Areas of Research

- Students & Placements

- [email protected]

- (517) 355-7486

Faculty-student collaboration is a significant part of the Broad experience. One of our strengths is that our faculty actively conducts research in a wide range of areas, providing excellent opportunities to our students.

Accounting doctoral students have the opportunity to work with some of the top researchers in the following areas:

- Financial accounting

- Managerial accounting

Accounting Research Opportunities

Our research aims to address pressing industry issues from a variety of perspectives and methodologies — analytical, archival, experimental, surveys, case studies, field studies and simulations. We conduct research in a number of accounting areas:

- Financial accounting, focusing on the link between accounting information and capital markets

- Auditing, focusing on the audit function, which sits between the accounting information produced by the firm and capital markets

- Managerial accounting, focusing on the link between accounting information and internal users

- Tax, focusing on the link between accounting information and taxation authorities as well as the capital markets

- Governance, focusing on corporate economic activities, which in turn drive accounting information

- Information systems, focusing on systems that collect, store and generate accounting information

Publications

The following research publications have resulted from faculty and Ph.D. student collaborations in recent years.

Allee, K., D. Lynch , K. Petroni and J. Schroeder . 2015. Do Firms Use Inventory to Manage Personal Property Taxes? An Analysis of U.S. Petroleum Refineries. Contemporary Accounting Research 32:2 (2015) pp. 736-762. Boland, C.M ., S.N. Bronson and C.E. Hogan. 2015. Accelerated Filing Deadlines, Internal Controls and Financial Statement Quality: The Case of Originating Misstatements. Accounting Horizons 29 (September): 551-575. Demere, W. , Krishnan, R., K. L. Sedatole, and A. Woods . 2015. Do the Incentive Effects of Relative Performance Measurement Vary with the Ex Ante Probability of Promotion? Management Accounting Research 30: 18-31. Krishnan, R., F. Miller , and K. L. Sedatole. 2011. The Use of Collaborative Interfirm Contracts in the Presence of Task and Demand Uncertainty. Contemporary Accounting Research 28 (4): 1397–1422. Lee, Y., K. Petroni and M. Shen . 2006. Cherry Picking, Disclosure Quality, and Comprehensive Income Reporting Choices: The Case of Property-Liability Insurers by Y. Lee, K. Petroni, and M. Shen, Contemporary Accounting Research 23: 3 (2006). Schroeder, J.H. and C.E. Hogan. 2013. The Impact of PCAOB AS5 and the Economic Recession on Client Portfolio Characteristics of the Big 4 Audit Firms. Auditing: A Journal of Practice and Theory 32 (November): 95-127. Sedatole, K. L., A. Swaney, and A. Woods . 2016. The Implicit Incentive Effects of Horizontal Monitoring and Team Member Dependence on Individual Performance. Forthcoming in Contemporary Accounting Research . Sedatole, K. L., D. Vrettos , and S. K. Widener. 2012. The Use of Management Control Mechanisms to Mitigate Moral Hazard in the Decision to Outsource. Journal of Accounting Research 50 (2): 553-592.

Accounting @ Broad

From the conversation, featuring anjana susarla, from npr marketplace, get connected with broad:.

- Business College Complex

- 632 Bogue St

- East Lansing, MI 48824

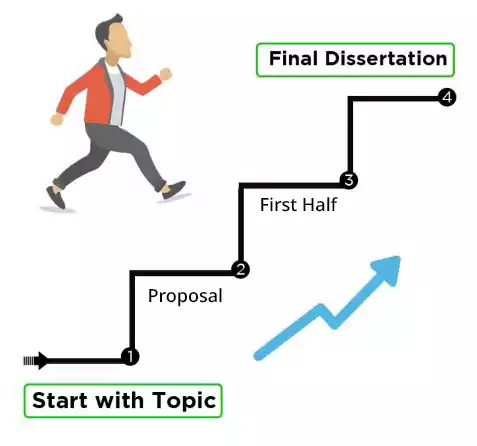

- How It Works

- PhD thesis writing

- Master thesis writing

- Bachelor thesis writing

- Dissertation writing service

- Dissertation abstract writing

- Thesis proposal writing

- Thesis editing service

- Thesis proofreading service

- Thesis formatting service

- Coursework writing service

- Research paper writing service

- Architecture thesis writing

- Computer science thesis writing

- Engineering thesis writing

- History thesis writing

- MBA thesis writing

- Nursing dissertation writing

- Psychology dissertation writing

- Sociology thesis writing

- Statistics dissertation writing

- Buy dissertation online

- Write my dissertation

- Cheap thesis

- Cheap dissertation

- Custom dissertation

- Dissertation help

- Pay for thesis

- Pay for dissertation

- Senior thesis

- Write my thesis

150 Original Accounting Research Paper Topics

Our academic experts understand how hard it can be to come up with original accounting research paper topics for assignments. Students are often dealing with multiple responsibilities and trying to balance numerous deadlines. Searching the web or class notes takes up a lot of time. Therefore, we have put together our list of 150 accounting research topics that students can choose from or gather inspiration from.

Managerial Accounting Topics for College Students

This area of study has tremendous upside as more businesses rely on managerial accountants to bring innovative changes to their organizations. Here is a list of topics for research paper in this area:

- Differences between financial accounting and managerial accounting.

- Managerial accounting in the 21 st century.

- The impact of managerial accounting in big businesses.

- The major components of activity-based costing.

- How managerial accounting affects international finance.

- The impact managerial accounting has on human resources.

- The major components of capital budgeting.

- How managerial accounting affects internal business decisions.

- Effective ways of adopting managerial accounting into small businesses.

- Differences between variable costing and absorption costing.

Accounting Blog Topics for Today’s Generation

The following collection can be considered accounting hot topics because they deal with the issues that are most important to today’s generation of accountants that utilize advanced software to keep businesses successful:

- Cost of manufacturing goods overseas.

- The cost of instituting anti-harassment programs.

- Inventory and cost of products sold in the U.S.

- Reinventing accounts payable processes.

- Using best practices to boost the bottom line.

- The cost of keeping human resources on staff.

- Simplifying procedures in accounts payable.

- The cost of updating internal systems with technology.

