- Share full article

Advertisement

Supported by

student opinion

Should All Schools Teach Financial Literacy?

And should students have to understand topics like budgets, consumer credit, student debt, saving and investing in order to graduate?

By Shannon Doyne

Students in U.S. high schools can get free digital access to The New York Times until Sept. 1, 2021.

How well do you think you manage money? Has anyone ever taught you any money-management skills? In general, how “financially literate” do you think you are? For instance, do you know how to budget and save? How to set up a bank account? Apply for financial aid and college loans?

Does your school teach these skills already? If not, do you wish it did? Should passing a financial-literacy class be a requirement for graduating from high school?

In “ Pandemic Helps Stir Interest in Teaching Financial Literacy ,” Ann Carrns writes about the growing interest in teaching students personal financial skills in U.S. schools:

As of early 2020, high school students in 21 states were required to take a personal finance course to graduate, according to the Council for Economic Education , which promotes economic and personal finance education for students in kindergarten through high school. That was a net gain of four states since the council’s previous count two years earlier. “We are making progress,” said Billy J. Hensley, president and chief executive of the National Endowment for Financial Education, a nonprofit group that promotes effective financial education. “I do think the pandemic is bringing more attention to the topic,” he said, noting that after the financial crisis more than a decade ago there was also a flurry of financial literacy proposals in state legislatures. An increasing number of studies support the effectiveness of financial literacy education when taught by well-trained teachers, said Nan J. Morrison, chief executive of the Council for Economic Education. And more teachers now say they feel confident teaching the material. A study released in March by researchers at the University of Wisconsin and Montana State University found significant increases in teacher participation in professional development. Still, the rigor of high school financial education varies. Just six states require high school students to complete a semester-long, stand-alone personal finance course, the council’s 2020 report found. Some states permit shorter courses or include the content as part of another class. In states that don’t require financial instruction, some schools opt to teach it and do an excellent job, but others ignore the subject completely — and they tend to be schools in less affluent districts, Mr. Hensley said.

The article also outlines the specifics on what the curriculum might look like:

Many financial literacy advocates consider a full-semester course the gold standard for personal finance instruction. Rebecca Maxcy, director of the Financial Education Initiative at the University of Chicago, said many courses focused mainly on skills, like writing a check or filing taxes. While those lessons can be helpful, she said, it’s important for courses to include discussions of how personal values and attitudes about money influence behavior, as well as an examination of the financial systems and potential barriers that students will encounter in the world of money. Questions like “Who benefits when you open a bank account?” can prompt meaningful discussions, she said. Some curriculum options, however, offer more condensed, basic instruction. Everfi, a digital instructional company, offers a free seven-session program for high school financial literacy. Students take interactive, self-guided lessons in topics like banking, budgeting and college financing. Sidney Strause, a freshman at Marshall University in West Virginia, said she had taken Everfi’s course as a junior in high school. The lessons were assigned as part of another course she was taking, and typically took 45 minutes to an hour to complete. “It taught me how to budget and save,” she said. “It’s crucial to adulthood.” Sometimes she would do the lessons at home and discuss them with her mother, she said, which led her mother to create a budget and set financial goals.

Students, read the entire article, then tell us:

What, if anything, in this article resonates with you and your experiences with learning about money?

Do you think schools should offer courses on financial literacy? Should taking them be mandatory for graduation?

What topics should financial literacy instruction in schools cover? In what grade should students start learning about it?

One of the experts quoted in this piece says that it’s important for courses to include discussions of how personal values and attitudes about money influence behavior. What are your general attitudes toward money, and where do you think you learned these attitudes? For instance, how much does making money factor into your goals for a future career?

Why do you think that some people believe the interest in teaching students skills about managing money increased during the pandemic? In this time, did you experience or witness any events that made you wish you had some knowledge of personal finances — or that made you grateful for what you know?

Earlier this year, the price of GameStop stock soared when individual traders, including some teenagers, purchased many shares as a way to both make money and retaliate against large hedge funds that forecast the stock losing value. Did you learn about this situation as it happened? Did you participate? Did any of your teachers talk about it, and if so, what did they say? If you have specific thoughts to contribute, answer our Student Opinion question, “ Should All Young People Learn How to Invest in the Stock Market? ”

About Student Opinion

• Find all of our Student Opinion questions in this column . • Have an idea for a Student Opinion question? Tell us about it . • Learn more about how to use our free daily writing prompts for remote learning .

Students 13 and older in the United States and the United Kingdom, and 16 and older elsewhere, are invited to comment. All comments are moderated by the Learning Network staff, but please keep in mind that once your comment is accepted, it will be made public.

Financial Literacy Education Could Help Millions of Americans

E ven as our country continues to move past the worst effects of the COVID-19 pandemic, supply chain issues persist, there is growing inflation, labor and wage pressure, and rising interest rates. While Americans work to make sense of all this—and plan around it—lack of financial literacy makes it difficult for many. Over the long run, this lack of knowledge puts the American Dream at risk for millions. We believe the private sector has an opportunity and a responsibility to help address this by providing employees, families, customers and communities with increased access to financial education.

There’s a big need for this kind of effort. Today, only about one-third of Americans have a working understanding of interest rates, mortgage rates and financial risk , according to the Financial Industry Regulatory Authority. And this measure of financial literacy has fallen 19 percent over the past decade. This gap is estimated to have cost Americans more than $415 billion in 2020 alone.

Lack of financial capability is impacting Americans both at home, and in the workplace. Stress over money has been linked to significant health conditions including heart disease, diabetes, sleep problems and depression. These life-threatening conditions can lead to expensive medical treatments, which in-turn creates more financial stress and worry. Financial difficulties are now the second leading cause of divorce. In the workplace, 97% of employees concede they spent time working on or worrying about finances during the workday. Stress related illnesses cost employers nearly $300 billion annually i n lost productivity, and 4 of 5 workers admit to being financially stressed .

Black America continues to be particularly impacted by these challenges. More than half (54%) of Black Americans have a credit score below 640, essentially unable to fully participate in free enterprise America. Half (54%) of Black Americans also report living paycheck-to-paycheck, as compared to 44% of Americans overall. Only 43% of Blacks own their home, compared to 72% of Whites. Blacks comprise 14% of the population, but own only 3.5% of small businesses.

These are more than just statistics. Behind the numbers are real people: tens of millions of parents, seniors and young people enduring financial stress, personal hardships and strained relationships as they struggle to save, borrow and invest in ways that provide greater financial stability, flexibility and security.

To help address these issues, we’re joining together to co-chair Financial Literacy for All , an inclusive, business-led movement aimed at helping more Americans reap the benefits that come from making more informed financial decisions. We plan to empower low- and middle-income individuals and families of every background, every walk of life and every community—from urban to rural and all points in between. We will use the creative brilliance of our partners to generate excitement and awareness around financial literacy; through our partners, grow workplace wellbeing for working adults; and support initiatives to deliver basic financial education to every school district in the country. And, given the wealth gap faced by Black and Hispanic households, we will ensure our efforts are relevant and readily available across those communities.

Since launching in May of last year, the Financial Literacy for All movement has been joined by nearly thirty other CEOs and board chairs, including the leaders of The Walt Disney Company, the National Football League, the National Basketball Association, Delta Air Lines, and several other leading financial institutions.

We believe financial literacy can be inclusive, creative, flexible and focused on results, and we think our coalition’s diversity will help us make meaningful progress to that goal. Disney, after all, specializes in engaging and entertaining people through the power of storytelling. The NFL and NBA know how to attract and inspire enthusiastic audiences. Operation HOPE is focused on equipping people with the financial tools to build a more secure future. And Walmart is deeply connected to communities, with 1.6 million associates, more than 4,700 stores, serving more than 137 million customers a week across the US. Each member organization will also do more for its employees and communities.

Our shared passion for improving financial education is rooted in our purposes and values. Almost 60 years ago, Walmart was founded on the idea of helping people save money so they could live better. Since 1992, Operation HOPE has been striving to expand economic opportunity and make free enterprise work for everyone. Each of us views this new endeavor as a natural extension of what our organizations have been doing for decades.

We know efforts like these can make a difference. As just one example, Operation HOPE has been providing no-cost, personalized financial coaching and education, helping some raise credit scores 54 points in six months, and more than 100 points over 24 months, lowering levels of debt, and helping clients create and increase their savings for emergencies and the future. And, in some cases, helping strivers go from being renters to homeowners, or from small business dreamers to small business owners.

