Vote Your Shares Here: www.proxyvote.com

Press Releases

3M Completes Spin-off of Solventum

ST. PAUL, Minn. , April 1, 2024 /PRNewswire/ -- Today, 3M completed the planned spin-off of its health care business, which formally launches Solventum Corporation as an independent company. Solventum is listed on the New York Stock Exchange as SOLV.

"This is an important day for 3M and Solventum, and I extend my sincere congratulations to members of both teams who have made this possible," said Mike Roman, 3M chairman and chief executive officer. "Both companies are positioned to pursue their respective growth and tailored capital allocation plans, and I am excited to see both companies succeed as they innovate new solutions and create value for their respective stakeholders."

Holders of 3M common stock received one share of Solventum common stock for every four shares of 3M common stock held at the close of business on March 18, 2024, the record date for the distribution. For U.S. federal income tax purposes, the distribution is generally intended to be tax-free to 3M shareholders. Additional information about this distribution is available here .

3M retained 19.9% of the outstanding shares of Solventum common stock, which will be monetized within five years following the spin-off.

Forward-Looking Statements This news release contains forward-looking statements. You can identify these statements by the use of words such as "plan," "expect," "aim," "believe," "project," "target," "anticipate," "intend," "estimate," "will," "should," "could," "would," "forecast" and other words and terms of similar meaning. Among the factors that could cause actual results to differ materially are the following: (1) worldwide economic, political, regulatory, international trade, geopolitical, capital markets and other external conditions and other factors beyond the Company's control, including inflation, recession, military conflicts, natural and other disasters or climate change affecting the operations of the Company or its customers and suppliers; (2) foreign currency exchange rates and fluctuations in those rates; (3) risks related to certain fluorochemicals, including liabilities related to claims, lawsuits, and government regulatory proceedings concerning various PFAS-related products and chemistries, as well as risks related to the Company's plans to exit PFAS manufacturing and discontinue use of PFAS across its product portfolio; (4) risks related to the proposed class-action settlement to resolve claims by public water systems in the United States regarding PFAS; (5) legal proceedings, including significant developments that could occur in the legal and regulatory proceedings described in the Company's Annual Report on Form 10-K for the year ended Dec. 31, 2023 and any subsequent quarterly reports on Form 10-Q (the "Reports"); (6) competitive conditions and customer preferences; (7) the timing and market acceptance of new product and service offerings; (8) the availability and cost of purchased components, compounds, raw materials and energy due to shortages, increased demand and wages, supply chain interruptions, or natural or other disasters; (9) unanticipated problems or delays with the phased implementation of a global enterprise resource planning (ERP) system, or security breaches and other disruptions to the Company's information technology infrastructure; (10) the impact of acquisitions, strategic alliances, divestitures, and other strategic events resulting from portfolio management actions and other evolving business strategies; (11) operational execution, including the extent to which the Company can realize the benefits of planned productivity improvements, as well as the impact of organizational restructuring activities; (12) financial market risks that may affect the Company's funding obligations under defined benefit pension and postretirement plans; (13) the Company's credit ratings and its cost of capital; (14) tax-related external conditions, including changes in tax rates, laws or regulations; (15) matters relating to the spin-off of the Company's Health Care business, including the risk that the expected benefits will not be realized; the risk that the costs or dis-synergies will exceed the anticipated amounts; potential business disruption; the diversion of management time; the impact of the transaction on the Company's ability to retain talent; potential impacts on the Company's relationships with its customers, suppliers, employees, regulators and other counterparties; the ability to realize the desired tax treatment; the risk that any consents or approvals required will not be obtained; risks under the agreements and obligations entered into in connection with the spin-off; and (16) matters relating to Combat Arms Earplugs ("CAE"), including those relating to, the August 2023 settlement that is intended to resolve, to the fullest extent possible, all litigation and alleged claims involving the CAE sold or manufactured by the Company's subsidiary Aearo Technologies and certain of its affiliates and/or 3M. Changes in such assumptions or factors could produce significantly different results. A further description of these factors is located in the Reports under "Cautionary Note Concerning Factors That May Affect Future Results" and "Risk Factors" in Part I, Items 1 and 1A (Annual Report) and in Part I, Item 2 and Part II, Item 1A (Quarterly Reports). The Company assumes no obligation to update any forward-looking statements discussed herein as a result of new information or future events or developments.

About 3M 3M (NYSE: MMM) believes science helps create a brighter world for everyone. By unlocking the power of people, ideas and science to reimagine what's possible, our global team uniquely addresses the opportunities and challenges of our customers, communities, and planet. Learn how we're working to improve lives and make what's next at 3M.com/news.

3M Investor Contact: Bruce Jermeland (651) 733-1807 or Diane Farrow (612) 202-2449 or Eric Herron (651) 233-0043

3M Media Contact: Sean Lynch [email protected]

SOURCE 3M Company

Released April 1, 2024

- Email Alerts

- RSS News Feed

3M Completes Health Care Spinoff, and a Court Finalizes 'Forever Chemicals' Settlement

Key takeaways.

