For IEEE Members

Ieee spectrum, follow ieee spectrum, support ieee spectrum, enjoy more free content and benefits by creating an account, saving articles to read later requires an ieee spectrum account, the institute content is only available for members, downloading full pdf issues is exclusive for ieee members, downloading this e-book is exclusive for ieee members, access to spectrum 's digital edition is exclusive for ieee members, following topics is a feature exclusive for ieee members, adding your response to an article requires an ieee spectrum account, create an account to access more content and features on ieee spectrum , including the ability to save articles to read later, download spectrum collections, and participate in conversations with readers and editors. for more exclusive content and features, consider joining ieee ., join the world’s largest professional organization devoted to engineering and applied sciences and get access to all of spectrum’s articles, archives, pdf downloads, and other benefits. learn more →, join the world’s largest professional organization devoted to engineering and applied sciences and get access to this e-book plus all of ieee spectrum’s articles, archives, pdf downloads, and other benefits. learn more →, access thousands of articles — completely free, create an account and get exclusive content and features: save articles, download collections, and talk to tech insiders — all free for full access and benefits, join ieee as a paying member., the story behind the blackberry case, a single filing with the u.s. patent and trademark office in 1991 has caused one of the largest patent disputes in recent memory, threatening to sever more than 3 million blackberry subscribers from their wireless e-mail service.

In 1991, 164 306 patent applications were filed with the U.S. Patent and Trademark Office (PTO). One was filed by Thomas Campana Jr. It, and the additional patents he ultimately received, would threaten the wireless e-mail industry 11 years later, when the BlackBerry system would be found to infringe Campana's patents. The ensuing tumult got so bad that at one point the U.S. Department of Justice intervened in court. The DOJ warned that disabling the service would harm the public, particularly since federal employees and even members of congress regularly use the wireless e-mailers, especially in emergencies.

Along the way were false reports of settlement, a second look at the Campana patents by the PTO, court decisions regarding whether that reexamination should have an effect on the pending litigation and the threat of an injunction, a first take on how certain aspects of U.S. patents affect activities conducted outside the United States, a decision regarding an important difference between patents for methods or processes and apparatuses or systems, and a hard lesson in the consequences of not adequately investigating a patent threat.

Let's take a closer look at what really happened in the infringement litigation, and learn how, in one possible scenario, a court could permanently shut down the BlackBerry system even if the Patent Office holds Campana's patents invalid.

The story begins on 20 May 1991. Campana filed a patent application for his idea to merge existing e-mail systems with radio-frequency wireless communication networks. Without the need for a computer connected to a landline, you'd be able to receive e-mail outside the office. The PTO granted the first patent on 25 July 1995, and that one ultimately spawned eight more.

In 1995, Research In Motion Ltd. (RIM) of Waterloo, Ont., Canada, was a pager company. But in the next few years, it would introduce its BlackBerry line of handheld wireless e-mail appliances and strike successful deals with various wireless carriers, quickly becoming a market leader. Campana was an electrical engineer, inventor, and entrepreneur. Interestingly, his first company, ESA Telecon Systems was a contract engineering concern supplying gear to pager companies. In 1992, he and his patent attorney formed Arlington, Va. firm NTP to patent and license Campana's inventions, then put the patents in NTP's name and brought in investors to cover litigation expenses.

Taking It to Court

NTP knew what it had in the patents: in a lawsuit, if even only a single infringement claim would withstand a validity challenge, the company would win. Combined, the Campana patents had over 2000 such claims. On 27 January 2000, NTP placed RIM on notice regarding six of the patents and offered a license. Charles Meyer, RIM's in-house attorney, talked with his staff and quickly (too quickly it later turned out) concluded there was no infringement.

When RIM refused to take a license, NTP filed suit during November of 2001 in Richmond, home of Virginia's Federal District Court. On this court's "rocket docket" things move fast: despite numerous RIM motions (most failed), a jury was impaneled within a year. After a 13-day trial, it found RIM guilty on 14 infringement claims represented in five NTP patents. Presiding Judge James Spencer said the case was not even close. Even before the verdict, he had summarily ruled that RIM infringed four claims across three patents.

Apart from the monetary damages, ultimately totaling $53.7 million, the biggest threat to RIM was an injunction, which could essentially shut down the BlackBerry system. To stave off that possibility, the company filed requests with the PTO for reexamination of the patents, moved for a new trial, filed an appeal, and moved to stay all court proceedings pending the reexamination. The odds were good (90 percent) that the Patent Office would take a second look but poor (12 percent) that it would strike all the claims.

The motion for a new trial didn't work and neither did the request to stay pending reexamination; but luckily for RIM, the appeal was reason enough to hold off on implementing the injunction until the Court of Appeals for the Federal Circuit in Washington, D.C. could review the rulings and verdict. That wouldn't be decided for some time. Meanwhile, RIM went to work on damage control. A finding of willful infringement could triple the jury's $34.4 million damage award and force RIM to pay NTP's attorney fees.

First RIM attempted to convince Judge Spencer that it had a good faith belief it hadn't infringed the patents. Citing the noninfringement conclusions of in-house attorney Meyer, RIM argued the infringement couldn't have been willful and thus enhanced damages weren't appropriate. Judge Spencer, however, found Meyer's opinions incompetent because they were based on insufficient information and lacking in objectivity, given that he worked for RIM. Spencer also found RIM's behavior during litigation to be egregious. Still, treble damages weren't warranted in his view since RIM didn't know about the patents when it developed the BlackBerry system. As a result, he enhanced the $33.4 million award by a factor of just 0.5 to $47 million.

For Spencer to award NTP the $5.25 million it spent on attorneys during litigation, he had to find the case exceptional (which he did given RIM's litigation behavior and limited investigation after receiving NTP's notice) and the fees reasonable. He held the fees were justified when shown that RIM's attorney bill in a single quarter amounted to $4.9 million. But because NTP filed suit claiming infringement of eight patents having a combined total of over 2400 claims, then later asserted only five patents and sixteen claims at trial, the judge cut 20 percent from the $5.25 million, for a total of $4.2 million.

Appealing the Decision

Now the only remaining procedures were the appeal and perhaps settlement. Although there was a chance the PTO might invalidate all the claims (it's happened before), RIM enjoined anyway, because the best it could hope for was a new trial--which might not be granted. And, remember, the judge had held the injunction against RIM in abeyance pending the appeal.

RIM filed its appeal on 29 August 2003, and on 14 December 2004 the Federal Circuit issued its first decision. Two months earlier, Campana had died of cancer, so he would never enjoy the damage award should the Federal Circuit side with NTP--which, indeed, the three judge panel largely did.

RIM moved for a rehearing but also pursued mediated settlement negotiations in front of a magistrate judge under Judge Spencer. In March of 2005, the company boldly announced a settlement whereby RIM would pay NTP $450 million. RIM's stock purportedly jumped $14 a share. NTP, however, declared there was no settlement. In response, RIM asked the Federal Circuit to stay the appeal and to have Judge Spencer decide this latest dispute. In a briefing on that issue, NTP asserted that RIM, once again, was simply attempting to avoid the consequences of infringement. The Federal Circuit refused RIM's request. Ultimately, in November of 2005, Spencer ruled there had been no settlement.

Interestingly, though, the Federal Circuit did agree to a rehearing of its earlier decision and issued a second decision in August of 2005. In that decision lies a fairly complex effect resulting from the confluence of U.S. patents and international law. The problem is that although BlackBerry devices are sold in the United States, RIM and its relay station for sending e-mail wirelessly are both located in Canada. In general, U.S. patents like NTP's do not extend to most activities conducted outside the United States. Moreover, the patents only covered complete systems and methods for wireless e-mail; not the BlackBerry device itself, which is only a component of the system.

