Elevating value with Accenture's integrated ESG reporting

Affirming our commitment to transparency and accountability to our ESG goals and progress.

5-MINUTE READ

A call for change

Organizations around the world are waking up to the opportunities that sustainability offers. Years ago, sustainability was viewed as a compliance issue, then as a corporate responsibility. Today, we believe that sustainability is about competitiveness and one of the most important drivers of growth for the coming decade. It is no longer a “nice-to-have,” but a “must-have” for all stakeholders.

The Accenture Sustainability Value Promise is to embed sustainability into everything we do, with everyone we work with, creating both business value and sustainable impact, enabled by technology and human ingenuity. Our approach is grounded in science, economics and data by design—it is built into our business strategy, not “bolted on.”

We have set ambitious sustainability goals—for climate action, net-zero emissions, workforce equality and other priorities—and we continue to build on the momentum that emerged from COP26 to combat climate change and achieve the United Nations Sustainable Development Goals.

To do this, we have implemented targeted actions for all our goals to drive change across our business and for our clients. But we knew we needed to do more—not only to meet the evolving needs of all our stakeholders, but to truly embed sustainability across our business.

To create 360° Value for all our stakeholders, we also had to measure and share our progress across multiple dimensions of value—including sustainability and financial performance—and do so in a way that’s not only data-driven, transparent and clear but connected and integrated with our business strategy.

Accenture defines “360° Value” as delivering the financial business case and unique value a client may be seeking, along with striving to partner with our clients to achieve greater progress across these additional dimensions: Client, Talent, Inclusion & Diversity, Experience, Sustainability and Financial. Accenture applies these same categories of value to how we operate our business.

There is now an opportunity for organizations to gather comprehensive ESG data that can help transform how they do business—building accountability across the organization, achieving global sustainability goals and ultimately creating greater business value.

Julie Sweet / Chair and CEO of Accenture

When tech meets human ingenuity

We launched our 360° Value Reporting Experience with our fiscal year 2021 results to demonstrate the multiple ways we create, drive and measure value, both in serving our clients and operating our business. The Reporting Experience brings together, for the first time, all our financial and environmental, social and governance (ESG) metrics, progress and performance in one place.

Integrating our ESG and financial reporting required a true partnership across Accenture and with key ecosystem partners. It also required fundamental changes to our core business processes and data-gathering and analytics.

The Reporting Experience involved an unprecedented collaboration across our organization. Functional Accenture teams—including Finance , Investor Relations , Legal, Sustainability , Corporate Citizenship , Human Resources, Global IT , Corporate Services & Sustainability , Marketing and the business—worked together to build the Accenture 360° Value Reporting Experience —a holistic, integrated and interactive digital hub. The Reporting Experience itself is innovative, in addition to the content and approach.

We transformed our approach to reporting by focusing on the information needs of all our stakeholders—our clients, people, shareholders, partners and communities. At the same time, we addressed the needs of compliance—to provide clear and transparent disclosure across the various ESG frameworks, demonstrating how we create value for all our stakeholders.

Here’s how we did it:

Started with reporting strategy, leadership and culture

We began with the fundamentals—securing clear direction from our Chair and CEO Julie Sweet and obtaining Accenture board and leadership commitment on our reporting strategy. We also created a consistent, integrated message about how we deliver 360° Value to our stakeholders.

We established a governance model to create a culture of shared success and a steering committee to execute on our reporting strategy. Additionally, we defined key roles and responsibilities across the organization and created a dedicated ESG team to work across the company. Among the team’s many activities, they collaborated to confirm our reporting experience met the needs of all our stakeholders.

Built on a strong ESG foundation

As a long-standing partner of the United Nations Global Compact (UNGC), we had an opportunity to build on our foundation of ESG reporting. Using our ESG priorities and relevant issues for all our key stakeholders, we advanced our goals and commitments and are implementing targeted actions with enhanced, transparent reporting.

In addition to our ongoing comprehensive United Nations Global Compact: Communication on Progress ESG report, we expanded our ESG reporting for fiscal year 2021 with three additional frameworks: the Sustainability Accounting Standards Board (SASB); the Task Force on Climate-related Financial Disclosures (TCFD); and the World Economic Forum International Business Council (WEF IBC) metrics. At the same time, we continued to report against the Global Reporting Initiative (GRI) Standards, the United Nations Global Compact’s (UNGC) Ten Principles and the Carbon Disclosure Project (CDP).

Ultimately, our goal is to create 360° Value for all our stakeholders. We measure our success by how well we are achieving this goal.

Raised the bar on data assurance and quality

Because sustainability is a business priority, we consider sustainability metrics as important as financial data. We leveraged the rigor and discipline of our Controllership function to evaluate our data governance over policies, systems, internal controls and assurance. We also aligned data-gathering and reporting timelines and established an integrated and unified reporting experience.

Applied technology

Technology not only enables transformation, it allows companies to facilitate reliable, real-time reporting. At Accenture, we leverage our centralized core systems, including a single global instance of SAP and a single global instance of Workday. We know that “one source of truth” is critical. This single instance best practice enables us to gather data efficiently and it ensures that the data is captured systematically, accurately and in a repeatable way.

Looking ahead, we’re assessing how technology can help better capture workflows and data across multiple sources in a more timely and accurate manner. We’re considering automation of data flows as well as calculation engines for analytics and dashboarding around our priorities, key goals and commitments. To help address our needs, we plan to look to some of our ecosystem partners, including Microsoft, Salesforce and SAP, for solutions.

Designed a new reporting experience

Our team led the creation of the new Accenture 360° Value Reporting Experience , uniquely designed to demonstrate comprehensively the value Accenture is delivering. The launch of this digital reporting hub achieved clear, consistent messaging around all our reporting, heightened the user experience and streamlined the creation and sharing of key data across all our reporting. This new, modular approach to reporting is designed to evolve and grow with Accenture’s business strategy and the transforming global environment for ESG standards.

A valuable difference

Our new integrated reporting delivers transparency and accountability—the hallmarks, we believe, of good governance and essential to the trust we have earned with our clients, people, shareholders, partners and communities. Our objective is to continually measure our performance and report how well we are achieving our goal to create 360° Value for all our stakeholders.

But reporting is just the beginning. Accenture continues to build sustainability into our business, making it one of our greatest responsibilities, with a goal of embedding it by design into everything we do and for everyone we work with: our clients, people, shareholders, partners and communities.

Leaders have a real opportunity to drive a new era of performance by making the best use of technology and new ways of collaborating to bring the right ESG data to stakeholders, while contributing to a company’s competitiveness in the marketplace.

Meet the team

Richard Clark Chief Transformation Officer – Business Enablement LinkedIn

Angie Park Managing Director – Investor Relations LinkedIn

Carmelina Pagliero Managing Director – Controllership LinkedIn

Ambrose Shannon Managing Director – Sustainability Services LinkedIn

Jill Huntley Managing Director – Global Corporate Citizenship

Lucy Murdoch Managing Director – Global Corporate Citizenship LinkedIn

Elizabeth Daggett Managing Director – Marketing + Communications LinkedIn

Margaret Smith Senior Managing Director and Executive Director – Corporate Services & Sustainability and Business Operations LinkedIn

Scott Wilson Managing Director – Corporate Services & Sustainability, Director of Operations LinkedIn

Mike Nicholus Director – Corporate Services & Sustainability, Environment & Sustainability LinkedIn

Related capabilities

- Finance at Accenture

- Sustainability services

- How Accenture does IT

January 12, 2023

Alarmed by Speed and Scale of Disruption, CEOs Embrace Sustainability to Build Long-Term Resilience, According to UN Global Compact and Accenture

As the halfway point to achieve the UN Sustainable Development Goals approaches and the deadline to meet key milestones of a 1.5C world looms, CEOs take action to avoid consequences to environment, society and business growth

NEW YORK; Jan. 12, 2023 – CEOs are facing an enormously challenging global context, with the vast majority (93%) experiencing 10 or more simultaneous challenges to their businesses and 87% warning that current levels of disruption will limit delivery of the UN Sustainable Development Goals (SDGs), finds the largest CEO study on sustainability ever conducted by the UN Global Compact and Accenture (NYSE: ACN). While CEOs are increasingly concerned about these headwinds, nearly all (98%) agree that sustainability is core to their role, a sentiment that has grown 15 percentage points over the last 10 years of the study.