- 3M completed the spinoff of its health care unit, called Solventum, which began trading on the New York Stock Exchange and entered the S&P 500 Monday.

- The conglomerate also announced a federal court has approved its $10.3 billion "forever chemicals" settlement.

- Shares of 3M rose on the news, while Solventum shares slid.

Two big announcements from 3M ( MMM ) sent shares of the conglomerate higher Monday.

The first involved the completion of the spinoff of Solventum, 3M’s health care business, which became listed on the New York Stock Exchange (NYSE) under the ticker symbol SOLV .

3M investors received one share of Solventum for every four shares of 3M they owned as of the close of business March 18. 3M added the transaction was generally intended to be tax-free for its shareholders.

3M Chief Executive Officer (CEO ) Mike Roman said both companies now “are positioned to pursue their respective growth and tailored capital allocation plans.”

With the execution of the spinoff, Solventum joined the S&P 500, replacing V.F. Corp. ( VFC ).

3M also reported that its legal settlement with public water utilities over so-called “forever chemicals” has received final approval from the federal district court in Charleston, S.C.

The company said the agreement will cost $10.3 billion, with payments spread over 13 years. It noted that the first installment will be made in the third quarter of this year, provided there are no appeals.

Roman explained that this decision, along with 3M’s continuing progress toward exiting all manufacturing of those chemicals by 2025, “will further our efforts to reduce risk and uncertainty as we move forward."

As of 11:20 a.m. ET Monday, shares of 3M were 3.3% higher, while Solventum and V.F. Corp. shares fell 3.6% and 0.6%, respectively.

Read the original article on Investopedia .

- Get 7 Days Free

3M Board of Directors Approves Spin-off of Solventum

PR Newswire

ST. PAUL, Minn., March 8, 2024

Record date set for March 18, 2024 and distribution date set for April 1, 2024

ST. PAUL, Minn., March 8, 2024 /PRNewswire/ -- 3M (NYSE: MMM) today announced that its Board of Directors has approved the planned spin-off of its Health Care business, which will be known as Solventum Corporation. The company is anticipated to spin off from 3M on April 1, 2024, and has applied to list on the New York Stock Exchange as "SOLV."

"Today's approval is another important milestone as we continue to make progress in building two world-class companies, both positioned to pursue their respective growth and tailored capital allocation plans," said Mike Roman, 3M chairman and chief executive officer. "We are pleased to have taken another step as Solventum prepares to independently pursue its mission and promise to innovate in the exciting and rapidly growing health care market."

Stock Distribution

Holders of 3M common stock will be entitled to receive one share of Solventum common stock for every four shares of 3M common stock held at the close of business on March 18, 2024, the record date for the distribution. The distribution is expected to occur prior to the opening of trading on April 1, 2024, subject to the satisfaction of remaining conditions. For U.S. federal income tax purposes, the distribution is generally intended to be tax-free to 3M shareholders. The spin-off is subject to the satisfaction or waiver of certain conditions described in the registration statement on the Form 10 filed by Solventum, including effectiveness of the registration statement.

3M's Board of Directors approved the distribution to 3M shareholders of 80.1% of the outstanding shares of Solventum. 3M will retain 19.9% of the outstanding shares of Solventum common stock, which will be monetized within five years following the spin-off.

3M shareholders of record as of the record date do not need to take any action to receive shares of Solventum common stock to which they are entitled as 3M shareholders. In addition, shareholders do not need to pay any consideration, or surrender or exchange shares of 3M common stock, to participate in the distribution. Shareholders will receive cash in lieu of fractional shares of Solventum common stock.

Trading Details

3M anticipates that "when-issued" trading in Solventum common stock on the NYSE will begin on or about March 26, 2024, under the symbol "SOLV WI," and Solventum common stock will begin "regular-way" trading on the NYSE on the distribution date, April 1, 2024, under the symbol "SOLV."

Beginning on March 26, 2024 and continuing through March 28, 2024, it is expected that there will be two markets in 3M common stock on the NYSE: a "regular-way" market under the symbol "MMM," in which 3M shares will trade with the right to receive shares of Solventum common stock in the distribution, and an "ex distribution market" under the symbol "MMM WI" in which 3M shares will trade without the right to receive shares of Solventum common stock in the distribution.

3M shareholders who hold shares of common stock on the record date of March 18, 2024, and decide to sell any of those shares before the distribution date should consult their stockbroker, bank or other nominee to understand whether the shares of 3M common stock will be sold with or without entitlement to Solventum common stock distributed pursuant to the distribution.

For more information about the distribution, please contact the distribution agent, EQ Shareowner Services, at P.O. Box 64854 St. Paul, MN 55164-0854 or at the telephone number 1-800-401-1952 (toll-free in the United States).