NTP had made the problem even more complex by phrasing some of its patent claims as "system" type, covering the various components of a wireless e-mail structure (such as gateway switches and radio frequency transmission networks), while others were of the "method" type. Rather than listing components, method claims list steps associated with running a system, reciting action verbs like "transmitting."

The Federal Circuit held that RIM put the patented system into use in the United States (even though the relay is in Canada), but not the method, since the relay utilization doesn't occur in the States. In the United States, patent infringement takes place when the product in question is imported into, or sold in the country. But what if the invention is a method? How do you import or sell it? Difficult question. When a method is applied outside U.S. borders to make a product that is shipped into the country, there can be patent infringement--but data and information don't really constitute products under U.S. patent laws.

The result was that RIM didn't infringe NTP's six method-type claims but did infringe seven system-type claims. And because of Spencer's incorrect interpretation of system-type claims, the Federal Circuit remanded the case back to him to determine if RIM infringed three other NTP claims of that type.

No bonus points if you guess what RIM did next: it appealed this decision to the United States Supreme Court. That court rarely decides patent cases, though, and even RIM admitted, "review by the Supreme Court is generally uncommon". Once the case came back before Judge Spencer, RIM again moved to stay it. The company asked Spencer to place the litigation on hold since, by this point, the Patent Office had initially rejected some of NTP's claims. RIM asked the Supreme Court for a stay pending that body's decision on whether it would hear the appeal of the Federal Circuit's stand. The Justice Department was on RIM's side here: it asked Spencer to hold off on a final ruling because an injunction against the BlackBerry service could adversely impact public safety. These motions for stays were again denied. And on 23 January 2006, the Supreme Court turned down RIM's appeal.

Many possibilities remain, though: RIM and NTP could settle. Judge Spencer could grant a new trial given the Federal Circuit's remand concerning three of the system-type patent claims, but that's unlikely. The Patent Office could strike down all of NTP's claims and its decision could be upheld after the inevitable appeals. Or if NTP sues someone else, say one of RIM's competitors, that trial could invalidate the patent claims.

Quirks of Law

The last two results could produce an interesting outcome which, on first blush, might not seem too fair. Suppose there's no settlement and no retrial. The injunction issues. RIM pays the damages it owes to NTP, then appeals again and loses. The BlackBerry system is shut down. Later, the patents are eradicated either in court or by the Patent Office, and NTP loses all appeals regarding those decisions. The injunction against RIM still might not be lifted, and the company might not get its money back. Or RIM might settle and pay NTP to avoid the injunction but still not get its money back if the patents are later stricken.

How can a product be found to infringe a patent, sales be prohibited, and the company be ordered to pay damages, then not allowed to sell the product later when the patent is cancelled? The answer doesn't really concern a patent law quirk so much as one in civil law in general: trial courts do not determine if a patent claim is really valid. Instead, the other side must prove with clear and convincing evidence that the claim, presumed by law to be valid, is in fact not. If the challenger cannot satisfy that evidentiary standard, the court simply finds that the opposing party failed to meet its burden. The patent claim isn't found valid, it's found not invalid, which is what happened in RIM's case: the company attempted to convince both Judge Spencer and the Federal Circuit that NTP's patent claims were invalid, but failed.

Later, in another court, someone else can challenge a patent previously found not invalid and get a different result. Or a company can challenge the patent at the Patent Office (as did RIM) via the reexamination procedure. The Office makes no presumption of validity and either allows a claim to stand as is, with some modification, or not at all.

In a case where a patent is reexamined out of existence by the PTO (a fairly rare occurrence), a company previously found to have infringed that patent would have to go back to court and ask for a new trial to determine if the infringing product--previously enjoined--could now be sold. But courts have fairly wide latitude in deciding whether or not to grant a new trial on that basis.

Imagine then that RIM's BlackBerry system is shut down per an injunction granted by Judge Spencer, but the patent claims are all later stricken. Now anyone but RIM could offer a BlackBerry-type service without fear of infringing NTP's patents. Or suppose RIM and NTP settle, and the patents are later invalidated. RIM would likely not get its money back, yet no competitors would have lost anything.

Fair? Probably not. But we all take our chances with the system, and rarely is life fair. It is also probably a little unfair that Thomas Campana will never see the rewards of his intellectual labor.

The full BlackBerry litigation story is, of course, not over. It might end with a settlement soon or continue with appeals for years to come. Along the way an inventor died, millions have been spent on attorneys, and probably more than a few trees have fallen in the numerous motions filed by both parties. Judge Spencer keeps a docket report in his court, and in the BlackBerry litigation there are 426 separate entries as of this writing. In late 2005, he reportedly said, "I intend to move swiftly on this [case]. I've spend enough of my life and my time on NTP and RIM". Perhaps the only certainty is that no matter how swiftly he continues to move, he won't see the end of these combatants for some time.

About the Author

Kirk Teska is a partner in the Waltham, Mass. law firm of Iandiorio and Teska, which specializes in intellectual property law. He was a cochairman of the IEEE Entrepreneurs' Network and is a columnist for Mass High Tech and Lawyers Weekly. He has published articles in Trial Magazine, Journal of the Patent and Trademark Office Society, Mechanical Engineering, and IEEE Spectrum , among others. Prior to law school, he worked as an engineer for the U.S. Department of Defense Naval Weapons Station in Seal Beach, Calif.

- BlackBerry Wins Patent Infringement Case ›

- RIM to Pay NTP $612.5 Million To Settle BlackBerry Patent Suit - WSJ ›

- BlackBerry sues Facebook, WhatsApp, Instagram over patent ... ›

Related Stories

The cheesy charm of the clapper, new ar system alters sight, sound and touch, the mac is selling like never before thanks to the m1 chip, this article is for ieee members only. join ieee to access our full archive., membership includes:.

- Get unlimited access to IEEE Spectrum content

- Follow your favorite topics to create a personalized feed of IEEE Spectrum content

- Save Spectrum articles to read later

- Network with other technology professionals

- Establish a professional profile

- Create a group to share and collaborate on projects

- Discover IEEE events and activities

- Join and participate in discussions

Why did Blackberry Fail? [Case Study]

Pratyusha Srivastava

When recalling the old BlackBerry Era, the most magnificent and best premium smartphone around the world comes to our mind. Yes, we are all well aware of the popularity and craze of blackberry in the early 2000s. BlackBerry smartphones were considered as the possession for all those symbolizing high-status people, rich and popular professionals. Also, Blackberry promised the complete and strong security of its users' privacy.

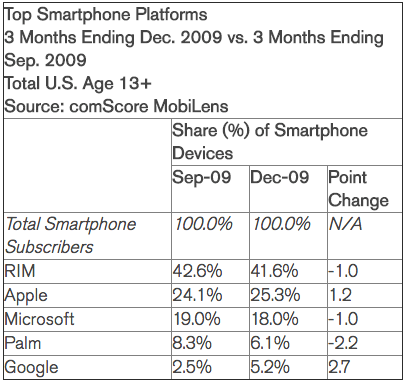

By the year 2009-2010, the BlackBerry smartphone gathered more than 85 million users who contributed highly to the success graph of this company. In fact, Blackberry owned over 50% of the US market share as well as 20% of the Global Market share at a single time.

However, by the year 2010, a sudden downfall occurred in the growth of BlackBerry. And soon by 2012, it came down to less than 5% of the market share . So, the question arises, How all of a sudden BlackBerry failed?

This came up to these points:

- The Reddit forum/wallstreetbets holds the dependence of the growth to great profit as the technology company is suffering for a long time. Rather of the fact that BlackBerry shares rise from day traders.

- Failed to strengthen the innovative features and resulted in being the example for the changes occurring in smartphones.

- Other companies are evolving with great fascinating and advanced features, while BlackBerry suffered majorly in offering new features for the convenience of customers.

As the era of advanced technology evolved, Blackberry experienced some major drawbacks which could not be settled. In this article, we'll get brief on how BlackBerry: Leader failed with no other choices. Let's get started!

