even more options. Birthing centers are rising in popularity and cost an average of $8,309. 5

That’s not all the “where” can mean when we’re talking about giving birth. The cost is also affected by what state—and even what city —you’re in! The cheapest state to have a baby is Mississippi at $7,639, and the priciest is California at $19,230. 6 Yeah. It’s more than double the cost to give birth in the birthplace of In-N-Out Burger than the birthplace of the Blues.

Type of Insurance

Not only does having insurance (or not) affect how much it costs to have a baby, the kind of insurance does too!

What’s your deductible (aka how much you’re responsible to pay before your health insurance provider starts sharing some of the medical treatment costs with you)? Do you have a more traditional plan or a health share plan ? Each of these affects what you’ll pay overall.

Length of Hospital Stay

If your hospital stay is just a couple days, you’ll pay less than someone who needs to be in for longer. You know, kind of like a lengthy hotel stay costs more than a short one. (Except they don’t wake you up to check your blood pressure at a hotel. Usually.)

Birth or Health Complications

If you or your baby has complications throughout the process, that can increase your stay, amount of care and medications—and all of these can increase your cost, depending on your insurance deductible .

How Much Does It Cost to Have a Baby Without Insurance

We keep saying “out of pocket” costs. That phrase means what you pay of your own money— if you have insurance. If you don’t have insurance, you’re looking at that average $18,865.

So, if you don’t have any kind of health insurance right now, look into how you can get covered pronto. Some plans won’t cover your pregnancy if you’re already pregnant, so read the fine print, and look into health insurance alternatives (only the legit ones, please) to see how you can help keep that number down.

Cost of Pregnancy

Between your prenatal checkups, baby essentials and even a new wardrobe to dress that growing belly, things can add up quickly. Here are some pre-baby expenses to include in your budget before your little one gets here.

The largest cost in prenatal care comes from doctor or midwife visits. Expect a few appointments in the first trimesters and more frequent visits later in your pregnancy. Review your coverage or speak with your provider to get details on the following:

- Copay amount for doctor visits

- Deductible required before coinsurance kicks in

- Percentage of coinsurance coverage

- Your out-of-pocket maximum for the year

- Any additional costs for doctor visits or care outside of your insurance network

Ultrasounds and Lab Work

Typically, insurance will cover a “visibility scan” in your first trimester to share your due date, check on the health, and give you that first peek at your sweet baby. You’ll probably get another sonogram around 20 weeks to check on the baby’s organ development (and reveal the gender, if you choose). Most required or standard tests, lab work and blood draws should be covered by your insurance provider too.

Every savings goal starts with a budget. Create yours today with EveryDollar.

Anything additional in these areas will probably be an added cost for you.

Prenatal Vitamins

Over-the-counter prenatal vitamins can cost $10–30 for a month-long supply, depending on your preferences. Not too bad, and completely worth the investment in your (and baby’s) health!

Dietary Needs

Sometimes pregnancy makes a mom take more interest in her diet. After all, she’s eating for two—not in quantity (that baby’s tiny), but in quality. The good news is that eating healthy on a budget is totally doable, pregnant or not. But it might mean upping your grocery budget, at least a bit.

Maternity Wardrobe

Growing a tiny human requires new clothes. At least, new to you. Remember, plenty of the things in your closet are stretchy enough to keep wearing. Also, borrow from others and check out consignment shops or thrift stores. You don’t have to pay a ton to still feel fashionable for the next nine months.

Before baby gets here, you’re probably buying a car seat, diapers, wipes, a crib and crib sheets. But there are plenty of other baby gear items people stock up on like a stroller, a bassinet, more diapers, a baby monitor, a high chair, more diapers, a baby bathtub, itty-bitty clothing, a changing table, more diapers and a diaper bag for all those diapers and multiple changes of that itty-bitty clothing.

Postpartum Expenses

Once baby’s here, the expenses will continue. Put some of these (and that baby gear) on your baby register, and don’t be afraid of hand-me-downs from family and friends. For what you still need to buy, we’ve got some quick ways to save money on these baby expenses.

If you’re going the formula route, ask your pediatrician for samples you can try out, and always be on the lookout for manufacturer coupons.

When baby’s ready to try some real food, try to make your own! Yes, it takes time—but often you have to spend a bit of time to save money .

If you and your spouse both work, make sure childcare is in the budget. Finding an in-home day care or a stay-at-home parent to watch your child can be a major budget saver.

Books and Toys

Ask for these as baby shower gifts. Gather coupons and look in secondhand consignment shops. And don’t forget to use the library for sweet books to read to your little one for free.

Life Insurance and Wills

Yeah, no one wants to talk about these two. But you need life insurance and you need a will . Both of these will give you so much peace of mind as you make sure your beautiful family will be well taken care of when you’re gone. Okay. We’ll stop talking about it—but don’t forget to do this!

Baby clothes can get pricey, so buy secondhand whenever you can. And remember: Baby doesn’t need to look like a runway model. Baby can’t even walk.

Also, babies grow out of things faster and stain things quicker than you’d think. We won’t get too detailed, but don’t buy a $40 onesie the bundle of joy could ruin in four minutes.

Higher Water and Electric Bills

You might notice your water and electric bills going up from all the extra laundry costs. Here’s an easy tip: Wait until you have a full load of Junior’s dirty clothes to wash before you run a load. Trust us, it won’t take long for that washer to fill up.

Diapers (Cloth or Disposable)

Cloth diapers were the norm when our grandparents were new parents. And they’re growing in popularity again. But not everyone’s about that dirty diaper laundry life, no matter how much money it saves.

If you prefer disposable diapers, we get it. Use these tips: Don’t be afraid of store-brand diapers. It’ll be trial and error as you find one you like—but some are just as good as the pricier ones. And consider buying diapers in bulk . You. Will. Use. Them.

Unpaid Time Off

Depending on your maternity and paternity leave policies, you might be taking paid time off or even some unpaid leave when baby arrives.

Could you live on one income during leave? Can you work from home for a time? Can you earn some extra cash to fill in the gaps? Start making plans now so you aren’t blindsided when the time comes.

How Much Should I Save Before Having a Baby?

Okay, that was a lot. But we’ll say it again: It’s worth it.

And no one is ever 100% ready to have a baby—though you can be more ready by making sure you get your budget ready .

Start saving so you can hand over cash for the bills, diapers, gear, itty-bitty clothing, new and different food costs, any income changes and more diapers. All the things.

The best way to get prepped is by budgeting for all these things. And the best way to budget is by using EveryDollar , which is free—so you can put more toward . . . all those diapers.

Did you find this article helpful? Share it!

About the author

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books (including 12 national bestsellers) published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners. Learn More.

Understanding the Link Between Financial Wellness and Mental Health

How your employees handle their money affects their mental health and ultimately affects the kind of employees they'll be. The sooner employees are financially well, the better their chances are for improving their mental health.

Best Places to Live in Wisconsin

Wisconsin is a great place to call home—green forests, friendly people and cheese! Thinking about moving to the Badger State? Check out our list of the best places to live in Wisconsin.

How much does it cost to have a baby?