- The cost-effectiveness of employee training.

- Working capital increasing in large companies.

Advanced Accounting Topics

As students advance academically, they may want to consider these topics for research paper to earn higher scores in their classes. Here are some suggestions:

- How to run an efficient large accounting department.

- Red flags in outdated accounting processes.

- Identifying unconventional processes in payment processes.

- Utilizing paperless processes in small businesses.

- Applying EDP to accounts payable processes.

- The benefits of automating payables and receivables.

- Outsourcing procurement processes to save money.

- Automation to handle repetitive processes.

- The need for diversifying skills in accounting.

- The ways time affects seasonal cash flow.

Controversial Accounting Topics

Many accounting topics for research papers need to draw a reader’s attention right from the start. This list of topics is controversial and should accomplish just that:

- The impact the Jobs Act will have on large businesses.

- The positive effects tax cuts will have on small business.

- The risks of offshore accounting on U.S. businesses.

- The need to update software each year to avoid accounting problems.

- How small businesses are falling behind in accounting practices.

- The impact bonus depreciation allows businesses.

- Applying to government relief programs.

- Describe the role the internet has on accounting.

- The trustworthiness of online accounting programs.

- The negatives of auditing collusion.

Intermediate Accounting Topics

These accounting paper topics are meant for students that have acquired skills in writing but may not have developed the skills needed to write a top-notch paper quite yet. They should be easy to research given a proper planning period:

- Discuss why companies need to incorporate automated processes.

- The problems with ethics in accounting practices.

- Technology advancements that improve accounting accuracy.

- The problem with accuracy in decade-old software.

- Explain the best way to help accountants work manually.

- Describe the historical prospect of best accounting practices.

- The most effective way to become a certified accountant.

- Compare accounting systems that improve processes.

- The quick flow of data and the value on today’s accountants.

- The negatives that come from relying on accounting software.

Interesting Accounting Topics

Sometimes you need to consider accounting project topics that would be great for numerous situations. You may need to present before a class or write a paper for a discussion panel. These ideas may suit your needs:

- Explain the concept of accounting theory to practice.

- The theories behind normative accounting practices.

- The effect theories in accounting have on businesses.

- Challenges of taking theory to practice.

- The major changes in accounting practices over the last 25 years.

- The impact the internet has had on accounting ethics.

- Accounting practices in the 21 st century.

- The challenges of accounting technologies on fast-growing companies.

- The dangers the internet poses toward ethical accounting.

- Describe the difficulties that come from putting theories into practice.

Accounting Projects Topics for a Short Project

Some cost accounting topics are worthy of an audience but need to be completed within a tight deadline. These project ideas are easy to research and can be completed within one week:

- Use of efficient accounting software in tax season.

- Applicable Professional and Legal Standards.

- The difficulties in using offshore accounting.

- The most effective way of managing earnings.

- The development of cash flow in the United Kingdom.

- The development of cash flow in the United States.

- The best way to manage personal finances.

- The effect financial markets have on personal spending.

- Debt management in large corporations.

- Accounting challenges during the pandemic.

Forensic Accounting Research Topics

This is another area of accounting that has a promising future for small to large businesses. Here are forensic accounting research paper topics you can use if you are interested in this booming segment:

- Methods for identifying instances of money laundering.

- The government’s right to search private accounts.

- The use of tax records to report possible crimes.

- Class action litigation cases in the United States.

- Court use of forensic accounting in criminal cases.

- Forensic accounting to develop better anti-fraud programs.

- A company’s reliance on forensic accounting to prevent theft.

- Establishing controls in emerging international markets.

- Forensic accountants and their role in court proceedings.

- Natural disaster and loss quantification practices.

Accounting Theory Topics for College

Good accounting thesis topics should mirror personally important issues. Essay ideas should reflect the things you want to learn more about and explore in-depth. Here is a list that may pique your interest:

- Impact of accounting research on financial practices.

- Scientific research studies in modern economies.

- Modern accounting concepts and applications.

- The change in accounting practices over the last two decades.

- Describe the components of Positive Theory.

- Marketplace discipline across major industries.

- Major accounting theories and techniques in big businesses.

- The use of technology to reduce accounting costs.

- Technology theory in the use of modern accounting.

- Risk management and the most effective theories.

Accounting Dissertation Topics for Grad Students

The following topic ideas delve into some serious issues in accounting and are much more difficult to handle. These should be approached with the utmost academic determination to earn a master’s or a Ph.D.:

- Compare accounting software versus manual accounting.

- Tax management procedures in the 21 st century.

- The risks of updated technology in small companies.

- The costs associated with broader health care in the workplace.

- The history of accounting in the 20 th century.

- The best method of managing debts without difficulties.

- Accounting problems caused by online transactions.

- Cryptocurrency and its impact on modern accounting practices.

- Forecasting jobs in the field of accounting.

- The danger technology poses to the accounting industry.

Current Accounting Topics for College

If you don’t have enough time to research current topics in accounting, these ideas will help you save time. There are plenty of online resources discussing current issues and you can also find information in the library:

- Compare and contrast different cryptocurrencies.

- The definition of a successful and modern business account.

- Non-profit organizations and tax reductions.

- Sports accounting in today’s world of social media.

- The financial benefits of having a second stream of revenue.

- Financial stock management of overall earnings.

- The relationship between corporate donations and accounting.

- Minimizing risks in big and small-sized businesses.

- The impact that tax deductions have on big businesses.

- Financial strategies to ensure employee retention.

Hot Topics in Accounting for a Graduate Level Course

These are the topics you should be considered for a graduate-level course if you want to make a great impression on the professor. Just be sure to do your due diligence and research your selected topic thoroughly:

- The instances of “cooking books” in the 21 st century.

- The best approach to update accounting systems.

- Fraud cases currently in the United States.

- The importance of forensic accountants in fraud cases.

- The reasons account reports have government regulations.

- The benefits of incorporating computerized accounting.

- The need for companies to make changes to accounting departments.

- Evolving accounting practices that reduce the risk of theft.

- The effects offshore gambling has had on accounting.

- Privacy protocols to keep accounting practices secret.