History of Blackberry What led to the Failure of BlackBerry The Final Try by Blackberry FAQ

History of Blackberry

The company, Blackberry was established in 1984 with the production house for only modems and pagers. However, in 2000, BlackBerry launched its first-ever model of smartphone which was named BlackBerry 957 . It's the first model of smartphone that contains the features of surfing on the Internet and sending momentum emails.

In the 2000s , BlackBerry was known as the most standard and premium brand for great business executives and also, those who maintained their privacy and security.

However when the advanced tech company, Apple launched its first smartphone in 2007; BlackBerry experienced good competition in the market. Later, as the technology evolved and other companies like Google launched their phones, the substantial competition began.

With the exponential growth graph of BlackBerry, no one even wondered that this company would fail! But soon after the year 2010, its growth graph experienced a great downfall. And, that's where the end of BlackBerry's era begins .

What led to the Failure of BlackBerry

When BlackBerry reached its peak, it took several non-strategic and unreasonable steps that resulted in some big losses. Likewise, it raised its highest stock with the value of $230 which is now worth $4. BlackBerry, a company with enormous goals and plans, failed due to its raging in no time.

These are some points that led to the failure of BlackBerry.

Hardware Innovation

With the evolving technology, BlackBerry was considered to be overpricing on its average hardware system. Soon as Apple and Samsung launched their smartphones with a complete touch screen body.

Also, after the typing is done, the keyword would disappear giving you a huge space for other purposes. However, BlackBerry with its QWERTY keyboard lacked such features and became a big reason for BlackBerry to fail .

Nonetheless, Blackberry did not invest in making a complete touch screen body, instead, it kept making phones with the outer keyboard such as Blackberry Key 2 . That's why its sales dropped by a major number.

Targeting Audience

BlackBerry majorly focused on the richer section such as Celebrities, Businessmen and other rich administrators . They tend to carry BlackBerry showing their superiority. They used Blackberry because:

- Powerful end-to-end encryption security

- Advanced PDA that majorly helped in their business

- Email services

But, soon as iPhone sales increased, Blackberry lost its enormous target audience and importance in just a little period.

Furthermore, BlackBerry only focused on enterprise-level marketing and neglected the consumer portion. This also played a big role in its failure.

Research and Development

BlackBerry did not fail. It lacked innovation and advanced features because it has always been up with technology and supervisions. But the reason why BlackBerry failed is money.

BlackBerry's innovation and features came from Research & Development (R&D). But this required money and due to the decreased sales and other failures, it could not invest its money in the R&D .

That's why BlackBerry could not evolve from its basic potential. Later, BlackBerry's brand was sold by RIM to TCD (a Chinese firm).

Operating System

BlackBerry's operating system lacked some major features and technology. It does not allow the developers to build apps on an abundance scale. Other Operating systems give a free directory for developers to build apps accordingly.

However, Android and iOS allowed the customization of applications as they could be removed and added as per the convenience of users.

Therefore, developers were absolutely happy with Android and iOS. Still, BlackBerry kept on developing its own OS which was a disaster.

The Final Try by Blackberry

BlackBerry ultimately brought new smartphones with demanding features to regain its lost significance and customers. It launched Priv with the features like a dual-curved UHD display, pop-up widgets, 3GB RAM and snapdragon 808 CPU. But, this was too late. The phone was an absolute failure. Its product quality and features lacked some major technology.

BlackBerry did not imply adding new features or advanced OS and because of this, the potential consumers of BlackBerry shifted back to Android and iOS.

What caused the downfall of BlackBerry?

The reasons BlackBerry failed is that it didn't adapted new technology, lack of consumer insight and poor design which led to its demise.

When was Blackberry Founded?

Blackberry was founded in 1984.

When did BlackBerry go out of business?

Blackberry in 2016 decided to stop making its own phones, after years of failures.

Today, the production of BlackBerry smartphones has been completely shut down. It has turned back to software and mobile security solutions. BlackBerry succeeded in the market because of its advanced technology and left behind the less-evolved technology. Yet when it came to evolving BlackBerry's technology, it failed because of its incapability to judge and compete with the competition level of the market.

BlackBerry left some major points and examples for other tech companies that to survive in the technology world, you need to keep evolving your features and technology.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Payment Gateway- Razorpay

- Spy on your Competitors- Adspyder

- Manage your business smoothly- Google Workspace

The 12 Best Alternatives To ChatGPT

ChatGPT was launched by OpenAI in 2022 and registered 100 million users in mid-February of 2023. Here’s a look at how it progressed over the past few months. ChatGPT was released to the public on November 30, 2022. It quickly gained popularity, reaching 1 million users in December, 1.

AI for Creating Stellar YouTube Content

The world of YouTube content creation is constantly evolving. With millions of channels vying for attention, creators are perpetually seeking new ways to streamline workflows, boost engagement, and stand out from the crowd. This is where Artificial Intelligence (AI) steps in, offering a powerful suite of tools to empower YouTubers

How to Use ChatGPT for Content Creation?

People who know how to write and write daily, be it for fun, as a hobby, or for a living, always feel that there must be something to put your innate thoughts into words. They write letters, articles, records and minutes of meetings, and all these kinds of letters— joining

Exploring Job Losses Due to Artificial Intelligence

Artificial Intelligence (AI) is rapidly transforming industries and reshaping the future of work. While AI promises advancements in efficiency, productivity, and innovation, a looming concern shadows this progress: job displacement. Headlines often paint a bleak picture – robots taking over jobs, leaving humans unemployed, and scrambling for new opportunities. This article

- Search Search Please fill out this field.

History of BlackBerry

The game changer, corporate comeback, will blackberry survive, the bottom line.

- Company Profiles

- Tech Companies

BlackBerry: A Story of Constant Success and Failure

:max_bytes(150000):strip_icc():format(webp)/Top100FinancialAdvisors_MargueritaCheng_2-54d1bcc14e3042818cb44df9456919f2.jpg)

BlackBerry Limited ( BB ), known as Research in Motion (RIM) until January 2013, has a long history of extreme success and failure. It’s credited by many as creating the first smartphone. And at its peak in September 2011, there were 85 million BlackBerry subscribers worldwide.

But the rise of Google’s Android platform and Apple’s iOS caused it to decline in popularity by nearly three-quarters. BlackBerry’s stock price effectively tanked from highs of $147 to around $3 as of April 2024.

How did a high-flying revolutionary tech company get eclipsed so badly? A movie, released in Canada in May 2023, told the tale.

Key Takeaways

- BlackBerry pioneered handheld devices but has lost market share to larger rivals like Apple.

- The company, formerly known as Research in Motion, grew by leaps and bounds from 1999 to 2007, as its innovative product lines were well received.

- The launch of the touchscreen iPhone in 2007 triggered a dramatic shift away from BlackBerry handheld devices.

- Hopes for a turnaround have been dashed as the company grapples with intense competition from larger technology companies.

- BlackBerry has lost more than half of its market value in two years.

- “BlackBerry,” a movie about the company’s founders, premiered in Canada on May 12, 2023.

The pioneer in bringing email services to handheld mobiles, with its trademark QWERTY keyboard, BlackBerry became an instant darling of world leaders, corporate honchos, and the rich and famous alike. Indeed, owning a BlackBerry device was once a status symbol , and BlackBerry addiction was a prevalent condition.

The always-on, always-connected wireless world that allowed secure and reliable access to emails turned out to be very useful for businesses. The first prominent release from BlackBerry, the Inter@ctive Pager 950, was in 1998. It had a small-sized screen, keyboard buttons, and the iconic trackball that allowed seamless syncing and continuous access to corporate emails. It became an instant hit, and then there was no looking back.

In 1999, the company introduced the 850 pager, which supported “push email” from the Microsoft Corp. ( MSFT ) exchange server, and in 2000, BlackBerry launched the first smartphone, called the BlackBerry 957.

