How To Write a Business Plan for Coal Mining Business in 9 Steps: Checklist

By henry sheykin, resources on coal mining.

- Financial Model

- Business Plan

- Value Proposition

- One-Page Business Plan

- SWOT Analysis

- Business Model

- Marketing Plan

Interested in starting a coal mining business? In 2021, the global coal mining industry was valued at $686.8 billion, with a projected growth rate of 3.3% from 2022 to 2028. As the demand for minerals extracted from coal deposits remains high, launching a business in this industry can be profitable. However, in order to succeed, you need a well-designed business plan.

Here are nine essential steps to help you create a successful business plan for your coal mining business. First, conduct thorough market research to understand industry trends and competition. Analyze the current state of the industry and potential customers to determine the optimal location for your coal mine.

Once you have a clear understanding of the industry, it's time to secure funding and investment opportunities . Establishing a comprehensive business strategy and financial projections will increase your chances of obtaining necessary funding. Ensure you obtain the necessary permits and licenses before launching your operations.

Building a strong team is critical to the success of your coal mining business. Hire a team of experts and consultants who have experience in the industry and can provide guidance and support. Additionally, establishing clear safety procedures and regulations for your team is crucial.

By following these nine essential steps and creating a comprehensive business plan, you can launch a successful coal mining business, contributing to the growing industry's prosperity.

Conduct Thorough Market Research

Before starting a coal mining business, it is essential to conduct thorough market research to ensure that there is a demand for your services and that you have a solid understanding of the industry. Conducting research will help you identify potential customers, estimate the demand for your services, determine the prices you can charge, and assess the competition.

- Research your target market: Identify the type of companies, governmental agencies, or individuals who are likely to need your services. Look into the size of the market, the demographics, and the needs of potential customers.

- Analyze the competition: Analyze your competitors' strengths and weaknesses, their pricing strategies, and their marketing techniques. This will help you identify areas where you can differentiate yourself from the competition.

- Assess industry trends: Research the current state of the coal mining industry, including the demand for coal, the prices of coal, and the factors that influence the industry's growth. This information will help you make informed decisions about your business strategy.

- Use online databases and industry reports to get up-to-date and reliable information about the coal mining industry.

- Attend industry events and conferences and seek advice from experts to gain valuable insights.

- Survey potential customers to get feedback on their needs and preferences.

By conducting thorough market research, you can gain a better understanding of your potential customers' needs and the competitive landscape of the coal mining industry. Use this information to develop a solid business plan that meets the needs of your target market and differentiates your business from the competition.

Analyze The Competition And Current Industry Trends

One of the crucial steps in establishing a coal mining business is to conduct a thorough analysis of the competition and the current industry trends. This step will provide important insights into the market, competition, and industry trends, which can help you to shape your business strategies and make well-informed decisions.

To begin with, you should gather information on your competitors, their strengths, weaknesses, and industry positioning. You can also research the trends in the coal mining industry, the demand for coal, and the changing regulations and policies that may affect the industry in the future.

It is also essential to look for the key players in the industry, their market share, and their profitability. This information will help you to identify gaps in the market that your business can fill.

- Conduct a SWOT analysis of your competitors to identify their strengths, weaknesses, opportunities, and threats

- Research industry trends, market demand for coal, and changing regulations and policies

- Identify the key players in the industry, their market share, and profitability

- Look for gaps in the market that your business can fill

- Use industry reports and publications to gather information on the competition and industry trends

- Attend industry conferences and seminars to network with experts and gather insights

- Use online research tools like Google Alerts and social media to stay up to date with the latest industry news and trends

Analyzing the competition and current industry trends is an important step in developing a successful coal mining business. By gaining a deep understanding of the market and competition, you can identify opportunities to differentiate your business and create a compelling value proposition to attract customers.

Determine The Ideal Location For The Coal Mine

Determining the ideal location for a coal mine is crucial for the success of the business. Here are some important factors to consider when choosing a location:

- Accessibility: Your coal mine should be accessible by various modes of transportation, such as rail, road, and water. This will ensure that you can easily transport your coal to customers and distributors.

- Availability of coal deposits: Conduct a geological survey to determine the extent and quality of coal deposits in the area. The more extensive and higher quality the deposits, the more profitable your business will be.

- Proximity to markets: Consider the distance of your mine from potential customers. The closer your mine is to these markets, the lower your transportation costs will be.

- Infrastructure: Look for areas with existing infrastructure such as power lines, water sources, and telecommunication networks. This will reduce your start-up costs and improve efficiency.

- Environmental regulations: Check local environmental regulations to ensure that you can operate in compliance with these requirements. You may need to invest in additional equipment to meet these requirements.

- Business culture: The culture and norms of the community in which you operate can affect your operations. Consider factors such as labor availability, local attitudes towards mining, and government policies that might affect your business operations.

- Security: Safety and security of your employees, assets, and operations are paramount. Ensure that the location is secure and does not present security risks that may disrupt operations.

- Choose a location where local authorities are supportive of mining operations and are willing to provide necessary support such as infrastructure and security.

- Consider conducting a risk assessment to identify potential hazards and risks associated with the location of your mine and develop a plan to mitigate these risks.

- Engage the local community and communicate how your business will benefit them, such as by creating job opportunities and contributing to local development initiatives.

In summary, choosing the right location for your coal mine is crucial for the success of your business. Thoroughly research and analyze all the factors that may affect your operations before settling on a location.

Secure Funding And Investment Opportunities

Starting a coal mining business is a capital-intensive venture that requires significant funding and investment. Securing financial resources can be a daunting task, but with a solid business plan in place and a clear understanding of the project's potential return on investment, attracting investors and securing funding becomes more manageable.

Determine Financial Needs: Before seeking funding, it's essential to determine the financial requirements for the business. This requires creating a detailed budget and financial projections that cover all aspects of the coal mining operation. Estimate the costs involved in acquiring land, mining equipment, hiring staff, and other operational expenses. The financial projection should also project profits based on realistic expectations.

Consider Different Funding Options: There are numerous funding options available to entrepreneurs. Choices include loans, grants, subsidies, and crowdfunding, among others. Each option has its requirements, advantages, and disadvantages. Entrepreneurs need to research and determine which financing option best suits their needs.

- Join an investment club or network for access to potential investors.

- Provide thorough financial statements and projections to potential investors.

- Consider seeking private equity financing

Create a Comprehensive Business Plan: Lenders and investors require a business plan before providing funding. It's imperative to create a comprehensive plan that clearly outlines the company's goals, financial projections, marketing strategies, management structure, and operational procedures.

Network and Seek Professional Assistance: Seek professional assistance from financial experts, business advisors, and other professionals who offer funding assistance. Attend relevant industry events and workshops, which are often an opportunity to meet potential investors.

Be Prepared to Answer Follow-Up Questions: Expect to receive various follow-up questions from potential funders, including profit projections, risk assessments, and target market analyses.

Conclusion: Securing funding is a critical step in starting a coal mining business. A well-planned, comprehensive business plan can attract investors and secure funding. Keep in mind that securing financing can be a lengthy process, so entrepreneurs must remain patient, persistent, and optimistic.

Develop A Comprehensive Business Strategy

Now that you have conducted thorough market research, analyzed your competition and current industry trends, determined the ideal location for your coal mine, and secured funding and investment opportunities, it is time to develop a comprehensive business strategy. This will be the roadmap that guides your coal mining business to success.

Identify your target audience: Your target audience for the coal mining business will be the companies, governmental agencies, and individuals in need of minerals extracted from coal deposits. Therefore, it is essential to identify your target audience and their needs, challenges, and expectations. This step can help you tailor your business strategy to meet their needs.

Create a value proposition: A value proposition is your unique selling point. It communicates to potential customers what your business does better than your competitors. Be sure to highlight the benefits of using your services. This can help differentiate your business from others in the industry.

Define your business goals: It is essential to set clear and achievable goals for your coal mining business. What are your short-term and long-term goals? How do you plan to achieve them? It is crucial to have specific, measurable, achievable, relevant, and time-bound goals (SMART).

Develop a marketing plan: Develop a marketing plan that outlines how you plan to reach your target audience, convey your value proposition, and achieve your business goals. Ensure your plan includes both online and offline marketing strategies.

Outline your operations plan: Your operations plan should outline the day-to-day operations of your business. This can include staff hiring and training, equipment and supply procurement, and coal extraction and transportation logistics.