Financial Accounting Topics Being Discussed Today

Topics in accounting are rooted in financial processes that date back centuries. Yet, there are still many innovative ideas that drive business success. Consider these topics for an essay on issues that are current for today’s world:

- The evolution of accounting practices over the last century.

- The biggest ethical concerns about accounting.

- Minimizing taxes when you are a small company.

- Accounting software that will cut company costs.

- The best way to lower taxes through accounting practices.

- Describe the way managerial accounting is affected by international markets.

- Explain the major factors of management earnings.

- The most accurate way to figure out the estimated tax on a company’s earnings.

- The quickest way to become a certified accountant.

- Describe how culture influences accounting practices.

Accounting Information Systems Research

The next set of topics are great for anyone wanting to combine accounting with technology. We put together this set to generate interest in this area:

- The ways small businesses can benefit from advanced technologies.

- Describe how IT affects financial analysis for reporting.

- Explain how companies use AIS to collect and store data.

- Explain the 10 elements used to understand AIS.

- Rank the best accounting information systems.

- The future of AIS in small business financial practices.

- Explain how AIS eliminates the use of balance sheets.

- AIS technologies save money in large businesses.

- The future of AIS in small to mid-size businesses.

- Describe the role of AIS in modern business.

Accounting Presentation Topics for College

These presentation topics cover a wide range of areas that are perfect for diverse interests. At the college level, students must conduct a lot of academic research to guarantee they have all the most relevant information needed to present on a great topic:

- Describe how forensic accounting can reduce risk to small businesses.

- Describe the challenges value and cost that managers deal with.

- The biggest changes to accounting practices in the 21 st century.

- The benefits of having separate controlling accounts.

- The rapid flow of data and the importance of modern accountants.

- Describe how forensic accountants conduct their investigations.

- The most likely causes of financial instability in small businesses.

- Explain the factors one must consider before investing.

- Describe the differences between financial and management accounting.

- Describe the impact of new taxation policies on managerial accounting.

What do you think of our accounting research topics? These are available for free and can be shared with other students. If you need a custom list of accounting topics, our academic experts can take your assignment details and provide you with original and simple accounting research topics to facilitate your project and help you earn a top grade. We can also provide you with writing, editing, and proofreading services to ensure your assignment is error-free and gets you the highest score possible.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Comment * Error message

Name * Error message

Email * Error message

Save my name, email, and website in this browser for the next time I comment.

As Putin continues killing civilians, bombing kindergartens, and threatening WWIII, Ukraine fights for the world's peaceful future.

Ukraine Live Updates

Research Topics & Ideas: Finance

120+ Finance Research Topic Ideas To Fast-Track Your Project

If you’re just starting out exploring potential research topics for your finance-related dissertation, thesis or research project, you’ve come to the right place. In this post, we’ll help kickstart your research topic ideation process by providing a hearty list of finance-centric research topics and ideas.

PS – This is just the start…

We know it’s exciting to run through a list of research topics, but please keep in mind that this list is just a starting point . To develop a suitable education-related research topic, you’ll need to identify a clear and convincing research gap , and a viable plan of action to fill that gap.

If this sounds foreign to you, check out our free research topic webinar that explores how to find and refine a high-quality research topic, from scratch. Alternatively, if you’d like hands-on help, consider our 1-on-1 coaching service .

Overview: Finance Research Topics

- Corporate finance topics

- Investment banking topics

- Private equity & VC

- Asset management

- Hedge funds

- Financial planning & advisory

- Quantitative finance

- Treasury management

- Financial technology (FinTech)

- Commercial banking

- International finance

Corporate Finance

These research topic ideas explore a breadth of issues ranging from the examination of capital structure to the exploration of financial strategies in mergers and acquisitions.

- Evaluating the impact of capital structure on firm performance across different industries

- Assessing the effectiveness of financial management practices in emerging markets

- A comparative analysis of the cost of capital and financial structure in multinational corporations across different regulatory environments

- Examining how integrating sustainability and CSR initiatives affect a corporation’s financial performance and brand reputation

- Analysing how rigorous financial analysis informs strategic decisions and contributes to corporate growth

- Examining the relationship between corporate governance structures and financial performance

- A comparative analysis of financing strategies among mergers and acquisitions

- Evaluating the importance of financial transparency and its impact on investor relations and trust

- Investigating the role of financial flexibility in strategic investment decisions during economic downturns

- Investigating how different dividend policies affect shareholder value and the firm’s financial performance

Investment Banking

The list below presents a series of research topics exploring the multifaceted dimensions of investment banking, with a particular focus on its evolution following the 2008 financial crisis.

- Analysing the evolution and impact of regulatory frameworks in investment banking post-2008 financial crisis

- Investigating the challenges and opportunities associated with cross-border M&As facilitated by investment banks.

- Evaluating the role of investment banks in facilitating mergers and acquisitions in emerging markets

- Analysing the transformation brought about by digital technologies in the delivery of investment banking services and its effects on efficiency and client satisfaction.

- Evaluating the role of investment banks in promoting sustainable finance and the integration of Environmental, Social, and Governance (ESG) criteria in investment decisions.

- Assessing the impact of technology on the efficiency and effectiveness of investment banking services

- Examining the effectiveness of investment banks in pricing and marketing IPOs, and the subsequent performance of these IPOs in the stock market.

- A comparative analysis of different risk management strategies employed by investment banks

- Examining the relationship between investment banking fees and corporate performance

- A comparative analysis of competitive strategies employed by leading investment banks and their impact on market share and profitability

Private Equity & Venture Capital (VC)

These research topic ideas are centred on venture capital and private equity investments, with a focus on their impact on technological startups, emerging technologies, and broader economic ecosystems.

- Investigating the determinants of successful venture capital investments in tech startups

- Analysing the trends and outcomes of venture capital funding in emerging technologies such as artificial intelligence, blockchain, or clean energy

- Assessing the performance and return on investment of different exit strategies employed by venture capital firms

- Assessing the impact of private equity investments on the financial performance of SMEs

- Analysing the role of venture capital in fostering innovation and entrepreneurship

- Evaluating the exit strategies of private equity firms: A comparative analysis

- Exploring the ethical considerations in private equity and venture capital financing

- Investigating how private equity ownership influences operational efficiency and overall business performance

- Evaluating the effectiveness of corporate governance structures in companies backed by private equity investments

- Examining how the regulatory environment in different regions affects the operations, investments and performance of private equity and venture capital firms

Asset Management

This list includes a range of research topic ideas focused on asset management, probing into the effectiveness of various strategies, the integration of technology, and the alignment with ethical principles among other key dimensions.

