About Stanford GSB

- The Leadership

- Dean’s Updates

- School News & History

- Commencement

- Business, Government & Society

- Centers & Institutes

- Center for Entrepreneurial Studies

- Center for Social Innovation

- Stanford Seed

About the Experience

- Learning at Stanford GSB

- Experiential Learning

- Guest Speakers

- Entrepreneurship

- Social Innovation

- Communication

- Life at Stanford GSB

- Collaborative Environment

- Activities & Organizations

- Student Services

- Housing Options

- International Students

Full-Time Degree Programs

- Why Stanford MBA

- Academic Experience

- Financial Aid

- Why Stanford MSx

- Research Fellows Program

- See All Programs

Non-Degree & Certificate Programs

- Executive Education

- Stanford Executive Program

- Programs for Organizations

- The Difference

- Online Programs

- Stanford LEAD

- Seed Transformation Program

- Aspire Program

- Seed Spark Program

- Faculty Profiles

- Academic Areas

- Awards & Honors

- Conferences

Faculty Research

- Publications

- Working Papers

- Case Studies

Research Hub

- Research Labs & Initiatives

- Business Library

- Data, Analytics & Research Computing

- Behavioral Lab

Research Labs

- Cities, Housing & Society Lab

- Golub Capital Social Impact Lab

Research Initiatives

- Corporate Governance Research Initiative

- Corporations and Society Initiative

- Policy and Innovation Initiative

- Rapid Decarbonization Initiative

- Stanford Latino Entrepreneurship Initiative

- Value Chain Innovation Initiative

- Venture Capital Initiative

- Career & Success

- Climate & Sustainability

- Corporate Governance

- Culture & Society

- Finance & Investing

- Government & Politics

- Leadership & Management

- Markets & Trade

- Operations & Logistics

- Opportunity & Access

- Organizational Behavior

- Political Economy

- Social Impact

- Technology & AI

- Opinion & Analysis

- Email Newsletter

Welcome, Alumni

- Communities

- Digital Communities & Tools

- Regional Chapters

- Women’s Programs

- Identity Chapters

- Find Your Reunion

- Career Resources

- Job Search Resources

- Career & Life Transitions

- Programs & Services

- Career Video Library

- Alumni Education

- Research Resources

- Volunteering

- Alumni News

- Class Notes

- Alumni Voices

- Contact Alumni Relations

- Upcoming Events

Admission Events & Information Sessions

- MBA Program

- MSx Program

- PhD Program

- Alumni Events

- All Other Events

- Operations, Information & Technology

- Classical Liberalism

- The Eddie Lunch

- Accounting Summer Camp

- Videos, Code & Data

- California Econometrics Conference

- California Quantitative Marketing PhD Conference

- California School Conference

- China India Insights Conference

- Homo economicus, Evolving

- Political Economics (2023–24)

- Scaling Geologic Storage of CO2 (2023–24)

- A Resilient Pacific: Building Connections, Envisioning Solutions

- Adaptation and Innovation

- Changing Climate

- Civil Society

- Climate Impact Summit

- Climate Science

- Corporate Carbon Disclosures

- Earth’s Seafloor

- Environmental Justice

- Operations and Information Technology

- Organizations

- Sustainability Reporting and Control

- Taking the Pulse of the Planet

- Urban Infrastructure

- Watershed Restoration

- Junior Faculty Workshop on Financial Regulation and Banking

- Ken Singleton Celebration

- Marketing Camp

- Quantitative Marketing PhD Alumni Conference

- Presentations

- Theory and Inference in Accounting Research

- Stanford Closer Look Series

- Quick Guides

- Core Concepts

- Journal Articles

- Glossary of Terms

- Faculty & Staff

- Researchers & Students

- Research Approach

- Charitable Giving

- Financial Health

- Government Services

- Workers & Careers

- Short Course

- Adaptive & Iterative Experimentation

- Incentive Design

- Social Sciences & Behavioral Nudges

- Bandit Experiment Application

- Conferences & Events

- Get Involved

- Reading Materials

- Teaching & Curriculum

- Energy Entrepreneurship

- Faculty & Affiliates

- SOLE Report

- Responsible Supply Chains

- Current Study Usage

- Pre-Registration Information

- Participate in a Study

This listing contains abstracts and ordering information for case studies written and published by faculty at Stanford GSB.

Publicly available cases in this collection are distributed by Harvard Business Publishing and The Case Centre .

Stanford case studies with diverse protagonists, along with case studies that build “equity fluency” by focusing on DEI-related issues and opportunities are listed in the Case Compendium developed by the Center for Equity, Gender and Leadership at the Berkeley Haas School of Business.

Adobe in 2023: Transforming Marketing Through Digital Experience

Adobe, founded in 1982, set out to develop software that would enable high-fidelity digital printing and publishing. A decade later, Adobe PDF quickly became the industry standard for preserving and sharing digital document formatting, fonts, images, and…

GoodLeap, spearheaded by Hayes Barnard, emerges as a pioneering financing platform offering comprehensive solutions for sustainable living, including solar loans, home purchasing, refinancing, and improvement loans. Barnard, with a robust background at…

Seconds to Save Lives with Viz.ai

Ajaib: building a high-growth southeast asian fintech venture, eyes on the prize: eyewa’s mena journey, hijra: building an islamic challenger bank.

Dima Djani founded Hijra in late 2018 to provide digitally-enabled financial services to businesses and consumers who followed Islamic finance principles. Islamic finance prohibited the use of usury (interest), mandated that all transactions been linked…

Polpharma Group: Transformation Through Innovation

When Markus Sieger was appointed CEO of Polpharma Group in 2016, he found himself at the helm of a company that would be deemed successful by virtually any metric. Polpharma Group included Poland’s leading pharmaceutical company and leading drug…

Stanford Health Care

- Dean Jonathan Levin

This Managing Growing Enterprises (MGE) case presents a multifaceted examination of leadership challenges in the academic sector, encompassing issues of faculty negotiation, student-faculty relations, crisis management, and institutional response to…

ClearMetal, a supply chain software-as-a-service startup, exemplifies the challenges of innovating in the global container shipping industry. Under CEO Adam Compain, the company developed a solution to reduce the costly repositioning of empty shipping…

Board Dynamics at Defy, Inc.: When is the Right Time to Raise the Next Round?

Defy, Inc. developed individual safety software solutions for highly automated aircraft operation through its FlySafe modular platform. Defy’s cofounders saw great potential in flying drones to solve the last-mile problem in deliveries. In addition to…

Founders Fund: Every Moment Happens Once

Nuveen and ecozen solutions: valuing a private equity impact investment.

In December 2021, Rekha Unnithan, CFA, received a cold outreach from Devendra Gupta, co-founder and CEO of Ecozen Solutions (“Ecozen”), an agriculture-focused cleantech business based in Pune, a major technology and manufacturing hub in India. Founded in…

APA Technologies

APA Technologies, a startup in the trucking industry, faced a significant challenge with its innovative product, the Tyro - an automatic tire inflation device. Founders Brad Miller and Jeffrey Howell, Stanford mechanical engineering students, developed…

APA Technologies (A): Just When We Were Hitting Our Stride

Apa technologies (b): no good deed goes unpunished, apa technologies (c): a potential partnership, apa technologies (d): reveal, senaca east africa (a): a family security business grapples with expansion.

Senaca East Africa, aka Sentry & Patrols, is a Kenya-based security guard firm founded in 2002 by John Kipkorir, a longtime member of the Kenyan police. At the time, there were only a few well-known Kenyan-owned security companies, and crime was rising…

Jason Scott: Creating a Dream Job to Find and Fund Entrepreneurs Across the Globe

Jason Scott’s superpower had always been his ability to connect people and ideas across industries, sectors, and geographies. After graduating from Stanford GSB, he pursued his professional North Star of finding the best entrepreneurs in the world and…

Impact Engine: Measuring Impact Across Investment Stages

Senaca east africa (b): a family security business grapples with expansion, senaca east africa (c): a family security business grapples with expansion, the ai academy: leveraging education in ai to unlock tajikistan’s economic potential.

