Home > ETD > DEP_FINMAN > ETDB_FINMAN

Financial Management Bachelor's Theses

Theses/dissertations from 2023 2023.

Financial literacy and financial well-being: A mediation analysis of fintech services adoption among selected generation Z in Metro Manila , Justine Marie M. Abad, Domique John T. Hernandez, Nehemih D. Pabillon, and Arianne Mae M. Teves

The impact of CSR practices and reporting on firm performance: Evidence from selected ASEAN-5 banks , Sharina B. Ahmed, Dominique Margaret O. Co, Marby Christina Alyanna R. Macob, and Julianne Annika Y. Yu

The impact of green investments on Philippine energy firms’ financial performance: The moderating role of environmental policies , Byrne Joshua B. Al-ag, Jillian Beatrice Roselli T. Gaerlan, Sean Daron Magat Guintu, and Jameson A. Ng

Behavioral finance and market efficiency: The responsiveness of the Philippine market during the COVID-19 pandemic , Greisa Eguia Alano, Arhen Richmond Payumo Nuguid, and Kenneth Gabriel Sanvictores Rojas

Sustainable finance: An analysis of the ASEAN-4 universal banking sector's sustainable growth rate (SGR) and its risk factors , Bianca Elise S. Alejandrino, Armandeep K. Bhuller, Arnel Jorge N. Francisco II, and Jean Christian C. Peralta

The long memory effect in ASEAN-6 stock markets from 2006 to 2022: A rescaled range analysis , Tricia Q. Almandres, Sharmaine Rose G. Estor, Michaela Wencee S. Ng, and Audrey T. Reyes

An analysis of the effect and influence of macroeconomic factors on 10-year government bond Yields in the ASEAN-4 , Dan Joseph L. Andres, Ronnie-Lans T. Ayuyao, Nathan John N. Deypalan, and Jan Marcus C. Naguit

The effects of behavioral biases on investment decisions of Filipino millennials and generation Z: Moderating role of financial literacy , Liezl Katherine C. Ang, Jean Ashley A. Masanque, Johannah Mae C. Nacario, and Renna Mae M. Paguntalan

Panel regression analysis of the link between ESG indicators and financial performance in the energy and transportation Industry of ASEAN 5 countries: A sectoral perspective , Rafael Antonio C. Arellano, Skye Orin L. Libarnes, Meg Allen G. Maayo, Joaquin Francisco T. Sun, and Pedro Enrique S.A. Villamejor

Smart beta investing: A comparative study of fundamental accounting metrics and traditional market capitalization indices to measure the performance of the Philippine Stock Exchange , Miguel Benedicto Ramirez Argamosa, Faith Robles Del Rosario, Veronica Marielle Ferrer Delmo, and Miguel Antonio Rodriguez Merino II

The moderating effect of institutional quality on the relationship between financial inclusion and the profitability of commercial banks in selected ASEAN-5 countries: An analysis , Miguel Rene Q. Balboa, Timothy Karl R. Dela Torre, Alexandra Yzabella H. Lazaro, and Nishie S. Yao

The impacts of oil price shocks on the stock market index of the ASEAN-4 countries from January 2012 to October 2022: An analysis , Miguel Enrico V. Banzon, Beatriz Colleen S. Calimlim, Hesed Heindrick S. Cariño, and Siegfried Paolo B. Malabanan

Granger causality between stock market and selected macroeconomic indicators: Evidence from the Philippines , Kenneth Richard O. Bardullas, Vinzze Joseph T. Co, Aaron Henric P. Leung, and Alyzza Ariane J. Tadeo

Sustainable finance: The impact of selected green bonds on issuing firms' greenhouse gas emission (GHG) levels in selected ASEAN countries , Jomabelle C. Bautista, Mary Aubrey C. Calma, Ezekiel C. Camilo, and Krystell Abigail L. Tan

Can it walk the talk? Determining the validity of random walk hypothesis and technical analysis in the Philippine stock market , Hazel P. Bongolan, Bea Eliza A. Delos Reyes, Jenielle Joye T. Ho, and Cale Robert S. Rasco

Total factor productivity using Malmquist DEA on selected ASEAN-5 life insurers from 2007 to 2021: An analysis , John Allen C. Caballa, Riana Jade Y. Ng, Cherilyn G. Tan, and Jon Calvin C. Uy

The relationship between economic indicators and stock exchange index of ASEAN-4 countries: Indonesia, Malaysia, Philippines, and Thailand , Craig Jimver Mikael C. Camino, Micko Briel D. Del Pilar, Paul A. Fuentebella Jr., and Bryan Stephen A. Hong

Utilization of financial ratios in selected financial models to predict financial distress among food manufacturing companies in the Philippines , Simon Hongying G. Chen, Jelline C. Cheng, Lyka Mari C. Javier, and Janine F. Ong

Analyzing the causal effects of the major ASEAN-4 countries exchange rates against the Philippine peso on the volatility of the Philippine stock market returns , Richmond Ryan S. Chua, Yung Ching S. Shi, Willy W. Tang, and Rico J. Wu

Impact of mega-sporting events on the host countries’ stock market performance and economic growth: Evidenced from the Southeast Asian Games , Wendy Cai Chua, Se Jin Kaibigan Jeong, Catherine Ke Ke, and Michelle Chen Lin

An evaluation of logistic regression and random forest model as early warning system models for assessing an equity market crisis in ASEAN-5 + 3 countries , Allister James R. del Rosario, Anne Ysobel P. Guzman, Michelle O. Kohzai, and Jay Ruel B. Zape

A comparative analysis of the performance of machine learning models for predicting stock prices from the years 2012 to 2022: Evidence from the ASEAN 5 stock market indices , Sameer D. Dhanani, Hugh Leon B. Escaño, Jasmine L. Lim, and Isaiah Franz Dominique L. Pascual

Evaluating the volatility spillovers in the foreign exchange market during extreme events from 2007 to 2022 using the EGARCH model: Evidence from the ASEAN-5 countries , Helen L. Diaz, Jan Peter T. Ignacio, Melanie Grace V. Namol, and Abby Gail C. So

An analysis on the impact of crude oil prices and macroeconomic indicators on the ASEAN-5 stock market index: The 2022 Russian invasion of Ukraine , Sophia Anne B. Gallardo, Jasmine F. Kau, Christelle Joy V. Remegio, and Jaylyn M. Vibar

An analysis of the relationship between stock prices and financial ratios of banks based on the ASEAN-4 , Rica Anne A. Ko, Clarea Felice C. Lim, and Stacey Elaine T. Yap

Determinants of property sector profitability: Empirical evidence from the selected publicly listed real estate companies in the ASEAN-5 , France Gabriel D. Palileo, Miguel Faustino O. Mallari, Paul John S. Sison, and Mary Angeleen V. Teodosio

Financial literacy and fintech adoption among millennials in Metro Manila, Philippines: An analysis , Alyanna Marie L. Toh, Stacey Eunice U. Lee, Jason W. Su, and Athena Micah B. De Guzman