- Analysing the effectiveness of different asset allocation strategies in diverse economic environments

- Analysing the methodologies and effectiveness of performance attribution in asset management firms

- Assessing the impact of environmental, social, and governance (ESG) criteria on fund performance

- Examining the role of robo-advisors in modern asset management

- Evaluating how advancements in technology are reshaping portfolio management strategies within asset management firms

- Evaluating the performance persistence of mutual funds and hedge funds

- Investigating the long-term performance of portfolios managed with ethical or socially responsible investing principles

- Investigating the behavioural biases in individual and institutional investment decisions

- Examining the asset allocation strategies employed by pension funds and their impact on long-term fund performance

- Assessing the operational efficiency of asset management firms and its correlation with fund performance

Hedge Funds

Here we explore research topics related to hedge fund operations and strategies, including their implications on corporate governance, financial market stability, and regulatory compliance among other critical facets.

- Assessing the impact of hedge fund activism on corporate governance and financial performance

- Analysing the effectiveness and implications of market-neutral strategies employed by hedge funds

- Investigating how different fee structures impact the performance and investor attraction to hedge funds

- Evaluating the contribution of hedge funds to financial market liquidity and the implications for market stability

- Analysing the risk-return profile of hedge fund strategies during financial crises

- Evaluating the influence of regulatory changes on hedge fund operations and performance

- Examining the level of transparency and disclosure practices in the hedge fund industry and its impact on investor trust and regulatory compliance

- Assessing the contribution of hedge funds to systemic risk in financial markets, and the effectiveness of regulatory measures in mitigating such risks

- Examining the role of hedge funds in financial market stability

- Investigating the determinants of hedge fund success: A comparative analysis

Financial Planning and Advisory

This list explores various research topic ideas related to financial planning, focusing on the effects of financial literacy, the adoption of digital tools, taxation policies, and the role of financial advisors.

- Evaluating the impact of financial literacy on individual financial planning effectiveness

- Analysing how different taxation policies influence financial planning strategies among individuals and businesses

- Evaluating the effectiveness and user adoption of digital tools in modern financial planning practices

- Investigating the adequacy of long-term financial planning strategies in ensuring retirement security

- Assessing the role of financial education in shaping financial planning behaviour among different demographic groups

- Examining the impact of psychological biases on financial planning and decision-making, and strategies to mitigate these biases

- Assessing the behavioural factors influencing financial planning decisions

- Examining the role of financial advisors in managing retirement savings

- A comparative analysis of traditional versus robo-advisory in financial planning

- Investigating the ethics of financial advisory practices

The following list delves into research topics within the insurance sector, touching on the technological transformations, regulatory shifts, and evolving consumer behaviours among other pivotal aspects.

- Analysing the impact of technology adoption on insurance pricing and risk management

- Analysing the influence of Insurtech innovations on the competitive dynamics and consumer choices in insurance markets

- Investigating the factors affecting consumer behaviour in insurance product selection and the role of digital channels in influencing decisions

- Assessing the effect of regulatory changes on insurance product offerings

- Examining the determinants of insurance penetration in emerging markets

- Evaluating the operational efficiency of claims management processes in insurance companies and its impact on customer satisfaction

- Examining the evolution and effectiveness of risk assessment models used in insurance underwriting and their impact on pricing and coverage

- Evaluating the role of insurance in financial stability and economic development

- Investigating the impact of climate change on insurance models and products

- Exploring the challenges and opportunities in underwriting cyber insurance in the face of evolving cyber threats and regulations

Quantitative Finance

These topic ideas span the development of asset pricing models, evaluation of machine learning algorithms, and the exploration of ethical implications among other pivotal areas.

- Developing and testing new quantitative models for asset pricing

- Analysing the effectiveness and limitations of machine learning algorithms in predicting financial market movements

- Assessing the effectiveness of various risk management techniques in quantitative finance

- Evaluating the advancements in portfolio optimisation techniques and their impact on risk-adjusted returns

- Evaluating the impact of high-frequency trading on market efficiency and stability

- Investigating the influence of algorithmic trading strategies on market efficiency and liquidity

- Examining the risk parity approach in asset allocation and its effectiveness in different market conditions

- Examining the application of machine learning and artificial intelligence in quantitative financial analysis

- Investigating the ethical implications of quantitative financial innovations

- Assessing the profitability and market impact of statistical arbitrage strategies considering different market microstructures

Treasury Management

The following topic ideas explore treasury management, focusing on modernisation through technological advancements, the impact on firm liquidity, and the intertwined relationship with corporate governance among other crucial areas.

- Analysing the impact of treasury management practices on firm liquidity and profitability

- Analysing the role of automation in enhancing operational efficiency and strategic decision-making in treasury management

- Evaluating the effectiveness of various cash management strategies in multinational corporations

- Investigating the potential of blockchain technology in streamlining treasury operations and enhancing transparency

- Examining the role of treasury management in mitigating financial risks

- Evaluating the accuracy and effectiveness of various cash flow forecasting techniques employed in treasury management

- Assessing the impact of technological advancements on treasury management operations

- Examining the effectiveness of different foreign exchange risk management strategies employed by treasury managers in multinational corporations

- Assessing the impact of regulatory compliance requirements on the operational and strategic aspects of treasury management

- Investigating the relationship between treasury management and corporate governance

Financial Technology (FinTech)

The following research topic ideas explore the transformative potential of blockchain, the rise of open banking, and the burgeoning landscape of peer-to-peer lending among other focal areas.

