- Customer Favourites

Private Banking

Powerpoint Templates

Icon Bundle

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

Business Proposal

Marketing Plan

Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

Digital Transformation

Human Resources

Product Management

Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories

- You're currently reading page 1

Stages // require(['jquery'], function ($) { $(document).ready(function () { //removes paginator if items are less than selected items per page var paginator = $("#limiter :selected").text(); var itemsPerPage = parseInt(paginator); var itemsCount = $(".products.list.items.product-items.sli_container").children().length; if (itemsCount ? ’Stages’ here means the number of divisions or graphic elements in the slide. For example, if you want a 4 piece puzzle slide, you can search for the word ‘puzzles’ and then select 4 ‘Stages’ here. We have categorized all our content according to the number of ‘Stages’ to make it easier for you to refine the results.

Category // require(['jquery'], function ($) { $(document).ready(function () { //removes paginator if items are less than selected items per page var paginator = $("#limiter :selected").text(); var itemsperpage = parseint(paginator); var itemscount = $(".products.list.items.product-items.sli_container").children().length; if (itemscount.

- Brochures (16)

- Brochures Layout (2)

- Business Plan Word (105)

- Business Plans (28)

- Business Slides (11508)

Title Ban Private Banking

Edmond de Rothschild is a conviction-based investment house driven by the firm belief that wealth is not an end in itself but an opportunity to build the future. Yours and that of future generations.

This is the philosophy that guides us when advising you. We draw on over 250 years of financial tradition and innovation to assist our clients on the preservation, development and transmission of their wealth, through solutions that combine long-term performance with a positive impact on the world around us.

HELPING YOU TO MAKE THINGS HAPPEN

A forward-looking relationship.

From our very first meeting, we focus on the future. We take a multi-generational view to ensure that the decisions made today are the right ones for tomorrow.

CONSTANTLY EVOLVING SUPPORT

Your needs and expectations evolve. Our role is to anticipate these changes in the best way possible. Drawing on our entrepreneurial approach, we rapidly mobilise our expertise to provide you with the most appropriate solutions.

GLOBAL VIEW OF YOUR ASSETS

Taking a global approach is paramount to managing your wealth efficiently. Our combination of business lines and expertise enables us to build solutions taking into consideration your total wealth. Our advice takes a holistic view of your personal and business assets.

CONVICTION-BASED INVESTMENT

We do not invest in index funds. We keep a close eye on economic, social and environmental transformations so we can help you give meaning to your investments and stay connected to the real economy.

A CONVICTION-DRIVEN INVESTMENT HOUSE

Independence.

Our Group is 100% family-owned and independent. This gives us the freedom to take a long-term view that is aligned with our clients' interests, and to develop innovative solutions that combine performance and impact.

We endeavour to always be creative, flexible and responsive, whatever your needs. Our decision-making processes are efficient and our teams driven by the desire to innovate while controlling risks.

It is our responsibility to offer you meaningful investments aligned with your values. Your dedicated private banker develops an in-depth understanding of your situation and expectations by offering you long-term support and commitment.

SUSTAINABILITY

We firmly believe that what is sustainable is profitable, and anything that is profitable should be sustainable. For us, profitability is about the long term and must be associated with a positive impact on the world around us.

A UNIQUE ECOSYSTEM

Bankers, sportsmen, philanthropists, farmers, hoteliers and winegrowers... our Group forms a unique ecosystem of women and men driven by the same ambition: to build the future.

All of our activities reflect our entrepreneurial spirit and demonstrate our desire to make an impact, to pass on and modernise a legacy. They contribute to the unique experience we wish to offer our clients by giving them access to our ecosystem and sharing our vision of the world.

Key figures at 31/12/2023

direct access, elsewhere on the website.

- Search Search Please fill out this field.

- Wealth Management

What Is Private Banking? Definition and How It Works

James Chen, CMT is an expert trader, investment adviser, and global market strategist.

:max_bytes(150000):strip_icc():format(webp)/photo__james_chen-5bfc26144cedfd0026c00af8.jpeg)

Investopedia / Michela Buttignol

What Is Private Banking?

Private banking consists of personalized financial services and products offered to the high-net-worth individual (HNWI) clients of a retail bank or other financial institution. It includes a wide range of wealth management services, and all provided under one roof. Services include investing and portfolio management , tax services, insurance, and trust and estate planning .

While private banking is aimed at an exclusive clientele, consumer banks and brokerages of every size offer it. This offering is usually through special departments, dubbed "private banking" or "wealth management" divisions.

Key Takeaways

- Private banking is an enhanced offering for the high-net-worth individual (HNWI) clients of a financial institution.

- Private banking consists of personalized financial and investment services and products from a dedicated personal banker.

- Private banking clients typically receive discounts or preferential pricing on financial products.

- However, the range of products and investment expertise offered by a private bank may be limited compared to other providers.

How Private Banking Works

Private banking includes common financial services like checking and savings accounts, but with a more personalized approach: A "relationship manager" or "private banker" is assigned to each customer to handle all matters. The private banker handles everything from involved tasks, like arranging a jumbo mortgage , to the mundane like paying bills. However, private banking goes beyond CDs and safe deposit boxes to address a client's entire financial situation. Specialized services include investment strategy and financial planning advice, portfolio management, customized financing options, retirement planning , and passing wealth on to future generations.

While an individual may be able to conduct some private banking with $50,000 or less in investable assets, most financial institutions set a benchmark of six figures' worth of assets, and some exclusive entities only accept clients with at least $1 million to invest.

Advantages of Private Banking

Private banking offers clients a variety of perks, privileges, and personalized service, which has become an increasingly prized commodity in an automated, digitized banking world. However, there are advantages to both the private bank clients as well as the banks themselves.

Privacy is the primary benefit of private banking. Customer dealings and services provided typically remain anonymous. Private banks often provide HNWIs with tailored proprietary solutions, which are kept confidential to prevent competitors from luring a prominent customer with a similar solution.

Preferential Pricing

Private banking clients typically receive discounted or preferential pricing on products and services. For example, they may receive special terms or prime interest rates on mortgages, specialized loans, or lines of credit (LOC) . Their savings or money market accounts might generate higher interest rates and be free of fees and overdraft charges. Also, customers who operate import-export ventures or do business overseas might receive more favorable foreign exchange rates on their transactions.

Alternative Investments

If they are managing a client's investments, private banks often provide the client with extensive resources and opportunities not available to the average retail investor. For example, an HNWI may be given access to an exclusive hedge fund or a private equity partnership or some other alternative investment .

One-Stop-Shop

In addition to the customized products, there is the convenience of consolidated services—everything under one financial roof. Private banking clients received enhanced services from their private banker that acts as a liaison with all of the other departments within the bank to ensure that the client receives the best possible product offerings and service.

Assets and Fees for Banks

The bank or brokerage firm benefits from having the clients' funds add to their overall assets under management (AUM). Even at discounted rates, the private bank's management fees for portfolio management and interest on loans underwritten can be substantial.

In an environment where interest rates in the U.S. have remained low, banks have been unable to charge higher loan rates to grow their profits. As a result, fee income has become an increasingly important financial metric in helping banks diversify their revenue stream. Banks have made strides in expanding beyond traditional banking products, such as loans and deposits, to more service-oriented and fee-based offerings like private banking.