- Ensure that your business strategy is flexible and can adapt to changes in the market and industry.

- Be realistic when setting your goals and do not overestimate your capabilities.

- Do not forget to consider the financial implications of your business strategy when developing it.

Developing a comprehensive business strategy is crucial to ensuring the success of your coal mining business. It is the foundation upon which you will build your business. Therefore, take your time and invest the necessary resources into developing a comprehensive strategy.

Create A Detailed Budget And Financial Projections

One of the most crucial steps in starting a coal mining business is creating a budget and financial projections. This will help you determine the estimated costs and expected revenue of the business, allowing you to make informed decisions and stay within budget. In this chapter, we will discuss how to create a detailed budget and financial projections for your business.

1. Estimate startup costs: Determine the expenses needed to start the coal mining business. This includes the cost of equipment, labor, permits, insurance, and other expenses. Make sure to include as much detail as possible, including the cost of each item and how much will be needed to purchase or rent them.

2. Estimate operating costs: Once you have determined the startup costs, estimate the ongoing costs of running the business. This includes expenses such as labor, fuel, maintenance, repairs, and taxes. Be sure to include as much detail as possible, including the cost of each item and how often it will need to be purchased or serviced.

3. Determine revenue: Estimate the revenue you can expect from your coal mining business. This includes the price of coal per ton, the number of tons you expect to produce, and any additional services you plan to offer, such as transportation or consulting. Consider the demand for coal in your target market and factor in any competition you may face.

4. Create financial projections: Using the estimates for startup and operating costs and revenue, create financial projections for the next few years. This will help you determine when the business is expected to break even and when you can expect to start making a profit.

- Tip: Be realistic with your financial projections. It's better to underestimate revenue and overestimate expenses to avoid any unexpected surprises.

5. Monitor and adjust: Once the business is up and running, regularly monitor your financial performance and adjust your budget and projections as needed. This will help you stay on track and adjust to any changes in the market or unexpected expenses.

- Tip: Consider using accounting software to help you monitor your finances and make adjustments more efficiently.

Creating a detailed budget and financial projections is essential to starting and maintaining a successful coal mining business. By estimating your expenses and revenue and monitoring your financial performance, you can make informed decisions and stay within budget, leading to long-term success.

Obtain Necessary Permits And Licenses

In order to start a coal mining business, it is essential to obtain the necessary permits and licenses. This ensures that the operation adheres to all applicable regulations and has the legal permission to operate. Obtaining permits and licenses can be a complex process and requires thorough research and preparation. Here are some important steps to follow to obtain the necessary permits and licenses:

- Research the necessary permits and licenses: The requirements for permits and licenses vary depending on the location of the mine and the type of coal mining operation. Research the specific requirements in the chosen location and familiarize yourself with the necessary permits and licenses.

- Identify the regulatory agencies: Different regulatory agencies oversee different aspects of the coal mining operation. Research and identify the relevant agencies and determine which permits and licenses are required from each agency.

- Prepare the necessary documentation: Each permit and license application requires specific documentation. Prepare all necessary documentation, such as environmental impact reports and safety plans, to ensure a smooth application process.

- Submit the applications: Submit all permit and license applications to the relevant agencies. Be sure to submit them in a timely manner and ensure that all necessary documentation is included.

- Follow up on the applications: Follow up with the regulatory agencies to ensure that the applications are being processed and all requirements are being met. Address any issues or concerns promptly.

- Obtain the permits and licenses: Once all requirements are met and the applications are approved, obtain the necessary permits and licenses. Keep these documents readily available and in a safe place.

- Engage with a consultant or expert who is knowledgeable in the regulatory process to ensure that all requirements are met.

- Be prepared for a lengthy and complex process. Allow yourself ample time to complete the process.

- Regularly check for updates or changes to the regulations and requirements.

Obtaining the necessary permits and licenses is a crucial step in starting a coal mining business. It ensures that the operation is legal and compliant with regulations. By following these steps, the process can be streamlined and successful.

Hire A Team Of Experts And Consultants

Launching a coal mining business requires a team of experts and consultants who can help you navigate the complexities of the industry. Depending on the nature and scale of your operation, you may need to hire professionals in a variety of areas, such as geology, mining engineering, environmental science, finance, and law.

To build a strong and efficient team, consider the following:

- Define your recruitment strategy: Determine the qualifications, skills, and experience required for each position and create a job description for each role. Identify the most effective recruitment channels, such as online job boards, professional associations, or referrals from industry contacts.

- Assess candidates: Once you have a pool of candidates, assess their qualifications and suitability for the job. Consider factors such as education, experience, certifications, and references. Conduct interviews, assessments, and background checks as necessary to evaluate their skills and fit.

- Provide ongoing training and development: Investing in your team's skills and knowledge can help improve productivity, safety, and compliance. Provide regular training sessions, workshops, and certifications to keep your team up-to-date with industry trends and best practices.

- Establish clear roles and responsibilities: Ensure that each team member understands their role, objectives, and performance expectations. Create a clear organizational structure and communication channels to facilitate collaboration and accountability.

- Consider hiring a consultant or advisor who has expertise in the coal mining industry and can provide guidance and strategic advice.

- Collaborate with local schools, universities, and vocational training centers to identify and train potential candidates.

- Offer competitive compensation, benefits, and incentives to attract and retain top talent.

- Develop a positive and supportive work culture that values diversity, inclusion, and safety.

It is important to hire a team that is passionate, qualified, and committed to your business's vision and values. By investing in your team's skills and expertise, you can improve your chances of success in the competitive and rapidly-evolving coal mining industry.

Establish Clear Safety Procedures And Regulations.

Considering the high risks associated with coal mining business , it is imperative to prioritize safety. The safety of employees and clients should be of paramount importance to any mining company. Therefore, it is vital to establish clear safety procedures and regulations to mitigate accidents and injuries in the workplace.

Here are some important safety measures that coal mining businesses must implement:

- Develop safety policies and procedures that conform to the industry standards and regulations. Make sure you keep them up-to-date and revise them as necessary.

- Appoint a qualified safety manager and a team of safety professionals to work alongside management to implement and enforce safety protocols.

- Provide appropriate training and education to employees about safety procedures, emergency protocols, and industry-specific hazards (e.g., coal dust, methane gas, equipment-related dangers).

- Ensure compliance with federal and state regulations and standards.

- Conduct regular safety checks and audits to identify any risk factors and areas that need improvement.

- Maintain and regularly inspect all equipment, machinery, and safety devices to ensure they are in proper working condition.

- Provide protective gear and equipment, such as helmets, respirators, and safety boots to employees working in dangerous work environments.

- Establish emergency response plans and provide staff with training and education on how to respond to accidents, injuries, and other hazardous situations.

- Encourage open communication and collaboration among employees and management to identify and address safety concerns proactively.

- Make safety a core value of the business culture

- Implement an incentive program to encourage workers to report unsafe conditions and suggest safety improvements

- Regularly communicate with employees about safety protocols, updates, and best practices.

Working in coal mines can be dangerous, but by establishing clear safety procedures and regulations that prioritize the safety of employees and clients, businesses can mitigate the risks associated with this industry and ensure that their operation runs smoothly.

Starting a coal mining business can be a profitable venture if done correctly. It’s important to conduct thorough market research, analyze the competition and trends, determine the ideal location, secure funding and investment, develop a comprehensive business strategy, create a detailed budget, obtain necessary permits and licenses, hire a team of experts, and establish clear safety procedures and regulations. By following these nine steps, you can create a successful coal mining business that provides services to companies, governmental agencies, or individuals in need of coal deposits.

$169.00 $99.00 Get Template

Related Blogs

- Starting a Business

- KPI Metrics

- Running Expenses

- Startup Costs

- Pitch Deck Example

- Increasing Profitability

- Sales Strategy

- Rising Capital

- Valuing a Business

- How Much Makes

- Sell a Business

- Business Idea

- How To Avoid Mistakes

Leave a comment

Your email address will not be published. Required fields are marked *

Please note, comments must be approved before they are published

How to Start a Coal Trading Business

- 13 comments

- 16,807 views

Starting a business is difficult; many factors must be considered to succeed. There might be several options to take when it comes to business start-ups, but take note that not all options will work for you. The right choice of techniques and tactics in business can result in success and stability.

- Google Share

Therefore, you need to stick only with these techniques. Pursuing a coal trading business must also stick to a comprehensive business guide.