The 12th United Nations Global Compact-Accenture CEO Study draws on insights from more than 2,600 CEOs across 128 countries, 18 industries, and over 130 in-depth interviews—making this the largest-ever sampling of executives, including the biggest group of CEOs from the Global South, since the start of the CEO study program in 2007. In the study, CEOs forewarn about the impact of converging setbacks for business and society, from faltering multilateralism and socioeconomic instability to supply-chain interruptions and the immediate effects of climate change. “In a world categorized by conflict, energy shortages, rising inflation and the threat of recession, this year’s study shows CEOs do not believe the world is as resilient to crises as we may have hoped. Businesses continue to be impacted by multiple shocks. As a result, on a broad range of issues, from runaway climate change to widening social and economic inequalities, business action right now does not match the ambition and pace needed to achieve the Sustainable Development Goals by 2030,” said Sanda Ojiambo, Assistant Secretary General, CEO and Executive Director UN Global Compact.

As these challenges stack up, CEOs point to global issues that traditionally lie outside the corporate sphere—such as climate change or socio-political conflicts—as reasons for worry over delivering value and impact for all stakeholders. With only eight years left to rescue the SDGs , nearly half (43%) of CEOs globally say their sustainability efforts have been hampered due to the geopolitical environment, with that number even higher for CEOs from developing countries (51%). When examining net zero targets set by the world’s largest companies , Accenture also found that nearly all will miss their own targets unless they double the rate of carbon emissions reductions by 2030. However, some CEOs continue to make a great impact and show clear pockets of success that deliver shared stakeholder value and competitive advantage in their industries and are reshaping the future of sustainable development through innovation and collaboration. Two-thirds of CEOs (66%) say their companies are engaging in long-term strategic partnerships to build resilience. These leaders are reconfiguring underlying supply chains, reskilling their workforces, reassessing their relationship with natural resources, and reimagining planetary boundaries through breakthroughs in technology spanning physical, digital and biological solutions. “Not meeting the promise of the SDGs is a real concern but, at the same time, an enormous opportunity for companies that reinvent their enterprises and harness sustainability as one of the key forces of change in the next decade,” said Peter Lacy, Accenture’s global Sustainability Services lead and chief responsibility officer. “CEOs are clearly concerned about resilience, but one leader’s resilience is another leader’s growth opportunity. New waves of technology investments and breakthrough innovation can put the SDGs back within reach – but only if leaders turn to sustainability for resilience to help create new markets, products and services that can correct the current trajectory and drive growth amid times of disruption.” CEOs also identify a clear need to focus on technology for finding solutions to tackle global challenges and drive growth. Leading CEOs are already embedding sustainability into their businesses through launching new products and services for sustainability (63%), enhancing sustainability data collection across their value chains (55%) and investing in renewable energy sources (49%). Nearly half (49%) are transitioning to circular business models, and 40% are increasing R&D funding for sustainable innovation. In their interviews, CEOs identify key initiatives to build resilience for companies, from establishing science-based climate targets and investing in their workforce’s diversity to engaging in cross-industry partnerships on technology solutions, enhancing supply chain visibility and advancing greater biodiversity. Additionally, CEOs continue calling for government engagement on policy changes1 that prioritize long-term measurable objectives as standardized ESG reporting frameworks , a global market for carbon and incentives for sustainable business models.

“Despite setbacks, there is room for hope. The CEOs we surveyed increasingly recognize they can build credibility and brand value by committing to the Ten Principles and the Sustainable Development Goals throughout their operations– not only because it’s the right thing to do, but also because it is good business sense,” added Ojiambo. You can explore Reimagining the Agenda: Unlocking the Global Pathways to Resilience, Growth, and Sustainability for 2030 in Accenture Foresight , our new thought leadership app, which provides a personalized feed of all our latest reports, case studies, blogs, interactive data charts, podcasts, and more. Visit http://www.accenture.com/foresight . About the CEO Study Program The CEO Study program, developed by the UN Global Compact and Accenture, is an effort to enhance understanding and commitment between the United Nations and the private sector. The program is an extensive review of the advancing corporate sustainability movement, and the publications coalesce dominant views of CEOs, business leaders and UN executives to track developments in sustainability. About the United Nations Global Compact As a special initiative of the UN Secretary-General, the United Nations Global Compact is a call to companies everywhere to align their operations and strategies with Ten Principles in the areas of human rights, labour, environment, and anti-corruption. Our ambition is to accelerate and scale the global collective impact of business by upholding the Ten Principles and delivering the Sustainable Development Goals through accountable companies and ecosystems that enable change. With more than 17,000 companies and 3,000 non-business signatories based in over 160 countries, and 69 Local Networks, the UN Global Compact is the world’s largest corporate sustainability initiative—one Global Compact uniting business for a better world. For more information, follow @globalcompact on social media and visit our website at unglobalcompact.org. About Accenture Accenture is a leading global professional services company that helps the world’s leading businesses, governments and other organizations build their digital core, optimize their operations, accelerate revenue growth and enhance citizen services—creating tangible value at speed and scale. We are a talent and innovation-led company with 738,000 people serving clients in more than 120 countries. Technology is at the core of change today, and we are one of the world’s leaders in helping drive that change, with strong ecosystem relationships. We combine our strength in technology with unmatched industry experience, functional expertise and global delivery capability. We are uniquely able to deliver tangible outcomes because of our broad range of services, solutions and assets across Strategy & Consulting, Technology, Operations, Industry X and Accenture Song. These capabilities, together with our culture of shared success and commitment to creating 360° value, enable us to help our clients succeed and build trusted, lasting relationships. We measure our success by the 360° value we create for our clients, each other, our shareholders, partners and communities. Visit us at www.accenture.com . 1 Policy positions do not necessarily reflect the views of Accenture. # # # Contacts: Alexander Aizenberg Accenture +1 917 452 9878 [email protected] Alex Gee United Nations Global Compact +447887 804594 [email protected] [email protected]

Commercial banking top trends in 2023

Breaking barriers: exploring how banks scale generative ai for growth, the ultimate guide to banking in the cloud, the ultimate guide to product innovation in banking, 3 ways generative ai will transform banking, accenture banking blog other blogs banking blog capital markets blog insurance blog.

- Meet Our Bloggers

- More From Banking

- English US English

- A clear-eyed approach to the data dilemma in sustainable banking

31 May 2021

Other parts of this series:

In banking, sustainability is the new digital. now what.

In my last blog post, I outlined the challenges and opportunities ahead for sustainable banking. With this post, I’m joined by my colleague Prithika Priyanshi, Senior Principal from the Center for Data & Insights at Accenture, who specializes in AI-powered sustainability.

Just as digital did ten years ago, sustainability now impacts every part of the bank—from the C-suite to the front office, from product development to risk management and compliance, from finance accounting to supply chain. Banks are at a green inflection point and the time is right to make big, bold moves to execute a sustainability agenda.

The world is moving fast. Pressure is building for banks to show that they meet increasingly rigorous environmental, social and governance (ESG) regulation targets. Recently published directives give guidance on calculating and disclosing ESG-related information. One example is the European Banking Authority’s proposal that banks be obliged to report their green asset ratio (GAR) . This key performance indicator shows the extent to which a bank’s activities—loans and advances, debt securities and equity instruments (trading books excluded)—are environmentally sustainable and in alignment with the EU’s Taxonomy Regulations.

Banks will need to manage ESG data on the client, product and even financial instrument level. But to demonstrate compliance with these regulations, banks need trusted data.

Accenture surveyed 100 executives across the 50 largest U.S. banks and found that more than one-third (35 percent) think that the availability and granularity of ESG data is insufficient to assess both climate risk and financial risk in evaluating lending decisions. More than one-third (35 percent) do not have a defined approach to measure and assess the potential impacts to their financial results due to the transition risks from mitigating climate change.

In a digital landscape, good data is the foundation for all good decision-making. Yet the banking industry’s secret—one that doesn’t make it into annual reports—is that in its current form, ESG data reporting isn’t very useful. In fact, the challenges associated with proper data collection and processing may be skewing results, misleading stakeholders, wasting resources and leading to poor decisions.

In a digital landscape, good data is the foundation for good decision-making.

Currently, the ESG data market could be worth $1 billion in annual revenues, but what does this mean? And is the available data supply the only answer to banks´ ESG data challenge?

Other large corporations looking to green their supply chains are also dependent on ESG scores for decision-making. On the surface, this makes sense. Companies with good ESG ratings should be performing better when it comes to sustainable business practices, and should be making less of a negative environmental impact than those with lower scores. But there’s a problem: The data doesn’t correlate. MIT’s Sloan School of Management looked at ratings from various ESG vendors and found that the correlation was, on average, just 0.61. That means the ESG rating outcomes of different companies are not sufficiently comparable to measure factors like their carbon footprint or working conditions.