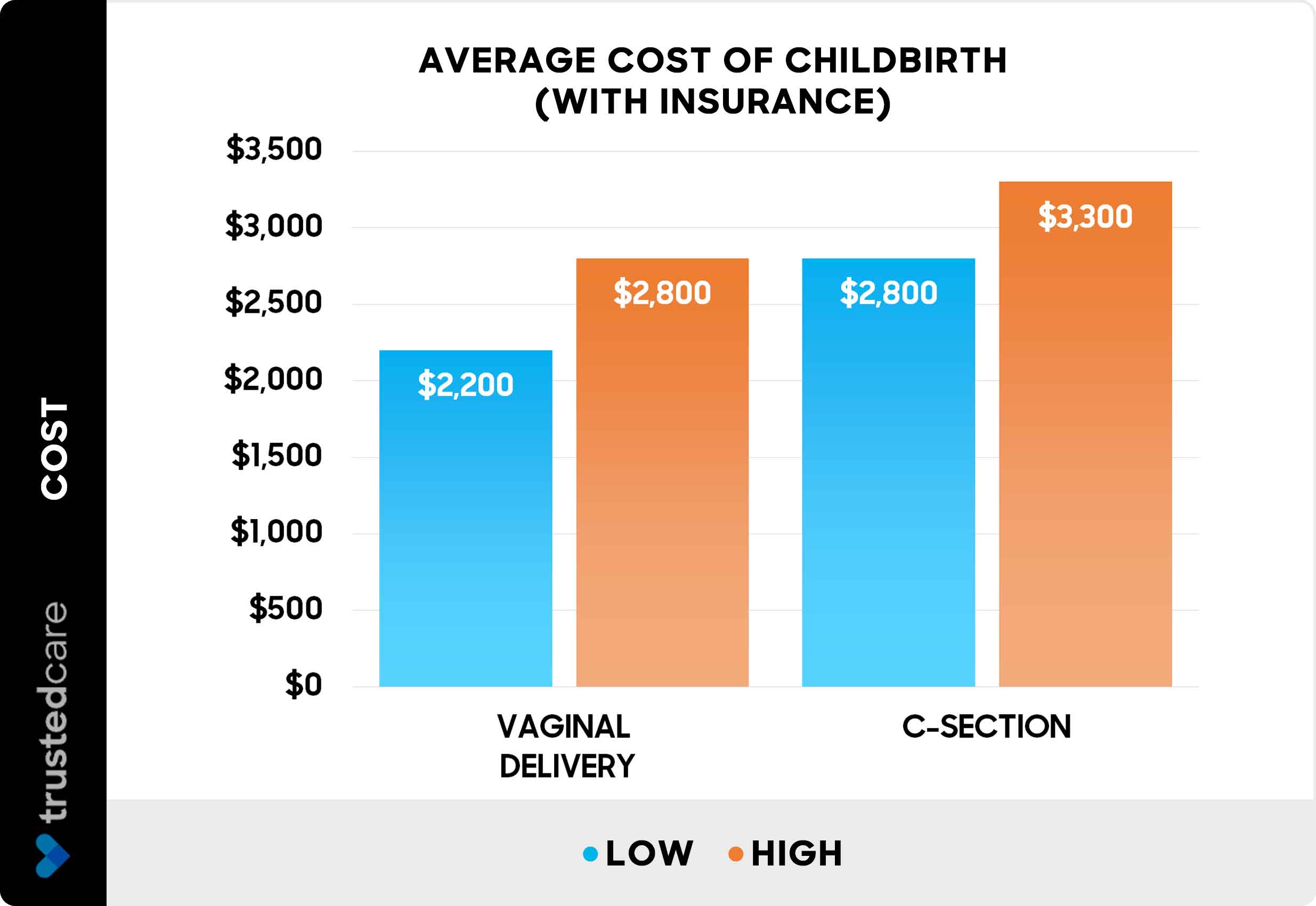

$2,200 – $3,300 average childbirth cost with insurance, $10,000 – $26,000 average childbirth cost without insurance.

Average cost to have a baby

The average out-of-pocket cost to have a baby with insurance is $2,200 to $2,800 for a vaginal delivery or $2,800 to $3,300 for a C-section, depending on your location, insurance coverage, and if there are complications during childbirth. The average cost to give birth without insurance is $10,000 to $26,000 .

Cost to have a baby with insurance

The cost of labor and delivery ranges from $1,300 to $4,700 with insurance, depending on the location, delivery type, and insurance coverage. These aspects of your insurance plan impact your out-of-pocket cost to have a baby:

Deductible – Your deductible is the minimum amount you're required to pay out-of-pocket before your insurance covers medical expenses, and this amount varies by plan. You must meet your yearly deductible before your insurance will cover childbirth costs.

Co-pay – Your co-payment, or "co-pay", is the flat fee you must pay out-of-pocket for hospital and doctor visits and is determined by your insurance plan.

Coinsurance – Some insurance plans require patients to pay a coinsurance amount—a percentage of the provider's or hospital's total fee—instead of a co-pay.

Out-of-pocket maximum – Once you meet your plan's out-of-pocket maximum for the year, your insurance will cover the rest of your health care costs.

In-network vs. out-of-network – When deciding where to give birth, choose a hospital and doctors in your insurance plan's network to minimize your out-of-pocket costs. Most plans cover only a small portion of out-of-network costs, and many plans do not cover them at all.

Common hospital charges related to childbirth include:

Your obstetrician's services

Hospital room and meals

Anesthesiology

Medications, which may include an epidural, other pain meds, or drugs to induce labor

Blood work, radiology, and other tests for you and your baby

Out-of-pocket costs can increase significantly for deliveries with complications or for mothers or infants requiring additional specialized care.

Cost to have a baby without insurance

The cost of having a baby without insurance ranges from $6,900 to $29,000 , depending on the delivery method, with most people paying around $12,000 for a vaginal delivery and over $15,000 for a C-section. Without insurance, you are responsible for the full cost of the birth and post-partum care for you and your new baby.

How to pay for childbirth without insurance

If you are uninsured, consider these other options to help you cover the cost of having a baby:

Enroll in a health insurance plan if you are within the open enrollment period.

If you're unable to afford insurance through the health marketplace, you may qualify for coverage through Medicaid.

Check with your state's Children's Health Insurance Program (CHIP) to see if you're eligible for coverage, as some states also cover pregnancy and childbirth costs.

Contact the Division of State and Community Health office in your location to find out if you're eligible for assistance through the Title V Maternal and Child Health Block Grant.

Ask the hospital and your OB/GYN if they offer discounted rates for patients without insurance. Most hospitals will negotiate healthcare costs.

Ask the hospital's billing department for a copy of their Financial Assistance Policy. Apply for financial assistance if you qualify.

Can you get insurance while pregnant?

Yes, you can get health insurance while pregnant. Pregnancy does not block your eligibility for new insurance, but you can only enroll during the open enrollment period—which begins on November 1 st and runs through early-December—or if you qualify for a special enrollment period (SEP).

Childbirth cost factors

Your insurance coverage and location are the two biggest factors impacting the cost to have a baby. However, these other factors also influence your total cost:

Delivery type

Vaginal delivery costs 20% to 30% less than a cesarean birth (C-section) with insurance. Costs for a C-section are higher because delivery requires an operating room, surgeon, and anesthesiologist, and requires a longer hospital stay.

Without insurance, costs for a C-section can run 50% to 70% more than costs for a vaginal birth.

Hospital vs. birthing center or home birth

Costs are typically lower at a birthing center than a hospital, if covered by your insurance. Home birth is another low-cost option but comes with higher risks. Some insurance companies cover only a small portion of the costs of a home birth or don't cover home births at all.

Birthing center and home births make up only about 1% of the total births in the U.S.

Mother's health

Health conditions like diabetes, obesity, and high blood pressure often cause complications that increase childbirth costs by $1,000 to $2,000 or more .

Talk with your OB/GYN during your prenatal appointments to determine if any existing health conditions are likely to increase your risk of complications during pregnancy and childbirth, and if so, how to prevent those complications.

Prenatal care

If your pregnancy is low risk and your health is normal, you'll have 10 to 15 prenatal visits with your OB/GYN. You may need to see your doctor more often during your pregnancy if you're over 35, overweight, have an existing health condition, or are pregnant with twins or other multiples.