- Priorities for the GSB's Future

- See the Current DEI Report

- Supporting Data

- Research & Insights

- Share Your Thoughts

- Search Fund Primer

- Affiliated Faculty

- Faculty Advisors

- Louis W. Foster Resource Center

- Defining Social Innovation

- Impact Compass

- Global Health Innovation Insights

- Faculty Affiliates

- Student Awards & Certificates

- Changemakers

- Dean Garth Saloner

- Dean Robert Joss

- Dean Michael Spence

- Dean Robert Jaedicke

- Dean Rene McPherson

- Dean Arjay Miller

- Dean Ernest Arbuckle

- Dean Jacob Hugh Jackson

- Dean Willard Hotchkiss

- Faculty in Memoriam

- Stanford GSB Firsts

- Certificate & Award Recipients

- Teaching Approach

- Analysis and Measurement of Impact

- The Corporate Entrepreneur: Startup in a Grown-Up Enterprise

- Data-Driven Impact

- Designing Experiments for Impact

- Digital Business Transformation

- The Founder’s Right Hand

- Marketing for Measurable Change

- Product Management

- Public Policy Lab: Financial Challenges Facing US Cities

- Public Policy Lab: Homelessness in California

- Lab Features

- Curricular Integration

- View From The Top

- Formation of New Ventures

- Managing Growing Enterprises

- Startup Garage

- Explore Beyond the Classroom

- Stanford Venture Studio

- Summer Program

- Workshops & Events

- The Five Lenses of Entrepreneurship

- Leadership Labs

- Executive Challenge

- Arbuckle Leadership Fellows Program

- Selection Process

- Training Schedule

- Time Commitment

- Learning Expectations

- Post-Training Opportunities

- Who Should Apply

- Introductory T-Groups

- Leadership for Society Program

- Certificate

- 2023 Awardees

- 2022 Awardees

- 2021 Awardees

- 2020 Awardees

- 2019 Awardees

- 2018 Awardees

- Social Management Immersion Fund

- Stanford Impact Founder Fellowships and Prizes

- Stanford Impact Leader Prizes

- Social Entrepreneurship

- Stanford GSB Impact Fund

- Economic Development

- Energy & Environment

- Stanford GSB Residences

- Environmental Leadership

- Stanford GSB Artwork

- A Closer Look

- California & the Bay Area

- Voices of Stanford GSB

- Business & Beneficial Technology

- Business & Sustainability

- Business & Free Markets

- Business, Government, and Society Forum

- Second Year

- Global Experiences

- JD/MBA Joint Degree

- MA Education/MBA Joint Degree

- MD/MBA Dual Degree

- MPP/MBA Joint Degree

- MS Computer Science/MBA Joint Degree

- MS Electrical Engineering/MBA Joint Degree

- MS Environment and Resources (E-IPER)/MBA Joint Degree

- Academic Calendar

- Clubs & Activities

- LGBTQ+ Students

- Military Veterans

- Minorities & People of Color

- Partners & Families

- Students with Disabilities

- Student Support

- Residential Life

- Student Voices

- MBA Alumni Voices

- A Week in the Life

- Career Support

- Employment Outcomes

- Cost of Attendance

- Knight-Hennessy Scholars Program

- Yellow Ribbon Program

- BOLD Fellows Fund

- Application Process

- Loan Forgiveness

- Contact the Financial Aid Office

- Evaluation Criteria

- GMAT & GRE

- English Language Proficiency

- Personal Information, Activities & Awards

- Professional Experience

- Letters of Recommendation

- Optional Short Answer Questions

- Application Fee

- Reapplication

- Deferred Enrollment

- Joint & Dual Degrees

- Entering Class Profile

- Event Schedule

- Ambassadors

- New & Noteworthy

- Ask a Question

- See Why Stanford MSx

- Is MSx Right for You?

- MSx Stories

- Leadership Development

- Career Advancement

- Career Change

- How You Will Learn

- Admission Events

- Personal Information

- Information for Recommenders

- GMAT, GRE & EA

- English Proficiency Tests

- After You’re Admitted

- Daycare, Schools & Camps

- U.S. Citizens and Permanent Residents

- Requirements

- Requirements: Behavioral

- Requirements: Quantitative

- Requirements: Macro

- Requirements: Micro

- Annual Evaluations

- Field Examination

- Research Activities

- Research Papers

- Dissertation

- Oral Examination

- Current Students

- Education & CV

- International Applicants

- Statement of Purpose

- Reapplicants

- Application Fee Waiver

- Deadline & Decisions

- Job Market Candidates

- Academic Placements

- Stay in Touch

- Faculty Mentors

- Current Fellows

- Standard Track

- Fellowship & Benefits

- Group Enrollment

- Program Formats

- Developing a Program

- Diversity & Inclusion

- Strategic Transformation

- Program Experience

- Contact Client Services

- Campus Experience

- Live Online Experience

- Silicon Valley & Bay Area

- Digital Credentials

- Faculty Spotlights

- Participant Spotlights

- Eligibility

- International Participants

- Stanford Ignite

- Frequently Asked Questions

- Founding Donors

- Location Information

- Participant Profile

- Network Membership

- Program Impact

- Collaborators

- Entrepreneur Profiles

- Company Spotlights

- Seed Transformation Network

- Responsibilities

- Current Coaches

- How to Apply

- Meet the Consultants

- Meet the Interns

- Intern Profiles

- Collaborate

- Research Library

- News & Insights

- Program Contacts

- Databases & Datasets

- Research Guides

- Consultations

- Research Workshops

- Career Research

- Research Data Services

- Course Reserves

- Course Research Guides

- Material Loan Periods

- Fines & Other Charges

- Document Delivery

- Interlibrary Loan

- Equipment Checkout

- Print & Scan

- MBA & MSx Students

- PhD Students

- Other Stanford Students

- Faculty Assistants

- Research Assistants

- Stanford GSB Alumni

- Telling Our Story

- Staff Directory

- Site Registration

- Alumni Directory

- Alumni Email

- Privacy Settings & My Profile

- Success Stories

- The Story of Circles

- Support Women’s Circles

- Stanford Women on Boards Initiative

- Alumnae Spotlights

- Insights & Research

- Industry & Professional

- Entrepreneurial Commitment Group

- Recent Alumni

- Half-Century Club

- Fall Reunions

- Spring Reunions

- MBA 25th Reunion

- Half-Century Club Reunion

- Faculty Lectures

- Ernest C. Arbuckle Award

- Alison Elliott Exceptional Achievement Award

- ENCORE Award

- Excellence in Leadership Award

- John W. Gardner Volunteer Leadership Award

- Robert K. Jaedicke Faculty Award

- Jack McDonald Military Service Appreciation Award

- Jerry I. Porras Latino Leadership Award

- Tapestry Award

- Student & Alumni Events

- Executive Recruiters

- Interviewing

- Land the Perfect Job with LinkedIn

- Negotiating

- Elevator Pitch

- Email Best Practices

- Resumes & Cover Letters

- Self-Assessment

- Whitney Birdwell Ball

- Margaret Brooks

- Bryn Panee Burkhart

- Margaret Chan

- Ricki Frankel

- Peter Gandolfo

- Cindy W. Greig

- Natalie Guillen

- Carly Janson

- Sloan Klein

- Sherri Appel Lassila

- Stuart Meyer

- Tanisha Parrish

- Virginia Roberson

- Philippe Taieb

- Michael Takagawa

- Terra Winston

- Johanna Wise

- Debbie Wolter

- Rebecca Zucker

- Complimentary Coaching

- Changing Careers

- Work-Life Integration

- Career Breaks

- Flexible Work

- Encore Careers

- D&B Hoovers

- Data Axle (ReferenceUSA)