We understand that the financial challenges facing millions of American households cannot be overcome solely through financial training. Other factors are also holding people back, including barriers to education, vocational training, financial services and job opportunities as well as discrimination of all kinds. These obstacles must also be addressed—and many in the private sector are making meaningful progress.

Even so, we believe better, more accessible financial education and higher levels of financial literacy could help millions of families. This and similar kinds of work, lifts ‘all boats’ across communities and across our nation. Raising GDP through enhanced financial intelligence, benefits the whole of society, and creates more sustainable opportunity for the nation. And the added benefit—less stressed-out citizens and workers—translates into more societal health, for all. These are big goals, but we believe they can be achieved—and that’s the challenge we’ve set for ourselves. We urge other business leaders to join this movement.

More Must-Reads From TIME

- Jane Fonda Champions Climate Action for Every Generation

- Biden’s Campaign Is In Trouble. Will the Turnaround Plan Work?

- Why We're Spending So Much Money Now

- The Financial Influencers Women Actually Want to Listen To

- Breaker Sunny Choi Is Heading to Paris

- Why TV Can’t Stop Making Silly Shows About Lady Journalists

- The Case for Wearing Shoes in the House

- Want Weekly Recs on What to Watch, Read, and More? Sign Up for Worth Your Time

Contact us at [email protected]

You May Also Like

Articles on Financial education

Displaying all articles.

There’s a financial literacy gender gap − and older women are eager for education that meets their needs

Lila Rabinovich , USC Dornsife College of Letters, Arts and Sciences

Financial education has its limits – if we want New Zealanders to be better with money, we need to start at home

Stephen Agnew , University of Canterbury

Don’t let financial shame be your ruin: open conversations can help ease the burden of personal debt

Matevz (Matt) Raskovic , Auckland University of Technology ; Aaron Gilbert , Auckland University of Technology , and Smita Singh , Auckland University of Technology

The royal commission should result not only in new regulation, but new education

Dirk Baur , The University of Western Australia ; Elizabeth Ooi , The University of Western Australia , and Paul Gerrans , The University of Western Australia

Why financial literacy should be taught in every school

Dilip Soman , University of Toronto

Related Topics

- Dollarmites

- Financial literacy

- Gender bias

- New Zealand stories

Top contributors

Professor of Finance, The University of Western Australia

Lecturer, Finance, The University of Western Australia

Professor and Co-Director of Behavioural Economics in Action at Rotman (BEAR), University of Toronto

Professor of Finance, Auckland University of Technology

Associate Professor of International Business & Strategy, Auckland University of Technology

Senior Lecturer International Business, Strategy & Entrepreneurship, Auckland University of Technology

Senior Lecturer of Economics, University of Canterbury

Social scientist, USC Dornsife College of Letters, Arts and Sciences

- X (Twitter)

- Unfollow topic Follow topic

- Conference key note

- Open access

- Published: 24 January 2019

Financial literacy and the need for financial education: evidence and implications

- Annamaria Lusardi 1

Swiss Journal of Economics and Statistics volume 155 , Article number: 1 ( 2019 ) Cite this article

385k Accesses

268 Citations

187 Altmetric

Metrics details

1 Introduction

Throughout their lifetime, individuals today are more responsible for their personal finances than ever before. With life expectancies rising, pension and social welfare systems are being strained. In many countries, employer-sponsored defined benefit (DB) pension plans are swiftly giving way to private defined contribution (DC) plans, shifting the responsibility for retirement saving and investing from employers to employees. Individuals have also experienced changes in labor markets. Skills are becoming more critical, leading to divergence in wages between those with a college education, or higher, and those with lower levels of education. Simultaneously, financial markets are rapidly changing, with developments in technology and new and more complex financial products. From student loans to mortgages, credit cards, mutual funds, and annuities, the range of financial products people have to choose from is very different from what it was in the past, and decisions relating to these financial products have implications for individual well-being. Moreover, the exponential growth in financial technology (fintech) is revolutionizing the way people make payments, decide about their financial investments, and seek financial advice. In this context, it is important to understand how financially knowledgeable people are and to what extent their knowledge of finance affects their financial decision-making.

An essential indicator of people’s ability to make financial decisions is their level of financial literacy. The Organisation for Economic Co-operation and Development (OECD) aptly defines financial literacy as not only the knowledge and understanding of financial concepts and risks but also the skills, motivation, and confidence to apply such knowledge and understanding in order to make effective decisions across a range of financial contexts, to improve the financial well-being of individuals and society, and to enable participation in economic life. Thus, financial literacy refers to both knowledge and financial behavior, and this paper will analyze research on both topics.

As I describe in more detail below, findings around the world are sobering. Financial literacy is low even in advanced economies with well-developed financial markets. On average, about one third of the global population has familiarity with the basic concepts that underlie everyday financial decisions (Lusardi and Mitchell, 2011c ). The average hides gaping vulnerabilities of certain population subgroups and even lower knowledge of specific financial topics. Furthermore, there is evidence of a lack of confidence, particularly among women, and this has implications for how people approach and make financial decisions. In the following sections, I describe how we measure financial literacy, the levels of literacy we find around the world, the implications of those findings for financial decision-making, and how we can improve financial literacy.

2 How financially literate are people?

2.1 measuring financial literacy: the big three.

In the context of rapid changes and constant developments in the financial sector and the broader economy, it is important to understand whether people are equipped to effectively navigate the maze of financial decisions that they face every day. To provide the tools for better financial decision-making, one must assess not only what people know but also what they need to know, and then evaluate the gap between those things. There are a few fundamental concepts at the basis of most financial decision-making. These concepts are universal, applying to every context and economic environment. Three such concepts are (1) numeracy as it relates to the capacity to do interest rate calculations and understand interest compounding; (2) understanding of inflation; and (3) understanding of risk diversification. Translating these concepts into easily measured financial literacy metrics is difficult, but Lusardi and Mitchell ( 2008 , 2011b , 2011c ) have designed a standard set of questions around these concepts and implemented them in numerous surveys in the USA and around the world.

Four principles informed the design of these questions, as described in detail by Lusardi and Mitchell ( 2014 ). The first is simplicity : the questions should measure knowledge of the building blocks fundamental to decision-making in an intertemporal setting. The second is relevance : the questions should relate to concepts pertinent to peoples’ day-to-day financial decisions over the life cycle; moreover, they must capture general rather than context-specific ideas. Third is brevity : the number of questions must be few enough to secure widespread adoption; and fourth is capacity to differentiate , meaning that questions should differentiate financial knowledge in such a way as to permit comparisons across people. Each of these principles is important in the context of face-to-face, telephone, and online surveys.

Three basic questions (since dubbed the “Big Three”) to measure financial literacy have been fielded in many surveys in the USA, including the National Financial Capability Study (NFCS) and, more recently, the Survey of Consumer Finances (SCF), and in many national surveys around the world. They have also become the standard way to measure financial literacy in surveys used by the private sector. For example, the Aegon Center for Longevity and Retirement included the Big Three questions in the 2018 Aegon Retirement Readiness Survey, covering around 16,000 people in 15 countries. Both ING and Allianz, but also investment funds, and pension funds have used the Big Three to measure financial literacy. The exact wording of the questions is provided in Table 1 .

2.2 Cross-country comparison

The first examination of financial literacy using the Big Three was possible due to a special module on financial literacy and retirement planning that Lusardi and Mitchell designed for the 2004 Health and Retirement Study (HRS), which is a survey of Americans over age 50. Astonishingly, the data showed that only half of older Americans—who presumably had made many financial decisions in their lives—could answer the two basic questions measuring understanding of interest rates and inflation (Lusardi and Mitchell, 2011b ). And just one third demonstrated understanding of these two concepts and answered the third question, measuring understanding of risk diversification, correctly. It is sobering that recent US surveys, such as the 2015 NFCS, the 2016 SCF, and the 2017 Survey of Household Economics and Financial Decisionmaking (SHED), show that financial knowledge has remained stubbornly low over time.

Over time, the Big Three have been added to other national surveys across countries and Lusardi and Mitchell have coordinated a project called Financial Literacy around the World (FLat World), which is an international comparison of financial literacy (Lusardi and Mitchell, 2011c ).