Key Information about Solventum

As outlined in the Form 10, Solventum will be:

- Focused on its mission , "Enabling better, smarter, safer healthcare to improve lives," powered by its more than 70 years of innovation creating breakthrough solutions, market-leading positions, trusted, recognized brands, and strong customer relationships with more than 100,000 channel partners and sales in more than 90 countries.

- A leading global healthcare company innovating at the intersection of health, material, and data science, with $8.2 billion in revenue in 2023. Solventum will serve an approximate $93 billion global addressable market anticipated to grow at 4-6% through 2026.

- Medical Surgical (MedSurg): A provider of wound care and surgical solutions intended to accelerate healing and prevent complications.

- Dental Solutions: A provider of dental prevention and procedure solutions and orthodontic solutions intended to promote lifelong oral health.

- Health Information Systems: A provider of software solutions powered by clinical intelligence that are intended to create time for clinicians to care for patients and ensure accuracy in health care reimbursement.

- Purification & Filtration: A provider of filters and membranes intended for life-saving biopharmaceuticals, vaccines, and medical treatments.

Solventum will include more than 20,000 engaged employees led by an experienced team, including Bryan Hanson as Chief Executive Officer, Wayde McMillan as Chief Financial Officer, and Carrie Cox as Board Chair.

Additional information about Solventum is available on our website .

Solventum Investor Day

As previously announced, Solventum plans to host an Investor Day in New York City on Tuesday, March 19, 2024, at 9:00 a.m. Eastern Time. Hanson and McMillan will be joined by members of Solventum's leadership team to provide an overview of the business and outline opportunities for value creation in advance of its planned spin from 3M. The event will include formal presentations and a Q&A session with leadership. Information on registering for in-person attendance will be provided ahead of the event.

A simultaneous webcast and replay of Solventum's presentation will be available on 3M's website at https://investors.3m.com/health-care-spin-off-resources . An archive of the webcast will also be available on the Company's website after the live event concludes.

Forward-Looking Statements This news release contains forward-looking statements about 3M's planned spin-off of its Health Care business, including the anticipated timing of the completion of the spin-off. You can identify these statements by the use of words such as "plan," "expect," "aim," "believe," "project," "target," "anticipate," "intend," "estimate," "will," "should," "could," "would," "forecast" and other words and terms of similar meaning in connection with any discussion of future operating or financial performance or business plans or prospects. Among the factors that could cause actual results to differ materially are the following: (1) worldwide economic, political, regulatory, international trade, geopolitical, capital markets and other external conditions and other factors beyond the Company's control, including inflation, recession, military conflicts, natural and other disasters or climate change affecting the operations of the Company or its customers and suppliers; (2) foreign currency exchange rates and fluctuations in those rates; (3) risks related to certain fluorochemicals, including liabilities related to claims, lawsuits, and government regulatory proceedings concerning various PFAS-related products and chemistries, as well as risks related to the Company's plans to exit PFAS manufacturing and discontinue use of PFAS across its product portfolio; (4) risks related to the proposed class-action settlement to resolve claims by public water systems in the United States regarding PFAS; (5) legal proceedings, including significant developments that could occur in the legal and regulatory proceedings described in the Company's Annual Report on Form 10-K for the year ended Dec. 31, 2023 and any subsequent quarterly reports on Form 10-Q (the "Reports"); (6) competitive conditions and customer preferences; (7) the timing and market acceptance of new product and service offerings; (8) the availability and cost of purchased components, compounds, raw materials and energy due to shortages, increased demand and wages, supply chain interruptions, or natural or other disasters; (9) unanticipated problems or delays with the phased implementation of a global enterprise resource planning (ERP) system, or security breaches and other disruptions to the Company's information technology infrastructure; (10) the impact of acquisitions, strategic alliances, divestitures, and other strategic events resulting from portfolio management actions and other evolving business strategies; (11) operational execution, including the extent to which the Company can realize the benefits of planned productivity improvements, as well as the impact of organizational restructuring activities; (12) financial market risks that may affect the Company's funding obligations under defined benefit pension and postretirement plans; (13) the Company's credit ratings and its cost of capital; (14) tax-related external conditions, including changes in tax rates, laws or regulations; (15) matters relating to the proposed spin-off of the Company's Health Care business, including whether the transaction will be completed, or if completed, will be on the expected terms or at the expected time; the risk that the expected benefits will not be realized; the risk that the costs or dis-synergies will exceed the anticipated amounts; the ability to satisfy the various closing conditions; potential business disruption; the diversion of management time; the impact of the transaction (or its pendency) on the Company's ability to retain talent; potential impacts on the Company's relationships with its customers, suppliers, employees, regulators and other counterparties; the ability to realize the desired tax treatment; the risk that any consents or approvals required will not be obtained; risks associated with financings undertaken and indebtedness incurred in connection with the transaction; and (16) matters relating to Combat Arms Earplugs ("CAE"), including those relating to, the August 2023 settlement that is intended to resolve, to the fullest extent possible, all litigation and alleged claims involving the CAE sold or manufactured by the Company's subsidiary Aearo Technologies and certain of its affiliates and/or 3M. Changes in such assumptions or factors could produce significantly different results. A further description of these factors is located in the Reports under "Cautionary Note Concerning Factors That May Affect Future Results" and "Risk Factors" in Part I, Items 1 and 1A (Annual Report) and in Part I, Item 2 and Part II, Item 1A (Quarterly Reports). The Company assumes no obligation to update any forward-looking statements discussed herein as a result of new information or future events or developments.