Key challenges to ESG data gathering and processing include:

- Only larger public companies are required to report ESG data, which is published in their annual reports. This limits the data pool to what these companies self-disclose.

- The lack of a single regulatory framework, although various guidelines exist.

- The lack of consensus on terminology and definitions.

- The lack of auditing, which limits the reliability of disclosure reports; there is no universal system to verify reported data, and public reports tend to highlight positive contributions to ESG and underplay or omit less flattering reporting (also known as greenwashing ).

- ESG scores are a black box; there is no regulation on how sustainability needs and performance are assessed, and every ESG rating agency has its own methodology which evolves over time. Reliance on ESG scores becomes questionable when underlying metrics are not revealed.

We expect some regulatory actions to improve the quality and reliability of self-published ESG information. The recently proposed update from the European Commission on the NFRD (non-financial reporting directive; now called the Corporate Sustainability Reporting Directive or CSRD) expands the scope of non-financial reporting and enforces more reporting rigor regarding net zero strategies. It also introduces new mandatory reporting standards that will include five times the number of companies. More companies mean more clients, and more clients mean more data. This will allow banks to feed their own ESG data models with reliable, publicly available company information.

Retooling the bank for sustainable lending

Banks that lead in sustainable finance will strengthen public trust, stay ahead of regulatory expectations and have significant growth opportunities.

The current ESG data landscape is inconsistent and contradictory. For banks to meet its challenges and navigate its complexities, they must be able to track their sustainability progress accurately and measure it against that of their competitors.

Meaningful and lasting global impact may be beyond the reach of any individual bank at the moment. But just because we can’t change everything , doesn’t mean we shouldn’t do something . Now is the time for banks to make wise and strategic investments in ESG data gathering, reporting and infrastructure, with bespoke sustainable solutions and intelligent insights. Banks that collect, validate and analyze ESG data, in the same way that they do with financial information from their clients, will set themselves apart, not only from a reporting perspective but also in terms of their future business.

Many believe that more standardization and regulation is the only way forward. We caution against this approach—we can’t regulate our way out of this challenge. Much like the digital transformation that came before it, the sustainability transformation will require a re-imagining of how a business is run. Banks will need to leverage intelligent sustainable technologies and smart ecosystem partnerships to make sure they’re getting the greatest insights from the best available data.

These four strategies can transform the way a bank gathers, reports and analyzes data:

1. Define a target operating model for ESG data:

Some banks try to nurture sustainability use cases with ‘fit for purpose’ ESG data feeds, but this results in vertical data silos. A horizontal, internal ESG data utility and service addresses inconsistencies and reduces the need to data-manage future ESG use cases from all parts of the bank. Integration with other non-financial data and the client/product perimeter is key.

2. Harmonize reporting standards and simplify disclosure requirements:

Multiple guidelines and their enhancements over the years have only complicated the ESG disclosure ecosystem. A harmonized, universal, simplified and industry-specific list of screening factors, and a disclosures and measurement methodology, will help banking move forward. Look for ecosystem partners that can provide support and leverage best practice use cases.

3. Scale with AI:

Advanced AI allows banks to build robust in-house ESG data capabilities. It can, with a high degree of accuracy, extract, structure and synthesize text, tables and charts from unstructured disclosure reports at speed and scale. By applying a custom natural language processing (NLP) pipeline and its self-learning algorithms, data from industry reports, home pages and other digital sources can be translated into meaningful binary key performance indicators. Natural language generation (NLG)/NLP identifies and summarizes best practices and other relevant insights, reducing manual effort by nearly 60 percent.

4. Partner with alternative data sources:

Enlist partners with deep data-gathering expertise, as well as banking industry knowledge, to enable ESG data gathering where it is not readily available and to validate the authenticity of the reported data. An example of this would be using weather data to assess air pollution at a manufacturing unit or construction site.

Banks have accepted their pivotal role in financing the sustainability agenda. Forty-three world-leading banks recently joined the Glasgow Financial Alliance for Net Zero . The industry is now at an intersection and needs to start planning for execution.

Accenture can help you design and manage your ESG data collection and processing. Download our Challenges in ESG data gathering brochure to find out more or contact us here .

Christof Innig’s next post will explore ESG in the banking supply chain. In the meantime, read more about sustainable banking in our latest report, “Optimizing the risks and returns of climate change for banks” here .

Disclaimer: This content is provided for general information purposes and is not intended to be used in place of consultation with our professional advisors. This document may refer to marks owned by third parties. All such third-party marks are the property of their respective owners. No sponsorship, endorsement or approval of this content by the owners of such marks is intended, expressed or implied. Copyright© 2022 Accenture. All rights reserved. Accenture and its logo are registered trademarks of Accenture.

Related posts, by jared rorrer, news from sibos: banks are excited for new trade finance solutions, by chris scislowicz, how can mid-sized banks compete in the big leagues, by mauro macchi, banks stand to benefit as sustainability co-stars alongside digital, by christof innig, by cameron krueger & joseph pulicano, why is digital transformation so difficult for auto and equipment lenders, digital and sustainable: the twin transformation you’re ignoring, by andy young, four keys to boosting digital fluency (and bonus: becoming more agile), hone your edge: why digital fluency is key to banking performance, how to get value from your crm platform. faster., by michael abbott, what purposeful, trust-based banking looks like, get the latest blogs delivered straight to your inbox..

Next Post - Introducing Banking Cloud Altimeter, an inside guide to banking in the cloud

Suggested Post - Introducing Banking Cloud Altimeter, an inside guide to banking in the cloud

Subscribe Get the latest blogs delivered straight to your inbox.

Share

5 predictions for the insurance industry in 2024

3 ways insurance underwriters can gain insights from generative ai, 5 ways to simplify and reinvent your insurance enterprise, 5 key generative ai use cases in insurance distribution, insurance news: international women’s day special edition, insurance blog | accenture other blogs banking blog capital markets blog insurance blog.

- Meet our bloggers

- More from insurance

Sustainability & ESG: A strategic resilience guide for insurers

Other parts of this series:.

- Strategic Resilience: What is it and why does it matter?

- Sustainability & ESG: A strategic resilience guide for insurers

- Strategic Resilience: 4 Opportunities You Can’t Ignore In P&C

The first part of this blog series introduced Accenture’s strategic resilience framework. In this blog, I will expand this introduction to take you through our framework step by step using the lens of sustainability and ESG (environment, social and governance).

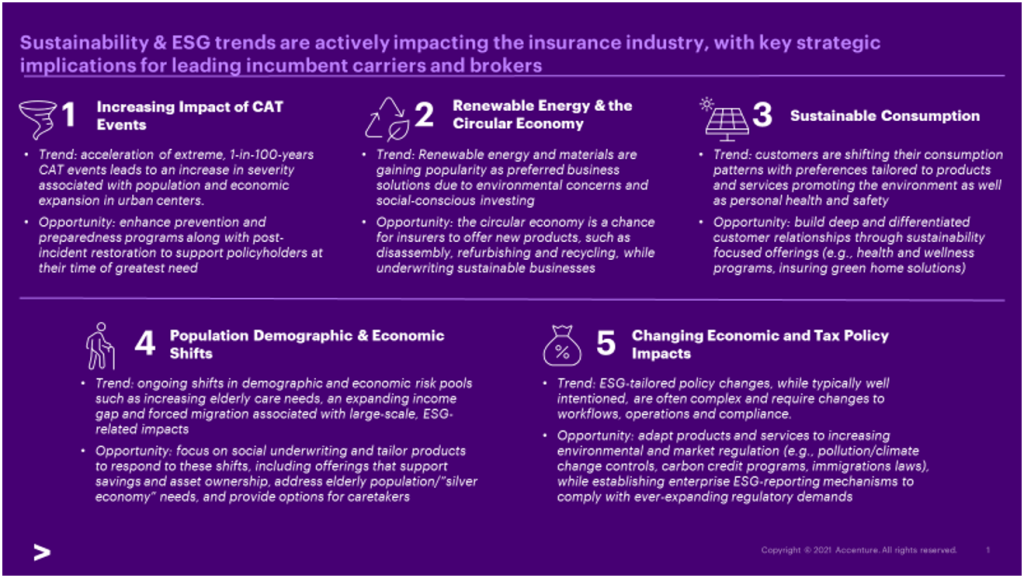

Sustainability and ESG trends are huge impact drivers in insurance—they are also among the most complex, unknown and disruptive. Tackling this issue can feel overwhelming because of how unclear the future is: How will climate change accelerate the frequency and severity of catastrophic (CAT) events? How will climate change along with the call for more social justice impact the economy, and by extension, consumer finances and preferences? Will stakeholder capitalism profoundly alter the current economic system and political landscape?

