We use cookies to enhance our website for you. Proceed if you agree to this policy or learn more about it.

- Essay Database >

- Essays Samples >

- Essay Types >

- Research Proposal Example

Banking Research Proposals Samples For Students

110 samples of this type

No matter how high you rate your writing skills, it's always a worthy idea to check out a competently written Research Proposal example, especially when you're dealing with a sophisticated Banking topic. This is exactly the case when WowEssays.com database of sample Research Proposals on Banking will prove useful. Whether you need to brainstorm an original and meaningful Banking Research Proposal topic or examine the paper's structure or formatting peculiarities, our samples will provide you with the necessary material.

Another activity area of our write my paper agency is providing practical writing support to students working on Banking Research Proposals. Research help, editing, proofreading, formatting, plagiarism check, or even crafting completely unique model Banking papers upon your request – we can do that all! Place an order and buy a research paper now.

Good Employee Motivation In The Workplace Research Proposal Example

Background of the company/environment of the company, reducing the interest on students loan research proposals examples, problem of study research proposal sample, information technology on international banking performance.

THE IMPACT OF INFORMATION TECHNOLOGY ON INTERATIONAL BANKING PERFORMANCE: COMPARATIVE CASE STUDY ANALYSIS OF NIGERIA, UNITED KINGDOM AND BRAZIL BANKING INDUSTRY

INTRODUCTION

Don't waste your time searching for a sample.

Get your research proposal done by professional writers!

Just from $10/page

Good Theses: Shadow Banking; Financial Instruments; Inaccurate Credit Rating; Crisis Research Proposal Example

Free research proposal on the effects of technology applications on the reserve bank of australia, chapter one: introduction, problem statement academic research proposal example.

The Relationship between Motivation, Organizational stressors and Job Satisfaction in the U.S.A Banking Industry

The Effects Of Training And Development On Employee Performance In The Banking Sector Research Proposal Sample

Research proposal on role of managing innovation and projects in banking industry, role of managing innovation and projects in banking industry research proposal example, example of financial crisis and consumption tendency research proposal, introduction, research plan economic downfall research proposal.

1. Research Question: What was the reason for the crisis and economic downfall which has caused the shrinking of America’s middle class? 2. Research key words: Middle class, American economy, Wall Street, housing mortgage fraud, economic crisis, class warfare, white collar crime, personal debt, banking, and financial institutions 3. Sub questions: What can be identified as the beginning of the economic downfall? Did Savings and Loans executives have anything to do with the situation?

What other financial institutions were involved?

The Great Depression - Causes Resolution Research Proposal Example

The great depression - causes & resolution, energy resource plan research proposal, environmental science.

Energy Resource Plan Introduction

Energy conservation is important to the environment. You have probably heard that said on television and read it in the headlines a million times but you may not have thought about what it means for your family. The environment needs to be clean for our families. Less air pollution in the atmosphere means healthier kids and less asthma.

Example Of Research Proposal On Risk Management In The UK Banking Industry

Good research proposal on the relationship between equity prices and banking industry performance in the united kingdom, advanced entrepreneurship – chase bank atm machines research proposal template for faster writing, expertly crafted research proposal on tangerine forward banking – advantages of online banking, the us subprime problems and the 2008 international financial crisis research proposal sample, capital markets: corporate companies under stock exchange research proposals example, factors that determine stock market of corporations, preventing online frauds in online banking transactions research proposal sample, labor policy proposal research proposal samples, e-commerce: the challenges with e-payments research proposals example, the risk of starting a small business by an emarati's women by taking a loan from abu dhabi islamic bank research proposal samples.

Project Proposal: The Risk of Starting a Small Business by an Emarati's Women By Taking a Loan from Abu Dhabi Islamic Bank

Perfect Model Research Proposal On Renewable Energy Proposal

Executive summary.

Lehigh Valley Campus in Pennsylvania is proposing to incorporate renewable sources of energy (Hybrid Photovoltaic Cells and Thermal Collector) into the campus and a cybercafé/bookstore business venture in honor of the recently deceased alumnus of PSU, Wayne K. Newton. It is our firm belief that this project will fulfill the Late Wayne Newton’s visionary dream and fulfill the family’s wishes to donate the funds. The campus aims to use these funds to procure hybrid solar module and design a cybercafé/bookstore business premise

The total cost of the project will be $87120.

Good example of shadow banking and systemic risks: a research proposal research proposal, problem statement.

Persistent downturns in the global economy have created renewed interest in the systematic risk, a concept that describes unpredictable breakdowns in financial systems. Systemic risks can arise because of correlated defaults among industry players such as banks, insurance companies, shadow banking institutions and other financial service providers(Allen & Gale, 2000). Recent studies have revealed a strong correlation between shadow banking and systematic risks. This research proposal outlines a methodology for understanding the relationship between shadow banking and systemic risks.

Research Aims and Objectives

Sample research proposal on statement of the problem, investigating the significance of reputation management in real estate business during an economic crisis.

Investigating the Significance of Reputation Management in Real Estate Business during an Economic Crisis Introduction

Exemplar Research Proposal On Prospectus To Write After

How to use policy to change public school’s funding and resources allocation.

Ph.D. in Education-Leadership, Change, Policy in Education

Learn To Craft Research Proposals On Expansion Into Brazil With This Example

“student’s name”, free merger & acquisition-gap research proposal example, inspiring research proposal about how stop cholela in haiti, the map of haiti and others countries in the caribbean, grant proposal for health system strengthening in kenya research proposal examples, good outsourcing research proposal example, switching from oil to alternative fuels: far-off dream or reality research proposal example, background of research:, example of cash flow research proposal, a study of vocabulary difference with children from different socio-economic background research proposals example, vocabulary instruction, expanding verizon services to australia research proposal sample, research proposal on effect of financial liberalization on economy growth in developing countries: china, background:, free research proposal about nursing research proposal, economics and financial analysis for technology managers research proposal example, free research proposal on funding for new business, research problem, free research proposal about hospitals: go green.

GREEN HOSPITALS

Executive summary

Hospitals go green research proposal samples, technical writing.

Introduction Many hospitals go against the practice of sustainable of development and environmental conservation. They contribute to pollution and environmental destruction through emission of carbon into the atmosphere, water wastage, unhealthy food and misuse of energy. These actions not only destroy the environmental but also contribute to high disease prevalence (HealthIT 2012). The concept of green hospitals has evolved over time to offer answers to some of the challenges.

Good Example Of What Effects And Or Contributions Can Childcare In The Workforce Provide For America Research Proposal

Recruitment of army officers in high school research proposal examples, example of research proposal on international economics, assignment 2: international economics part 2, good research proposal about problem, sample research proposal on third party player proposition services - research proposal, project proposal for construction of affordable house units for students near the austin community college by dds ltd {type) to use as a writing model, research proposal on reasons for healthy diet: beauty, mental health, treatment, lifestyle, exemplar research proposal on winston educational foundation to write after, improvements in public education.

1598 Camarillo Street

Anaheim, California

818.432.2465

Dear City Councilman Roberts:

Free research proposal about potential cost reduction measures of musculoskeletal care, justification for the choice of the topic, free research proposal on the effectiveness of anti-corruption policy in the uk, research proposal on research approach and methodology, good research proposal about statement: in my field of information system operation management (isom), the current, proposal for the current issue in my field research project.

There has been an increase in incidents involving digital cyber attacks worldwide. Most of the databases of corporations are targeted by criminals since they contain sensitive company information, which obtained can be used against the company. Hackers normally attack the databases to acquire sensitive information such as credit card numbers and other personal information of unsuspecting customers and use it to commit internet fraud.