Businessmen, especially those just starting up, will encounter complexities when setting up a coal trading business. But, they are advised not to be discouraged by these difficulties because once they have adopted the right means to start up, the effort will surely pay off. The coal trading business is profitable, but the cash flow consistency depends on how you start and build a foundation for your business.

Recommended Techniques

A sound business plan is the most crucial technique to pay serious attention to. This plan will serve as the critical foundation of your coal trading business. Without a comprehensive business plan to follow, your business might go nowhere. Coal trading is one of the most profitable businesses, but one effective technique to ensure a smooth and successful operation is determining if there are fantastic business opportunities in your targeted location. Establishing an ideal business plan also entails achieving positive results.

Other Essential Steps

Preparing a business plan is not the only concern when starting a business. Other essential steps need to be taken seriously. One of these steps is to prepare the needed capital. This is considered the blood of a business; business operations are impossible without this. With sufficient capital, you can confidently proceed with the other steps. You must also secure permits and licenses in your locality to gain authorization for your coal trading operations.

Similar Articles

- How to Start a Coal Grinding Mill

- Learning about Global Commodity Trading

Some Considerations for Setting up a New Business

When setting up this type of business, you must consider other essential matters like hiring employees and skilled workers to help you with the operation. Find people willing to work on this type of business to ensure you are not wasting your time and investment. You must also deal with purchasing supplies and all other things needed to start your business.

Recommended Articles

- Things to Know in Trading Business Trading business idea seems to be a complicated task. It requires too much research regarding the subject matter. Once you have the proper learning, it will be easy for you to know the ways and how’s of business idea trading.

- How to Start a Trading Business Technically, starting a trading business needs sharpening your strategies in the business - master it, be open to changes, and consistently deliver quality. Having a defined way of starting it right will lead you on just the right track.

13 Comments

- Lekha janeh said on March 1, 2014 How much money will invest in coal trading business?

- Harish Pathak said on October 14, 2014 hello sir, please let me know how to start coal business and by what factor and at what level i can start.

- Sibusiso said on November 27, 2017 Please help me to start with coal trading

- ankit agrawal said on January 18, 2018 sir is there any requirements for tradind coal like any license or fire safety license etc

- MOOKETSI SAMUEL KGWARAPI said on March 8, 2018 I am currently working for a Coal Mine and I would like to start a coal trading business. My approach would be to buy coal (various types) transport it to a area closer to my market and supply market from there. I would appreciate it very much if you could assist me with the flow diagram and key activity areas at each turn that need to be addressed to run such a business. kind regards

- Sujeet Kumar singh said on June 10, 2018 Hello sir, I am from bihar. I want to know how I do coal trading business and how much money needed

- mandla said on August 25, 2018 If you needed help in terms for business write proposed and applications from to join ereba.co.za

- Mabine Caswell Lethata said on July 30, 2019 I want to start mining trading so please help me with all information needed to start such a business and most importantly first I want to transport coal to mines. Hope to hear from you soon

- SUMIT said on August 6, 2019 How much money will invest in the coal trading business?

- Neel bhatia said on October 25, 2019 Help me to restart the coal business.

- B khan said on November 1, 2021 Coal trading & supply merchant agent under CIL. Necessary documents. I went to coal buying selling business Gide me. In India, online services.

- Sbusiso said on April 6, 2022 I have a registered company now. I need information on coal transportation to supply coal to power stations.

- Duduzile said on July 21, 2022 How do I get deals transporting coal from one mine to another using a truck?

- Franchise Opportunities

- Wholesale Business Opportunities

- Small Manufacturing Business

- Farming Business Ideas

- Unique Business Opportunities

- Shop Business Ideas

- Small Business Opportunities

- Startup Company Ideas

- Home Based Business Opportunity

- Rural Business Opportunities

- Tips for Buying and Selling

- Starting Rental Business

- Ideas for Small Business

- Free Business Ideas

- Cheap Business Opportunities

- Easiest Business to Start

- Genuine Business Opportunity

- Good Small Business to Start

- Hot Business Opportunity

- Latest Business Opportunity

- Money Making Business Idea

- Internet Business Ideas

- Store Business Opportunities

- Entrepreneur Business Idea

- Retail Store Ideas

- Service Business Ideas

- Advice for Small Business

- Financing a Small Business

- Restaurant Business Opportunities

- Small Business Articles

- Business Marketing and Advertising

- Repair Business Opportunity

- Professional Career Opportunities

- Business Insurance Information

- Instructor Guides

Popular Articles

- How to Start a Cold Storage Business

- How to Start a Condom Business

- How to Start a Boarding House Business

- How to Start a Procurement Business

- Starting a Fabrication Business

- How to Start a French fry Business

- How to Start a Garbage Collection Business

- Starting a Geico Agency

Sample Coal Mining Business Plan

Writing a good coal mining business plan largely depends on what you want to see actualized. It’s about proper structuring and implementation of the business idea. If you need help writing your plan, we’re here to offer it.

This article provides a guide to follow to arrive at your objective.

COAL MINING BUSINESS PLAN SAMPLE

Mining gold or coal is a serious business that requires all of the work and planning necessary to succeed.

First off, your energy will need to be focused on how to launch. Your business plan contains all such strategies from the name the business will be called by to its employees and more.

Basically, there are 7 key sections of a plan you should consider. These should form the building blocks on which the article is written.

They include the executive summary, company description, and products & services section.

Others are the market analysis, strategy & implementation, organization & management team, and the financial plan & projection sections.

i. Executive Summary

The executive summary section should appear at the start of your coal mining business plan. This is the first section any reader sees when they open the plan. It’s rightly positioned to serve as an overview of the plan.

As the name implies, this section must be brief but capture essential aspects of the plan.

Key subsections to include are your business name & location, products & services, mission & vision statements as well as the purpose of the coal mining business plan.

The executive summary should be easy to read through.

In other words, it should be only a few pages long (about 3 to 5 pages) but hold vital information. Plus, it should be interesting enough to hold the reader’s attention.

- Business Name & Location

Every introduction of a business should begin with the provision of the business’ identity.

Here, the name serves as its identity. You’re expected to have picked a suitable name for your coal mining business before now.

Also, there’s a need for stating its location. Since we’re talking about coal mining, it’s only logical that the business should be located around a coal mining site.

- Products & Services

It’s obvious from the type of business that you’ll be involved in coal mining.

Of course, the resulting products will be coal. However, it’s important to include any other service or product you wish to sell. This will depend on whether you wish to offer any of such.

- Mission & Vision Statements

Your vision statement should be about your coal business’s planned future. This is largely based on your core ideals. One thing stands out in a vision statement; it should inspire.

Here, your employees as well as any reader should feel inspired when they go through it.

What more? A vision statement should chart a long-term roadmap for the execution and actualization of your business’ overall strategies. The mission statement on the other hand is all about the implementation of the vision.

It’s about the “how.” It should also capture the overall value of your products.

- Purpose of the Plan

Without purpose, there’s little you can achieve.

As such, your coal mining business plan should have a purpose from the onset. Asides from set strategies, what other purposes do you wish to accomplish with the plan?

For many, securing investors will be critical. You’ll have to carefully brainstorm on this area.

ii. Company Description

This next section of your business plan should explain what your business is about, its mode of operation as well as the goals targeted. Information on the legal structure of the business must be provided here.

Also important is the need for a brief history of the business and the demands you seek to fill.

What more? There should be covered on your coal products plus any services offered. You’ll also need to demonstrate an understanding of your target market.

Have a summary of company growth included with financial and market highlights.

In addition to the above points, have a summary of short and long-term business goals. Of utmost importance is the need to state how you plan on making a profit.

iii. Products & Services

Your mining products as well as other related services must be described in detail.

One major area to focus on is how these products and services are beneficial to clients. What’s the market role of your products and service? Provide such information as well as its edge over competitors.

iv. Market Analysis

Successfully launch your business; a thorough understanding of the coal mining industry is necessary.

This is demonstrated in a detailed analysis. Here, your market analysis should include a target customer segment sketch with a focus on size and demographics.

Industry outlook and description are also key.

Here, some statistics should be included that covers such information. What more? Consider including historical, current & projected marketing data regarding services and products.

Have an assessment of other competing coal mining businesses. Here, you’ll need to highlight their strengths and weaknesses.

v. Strategy & Implementation

Strategy and implementation are critical to sales and marketing. This section should provide detailed information on how you’ll promote and introduce your mining business to your target market.

