- Entrepreneurs

- News About Crunchbase

- New Features

- Partnerships

The Types of Market Research [+10 Market Research Methods]

- Market research

Jaclyn Robinson, Senior Manager of Content Marketing at Crunchbase

Market research can help startups understand where they should be placing their resources and time. It can tell you everything from how people are perceiving your company, as well as which features to drop or continue developing. And while there are plenty of ways to conduct market research, not every market research method is right for every situation.

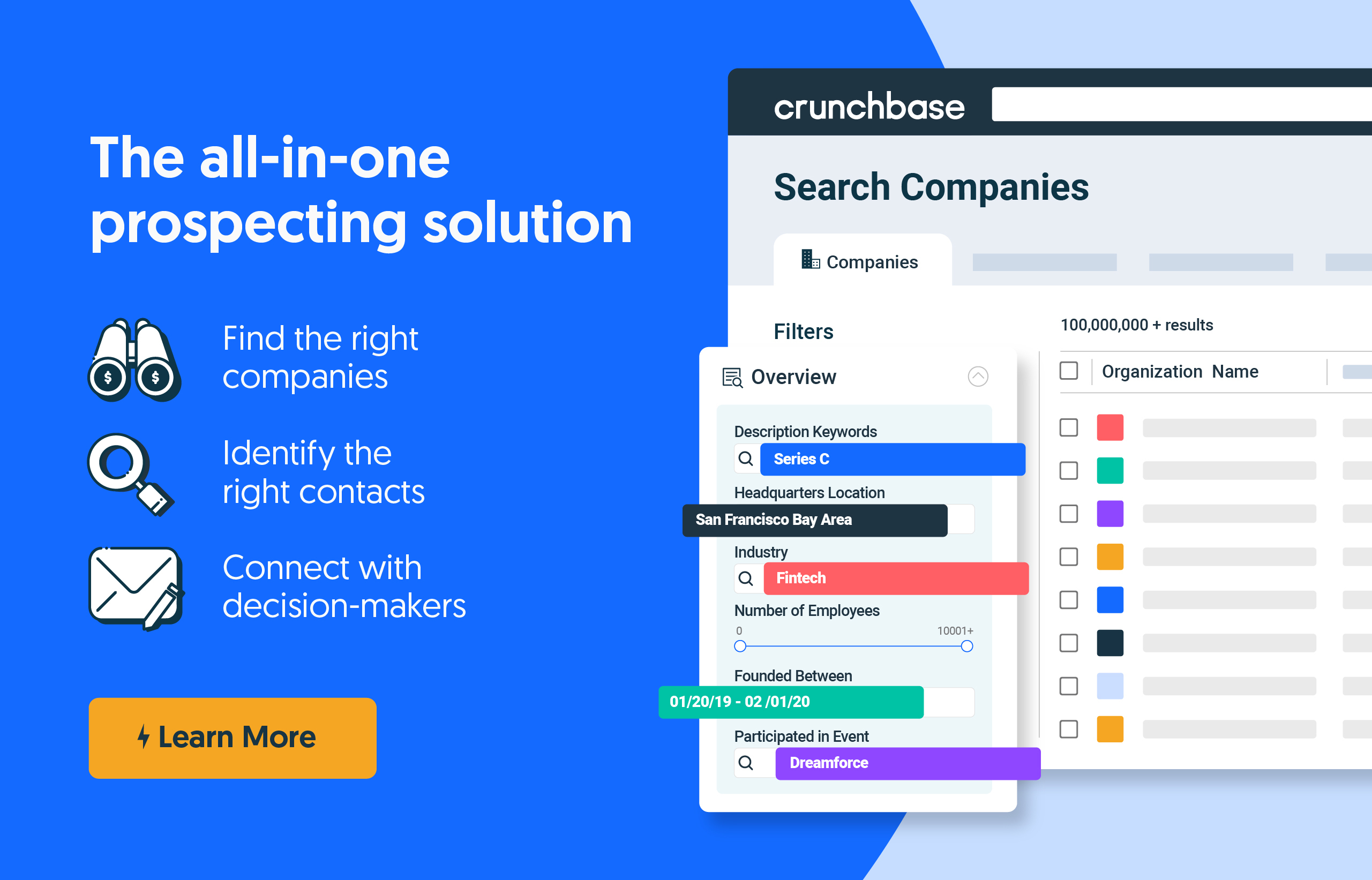

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

Market research can help play a major role in developing your product, marketing, and overall business strategy. Understanding the different market research methods can be the difference between wasting months of engineering time or exceeding your ambitious revenue targets.

We review the types of market research as well as the market research methods you can pursue based on your primary objectives and business goals.

The 2 types of market research

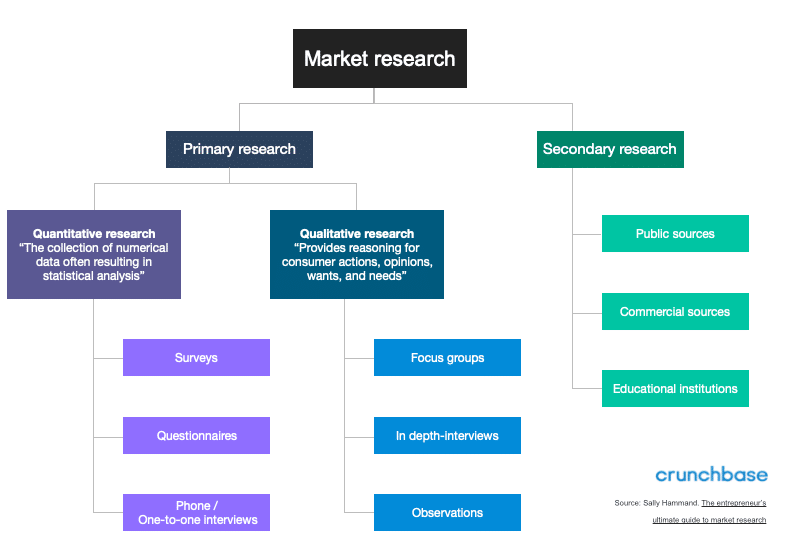

All market research falls under two distinct categories: primary research and secondary research.

Primary research looks at any data you collect yourself (or someone you pay). It encompasses analyzing current sales, metrics, and customers. It also takes into account the effectiveness of current practices, while taking competitors into account.

Secondary research looks at data that has already been published by others. It includes reports and studies from other companies, government organizations, and others in your industry.

10 market research methods

The type of data you need will decide which market research technique to use. Here are the most commonly used market research methods:

Primary research methods

These primary research methods will help you identify both qualitative and quantitative data. Qualitative data is information that cannot be measured while qualitative data is taken from a large sample size and is a statistically significant mathematical analysis.

1. Interviews

Great for: expert advice

Consisting of one-on-one discussions, interviews are a great source of qualitative data. You can either perform interviews by telephone, video conference, or face-to-face. Interviews are great for an in-depth look for target audience insights.

In-depth interviews are great when expert advice is needed or when discussing highly complex or sensitive topics. Interviews are usually 10 to 30 minutes long with 25 to 75 respondents.

Great for: understanding brand awareness, satisfaction and loyalty analysis, pricing research, and market segmentation .

One of the most commonly used market research methods, Surveys are an easy way to understand your target audience and allow you to test a large sample size to determine if findings are true across a larger segment of your customers.