American Sanctions On Russia: The Impacts Of Sanctions To Russia After The Annexation Research Proposals Examples

After the Russian takeover of the Ukraine- controlled Crimea on March 14, 2014, sanctions were immediately imposed by the Americans as an attempt to control Russia’s continuous attempts to destabilize Ukraine. However, many question as to what effects these Americans sanctions have on the economy, business sector and people. In order to answer this question, this study proposes to use observational and narrative research in order to discuss the overall nature of the issue and analyze the changes within the duration of the issue.

Abstract: 2

Example of research proposal on sustainable infrastructure - earth systems engineering and management, free how to secure information in public entities research proposal sample, the oslo accords research proposal example, provide a critical analysis of the journal research proposal, analysis of the article, hypotheses research proposals examples.

Password recovery email has been sent to [email protected]

Use your new password to log in

You are not register!

By clicking Register, you agree to our Terms of Service and that you have read our Privacy Policy .

Now you can download documents directly to your device!

Check your email! An email with your password has already been sent to you! Now you can download documents directly to your device.

or Use the QR code to Save this Paper to Your Phone

The sample is NOT original!

Short on a deadline?

Don't waste time. Get help with 11% off using code - GETWOWED

No, thanks! I'm fine with missing my deadline

Research Topics & Ideas: Finance

120+ Finance Research Topic Ideas To Fast-Track Your Project

If you’re just starting out exploring potential research topics for your finance-related dissertation, thesis or research project, you’ve come to the right place. In this post, we’ll help kickstart your research topic ideation process by providing a hearty list of finance-centric research topics and ideas.

PS – This is just the start…

We know it’s exciting to run through a list of research topics, but please keep in mind that this list is just a starting point . To develop a suitable education-related research topic, you’ll need to identify a clear and convincing research gap , and a viable plan of action to fill that gap.

If this sounds foreign to you, check out our free research topic webinar that explores how to find and refine a high-quality research topic, from scratch. Alternatively, if you’d like hands-on help, consider our 1-on-1 coaching service .

Overview: Finance Research Topics

- Corporate finance topics

- Investment banking topics

- Private equity & VC

- Asset management

- Hedge funds

- Financial planning & advisory

- Quantitative finance

- Treasury management

- Financial technology (FinTech)

- Commercial banking

- International finance

Corporate Finance

These research topic ideas explore a breadth of issues ranging from the examination of capital structure to the exploration of financial strategies in mergers and acquisitions.

- Evaluating the impact of capital structure on firm performance across different industries

- Assessing the effectiveness of financial management practices in emerging markets

- A comparative analysis of the cost of capital and financial structure in multinational corporations across different regulatory environments

- Examining how integrating sustainability and CSR initiatives affect a corporation’s financial performance and brand reputation

- Analysing how rigorous financial analysis informs strategic decisions and contributes to corporate growth

- Examining the relationship between corporate governance structures and financial performance

- A comparative analysis of financing strategies among mergers and acquisitions

- Evaluating the importance of financial transparency and its impact on investor relations and trust

- Investigating the role of financial flexibility in strategic investment decisions during economic downturns

- Investigating how different dividend policies affect shareholder value and the firm’s financial performance

Investment Banking

The list below presents a series of research topics exploring the multifaceted dimensions of investment banking, with a particular focus on its evolution following the 2008 financial crisis.

- Analysing the evolution and impact of regulatory frameworks in investment banking post-2008 financial crisis

- Investigating the challenges and opportunities associated with cross-border M&As facilitated by investment banks.

- Evaluating the role of investment banks in facilitating mergers and acquisitions in emerging markets

- Analysing the transformation brought about by digital technologies in the delivery of investment banking services and its effects on efficiency and client satisfaction.

- Evaluating the role of investment banks in promoting sustainable finance and the integration of Environmental, Social, and Governance (ESG) criteria in investment decisions.

- Assessing the impact of technology on the efficiency and effectiveness of investment banking services

- Examining the effectiveness of investment banks in pricing and marketing IPOs, and the subsequent performance of these IPOs in the stock market.

- A comparative analysis of different risk management strategies employed by investment banks

- Examining the relationship between investment banking fees and corporate performance

- A comparative analysis of competitive strategies employed by leading investment banks and their impact on market share and profitability

Private Equity & Venture Capital (VC)

These research topic ideas are centred on venture capital and private equity investments, with a focus on their impact on technological startups, emerging technologies, and broader economic ecosystems.

- Investigating the determinants of successful venture capital investments in tech startups

- Analysing the trends and outcomes of venture capital funding in emerging technologies such as artificial intelligence, blockchain, or clean energy

- Assessing the performance and return on investment of different exit strategies employed by venture capital firms

- Assessing the impact of private equity investments on the financial performance of SMEs

- Analysing the role of venture capital in fostering innovation and entrepreneurship

- Evaluating the exit strategies of private equity firms: A comparative analysis

- Exploring the ethical considerations in private equity and venture capital financing

- Investigating how private equity ownership influences operational efficiency and overall business performance

- Evaluating the effectiveness of corporate governance structures in companies backed by private equity investments

- Examining how the regulatory environment in different regions affects the operations, investments and performance of private equity and venture capital firms

Asset Management

This list includes a range of research topic ideas focused on asset management, probing into the effectiveness of various strategies, the integration of technology, and the alignment with ethical principles among other key dimensions.

- Analysing the effectiveness of different asset allocation strategies in diverse economic environments

- Analysing the methodologies and effectiveness of performance attribution in asset management firms

- Assessing the impact of environmental, social, and governance (ESG) criteria on fund performance

- Examining the role of robo-advisors in modern asset management

- Evaluating how advancements in technology are reshaping portfolio management strategies within asset management firms

- Evaluating the performance persistence of mutual funds and hedge funds

- Investigating the long-term performance of portfolios managed with ethical or socially responsible investing principles

- Investigating the behavioural biases in individual and institutional investment decisions

- Examining the asset allocation strategies employed by pension funds and their impact on long-term fund performance

- Assessing the operational efficiency of asset management firms and its correlation with fund performance

Hedge Funds

Here we explore research topics related to hedge fund operations and strategies, including their implications on corporate governance, financial market stability, and regulatory compliance among other critical facets.

- Assessing the impact of hedge fund activism on corporate governance and financial performance

- Analysing the effectiveness and implications of market-neutral strategies employed by hedge funds

- Investigating how different fee structures impact the performance and investor attraction to hedge funds

- Evaluating the contribution of hedge funds to financial market liquidity and the implications for market stability

- Analysing the risk-return profile of hedge fund strategies during financial crises

- Evaluating the influence of regulatory changes on hedge fund operations and performance

- Examining the level of transparency and disclosure practices in the hedge fund industry and its impact on investor trust and regulatory compliance

- Assessing the contribution of hedge funds to systemic risk in financial markets, and the effectiveness of regulatory measures in mitigating such risks

- Examining the role of hedge funds in financial market stability

- Investigating the determinants of hedge fund success: A comparative analysis

Financial Planning and Advisory

This list explores various research topic ideas related to financial planning, focusing on the effects of financial literacy, the adoption of digital tools, taxation policies, and the role of financial advisors.

- Evaluating the impact of financial literacy on individual financial planning effectiveness

- Analysing how different taxation policies influence financial planning strategies among individuals and businesses

- Evaluating the effectiveness and user adoption of digital tools in modern financial planning practices

- Investigating the adequacy of long-term financial planning strategies in ensuring retirement security

- Assessing the role of financial education in shaping financial planning behaviour among different demographic groups

- Examining the impact of psychological biases on financial planning and decision-making, and strategies to mitigate these biases

- Assessing the behavioural factors influencing financial planning decisions

- Examining the role of financial advisors in managing retirement savings

- A comparative analysis of traditional versus robo-advisory in financial planning

- Investigating the ethics of financial advisory practices

The following list delves into research topics within the insurance sector, touching on the technological transformations, regulatory shifts, and evolving consumer behaviours among other pivotal aspects.