One-stop shopping for financial affairs

Concierge services and dedicated employees

Favorable rates, discounted charges

Perks and privileges

Less institutional expertise

Options limited to proprietary products

High staff turnover

Possible conflict-of-interest for employees

Disadvantages of Private Banking

Although there are many advantages to private banking, drawbacks do exist to this exclusivity.

Bank Employee Turnover

Employee turnover rates at banks tend to be high, even in the elite private banking divisions. There may also be some concern over conflicts of interest and loyalty: The private banker is compensated by the financial institution, not the client—in contrast to an independent money manager.

Limited Product Offerings

In terms of investments, a client might be limited to the bank's proprietary products. Also, while the various legal, tax, and investment services offered by the bank are doubtlessly competent, they may not be as creative or as expert as those offered by other professionals that specialize in various types of investments. For example, small regional banks might provide stellar service that beats out the larger institutions. However, the investment choices at a smaller, regional bank might be far less than a major player such as JPMorgan Chase & Company ( JPM ).

Regulatory Constraints for Banks

Lucrative as private banking can be, it can pose challenges for the institution, as well. Private banks have dealt with a restrictive regulatory environment since the global financial crisis of 2008. The Dodd-Frank Wall Street Reform and Consumer Protection Act , along with other legislation passed in the U.S. and around the world, has resulted in a higher level of transparency and accountability. There are more stringent licensing requirements for private banking professionals that help ensure customers are appropriately advised about their finances.

Real World Example of Private Banking

UBS, Merrill Lynch, Wells Fargo, Morgan Stanley, Citibank, and Credit Suisse are all examples of financial institutions with substantial private banking operations. Another bank that offers private banking is TD Bank ( TD ), with its TD Wealth® Private Client Group.

Available to clients with at least $750,000 in assets, it offers many services to its clients. Services include money management, strategies for business owners, real estate financing, and custom lending solutions. The private banking team also offers retirement, succession, and estate planning, which help reduce taxes.

The TD website promises that beyond the product offerings, each private client will receive a local relationship manager that will deliver exceptional, customized service as outlined in the quote below.

We build a customized financial strategy that aligns to your individual and/or family goals.

TD Bank. " TD Wealth® Private Client Group ." Accessed Aug. 30, 2020.

:max_bytes(150000):strip_icc():format(webp)/GettyImages-951640954-80000cd0cf8541299479d92e21723a85.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Join 307,012+ Monthly Readers

Get Free and Instant Access To The Banker Blueprint : 57 Pages Of Career Boosting Advice Already Downloaded By 115,341+ Industry Peers.

- Break Into Investment Banking

- Write A Resume or Cover Letter

- Win Investment Banking Interviews

- Ace Your Investment Banking Interviews

- Win Investment Banking Internships

- Master Financial Modeling

- Get Into Private Equity

- Get A Job At A Hedge Fund

- Recent Posts

- Articles By Category

Investment Banking Pitch Books: Design, Examples & Templates

If you're new here, please click here to get my FREE 57-page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking . Thanks for visiting!

Bankers like to complain about almost everything, but near the top of the complaint list is “investment banking pitch books.”

Some Analysts claim that you’ll devote all your waking hours to creating these documents, while others say they’re time-consuming but not that terrible to create.

Some senior bankers swear by pitch book presentations, claiming that they help to win and close deals, while others think they’re over-hyped.

We’ll look at all those points and more in this article, including downloadable pitch book examples and templates for you to use.

Table Of Contents:

- What Is An Investment Banking Pitch Book?

How to Create a Pitch Book

Pitch book presentation, part 1: pitching your team as the advisor of choice, pitch book presentation, part 2: providing background and context, pitch book presentation, part 3: choose your own adventure, sell-side pitch books for sell-side mandates, buy-side pitch book examples, equity pitch book and debt pitch book examples for financing mandates, other types of pitch books, why do you spend so much time on investment banking pitch books as a junior banker, what do you need to know about pitch books as an intern or new hire, what is an investment banking pitch book.

Pitch Book Definition: In investment banking, pitch books refer to sales presentations that a bank uses to persuade a client or potential client to take action and pay for the bank’s services. Pitch books typically contain sections on the merits of the transaction; analysis of potential buyers or sellers; pricing and valuation information; as well as key risks to mitigate.

That is the classic definition, but in practice, people use the term “pitch book” to refer to almost any presentation created by a bank.

We’re going to focus on presentations to potential clients here because they tend to be the most time-consuming ones, and they generate the most horror stories as well.

There’s no way to “measure” how much pitch books matter, but it’s safe to say that they’re less important than the time spent on them implies.

Bankers win deals primarily because of relationships cultivated over a long time ; a pretty presentation right before a company goes public means little compared with the 5-10 years of meeting the CEO and CFO before that point.

Pitch books matter to you as an investment banking analyst or associate primarily because you’ll spend a good amount of time creating them – and you can’t screw up if you want a good bonus .

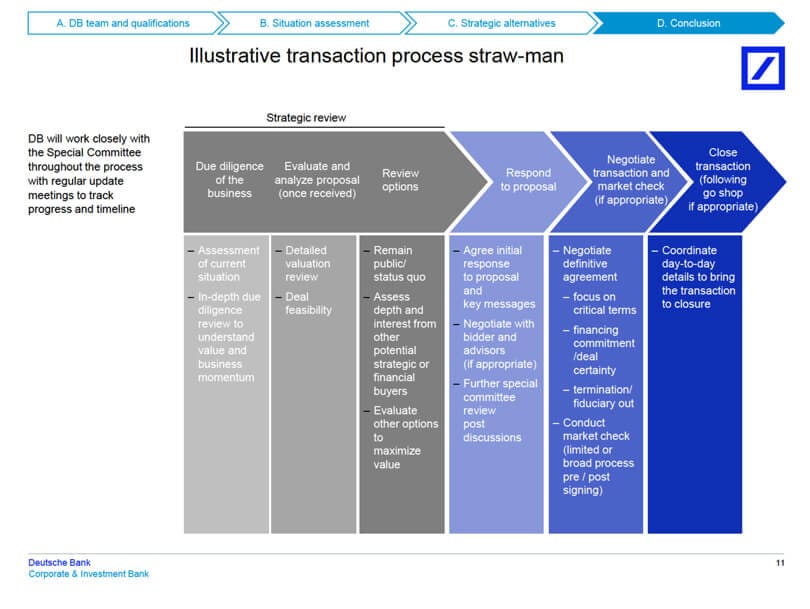

Almost all investment banking pitch books use a structure similar to the following:

- Situation, 0r “Current State”: Your prospective client is looking for growth.

- Complication, or “Problem”: The potential client’s growth rate has been slowing down.

- Hypothesis, or “Solution”: Acquiring a growing company can meet the potential client’s need for growth.

Then, you go into detail showing why the hypothesis might be true – including why your team is qualified to lead this transaction, similar transactions you’ve led before, and the valuation this company can expect to receive.