Findings from the FLat World project, which so far includes data from 15 countries, including Switzerland, highlight the urgent need to improve financial literacy (see Table 2 ). Across countries, financial literacy is at a crisis level, with the average rate of financial literacy, as measured by those answering correctly all three questions, at around 30%. Moreover, only around 50% of respondents in most countries are able to correctly answer the two financial literacy questions on interest rates and inflation correctly. A noteworthy point is that most countries included in the FLat World project have well-developed financial markets, which further highlights the cause for alarm over the demonstrated lack of the financial literacy. The fact that levels of financial literacy are so similar across countries with varying levels of economic development—indicating that in terms of financial knowledge, the world is indeed flat —shows that income levels or ubiquity of complex financial products do not by themselves equate to a more financially literate population.

Other noteworthy findings emerge in Table 2 . For instance, as expected, understanding of the effects of inflation (i.e., of real versus nominal values) among survey respondents is low in countries that have experienced deflation rather than inflation: in Japan, understanding of inflation is at 59%; in other countries, such as Germany, it is at 78% and, in the Netherlands, it is at 77%. Across countries, individuals have the lowest level of knowledge around the concept of risk, and the percentage of correct answers is particularly low when looking at knowledge of risk diversification. Here, we note the prevalence of “do not know” answers. While “do not know” responses hover around 15% on the topic of interest rates and 18% for inflation, about 30% of respondents—in some countries even more—are likely to respond “do not know” to the risk diversification question. In Switzerland, 74% answered the risk diversification question correctly and 13% reported not knowing the answer (compared to 3% and 4% responding “do not know” for the interest rates and inflation questions, respectively).

These findings are supported by many other surveys. For example, the 2014 Standard & Poor’s Global Financial Literacy Survey shows that, around the world, people know the least about risk and risk diversification (Klapper, Lusardi, and Van Oudheusden, 2015 ). Similarly, results from the 2016 Allianz survey, which collected evidence from ten European countries on money, financial literacy, and risk in the digital age, show very low-risk literacy in all countries covered by the survey. In Austria, Germany, and Switzerland, which are the three top-performing nations in term of financial knowledge, less than 20% of respondents can answer three questions related to knowledge of risk and risk diversification (Allianz, 2017 ).

Other surveys show that the findings about financial literacy correlate in an expected way with other data. For example, performance on the mathematics and science sections of the OECD Program for International Student Assessment (PISA) correlates with performance on the Big Three and, specifically, on the question relating to interest rates. Similarly, respondents in Sweden, which has experienced pension privatization, performed better on the risk diversification question (at 68%), than did respondents in Russia and East Germany, where people have had less exposure to the stock market. For researchers studying financial knowledge and its effects, these findings hint to the fact that financial literacy could be the result of choice and not an exogenous variable.

To summarize, financial literacy is low across the world and higher national income levels do not equate to a more financially literate population. The design of the Big Three questions enables a global comparison and allows for a deeper understanding of financial literacy. This enhances the measure’s utility because it helps to identify general and specific vulnerabilities across countries and within population subgroups, as will be explained in the next section.

2.3 Who knows the least?

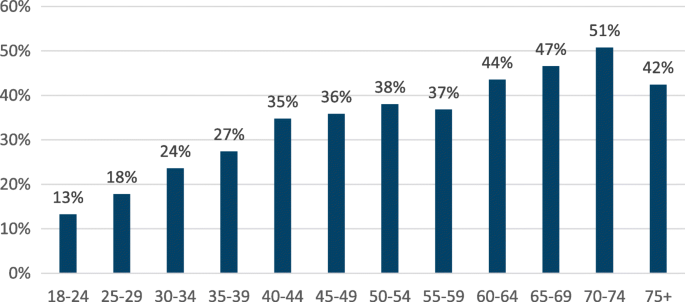

Low financial literacy on average is exacerbated by patterns of vulnerability among specific population subgroups. For instance, as reported in Lusardi and Mitchell ( 2014 ), even though educational attainment is positively correlated with financial literacy, it is not sufficient. Even well-educated people are not necessarily savvy about money. Financial literacy is also low among the young. In the USA, less than 30% of respondents can correctly answer the Big Three by age 40, even though many consequential financial decisions are made well before that age (see Fig. 1 ). Similarly, in Switzerland, only 45% of those aged 35 or younger are able to correctly answer the Big Three questions. Footnote 1 And if people may learn from making financial decisions, that learning seems limited. As shown in Fig. 1 , many older individuals, who have already made decisions, cannot answer three basic financial literacy questions.

Financial literacy across age in the USA. This figure shows the percentage of respondents who answered correctly all Big Three questions by age group (year 2015). Source: 2015 US National Financial Capability Study

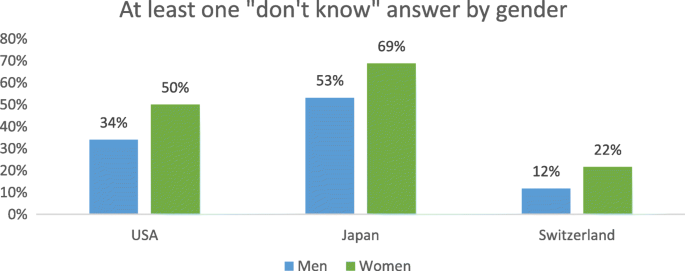

A gender gap in financial literacy is also present across countries. Women are less likely than men to answer questions correctly. The gap is present not only on the overall scale but also within each topic, across countries of different income levels, and at different ages. Women are also disproportionately more likely to indicate that they do not know the answer to specific questions (Fig. 2 ), highlighting overconfidence among men and awareness of lack of knowledge among women. Even in Finland, which is a relatively equal society in terms of gender, 44% of men compared to 27% of women answer all three questions correctly and 18% of women give at least one “do not know” response versus less than 10% of men (Kalmi and Ruuskanen, 2017 ). These figures further reflect the universality of the Big Three questions. As reported in Fig. 2 , “do not know” responses among women are prevalent not only in European countries, for example, Switzerland, but also in North America (represented in the figure by the USA, though similar findings are reported in Canada) and in Asia (represented in the figure by Japan). Those interested in learning more about the differences in financial literacy across demographics and other characteristics can consult Lusardi and Mitchell ( 2011c , 2014 ).

Gender differences in the responses to the Big Three questions. Sources: USA—Lusardi and Mitchell, 2011c ; Japan—Sekita, 2011 ; Switzerland—Brown and Graf, 2013

3 Does financial literacy matter?

A growing number of financial instruments have gained importance, including alternative financial services such as payday loans, pawnshops, and rent to own stores that charge very high interest rates. Simultaneously, in the changing economic landscape, people are increasingly responsible for personal financial planning and for investing and spending their resources throughout their lifetime. We have witnessed changes not only in the asset side of household balance sheets but also in the liability side. For example, in the USA, many people arrive close to retirement carrying a lot more debt than previous generations did (Lusardi, Mitchell, and Oggero, 2018 ). Overall, individuals are making substantially more financial decisions over their lifetime, living longer, and gaining access to a range of new financial products. These trends, combined with low financial literacy levels around the world and, particularly, among vulnerable population groups, indicate that elevating financial literacy must become a priority for policy makers.

There is ample evidence of the impact of financial literacy on people’s decisions and financial behavior. For example, financial literacy has been proven to affect both saving and investment behavior and debt management and borrowing practices. Empirically, financially savvy people are more likely to accumulate wealth (Lusardi and Mitchell, 2014 ). There are several explanations for why higher financial literacy translates into greater wealth. Several studies have documented that those who have higher financial literacy are more likely to plan for retirement, probably because they are more likely to appreciate the power of interest compounding and are better able to do calculations. According to the findings of the FLat World project, answering one additional financial question correctly is associated with a 3–4 percentage point greater probability of planning for retirement; this finding is seen in Germany, the USA, Japan, and Sweden. Financial literacy is found to have the strongest impact in the Netherlands, where knowing the right answer to one additional financial literacy question is associated with a 10 percentage point higher probability of planning (Mitchell and Lusardi, 2015 ). Empirically, planning is a very strong predictor of wealth; those who plan arrive close to retirement with two to three times the amount of wealth as those who do not plan (Lusardi and Mitchell, 2011b ).