Attributed to increased use by enterprises and governments, RIM’s revenues grew by leaps and bounds from 1999 to 2001. The company continued to expand functionality in the BlackBerry Enterprise Server (BES) and BlackBerry OS. The golden period of 2001 to 2007 saw BlackBerry’s global expansion and the addition of new products to its portfolio. After successfully gaining a foothold in the enterprise market, BlackBerry expanded into the consumer market. The BlackBerry Pearl series was very successful, and subsequent releases of the Curve and Bold product lines were well received.

“BlackBerry,” the movie, tells the story of the founders who created the world’s first smartphone. The satirical history is loosely based on the book “Losing the Signal: The Untold Story Behind the Extraordinary Rise and Spectacular Fall of BlackBerry,” by Sean Silcoff and Jacquie McNish. It premiered in Canada on May 12, 2023.

BlackBerry’s stock price peaked at an all-time high of $147 in mid-2008. A year earlier, Apple Inc. ( AAPL ) introduced its iPhone—the first prominent touchscreen phone. BlackBerry ignored it initially, perceiving it to be an enhanced mobile phone with playful features targeted at younger consumers. However, iPhone was a huge hit—and this was the start of BlackBerry’s demise.

Not just aimed at individuals, the iPhone managed to attract business leaders, penetrating BlackBerry’s core market, which was soon flooded with many similar email-enabled smartphones from other manufacturers. Yet, BlackBerry managed to maintain its status as a “business email device.” People used to carry two phones: a BlackBerry for business and another personal phone.

BlackBerry introduced Storm in 2008, its first touchscreen phone to compete with the iPhone. But after high initial sales, complaints started pouring in about the device’s performance. This was the first time that investors, analysts , and the media started to worry about the business prospects of BlackBerry.

In 2009, RIM secured first place in Fortune’s 100 fastest-growing companies. In September 2010, Comscore reported RIM having the largest market share (37.3%) in the U.S. smartphone market. Its global user base stood at 41 million subscribers. Unfortunately, that was the peak of market penetration for RIM in the United States. After that, the company continued to lose ground to rival operating systems—the Apple iOS and Google’s ( GOOG ) Android —and was never able to make it back.

By November 2012, BlackBerry’s U.S. market share had dropped to just 7.3%, with Google and Apple claiming 53.7% and 35%, respectively. Despite declining U.S. sales, BlackBerry continued to have success globally. It reported 77 million users globally during the last quarter of 2012, demonstrating its success in global expansion.

Owing to these local losses vs. global success, the stock displayed high volatility . The worst year was 2011, as BlackBerry’s stock price tanked around 80% amid declining market share. Continued earnings losses resulted in further declines—most prominently the first-quarter loss in 2014 of $84 million, which led to a roughly 30% decline in the share price on the day after the announcement.

The high volatility in the stock is attributed to several comeback attempts, corporate developments, associated recommendations by analysts, and competitor developments. In April 2010, RIM acquired the real-time operating system QNX, which formed the basis of the BlackBerry Tablet OS. The BlackBerry Playbook tablet was introduced on the QNX platform. Unfortunately, it turned out to be a total failure due to its high price, limited features, and poor performance.

The next generation of BlackBerry phones were announced in 2011, but the eventual product—the BlackBerry 10— failed to catch on . Nonetheless, based on interim forecasts that the BlackBerry 10 would surpass sales predictions, the company’s stock saw an upswing of 14% in November 2012. By January 2013, the stock had risen around 50%, and the volatility continued.

Wide positive swings to the tune of +35% were observed a couple of times during the first half of 2014. Those were based on announcements of BlackBerry transforming from mobile devices to a mobile solutions company. Those plans yielded less-than-meaningful results.

Another swing came in January 2015, when it was reported that Samsung was interested in buying BlackBerry. This led to a 30% spike in the latter’s share price . However, the jump proved to be a short-term blip, as the stock resumed a downtrend through 2015 and 2016.

Enterprise software sales represent almost half of BlackBerry’s revenue in 2020.

Hopes for a dramatic turnaround at BlackBerry have been dashed repeatedly. The stock rallied to a closing high of $12.66 in early 2018—almost doubling value after two years of gains. Since then, however, the stock has lost more than half of its market value , as the company’s mobile business has been decimated by the competition and it has been forced to shift its focus its efforts toward other segments like enterprise software.

In its current iteration, BlackBerry Limited is a provider of cybersecurity and Internet of Things (IoT) services, having effectively given up on smartphones as a business. On April 3, 2024, the company issued fiscal year (FY) 2024 total revenue of $853 million, with IoT revenue of $815 million and cybersecurity revenue of $280 million. Q4 fiscal 2024 revenue for the company’s IoT business showed 25% year-over-year (YOY) revenue growth, according to BlackBerry.

It is possible, often even necessary, for a technology company to change its stripes. Google and Meta (formerly Facebook) ( META ) have blazed trails in that arena. BlackBerry, however, will not only have to morph but will also have to overcome its reputation as a failed smartphone maker. Time, as they say, will tell whether BlackBerry is up to these tasks. Stay tuned.

What Business Is BlackBerry in Now That It Has Stopped Making Smartphones?

Currently, BlackBerry Limited is primarily a provider of cybersecurity and Internet of Things (IoT) services. The company recently reported FY2024 total revenue of $853 million.

Why Did BlackBerry Smartphones Fail?

Competition, in a nutshell. The introduction of the Apple iPhone, which BlackBerry didn’t take seriously, caused a loss of market share that BlackBerry couldn’t recover from. More competitors entered the smartphone space, eventually crowding BlackBerry out.

When Was the BlackBerry Movie Out?

“BlackBerry,” which premiered across Canada on May 12, 2023, told the story of the three men who took an idea and turned it into the world’s first smartphone. The movie, described as more satire than history, is loosely based on the 2015 book “Losing the Signal: The Untold Story Behind the Extraordinary Rise and Spectacular Fall of BlackBerry.”

BlackBerry is an example of the big risks associated with the highly dynamic technology sector . None of the industry rankings, predictions, or recommendations seems to fit the BlackBerry stock play. Long-term investors have been burned, while only a few traders may have made money on the wide swings. Unless confirmed news of solid acquisition or partnership comes in, this stock will likely remain a pure trader ’s play.

BGR. “ BlackBerry Lost 4 Million Subscribers in Q1 Despite New Launches .”

Yahoo! Finance. “ BlackBerry Limited (BB): Summary .”

The Canadian Encyclopedia. “ Blackberry Limited .”

York University Computer Museum. “ Research in Motion Inter@ctive 950 Pager .”

National Museum of American History. “ Blackberry .”

Global News. “ ‘BlackBerry’ Filmmakers Toe the Line Between Fact and Fiction .”

Macrotrends. “ BlackBerry—25-Year Stock Price History | BB .”

Comscore. “ Comscore Reports September 2010 U.S. Mobile Subscriber Market Share .”

AnnualReports.com. “ RIM 2010 ,” Page 4 of PDF.

Comscore. “ Comscore Reports February 2013 U.S. Smartphone Subscriber Market Share .”

AnnualReports.com. “ Research in Motion Limited, Form 40-F ,” Page 7 (Page 14 of PDF).

Yahoo! Finance. “ BlackBerry Limited (BB): Historical Data .”

BlackBerry, via Internet Archive Wayback Machine. “ BlackBerry Reports First Quarter Fiscal 2014 Results ,” Page 1.

BlackBerry. “ BlackBerry Reports Fourth Quarter and Full Fiscal Year 2024 Results .”