Investment Banking Pitch Book Sample PPT and PDF Files and Downloadable Templates

Here are a number of example pitch books in editable Powerpoint (PPT, PPTX) and PDF versions, drawn from some of the case studies within our investment banking courses :

- Jazz Pharmaceuticals – Valuation and Sell-Side M&A Pitch Book (PPT)

- Jazz Pharmaceuticals – Valuation and Sell-Side M&A Pitch Book (PDF)

- KeyBank and First Niagara – FIG M&A Pitch Book (PPT)

- KeyBank and First Niagara – FIG M&A Pitch Book (PDF)

- Netflix – Equity, Debt, and Convertible Bond Financing Pitch Book (PPT)

- Netflix – Equity, Debt, and Convertible Bond Financing Pitch Book (PDF)

Here’s what you can expect in the first few parts of any pitch book, including many examples from actual bank presentations:

The first section of investment banking pitch books introduces your firm’s platform, recent transactions, and team.

You might include stats on your firm’s position in the league tables , or explain its growth story and how it’s different from its competitors. Here are a couple of examples:

You might also write about distribution partnerships and other strategic developments here.

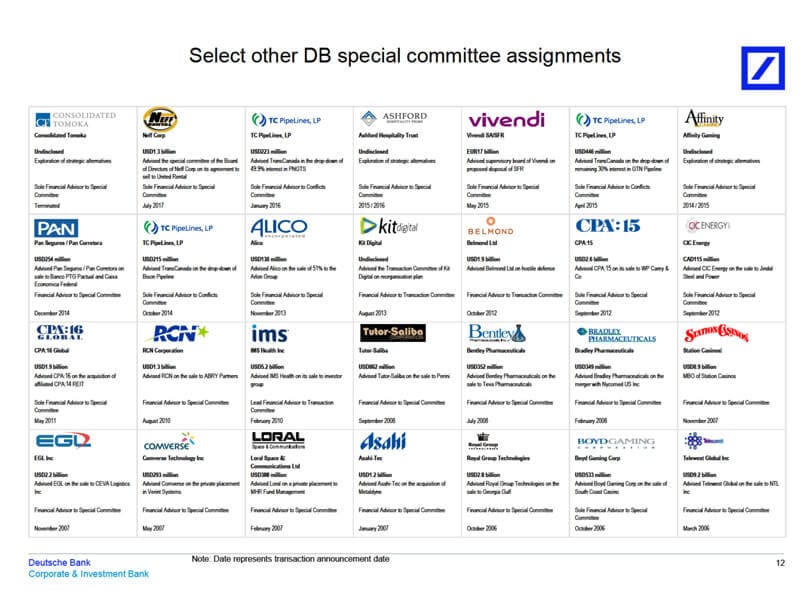

The next section consists of credentials , which include similar transactions your team has completed. Since turnover at banks is high, these lists often include transactions completed by team members when they were at other banks.

Here are a few examples:

These pages look simple, but they can be time-consuming to put together because you need to find the most relevant deals and rearrange elements from other presentations.

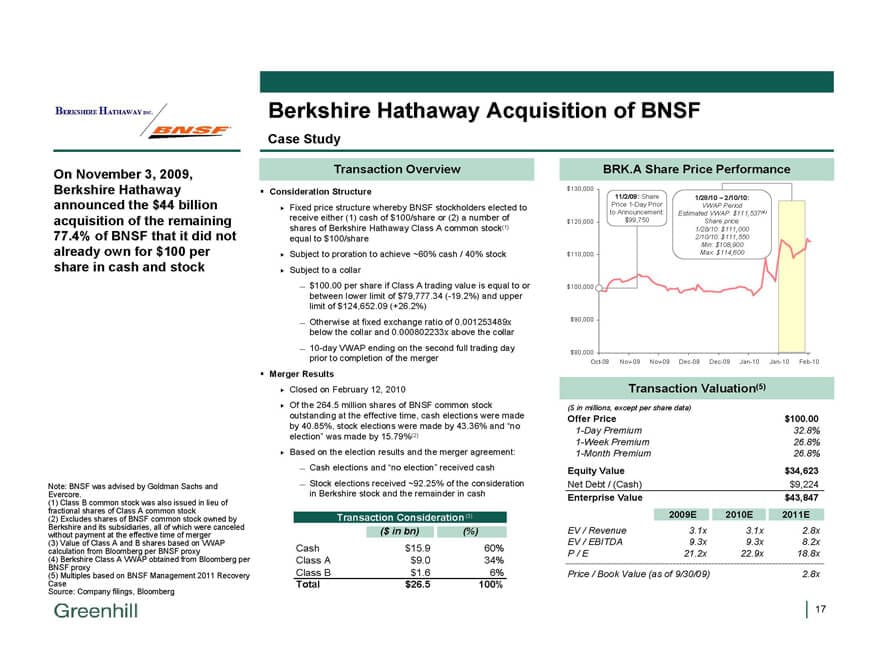

You may also go into more detail on a few deals and devote entire pages to them.

Banks often call these 1-page descriptions “ case studies ,” and you can see a few examples below:

Finally, this section will include a team biography , including previous firms, relevant deals/clients, and education for each member:

Before you move into the specific situation of the company you’re meeting, you’ll usually share some updates on the industry as a whole and recent deal activity in the sector.

Unlike the first part, which was about your team ’s experience, this one is more about general trends that affect everyone.

For example, if a tech startup is considering an initial public offering , you’ll review tech IPOs from the past 6-12 months, explain how they’ve performed, and discuss the types of companies that tend to go public.

Here are a few examples of industry updates:

And here are a few examples of deal/transaction updates:

After these first few sections, which are similar in any pitch book, the structure and content start to differ based on what the bank is pitching.

We’ll look at three broad categories here:

- Sell-side mandates (i.e., convince a company to sell itself)

- Buy-side mandates (convince a company to acquire another company)

- Financing mandates (raise debt or equity).

You’ll start by including a few slides on how your bank would position the company and make it attractive to potential buyers.

For example, if the firm is a traditional services provider with a growing online presence, you might attempt to spin it as a “SaaS” (Software-as-a-Service) company – within reason.

If you’re pitching a large company on a divestiture, you might explain how you’ll make the division sound like more of a standalone entity – meaning that buyers won’t have to spend as much time and money integrating it.

Next, you’ll lay out the company’s valuation and the price it might expect to receive in a sale.

This valuation section might be only 1-2 slides in a short pitch book or 20+ slides in a longer one.

Common elements include the valuation football field , output of a DCF model , comparable public companies , and precedent transactions .

The “football field,” or summary valuation, pages range from simple to more interesting to so complicated they could be eye charts .

Here are a few examples of other valuation-related slides:

It is unusual to include a Contribution Analysis or any M&A analysis in this section unless the deal is highly targeted or has advanced quite far.