- EBSCO Business Source

- Global Newsstream

- Market Share Reporter

- ProQuest One Business

- Student Clubs

- Entrepreneurial Students

- Stanford GSB Trust

- Alumni Community

- How to Volunteer

- Springboard Sessions

- Consulting Projects

- 2020 – 2029

- 2010 – 2019

- 2000 – 2009

- 1990 – 1999

- 1980 – 1989

- 1970 – 1979

- 1960 – 1969

- 1950 – 1959

- 1940 – 1949

- Service Areas

- ACT History

- ACT Awards Celebration

- ACT Governance Structure

- Building Leadership for ACT

- Individual Leadership Positions

- Leadership Role Overview

- Purpose of the ACT Management Board

- Contact ACT

- Business & Nonprofit Communities

- Reunion Volunteers

- Ways to Give

- Fiscal Year Report

- Business School Fund Leadership Council

- Planned Giving Options

- Planned Giving Benefits

- Planned Gifts and Reunions

- Legacy Partners

- Giving News & Stories

- Giving Deadlines

- Development Staff

- Submit Class Notes

- Class Secretaries

- Board of Directors

- Health Care

- Sustainability

- Class Takeaways

- All Else Equal: Making Better Decisions

- If/Then: Business, Leadership, Society

- Grit & Growth

- Think Fast, Talk Smart

- Spring 2022

- Spring 2021

- Autumn 2020

- Summer 2020

- Winter 2020

- In the Media

- For Journalists

- DCI Fellows

- Other Auditors

- Academic Calendar & Deadlines

- Course Materials

- Entrepreneurial Resources

- Campus Drive Grove

- Campus Drive Lawn

- CEMEX Auditorium

- King Community Court

- Seawell Family Boardroom

- Stanford GSB Bowl

- Stanford Investors Common

- Town Square

- Vidalakis Courtyard

- Vidalakis Dining Hall

- Catering Services

- Policies & Guidelines

- Reservations

- Contact Faculty Recruiting

- Lecturer Positions

- Postdoctoral Positions

- Accommodations

- CMC-Managed Interviews

- Recruiter-Managed Interviews

- Virtual Interviews

- Campus & Virtual

- Search for Candidates

- Think Globally

- Recruiting Calendar

- Recruiting Policies

- Full-Time Employment

- Summer Employment

- Entrepreneurial Summer Program

- Global Management Immersion Experience

- Social-Purpose Summer Internships

- Process Overview

- Project Types

- Client Eligibility Criteria

- Client Screening

- ACT Leadership

- Social Innovation & Nonprofit Management Resources

- Develop Your Organization’s Talent

- Centers & Initiatives

- Student Fellowships

- © 1971

Case Studies in Business Finance and Financial Analysis

- K. Midgley ,

- R. G. Burns

You can also search for this author in PubMed Google Scholar

302 Accesses

11 Citations

- Table of contents

Bibliographic Information

- Publish with us

This is a preview of subscription content, log in via an institution to check for access.

Table of contents (6 chapters)

Front matter, starting a small business.

- K. Midgley, R. G. Burns

The Effects of Budgetary and Other Governmental Measures on Profitability

Raising long-term capital, evaluating returns from long-term investment, head office integration following a merger, evaluation of an ordinary share, back matter.

- Case Studies

Book Title : Case Studies in Business Finance and Financial Analysis

Authors : K. Midgley, R. G. Burns

DOI : https://doi.org/10.1007/978-1-349-00981-7

Publisher : Palgrave Macmillan London

eBook Packages : Palgrave Business & Management Collection , Business and Management (R0)

Copyright Information : K. Midgley and R. G. Burns 1971

Softcover ISBN : 978-0-333-11624-1 Published: 18 June 1971

eBook ISBN : 978-1-349-00981-7 Published: 18 June 1971

Edition Number : 1

Number of Pages : IV, 128

Topics : Business Finance

Policies and ethics

- Find a journal

- Track your research

Business resiliency in Finance

Accenture Finance outmaneuvers uncertainty with a robust business resiliency plan, critical to delivering financial commitments to the company

- Call for Change

- When Tech Meets Human Ingenuity

- A Valuable Difference

- Meet the Team

- Related Capabilities

Call for change

Business resilience is the ability of an organization to recover from difficulty, adapt to change and persevere with the occurrence of unexpected disruption. Making an enterprise resilient is an ongoing journey of continuous improvement. It involves governance, strategy, business services, information security, change management, run processes and disaster recovery, all of which depend on people that understand, adapt to and prioritize operational resilience.

Accenture Finance set out to ensure that critical finance operations run continuously during business disruptions given a critical dependency on activities performed extensively across Accenture’s shared services and office locations around the world. Seventy percent of Finance’s services are performed in these shared services centers and many involve complex accounting, business and tax advisory activities, making business continuity a priority. Accenture Finance has always had a disaster recovery plan in place, but in recent years wanted to create a formal business resiliency strategy and plan to enhance the protection of our people, clients and operations.

Blog: How to develop robust finance business resiliency

View Transcript

When tech meets human ingenuity

The Accenture Controllership organization, which includes nine shared services centers, led the business resiliency plan and implementation effort by collaborating with the Risk Management and Compliance team under Accenture’s Global Business Services Network group. From the outset, the project team designed a rigorous business resiliency plan with the realistic view that such a plan for an organization of 7,000 people would take time to shape, implement and test. The plan took shape in five stages:

Organization and governance The team used the ISO 22301 Business Continuity Planning Framework to structure the capability, drawing also on the experience and knowledge of the Global Risk Management and Compliance group. A governance model was established along with leadership commitment. The team defined roles and responsibilities that spanned locations globally. These initial steps helped embed a business resilience mindset in Controllership, which fosters a “One Controllership” culture of working as one unit, using common language and driving the same objectives and goals.

Document review The team proceeded to work through an information gathering exercise. Team members reviewed every Controllership activity, identifying which were critical and at what point in the month they were critical—and which activities to put on hold in the event of having to execute to the plan. The activities went through a business impact analysis and a threat and risks assessment. The results of this analysis were used to determine how to provide the fail-over support. In parallel, the team identified the need to develop incident response documentation for the teams.

Incident response planning To help respond to the most common scenarios, the team prepared an extensive location and recovery strategy. The strategy focused not only on a few locations, but on all shared services center locations along with connections to other key Accenture functions. During this stage, Controllership teams put in place cross-training and transferred knowledge. A very important step was establishing accelerated access management rights for critical systems during an incident when work is shifted to another team in another geography. Throughout this stage, Controllership sent out communications to inform and educate all impacted employees and stakeholders on implementing business resiliency actions should an incident arise.

Testing The team conducted several waves of rigorous testing and retesting between different sending and receiving shared services centers for up to 12 critical financial processes. Initially, participants were aware, but subsequent tests were surprise simulations. All were executed in a controlled manner and tactically covered critical close days where key employees who would normally undertake activities were restricted during the test period.

This left teams in the failover location to be fully responsible to ensure the accuracy of the financial processing both for their existing and temporary customers. Testing revealed areas for improvement and lessons learned, which was to be expected. The testing and retesting are what help teams to ultimately be prepared in the event of a real incident. It also made the program real and a success.

Results analysis and actions After each wave of testing, the project team analyzed the results, performed quality assurance reviews and audited transactions for accuracy. They shared test outcomes with stakeholders. Learnings were documented and plans were made to make improvements where needed. On an ongoing basis, Controllership plans to periodically test for existing scope of the plan. For new scope, the plan is to actively create job aids at the time new work is received.

The experience Controllership went through to formalize its business resiliency capability reaffirmed the organization’s One Controllership culture. Individuals and teams across shared services centers and offices collaborated well across locations and with other Accenture corporate functions in the activities and in preparing job aids. Keys to the program’s success included a dedicated business resiliency team, knowledge sharing with other corporate functions and locations, and aggressive testing. In support of Accenture’s digital worker strategy, an added advantage to collaboration—and physical location mobility—was Controllership’s move in recent years to enable almost all of the organization with laptops and mobile devices. This enablement and the other factors helped teams respond to business resiliency tests with no major issues.

The entire program instilled pride among the organization with the way everyone worked together and delivered the plan.

