Custody and Trading Platform

Visit the Fidelity Digital Assets SM custody and trading platform to manage your digital assets.

Go to platform

Digital Asset Management

To view your holdings in one of our investment products, please use the access details provided to you by your administrator. If you have any questions, email [email protected] .

Are you looking for Fidelity Crypto ® , Fidelity’s crypto offering for individual investors? Click here.

- Custody and Trading

- Asset Management

- Terms of Use

- Privacy Policy

- Cookie Policy

Research Study

Ethereum investment thesis.

Ethereum’s Potential as Digital Money and a Yield-Bearing Asset

by Fidelity Digital Assets

August 30, 2023 • 32 min read

While users may get technological utility from the Ethereum network by accessing the various applications in the ecosystem, some may wonder, “how does utility translate into value for ether the token?” In this paper, we consider this question and discuss the following set of observations:

- Ethereum may be best understood as a technology platform that uses ether (ETH) as a means of payment.

- Ethereum’s overall platform usage may pass value on to token holders.

- Ether’s perceived value is tied to network usage and supply and demand dynamics, which have changed since The Merge.

- Ethereum’s switch to proof-of-stake (The Merge) now lets token holders receive yield, some of which is driven by increased network usage.

- Ethereum is not complete, so yearly upgrades are expected, introducing recurring technical risks and unknowns that degrade its prospects as a store of value asset.

Read full report here

The value exchange webinar.

We were pleased to welcome Bitwise Chief Investment Officer, Matt Hougan to our latest episode of “The Value Exchange: Ethereum’s Potential as Digital Money and a Yield-Bearing Asset.”

Catch up and watch the entire discussion below.

The information herein was prepared by Fidelity Digital Asset Services, LLC and Fidelity Digital Assets, Ltd. It is for informational purposes only and is not intended to constitute a recommendation, investment advice of any kind, or an offer or the solicitation of an offer to buy or sell securities or other assets. Please perform your own research and consult a qualified advisor to see if digital assets are an appropriate investment option.

Custody and trading of digital assets are provided by Fidelity Digital Asset Services, LLC, a New York State-chartered, limited liability trust company (NMLS ID 1773897) or Fidelity Digital Assets, Ltd. Fidelity Digital Assets, Ltd. is registered with the U.K. Financial Conduct Authority for certain cryptoasset activities under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017. The Financial Ombudsman Service and the Financial Services Compensation Scheme do not apply to the cryptoasset activities carried on by Fidelity Digital Assets, Ltd.

This information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Persons accessing this information are required to inform themselves about and observe such restrictions.

Digital assets are speculative and highly volatile, can become illiquid at any time, and are for investors with a high-risk tolerance. Investors in digital assets could lose the entire value of their investment.

Fidelity Digital Asset Services, LLC and Fidelity Digital Assets. Ltd. do not provide tax, legal, investment, or accounting advice. This material is not intended to provide, and should not be relied on, for tax, legal, or accounting advice. Tax laws and regulations are complex and subject to change. You should consult your own tax, legal, and accounting advisors before engaging in any transaction. Some of this information is forward-looking and is subject to change.

Past performance is no guarantee of future results. Investment results cannot be predicted or projected.

Views expressed are as of the date indicated, based on the information available at that time, and may change based on market or other conditions. Unless otherwise noted, the opinions provided are those of the speaker or author and not necessarily those of Fidelity Digital Assets or its affiliates. Fidelity Digital Assets does not assume any duty to update any of the information.

Fidelity Digital Asset Services, LLC 245 Summer Street, Boston, MA 02210

Fidelity Digital Assets, Ltd. 1 St. Martin's Le Grand, London, England, EC1A 4AS

Fidelity Digital Assets and the Fidelity Digital Assets logo are service marks of FMR LLC

© 2023 FMR LLC. All rights reserved.

The Omnibus Model for Custody

Learn about the origins of the omnibus custody model in traditional finance and explore how and why digital asset custodians apply the omnibus model to securing customer assets.

by Ria Bhutoria January 21, 2020 • 14 minutes read

Institutional digital asset survey report.