- Evaluating the impact of blockchain technology on financial services

- Investigating the implications of open banking on consumer data privacy and financial services competition

- Assessing the role of FinTech in financial inclusion in emerging markets

- Analysing the role of peer-to-peer lending platforms in promoting financial inclusion and their impact on traditional banking systems

- Examining the cybersecurity challenges faced by FinTech firms and the regulatory measures to ensure data protection and financial stability

- Examining the regulatory challenges and opportunities in the FinTech ecosystem

- Assessing the impact of artificial intelligence on the delivery of financial services, customer experience, and operational efficiency within FinTech firms

- Analysing the adoption and impact of cryptocurrencies on traditional financial systems

- Investigating the determinants of success for FinTech startups

Commercial Banking

These topic ideas span commercial banking, encompassing digital transformation, support for small and medium-sized enterprises (SMEs), and the evolving regulatory and competitive landscape among other key themes.

- Assessing the impact of digital transformation on commercial banking services and competitiveness

- Analysing the impact of digital transformation on customer experience and operational efficiency in commercial banking

- Evaluating the role of commercial banks in supporting small and medium-sized enterprises (SMEs)

- Investigating the effectiveness of credit risk management practices and their impact on bank profitability and financial stability

- Examining the relationship between commercial banking practices and financial stability

- Evaluating the implications of open banking frameworks on the competitive landscape and service innovation in commercial banking

- Assessing how regulatory changes affect lending practices and risk appetite of commercial banks

- Examining how commercial banks are adapting their strategies in response to competition from FinTech firms and changing consumer preferences

- Analysing the impact of regulatory compliance on commercial banking operations

- Investigating the determinants of customer satisfaction and loyalty in commercial banking

International Finance

The folowing research topic ideas are centred around international finance and global economic dynamics, delving into aspects like exchange rate fluctuations, international financial regulations, and the role of international financial institutions among other pivotal areas.

- Analysing the determinants of exchange rate fluctuations and their impact on international trade

- Analysing the influence of global trade agreements on international financial flows and foreign direct investments

- Evaluating the effectiveness of international portfolio diversification strategies in mitigating risks and enhancing returns

- Evaluating the role of international financial institutions in global financial stability

- Investigating the role and implications of offshore financial centres on international financial stability and regulatory harmonisation

- Examining the impact of global financial crises on emerging market economies

- Examining the challenges and regulatory frameworks associated with cross-border banking operations

- Assessing the effectiveness of international financial regulations

- Investigating the challenges and opportunities of cross-border mergers and acquisitions

Choosing A Research Topic

These finance-related research topic ideas are starting points to guide your thinking. They are intentionally very broad and open-ended. By engaging with the currently literature in your field of interest, you’ll be able to narrow down your focus to a specific research gap .

When choosing a topic , you’ll need to take into account its originality, relevance, feasibility, and the resources you have at your disposal. Make sure to align your interest and expertise in the subject with your university program’s specific requirements. Always consult your academic advisor to ensure that your chosen topic not only meets the academic criteria but also provides a valuable contribution to the field.

If you need a helping hand, feel free to check out our private coaching service here.

You Might Also Like:

thank you for suggest those topic, I want to ask you about the subjects related to the fintech, can i measure it and how?

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Print Friendly

250+ Exciting Accounting and Finance Project Topics: Explore All

When you’re studying accounting and finance, one big choice stands out: what project topic should you pick? This decision is super important. It affects how your research goes, how well you do in school, and even what jobs you can get later. In this blog post, we’re going to help you figure out the best accounting and finance project topics.

The Significance of Choosing the Right Topic

Table of Contents

Before we dive into specific project topics, it’s essential to understand why selecting the right topic is crucial. The choice of your project topic can impact several aspects of your academic and professional journey.

- Firstly, a well-chosen topic aligns with your interests and passions. It allows you to delve into a subject matter that genuinely excites you. When you’re passionate about your research, you’re more likely to invest the time and effort required to excel.

- Secondly, the right topic contributes to the quality of your research. It’s essential that your project is relevant and meaningful, not just to you, but also to the broader academic and professional community. A well-selected topic has the potential to generate new insights, solutions to real-world problems, or advancements in the field.

- Lastly, your choice of topic can have career implications. It can help you build expertise in a specific area of accounting and finance, making you a sought-after candidate in the job market. Employers value individuals who have conducted in-depth research and possess specialized knowledge.

Now that we understand the importance of choosing wisely, let’s explore 10 categories of accounting and finance project topics that offer a wide range of possibilities for your research endeavors.

250+ Accounting and Finance Project Topics

25 financial analysis and reporting project topics.

- Comparative Financial Analysis: Analyzing the financial performance of two or more companies in the same industry.

- Ratio Analysis: Evaluating a company’s financial health using various financial ratios like liquidity, profitability, and solvency ratios.

- Trend Analysis: Examining the historical financial data of a company to identify trends and patterns.

- DuPont Analysis: Applying the DuPont formula to dissect a company’s return on equity (ROE) into its components.

- Earnings Quality: Investigating the quality of reported earnings and potential earnings management practices.

- Cash Flow Analysis: Assessing a company’s cash flow statement to understand its liquidity and cash management.

- Financial Statement Forecasting: Developing models to forecast future financial statements of a company.

- Credit Risk Analysis: Evaluating the creditworthiness of borrowers or companies.

- Valuation of Companies: Applying various valuation methods (e.g., DCF, comparables) to determine the intrinsic value of a company’s stock.

- Financial Distress Prediction: Building models to predict the likelihood of a company facing financial distress.

- Impacts of Accounting Standards: Investigating how changes in accounting standards affect financial reporting and analysis.

- Mergers and Acquisitions (M&A) Analysis: Analyzing the financial aspects of M&A transactions, including post-merger performance.

- Analysis of Financial Scandals: Studying high-profile financial scandals and their impact on financial reporting.

- Working Capital Management: Evaluating a company’s management of its current assets and liabilities.

- Economic Value Added (EVA) Analysis: Assessing a company’s performance based on its economic value added.

- Dividend Policy Analysis: Investigating a company’s dividend decisions and their impact on shareholder value.

- Cash Conversion Cycle Analysis: Analyzing the efficiency of a company’s cash flow cycle.

- Earnings Per Share (EPS) Analysis: Studying factors affecting EPS and its implications for investors.

- Corporate Governance and Financial Reporting: Exploring the relationship between corporate governance practices and financial reporting quality.