You’ll need to provide information on costing, pricing and promotions.

It’ll be necessary to state exactly how your coal mining business will function. Such information should cover the operations cycle. Details on your labor sources as well as the number of employees are also crucial.

vi. Organization & Management Team

Your coal mining business’s organizational structure determines how smoothly it operates.

Here, the goal is to identify the owners, the management team as well as the board of directors. So, start with an organization chart that details the departments and key employees.

The owner’s names, percentage ownership as well as the extent of involvement are important.

What are their background and skills? Moving on to your management team, you’ll need to include information on their names, positions held as well as responsibilities and experience.

vii. Financial Plan & Projection

One of the things necessary for a sound coal mining business plan is to have competent help when writing the financial plan & projection section.

By competent help, we mean having a professional such as an accountant help out.

Here, historical financial data must be provided (this applies to established coal mining businesses). The historical financial data consists of income statements, balance sheets, and cash flow statements.

This coal mining business plan guide covers all the key areas anyone writing a plan should consider. It’s a lot of work that requires an equal amount of dedication. It’s important to never rush the process.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

- DIGITAL MAGAZINE

- Sign In Log out

- Newsletter signup

- Underground

- Environment

- LATEST HEADLINES

- News Analysis

- Partner Content

- About Mining Monthly

- Frequently Asked Questions

- Terms and Conditions

- Privacy Policy

- Cookie Policy

Coal Trading Handbook published

HILL & Associates and Doyle Trading Consultants have published the Coal Trading Handbook 2005-06: An Insider's Guide to Coal Trading and the Coal Industry.

The publisher said the handbook combined an exhaustive, no-nonsense analysis of the United States and global coal markets with comprehensive coverage of coal trading techniques and risk management strategies.

"We created this product for companies with ‘coal capital’ at risk: hedge funds, electric utilities, coal companies, merchant generators, banks, energy traders, bankers, energy analysts, railroads, barge lines and PUC commissioners," said co-author Stephen Doyle, founder of Doyle Trading Consultants.

"I have been in the coal business since 1983 as a scheduler, exporter, importer, salesman, buyer, negotiator, OTC trader and futures trader.

“Over the years, I have established a reputation for developing and executing successful trading and hedging strategies for premier companies such as Ruhrkohle Trading, Integrity International, Peabody Coaltrade, Vitol/Avista, Sithe Energies and Allegheny Energy.

“My outcome was to transfer my coal industry experience and my trading acumen into the Coal Trading Handbook. This is a reference manual and a trading manual wrapped up into one."

Doyle said the collaboration with Hill & Associates and leading coal and emissions broker Evolution Markets allowed the inclusion of proprietary data and analysis not available elsewhere.

“Our goal is that the Coal Trading Handbook becomes the 'Physician's Desk Reference' of the energy industry,” Doyle said.

The handbook has 400 pages of information and commentary on every market driver that affects the coal sector: mining techniques, physical characteristics of coal, combustion methods, coal reserves, transportation costs, inventories, mining companies, supply/demand drivers, price volatility drivers, utilities, merchant generators, synfuel plants, importers/exporters, traditional risk management techniques, OTC participants, details of standardized OTC products, regulated/unregulated trading groups, futures trading, the principles of hedging, basis trading, options trading, swaps trading, equity trading, tips for working with OTC brokers, OTC FAQ's, the use of structured products, how to interpret forward curves, the function of the back office, the role of the risk manager and prognostications on the future of coal the coal sector and coal trading.

Also included are tables, charts and graphs, such as global steam/coking coal flows, volatility curves, basis trends, market participants, coal curves, emission curves, ocean freight curves, energy correlation matrices, option pay-outs, equity charts, OTC trading volume, and regional coal consumption by electricity regions.

The Coal Trading Handbook concludes with a fifteen-page chapter titled: A Day in the Life of a Coal Trader. This puts the reader in the shoes of an OTC trader and takes them minute-by-minute through a roller-coaster of a trading day.

Not only is it a very entertaining chapter, it was designed to bring many of the concepts covered in the handbook into a real-life setting.

A six-page, detailed table of contents, a five-page Introduction to the Coal Trading Handbook and excerpts from 21 chapters can be downloaded from Doyle Trading Consultants' website: http://www.coaltradinghandbook.com

- All Regions

RELATED ARTICLES

- Asian demand could offer hope for Aussie coal juniors

- The energy industrys physician desk reference

- Hot topic: over the counter

- Mining and trading oil and vinegar (or not)?

< PREVIOUS ARTICLE

Cockatoo Coal flies in

NEXT ARTICLE >

Change-outs affect Centennial quarter

Get the Mining Monthly Newsletter delivered free each day

From our partners, partner content, emesent hovermap riding high on uavs, robots and automobiles, tackling tailings risk with dewatered solutions, most popular, olive downs officially opened after first coal delivered, whitehaven open pits to drive production growth, gruyere going again with supplies finally getting through, lhds collide after failing to notice horns, premium subscribers only.

A growing series of reports, each focused on a key discussion point for the mining sector, brought to you by the Mining Monthly Intelligence team.

Mining Magazine Intelligence Future Fleets Report 2024

The report paints a picture of the equipment landscape and includes detailed profiles of mines that are employing these fleets

Mining Magazine Intelligence Digitalisation Report 2023

An in-depth review of operations that use digitalisation technology to drive improvements across all areas of mining production

Mining Magazine Intelligence Automation Report 2023

An in-depth review of operations using autonomous solutions in every region and sector, including analysis of the factors driving investment decisions

Mining Magazine Intelligence Exploration Report 2023 (feat. Opaxe data)

A comprehensive review of current exploration rates, trending exploration technologies, a ranking of top drill intercepts and a catalogue of 2022 Initial Resource Estimates and recent discovery successes.

- Newsletter Signup

- Terms And Conditions

THE ASPERMONT BRAND PORTFOLIO

Copyright © 2000-2024 Aspermont Media Ltd. All rights reserved. Aspermont Media is a company registered in England and Wales. Company No. 08096447. VAT No. 136738101. Aspermont Media, WeWork, 1 Poultry, London, England, EC2R 8EJ.

Not a Subscriber?

Subscribe now.

Coal Mining Business Plan

- Description

- Executive Summary

- Products & Services

- Market Analysis

Marketing Plan

- Management Plan

Financial Plan

What you get with coal mining business plan package, i.- executive summary.

The coal industry is changing rapidly across the United States, with some regions lacking reliable and beneficial energy sources. In response to this situation, CoalCorp Inc. intends to provide customers in Wyoming, Montana and the surrounding region with a reliable and competitively priced energy source of coal. This will be done through a network of mining suppliers and processing facilities, a suite of speciality services and solutions, and the production and delivery of different types of coal.

Furthermore, CoalCorp Inc. will fill an identifiable need in the market by giving its clients the ability to acquire a tailored energy source. By granting individual requests and developing bespoke coal production and delivery schedules, CoalCorp Inc. will cater to the unique needs of both large-scale and individual clients alike.

CoalCorp Inc. will provide clients with a complete range of coal services that are tailored to their individual needs. From sourcing and processing to delivery and long-term solutions, CoalCorp's comprehensive solutions can meet all their coal requirements. CoalCorp Inc. will provide a full range of coal products from thermal coal to met and steam coal, all of which can be supplied in bulk, based on individual schedule requirements. In addition, CoalCorp Inc. will provide specialty solutions and services that can accommodate large-scale contracts and individual requests, such as the development of bespoke coal production and delivery schedules.

Target Market

CoalCorp Inc. is strategically positioned to effectively target a defined customer base that is looking for a reliable and cost-effective source of coal energy. This customer base consists primarily of energy companies located in Wyoming, Montana, and the surrounding region that are in need of a steady and consistent supply of energy resources. CoalCorp Inc. plans to further expand outreach to customers located in adjacent states, such as Colorado and Utah, who have growing energy needs.

CoalCorp Inc. also intends to extend its customer base by offering specialty services and solutions that can accommodate large-scale contracts and individual requests. By leveraging its network of mining suppliers and processing facilities, CoalCorp Inc. is uniquely positioned to respond quickly and reliably to customers' needs.

Competition

CoalCorp Inc. will be competing in the coal market against a range of sources, from alternative energy sources such as natural gas and renewable energy sources, to other coal producers. The alternative energy sources are becoming increasingly preferred by consumers due to their environmental advantages, though coal remains a significant source of energy for many parts of the United States.