Other prenatal costs include blood work, ultrasounds, and other lab tests, along with prenatal vitamins.

Additional childbirth costs

When bringing your new baby home, you'll also need a car seat, bassinet or crib, nursing and feeding equipment, diapers and changing supplies, and other baby gear. Check out our guide about the average cost to have a baby per month for a list of the expenses you should expect.

Childbirth costs by state

The cost of having a baby varies significantly depending on your location. Childbirth costs are lowest in Mississippi and Arkansas and highest in California, New York, and Alaska. The table below shows the average delivery cost by state with and without insurance.

Source: Health Care Cost Institute: Price of Childbirth in the U.S. (No reported data available for Hawaii, North Dakota, or Wyoming.)

FAQs about the cost to have a baby

How can i save money on childbirth.

Follow these tips to save money on having a baby:

Review your insurance plan in advance to confirm which maternity and delivery costs it covers and what your financial responsibility will be.

Compare the delivery costs at several nearby hospitals and birthing centers.

Select an OB/GYN and hospital in your insurance company's network.

Consider using a midwife if your pregnancy is low risk.

Choose generic, over-the-counter prenatal vitamins instead of prescription vitamins.

Look for free community-sponsored childbirth classes.

What is the cheapest way to give birth?

A home birth is the cheapest way to give birth, as you'll save on hospital fees. However, home births present more risks, and some insurance companies do not cover the costs. Consult a licensed midwife or doula for information if you're considering giving birth at home.

Do all health insurance plans cover maternity care?

Yes, all qualified health insurance plans must cover maternity care, including prenatal, childbirth, and newborn care services. However, co-pays and deductibles vary by plan.

Will my health insurance cover my newborn baby?

If you already have health insurance, your plan will typically cover your baby for the first 30 days of life as long as you add your baby to the plan during that time.

You must enroll your baby in your insurance plan within the first 30 days for coverage to apply retroactively to the date of birth and for it to continue after day 30.

Using our proprietary cost database, in-depth research, and collaboration with industry experts, we deliver accurate, up-to-date pricing and insights you can trust, every time.

Baby Cost Calculator for the First Year (Interactive)

The first years of your new baby’s life can get incredibly expensive. Our first year Baby Cost Calculator helps you build a budget for your new baby by estimating both ongoing and one-time expenses.

Our calculator takes a look at just about everything you’ll need to consider and plan for with your new baby. We’ll cover baby expenses associated with the following categories:

- Delivery Cost: Delivering the baby at a hospital or in a home setting.

- Ongoing Costs: Caring for the baby’s daily or reoccurring needs such as diapers and feeding.

- One-Time Costs: Necessary baby gear for everyday life such as cribs, bottles, bathtubs, and strollers.

We’ll guide you through each of these sections to help you figure out the estimated cost of having a baby. Once you’re done providing your inputs, we’ll create a new Baby Budget for your little one and give you the option to email a copy to yourself!

Our mission is to help future and new parents be financially ready for the first year of your baby’s life.

Baby Cost Calculator

Step 1 of 4 – basic info, let’s start with some basics.

- Yes, I will be paying for childcare

- No, I do not need childcare

- Not sure, but let’s assume I will be for now

BABY DELIVERY COST

- Hospital or Birth Center Delivery

- Home Delivery

- Vaginal with Insurance – Low ($5,230)

- Vaginal with Insurance – Average ($7,700)

- Vaginal with Insurance – High ($10,171)

- C-Section with Insurance – Low ($8,221)

- C-Section with Insurance – Average ($11,230)

- C-Section with Insurance – High ($14,239)

- Vaginal with No Insurance – Low ($9,516)

- Vaginal with No Insurance – Average ($13,702)

- Vaginal with No Insurance – High ($17,888)

- C-Section with No Insurance – Low ($13,589)

- C-Section with No Insurance – Average ($18,668)

- C-Section with No Insurance – High ($23,746)

- Low ($2,000)

- Average ($5,500)

- High ($9,000)

ONGOING BABY EXPENSES

- Disposable Diapers – $87 per month

- Cloth Diaper Service – $120 per month

- Cloth Diaper Self-Cleaning – $16 per month

- Exclude Diapers – $0 per month

- Lowest Cost – $6 per month

- Average Cost – $12 per month

- Highest Cost – $24 per month

- Exclude Wipes – $0 per month

- No Disposable Diaper Bags

- 100-200 Disposable Diaper Bags – $8/month

- Lowest – 650 ounces per month

- Average – 800 ounces per month

- Highest – 1,000 ounces per month

- Yes, I’ll buy the cheapest in bulk ($0.35/ounce)

- Yes, I’ll buy from my local store ($0.67/ounce)

- No, I’ll only use brand names ($1.14/ounce)

Child Care Costs

- If you plan to use childcare, it’s recommended to look into any tax savings options that may be available to you when filing your taxes. Many employers also offer the ability to deduct childcare expenses pre-tax from your paycheck.

- Daycare Center

- Home Daycare

- Nanny / Babysitter

- No Childcare

- Very Low – $550

- Low – $770

- Average – $990

- High – $1,100

- Very High – $1,400

- Low – $300

- Average – $650

- High – $1,050

- Babysitting Hours Per Month Do you need a babysitter every day or select days? Is it just during work hours or do you need additional time each day for travel? Please enter a number from 1 to 200 .

- Babysitting Number of Months Will there be certain months where you won’t need a babysitter for vacations or extended off-time? Please enter a number from 1 to 12 .

- Babysitting Hours Per Month Please enter a number from 1 to 200 .

- Lower – $40 per month

- Average – $55 per month

- Higher – $75 per month

College Savings

- No College Savings

- College Basics – $50 per month

- About Half – $163 per month

- Nearly Full (In-State) – $325 per month

- Nearly Full (Out-of-State) – $500 per month

Health Insurance

- No Insurance or Family Already Covered

- Low – $100 per month

- Average – $250 per month

- High – $450 per month

Medicine / Skin Care

- Medicine & Skin Care Costs Per Month This includes soap & shampoo, gas drops, baby lotions, and diaper creams/ointments. A safe starting point would be around $25 per month.

Toys & Entertainment

- Toys and Other Entertainment Per Month This includes things like toys, books, videos/movies, subscription services, or other entertainment for your baby. A starting point would be around $40 per month ($480 per year).

ONE-TIME BABY EXPENSES

Home safety.

- Baby Gate or Play Yard ($60 – $200) Multiply your estimate by the number of retractable baby gates you will need around the home to block off stairs, rooms, or hallways.

- Outlet Covers ($5 – $10) You should get enough covers to plug each outlet in your home when not being used.

- Table / Corner Bumpers ($15 – $40) You should get enough bumpers to cover dangerous corners on tables, countertops, and walls in your home as your baby starts to crawl or walk.

- Cabinet Locks ($10 – $40) You should get enough locks to seal cabinets in your kitchen, bathrooms, or other areas where chemicals or other potentially dangerous items are stored.

- Infant Car Seat ($90 – $300) Convertible or 3-in-1 car seats will be on the higher end of the range, but won’t require buying a separate toddler car seats. Multiply by the number of vehicles or children if you need more than one car seat.

- Toddler / Convertible Car Seat ($120 – $300) Larger convertible car seats will be needed when your infant outgrows the infant car seat. Multiply by the number of vehicles or children if you need more than one car seat.

- Car Window Sunshade ($10 – $25) Sunshades can be attached to your car’s windows to keep sunlight off of your child’s face. Multiply the number of car window shades for baby by the number of windows you need to cover.

- Headrest Mirror ($10 – $30) Most cars do not have a way to keep an eye on your rear-facing child without attaching a mirror to the headrest. Multiply by the number of mirrors needed.