Theses/Dissertations from 2022 2022

Effects of volatilities on property sector indices of ASEAN-6 pre, during, and after the Global Financial Crisis and during the COVID-19 pandemic from 2006 to 2022 , Maria Charizza Acuña, Ernest Joseph Coronel, Margarita Lauren Cortez, and Nathalie Raika Julio

The impact of exchange rate volatility on the stock market index returns of select developed and developing Asian countries: An analysis , Alianne J. Alfonso, Mariela C. Cai, Erika Anne D. Jaurigue, and Sofia Eloisa U. Placino

Philippine financial institutions' counterparty default risk and stock price relationships: An analysis , Gerard Constantine Amano, Juwan Kenzie Gomez, Gilbert Angelo Juan, and Jan Michael Pioquinto

The effect of ESG activities on the financial performance of PSE listed companies during the COVID-19 pandemic—Evidence from the Philippines , Andrea Danielle S. Amil, Raizen Philippe M. King, Rondel Y. Ortiz, and Gweneth Allona Mikaela B. Te Tan

The impact of COVID-19 and specific control indicators on the performance of selected universal banks in the Philippines , Keana Aedrielle Modesto Ang, Bea Alexis Gotay Lim, Issey Miuccia Domminiq Uy Tan, and Jenny Huang Zhang

A study on the determinants of dividend payout policy: Evidence from the ASEAN-5 countries , Princess Askha Intal Artates, Mary Coshey Israel Dabatos, Claire Aimy Padilla Sendin, and Reynalyn Del Mundo Tenorio

Forecasting value-at-risk during crises in select ASEAN stock market indices through GARCH-EVT models , Janelle Fatima A. Balmaceda, Maxim Anthonnae M. Miranda, Mary Haniel Joy M. Parba, and Patricia Anne M. Zapanta

The relationship of the daily number of COVID-19 cases, lockdown classifications in the National Capital Region, and Philippine stock returns: An analysis , Beatrice Q. Bañagale, Dazle M. Edralin, Joaquin Pierre T. Guinto, and Isabelle Rhein D. Rivera

Financial development in the ASEAN 8: Impact of foreign direct investment and institutional quality , Katherine Marie F. Batto, Julie T. Caguioa, Sophia L. Cruz, and Sofia Julia S. Uy

The rise of fintech in the Philippines: A study on the impact of digital finance and demographics on financial inclusion and its effect on economic growth , Sofia Angeli M. Bobier, Gillian Clare O. Carbonilla, Alessandra Rayne L. Mallari, and Erika Marie D. Moleno

Investigating the long-term co-movement and spillover effects of the stock markets between the United States and the ASEAN-5 countries for the periods up to and after the 2008 Global Financial Crisis and the COVID-19 pandemic , James Paul Misa Calub, Stephanie Joyce Chua Chan, and Elisa Kyle Agulto Lim

The effect of credit and liquidity risk management practices on the profitability ratios of selected Philippine thrift banks , Renee Ysobelle S. Canlas, Jerlene E. Coronado, Joana Raquel S. Gianan, and Stephanie Mae C. Hu

A relationship between world oil prices and Philippine mining and oil sector index: A comparative study of multivariate GARCH approaches , Errol Stephen Santos Chan, Justin Matthew Carrasco Hou, Mychael John Llamado Ong, and Marcus Adrian Garyth Ejercito Tan

Evaluating the impact of competition on the profitability and the stability of the commercial banking sector: A case of selected Asian countries (2008-2020) , Gianina Jewel Paredes Chan, John Matthew Menco Chua, Jeanne Marie Lim Si, and Christian Rosales Sy

Examining financial performance of ASEAN REITs from 2020-2022 , Lorenz Dominick Santos Chon, Martin Clifford King Ornido, Bryce Harvey Angsanto Tan, and John Henderson Co Tan

An analysis on the total factor productivity of selected commercial banks in the ASEAN-5 countries using Malmquist-DEA analysis from 2006-2020 , Kervin T. Chua, Maria Jeanette C. Mallari, Joacquin Carlo A. Navales, and Chelsea Ann A. Yu

The impact of human development in the ASEAN 5 countries on financial inclusion (2015-2019): An analysis , Danica Deryll C. Condes, Justin Nicholas D. Nocum, and Kenneth C. Sevilla

Behavioral biases and demographic factors influencing Filipino’s investment decision during the COVID-19 pandemic: An empirical study , Chevy Louise G. De Guzman, Pierre Angelo A. Lopez, Alley Jill Q. Ocampo Tan, and Jannah Andre A. Seville

Relationship of information and communication technology (ICT) and stock market development (SMD): Empirical evidence using a panel of ASEAN-6 and East Asian-3 countries , Erica Jillian Allison S. Dela Cruz, Huihuang Shi, Edward Spencer D. Tan, and Micah Lovell V. Tan

Analysis of the impact of selected financial ratios and macroeconomic factors on share price: Empirical evidence from selected emerging ASEAN countries mining and oil sector , Marielle C. Dela Cruz, Kieza Francesca C. Garra, Samantha Rose V. Pontines, and Serin Hanbyeol A. You

Will the renminbi emerge as a safe-haven currency? Evidence from the tiger cub economies’ stock market volatility from 2016 to 2021 , Paolo Manuel D. Delfin, Kay Lin Ding, Hana Juniela N. Sebe, and Sofia Nicole C. Villanueva

Financial integration in ASEAN emerging markets: The relationship between macroeconomic variables and stock index performance from 2011 to 2020 , Loren Margaret Malabanan Dizon, Mico Angelo Pasion Magturo, Maria Nicole Sebastian Molina, and Rainiele Clarice Galaura San Juan

A comparative analysis of the risk-adjusted performance of Philippine active and passive equity funds before and during the COVID-19 pandemic , Luisa L. Dizon, Irvin Avery F. Ng, Audrey Nicole F. See, and Lance Spencer T. Yu

Information and communication technology (ICT), economic indicators, and banking sector indicators: Its impact on the ASEAN-5 countries' banking sector performance: An analysis , Piero Antonio D. Dominguez, Samantha Colleen M. Francisco, and Maria Regina T. Ignacio

Influence of digital finance accessibility on financial inclusion and bank stability: Evidence from the ASEAN , Jameson Esparas and Faustine Angela B. Zipagan

A study on Filipino investors and their intention to invest in mutual funds in the Philippines , Jaan Alexander Lacap Gana, Mauro Ramon Campos Lacson, Dheeraj Motiani, and Yu-jin Dacula Nam

A comparative study on the impact of COVID-19 pandemic and exchange rate on the stock market returns of the Philippines and Thailand , Jan Gavin Santos Go, Bea Jilian Banaag Llana, Reignard Alric Chong Uy, and Aaron Elian Lardizabal Yaneza

The significance of microfinance to Pototan rice farmers in the Philippines: An analysis , Mikaela Luis A. Gutierrez and John Dominic D. Hechanova

Comparative analysis of top cryptocurrencies to other financial markets , Chadwick Wayne G. Ilagan, Stephen C. Ong, and Juanito P. Valdecantos IV