Current trends impacting sustainability in insurance

Some trends present opportunities for insurers, while others present challenges—both are important to prepare for. Below, I’ve outlined five sustainability and ESG-related trends currently impacting the insurance industry (and the world). This is a high-level, small snapshot of the potential impact of these trends.

Use the unknown to move from trends to scenarios

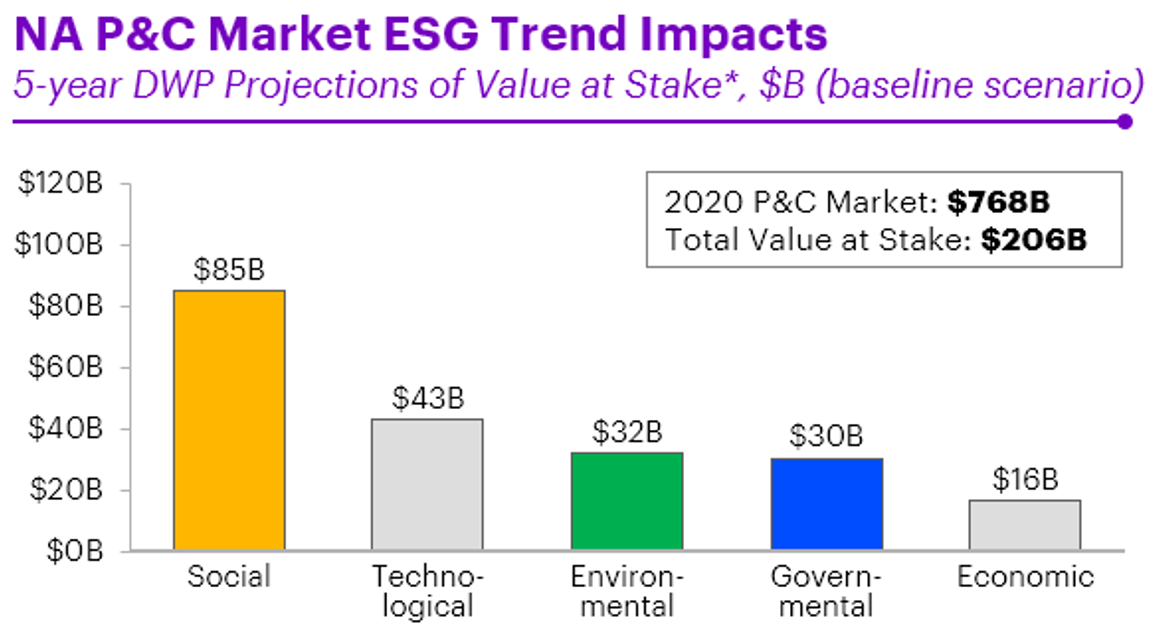

There is a real risk to ignoring these sustainability trends in insurance—and a real opportunity to respond to them. Looking at the opportunities in the North American P&C market, we found that ESG-related trends are projected to drive a $206 billion opportunity in the next five years. If these trends accelerate, that opportunity could increase to $385 billion.

*Value at stake includes both new premium opportunities entering the market and legacy premium shifting to new product offerings

If not responding to these sustainability and ESG trends isn’t an option, what is a business supposed to do when the future of these trends remains unknown? The answer is scenario planning through a strategic resilience framework.

Since these trends are based on the “social,” “environmental” and “governance” pieces of the PESTEL framework, we can create a graph to understand what happens if these categories accelerate or decelerate. (Note: Governance combines political and legal, and is integrated into the social- and environmental-focused scenarios).

This really is the heart of strategic resilience. By their nature, trends are a high-level vantage point because the details of how they play out could change at any moment. Strategic resilience is designed to withstand this uncertainty. By looking at what will happen if these trends accelerate, businesses can make long-term decisions to build-in resiliency from the start of their strategy planning.

Turn scenarios into an actionable roadmap using Accenture’s strategic resilience model

The point of scenarios is to arm your business with knowledge. When you envision a world where a trend moves faster or slower, you give yourself a range of potential scenarios to work with when deciding on a strategic roadmap. So then how do you determine which scenario(s) to follow?

The future world is only one piece of the puzzle. You still have the current reality of the trend to contend with, and you also have the reality of your current business state that will influence your decision. In essence, you need to see how the different scenarios will impact your specific business and where the greatest opportunities lie. This is why we have built a strategic resilience model.

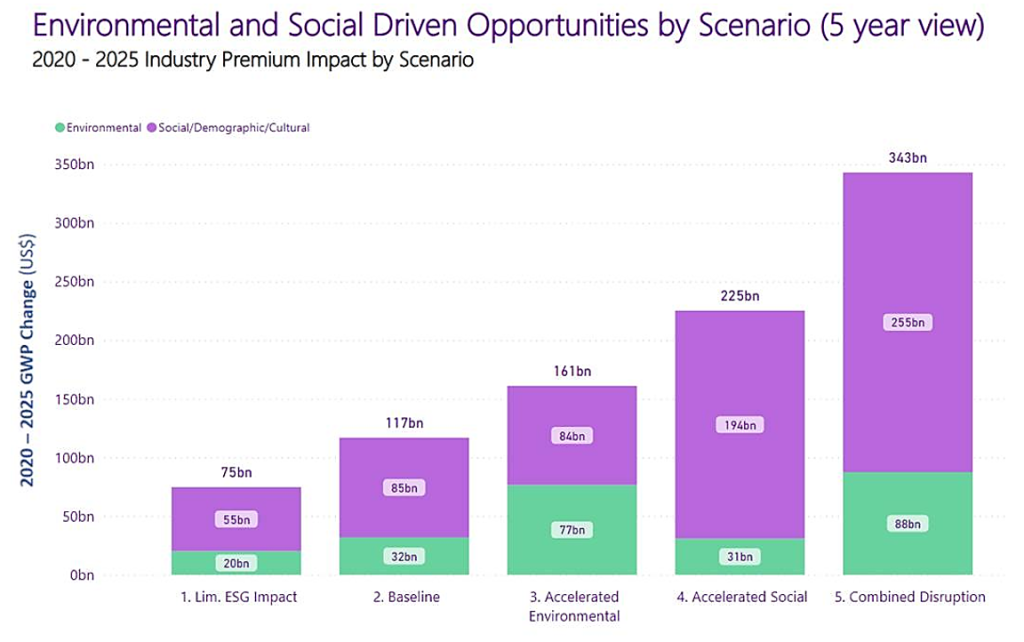

Using our strategic resilience model, we can determine the baseline—the financial impact of each trend on its current trajectory—and then the financial impact if a trend accelerates or decelerates in ESG-driven scenarios. For example, based on the chart below, our model predicts that there will be a $117B new business opportunity in the next 5 years driven by environmental and social trends. However, the combinatorial effect of high acceleration of these trends together could yield as much as $343B. Insurers need to have their plans in place to capitalize on these opportunities.

With this information, combined with industry expertise, you can make well-informed decisions about the future of your business. Looking into the future systematically in this way can help you to stay ahead of changing winds, allowing you to tap into opportunities that your competitors might not recognize.

We might not be able to predict the future, but we can predict the range of future possibilities. This is just one example of looking at a category—sustainability/ESG—and using our PESTEL framework and strategic resilience model to build a roadmap that is both durable and flexible. In the next blog of this series, we will analyze our strategic resilience framework from a different angle—an industry angle.

You can contact Nina Jais or Ravi Malhotra for help in developing your insurance ESG strategy and using our strategic resilience model to build you a long-term roadmap that will keep you competitive and agile.

Disclaimer: This content is provided for general information purposes and is not intended to be used in place of consultation with our professional advisors.

Related posts, by kenneth saldanha & cindy de armond, insurance news: when states are the insurers of last resort, by kenneth saldanha, insurance news: the heat is on—from climate change to claims, by silvia milian, explore the insurance trends for 2022 and beyond, how sustainability and workforce transformation inspire innovation, resilience inspires optimism in the insurance industry, by ravi malhotra, strategic resilience: 4 opportunities you can’t ignore in p&c, by scott stice & bob besio, key strategies for p&c carriers to win in wealth management, insurance news: building the digital core with data quality, female leadership in insurance – practical next steps, get the latest blogs delivered straight to your inbox..

Next Post - Strategic Resilience: 4 Opportunities You Can’t Ignore In P&C

Subscribe Get the latest blogs delivered straight to your inbox.

Share

The generative AI revolution in capital markets

The battle for better: mobile apps in wealth management, the changing retirement recordkeeping landscape in the us, how dlt could help with green bonds, first base for your gen ai journey could be efficiency, accenture capital markets blog other blogs banking blog capital markets blog insurance blog, asset management.