A preview and available download of our survey analysis — “A Review of the Institutional Investors Digital Assets Study (Phase II)”

by Ria Bhutoria June 15, 2020 • 16 minutes read

- Metaverse Post

- News Report

Fidelity’s Ethereum Investment Thesis Points to Network Demand Driving ETH Price

To improve your local-language experience, sometimes we employ an auto-translation plugin. Please note auto-translation may not be accurate, so read original article for precise information.

The research highlights that the perceived value of Ethereum is tied to network usage.

While ETH shares similarities with Bitcoin as a form of digital money, it faces significant headwinds in becoming widely accepted as a monetary asset.

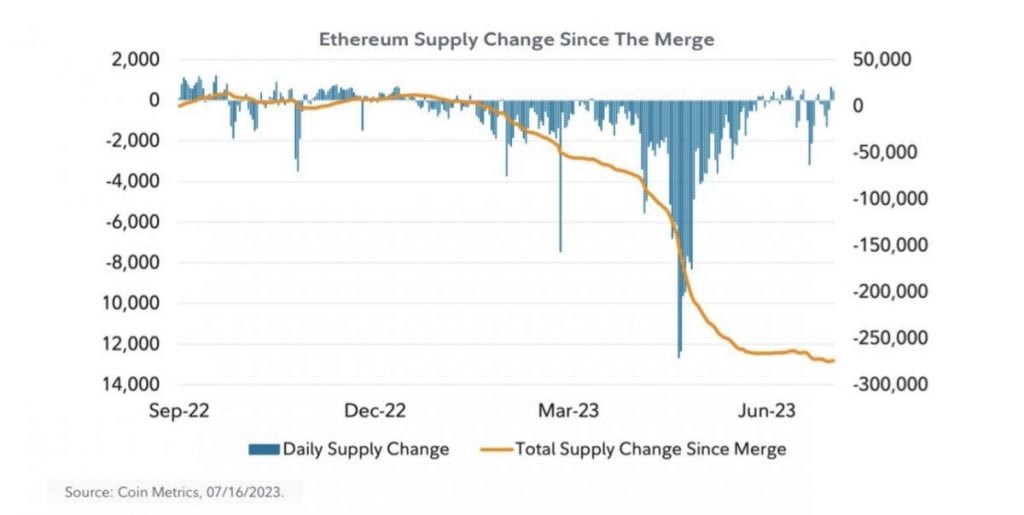

Ethereum’s transition to proof-of-stake and the introduction of mechanisms like MEV have reshaped its tokenomics.

In a new research report , Fidelity examines the burning question: how does the utility of the Ethereum network translate into value for its native cryptocurrency, ETH?

While users have enjoyed the technological benefits of Ethereum’s extensive ecosystem, the investment community has sought to understand the reasons behind acquiring and holding ETH beyond its utility as a transactional token.

Fidelity’s Ethereum Investment Thesis delves into the value proposition of ETH from an investment thesis perspective, while also dissecting the technical aspects related to various investment theses.

Key observations from the report include:

- Value Linked to Network Usage: The perceived value of Ethereum is tied to network usage and the dynamics of supply and demand, which have evolved significantly since the implementation of The Merge.

- Platform Usage and Value Accrual: Increased utilization of the Ethereum network and platform may contribute to the accumulation of value for Ether token holders.

- Ether as an Emerging Form of Money: One investment thesis posits Ether as an emerging form of digital money, akin to Bitcoin.

- Challenges in Competing with Bitcoin: The report acknowledges that while other digital assets, including Ether, may attempt to serve as forms of money, competing with Bitcoin’s characteristics and network effects could be a formidable challenge.

- Ether’s Functions as Money: The report explores Ether’s ability to fulfill two primary functions of money: a store of value and a means of payment.

Ether’s Aspiration as Money

A prevailing narrative in the cryptocurrency space often positions Bitcoin as a nascent form of digital money. This begs the question: Can ETH assume a similar role? In essence, can it be considered “money”?

The answer, as per Fidelity’s analysis, is affirmative but comes with caveats. ETH does indeed share several characteristics with traditional forms of money, including Bitcoin, such as its role as a medium of exchange. However, there are notable differences to consider.