The impact of sustainability reporting on corporate financial performance: A multilevel modelling approach using evidence from publicly listed companies in the Philippines , Julienne Elisha Q. Juan, David Joshua T. Marin, John Raymond D. Reyes, and Shaila Kimberly U. Sy

A comparative assessment of Benjamin Graham's stock selection criteria as quantitative investment strategy in ASEAN-5 markets post global financial crisis: An examination of the defensive and enterprising investor approach , Geoffrey James O. Lim, Jose Rafael M. Malamug, and Ethen Aldrich P. Panugayan

The effects of the adoption of blockchain technology on selected ASEAN banks’ stock performance: An event study , Angelo Gabriel G. Lopez, Joachim Santino G. Palacios, Romualdo Anton T. Rosas, and Samantha T. Santos

The effect of fintech on the efficiency of selected Philippine universal banks using DEA from 2010 to 2019 , Sarah Frances O. Ludo, Joaquin Vicente C. Sese, Leah Beatrice S.D. Tagabucba, and Regine Elixhea S. Torres

An assessment of risk management's mediating effect on financial innovation and bank's performance: A study of selected ASEAN-5 listed commercial banks from 2018-2020 , Raphael Gerardo Nisce, Louise Kate R. Ramirez, and Kataaki M. Watanabe

The effect of selected financial ratios and macroeconomic factors on stock price: A study of Bursa Malaysia Berhad's listed energy companies from 2015 to 2019 , Rexwin Anthony Osida, Joanne Chelsea B. Pecson, and Miguel Benedicto C. Tupas

Efficiency, financial performance, and stock returns of the food and beverage industry: A study on the ASEAN 5 , Jan Dominique O. Tan, Hanns Dominic W. Chen, Christian Lance L. Haw, and Queenie Yvette S. Shi

Theses/Dissertations from 2021 2021

A comparative study: Underpricing and long-run performance of initial public offerings in Singapore Exchange and Bursa Malaysia from 2007-2016 , Ann Nicole Louise L. Ang, Alexa May B. Domingo, Paula M. Maniulit, and Ysabel T. Maniulit

Women empowerment through microfinance: Twenty year historical data analysis of selected microfinance institutions in NCR and CALABARZON , Bianca Erica D. Bala, Cristina Mae Y. Chu, Paolo Tristan L. Chu, and Dustinmico S. Wee

The relationship of stock returns with systematic risk in the ASEAN-5 Region: A panel data approach analysis of the relationship prior to and during the COVID-19 pandemic , Wren Angelo Encarnacion Banaag, Maxinne Vaughn Julia Catoto De Guzman, and Kassandra Mari Banawa Luces

The impact of financial literacy, attitude, and behavior on financial well-being among Metro Manila residents , Erika Shaine Chong Bana Lim, Domingo Maria Carmona Garcia IV, Joiecel Labung Tan, and Alyssa Janine Hong Yao

The effect of the coronavirus (COVID-19) on the optimal portfolio composition of select industry sectors in the Philippines , Laxmir Roselle Magpantay Biacora, Ida Augusta Ramos Lim, Marc Ivan Pagtama Lanuza, and Denise Nicole Pimentel Lim

Cardinality-constrained approach: Small portfolios breakthrough in the Philippine market from January 2015 to December 2019 , Judely Ann Calipusan Cabador, Clarissa Lingat Calo-oy, Krisma Allu Gapasin Duldulao, and Juliene Faye Palmares Zamora

Empirical analysis: Application of specific GARCH models in examining stock market volatility , Adrianne Nicole J. Canonizado, Charles Lawrence L. Chua, Jon Pryce Y. Go, and Jackie C. Yu

The relationship between financial literacy and fraud detection between generation X and Y Filipinos in Metro Manila, Philippines , Elijah Climaco Castañeda, Eric Paul Mariano, and Mark Ildefonso M. Zurbano III

Evaluating early warning systems for currency crisis in select emerging ASEAN economies , Mikhaela Kristine R. Chan, Berndhart S. Co, Mary Khristine P. Juan, and Erryl Ron M. Lacanlale

A PLS-structural equation modelling of the role of financial inclusion, financial technology, financial stability, and bank competition on economic growth in ASEAN , Lou Marie Princess Dimalibot Chua, Richelyn May Pantig Chua, Kim Borja Fernandez, and Ericka Christian Ando Javate

A panel analysis of Philippine banks’ loan portfolio quality in relation to their bank lending rates, bank performance, and key accounts , Antonio Miguel Tayag Coronel, Lorenzo Jose Morales Prieto, Zach Gabriel Server Rapanot, and Xavier Maria Castro Roxas

An analysis on the effect of demographic characteristics and e-money usage towards bank account ownership in the Philippines , Miguel Carlos S. De Guzman, Zores Miguel A. Declaro, Vincent Thomas F. Garcia, and Dana Erika E. Julaton

A comparative analysis of the inflation hedging properties of gold, stocks, corporate bonds, and foreign currency in the Philippines from years 2011-2019 , Ma. Danielle Kyle L. de Jesus, Eduardo Wolfgang U. Gargarita, Dessa Fay A. Isubol, and Eira Jasmine H. Javaluyas

The impact of the COVID-19 pandemic on revenue diversification of selected banks in the ASEAN 5 countries , Alma Grace De Vera, Adrian Keith Deparene, Regina Sofia Ong, and Jonas Marvin Villar

Examining the impacts of environmental, social, and governance (ESG) considerations on millennials and generation Z’s investment attitudes and behaviors , Micaella Danielle Go, Mary Agnes Alita Grino, and Tyrone Kyle Jambalos

Behavioral factors influencing retail investors’ decision making during the COVID-19 pandemic: A study on the Philippine stock exchange , Justin Martin Meneses Jacaria, Ma. Isabel Anacleta San Jose Paredes, Matthew Jeremy Sacdalan Quismorio, and Gonzalo Philip Centennial Caligagan Exconde

Value investing and technical analysis in the Philippine Stock Exchange, investing in the five different sectors after the financial crisis of 2008 from the years 2010-2019 , Mathew Luis L. Marzan, James Ryan A. Sese, and Bryan Michael C. Yap

An analysis of the relationship between financial performance of Microfinance Institutions and the Sustainable Development Goals , Samuel Villacruz, Dallin Torio, Jing-Jing Go, and Carolyn Tan

Theses/Dissertations from 2020 2020

The effect of ASEAN-4 stock market volatility on the Japanese yen as a safe haven asset from 2003 to 2019 , Angela Angie Wu Chen, Kymberlin Rae Chan Cua, and Shiela Camille Chua Lao

Advanced Search

- Notify me via email or RSS

- Collections

- Disciplines

- Colleges and Units

Submissions

- Submission Consent Form

- Animo Repository Policies

- Submit Research

- Animo Repository Guide

- AnimoSearch

- DLSU Libraries

- DLSU Website

Home | About | FAQ | My Account | Accessibility Statement

Privacy Copyright

Skip to Content

University of Colorado Denver

- Campus Directory

- Events Calendar

- Human Resources

- Student Services

- Auraria Library

- CU Denver Police

- University Policies

Schools and Colleges

- College of Architecture and Planning

- College of Arts & Media

- Business School

- School of Education & Human Development

- College of Engineering, Design and Computing

- Graduate School

- College of Liberal Arts and Sciences

- School of Public Affairs

Campus Affiliates

- CU Anschutz Medical Campus

- CU Colorado Springs

Major in Financial Management (Bachelor's)

Credit hours: 120

Full-time, part-time, most classes have online options

12:1 student-faculty ratio

Start terms: fall, spring, summer

Learn with purpose

The backbone to any company is its finance team. This degree gives you a strong base in both accounting and finance. With a solid understanding of both disciplines, you’ll be well-versed in corporate finance and investment services. Our graduates go into careers in areas such as banking, trading, and brokerage firms.