3. Questionnaires

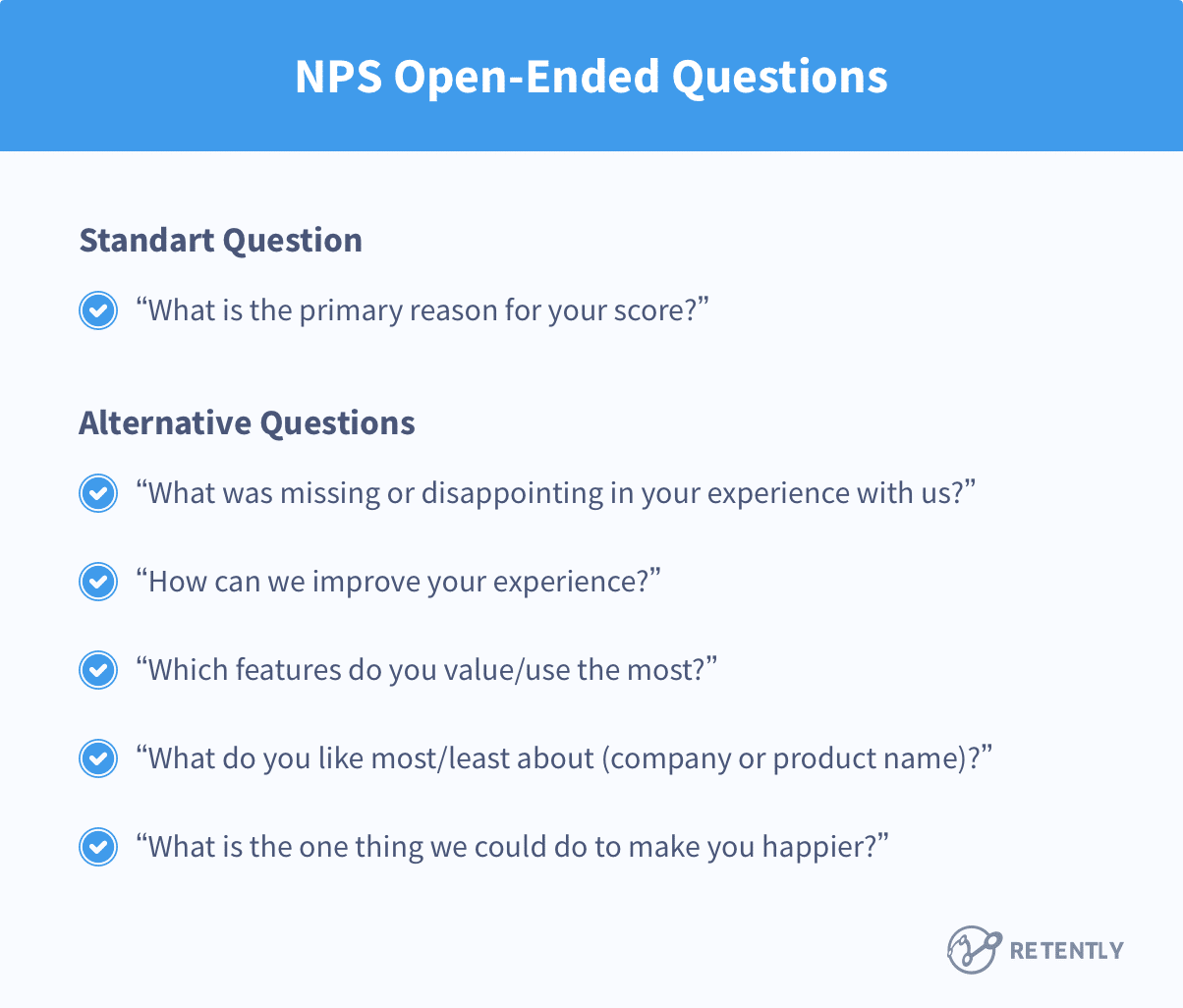

Great for: Customer feedback and satisfaction surveys (NPS surveys), and when you want more detail on your target audience and customer base.

Do not confuse questionnaires for surveys ! While surveys are aggregated for statistical analysis, questionnaires are a set of written questions used for collecting information.

Questionnaires are used to collect information rather than draw a conclusion. Surveys can include a questionnaire, but a survey must aggregate and analyze the responses to the questions.

When writing questionnaires for market research, keep the number of questions in mind.

In one study, SurveyMonkey found that questionnaires with 40 questions have about a 10% lower response rate than questionnaires with 10 questions . The more questions, the less likely people will finish your questionnaire.

4. Focus groups

Great for: Price testing, advertising concepts, product/messaging testing

Even with the rise of big data, focus groups have remained an integral part of how companies build their products, strategy, and messaging. Focus groups are intentionally compromised by a group of purposefully selected individuals. Above all, the collaborative setting ensures that members of the group are able to interact and influence each other.

Typically these open and interactive groups are composed of around five to 12 screened individuals . Make sure that your participants are diverse so you can get a range of opinions and you have enough representation from several segments of your market.

Many smaller startups will conduct DIY focus groups and will use video conferencing technology, which is one of the most cost-effective and time-efficient market research methods.

This is a great resource to see some good questions to ask your focus groups as well as what topics focus groups should touch on.

5. User groups

Great for: Feature testing, UX and web design feedback

User groups are used to gather UX data and provide insight for website design. User groups usually meet regularly to discuss their experience with a product, while researchers capture their comments.

Here’s a great guide on how to format questions for user groups .

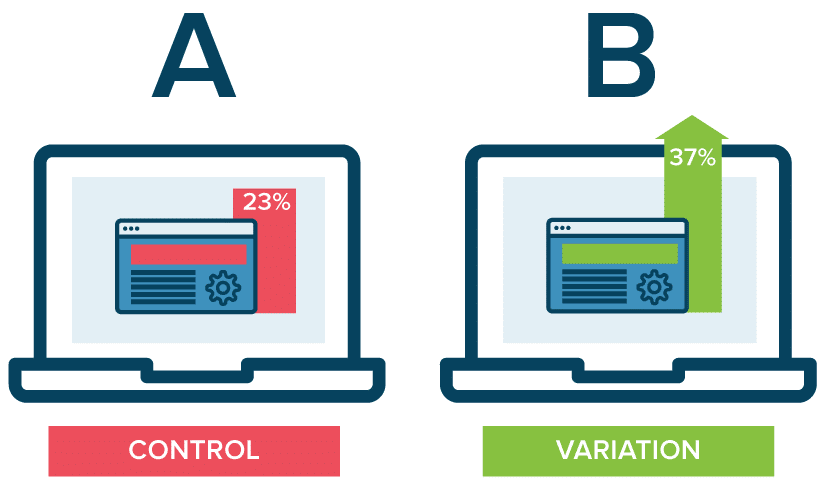

6. Test markets

Great for: Testing new marketing campaigns

Test markets represent a larger market. Using a test group as well as a control group can show you the success of a new landing page, messaging copy, or CTA button. We particularly like the free version of Google Optimize to get quantitative data on how your experiment is performing based on a specific goal.

Secondary research methods

Secondary research can help establish a starting point prior to diving into more expensive primary research techniques. While there is a lot of data on the web regarding basic statistics, you may have to purchase a distinct data provider for a more in-depth look at your market.

Crunchbase Pro and Marketplace partners are a great and inexpensive way to start your secondary research directly on Crunchbase.com.

7. Competitor benchmarks

Great for: Understanding your revenue, churn, operating costs, sales, profit margin, and burn rate.

Competitor benchmarks are the most valuable and widely used of the secondary research methods. Moreover, competitor benchmarks measure specific growth metrics or key performance indicators in comparison to business within the same industry and of a similar size.

You can use Crunchbase Pro to find how much companies in a certain industry are raising and who are the leading players with our global coverage on companies ranging from pre-seed to late-stage. So, as one of the most informative of the market research methods, competitive benchmarks are a great way to inform your business strategy.

Free Crunchbase registered users have access to revenue estimates as well as web traffic data.

8. Sales data

Great for: Understanding your audience and where to place marketing efforts.

Taking a look at internal sales data not only reveals profitability but also helps market researchers segment customer trends.

However, taking a look at competitive sales data is a great way to make sure that you’re meeting the numbers you should be targeting as well as capturing the full potential of the market

9. Government publications and statistics

Great for: General demographic information and larger trends

The U.S. Census Bureau is a great resource of national demographic data. You can also review patents as a preview of industry trends and future innovation.

Also, you can find additional data and research from Data.gov , The World Bank , as well as the Pew Research Center to help inform your market research decisions.

10. Commercial data

Great for: Greater insight into industry trends and reports

If you’re interested in purchasing secondary market research, commercial data is available. For comprehensive reports, Mintel and IBISWorld are both traditional market research companies that provide commercial data.

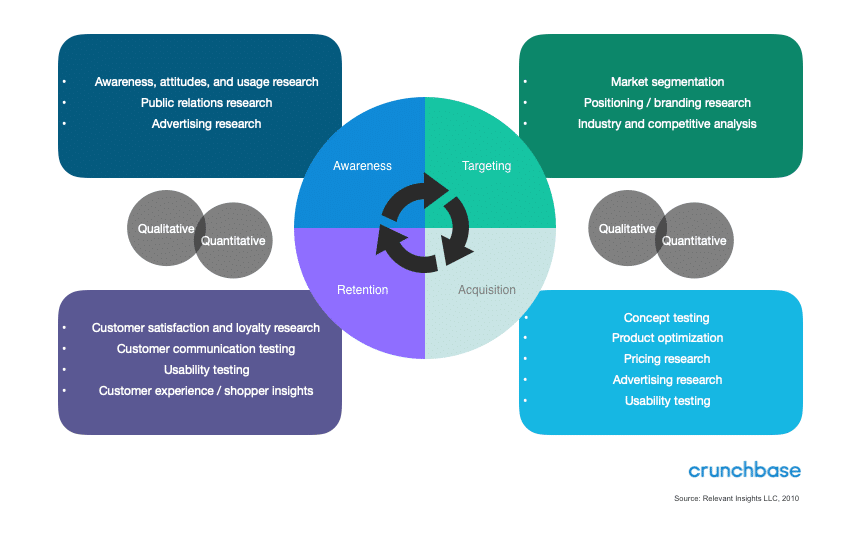

Additionally, to choose which type of market research method is best for your goal, follow this graph from Relevant Insights. Begin with the metric you’re trying to move and then backtrack into a targeted market research method.

How can Crunchbase help with my market research?

Crunchbase gives market researchers flexible access to Crunchbase’s complete company data. Innovative teams and leaders in market research rely on Crunchbase’s live company data to build powerful internal databases and research insights in respective industries. Learn more about how Crunchbase can help you with your market research .

- Originally published March 14, 2019, updated April 26, 2023

You may also like

- 10 min read

How to Do Market Research for a Startup: Tips for Success

Eastern Europe Industry Review: Russia-Connected SPACs, New VC Darlings, Food Delivery Disruption

By Adrien Henni, Chief Editor, East-West Digital News

Women In Russian VC: How Gender Stereotypes Hinder Investment

Daria Zharkova, Senior Research Manager at Dsight

The all-in-one prospecting solution

- Find the right companies

- Identify the right contacts

- Connect with decision-makers

Read the practical framework for leveling up your social media team.

- · Brandwatch Academy

- Forrester Wave

Brandwatch Consumer Research

Formerly the Falcon suite

Formerly Paladin

Published October 17 th 2023

10 Essential Methods for Effective Consumer and Market Research

When it comes to understanding the world around you, market research is an essential step.

We live in a world that’s overflowing with information. Sifting through all the noise to extract the most relevant insights on a certain market or audience can be tough.

That’s where market research comes in – it’s a way for brands and researchers to collect information from target markets and audiences.

Once reliant on traditional methods like focus groups or surveys, market research is now at a crossroads. Newer tools for extracting insights, like social listening tools, have joined the array of market research techniques available.