Challenges in Becoming Widely Accepted

One of the key challenges ETH faces in becoming a widely accepted form of money is its supply dynamics. Unlike Bitcoin, which adheres to a fixed supply schedule and is seen as a secure and sound digital currency by many, ETH supply parameters are technically unlimited. These parameters can fluctuate based on factors like the number of validators and burning mechanisms.

Furthermore, ETH’s track record as a monetary asset differs from Bitcoin’s. Ethereum undergoes network upgrades approximately once a year, requiring time and developer attention to establish a stable performance history. This is important for garnering trust among stakeholders.

Competing Forms of Money

While Bitcoin holds a strong position as a monetary asset, Fidelity suggests that this does not preclude the existence of other forms of digital money, including ETH.

Ethereum’s unique attributes, such as its ability to facilitate complex transactions and execute smart contract logic, set it apart from its digital currency counterparts. These capabilities provide it with a unique utility beyond being a simple medium of exchange.

Real-World Ethereum Integrations

While widespread everyday transactions on Ethereum are yet to materialize, Fidelity provides examples of already noteworthy integrations between the Ethereum ecosystem and the physical world as well as the traditional finance sector:

- MakerDAO’s Multimillion-Dollar Purchase: MakerDAO, a project operating on the Ethereum blockchain, recently completed a substantial purchase of $500 million, highlighting Ethereum’s growing influence.

- Ethereum’s Role in Real Estate: Ethereum marked a historic milestone as the platform for the sale of the first U.S. house using a non-fungible token (NFT), showcasing its potential to disrupt the real estate market.

- Blockchain Bonds by European Investment Bank: The European Investment Bank ventured into the blockchain realm by issuing bonds directly on the blockchain, a sign of traditional finance’s growing embrace of Ethereum’s technology.

- Franklin Templeton’s Ethereum-Powered Money Market Fund: Franklin Templeton introduced a money market fund utilizing Ethereum and Polygon to streamline transaction processing and record share ownership.

Challenges on the Path to Mass Adoption

While the convergence of the Ethereum ecosystem with real-world assets is undeniably underway, the report suggests that there are tough challenges to overcome.

These include the need for continuous network improvement, regulatory clarity, education, and the passage of time to instil confidence in Ethereum and similar platforms.

It may take years before Ethereum sees widespread adoption for everyday transactions, making ETH a niche form of money for the time being.

Fidelity’s Concluding Thought

According to Fidelity, the key question on the minds of investors is whether Ethereum’s robust developer activity and the proliferation of applications translate into tangible value for ETH.

“We have shown that, in both theory and data thus far, increased activity on Ethereum’s network drives demand for block space, which, in turn, generates cash flow that can accrue to token holders,” Fidelity concludes.

“What is also evident, though, is that these various drivers are complex, nuanced, and have changed over time with various protocol upgrades and the emergence of scaling developments, like layer 2, and may change again in the future.”

- Cryptocurrency

In line with the Trust Project guidelines , please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Cindy is a journalist at Metaverse Post, covering topics related to web3, NFT, metaverse and AI, with a focus on interviews with Web3 industry players. She has spoken to over 30 C-level execs and counting, bringing their valuable insights to readers. Originally from Singapore, Cindy is now based in Tbilisi, Georgia. She holds a Bachelor's degree in Communications & Media Studies from the University of South Australia and has a decade of experience in journalism and writing. Get in touch with her via [email protected] with press pitches, announcements and interview opportunities.

Tenet Gears Up To Launch Its Mainnet In Three Phases, Introduces Interstellar Incentive Token

Galxe introduces gal staking with $5m rewards pool, enables users to receive benefits via galxe earn, web3 data infrastructure provider syntropy rebrands to synternet, aligns its appearance with tech advancements, dexalot launches its central limit order book decentralized exchange on arbitrum, the doge frenzy: analysing dogecoin’s (doge) recent surge in value.

The cryptocurrency industry is rapidly expanding, and meme coins are preparing for a significant upswing. Dogecoin (DOGE), ...

The Evolution of AI-Generated Content in the Metaverse

The emergence of generative AI content is one of the most fascinating developments inside the virtual environment ...