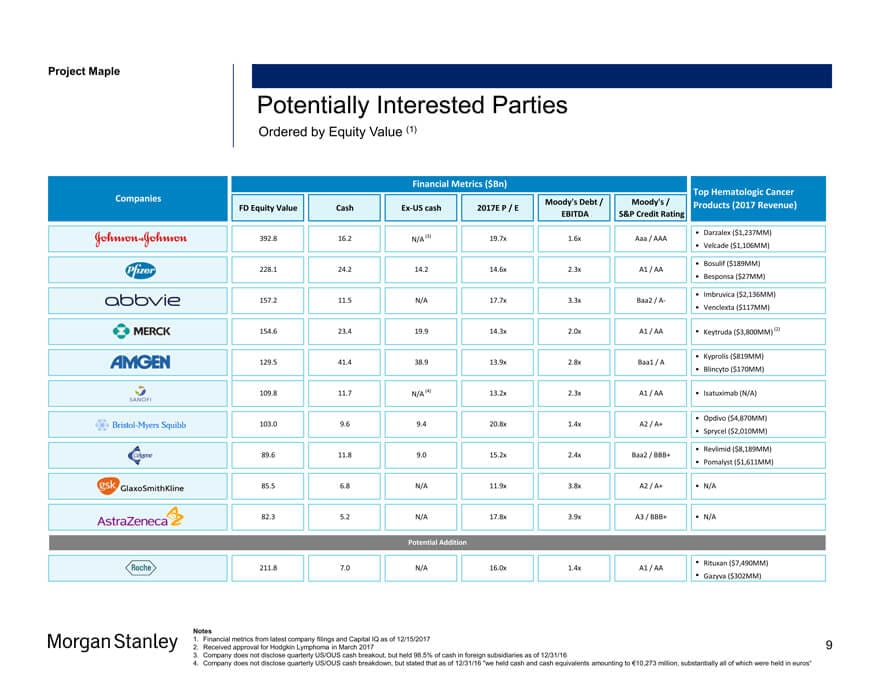

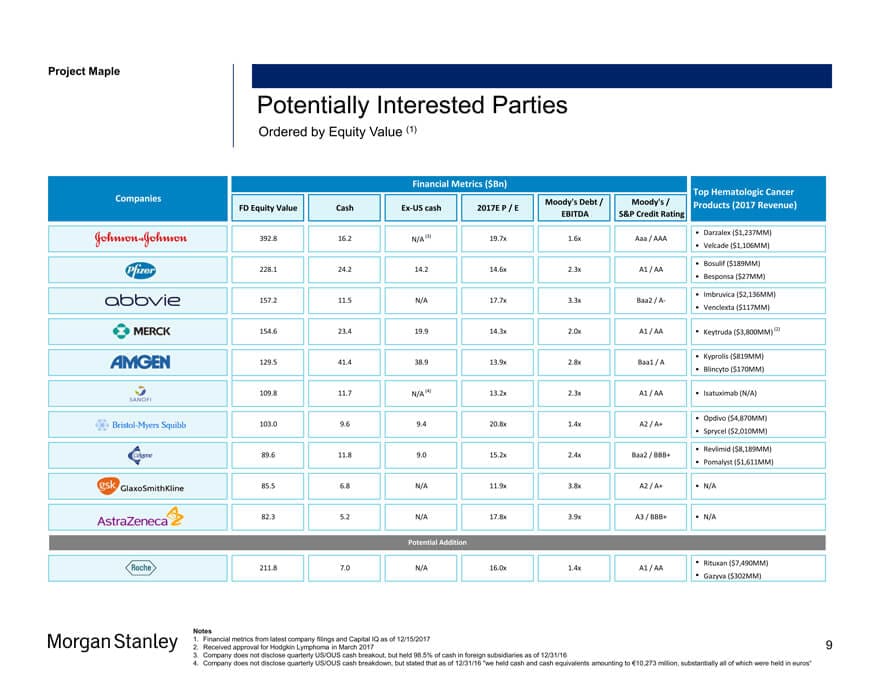

After the valuation section, you’ll discuss “potential buyers,” a list that is sometimes the longest and most time-consuming section of the entire pitch book.

Short summaries aren’t too bad, but if a senior banker wants a full page on each acquirer, you can look forward to a lot of monotonous work gathering the information.

Here are a few shorter examples:

You’ll conclude the pitch book with a summary of your recommendations and the company’s next steps.

For example, you might suggest that the company pursue a targeted sale process with the 5-10 best buyers and aim to complete a deal within 12 months.

These slides tend to be generic ones, used across multiple presentations:

Finally, in longer investment banking pitch books, there is often an Appendix with more detailed models and data, and sometimes even longer lists of potential acquirers.

No one reads this section, but bankers enjoy spending time on unnecessary work (read: evidence of effort).

Investment banking pitch books for buy-side M&A deals follow a similar structure, with a few key differences:

- The “Positioning” part in the beginning might be more about the types of acquisitions the company should pursue and how your bank will help close these deals.

- There may be valuation information, but the purpose will be different: in buy-side deals, you value the buyer to estimate how much a stock issuance to fund the deal might be worth. You might also include quick valuations of potential targets.

- Instead of profiling potential acquirers, you’ll profile potential targets . This list is often longer than the list of potential buyers because a large company could, in theory, choose from hundreds or thousands of potential targets to acquire.

Buy-side M&A pitch books are often shorter than sell-side ones, but they can be more tedious to create due to the longer profile lists.

As a junior banker, you won’t have much input into the acquisition targets that are profiled in these presentations, but senior bankers try to present ideas that:

- Maintain or exceed the firm’s cost of capital.

- Maintain the firm’s competitive advantage.

- Enhance the firm’s ability to serve clients.

- Help the firm expand into high-growth geographies or industries.

Large companies often meet with dozens of bankers per month, so originality can be important as well; many investment banks pitch the same set of acquisition targets repeatedly.

If you present an idea the company has seen 100 times before, they’re unlikely to be excited – but if you find a company they haven’t considered, or you have some exclusive insight, you’ll capture their attention.

It’s tough to find real investment banking pitch books for these transactions because most buy-side M&A deals never close, so the banks do not disclose any of the documents.

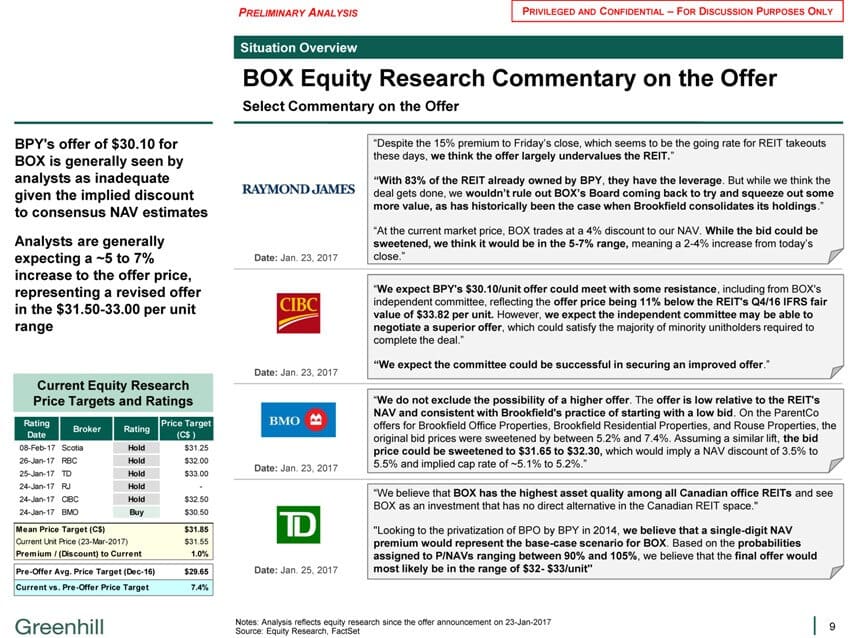

But here are a few company profile and associated commentary slides similar to the ones found in buy-side pitch books:

