Build my resume

- Resume builder

- Build a better resume in minutes

- Resume examples

- 2,000+ examples that work in 2024

- Resume templates

- 184 free templates for all levels

- Cover letters

- Cover letter generator

- It's like magic, we promise

- Cover letter examples

- Free downloads in Word & Docs

7 Bank Teller Resumes That Got the Job in 2024

Bank Teller

Best for careers that encourage creativity

Browsing for creative resume templates? In graphic design, photography, or event planning? Make a statement with this modern resume.

Resume Builder

Like this template? Customize this resume and make it your own with the help of our Al-powered suggestions, accent colors, and modern fonts.

- Bank Teller Resumes

- Bank Teller Resumes by Experience

- Bank Teller Resumes by Role

As a bank teller, you’re the first point of interaction for customers. You’re responsible for verifying customers’ identities and processing various financial requests.

Bank tellers answer product and service questions and direct customers to more senior staff for complex bank transactions.

Each level of your career, the type of institution you work at, and the financial transactions you have experience with will determine how to write your resume and make a cover letter to attract the attention of a hiring manager or recruiter for your dream job .

We analyzed countless resumes from all stages of teller careers and created seven bank teller resume samples to help you build an eye-catching resume and land more interviews in 2024.

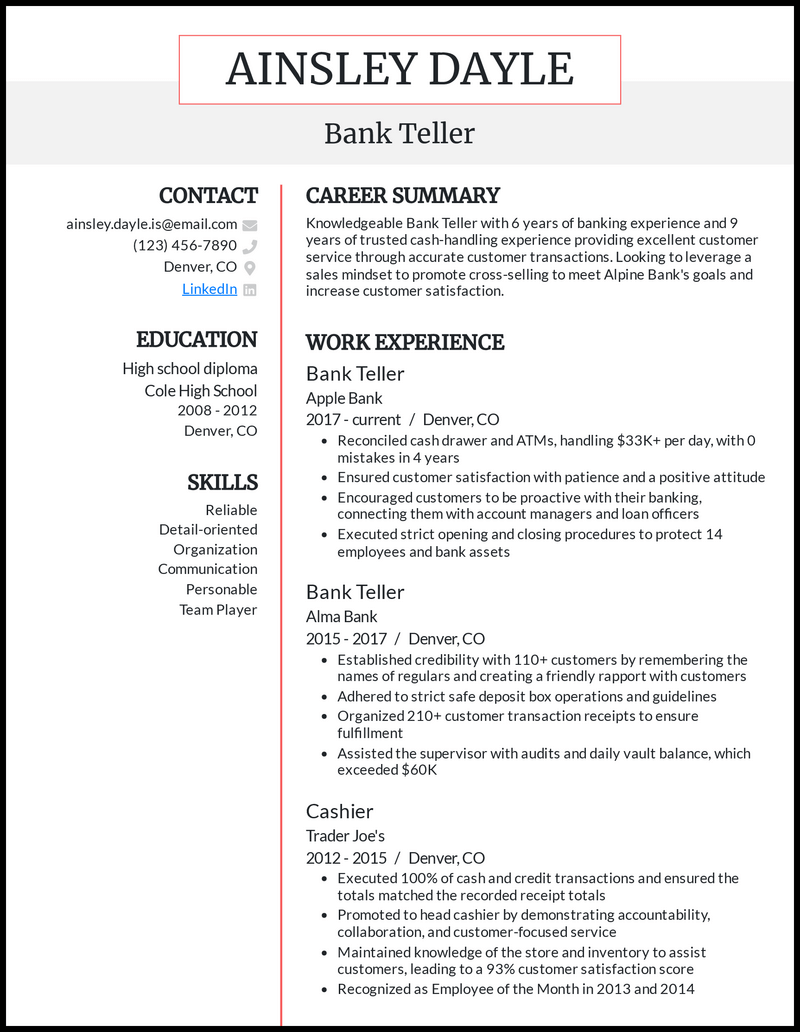

Bank Teller Resume

or download as PDF

Why this resume works

- Be sure to draw attention to any unique skills, such as speaking another language or managing security systems.

- Good security guard metrics can include how many visitors you greeted, the number of patrols you did per shift, and how much you increased efficiency with your efforts.

Bank Clerk Resume

- Put numbers (hint: reduced processing errors by 26%, and reduced average waiting time by 81%, and so on) in your piece and let recruiters be impressed by what they see.

- Complement this in your bank teller cover letter by explaining the how and why of your greatest achievements.

Entry-Level Bank Teller Resume

- List any job where you handled money; cashier, retail, food service. The business does not have to be a bank or credit union; it can be an environment where you provided trusted money handling.

- Customer service is very important for a bank teller, so showcase your ability to provide exceptional customer service (in any environment). Employers will appreciate seeing the applicable skills easily, ensuring your resume catches their eye.

- Use a resume objective to tell the hiring manager how your skills can be used in the bank teller role, how you will impact the company, and be sure to mention the target company by name.

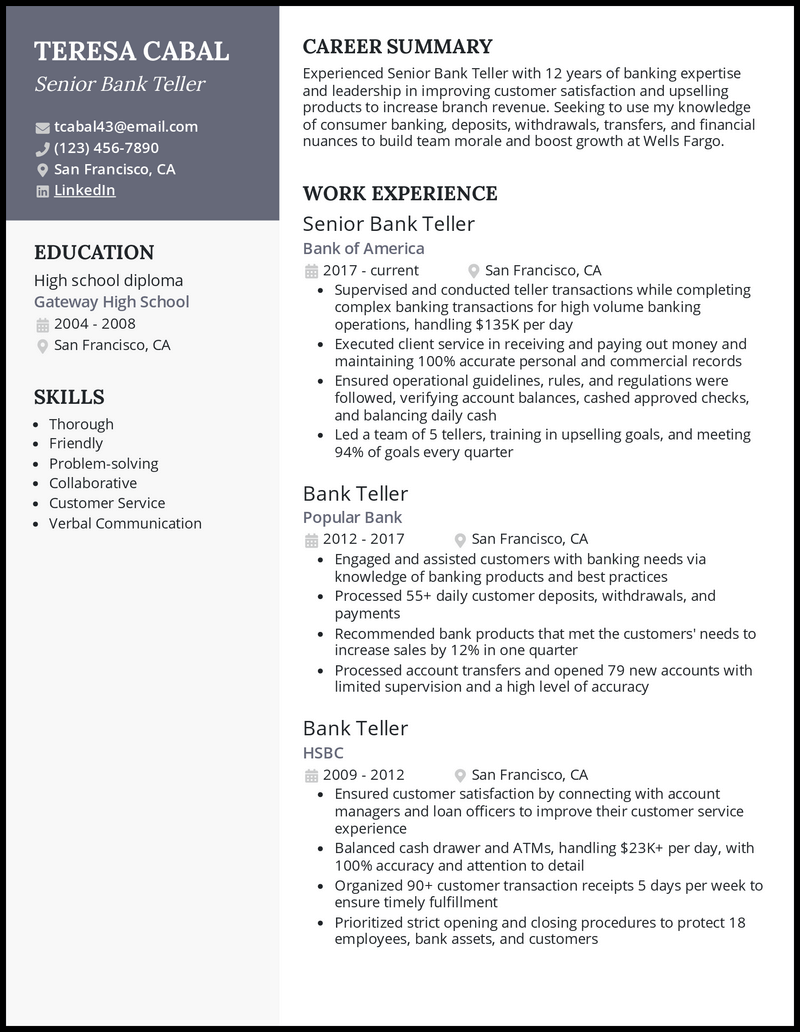

Senior Bank Teller Resume

- Use our resume checker to ensure your senior bank teller resume is the highest quality.

- Senior bank tellers are leaders, so including your leadership experience is important to hiring managers. They want to see that you share your knowledge, ensure the morale of your branch, and can meet or exceed your assigned branch goals.

- Focus on your ability to follow the bank’s rules and regulations. As a senior bank teller, it is important to showcase your knowledge in the financial industry and your ability to audit transactions, ensuring the bank is compliant with all laws.