- Metaverse Wiki

- Web 3.0 Wiki

- Crypto Wiki

- AI Fundraising Report Q1 2023

- VR Fundraising Report Q1 2023

- Web3 Fundraising Report Q1 2023

- Trend Reports 2023: Global Industry Forecasting

- AI Generative Models Database 2023

- AI Artist Styles Database 2023

- AI Music Industry Report 2023

- AI Accelerators

- AI Podcasts

- Best AI Anime Character Creators

- Best AI Apps for iPhones

- Best AI Avatar Apps

- Best AI Art Generators

- Best AI Art Generator Mobile Apps

- Best AI Business Name Generators

- Best AI GPT-4 / GPT-3 Chatbots

- Best AI Telegram Chatbots

- Best AI Logo Makers

- Best AI Lyrics Generators

- Best AI Photo Editors

- Best AI Photo Enhancers

- Best AI Photo Stocks

- Best AI Resume Builders and CV

- Best AI Text-to-Video Generators

- Best AI Tools for Data Analysts

- Best AI Trading Bots

- Best AI Video Editors

- Best AI Voice Generators

- Best AI Website Builders

- Best AI 3D Generators

- Best AI Text-to-Image Prompt Guides

- Best Prompt Marketplaces and Hubs

- Best ChatGPT Prompts

- Best ChatGPT Games

- Best Stable Diffusion Prompts

- Best Midjourney Prompts

- Best AI Prompt Generators

- Top 100+ Words Detectable by AI Detectors

- Working with us

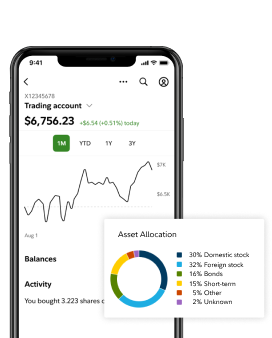

Digital Assets Account

A first-of-its-kind investment account.

Offer your employees the ability to gain exposure to digital assets within their 401(k)

Fidelity’s proprietary Digital Assets Account (DAA) is an innovative investment account that gives your employees the option to gain exposure to digital asset investments and provides you more choice in your investment options to help meet the demands of your evolving workforce. The DAA leverages leading-edge technology, enterprise capabilities, and a 75-year history of putting customers first.

Account diversification

Offers a new way for your employees to diversify investments in their portfolio with digital assets.

Institutional-grade custody platform

Fidelity Digital Asset Services, LLC provides custodial and trading services for the underlying digital assets held by the DAA.¹

Educational materials

Comprehensive educational materials, tools, and resources are available for you and your employees.

Simplified approach

Participants receive units of their plan’s Digital Assets Account that primarily holds bitcoin plus a short-term money market investment.

Plan sponsor duties

As your plan’s fiduciary, you should evaluate this offering with your ERISA counsel and consider the risks, opportunities, and the role digital assets may play in your plan’s investment portfolio.

Dollar cost averaging 2

As with other investments within their 401(k), employees can benefit from dollar cost averaging in a tax deferred account to help them manage risks associated with price volatility.

1. Digital assets transactions are made through digital asset trading platforms, including Fidelity Digital Asset Services, LLC, that use multiple liquidity providers to achieve quality execution.

2. Dollar cost averaging does not assure a profit or protect against loss in declining markets. For the strategy to be effective, you must continue to purchase shares in both market ups and downs.

A seamless employee experience

When you offer employees access to the DAA, they will have many resources available to educate themselves so they can make more informed decisions. This includes our Destination Digital Assets experience in NetBenefits ® , which includes an informative video, overview flyer, brochures, and educational articles.

75 years of innovation

Fidelity leads the way with a personalized and more secure workplace benefits experience.

Digital assets public policy

See our Digital Assets section to learn how Fidelity engages with policymakers to support the industry.

The future of digital assets

Learn about Fidelity’s focus on how digital assets will become part of the financial industry’s future.

Insights and education for plan sponsors

Read news and views from the Fidelity Digital Assets℠ team.

Bitcoin Investment Thesis Report (PDF)*

Bitcoin as an Aspirational Store of Value

Fidelity Digital Assets℠ 2022 Institutional Investor Digital Assets Study (PDF)*

A look at institutional investors’ perceptions of digital assets and investment trends

Learn more at Fidelity Digital Assets℠ (WEB)*

For digital assets thought leadership and industry research

*You are leaving this site for a site supported by Fidelity Digital Assets℠. Fidelity Digital Assets℠ is solely responsible for the information and services it provides via its website. Review the new site’s terms of use and privacy policy.