Here, we break down what market research is and the different methods you can choose from to make the most of it.

What is market research, and why is it critical for you as a marketer?

Market research involves collecting and analyzing data about a specific industry, market, or audience to inform strategic decision-making. It offers marketers valuable insights into the industry, market trends, consumer preferences, competition, and opportunities, enabling businesses to refine their strategies effectively.

By conducting market research, organizations can identify unmet needs, assess product demands, enhance value propositions, and create marketing campaigns that resonate with their target audience.

This practice serves as a compass, guiding businesses in making data-driven decisions for successful product launches, improved customer relationships, and a stronger positioning in the business landscape.

For marketers and insights professionals, market research is an indispensable tool. It helps them make smarter decisions and achieve growth and success in the market.

These 10 market research methods form the backbone of effective market research strategies.

Continue reading or jump directly to each method by tapping the link below.

- Focus groups

- Consumer research with social media listening

- Experiments and field trials

- Observation

- Competitive analysis

- Public domain data

- Buy research

- Analyze sales data

Use of primary vs secondary market research

Market research can be split into two distinct sections: primary and secondary. These are the two main types of market research.

They can also be known as field and desk, respectively (although this terminology feels out of date, as plenty of primary research can be carried out from your desk).

Primary (field) research

Primary market research is research you carry out yourself. Examples of primary market research methods include running your own focus groups or conducting surveys. These are some of the key methods of consumer research. The ‘field’ part refers to going out into the field to get data.

Secondary (desk) research

Secondary market research is research carried out by other people that you want to use. Examples of secondary market research methods include studies carried out by researchers or financial data released by companies.

10 effective methods to do market research

The methods in this list cover both areas. Which ones you want to use will depend on your goals. Have a browse through and see what fits.

1. Focus groups

It’s a simple concept but one that can be hard to put into practice.

You bring together a group of individuals into a room, record their discussions, and ask them questions about various topics you are researching. For some, it’ll be new product ideas. For others, it might be views on a political candidate.

From these discussions, the organizer will try to pull out some insights or use them to judge the wider society’s view on something. The participants will generally be chosen based on certain criteria, such as demographics, interests, or occupations.

A focus group’s strength is in the natural conversation and discussion that can take place between participants (if they’re done right).

Compared to a questionnaire or survey with a rigid set of questions, a focus group can go off on tangents the organizer could not have predicted (and therefore not planned questions for). This can be good in that unexpected topics can arise; or bad if the aims of the research are to answer a very particular set of questions.

The nature of the discussion is important to recognize as a potential factor that skews the resulting data. Focus groups can encourage participants to talk about things they might not have otherwise, and others might impact the group. This can also affect unstructured one-on-one interviews.

In survey research, survey questions are given to respondents (in person, over the phone, by email, or via an online form). Questions can be close-ended or open-ended. As far as close-ended questions go, there are many different types:

- Dichotomous (two choices, such as ‘yes’ or ‘no’)

- Multiple choice

- Rating scale

- Likert scale (common version is five options between ‘strongly agree’ and ‘strongly disagree’)

- Matrix (options presented on a grid)

- Demographic (asking for information such as gender, age, or occupation)

Surveys are massively versatile because of the range of question formats. Knowing how to mix and match them to get what you need takes consideration and thought. Different questions need the right setup.

It’s also about how you ask. Good questions lead to good analysis. Writing clear, concise questions that abstain from vague expressions and don’t lead respondents down a certain path can help your results reflect the true colors of respondents.

There are a ton of different ways to conduct surveys as well, from creating your own from scratch or using tools that do lots of the heavy lifting for you.

3. Consumer research with social media listening

Social media has reached a point where it is seamlessly integrated into our lives. And because it is a digital extension of ourselves, people freely express their opinions, thoughts, and hot takes on social media.

Because people share so much content on social media and the sharing is so instant, social media is a treasure trove for market research. There is plenty of data to monitor , tap into, and dissect.

By using a social listening tool, like Consumer Research , researchers can identify topics of interest and then analyze relevant social posts. For example, they can track brand mentions and what consumers are saying about the products owned by that brand. These are real-world consumer research examples.

View this post on Instagram A post shared by Brandwatch (@brandwatch)

Social media listening democratizes insights, and is especially useful for market research because of the vast amount of unfiltered information available. Because it’s unprompted, you can be fairly sure that what’s shared is an accurate account of what the person really cares about and thinks (as opposed to them being given a subject to dwell on in the presence of a researcher).

You might like

Your complete social listening guide.

Learn how to get started with social listening

4. Interviews

In interviews, the interviewer speaks directly with the respondent. This type of market research method is more personal, allowing for communication and clarification, making it good for open-ended questions. Furthermore, interviews enable the interviewer to go beyond surface-level responses and investigate deeper.

However, the drawback is that interviews can be time-intensive and costly. Those who opt for this method will need to figure out how to allocate their resources effectively. You also need to be careful with leading or poor questions that lead to useless results. Here’s a good introduction to leading questions .

5. Experiments and field trials

Field experiments are conducted in the participants’ environment. They rely on the independent variable and the dependent variable – the researcher controls the independent variable in order to test its impact on the dependent variable. The key here is to establish whether there’s causality.

For example, take Hofling’s experiment that tested obedience, conducted in a hospital setting. The point was to test if nurses followed authority figures (doctors) and if the authority figures’ rules violated standards (The dependent variable being the nurses, the independent variable being a fake doctor calling up and ordering the nurses to administer treatment.)

According to Simply Psychology , there are key strengths and limitations to this method.

The assessment reads:

- Strength: Behavior in a field experiment is more likely to reflect real life because of its natural setting, i.e., higher ecological validity than a lab experiment.

- Strength: There is less likelihood of demand characteristics affecting the results, as participants may not know they are being studied. This occurs when the study is covert.

- Limitation: There is less control over extraneous variables that might bias the results. This makes it difficult for another researcher to replicate the study in exactly the same way.

There are also massive ethical implications for these kinds of experiments and experiments in general (especially if people are unaware of their involvement). Don’t take this lightly, and be sure to read up on all the guidelines that apply to the region where you’re based.

6. Observation

Observational market research is a qualitative research method where the researcher observes their subjects in a natural or controlled environment. This method is much like being a fly on the wall, but the fly takes notes and analyzes them later. In observational market research, subjects are likely to behave naturally, which reveals their true selves.

They are not under much pressure. However, if they’re aware of the observation, they can act differently.

This type of research applies well to retail, where the researcher can observe shoppers’ behavior by day of the week, by season, when discounts are offered, and more. However, observational research can be time-consuming, and researchers have no control over the environments they research.

7. Competitive analysis

Competitive analysis is a highly strategic and specific form of market research in which the researchers analyze their company’s competitors. It is critical to see how your brand stacks up to rivals.

Competitive analysis starts by defining the product, service, brand, and market segment. There are different topics to compare your firm with your competitors. It could be from a marketing perspective: content produced, SEO structure, PR coverage, and social media presence and engagement. It can also be from a product perspective: types of offerings, pricing structure. SWOT analysis is key in assessing strengths, weaknesses, opportunities, and threats.

We’ve written a whole blog post on this tactic, which you can read here .

8. Public domain data

The internet is a wondrous place. Public data exists for those strapped for resources or simply seeking to support their research with more data. With more and more data produced every year, the question about access and curation becomes increasingly prominent – that’s why researchers and librarians are keen on open data.

Plenty of different types of open data are useful for market research: government databases, polling data, “fact tanks” like Pew Research Center, and more.

Furthermore, APIs grant developers programmatic access to applications. A lot of this data is free, which is a real bonus.

9. Buy research

Money can’t buy everything, but it can buy research. Subscriptions exist for those who want to buy relevant industry and research reports. Sites like Euromonitor, Statista, Mintel, and BCC Research host a litany of reports for purchase, oftentimes with the option of a single-user license or a subscription.

This can be a massive time saver, and you’ll have a better idea of what you’re getting from the very beginning. You’ll also get all your data in a format that makes sense, saving you effort in cleaning and organizing.

10. Analyze sales data

Sales data is like a puzzle piece that can help reveal the full picture of market research insights. Essentially, it indicates the results. Paired with other market research data, sales data helps researchers better understand actions and consequences. Understanding your customers, their buying habits, and how they change over time is important.

This research will be limited to customers, and it’s important to keep that in mind. Nevertheless, the value of this data should not be underestimated. If you’re not already tracking customer data, there’s no time like the present.

Choosing the right market research method for your strategy

Not all methods will be right for your situation or your business. Once you’ve looked through the list and seen some that take your fancy, spend more time researching each option.You’ll want to consider what you want to achieve, what data you’ll need, the pros and cons of each method, the costs of conducting the research, and the cost of analyzing the results.

Get it right, and it’ll be worth all the effort.

Former Brandwatch Employee

Share this post

Brandwatch bulletin.

Offering up analysis and data on everything from the events of the day to the latest consumer trends. Subscribe to keep your finger on the world’s pulse.

New: Consumer Research

Make the world your focus group.

With Brandwatch Consumer Research, you can turn billions of voices into valuable insights.

More in marketing

20 social media holidays to celebrate this may.

By Yasmin Pierre Apr 10

The Ultimate Guide to Competitor Analysis

By Ksenia Newton Apr 5

How to Market Your Sustainability as a Brand in 2024

By Emily Smith Mar 18

The Swift Effect: What Brands Can Learn from Taylor Swift

By Emily Smith Feb 29

We value your privacy

We use cookies to improve your experience and give you personalized content. Do you agree to our cookie policy?

By using our site you agree to our use of cookies — I Agree

Falcon.io is now part of Brandwatch. You're in the right place!