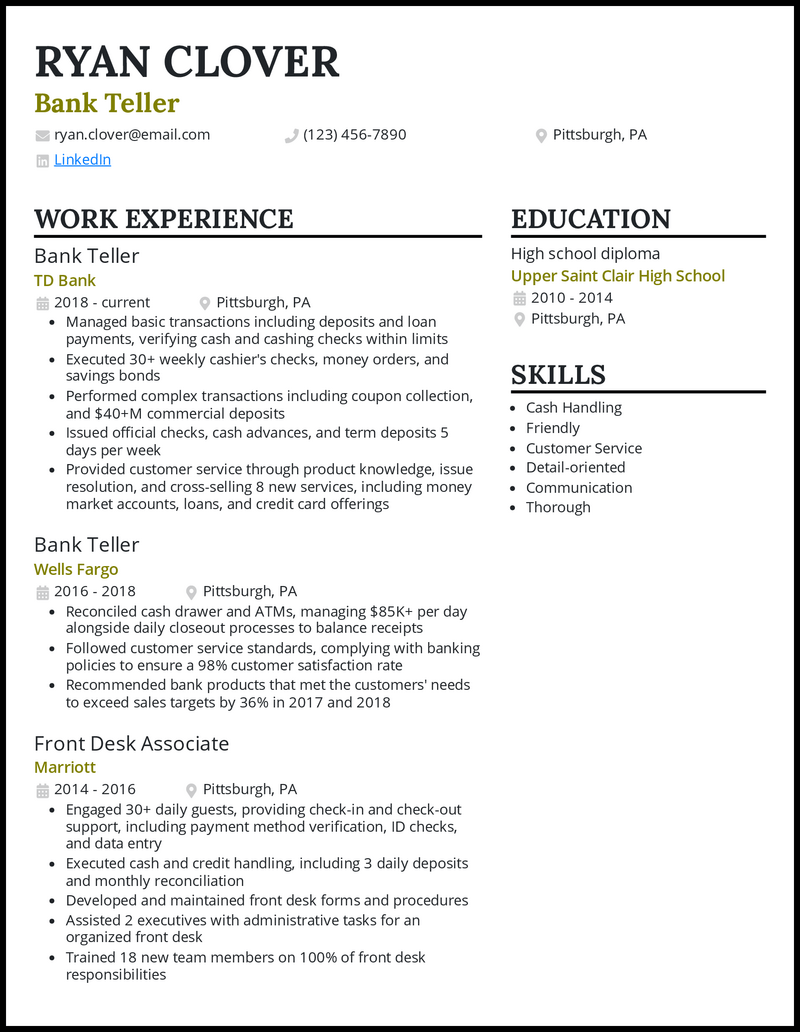

Wells Fargo Bank Teller Resume

- For instance, mentioning how you maintained a customers’ satisfaction rate of 98% would position you ahead of other applicants.

TD Bank Teller Resume

- Bank teller backgrounds can be vast; highlight any roles where money handling and customer service were a daily responsibility. Adding data behind your responsibilities is a great way to get the attention of a hiring manager or recruiter.

- If you know a financial product, stand out by highlighting this experience on your resume.

- Add your applicable skills and knowledge to ensure the hiring manager sees you are the right person for the job.

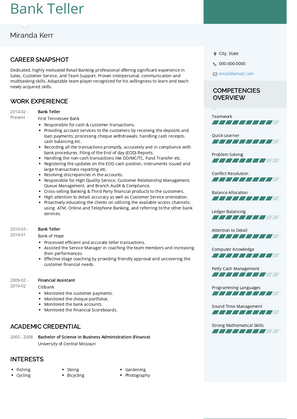

Cash Management Services Teller Resume

- Use a muted, appropriate, but thoughtfully contrasting color for your header and the smaller sections on your resume.

- Organize your work experience and projects with bullet points, and don’t shy away from numbers.

- Including metrics that quantify your work experience will demonstrate to hiring managers that you’re accurate and efficient with numbers, essential for the job.

- This creates more applicable content for your resume, increasing your chances of an interview.

Related resume guides

- Investment Banking

- Financial Analyst

Bank Teller Resume Examples [Updated for 2024]

As a bank teller, you’re a trusted individual that handles large sums of cash.

In fact, you’re the face of the bank!

You’ll be faced with many problems during your shifts, but perhaps you didn’t expect to face one so soon...

Your resume!

What does a good bank teller resume look like, anyway?

With so many people competing for the best bank teller positions, you can’t leave any questions unanswered.

But don’t worry, this guide has you covered!

- A job-winning bank teller resume example

- How to create a bank teller resume that hiring managers love

- Specific tips and tricks for the banking industry

Here’s a bank teller resume example, built with our own resume builder :

Looking for a resume example for a different finance position? We've got more resume examples right here:

- Banking Resume

- Financial Analyst Resume

- Accountant Resume

- Bookkeeper Resume

- Business Analyst Resume

- Executive Assistant Resume

- Consultant Resume

- Administrative Assistant Resume

- Office Assistant Resume

- Career Change Resume

Follow the steps below to create a bank teller resume of your own.

How to Format a Bank Teller Resume

Banking is always going to be a competitive segment of the job market.

However, you may be surprised at just how many apply for the position of bank teller.

Now, we aren’t telling you this to scare you.

Rather, that you must do everything in your power to make your resume stand out .

The first course of action is to choose the correct format.

You see, even those with the richest of bank teller experience won’t be able to impress a hiring manager that is struggling to read the content.

The “ reverse-chronological ” format is the most popular format for bank tellers, and it’s for good reason. It displays your most recent work experience first, and then works backwards through your history and skills.

You could also try the two following formats:

- Functional Resume - This format places a large emphasis on your skills, which makes it the best format for bank tellers that are highly-skilled, but have little in the way of bank teller work experience.

- Combination Resume - This format mixes both “Functional” and “Reverse-Chronological” formats, which means it focuses on both your banking skills AND work experience.

- Try to keep your bank teller resume to one-page. Doing this will show the hiring manager that you present information is a precise way. Feel free to check out our one-page resume templates .

Once the format is sorted, you need to choose the correct resume layout .

We recommend the following layout:

- Margins - One-inch margins on all sides

- Font - Pick a font that stands out, but make it professional

- Font Size - 11-12pt for normal text and 14-16pt for headers

- Line Spacing - Use only 1.0 or 1.15 line spacing

- Resume Length – Stick to 1-page. Having trouble fitting everything into one page? Check out these one-page resume templates .

- As a bank teller, the recruiter wants to see a highly-professional resume. As such, limit how creative you are with the font and layout.

Use a Bank Teller Resume Template

Ever made a resume?

If so, there’s a good chance that Word was the program of choice.

There’s also a good chance that your resume wasn’t as well-formatted as it could be.

It’s no secret that Word is far from the best tool for the job.

For a professional bank teller resume that has a solid structure, you may want to use a resume template .

What to Include in a Bank Teller Resume

The main sections in a bank teller resume are:

- Contact Information

- Work Experience

For a bank teller resume that stands out from other applications, add these optional sections:

- Awards & Certification

Interests & Hobbies

Right, now let’s talk about each of the above sections, and explain how to write each of them.

For even more information, check out our guide on What to Put on a Resume .

How to Write Your Contact Information Section

As a bank teller, you should know that not a single digit can be out of place.

And this is exactly the case with your contact information section. One small misspelling of your phone number can render your whole application useless.

For your contact information section, include:

- Title - This should be specific to the exact job you’re applying for, which is “Bank Teller”

- Phone Number - Check this multiple times. You see, one minor error can really mess up your chances

- Email Address - Use a professional email address ([email protected]), NOT that email you created back in school [email protected])

- (Optional) Location - Applying for a job abroad? Mention your location

- Emily Hembrow - Bank Teller. 101-358-6095. [email protected]

- Emily Hembrow - Banking Admin Angel. 101-358-6095. [email protected]

How to Write a Bank Teller Resume Summary or Objective

Now, you should be aware that making your resume stand out is the #1 goal .

But HOW can you do this?

There’s no use putting your best achievements right at bottom of the resume.

Nope – you need an opening paragraph that you can bank on!

These opening paragraphs are known as either a resume summary or objective .

Both are short, snappy paragraphs that sum up the main points of your resume. They are great for introducing your skills and experiences.

The difference between a summary and objective is that.

A resume summary is a paragraph that summarizes your most notable experiences and achievements. It is the best option for individuals who have multiple years of bank experience.

- Committed bank teller with five years of experience at YZX Bank, where I balanced ledgers, handled cashed, maintained accounts, and more. Maintained a 99.80% customer satisfaction rating during the total period of employment. Seeking a chance to leverage my interpersonal skills and banking knowledge to become a bank teller at Bank XYZ.

On the other hand, a resume objective should give a run-down of your professional goals and aspirations. It is ideal for entry-level bank teller candidates. Although you’re talking about your own goals, it is important to align these goals with the employer’s vision.