Ready to talk?

Contact your Managing Director to learn more about how we can help you.

- INTEGRATION

- FINANCIAL WELLNESS

For plan sponsor use only.

Information provided in and presentation of this document is for illustrative and educational purposes only and is being provided without regard to the individualized needs of any retirement plan or its participants and beneficiaries, any plan terms, or investment policies. Fidelity and its affiliates and representatives will not and do not (a) act or serve in an ERISA fiduciary or investment advisor or management capacity for the Digital Assets Account (“DAA”), (b) provide recommendations or advice to plan sponsors, plan fiduciaries or plan participants or beneficiaries concerning whether to invest, hold, or divest the DAA, or (c) perform any trustee services with respect to the DAA, even where a Fidelity entity may serve as Trustee to other assets of the Plan. The information and content of this document is not meant to be a recommendation, impartial investment advice, or advice in a fiduciary capacity, and it is not intended to be used as a primary basis for any investment decision. Fidelity entities and their representatives may have a conflict of interest in the products or services mentioned in this material because they receive compensation, directly or indirectly, in connection with the servicing of the DAA or other products or services described herein, as applicable. Please review all disclosures in this document when reviewing its content.

The DAA is not a mutual fund, commingled pool, or registered security.

Digital assets are speculative and highly volatile, can become illiquid at any time, and are for investors with a high risk tolerance. Investors in digital assets could lose the entire value of their investment. The Department of Labor (“DOL”) has cautioned ERISA plan fiduciaries to exercise “extreme care” before adding a cryptocurrency option to a plan investment menu and indicated that plan fiduciaries that do so “should expect to be questioned about how they can square their actions with their duties of prudence and loyalty in light of” certain risks, including the speculative and volatile nature of cryptocurrency, a potential lack of sufficient knowledge on the part of participants, potential custodial and recordkeeping concerns, valuation concerns, and the evolving regulatory environment. A copy of the DOL’s Compliance Assistance Release No. 2022-01, 401(k) Plan Investments in Cryptocurrencies, is available at www.dol.gov/agencies/ebsa/employers-and-advisers/plan-administration-and-compliance/compliance-assistance-releases/2022-01 .

Fidelity Digital Asset Services, LLC, a limited liability trust company chartered by the New York Department of Financial Services (NMLS ID 1773897), provides custodial and trading services for the underlying digital assets held by the DAA.

Fidelity Workplace Services LLC provides recordkeeping, trustee, and custodial services to employer-sponsored retirement plans.

Fidelity Brokerage Services LLC does not offer digital assets or provide clearing or custody services for such assets.

Page Unavailable

Unfortunately, the page you requested is temporarily unavailable.

Please try again later or call 1-800-522-7297 between the hours of 8:30AM – 7:00PM EST

Akamai Reference Number: 18.24fc733e.1714011449.1c87c033

Page Unavailable

Unfortunately, the page you requested is temporarily unavailable.

Please try again later or call 1-800-522-7297 between the hours of 8:30AM – 7:00PM EST

Akamai Reference Number: 18.24fc733e.1714011449.1c87c10e

It’s time to meet your financial goals

Discovering your goals is the first step to reaching them. We’ve made it easy to get started. We offer account choices based on your needs.

You've got goals. We've got solutions.

Spending & saving.

Do more with your money

Fidelity cash management products help you spend and save smarter so you can reach your goals.

Trading & investing

Invest the way you want to

Whether you are an active trader or investing in the future, we can help you reach your goals.

Your future starts now

Whether you want to manage retirement planning on your own or have us guide you, we’re here to help along the way.

Wealth Management

Work with a dedicated advisor

We'll partner with you on a customized plan designed to help grow and protect your wealth.

Review Fidelity Brokerage Services with FINRA's BrokerCheck

Regulatory summary of Fidelity services (PDF)

Get started with some of our most popular accounts

Whether you want to invest on your own, or have us do the work, we have account choices for you. And we’ve got tools and resources to help along the way.

Brokerage account

Diy investing.

Manage your own investments (stocks, ETFs, mutual funds, CDs, and more), with help from our free resources.