- Risk-Return Analysis: Assessing the trade-off between risk and return in investment portfolios.

- Environmental, Social, and Governance (ESG) Reporting Impact: Examining the influence of ESG factors on financial performance and reporting.

- IFRS vs. GAAP Comparison: Comparing financial statements prepared under International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP).

- Impact of Taxation on Financial Reporting: Analyzing how tax regulations affect financial statements and reporting.

- Financial Statement Restatements: Investigating reasons for financial statement restatements and their consequences.

- Impact of Technology on Financial Reporting: Exploring the role of technology, such as AI and blockchain, in improving financial reporting accuracy and efficiency.

25 Risk Management Project Topics

- Evaluation of Risk Management Strategies in the Banking Sector

- Analysis of Credit Risk Assessment Models in Financial Institutions

- Assessing the Impact of Economic Factors on Financial Risk

- Comparative Study of Risk Management Practices in Insurance Companies

- Risk Management in the Context of Climate Change and Environmental Risks

- The Role of Cybersecurity in Risk Management for Financial Institutions

- Operational Risk Management in the Healthcare Industry

- Quantitative vs. Qualitative Approaches to Risk Assessment: A Comparative Analysis

- The Effectiveness of Enterprise Risk Management (ERM) in Multinational Corporations

- Stress Testing and Scenario Analysis in Risk Management

- Risk Management in Supply Chain and Logistics

- Assessing Market Risk in Investment Portfolios

- The Role of Risk Culture in Effective Risk Management

- Measuring and Managing Liquidity Risk in Banks

- The Impact of Regulatory Changes on Risk Management in the Financial Industry

- Credit Default Swap (CDS) and its Role in Mitigating Credit Risk

- Operational Risk Assessment in the Hospitality Industry

- Risk Management in Project Management: A Case Study Approach

- Assessing the Effectiveness of Risk Management in Start-up Businesses

- The Role of Risk Management in Healthcare Quality Improvement

- Risk Management Strategies in the Oil and Gas Industry

- The Relationship between Risk Management and Corporate Governance

- Risk Management in Information Technology Projects

- Implementing Risk Management in Non-profit Organizations

- The Impact of Geopolitical Risk on International Business Operations

25 Investment and Portfolio Management Project Topics

- Portfolio Optimization Using Modern Portfolio Theory: Analyzing the allocation of assets to maximize returns while minimizing risk.

- Performance Evaluation of Mutual Funds: Assessing the historical performance of different mutual funds and their suitability for investors.

- Factor-Based Investing Strategies: Investigating the effectiveness of factors like value, growth, and momentum in portfolio construction.

- Asset Allocation Strategies for Retirement Planning: Developing investment strategies tailored to retirement goals and risk tolerance.

- Hedging Strategies for Risk Management: Evaluating the use of derivatives and other tools to hedge against market risks.

- Real Estate Investment Analysis: Analyzing the feasibility and potential returns of real estate investments.

- Behavioral Biases in Investment Decision-Making: Studying how psychological factors influence investment choices.

- Evaluating the Impact of Economic Indicators on Stock Prices: Assessing the relationship between economic data and stock market movements.

- Impact of Dividend Policy on Stock Prices: Analyzing how a company’s dividend decisions affect its stock price.

- Value vs. Growth Investing: Comparing the performance of value and growth investment strategies over time.

- Risk-Adjusted Performance Metrics: Developing and comparing various risk-adjusted performance measures for investment portfolios.

- Impact of Interest Rate Changes on Bond Portfolios: Evaluating how interest rate fluctuations affect bond investments.

- Sustainable and ESG Investing: Analyzing the performance and impact of environmental, social, and governance (ESG) criteria in portfolio management.

- Factor Investing in Fixed Income: Exploring the application of factors in bond and fixed income portfolio strategies.

- Portfolio Diversification Across Asset Classes: Examining the benefits of diversifying across stocks, bonds, real estate, and other asset classes.

- Algorithmic Trading Strategies: Developing and backtesting algorithmic trading strategies for equities or other financial instruments.

- Impact of News and Social Media on Stock Prices: Investigating the relationship between news sentiment and stock market movements.

- Volatility Forecasting Models: Developing models to predict market volatility and its impact on portfolio risk.

- Global Portfolio Diversification: Analyzing the benefits and challenges of diversifying a portfolio internationally.

- Peer-to-Peer Lending and Investment Returns: Studying the returns and risks associated with peer-to-peer lending investments.

- Currency Risk Management for International Portfolios: Strategies to hedge currency risk in global investment portfolios.

- Alternative Investments and Portfolio Diversification: Examining the role of alternative assets like hedge funds, private equity, and cryptocurrencies in portfolio diversification.

- Risk Parity Strategies: Analyzing the risk parity approach to portfolio construction and its advantages.

- Robo-Advisors and Automated Portfolio Management: Evaluating the performance and adoption of robo-advisory services.

- Portfolio Rebalancing Strategies: Developing and testing strategies for maintaining the desired asset allocation in a portfolio.

25 Corporate Finance Project Topics

- Optimal Capital Structure Analysis: Investigate the ideal mix of debt and equity for a specific company or industry.

- Valuation of Private Companies: Explore methods for valuing privately-held businesses.

- IPO Pricing Strategies: Analyze the factors influencing initial public offering (IPO) pricing decisions.

- Dividend Policy and Shareholder Value: Examine how a company’s dividend policy affects shareholder wealth.

- Mergers and Acquisitions (M&A) Impact: Investigate the financial consequences of mergers and acquisitions on involved companies.

- Corporate Restructuring Strategies: Evaluate different strategies for corporate restructuring, such as spin-offs and divestitures.

- Capital Budgeting and Investment Analysis: Analyze the process of evaluating potential investments and capital expenditure decisions.

- Financial Risk Management: Explore methods to mitigate financial risks, such as interest rate risk or currency risk.

- Corporate Governance and Firm Performance: Investigate the relationship between corporate governance practices and financial performance.

- Financial Distress Prediction: Develop models to predict financial distress or bankruptcy for companies.

- Working Capital Management: Study strategies for optimizing a company’s working capital to improve liquidity and profitability.

- Real Options Analysis: Apply real options theory to assess strategic investment decisions in uncertain environments.