- Analysing the impact of technology adoption on insurance pricing and risk management

- Analysing the influence of Insurtech innovations on the competitive dynamics and consumer choices in insurance markets

- Investigating the factors affecting consumer behaviour in insurance product selection and the role of digital channels in influencing decisions

- Assessing the effect of regulatory changes on insurance product offerings

- Examining the determinants of insurance penetration in emerging markets

- Evaluating the operational efficiency of claims management processes in insurance companies and its impact on customer satisfaction

- Examining the evolution and effectiveness of risk assessment models used in insurance underwriting and their impact on pricing and coverage

- Evaluating the role of insurance in financial stability and economic development

- Investigating the impact of climate change on insurance models and products

- Exploring the challenges and opportunities in underwriting cyber insurance in the face of evolving cyber threats and regulations

Quantitative Finance

These topic ideas span the development of asset pricing models, evaluation of machine learning algorithms, and the exploration of ethical implications among other pivotal areas.

- Developing and testing new quantitative models for asset pricing

- Analysing the effectiveness and limitations of machine learning algorithms in predicting financial market movements

- Assessing the effectiveness of various risk management techniques in quantitative finance

- Evaluating the advancements in portfolio optimisation techniques and their impact on risk-adjusted returns

- Evaluating the impact of high-frequency trading on market efficiency and stability

- Investigating the influence of algorithmic trading strategies on market efficiency and liquidity

- Examining the risk parity approach in asset allocation and its effectiveness in different market conditions

- Examining the application of machine learning and artificial intelligence in quantitative financial analysis

- Investigating the ethical implications of quantitative financial innovations

- Assessing the profitability and market impact of statistical arbitrage strategies considering different market microstructures

Treasury Management

The following topic ideas explore treasury management, focusing on modernisation through technological advancements, the impact on firm liquidity, and the intertwined relationship with corporate governance among other crucial areas.

- Analysing the impact of treasury management practices on firm liquidity and profitability

- Analysing the role of automation in enhancing operational efficiency and strategic decision-making in treasury management

- Evaluating the effectiveness of various cash management strategies in multinational corporations

- Investigating the potential of blockchain technology in streamlining treasury operations and enhancing transparency

- Examining the role of treasury management in mitigating financial risks

- Evaluating the accuracy and effectiveness of various cash flow forecasting techniques employed in treasury management

- Assessing the impact of technological advancements on treasury management operations

- Examining the effectiveness of different foreign exchange risk management strategies employed by treasury managers in multinational corporations

- Assessing the impact of regulatory compliance requirements on the operational and strategic aspects of treasury management

- Investigating the relationship between treasury management and corporate governance

Financial Technology (FinTech)

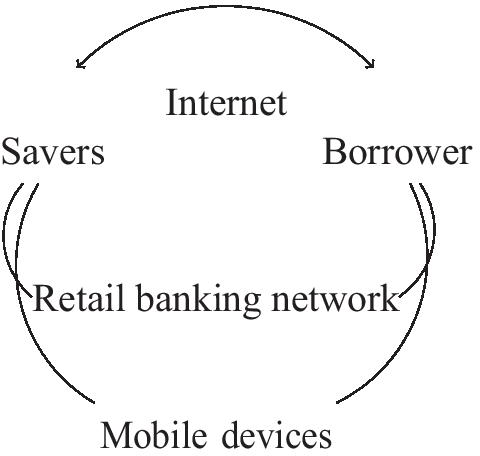

The following research topic ideas explore the transformative potential of blockchain, the rise of open banking, and the burgeoning landscape of peer-to-peer lending among other focal areas.

- Evaluating the impact of blockchain technology on financial services

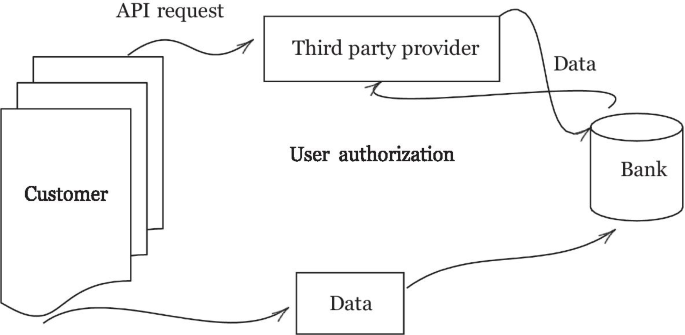

- Investigating the implications of open banking on consumer data privacy and financial services competition

- Assessing the role of FinTech in financial inclusion in emerging markets

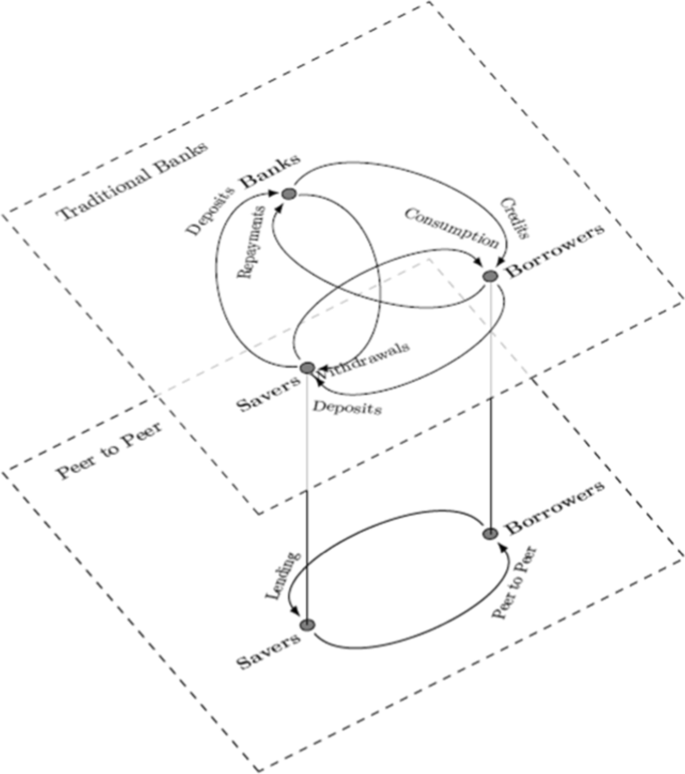

- Analysing the role of peer-to-peer lending platforms in promoting financial inclusion and their impact on traditional banking systems

- Examining the cybersecurity challenges faced by FinTech firms and the regulatory measures to ensure data protection and financial stability

- Examining the regulatory challenges and opportunities in the FinTech ecosystem

- Assessing the impact of artificial intelligence on the delivery of financial services, customer experience, and operational efficiency within FinTech firms

- Analysing the adoption and impact of cryptocurrencies on traditional financial systems

- Investigating the determinants of success for FinTech startups

Commercial Banking

These topic ideas span commercial banking, encompassing digital transformation, support for small and medium-sized enterprises (SMEs), and the evolving regulatory and competitive landscape among other key themes.