Top takeways

Make cross-training a top priority

Conduct rigorous testing

Communications

Articulate preparedness among groups and educate on timely actions

A valuable difference

After 18 months of rigorous planning, implementing and testing, Controllership reached a point of achieving its objectives and elevating the state of its business resiliency capability. In keeping with Accenture Finance’s focus on developing a world-class business resiliency approach, other teams, including Client Financial Management and Treasury, are also leading the charge in honing their business resiliency capabilities. Next steps are to implement the business resiliency capability across all of Accenture Finance.

Business resiliency for Controllership and all of Accenture Finance was put to a real-life test when the COVID-19 pandemic set in. A robust capability contributed to Accenture Finance’s ability to carry out business as usual without delays. Controllership, Client Financial Management and Treasury teams facilitated continued quality and accuracy of financial information and data, ultimately addressing Accenture’s commitments to its stakeholders.

A snapshot of business as usual outcomes during this time included:

Closed Q2 and Q3

Filed the 10Q

Virtual earnings call and preparation

Seamlessly managed

Commercial finance—clients, payments, new work

Performed liquidity assessment

To provide real-time data on cash collection and liquidity health

Finance people enabled to work from home

Time reports processed—online or via the mobile app

New laptops purchased for Accenture Operations and Technology people who shifted to work from home

Meet the team

Richard Clark

Melissa Burgum

Ronald Stevens

Abhijit Dasgupta

Murali Venkatesan

Anwar Mohammed

Related capabilities, finance at accenture, cfo and enterprise value.

7 Favorite Business Case Studies to Teach—and Why

Explore more.

- Case Teaching

- Course Materials

FEATURED CASE STUDIES

The Army Crew Team . Emily Michelle David of CEIBS

ATH Technologies . Devin Shanthikumar of Paul Merage School of Business

Fabritek 1992 . Rob Austin of Ivey Business School

Lincoln Electric Co . Karin Schnarr of Wilfrid Laurier University

Pal’s Sudden Service—Scaling an Organizational Model to Drive Growth . Gary Pisano of Harvard Business School

The United States Air Force: ‘Chaos’ in the 99th Reconnaissance Squadron . Francesca Gino of Harvard Business School

Warren E. Buffett, 2015 . Robert F. Bruner of Darden School of Business

To dig into what makes a compelling case study, we asked seven experienced educators who teach with—and many who write—business case studies: “What is your favorite case to teach and why?”

The resulting list of case study favorites ranges in topics from operations management and organizational structure to rebel leaders and whodunnit dramas.

1. The Army Crew Team

Emily Michelle David, Assistant Professor of Management, China Europe International Business School (CEIBS)

“I love teaching The Army Crew Team case because it beautifully demonstrates how a team can be so much less than the sum of its parts.

I deliver the case to executives in a nearby state-of-the-art rowing facility that features rowing machines, professional coaches, and shiny red eight-person shells.

After going through the case, they hear testimonies from former members of Chinese national crew teams before carrying their own boat to the river for a test race.

The rich learning environment helps to vividly underscore one of the case’s core messages: competition can be a double-edged sword if not properly managed.

Executives in Emily Michelle David’s organizational behavior class participate in rowing activities at a nearby facility as part of her case delivery.

Despite working for an elite headhunting firm, the executives in my most recent class were surprised to realize how much they’ve allowed their own team-building responsibilities to lapse. In the MBA pre-course, this case often leads to a rich discussion about common traps that newcomers fall into (for example, trying to do too much, too soon), which helps to poise them to both stand out in the MBA as well as prepare them for the lateral team building they will soon engage in.

Finally, I love that the post-script always gets a good laugh and serves as an early lesson that organizational behavior courses will seldom give you foolproof solutions for specific problems but will, instead, arm you with the ability to think through issues more critically.”

2. ATH Technologies

Devin Shanthikumar, Associate Professor of Accounting, Paul Merage School of Business

“As a professor at UC Irvine’s Paul Merage School of Business, and before that at Harvard Business School, I have probably taught over 100 cases. I would like to say that my favorite case is my own, Compass Box Whisky Company . But as fun as that case is, one case beats it: ATH Technologies by Robert Simons and Jennifer Packard.

ATH presents a young entrepreneurial company that is bought by a much larger company. As part of the merger, ATH gets an ‘earn-out’ deal—common among high-tech industries. The company, and the class, must decide what to do to achieve the stretch earn-out goals.

ATH captures a scenario we all want to be in at some point in our careers—being part of a young, exciting, growing organization. And a scenario we all will likely face—having stretch goals that seem almost unreachable.

It forces us, as a class, to really struggle with what to do at each stage.

After we read and discuss the A case, we find out what happens next, and discuss the B case, then the C, then D, and even E. At every stage, we can:

see how our decisions play out,

figure out how to build on our successes, and

address our failures.

The case is exciting, the class discussion is dynamic and energetic, and in the end, we all go home with a memorable ‘ah-ha!’ moment.

I have taught many great cases over my career, but none are quite as fun, memorable, and effective as ATH .”

3. Fabritek 1992

Rob Austin, Professor of Information Systems, Ivey Business School

“This might seem like an odd choice, but my favorite case to teach is an old operations case called Fabritek 1992 .

The latest version of Fabritek 1992 is dated 2009, but it is my understanding that this is a rewrite of a case that is older (probably much older). There is a Fabritek 1969 in the HBP catalog—same basic case, older dates, and numbers. That 1969 version lists no authors, so I suspect the case goes even further back; the 1969 version is, I’m guessing, a rewrite of an even older version.

There are many things I appreciate about the case. Here are a few:

It operates as a learning opportunity at many levels. At first it looks like a not-very-glamorous production job scheduling case. By the end of the case discussion, though, we’re into (operations) strategy and more. It starts out technical, then explodes into much broader relevance. As I tell participants when I’m teaching HBP's Teaching with Cases seminars —where I often use Fabritek as an example—when people first encounter this case, they almost always underestimate it.

It has great characters—especially Arthur Moreno, who looks like a troublemaker, but who, discussion reveals, might just be the smartest guy in the factory. Alums of the Harvard MBA program have told me that they remember Arthur Moreno many years later.

Almost every word in the case is important. It’s only four and a half pages of text and three pages of exhibits. This economy of words and sparsity of style have always seemed like poetry to me. I should note that this super concise, every-word-matters approach is not the ideal we usually aspire to when we write cases. Often, we include extra or superfluous information because part of our teaching objective is to provide practice in separating what matters from what doesn’t in a case. Fabritek takes a different approach, though, which fits it well.

It has a dramatic structure. It unfolds like a detective story, a sort of whodunnit. Something is wrong. There is a quality problem, and we’re not sure who or what is responsible. One person, Arthur Moreno, looks very guilty (probably too obviously guilty), but as we dig into the situation, there are many more possibilities. We spend in-class time analyzing the data (there’s a bit of math, so it covers that base, too) to determine which hypotheses are best supported by the data. And, realistically, the data doesn’t support any of the hypotheses perfectly, just some of them more than others. Also, there’s a plot twist at the end (I won’t reveal it, but here’s a hint: Arthur Moreno isn’t nearly the biggest problem in the final analysis). I have had students tell me the surprising realization at the end of the discussion gives them ‘goosebumps.’

Finally, through the unexpected plot twist, it imparts what I call a ‘wisdom lesson’ to young managers: not to be too sure of themselves and to regard the experiences of others, especially experts out on the factory floor, with great seriousness.”

4. Lincoln Electric Co.

Karin Schnarr, Assistant Professor of Policy, Wilfrid Laurier University

“As a strategy professor, my favorite case to teach is the classic 1975 Harvard case Lincoln Electric Co. by Norman Berg.

I use it to demonstrate to students the theory linkage between strategy and organizational structure, management processes, and leadership behavior.

This case may be an odd choice for a favorite. It occurs decades before my students were born. It is pages longer than we are told students are now willing to read. It is about manufacturing arc welding equipment in Cleveland, Ohio—a hard sell for a Canadian business classroom.