- Behavioral Finance in Corporate Finance: Explore how behavioral biases affect financial decision-making within corporations.

- Corporate Tax Planning: Investigate strategies for minimizing corporate taxes legally.

- Financial Fraud Detection: Analyze methods and tools for detecting financial fraud within organizations.

- Initial Public Offerings (IPO) Performance: Evaluate the long-term performance of companies after going public.

- Corporate Debt Issuance Strategies: Study the timing and structure of corporate bond issuances.

- Corporate Ethics and Financial Performance: Examine the impact of ethical corporate behavior on financial performance.

- Leveraged Buyouts (LBOs): Analyze the mechanics and financial implications of leveraged buyout transactions.

- Corporate Social Responsibility (CSR) Reporting: Evaluate the financial consequences of CSR initiatives and reporting.

- Credit Risk Assessment: Develop models for assessing the creditworthiness of corporate borrowers.

- Share Repurchase Programs: Study the effects of share repurchase programs on a company’s stock price and financials.

- Financial Distress and Restructuring: Analyze the financial strategies used by distressed companies for recovery.

- Corporate Debt Restructuring: Investigate the methods and implications of corporate debt restructuring.

- Environmental, Social, and Governance (ESG) Integration: Explore how ESG factors are incorporated into corporate finance decisions.

25 Financial Markets and Instruments Project Topics

1. Analysis of Stock Market Volatility

– Investigate the causes and implications of stock market volatility.

2. The Role of Derivatives in Hedging Financial Risk

– Explore how derivatives, like options and futures, are used to manage financial risk.

3. Impact of High-Frequency Trading on Financial Markets

– Study the effects of high-frequency trading on market efficiency and stability.

4. Asset Pricing Models: A Comparative Analysis

– Compare and contrast different asset pricing models, such as CAPM and APT.

5. Initial Public Offerings (IPOs) and Market Performance

– Analyze the performance of stocks after their initial public offerings.

6. Behavioral Biases in Investment Decision-Making

– Investigate how psychological biases influence investment choices.

7. The Role of Exchange-Traded Funds (ETFs) in Diversification

– Explore the benefits and drawbacks of using ETFs for portfolio diversification.

8. Cryptocurrency Market Dynamics and Investment Strategies

– Study the behavior of cryptocurrencies and develop investment strategies.

9. Impact of News and Social Media on Financial Markets

– Analyze how news and social media affect market sentiment and trading decisions.

10. Credit Default Swaps (CDS) and Credit Risk Assessment

– Examine the use of CDS in assessing and managing credit risk.

11. Role of Central Banks in Monetary Policy and Financial Stability

– Investigate the influence of central banks on financial markets and economic stability.

12. Algorithmic Trading Strategies and Their Impact

– Study various algorithmic trading strategies and their effects on market dynamics.

13. Real Estate Investment Trusts (REITs) Performance Analysis

– Analyze the performance of REITs in different economic environments.

14. Risk-Return Tradeoff in Bond Investments

– Explore the relationship between risk and return in bond investments.

15. Analysis of Commodity Markets and Investment Opportunities

– Investigate the behavior of commodity markets and potential investment strategies.

16. Role of Options in Hedging Strategies

– Study the use of options as tools for hedging against market risk.

17. Foreign Exchange Market Dynamics and Currency Forecasting

– Analyze factors influencing exchange rates and develop currency forecasting models.

18. Mutual Fund Performance Evaluation

– Evaluate the performance of mutual funds using various metrics and benchmarks.

19. Impact of Regulatory Changes on Financial Markets

– Investigate how regulatory changes affect market behavior and investor sentiment.

20. Sovereign Debt Crisis Analysis

– Study historical sovereign debt crises and their implications for financial markets.

21. Private Equity Investment Strategies and Returns

– Analyze private equity investment strategies and their potential returns.

22. Market Microstructure and Order Flow Analysis

– Explore the structure of financial markets and analyze order flow data.

23. Role of Credit Rating Agencies in Financial Markets

– Investigate the influence of credit rating agencies on investor decisions.

24. Impact of Earnings Announcements on Stock Prices

– Analyze how corporate earnings announcements affect stock prices and trading volume.

25. Financial Market Efficiency and Anomalies

– Study market efficiency theories and anomalies like the January effect or the small-cap effect.

25 Auditing and Internal Controls Project Topics

1. The Effectiveness of Internal Controls in Fraud Prevention

– Investigate how well internal controls can prevent fraudulent activities within organizations.

2. Auditing the Cybersecurity Measures in Financial Institutions

– Analyze the cybersecurity measures in financial institutions and assess their adequacy from an audit perspective.

3. Internal Audit’s Role in Corporate Governance

– Explore the contribution of internal audit in maintaining and improving corporate governance.

4. Evaluating the Impact of Data Analytics in Auditing

– Investigate how data analytics tools and techniques are transforming the audit process.

5. Assessing the Internal Control Systems of Small and Medium-sized Enterprises (SMEs)

– Study the effectiveness of internal controls in SMEs compared to larger organizations.

6. Auditing the Supply Chain: Risks and Controls

– Examine the risks associated with supply chain management and the controls needed to mitigate them.

7. The Role of Forensic Accounting in Detecting Financial Fraud

– Explore the techniques and methodologies of forensic accounting in fraud detection.

8. Compliance Audit: A Case Study on a Specific Industry

– Choose a particular industry and conduct a compliance audit to assess adherence to relevant regulations.

9. The Impact of Internal Audit on Organizational Performance

– Investigate how internal audit activities contribute to the overall performance of organizations.

10. Audit of Non-profit Organizations: Challenges and Best Practices

– Analyze the unique challenges faced by auditors when dealing with non-profit organizations.

11. Auditing Environmental, Social, and Governance (ESG) Practices

– Evaluate the integration of ESG factors in auditing and assess their impact on financial reporting.

12. IT Audit and Information Security

– Explore the intersection of IT audit and information security to ensure data protection and privacy.

13. Auditing in the Healthcare Industry

– Investigate the specific challenges and requirements of auditing in the healthcare sector.