- Motivated finance student looking for a bank teller role at Bank XYZ. Two years of experience at a gym reception with heavy traffic. Excellent communication, organization, and problem solving skills. Enthusiastic to support your client-facing staff, where I can use my interpersonal skills to achieve the best quality of service.

So, which one is best for bank tellers?

Well, a summary is suited for bank tellers with work experience, whereas an objective is suited for those who are entering the field for the first time (student, graduate, or switching careers).

How to Make Your Bank Teller Work Experience Stand Out

There’s no easier way to impress the hiring manager than with a rich work experience.

Sure, talking about your education and banking knowledge is super important, but nothing proves your talents like a wealth of bank teller experience.

Follow this layout in your experience section:

- Position name

- Company Name

- Responsibilities & Achievements

Bank Teller

01/2018 - 03/2020

- Voted “Teller of the Year” in 2018 and 2019

- Set-up a new database system that accurately secured all transactions

- Processed withdrawals, deposits, transfers, loan payments, and cashier’s checks for 50+ people every day]

To make your experience stand out, you should focus on your most impressive achievements , rather than your daily responsibilities.

Instead of saying:

“Data entry”

“Set-up a new database system that accurately secured all transactions”

So, what exactly are we suggesting here?

Simply put, the first statement isn’t impressive – at all!

On the other hand, the second statement goes into more detail and shows that you’re an excellent asset to the bank.

- Tailor your experience to the job advertisement. Simply look for any required skills that you can demonstrate in your work experience.

What if You Don’t Have Work Experience?

Maybe you’re a finance graduate who hasn’t worked before?

Or maybe you’re transitioning from a different banking position?

Whatever the situation, don’t threat.

You see, it doesn’t matter if you haven’t been a bank teller in the past, as you can still add relevant skills and experiences from previous jobs.

For example, if you’ve worked store manager, you can talk about any crossover skills and experiences. Just like a bank teller, you would have to be friendly, give advice to customers, and help with cashier duties.

For the students read this, you’ll enjoy our guide on how to make a student resume !

Use Action Words to Make Your Bank Teller Resume POP!

- “Responsible for”

- “Worked with”

You’ll find these same words on nearly all bank teller resumes.

And since you need your bank teller resume stand out, we’d recommend using some of these action words instead:

- Conceptualized

- Spearheaded

How to List Your Education Correctly

The next section in any bank teller resume is the education section.

Now, there isn’t just one correct path to becoming a professional bank teller.

In fact, a high school diploma or GED certificate is usually all that’s required.

So whatever path you have taken, just include the following details:

- Degree Type & Major/Courses

- University/School Name

- Years Studied

- GPA, Honours, Courses, and other relevant achievements

B.A in Banking and Finance

Boston State University

- Relevant Modules: Principles of Accounting, Consumer Finance and Banking Fundamentals, Risk Analysis, Financial Management, Bank Lending and the Legal Environment, Quantitative Methods for Banking, Finance and Economics, and more]

Now, you may have a few questions, so here are the most frequently asked questions:

- What if I haven’t finished studying?

No problem. Regardless of whether you’re still studying or not, you should still mention all of the years that you have studied to date

- Should I include my high school education?

Only if you don’t have any higher education. The bank manager will have little care for your high school education if you have a finance degree

- What is more important for a bank teller, education or experience?

If you’re an experienced bank teller, your work experience should come before your education

If you still have questions, you can check out our guide on how to list education on a resume .

Top 15 Skills for a Bank Teller Resume

Being a professional bank teller requires having a certain set of skills.

And the hiring manager needs to see that you have them!

Now, you may be the most skilled bank teller in the world, but you need to make these skills clearly displayed on your resume.

You see, the manager can’t see your skills if you hide them away in a bank vault!

Here are some of the skills a hiring manager wants to see from a bank teller...

Hard Skills:

- Balancing Ledgers

- Mortgages and Loans

- Deposits and Withdrawals

- Investments

- Safety Deposit Boxes

- Cash Handling

- Risk Assessment

- Account Maintenance

- Foreign Currency Exchange

Soft Skills:

- Excellent Communicator

- Time Management

- Problem Solving

- Confident & Professional Manner

- Organization

- Although soft skills are important for a bank teller, they’re difficult to prove on your resume. As such, try not to go too overboard with the generic soft skills. You should also think of situations that you have used your soft skills, just in case the interviewer asks.

Looking for a more comprehensive list? Here’s a mega-list of 150+ must-have skills .

Other Resume Sections You Can Include

By now, you should have fantastic-looking resume that highlights your array of skills and experiences!

But wait...

Is your resume the absolute best it can be?

Remember, the #1 goal is for your resume to stand out .

And a carbon copy of your competitors resume is not going to do that.

The following sections will set you apart from the other bank teller candidates.

Awards & Certifications

Did you win any recognition awards at your previous work place?

Did you win a competition during your studies?

Have you completed any relevant courses on Coursera?

Whatever the recognition, be sure to add any awards and certifications to your resume.

Awards & Certificates

- “Economics of Money and Banking” - Coursera Certificate

- “Learning How to Learn” - Coursera Certificate

- “Teller of the Year” 2018 and 2019 - XYZ Bank]

Whether or not the bank teller requires knowledge of another language, being able to speak multiple languages is an impressive skill.

If you can speak any other language, even to a basic standard, feel free to add it to your resume, but only if you have space.

Order the languages by proficiency:

- Intermediate

Now, you’re likely wondering, “why does the hiring manager need to know about my book club meeting every Friday?”

Well, they don’t need to know, but it allows the hiring manager to learn more about you as a person.

And this is a good thing, as banks are looking for someone who they’ll get along with.

The best way to do this is by listing your hobbies and interests!

Especially if your hobby involves social interaction, as you’ll be working in a customer-facing role.

If you want some ideas of hobbies & interests to put on your resume , we have a guide for that!

Match Your Cover Letter with Your Resume

According to the U.S. BLS , bank teller jobs will decline by 12% between 2018 and 2028.

And this means there will be a constant increase in competition for the top jobs.

As such, you need to do everything in your power to stand out.

But HOW can you do this?

Well, by writing a convincing cover letter !

You see, a letter is perfect for communicating with more depth and personality.

Even better, you can show the bank’s hiring manager that want THIS position in THIS bank.

As with your resume, your cover letter should also have the correct structure.

Here’s how to do that:

And here’s what to put in each section:

Contact Details

All personal contact information, including your full name, profession, email, phone number, location, website (or Behance / Dribble)

Hiring Manager’s Contact Information

Including full name, position, location, email

Opening Paragraph

It’s critical to hook the hiring manager with your opening paragraph, so it needs to be very powerful, otherwise they’re not going to read the rest of your resume. So, mention:

- The specific position you’re applying for – Bank Teller

- A short, punchy summary of your most notable experiences achievements

Once you’ve got the hiring manager hooked with your opener, you can go deeper into the rest of your work history and background. Some of the points you can mention here are:

- Why you want to work for this specific bank

- Anything you know about the bank’s culture

- What are your most notable and how do they relate to this job

- If you’ve worked in other banks or similar positions

Closing Paragraph

This is where you:

- Wrap up the main points of the body paragrpah

- Thank the hiring manager for their time

- Finish with a call to action, such as “It would be great to further discuss how my experience as an X can help the bank with Y”

Formal Salutations

To keep your resume professional, use a formal closing, such as “Sincerely” or “Best regards”.

Creating a job-winning cover letter can be a challenging craft. But don’t worry, you can rely on our how to write a cover letter for guidance.

Key Takeaways

You now have the knowledge and tools to create a job-winning bank teller resume.

Let’s quickly recap everything we’ve covered:

- Choose the correct format based on your specific circumstances. Prioritize a reverse-chronological format, and follow the best layout practices to keep everything clear and concise

- Use a resume summary or objective to hook the reader

- Talk about your most notable achievements, instead of your daily duties

- Match your bank teller resume with a convincing cover letter

Suggested reading:

- Guide to Green Careers - All You Need to Know

- Why Should We Hire You - 10+ Best Answers

- 26+ Biggest Interview Mistakes (To Avoid in 2024)

To provide a safer experience, the best content and great communication, we use cookies. Learn how we use them for non-authenticated users.

3 Bank Teller Resume Examples & Templates (with Job Description Samples)

This page provides you with Bank Teller resume samples to use to create your own resume with our easy-to-use resume builder . Below you'll find our how-to section that will guide you through each section of a Bank Teller resume.

If you want to apply as a bank teller, you’ll need a solid resume.