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1036256804-6f03495f031246a6b1d86daa43df73ee.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Brought to you by:

The Rise and Fall of BlackBerry

By: Deborah Himsel, Andrew C. Inkpen

The launch of BlackBerry by Research in Motion (RIM) in 1999 laid the foundation for the development of smartphones. The next decade was a period of spectacular growth for RIM, making its two co-CEOs…

- Length: 10 page(s)

- Publication Date: Jun 1, 2017

- Discipline: Strategy

- Product #: TB0485-PDF-ENG

What's included:

- Teaching Note

- Educator Copy

$4.95 per student

degree granting course

$8.95 per student

non-degree granting course

Get access to this material, plus much more with a free Educator Account:

- Access to world-famous HBS cases

- Up to 60% off materials for your students

- Resources for teaching online

- Tips and reviews from other Educators

Already registered? Sign in

- Student Registration

- Non-Academic Registration

- Included Materials

The launch of BlackBerry by Research in Motion (RIM) in 1999 laid the foundation for the development of smartphones. The next decade was a period of spectacular growth for RIM, making its two co-CEOs billionaires. At the end of 2007 the company had a market capitalization of more than $60 billion. Sales peaked at almost $20 billion in 2011. In 2016, sales were $2.2 billion and the company had lost money for four straight years. With the market capitalization having fallen to $4 billion by August 2016, the survival of BlackBerry (the company changed its name from RIM to BlackBerry) was uncertain.

Learning Objectives

This case can be used for several teaching purposes. The case can be used to illustrate the process of innovation and the linkages between strategy, competitive advantage, and innovation. BlackBerry created a unique product and for a few years occupied a competitive position with no rivals. The company established a competitive advantage based on product differentiation and saw BlackBerry become one of the most recognizable and valuable global brands. Unfortunately, the initial success could not be sustained once competitors, and particularly Apple, entered the smartphone market. After many attempts to change its strategy, BlackBerry eventually was forced to exit the hardware market. In a marketing class the case could be used to illustrate the challenges of being a pioneer versus a follower. The case can also be used to focus on leadership and building a culture of adaptability and change, especially in a successful organization. Initially the yin and yang of Lazaridis and Balsillie's complementary approaches led to innovation and growth. Rapid growth, distraction from lawsuits and increased competition, highlighted a fundamental lack of strategy, vision, reactive leadership and hierarchical, undisciplined, siloed, arrogant organization culture. The case can also highlight some of the fundamental leadership differences between Lazaradis/Balsillie and Steve Jobs, especially as it relates to vision, customer focus and simplicity of message.

Jun 1, 2017

Discipline:

Thunderbird School of Global Management

TB0485-PDF-ENG

We use cookies to understand how you use our site and to improve your experience, including personalizing content. Learn More . By continuing to use our site, you accept our use of cookies and revised Privacy Policy .

A business journal from the Wharton School of the University of Pennsylvania

Knowledge at Wharton Podcast

Victim of success: the rise and fall of blackberry, december 15, 2015 • 18 min listen.

A new book by Jacquie McNish and Sean Silcoff looks at what went wrong with the iconic device that was once so beloved and addictive it was nicknamed “Crackberry.”

Though BlackBerry has less than 1% of the smartphone market share today, it once had more than 50%. The question is how such a successful company could fall so far. Journalists Jacquie McNish and Sean Silcoff provide many of the answers in their book, Losing the Signal: The Untold Story Behind the Extraordinary Rise and Spectacular Fall of BlackBerry.

Wharton marketing professor Americus Reed recently had an opportunity to talk with McNish about what we can learn from the rise and fall of BlackBerry.

An edited transcript of the conversation follows.

Americus Reed: I want to start off with some questions about what drew you to this topic. Tell us a little bit about why you wrote this book, Jacquie.

Jacquie McNish: It started with an investigation I did when I worked at The Globe and Mail here in Canada with my colleague Sean Silcoff. The great untold story in Canada in the technology sector globally was how the maker of something that we loved so much and that we were so addicted to — the BlackBerry – could fail so quickly. It was an enduring mystery that was very hard for any business journalist to crack: [Research in Motion (RIM), was a] very, very insular company based in Waterloo, Ontario, outside of Toronto, [with] a very small business feel to it despite its global reach. We spent a lot of time trying to crack it.

We were finally able to talk to some of the principals and did an investigation for the Globe and Mail that led to a wonderful agent in Washington, Howard Yoon, calling up and saying, “You guys should write a book,” and that’s how it all began.

Reed: What do you think sets this book apart?… Tell us a little bit about why this particular book should be on people’s must-read lists.

McNish: We live in an era of constant disruption. No matter where you are, there’s an algorithm or a new way of doing something that’s more efficient, that challenges the old way of doing things. We will look back on this period as being as significant socially and economically as the industrial revolution.

“In this era of disruption, the mother of disruption stories is the BlackBerry story.”

In this era of disruption, the mother of disruption stories is the BlackBerry story. A company that introduced the BlackBerry in 1998 became a $20 billion company from nothing in less than a decade. Then four or five years later, it was back down to a $3 billion company, gasping for breath. It’s not only a disruption story; it is a story of the speed of the technology race today. There has not been a technology that has so quickly penetrated the consumer market as the smartphones did with the BlackBerry being the innovator. Not since the television in the 1950s. We’ve never gone from zero to more than 50% of the consumer market so quickly.

Reed: When I look back on the heyday of the BlackBerry brand, I’m reminded of those images of how deeply it was connected to the business community. In other words, it was seen as a symbol as those who had made it professionally. I remember very vividly our President at the time holding up his BlackBerry and saying, “I cannot live without my BlackBerry,” very much in line with what you were describing with respect to this iconic rise of such a great brand. Tell us a little bit about the genesis of this rise. What were the key business moments that precipitated this rise to greatness for that particular brand?

McNish: Timing is everything, and coming from an outside perspective is very important in innovation. At the time, in the 1990s, a lot of people were racing in the handheld device space. I remember when the Palm was the “It” thing. That only synced your calendars and your contacts with your desktop, but it was the hot thing then. The other hot thing was Motorola’s Tango, the one-way pager that you could [use to] send a few messages … but they were very distant and very unreliable because of their big network.

You had IBM trying to do stuff. You had Ericsson as well strapping … a very successful cell phone onto a very tiny keyboard. If you had fingers the size of a squirrel, you might be able to tap onto it. So all these people were racing to get into that space, essentially with products they already had. Even Apple tried with the Apple Newton with the stylus; that was a disaster because the software just wasn’t right.

BlackBerry looked at this market and came at it from a very different point of view, and this is the key thing about successful innovation. You’re not only offering new innovation, you’re changing the rules of the game. What none of the competitors, the big players, understood was that at that time in the 1990s, bandwidth was very limited for data transmissions. Mike Lazaridis, the founder of Research in Motion, which was BlackBerry’s founding name, understood … how limited the bandwidth was at that time. So he created an instrument that parceled out bits of data communications … so that it would not overtax the networks, whereas everyone else wanted to charge you $4,000 for something that the networks could barely function to transmit. They had that simplicity of design [and] the conservation of the data being transmitted.

The final wonderful thing was that everyone was using their little squirrel keyboards. He said, “What if we create this kind of arched keyboard where you could use opposable thumbs?” That was just one of those breakthrough moments he had one night. That’s the innovation side of the story.

The other side of the story is staying alive because then you’re a small company from Waterloo, Ontario, that’s struggling to make it. You get something right like the BlackBerry, and the big players want it. Some of the big players were there from the beginning. Palm tried to buy them. US Robotics, when it was making modems for mobile data communications, placed a big order and then withdrew it, nearly killing the company because they took on debt to meet that order…. That was managed by Jim Balsillie, a Canadian businessman who went to Harvard, who came back and decided that technology was going to be the key to his success. The two of them were a powerful combination in the early days….

Reed: Can you speak a little bit about the particular strategies that were being pursued at that time by the company?…

McNish: [RIM] did something very innovative. They created these guerilla marketing teams…. They threw boxes of BlackBerrys in the back of their cars, and they went to conferences, they went to airports. They specifically looked at airports for people who were carrying back then the big, heavy laptop computers with the large modems that may or may not have worked, and said “Here, try this.”