About 3M 3M (NYSE: MMM) believes science helps create a brighter world for everyone. By unlocking the power of people, ideas and science to reimagine what's possible, our global team uniquely addresses the opportunities and challenges of our customers, communities, and planet. Learn how we're working to improve lives and make what's next at 3M.com/news.

About Solventum At Solventum, we enable better, smarter, safer healthcare to improve lives. As a new company with a long legacy of creating breakthrough solutions for our customers' toughest challenges, we pioneer game-changing innovations at the intersection of health, material and data science that change patients' lives for the better — while empowering healthcare professionals to perform at their best. See how at Solventum.

3M Investor Contact: Bruce Jermeland (651) 733-1807 or Diane Farrow (612) 202-2449 or Eric Herron (651) 233-0043

3M Media Contact: Sean Lynch [email protected]

Solventum Investor Contact: Kevin Moran [email protected] (651) 968-7608

Solventum Media Contact: Carly Rotman [email protected]

SOURCE 3M Company

Market Updates

These 4 charts show plunging expectations for fed rate cuts, march cpi report: why is inflation still so sticky, forecasts for march cpi report show more mixed signals on inflation, 5 dirt-cheap stocks to buy in april, markets brief: what fewer rate cuts could mean for stock valuations, will small-cap stocks ever catch up, what’s happening in the markets this week, these stocks led the q1 value rally you may have missed, stock picks, the best technology stocks to buy, 15 stocks that have destroyed the most wealth over the past decade, 4 undervalued stocks that just raised dividends, tilray earnings: slower revenue growth and margin contraction, the best stock to buy now in a growing industry, 5 top dividend stocks to buy from the best managers, tesla stock is down 30% in 2024. is it a buy, the best reits to buy, sponsor center.

Sure Dividend

High-quality dividend stocks, long-term plan, 3m healthcare spinoff: how should shareholders proceed.

Published on September 28th, 2022 by Thomas Richmond

Updated on August 31st, 2023

3M Company (MMM) is a storied company with a long history of growing shareholder wealth. 3M has increased its dividend for over 60 consecutive years, a milestone that only a small handful of companies have reached.

As a result, it is on the exclusive Dividend Kings list. To be a Dividend King, a stock must have 50+ years of consecutive dividend increases.

You can download the full list of all 50 Dividend Kings (along with important financial metrics such as dividend yields and price-to-earnings ratios) by clicking on the link below:

Click here to instantly download your free spreadsheet of all Dividend Kings now, along with important investing metrics .

3M has established itself as a premiere dividend growth stock due to the strength of its business model. Diversity has been a big part of 3M’s success over the years. Operating large businesses across multiple economic industries has allowed 3M to post consistent profits year after year, even during recessions.

In many instances, weakness in one or multiple segments has been offset by strength in other areas, giving the company steady growth over time.

At the same time, companies need to reinvent themselves as time passes, to stay on top of economic trends and continue on a path of long-term growth. Mergers and acquisitions are a part of 3M’s long-term growth plan, as are occasional divestitures and spinoffs.

The company recently announced that it would undergo a major change, planning to spin off its healthcare segment into an independent company.

For investors, the question now is how the spinoff will impact the long-term direction of the business. This article will attempt to answer this question.

3M Spinoff Overview

3M is a leading global manufacturer, with operations in more than 70 countries. The company has a product portfolio comprised of over 60,000 items, which are sold to customers in more than 200 countries. These products are used every day in homes, office buildings, schools, hospitals, and others.

For the time being, 3M operates four separate segments: Safety & Industrial, Transportation & Electronics, Consumer, and Healthcare.

On July 27th, 2023, 3M announced earnings results for the second quarter for the period ending June 30th, 2023. For the quarter, revenue declined 4.4% to $8.3 billion, but this was $440 million above estimates. Adjusted earnings-per-share of $2.17 compared unfavorably to $2.48 in the prior year, but was $0.41 more than projected.