Excelling as a bank teller requires excellent customer service skills, an eye for detail, and an ability to work with numbers.

As banking becomes increasingly digitized, bank teller positions are declining. As a result, you need an excellent bank teller resume to stand out.

Read on to see three different bank teller resume examples, plus a detailed look at other sections like objectives and summaries, skills, and more.

Note : Leverage AI to level-up your resume - Try our AI Resume Builder

Bank Teller Resume

David L Gilmore 3668 Dane Street, Spokane, WA 99201 | [email protected] Energetic Bank Teller with 10+ years experience providing attentive, high-quality customer service, handling customer transactions, and balancing cash drawers. Seeking the Head Teller position to further knowledge of banking products and procedures. Determined and trustworthy team player, also speaks French and Spanish. Experience Bank Teller | ABS Bank, Spokane, WA | Sept 2016 - Present

- Processed 20+ transactions per hour with high level of precision

- Processed transactions for customers, including loan payments, safe box deposits, balanced cash drawers, and cashed checks

- Balanced ATMs totaling averages of $150,000

- Responded to an average 150 customer account inquiries per week

- Assisted with the training of 4 new tellers, bringing them up to speed on compliance and regulatory processes

Bank Teller | Grand Bank, Spokane, WA | June 2011 - Sept 2016

- Provided excellent, personable customer service

- Processed 250+ checks, deposits, and withdrawals per day

- Assisted supervisors with daily audits and vault balancing

- Recorded and filed customer recipes daily

- Followed safety deposit guidelines and procedures

Education High School Diploma, Spokane High School, Spokane, WA

- Proficient in Microsoft Office (Excel, Word, Outlook)

- Excellent mathematical skills

- Problem-solving

- Typing 80 wpm

- Fluent in Spanish

- Analytic and critical thinking

Achievements -Bank Teller of the Year (2017)

The above is a good bank teller resume because it features a resume summary that is easy to read and gets all the main points across, including the candidate's experience and ambitions. It features a work experience that demonstrates proven competence, responsibility, and flexibility. Furthermore, the work experience section features quantifiable achievements.

Bank Teller Resume With No Experience Sample

Gordon Miller High Point, NC 27265 | [email protected] Reliable, enthusiastic individual with several years of cash handling and customer service and experience seeking entry-level Bank Teller position. Trustworthy, detail-oriented team player with a strong desire for career progression. Speaks English and Spanish. Experience Cashier | XYZ Electronics | 2018-present

- Managed more than 250 customer transactions per day

- Balanced cash drawers at the end of each shift

- Maintained good customer service and professionalism at all times

- Processed bank transfers and withdrawals

Education High School Diploma, NC High School, High Point NC, 2018 Skills

- Petty cash management

- Customer service

- Strong mathematical skills

- Detail-oriented

- Microsoft Office

Awards and acknowledgments

- Employee of the Year, XYC Electronics, 2020

This bank teller resume is targeting an entry-level position. This resume is good because while the candidate doesn’t have direct banking experience, they do have transferable skills from working as a cashier at bookmakers.

How Do I Write a Resume for a Bank Teller with No Experience?

Many bank teller jobs are entry-level positions. As such, hiring managers won't expect you to have experience in the banking sector. However, if you want to stand out from the other applicants, including any relevant skills or experience is advisable.

For example, previous employment as a cashier could be helpful because it requires customer service skills and cash handling. These are two of the most critical skills for a bank teller position.

If you don't have relevant work experience to draw on, focus on your education, particularly subjects like mathematics, finance, economics, etc., that suggests an aptitude for working with numbers.

Experienced Bank Teller Resume (5+ Years of Experience) Example

Jane Diaz Marks, MS 38646 | 662-201-8241 | [email protected]

Dedicated Bank Teller supervisor with 5+ years experience. First-rate customer service, sales skills, and attention to detail. Skills include recording daily financial transactions, overseeing day-to-day operations, answering customer service issues, and managing employees. Experienced training new employees on compliance and regulations. Familiar with Microsoft Office. Fluent in Spanish.

Experience Bank Teller Supervisor | Mississippi Bank | 2016-present

- Answered and directed telephone calls

- Loaded and unloaded ATMs

- Provided excellent customer service through clear and friendly communication

- Proactively educated customers on using different channels for banking communication (online, messenger app, etc.)

- Made sales referrals and promoted bank products and services

- Processed auto loans, mortgages, credit card payments

- Stayed informed about KYC and AML regulations via conferences

Education Bachelor of Science, University of Mississippi Skills

- Cash-handling

- Transaction processing

- Financial compliance and regulation knowledge

How to Select the Perfect Bank Teller Resume Template

Selecting the perfect Bank Teller resume template is about finding something that is clear and concise.

The format of a Bank Teller resume template should use the following:

Layout: Use reverse chronological order for listing work experience. Subheadings: Each section (resume summary, experience, skills, etc.) should have its own subheading to make it easy for the hiring manager to scan Font: Choose easy-to-read resume font of around size 11 Spacing: Use lots of white space to make your resume appealing to read Length: Keep the resume down to a nice, punchy one-page document.

What Should a Bank Teller Put on a Resume?

Bank tellers provide several important services for businesses. Though the role is primarily customer-facing, it also involves handling and processing large amounts of cash, checks, and financial information.

A good bank teller resume will feature:

- Resume Header: Your name, address, and contact details.

- Resume summary or resume objective (depending on your revel of experience)

- Work experience: List of previous relevant positions and responsibilities

- Awards or achievements (if applicable)

How to Write a Bank Teller Resume Summary

A bank teller resume summary is an excellent way to stand out from the crowd. Most hiring managers will just scan a resume for a few seconds, looking for specific candidates. Or your application will go through an Applicant Tracking System (ATS).

What to include on a bank teller resume summary will partially depend on the job position. For example, the job posting might require a specific level of experience, knowledge of some software, or other practices. It's worth touching on a few of these points in your summary if you can.

Otherwise, keep your resume summary short, punchy, and to the point. Detail the characteristics that make you a good candidate, relevant work experience, and any relevant achievements.

- Bank Teller Resume Summary Example

Motivated and knowledgeable Bank Teller with 3+ years experience in cash handling, processing deposits, withdrawals, and transfers. Looking to leverage a sales-oriented mindset to help upsell banking products to increase bank revenue.

- Bank Teller Resume With Experience Summary Example

Reliable, hard-working Bank Teller with 5+ years experience providing outstanding customer service, processing banking transactions, and balancing cash drawers. Proficient with Oracle FLEXCUBE and Mamba, maintained a 96% customer satisfaction rating at Chase. Bilingual: English and Spanish.

This Bank Teller with experience summary works for several reasons. Firstly, it gets across the point that the candidate is experienced and diligent. Additionally, it highlights two core banking softwares commonly used in the industry. These would be good to include if the job posting requires experience in this software.

Next, the resume summary uses hard data to support the candidate's claims of excellent customer service before detailing the fact that the candidate is bilingual. In some regions or markets, being bilingual will be a crucial skill.

What is a good objective for a resume for a bank teller?

A resume objective is a crucial part of your bank teller resume if you don't have a lot of (or any) direct work experience in the banking sector.

A bank teller resume objective is a good option for:

- an entry-level bank teller resume

- a candidate making a career change.

Here is an excellent example of a bank teller resume objective summary:

Motivated and reliable self-starter seeking an entry-level position in ABC Bank. 3+ years experience as a cashier. Excellent math and customer service skills. Good team player.

How to Write the Perfect Bank Teller Resume Experience

The perfect Bank Teller resume experience section summarizes your work experience and past responsibilities. This section is an excellent chance to sell yourself and your achievements.

Candidates should study the job posting in detail and look to tailor their work experience section with the job requirements. For example, if a position uses a specific core banking software and you used it in a previous job, make sure to include it as part of your responsibilities in that job section.

A Bank Teller resume experience section should follow this format:

- Start with your current or last position, and list your jobs reverse-chronologically

- Add your job title, the company name, location, and dates employed

- Add 4-6 bullet points demonstrating past responsibilities

- Try and match your responsibilities and duties to the job requirement posting

- Use data where possible to verify your skills or achievements

- Bank Teller Resume Sample

Bank Teller | Sunny Bank, Salinas, CA | July 2016–December 2021

Qualifications & Responsibilities

- Processed customer deposits, withdrawals, and payments accurately.

- Provided customers with a warm, friendly attitude and a high level of service

- Opened customer accounts with limited supervision

- Recommended banking products to customers, increasing sales revenue by 9%

- Balanced ATMs and cash drawers daily

Key Achievements

- 100% accuracy rate throughout five years of cash drawer audits.