Tax-free growth 1

With a Fidelity Roth IRA, you get the flexibility to save for retirement, while balancing your long-term goals with your short-term needs.

Fidelity Go ®

Robo investing.

Our robo advisor will handle your investments, so you don’t have to. Automated investing with no account minimums. 2

Retirement IRAs

Rollover IRA

Traditional IRA

Investing & Trading

Brokerage Account

Spending & Saving

Cash Management Account

See all accounts

Small investments could help your money grow

Investing account

FDIC-insured savings account

Chart is a hypothetical comparison. Investing involves risk of loss and performance is not guaranteed.

The hypothetical chart above illustrates the potential growth of an investment account assuming a 7% annual nominal investment growth rate vs. a 0.47% National savings account deposit rate as of January 16, 2024.* This chart assumes estimated/average return rates stay constant over the course of the time horizon and that no withdrawals were taken. Taxes, fees, and inflation are not included. Unlike traditional FDIC savings accounts, investment accounts are subject to market risk and do not carry FDIC insurance to protect from loss. Each type of account has its own unique set of potential benefits and limitations that you should consider before deciding what type is right for you.

Interact with the slider to increase or decrease the monthly contribution to discover how the money could grow in an investment account vs. an FDIC savings account. The monthly contribution is how much you want to invest every month. In this chart it is set at $250, but you can move the slider from $1 to $1,000 to see how your contributions could grow over time. For example, a $250 monthly contribution in an investment account could grow to $304,993 in 30 years compared to $96,634 in a traditional savings account, using end of month compounding.

This example is for illustrative purposes only and does not represent the performance of any security. The assumed rate of return is not guaranteed. Investments that have potential for a 7% rate of return also come with risk of loss. Past performance does not guarantee future results.

* FDIC: National Rates and Rate Caps

Best Online Broker for Beginning Investors

Rated #1 for Overall Broker

Best Online Broker

Why choose Fidelity?

Affordable accounts

We put you first by charging no fees or minimums to open a retail brokerage account 3 to help you spend and save smarter.

We are here to help

Our dedicated team of professionals are here to help when you need them.

Tools for every solution

From managing your everyday finances to planning for your child’s college education, we offer support to help you plan.

Use our Virtual Assistant

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

For a distribution to be considered qualified, the 5-year aging requirement has to be satisfied, and you must be age 59 ½ or older or meet one of several exemptions (disability, qualified first-time home purchase, or death among them).

2. There is no minimum amount required to open a Fidelity Go account. However, in order for us to invest your money according to the investment strategy you've chosen, your account balance must be at least $10.

Zero account minimums and zero account fees apply to retail brokerage accounts only. Expenses charged by investments (e.g., funds, managed accounts, and certain HSAs) and commissions, interest charges, or other expenses for transactions may still apply. See Fidelity.com/commissions for further details.

The Fidelity Cash Management Account is a brokerage account designed for spending and cash management. It is not intended to serve as a customer's main account for securities trading. Customers interested in securities trading should consider a Fidelity Account ® .

Fidelity Go ® provides discretionary investment management, and in certain circumstances, non-discretionary financial planning, for a fee. Advisory services offered by Fidelity Personal and Workplace Advisors LLC (FPWA), a registered investment adviser. Brokerage services provided by Fidelity Brokerage Services LLC (FBS), and custodial and related services provided by National Financial Services LLC (NFS), each a member NYSE and SIPC. FPWA, FBS and NFS are Fidelity Investments companies.

Fidelity was named NerdWallet's 2023 winner for Best Online Broker for Beginning Investors, Best Online Broker for IRA Investing and Best App for Investing. Results based on evaluating 17 brokers per category. ©2017-2023 and TM, NerdWallet, Inc. All Rights Reserved.

StockBrokers.com 2023 Online Broker Review, January 2023: Fidelity was ranked No. 1 overall out of 17 online brokers evaluated in the StockBrokers.com 2023 Online Broker Review.

Investopedia , February 2023: Fidelity was named Best Overall online broker, Best Broker for ETFs, and Best Broker for Low Costs, among 25 companies.

The Fidelity Investments logo is a registered service mark of FMR LLC.