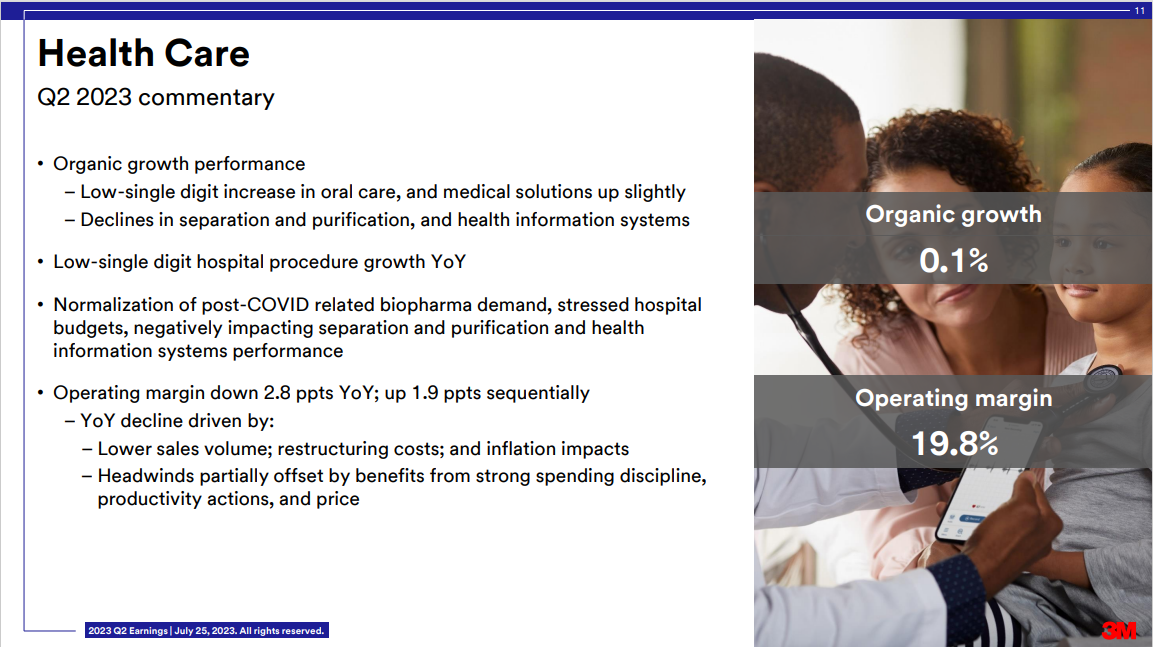

Organic growth for the quarter fell 2.5% for the period, but the Health Care business was a standout performer with positive organic growth of 0.1% year-over-year.

Source: Investor Presentation

3M updated its outlook for 2023, with the company now expecting adjusted earnings-per-share in a range of $8.60 to $9.10 for the year, up from $8.50 to $9.00.