The above is a good bank teller experience summary because it’s very detailed. It explains the duties and responsibilities, suggests the candidate can cross-sell, and is responsible and trustworthy. Additionally, it uses two pieces of quantifiable data to demonstrate the candidate's qualities.

- Bank Teller Job Description for Resume Example

- Executed 250 daily transactions worth $500,000 while adhering to operational procedures, ensuring the security of customer and bank assets.

- Provided reports examining customers' financial status in support of new product sales and opportunities that drove the banking center to achieve the second-highest sales in the Arkansas market.

- Worked with compliance team to collect and verify documentation

- Assisted management in the review of proof works for documents with missing or erroneous information before data entry processing

This bank teller's job description is good because it’s thorough, detailed, shows the candidate's ability to be trusted, and uses quantifiable figures to demonstrate their achievements.

Rules to Follow While Adding Bank Teller Responsibilities on Resume

There are a few general rules to follow when adding bank teller responsibilities on your resume.

- Read the job description and try to tailor your responsibilities

- Try and use quantifiable data to back up your claims

- Keep descriptions tight and punchy

- Be very selective about what duties you include

- Emphasize your accomplishments

Focus on highlighting your skills and achievements

Top Bank Teller Resume Skills in 2022

What are good skills to put on a resume for a bank teller?

The role of a bank teller is mostly customer-facing. However, to help the customer with financial needs, a bank teller needs to be organized and understand math and finance. Here is a list of the top bank teller resume skills in 2022.

- Cash handling

- Cash drawer maintenance

- Computer knowledge

- Written and Verbal Skills

- Conflict resolution

- Proficient with Microsoft Office (Excel, Word, Outlook, etc.)

Final Thoughts

To some, bank tellers can seem like an outdated career path -- but you understand that they're a crucial part of the way a bank branch operates. With decreased bank teller roles available comes increased competition, which means you'll need a stellar resume to stand out from the crowd and land your dream bank teller job. With VisualCV Pro, you gain access to unlimited resume templates and downloads to ensure you have the best shot possible!

Copyright © 2024 VisualCV

Select Your Language :

Bank Teller Job Description [Updated for 2024]

In the world of finance, the role of bank tellers is undeniably pivotal.

As the banking industry evolves, the demand for proficient individuals who can streamline, facilitate, and safeguard our financial transactions intensifies.

But what’s really expected from a bank teller?

Whether you are:

- A job seeker trying to understand the scope of this role,

- A hiring manager defining the perfect candidate,

- Or simply curious about the day-to-day responsibilities of bank tellers,

You’re in the right place.

Today, we present a customizable bank teller job description template, designed for seamless posting on job boards or career sites.

Let’s delve right into it.

Bank Teller Duties and Responsibilities

Bank Tellers provide exceptional customer service while conducting a variety of transactions at the teller line.

They are known for their accuracy, attention to detail, and ability to handle large amounts of cash.

Bank Tellers have the following duties and responsibilities:

- Handle customer transactions, including deposits, withdrawals, check cashing, and loan payments

- Count and package currency and coins

- Record all transactions accurately and balance cash drawer at the end of each shift

- Identify customer needs and suggest appropriate bank services

- Respond to customer inquiries and concerns promptly and professionally

- Ensure customer information remains confidential and secure

- Identify potential fraudulent activities and follow bank procedures to report them

- Perform routine bank procedures, such as ordering checks, issuing bank cards, and opening or closing accounts

- Assist customers with navigating electronic banking equipment such as ATMs and online banking

Bank Teller Job Description Template

We are seeking a reliable and professional individual to join our banking team as a Bank Teller.

Your chief responsibility will be to assist customers with their financial transactions, involving cash handling, check processing, and account management.

As a Bank Teller, you should have a strong understanding of financial products and services, be able to deliver excellent customer service, and operate a teller drawer.

Your ultimate goal will be to provide our clients with outstanding customer service and accurate banking transactions, while adhering to bank policies and federal regulations.

Responsibilities

- Process customer transactions (cash deposits, withdrawals, transfers, etc.) accurately and efficiently

- Maintain and balance cash drawers and reconcile discrepancies

- Packaging cash and rolling coins to be stored in drawers or the bank vault

- Build and maintain customer loyalty by providing excellent customer service

- Resolve customer complaints in a timely and professional manner

- Ensure compliance with all financial policies and regulations

- Report suspicious transactions to management

Qualifications

- High school diploma or equivalent

- Previous banking or cash handling experience is a plus

- Strong mathematical skills

- Excellent communication and interpersonal skills

- Good organizational and time management skills

- Computer proficiency, especially with banking systems and software

- High level of integrity and trustworthiness

- Health insurance

- Dental insurance

- Retirement plan

- Paid time off

- Professional development opportunities

Additional Information

- Job Title: Bank Teller

- Work Environment: This position is based in a bank branch setting and involves frequent interaction with the public.

- Reporting Structure: Reports to the Branch Manager.

- Salary: Salary is based upon candidate experience and qualifications, as well as market and business considerations.

- Pay Range: $30,000 minimum to $45,000 maximum

- Location: [City, State] (specify the location or indicate if remote)

- Employment Type: Full-time

- Equal Opportunity Statement: We are an equal opportunity employer and value diversity at our company. We do not discriminate on the basis of race, religion, color, national origin, gender, sexual orientation, age, marital status, veteran status, or disability status.

- Application Instructions: Please submit your resume and a cover letter outlining your qualifications and experience to [email address or application portal].

What Does a Bank Teller Do?

Bank Tellers are typically employed by banks, credit unions, and other financial institutions.

They serve as the primary point of contact for customers conducting routine transactions, such as depositing and withdrawing money, transferring funds between accounts, and making loan payments.

Bank Tellers also provide information about the bank’s products and services, and they may help customers open new accounts or close existing ones.

They are responsible for counting cash, ensuring the accuracy of transactions, and verifying the identity of individuals to prevent fraudulent activities.

Some Bank Tellers may also be tasked with selling additional banking services, such as credit cards or loans.

They are expected to provide excellent customer service, handle customer complaints, and resolve any issues that arise during transactions.

In all their tasks, Bank Tellers must adhere to the bank’s policies and regulations, and they must maintain the confidentiality of customer information.

Bank Teller Qualifications and Skills

A proficient bank teller should have the skills and qualifications that align with the job role, which include:

- Strong numeracy skills to accurately manage cash transactions and balance cash drawers at the end of each day.

- Excellent customer service skills to handle customer inquiries, offer appropriate products or services, and resolve any issues or complaints.

- Effective communication skills to accurately and clearly explain banking policies, procedures, and services to customers.

- Attention to detail to ensure accurate handling of transactions, completion of paperwork, and adherence to bank policies and procedures.

- Computer literacy to use banking software and applications for data entry, transaction processing, and record keeping.

- Interpersonal skills to interact with a diverse customer base and foster positive customer relationships.

- Ability to work well under pressure, manage multiple tasks simultaneously, and make quick, accurate decisions.

- Problem-solving skills to identify, analyze, and resolve customer issues and operational problems.

- Familiarity with basic banking products and services, such as checking and savings accounts, loans, and credit cards.

Bank Teller Experience Requirements

Bank Tellers are generally required to have a high school diploma or GED as a minimum educational requirement.

However, most banks prefer candidates with some level of banking or customer service experience.

Entry-level candidates may have 1 to 2 years of experience, often gained through part-time roles or internships in banking, retail, or customer service.

This helps them develop the necessary skills in cash handling, customer service, and basic computer operations.

Candidates with more than 3 years of experience are often considered for senior teller positions.

They may have gained experience through roles such as Customer Service Representative, Personal Banker, or Assistant Branch Manager in a banking environment.

This experience helps them to develop their skills in bank operations, sales, and complex transactions.

Those with more than 5 years of experience may have leadership experience and might be ready for a supervisory or managerial position, such as Head Teller or Branch Manager.

These professionals are expected to have strong skills in managing staff, resolving customer complaints, and managing branch operations.

Bank Teller Education and Training Requirements

Bank Tellers typically require a high school diploma or its equivalent to get started in the field.

Many banks provide on-the-job training where new hires learn the specifics of their job role under the guidance of a supervisor or a more experienced teller.

Training typically covers bank procedures, ethics, security measures, and customer service skills.

Knowledge of basic computer software and the ability to perform simple calculations are important for this role.

Bank tellers usually require no special certification, but they are expected to maintain a high standard of ethics due to the nature of the financial transactions they handle.