Request Information

Visit Us Online or In Person

Apply to CU Denver

places us in the top 5% worldwide

of all new CU Denver freshman identify as students of color

Classes offered on-campus and online

Real-world experience required as a part of your degree

- Program Features

- Careers and Learning Outcomes

- Tuition and Scholarships

- Double Major and Certificates

- How to Apply

- Application Deadlines

When you choose CU Denver, you turn your passion into the career you love. Any of the programs you join support that mission by incorporating applied coursework into your classes. Distinguishing features of our program include:

Learn by doing – a required experiential learning component as a part of your degree

Well-rounded education – build a foundation in liberal arts classes before honing in on your business education

Access to business leaders – proximity and close ties to businesses make it easy for executives to visit our classrooms and career events

You’ll be surrounded by people finding their passion and making something of themselves. You could also take advantage of the location and flexible schedule to complete internships and class projects in some of the hundreds of businesses nearby. With over 300 business partnerships tied to the Business School, you’ll graduate ready and confident to enter the workforce at your desired job.

Denver Built. Global Ready.

Business can be a powerful force for good. But the promise of business hasn’t been extended to enough people. We want to change that. At CU Denver Business School, we make the most of being deeply embedded in the heart of Denver and the nation’s fastest-growing economy to open doors and lower barriers to success. Through our programs and partnerships, we create more inclusive business networks and cultures. We can equip any future, locally and globally.

The bachelor of science in business administration curriculum consists of 120 hours comprised of business classes and liberal arts classes to give you a well-rounded education.

CU Denver core (34 hours)

Hone your knowledge with coursework in English, math, behavioral and social science, humanities, international perspectives, and cultural diversity.

General non-business courses (12 hours)

These courses are taken outside of the Business School, but support a stronger awareness of disciplines relevant to business studies. Course topics include:

- Professional speaking

- Microeconomics

- Business writing

- Experiential learning

Business core (36 hours)

Making an impact looks like YOU! Apply your education directly to a problem facing business today. Choose from an internship, a project-based course, or study abroad for your experiential learning experience. Your business classes will take you through the hard and soft skills necessary to succeed in business. You will also gain an international business perspective through the required international course.

Your business classes will take you through the hard and soft skills necessary to succeed in business. You will also gain an international perspective of business through the required international course. Course topics include:

- Career and professional development

- Business statistics

- Business problem solving

- Managerial accounting

- Business law and ethics

- Operations management

- Business policy and strategy management

- Managing of individuals and teams

Major classes

A mix of both the accounting and finance coursework, you’ll have a strong understanding of the distinctions and overlap between both disciplines. Financial Management course topics include:

- Management of business capital

- Investment and portfolio management

- Income tax accounting

- Financial accounting

Electives and/or foreign language proficiency

Foreign language courses may be satisfied if you’ve taken a certain number of classes in high school. These electives give you the freedom to dive deeper into topics or courses that interest you.

Careers in Financial Management

Financial Management jobs are found in nearly all corporate, public sector and non-profit organizations. Key areas include corporate or public finance, banking, and investment services.

Financial Services Job Titles

- Financial Analyst

- Chief Financial Officer

- Credit Manager

- Risk Manager

Visit our Careers page for more detailed information on the resources available.

Core Courses (November 13, 2019)

Value 1: Foundational Business Knowledge

Outcome: Explain foundational concepts associated with core business disciplines, including accounting, economics, finance, business statistics, operations management, business law, organizational behavior, marketing, information technology, and global strategy.

Value 2: Critical Thinking

Outcome: Analyze business problems using appropriate analytical and critical thinking skills.

Value 3: Ethical Practice

Outcome: Make ethical decisions, translating ethical principles into business practice.

Value 4: Effective Communication

Outcome: Effectively communicate a business message.

Value 5: International Perspectives

Outcome: Explain the impact of international perspectives on business strategy and operations.

Value 6: Business Technology

Outcome: Use appropriate business-related technologies to address business problems.

To demonstrate understanding of Business Concepts undergraduate business students take the ETS® Exam which contains 120 multiple-choice questions designed to measure a student’s subject knowledge in Accounting, Economics, Management, Quantitative Business Analysis, Information Systems, Finance, Marketing, Legal and Social Environment, and International Issues. More information.

Other objectives are assessed in individual courses using relevant projects, presentations or exam questions.

The cost of tuition for the BS in business administration degree is different for in-state and out-of-state students.

Residents of Western Interstate Commission for Higher Education (WICHE) states may qualify for reduced tuition rates. The Western Undergraduate Exchange (WUE) program requires students to maintain current residency of WICHE state until degree completion.

Learn more about the WUE program

Scholarships

If you’re worried about financing your education, the Business School offers scholarships for incoming students. Each scholarship looks at a number of different factors from academic performance to community involvement. You will automatically be considered for these scholarships when you submit your application.

$2,000 scholarship ($500/semester for 4 semesters) open to incoming freshmen who have 2.75 or higher GPA and are first-generation college students.

$2,000 scholarship ($500/semester for 4 semesters) open to incoming transfer students who have at least 24 transfer credits and a 3.3 college GPA.

Up to $10,000 scholarship (up to $1,250/semester for 8 semesters) open to incoming freshmen who have demonstrated superior high school performance and community service. Minimum 3.5 HS GPA.

$2,000 scholarship ($500/semester for 4 semesters) open to Veteran or Active Military students who have a 2.75 or higher GPA.

$2,000 scholarship ($500/semester for 4 semesters) open to high school graduates of Denver Public Schools with a minimum 2.75 GPA. Must indicate interest in Business when applying to CU Denver.

We also offer additional scholarship opportunities for current students every semester. Scholarship opportunities are based on program and course enrollment.

Double Major

Many students utilize the flexibility of the degree to major in two separate disciplines. With careful planning, you may be able to add a double major without extending your graduation date. Major requirements could overlap depending on which majors you decide on.

Discover other BSBA majors that might interest you.

Certificates

You can add an undergradute for-credit certificate to enhance your degree or explore a new area of interest to you.

Application Checklist

Online application $50 domestic, $75 international application fee SAT and ACT optional High school transcript or GED score College or community college transcript – transfer applicants only English language proficiency — international applicants only

Apply Now

Admission Requirements

If you are an incoming freshman to CU Denver, you can apply through either the Common Application or the Milo Application. Transfer students and international students will need to submit the Milo Application.