Existing customer? Log in to access your existing Falcon products and data via the login menu on the top right of the page. New customer? You'll find the former Falcon products under 'Social Media Management' if you go to 'Our Suite' in the navigation.

Paladin is now Influence. You're in the right place!

Brandwatch acquired Paladin in March 2022. It's now called Influence, which is part of Brandwatch's Social Media Management solution. Want to access your Paladin account? Use the login menu at the top right corner.

Learn / Blog / Article

Back to blog

How to do market research in 4 steps: a lean approach to marketing research

From pinpointing your target audience and assessing your competitive advantage, to ongoing product development and customer satisfaction efforts, market research is a practice your business can only benefit from.

Learn how to conduct quick and effective market research using a lean approach in this article full of strategies and practical examples.

Last updated

Reading time.

A comprehensive (and successful) business strategy is not complete without some form of market research—you can’t make informed and profitable business decisions without truly understanding your customer base and the current market trends that drive your business.

In this article, you’ll learn how to conduct quick, effective market research using an approach called 'lean market research'. It’s easier than you might think, and it can be done at any stage in a product’s lifecycle.

How to conduct lean market research in 4 steps

What is market research, why is market research so valuable, advantages of lean market research, 4 common market research methods, 5 common market research questions, market research faqs.

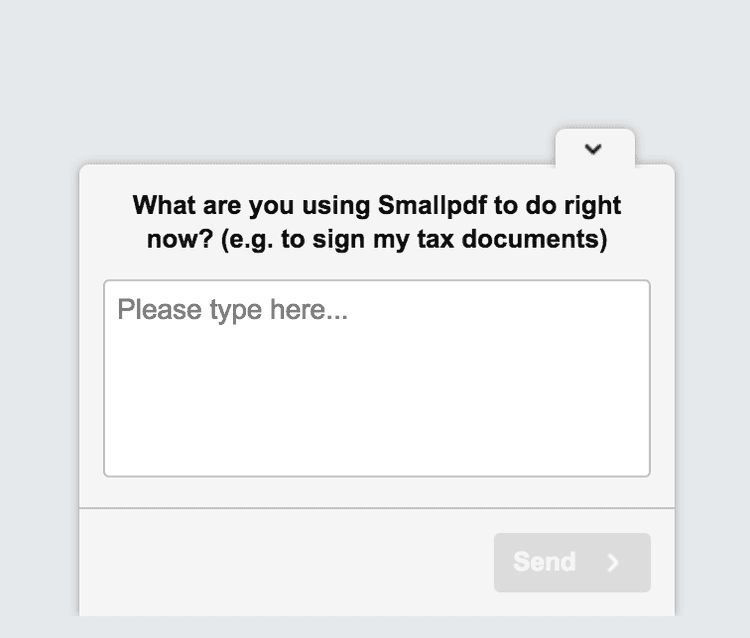

We’ll jump right into our 4-step approach to lean market research. To show you how it’s done in the real world, each step includes a practical example from Smallpdf , a Swiss company that used lean market research to reduce their tool’s error rate by 75% and boost their Net Promoter Score® (NPS) by 1%.

Research your market the lean way...

From on-page surveys to user interviews, Hotjar has the tools to help you scope out your market and get to know your customers—without breaking the bank.

The following four steps and practical examples will give you a solid market research plan for understanding who your users are and what they want from a company like yours.

1. Create simple user personas

A user persona is a semi-fictional character based on psychographic and demographic data from people who use websites and products similar to your own. Start by defining broad user categories, then elaborate on them later to further segment your customer base and determine your ideal customer profile .

How to get the data: use on-page or emailed surveys and interviews to understand your users and what drives them to your business.

How to do it right: whatever survey or interview questions you ask, they should answer the following questions about the customer:

Who are they?

What is their main goal?

What is their main barrier to achieving this goal?

Pitfalls to avoid:

Don’t ask too many questions! Keep it to five or less, otherwise you’ll inundate them and they’ll stop answering thoughtfully.

Don’t worry too much about typical demographic questions like age or background. Instead, focus on the role these people play (as it relates to your product) and their goals.

How Smallpdf did it: Smallpdf ran an on-page survey for a couple of weeks and received 1,000 replies. They learned that many of their users were administrative assistants, students, and teachers.

Next, they used the survey results to create simple user personas like this one for admins:

Who are they? Administrative Assistants.

What is their main goal? Creating Word documents from a scanned, hard-copy document or a PDF where the source file was lost.

What is their main barrier to achieving it? Converting a scanned PDF doc to a Word file.

💡Pro tip: Smallpdf used Hotjar Surveys to run their user persona survey. Our survey tool helped them avoid the pitfalls of guesswork and find out who their users really are, in their own words.

You can design a survey and start running it in minutes with our easy-to-use drag and drop builder. Customize your survey to fit your needs, from a sleek one-question pop-up survey to a fully branded questionnaire sent via email.

We've also created 40+ free survey templates that you can start collecting data with, including a user persona survey like the one Smallpdf used.

2. Conduct observational research

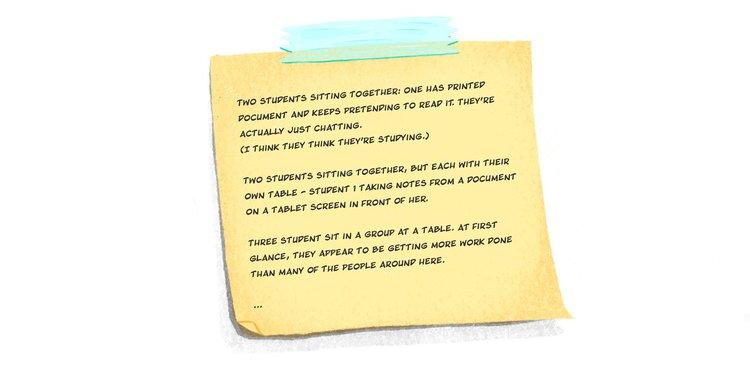

Observational research involves taking notes while watching someone use your product (or a similar product).

Overt vs. covert observation

Overt observation involves asking customers if they’ll let you watch them use your product. This method is often used for user testing and it provides a great opportunity for collecting live product or customer feedback .

Covert observation means studying users ‘in the wild’ without them knowing. This method works well if you sell a type of product that people use regularly, and it offers the purest observational data because people often behave differently when they know they’re being watched.

Tips to do it right:

Record an entry in your field notes, along with a timestamp, each time an action or event occurs.

Make note of the users' workflow, capturing the ‘what,’ ‘why,’ and ‘for whom’ of each action.

Don’t record identifiable video or audio data without consent. If recording people using your product is helpful for achieving your research goal, make sure all participants are informed and agree to the terms.

Don’t forget to explain why you’d like to observe them (for overt observation). People are more likely to cooperate if you tell them you want to improve the product.

💡Pro tip: while conducting field research out in the wild can wield rewarding results, you can also conduct observational research remotely. Hotjar Recordings is a tool that lets you capture anonymized user sessions of real people interacting with your website.

Observe how customers navigate your pages and products to gain an inside look into their user behavior . This method is great for conducting exploratory research with the purpose of identifying more specific issues to investigate further, like pain points along the customer journey and opportunities for optimizing conversion .

With Hotjar Recordings you can observe real people using your site without capturing their sensitive information

How Smallpdf did it: here’s how Smallpdf observed two different user personas both covertly and overtly.

Observing students (covert): Kristina Wagner, Principle Product Manager at Smallpdf, went to cafes and libraries at two local universities and waited until she saw students doing PDF-related activities. Then she watched and took notes from a distance. One thing that struck her was the difference between how students self-reported their activities vs. how they behaved (i.e, the self-reporting bias). Students, she found, spent hours talking, listening to music, or simply staring at a blank screen rather than working. When she did find students who were working, she recorded the task they were performing and the software they were using (if she recognized it).

Observing administrative assistants (overt): Kristina sent emails to admins explaining that she’d like to observe them at work, and she asked those who agreed to try to batch their PDF work for her observation day. While watching admins work, she learned that they frequently needed to scan documents into PDF-format and then convert those PDFs into Word docs. By observing the challenges admins faced, Smallpdf knew which products to target for improvement.

“Data is really good for discovery and validation, but there is a bit in the middle where you have to go and find the human.”

3. Conduct individual interviews

Interviews are one-on-one conversations with members of your target market. They allow you to dig deep and explore their concerns, which can lead to all sorts of revelations.

Listen more, talk less. Be curious.

Act like a journalist, not a salesperson. Rather than trying to talk your company up, ask people about their lives, their needs, their frustrations, and how a product like yours could help.

Ask "why?" so you can dig deeper. Get into the specifics and learn about their past behavior.

Record the conversation. Focus on the conversation and avoid relying solely on notes by recording the interview. There are plenty of services that will transcribe recorded conversations for a good price (including Hotjar!).

Avoid asking leading questions , which reveal bias on your part and pushes respondents to answer in a certain direction (e.g. “Have you taken advantage of the amazing new features we just released?).

Don't ask loaded questions , which sneak in an assumption which, if untrue, would make it impossible to answer honestly. For example, we can’t ask you, “What did you find most useful about this article?” without asking whether you found the article useful in the first place.

Be cautious when asking opinions about the future (or predictions of future behavior). Studies suggest that people aren’t very good at predicting their future behavior. This is due to several cognitive biases, from the misguided exceptionalism bias (we’re good at guessing what others will do, but we somehow think we’re different), to the optimism bias (which makes us see things with rose-colored glasses), to the ‘illusion of control’ (which makes us forget the role of randomness in future events).