- Baby Carriers

- Backpack Carrier ($30 – $190) Allows your baby to be secured to your back just like you’d wear a backpack. These are often used when the baby is a little older.

- Front Carrier ($25 – $210) Keep an eye on your baby at all times by having them strapped close to your chest. Many baby carriers provide the ability to be worn on the front or back, so you likely only need one.

- Wrap or Sling Carrier ($25 – $80) Baby wraps are made of a wide and long piece of cloth that wraps around the baby and you to keep them secure.

- Lightweight Umbrella Stroller ($50 – $125) Umbrella strollers are for babies and toddlers that can sit up on their own. These lightweight umbrella strollers are great for quick trips where you can toss it in the car and go.

- Full-Size / Convertible Stroller ($100 – $500) A full-size stroller is larger than an umbrella stroller and might have an adjustable handlebar, storage basket, and larger wheels for a smoother ride. Most full-size and travel system strollers have attachments to hold a car seat when your baby is still little.

- Double Stroller ($100 – $500) Got two kids or expecting twins? A double stroller is likely what you’ll need to push both children around either side-by-side, tandem (front-and-back), or sit-and-stand .

- Jogging Stroller ($100 – $500) If you’re an active parent, a jogging stroller is likely a must-have. These strollers have 3 air-filled wheels with a suspension system to provide a smooth ride on all-terrain while jogging or hiking. Some even work well as a beach stroller to handle your sand-and-sun vacations.

- Stroller Parent Console / Cup Holder ($10 – $40) You’ll want a place to put your water bottle, car keys, and phone while pushing your baby around. Some stroller brands require you to purchase them separately.

- Child Snack Tray ($15 – $40) As much as babies and toddlers eat, you’ll need a snack tray for your child’s sippy cup and snacks. Some stroller brands provide the tray along with the stroller while others don’t.

- Rain Cover ($10 – $25) If you live in an area where it frequently rains, you’ll need a stroller rain cover to keep everything dry during the showers.

- Stroller Travel Bag ($20 – $50) Thinking of bringing your little one on a trip? You may want to store the stroller in a handy stroller bag while on the plane or in the car.

- Crib ($150 – $1,000+) The baby’s crib is likely one of the most expensive items for a new baby. They range from very cheap to high-end luxury cribs that often have a price tag and quality to match.

- Crib Mattress ($80 – $200) Baby crib mattresses are often purchased separately from the crib itself. Often, one side of the baby mattresses is firm for use during the infant months and softer for when they grow into a toddler.

- Crib Bedding Set ($40 – $140) The options are endless. Bedding sets come in just about every color and cute animal print you can possibly imagine.

- Baby Monitor ($40 – $170) Audio only baby monitors will be on the low end of the cost range. Advanced video monitors will be considerably more expensive.

- Crib Mobile ($20 – $50) Mobiles are suspended over the top of the crib to play soft music and slowly rotate to soothe the baby. While not absolutely necessary, babies love to watch the mobile go around.

- Bassinet ($100 – $400) In the first few months, the baby should be sleeping in the same room (not the same bed) as you. A bassinet is much smaller than the crib and portable so you can move it around.

- Portable Crib / Pack n' Play ($80 – $400) A portable crib is great for traveling and visits to a family member or friend’s house. The quickly fold up and down to fit in a travel bag for your baby or toddler to sleep anywhere.

- Changing Table ($100 – $250) A table for the nursery that’s at the right height for you to comfortably and safely change baby’s diaper. These are great for the middle of the night changes.

- Clothes Hamper / Basket ($15 – $40) Unless you want baby clothes to be all over the floor, you’ll need a clothes hamper or basket.

- Dresser ($150 – $500) You’ll want a dresser that’s big enough to hold baby, toddler, or kid clothes as they get older.

- Lamp ($15 – $40) You’ll want a small lamp with a low watt light bulb for late-night check-ins or diaper changes.

- White Noise Machine / Nightlight ($20 – $50) Some babies are able to fall asleep faster with a noise machine going in the background. Some double as a nightlight to help you see better when you check on them.

- Nursery Decorations ($50 – $300) You may want to decorate the nursery with cute animal accessories, room darkening curtains, custom baby pictures, or stuffed animals.

- Infant Bathtub ($15 – $40) Giving a baby in a full-size bathtub is near impossible and dangerous since there’s no easy way to support them. You won’t need to bathe your baby until the umbilical cord stump falls off, but you’ll want a separate tub to make your life easier.

- Washcloths ($8 – $14) Washcloths used on a baby’s sensitive skin should be either 100% soft cotton or hypoallergenic bamboo.

- Hooded Towels ($15 – $50) Baby bath towels with a hood aren’t just practical for drying after bathtime – they’re also adorable.

- Hairbrush / Comb ($4 – $8) A hairbrush will help with babies that have longer hair or cradle cap that needs to be brushed more frequently.

- Baby Nail Clippers ($5 – $12) Baby’s nails are paper-thin, incredibly soft, and require caution when cutting so you don’t snip their skin. Don’t use the same massive clippers you use on your finger and toenails.

- Diaper Bag ($20 – $100) A good-sized diaper bag is essential for all parents that ever leave the house. You’ll want to throw extra diapers, milk/formula, change of clothes, and toys in the bag to bring along.

- Changing Pads ($15 – $30 each) You’ll likely need more than one changing pad unless you’ll be confined to one spot of the house. You may need one for the family/living room and another for the nursery.

- Portable Changing Pad ($10 – $30 each) You’ll want to keep a portable changing pad in your diaper bag for when you’re on the go.

- Diaper Pail ($30 – $80) Whether using disposable or cloth diapers, a diaper pail can help trap the tremendous scent of a poopy diaper.

- Diaper Pail Refills ($80 – $100) Diaper pail refills will hold about 270 diapers before the ring needs to be replaced. You can expect to use 18 or more refill rings in the first year at a cost of $4-6 each.

Bottle Feeding

- Nursing / Feeding Pillow ($30 – $40) These pillows are for laying your baby on while you feed them in your lap or on the floor. They work well to keep your arms from sweating or falling asleep.

- Regular Bottles & Nipples – 12 Bottles ($45 – $75) Bottles are a necessity for almost any parent. Even if you’re breastfeeding, you may freeze extra milk that you’ll want to heat up in the bottle later.

- Anti-Colic / Vented Bottles & Nipples – 12 Bottles ($50 – $115) If your baby has colic or gets super gassy, you may need to try special bottles that vent the air bubbles as they drink. You should only need one or the other of the Regular or Anit-Colic bottles.

- Burp Cloths – 6-10 Cloths ($10 – $24) Babies drool and spit up frequently. Soft burp cloths are essential for cleaning their face and wiping up messes.

- Cloth Bibs – 10-15 Bibs ($15 – $30) Infants rarely get all the milk or formula in their mouths. A cloth bib catches it as it runs down their mouth to stop it from ruining their clothes.

- Waterproof / Silicone Bibs – 3-5 Bibs ($10 – $25) As babies and toddlers begin trying solid foods, they’ll need a more durable and waterproof bib. These often have pouches to catch crumbs and bits of food that don’t make it into their mouth.

- Bottle Brush ($6 – $12) Over time, the formula and milk begin to leave a residue on the bottle that is hard to clean. A bottle brush may be the only way to get them really clean.

- Bowl & Plate Set ($10 – $15) You’ll want silicone bowls and plates for when your baby begins trying cereal and soft baby foods.

- Plastic Spoon & Fork Set ($4 – $14) Babies have an easier time feeding when you use plastic or silicone tipped spoons.

- Sippy Cups ($5 – $20) Not needed right away, but a sippy cup is how they learn to transition from a bottle to a regular cup. It also helps prevent water and juice from spilling.