CoalCorp Inc. will compete with other coal producers on the basis of quality, cost, and delivery times. We plan to leverage our strong network of suppliers and our experienced production team to create a competitive offering of coal, tailored to the needs of our clients. We will target large-scale contracts and individual requests, to ensure the best coal and service for our customers.

Financial Summary

CoalCorp Inc. pledges to offer competitively priced coal products and services to the US market. Our business plan estimates the following financial highlights over the coming years:

- Minimal startup costs, with the majority of investments going towards sourcing and processing quality coal.

- Projected sales for the first full year of business estimated at $10M, rising sharply over the next five years to exceed $45M.

- High profitability from our quick-turnaround service that supplies customers from day one.

- Net profits estimated at 30% of total revenues.

- Continued reinvestment in operations and development.

Funding Requirements

CoalCorp Inc. will require a significant amount of capital in order to commence operations and grow the business. This capital will be used for the following:

- Purchasing and leasing of land, equipment and other resources

- Hiring and training staff

- Meeting legal and environmental standards

- Collaborating with suppliers and third-party stakeholders

- Developing a product portfolio of thermal and met coal

- Developing specialised coal delivery and production services

- Marketing and advertising campaigns

- Covering operational costs

Milestones and Traction

At CoalCorp Inc., we are proud of the accomplishments we have achieved over the last decade. We have established a solid foundation upon which to build a vibrant and profitable coal mining operation with a penchant for excellence and a commitment to delivering on time and within budget. To date, we have completed the following milestones:

- Established a network of mining suppliers and processing facilities in Wyoming, Montana, and the surrounding region.

- Developed a broad selection of coal products, from thermal coal to met and steam coal, designed to meet the needs of clients both large and small.

- Successfully delivered on large-scale contracts as well as individual requests for coal production and delivery scheduling.

- Expanded our regional presence, shipping to states across the US.

- Solidified our standing in the coal industry as a reliable and competitively priced energy source.

As we move forward, CoalCorp Inc. will continue to build upon these accomplishments and strive towards further success. The coming months will see our aspirations to become the premier provider of coal in the United States realized. Our roadmap will set out specific milestones to be achieved, such as meeting production targets, expanding our supply chain, and increasing our customer base. We look forward to embracing our goals and achieving them in a timely and efficient manner.

II.- Products & Services

The energy industry is experiencing dramatic changes due to climate change, the increasing use of renewables, and the declining availability of accessible and reliable coal deposits. This has led to difficulties in sourcing and processing coal for clients, and has led to customers large and small facing challenges when seeking reliable and competitively priced fuel.

CoalCorp Inc. will address these challenges with a wide selection of coal products, from thermal coal to met and steam coal, designed to meet the individual needs of customers large and small. Additionally, CoalCorp Inc. will enable customers to take advantage of specialized services and solutions, such as bespoke coal production and delivery schedules.

At CoalCorp Inc., we will provide a comprehensive selection of coal products, from thermal coal to met and steam coal, tailored to suit our customers’ individual needs. We understand that customers come in all sizes, from small residential orders to large corporate contracts, and we are committed to offering quality products at competitive prices to all. Our coal products will strictly adhere to quality control standards and will be even further enhanced with our suite of specialty services, such as the development of bespoke coal production and delivery schedules.

Our range of services will make obtaining coal for any project easy and efficient. Our supply chain expertise will allow us to carefully select the right suppliers to meet specific requirements, while our processing facilities will provide additional opportunities to tailor coal products to your exact specifications. With CoalCorp Inc., customers are guaranteed reliable, cost-effective, and effective service.

Validation of Problem and Solution

CoalCorp Inc. is committed to providing customers with an energy source that is reliable and cost-competitive. In 2019, an independent cost-comparison study found that CoalCorp Inc. prices were on average 17% lower than their competitors in the region. Additionally, CoalCorp Inc.'s customer satisfaction — measured through survey feedback — was 3% higher than its competitors. These metrics provide evidence that CoalCorp Inc. is offering a solution to its customers that is both cost-effective and high-quality.

Furthermore, the network of suppliers and processors employed by CoalCorp Inc. allows them to provide customers with a largely flexible product offering that can accommodate many different needs. This can be confirmed by the 80% increase in long-term coal contracts agreements that CoalCorp Inc. achieved in 2020 due to their ability to procure and process these customised coal products.

Product Overview

CoalCorp Inc. provide an extensive selection of coal products and services, ranging from thermal coal to met and steam coal, designed to suit the individual needs of customers. All our coal is sourced and processed in the United States, with a particular focus on Wyoming, Montana, and the surrounding region. Speciality services and solutions are also available for large-scale contracts, as well as individual requests.

By purchasing from us, clients cans expect a reliable, competitively priced energy source, as well as the assurance that their needs and requirements are fully taken into consideration. CoalCorp Inc. also offers an additional suite of services, such as the development of bespoke coal production and delivery schedules.

Our coal products and services are specifically tailored to meet the needs of clients large and small, offering reliable and competitively priced energy solutions for all industries.

CoalCorp Inc. will primarily compete with other coal mining firms in the United States, offering a wide range of products and services. While some of our competitors focus solely on thermal coal, CoalCorp Inc. will offer a range of thermal, met, and steam coal, each designed to meet the individual needs of customers. Moreover, we will provide specialty services and solutions, such as the development of bespoke coal production and delivery schedules, while our competitors may be limited to providing only pre-packaged services.

As a provider of coal products and services, CoalCorp Inc. will strive to offer the highest quality offerings at the most competitive prices. While our competitors may be able to offer lower prices, CoalCorp Inc. will make sure that the quality of our products remains superior. Additionally, CoalCorp Inc.’s extensive network of mining suppliers and processing facilities will help ensure that our clients receive reliable delivery times that meet their individual needs.

CoalCorp Inc. has already established a network of suppliers, processing facilities, and services to source and process coal for clients in the United States. Going forward, CoalCorp intends to take the following steps in its business plan to further develop and establish the coal mining and processing business.

1. Expand coal supplier network – CoalCorp Inc. seeks to expand its coal supplier network by entering into partnerships and agreements with new suppliers. This will reduce supply costs, allowing the company to provide competitively-priced coal products and services.

2. Increase processing capacity – CoalCorp Inc. plans to increase its processing capacity to meet the needs of its customers. This will involve investing in the latest technologies and equipment and expanding its workforce.

3. Improve customer service – CoalCorp Inc. will aim to improve customer service by increasing communication with customers and providing tailored solutions based on their needs. This will include providing personalized delivery schedules, as well as speciality services such as analyzing samples and quality control.

4. Develop marketing initiatives – CoalCorp Inc. will develop and implement marketing initiatives to increase visibility in the industry and drive demand for its products and services. This will include advertising campaigns and promotions, as well as attending industry events.

These are the steps CoalCorp Inc. will take to establish and grow its coal mining and processing business. By taking these proactive steps, the company will be well positioned to meet the energy needs of its customers and be a leader in the industry.

III.- Market Analysis

Market segmentation.

CoalCorp Inc. is well-placed to target a range of distinct market segments through its products, services and strategic positioning within the coal mining industry. To that end, the table below outlines the potential groups of customers CoalCorp Inc. may distinguish by specific characteristics, such as type of industry, size and use of coal, and desired services.

Target Market Segment Strategy

Our target market includes commercial and industrial coal Customers, with an emphasis on customers who need low-cost, reliable coal delivery to meet their operations needs. Our ideal customer would most likely be businesses that run large-scale operations such as energy producers, steel manufacturers, and other industries that rely on coal as a fuel source. With our reliable delivery and competitive pricing, we can provide these businesses with the coal they need on a dependable and budget-friendly basis.

Key Customers

Our ideal customer archetype is a large industrial coal consumer who values high-quality product and efficient delivery. This customer will be our main advocate for our business as they are in possession of the greatest buying power and are in need of a reliable and dependable supplier. With our business, we hope to provide customers with greater assurance that their orders will be fulfilled to their exact requirements and will be delivered on time. We plan to exceed customer expectations by assuring them that we are a trustworthy and reliable supplier.