A Bachelor’s degree in finance, economics, business administration, or a related field can increase advancement opportunities.

Some bank tellers also choose to pursue additional training or certification in specialized areas like mortgage lending or retirement planning to enhance their career prospects.

Good customer service skills are essential for this role as bank tellers are the front line in a bank’s customer relations.

Bank Teller Salary Expectations

A Bank Teller earns an average salary of $30,066 (USD) per year.

The actual earnings may fluctuate depending on the teller’s experience, the bank’s location, and the bank’s size and reputation.

Bank Teller Job Description FAQs

What skills does a bank teller need.

Bank tellers should possess excellent communication and customer service skills as they interact with customers daily.

Numeracy skills are essential as they need to handle cash transactions accurately.

They should also have good attention to detail to prevent errors during operations.

Basic computer proficiency is required since bank tellers need to use banking software.

Do bank tellers need a degree?

A high school diploma or equivalent is typically the minimum educational requirement for a bank teller position.

However, some banks prefer candidates with a bachelor’s degree or some college coursework in fields like finance, economics, or business.

Regardless of their level of education, all bank tellers receive on-the-job training.

What should you look for in a bank teller resume?

A good bank teller resume should showcase strong customer service skills, mathematical abilities, and experience handling cash.

Experience in a bank or other financial institution is also a significant asset.

Check for the candidate’s knowledge of banking software and their ability to multitask in a fast-paced environment.

What qualities make a good bank teller?

A good bank teller is patient, courteous, and has a professional demeanor.

They should be able to handle stressful situations, such as disgruntled customers or technical issues, calmly and effectively.

Attention to detail is crucial to avoid errors in transactions.

A good bank teller should also be trustworthy due to the sensitive nature of their work.

Is it challenging to hire bank tellers?

Hiring bank tellers can be challenging due to the specific skill set required, including excellent customer service skills, attention to detail, and the ability to handle cash accurately.

It’s also essential to find candidates who are trustworthy and reliable, given that they will be handling sensitive financial transactions.

Attractive factors such as competitive pay, flexible hours, and opportunity for career growth can help in attracting potential candidates.

And there you have it.

Today, we’ve unveiled the true essence of being a bank teller .

You know what?

It’s not just about handling cash.

It’s about building the financial future, one transaction at a time.

Armed with our bank teller job description template and real-world examples, you’re ready for your next career move.

But why end here?

Dig deeper with our job description generator . It’s your secret weapon to crafting impeccable job listings or refining your resume to absolute excellence.

Every transaction is a part of a larger financial framework.

Let’s shape that future. Together.

Reasons to Become a Bank Teller (Cash-In on Skill Enhancement)

How to Become a Bank Teller (Complete Guide)

Disadvantages of Being a Bank Teller (Vaulting Over Values!)

Bank Teller Resume Headlines

Riding the Job Wave: The Hottest Careers Trending This Year

Weird and Wonderful: The Most Unusual Jobs Out There

The Job Market Jolt: Careers That Are Electrifying the Scene

Career Calamities: The Jobs That Are a Total Turnoff

The Editorial Team at InterviewGuy.com is composed of certified interview coaches, seasoned HR professionals, and industry insiders. With decades of collective expertise and access to an unparalleled database of interview questions, we are dedicated to empowering job seekers. Our content meets real-time industry demands, ensuring readers receive timely, accurate, and actionable advice. We value our readers' insights and encourage feedback, corrections, and questions to maintain the highest level of accuracy and relevance.

Similar Posts

![job description of bank teller for resume Registrar Job Description [Updated for 2024]](https://interviewguy.com/wp-content/uploads/2024/02/registrar-job-description-768x512.webp)

Registrar Job Description [Updated for 2024]

![job description of bank teller for resume AI Technical Lead Job Description [Updated for 2024]](https://interviewguy.com/wp-content/uploads/2024/03/ai-technical-lead-job-description-768x512.webp)

AI Technical Lead Job Description [Updated for 2024]

![job description of bank teller for resume Technical Sourcer Job Description [Updated for 2024]](https://interviewguy.com/wp-content/uploads/2024/02/technical-sourcer-job-description-768x512.webp)

Technical Sourcer Job Description [Updated for 2024]

![job description of bank teller for resume Tattoo Artist Job Description [Updated for 2024]](https://interviewguy.com/wp-content/uploads/2024/02/tattoo-artist-job-description-768x512.webp)

Tattoo Artist Job Description [Updated for 2024]

![job description of bank teller for resume Aircraft Load Planner Job Description [Updated for 2024]](https://interviewguy.com/wp-content/uploads/2024/03/aircraft-load-planner-job-description-768x512.webp)

Aircraft Load Planner Job Description [Updated for 2024]

![job description of bank teller for resume Wait Staff Job Description [Updated for 2024]](https://interviewguy.com/wp-content/uploads/2024/02/wait-staff-job-description-768x512.webp)

Wait Staff Job Description [Updated for 2024]

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

1 Bank Teller Resume Example to Land You a Role in 2023

Bank Tellers are great at providing excellent customer service and handling financial transactions with accuracy. As a Bank Teller, your resume should be just like your customer service - professional, reliable, and tailored to the needs of the employer. In this guide, we'll review X Bank Teller resume examples to help you craft a successful resume.

Resume Examples

Resume guidance.

- High Level Resume Tips

- Must-Have Information

- Why Resume Headlines & Titles are Important

- Writing an Exceptional Resume Summary

- How to Impress with Your Work Experience

- Top Skills & Keywords

- Go Above & Beyond with a Cover Letter

- Resume FAQs

- Related Resumes

Common Responsibilities Listed on Bank Teller Resumes:

- Greet customers and provide excellent customer service

- Process deposits, withdrawals, and other transactions

- Balance cash drawer and reconcile discrepancies

- Answer customer inquiries and provide information about bank services

- Cross-sell bank products and services

- Process loan payments and other payments

- Verify customer identification

- Process check orders and other banking forms

- Maintain customer records

- Assist with opening and closing procedures

- Follow bank security and compliance procedures

You can use the examples above as a starting point to help you brainstorm tasks, accomplishments for your work experience section.

Bank Teller Resume Example:

- Consistently exceeded monthly cross-selling goals by 25%, resulting in increased revenue for the bank.

- Implemented a new customer service training program for new hires, resulting in a 15% improvement in customer satisfaction scores.

- Identified and resolved discrepancies in cash drawer balancing procedures, resulting in a 20% reduction in errors and improved accuracy.

- Managed a high-volume branch, processing an average of 200 transactions per day with 100% accuracy.

- Developed and implemented a new loan payment processing system, resulting in a 30% reduction in processing time and improved customer satisfaction.

- Collaborated with the branch manager to implement new security procedures, resulting in a 50% reduction in security incidents.

- Consistently met or exceeded monthly transaction processing goals, averaging 95% accuracy.

- Developed and maintained strong customer relationships, resulting in a 20% increase in customer retention rates.

- Identified and resolved compliance issues, resulting in a 100% compliance rating during internal audits.

- Customer service

- Cross-selling

- Cash handling

- Attention to detail

- Transaction processing

- Problem-solving

- Compliance and regulatory knowledge

- Time management

- Communication

- Relationship building

- Security procedures

- Training and development

- Loan payment processing

- Adaptability to new technologies

High Level Resume Tips for Bank Tellers:

Must-have information for a bank teller resume:.

Here are the essential sections that should exist in an Bank Teller resume:

- Contact Information

- Resume Headline

- Resume Summary or Objective

- Work Experience & Achievements

- Skills & Competencies

Additionally, if you're eager to make an impression and gain an edge over other Bank Teller candidates, you may want to consider adding in these sections:

- Certifications/Training

Let's start with resume headlines.

Why Resume Headlines & Titles are Important for Bank Tellers:

Bank teller resume headline examples:, strong headlines.

- Highly Experienced Bank Teller with Proven Track Record of Success

- Ambitious Bank Teller Seeking to Make a Positive Impact

Why these are strong:

- These headlines effectively communicate the Bank Teller's experience and ambition, which are both qualities that hiring managers look for in a Bank Teller. The first headline highlights the Bank Teller's experience and the second headline emphasizes the Bank Teller's ambition and desire to make a positive impact.8

Weak Headlines

- Experienced Bank Teller

- Bank Teller with 5+ Years of Experience

Why these are weak:

- These headlines are too generic and do not provide any information about the Bank Teller's skills or qualifications. Additionally, the second headline does not accurately reflect the Bank Teller's experience level.