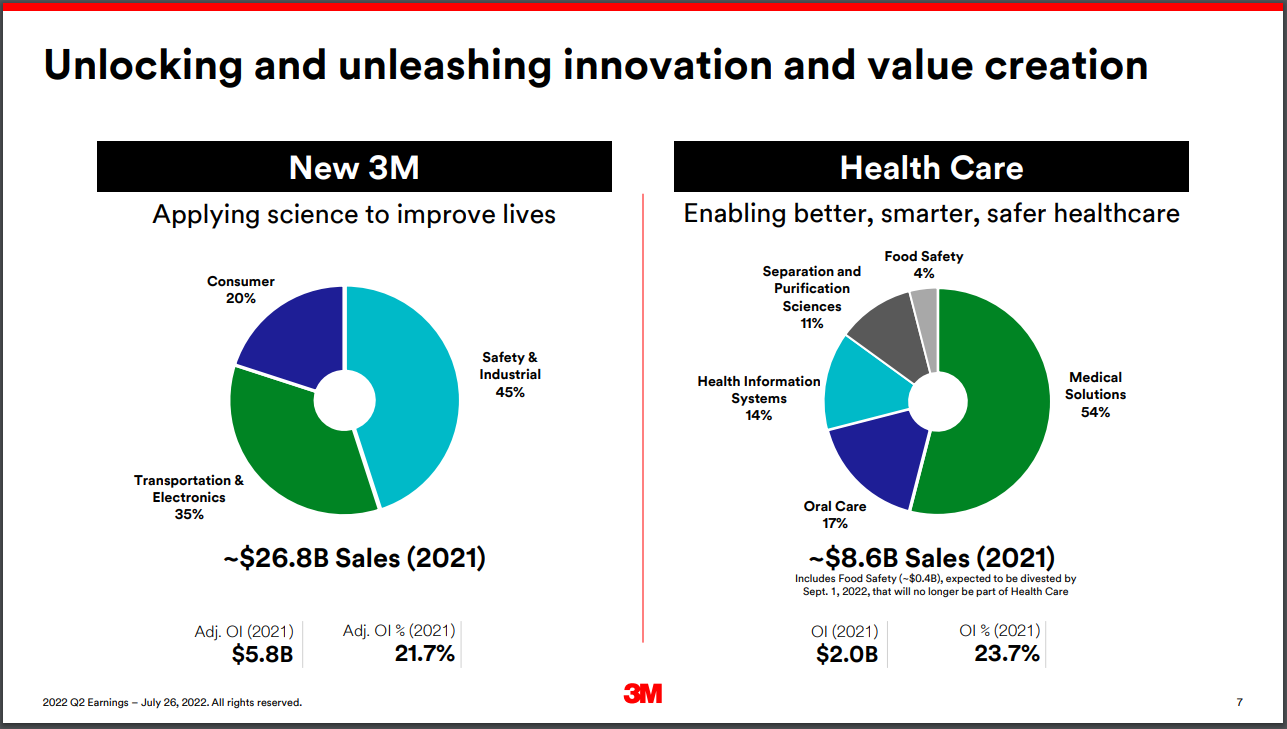

Along with its quarterly results, the company separately announced that it will spinoff its healthcare segment. This is a major announcement, as the healthcare business itself generates over $8 billion in annual sales.

The healthcare spin-off will retain the product portfolio which generated $8.6 billion of sales in 2021.

3M intends the transaction to be a tax-free spinoff into a standalone publicly-traded company. The “new” 3M is expected to retain a 19.9% stake in the healthcare company, which may be divested over time.

The new healthcare company is also expected to have a net leverage of 3.0x–3.5x adjusted EBITDA. While this is fairly high, 3M expects rapid deleveraging.

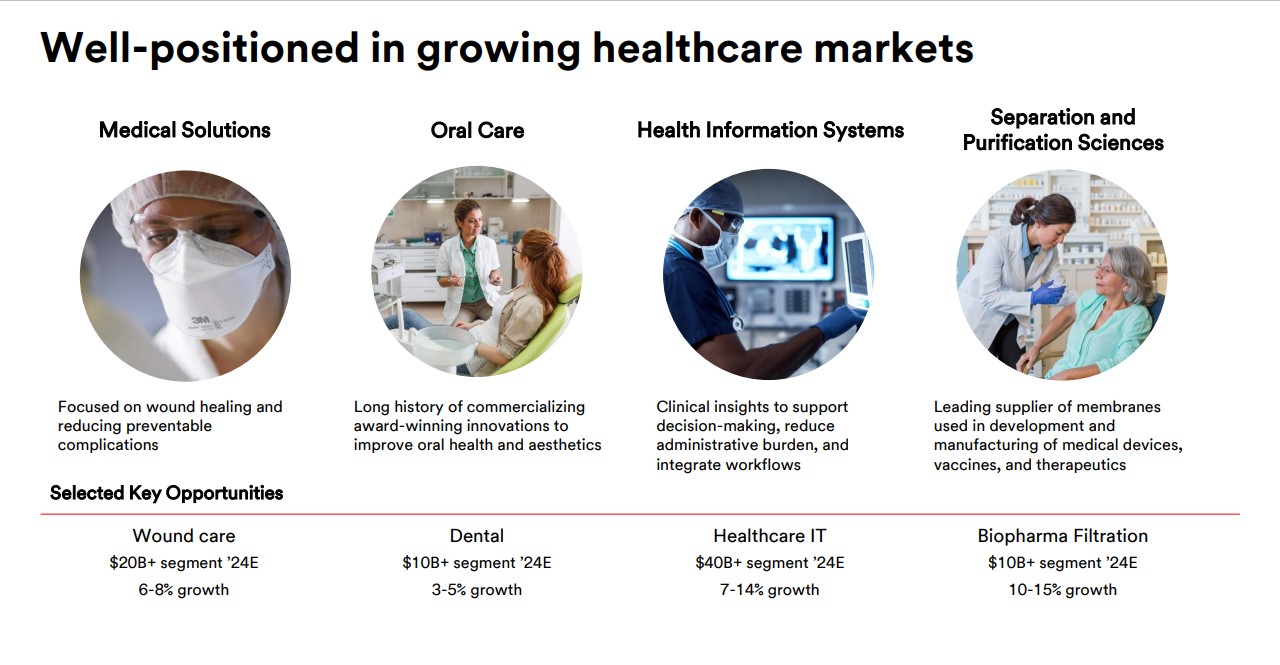

The stand-alone healthcare technology business will focus on wound care, oral care, healthcare IT, and biopharma filtration. The spin-off is expected to be complete by the end of 2023 or early 2024.

3M Separation of the Food Safety Business

Aside from the recent news about the Healthcare spinoff, 3M announced on August 29th that they had finalized the spinoff of their Food Safety business, Garden SpinCo, which is set to merge with Neogen.

This deal was originally announced back in December of 2021. For months, shareholders have known about this deal, valuing the Food Safety business at $5.3 billion. Now, the deal has been finalized.

The final exchange ratio was announced as approximately 6.7713, meaning that while the tender offer was available, 3M shareholders could choose to receive 6.7713 shares of Neogen if they wanted to exchange their 3M shares.