- Investment Banking

- Market Infrastructure

Wealth Management

- Meet Our Bloggers

- More from Capital Markets

Testing your sustainability DNA

24 Mar 2022

Leadership teams across Capital Markets increasingly hold responsible values and good environmental, social and governance (ESG) intentions. This is true not only for many of the new products they develop but also for their own organizations, for very good reasons. However, some may be outrunning the ability of their companies to deliver the necessary behavioral change to bring those values to life. Progress on most of the United Nations’ 17 Sustainable Development Goals has stalled or eroded, according to Accenture research, Delivering on the promise of sustainability .

The recent health, economic and social crises have raised people’s expectations about the role businesses play in solving global problems. While there’s no one-size-fits-all answer, it’s obvious that sustainability needs to be built into the core of all businesses today. This is true from a consumer, employee and investor perspective. We all sink or swim together.

Sustainability in the marrow

I believe that in order to succeed in the future and to build a sustainable organization, all businesses should strengthen their “ Sustainability DNA ”—a set of management practices, systems and processes that shape new behaviors and decision-making capabilities. These capabilities:

- Foster human connections by sensing and championing the values and needs of diverse (and often unheard) stakeholders across the business ecosystem.

- Boost collective intelligence by developing decision-making processes focused on diverse stakeholders.

- Help to build accountability at all levels, so delivering broad-based stakeholder value becomes the responsibility of all employees.

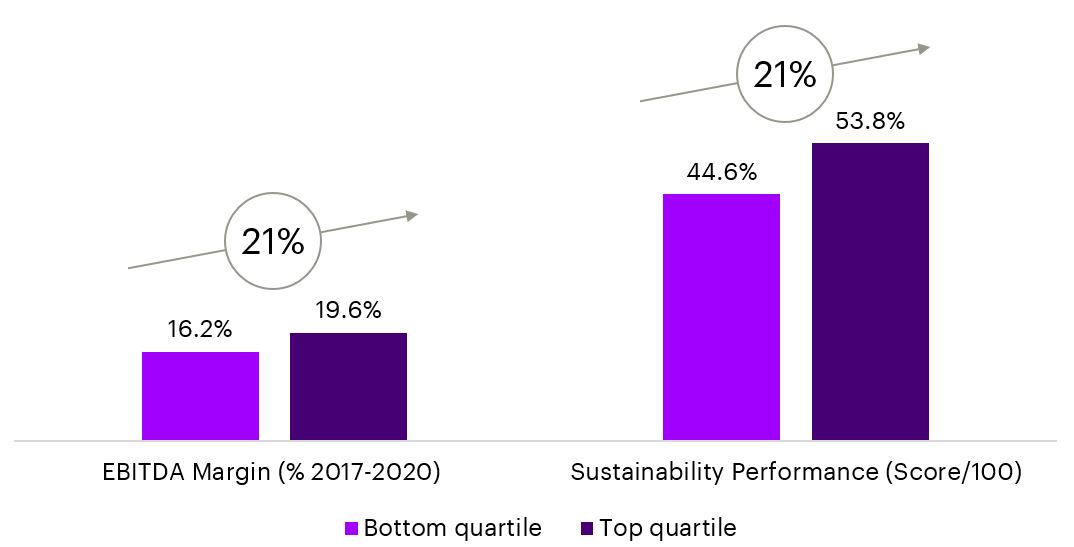

Interestingly, our research, Shaping the Sustainable Organization , demonstrates that companies with strong Sustainability DNA are more likely to deliver financial value and a lasting positive impact for their people, society and the environment. It shows that companies with the most deeply embedded sustainability management practices outperform their peers by 21% on profitability as well as positive environmental and societal outcomes .

The EBITDA margin of top quartile companies on our Sustainable Organization Index is 21% higher (+3.4 percentage points) compared with the bottom quartile. Their sustainability performance is also 21% higher (+9.2 index points).

Capital Markets’ scorecard on Sustainability DNA

In this latest research, we graded the Sustainability DNA of nearly 4,000 companies globally across various industries. Overall, we found that the average score was 52 out of a possible 100 points. Capital Markets, on average, clocked a score of 48. This result clearly indicates that there is an opportunity for companies to further drive impact and value—across industries as well as in Capital Markets.

Across all industries, we found that organizations tend to be better at building what we called human connections than they are at developing collective intelligence. In other words, they are better at understanding stakeholder perspectives than they are at baking those insights into decision-making. Capital Markets is no exception. For example, in terms of stakeholder inclusion, companies are better at championing human dignity (52/100) than turning that sentiment into tangible empathy (44/100). This points to the fact that there might be a need to further establish practices that enable teams to make more stakeholder-centric decisions.

Interestingly, in one area—Technology & Innovation—Capital Markets bucks the overall trend. It scores higher for progressive technology (47) than for planetary boundaries (42). That speaks to the fact that many companies seem to have appropriate practices in place to monitor the side effects from the use of technology (the topic of responsible AI comes to mind here as an example) but that the links back into what stakeholders want and need could be strengthened.

The time is right, right now

If you want to check your company’s Sustainability DNA, I would encourage you to make use of Accenture’s online diagnostic tool , developed with the World Economic Forum and powered by Arabesque S-Ray—an ESG data provider. If you want to start working directly to build a more sustainable organization, here are some key thoughts to bear in mind:

- Don’t forget to involve your people. Actively solicit stakeholder feedback on how to meet your sustainability goals. Crowdsourcing that is well incentivized and moves beyond the superficial builds shared ownership.

- It’s always helpful to disaggregate any data that you get (e.g., by department or geography) and triangulate between different data sources and perspectives (e.g., customer, leader, team member) to identify areas of your business where Sustainability DNA is relatively stronger. You can use these to build best-practice case studies, helping to show the rest of the firm how it’s done.

- Finally, the old saying about not being able to manage it if you can’t measure it still holds true. Develop a set of clear KPIs to measure the extent to which Sustainability DNA informs day-to-day decision-making—then build associated incentives into your performance management practices.

There is so much more to this topic, too much to cover in a blog. If you and your team are grappling with sustainability and how to blend it into your business more fully, that’s a conversation I’d be happy to have with you.

Related Posts

By caroline chambers, the convergence of investment stewardship and management, by nicole bodack, how sovereign asset owners can use data to tackle a new business agenda, by zabeen moser, how wealth managers can help clients lift the lid on sustainable investments, the role of stewardship in esg and beyond, by scott reddel, wealth managers need to get real with remote, by keri smith, esg investing: all eyes on data and ai, wealth clients want it all. can you deliver, get the latest blogs delivered straight to your inbox..

Next Post - How to serve clients across different wealth tiers

Suggested Post - How to serve clients across different wealth tiers

Subscribe Get the latest blogs delivered straight to your inbox.

Share

Type to search

Daily Newsletter

Latest News

Help us improve your experience, delivering more of what you want

Accenture Strengthens Sustainability Capabilities with Acquisition of akzente

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

Accenture has acquired akzente, a recognized sustainability consultancy. akzente helps companies across a broad range of industries including automotive, financial services, energy and consumer goods build sustainability into the core of their businesses and create sustainable value for their stakeholders. Terms of the transaction were not disclosed.

See related article: Accenture Announces Intent to Acquire Greenfish, an Independent, Belgium-Based Sustainability Engineering and Advisory Company

Headquartered in Munich, Germany, with an additional office in Berlin, akzente’s team of more than 60 professionals brings extensive knowledge in sustainability strategy, reporting, communication, and stakeholder management to Accenture Sustainability Services. A recognized expert in environmental, social and governance (ESG) issues and non-financial reporting, akzente significantly strengthens Accenture’s sustainability capabilities. The move also builds on Accenture’s Sustainability Value Promise to embed sustainability into everything the company does and with everyone it serves, leveraging the power of technology, human ingenuity and industry leading ecosystem partners to create business value and sustainable impact.

“Companies face a critical choice on how they manage, measure and report on sustainability. They can either tidy up their disclosure and reporting or they can recognise this is a fundamental shift in the basis of competitiveness and prepare the technology, tools and skills to win — especially as increasing regulation and new standards call for accurate data in decision-making by companies across industries,” said Peter Lacy, Accenture’s global Sustainability Services lead and chief responsibility officer. “The addition of akzente expands our ability to help our clients navigate this transformation, drive greater value and impact and deliver on the promise of sustainability.”

akzente also has deep relationships with policy makers, academia and experts and leadership involvement in the development of global sustainability standards – which gives the company knowledge and insights to anticipate trends faster and turn them into actionable results for clients.