How Smallpdf did it: Kristina explored her teacher user persona by speaking with university professors at a local graduate school. She learned that the school was mostly paperless and rarely used PDFs, so for the sake of time, she moved on to the admins.

A bit of a letdown? Sure. But this story highlights an important lesson: sometimes you follow a lead and come up short, so you have to make adjustments on the fly. Lean market research is about getting solid, actionable insights quickly so you can tweak things and see what works.

💡Pro tip: to save even more time, conduct remote interviews using an online user research service like Hotjar Engage , which automates the entire interview process, from recruitment and scheduling to hosting and recording.

You can interview your own customers or connect with people from our diverse pool of 200,000+ participants from 130+ countries and 25 industries. And no need to fret about taking meticulous notes—Engage will automatically transcribe the interview for you.

4. Analyze the data (without drowning in it)

The following techniques will help you wrap your head around the market data you collect without losing yourself in it. Remember, the point of lean market research is to find quick, actionable insights.

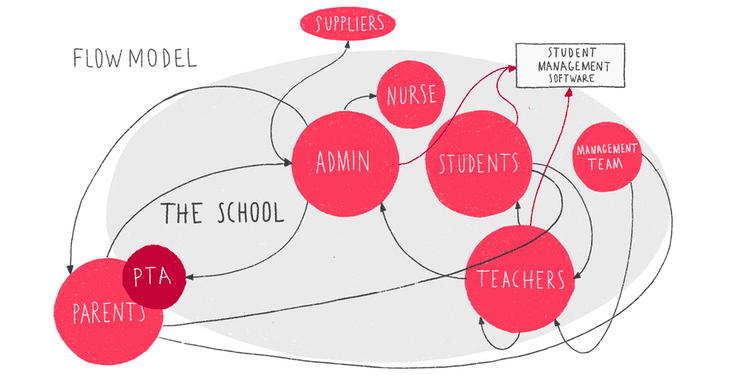

A flow model is a diagram that tracks the flow of information within a system. By creating a simple visual representation of how users interact with your product and each other, you can better assess their needs.

You’ll notice that admins are at the center of Smallpdf’s flow model, which represents the flow of PDF-related documents throughout a school. This flow model shows the challenges that admins face as they work to satisfy their own internal and external customers.

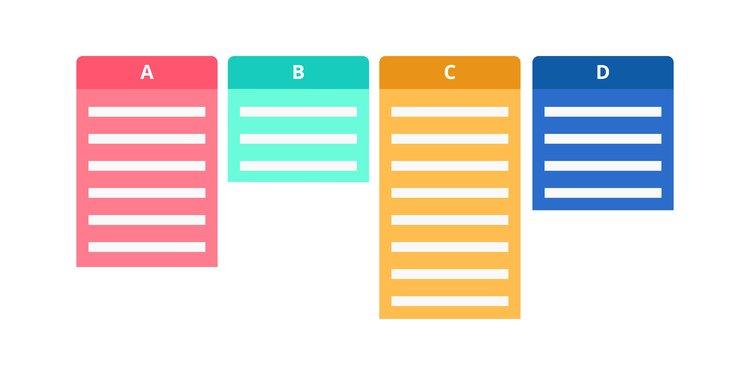

Affinity diagram

An affinity diagram is a way of sorting large amounts of data into groups to better understand the big picture. For example, if you ask your users about their profession, you’ll notice some general themes start to form, even though the individual responses differ. Depending on your needs, you could group them by profession, or more generally by industry.

We wrote a guide about how to analyze open-ended questions to help you sort through and categorize large volumes of response data. You can also do this by hand by clipping up survey responses or interview notes and grouping them (which is what Kristina does).

“For an interview, you will have somewhere between 30 and 60 notes, and those notes are usually direct phrases. And when you literally cut them up into separate pieces of paper and group them, they should make sense by themselves.”

Pro tip: if you’re conducting an online survey with Hotjar, keep your team in the loop by sharing survey responses automatically via our Slack and Microsoft Team integrations. Reading answers as they come in lets you digest the data in pieces and can help prepare you for identifying common themes when it comes time for analysis.

Hotjar lets you easily share survey responses with your team

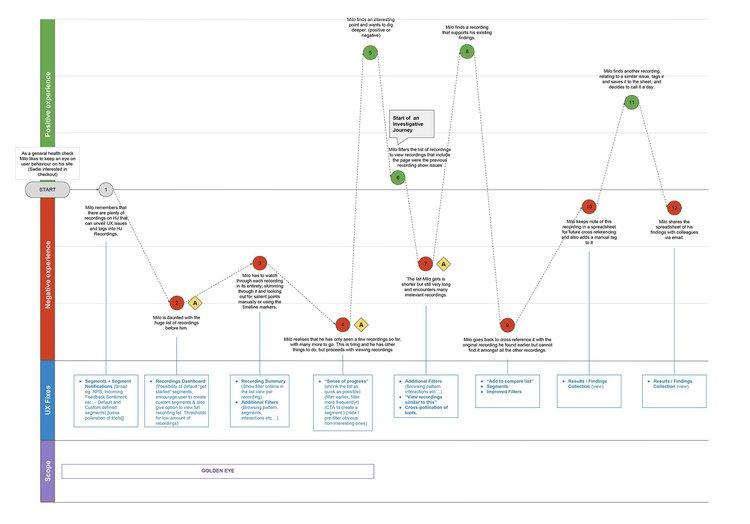

Customer journey map

A customer journey map is a diagram that shows the way a typical prospect becomes a paying customer. It outlines their first interaction with your brand and every step in the sales cycle, from awareness to repurchase (and hopefully advocacy).

The above customer journey map , created by our team at Hotjar, shows many ways a customer might engage with our tool. Your map will be based on your own data and business model.

📚 Read more: if you’re new to customer journey maps, we wrote this step-by-step guide to creating your first customer journey map in 2 and 1/2 days with free templates you can download and start using immediately.

Next steps: from research to results

So, how do you turn market research insights into tangible business results? Let’s look at the actions Smallpdf took after conducting their lean market research: first they implemented changes, then measured the impact.

Implement changes

Based on what Smallpdf learned about the challenges that one key user segment (admins) face when trying to convert PDFs into Word files, they improved their ‘PDF to Word’ conversion tool.

We won’t go into the details here because it involves a lot of technical jargon, but they made the entire process simpler and more straightforward for users. Plus, they made it so that their system recognized when you drop a PDF file into their ‘Word to PDF’ converter instead of the ‘PDF to Word’ converter, so users wouldn’t have to redo the task when they made that mistake.

In other words: simple market segmentation for admins showed a business need that had to be accounted for, and customers are happier overall after Smallpdf implemented an informed change to their product.

Measure results

According to the Lean UX model, product and UX changes aren’t retained unless they achieve results.

Smallpdf’s changes produced:

A 75% reduction in error rate for the ‘PDF to Word’ converter

A 1% increase in NPS

Greater confidence in the team’s marketing efforts

"With all the changes said and done, we've cut our original error rate in four, which is huge. We increased our NPS by +1%, which isn't huge, but it means that of the users who received a file, they were still slightly happier than before, even if they didn't notice that anything special happened at all.”

Subscribe to fresh and free monthly insights.

Over 50,000 people interested in UX, product, digital empathy, and beyond, receive our newsletter every month. No spam, just thoughtful perspectives from a range of experts, new approaches to remote work, and loads more valuable insights. If that floats your boat, why not become a subscriber?

I have read and accepted the message outlined here: Hotjar uses the information you provide to us to send you relevant content, updates and offers from time to time. You can unsubscribe at any time by clicking the link at the bottom of any email.

Market research (or marketing research) is any set of techniques used to gather information and better understand a company’s target market. This might include primary research on brand awareness and customer satisfaction or secondary market research on market size and competitive analysis. Businesses use this information to design better products, improve user experience, and craft a marketing strategy that attracts quality leads and improves conversion rates.

David Darmanin, one of Hotjar’s founders, launched two startups before Hotjar took off—but both companies crashed and burned. Each time, he and his team spent months trying to design an amazing new product and user experience, but they failed because they didn’t have a clear understanding of what the market demanded.

With Hotjar, they did things differently . Long story short, they conducted market research in the early stages to figure out what consumers really wanted, and the team made (and continues to make) constant improvements based on market and user research.

Without market research, it’s impossible to understand your users. Sure, you might have a general idea of who they are and what they need, but you have to dig deep if you want to win their loyalty.

Here’s why research matters:

Obsessing over your users is the only way to win. If you don’t care deeply about them, you’ll lose potential customers to someone who does.

Analytics gives you the ‘what’, while research gives you the ‘why’. Big data, user analytics , and dashboards can tell you what people do at scale, but only research can tell you what they’re thinking and why they do what they do. For example, analytics can tell you that customers leave when they reach your pricing page, but only research can explain why.

Research beats assumptions, trends, and so-called best practices. Have you ever watched your colleagues rally behind a terrible decision? Bad ideas are often the result of guesswork, emotional reasoning, death by best practices , and defaulting to the Highest Paid Person’s Opinion (HiPPO). By listening to your users and focusing on their customer experience , you’re less likely to get pulled in the wrong direction.

Research keeps you from planning in a vacuum. Your team might be amazing, but you and your colleagues simply can’t experience your product the way your customers do. Customers might use your product in a way that surprises you, and product features that seem obvious to you might confuse them. Over-planning and refusing to test your assumptions is a waste of time, money, and effort because you’ll likely need to make changes once your untested business plan gets put into practice.

Lean User Experience (UX) design is a model for continuous improvement that relies on quick, efficient research to understand customer needs and test new product features.

Lean market research can help you become more...

Efficient: it gets you closer to your customers, faster.

Cost-effective: no need to hire an expensive marketing firm to get things started.