Future Markets

This section provides a snapshot of the potential market for the proposed coal mining business and how the resulting business strategy will function within it. It is assumed that this business will serve larger industrial businesses seeking to meet their energy needs, and so a focus will be placed on high-volume energy supply contracts that generate sustained profit for the business. In particular, it will focus on providing coal to industries such as power plant administration, synthetic fuel production, and manufacturing, who will be the most reliable customers in return for the most profits.

It is also assumed that the target market will include those businesses who wish to access coal which is of a higher quality and can provide higher efficiency with lower cost, so the proposed business will take advantage of the latest in underground mining technology and processes in order to provide the highest quality product. Furthermore, as the proposed business also includes a transportation and logistics service, there is also potential to supply to businesses outside of the local area, either at the same price or a slightly higher rate, depending on the distance and complexity of delivery.

By focusing on these higher quality and more reliable long-term contracts, the business will benefit from a steady influx of profits and the satisfaction of providing energy to those who need it.

The coal mining industry is a highly competitive sector characterized by a number of major players operating in and around Gillette, Wyoming. Some of CoalCorp Inc.'s key competitors include:

- Cheyenne Mining & Machinery

- Hecla Mining Co

- Wyoming Mining Supply, LLC

- Rockies Coal, LLC

- Kendall Coal, Inc.

CoalCorp Inc. must compete with these established organizations to remain competitive and profitable. In order to do so, CoalCorp Inc. must offer affordable prices, reliable delivery times, and a wide selection of coal products designed to meet the individual needs of customers large and small.

IV.- Marketing and Sales Plan

CoalCorp Inc’s marketing plan is designed to reach customers using a variety of channels, including print, radio/TV, direct mail, and an interactive website. Through these channels, CoalCorp Inc. will seek to build brand recognition and trust with our customers, while providing advice and services to the industry.

To accomplish this, CoalCorp Inc. will need to invest in a comprehensive marketing strategy that incorporates traditional, digital, and direct mail tactics.

For traditional media, CoalCorp Inc. will focus on local print, radio, and television advertising via spot purchasing as well as ongoing advertising packages. To reach customers outside of the local region, CoalCorp Inc. will also invest in search engine marketing, display advertising, and pay per click campaigns.

For direct mail, CoalCorp Inc. will create a series of collateral to be distributed throughout the region. This collateral will be print-to-order, allowing us to target specific markets and customers with the appropriate information and message.

Finally, CoalCorp Inc. will create a digital presence that allows customers to view our product offerings, read company and industry news, and contact us with questions and inquiries. The website will be optimized to ensure that we remain at the top of search engine rankings.

The following table outlines our estimated marketing costs:

It is the goal of CoalCorp Inc. to reach our target markets in the most cost-effective manner possible, delivering a message that resonates with potential customers. As markets evolve, the company will reevaluate our tactics and invest in new strategies and services as necessary to ensure that CoalCorp Inc. remains competitive.

It is important to be realistic when crafting a sales plan for a coal mining business. Our team has developed an initial estimate of the number of sales we anticipate based on market conditions, capacity, our pricing strategy, and other relevant factors. We anticipate an average of thirty (30) sales of coal per month over the course of the next fiscal year.

Our pricing strategy is competitive and designed to ensure the profitability of the company. We also have plans to increase our marketing efforts to attract more potential customers. Additionally, we have the capacity to increase our production and expand our sales as needed, allowing us to take advantage of any emerging market opportunities.

Location and Facilities

CoalCorp Inc. is currently located in Gillette, Wyoming, and plans to operate from this location for the foreseeable future. Being based here puts us in what is regarded as a prime geographical area for the coal industry, in the heart of a major coal producing district.

Our facility is located a few miles outside of Gillette and is spacious enough to accommodate our current and expected operations. This space encompasses our offices, industrial-grade equipment, storage facilities for coal, and a trucking depot.

Due to the availability of locally mined coal resources and our specialty services, operating in Gillette and offering services to the surrounding region will not only be cost-effective, but can also capitalize on existing infrastructure and transportation capabilities.

Our coal mining business plan makes use of the latest in technological advancements in order to maximize efficiency and profitability. We plan to use mining and sorting methods that are more automated and efficient, such as advanced 3D mapping, GPS navigation systems, automated monitoring of mining operations, and automated haulage and materials handling.

These technologies will allow us to mine more coal from a more efficient operation that is safe, cost-effective, and which minimizes environmental impacts. This will ensure that our business remains competitive through the years and that we are able to remain profitable and successful.

The automated systems we plan to use will also provide us with accurate data and feedback on our operations, allowing us to make informed decisions and improvements quickly and effectively. We will monitor our operations and analyse performance, safety and efficiency across all departments to ensure our process is as optimized as possible.

Equipment and Tools

The equipment and tools required to operate a successful coal mining business plan are varied and come with a wide range of associated costs. To maximize our productivity, we will need to make sure we have the right equipment to get the job done. In order to accomplish this, we need to outline the equipment and tools needed and the cost associated with purchasing or renting them. The table below outlines an example of the required equipment and tools associated with mining operations, along with estimated costs.

V.- Management and Organization

Organizational structure.

Our coal mining business plan organizational structure is designed to maximize efficiency and productivity. To help achieve our objectives, we have set up a hierarchical management model, detailing the roles and responsibilities of each employee, as well as the types of information exchanged between different levels of the organization. The following table provides an overview of our organization:

Management Team

At the helm of our coal mining business plan are a team of experienced professionals who will carry out the day-to-day operations of the company. Below is a table that lists the key positions within the management team and potential candidates who may be considered for those roles:

Management Team Gaps

While we have sourced an experienced and qualified team to manage our coal mining business, there are still some areas that require additional expertise and personnel. Specifically, we do not currently have candidates for roles in budgeting, forecasting and financial planning, as well as roles in operations management.

These roles are critical for ensuring the successful operation of our business, and we will appreciate any recommendations of suitable professionals to fill such positions.

Personnel Plan

In order to effectively run our coal mining business, we will need to carefully consider our personnel plan, and outline the positions that need to be filled in order to ensure our operations are operating at the maximum efficiency. We anticipate requiring the following key personnel in order to ensure the business runs smoothly and efficiently:

A table of potential positions that we expect to require to run our business effectively can be seen below:

Company History and Ownership

CoalCorp Inc. has its roots in the coal mining industry, beginning as a small, independent prospector operating in the Gillette, Wyoming region in the late 19th century. Over time, CoalCorp Inc. has grown to become one of the leading suppliers of coal in the United States, recognized for its high quality products and industry leading services. Earlier this year, CoalCorp Inc. decided to take a step forward and expand its services with the development of a coal manufacturing and delivery program tailored to the specific needs of each customer.

CoalCorp Inc. is currently owned by a group of three investors, all with deep experience in the coal industry. This group of committed investors has brought decades of collective knowledge to CoalCorp Inc., offering comprehensive expertise on safety regulations, supply chain efficiency, and the development of innovative coal-related solutions.

Achieving key milestones is important for the success of any business. The coal mining plan establishes the following milestones to ensure accurate and successful management and organization of the business:

A detailed roadmap in a table format of specific goals and objectives to be achieved will provide guidance on key steps that need to be taken in order to manage and steer the business forward. This roadmap should include clear timelines and target completion dates, as well as metrics that can be used to measure success. As each milestone is achieved, the team can ensure that the next goals and objectives can be tackled effectively.

Some of the milestones that will be established include obtaining the necessary licenses and permits, securing any necessary investments, generating employees, and acquiring the right equipment. Other milestones include launching the business, and marketing to the target market. Achieving these milestones will be key to the success of the business.

Key Metrics

The success of any coal mining business venture can be accurately gauged by tracking its key performance indicators (KPIs). As such, it is essential to track vital business information such as production costs, level of output, turnaround time, safety record, customer satisfaction, employee records, and more. By measuring the performance of these KPIs, owners and management can quickly identify areas that need improvement, track successes and failures, and measure the overall health of the business.

Additionally, monitoring KPIs can help the coal mining business to produce a more accurate business plan and make informed decisions in order to ensure the long-term success of the venture. Furthermore, carefully tracking and evaluating these KPIs will allow the business to adjust its operations in order to improve its overall performance and efficiency.

VI.- Financial Plan and Metrics

Sales forecast.

Our sales projections are based on the assumption that the business will maintain its prices and keep up its current services and offerings. Below are the projected sales for the next 3 years:

Coal Mining Financial Plan Key Inputs

Starting and operating a coal mining business requires investing in plenty of resources and capital. There are two main types of expenses related to this business plan: startup costs and operational expenses. The following tables detail the expected costs associated with each.