Financial literacy is also associated with higher returns on investments and investment in more complex assets, such as stocks, which normally offer higher rates of return. This finding has important consequences for wealth; according to the simulation by Lusardi, Michaud, and Mitchell ( 2017 ), in the context of a life-cycle model of saving with many sources of uncertainty, from 30 to 40% of US retirement wealth inequality can be accounted for by differences in financial knowledge. These results show that financial literacy is not a sideshow, but it plays a critical role in saving and wealth accumulation.

Financial literacy is also strongly correlated with a greater ability to cope with emergency expenses and weather income shocks. Those who are financially literate are more likely to report that they can come up with $2000 in 30 days or that they are able to cover an emergency expense of $400 with cash or savings (Hasler, Lusardi, and Oggero, 2018 ).

With regard to debt behavior, those who are more financially literate are less likely to have credit card debt and more likely to pay the full balance of their credit card each month rather than just paying the minimum due (Lusardi and Tufano, 2009 , 2015 ). Individuals with higher financial literacy levels also are more likely to refinance their mortgages when it makes sense to do so, tend not to borrow against their 401(k) plans, and are less likely to use high-cost borrowing methods, e.g., payday loans, pawn shops, auto title loans, and refund anticipation loans (Lusardi and de Bassa Scheresberg, 2013 ).

Several studies have documented poor debt behavior and its link to financial literacy. Moore ( 2003 ) reported that the least financially literate are also more likely to have costly mortgages. Lusardi and Tufano ( 2015 ) showed that the least financially savvy incurred high transaction costs, paying higher fees and using high-cost borrowing methods. In their study, the less knowledgeable also reported excessive debt loads and an inability to judge their debt positions. Similarly, Mottola ( 2013 ) found that those with low financial literacy were more likely to engage in costly credit card behavior, and Utkus and Young ( 2011 ) concluded that the least literate were more likely to borrow against their 401(k) and pension accounts.

Young people also struggle with debt, in particular with student loans. According to Lusardi, de Bassa Scheresberg, and Oggero ( 2016 ), Millennials know little about their student loans and many do not attempt to calculate the payment amounts that will later be associated with the loans they take. When asked what they would do, if given the chance to revisit their student loan borrowing decisions, about half of Millennials indicate that they would make a different decision.

Finally, a recent report on Millennials in the USA (18- to 34-year-olds) noted the impact of financial technology (fintech) on the financial behavior of young individuals. New and rapidly expanding mobile payment options have made transactions easier, quicker, and more convenient. The average user of mobile payments apps and technology in the USA is a high-income, well-educated male who works full time and is likely to belong to an ethnic minority group. Overall, users of mobile payments are busy individuals who are financially active (holding more assets and incurring more debt). However, mobile payment users display expensive financial behaviors, such as spending more than they earn, using alternative financial services, and occasionally overdrawing their checking accounts. Additionally, mobile payment users display lower levels of financial literacy (Lusardi, de Bassa Scheresberg, and Avery, 2018 ). The rapid growth in fintech around the world juxtaposed with expensive financial behavior means that more attention must be paid to the impact of mobile payment use on financial behavior. Fintech is not a substitute for financial literacy.

4 The way forward for financial literacy and what works

Overall, financial literacy affects everything from day-to-day to long-term financial decisions, and this has implications for both individuals and society. Low levels of financial literacy across countries are correlated with ineffective spending and financial planning, and expensive borrowing and debt management. These low levels of financial literacy worldwide and their widespread implications necessitate urgent efforts. Results from various surveys and research show that the Big Three questions are useful not only in assessing aggregate financial literacy but also in identifying vulnerable population subgroups and areas of financial decision-making that need improvement. Thus, these findings are relevant for policy makers and practitioners. Financial illiteracy has implications not only for the decisions that people make for themselves but also for society. The rapid spread of mobile payment technology and alternative financial services combined with lack of financial literacy can exacerbate wealth inequality.

To be effective, financial literacy initiatives need to be large and scalable. Schools, workplaces, and community platforms provide unique opportunities to deliver financial education to large and often diverse segments of the population. Furthermore, stark vulnerabilities across countries make it clear that specific subgroups, such as women and young people, are ideal targets for financial literacy programs. Given women’s awareness of their lack of financial knowledge, as indicated via their “do not know” responses to the Big Three questions, they are likely to be more receptive to financial education.

The near-crisis levels of financial illiteracy, the adverse impact that it has on financial behavior, and the vulnerabilities of certain groups speak of the need for and importance of financial education. Financial education is a crucial foundation for raising financial literacy and informing the next generations of consumers, workers, and citizens. Many countries have seen efforts in recent years to implement and provide financial education in schools, colleges, and workplaces. However, the continuously low levels of financial literacy across the world indicate that a piece of the puzzle is missing. A key lesson is that when it comes to providing financial education, one size does not fit all. In addition to the potential for large-scale implementation, the main components of any financial literacy program should be tailored content, targeted at specific audiences. An effective financial education program efficiently identifies the needs of its audience, accurately targets vulnerable groups, has clear objectives, and relies on rigorous evaluation metrics.

Using measures like the Big Three questions, it is imperative to recognize vulnerable groups and their specific needs in program designs. Upon identification, the next step is to incorporate this knowledge into financial education programs and solutions.

School-based education can be transformational by preparing young people for important financial decisions. The OECD’s Programme for International Student Assessment (PISA), in both 2012 and 2015, found that, on average, only 10% of 15-year-olds achieved maximum proficiency on a five-point financial literacy scale. As of 2015, about one in five of students did not have even basic financial skills (see OECD, 2017 ). Rigorous financial education programs, coupled with teacher training and high school financial education requirements, are found to be correlated with fewer defaults and higher credit scores among young adults in the USA (Urban, Schmeiser, Collins, and Brown, 2018 ). It is important to target students and young adults in schools and colleges to provide them with the necessary tools to make sound financial decisions as they graduate and take on responsibilities, such as buying cars and houses, or starting retirement accounts. Given the rising cost of education and student loan debt and the need of young people to start contributing as early as possible to retirement accounts, the importance of financial education in school cannot be overstated.

There are three compelling reasons for having financial education in school. First, it is important to expose young people to the basic concepts underlying financial decision-making before they make important and consequential financial decisions. As noted in Fig. 1 , financial literacy is very low among the young and it does not seem to increase a lot with age/generations. Second, school provides access to financial literacy to groups who may not be exposed to it (or may not be equally exposed to it), for example, women. Third, it is important to reduce the costs of acquiring financial literacy, if we want to promote higher financial literacy both among individuals and among society.

There are compelling reasons to have personal finance courses in college as well. In the same way in which colleges and university offer courses in corporate finance to teach how to manage the finances of firms, so today individuals need the knowledge to manage their own finances over the lifetime, which in present discounted value often amount to large values and are made larger by private pension accounts.

Financial education can also be efficiently provided in workplaces. An effective financial education program targeted to adults recognizes the socioeconomic context of employees and offers interventions tailored to their specific needs. A case study conducted in 2013 with employees of the US Federal Reserve System showed that completing a financial literacy learning module led to significant changes in retirement planning behavior and better-performing investment portfolios (Clark, Lusardi, and Mitchell, 2017 ). It is also important to note the delivery method of these programs, especially when targeted to adults. For instance, video formats have a significantly higher impact on financial behavior than simple narratives, and instruction is most effective when it is kept brief and relevant (Heinberg et al., 2014 ).

The Big Three also show that it is particularly important to make people familiar with the concepts of risk and risk diversification. Programs devoted to teaching risk via, for example, visual tools have shown great promise (Lusardi et al., 2017 ). The complexity of some of these concepts and the costs of providing education in the workplace, coupled with the fact that many older individuals may not work or work in firms that do not offer such education, provide other reasons why financial education in school is so important.

Finally, it is important to provide financial education in the community, in places where people go to learn. A recent example is the International Federation of Finance Museums, an innovative global collaboration that promotes financial knowledge through museum exhibits and the exchange of resources. Museums can be places where to provide financial literacy both among the young and the old.

There are a variety of other ways in which financial education can be offered and also targeted to specific groups. However, there are few evaluations of the effectiveness of such initiatives and this is an area where more research is urgently needed, given the statistics reported in the first part of this paper.

5 Concluding remarks

The lack of financial literacy, even in some of the world’s most well-developed financial markets, is of acute concern and needs immediate attention. The Big Three questions that were designed to measure financial literacy go a long way in identifying aggregate differences in financial knowledge and highlighting vulnerabilities within populations and across topics of interest, thereby facilitating the development of tailored programs. Many such programs to provide financial education in schools and colleges, workplaces, and the larger community have taken existing evidence into account to create rigorous solutions. It is important to continue making strides in promoting financial literacy, by achieving scale and efficiency in future programs as well.