Competitive: quick, powerful insights can place your products on the cutting edge.

As a small business or sole proprietor, conducting lean market research is an attractive option when investing in a full-blown research project might seem out of scope or budget.

There are lots of different ways you could conduct market research and collect customer data, but you don’t have to limit yourself to just one research method. Four common types of market research techniques include surveys, interviews, focus groups, and customer observation.

Which method you use may vary based on your business type: ecommerce business owners have different goals from SaaS businesses, so it’s typically prudent to mix and match these methods based on your particular goals and what you need to know.

1. Surveys: the most commonly used

Surveys are a form of qualitative research that ask respondents a short series of open- or closed-ended questions, which can be delivered as an on-screen questionnaire or via email. When we asked 2,000 Customer Experience (CX) professionals about their company’s approach to research , surveys proved to be the most commonly used market research technique.

What makes online surveys so popular?

They’re easy and inexpensive to conduct, and you can do a lot of data collection quickly. Plus, the data is pretty straightforward to analyze, even when you have to analyze open-ended questions whose answers might initially appear difficult to categorize.

We've built a number of survey templates ready and waiting for you. Grab a template and share with your customers in just a few clicks.

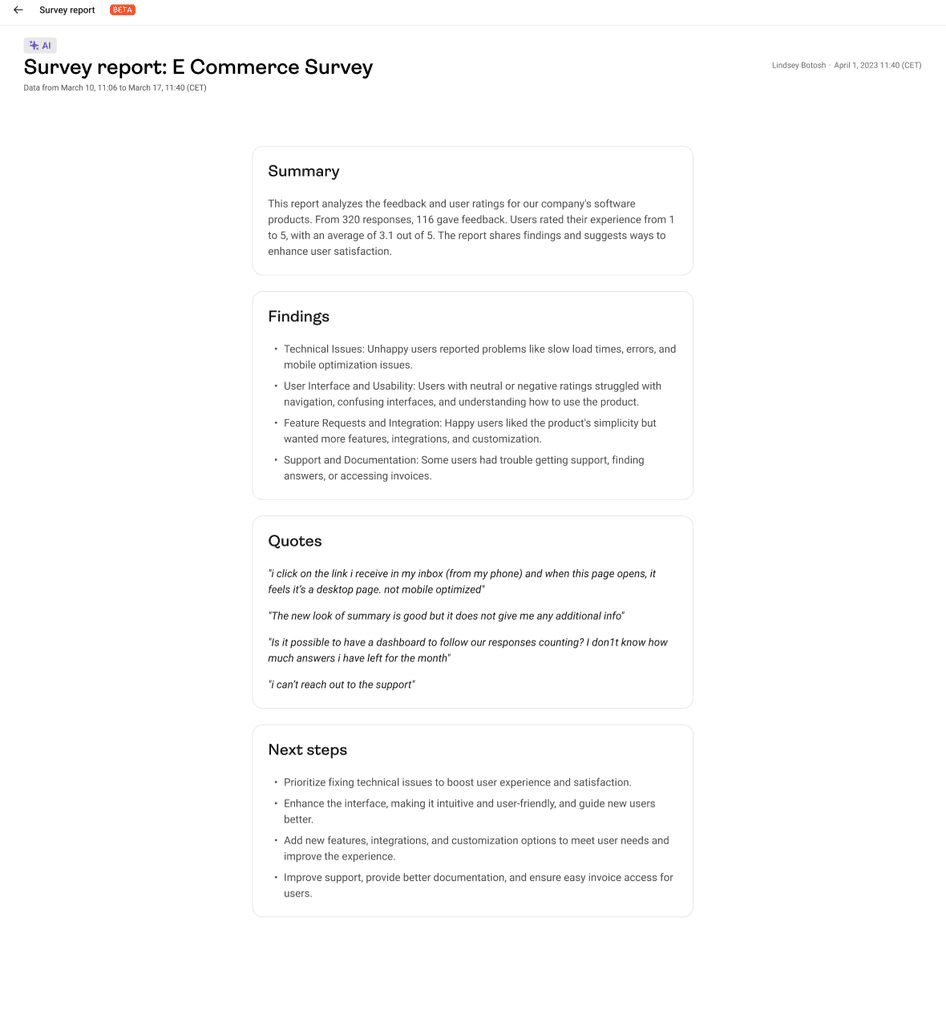

💡 Pro tip: you can also get started with Hotjar AI for Surveys to create a survey in mere seconds . Just enter your market research goal and watch as the AI generates a survey and populates it with relevant questions.

Once you’re ready for data analysis, the AI will prepare an automated research report that succinctly summarizes key findings, quotes, and suggested next steps.

An example research report generated by Hotjar AI for Surveys

2. Interviews: the most insightful

Interviews are one-on-one conversations with members of your target market. Nothing beats a face-to-face interview for diving deep (and reading non-verbal cues), but if an in-person meeting isn’t possible, video conferencing is a solid second choice.

Regardless of how you conduct it, any type of in-depth interview will produce big benefits in understanding your target customers.

What makes interviews so insightful?

By speaking directly with an ideal customer, you’ll gain greater empathy for their experience , and you can follow insightful threads that can produce plenty of 'Aha!' moments.

3. Focus groups: the most unreliable

Focus groups bring together a carefully selected group of people who fit a company’s target market. A trained moderator leads a conversation surrounding the product, user experience, or marketing message to gain deeper insights.

What makes focus groups so unreliable?

If you’re new to market research, we wouldn’t recommend starting with focus groups. Doing it right is expensive , and if you cut corners, your research could fall victim to all kinds of errors. Dominance bias (when a forceful participant influences the group) and moderator style bias (when different moderator personalities bring about different results in the same study) are two of the many ways your focus group data could get skewed.

4. Observation: the most powerful

During a customer observation session, someone from the company takes notes while they watch an ideal user engage with their product (or a similar product from a competitor).

What makes observation so clever and powerful?

‘Fly-on-the-wall’ observation is a great alternative to focus groups. It’s not only less expensive, but you’ll see people interact with your product in a natural setting without influencing each other. The only downside is that you can’t get inside their heads, so observation still isn't a recommended replacement for customer surveys and interviews.

The following questions will help you get to know your users on a deeper level when you interview them. They’re general questions, of course, so don’t be afraid to make them your own.

1. Who are you and what do you do?

How you ask this question, and what you want to know, will vary depending on your business model (e.g. business-to-business marketing is usually more focused on someone’s profession than business-to-consumer marketing).

It’s a great question to start with, and it’ll help you understand what’s relevant about your user demographics (age, race, gender, profession, education, etc.), but it’s not the be-all-end-all of market research. The more specific questions come later.

2. What does your day look like?

This question helps you understand your users’ day-to-day life and the challenges they face. It will help you gain empathy for them, and you may stumble across something relevant to their buying habits.

3. Do you ever purchase [product/service type]?

This is a ‘yes or no’ question. A ‘yes’ will lead you to the next question.

4. What problem were you trying to solve or what goal were you trying to achieve?

This question strikes to the core of what someone’s trying to accomplish and why they might be willing to pay for your solution.

5. Take me back to the day when you first decided you needed to solve this kind of problem or achieve this goal.

This is the golden question, and it comes from Adele Revella, Founder and CEO of Buyer Persona Institute . It helps you get in the heads of your users and figure out what they were thinking the day they decided to spend money to solve a problem.

If you take your time with this question, digging deeper where it makes sense, you should be able to answer all the relevant information you need to understand their perspective.

“The only scripted question I want you to ask them is this one: take me back to the day when you first decided that you needed to solve this kind of problem or achieve this kind of a goal. Not to buy my product, that’s not the day. We want to go back to the day that when you thought it was urgent and compelling to go spend money to solve a particular problem or achieve a goal. Just tell me what happened.”

— Adele Revella , Founder/CEO at Buyer Persona Institute

Bonus question: is there anything else you’d like to tell me?

This question isn’t just a nice way to wrap it up—it might just give participants the opportunity they need to tell you something you really need to know.

That’s why Sarah Doody, author of UX Notebook , adds it to the end of her written surveys.

“I always have a last question, which is just open-ended: “Is there anything else you would like to tell me?” And sometimes, that’s where you get four paragraphs of amazing content that you would never have gotten if it was just a Net Promoter Score [survey] or something like that.”

What is the difference between qualitative and quantitative research?

Qualitative research asks questions that can’t be reduced to a number, such as, “What is your job title?” or “What did you like most about your customer service experience?”

Quantitative research asks questions that can be answered with a numeric value, such as, “What is your annual salary?” or “How was your customer service experience on a scale of 1-5?”

→ Read more about the differences between qualitative and quantitative user research .

How do I do my own market research?

You can do your own quick and effective market research by

Surveying your customers

Building user personas

Studying your users through interviews and observation

Wrapping your head around your data with tools like flow models, affinity diagrams, and customer journey maps

What is the difference between market research and user research?

Market research takes a broad look at potential customers—what problems they’re trying to solve, their buying experience, and overall demand. User research, on the other hand, is more narrowly focused on the use (and usability ) of specific products.

What are the main criticisms of market research?

Many marketing professionals are critical of market research because it can be expensive and time-consuming. It’s often easier to convince your CEO or CMO to let you do lean market research rather than something more extensive because you can do it yourself. It also gives you quick answers so you can stay ahead of the competition.

Do I need a market research firm to get reliable data?

Absolutely not! In fact, we recommend that you start small and do it yourself in the beginning. By following a lean market research strategy, you can uncover some solid insights about your clients. Then you can make changes, test them out, and see whether the results are positive. This is an excellent strategy for making quick changes and remaining competitive.