Yet, I have never come across a case that so perfectly illustrates what I want students to learn about how a company can be designed from an organizational perspective to successfully implement its strategy.

And in a time where so much focus continues to be on how to maximize shareholder value, it is refreshing to be able to discuss a publicly-traded company that is successfully pursuing a strategy that provides a fair value to shareholders while distributing value to employees through a large bonus pool, as well as value to customers by continually lowering prices.

However, to make the case resonate with today’s students, I work to make it relevant to the contemporary business environment. I link the case to multimedia clips about Lincoln Electric’s current manufacturing practices, processes, and leadership practices. My students can then see that a model that has been in place for generations is still viable and highly successful, even in our very different competitive situation.”

5. Pal’s Sudden Service—Scaling an Organizational Model to Drive Growth

Gary Pisano, Professor of Business Administration, Harvard Business School

“My favorite case to teach these days is Pal’s Sudden Service—Scaling an Organizational Model to Drive Growth .

I love teaching this case for three reasons:

1. It demonstrates how a company in a super-tough, highly competitive business can do very well by focusing on creating unique operating capabilities. In theory, Pal’s should have no chance against behemoths like McDonalds or Wendy’s—but it thrives because it has built a unique operating system. It’s a great example of a strategic approach to operations in action.

2. The case shows how a strategic approach to human resource and talent development at all levels really matters. This company competes in an industry not known for engaging its front-line workers. The case shows how engaging these workers can really pay off.

3. Finally, Pal’s is really unusual in its approach to growth. Most companies set growth goals (usually arbitrary ones) and then try to figure out how to ‘backfill’ the human resource and talent management gaps. They trust you can always find someone to do the job. Pal’s tackles the growth problem completely the other way around. They rigorously select and train their future managers. Only when they have a manager ready to take on their own store do they open a new one. They pace their growth off their capacity to develop talent. I find this really fascinating and so do the students I teach this case to.”

6. The United States Air Force: ‘Chaos’ in the 99th Reconnaissance Squadron

Francesca Gino, Professor of Business Administration, Harvard Business School

“My favorite case to teach is The United States Air Force: ‘Chaos’ in the 99th Reconnaissance Squadron .

The case surprises students because it is about a leader, known in the unit by the nickname Chaos , who inspired his squadron to be innovative and to change in a culture that is all about not rocking the boat, and where there is a deep sense that rules should simply be followed.

For years, I studied ‘rebels,’ people who do not accept the status quo; rather, they approach work with curiosity and produce positive change in their organizations. Chaos is a rebel leader who got the level of cultural change right. Many of the leaders I’ve met over the years complain about the ‘corporate culture,’ or at least point to clear weaknesses of it; but then they throw their hands up in the air and forget about changing what they can.

Chaos is different—he didn’t go after the ‘Air Force’ culture. That would be like boiling the ocean.

Instead, he focused on his unit of control and command: The 99th squadron. He focused on enabling that group to do what it needed to do within the confines of the bigger Air Force culture. In the process, he inspired everyone on his team to be the best they can be at work.

The case leaves the classroom buzzing and inspired to take action.”

7. Warren E. Buffett, 2015

Robert F. Bruner, Professor of Business Administration, Darden School of Business

“I love teaching Warren E. Buffett, 2015 because it energizes, exercises, and surprises students.

Buffett looms large in the business firmament and therefore attracts anyone who is eager to learn his secrets for successful investing. This generates the kind of energy that helps to break the ice among students and instructors early in a course and to lay the groundwork for good case discussion practices.

Studying Buffett’s approach to investing helps to introduce and exercise important themes that will resonate throughout a course. The case challenges students to define for themselves what it means to create value. The case discussion can easily be tailored for novices or for more advanced students.

Either way, this is not hero worship: The case affords a critical examination of the financial performance of Buffett’s firm, Berkshire Hathaway, and reveals both triumphs and stumbles. Most importantly, students can critique the purported benefits of Buffett’s conglomeration strategy and the sustainability of his investment record as the size of the firm grows very large.

By the end of the class session, students seem surprised with what they have discovered. They buzz over the paradoxes in Buffett’s philosophy and performance record. And they come away with sober respect for Buffett’s acumen and for the challenges of creating value for investors.

Surely, such sobriety is a meta-message for any mastery of finance.”

More Educator Favorites

Emily Michelle David is an assistant professor of management at China Europe International Business School (CEIBS). Her current research focuses on discovering how to make workplaces more welcoming for people of all backgrounds and personality profiles to maximize performance and avoid employee burnout. David’s work has been published in a number of scholarly journals, and she has worked as an in-house researcher at both NASA and the M.D. Anderson Cancer Center.

Devin Shanthikumar is an associate professor and the accounting area coordinator at UCI Paul Merage School of Business. She teaches undergraduate, MBA, and executive-level courses in managerial accounting. Shanthikumar previously served on the faculty at Harvard Business School, where she taught both financial accounting and managerial accounting for MBAs, and wrote cases that are used in accounting courses across the country.

Robert D. Austin is a professor of information systems at Ivey Business School and an affiliated faculty member at Harvard Medical School. He has published widely, authoring nine books, more than 50 cases and notes, three Harvard online products, and two popular massive open online courses (MOOCs) running on the Coursera platform.

Karin Schnarr is an assistant professor of policy and the director of the Bachelor of Business Administration (BBA) program at the Lazaridis School of Business & Economics at Wilfrid Laurier University in Waterloo, Ontario, Canada where she teaches strategic management at the undergraduate, graduate, and executive levels. Schnarr has published several award-winning and best-selling cases and regularly presents at international conferences on case writing and scholarship.

Gary P. Pisano is the Harry E. Figgie, Jr. Professor of Business Administration and senior associate dean of faculty development at Harvard Business School, where he has been on the faculty since 1988. Pisano is an expert in the fields of technology and operations strategy, the management of innovation, and competitive strategy. His research and consulting experience span a range of industries including aerospace, biotechnology, pharmaceuticals, specialty chemicals, health care, nutrition, computers, software, telecommunications, and semiconductors.

Francesca Gino studies how people can have more productive, creative, and fulfilling lives. She is a professor at Harvard Business School and the author, most recently, of Rebel Talent: Why It Pays to Break the Rules at Work and in Life . Gino regularly gives keynote speeches, delivers corporate training programs, and serves in advisory roles for firms and not-for-profit organizations across the globe.

Robert F. Bruner is a university professor at the University of Virginia, distinguished professor of business administration, and dean emeritus of the Darden School of Business. He has also held visiting appointments at Harvard and Columbia universities in the United States, at INSEAD in France, and at IESE in Spain. He is the author, co-author, or editor of more than 20 books on finance, management, and teaching. Currently, he teaches and writes in finance and management.

Related Articles

We use cookies to understand how you use our site and to improve your experience, including personalizing content. Learn More . By continuing to use our site, you accept our use of cookies and revised Privacy Policy .

Move fast, think slow: How financial services can strike a balance with GenAI

Take on Tomorrow @ the World Economic Forum in Davos: Energy demand

PwC’s Global Investor Survey 2023

Climate risk, resilience and adaptation

Business transformation

Sustainability assurance

The Leadership Agenda

PwC and TED

Built to give leaders the right tools to make tough decisions

The New Equation

PwC’s Global Annual Review

Committing to Net Zero

The Solvers Challenge

Loading Results

No Match Found

Corporate finance case studies

{{filtercontent.facetedtitle}}.

{{item.publishDate}}

{{item.title}}

{{item.text}}

Let us be part of your success story

Reach out to start a conversation

David Brown

Partner, Global Corporate Finance Leader, PwC China

© 2017 - 2024 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

- Legal notices

- Cookie policy

- Legal disclaimer

- Terms and conditions

Top 40 Most Popular Case Studies of 2021

Two cases about Hertz claimed top spots in 2021's Top 40 Most Popular Case Studies

Two cases on the uses of debt and equity at Hertz claimed top spots in the CRDT’s (Case Research and Development Team) 2021 top 40 review of cases.