Investment advisory services provided through Fidelity Personal and Workplace Advisors LLC, a registered investment adviser, for a fee. Brokerage services provided through Fidelity Brokerage Services LLC, Member NYSE, SIPC. Both are Fidelity Investments companies.

The images, graphs, tools, and videos are for illustrative purposes only.

Fidelity Brokerage Services LLC, Member NYSE, SIPC , 900 Salem Street, Smithfield, RI 02917

- Mutual Funds

- Fixed Income

- Active Trader Pro

- Investor Centers

- Online Trading

- Life Insurance & Long Term Care

- Small Business Retirement Plans

- Retirement Products

- Retirement Planning

- Charitable Giving

- FidSafe , (Opens in a new window)

- FINRA's BrokerCheck , (Opens in a new window)

- Health Savings Account

Stay Connected

- News Releases

- About Fidelity

- International

- Terms of Use

- Accessibility

- Contact Us , (Opens in a new window)

- Disclosures , (Opens in a new window)

- Customer Service

- Open an Account

- Virtual Assistant

- Portfolio Log In Required

- Account Positions Log In Required

- Account Positions

- Trade Log In Required

- Trading Dashboard Log In Required

- Trading Dashboard

- Active Trader Pro

- Cash Management Log In Required

- Cash Management

- Bill Pay Log In Required

- Security Settings Log In Required

- Security Settings

- Account Features Log In Required

- Account Features

- Documents Log In Required

- Fidelity Alternative Investments Program Log In Required

- Tax Forms & Information

- Retirement Distributions Log In Required

- New Account Checklist Log In Required

- Refer a Friend

- What We Offer

- Build Your Free Plan

- Financial Basics

- Building Savings

- Robo Investing Plus Advice

- Wealth Management

- Find an advisor

- Life Events

- Saving & Investing for a Child

- Charitable Giving

- Life Insurance & Long Term Care Planning

- Wealth Management Insights

- Watchlist Log In Required

- Alerts Log In Required

- Mutual Funds

- Fixed Income, Bonds & CDs

- Markets & Sectors

- Retirement & IRAs

- Spending & Saving

- Investing & Trading

- Direct Indexing

- Sustainable Investing

- Managed Accounts

- 529 College Savings

- Health Savings Accounts

- Life Insurance

- The Fidelity Advantage

- Planning & Advice

- Straightforward Pricing

- Insights & Tools

- Security & Protection

- FDIC & SIPC Coverage

- Marketplace Solutions

- About Fidelity

IMAGES

VIDEO

COMMENTS

why the ether token may accrue value. In this paper, we examine this question more deeply on an investment thesis level and include some of the technical aspects related to the various investment theses. The following observations are discussed: • Ethereum may be best understood as a technology platform that uses ether (ETH) as a means of ...

We would like to show you a description here but the site won't allow us.

An executive from financial services giant Fidelity says that the investment thesis centered around Ethereum may be easier for institutions to understand compared to Bitcoin ().In a new interview on the Bankless YouTube channel, Fidelity's director of research Chris Kuiper says that the firm's Ethereum investment thesis could be an easier concept for blue-chip firms to understand.

Source: Fidelity Investments and FactSet. The performance shown above is in U.S. dollars and was calculated using monthly returns. The chart shows the cumulative performance of ... investment thesis on an existing investment changes. Designed to capitalize on Fidelity's research edge and expertise in generating differentiated insights.

Fidelity Digital Assets: Bitcoin Investment Thesis - An Aspirational Store of Value In this report, Fidelity Digital Assets focuses on the view that Bitcoin is an aspirational store of value.

Fidelity Investments, ... Statistical arbitrage/trading strategies consist of strategies in which the investment thesis is predicated on exploiting pricing anomalies that may occur as a function of expected mean reversion inherent in security prices; high frequency techniques may be employed and trading strategies may also be employed on the ...

At Fidelity Digital AssetsSM, we have conversations with investors at distinct stages in their digital asset journey - investors who are proactively working on their investment thesis, seeking validation of their thesis or have yet to embark on the process. In response to the range of investors in different stages,

Fidelity's Ethereum Investment Thesis delves into the value proposition of ETH from an investment thesis perspective, while also dissecting the technical aspects related to various investment theses. Key observations from the report include: Value Linked to Network Usage: The perceived value of Ethereum is tied to network usage and the ...