Incoming first-year students

CU Denver requires that students complete the Colorado Higher Education Admission Requirements (HEAR). You will not have to meet all Minimum Academic Preparation Standards (MAPS) for admission, but you will need to be completed through CU Denver coursework by graduation.

Transfer Students

We have strong connections with other four-year and community colleges. If you have completed more than 24 hours of transferable coursework, you will be evaluated for admission on the basis of your college GPA without regard to your high school performance. If you have fewer than 24 hours, you will be evaluated based on both your high school and college GPAs. For more information and to plan your transfer, see transfer admissions in the admissions office.

International Students

You will need to begin your application through the Office of International Affairs . They will help you manage your application process.

Domestic Applications

International applications.

Priority: September 15 Final: October 15

Priority: January 15 Final: March 15

Priority: March 15 Final: May 15

See yourself at CU Denver

Follow your passion

No matter your background, you’ll have access to a career and professional development course as a Business School student. Through this course, you’ll be introduced to all of the resources available to you as a student including:

- Career events

- Student organizations

- Resume and personal branding training

- Career planning

Find your people

Our students bring their passions outside of the classroom. We offer a number of clubs that give you an opportunity to build your resume and relationships with your peers at the same time.

- Beta Gamma Sigma

- Business Student Ambassador Committee

- Student Center for the Public Trust

- Beta Alpha Psi

- Portfolio Management Group

See your future

“This degree not only opens doors of opportunities but also reflects my gratitude for the support network at home and CU Denver that played an important role in my success. I believe this degree truly symbolizes the power of perseverance and support in overcoming challenges.”

– Alexxis Cornelius, ‘23 , BSBA, Accounting & Financial Management

Major in what matters

A career team dedicated to you.

In the heart of downtown Denver, you have easy access to hundreds of employers. Our career team has developed close relationships with quality employers and regularly brings them in for career fairs and panel events. It’s no surprise that employers have told us they prefer CU Denver students, because they know how motivated our students are to succeed.

Take the first step of many towards your future career. Our career team offers a number of services that help you:

- Gain confidence to interview and network with employers

- Find opportunities to land an internship or job of your dreams

- Create your personal brand —online and in-person

- Introduce you to business etiquette and corporate culture

Employers know we produce work-ready graduates

“CU Denver students have real-world experience and are ready to talk about their jobs. There’s a reason we keep coming back.” – S&P Global

“When I see a name tag with ‘CU Denver Business’ on it, I know that I’m talking to a high-quality candidate.” – TIAA

“Every single student has shown up excited about why we’re here. I’ve been really impressed with students’ knowledge, their preparedness, and what they are bringing to the table. It has upped the game tremendously for new hires.” – Marketo

Start the conversation.

Request More Information

- MBA Programs

- MS Programs

- BSBA Program

- For Current Students

- Faculty & Staff Intranet

- Website Feedback

- Privacy Policy

- Legal Notices

- Accreditation

© 2021 The Regents of the University of Colorado , a body corporate. All rights reserved.

Accredited by the Higher Learning Commission . All trademarks are registered property of the University. Used by permission only.

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

The Bachelor of Science in Business Administration Major in Financial Management Graduates of Tarlac State University

This paper aimed to determine the employment status of Tarlac State University (TSU) Bachelor of Science in Business Administration major in Financial Management (BSBA-FM) graduates. Two hundred sixty eight (268) questionnaires were fielded to respondents covering academic years 2010 to 2015. The findings revealed that a large majority of BSBA-FM graduates are employed in private and government entities. Likewise, the BSBA Financial Management Program and the specific subjects contained therein matched the needs of employers. The results proved that TSU produces graduates who can be employed. However, only a small percentage of the graduates are working in Manila-based firms and in areas outside of Tarlac. In addition, only a handful of the graduates are master's degree holders. The study revealed the need to encourage graduates to pursue postgraduate studies so as to boost their confidence and increase their chances of landing jobs in bigger Manila-based firms.

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

Popular Keywords

No Record Found

Bachelor of Science in Business Administration, major in Financial Management (4 years)

Offered by the College of Commerce and Business Administration – Department of Financial Management

Description

The Bachelor of Science in Business Administration program offers a wide range of specialized majors, namely Business Economics, Financial Management, Human Resource Management, and Marketing Management. The program focuses on the interrelationship of the different functional areas of business. It equips students with technical and practical knowledge in making informed business decisions.

Bachelor of Science in Business Administration, Major in Financial Management is a four-year degree program that provides students with a strong foundation on theories, principles, and concepts that equip them with relevant technical and analytical skills necessary in financial decision-making, cognizant of a dynamic domestic and global business environments, and mindful of their role in nation-building. The students’ terminal outputs are research undertakings that are geared toward both application of learned concepts and/or theory development.

The program is anchored on its three-item agenda: (1) a competency-based curriculum; (2) a mix of faculty who have relevant industry practice and years of teaching experience; and (3) student-centered co-curricular and extra-curricular activities.

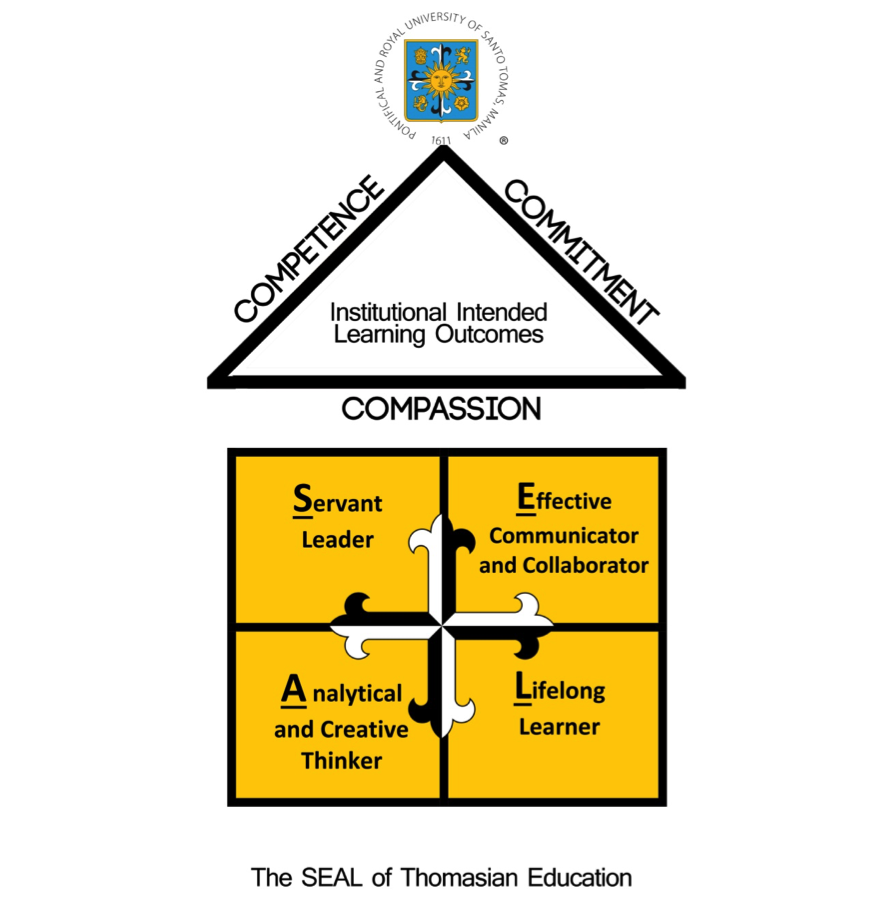

Becoming Part of the Program

The University of Santo Tomas, in pursuit of truth, guided by reason and illumined by faith, dedicates herself to the generation, advancement, and transmission of knowledge to form competent and compassionate professionals committed to the service of the Church, the nation, and the global community.