Startup Costs

Operational expenses.

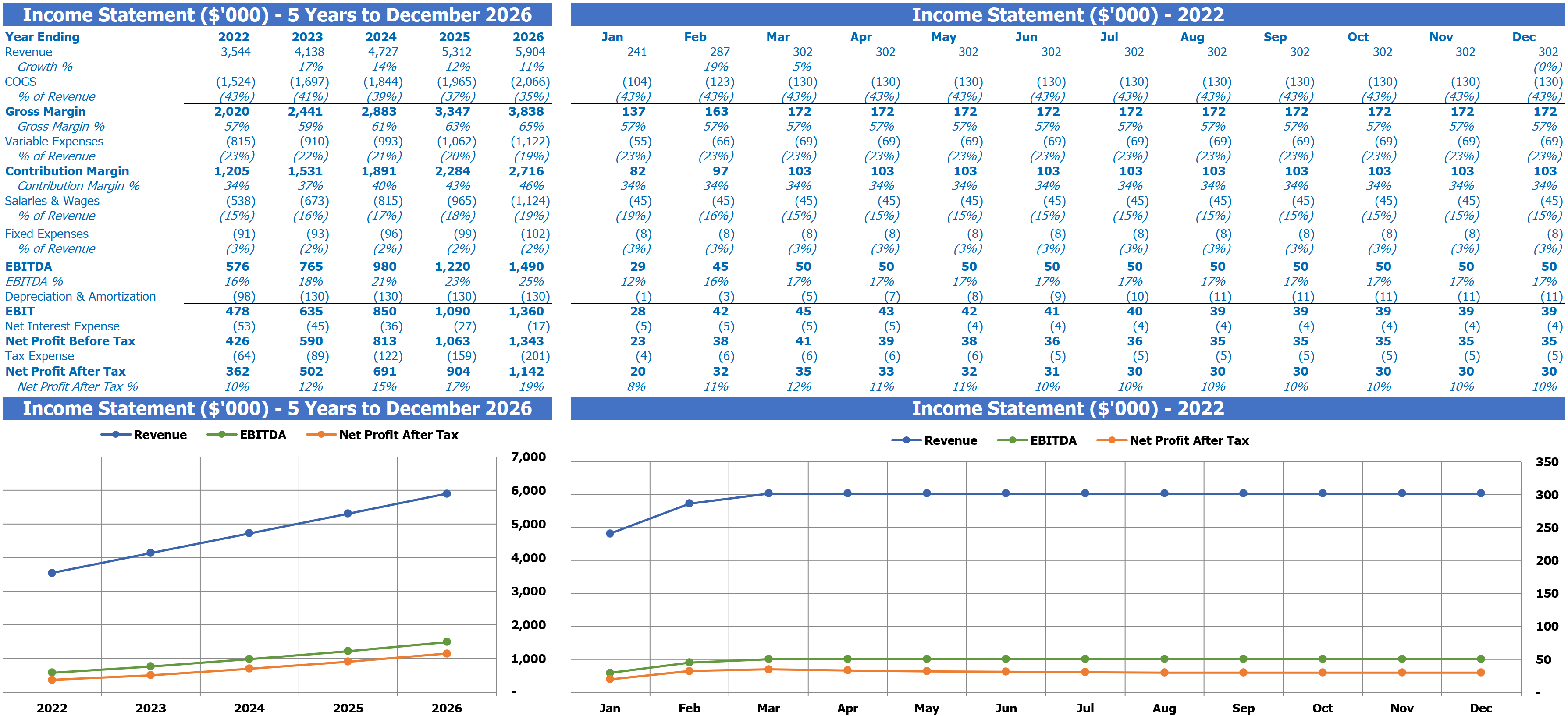

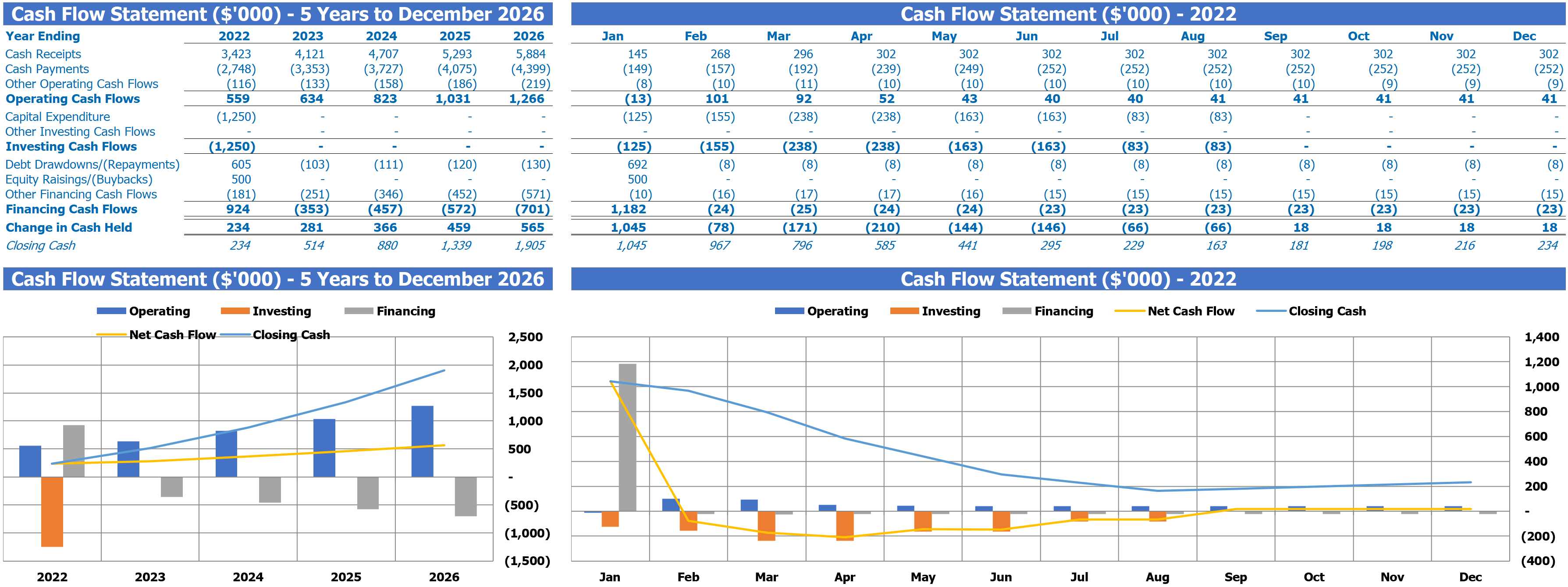

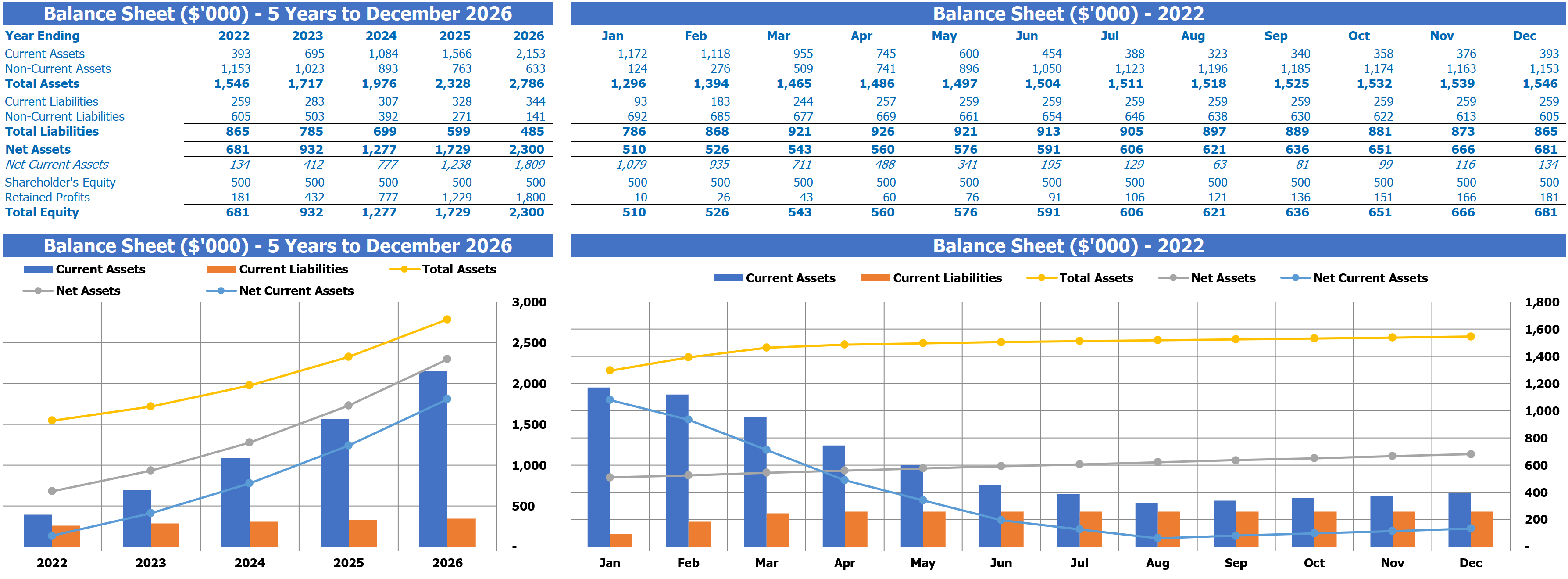

This part of the business plan is where you present the three main financial documents of any startup: the income statement, the cash flow statement, and the balance sheet. These documents provide detailed information on the expected cash flow, revenues, profits and losses, and other indicators of your company's financial health. The income statement shows expected income, expenses, and profits. The cash flow statement shows the change in cash available to the business, which can be used to invest in necessary assets. The balance sheet shows the assets and liabilities of the business, and reveals its economic value.

It is important to have a plan for the financial resources your business will require to operate and grow. This includes assessing the need for funds, such as a loan, venture capital, or other sources of investment. It is important to be realistic and responsible when considering these financial resources. The plan should include a timeline and a budget for each of the resources mentioned. Additionally, the plan should detail any risks associated with the company’s financial security, such as potential legal liabilities, the possibility of defaulting on a loan, and any other factors that could have an effect on the business’s financial health.

Coal Mining Financial Plan Profit & Loss Statement

Coal Mining Financial Plan Cash Flow Statement

Coal Mining Financial Plan Balance Sheet Statement

As part of our coal mining business plan, we intend to hire an experienced team of personnel to assist in the operation of our mine. Our personnel plan will include those who are essential for the smooth running of our operations and for assisting us in achieving our objectives. We will be looking for highly qualified individuals to train and lead our team. As far as compensation is concerned, we will strive to offer competitive salaries in the industry and will provide additional benefits as appropriate.

Our personnel plan consists of the following personnel: a project manager to plan, manage, and coordinate the project activities; a safety manager to ensure safe operation of the mine and minimize potential risks; and a number of workers who will carry out the day-to-day tasks at the mine, such as excavation and extraction. The exact number of personnel and their roles will depend on the size and scope of our project.

This personnel plan is designed to ensure the maximum efficiency and effectiveness of our business operations. There will be clear instructions and expectations given to each role, and our personnel will understand how they fit into the overall business operations. This will allow our personnel to focus on their duties and lead to greater productivity.

Capital Requirements and Use of Funds

The capital requirements of our coal mining business plan reflect our need to raise adequate funds in order to launch and grow the business. We understand the importance of transparency when it comes to informing potential investors and lenders of our proposed use of funds and are seeking funding of $1 million. This amount is broken down as follows.

$250,000 of the requested sum is for start-up costs, such as securing a location, purchasing equipment and hiring personnel. Once operational, $350,000 of funds will be used for purchasing coal and other resources necessary for production, as well as to cover reseller expenses. Additional funds will be used for marketing, estimated to reach $150,000, followed by a further $150,000 for overhead and general administration expenses. We have designated a further $50,000 for contingencies and other miscellaneous costs.

With the right capital resources and investments, we are confident that we can successfully launch and manage our coal mining business. We are looking to investors who can help us get our vision off the ground and establish a successful business that will generate future growth and revenue.

Exit Strategy

Our exit strategy consists of the sale of the coal mining business. We plan to identify a potential buyer through an extensive marketing process that includes targeted advertising campaigns and active engagement with relevant sector networks. We anticipate that the process of finding a suitable buyer and negotiating a sale of the business will take up to two years. We will apply a multi-disciplinary approach to find the right buyer and secure a favorable sale of the coal mining business.