- Assessing the impact of digital transformation on commercial banking services and competitiveness

- Analysing the impact of digital transformation on customer experience and operational efficiency in commercial banking

- Evaluating the role of commercial banks in supporting small and medium-sized enterprises (SMEs)

- Investigating the effectiveness of credit risk management practices and their impact on bank profitability and financial stability

- Examining the relationship between commercial banking practices and financial stability

- Evaluating the implications of open banking frameworks on the competitive landscape and service innovation in commercial banking

- Assessing how regulatory changes affect lending practices and risk appetite of commercial banks

- Examining how commercial banks are adapting their strategies in response to competition from FinTech firms and changing consumer preferences

- Analysing the impact of regulatory compliance on commercial banking operations

- Investigating the determinants of customer satisfaction and loyalty in commercial banking

International Finance

The folowing research topic ideas are centred around international finance and global economic dynamics, delving into aspects like exchange rate fluctuations, international financial regulations, and the role of international financial institutions among other pivotal areas.

- Analysing the determinants of exchange rate fluctuations and their impact on international trade

- Analysing the influence of global trade agreements on international financial flows and foreign direct investments

- Evaluating the effectiveness of international portfolio diversification strategies in mitigating risks and enhancing returns

- Evaluating the role of international financial institutions in global financial stability

- Investigating the role and implications of offshore financial centres on international financial stability and regulatory harmonisation

- Examining the impact of global financial crises on emerging market economies

- Examining the challenges and regulatory frameworks associated with cross-border banking operations

- Assessing the effectiveness of international financial regulations

- Investigating the challenges and opportunities of cross-border mergers and acquisitions

Choosing A Research Topic

These finance-related research topic ideas are starting points to guide your thinking. They are intentionally very broad and open-ended. By engaging with the currently literature in your field of interest, you’ll be able to narrow down your focus to a specific research gap .

When choosing a topic , you’ll need to take into account its originality, relevance, feasibility, and the resources you have at your disposal. Make sure to align your interest and expertise in the subject with your university program’s specific requirements. Always consult your academic advisor to ensure that your chosen topic not only meets the academic criteria but also provides a valuable contribution to the field.

If you need a helping hand, feel free to check out our private coaching service here.

You Might Also Like:

thank you for suggest those topic, I want to ask you about the subjects related to the fintech, can i measure it and how?

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Print Friendly

Research Proposal Topics for Banking and Finance: Exploring Emerging Trends and Innovative Solutions

Delve into the realm of banking and finance with our comprehensive guide to research proposal topics. Explore emerging trends and innovative solutions that are shaping the future of the financial industry. Discover the latest developments in banking regulations, fintech advancements, and sustainable finance practices. Unravel the intricacies of risk management, investment strategies, and financial inclusion. Join us on a journey to uncover the untapped potential of banking and finance research.

Key Takeaways:

Investigate the economic crisis and its impact on banking and finance.

Critically review the concept of standard deviation and its applications in business.

Explore the political and economic risks involved in national bank transactions.

Conduct a study on corporate developments in European banking.

Investigate the impact of internal control on the efficiency of an organization’s accounting system.

Evaluate bank lending practices and credit management in Cameroon.

Analyze the effect of interest rate fluctuation on the profitability of commercial banks.

Study the role of microfinance institutions in poverty reduction and women empowerment.

Table of Contents

Research Proposal Topics for Banking and Finance

Banking and finance are constantly evolving fields, offering a treasure trove of research opportunities. Whether you’re a seasoned researcher or just starting, finding the right topic can be daunting. Fear not! This guide will equip you with intriguing research proposal topics for banking and finance, helping you navigate this dynamic landscape and make a meaningful contribution to the industry.

- Blockchain Technology and Its Impact on Banking:

Explore how blockchain can revolutionize banking operations, enhance security, and reduce costs.

Mobile Banking and Financial Inclusion:

Investigate the role of mobile banking in promoting financial inclusion, especially in underserved communities.

AI and Machine Learning in Risk Assessment:

Analyze how AI and machine learning can enhance risk assessment models, enabling banks to make more informed decisions.

Sustainable Banking Practices:

Study the impact of sustainable banking practices on financial performance and stakeholder satisfaction.

Cybersecurity in Banking and Finance:

Examine cybersecurity threats and vulnerabilities, and propose strategies to strengthen defenses against cyberattacks.

FinTech and the Future of Banking:

Investigate how FinTech is disrupting traditional banking models and shaping the future of the industry.

Behavioral Finance and Investor Decision-Making:

Analyze how psychological factors influence investment decisions and explore strategies to promote rational behavior.

Islamic Banking and Financial Inclusion:

Study the role of Islamic banking in fostering financial inclusion and economic development in Muslim-majority countries.

Impact of Regulation on Banking and Finance:

Assess the impact of regulatory changes on the stability and efficiency of the banking and finance sector.

Central Bank Digital Currencies (CBDCs):

- Evaluate the potential benefits and challenges of CBDCs and their impact on monetary policy and financial stability.

Impact of Digitalization on Financial Markets:

- Investigate the implications of digitalization on market structure, trading behavior, and systemic risk.

Financial Literacy and Investor Protection:

- Analyze the effectiveness of financial literacy programs and explore ways to enhance investor protection.

Role of Cryptocurrency in International Trade:

- Study the challenges and opportunities of using cryptocurrency in international trade and propose regulatory frameworks.

Banking and Finance in Emerging Markets:

- Examine the unique challenges and opportunities faced by banks and financial institutions in emerging markets.

Corporate Governance and Bank Performance:

- Investigate the relationship between corporate governance practices and bank performance, identifying key factors that drive success.

Seeking inspiration for your academic journey? Dive into our comprehensive research topics for accounting students in the Philippines 2024 to unravel groundbreaking ideas and excel in your studies.

Unlock the gateway to academic excellence! Explore our curated research topics for accounting students in the Philippines 2024 and embark on a path of knowledge and discovery.

Research proposal topics in accounting and finance pdf offers a treasure trove of insights and inspiration, empowering you to craft a compelling research proposal that will leave a lasting impression.

Step into the world of financial exploration with our extensive list of research project topics on banking and finance . Discover innovative angles and delve into the intricacies of the banking and finance industry.

Uncover a wealth of research possibilities with our carefully selected research project topics in banking and finance in Kenya . Explore the unique challenges and opportunities within Kenya’s financial landscape.

Key concepts and theories in banking and finance research

Banking and finance have long been interconnected and crucial pillars of the global economy. Researchers delve into this field to unearth insights that benefit financial institutions, investors, and policymakers. To help you grasp the complexities of banking and finance research, let’s explore some fundamental concepts and theories.

Risk and Return: A central concept in finance is the trade-off between risk and return. Investors seek higher returns, but these often come with increased risk.

Time Value of Money: This concept asserts that money today is worth more than the same amount in the future due to its earning potential.

Efficient Market Hypothesis: This theory proposes that all available information is reflected in asset prices, making it challenging to outperform the market consistently.

Capital Structure: This refers to the composition of a company’s financing sources, including debt and equity. An optimal capital structure can minimize a firm’s cost of capital.

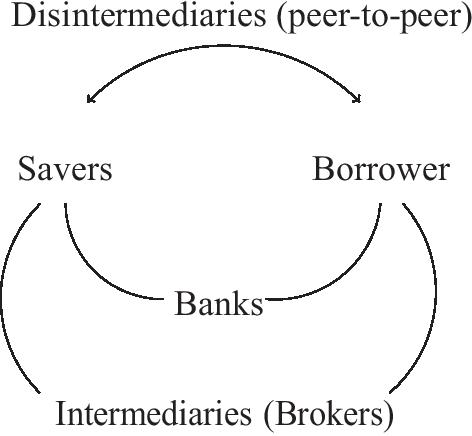

Financial Intermediation: Banks and other financial institutions act as intermediaries between savers and borrowers, facilitating the flow of funds in the economy.

– Monetary Policy: Central banks use monetary policy tools to influence the money supply and interest rates, impacting economic activity and inflation.