- Silicone Suction Place Mat ($9 – $25) Silicone placemats are portable bowls/plates that suction to the table at a restaurant or the family dinner table.

- Disposable Place Mat ($8 – $20) These fold up nicely in a diaper bag and help keep your baby from touching or licking dirty tables.

Breast Feeding

- Breast Pump – Electric ($60 – $500) If you’re a frequent pumper, an electric breast pump makes the task much easier. Note: Check with your health insurance provider to see what they can offer for free.

- Breast Pump – Manual ($13 – $40) A manual breast pump is ideal for pumping milk while on the go.

- Breast Milk Storage Bags – 500 Bags ($65 – $75) You will likely need to store excess breast milk for later use in the freezer or refrigerator.

- Nursing Bras – 3 Pack ($20 – $40) These special nursing bras have easy access for pumping or breastfeeding your baby.

- Nursing Cover / Wrap ($10 – $40) Provides coverage so you can discreetly feed your baby in public places.

- Breast Pads – 800 Pads ($80 – $90) These pads help absorb extra breast milk that may periodically leak for nursing mothers.

- Breast Shields ($8 – $12) A breast shield is a soft silicone or rubber piece that fits over the areola while feeding. This may be needed if things get too tender after the constant feedings.

- Nursing Ice Packs ($9 – $20) These are ice packs for the bra that provide some soothing as nursing mothers recover after feedings.

Baby Gym & Activity Gear

- Baby Swing ($80 – $180) A baby swing can help soothe a cranky baby and gives you an additional spot to hold your baby for a short time.

- Bouncer Seat ($30 – $200) A bouncer seat works great to hold your baby while the family is eating dinner or just lounging by the TV.

- Activity Play Mat ($25 – $100) These small activity mats sit on the floor for your baby to play with toys or teethers that hang down.

- Activity Center ($40 – $130) A baby activity center is for babies closer to 6 months old that can sit up on their own. It has a suspended seat and several toys to keep them entertained.

- Jumper ($40 – $120) As the name implies, a baby jumper is a seat for your little one to jump around or practice standing on their own.

- Baby Walker ($20 – $90) A baby walker helps your baby learn to stand and walk on their own. They often have lights, toys, and music to keep your baby entertained as well.

Comfort & Soothing

- Pacifiers ($8 – $24) The ultimate baby soother, you’ll want several pacifiers since they frequently find their way to the dirty floor.

- Teethers ($5 – $8) Your baby’s teeth will begin to show around 6 months. Baby teethers help soothe them as they struggle with the pain of teeth breaking through their gums.

- Cool Mist Humidifier ($30 – $80) A humidifier is great if you live in dry climates or experience cold winters. These help keep your baby comfortable as they sleep.

- Air Purifier ($40 – $100) An air purifier can help remove pollen, pet dander, and other allergens from the air.

Keepsakes & Photos

- Birth Announcements ($35 – $75) You’ll want to shout it to the world when your new baby arrives! A simple postcard or picture of your baby is a great way to get the word out.

- Photo Album or Scrapbook ($16 – $35) You’ll likely have hundreds, if not thousands, of baby pictures on your phone in the first year. A photo album is a safe way to keep and share them with others.

- Newborn & Milestone Pictures ($200 – $400+) Getting adorable pictures of your newborn isn’t cheap, but it’s amazing what a good photographer can do with your little one.

Miscellaneous

- Any Additional Baby Expenses Are there any other costs you can think of that we may have missed? Put the total in the box below.

- Alright, let’s check out your new Baby Budget! If you’d like to make adjustments, you can scroll down to click the “Back” button to change your selections. Don’t forget to scroll down and enter your email so we can send you a copy of your new Baby Budget!

BABY BUDGET

Ongoing baby expenses per month.

- Child Care Cost

- Diapering Cost

- Formula Cost

- Clothing Cost

- College Savings Cost

- Health Insurance Cost

- Medicine / Skin Care Cost

- Toys & Entertainment Cost

- ESTIMATED MONTHLY COST (FIRST YEAR)

ONE-TIME COSTS FOR THE NEW BABY

- Baby Delivery Cost

- Baby Gates & Other Safety Gear

- Car Seats & Accessories

- Strollers & Accessories

- Nursery Furniture & Decorations

- Bath Tub & Accessories

- Diaper Changing Gear

- Bottles & Feeding Gear

- Baby Swing & Activity Gear

- Comfort & Soothing Gear

- Baby Keepsakes & Other Costs

- ESTIMATED ONE-TIME COSTS

- TOTAL FIRST YEAR BABY COST

Whew, babies need a lot of stuff! Where would you like us to email your baby budget?

- Name * First Name

Frequently Asked Questions

How much does it cost to have a baby, what is the average monthly cost for a baby, how much does it cost to have a baby in the first year, what should i do to prepare financially for having a baby.

Shop for Car Insurance

Other Insurance Products

Types of mortgages

Calculators

Find & Compare Credit Cards

Cards with Rewards

Cards for a Purpose

Cards for Building Credit

Credit Card Reviews

Understanding Credit & Score

Student Loans

Paying for College

Personal Finance for College Students

Life Events

A Budget Guide to Pregnancy, Your Baby's First Year and Fertility Treatments

Budgeting for a Baby: Pregnancy, Infancy, & Fertility Treatment

Quality Verified

Updated: November 8, 2023

Featured Expert:

On This Page:

- Fundamentals Before Having a Baby

How Much Does Pregnancy Cost?

- The Cost of Fertility Treatments

The Cost of Your Baby's First Year

- What Type of Leave Can You Take?

Advertising & Editorial Disclosure

No one would argue that having a child isn't worth the money, but there's no question it can be expensive. Along with their first steps and unconditional love, a little baby can come with some big bills—and those costs can start adding up before your child is even born. But keeping finances in check isn't impossible: it just involves planning ahead, doing some smart budgeting and taking advantage of insurance benefits and government programs designed to help parents. Keep reading to find out how to manage costs each step of the way from conception through your baby's first year.

Fertility When nature needs a little help taking its course, many hopeful parents turn to fertility treatments. Take a look at the cost of different medical options for various fertility treatments, as well as some free or inexpensive methods to try first.

Pregnancy Affordable Care Act (ACA) programs, Medicare, and employer-based health insurance all offer benefits for pregnant women and their partners. Learn about what's covered for nutrition, prenatal testing and parental leave options, as well as what other expenses to expect.

Baby Diapers, clothes and strollers—those are just the basics. There are plenty of other baby necessities to keep in mind (cradle cap brushes and nasal aspirators, anyone?). Find out what costs to expect and discover strategies to get through the first year without going bankrupt.

Financial Fundamentals Before You Have a Baby

From a financial perspective, there's rarely a perfect time to have a child, but if parents examine their spending before getting pregnant, they'll get a better idea of how to handle new baby costs. Here are some basic steps to take before your baby arrives:

Make a Budget Does your budget have room for a baby? Now's the time to figure out how—and how much—you spend. Some things, such as car payments and utilities, will likely remain fixed after the baby, but others will probably change to reflect shifting priorities. Money spent on dining out, for example, may be channeled into diapers. Make a budget to see where you have wiggle room. You should look at common monthly expenses, such as credit cards , your car insurance and auto loan, and homeowners and renters insurance for cost-saving measures. You can budget spending with a prepaid , cash-back or a gas credit card ; refinance your current auto loan or estimate a new payment; discuss good driver discounts with your current car insurance company or shop around for new car insurance with lower premiums , or more affordable renters insurance or homeowners insurance for savings.

Check Your Insurance Does your insurance cover pregnancy costs? Thanks to the Affordable Care Act, Americans are entitled to get health insurance plans that provide essential health benefits —including maternity coverage. All plans obtained through the federal and state Marketplaces meet these standards, as well as most that are available through individual employers. But there are some exceptions: if you obtain your insurance privately, or have grandfathered into the ACA regulations with an existing plan, your benefits may differ. Families who need fertility treatments should also compare insurance plans to find the best benefits.