“Everyone was using their little squirrel keyboards. He said, ‘What if we create this kind of arched keyboard where you could use opposable thumbs?’”

They called it the Puppy Dog Routine. They said, “Give us your card. You can have this free for a month. Let us know what you think of it.” They were so successful at it, and they had such a small back office that for years, people were using their BlackBerrys for free because they couldn’t figure out who their clients were because they were handing so many of them out spontaneously.

Reed: They had that much faith in the power of the technology that they were literally willing to let people just try it to form an impression.

McNish: That’s right…. Word of mouth was very key. Early adopters were Michael Dell and Jack Welch. Just as you described, the CEO of your company says, “Wow, I love this thing, I’m addicted to it,” and everyone wants to have it … and it ripples down the organization….

Reed: Talk a little bit about the BlackBerry brand and how it was part of this calculus associated with the business strategy.

McNish: This company grew so fast that I don’t think they even thought about brand. That’s the amazing thing, and they could do that as long as they had the technology…. Their main clients, and the people who mattered the most, were the carriers. They had to convince the carriers to sell it, and then they entered this new world where they’d be offering discounts on the smartphones, which really sort of juiced sales and put them in the hands of a lot of consumers.

That was an advantage in the early days, and then later as things started to fall apart, a lot of people believed that one of their biggest problems was they didn’t fully understand who their consumers were because they had to spend so much time making the carriers happy.

It was a very limiting relationship because, again, back in the days of limited bandwidth on the networks, the carriers were very rigorous about what they would allow, and Steve Jobs said for years, “I will never make a smartphone.” He called the carriers the “four orifices”; you couldn’t get anything down their pipeline without their permission. Only when he saw the success of BlackBerry, which leapt to control right away, 58% of the smartphone market, did they set their sights on that market, and then they reinvented it on their terms….

Reed: You talked to some extent about this notion of this rise to greatness and its equally iconic fall, if you will. Can you talk a little bit about that? What was it that was behind this kind of deceleration? Was it a series of events? Was it death by a thousand cuts? Was it something foreseeable? Give us some insight into that.

McNish: The pivotal moment is January 2007 when Steve Jobs walks onto the stage in San Francisco and holds up that shiny glass object that we all [now] know and love so much, and says, “This is an iPhone.” It brings you computing, it brings you the Internet and it brings you email — three things. The interesting thing is that he not only brought on the prototype for the iPhone, and said “I’m going to change the world,” he also brought on stage the head of AT&T Mobility. This is where he changed the rules of the game because really the iPhone is just an iteration of the smartphone that BlackBerry started, only they added more.

“The race is faster than ever. It never ends, and the people who are the leaders today will most likely be the followers tomorrow because it’s very, very difficult to stay ahead.”

They brought the AT&T executive onstage, announced a five-year exclusive contract, and that did two things. It gave AT&T the incentive to spend billions of dollars on upgrading its network, and it made every other carrier nuts because they wanted to have the same thing, and they all went out looking for an antidote to the iPhone. The really compelling part of the BlackBerry story is how they reacted that day. Over in Mountain View, California, you had the folks at Google under a secret project. One was for a new keyboard phone and the other was for a touch screen phone that was going to be run on Android. The minute they watched that live, streaming on the internet, they realized that their project keyboard was dead, and they immediately shifted everything to the touch screen phone….

Mike Lazaridis looked at this announcement, looked at what Steve Jobs was offering, and said, “This is an impossibility.” Again, the conservative engineer brought up on conservation said, “The networks won’t be able to carry this. It’s an impossibility. It’s illogical that anyone would even propose this.” He was right for the first two years. Remember all the dropped calls, all the frustrations, all the lawsuits against Apple and the carriers. It didn’t work….

But then it did, and RIM got it wrong. Two years is a lifetime at a technology rate, and by the time they realized what a serious threat it was, they were at that point followers.

Reed: What do you think is the public’s greatest misconception about the BlackBerry story?

McNish: A lot of people think that Mike and Jim and the folks at the senior offices in BlackBerry were arrogant and didn’t understand iPhone and just focused only on BlackBerry. There is an element of truth to all of that. Yes, they missed the turn, but they were missing the turn at a time when they were going from zero to $20 billion. They were growing at a rate of 25% every quarter. You talk to any business person, that’s an impossibility.

They were expanding in Indonesia and India, in other parts of the world. They were huge. They couldn’t keep up with the demand, and they were coproducing new factories everywhere to keep up with it. So imagine going to your board of directors or your shareholders because you’re a publicly traded company and saying, “You know this BlackBerry thing? It’s probably going to be history in a couple of years. We’re going to stop making it, and we’re going to regroup and move into something we know nothing about.” When you have that kind of momentum, it’s really hard.

Reed: It’s hard. You become a victim of your own success in some senses.

McNish: Exactly, exactly…. When you’re a publicly traded company, your options are pretty limited. What I would layer on top of that is they had a series of really unfortunate events. Everything from a horrific and badly managed patent battle in the United States [to] the three-day outage of 2009, which made everyone question their faith in the BlackBerry. We all remember where we were for those three days….

Then there was the Playbook, and then there were other phones. There was just one disaster after another, and this is how businesses fail. At first it’s slow, and then it’s very fast.

Reed: John Chen is now charged with the difficult task of turning this thing around. What are some of the broader takeaways and learnings that you think are critical from having written the book?

McNish: The thing that I take away, and we conclude with, is that the race is faster than ever. It never ends, and the people who are the leaders today will most likely be the followers tomorrow because it’s very, very difficult to stay ahead. It is so easy today to innovate…. In the old days when you were a GE factory or an auto factory or a parts supplier, there were huge barriers to entry because you were spending hundreds of millions of dollars on plants. You were pretty well assured that there wouldn’t be an excess of competitors.

Today, that’s disappeared. There are groups of kids coming out of Stanford, out of Waterloo University, all these technology companies. All they have to do if they’ve got a Visa card is rent server time, set up an office, get some people with code experience…. Those barriers don’t exist anymore….

These days you’re an algorithm away from some pretty serious competition. Look at what Apple is trying to do with payment system. I wouldn’t want to be a bank right now. It’s a lot of disruption, and the worst mistake you can make is think that we’re better, we can out-muscle them or we can buy them or handle that competition. I don’t think you can.

More From Knowledge at Wharton

From Amazon to Uber: Why Platform Accountability Requires a Holistic Approach

The YouTube Algorithm Isn’t Radicalizing People: Why User Choice Matters on Social Media

Employees Have Specific Expectations Around Inclusive Work Environments & Culture

Looking for more insights.

Sign up to stay informed about our latest article releases.

- Harvard Business School →

- Faculty & Research →

- HBS Case Collection

Transforming BlackBerry: From Smartphones to Software

- Format: Print

- | Language: English

- | Pages: 32

About The Author

Ranjay Gulati

Related work.

- Faculty Research

John Chen's Decision to Join BlackBerry

Building the team at blackberry, key learnings about turnarounds.

- Transforming BlackBerry: From Smartphones to Software By: Ranjay Gulati and Eppa Rixey

- John Chen's Decision to Join BlackBerry By: Ranjay Gulati

- Building the Team at BlackBerry By: Ranjay Gulati

- Key Learnings about Turnarounds By: Ranjay Gulati

Digital Innovation and Transformation

Mba student perspectives.

- Assignments

- Assignment: Digital Winners & Losers

The Rise and Fall (and Rise Again?) of BlackBerry

The roller coaster journey of the world's original smartphone leader.

In many ways, BlackBerry was the producer of the world’s first widely-adopted premium smartphone brand. At its peak, Blackberry owned over 50% of the US and 20% of the global smartphone market, sold over 50 million devices a year, had its device referred to as the “CrackBerry”, and boasted a stock price of over $230. Today, BlackBerry has 0% share of the smartphone market and has a stock price that has hovered in the high single digits for most of the past few years. How did BlackBerry fall from such soaring heights?