With these fundamental concepts in mind, researchers can explore diverse topics in banking and finance. Emerging trends include the impact of fintech on traditional banking, sustainable banking practices, and the role of artificial intelligence in risk management and fraud detection. By leveraging these concepts and theories, researchers contribute to the advancement of knowledge and drive innovation in the financial sector.

Dive deeper into the world of banking and finance research by exploring reputable sources like the Journal of Banking and Finance and the Review of Financial Studies. These platforms showcase cutting-edge research and analysis, keeping you informed of the latest developments in this dynamic field.

Journal of Banking and Finance

Review of Financial Studies

Data Sources and Methodologies for Banking and Finance Research

Navigating the ever-evolving landscape of banking and finance demands cutting-edge research and data-driven insights. Let’s delve into some promising data sources and methodologies to fuel your research endeavors in this dynamic field.

Data Sources for Banking and Finance Research:

- Public Data Sources:

- Central banks, regulatory authorities, and statistical agencies often provide comprehensive datasets related to economic and financial indicators.

World Bank, International Monetary Fund (IMF), and Organisation for Economic Co-operation and Development (OECD) offer valuable cross-country data.

Private Data Sources:

- Financial institutions, market research firms, and credit rating agencies possess valuable proprietary data.

Collaborations with banks, investment firms, and fintech companies can provide access to unique datasets.

Alternative Data Sources:

- Social media data, web scraping, and satellite imagery can offer novel insights into consumer behavior, economic trends, and market sentiment.

- Unstructured data from news articles, financial reports, and social media can be analyzed using text mining techniques.

Methodologies for Banking and Finance Research:

- Quantitative Research Methods:

- Statistical analysis, econometrics, and time series analysis help uncover patterns and relationships in financial data.

Regression models, factor analysis, and forecasting techniques are widely used to analyze financial phenomena.

Qualitative Research Methods:

- Case studies, interviews, and focus groups provide in-depth understanding of individual and organizational behaviors in financial markets.

Content analysis and discourse analysis help researchers interpret financial texts, reports, and regulations.

Mixed Methods Research:

- Combining quantitative and qualitative methods enables a more comprehensive understanding of complex financial phenomena.

Surveys, experiments, and simulations can complement statistical analysis and textual analysis.

Machine Learning and Artificial Intelligence:

- Advanced algorithms and techniques can be applied to analyze large datasets, identify patterns, and predict financial outcomes.

- Natural language processing and sentiment analysis can extract insights from financial news and social media data.

- Diverse Data Sources: Utilize a mix of public, private, and alternative data sources to gather comprehensive insights.

- Methodological Rigor: Employ appropriate research methods to ensure the validity and reliability of your findings.

- Ethical Considerations: Adhere to ethical guidelines and data protection regulations when collecting and analyzing data.

- Interdisciplinary Approach: Integrate knowledge from economics, finance, mathematics, and computer science to tackle complex research questions.

- Real-World Impact: Conduct research that addresses real-world problems and contributes to policymaking and industry practices.

- Data Sources for Banking and Finance Research

- Research Methods in Banking and Finance

Ethical considerations and challenges in banking and finance research

In the world of banking and finance, ethical considerations and challenges play a pivotal role in ensuring responsible, transparent, and sustainable practices. As a seasoned professional, I’m enthusiastic about delving into some of these critical aspects that researchers and practitioners must navigate.

Ethical considerations are of utmost importance in banking and finance research, ensuring transparent, accountable, and responsible practices.

Researchers must address conflicts of interest, maintain data privacy, and adhere to regulatory requirements.

Balancing the pursuit of profit with social responsibility and environmental sustainability poses significant challenges.

Researchers should embrace interdisciplinary approaches, incorporating insights from economics, sociology, and psychology to tackle complex ethical dilemmas.

Ethical considerations extend beyond individual research projects, influencing policymaking, industry practices, and the overall reputation of banking and finance.

Navigating Conflicts of Interest:

One of the primary ethical challenges in banking and finance research is managing conflicts of interest. Researchers affiliated with financial institutions or receiving funding from industry sources may face pressure to produce favorable results or downplay risks. To maintain integrity, researchers must disclose any potential conflicts and ensure that their findings are unbiased and objective.

Ensuring Data Privacy and Security:

In an era of big data and advanced analytics, protecting the privacy and security of financial data is paramount. Researchers must implement robust data protection measures, adhering to regulatory requirements and industry best practices. This includes obtaining informed consent from participants, anonymizing sensitive information, and employing encryption techniques to safeguard data confidentiality.

Balancing Profit and Social Responsibility:

The pursuit of profit is often seen as the primary objective in banking and finance. However, researchers must also consider the broader social and environmental implications of their work. This includes examining the impact of financial products and services on vulnerable populations, assessing the carbon footprint of financial transactions, and promoting responsible lending practices.

Embracing Interdisciplinary Approaches:

To effectively address complex ethical dilemmas in banking and finance, researchers need to embrace interdisciplinary approaches. Integrating insights from economics, sociology, psychology, and other disciplines can provide a more comprehensive understanding of the ethical challenges and potential solutions. This collaborative approach can lead to innovative and impactful research that transcends traditional boundaries.

Shaping Policy and Practice:

Ethical considerations in banking and finance research extend beyond individual research projects. They influence policymaking, industry practices, and the overall reputation of the financial sector. By highlighting ethical issues, researchers can inform regulatory reforms, encourage responsible business practices, and foster a culture of integrity and transparency in banking and finance.

Conclusion:

Ethical considerations are at the heart of responsible and sustainable banking and finance research. By addressing conflicts of interest, ensuring data privacy, balancing profit with social responsibility, embracing interdisciplinary approaches, and influencing policy and practice, researchers can contribute to a more ethical and responsible financial system.

Relevant URL Source:

- Ethics in Banking and Finance: A Review of the Literature

- Ethical Challenges in Banking and Finance: A Call for Attention

Q1: What are some emerging trends in banking and finance that researchers can explore for their dissertations?

A1: Emerging trends in banking and finance include the rise of digital banking, the increasing use of artificial intelligence and big data analytics, the growing importance of sustainable and responsible investing, and the evolving regulatory landscape. Researchers can investigate these trends to gain insights into the future of the financial industry.

Q2: What are some innovative solutions that researchers can propose in their dissertations to address current challenges in banking and finance?

A2: Innovative solutions to address current challenges in banking and finance include developing new financial products and services that meet the needs of underserved populations, exploring alternative lending models to promote financial inclusion, and implementing blockchain technology to enhance security and transparency in financial transactions.

Q3: How can researchers ensure that their dissertation topics are relevant to the needs of the banking and finance industry?

A3: Researchers can ensure the relevance of their dissertation topics by conducting thorough research on current industry trends and challenges, engaging with industry professionals to gain insights into real-world problems, and aligning their research objectives with the strategic priorities of financial institutions.

Q4: What are some key factors that researchers should consider when selecting a dissertation topic in banking and finance?

A4: Key factors to consider when selecting a dissertation topic in banking and finance include the availability of data, the potential impact of the research findings on the industry, the feasibility of conducting the research within the given time and resource constraints, and the researcher’s own interests and expertise.

Q5: How can researchers effectively communicate the findings of their dissertations to banking and finance professionals and policymakers?

A5: Researchers can effectively communicate their dissertation findings to banking and finance professionals and policymakers by presenting their research in clear and concise language, using visuals and infographics to illustrate key points, and tailoring their communication strategies to the specific audience they are targeting.

Research Proposal Topics for Banking and Finance: Delving into Critical Issues and Opportunities

Get ready to delve into the exciting world of research proposal topics for banking and finance! In this article, we will explore various areas of study that are shaping the future of the industry. From the impact of blockchain technology on payment systems to the implications of artificial intelligence on financial markets, this comprehensive guide will provide you with valuable insights and equip you to make a meaningful contribution to the field of banking and finance.