- Brookfield Canada Office Properties by Greenhill

- Banco Santander S.A. by Goldman Sachs

- Side-by-Side Comparison of Buyer and Seller by JP Morgan

- Equity Research Commentary on Buyer’s Offer for Seller by Greenhill

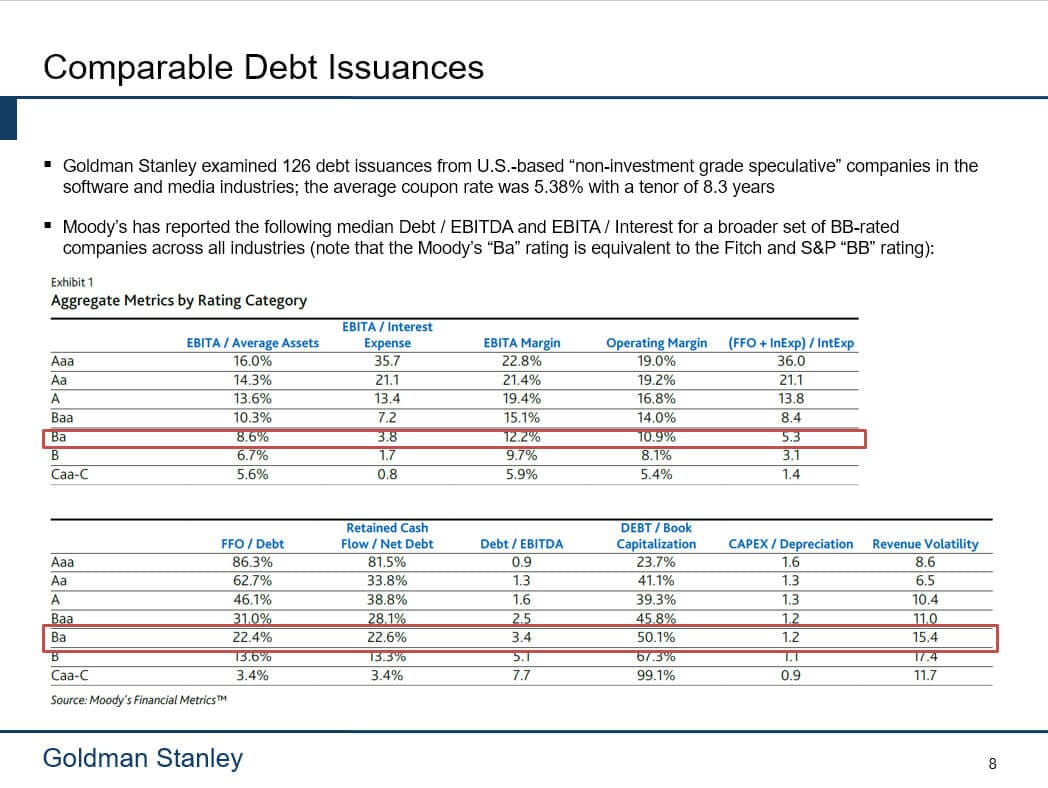

In financing mandates – for equity, debt, and even restructuring deals – there are a few major differences compared with the investment banking pitch books described above:

- No Profiles – You are simply pitching the company on raising capital or restructuring its capital, so there is no need to discuss potential buyers or sellers.

- Financing Models Instead of / or In Addition to Valuation – Valuation still matters for equity and restructuring deals, but you will also have to present additional analyses that are relevant to the deal.

For example, if you’re pitching an IPO, you might show the range of multiples at which the company could go public, the range of proceeds it might receive, and how its value might change after the deal.

In a debt deal, you’ll show the credit stats and ratios for the company under different scenarios, such as Term Loans vs. Subordinated Notes, and explain which one is best based on that.

For more examples, please see the articles on ECM , DCM , and Restructuring .

Also, see our coverage of IPO valuation models and debt vs. equity analysis :

Many other presentations get labeled “pitch books” even if banks pitching their own services do not create them.

For example, management presentations for pitching clients to potential buyers are often labeled “pitch books.”

However, they’re just extended versions of the Confidential Information Memorandum (CIM) .

And in the EMEA region, they’re the same thing because CIMs tend to be more like presentations than written documents.

Banks also create presentations to deliver Fairness Opinions , update clients on recent buyer or seller activity, and update clients on the status of M&A deal negotiations.

None of these is a pitch book according to the classic definition, but the slides often look similar, and there may be some common elements, such as the valuation section.

Not all pitch books take days or weeks to complete – shorter ones might require only a few hours of work.

But they can easily spiral into never-ending projects that require all-nighters and extraordinary effort to finish, resulting in those legendary investment banking hours .

That’s because of:

- Attention to Detail – You’ll spend a lot of time making sure your punctuation is consistent, that all the footnotes are in the right spots, and that the dates are correct.

- Dozens of Revisions – Senior bankers love to make changes well past the point of diminishing returns. It’s not uncommon to see “v44” at the end of file names.

- Conflicting Changes – The Associate wants one thing, the VP wants another, and the MD wants something else. And if you implement the MD’s version based on seniority, the others may fight back.

- Random Graphic Design Work – This one is more of an issue at boutique firms that lack presentations departments, but sometimes you’ll have to spend time creating fancy visual elements on slides – which end up being useless once your MD changes his mind and rips out those slides.

If you’re new to the industry, you should familiarize yourself with the layout and design elements of pitch books, but you do not need to be an expert on the creation process.

Different banks use different tools and methods, so it might be counterproductive to learn too much in advance.

You should also learn the key PowerPoint shortcuts very well, including how to customize PowerPoint to make it more efficient (see our tutorial on PowerPoint Shortcuts in Investment Banking below):

https://www.youtube.com/watch?v=tnJ1e2xJmFc

Everyone knows that Excel is important in finance, but people tend to underestimate PowerPoint – even though most junior bankers spend more time in PowerPoint than Excel.

To learn those efficiently, check out our PowerPoint Pro course , which covers the fundamentals of presentation creation, including how to set up PowerPoint properly in the first place, alignment and formatting tricks, slide organization, pasting in Excel data, and applying the “finishing touches.”

There are also practice exercises for creating deal and company profiles and fixing slides with formatting problems.

If you learn all that and understand the structure and layout of investment banking pitch books, you won’t have much to complain about – even as the other interns and analysts around you are whining.

You might be interested in a detailed tutorial on investment banking PowerPoint shortcuts or this article titled Stock Pitch Guide: How to Pitch a Stock in Interviews and Win Offers .

About the Author

Brian DeChesare is the Founder of Mergers & Inquisitions and Breaking Into Wall Street . In his spare time, he enjoys lifting weights, running, traveling, obsessively watching TV shows, and defeating Sauron.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Read below or Add a comment

10 thoughts on “ Investment Banking Pitch Books: Design, Examples & Templates ”

Hi Brian. Thank you for valuable information!

I’m currently interning. After sitting in a client presentation. What questions should I ask my supervisor regarding the presentation. As we’re going to have a follow up call

I’m not sure I understand your question. The questions you ask are completely dependent on the presentation, so I can’t really answer this without knowing the contents of the presentation.

Its a great article. Appreciate if you also have a link or article for new PE firm Pitch Deck (presenting to investment banks or FIGs), please. Thanks

Sorry, don’t have anything there.

Great article! The information is very helpful and informative. Where and how can I find other examples of sell-side pitchbooks similar to the ones mentioned in this article?