Net Promoter, Net Promoter System, Net Promoter Score, NPS, and the NPS-related emoticons are registered trademarks of Bain & Company, Inc., Fred Reichheld, and Satmetrix Systems, Inc.

Related articles

6 traits of top marketing leaders (and how to cultivate them in yourself)

Stepping into a marketing leadership role can stir up a mix of emotions: excitement, optimism, and, often, a gnawing doubt. "Do I have the right skills to truly lead and inspire?" If you've ever wrestled with these uncertainties, you're not alone.

Hotjar team

The 7 best BI tools for marketers in 2024 (and how to use them)

Whether you're sifting through campaign attribution data or reviewing performance reports from different sources, extracting meaningful business insights from vast amounts of data is an often daunting—yet critical—task many marketers face. So how do you efficiently evaluate your results and communicate key learnings?

This is where business intelligence (BI) tools come in, transforming raw data into actionable insights that drive informed, customer-centric decisions.

6 marketing trends that will shape the future of ecommerce in 2023

Today, marketing trends evolve at the speed of technology. Ecommerce businesses that fail to update their marketing strategies to meet consumers where they are in 2023 will be left out of the conversations that drive brand success.

Geoff Whiting

EXCLUSIVE SUMMIT OFFER Join foundr+ and get Ecommerce Kickstarter program free!

- Skip to primary navigation

- Skip to main content

A magazine for young entrepreneurs

The best advice in entrepreneurship

Subscribe for exclusive access, the complete guide to market research: what it is, why you need it, and how to do it.

Written by Mary Kate Miller | June 1, 2021

Comments -->

Get real-time frameworks, tools, and inspiration to start and build your business. Subscribe here

Market research is a cornerstone of all successful, strategic businesses. It can also be daunting for entrepreneurs looking to launch a startup or start a side hustle . What is market research, anyway? And how do you…do it?

We’ll walk you through absolutely everything you need to know about the market research process so that by the end of this guide, you’ll be an expert in market research too. And what’s more important: you’ll have actionable steps you can take to start collecting your own market research.

What Is Market Research?

Market research is the organized process of gathering information about your target customers and market. Market research can help you better understand customer behavior and competitor strengths and weaknesses, as well as provide insight for the best strategies in launching new businesses and products. There are different ways to approach market research, including primary and secondary research and qualitative and quantitative research. The strongest approaches will include a combination of all four.

“Virtually every business can benefit from conducting some market research,” says Niles Koenigsberg of Real FiG Advertising + Marketing . “Market research can help you piece together your [business’s] strengths and weaknesses, along with your prospective opportunities, so that you can understand where your unique differentiators may lie.” Well-honed market research will help your brand stand out from the competition and help you see what you need to do to lead the market. It can also do so much more.

The Purposes of Market Research

Why do market research? It can help you…

- Pinpoint your target market, create buyer personas, and develop a more holistic understanding of your customer base and market.

- Understand current market conditions to evaluate risks and anticipate how your product or service will perform.

- Validate a concept prior to launch.

- Identify gaps in the market that your competitors have created or overlooked.

- Solve problems that have been left unresolved by the existing product/brand offerings.

- Identify opportunities and solutions for new products or services.

- Develop killer marketing strategies .

What Are the Benefits of Market Research?

Strong market research can help your business in many ways. It can…

- Strengthen your market position.

- Help you identify your strengths and weaknesses.

- Help you identify your competitors’ strengths and weaknesses.

- Minimize risk.

- Center your customers’ experience from the get-go.

- Help you create a dynamic strategy based on market conditions and customer needs/demands.

What Are the Basic Methods of Market Research?

The basic methods of market research include surveys, personal interviews, customer observation, and the review of secondary research. In addition to these basic methods, a forward-thinking market research approach incorporates data from the digital landscape like social media analysis, SEO research, gathering feedback via forums, and more. Throughout this guide, we will cover each of the methods commonly used in market research to give you a comprehensive overview.

Primary vs. Secondary Market Research

Primary and secondary are the two main types of market research you can do. The latter relies on research conducted by others. Primary research, on the other hand, refers to the fact-finding efforts you conduct on your own.

This approach is limited, however. It’s likely that the research objectives of these secondary data points differ from your own, and it can be difficult to confirm the veracity of their findings.

Primary Market Research

Primary research is more labor intensive, but it generally yields data that is exponentially more actionable. It can be conducted through interviews, surveys, online research, and your own data collection. Every new business should engage in primary market research prior to launch. It will help you validate that your idea has traction, and it will give you the information you need to help minimize financial risk.

You can hire an agency to conduct this research on your behalf. This brings the benefit of expertise, as you’ll likely work with a market research analyst. The downside is that hiring an agency can be expensive—too expensive for many burgeoning entrepreneurs. That brings us to the second approach. You can also do the market research yourself, which substantially reduces the financial burden of starting a new business .

Secondary Market Research

Secondary research includes resources like government databases and industry-specific data and publications. It can be beneficial to start your market research with secondary sources because it’s widely available and often free-to-access. This information will help you gain a broad overview of the market conditions for your new business.

Identify Your Goals and Your Audience

Before you begin conducting interviews or sending out surveys, you need to set your market research goals. At the end of your market research process, you want to have a clear idea of who your target market is—including demographic information like age, gender, and where they live—but you also want to start with a rough idea of who your audience might be and what you’re trying to achieve with market research.

You can pinpoint your objectives by asking yourself a series of guiding questions:

- What are you hoping to discover through your research?

- Who are you hoping to serve better because of your findings?

- What do you think your market is?

- Who are your competitors?

- Are you testing the reception of a new product category or do you want to see if your product or service solves the problem left by a current gap in the market?

- Are you just…testing the waters to get a sense of how people would react to a new brand?

Once you’ve narrowed down the “what” of your market research goals, you’re ready to move onto how you can best achieve them. Think of it like algebra. Many math problems start with “solve for x.” Once you know what you’re looking for, you can get to work trying to find it. It’s a heck of a lot easier to solve a problem when you know you’re looking for “x” than if you were to say “I’m gonna throw some numbers out there and see if I find a variable.”

How to Do Market Research

This guide outlines every component of a comprehensive market research effort. Take into consideration the goals you have established for your market research, as they will influence which of these elements you’ll want to include in your market research strategy.

Secondary Data

Secondary data allows you to utilize pre-existing data to garner a sense of market conditions and opportunities. You can rely on published market studies, white papers, and public competitive information to start your market research journey.

Secondary data, while useful, is limited and cannot substitute your own primary data. It’s best used for quantitative data that can provide background to your more specific inquiries.

Find Your Customers Online

Once you’ve identified your target market, you can use online gathering spaces and forums to gain insights and give yourself a competitive advantage. Rebecca McCusker of The Creative Content Shop recommends internet recon as a vital tool for gaining a sense of customer needs and sentiment. “Read their posts and comments on forums, YouTube video comments, Facebook group [comments], and even Amazon/Goodreads book comments to get in their heads and see what people are saying.”

If you’re interested in engaging with your target demographic online, there are some general rules you should follow. First, secure the consent of any group moderators to ensure that you are acting within the group guidelines. Failure to do so could result in your eviction from the group.

Not all comments have the same research value. “Focus on the comments and posts with the most comments and highest engagement,” says McCusker. These high-engagement posts can give you a sense of what is already connecting and gaining traction within the group.

Social media can also be a great avenue for finding interview subjects. “LinkedIn is very useful if your [target customer] has a very specific job or works in a very specific industry or sector. It’s amazing the amount of people that will be willing to help,” explains Miguel González, a marketing executive at Dealers League . “My advice here is BE BRAVE, go to LinkedIn, or even to people you know and ask them, do quick interviews and ask real people that belong to that market and segment and get your buyer persona information first hand.”

Market research interviews can provide direct feedback on your brand, product, or service and give you a better understanding of consumer pain points and interests.

When organizing your market research interviews, you want to pay special attention to the sample group you’re selecting, as it will directly impact the information you receive. According to Tanya Zhang, the co-founder of Nimble Made , you want to first determine whether you want to choose a representative sample—for example, interviewing people who match each of the buyer persona/customer profiles you’ve developed—or a random sample.

“A sampling of your usual persona styles, for example, can validate details that you’ve already established about your product, while a random sampling may [help you] discover a new way people may use your product,” Zhang says.

Market Surveys

Market surveys solicit customer inclinations regarding your potential product or service through a series of open-ended questions. This direct outreach to your target audience can provide information on your customers’ preferences, attitudes, buying potential, and more.

Every expert we asked voiced unanimous support for market surveys as a powerful tool for market research. With the advent of various survey tools with accessible pricing—or free use—it’s never been easier to assemble, disseminate, and gather market surveys. While it should also be noted that surveys shouldn’t replace customer interviews , they can be used to supplement customer interviews to give you feedback from a broader audience.

Who to Include in Market Surveys

- Current customers

- Past customers

- Your existing audience (such as social media/newsletter audiences)

Example Questions to Include in Market Surveys

While the exact questions will vary for each business, here are some common, helpful questions that you may want to consider for your market survey. Demographic Questions: the questions that help you understand, demographically, who your target customers are:

- “What is your age?”

- “Where do you live?”

- “What is your gender identity?”

- “What is your household income?”

- “What is your household size?”

- “What do you do for a living?”

- “What is your highest level of education?”

Product-Based Questions: Whether you’re seeking feedback for an existing brand or an entirely new one, these questions will help you get a sense of how people feel about your business, product, or service:

- “How well does/would our product/service meet your needs?”

- “How does our product/service compare to similar products/services that you use?”

- “How long have you been a customer?” or “What is the likelihood that you would be a customer of our brand?