Tender offers are generally beneficial to shareholders, because shareholders can exchange their shares at a slight premium to market value. Shareholders who tendered shares were expected to receive $107.53 of Neogen common stock for every $100 of 3M common stock they tendered.

This deal, along with the Healthcare spinoff, are both going to have a strong impact on 3M’s future.

How Will the Spinoff Impact Future Growth?

3M has been in business for over a century, which may prompt investors to ask why the company would spinoff one of its largest operating segments.

Generally, companies pursue spinoffs for a few common reasons. Spinning off a segment makes it its own publicly-traded entity, with its own dedicated management team. This provides the new entity greater resources than it had under the umbrella of its former parent company.

In addition, there is usually a view among company management that the post-spinoff entities can earn a higher cumulative valuation than the single entity previously had. This is often done after management performs a sum-of-the-parts valuation analysis of the underlying businesses.

There is also precedent for large companies to pursue spinoffs as a way of generating better long-term growth (and value for shareholders). For example, Pfizer (PFE) separated its consumer segment in 2018 before combining it with GlaxoSmithKline’s (GSK) consumer business just a few months later.

More recently, diversified healthcare giant Johnson & Johnson (JNJ) spun-off its consumer healthcare business from its pharmaceutical and medical devices businesses, which is now called Kenvue (KVUE).

To summarize, the motivation behind such a shift in strategy is likely due to the goal of unlocking value for shareholders. By focusing on its core industrial businesses while allowing its healthcare business to flourish on its own, the “new” 3M is likely to receive a higher valuation from the market, as these businesses generate higher growth.

How Should 3M Shareholders React?

A sizeable change in direction for one of the country’s oldest companies could be a shock to many shareholders. That said, we feel that investors shouldn’t panic and sell their positions. Instead, we recommend investors receive shares of the new company and hold through the spinoff.

Going forward, the “new” 3M will be able to focus on its own strategic growth priorities, which include automotive/mobility, electronics, sustainability, digitization, robotics and automation, e-commerce, and more.

Meanwhile, the healthcare spinoff will have a strong business of its own, with annual sales of approximately $8.6 billion, earnings before interest, taxes, depreciation, and amortization (EBITDA) of $2.7 billion, and EBITDA margins of ~30%.

The new healthcare company will have diversification of its own, with leading products and services across multiple areas including medical solutions, oral care, health information systems, and separation and purification sciences. Each of these segments is large, and growing.

What many shareholders are probably most concerned with is how this will impact the company’s dividend. After all, 3M has one of the longest dividend growth streaks in the entire stock market, at 65 years. The payout ratio is reasonable, expected at 68% of adjusted EPS for 2023. With the company’s long dividend history, we’re not concerned about 3M cutting their dividend.

Investors can look back at other similar separations to see what the future of the dividend holds. Other healthcare companies that have split have continued to raise dividends, with Abbott Laboratories (ABT) and AbbVie Inc. (ABBV) being the most prominent example.

The two combined dividends of these companies are greater today than at the time that they were separated in 2013. Both companies have continued to raise their dividends in the years since they separated.

We believe that the eventual separation of the healthcare segment will not result in a lower combined dividend than what shareholders currently receive. For its part, 3M management stated in the spinoff announcement that it does not anticipate any change in its capital allocation priorities through the separation.

Of course, what happens moving forward is what’s important for current shareholders. Much depends on the future growth of the new 3M, and the healthcare company. Both companies should continue to grow their sales and earnings in the years ahead.

For this reason, we believe both companies will have the ability to raise their respective dividends each year, as the current 3M has done for over 60 years.

Final Thoughts

3M has a long history of steady growth over the decades. Since its inception, it has routinely utilized acquisitions to supplement its growth, but it has rarely reorganized its business in such a dramatic fashion as the planned spinoff of the healthcare business.

The upcoming spinoff may be a concern for 3M shareholders. After reviewing the details of the spinoff, it appears both companies will be able to continue growing. The new 3M and the healthcare company both possess durable competitive advantages and specific long-term growth catalysts.

We remain confident that 3M will create greater shareholder value with the spinoff, and the dividend looks very safe.

Therefore, we feel 3M will remain a top dividend growth stock to own. It is likely the new company receives a higher valuation and the new healthcare company will attain its own leadership position in the healthcare industry .

Additional Reading

The following Sure Dividend lists contain many more high-quality dividend stocks:

- The Dividend Aristocrats: S&P 500 stocks with 25+ years of consecutive dividend increases.

- The High Yield Dividend Aristocrats List is comprised of the Dividend Aristocrats with the highest current yields.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The High Dividend Stocks List : stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List : stocks that pay dividends every month, for 12 dividend payments per year.

- The 20 Highest Yielding Monthly Dividend Stocks : Monthly dividend stocks with the highest current yields.