Christina Raab, market unit lead for Accenture in Germany, Austria and Switzerland added: “We’re delighted to welcome akzente to our team, adding significant expertise to our sustainability capabilities while jointly extending our services powered by technology and human ingenuity. Helping our clients drive this change across all dimensions paves the way to a more sustainable economy and future for all.”

“akzente is known for deep consulting expertise and thorough experience in all facets of sustainability for almost 30 years,” said Sabine Braun, founder and managing partner of akzente. “Accenture’s scale and commitment to sustainability will enable us to extend our value proposition to new customers across industries and geographies. Being part of Accenture will lead to new opportunities for our people and our combined expertise will help our clients to integrate sustainability at the core of their business.”

Accenture Sustainability Services provide distinctive services and solutions across the full set of ESG issues, that includes social and governance efforts equally alongside environmental, to help clients become net-zero and circular businesses, leveraging digital investment to create intelligent organizations that are sustainable at their core. Along with its ecosystem partners and ventures into disruptive technologies, as well as deep functional expertise in CFO & Enterprise Value , Accenture is driving transformations at scale with the tools, technology, and methodologies that embed sustainability data, decision-making and performance to effectively measure business value and sustainable impact for all stakeholders.

akzente is the latest move by Accenture to expand its Sustainability Services and ESG capabilities globally to help clients build resilience into their global value chains and drive innovation at the intersection of physical and digital aspects of sustainability; as it becomes an imperative for both shareholder value and stakeholders’ values in an increasingly unpredictable world. Last month, Accenture announced the acquisitions of Avieco in the U.K. and Greenfish in France, Belgium and the Netherlands.

Source: BusinessWire

- Sustainability

- Sustainability Value Promise

Related Articles

Brent floating farms invites participation to combat environmental damage and ensure food security, nature action 100 unveils guide to help investors drive corporate action on nature loss, starbucks verifies 6,000 greener stores in over 40 markets across the globe, mercedes-benz embarks on sustainable business journey beyond products, leave a comment cancel comment.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

World Autism Awareness Day

Transformation: toward a neuro-inclusive world for all, international day for mine awareness and assistance in mine action, international day of conscience, international day of sport for development and peace, today’s top esg stories.

ESG News Quote of the Day

You have a responsibility to make inclusion a daily thought, so we can get rid of the word ‘inclusion'. Theodore Melfi, American filmmaker Tweet

ESG News Daily Newsletter

Email address:

Related Stories

About ESG News

Become a Contributor

Advertise With Us

Sponsorships

News Agency

Terms & Privacy

Terms & Conditions

Privacy Policy

Add ESG News to your home screen?

Add this web page on your home screen for quick and easy access when you’re on the go.

- S&P Dow Jones Indices

- S&P Global Market Intelligence

- S&P Global Mobility

- S&P Global Commodity Insights

- S&P Global Ratings

- S&P Global Sustainable1

- Investor Relations Home

- Presentations

- Investor Fact Book

- News Releases

- Quarterly Earnings

- SEC Filings & Reports

- Executive Committee

- Merger Information

- Stock & Dividends

- Shareholder Services

- Media Contacts

Case Studies

A large manufacturing company looks to carbon offsets to meet its net zero goals.

- 26 Sep, 2022

- Theme The Path to Net Zero

- Segment Corporations

The Client: A large manufacturing company

Users: The corporate ESG team

“Race to Zero” is the UN-backed global campaign rallying non-state actors – including companies, cities, regions and financial and educational institutions – to take rigorous and immediate action to halve global emissions by 2030 and deliver a healthier, fairer zero carbon world in time. 1 Members are committed to the same overarching goal: reducing emissions across all scopes swiftly and fairly in line with the Paris Agreement, with transparent action plans and robust near-term targets.

As of early 2021, at least one fifth (21%) of the world’s 2,000 largest public companies had committed to meet net zero targets. 2 The companies together represented sales of nearly $14 trillion. However, to keep global warming to no more than 1.5°C as called for in the Paris Agreement , emissions need to be reduced by 45% by 2030 and reach net zero by 2050. Strong action plans need to be put in place to meet these ambitious goals.

Global emissions at this large manufacturing company stood at approximately 20 million metric tons (MT) in 2021. The company plans to reduce its total emissions to 6 million MT by 2030 and offset this amount to become a net zero emissions company within the decade. The aim is to offset mainly with forestry projects and then with soil carbon sequestration projects.

Pain Points

ESG performance is becoming more transparent as disclosure and reporting takes hold and is increasingly being used to evaluate a company’s potential as an investment option. Given the nature of this manufacturing business, members of the corporate ESG team recognized the need to obtain carbon credits in order to meet the company’s net zero goals. For this to be effective, it was important to have access to:

- Insights on carbon market developments around the world.

- A comprehensive picture of prices that capture individual attributes of particular projects, including standard certification, volume, vintage and geography.

- Credible offset projects that are validated and verified to the highest standards.

- An auction platform to view and bid on available offsets, see final prices and have electronic position settlement.

- Registration capabilities for carbon accounts in different markets, with easy online access to see credits available for sale, along with indicative quantities and prices.

- Credit tracking from issuance to transfer to cancellation or retirement.

The company was a long-standing client of S&P Global Market Intelligence for credit risk solutions and knew that IHS Markit was now part of the group. It was suggested that the team meet with S&P Global Sustainable1 (“Sustainable1”) to discuss the firm’s extensive capabilities in the carbon market arena. Sustainable1 brings together capabilities from across the enterprise to serve as a single source of essential energy transition intelligence.

With the push to transition to a low-carbon economy, this ESG team saw carbon offsets as a viable option to help decarbonize the business and achieve the company’s stated climate goals.

Looking for esg insights tailored to you, the solution.

Specialists from Sustainable1 spoke to members of the ESG team about their net zero goals and desire to offset emissions. They then described a number of carbon-specific capabilities, including solutions from:

- S&P Global Commodity Insights. As of March 2022, IHS Markit became part of S&P Global, and S&P Global Platts and IHS Markit Energy & Natural Resources combined to become S&P Global Commodity Insights.

- S&P Dow Jones Indices .

- Trucost, the data and analytics engine of Sustainable1.

Together, these capabilities would enable the company to:

Assess greenhouse gas emissions

Carbon Footprinting helps company’s understand their organization’s carbon footprint and underlying sources of carbon emissions – as well providing forward-looking metrics on their exposure to physical and transition climate risks.

Carbon Earnings at Risk Dataset assesses company-level exposure to current and future carbon pricing scenarios. Integral to this analysis is the Unpriced Carbon Cost, which is defined as the difference between what a company pays for carbon today and what it may pay at a given future date based on its sector, operations and under different climate change scenarios.

Physical Climate Risk Dataset helps assess company exposure to seven climate-related hazards (sea-level rise, flooding, heatwaves, coldwaves, drought, hurricanes, and wildfires) under low, medium and high climate change scenarios. Over 2.7 million assets are mapped to over 15,000 listed companies, with risk metrics provided from a 2020 baseline to 2030 and 2050. 3

Stay on top of breaking carbon news

Latest news and market commentary across the global carbon markets provides real-time insights on what is moving global carbon markets to support informed decisions in today’s fast-changing environment. A diverse range of topics are covered, including technological breakthroughs, changes in regional pricing patterns, global trading opportunities, the strategies of global and regional companies, the intricacies of policy and regulation in producing and consuming nations, key asset announcements and more.

Emissions Market Analysis covers the latest news coming out of the compliance and voluntary carbon markets across the globe This includes specific details on the short-, medium- and long-term outlooks for the compliance markets in each region to help organizations actively cover their positions and understand fundamentals in these markets.

Gain additional market context

Global Integrated Energy Model (GIEM) provides users with a tool to study the evolution of the global energy system. Containing all components of integrated balances, GIEM is used to compute long-term energy demand under various scenarios, providing a broad view in which to assess fossil fuels.

Track price developments in compliance markets

Carbon Allowance Price Assessments for the compliance market involve evaluations of OTC forward prices for December European Union Allowances (EUAs) and United Kingdom Allowances (UKAs), which are financial instruments used in these two trading schemes. The assessments are complemented with extensive news coverage.

Low Carbon Fuel Standard Credit (LCFS) P rice Assessments are published daily. Producers of petroleum and diesel are purchasing these credits from producers of ethanol, bio diesel, hydrogen and electric charging to meet their deficit shortcomings.

California Offsets Price Assessments look at physically delivered GHG emissions offset credits that are limited to emissions-reduction projects in the U.S. and specifically to five areas: forestry, urban forestry, destruction of ozone-depleting substances and mine methane capture.