In August 2017, I was appointed Director of the Italian Financial Education Committee, tasked with designing and implementing the national strategy for financial literacy. I will be able to apply my research to policy and program initiatives in Italy to promote financial literacy: it is an essential skill in the twenty-first century, one that individuals need if they are to thrive economically in today’s society. As the research discussed in this paper well documents, financial literacy is like a global passport that allows individuals to make the most of the plethora of financial products available in the market and to make sound financial decisions. Financial literacy should be seen as a fundamental right and universal need, rather than the privilege of the relatively few consumers who have special access to financial knowledge or financial advice. In today’s world, financial literacy should be considered as important as basic literacy, i.e., the ability to read and write. Without it, individuals and societies cannot reach their full potential.

See Brown and Graf ( 2013 ).

Abbreviations

Defined benefit (refers to pension plan)

Defined contribution (refers to pension plan)

Financial Literacy around the World

National Financial Capability Study

Organisation for Economic Co-operation and Development

Programme for International Student Assessment

Survey of Consumer Finances

Survey of Household Economics and Financial Decisionmaking

Aegon Center for Longevity and Retirement. (2018). The New Social Contract: a blueprint for retirement in the 21st century. The Aegon Retirement Readiness Survey 2018. Retrieved from https://www.aegon.com/en/Home/Research/aegon-retirement-readiness-survey-2018/ . Accessed 1 June 2018.

Agnew, J., Bateman, H., & Thorp, S. (2013). Financial literacy and retirement planning in Australia. Numeracy, 6 (2).

Allianz (2017). When will the penny drop? Money, financial literacy and risk in the digital age. Retrieved from http://gflec.org/initiatives/money-finlit-risk/ . Accessed 1 June 2018.

Almenberg, J., & Säve-Söderbergh, J. (2011). Financial literacy and retirement planning in Sweden. Journal of Pension Economics & Finance, 10 (4), 585–598.

Article Google Scholar

Arrondel, L., Debbich, M., & Savignac, F. (2013). Financial literacy and financial planning in France. Numeracy, 6 (2).

Beckmann, E. (2013). Financial literacy and household savings in Romania. Numeracy, 6 (2).

Boisclair, D., Lusardi, A., & Michaud, P. C. (2017). Financial literacy and retirement planning in Canada. Journal of Pension Economics & Finance, 16 (3), 277–296.

Brown, M., & Graf, R. (2013). Financial literacy and retirement planning in Switzerland. Numeracy, 6 (2).

Bucher-Koenen, T., & Lusardi, A. (2011). Financial literacy and retirement planning in Germany. Journal of Pension Economics & Finance, 10 (4), 565–584.

Clark, R., Lusardi, A., & Mitchell, O. S. (2017). Employee financial literacy and retirement plan behavior: a case study. Economic Inquiry, 55 (1), 248–259.

Crossan, D., Feslier, D., & Hurnard, R. (2011). Financial literacy and retirement planning in New Zealand. Journal of Pension Economics & Finance, 10 (4), 619–635.

Fornero, E., & Monticone, C. (2011). Financial literacy and pension plan participation in Italy. Journal of Pension Economics & Finance, 10 (4), 547–564.

Hasler, A., Lusardi, A., and Oggero, N. (2018). Financial fragility in the US: evidence and implications. GFLEC working paper n. 2018–1.

Heinberg, A., Hung, A., Kapteyn, A., Lusardi, A., Samek, A. S., & Yoong, J. (2014). Five steps to planning success: experimental evidence from US households. Oxford Review of Economic Policy, 30 (4), 697–724.

Kalmi, P., & Ruuskanen, O. P. (2017). Financial literacy and retirement planning in Finland. Journal of Pension Economics & Finance, 17 (3), 1–28.

Klapper, L., Lusardi, A., & Van Oudheusden, P. (2015). Financial literacy around the world. In Standard & Poor’s Ratings Services Global Financial Literacy Survey (GFLEC working paper).

Google Scholar

Klapper, L., & Panos, G. A. (2011). Financial literacy and retirement planning: The Russian case. Journal of Pension Economics & Finance, 10 (4), 599–618.

Lusardi, A., & de Bassa Scheresberg, C. (2013). Financial literacy and high-cost borrowing in the United States, NBER Working Paper n. 18969, April .

Book Google Scholar

Lusardi, A., de Bassa Scheresberg, C., and Avery, M. 2018. Millennial mobile payment users: a look into their personal finances and financial behaviors. GFLEC working paper.

Lusardi, A., de Bassa Scheresberg, C., & Oggero, N. (2016). Student loan debt in the US: an analysis of the 2015 NFCS Data, GFLEC Policy Brief, November .

Lusardi, A., Michaud, P. C., & Mitchell, O. S. (2017). Optimal financial knowledge and wealth inequality. Journal of Political Economy, 125 (2), 431–477.

Lusardi, A., & Mitchell, O. S. (2008). Planning and financial literacy: how do women fare? American Economic Review, 98 , 413–417.

Lusardi, A., & Mitchell, O. S. (2011a). The outlook for financial literacy. In O. S. Mitchell & A. Lusardi (Eds.), Financial literacy: implications for retirement security and the financial marketplace (pp. 1–15). Oxford: Oxford University Press.

Chapter Google Scholar

Lusardi, A., & Mitchell, O. S. (2011b). Financial literacy and planning: implications for retirement wellbeing. In O. S. Mitchell & A. Lusardi (Eds.), Financial literacy: implications for retirement security and the financial marketplace (pp. 17–39). Oxford: Oxford University Press.

Lusardi, A., & Mitchell, O. S. (2011c). Financial literacy around the world: an overview. Journal of Pension Economics and Finance, 10 (4), 497–508.

Lusardi, A., & Mitchell, O. S. (2014). The economic importance of financial literacy: theory and evidence. Journal of Economic Literature, 52 (1), 5–44.

Lusardi, A., Mitchell, O. S., & Oggero, N. (2018). The changing face of debt and financial fragility at older ages. American Economic Association Papers and Proceedings, 108 , 407–411.

Lusardi, A., Samek, A., Kapteyn, A., Glinert, L., Hung, A., & Heinberg, A. (2017). Visual tools and narratives: new ways to improve financial literacy. Journal of Pension Economics & Finance, 16 (3), 297–323.

Lusardi, A., & Tufano, P. (2009). Teach workers about the peril of debt. Harvard Business Review , 22–24.

Lusardi, A., & Tufano, P. (2015). Debt literacy, financial experiences, and overindebtedness. Journal of Pension Economics & Finance, 14 (4), 332–368.

Mitchell, O. S., & Lusardi, A. (2015). Financial literacy and economic outcomes: evidence and policy implications. The Journal of Retirement, 3 (1).

Moore, Danna. 2003. Survey of financial literacy in Washington State: knowledge, behavior, attitudes and experiences. Washington State University Social and Economic Sciences Research Center Technical Report 03–39.

Mottola, G. R. (2013). In our best interest: women, financial literacy, and credit card behavior. Numeracy, 6 (2).

Moure, N. G. (2016). Financial literacy and retirement planning in Chile. Journal of Pension Economics & Finance, 15 (2), 203–223.

OECD. (2017). PISA 2015 results (Volume IV): students’ financial literacy . Paris: PISA, OECD Publishing. https://doi.org/10.1787/9789264270282-en .

Sekita, S. (2011). Financial literacy and retirement planning in Japan. Journal of Pension Economics & Finance, 10 (4), 637–656.

Urban, C., Schmeiser, M., Collins, J. M., & Brown, A. (2018). The effects of high school personal financial education policies on financial behavior. Economics of Education Review . https://www.sciencedirect.com/science/article/abs/pii/S0272775718301699 .

Utkus, S., & Young, J. (2011). Financial literacy and 401(k) loans. In O. S. Mitchell & A. Lusardi (Eds.), Financial literacy: implications for retirement security and the financial marketplace (pp. 59–75). Oxford: Oxford University Press.

Van Rooij, M. C., Lusardi, A., & Alessie, R. J. (2011). Financial literacy and retirement preparation in the Netherlands. Journal of Pension Economics and Finance, 10 (4), 527–545.