Thanks, Ryan

Thanks. Unfortunately, sell-side pitch books are hard to find because they’re not disclosed publicly. You can find presentations for recently announced deals by Googling the deal’s name and limiting the search to the sec.gov site and going through those results.

Is an information memorandum informally called a teaser or is this something else?

A teaser is a much shorter document, such as a 1-2-page summary of the company’s key benefits, financials, growth opportunities, etc.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Perfect Your PowerPoint Skills

The BIWS PowerPoint Pro course gives you everything you need to complete pitch books and presentations in half the time and move straight to the front of the "top tier bonus" line.

Home Collections Financials Banking

Free Banking Presentation Templates

Tired of boring bank presentations try free banking powerpoint templates and google slides from slide egg we've slides for every banking topic, from investment strategies to mobile apps, designed to make your presentation shine. easy to edit, royalty-free, and available in multiple formats. so, skip the stress and download your free templates today.

- Diverse themes: A wide range of banking topics, from mobile banking apps and online banking systems to commercial loan processes and digital banking security tips are available here. We even have special slides dedicated to International Banking Day!

- Creative and engaging: Forget boring bullet points and usual layouts. Our banking slides are bursting with vibrant colors, captivating infographics, and dynamic layouts that keep your audience glued to the screen.

- Flexibility at your fingertips: Whether you prefer PowerPoint or Google Slides, portrait or landscape, 4:3 or 16:9 aspect ratio, we've slides here! Choose the format that best suits your needs and platform.

Become an expert with SlideEgg

How to make a banking PowerPoint presentation

We're here to help you, what kind of banking presentation templates do you have.

We have a wide variety of templates for all your banking needs, including slides on investment banking, mobile banking, commercial loans, online banking, E-wallets, and more. We even have special slides for International Banking Day!

Are your templates free?

Yes, we offer a selection of free banking templates to get you started. You can also upgrade to a premium plan for access to even more templates and features.

Can I edit the templates?

Absolutely! All our templates are 100% editable, so you can customize them to match your brand and message. Change colors, fonts, layouts – the possibilities are endless!

Can I use your templates for commercial purposes?

Yes, our templates are royalty-free, so you can use them for both personal and commercial presentations.

How can I download the templates?

Simply browse our "Banking Presentation Templates" category page and click on the template you want to download. You'll be able to download it as a PowerPoint file or a Google Slides file.

I need help using the templates. What can I do?

We're happy to help! Contact our support team for assistance.

What are some tips for creating a great banking presentation?

Use clear and concise language. Keep your slides visually appealing. Use data and charts to support your points. Practice your presentation beforehand.

PRIVATE BANK

Nov 13, 2014

1.39k likes | 5.25k Views

PRIVATE BANK. Presented by:-Kusum B.com(Prof.)059 100243014. What is private bank. Private banks are banks owned by either an individual or a general partner(s) with limited partner(s).

Share Presentation

- private banking

- private banks

- private bank

- private sector bank

- high quality financial planning

Presentation Transcript

PRIVATE BANK Presented by:-Kusum B.com(Prof.)059 100243014

What is private bank • Private banks are banks owned by either an individual or a general partner(s) with limited partner(s). • Private banks are not incorporated. • In any such case, the creditors can look to both the “entirely of the bank’s assets” as well as the entirely of the sole-proprietor/general-partners’ assets.

Private banks are two categories are:- • Old private banks and • New private banks

Old private banks • The banks, which were not nationalized at the time of bank nationalization that look place during 1969 and 1980 are known to be the old private-sectors banks. • These were not nationalized, because of their small size and regional focus.

List of the private banks

New private bank • The banks, which came in operation after 1991, with the introduction of economic reforms and financial sector reform are called “new private-sector banks”. • Banking regulation act was then amended in 1993, which permitted the enter of new private-sector bank in the Indian banking sector.

List of new private bank

What do we offer to the private banking customers. • There are different levels are service offered by different financial institutions associated with private banking. • Full range of banking services on a “one-stop-shop” basis • Private banker’s service and assistance of qualified specialists • High-quality financial planning and advisory

Advantage of private banks • Personal team • A private banking client contract • A personal financial strategy • It will be invited to regular client seminars and other events

Disadvantage of private banks • Surplus employee • No of branches in rural areas • Unbalanced growth • Job for relatives • Loans for few persons • Owners association

- More by User

Public Private Partnerships (PPPs) and The World Bank

Public Private Partnerships (PPPs) and The World Bank. Riga (Latvia) – March 6-8, 2007 . Michel Audigé Lead Transport Specialist World Bank . Contents. General overview The role of Governments World Bank support for PPP development. PPPs: General Overview . PPP Defined.

427 views • 18 slides

Inter-American Development Bank Private Sector Department

Trade Finance Facilitation Program (TFFP). Inter-American Development Bank Private Sector Department. - June 14 - . TFFP – The Context. During times of volatile international capital flows and/or temporary liquidity squeezes, international banks actively involved in trade finance:

498 views • 16 slides

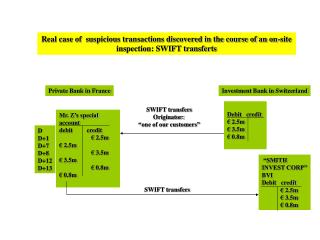

Private Bank in France

Real case of suspicious transactions discovered in the course of an on-site inspection: SWIFT transferts. Private Bank in France. Investment Bank in Switzerland. Debit credit € 2.5m € 3.5m € 0.8m. SWIFT transfers Originator: “one of our customers”.

198 views • 4 slides

World Bank Toolkit for Public-Private Partnership in Highways

Tallinn Technical University. World Bank Toolkit for Public-Private Partnership in Highways. Cesar Queiroz Lead Highway Engineer World Bank Tallinn, 4 October 2004. Presentation Outline. Public policy requirements The main risks of highway projects

608 views • 43 slides

Private Sector Liaison Office to the World Bank

Private Sector Liaison Office to the World Bank. Opportunities for NW Businesses and Non-Profits. Trade Development Alliance of Greater Seattle Our Partner Organizations. The What, Where & How of Trade Alliance. What: Branding the Greater Seattle Region Where: Target Markets

315 views • 18 slides

INTER-AMERICAN DEVELOPMENT BANK Private Sector Department Financing Private Investment

INTER-AMERICAN DEVELOPMENT BANK Private Sector Department Financing Private Investment in Infrastructure in Latin America and the Caribbean. July 2004. Natacha C. Marzolf. Private Sector Department (PRI).