In October 2020, Fidelity Digital Assets, a branch of Fidelity focused on the crypto markets, released a report named "Bitcoin Investment Thesis: Bitcoin's Role As An Alternative Investment." In it, they analyze Bitcoin's role as an investment and what the future could bring for the world's first cryptocurrency.

Fidelity Bitcoin Investment Thesis - Jameson Lopp

Fidelity's proprietary Digital Assets Account (DAA) is an innovative investment account that gives your employees the option to gain exposure to digital asset investments and provides you more choice in your investment options to help meet the demands of your evolving workforce. The DAA leverages leading-edge technology, enterprise ...

In this video, Eryka Gemma from The Independent discusses Fidelity Investments' thesis on bitcoin.Fidelity Investments has announced that it will be investin...

Fidelity just released its Ethereum investment thesis. Copy and pasting this summary from a twitter thread by @beaniemaxi since the PDF is 18 pages long. The thesis basically says that unlike Bitcoin, Ethereum can be used to facilitate complex transactions which gives it a unique money like utility that hasn't really been considered.

BITCOIN'S ROLE AS AN ALTERNATIVE INVESTMENT 2 INTRODUCTION At Fidelity Digital AssetsSM, we have conversations with people at distinct stages in their digital asset journey who are proactively working on their investment thesis, seeking validation of their thesis or have yet to embark on the process. In response, we are compiling a series of ...

If there's one constant in the world of crypto, it's that it's never boring. In 2021, the markets went parabolic, with bitcoin making all-time highs and altcoins (non-bitcoin cryptocurrencies) taking off left and right. Then, 2022 ushered in a crypto bear market, bankrupting several crypto platforms and slashing bitcoin's price by over 70%.

Fidelity's Bitcoin Investment Thesis research shows that Bitcoin has extremely low correlation with other assets like stocks or gold. The report considers a situation of an investor allocating 5% of a multi-asset portfolio to Bitcoin. Fidelity has been a consistent supporter of Bitcoin and other digital assets.

News and other info. Fidelity Investments has been family-owned since it was founded by Edward Johnson II in 1946. The family currently owns 49% of the company. In 2015, Abigail Johnson climbed to ...

Bitcoin was the first cryptocurrency and has emerged as the most popular digital asset. Many investors and advisors have started to explore how Bitcoin works in order to consider introducing it to their investment practice. However, digital assets are still very new, and can seem complex from an investment and regulatory perspective.

Jameson Lopp :: Professional Cypherpunk

alternative investments. There are numerous factors to consider: 1. Riksa essmenss —t The digital asset space is volatile and is not appropriate for an investor with a low risk tolerance. Develop and agree on an investment thesis. Discuss how best to implement digital asset acquisitions and sales

Investment thesis. By thoroughly understanding each aspect of a company's business operations ... advice or advice in a fiduciary capacity and is not intended to be used as a primary basis for you or your client's investment decisions. Fidelity and its representatives may have a conflict of interest in the products or services mentioned in ...

Before investing have your client consider the funds', variable investment products', exchange-traded products', or 529 Plans' investment objectives, risks, charges, and expenses. Contact Fidelity for a prospectus or a summary prospectus, if available, or offering statement containing this information. Have your client read it carefully.

Before investing, consider the funds' investment objectives, risks, charges, and expenses. Contact Fidelity for a prospectus or, if available, a summary prospectus containing this information. Read it carefully. Fidelity Brokerage Services LLC, Member NYSE, SIPC. 900 Salem Street, Smithfield, RI 02917. 609606.8.0

Fidelity Investments offers Financial Planning and Advice, Retirement Plans, Wealth Management Services, Trading and Brokerage services, and a wide range of investment products including Mutual Funds, ETFs, Fixed income Bonds and CDs and much more.

Investment Thesis. Fidelity National Information Services (NYSE:FIS) has been struggling in the past two years, with the share price currently down over 65% from its all-time high in early 2021.

Analyze the Fund Fidelity ® Blue Chip Growth Fund having Symbol FBGRX for type mutual-funds and perform research on other mutual funds. Learn more about mutual funds at fidelity.com.