Look Into Maternity or Paternity Leave Some expecting parents work at companies with maternity and/or paternity leave policies that allow them to take extended time off. These leaves may be provided with pay, with partial pay or without pay. Factor in the amount of leave you expect to take, how much you're covered and what the impact will be on your budget.

Decide if You're Staying Home Child care is expensive, especially for newborns, and the costs can be steep for families where both parents work. Full-time child care can easily run $5,000—or more—per year, and although married families can get up to $3,000 or $6,000 back as an income tax credit , for some families it's not enough to offset the cost of outside care.

Although every family's costs will vary depending on whether they're covered by insurance—and to what extent—in general, it's important to expect some additional expenses during pregnancy. Medical expenses are perhaps the most expensive line item, but it's also important for pregnant women to budget for a healthy pregnancy diet, maternity clothing and other lifestyle changes.

Is Your Prenatal Care Covered?

What most insurance plans cover (under the affordable care act).

- Prenatal doctor visits

- Ultrasounds

- Screening for infections such as hepatitis B and syphilis

- Screenings for anemia

- Screenings for Rh (blood) incompatibility between mother and baby

- Counseling about genetic testing (and genetic screening, if appropriate)

- Tobacco use counseling

- Breastfeeding counseling and supplies

Does Your Income Qualify You for Medicaid or CHIP?

Low-income families may be eligible for coverage under the government-sponsored healthcare programs Medicaid or Children's Health Insurance Program (CHIP).

Medicaid includes prenatal care and delivery services to families with incomes of less than 133 percent of the federal poverty level . CHIP covers children whose families earn too much to get Medicaid, but too little to afford a Marketplace insurance plan. It covers regular checkups for children, and in many states may also be used to cover pregnant women.

For more information on these programs and other benefits for lower-income individuals and families, see our guide .

How Much Does Prenatal Care Cost Without Insurance?

For women who don't have insurance and don't qualify for Medicaid or CHIP, being pregnant can get very expensive. Even for a healthy pregnancy with no complications, families will be responsible for significant out-of-pocket expenses. There are some options for reducing your costs, however.

Not having to go through insurance saves doctors and hospitals time and money, so ask if there's a special rate for uninsured patients. It's often quite a bit less, especially if you pay with cash.

Pregnant women can join a discount program such as Ameriplan . Members pay a monthly fee to receive discounted services from certain healthcare providers. It's worth investigating these programs thoroughly; they could be worth their money, but aren't always.

Regardless of which combination of the above routes you take, there will still be some out-of-pocket costs. While they vary depending on the area and individual provider, a fair price for a fetal ultrasound, according to Healthcare Bluebook , is about $240. Amniocentesis, a prenatal genetic test, is listed at 242 . A vaginal delivery is listed at $11,755 and a c-section is listed at $13,541 .

Work with your doctor to determine what prenatal care is essential for the health of your baby and what elective care you can safely skip if cost is a concern. The Text4baby program , which sends free text reminders on everything from scheduling doctor visits to taking prenatal vitamins, can also help you keep track of your care.

How to Budget for Your Pregnancy Diet

Even women with healthy eating habits will probably have to tweak their diet when they become pregnant. Notably, it's recommended to completely avoid some foods and beverages such as alcohol —which has been linked to fetal alcohol syndrome— and some types of soft cheeses, raw fish and deli salads —which can harbor bacteria. The good news is that cutting out these items frees up money for other groceries.

One essential for pregnant women is prenatal vitamins. The Mayo Clinic recommends these to get concentrated levels of folic acid, which helps prevent brain and spinal cord defects, and iron, which helps the baby grow. The good news? Prenatal vitamins are fully covered by qualified health plans offered by employers and through the ACA Marketplace.

For some women and their partners, pregnancy comes with a big shift in dining habits and can mean added expense. It helps to create a weekly meal plan and budget, stick to buying what's on the list, and buy things in bulk or on sale.

For people who cannot afford to regularly buy essentials, other options exist. Local food pantries can be found by calling the USDA hotline at (866) 348-6479. Another option is WIC, a supplemental nutrition program for women, infants and children. WIC provides some basics—such as eggs, produce, tuna, beans, bread, cereal and peanut butter — free to eligible women who do not meet minimum income thresholds; this online tool allows you to see if you qualify.

THE 5 BEST FOODS FOR PREGNANT WOMEN

Not sure which healthy foods will give you the most bang for your buck? Dr. Kacey Durant shares some of the top foods for mom and baby to stick in your cart when you hit the grocery aisles:

Greek Yogurt

Dark, Leafy Green Vegetables

Citrus Fruit

Managing Other Pregnancy Costs

For nine months, expectant mothers will experience rapid changes—both physically and emotionally—and they might run into some unexpected costs as their bumps grow. Here's what to expect.

Getting Pregnant: The Cost of Fertility Treatments

Some people conceive quickly and easily, but for others the journey is longer and costlier. According to WomensHealth.gov , around 10 percent of women of childbearing age have difficulties getting—and staying—pregnant. Medical remedies may help, but they can be expensive. Discover what costs to expect, as well as some doctor-recommended fertility tips.

How Much Do Fertility Treatments Cost?

If you're under age 35 and have been trying for over a year to get pregnant, or if you're over 35 and have been trying for at least six months with no luck, your doctor may recommend seeking fertility treatment. With good insurance, these treatments can be quite affordable, but few states require insurers to cover infertility. Even then, coverage can be quite different: some states exclude in vitro fertilization (IVF), for example, while others only include it. That leaves many people paying out-of-pocket for treatment and then trying to offset the costs through tax deductions.

There are several strategies to increase fertility, depending on what's causing the problem. Medications are among the least expensive options, while IVF can run tens of thousands of dollars. In addition, surgery may be required to correct problems affecting fertility, with costs varying according to the type and complexity of the surgery. Surrogacy is another option, but it's one of the most difficult to gauge costs for and is rarely covered through insurance.

Depending on test results, doctors typically encourage families to try less-invasive options first. In addition, although the ACA guarantees maternity coverage, infertility treatments are not considered essential health benefits.

The Average Cost of Fertility Treatments

Source: National Institutes of Health

Cheap Ways to Boost Your Fertility

Some couples can increase their odds of getting pregnant and decrease the time they spend trying to conceive without fertility treatments. Here are some proven methods to try first, recommended by Dr. Durant:

Even with a well-attended baby shower with generous family and friends, parents will likely still need to pony up for many of the big-ticket items - like a stroller and a car seat - and the easily-overlooked small stuff like teethers, pacifiers, and nail clippers. And prices can be all over the map. Your basic stroller can range from under $100 to over $1,000, depending on how many bells and whistles you're looking for. And cribs range from under $100 for a no-frills model to over $2,000 for a luxury pick.

The little things add up, too. Expect disposable diapers to run almost $1,000 for the first year, and tack on another $700 for clothes. And don't forget college. The baby's little now, but high school graduation will arrive sooner than you can imagine. Budget $600 to start building that nest egg now.

Your individual costs will vary depending on where you live, the type of childcare you use - if any - and other factors like whether you breastfeed or formula-feed your child, but all in, according to the USDA, a two-parent household with an annual income between $61,000 and $106,000 can expect to pay more than $16,000 for their baby's first year for housing, food, healthcare, childcare and other expenses.

You can use the USDA calculator to get a more personalized cost estimate for your circumstances. Or try this calculator at BabyCenter.com , which provides an estimated baby budget and allows you to alter the figures.