363 views • 17 slides

Private Partnership in Infrastructure Facilitating – World Bank Guarantees

Private Partnership in Infrastructure Facilitating – World Bank Guarantees. October 25, 2004. Pushing the frontier of private investments. IFC MIGA IBRD/IDA IFC A Loan Political Risk Insurance Guarantees IFC B Loan (expropriation, transfer restriction, -Partial Risk

581 views • 47 slides

Private Bank & Financing in Africa

Private Bank & Financing in Africa. 24 June 2008. 24 June 2008. Henry K. Hall, CFA Managing Director GEM Equity Derivative Sales, Structuring and Financing. Equity Linked Financing. Basic Concept. Equity Linked Financing. Collateral Value

495 views • 29 slides

Global Private Bank Services to Affluent Asians

Global Private Bank Services to Affluent Asians. AILENE M. LITONJUA Chief Representative HSBC Private Bank (Suisse) SA Manila Representative Office. The Market Size. Market Size Based on Total Assets

273 views • 16 slides

Aarkstore.com - Hyposwiss Private Bank Geneve SA

Hyposwiss Private Bank Geneve SA : Company Profile and SWOT Analysis contains in depth information and data about the company and its operations. The profile contains a company overview, key facts, major products and services, SWOT analysis, business description, company history, key employees, company locations and subsidiaries as well as employee biographies. Browse full report @ goo.gl/cocrPk

281 views • 9 slides

Agricultural Bank of China Private Banking: JSBMarketResearch

This report is a crucial resource for industry executives and anyone looking to access key information about Agricultural Bank of China Private Banking. See Full Report: http://goo.gl/6imzjx

272 views • 7 slides

Investec Private Bank in UK & Europe: JSBMarketResearch

Investec Private Bank (UK & Europe): Company Profile and SWOT Analysis contains in depth information and data about the company and its operations. See Full Report: http://goo.gl/O2QJP8

198 views • 7 slides

Private Firm for Locating Bank Accounts

There are lots of significance of a professional private investigator like BAnkAccountSearch.Com which may help you to retrieve your hidden debts and collections.

204 views • 10 slides

Bank Software | EQL Business Solutions Private Limited

EQL Business Solutions Pvt Ltd is software company.EQL is a best IT company providing software for bank. In this software eql provide different type of module which is important for all banks and finance sectors.

244 views • 12 slides

Bank, Railway, software, govt & private job vacancies

Get first and best information about the latest job vacancy for fresher related to banking, Railway, Software, Govt and Private jobs. In bank jobs get all detail to fill forms online or offline at a time.

98 views • 5 slides

YES BANK (Yes Bank), one of the new generation private sector banks

Assignment Solutions, Case study Answer sheets Project Report and Thesis contact [email protected] www.mbacasestudyanswers.com ARAVIND – 09901366442 – 09902787224 Principles and Practice of Management Case (20Marks) YES BANK (Yes Bank), one of the new generation private sector banks, was set up in India after reforms were introduced in the banking sector in the 1990s. Yes Bank entered the market in late 2004 when the banking space in India was already overcrowded with a number of public sector banks, private sector banks, and cooperative banks. Foreign multinational banks, which were Growth constrained, were also waiting eagerly for the sector to open up further in 2009 to make a major foray into this emerging market. However, despite being a late entrant, Yes Bank drew the attention of its competitors and analysts by the speed at which it grew and by increasing its operations throughout the country. Answer the following question. Q1. Give an overview of the case. Q2. Explain how Yes bank differentiated from its competitors and used it to turn its late entry into an advantage. Assignment Solutions, Case study Answer sheets Project Report and Thesis contact [email protected] www.mbacasestudyanswers.com ARAVIND – 09901366442 – 09902787224

64 views • 4 slides

Cordlife – the best private bank in India

If you choose to bank your babyu2019s stem cells, donu2019t forget to vet the agreements of the various companies yourself or with the help of a competent legal advisory to gather transparency on the organization. This will help you to decide the best company providing stem cell preservation in India.

114 views • 10 slides

Eliminate Your Doubts About Offshore Bank | Private bank

An offshore bank is the banking services utilized outside oneu2019s country of residence. If you can take advantage of this service then you can get many benefits. See more: https://bit.ly/2ARzAww

87 views • 8 slides

SBI ETF Private Bank New Fund Offer Details

SBI Mutual Fund presented its new store offer,SBI ETF Private Bank. So at that point, this reserve comes as an open-finished plan and the store classification is Other Scheme-Other ETFs support.

23 views • 2 slides

Banking courses, bank exam course, bank coaching classes, banking coaching centre, private bank jobs for freshers, bank

Banking courses,bank exam course,bank coaching classes,banking coaching centre,private bank jobs for freshers,bank jobs for freshers,banking course with placement,best digital marketing training institute,digital marketing training institute,best digital marketing course,https://phire.in

58 views • 1 slides

Gazprombank - Company Profile

All the data and insights you need on Gazprombank in one report.

Gazprombank Company profile

Unlock Gazprombank profile and new opportunities for your business

- Save hours of research time and resources with our up-to-date, most comprehensive Gazprombank. report available on the market

- Understand Gazprombank position in the market, performance and strategic initiatives

- Gain competitive edge and increase your chances of success

- Save hours of research time and resources with our up-to-date Gazprombank Strategy Report

- Understand Gazprombank position in the market, performance and strategic initiatives.

Gazprombank: Overview

- Share on Twitter

- Share on LinkedIn

- Segment Analysis

- SWOT Analysis

- Competitors

- Filing Analytics

- Theme Exposure

IT Services Contracts

Ict spend & tech priorities.

Gazprombank is a financial services provider. It offers banking and investment solutions to financial institutions, corporate and private clients. The bank offers products and services such as bank accounts, term deposits, retail loans, debit and credit cards, syndicated loans, private banking, and asset management. It is engaged in production of machinery for construction, nuclear power plants and mining. It also provides project financing, leveraged acquisition financing, export and import financing, capital market services, cash collection services, savings accounts, brokerage services, depository services, and safety deposit boxes. Gazprombank, through its subsidiaries and affiliated banks, operates in Russia, Uzbekistan, China, India, Kazakhstan, Mongolia. Gazprombank is headquartered in Moscow, Russia.

Gazprombank premium industry data and analytics

Improve competitive bidding with insights into all publicly disclosed IT services contracts for Gazprombank (including IT outsourcing, business process outsourcing, systems integration & consulting and more).

IT Client Prospector provides intelligence on Gazprombank’s likely spend across technology areas enabling you to understand the digital strategy.

Products and Services

History section provides information on new products, mergers, acquisitions, expansions, approvals, and many more key events.

Competitor Comparison

Have you found what you were looking for? From start-ups to market leaders, uncover what they do and how they do it.

Access more premium companies when you subscribe to Explorer

Explore the world with tourHQ

- Destinations

- I am a Guide

- I am a Traveller

- Online Experiences

- Currency (USD)

The epicenter of modern Russia, Moscow booms with shiny new skyscrapers, the bulbous onion domes of the tsars and politically-rich Red Square. Explore the metropolis with a tourHQ guide.

Search Cities in Russia

Moscow Tour Guides

Jorge De Reval

I am a happy, enthusiastic, amusing Spanish guy. Lively and hyperactive. Recently became qualified ...

Tanya Neyman

I became a local tour guide 6 years ago in Moscow and now we are a team of passionate guides ...

Ekaterina Smirnova

Please note: I'm away from Moscow June 11-26, 2021. I am a native Muscovite but traveled ...

Vasil Valiev

Occupation: Senior guide-translator. Guiding since 2012 in Altai mountains, North of Russia ...

Marina Spasskaya

Hi there! My name is Marina and I'm a licensed Moscow city guide.Moscow is like ...

Greetings from Saint Petersburg. This is your private tour guide Ali in Saint Petersburg. I was ...

Maria Deulina

Dear friends,My name is Maria, I am a licensed guide about Moscow. Being a native Muscovite I have ...

Ashraf Rabei

My name is Ashraf ...I'm graduated from faculty of tourism and hotel guidance department, in Egypt ...

Hengameh Ghanavati

My name is Hengameh Ghanavati. Im a licenced international tour guide since 2014 and I have ...