Research proposal topics in banking and finance encompass a wide range of topics.

The banking and finance dissertation topics listed include contemporary issues like implementing blockchain applications and examining the impact of the COVID-19 pandemic on the industry.

Students can select dissertation topics based on their academic requirements and personal interests.

Topics cover various areas such as economic crises, business risk, political and economic risks in banking transactions, corporate developments, and security measures in financial institutions.

Research Proposal Topics for Banking and Finance: Unveiling New Frontiers

Navigating the Maze of Research Opportunities

The realm of banking and finance presents a fertile ground for research exploration, encompassing a vast array of intriguing topics that can illuminate critical issues and unveil promising opportunities. Crafting a compelling research proposal in this dynamic field requires careful consideration of relevant themes, ensuring methodological rigor and practical significance.

Selecting a Research Topic: A Journey of Relevance and Fascination

The selection of a research topic is akin to embarking on an intellectual odyssey, guided by both academic curiosity and the desire to address real-world challenges. Your chosen topic should resonate with your academic interests and expertise, while simultaneously possessing relevance to the broader banking and finance landscape.

Navigating the Maze of Banking and Finance Research Questions

- The Era of Digital Transformation:

How can banks leverage artificial intelligence and blockchain technology to enhance customer experiences and optimize operational efficiency?

The Future of Sustainable Finance:

How can financial institutions promote sustainable business practices, driving positive environmental and social impact while ensuring profitability?

Fostering Financial Inclusion:

How can fintech innovations expand access to financial services for underserved communities, bridging the financial divide?

Risk Management in a Volatile Market:

How can banks mitigate risks associated with economic fluctuations, geopolitical crises, and regulatory changes?

The Impact of Regulatory Reforms:

- How do regulatory policies influence the stability and competitiveness of the banking and finance sector?

Essential Elements of a Strong Research Proposal

- A Compelling Introduction:

Capture the reader’s attention with a captivating introduction that establishes the significance of your research topic and articulates your research objectives.

Literature Review:

Demonstrate your understanding of existing literature in your chosen field, identifying gaps and opportunities for further investigation.

Methodology:

Outline the research methods you intend to employ, justifying their appropriateness and ensuring transparency in data collection and analysis.

Expected Outcomes:

Clearly articulate the anticipated outcomes and implications of your research, highlighting its potential contribution to academia and the banking and finance industry.

Budget and Timeline:

- Provide a detailed budget outlining the estimated costs associated with your research, along with a realistic timeline that demonstrates your project’s feasibility.

Conclusion: Unveiling New Horizons

The realm of banking and finance research presents a panorama of opportunities for inquisitive minds, enabling scholars to delve into critical issues, uncover innovative solutions, and contribute to the advancement of knowledge. With careful topic selection, a well-structured research proposal, and unwavering dedication, you can navigate the complexities of this dynamic field and make your mark as a thought leader in banking and finance.

Learn about the latest trends and opportunities in the accounting field by exploring our extensive collection of research topics for accounting students from top universities in the Philippines.

Unlock a treasure trove of research topics designed specifically for accounting students in the Philippines. Find the inspiration and guidance you need to succeed in your studies.

Dive into the world of finance and accounting research with our comprehensive database of research proposal topics . Discover the most relevant and impactful areas of study.

Embark on a journey of discovery with our curated selection of research project topics in banking and finance. Tackle real-world problems and contribute to the advancement of the industry.

Explore the dynamic banking and finance sector in Kenya through our carefully selected research project topics . Engage with cutting-edge ideas and contribute to the growth of the financial system.

Important financial data sources and their significance

The banking and finance industry has undergone a profound transformation driven by the advent of Big Data. With the exponential growth of financial data, banks and financial institutions now have a wealth of information at their fingertips that can be leveraged to improve their decision-making, enhance customer experiences, and mitigate risks.

- Data Sharing and Collaboration:

Big data analytics enables financial institutions to share and collaborate on data, leading to enhanced user convenience and improved operational efficiency.

Data-Driven Insights:

Financial institutions can utilize big data analytics to extract valuable insights from vast amounts of data, informing strategic decisions and improving overall banking operations.

Risk Assessment and Management:

Big data analytics empower banks to analyze vast amounts of data, facilitating effective risk assessment, fraud detection, and proactive risk management.

Changing Business Models:

Big data is disrupting traditional banking models, driving innovation, and leading to the emergence of new products and services.

Compliance and Regulation:

- Big data analytics can assist financial institutions in meeting regulatory compliance requirements, ensuring adherence to industry standards and regulations.

Essential Financial Data Sources:

Unleashing the Power of Financial Data:

- Data Collection and Integration:

- Gather data from various sources, including internal systems, external databases, and third-party providers.

Integrate data into a centralized repository for comprehensive analysis.

Data Cleaning and Preparation:

- Clean and prepare data to ensure accuracy, consistency, and completeness.

Handle missing values, outliers, and data inconsistencies.

Data Analysis and Visualization:

- Apply statistical techniques, machine learning algorithms, and data visualization tools to uncover patterns and trends.

Create interactive dashboards and reports for easy data exploration and insights dissemination.

Actionable Insights and Decision-Making:

- Derive actionable insights from data analysis to inform strategic and operational decisions.

- Implement data-driven strategies to improve financial performance, optimize risk management, and enhance customer satisfaction.

In the ever-evolving landscape of banking and finance, important financial data sources play a pivotal role in driving innovation, empowering decision-makers, and ensuring the stability and growth of the financial system.

[1] Big Data Applications in the Banking Sector: A Bibliometric Analysis

[2] Financial Technology and the Future of Banking

Propelling Research Findings into Practical Applications

Research Opportunities in Banking and Finance: Explore compelling topics that intersect academic curiosity with real-world challenges, shaping the future of the financial industry.

Selecting a Meaningful Topic: Align your research interests and expertise with relevant issues in banking and finance, ensuring practical relevance and impact.

Uncover New Insights: Investigate digital transformation, sustainable finance, financial inclusion, risk management, and regulatory reforms to uncover innovative solutions.

Essential Elements: Craft a compelling research proposal with a solid introduction, literature review, methodology, anticipated outcomes, and a detailed budget and timeline.

Impactful Research: Contribute to academia, inform industry practices, and influence policy decisions through well-executed research that addresses critical issues in banking and finance.

Banking and finance research isn’t just about churning out academic papers; it’s about exploring critical issues, uncovering innovative solutions, and propelling research findings into practical applications that shape the real world.

There’s a treasure trove of research topics waiting to be explored, from digital transformation and sustainable finance to financial inclusion, risk management, and the impact of regulatory reforms. Each topic is a gateway to uncovering new insights and developing solutions that can transform the banking and finance industry.

Creating a strong research proposal is the key to unlocking these opportunities. It’s like building a roadmap for your research journey, ensuring you have a clear direction and a solid plan to get there. Your proposal should include a compelling introduction, a comprehensive literature review, a well-defined methodology, anticipated outcomes, and a detailed budget and timeline.

The ultimate goal is to make a difference. Well-executed research can contribute to academia, inform industry practices, and influence policy decisions, ultimately shaping the future of banking and finance. So, dive into the world of research, explore critical issues, and propel your findings into practical applications that make a tangible impact.

Relevant Sources:

- Research Proposal Writing Guide

- 120+ Research Topics In Finance (+ Free Webinar) – Grad Coach

Ethical considerations and potential impact in banking and finance research

While research is vital for advancements, it’s imperative to consider ethical considerations and potential impact in banking and finance research . Our actions today shape the future, and banking and finance are no exception. Let’s delve into this crucial topic:

Ethical considerations in banking and finance research ensure responsible and transparent practices that align with societal values.