We plan to employ the assistance of an experienced professional services firm to ensure that all potential buyers are thoroughly vetted and that all regulatory criteria for the sale of the business are met. We will obtain legal advice to ensure all documentation associated with the sale is correctly prepared and filed in an expeditious manner. We also plan to use financial advisors to ensure all financial aspects of the sale are properly managed.

We believe that through a combination of advertising, targeted marketing, and the assistance of professional support services, we can realize the successful sale of the coal mining business within the two-year timeframe.

Customer Reviews

- Business & Office

- Business & Marketing Plans

- Business Planning

No featured offers available

- Quality Price,

- Reliable delivery option, and

- Seller who offers good customer service

Image Unavailable

- To view this video download Flash Player

How to Start a Coal Trader Plus Business Plan

- Everything You Need to Know About Starting a Coal Trader.

- Plus get a 425+ Page SBA Approved Lender Directory!

- 9 Chapter Business Plan (MS Word) - Full Industry Research - Included In the Guide!

- Same Day Shipping (If order is placed before 5PM EST)! Delivered as CD-ROM.

- Easy to Use MS Excel 3 Year Financial Model

Product details

- Is Discontinued By Manufacturer : No

- Date First Available : August 24, 2011

- Manufacturer : HowToStartABusinessDB

- ASIN : B0098C4MV4

Product Description

The How to Start a Coal Trader will provide you with all of the necessary steps and information that you need in order to launch your business. You will learn how to how to raise capital, manage startup, how to establish a location, how to market your Coal Trader, and how to maintain your day to day operations. Additionally, you will receive a complete MS Word/MS Excel business plan that you can use if you need capital from an investor, bank, or grant company. The MS Word and MS Excel documents feature a completely automated table of contents, industry research, and specific marketing plans that are for a Coal Trader. You will also receive a customizable PowerPoint Presentation.

Looking for specific info?

Customer reviews.

Customer Reviews, including Product Star Ratings help customers to learn more about the product and decide whether it is the right product for them.

To calculate the overall star rating and percentage breakdown by star, we don’t use a simple average. Instead, our system considers things like how recent a review is and if the reviewer bought the item on Amazon. It also analyzed reviews to verify trustworthiness.

No customer reviews

- Amazon Newsletter

- About Amazon

- Accessibility

- Sustainability

- Press Center

- Investor Relations

- Amazon Devices

- Amazon Science

- Sell on Amazon

- Sell apps on Amazon

- Supply to Amazon

- Protect & Build Your Brand

- Become an Affiliate

- Become a Delivery Driver

- Start a Package Delivery Business

- Advertise Your Products

- Self-Publish with Us

- Become an Amazon Hub Partner

- › See More Ways to Make Money

- Amazon Visa

- Amazon Store Card

- Amazon Secured Card

- Amazon Business Card

- Shop with Points

- Credit Card Marketplace

- Reload Your Balance

- Amazon Currency Converter

- Your Account

- Your Orders

- Shipping Rates & Policies

- Amazon Prime

- Returns & Replacements

- Manage Your Content and Devices

- Recalls and Product Safety Alerts

- Conditions of Use

- Privacy Notice

- Consumer Health Data Privacy Disclosure

- Your Ads Privacy Choices

- Cart 0 View Cart

- Inquiry Basket 0

- Track your Order

- Case Studies

- Certificates

- Submit Manuscript

- Project Consultancy, Reports & Profiles

- Feasibility Reports List

- Project Identification

- Market Research Report

- Directory & Databases

- Middle East

- Rest of the World

- Best Industry

- Best Business Ideas

- Startup Business Ideas

- Startup Consulting Services

- Useful Readings

- Pdf and Docs

- Business Listings

- Add Your Company

- How Do I Start a Coal Distribution?

Normal 0 false false false EN-US X-NONE X-NONE MicrosoftInternetExplorer4

NIIR PROJECT CONSULTANCY SERVICES (NPCS) is a reliable name in the industrial world for offering integrated technical consultancy services. NPCS is manned by engineers, planners, specialists, financial experts, economic analysts and design specialists with extensive experience in the related industries.