Todd Passey

We are a cooperative of highly experienced, certified, professional guides. Each guide takes ...

Tim Brinley

Young at heart, adventurous, organized, good people skills, a good speaker, entertaining, ...

Nikolay Borkovoy

Hace 32 años nací en la ciudad de Moscú. Tengo experiencia trabajando como guía turístico en ...

Anika Socotra-International

Our mission is to provide you with the kind of holiday you want: where you can relax in wonderful ...

Al'bina Andreeva

Moscow guide&photo! Feel Putin vibes and explore the enigmatic Russian soul through history ...

The sprawling, mind-boggling metropolis of Russian Moscow has long been one of the theatrical stages on which the great dramas of Europe and Asia have been played out in grand style. Burned by Napoleon in 1812, immortalised by Tolstoy, utilised by the Bolsheviks and championed as a bastion of heroic defiance by the post-war communists, it’s almost hard to believe just how defining the historical events that found their home on Moscow’s streets have been. Moscow tour guides will easily be able to mark the major must-see landmarks on the map, from the onion-domed orthodox Saint Basil's Cathedral, to the political powerhouse of Red Square just next door, while others will be quick to recommend a ride on Moscow’s famous subterranean metro system, or a visit to the UNESCO-attested Novodevichy Convent on the city’s southern side. But Moscow is a city also in the throes of a cultural wrangling between the old and the new. Creative energies abound here: Boho bars and pumping super clubs now occupy the iconic mega structures of the old USSR; high-fashion outlets, trendy shopping malls and luxurious residential districts stand as testimony to a city that’s now the undisputed playground of the world’s super-rich, while sprawling modern art museums dominate the cultural offering of the downtown districts north of the Moskva River.

Tell us your destination, date, and group size.

Our team of travel experts and guides will design a tailored itinerary just for you., enjoy your trip with peace of mind knowing everything is taken care of..

Say Goodbye to Travel Stress

Choose Currency Close modal

- USD US, dollar

- GBP British Pounds

Cookie icon We use cookies!

We, and third parties, use cookies for technical and analytical purposes, for marketing purposes and for integration with social media. For more information, refer to our Privacy Policy and Terms of Consent.

By clicking on 'I agree', you consent to the use of these cookies.

IMAGES

VIDEO

COMMENTS

9 Block Business Model Of Private Banks. Slide 1 of 6. Private Banking Commercial Banking In Powerpoint And Google Slides Cpb. Slide 1 of 10. Private Banking Corporate Banking In Powerpoint And Google Slides Cpb. Slide 1 of 2. Client acquisition strategy private banking ppt powerpoint presentation slides cpb.

Private Banking . Edmond de Rothschild is a conviction-based investment house driven by the firm belief that wealth is not an end in itself but an opportunity to build the future. Yours and that of future generations. This is the philosophy that guides u s when advising you. We draw on over 250 years of financial tradition and innovation to ...

Private banking is an elite service that generally features concierge-like attention to your finances, plus other perks and customized financial services. In most cases, however, only high-net ...

Presenting this set of slides with name integration private banking ppt powerpoint presentation ideas slideshow cpb pdf. This is an editable Powerpoint four stages graphic that deals with topics like integration private banking to help convey your message better graphically. This product is a premium product available for immediate download and ...

Presentation Overview BNP Paribas Private Banking Going Forward. BNP Paribas Private Banking Market Dynamics 4 A Fast-Growing Private Banking Market 2004 2006e 2010e 30.7 35 44.6 Global Financial Assets Held by HNWIs ... BNP Paribas Private Banking Rolling Out the Model Across Regions 18 14 15 22 24

Private Banking Chapter. This document summarizes key aspects of private banking and financial regulations related to private banking services and investment product sales. It defines private banking, outlines common private banking services, and describes why private banking is beneficial for both customers and banks. It then discusses ...

Private banking signifies the personal financial services offered to high-net-worth clients by privately owned banking institutions. Convey information on how banks provide customized financial plans and products to specific clients by adding our Private Banking presentation template, which features 100% compatibility with Microsoft PowerPoint and Google Slides, in your slideshow.

Private banking includes personalized financial and banking services that are traditionally offered to a bank's wealthy high net worth individual (HNWI) clients. For wealth management purposes ...

This exclusive PPT is embedded with stunning visuals to present the information smoothly. The subtle background, bold text, and latest designs will quickly engage the audience and help you connect with them. So, download these breathtaking PowerPoint slides today! A unique diagram incorporated with appealing icons showcases how private banking ...

Presenting this set of slides with name integration private banking ppt powerpoint presentation ideas slideshow cpb pdf. This is an editable Powerpoint four stages graphic that deals with topics like integration private banking to help convey your message better graphically. This product is a premium product available for immediate download and ...

Investment Banking Pitch Book Sample PPT and PDF Files and Downloadable Templates. Pitch Book Presentation, Part 1: Pitching Your Team as the Advisor of Choice. Pitch Book Presentation, Part 2: Providing Background and Context. Pitch Book Presentation, Part 3: Choose Your Own Adventure. Sell-Side Pitch Books for Sell-Side Mandates.

Private Banking Client Demographic. While specific definitions and asset thresholds vary by firm and jurisdiction, most retail banking customers typically have under USD $100,000 in investable assets.. A second segment, often referred to as mass affluent, includes personal banking customers with between $100,000 and $1MM in investable assets.As customers approach this $1MM asset threshold ...

Private Bank Presentations. ... greater chaos than usual, and the pressure to bring in new business has reached a whole new level. In today's climate, private investors and wealthy families need help and advice more than ever. Many are disenchanted with their current banks; the 2008 market crisis revealed all the cracks in their bank's ...

Try free banking PowerPoint templates and Google Slides from Slide Egg! We've slides for every banking topic, from investment strategies to mobile apps, designed to make your presentation shine. Easy to edit, royalty-free, and available in multiple formats. So, skip the stress and download your free templates today!

Presentation Transcript. PRIVATE BANK Presented by:-Kusum B.com (Prof.)059 100243014. What is private bank • Private banks are banks owned by either an individual or a general partner (s) with limited partner (s). • Private banks are not incorporated. • In any such case, the creditors can look to both the "entirely of the bank's ...

Presentation for investors . IR distribution list. We will keep you updated. Material fact notice. Disclosure of announcements regarding corporate actions and other material facts of the Bank. News. ... 2007-2024 General license №1978 issued by the Bank of Russia on 06 May 2016.

Private credit providers want to turn financial slicing and dicing into a work of art. Sotheby's Financial Services, the lending arm of French billionaire Patrick Drahi's auction house, has ...

So how do you show off the fact that you are Russia's largest private bank and at the same time curry a little favor with Moscow's ruling elite? You entertain 800,000 Muscovites with a world ...

Gazprombank: Overview. Share. Gazprombank is a financial services provider. It offers banking and investment solutions to financial institutions, corporate and private clients. The bank offers products and services such as bank accounts, term deposits, retail loans, debit and credit cards, syndicated loans, private banking, and asset management.

Tell us your destination, date, and group size. Our team of travel experts and guides will design a tailored itinerary just for you. Enjoy your trip with peace of mind knowing everything is taken care of. The epicenter of modern Russia, Moscow booms with shiny new skyscrapers, the bulbous onion domes of the tsars and politically-rich Red Square.