Download references

Acknowledgements

This paper represents a summary of the keynote address I gave to the 2018 Annual Meeting of the Swiss Society of Economics and Statistics. I would like to thank Monika Butler, Rafael Lalive, anonymous reviewers, and participants of the Annual Meeting for useful discussions and comments, and Raveesha Gupta for editorial support. All errors are my responsibility.

Not applicable

Availability of data and materials

Author information, authors and affiliations.

The George Washington University School of Business Global Financial Literacy Excellence Center and Italian Committee for Financial Education, Washington, D.C., USA

Annamaria Lusardi

You can also search for this author in PubMed Google Scholar

Contributions

The author read and approved the final manuscript.

Corresponding author

Correspondence to Annamaria Lusardi .

Ethics declarations

Competing interests.

The author declares that she has no competing interests.

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License ( http://creativecommons.org/licenses/by/4.0/ ), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

Reprints and permissions

About this article

Cite this article.

Lusardi, A. Financial literacy and the need for financial education: evidence and implications. Swiss J Economics Statistics 155 , 1 (2019). https://doi.org/10.1186/s41937-019-0027-5

Download citation

Received : 22 October 2018

Accepted : 07 January 2019

Published : 24 January 2019

DOI : https://doi.org/10.1186/s41937-019-0027-5

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

Financial Literacy: What College Students Need to Know

Many college students are unprepared to manage their own finances, according to some research and experts.

Financial Literacy in College

Getty Images

Making financial decisions – including around budgeting, taking out loans or investing – can be daunting, and many college students feel ill-equipped to do so.

Given the rising cost of tuition , college students need to be more informed than ever about the implications of paying for higher education. But making financial decisions – including around budgeting, taking out loans or investing – can be daunting, and many college students feel ill-equipped to do so.

In a survey of about 30,000 college students from more than 440 schools across the country, only 53% said they felt prepared to manage their money, according to a 2019 report by EVERFI, sponsored by AIG Retirement Services.

"We see a lot of students who haven't had to deal with a whole lot of the complexities of the financial world" before college, says Phil Schuman, president of the Higher Education Financial Wellness Alliance and executive director of financial wellness and education at Indiana University—Bloomington . "The most experience we see students have with finances tend to be they had some sort of part-time job while they were in high school. So they come in with a little bit of understanding of their earning process, a little bit of understanding of the tax process and just how to bank."

What Is Financial Literacy?

Financial literacy, sometimes under the umbrella of financial wellness, is the understanding of financial concepts – like interest rates, student loans, credit scores and budgeting – and how your personal finances work.

Not having an understanding of some of these concepts can result in negative consequences after college, like going into unnecessary debt or student loan default, says Andrea Janssen, interim director of the University of Montana 's Financial Education Program.

Do States Require Financial Literacy in High School?

Fifteen states require or are in the process of mandating that students take a stand-alone personal financial course of at least one semester to graduate, according to Next Gen Personal Finance’s 2022 "State of Financial Education" report. Only eight of those states have fully implemented their requirements statewide.

In the 42 states that have yet to implement statewide requirements, fewer than 1 in 10 students have guaranteed access to a stand-alone personal finance course, the report found.

"I think public schools and universities have a responsibility to make sure that when students graduate and they either go off to college, start their own business, enter the workforce or decide to serve the country through the military, they should have a deep understanding of how the economy works, how money works and they are prepared to navigate a much more complex financial services system than has ever existed before," says Ray Martinez, co-founder and president of EVERFI, a Washington, D.C.-based company that provides financial education, workplace training and community education.

Financial Concepts Students Should Know

When transitioning from high school to college, students should learn to budget, track spending habits and understand loans, experts say.

One rule of thumb is "don't spend what you don't have," says Dana Kelly, vice president of professional development and institutional compliance at the National Association of Student Financial Aid Administrators. She advises students to avoid using a credit card while in college.

"That's where budgeting really comes into play because if you're sticking to your budget, then you're working with the cash that you have," she says. Students who decide to use a credit card in college should be clear on what the interest rates are, what a credit score is and how to make payments on time, Kelly adds.

If you have money left over for the month, Janssen recommends dividing it into thirds. One-third can be used for something fun as a reward. The next third is to pay off any debts while the remaining funds can be invested or saved.

Develop an early habit of saving, if possible, Kelly says.

"Even if you start putting away even small amounts, you are fostering a really good habit there," she adds. "And then as you get through college and you move into that first apartment, you then have something to put away and potentially can look at other investment options and growing that savings."

Track Spending Habits

Whether you spend money on activities, gifts or going out to eat, it's important to understand your personal habits and attitudes around finances, experts say – especially before entering a relationship.

"Statistically speaking, every single year, one of the top reasons for divorce has to do with financial stress," Schuman says. "And part of it is because people don't know how to understand their financial background or understand their partner's financial background. And when they try and have conversations, there's no positivity that comes out of it."

Understand Student Loans

Not all student loans are bad, experts say, but students need to be aware of the different types of loans, repayment obligations and interest rates.

"Student loans can be a really effective tool for helping you progress in your life," Schuman says. "Borrowing more than what you need and then using that money to potentially buy stuff that's not relevant to your college experience, that's bad."

Students and their families need to plan early and have discussions around how they're going to pay for college before enrolling, experts say. To qualify for federal loans and other sources of financial aid such as scholarships, grants or work-study, students must first fill out the Free Application for Federal Student Aid, or FAFSA .

College Efforts to Improve Student Financial Literacy

With the growing need for financial literacy efforts on college campuses, many schools have responded by opening financial wellness offices, Kelly says. These offices are designed to host informational seminars and improve students' overall financial knowledge.

The University of Montana's Financial Education Program, for instance, offers one-on-one financial counseling and workshops on topics such as budgeting, credit, savings and navigating the financial aid process to current and potential students, faculty and staff. The program recently expanded to include outreach to local high schools to discuss how to fill out the FAFSA and pay for college.

"We educate students about their personal finances and those financial options when it comes to paying and repaying for college," Janssen says. "And by going through all of that, we are setting them up for success and a solid financial future."

Similarly, Indiana University created MoneySmarts, which offers peer educators and financial literacy classes for credit. Students may take three five-week classes for one credit or a three-credit-hour class that is more comprehensive.

"On the college side of things, we want to take whatever is taught in high school, if anything, and expand upon it," Schuman says. "Really provide people a look at what post-college life could look like with what their financial situation may be based on their degree and based on how much student loan debt they may have."

Financial Resources for Students

It may be hard for students to ask their parents financial questions "because money is tough to talk about," Janssen says. However, there are other resources or tools available to students.

While on campus, students can visit their school's financial wellness office or financial aid office.

"You should never feel ashamed or embarrassed about going to talk to financial aid and asking them questions," Schuman says.

Experts also recommend students use budgeting apps like Mint or reach out to their bank, as banks often have financial planning tools or their own budgeting calculators.

Searching for a college? Get our complete rankings of Best Colleges.

10 Steps to Minimize Student Loan Debt

Tags: education , students , colleges , financial literacy

College Admissions: Get a Step Ahead!

Sign up to receive the latest updates from U.S. News & World Report and our trusted partners and sponsors. By clicking submit, you are agreeing to our Terms and Conditions & Privacy Policy .

Ask an Alum: Making the Most Out of College

Paying for College

College Financial Aid 101

College Scholarships

College Loan Center

College Savings Center

529 College Savings Plans

Get updates from U.S. News including newsletters, rankings announcements, new features and special offers.

Sign in to manage your newsletters »

Sign up to receive the latest updates from U.S News & World Report and our trusted partners and sponsors. By clicking submit, you are agreeing to our Terms and Conditions & Privacy Policy .

You May Also Like

Fafsa delays alarm families, colleges.

Sarah Wood March 25, 2024

Help Your Teen With the College Decision

Anayat Durrani March 25, 2024

20 Lower-Cost Online Private Colleges

Sarah Wood March 21, 2024

How to Avoid Scholarship Scams

Cole Claybourn March 15, 2024

What You Can Buy With a 529 Plan

Emma Kerr and Sarah Wood March 1, 2024

What Is the Student Aid Index?