First, a little bit of history. BlackBerry was founded in 1984 (as Research in Motion) and was originally a developer of connectivity technology like modems and pagers. In 2000, the company introduced its first mobile phone product in the BlackBerry 957, which came with functionality for push email and internet. Over the ensuing decade, the BlackBerry became the device of choice in corporate America due to its enterprise-level security and business functionality. Even after the competitive entry of the iPhone in 2007 and Google’s Android OS in 2008, BlackBerry was certainly not destined for failure. In fact, BlackBerry continued to dominate the smartphone market through 2010, when it still held over 40% of domestic and nearly 20% of global market share.

Ultimately, however, it was a combination of slow market reactions, focusing on the wrong end market, misunderstanding the smartphone’s value proposition, and poor execution that sealed BlackBerry’s fate.

Slow market reaction to competition. BlackBerry’s leadership initially dismissed Apple’s touchscreen iPhone, insisting that users preferred their physical keyboard. When the iPhone sold well, BlackBerry hastily released a touchscreen device (BlackBerry Storm), which often didn’t work properly and was met with horrendous reviews. Subsequent devices reintroduced the keyboard in a combo touchscreen-keyboard setup (e.g., BlackBerry Bold), which momentarily stemmed the tide, but would eventually prove misguided as the market continued moving toward larger screen real-estate.

Pathways to a Just Digital Future

Focusing on the wrong end market . As Apple and Google made smartphones accessible to the mass consumer by creating slick user interfaces and attractive apps, BlackBerry remained doggedly focused on its enterprise customers and their security and connectivity requirements. This was the traditional innovator’s dilemma at work – BlackBerry catered to its most important customers that generated most of its revenue and profits, and hence neglected the end market that would ultimately become the most important. When enterprises adopted “Bring Your Device” policies, it was no surprise that employees began replacing work BlackBerries with personal iPhones or Android phones en masse.

Misunderstanding the smartphone’s value proposition. In part due to its enterprise focus, BlackBerry innovated primarily around feature improvement – faster email, better security, etc. In doing so, it missed the value proposition of the smartphone as a platform for personal productivity and entertainment. While Apple and Google built a moat around their third-party app ecosystems, BlackBerry’s insistence on first-party development made its devices far inferior. Even its most popular app, BlackBerry Messenger (BBM), was leveraged ineffectively – by mandating that BBM be installed only on BlackBerry devices instead of building up a larger user base across platforms, BlackBerry missed the opportunity that third-party messaging apps like WhatsApp eventually took advantage of.

Poor execution. Even when it did try to adapt, BlackBerry couldn’t execute properly. The launch of the touchscreen Storm in 2008 was a colossal failure. The 2010 release of the Playbook tablet was largely derided for a lack of native email, calendar, and contacts applications. Even its more recent incarnations, like the BlackBerry Priv in 2015, suffered from ineffective product launches, poor functionality, and incoherent value propositions.

It’s not surprising that BlackBerry lost the smartphone wars. But BlackBerry’s story may have another chapter that is yet to be written. Since bringing on turnaround veteran John Chen as CEO in late 2013, BlackBerry has given up on producing phones and has reinvented itself as a software and services business. Leveraging a portfolio of enterprise security products and riding the wave of automotive innovation with its QNX system, Chen seems to have righted the ship. In its most recent quarter (Q3 2017), BlackBerry reported 7% growth in software and services and guided to 10-15% growth for the year. In the autonomous vehicle space, BlackBerry has partnered with Baidu, Nvidia, and Qualcomm to secure their software. Investors have rewarded the company – its stock price now sits around $13 per share, a level not seen since mid-2013. Though the situation looks more promising than it has for a long time, only time will tell whether BlackBerry will rise again.

- BlackBerry Financial Reports. https://us.blackberry.com/company/investors.

- “BlackBerry Doubles Down on Car Software With Hack Protection.” Bloomberg.Com , January 15, 2018. https://www.bloomberg.com/news/articles/2018-01-15/blackberry-doubles-down-on-car-software-with-hack-protection .

- “BlackBerry Jumps as CEO Forecasts High End of Revenue Range.” Bloomberg.Com , December 20, 2017. https://www.bloomberg.com/news/articles/2017-12-20/blackberry-beats-estimates-on-new-government-software-contracts .

- Dunn, Jeff. “Here’s How Dramatic BlackBerry’s Fall Has Actually Been.” Business Insider. Accessed January 31, 2018. http://www.businessinsider.com/blackberry-phone-sales-decline-chart-2016-9 .

- Reed, Brad. “Why the BlackBerry Storm Was the Single Biggest Disaster in Smartphone History.” BGR (blog), May 25, 2015. http://bgr.com/2015/05/25/worst-smartphone-ever-blackberry-storm/ .

- Savov, Vlad. “BlackBerry’s Success Led to Its Failure.” The Verge, September 30, 2016. https://www.theverge.com/2016/9/30/13119924/blackberry-failure-success .

- Vara, Vauhini. “How BlackBerry Fell.” The New Yorker , August 12, 2013. https://www.newyorker.com/tech/elements/how-blackberry-fell .

- Warren, Christina. “BlackBerry Bust: RIM Takes a $485 Million Hit on the Ailing PlayBook.” Mashable. Accessed January 31, 2018. https://mashable.com/2011/12/02/playbook-485-million-charge/ .

- Woods, Ben. “The Road to BlackBerry 10: The Evolution of RIM’s OS and BES.” ZDNet. Accessed January 31, 2018. http://www.zdnet.com/article/the-road-to-blackberry-10-the-evolution-of-rims-os-and-bes/ .

Student comments on The Rise and Fall (and Rise Again?) of BlackBerry

Thank you for the post, very interesting! I totally agree with the reasons why Blackberry lost the smartphone war. I also agree with the new CEO’s vision on no longer focusing on phones and targeting software, security, and internet of things. I believe that this is a good way of staying in business. Only one new though on this space, should they still use the brand Blackberry for selling their services? should the company still be named Blackberry? isn’t Blackberry’s brand related to an obsolete and weak technology? Is this the best way to proceed in terms of marketing?

Leave a comment Cancel reply

You must be logged in to post a comment.

You are here

The Rise and Fall of BlackBerry

This is a sample. For full access:

Please choose from the following options to gain full access to this content

Log in via your academic institution

Related items, view my options.

Create an account and get 24 hours access for free.

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Blackberry Forgot to Manage the Ecosystem

- Michael G. Jacobides

A sound value proposition isn’t enough to keep you on top of the food chain.

The story of Blackberry underlines a new truth about the competitive landscape we live in: success or failure isn’t a function of a good product or service, or a well-run, cost effective company with a sound capital structure. It also requires an effective strategy to manage your ecosystem.

- Michael G. Jacobides is the Sir Donald Gordon Chair of Entrepreneurship & Innovation and a professor of strategy at London Business School. He is the author of In the Ecosystem Economy, What’s your Strategy? (HBR, September–October 2019).

Partner Center

From Sectors and Smart Beta to Fixed Income, SPDR Exchange Traded Funds (ETFs) give you wide access to diverse investment opportunities. Find out more.

BlackBerry: A Case Study on the Quality Premium

On January 4, 2022, BlackBerry shut down its smart phone servers for the final time, ending over two decades of service. Many would argue that the original BlackBerry device was responsible for kicking off the tidal wave of smart phone adoption. But not coincidentally, the BlackBerry service was ended almost 15 years to the day after Apple Inc. announced its first iPhone.

The rise and fall of BlackBerry—previously known as Research in Motion—is well-known to individuals who lived through the early-adoption stages of the smart phone revolution. This storied relic of corporate communication might also help illustrate an important characteristic of the quality factor that explains the source of its return premium.