I am a Thomasian. I carry the SEAL of Thomasian education. I am a S ervant leader, an E ffective communicator and collaborator, an A nalytical and creative thinker, and a L ifelong learner. With Christ at the center of my formation as a Thomasian, I am expected to demonstrate the following Thomasian Graduate Attributes ( ThoGAs ):

SERVANT LEADER

- Show leadership abilities to promote advocacies for life, freedom, justice, and solidarity in the service of the family, the local and global communities, the Church, and the environment.

- Implement relevant projects and activities that speak of Christian compassion to the poor and the marginalized in order to raise their quality of life.

- Show respect for the human person, regardless of race, religion, age, and gender.

EFFECTIVE COMMUNICATOR AND COLLABORATOR

- Express oneself clearly, correctly, and confidently in various environments, contexts, and technologies of human interaction.

- Work productively with individuals or groups from diverse cultures and demographics.

- Show profound respect for individual differences and/or uniqueness as members of God’s creation.

ANALYTICAL AND CREATIVE THINKER

- Show judiciousness and resourcefulness in making personal and professional decisions.

- Engage in research undertakings that respond to societal issues.

- Express personal and professional insights through an ethical and evidence-based approach.

LIFELONG LEARNER

- Engage in reflective practice to ensure disciplinal excellence and professional development.

- Exhibit preparedness and interest for continuous upgrading of competencies required by the profession or area of specialization.

- Manifest fidelity to the teachings of Christ, mediated by the Catholic Church, in the continuous deepening of faith and spirituality in dealing with new life situations and challenges.

- Apply both basic knowledge and practical skills that are relevant in the real-world setting

- Acquire knowledge and understanding of various management concepts, theories, and principles requisite of a sound decision-making as applied in various business situations

- Articulate ideas through written and verbal forms, aided by information technology, to critically, analytically and creatively solve problems

- Demonstrate commitment to the core values of being a Thomasian guided by the teachings of the Church

Program Intended Learning Outcomes (PILOs) Specific to BSBA, Major in Financial Management

- Demonstrate knowledge and understanding of various financial management concepts, theories, and principles requisite of a sound decision-making as applied in both individual and corporate settings, cognizant of their role in nation-building.

- Graduates acquired eligibility to take certification examinations because of the alignment and conformance of curriculum with international and local standards (i.e., CFA, CISI, SEC-PSE, BAP, PIRA, etc.).

Application Period: July to December of each year

Application Website

Release of Results: January 28 of the following year

Go to THIS PAGE and look for the “College of Commerce and Business Administration” tab for the tuition fees.

With the current global issue on the spread of Covid-19, it is highly anticipated that for the First Term, AY 2020-2021, course delivery may be through online or blended learning. Online delivery will be in the form of synchronous classes and/or asynchronous classes (modular, content-based, etc.). Assessments may also be done online.

Career Opportunities

Financial Analyst

Investment Researcher

FOREX Specialist

Fund Manager

Trust/Treasury Assistant

Equity Analyst/Bond Analyst

Stocks/Bonds/Derivatives Trader or Broker

Bank Management Trainee

Financial Consultant

Finance Supervisor

Risk Management Associate

Student Experience and Support

The University of Santo Tomas provides student services that cater to academic, spiritual, and wellness concerns of students. These support units are found in the different parts of the campus and can be accessed by Thomasians. When the University shifted to distance learning, the services also transitioned to online services to continue addressing the needs of Thomasians.

Program Curriculum (New)

Program curriculum (new).

Effectivity: A.Y. 2023-2024

This curriculum may have some changes upon the availability of new guidelines.

Effectivity: A.Y. 2021-2022

Effectivity: A.Y. 2018-2019

Program Policies

• Religious activities are given to students, such as recollection for 1st & 2nd year (in-campus); pilgrimage to Manaoag for 3rd year (off-campus); and retreat at Calaruega for 3 days-2 nights (off-campus) for 4th year. Attendance is a must and expected to all students who will enroll in the University.

Other academic requirements are given to students, such as educational trips (local & international), research works including thesis, project development, feasibility studies, strategic papers, business plan, business implementation, attendance in seminars (in- or off-campus), and participation in competitive contests.

Note: For all official off-campus activities, the College/Department provides an Undertaking Form requesting for Parental Consent & Waiver prior to the said activity. Medical clearance is needed in all off-campus activities.

Certification Exams such as TOEIC (English proficiency exam) for all 1st and 4th year students are also conducted.

All enrolled students are requested to read the student handbook that can be downloaded from their MyUSTe student portal (https://myuste.ust.edu.ph/student/). Important areas of consideration are as follows:

The University, in accordance with its Catholic & Dominican teachings, puts a high premium on the practice of honesty, the act of truth-telling, truth-seeking, truth-doing. Consequently, any act of dishonesty should be avoided. Acts of dishonesty may be sanctioned depending on the gravity of the case, even to the extent of dismissal or expulsion.

2. Courtesy

Courtesy is an act of respect towards another, in recognition of fundamental human dignity. Courtesy is a sign of one’s maturity. Its observance creates a climate of goodwill and fellowship. Thomasian students must, at all times, be courteous and respectful of others, most especially the guards-on-duty when they are approached for improper grooming.

3. Diligence

Thomasian students give honor to their family and to the University by being diligent in their studies. They should have a natural thirst for knowledge and view their attendance in the University as an opportunity to learn and improve themselves.

Thus, the student must:

a. Be punctual b. Be present in their classes and participate in school-sanctioned activities (cutting classes can be sanctioned & can be considered violation of this policy provision) c. Be prepared for their lessons, homework, and examinations given. d. Students are only allowed up to 10 hours of absences for the whole semester for each course/subject. Excused absences and absences due to sickness are also included in the 10 hours allowable absences.

- FA = failure due to absences; a student who incurs more than 10 allowable absences and has taken the preliminary exam but shall not be allowed to take the final exams

- WF = grade that is given to a student who stops attending classes before the preliminary examinations (did not take the prelim exams) without officially dropping the course/subject.

- WP = grade given to a student who stops attending classes after officially dropping the course/subject.

4. Good Grooming

Good grooming includes the wearing of the prescribed college uniform, the authorized shoes, the ID, the male haircut and other considerations that are similar to these. There are two (2) types of uniform for the College. Type A uniforms are worn starting the First Term up to Ash Wednesday. Type B uniforms are worn after Ash Wednesday up to the end of the Special Term.

Note: Unless otherwise allowed through a written permission by the administrators (Dean/Asst. Dean), all students must wear the proper uniform at all times within the University premises.