6 Tips to Save on Baby Costs

Even though babies are expensive, there are dozens of cost-saving measures for budget-conscious parents. Give these a try:

Buy Secondhand

There are plenty of deals to be found through resources like Craigslist, Freecycle and Just Between Friends. Certain items, however, are too important to skimp on. Cribs, car seats and strollers should always be bought new. And don't forget to make sure your new-to-you items aren't listed on the CPSC recall list before you use them.

Take Advantage of Social Programs

Children's healthcare was an ACA priority, which is why well-child checkups and vaccinations are covered (without a significant copay). If insurance isn't an option or if coverage changes, you may qualify for Medicaid or CHIP .

Make Parent Friends

Chances are, you know someone with a baby bathtub or wipe warmer gathering dust in their garage. Friends are usually happy to pass on things they no longer use.

Don't Overdo It

You probably don't need much to entertain your baby during the first year. Avoid buying things that have only one purpose, or where a less expensive item will do the trick. To a baby, measuring cups or wooden spoons are just as interesting as pricey toys—just be sure there's no choking risk or other safety hazard.

Do It Yourself

When your baby moves on to solid food, it's easy to find yourself buried in tiny—and expensive—jars of store-bought food. But making your own pureed peas and carrots is extremely easy, and much cheaper.

Use Alternative Childcare

Parents with flexible work schedules can trade days to watch each other's children, saving on child care costs while letting their children socialize. Family members are another good resource, since they often welcome time with their new relatives and may not charge as much—if any. Plus, the tax credit for child care still applies if that money went to extended family members who watched the child during working hours.

What Type of Maternity or Paternity Leave Can You Take?

Types of available leave.

Short-term disability Short-term disability insurance is offered by some employers as part of a benefits package, but also may be purchased by individuals. After delivering, it pays a percentage of the mother's wages to allow her to take several weeks off work. However, short-term disability cannot be used by fathers.

FMLA The Family and Medical Leave Act (FMLA) mandates that employers provide new mothers and fathers with 12 weeks of leave after the birth of a child and still keep their jobs and insurance coverage. It's important to note, however, that the only requirement is to provide leave—not to pay for it. Individual companies decide their own policies about whether to provide full or partial pay to employees on leave. In addition, there are significant exceptions that may make employees ineligible for this option. More information is available from the U.S. Department of Labor .

Personal leave Many parents-to-be save up sick leave and vacation days so they can still get paid when they take time off during pregnancy and after a birth. In many cases, personal leave may need to be used up before FMLA can kick in.

Employer-sponsored leave Any leave granted by an employer as part of a benefits package counts toward FMLA time. For example, if an employer grants 12 weeks of paid leave, an employee cannot use both this time and then additional FMLA unpaid leave. Some employers, however, provide leave beyond 12 weeks.

With a basic understanding of the types of leave available, the next step is to look at your own individual situation and determine how to maximize the benefits you qualify for.

Action Plan: How to Determine Your Maternity Coverage

Total up your available personal leave.

Typically, you'll be required to use this up before moving on to other types of leave, although some employers are more flexible.

Visit the Department of Labor website

http://www.dol.gov/ There, you'll be able to determine the short-term disability benefits in your state and find out more about FMLA.

Talk with your HR department

As soon as you're comfortable sharing your pregnancy, visit HR to review your benefits package and get a clear handle on what's available to you—and how much it covers.

Make a schedule with your employer

The more advance notice employers have about an employee's pregnancy and postpartum plans, the more flexibility there is with scheduling. For example, FMLA doesn't have to be used consecutively, meaning parents could split it up between pregnancy and the first year after delivery.

Baby Costs Calculator Make a personalized budget for first-year baby costs with this calculator from BabyCenter.com.

FoodSafety.gov's Checklist of Foods to Avoid During Pregnancy Learn what not to eat when you're expecting—and find safe alternatives to replace them.

MommyMeds Get information on what over-the-counter drugs can affect pregnancy. This site, which features info gathered from the InfantRisk Center at Texas Tech University, also offers a smartphone app that gives the lowdown on how safe each medication is for your unborn baby.

MoneyGeek's "A Saver's Guide to Eating and Living Well" Enjoy the high life while keeping expenses low. We've got you covered with budget hacks.

RESOLVE: The National Infertility Association Learn more about fertility problems and find free support programs from this non-profit organization dedicated to helping families living with infertility.

Speak to an Expert at smokefree.gov It's vital that fetuses not be exposed to cigarette smoke. Get help quitting via instant messaging or phone at this site.

Women, Infants, and Children (WIC) Low-income pregnant, breastfeeding and postpartum women and babies and children up to age 5 who are at nutritional risk can get nutrition information, supplemental food and health care referrals through WIC.

About Jeff Benson

Jeff Benson has been published in Via Magazine, Inspired Bali and Kampala Dispatch. He's also written and edited dozens of online guides on education and personal finance. He's currently trying to find time to finish his first novel. Find his work at serialmonography.com.

The True Cost of Raising a Child in the United States

And it’s getting more expensive at an alarming rate.

Yes, the moment a squishy new baby enters the world, it becomes immediately apparent that they're worth every penny — and then some. But just how many pennies does it take?