Regional Greenhouse Gas Initiative (RGGI) Price Assessments look at the cooperative effort among the states of Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Rhode Island, Vermont and Virginia to cap and reduce CO2 emissions from the power sector.

Track price developments in voluntary markets

Voluntary Carbon Market Price Assessments cover a full range of different projects using a market-appropriate pricing methodology and assessment criteria. The assessments reflect bids, offers and trades as reported in the Commodity Insights Market on Close assessment process, the brokered market or on trading and exchange instruments. The assessments reflect the individual attributes of particular projects and factor in standard certification, volume, vintage, region, co-benefits and geographic location.

The market is segmented into avoidance and removal credits, and price assessments are provided for several project types. Avoidance projects include Household Devices, Industrial Pollutants and Nature-Based. Removal projects include Tech-Based and Natural Carbon Capture. Individual daily spot assessments are published for each type of project, and then the most competitive assessment sets the category for the day.

Additional assessments reflect credit types, including carbon credits eligible for the International Civil Aviation Organization’s CORSIA program, methane collection carbon credits that avoid or reduce GHG emissions and carbon credits from renewable energy projects.

Carbon Credit Settlements and Assessments data leverages Commodity Insight’s partnership with the Xpansiv spot-market and CME futures exchanges. Commodity Insights publishes daily assessments and settlement prices for the Xpansiv carbon credit spot market contracts using market data directly from Xpansiv CBL. In addition to providing settlements for spot markets, Commodity Insights provides the settlement prices for the physically delivered CME CBL futures contracts for 48 forward months at the 2:30pm New York close. Market reporters assess these settlements using bids, offers and transaction data directly from the NYMEX exchange.

Evaluate potential price appreciation

The Global Carbon Index was launched by IHS Markit together with Climate Finance Partners (CLIFI) as a first-of-its-kind index that tracks the underlying assets of the most liquid compliance carbon markets: EU ETS, the California Cap-and-Trade system and RGGI.

The S&P GSCI Carbon Emission Allowances (EUA) is designed to measure the performance of the European EUA market.

CARBEX Carbon Credit Indices are published in partnership with Viridios AI. The six indices reflect the value of different types of voluntary carbon credits and enhance market transparency in the complex voluntary carbon credit and co-benefit markets. Co-benefits are terms attached to carbon credits that provide evidence of meeting the 17 Sustainable Development Goals (SDGs) defined by the United Nations.

The S&P GSCI Global Voluntary Carbon Liquidity Weighted is the first-to-market benchmark for the current performance of global voluntary carbon futures markets. The index is very flexible and constituents can easily be added or removed at regular intervals to ensure that the index reflects the rapidly changing carbon environment.

Participate in auctions

Auction Platform is used by jurisdictions to provide comprehensive auction services across over-the-counter (OTC) asset classes. The platform seamlessly connects all auction participants, including bidders, registries, auction monitors, regulators and other program stakeholders. Entity account representatives of qualified bidders submit bids at the date and time identified in the event notice. With transparent rules for each auction, the market determines a clearing price via an equitable buying/selling mechanism.

In addition, a centralized, online platform enables auction participants to share and disseminate documentation. Participants can upload, review and track key documents and receive automated notifications of any changes to the materials.

Register and track carbon credits

Environmental Registry is a secure online platform for organizations setting standards and enables companies and others to manage all their global carbon credits in a centralized, financial markets-based system. The registry provides unique serial numbers and credit tracking. In addition, credits are searchable and viewable by registered buyers who can send expressions of interest. Buyers may also enter specific criteria for credits that they wish to purchase. Introduction through the platform enables the parties to discuss potential bilateral transaction terms.

Users can also track forward sales of anticipated credits with the ‘pending issue unit’ (PIU) tool. Each PIU represents an anticipated credit to be delivered based on a specified standard compliant project validation report. These anticipated units can be listed, serialized, held and tracked on the registry.

A project management dashboard lets users easily monitor and forecast the status of projects and issuances.

Leverage a centralized access point for data and news

Dimensions Pro supports advanced charting, personalized dashboards and watch lists, plus access to price assessments and indices for compliance and voluntary carbon markets, market commentaries and news.

Key Benefits

Members of the ESG team thought this comprehensive set of data and tools for the carbon markets would enable them to better understand this quickly evolving space and identify appropriate projects for their offset plans. They subscribed to the capabilities discussed and now have access to:

- Information to determine their current emissions levels and set goals to reduce them over time.

- Relevant insights into the trends that shape carbon markets across a large range of project types, geographies and standards.

- Carbon price assessments that reflect projects certified by established entities: The Gold Standard, Climate Action Reserve (CAR), Verified Carbon Standard (VCS), Architecture for REDD+ Transactions and American Carbon Registry (ACR).

- Well-tested and secure registry platforms with extensive functionality to efficiently manage carbon credits.

- Auction capabilities backed by a leading provider that has recognized expertise in collecting, processing and distributing content in the carbon and water marketplaces.

Learn more about how "The Quality Imperative" differentiates our essential sustainability intelligence.

Find out more about the data sets and solutions used in this case study., learn how our clients are successfully navigating the transition to a sustainable future.

- The Path to Net Zero

- Corporations

Related Insights

A bank commodity trading team seeks deep intelligence on carbon markets, a national government’s need for a carbon registry and auction platform, a stock exchange vets environmental registries and auction platforms, quantifying physical climate risks for infrastructure financing.

- Youth Program

- Wharton Online

ESG Case Studies

The esg initiative at the wharton school, the environmental, social and governance initiative seeks to advance academic research on esg topics. , we drive innovative research in the field of esg to investigate when, where, and how esg factors impact business value., esg integration in finance, esg integration in strategy, esg and organizational change.

Parnassus Investments and Wells Fargo & Co.: Balancing Morals, Metrics and Materiality

A look at the efforts of Ben Allen, CEO of Parnassus, to invest in Wells Fargo while advancing the financial welfare of the firm’s investors and the ESG values so important to many of them and to the staff of the firm.

Engine No. 1: An ESG Upstart Challenges Fund-Industry Assumptions About Organizing An ETF and Everyone’s Assumptions About Proxy Fights

A look into Engine No. 1’s efforts to combine a new ETF that both met a need in the market for active ownership and satisfied gatekeepers with a hedge fund that occasionally pursued activist campaigns needing the support of the Big Three to succeed.

Striking a Balance Between Valuation and Values: Investment Managers Weigh Whether Investments in a Major Oil Company and an Ethanol Producer Serve their Dual Mandate

A look at the decisions Michelle Dunstan and Jeremy Taylor, co-managers of the Alliance Bernstein Global ESG Improvers Strategy, had to make in their effort to buy stocks they believed had the best chance to deliver excellent long-term financial results and improve their ESG performance.

Calculating the Net Present Value of Sustainability Initiatives at Newmont’s Ahafo Mine in Ghana

This case study examines the value and strategy of estimating the net present value of sustainability at Newmont’s Ahafo Mine in Ghana.

Choppies’ Waters: Retailing in Botswana and Sub-Saharan Africa

This case study looks at the impact of Choppies, under the guidance of CEO Ramachandran (“Ram”) Ottapathu, on Botswana and Sub-Saharan Africa.

Designing and Implementing an Integrated Project Management System at Minas-Rio

This case study examines the design and implementation of an Integrated Project Management System to achieve the ultimate goal of First Ore on Ship (FOOS) by November 30, 2014, by Paulo Castellari, CEO of the Anglo American subsidiary Iron Ore Brazil.

Glenmede: How to Credibly Bring an ESG Lens to Investing and Secure Buy-in from Analysts and Clients

A look at Amy Wilson’s efforts to direct ESG investing within the Glenmede Investment Firm credibly and effectively.

Abraaj Group’s Integration of ESG Policies into the Turnaround of K-Electric

This case study explores the efficacy of the Abraaj Group’s strategy in changing the K-Electric company’s direction, with the aim of transforming it into a sustainable, growth-oriented, private sector utility.

Kerovka simulation

The Kerovka simulation is a highly innovative software tool that is used as part of an organised workshop, either in a classroom or in remote format, to deliver an intense experience that helps participants with a wide variety of experience levels to develop skills for dealing with challenges such as managing crisis scenarios, and leading responsibly & sustainably.

About the Environmental, Social and Governance Initiative

The Environmental, Social and Governance Initiative conducts academically rigorous and practically relevant research with industry partners and across all Wharton departments that investigates when, where, and how ESG factors impact business value. Informed by research, we offer 30+ courses that MBA and undergraduate students can assemble into a major or concentration, over a dozen co-curricular experiences, and three Executive certificate programs. Led by Vice Dean Witold Henisz, the ESG Initiative advances Wharton’s best-in-class education of current and future leaders, enabling them to serve a world undergoing tremendous change.