5. Decency & Modesty in Action

Thomasian students must, at all times, act with proper decorum and etiquette. Engaging in indecent or lewd conduct is contrary to the mores of Catholic behavior and morality.

- The University upholds the sanctity of human life, as well as the sanctity of the conjugal act within marriage. However, in the event that an unmarried student gets pregnant, she is encouraged to inform and seek the help of the SWDB Coordinator or the Guidance Counselor.

- The University, through the collaboration of the Regent, the Health Service Director, SWDB Coordinator, Guidance Counsellor, and the student’s parents, shall accompany the student through spiritual direction, medical assistance and guidance counselling.

- To give the student adequate time and space to prepare for the important responsibility of single parenthood and, secondarily, to avoid the possibility of offending the moral sensibility of students, parents, and the university community on account of her irregular status, a pregnant student shall then take a Mandatory Leave of Absence from the University upon public disclosure, whether deliberate or otherwise.

6. Maintenance of Peace & Order

The University upholds and protects peace & order within its community. Members of the Thomasian community are expected to give due regard to the rules and regulations formulated and implemented by the University authorities to ensure that peace & order may prevail. Thomasian students who impede, obstruct, prevent or defeat the right and obligation of a teacher or professor to teach his/her subject, or the right to attend his classes or any official activity shall be subject to disciplinary action. *REMINDER: Physical Examination is a must since a Medical Clearance is a requirement for all off-campus activities (co-curricular & extra-curricular) as mandated by the Commission of Higher Education.

7. Camaraderie

The University recognizes the role of molding Thomasian students as well-rounded social beings by encouraging formation and membership in organizations that advocate positive values and self-improvement. Hence, only student organizations whose objectives uphold the mission and goals of the University may be formed and recognized.

Students are advised to join only duly recognized student organizations either college-based or university-wide level to avoid being a victim of hazing.

8. Care for the Environment

The task of caring for and of maintaining a clean campus belongs not only to the University Administration, but also to the community. A clean, smoke-free and well-kept environment benefits everyone. Hence, Thomasian students are encouraged to actively participate in keeping the campus clean and in preventing pollution or other environmental degradation.

Environmental degradation may result from: a. Smoking (the whole University is a NON-SMOKING AREA) b. Littering and improper solid waste disposal (the St. Raymund de Peñafort Building is a styro-free building) c. Smoke-belching vehicles, or leaving the car engine on while parked inside the University premises d. Playing of car stereo with the use of bass amplifiers/boosters at a high volume; and e. Similar situations deemed detrimental to the environment

PPS 1028 – PENALTIES

Penalties shall be imposed for violations of the Code of Conduct to instill in the student the understanding that any act of misbehavior, willful violation and/or defiance of lawful rules and regulations has no place in a Catholic University.

When violations are committed, the ID of the student is confiscated by any administrative or academic official, faculty member, support staff, members of the Security force of the University and turned over to the SWDB Coordinator of the College. The erring student should claim his ID from the SWDB Coordinator or Assistant Dean at the earliest possible time to avoid additional violations.

Penalties are PROGRESSIVE in character, taking into account the previous violations committed by the offender. The penalties imposed shall range from: • Warning • Admonition (parents are called already) • Suspension • Exclusion (the name of the student is removed from the rolls of the University) • Expulsion (excluded from admission to any public or private school in the Philippines)

Additional penalties may be in other forms, such as but not limited to: • Payment of fine/civil liabilities • Non-issuance of certificate of good moral character • Disqualification from further enrolling in the University • Withholding/non-issuance of credentials (diploma & TOR)

Kindly abide or follow the Policy Guidelines of PPS 1027 – Code of Conduct & Discipline to avoid sanctions for violations and non-compliance thereof.

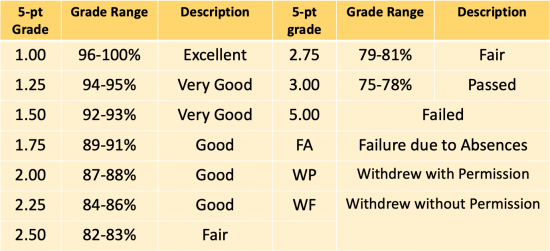

- Based on the 5-point numerical grading system, 1.0 is the highest and 3.0 is the lowest and 5.0 means failed (with .25 interval).

- The passing mark for all courses in the College is 75%.

- A grade of Incomplete (INC) is given to students who have failed to take the final examination or to submit a major requirement for a course on account of illness or other valid reasons. The student receiving a grade of INC should be able to complete the requirements immediately within the succeeding term; otherwise, a failing grade will be given.

The University confers honors upon her students who exhibited academic excellence in their fields of specialization. The following honors are awarded to graduating students:

- Cum Laude: GWA 1.46 – 1.75

- Magna Cum Laude: GWA 1.21 – 1.45

- Summa Cum Laude: GWA 1.00 – 1.20

The general weighted average (GWA) is based on all grades for academic courses including Theology and non-academic courses, PE and ROTC or NSTP from first year to fourth year.

In addition, no grade of 3.00 in any course and no major or grave offense committed based on the UST Student Handbook and not convicted of crime involving moral turpitude.

- Students with failures/deficiencies (less than 9 units) can enroll the concerned courses only on petition basis during the regular semester or special term.

- In case of failure/deficiency in a Theology course, there will be no petition class in the regular term or special term.

The University shall debar students who do not show satisfactory performance in their academic undertaking. Students with failures corresponding to nine (9) or more units are not to be readmitted in the succeeding semesters.

Program Recognition

PACUCOA Level III Re-Accreditation

The University of Santo Tomas is one of the leading private research universities in the Philippines and is consistently ranked among the top 1000 universities in the whole world. With academic degrees and research thrusts in the natural, health, applied, social, and sacred sciences, as well as business and management, the University continuously strives to make a positive impact on the society.

Visit Us: Espana Blvd., Sampaloc, Manila, Philippines 1008

Be Informed. Subscribe.

Send us your feedback.

© Copyright 2023. University of Santo Tomas. All Rights reserved. | Powered by Communications Bureau

Do more with Edukasyon.ph!

Get more college and career guidance by signing up to Edukasyon.ph! Gain access to free and premium career assessment tests, useful content to help you navigate college and helpful internship guides to start your career journey.

Join 500,000 students in the Edukasyon.ph community!

Create a FREE account to discover opportunities

and get personalized advice for your education to career path.

(We'll help you get there the easiest way possible.)

Come for the rewards , stay for the learning .

You must agree to the Terms of Service and Privacy Policy before proceeding

I accept the terms of service and privacy policy.

Testimonials of BSBA in Financial Management Graduates from the Philippines

Find Finance & Banking schools

Philippine E-Journals

Home ⇛ the mindanao forum ⇛ vol. 23 no. 1 (2010), tracer study on the graduates of the bsba program: an input to curricular development.

Anne Jalandoni Orejana | Pamela F. Resurreccion

Discipline: Education

The alumni are considered as the best evidence of a program’s effectiveness in terms of employment and positions held. Moreover, they are a good source of feedback regarding the program’s relevance in the current labor market.