- The Dividend Champions List : stocks that have increased their dividends for 25+ consecutive years. Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500.

- The Dividend Contenders List : 10-24 consecutive years of dividend increases.

- The Dividend Challengers List : 5-9 consecutive years of dividend increases.

- The Complete List of Russell 2000 Stocks : arguably the world’s best-known benchmark for small-cap U.S. stocks.

- The Best DRIP Stocks : The top 15 Dividend Aristocrats with no-fee dividend reinvestment plans.

- The High ROIC Stocks List : The top 10 stocks with high returns on invested capital.

- The High Beta Stocks List : The 100 stocks in the S&P 500 Index with the highest beta.

- The Low Beta Stocks List : The 100 stocks in the S&P 500 Index with the lowest beta.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

More from sure dividend

Articles golden rule commitment contact - legal - testimonials.

IMAGES

VIDEO

COMMENTS

Apr 1, 2024 • 6:30 AM EDT Download as PDF. ST. PAUL, Minn., April 1, 2024 /PRNewswire/ -- Today, 3M completed the planned spin-off of its health care business, which formally launches Solventum Corporation as an independent company. Solventum is listed on the New York Stock Exchange as SOLV. "This is an important day for 3M and Solventum, and ...

ST. PAUL, Minn., April 1, 2024. ST. PAUL, Minn., April 1, 2024 /PRNewswire/ -- Today, 3M completed the planned spin-off of its health care business, which formally launches Solventum Corporation ...

Key Takeaways 3M completed the spinoff of its health care unit, called Solventum, which began trading on the New York Stock Exchange and entered the S&P 500 Monday.The conglomerate also announced ...

ST. PAUL, Minn., March 8, 2024 /PRNewswire/ -- 3M (NYSE: MMM) today announced that its Board of Directors has approved the planned spin-off of its Health Care business, which will be known as ...

ST. PAUL, Minn., March 8, 2024 /PRNewswire/ -- 3M (NYSE: MMM) today announced that its Board of Directors has approved the planned spin-off of its Health Care business, which will be known as ...

The Company is anticipated to spin off from 3M ... Solventum historical financials in Form 10 and Q1 2024 are prepared as a carve-out of 3M Company. This basis of presentation is different than ...

The company is anticipated to spin off from 3M on April 1, 2024, and has applied to list on the New York Stock Exchange as "SOLV." ... The event will include formal presentations and a Q&A session ...

3M's share price rose 6% on market close Monday, following the completion of its spinoff of Solventum and the announcement that a federal court had approved a more than $10 billion settlement with ...

The new name and branding will go into effect when the spin-off of the independent health care company occurs, which is expected in the first half of 2024, subject to final approval by 3M's Board ...

3M has finished carving out its healthcare business, formally establishing Solventum as an independent, St. Paul, Minnesota-based manufacturer of a medtech catalog that brought in $8.2 billion in ...

Shares of Solventum (SOLV), which incorporates healthcare information technology, wound care and other businesses, edged lower on their first day of trading Monday. Solventum, spun off from 3M, a ...

Maplewood-based 3M's long-anticipated spinoff of its health care business group into an independent, publicly traded Fortune 500 company took a step closer to reality with the filing of a ...

PAUL, Minn., March 19, 2024 /PRNewswire/ -- Solventum will host its inaugural Investor Day today in New York City ahead of its planned spinoff from 3M (NYSE: MMM). The Company is anticipated to spin off from 3M on April 1, 2024, and has been approved for listing on the New York Stock Exchange as "SOLV." During today's event, Solventum chief ...

We arrive at a consolidated target price of $105.00 (Previously: $102.00) per share (adjusting for a 19.9% stake in Solventum) for 3M Company, which implies a potential upside of 14.4% from the ...

3M 's ( MMM 0.54%) spin-off announcement last month caught the market by surprise and inevitably raised comparisons with General Electric 's ( GE 6.04%) impending breakup. Both companies plan to ...

Solventum Corp., a health company spun out of 3M Co., has traded in the other direction, with the stock falling nearly 30% from the start of when-issued trading last week, Bloomberg data show.

3M Spinoff Solventum Closed Higher. What Happens Next. By Al Root. Updated April 01, 2024, 4:34 pm EDT / Original April 01, 2024, 11:47 am EDT. Share. Resize. Reprints.

Source: Investor Presentation. The healthcare spin-off will retain the product portfolio which generated $8.6 billion of sales in 2021. 3M intends the transaction to be a tax-free spinoff into a standalone publicly-traded company. The "new" 3M is expected to retain a 19.9% stake in the healthcare company, which may be divested over time.

The Solventum spin-off will help 3M prepare for legal settlements related to defective earplugs and water supply damages. 3M is risky due to potential future additional legal battles. 3M is a slow ...

Solventum Corporation, the spinoff of 3M's healthcare business, has started trading as a separate entity. The company is a global healthcare company with a broad portfolio of solutions and ...