[email protected]

Customer Case Study: Accenture and Semantic Kernel

Sophia Lagerkrans-Pandey

March 26th, 2024 0 2

Accenture Evolves its Data Analytics with Microsoft Semantic Kernel

Below we’ve provided a brief overview of the Customer Story of Accenture. Check out the entire Accenture Customer Story featured here: Accenture evolves its data analytics with Microsoft Fabric to calibrate the new “experience office”

Accenture created DEX, an AI-enhanced experience measurement framework. Leveraging Microsoft Fabric, DEX transforms data collection and analysis with AI, prioritizing user experience and productivity and allowing you to fine-tune your digital strategies to align with your workforce’s needs and expectations. It’s a shift towards a user-focused model that simplifies complexity and paves the way for better customer outcomes. Built and tested within Accenture itself, DEX is set to transform workplace dynamics in organizations worldwide.

Quantifying success through better enterprise data analysis

As one of the world’s largest professional services companies, Accenture is a leader in the current and evolving states of workplaces across the globe. Accenture has been working to help clients measure the efficiencies of remote, in-person, and hybrid work approaches. Accenture is at the forefront of helping companies measure what’s working, what isn’t, and the ways in which employees are navigating the numerous styles of workplaces, processes, and collaboration tools.

The challenge is not the ability to accumulate data towards this goal, but rather in managing and mining insights from that data.

Reinventing workplaces by democratizing data and insights

Accenture turned to longtime partner Microsoft to help realize the first generation of its new Digital Experience Measurement (DEX) Platform; a standardized system that quantifies six dimensions of an employee’s experience within a company: usability, user adoption, sentiment, support, performance, and accessibility.

DEX uses Microsoft Fabric and Microsoft Semantic Kernel with an open-source library. Microservices move data and responses using Microsoft Azure OpenAI to create an AI Large Language Model (LLM) on the back end.

Fabric integrates an extensive array of datasets, pulling from diverse sources such as custom applications, data warehouses, and other disparate repositories, and consolidating them into a single, unified repository within Fabric’s OneLake.

Unlocking information from data had previously been a complex exercise – structuring data, then building custom tools to accomplish a defined set of anticipated needs. Mining the data required custom-built tools to parse and deliver a limited data set. This created a number of isolated data silos that continued to grow over time.

DEX isn’t just about bringing data together; it’s about creating a unified, secure, integrated experience from end to end. Whether it’s visualization, developer interaction, or data analysis, Fabric simplifies the complexities for Accenture.

“Creating a seamless, connected digital experience that helps our people navigate across the expert knowledge at Accenture we believe will, in turn, have a positive correlation on customer satisfaction,” says Christensen.

“That’s where DEX is ultimately headed: getting the tools in the hands of the end users themselves,” says Tybor. “Our IT department can of take a step back and focus on enabling our business goals while ensuring we have a more secure and governed data estate—ultimately enabling the businesses’ strategic goals,” he added.

Please reach out if you have any questions or feedback through our Semantic Kernel GitHub Discussion Channel . We look forward to hearing from you! We would also love your support, if you’ve enjoyed using Semantic Kernel, give us a star on GitHub .

Leave a comment Cancel reply

Log in to start the discussion.

Insert/edit link

Enter the destination URL

Or link to existing content

IMAGES

VIDEO

COMMENTS

The Reporting Experience brings together, for the first time, all our financial and environmental, social and governance (ESG) metrics, progress and performance in one place. Integrating our ESG and financial reporting required a true partnership across Accenture and with key ecosystem partners. It also required fundamental changes to our core ...

In its Measuring sustainability. Creating value. report, Accenture analyzed responses from over 640 finance leaders in 12 industries and six countries to understand how companies can better measure, manage and report ESG performance to fully deliver on their sustainability commitments. The report found that while the majority (78%) of finance ...

Recent Accenture research shows that while the majority (78%) of finance leaders are seeking to understand the financial risk to their business that sustainability represents, only 47% have defined key metrics and data sources for their ESG reporting. Together, Accenture and pulsESG will look to build joint product offerings that will enable ...

The report, Shaping the Sustainable Organization, finds that the responsible values and environmental, social and governance (ESG) intentions of companies are outrunning the ability of their organizations to deliver.To convert sustainability goals into reality, Accenture and the World Economic Forum decoded "Sustainability DNA," a set of 21 management practices, systems and processes that form ...

Nearly All Companies Will Miss Net Zero Goals Without At Least Doubling Rate of Carbon Emissions Reductions by 2030, Accenture Report Finds. NEW YORK; Nov. 1, 2022 - While more than one-third (34%) of the world's largest companies are now committed to Net Zero[1], nearly all (93%) will fail to achieve their goals if they don't at least double the pace of emissions reduction by 2030 ...

Accenture is a global professional services company with leading capabilities in digital, cloud and security. Combining unmatched experience and specialized skills across more than 40 industries, we offer Strategy and Consulting, Technology and Operations services and Accenture Song — all powered by the world's largest network of Advanced ...

The 12th United Nations Global Compact-Accenture CEO Study draws on insights from more than 2,600 CEOs across 128 countries, 18 industries, and over 130 in-depth interviews—making this the largest-ever sampling of executives, including the biggest group of CEOs from the Global South, since the start of the CEO study program in 2007. In the study, CEOs forewarn about the impact of converging ...

In order to articulate its ESG strategy, Accenture provided VW with services to help shape its sustainability narrative—setting KPIs to benchmark its progress and adopting means of reporting and analysing its growth. The company took VW through a three-phase process, which included generating an S-Ray score—a data-driven measure of ESG that ...

These four strategies can transform the way a bank gathers, reports and analyzes data: 1. Define a target operating model for ESG data: Some banks try to nurture sustainability use cases with 'fit for purpose' ESG data feeds, but this results in vertical data silos. A horizontal, internal ESG data utility and service addresses ...

The report cites recent Accenture studies, for example, that found that while 73% of executives identify "becoming a truly sustainable and responsible business" as a top priority, 43% of companies fail to match their ESG rhetoric with results. ... Prior to founding ESG Today, Mark worked at Delaney Capital Management (DCM) in Toronto ...

The first part of this blog series introduced Accenture's strategic resilience framework. In this blog, I will expand this introduction to take you through our framework step by step using the lens of sustainability and ESG (environment, social and governance). Sustainability and ESG trends are huge impact drivers in insurance—they are also ...

Companies need full visibility across their supplier base in order to make significant progress on net zero targets by 2050. However, that visibility is challenged by the fact that nearly two-thirds of upstream Scope 3 emissions in supply chains come from suppliers that companies don't deal with directly, according to a new report by Accenture.

The 12th United Nations Global Compact-Accenture CEO Study draws on insights from more than 2,600 CEOs across 128 countries, 18 industries, and over 130 in-depth interviews—making this the largest-ever sampling of executives, including the biggest group of CEOs from the Global South, since the start of the CEO study program in 2007.

In her latest blog, Nicole Bodack looks at how firms can find out more on their Sustainability DNA, based on new Accenture research on 4000 companies. Read more. Popular. ... You can use these to build best-practice case studies, helping to show the rest of the firm how it's done. ... The role of stewardship in ESG and beyond 6514 Views. ESG ...

by ESG News • May 2, 2022. Accenture has acquired akzente, a recognized sustainability consultancy. akzente helps companies across a broad range of industries including automotive, financial services, energy and consumer goods build sustainability into the core of their businesses and create sustainable value for their stakeholders.

More than three quarters of large companies globally have succeeded in cutting their operational emissions intensity, or the emissions per unit of revenue, since the implementation of the Paris Agreement in 2016, but less than a fifth are on track to achieve net zero emissions by 2050 - the goal required to meet the Agreement's ambition to limit global warming to 1.5°C - according to a ...

As of early 2021, at least one fifth (21%) of the world's 2,000 largest public companies had committed to meet net zero targets. 2 The companies together represented sales of nearly $14 trillion. However, to keep global warming to no more than 1.5°C as called for in the Paris Agreement , emissions need to be reduced by 45% by 2030 and reach ...

The Environmental, Social and Governance Initiative conducts academically rigorous and practically relevant research with industry partners and across all Wharton departments that investigates when, where, and how ESG factors impact business value. Informed by research, we offer 30+ courses that MBA and undergraduate students can assemble into ...

Accenture has been working to help clients measure the efficiencies of remote, in-person, and hybrid work approaches. Accenture is at the forefront of helping companies measure what's working, what isn't, and the ways in which employees are navigating the numerous styles of workplaces, processes, and collaboration tools.