Members of the smart beta investment community, both professional and academic, generally fall into one of two major camps that explain the existence of smart beta factor premiums: one can be described as risk-based, and the other, behavioral. The risk-based argument states that markets are efficient, so securities with higher exposures to factors can produce a higher return only if these securities represent some higher form of risk. In order for investors to justify holding these higher risk securities, capital markets must compensate them with the prospect of increased returns on average and over the long term.

The value and size factors tend to be more closely associated with the risk-based explanation. Companies that have operated inefficiently, that have become distressed and that now face riskier prospects tend to see their stock prices decline, pushing them into deeper value territory and greater size exposure as well. In other words, distressed companies tend to see both their valuations and their market capitalizations decline. Some of these companies will ultimately fail but some will successfully bounce back, and in doing so, reward their investors handsomely. The combination of the winners and losers ultimately produces an expected long-term excess return premium.

The behavioral argument states that the psychology of investors and the natural structures of markets produce factor premiums because investor behavior is consistently biased towards those securities which exhibit higher exposure to those factors. This behavioral bias pushes markets and boosts returns. The momentum and low volatility factors tend to be more associated with the behavioral explanation.

The quality factor is a bit of a conundrum as it can’t be easily sorted into either the risk-based or the behavioral camp. On one hand, it doesn’t seem to make intuitive sense for higher quality companies to be riskier, thereby requiring superior returns in the equity capital markets to attract investors. Companies with excellent quality characteristics—higher profitability being one of those characteristics 1 —would seem to be less risky for the investor, not more. And it’s tough to imagine what sort of behavioral bias would induce higher quality companies to generate increased returns.

In the early stages of the smart phone revolution, BlackBerry was not a high quality company. It was not until late 2006 that BlackBerry unit sales started to take off, jump-starting profits and moving BlackBerry from the lower end of the quality spectrum to the higher end. In turn, BlackBerry’s stock price increased five-fold over the next two years. From 2006 to 2008, the higher quality nature of BlackBerry was indeed accompanied by a higher return (Figure 1).

But as BlackBerry sales continued to grow, driving profits and pushing BlackBerry even higher along the quality spectrum, BlackBerry’s stock returns did not keep pace. BlackBerry’s stock price peaked in mid-2008 and fell precipitously from there, despite unit sales and net income continuing to grow into 2011, and despite the company being in the top quality quintile all the way into 2013.

What happened to BlackBerry is quite simple—competition. Apple entered the smart phone market with the iPhone in 2007, and Google launched its Android operating system in 2008. These two smart phones devoured BlackBerry’s market share, sending unit sales into decline from 2011 onward and ultimately closing down the BlackBerry for good by 2022.

Perhaps this explains how the quality factor fits into the risk-based explanation for its premium. High profitability is a prominent element of quality, and those companies with high profitability do not go unnoticed by market participants. A highly profitable company essentially has a target on its back, enticing new entrants to capture some of those juicy profits for themselves. We tend to think of “riskier companies” as those that are currently distressed. Perhaps “riskier companies” also includes those which face the risk of significantly increased competition.

Companies that completely fail are usually value companies or small cap companies just before they go out of business. The premium is generated by those companies that somehow pull out of their death spiral, rewarding their investors who take that risk. Similarly, highly profitable companies are those whose soaring profits are inevitably going to be attacked by new competition. Those that survive the competitive onslaught earn a return premium, rewarding investors who remained invested in the face of that expanding competition.

Unfortunately for companies like BlackBerry, being a highly profitable, high quality company may involve some elevated and unexpected risks—as we have proposed here—in the form of new competition. Competition in profit-generating markets can be fierce, and highly profitable companies don’t always win their fight to stay that way.

1 In this context, quality refers to the SSGA definition of quality which is a combination of three characteristics: profitability (ROA), leverage (D/E) and earnings variability.

State Street Global Advisors Worldwide Entities

The information provided does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your tax and financial advisor. Investing involves risk including the risk of loss of principal.

The views expressed are the views of John Law through April 30, 2023, and are subject to change based on market and other conditions. This document contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

The information contained in this communication is not a research recommendation or ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with the Markets in Financial Instruments Directive (2014/65/EU) or applicable Swiss regulation. This means that this marketing communication (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research (b) is not subject to any prohibition on dealing ahead of the dissemination of investment research.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without State Street Global Advisors’ express written consent.

Equity securities may fluctuate in value and can decline significantly in response to the activities of individual companies and general market and economic conditions.

“A “quality” style of investing emphasizes companies with high returns, stable earnings, and low financial leverage. This style of investing is subject to the risk that the past performance of these companies does not continue or that the returns on “quality” equity securities are less than returns on other styles of investing or the overall stock market.”

© 2023 State Street Corporation. All Rights Reserved. 5664907.1.1.GBL.RTL Exp. Date: 05/31/2024

More on Equities

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

Management Theory into Practice : The BlackBerry Case

Related Papers

Ibrahim Naeem

Contemporary trends in the area of business strategy have shown an inclination toward searching new markets and creating new demands. Deriving from a similar line of inquiry, the Blue Ocean Strategy (BOS) has become very popular among practitioners particularly during the recent decades. However, the evolution of such strategies also brings with it the question of sustainability. This study interrogates the sustainability aspect of the BOS and thereby aims to propose an integrated model designed to address this issue. By grounding the BOS on the models of technological innovations and network externalities, a new model, entitled as the Blue Innovations Network (BIN), is proposed as a generic framework to help achieve sustainable blue oceans in the future. Using a systematic approach, this model is applied to and tested on the case of Blackberry, a Canadian mobile handheld manufacturer which is accredited with being the pioneer of the smartphones industry. The study thus highlights three different periods of the success, peak and decline of Blackberry, consequently applying each dimension of the proposed model individually and then collectively in an effort determine how BIN could have helped the company sustain its BOS. The BIN model thus carries the possibility of being explored and further refined through cross-industry applications and hence provides solid ground for the future researches. Key Words: 1) Blue Ocean Strategy 2) Technological Innovations 3) Network Externalities 4) Blue Innovation Networks 5) Blackberry 6) Smartphones Industry

Violet Zhang

Sofia Muller Beglari

Pinon Ratul

RELATED TOPICS

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

- Strategic Management

- SWOT Analysis of Blackberry

Introduction

Blackberry, which was the pioneer in mobile-based technologies with its best selling original Smartphones, has been in the news for all the wrong reasons. First, the company known as Research in Motion (RIM), which made and marketed the Blackberries, missed the emerging Smartphone revolution though it was one of the pioneers of mobile computing. Next, the company was unable to read the market and hence, it lost market share to Apple and Samsung. This resulted in the company nearly going bankrupt and despite changes in leadership; it could never regain its position. In the past month, the company has been in the news again because it rejected a buyout offer and rescinded a sale option and instead, chose to appoint a new CEO along with accepting fresh infusion of capital into the company.

This article discusses the changing strategies of Blackberry through a SWOT Analysis, which would provide clues into how the company would position itself in the future. The key theme here is that Blackberry needs to urgently revamp and rejuvenate itself if it has to regain market share and forget about market leadership, it has to ensure that it stays afloat.

Opportunities

the preceding discussion has highlighted the need for Blackberry and its management to take proactive steps to pull the company from the quagmire it finds itself in.

The recent strategic moves made by the new leadership are to be seen in the light of the company’s drift away from its profit making and market leadership model to a situation where it is no longer in the reckoning. In conclusion, Blackberry and its leadership have their task cut out as they gear themselves to take on the challenges from the Smartphone companies like Apple and Samsung.

Related Articles

- SWOT Analysis

- Personal SWOT Analysis

- SWOT Analysis of Google

- SWOT Analysis of Starbucks

- SWOT Analysis of Amazon

- SWOT Analysis of IKEA

- SWOT Analysis of Nike

- SWOT Analysis of Microsoft

- SWOT Analysis of China Mobile

- Competitor Analysis

- Porter’s Five Forces Model