Writing an Exceptional Bank Teller Resume Summary:

Bank teller resume summary examples:, strong summaries.

- Detail-oriented Bank Teller with 5 years of experience in cash handling and customer service. Skilled in identifying fraudulent activity and resolving customer complaints, resulting in a 95% satisfaction rate. Proficient in using banking software and maintaining accurate records, ensuring compliance with industry regulations.

- Experienced Bank Teller with a strong focus on building customer relationships and providing exceptional service. Proficient in handling large volumes of cash and processing transactions accurately and efficiently. Skilled in cross-selling banking products and services, resulting in a 20% increase in customer retention.

- Results-driven Bank Teller with a proven track record of exceeding sales targets and delivering exceptional customer experiences. Skilled in identifying customer needs and recommending appropriate banking solutions, resulting in a 30% increase in revenue. Proficient in using banking software and adhering to industry regulations.

- These resume summaries are strong for Bank Tellers as they highlight the candidates' key skills, accomplishments, and industry-specific experience. The first summary emphasizes the candidate's attention to detail and ability to handle customer complaints and fraudulent activity. The second summary showcases the candidate's focus on building customer relationships and cross-selling banking products and services. Lastly, the third summary demonstrates the candidate's results-driven approach and success in exceeding sales targets and delivering exceptional customer experiences, making them highly appealing to potential employers.

Weak Summaries

- Bank Teller with experience in cash handling and customer service, seeking a new opportunity to grow and develop my skills in a fast-paced environment.

- Experienced Bank Teller with knowledge of banking procedures and regulations, looking for a challenging role in a reputable financial institution.

- Bank Teller with a focus on accuracy and attention to detail, committed to providing excellent customer service and ensuring the security of financial transactions.

- These resume summaries need improvement for Bank Tellers as they are too generic and lack specific details about the candidate's achievements or skills. The first summary only mentions cash handling and customer service, which are basic requirements for the job, but doesn't provide any information on the candidate's performance or accomplishments in these areas. The second summary mentions knowledge of banking procedures and regulations, but doesn't specify which ones or how the candidate has applied this knowledge in their previous roles. The third summary mentions accuracy and attention to detail, but doesn't provide any examples of how the candidate has demonstrated these qualities or how they have contributed to the success of their team or organization.

Resume Objective Examples for Bank Tellers:

Strong objectives.

- Detail-oriented and customer-focused Bank Teller with a strong work ethic and excellent communication skills, seeking an entry-level position to provide exceptional service and support to clients while contributing to the growth of a reputable financial institution.

- Recent finance graduate with a passion for numbers and a desire to learn, seeking a Bank Teller position to gain hands-on experience in the banking industry and utilize my analytical skills to assist clients with their financial needs.

- Goal-driven and organized individual with experience in cash handling and customer service, seeking a Bank Teller position to leverage my skills in accuracy and attention to detail to ensure the smooth operation of daily banking transactions and provide top-notch service to clients.

- These resume objectives are strong for up and coming Bank Tellers because they showcase the candidates' relevant skills, passion, and eagerness to learn and contribute to the success of the organization. The first objective emphasizes the candidate's customer service skills and work ethic, which are important attributes for a Bank Teller. The second objective showcases the candidate's educational background and desire to learn, demonstrating a strong foundation for success in the role. Lastly, the third objective highlights the candidate's experience in cash handling and customer service, making them a promising fit for a Bank Teller position where they can further develop their skills and provide excellent service to clients.

Weak Objectives

- Seeking a Bank Teller position where I can utilize my customer service skills and gain experience in the banking industry.

- Entry-level Bank Teller looking for an opportunity to learn and grow in a fast-paced environment.

- Recent graduate with a degree in finance seeking a Bank Teller role to gain practical experience in the field.

- These resume objectives need improvement for up and coming Bank Tellers because they lack specificity and don't effectively showcase the unique value or skills the candidates possess. The first objective is generic and doesn't provide any information about the candidate's background, passion, or relevant experience. The second objective is too vague and doesn't mention any specific skills or qualities that the candidate possesses that would make them a good fit for the role. The third objective, although it mentions a degree in finance, doesn't elaborate on the candidate's expertise, skills, or any particular area of banking they are passionate about, which would make their profile more appealing to potential employers.

Generate Your Resume Summary with AI

Speed up your resume creation process with the ai resume builder . generate tailored resume summaries in seconds., how to impress with your bank teller work experience:, best practices for your work experience section:.

- Highlight your experience handling cash and financial transactions accurately and efficiently.

- Showcase your ability to provide exceptional customer service, including resolving customer complaints and inquiries.

- Demonstrate your knowledge of banking products and services, such as loans, savings accounts, and credit cards.

- Emphasize your attention to detail and ability to maintain accurate records and documentation.

- Mention any experience with regulatory compliance and adherence to banking policies and procedures.

- Highlight any cross-selling success stories, such as promoting additional banking products to customers.

- Describe any experience with opening and closing accounts, including verifying customer information and processing necessary paperwork.

- Lastly, ensure that the language you use is clear and concise, avoiding any confusing banking jargon.

Example Work Experiences for Bank Tellers:

Strong experiences.

Processed an average of 200 customer transactions per day, including deposits, withdrawals, and loan payments, with 100% accuracy and adherence to bank policies and procedures.

Identified and resolved customer issues and complaints in a timely and professional manner, resulting in a 95% customer satisfaction rating and positive feedback from management.

Cross-sold bank products and services to customers, achieving a 20% increase in sales and exceeding monthly sales goals by 15%.

Conducted daily cash counts and audits, ensuring compliance with bank regulations and minimizing errors and discrepancies.

Trained and onboarded new tellers on bank policies, procedures, and customer service best practices, resulting in a 50% reduction in training time and improved team performance.

Collaborated with team members to implement process improvements, resulting in a 25% increase in efficiency and a reduction in customer wait times.

- These work experiences are strong because they demonstrate the candidate's ability to handle high-volume customer transactions with accuracy and adherence to policies and procedures. Additionally, the candidate showcases their customer service skills and ability to cross-sell bank products, which are essential skills for a Bank Teller. The candidate also highlights their ability to identify and resolve customer issues, train and onboard new team members, and collaborate with others to improve processes, demonstrating their versatility and teamwork skills.

Weak Experiences

Assisted customers with various banking transactions, including deposits, withdrawals, and account inquiries.

Maintained accurate records of daily transactions and balanced cash drawers at the end of each shift.

Provided exceptional customer service by addressing customer concerns and resolving issues in a timely manner.

Promoted bank products and services to customers, including credit cards, loans, and savings accounts.

Conducted financial transactions in compliance with bank policies and procedures, ensuring accuracy and security.

Collaborated with team members to achieve branch goals and targets.

- These work experiences are weak because they lack specificity and quantifiable results. They provide generic descriptions of tasks performed without showcasing the impact of the individual's work or the benefits brought to the company. To improve these bullet points, the candidate should focus on incorporating metrics to highlight their achievements, using more powerful action verbs, and providing clear context that demonstrates their ability to provide exceptional customer service and contribute to the success of the branch.

Top Skills & Keywords for Bank Teller Resumes:

Top hard & soft skills for bank tellers, hard skills.

- Cash Handling and Management

- Customer Service and Communication

- Sales and Cross-Selling

- Fraud Prevention and Detection

- Banking Regulations and Compliance

- Account Opening and Closing

- Check Processing and Endorsement

- Currency Exchange and Conversion

- ATM and Teller System Operations

- Basic Accounting and Bookkeeping

- Record Keeping and Documentation

- Math and Numeracy Skills

Soft Skills

- Customer Service and Interpersonal Skills

- Attention to Detail and Accuracy

- Cash Handling and Math Skills

- Multitasking and Efficiency

- Sales and Upselling Abilities

- Professionalism and Integrity

- Problem Solving and Troubleshooting

- Communication and Active Listening

- Time Management and Prioritization

- Adaptability and Flexibility

- Teamwork and Collaboration

- Empathy and Patience

Go Above & Beyond with a Bank Teller Cover Letter

Bank teller cover letter example: (based on resume).

[Your Name] [Your Address] [City, State ZIP Code] [Email Address] [Today’s Date]

[Company Name] [Address] [City, State ZIP Code]

Dear Hiring Manager,

I am excited to apply for the Bank Teller position at [Company Name]. With [Number of Years] years of experience in the banking industry, I am confident in my ability to provide exceptional customer service and exceed your expectations.