Sarah Wood Feb. 9, 2024

Affordable Out-of-State Online Colleges

Sarah Wood Feb. 7, 2024

The Cost of an Online Bachelor's Degree

Emma Kerr and Cole Claybourn Feb. 7, 2024

How to Use Scholarship Money

Rebecca Safier and Cole Claybourn Feb. 1, 2024

FAFSA Deadlines You Should Know

Sarah Wood Jan. 31, 2024

What's New on the 2024-2025 FAFSA

College Financial Planning for Parents

Cole Claybourn Jan. 29, 2024

How to Find Local Scholarships

Emma Kerr and Sarah Wood Jan. 22, 2024

Help for Completing the New FAFSA

Diona Brown Jan. 11, 2024

Aid Options for International Students

Sarah Wood Dec. 19, 2023

10 Sites to find Scholarships

Cole Claybourn Dec. 6, 2023

A Guide to Completing the FAFSA

Emma Kerr and Sarah Wood Nov. 30, 2023

Are Private Student Loans Worth It?

Erika Giovanetti Nov. 29, 2023

Colleges With Cheap Out-of-State Tuition

Cole Claybourn and Travis Mitchell Nov. 21, 2023

Steps for Being Independent on the FAFSA

Emma Kerr and Sarah Wood Nov. 17, 2023

- Work & Careers

- Life & Arts

Add to myFT Digest

Add this topic to your myFT Digest for news straight to your inbox

An effect of the new technology ‘doesn’t have to be the removal’ of teachers from the classroom

Institution adopts moratorium on accepting Shell and BP funds amid scrutiny of companies’ influence on academia

Congressional panel whose hearings prompted resignation of Harvard president turns gaze on Doha

Knowledge intensive companies can benefit from their co-location with strong academic centres

VC money may be further away but regional start-up centres bank on local strengths to attract entrepreneurs

In ‘The Language Puzzle’, archaeologist Steven Mithen explores how linguistic and evolutionary development go hand in hand, from our grunt-filled past to our garrulous present

Litigation raises pressure as universities struggle to satisfy demands of donors and students

Safe spaces and sponsorship programmes are providing vital schooling to displaced children and those in war-affected cities

Part 2 of a new series of business-school-style teaching case studies on sustainability dilemmas looks at electric vehicle subsidies and tariffs. Read selected FT articles and answer questions on sustainability, governance and social obligations

How should western policymakers use subsidies and tariffs to encourage drivers to switch? Probe the arguments with this ‘instant teaching case study’

This year’s FT ranking of courses comes as business schools and other higher education providers seek to meet rising demand for cheaper, more flexible and blended programmes from a broader cohort of students

The comedian paints a picture of the malaise hanging over the nation’s campuses in a new BBC documentary

Teaching case study: IP rebranding and the role of the digital ecosystem in adding brand value

How the Online MBA ranking of the top 10 programmes was compiled

Blended online MBA programmes and new platforms are enabling the collaboration deemed vital to learning

Undisclosed digital trials can affect workers, users, and society in ways that are ill-understood, academics warn

Lower costs and easier access fuel expansion in digital-only course providers

Top business schools are blending web-based and in-person learning as professionals seek flexible route to qualifications

Latest FT ranking comes at a time when the use of advanced technology and more tailored learning are reshaping online education

MBA graduates should assess the relative strengths and weaknesses in an organisation’s sustainability targets and strategy

Also in this newsletter: Greek parliament to approve private higher education after decades of wrangling

Women at the top, workplace trends and career tips, including an interview with fashion entrepreneur Emma Grede. Plus: US unions woo women; managing tensions at work; grandmothers do childcare; life after the sack; and Korean women’s baby dilemma

Watching tech companies swallow their industry has given Jimmy Iovine and Dr Dre a perspective they can pass on

The Conservatives seem determined to ignore one of their few achievements in office

Consumer champion tells MPs resources were pulled from private providers after subject’s 2014 addition to curriculum

International Edition

CUNA is now America's Credit Unions.

A stronger voice to advance the credit union industry.

Delivering focused financial education

Virginia credit union’s data benefits financial success for women series..

Listen to the article

When Virginia Credit Union in Richmond teamed up with the Financial Health Network and George Fox University to conduct a series of member surveys, it learned that its female members struggled the most with financial health and confidence.

“Women actually scored all right with financial knowledge, compared to men, but their scores with financial health and confidence were lower,” says Cherry Dale, vice president of financial education.

In response, the $4.8 billion credit union created Financial Success for Women , a month-long, virtual financial education series.

The program included four components: spend, save, borrow, and plan. Each week, participants received an email with content and recorded webinars. Every Thursday, a different expert spoke with the participants in a live virtual program.

The first live session featured The Washington Post personal finance columnist Michelle Singletary.

Virginia Credit Union measured participants’ financial health and understanding before and after the series. The goal was to determine whether or not the series could move the needle and increase members’ overall financial health.

In the initial assessment, participants designated their financial health as coping (57%), vulnerable (23%), and healthy (20%). Following the series, 17% rated themselves as vulnerable, 59% coping, and 24% healthy.

Participants who were not confident decreased from 19% to 8% while those who considered themselves somewhat confident rose from 16% to 23% and confident increased from 65% to 68%.

Participants also left with a better view of the credit union. In the post-series assessment, 80% of respondents agreed “Virginia Credit Union helps people feel more confident about their finances,” up 26% from the initial assessment. Plus, respondents who agreed “Virginia Credit Union offers good financial advice or education” jumped from 58% to 91%.

Dale will use this information to create focused financial education that will improve members’ confidence in their finances.

Using financial health surveys to segment out demographics and see who needs what kind of education is exciting to Dale. She believes the financial education space is only going to continue to be more and more focused in the future.

“We should be doing financial education and helping our members with their overall financial health. It's just the right thing to do,” Dale says. “But as we're evolving, we need to really make sure that we are targeting and providing programs that are able to move the needle. We want to be able to actually measure how programs positively impact participants.”

Post a comment to this article

Report abusive comment, future success requires ceo succession planning, open banking: not if, but how, your journey toward financial empowerment, innovation, and community impact, have you eliminated or reduced overdraft/nsf fees.

Everyone needs financial literacy education

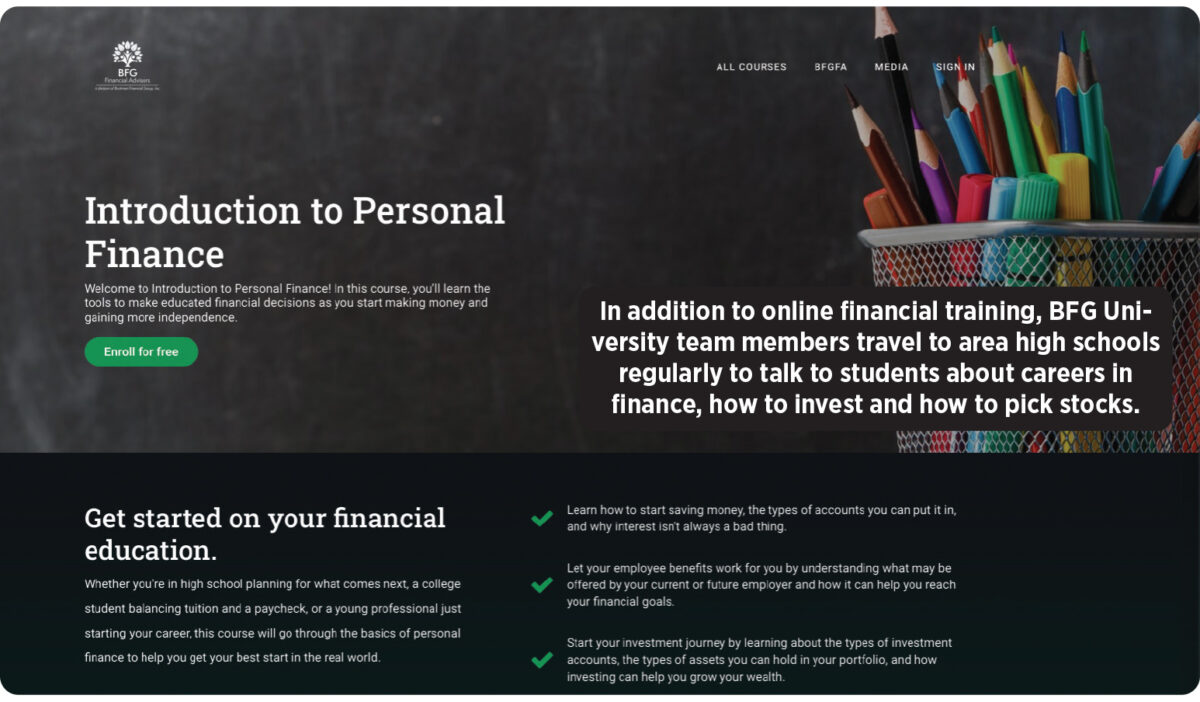

Lena Nebel and the rest of the team at BFG Financial Group saw a need to teach young people about financial literacy concepts. So they created a university to do just that.