Researchers must prioritize data privacy, informed consent, and avoiding conflicts of interest to maintain trust and integrity.

Balancing rigor and relevance is key, as research should strive to address real-world issues while adhering to ethical standards.

Researchers should consider the potential impact of their findings on stakeholders, including investors, customers, and the broader economy.

Continuous monitoring and evaluation of research practices are necessary to adapt to evolving societal norms and technological advancements.

Ethical Considerations in Banking and Finance Research:

Ethical research practices are paramount in banking and finance. Researchers must respect data privacy and confidentiality, ensuring informed consent from participants and handling sensitive information with utmost care.

Moreover, potential conflicts of interest, such as ties to financial institutions or personal financial interests, must be disclosed and managed to maintain objectivity and avoid bias.

Balancing Research Rigor and Relevance:

Banking and finance research should strike a delicate balance between academic rigor and practical relevance. While methodological soundness and theoretical contributions are essential, research should also address real-world issues and provide practical insights for decision-makers.

This balance ensures that research findings are impactful and have the potential to drive positive change in the banking and finance industry.

Weighing the Potential Impact of Research Findings:

Researchers must carefully consider the potential impact of their findings on various stakeholders. This includes investors, customers, and the broader economy.

For instance, research on a new financial product should assess its potential benefits and risks for various consumer groups, while research on regulatory changes should consider their impact on market dynamics and economic stability.

Continuously Monitoring and Evaluating Research Practices:

Ethical considerations in banking and finance research are not static but evolve with societal norms, technological advancements, and regulatory changes.

Therefore, researchers should continuously monitor and evaluate their practices to ensure they remain aligned with current ethical standards and address emerging concerns.

In banking and finance research, ethical considerations and potential impact are inseparable. Researchers have a responsibility to conduct their work with integrity, transparency, and a deep understanding of the potential consequences of their findings. By embracing these ethical considerations, we can ensure that banking and finance research contributes positively to society and drives positive change in the industry.

Sources: Research Ethics in Banking and Finance

Ethical Research Practices in Finance

Q1: What are some important considerations for choosing a research proposal topic in banking and finance?

A1: When selecting a research proposal topic in banking and finance, it’s crucial to consider factors such as the topic’s relevance, its potential contribution to the field, the availability of data and resources, and your own interests and expertise. It’s also important to ensure that the topic is manageable within the given timeframe and aligns with the requirements and expectations of your academic institution or funding body.

Q2: What are some trending research topics in banking and finance that offer promising opportunities for exploration?

A2: Some trending research topics in banking and finance include the impact of fintech and artificial intelligence on the financial sector, the role of blockchain technology in banking and finance, sustainable and ethical banking practices, the impact of the COVID-19 pandemic on financial markets, and the challenges and opportunities presented by digitalization in banking and finance. These topics offer ample scope for in-depth research and can provide valuable insights to stakeholders.

Q3: What are some common challenges that researchers might encounter when conducting research in banking and finance?

A3: Some common challenges that researchers may face when conducting research in banking and finance include data availability and accessibility, the complexity and evolving nature of the financial sector, the need for specialized knowledge and expertise, ethical considerations, and the potential influence of industry stakeholders on research outcomes. It’s important for researchers to carefully navigate these challenges through rigorous research design, transparent data collection and analysis methods, and ethical practices.

Q4: How can researchers ensure the rigor and credibility of their research findings in banking and finance?

A4: To ensure the rigor and credibility of research findings in banking and finance, researchers should employ robust research methodologies, utilizing appropriate data collection and analysis techniques. Transparency and replicability are key, and researchers should provide detailed information about their methods and findings to allow for scrutiny and validation by peers. Additionally, researchers should consider the limitations and potential biases in their research and engage in peer review and critical discussions to strengthen the validity of their conclusions.

Q5: What are some potential career paths for individuals with a background in banking and finance research?

A5: Individuals with a background in banking and finance research can pursue a variety of career paths, including academia, where they can conduct research, teach, and mentor students. They can also work in the financial industry, applying their research insights to inform investment decisions, risk management, and policy development. Additionally, they may find opportunities in government agencies, regulatory bodies, or non-profit organizations, where they can contribute to policymaking, financial regulation, and the development of sustainable financial practices.

Related Posts:

- The Future of Fintech Login: Secure & User-Friendly…

- Research Proposal Topics in Accounting and Finance…

- MBA Finance Project Topics for the Future: Exploring…

- Driving Profitable Change: The Importance of…

- Innovating Sustainable Business Practices

- Understanding Sustainable Business Practices: A…

Recent Posts

Ways to Save Effectively on Vacations: Insider Tips for Budget Travelers

Vacation Savings Strategies: Maximize Your Vacation Enjoyment and Minimize Financial Burden

Techniques for Vacation Cost Reduction: Unveiling Budget-Friendly Travel Secrets

Effective Ways to Save Money on Vacations: A Budget-Savvy Travel Guide

Mastering Rental Properties for Passive Income: A Comprehensive Guide

Investing for Passive Income and Cash Flow: Proven Strategies for Financial Freedom

How to Build a Passive Income Portfolio: A Guide for Financial Empowerment

Discover the Best Passive Investments That Generate Income: A Guide to Financial Freedom