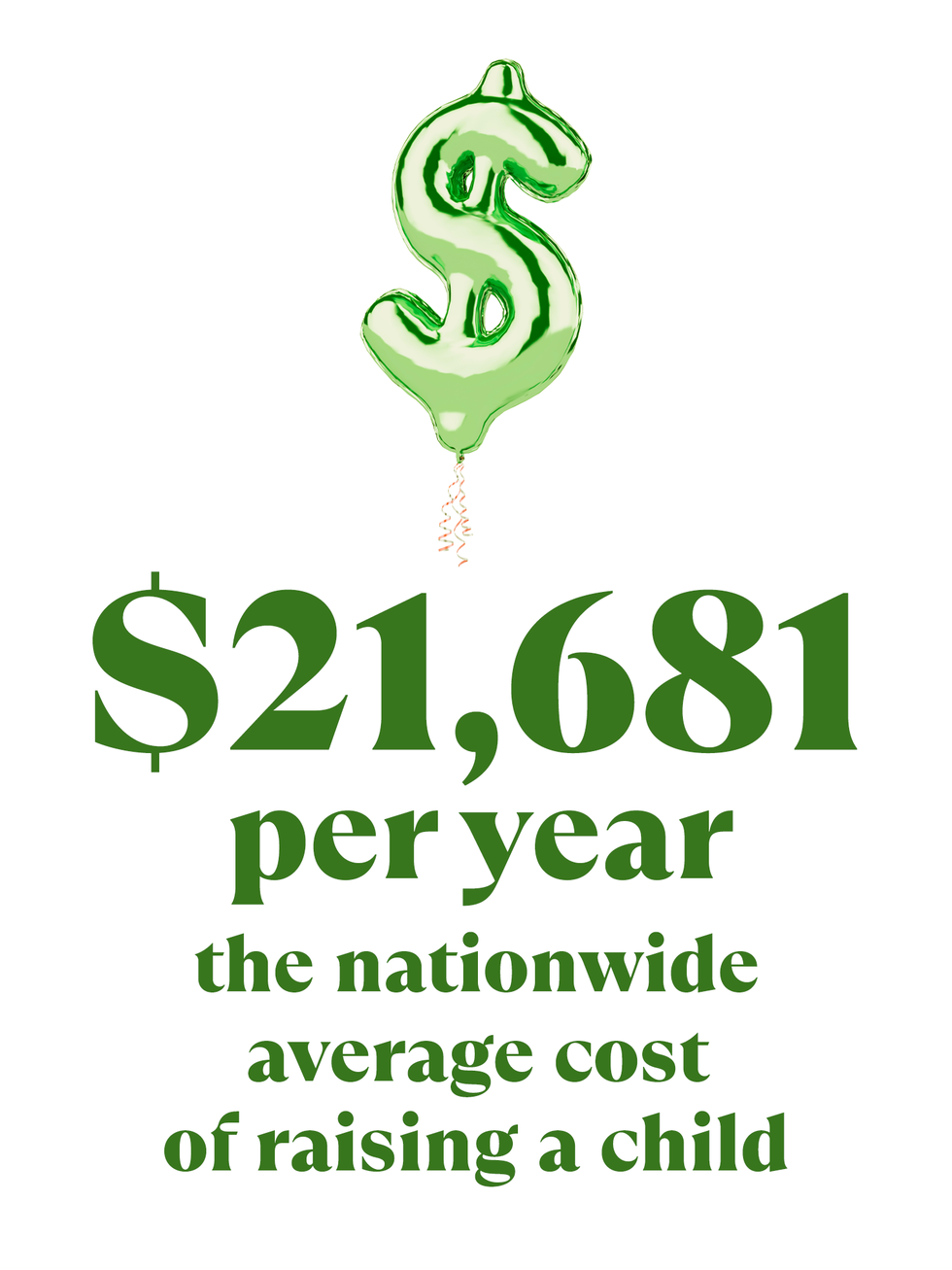

With these (and inflation) in mind, LendingTree estimates that the cost of raising a child over 18 years is $237,482, just for the basic necessities — the study doesn’t include the nice-to-haves like vacations, outings or enrichment classes, which can also take a big bite out of a family budget.

It’s not just that the cost of raising a child is high. It’s that it’s getting more expensive at an alarming rate. The same LendingTree study estimates a 19% jump in the cost of raising a kid just from 2016 and 2023.

Look back further, and the picture doesn’t get any rosier. The USDA also tabulates its own estimate of the cost of raising a child from birth to age 17. It uses many of the same expenses as LendingTree but also includes room for miscellaneous expenses, like toothpaste, haircuts and entertainment. For the most recent year available (2015, which doesn’t even account for how much more expensive everything has gotten post-pandemic), the total estimate for the cost of raising a child was $233,610. (Brookings says that, to account for higher inflation, that number could be even higher — closer to $310,605.) That represents a price tag of “between $12,350 and $13,900 for a child in a two-child, married-couple family in the middle-income group,” the USDA report says.

Twenty years earlier, in 1995 , the USDA estimated cost for the same group was between $7,610 and $8,710. That represents a 38% increase. And yet, in the same period, middle-income parents’ hourly wages and purchasing power basically remained flat, according to Pew Research , which means that the costs of raising kids is taking up a bigger slice of the overall household budget.

So, why does it take so much?

Child care is so expensive.

The United States is a country with no federal paid parental leave and no universal (or even affordable) federal child care programs, the cost burden of child care falls squarely on parents’ shoulders. And, since federal funds that propped up the child care industry during the worst of the COVID-19 pandemic have expired — a crisis known as the going over the “ child care cliff ” — that cost is only going up.

"With child care costs climbing, parents are becoming adept at crafting their own unique 'child care recipe' — a blend of support from family and friends, shared arrangements like nanny shares or co-ops, and leveraging after-school programs, camps and employer subsidies,” says Lynn Perkins, CEO and co-founder, UrbanSitter . “This approach to the child care puzzle is a testament to the resourcefulness of families striving to balance quality care for their children with the financial realities of today, where childcare for two kids can consume up to 39% of a household's income."

According to UrbanSitter’s 2023 Working Parent & Child Care Report , more than half of parents (52%) spend $1,000 or more on child care per month, and nearly a quarter (24%) spend $2,000 or more.

According to a new, 2024 study by LendingTree , families who pay for child care spend on average nearly a fifth of their budget on it. This is an 18% increase since going over the child care cliff. "Unfortunately, the trend toward higher and higher child care costs is almost certain to continue, at least in the near future," says Matt Schulz, LendingTree's chief credit analyst. "While inflation isn't rising as fast as it was a year or two ago, it definitely isn't gone. That means that struggling families should expect to have to pay more for child care in the next few years than what they're paying now. That's bad news, considering just how tight so many Americans' household budgets are."

Parents also have to spend more on necessities.

According to the USDA’s most recent study, in addition to child care, the biggest child-raising expenses were housing and food. Housing represented 29% of a family’s budget, while food was 18%.

And again, the overall picture has changed in ways that make it more difficult for parents today. In 1995, according to the National Association of Realtors , the housing affordability index was 126.9 (where higher numbers equal more affordable houses) and the income needed to purchase a home was $64,192 in 2023 dollars. Today, the housing affordability index is just 94.2, the qualifying income to purchase a home is $105,504.

And food? Forget about it. “In 2022, food prices increased by 9.9 percent, faster than any year since 1979,” due to a combination of factors, from inflation to the conflict in Ukraine and an avian flu outbreak that affected poultry, the Economic Research Service of the U.S. Department of Agriculture reports . It says that the increases in food prices appear to be slowing, but we know from the bottom line at the grocery checkout that true relief has not come yet.

The first year of a baby’s life comes with unique expenses.

Cribs, car seats, diapers — babies require a lot of gear . A 2022 study conducted by BabyCenter revealed that common expenses just for the first year of a baby’s life now exceed $15,000 , which represents 27% of a family’s annual income.

Of course, this isn’t just about the gear and equipment, which BabyCenter estimates is about $2,800 of that figure. It also includes the bigger expenses we mentioned above — the child care ($6,525 for the first year) and nutrition ($2,479). But BabyCenter also estimates the first-year cost of diapers at $1,104, which first-time parents may forget to add to the budget.

And while the cost of raising children seems like an individual problem, "This has potentially huge implications for our society going forward," Shulz says. "People are terrified of the costs of having children. This could lead to families having fewer kids or no kids at all. For those that do have kids, they simply may not be able to afford to go into the workforce when their kids are young. That means less expendable income for things like emergency funds, retirement savings, mortgage down payments, small business startups and even just fun things like vacations and concert tickets. All of this adds up to a potentially very big deal for the economy."

And while things now look particularly bleak, with no indication of relief in sight, there is reason for hope. "Tough economic times don't last forever," Shulz says. "Inflation eventually subsides. Good things begin to happen. That doesn't mean that anyone should expect child care costs will fall in coming years, but it does mean that the hockey-stick price growth we've seen in recent years won't always be the norm."

In the meantime, here are some things Shulz recommends for weathering the storm.

- Seek out assistance from government organizations and other nonprofit groups. They might be able to help struggling parents manage child care costs. (Family and friends might be able to help if you're lucky, too.)

- Adjust your budget to assume that prices are going to keep rising. " Better to plan ahead for the worst-case scenario and be pleasantly surprised than to hope for the best and be disappointed," Shulz says.

- Work to reduce debts. If you see a kid in your future, freeing up the funds that go toward loan repayment can certainly help. Shulz recommends consolidating your debts with a 0% balance transfer credit card or a low-interest personal loan.

@media(max-width: 64rem){.css-o9j0dn:before{margin-bottom:0.5rem;margin-right:0.625rem;color:#ffffff;width:1.25rem;bottom:-0.2rem;height:1.25rem;content:'_';display:inline-block;position:relative;line-height:1;background-repeat:no-repeat;}.loaded .css-o9j0dn:before{background-image:url(/_assets/design-tokens/goodhousekeeping/static/images/Clover.5c7a1a0.svg);}}@media(min-width: 48rem){.loaded .css-o9j0dn:before{background-image:url(/_assets/design-tokens/goodhousekeeping/static/images/Clover.5c7a1a0.svg);}} Money

Ree Is 'Obsessed' With This $20 Fry Pan

10 Best Shapewear on Amazon in 2024