Nebel is president and chief operating officer at BFG Financial Group, located in Timonium, Md. She said the company’s interest in providing financial literacy education stems from the company CEO Eric Brotman’s desire to teach others to free themselves from debt and have a secure retirement. Brotman is the author of three books, including Don’t Retire…Graduate!: Building a Path to Financial Freedom and Retirement at Any Age ; Retire Wealthy: The Tools You Need to Help Build Lasting Wealth – On Your Own or With Your Financial Advisor ; and Debt-Free for Life: The Tools You Need to Free Yourself from Debt .

“BFG University starts with students in their freshman year of high school and going into their senior year, starting with the basic financial topics and then getting into the more advanced topics,” Nebel said.

She added that BFG University was born from the firm’s marketing department. “They saw there is this need among individuals who are underserved in the financial community,” she said. “With our CEO writing this book about retirement being like graduation, we started brainstorming how to present this information in a university-like program.”

Nebel and the other members of the BFG team travel to area high schools regularly to talk to students about careers in finance, how to invest and how to pick stocks. Nebel often works with investment clubs in local high schools.

BFG University and related financial literacy programs are among the ways financial professionals give of their time and expertise to help members of their communities improve their financial knowledge.

The need for financial literacy education continues to grow. Consider these statistics from zippia.com:

• 73% of teens want a more personal finance education . • Americans lose an average of $1,819 annually due to financial illiteracy. • 77% of Americans are financially anxious . • Only 25% of American teens have confidence in their personal finance knowledge.

“We do go into schools and talk about financial topics as much as we can, because unfortunately a lot of young people, even when they get into college, aren’t aware of some of these things,” Nebel said.

BFG also created a program called Financial Planning for All.

“It allows any individual, regardless of their assets, to work with a Certified Financial Planner,” Nebel said. “Many of our peers in this industry require clients to have a minimum amount of assets before they will work with them. We partner with a lot of firms and form strategic alliances. We call it ‘collaboration over competition,’ where we can meet with clients and help them because there are a lot of people who need planning advice, but they may not have any money.”

Nebel said she started an investment club at York College of Pennsylvania when she was a student there. She loves to work with Junior Achievement and high school students to teach young people about the stock market.

“There are high schools in our area that have an investment club, where they begin picking stocks on Sept. 1 and the students’ portfolio runs until the end of the school year. And I work with Junior Achievement on their stock market challenge. I’m a trader for the day, so I run back and forth to the tables where the kids are placing orders. It’s a lot of fun.”

Nebel said she believes financial literacy education should begin as early as possible. “I think the more we can talk about these issues and emphasize the importance of starting early, the better.”

Not just for kids

Financial literacy education isn’t just for students. Adults need help in understanding an array of financial topics. Protection Point Advisors in Roseville, Calif., uses everything from webinars to a network of professionals to provide financial education for clients and nonclients alike.

“We have something called 3-D Asset Care, which is a series of monthly webinars on topics that are important for our clients,” he said. The topics are not confined to financial planning matters. For example, 3-D Asset Care conducted a webinar on “Reverse Mortgages: The Good, the Bad and the Ugly.”

“To my knowledge, there’s no one in my firm who even holds a mortgage broker license, so it wasn’t about generating business,” he said. “It’s more because clients are asking about reverse mortgages as property values go up and there’s a lot of equity stored in people’s houses.”

Heck said his firm also offers financial literacy education to its clients as well as clients’ children and grandchildren.

“We have a financial education system that’s accessible through our website,” he said. “It has hundreds of modules in 17 or 18 different categories — everything from budgeting and spending to buying a car or a house, debt management, taxes, workplace transition. We make all that available to our clients when they come on board with us, but we also encourage them to give their children and grandchildren access to that information.”

Heck described his firm’s financial education system as “real-world topics, things that will benefit people, especially people who are just starting out, because these are things that aren’t taught in school anymore.”

The founders of Protection Point Advisors created the National Referral Network, in which they teach professionals such as accountants, insurance agents, mortgage brokers and real estate professionals how to educate and deliver value to their clients. Heck said that his company produces a weekly podcast with different professionals within the network to discuss various financial education issues. He also writes articles regularly for LinkedIn and industry publications.

When it comes to educating people about financial issues, Heck said most of those he works with want guidance more than anything else.

“They want guidance as to what they can do to empower themselves, to know more about the direction in which they want to go, because a lot of people know where they want to go but they usually don’t know how to get there. So what they are largely looking for is, ‘OK, John, this is where we’re at and how do we get from Point A to Point B?’”

Heck said his company was inspired to take on financial literacy education after its founders acknowledged that people often are uncomfortable discussing financial topics.

“We asked ourselves, ‘How can we do this differently? How can we do it better?’ That’s where all this came from — from a place of asking ourselves how we can add more value to the client relationships we have.”

Repairing the disconnect

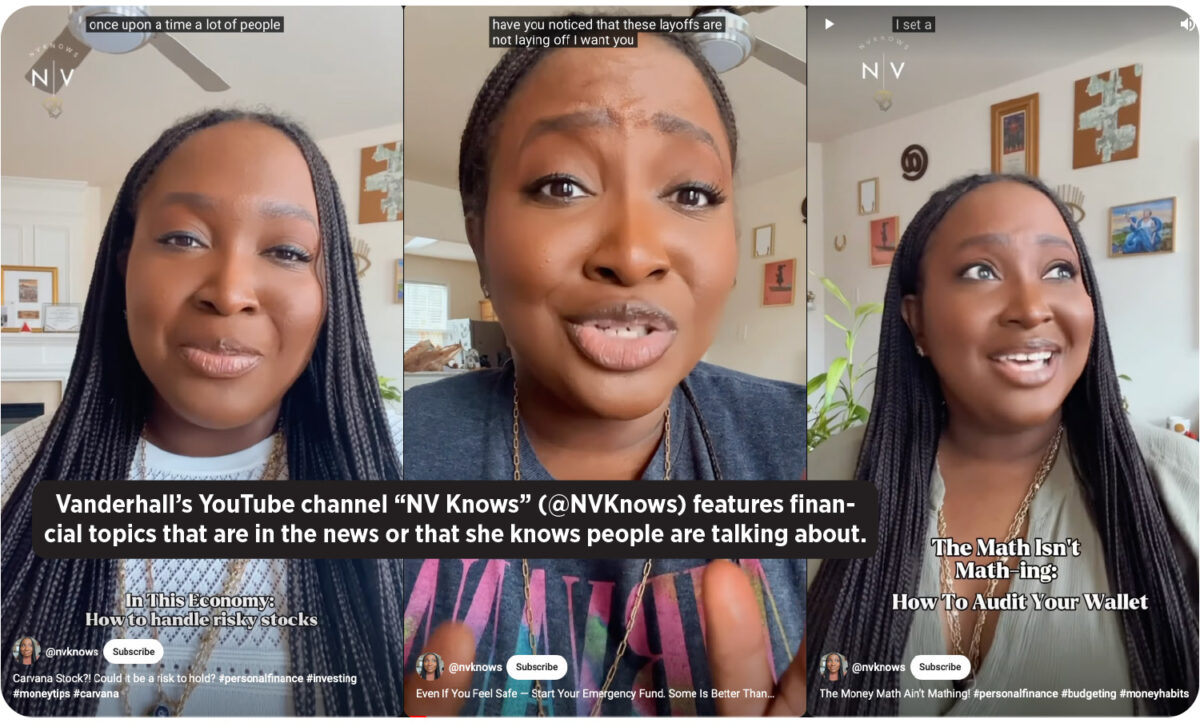

When Nadia Vanderhall first started working in marketing for financial services companies, she noticed a disconnect between the information consumers needed to make financial decisions and the information that was out there. So she set out to fix it.

“I create content and educate people on different topics that are within the personal finance space,” she said.

Vanderhall’s content appears on several platforms, including YouTube, Facebook, Instagram, LinkedIn and X.