Successful Saving Techniques: Guiding You Towards Financial Well-being

Proven Strategies for Saving Effectively

Privacy Policy

- Google Meet

- Mobile Dialer

Resent Search

Management Assignment Writing

Technical Assignment Writing

Finance Assignment Writing

Medical Nursing Writing

Resume Writing

Civil engineering writing

Mathematics and Statistics Projects

CV Writing Service

Essay Writing Service

Online Dissertation Help

Thesis Writing Help

RESEARCH PAPER WRITING SERVICE

Case Study Writing Service

Electrical Engineering Assignment Help

IT Assignment Help

Mechanical Engineering Assignment Help

Homework Writing Help

Science Assignment Writing

Arts Architecture Assignment Help

Chemical Engineering Assignment Help

Computer Network Assignment Help

Arts Assignment Help

Coursework Writing Help

Custom Paper Writing Services

Personal Statement Writing

Biotechnology Assignment Help

C Programming Assignment Help

MBA Assignment Help

English Essay Writing

MATLAB Assignment Help

Narrative Writing Help

Report Writing Help

Get Top Quality Assignment Assistance

Online Exam Help

Macroeconomics Homework Help

Change Management Assignment Help

Operation management Assignment Help

Strategy Assignment Help

Human Resource Management Assignment Help

Psychology Assignment Writing Help

Algebra Homework Help

Best Assignment Writing Tips

Statistics Homework Help

CDR Writing Services

TAFE Assignment Help

Auditing Assignment Help

Literature Essay Help

Online University Assignment Writing

Economics Assignment Help

Programming Language Assignment Help

Political Science Assignment Help

Marketing Assignment Help

Project Management Assignment Help

Geography Assignment Help

Do My Assignment For Me

Business Ethics Assignment Help

Pricing Strategy Assignment Help

The Best Taxation Assignment Help

Finance Planning Assignment Help

Solve My Accounting Paper Online

Market Analysis Assignment

4p Marketing Assignment Help

Corporate Strategy Assignment Help

Project Risk Management Assignment Help

Environmental Law Assignment Help

History Assignment Help

Geometry Assignment Help

Physics Assignment Help

Clinical Reasoning Cycle

Forex Assignment Help

Python Assignment Help

Behavioural Finance Assignment Help

PHP Assignment Help

Social Science Assignment Help

Capital Budgeting Assignment Help

Trigonometry Assignment Help

Java Programming Assignment Help

Corporate Finance Planning Help

Sports Science Assignment Help

Accounting For Financial Statements Assignment Help

Robotics Assignment Help

Cost Accounting Assignment Help

Business Accounting Assignment Help

Activity Based Accounting Assignment Help

Econometrics Assignment Help

Managerial Accounting Assignment Help

R Studio Assignment Help

Cookery Assignment Help

Solidworks assignment Help

UML Diagram Assignment Help

Data Flow Diagram Assignment Help

Employment Law Assignment Help

Calculus Assignment Help

Arithmetic Assignment Help

Write My Assignment

Business Intelligence Assignment Help

Database Assignment Help

Fluid Mechanics Assignment Help

Web Design Assignment Help

Student Assignment Help

Online CPM Homework Help

Chemistry Assignment Help

Biology Assignment Help

Corporate Governance Law Assignment Help

Auto CAD Assignment Help

Public Relations Assignment Help

Bioinformatics Assignment Help

Engineering Assignment Help

Computer Science Assignment Help

C++ Programming Assignment Help

Aerospace Engineering Assignment Help

Agroecology Assignment Help

Finance Assignment Help

Conflict Management Assignment Help

Paleontology Assignment Help

Commercial Law Assignment Help

Criminal Law Assignment Help

Anthropology Assignment Help

Biochemistry Assignment Help

Get the best cheap assignment Help

Online Pharmacology Course Help

Urgent Assignment Help

Paying For Assignment Help

HND Assignment Help

Legitimate Essay Writing Help

Best Online Proofreading Services

Need Help With Your Academic Assignment

Assignment Writing Help In Canada

Assignment Writing Help In UAE

Online Assignment Writing Help in the USA

Assignment Writing Help In Australia

Assignment Writing Help In the UK

Scholarship Essay Writing Help

University of Huddersfield Assignment Help

Ph.D. Assignment Writing Help

Law Assignment Writing Help

Website Design and Development Assignment Help

90 Finance Research Proposal Topics

Research papers are an academic type of writing that requires the ability to find the results of a subject and analyse those results to make conclusions and recommendations. In the realm of finance, there are numerous things one could investigate. The management of risk Corporate and organizational governance, investment and many more are just the beginning of the things this field of study covers. Before we dive into the most common topics of finance research papers, it is essential to know about the basics of finance.

What is Finance?

Simply put financial management is the administration of money. However, this type of management encompasses activities like forecasting, savings and lending, borrowing and investing. Finance is a leading area to a swath of different activities related to investing, money credit, capital markets leverage or debit, and banking. Finance-related careers have for quite a while been rewarding because it gives you an advantage over virtually all other courses available. However, in this vast array of subjects, where do students in finance have resources available for writing research papers on finance ? There are several websites that concentrate on topics for finance research papers online.

Select the most appropriate research topic for the Finance Research Proposal

It is essential to select your subject carefully and eliminate any irrelevant information. There are a lot of things you should be aware of when choosing the best research topic, for instance, its importance in the context of current application and its relationship to prior research and the type of research issue and more. Additionally, you'll need to ensure that the subject is focused on a specific issue which you'll be dealing with during your research analysis.

- When you are deciding on your research paper , it is crucial to choose the subject you are fascinated by.

- Find a question with no answer within the area of your research and conduct additional study to discover a feasible solution.

- Before you begin writing your essay, be sure you've completed some preliminary research to make sure you have enough research materials to write about your topic .

- Conduct a search online and discover which topics could be an issue that you must tackle these.

- Be sure you're taking a look at current, up-to-date and current information so that you can ensure your report is current.

- Check out a variety of financial theses and papers to get an concept of your chosen subject;

- Find a general view on your topic of financial research and then use the information to focus on one specific aspect.

- Discuss your subject with your friends or others who have written essays. It is also possible to consult with your professors as well.

A list of finance-related topics to write about

We have compiled an array of interesting topics for writing about. They are divided into groups. This will allow you to select the most relevant topic for your audience and be sure to write it down completely. Enjoy doing your research.

Innovative finance topics

Perhaps you're planning to write a fascinating business essay. You'll have to pick some of the most popular topics for finance papers and then create a persuasive essay. This is our list of 10 topics we think are the fascinating.

- A comparative study of the benefits and setbacks of mergers and acquisitions

- Potential solutions possible solutions Capital Asset Pricing Model

- The future of commerce as well as the consequences of manipulating commodities

- A comparative study of the Continuous-time model's use

- Stability for retail investors by implementing the Systematic Investment Strategy

- US economic growth and taxation of income

- How will the American economy function in conjunction with the current banking system?

- Analysis of financial statements and ratio analysis are they a real element?

- Senior citizen investments - a review of this portfolio

- Multilevel Marketing and it's application across different economies around the world

- The similarities and differences between traditional finance and behavioral

- Customer satisfaction with e-banking

- The most effective risk management strategies for manufacturing - thorough analysis

- A derivative market and its financial risk Identification and measurement

- Risks that could be posed to the banking sector, and how to mitigate them?

- The latest technology that are behind commercial banking

Research topics on finance for MBA

The following list of research subjects in finance will inspire your professors and view finance from a different view.

- An analysis of the investment potential of your selected company

- Capital management - a detailed report

- Considerations for saving taxes and financial strategies

- Life insurance investment and the participation of investors in these investments

- An analysis of the comparison between the traditional product and UIL

Topics related to public finance

Topics in public finance are financial research topics that cover the tax system, borrowing by the government as well as other aspects.

- Budgeting for government and accounting

- The economic austerity is a result of finance and education in the government

- The concept and practice of the taxation by the government

- How can the government get money by borrowing?

- The revenue collection plan of the government

- Accounting and budgeting for the government

Research topics for international research in Finance

Because business transactions are taking place globally, and local commerce is no longer an only alternative, it is essential to study international business.

- How can we help prevent the onset of global economic crisis?

- Does the banking industry have the ability to lessen the consequences of the financial crisis?

- Can a country get the goal of providing healthcare to homeless people?

- Which areas of healthcare require more money?

- The issues with the high cost of medications in the US

Topics in research on healthcare finance

Here are a few of the most important issues in the field of healthcare finance:

- Which is better, free or paid healthcare?

- Healthcare finance - its origins

- Is financing healthcare a privilege or a right?

- Health policies throughout America U.S. through history

- What can countries in the first world do to enhance healthcare?

- What impact has the government had on health care?

- Are we able to achieve universal healthcare for all?

Topics in Corporate Finance

Corporate finance is the process of the organization of capital, financing, and making choices on every investment. Following is a list of finance research topics will help you avoid errors in this field.

- Potential solutions to ethical issues in the field of corporate finance

- Understanding the investment trends of small and medium-sized firms

- Mutual funds and investment A thorough analysis of its various streams

- How can equity investors deal with the potential risk

- What are the possible advantages and disadvantages of SWIFT and how will it function?

Topics in Business Finance

Every decision we make in the business world has financial consequences. We must therefore be aware of the basics to write finance-related topics that need analysis, management valuation, management, etc.

- The establishment of business entities and the use of business finance

- Modernization of business and the role of finance in business

- Selling our life insurance Do we have a tax incentive that is effective in this case?

- Who are the people who mutual funds affect in the private and public sectors?

- Diverse investment options for various types of financials - Do you have an investment option you prefer?

- The preferences and choices of investors - A thorough analysis

- The investor's perspective regarding taking a stake in private insurers

- Corporate entities and raising their accountability

- Business finance and ethical issues

- Taxes on small and medium-sized business payment

Personal financial topics