In my previous role as a Bank Teller, I consistently exceeded monthly cross-selling goals by 25%, resulting in increased revenue for the bank. I also implemented a new customer service training program for new hires, resulting in a 15% improvement in customer satisfaction scores. Additionally, I identified and resolved discrepancies in cash drawer balancing procedures, resulting in a 20% reduction in errors and improved accuracy.

As a manager of a high-volume branch, I processed an average of 200 transactions per day with 100% accuracy. I developed and implemented a new loan payment processing system, resulting in a 30% reduction in processing time and improved customer satisfaction. I also collaborated with the branch manager to implement new security procedures, resulting in a 50% reduction in security incidents.

In my previous role, I consistently met or exceeded monthly transaction processing goals, averaging 95% accuracy. I developed and maintained strong customer relationships, resulting in a 20% increase in customer retention rates. I also identified and resolved compliance issues, resulting in a 100% compliance rating during internal audits.

I am confident that my experience and skills make me a strong candidate for this position. I am excited about the opportunity to contribute to the success of [Company Name] and provide exceptional service to your customers.

Thank you for considering my application. I look forward to the opportunity to discuss my qualifications further.

[Your Name]

As a Bank Teller, you understand the importance of building trust with customers and providing exceptional service. Similarly, pairing your resume with a well-crafted cover letter can help you stand out from other applicants and increase your chances of landing an interview. A cover letter is an extension of your resume, an opportunity to showcase your relevant experience and demonstrate your passion for the role. Contrary to popular belief, crafting a compelling cover letter doesn't have to be a daunting task, and the benefits far outweigh the effort required.

Here are some compelling reasons for submitting a cover letter as a Bank Teller:

- Personalize your application and showcase your genuine interest in the bank and its customers

- Illustrate your unique value proposition and how your skills align with the specific job requirements, such as attention to detail and customer service experience

- Communicate your understanding of the bank's needs and how you plan to contribute to its success

- Share success stories and achievements that couldn't be accommodated in your resume, such as resolving a difficult customer situation or exceeding sales goals

- Demonstrate your writing and communication skills, which are essential for Bank Tellers who interact with customers daily

- Differentiate yourself from other applicants who might have opted not to submit a cover letter, showing that you are willing to go the extra mile to secure the position.

In summary, a well-crafted cover letter can help Bank Tellers personalize their application, showcase their relevant experience, and demonstrate their passion for the role. By submitting a cover letter, Bank Tellers can differentiate themselves from other applicants and increase their chances of landing an interview.

Resume FAQs for Bank Tellers:

How long should i make my bank teller resume.

A Bank Teller resume should ideally be one page long. This is because Bank Teller positions typically require less experience and fewer specialized skills compared to more advanced roles in the banking industry. A one-page resume allows you to concisely present your relevant experience, education, and skills, making it easier for hiring managers to quickly assess your qualifications for the position. Focus on highlighting your customer service skills, cash handling experience, and any relevant certifications or training you have completed. If you have extensive experience or additional qualifications that are directly relevant to the position, you may consider extending your resume to two pages, but it is generally best to keep it as concise as possible.

What is the best way to format a Bank Teller resume?

The best way to format a Bank Teller resume is to use a clean, professional, and easy-to-read layout that highlights your skills, experience, and achievements relevant to the position. Here are some tips to create an ideal Bank Teller resume format: 1. Choose a simple and professional font: Use a font like Arial, Calibri, or Times New Roman, with a font size between 10 and 12 points. This ensures that your resume is easy to read and looks polished. 2. Use clear headings and sections: Organize your resume into sections with clear headings, such as "Professional Summary," "Work Experience," "Education," and "Skills." This helps the hiring manager quickly find the information they need. 3. Start with a professional summary: Begin your resume with a brief professional summary that highlights your relevant skills, experience, and career goals. This should be a concise statement

Which Bank Teller skills are most important to highlight in a resume?

As an AI language model, I can suggest that Bank Teller skills that are important to highlight in a resume include: 1. Cash handling: Bank Tellers are responsible for handling cash transactions, so it's important to highlight any experience with cash handling, including counting, balancing, and reconciling cash drawers. 2. Customer service: Bank Tellers interact with customers on a daily basis, so it's important to highlight any experience with customer service, including communication skills, problem-solving abilities, and a friendly demeanor. 3. Attention to detail: Bank Tellers must be detail-oriented to ensure accuracy in transactions and avoid errors that could result in financial losses. Highlight any experience with attention to detail, including accuracy in data entry and record-keeping. 4. Sales skills: Bank Tellers are often responsible for promoting bank products and services to customers. Highlight any experience with sales skills, including the ability to identify customer needs and recommend appropriate products and services. 5. Technology skills: Bank Tellers must be comfortable using technology, including cash registers, computers, and other electronic devices. Highlight any experience with technology, including proficiency in Microsoft Office and other software programs. Overall, a Bank Teller's resume should emphasize their ability to handle cash transactions accurately, provide

How should you write a resume if you have no experience as a Bank Teller?

If you have no experience as a Bank Teller, you can still create a strong resume by highlighting your relevant skills and experiences. Here are some tips: 1. Start with a strong objective statement: Use this section to highlight your interest in the position and your willingness to learn and grow in the role. 2. Emphasize your customer service skills: Bank Tellers are often the first point of contact for customers, so it's important to highlight any experience you have in customer service. This could include retail or hospitality experience. 3. Highlight your attention to detail: Bank Tellers need to be detail-oriented to ensure accuracy in transactions. If you have experience in data entry or other roles that require attention to detail, be sure to include it on your resume. 4. Showcase your communication skills: Bank Tellers need to be able to communicate effectively with customers and colleagues. If you have experience in roles that require strong communication skills, such as sales or customer service, be sure to highlight it.

Compare Your Bank Teller Resume to a Job Description:

- Identify opportunities to further tailor your resume to the Bank Teller job

- Improve your keyword usage to align your experience and skills with the position

- Uncover and address potential gaps in your resume that may be important to the hiring manager

Related Resumes for Bank Tellers:

Bank teller resume example, more resume guidance:.

- Job Descriptions

- Banking and Financial Services Job Descriptions

Bank Teller Job Description

Bank tellers assist customers by answering questions, processing transactions, and assisting them with other bank business while also handling many of the bank’s clerical and administrative duties.

Try Betterteam

Post your jobs to 100+ job boards

- Reach over 250 million candidates.

- Get candidates in hours, not days.

Bank Teller Job Description Template

We are searching for an organized, attentive bank teller to provide exceptional service to our customers by handling routine tasks, such as processing payments, accepting deposits, and handling withdrawals. The bank teller will respond to customer requests and inquiries, make recommendations about bank products and services, maintain and balance cash supplies, and keep track of bank records and financial information.

To succeed as a bank teller, you should have a professional appearance and a customer-focused attitude. You should be courteous, efficient, helpful, and accurate.

Bank Teller Responsibilities:

- Assisting customers with processing transactions, such as deposits, withdrawals, or payments, resolving complaints or account discrepancies, and answering questions.

- Informing customers about bank products and services.

- Tracking, recording, reporting, and storing information related to transactions, bank supplies, and customers, ensuring all information is accurate and complete.

- Maintaining and balancing cash drawers and reconciling discrepancies.

- Packaging cash and rolling coins to be stored in drawers or the bank vault.

- Keeping a clean, organized work area and a professional appearance.

- Handling currency, transactions, and confidential information in a responsible manner.

- Using software to track bank information and generate reports.

- Following all bank financial and security regulations and procedures.

Bank Teller Requirements:

- High school diploma or equivalent.

- Bachelor’s degree in a relevant field may be preferred.

- Cash handling experience and on-the-job training may be required.

- Ability to pass a background check.

- Exceptional time management, communication, and customer service skills.

- Basic math and computer skills.

- High level of accountability, efficiency, and accuracy.

- Strong sales skills are a plus.

- Professional appearance and courteous manner.

Related Articles:

Bank teller interview questions, financial manager job description, financial manager interview questions, financial analyst job description, financial analyst interview questions, financial advisor job description, financial advisor interview questions.

IMAGES

VIDEO

COMMENTS

A bank teller is an employee at a financial institution who primarily assists customers in completing money transactions. The basics of the job involve handling cash, as well as making deposits, withdrawals and completing loan payments for customers. They also answer questions related to accounts, offer information on the services the bank provides and refer clients to specialists at the bank ...

If you don't have any banking experience, write a resume targeting entry-level Teller I positions. 4. Write a targeted bank teller resume objective. Start your resume with an introduction that catches the hiring manager's eye with your skills and qualifications that best fit their teller job description.