Hertz (A) took the top spot. The case details the financial structure of the rental car company through the end of 2019. Hertz (B), which ranked third in CRDT’s list, describes the company’s struggles during the early part of the COVID pandemic and its eventual need to enter Chapter 11 bankruptcy.

The success of the Hertz cases was unprecedented for the top 40 list. Usually, cases take a number of years to gain popularity, but the Hertz cases claimed top spots in their first year of release. Hertz (A) also became the first ‘cooked’ case to top the annual review, as all of the other winners had been web-based ‘raw’ cases.

Besides introducing students to the complicated financing required to maintain an enormous fleet of cars, the Hertz cases also expanded the diversity of case protagonists. Kathyrn Marinello was the CEO of Hertz during this period and the CFO, Jamere Jackson is black.

Sandwiched between the two Hertz cases, Coffee 2016, a perennial best seller, finished second. “Glory, Glory, Man United!” a case about an English football team’s IPO made a surprise move to number four. Cases on search fund boards, the future of malls, Norway’s Sovereign Wealth fund, Prodigy Finance, the Mayo Clinic, and Cadbury rounded out the top ten.

Other year-end data for 2021 showed:

- Online “raw” case usage remained steady as compared to 2020 with over 35K users from 170 countries and all 50 U.S. states interacting with 196 cases.

- Fifty four percent of raw case users came from outside the U.S..

- The Yale School of Management (SOM) case study directory pages received over 160K page views from 177 countries with approximately a third originating in India followed by the U.S. and the Philippines.

- Twenty-six of the cases in the list are raw cases.

- A third of the cases feature a woman protagonist.

- Orders for Yale SOM case studies increased by almost 50% compared to 2020.

- The top 40 cases were supervised by 19 different Yale SOM faculty members, several supervising multiple cases.

CRDT compiled the Top 40 list by combining data from its case store, Google Analytics, and other measures of interest and adoption.

All of this year’s Top 40 cases are available for purchase from the Yale Management Media store .

And the Top 40 cases studies of 2021 are:

1. Hertz Global Holdings (A): Uses of Debt and Equity

2. Coffee 2016

3. Hertz Global Holdings (B): Uses of Debt and Equity 2020

4. Glory, Glory Man United!

5. Search Fund Company Boards: How CEOs Can Build Boards to Help Them Thrive

6. The Future of Malls: Was Decline Inevitable?

7. Strategy for Norway's Pension Fund Global

8. Prodigy Finance

9. Design at Mayo

10. Cadbury

11. City Hospital Emergency Room

13. Volkswagen

14. Marina Bay Sands

15. Shake Shack IPO

16. Mastercard

17. Netflix

18. Ant Financial

19. AXA: Creating the New CR Metrics

20. IBM Corporate Service Corps

21. Business Leadership in South Africa's 1994 Reforms

22. Alternative Meat Industry

23. Children's Premier

24. Khalil Tawil and Umi (A)

25. Palm Oil 2016

26. Teach For All: Designing a Global Network

27. What's Next? Search Fund Entrepreneurs Reflect on Life After Exit

28. Searching for a Search Fund Structure: A Student Takes a Tour of Various Options

30. Project Sammaan

31. Commonfund ESG

32. Polaroid

33. Connecticut Green Bank 2018: After the Raid

34. FieldFresh Foods

35. The Alibaba Group

36. 360 State Street: Real Options

37. Herman Miller

38. AgBiome

39. Nathan Cummings Foundation

40. Toyota 2010

- Browse All Articles

- Newsletter Sign-Up

FinancingandLoans →

No results found in working knowledge.

- Were any results found in one of the other content buckets on the left?

- Try removing some search filters.

- Use different search filters.

Asking the better questions that unlock new answers to the working world's most complex issues.

Trending topics

AI insights

EY podcasts

EY webcasts

Operations leaders

Technology leaders

Marketing and growth leaders

Cybersecurity and privacy leaders

Risk leaders

EY Center for Board Matters

EY helps clients create long-term value for all stakeholders. Enabled by data and technology, our services and solutions provide trust through assurance and help clients transform, grow and operate.

Artificial Intelligence (AI)

Strategy, transaction and transformation consulting

Technology transformation

Tax function operations

Climate change and sustainability services

EY Ecosystems

Supply chain and operations

EY Partner Ecosystem

Explore Services

We bring together extraordinary people, like you, to build a better working world.

Experienced professionals

MBA and advanced-degree students

Student and entry level programs

Contract workers

EY-Parthenon careers

Discover how EY insights and services are helping to reframe the future of your industry.

Case studies

Energy and resources

How data analytics can strengthen supply chain performance

13-Jul-2023 Ben Williams

How Takeda harnessed the power of the metaverse for positive human impact

26-Jun-2023 Edwina Fitzmaurice

Banking and Capital Markets

How cutting back infused higher quality in transaction monitoring

11-Jul-2023 Ron V. Giammarco

At EY, our purpose is building a better working world. The insights and services we provide help to create long-term value for clients, people and society, and to build trust in the capital markets.

EY is now carbon negative

19-Sep-2022 Carmine Di Sibio

Our commitment to audit quality

13-Nov-2023 Julie A. Boland

No results have been found

Recent Searches

BEPS 2.0: as policies evolve, engagement is key

It remains to be seen whether the US will align its tax law with the OECD/G20’s global BEPS 2.0 rules. MNEs will feel the impact in 2024. Learn more.

How GenAI strategy can transform innovation

Companies considering or investing in a transformative GenAI strategy should tie generative artificial intelligence use cases to revenue, cost and expense. Learn more

Top five private equity trends for 2024

Read about the five key trends private equity firms will emphasize in 2024 as they create value

Select your location

close expand_more

Banking & Capital Markets

The bank of the future will integrate disruptive technologies with an ecosystem of partners to transform their business and achieve growth.

Disruption is creating opportunities and challenges for global banks. While the risk and regulatory protection agenda remains a major focus, banks must also address financial performance and heightened customer and investor expectations, as they reshape and optimize operational and business models to deliver sustainable returns. Innovation and business-led transformation will be critical for future growth. To remain competitive and relevant, every bank must embrace disruption and strategically build a better ecosystem — not a bigger bank.

Our worldwide team of industry-focused assurance, tax, transaction and consulting professionals integrates sector knowledge and technical experience. We work with clients to navigate digital innovation, new business models and ecosystem partnerships, helping banks become the nimble, responsive organizations that customers demand.

Five priorities for harnessing the power of GenAI in banking</p> "> Five priorities for harnessing the power of GenAI in banking

What to expect from global financial services in 2024 — Americas and EMEIA

In this webcast for Americas and EMEIA audiences, the EY Global Regulatory Network will discuss the direction of travel for regulators across key areas and how to prepare for what's coming.

Our latest thinking on Banking & Capital Markets

Can core platform modernization position a bank for future success?

Case study: how one regional bank used core platform modernization to build a strong foundation for future profitability.

The case for a modern transaction banking platform

The evolution of corporate treasury management needs presents an opportunity for corporate banks. Learn from an industry approach.

How to transition from a tactical to strategic adoption of ISO 20022

With ISO 20022 adoption lagging amid competing global deadlines, a successful migration may hinge on changing from a tactical to a strategic mindset.

How Gen Z’s preference for digital is changing the payments landscape

EY survey shows Gen Z embraces simple, seamless payment methods. Learn more.

How can financial institutions modernize their fair-lending practices?

FIs that disregard fair banking are lagging behind FIs that enhance compliance procedures, lending models and data analytics to become more compliant. Read more.

Digital identity opportunities in financial services

Exploring the policy and regulatory trends shaping digital identity and opportunities for financial services companies in a changing payment landscape.

Explore our Banking & Capital Markets case studies

Impacts of Central Clearing of US Treasuries and Repo

In this webcast, panelists will discuss key themes and high-level requirements of the US Treasury and repo central clearing rules.

Using AI to augment pricing intelligence for banks

How an AI-powered digital tool, Smart Advisor (SA), helped one bank deliver better client service while maximizing value creation.