This study was conducted to determine the employability of the graduates of the BSBA programs. The study further aimed to gather inputs about the BSBA program that could be used to improve its quality education.

The study used the descriptive research design. There respondents were BSBA graduates from 2002 – 2006 identified using the snowballing technique. A structured, non-disguised questionnaire was used to gather data. Data collected were subjected to basic descriptive statistical tools such as frequency, percentage, proportions, and mean.

Findings of the study indicate that 91% of the respondents are employed, with 20% holding supervisory positions and 4% holding managerial positions. Content or topics covered by the programs is found to be the main strength in the aspect of curriculum as supported by 45% of the respondents while lack of applications and exposures came out as the main weakness as indicated by 29% of the respondents. Correspondingly, the primary recommendation was to have more exposures and applications as expressed by 45% of the respondents.

Share Article:

ISSN 0115-7892 (Print)

- Citation Generator

- ">Indexing metadata

- Print version

Copyright © 2024 KITE E-Learning Solutions | Exclusively distributed by CE-Logic | Terms and Conditions

IMAGES

COMMENTS

The study found that there is a significant relationship between financial literacy, family influence, and saving attitude with the student's financial management behaviour, contributing to 63.3% ...

The Bachelor of Science in Business Administration (BSBA) curriculum of a private higher education institution was revised in June, 2018 with the integration of personal finance into curriculum and instruction, aimed at boosting students' financial attitude towards budgeting, saving, borrowing, and investing.

Theses/Dissertations from 2023. PDF. Financial literacy and financial well-being: A mediation analysis of fintech services adoption among selected generation Z in Metro Manila, Justine Marie M. Abad, Domique John T. Hernandez, Nehemih D. Pabillon, and Arianne Mae M. Teves. PDF.

Graduates, Business Economics, and Financial Management, descriptive research design, Philippines INTRODUCTION The economy of a country is based on the knowledge and skills of its people. Skills need change as a result of outside funding, technical ... Bachelor of Science in Business Administration of Surigao del Sur State University-Lianga ...

Lim, J. L. (2019). The Effect of Inflation on the Financial Management Practices of Divine Word College BSBA Financial Management Students. Under-graduate unpublished thesis from Divine Word College in Manila. Inflation's impact on the financial management practices of Divine Word College BSBA Financial Management students was the focus of this ...

INTERNATIONAL HOSPITALITY MANAGEMENT . Tel. No. (043)980-0385 loc 1124; Email: [email protected] CURRICULUM . Bachelor of Science in Business Administration (BSBA) Major in Financial Management . Academic Year 2018-2019 . Reference CMOs: CMO 17, s. 2017, CMO 4, s.2018 and CMO 20,s. 2013 . FIRST YEAR FIRST SEMESTER Course Code Course Title ...

Poor financial management, including the lack of budget use for planning and control, often leads to poor financial performance and eventual business failure (Karadag, 2015). Over 390,000 businesses failed in the United States in 2014 (U.S. Census Bureau, 2017), and the primary cause for most business failures is poor planning (U.S. Small

Management g raduates, followed by Marketing M anagement major with 79 or 25.82%. There are 69 or 22.55 % who graduat ed with Man agement Accounting major and 22 or 7.19 % are graduat es who majore d

graduates, followed by Financial Management major with 70 or 25.09 %. There are 6 5 or 23.30 % who graduated with Management A ccounting major and 3 6 or 1 2. 90 % are graduates who major ed in Human

Program Overview. The Bachelor of Science in Business Administration major in Financial Management is a four-year program recommended for people who plan to pursue a career in Banking and Finance Industry. The program aims to help students acquire analytical skills, perception, and competencies necessary for sound financial decision making in ...

With a solid understanding of both, graduates are well-versed in corporate finance and investment services and enter careers in banking, trading, and brokerage firms. The bachelor of science in business administration curriculum consists of 120 hours comprised of business classes and liberal arts classes to give you a well-rounded education.

SCOPE AND DELIMITATION The study covers graduates of the Bachelor of Science in Business Administration major in Financial Management of the Tarlac State University and, in particular, those who have graduated during the following academic years: 2010-2011; 2011-2012; 2012-2013; 2013-2014; and 2014-2015, totaling 268 respondents.

A Thesis Presented to the Faculty of College of Business and Accountancy University of Batangas - Batangas City Batangas City ... In Partial Fulfilment of the Requirements for the Degree Bachelor of Science in Business Administration Major in Financial Management. By: Atienza, Kriscela Mae C. Manalo, Marikharl Xuzhean M. Marasigan, Christine ...

The Bachelor of Science in Business Administration program offers a wide range of specialized majors, namely Business Economics, Financial Management, Human Resource Management, and Marketing Management. ... (local & international), research works including thesis, project development, feasibility studies, strategic papers, business plan ...

I was referred by a friend who also worked at that company. Do I recommend studying BSBA in Financial Management: To graduate Finance management, opportunities of working on banks, private companies, and even abroad opens up. Salary level of P10,000 - P15,000/month as minimum.

With our online Bachelor of Science in Financial Management program, you'll gain the knowledge and skills you need to manage finances effectively. You'll learn about financial planning, investment strategies, and risk management. You'll also develop strong analytical and problem-solving skills that will prepare you in your corporate journey.

FOLK- Dances - BSBA financial management fundamental rhytyms 1st year college modules. 10 pages 2019/2020 100% (1) 2019/2020 100% (1) Save. Potato - analysis. 32 pages 2019/2020 100% (1) 2019/2020 100% (1) Save. The Art of War The Definitive Interpretation of Sun Tzus Classic Book of Strategy by Stephen F. Kaufman (z-lib.

You are on the right track! Took BSBA major in Financial Management in UST. For me it's worth it lalo na sa career ko now, I'm a treasury trader in food and bev company. Finance is a broad field, you can be an investment research analyst, treasury trader, equity trader or risk analyst etc. After you graduate you can get a CFA (Chartered ...

The study further aimed to gather inputs about the BSBA program that could be used to improve its quality education. The study used the descriptive research design. There respondents were BSBA graduates from 2002 - 2006 identified using the snowballing technique. A structured, non-disguised questionnaire was used to gather data.

With over six years of experience in analytics, I am a Head of Insights at BrainRocket, a… · Experience: Freelance · Education: MIT Sloan School of Management · Location: Limassol · 500+ connections on LinkedIn. View Andrey Gubanov's profile on LinkedIn, a professional community of 1 billion members.

The Moscow International Business Center (MIBC), also known as Moscow-City, is a commercial development in Moscow, the capital of Russia.The project occupies an area of 60 hectares, and is located just east of the Third Ring Road at the western edge of the Presnensky District in the Central Administrative Okrug.Construction of the MIBC takes place on the Presnenskaya Embankment of the Moskva ...

Led commercial and financial assessment, developed partnership terms and led further implementation of Business Development in integration with innovative company to open opportunities for the ...

My guiding star is the passion for making a positive impact on our planet, for each other, and the future. I enjoy designing and implementing sustainable and innovative strategies. Let's connect ...