Personal/Informative Questions: the deeper questions that help you understand how your audience thinks and what they care about.

- “What are your biggest challenges?”

- “What’s most important to you?”

- “What do you do for fun (hobbies, interests, activities)?”

- “Where do you seek new information when researching a new product?”

- “How do you like to make purchases?”

- “What is your preferred method for interacting with a brand?”

Survey Tools

Online survey tools make it easy to distribute surveys and collect responses. The best part is that there are many free tools available. If you’re making your own online survey, you may want to consider SurveyMonkey, Typeform, Google Forms, or Zoho Survey.

Competitive Analysis

A competitive analysis is a breakdown of how your business stacks up against the competition. There are many different ways to conduct this analysis. One of the most popular methods is a SWOT analysis, which stands for “strengths, weaknesses, opportunities, and threats.” This type of analysis is helpful because it gives you a more robust understanding of why a customer might choose a competitor over your business. Seeing how you stack up against the competition can give you the direction you need to carve out your place as a market leader.

Social Media Analysis

Social media has fundamentally changed the market research landscape, making it easier than ever to engage with a wide swath of consumers. Follow your current or potential competitors on social media to see what they’re posting and how their audience is engaging with it. Social media can also give you a lower cost opportunity for testing different messaging and brand positioning.

SEO Analysis and Opportunities

SEO analysis can help you identify the digital competition for getting the word out about your brand, product, or service. You won’t want to overlook this valuable information. Search listening tools offer a novel approach to understanding the market and generating the content strategy that will drive business. Tools like Google Trends and Awario can streamline this process.

Ready to Kick Your Business Into High Gear?

Now that you’ve completed the guide to market research you know you’re ready to put on your researcher hat to give your business the best start. Still not sure how actually… launch the thing? Our free mini-course can run you through the essentials for starting your side hustle .

About Mary Kate Miller

Mary Kate Miller writes about small business, real estate, and finance. In addition to writing for Foundr, her work has been published by The Washington Post, Teen Vogue, Bustle, and more. She lives in Chicago.

Related Posts

14 Punchy TikTok Marketing Strategies to Amplify Your Growth

How to Grow Your YouTube Channel and Gain Subscribers Quickly

How to Get More Views on Snapchat with These 12 Tactics

12 Instagram Growth Hacks For More Engaged Followers (Without Running Ads)

Create Viral Infographics That Boost Your Organic Traffic

How to Create a Video Sales Letter (Tips and Tricks from a 7-Figure Copywriter)

How to Write a Sales Email That Converts in 2024

What Is a Media Kit: How to Make One in 2024 (With Examples)

Namestorming: How to Choose a Brand Name in 20 Minutes or Less

10 Ways to Increase Brand Awareness without Increasing Your Budget

What Is a Content Creator? A Deep Dive Into This Evolving Industry

Content Creator vs Influencer: What’s the Difference?

How Much Do YouTube Ads Cost? A Beginner’s Pricing Breakdown

How to Get Podcast Sponsors Before Airing an Episode

How Founders Can Overcome Their Sales Fears with AJ Cassata

FREE TRAINING FROM LEGIT FOUNDERS

Actionable Strategies for Starting & Growing Any Business.

How To Do Market Research: Definition, Types, Methods

Jan 2, 2024

11 min. read

Market research isn’t just collecting data. It’s a strategic tool that allows businesses to gain a competitive advantage while making the best use of their resources. Research reveals valuable insights into your target audience about their preferences, buying habits, and emerging demands — all of which help you unlock new opportunities to grow your business.

When done correctly, market research can minimize risks and losses, spur growth, and position you as a leader in your industry.

Let’s explore the basic building blocks of market research and how to collect and use data to move your company forward:

Table of Contents

What Is Market Research?

Why is market research important, market analysis example, 5 types of market research, what are common market research questions, what are the limitations of market research, how to do market research, improving your market research with radarly.

Market Research Definition: The process of gathering, analyzing, and interpreting information about a market or audience.

Market research studies consumer behavior to better understand how they perceive products or services. These insights help businesses identify ways to grow their current offering, create new products or services, and improve brand trust and brand recognition .

You might also hear market research referred to as market analysis or consumer research .

Traditionally, market research has taken the form of focus groups, surveys, interviews, and even competitor analysis . But with modern analytics and research tools, businesses can now capture deeper insights from a wider variety of sources, including social media, online reviews, and customer interactions. These extra layers of intel can help companies gain a more comprehensive understanding of their audience.

With consumer preferences and markets evolving at breakneck speeds, businesses need a way to stay in touch with what people need and want. That’s why the importance of market research cannot be overstated.

Market research offers a proactive way to identify these trends and make adjustments to product development, marketing strategies , and overall operations. This proactive approach can help businesses stay ahead of the curve and remain agile as markets shift.

Market research examples abound — given the number of ways companies can get inside the minds of their customers, simply skimming through your business’s social media comments can be a form of market research.

A restaurant chain might use market research methods to learn more about consumers’ evolving dining habits. These insights might be used to offer new menu items, re-examine their pricing strategies, or even open new locations in different markets, for example.

A consumer electronics company might use market research for similar purposes. For instance, market research may reveal how consumers are using their smart devices so they can develop innovative features.

Market research can be applied to a wide range of use cases, including:

- Testing new product ideas

- Improve existing products

- Entering new markets

- Right-sizing their physical footprints

- Improving brand image and awareness

- Gaining insights into competitors via competitive intelligence

Ultimately, companies can lean on market research techniques to stay ahead of trends and competitors while improving the lives of their customers.

Market research methods take different forms, and you don’t have to limit yourself to just one. Let’s review the most common market research techniques and the insights they deliver.

1. Interviews

3. Focus Groups

4. Observations

5. AI-Driven Market Research

One-on-one interviews are one of the most common market research techniques. Beyond asking direct questions, skilled interviewers can uncover deeper motivations and emotions that drive purchasing decisions. Researchers can elicit more detailed and nuanced responses they might not receive via other methods, such as self-guided surveys.

Interviews also create the opportunity to build rapport with customers and prospects. Establishing a connection with interviewees can encourage them to open up and share their candid thoughts, which can enrich your findings. Researchers also have the opportunity to ask clarifying questions and dig deeper based on individual responses.

Market research surveys provide an easy entry into the consumer psyche. They’re cost-effective to produce and allow researchers to reach lots of people in a short time. They’re also user-friendly for consumers, which allows companies to capture more responses from more people.

Big data and data analytics are making traditional surveys more valuable. Researchers can apply these tools to elicit a deeper understanding from responses and uncover hidden patterns and correlations within survey data that were previously undetectable.

The ways in which surveys are conducted are also changing. With the rise of social media and other online channels, brands and consumers alike have more ways to engage with each other, lending to a continuous approach to market research surveys.

3. Focus groups

Focus groups are “group interviews” designed to gain collective insights. This interactive setting allows participants to express their thoughts and feelings openly, giving researchers richer insights beyond yes-or-no responses.

One of the key benefits of using focus groups is the opportunity for participants to interact with one another. They spark discussions while sharing diverse viewpoints. These sessions can uncover underlying motivations and attitudes that may not be easily expressed through other research methods.

Observing your customers “in the wild” might feel informal, but it can be one of the most revealing market research techniques of all. That’s because you might not always know the right questions to ask. By simply observing, you can surface insights you might not have known to look for otherwise.

This method also delivers raw, authentic, unfiltered data. There’s no room for bias and no potential for participants to accidentally skew the data. Researchers can also pick up on non-verbal cues and gestures that other research methods may fail to capture.

5. AI-driven market research

One of the newer methods of market research is the use of AI-driven market research tools to collect and analyze insights on your behalf. AI customer intelligence tools and consumer insights software like Meltwater Radarly take an always-on approach by going wherever your audience is and continuously predicting behaviors based on current behaviors.

By leveraging advanced algorithms, machine learning, and big data analysis , AI enables companies to uncover deep-seated patterns and correlations within large datasets that would be near impossible for human researchers to identify. This not only leads to more accurate and reliable findings but also allows businesses to make informed decisions with greater confidence.

Tip: Learn how to use Meltwater as a research tool , how Meltwater uses AI , and learn more about consumer insights and about consumer insights in the fashion industry .

No matter the market research methods you use, market research’s effectiveness lies in the questions you ask. These questions should be designed to elicit honest responses that will help you reach your goals.

Examples of common market research questions include:

Demographic market research questions

- What is your age range?

- What is your occupation?

- What is your household income level?

- What is your educational background?

- What is your gender?

Product or service usage market research questions

- How long have you been using [product/service]?

- How frequently do you use [product/service]?

- What do you like most about [product/service]?

- Have you experienced any problems using [product/service]?

- How could we improve [product/service]?

- Why did you choose [product/service] over a competitor’s [product/service]?

Brand perception market research questions

- How familiar are you with our brand?

- What words do you associate with our brand?

- How do you feel about our brand?

- What makes you trust our brand?

- What sets our brand apart from competitors?

- What would make you recommend our brand to others?

Buying behavior market research questions

- What do you look for in a [product/service]?

- What features in a [product/service] are important to you?

- How much time do you need to choose a [product/service]?

- How do you discover new products like [product/service]?

- Do you prefer to purchase [product/service] online or in-store?

- How do you research [product/service] before making a purchase?

- How often do you buy [product/service]?

- How important is pricing when buying [product/service]?

- What would make you switch to another brand of [product/service]?

Customer satisfaction market research questions

- How happy have you been with [product/service]?

- What would make you more satisfied with [product/service]?

- How likely are you to continue using [product/service]?

Bonus Tip: Compiling these questions into a market research template can streamline your efforts.