How a global FinTech captured growth in the SME segment

A global Fintech captured growth in an opportunistic SME segment with a differentiated, holistic strategy. Learn more in this case study.

Using AI to improve a bank’s agent effectiveness

Leveraging the power of AI and machine learning, one bank mined sales agents’ calls for performance-boosting insights. Learn more in this case study.

After cloud migration, investment bank sees potential for big dividends

A leading investment bank sought to move vital assets to the clouds by building an experienced, cross-functional team. Find out how.

How digital transformation is redesigning trade finance

Banks that adopt an agile, design-based approach to digital transformation can boost the success of their trade finance functions.

How to transform product development to outperform the competition

EY Nexus is a cloud-based platform offering access to the most advanced technologies to launch new products, businesses and services.

How EY can help

Capital Markets Services

Know how our Capital Markets consulting team can help your business grow, manage costs and meet regulatory requirements.

Consumer banking and wealth services

EY consumer banking and wealth technology solutions are designed to drive operational excellence and profitable growth. Learn more.

Corporate, Commercial and SME Banking services

Our Corporate, Commercial and SME (CCSB) Banking services team can help your business navigate through rising market expectation. Learn more.

Cost transformation

EY cost transformation teams help banks to optimize profits and fund transformation. Find out more.

Consumer lending services

Our consumer lending team can help navigate the complexities of unique lending propositions. Find out how.

EY Nexus for Banking

A transformative solution that accelerates innovation, unlocks value in your ecosystem, and powers frictionless business. Learn more.

Finance transformation

We help clients transform finance functions to be a strategic business partner for the business via value creation and controllership activities.

EY Financial Crime solutions

Our skilled teams, operational efficiencies enabled by innovative technology and flexible global delivery service centers can help you manage financial crime risk in a cost-effective, sustainable way.

Financial services risk management

Discover how EY can help the banking & capital markets, insurance, wealth & asset management and private equity sectors tackle the challenges of risk management.

IBOR transition services

EY helps global institutions prepare for the imminent transition away from Interbank Offered Rates (IBORs) to Alternate Reference Rates (ARRs). We also play a leading role in supporting regulators, trade associations and others to increase awareness and education.

Open banking services

Our open banking professionals can help your business maintain a trusted and secure open banking ecosystem while managing its risks. Learn more.

Payment services

Our payments professionals can help your business enhance innovation, drive growth and improve performance. Find out more.

Third-party risk management services

Discover how EY's Third Party Risk Management team can enable your business to make better decisions about the third parties they choose to work with.

Direct to your inbox

Stay up to date with our Editor‘s picks newsletter.

The Banking & Capital Markets team

Enjoys traveling with family, and coaching his daughters’ basketball and soccer teams. Enjoys running and playing basketball and golf.

Lee Ann Lednik

People-focused leader committed to building trust and transparency amid increasing complexity. Passionate working mom of three. Aspiring photographer. Avid sports fan.

David Kadio-Morokro

Passionate about technology, innovation, and leading EY people to solve clients’ most challenging problems.

Heidi Boyle

Passionate about helping people thrive in the workplace and creating a sense of belonging for all. Writer. Musician. Cooking enthusiast.

Seasoned financial services professional. Resides in Massachusetts with her husband and three children.

Kellen Maia de Sá

Collaborator and problem-solver with the desire to do the right thing. Leads efforts to help financial services clients with the disruption and impact of COVID-19.

Terry Cardew

Builds trust by helping banks solve business issues and stay competitive. Devoted husband. Father of six. Avid skier. NY Giants and Yankees fan. Supporter of The Fresh Air Fund and Lynne’s Kids.

- Connect with us

- Our locations

- Do Not Sell or Share My Personal Information

- Legal and privacy

- Accessibility

- Open Facebook profile

- Open X profile

- Open LinkedIn profile

- Open Youtube profile

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Case Related Links

Case studies collection.

Business Strategy Marketing Finance Human Resource Management IT and Systems Operations Economics Leadership and Entrepreneurship Project Management Business Ethics Corporate Governance Women Empowerment CSR and Sustainability Law Business Environment Enterprise Risk Management Insurance Innovation Miscellaneous Business Reports Multimedia Case Studies Cases in Other Languages Simplified Case Studies

Short Case Studies

Business Ethics Business Environment Business Strategy Consumer Behavior Human Resource Management Industrial Marketing International Marketing IT and Systems Marketing Communications Marketing Management Miscellaneous Operations Sales and Distribution Management Services Marketing More Short Case Studies >

- Work & Careers

- Life & Arts

- Currently reading: Business school teaching case study: can green hydrogen’s potential be realised?

- Business school teaching case study: how electric vehicles pose tricky trade dilemmas

- Business school teaching case study: is private equity responsible for child labour violations?

Business school teaching case study: can green hydrogen’s potential be realised?

- Business school teaching case study: can green hydrogen’s potential be realised? on x (opens in a new window)

- Business school teaching case study: can green hydrogen’s potential be realised? on facebook (opens in a new window)

- Business school teaching case study: can green hydrogen’s potential be realised? on linkedin (opens in a new window)

- Business school teaching case study: can green hydrogen’s potential be realised? on whatsapp (opens in a new window)

Jennifer Howard-Grenville and Ujjwal Pandey

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

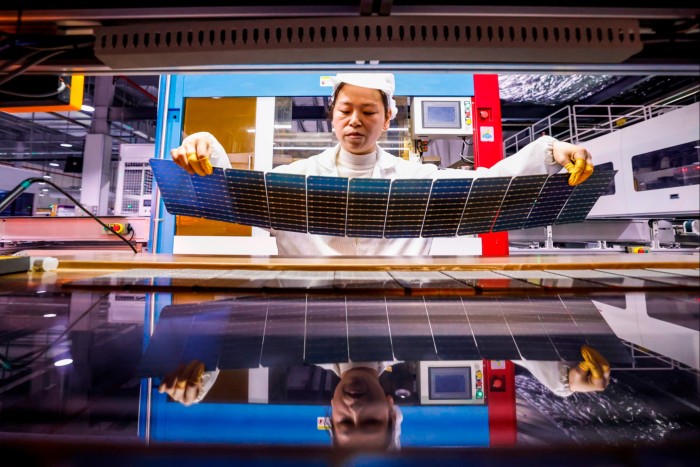

Hydrogen is often hyped as the “Swiss army knife” of the energy transition because of its potential versatility in decarbonising fossil fuel-intensive energy production and industries. Making use of that versatility, however, will require hydrogen producers and distributors to cut costs, manage technology risks, and obtain support from policymakers.

To cut carbon dioxide emissions, hydrogen production must shift from its current reliance on fossil fuels. The most common method yields “grey hydrogen”, made from natural gas but without emissions capture. “Blue hydrogen,” which is also made from natural gas but with the associated carbon emissions captured and stored, is favourable.

But “green hydrogen” uses renewable energy sources, including wind and solar, to split water into hydrogen and oxygen via electrolysis. And, because there are no carbon emissions during production or combustion, green hydrogen can help to decarbonise energy generation as well as industry sectors — such as steel, chemicals and transport — that rely heavily on fossil fuels.

Ultimately, though, the promise of green hydrogen will hinge on how businesses and policymakers weigh several questions, trade-offs, and potential long-term consequences. We know from previous innovations that progress can be far from straightforward.

Wind power, for example, is a mature renewable energy technology and a key enabler in green hydrogen production, but it suffers vulnerabilities on several fronts. Even Denmark’s Ørsted — the world’s largest developer of offshore wind power and a beacon for renewable energy — recently said it was struggling to deliver new offshore wind projects profitably in the UK.

Generally, the challenge arises from interdependencies between macroeconomic conditions — such as energy costs and interest rates — and business decision-making around investments. In the case of Ørsted, it said the escalating costs of turbines, labour, and financing have exceeded the inflation-linked fixed price for electricity set by regulators.

Business leaders will also need to steer through uncertainties — such as market demand, technological risks, regulatory ambiguity, and investment risks — as they seek to incorporate green hydrogen.

Test yourself

This is the third in a series of monthly business school-style teaching case studies devoted to responsible-business dilemmas faced by organisations. Read the piece and FT articles suggested at the end before considering the questions raised.

About the authors: Jennifer Howard-Grenville is Diageo professor of organisation studies at Cambridge Judge Business School; Ujjwal Pandey is an MBA candidate at Cambridge Judge and a former consultant at McKinsey.

The series forms part of a wide-ranging collection of FT ‘instant teaching case studies ’ that explore business challenges.

Two factors could help business leaders gain more clarity.

The first factor will be where, and how quickly, costs fall and enable the necessary increase to large-scale production. For instance, the cost of the electrolysers needed to split water into hydrogen and oxygen remains high because levels of production are too low. These costs and slow progress in expanding the availability and affordability of renewable energy sources have made green hydrogen much more expensive than grey hydrogen, so far — currently, two to three times the cost.

The FT’s Lex column calculated last year that a net zero energy system would create global demand for hydrogen of 500mn tonnes, annually, by 2050 — which would require an investment of $20tn. However, only $29bn had been committed by potential investors, Lex noted, despite some 1,000 new projects being announced globally and estimated to require total investment of $320bn.

Solar power faced similar challenges a decade ago. Thanks to low-cost manufacturing in China and supportive government policies, the sector has grown and is, within a very few years , expected to surpass gas-fired power plant installed capacity, globally. Green hydrogen requires a similar concerted effort. With the right policies and technological improvements, the cost of green hydrogen could fall below the cost of grey hydrogen in the next decade, enabling widespread adoption of the former.

Countries around the world are introducing new and varied incentives to address this gap between the expected demand and supply of green hydrogen. In Canada, for instance, Belgium’s Tree Energy Solutions plans to build a $4bn plant in Quebec, to produce synthetic natural gas from green hydrogen and captured carbon, attracted partly by a C$17.7bn ($12.8bn) tax credit and the availability of hydropower.

Such moves sound like good news for champions of green hydrogen, but companies still need to manage the short-term risks from potential policy and energy price swings. The US Inflation Reduction Act, which offers tax credits of up to $3 per kilogramme for producing low-carbon hydrogen, has already brought in limits , and may not survive a change of government.

Against such a backdrop, how should companies such as Hystar — a Norwegian maker of electrolysers already looking to expand capacity from 50 megawatts to 4 gigawatts a year in Europe — decide where and when to open a North American production facility?

The second factor that will shape hydrogen’s future is how and where it is adopted across different industries. Will it be central to the energy sector, where it can be used to produce synthetic fuels, or to help store the energy generated by intermittent renewables, such as wind and solar? Or will it find its best use in hard-to-abate sectors — so-called because cutting their fossil fuel use, and their CO₂ emissions, is difficult — such as aviation and steelmaking?

Steel producers are already seeking to pivot to hydrogen, both as an energy source and to replace the use of coal in reducing iron ore. In a bold development in Sweden, H2 Green Steel says it plans to decarbonise by incorporating hydrogen in both these ways, targeting 2.5mn tonnes of green steel production annually .

Meanwhile, the global aviation industry is exploring the use of hydrogen to replace petroleum-based aviation fuels and in fuel cell technologies that transform hydrogen into electricity. In January 2023, for instance, Anglo-US start-up ZeroAvia conducted a successful test flight of a hydrogen fuel cell-powered aircraft.

The path to widespread adoption, and the transformation required for hydrogen’s range of potential applications, will rely heavily on who invests, where and how. Backers have to be willing to pay a higher initial price to secure and build a green hydrogen supply in the early phases of their investment.

It will also depend on how other technologies evolve. No industry is looking only to green hydrogen to achieve their decarbonisation aims. Other, more mature technologies — such as battery storage for renewable energy — may instead dominate, leaving green hydrogen to fulfil niche applications that can bear high costs.

As with any transition, there will be unintended consequences. Natural resources (sun, wind, hydropower) and other assets (storage, distribution, shipping) that support the green hydrogen economy are unevenly distributed around the globe. There will be new exporters — countries with abundant renewables in the form of sun, wind or hydropower, such as Australia or some African countries — and new importers, such as Germany, with existing industry that relies on hydrogen but has relatively low levels of renewable energy sourced domestically.

How will the associated social and environmental costs be borne, and how will the economic and development benefits be shared? Tackling climate change through decarbonisation is urgent and essential, but there are also trade-offs and long-term consequences to the choices made today.

Questions for discussion

Lex in depth: the staggering cost of a green hydrogen economy

How Germany’s steelmakers plan to go green

Hydrogen-electric aircraft start-up secures UK Infrastructure Bank backing

Aviation start-ups test potential of green hydrogen

Consider these questions:

Are the trajectories for cost/scale-up of other renewable energy technologies (eg solar, wind) applicable to green hydrogen? Are there features of the current economic, policy, and business landscape that point to certain directions for green hydrogen’s development and application?

Take the perspective of someone from a key industry that is part of, or will be affected by, the development of green hydrogen. How should you think about the technology and business opportunities and risks in the near term, and longer term? How might you retain flexibility while still participating in these key shifts?

Solving one problem often creates or obscures new ones. For example, many technologies that decarbonise (such as electric vehicles) have other impacts (such as heavy reliance on certain minerals and materials). How should those participating in the emerging green hydrogen economy anticipate, and address, potential environmental and social impacts? Can we learn from energy transitions of the past?

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here .

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here

Promoted Content

Explore the series.

Follow the topics in this article

- Carbon footprint Add to myFT

- Climate change Add to myFT

- Renewable energy Add to myFT

- Environment Add to myFT

- Business school Add to myFT

International Edition

High School

Business finance series.

In the Business Finance Series events, participants will be challenged to perform management functions and tasks focusing on high-level financial and business planning, including collection and organization of data, development and use of reports, and analysis of data to make business decisions. Concepts include understanding the source and purpose of financial statements, the impact of management decisions on statements, and the analysis and interpretation of data for corporate planning.

Participants

Written entry page limit, appear before a judge, 2 role-plays, third role-play for finalists, interview time, sponsored by:.

Essential Elements

Related resources, business finance.

You are to assume the role of the senior accountant with FISHER INDUSTRIES. Your manager (judge) wants you to analyze a potential investment and determine issues that should be considered.

You are to assume the role of the accountant at COUNTY COURIER, a small logistics business in the region. The president of the company (judge) wants to know the current depreciation expense of the office building and your opinion on reclassification.

You are to assume the role of an accountant for RETAIL, INC. The president of the company (judge) has asked you to calculate and analyze net profit margins for the last three years and this current year.

The vice president of finance (judge) has hired you to perform an analysis and determine the payback period for a potential investment.

Become a DECA Insider

Get the latest news, important notifications, weekly case study and more delivered in your inbox with DECA Direct Weekly.

Become a DECA Insider

Get the latest news, important notifications, weekly case study and more delivered in your inbox.

DECA prepares emerging leaders and entrepreneurs in marketing, finance, hospitality and management in high schools and colleges around the globe.

Video Case Studies: PayPal Braintree offers cutting-edge functionality with proven reliability

PayPal Editorial Staff

April 18, 2024

As a subscription-based business, ensuring the continuity of the customer experience across all its brands is critical. Maintaining a customer’s desire to improve their health is key to their purchasing decision, so ease of checkout is paramount.

All in a single integration, PayPal Braintree enables Wellful to offer PayPal, Venmo, credit cards, and other alternative payment methods. Additional functions like network tokenization and real-time account updater help ensure secure transacting and up-to-date customer data.

We sat down with Wellful’s CTO Nitin Chaudhary and CEO Brandon Adcock to talk how the company sought a payment processor that could provide advanced technology and align with Wellful’s forward-looking approach. And with the ability to implement several payment methods quickly via a single integration.

Watch the testimonial videos to learn more about how a seamless checkout process removes any barriers that may dissuade their customers.