14. Whistleblower Programs and Their Role in Enhancing Internal Controls

– Analyze the effectiveness of whistleblower programs in identifying internal control weaknesses.

15. Auditing in the Public Sector

– Examine the unique aspects of auditing in government agencies and public-sector organizations.

16. Auditing the Procurement Process: A Case Study Approach

– Choose a specific organization and audit its procurement process to identify vulnerabilities.

17. The Role of Audit Committees in Strengthening Internal Controls

– Investigate how audit committees contribute to enhancing internal controls within organizations.

18. Auditing Ethical Practices and Corporate Social Responsibility (CSR)

– Assess how ethical practices and CSR initiatives are audited and reported.

19. The Use of Artificial Intelligence (AI) in Auditing

– Explore the applications and challenges of AI in the audit process.

20. Auditor Independence and Objectivity

– Investigate the importance of auditor independence in maintaining objectivity during audits.

21. Auditing in a Global Context: International Standards and Challenges

– Analyze the challenges and opportunities of auditing in a globalized business environment.

22. Auditing Tax Compliance

– Explore the role of auditors in ensuring compliance with tax regulations.

23. Internal Controls in Financial Institutions: A Comparative Study

– Compare and contrast the internal control systems of different financial institutions.

24. Fraudulent Financial Reporting: Detection and Prevention

– Investigate the methods and tools for detecting and preventing fraudulent financial reporting.

25. Auditor Liability and Legal Issues

– Examine the legal implications and liabilities associated with auditing practices.

25 Taxation Project Topics

- The Impact of Recent Tax Reforms on Small Businesses.

- Analyzing the Effectiveness of Tax Incentives for Foreign Direct Investment.

- Tax Evasion and Its Economic Consequences: A Case Study.

- The Role of Transfer Pricing in International Taxation.

- Tax Compliance Behavior: A Behavioral Economics Approach.

- Evaluating the Impact of Tax Credits on Renewable Energy Adoption.

- Taxation and Income Inequality: A Cross-Country Analysis.

- The Effect of the Digital Economy on Taxation: Challenges and Solutions.

- Taxation of Cryptocurrency Transactions: Emerging Issues.

- Comparative Analysis of Value Added Tax (VAT) Systems Worldwide.

- Taxation of E-commerce Transactions: Jurisdictional Challenges.

- The Role of Tax Policy in Promoting Sustainable Business Practices.

- Taxation and Foreign Investment: Case Study of a Developing Economy.

- Taxation and Wealth Redistribution: Pros and Cons.

- Taxation of Multinational Corporations: Transfer Pricing Strategies.

- Taxation of Real Estate Transactions: Impact on Property Markets.

- Taxation and Economic Growth: A Longitudinal Analysis.

- Taxation of the Gig Economy: Implications for Tax Collection.

- Taxation of High-Income Earners: Progressive vs. Flat Tax Systems.

- Tax Compliance Costs for Small Businesses: An Empirical Study.

- Taxation and Charitable Giving: Incentives and Behavior.

- Tax Havens and Their Impact on Global Taxation Systems.

- Environmental Taxes and Their Role in Promoting Sustainability.

- Taxation of Cross-Border Investments: Double Taxation Agreements.

- Taxation and Innovation: Incentives for Research and Development.

25 Sustainability and Corporate Social Responsibility (CSR) Project Topics

- Assessing the Impact of Sustainable Practices on Profitability: Analyze how adopting sustainable initiatives affects a company’s bottom line.

- Measuring the Effectiveness of CSR Programs: Evaluate the outcomes and benefits of various CSR programs implemented by companies.

- Environmental Reporting and Disclosure: Investigate the transparency of companies in disclosing their environmental performance in annual reports.

- Stakeholder Engagement in CSR: Study how companies engage with stakeholders in developing and implementing CSR strategies.

- Sustainable Supply Chain Management: Assess the integration of sustainability practices in supply chain management and its impact on overall sustainability.

- Sustainability Reporting Frameworks: Compare and contrast different sustainability reporting frameworks like GRI, SASB, and IIRC.

- Impact of Sustainable Investing on Financial Markets: Analyze how sustainable investing and ESG criteria influence stock market performance.

- Sustainable Procurement Strategies: Examine how organizations can promote sustainability by implementing eco-friendly procurement practices.

- CSR in the Pharmaceutical Industry: Investigate CSR initiatives in the pharmaceutical sector, especially related to drug pricing and access to medicines.

- Renewable Energy Investment and CSR: Analyze how companies’ investments in renewable energy sources contribute to CSR and sustainability goals.

- Employee Engagement and Sustainability: Study the role of employees in driving sustainability initiatives within organizations.

- CSR and Consumer Behavior: Explore how consumers’ purchasing decisions are influenced by a company’s CSR efforts.

- Sustainable Tourism and its Economic Impact: Investigate the economic effects of sustainable tourism practices in a specific region.

- Sustainability in the Fashion Industry: Analyze the efforts of fashion brands to adopt sustainable practices in manufacturing and sourcing.

- CSR in Emerging Markets: Examine CSR practices in emerging economies and their unique challenges and opportunities.

- Sustainable Agriculture and Food Security: Study the relationship between sustainable agriculture practices and food security in a given area.

- Circular Economy Strategies: Evaluate how companies are implementing circular economy principles to reduce waste and enhance sustainability.

- CSR and Ethical Leadership: Investigate the role of ethical leadership in promoting CSR within organizations.

- Carbon Footprint Reduction Strategies: Analyze different strategies employed by companies to reduce their carbon footprint.

- CSR and Disaster Relief: Study the CSR initiatives of companies involved in disaster relief efforts and humanitarian aid.

- Social Impact Assessment of CSR Projects: Evaluate the social impact of specific CSR projects, such as community development programs or education initiatives.

- Sustainability and Green Building Practices: Examine the adoption of green building practices in the construction industry.

- CSR and Gender Equality: Investigate how companies are promoting gender equality through CSR programs and policies.

- Water Resource Management and CSR: Analyze the role of companies in sustainable water resource management and conservation.

- CSR and Small-to-Medium Enterprises (SMEs): Study the challenges and benefits of CSR adoption for SMEs and its impact on their competitiveness.

25 Financial Technology (FinTech) Project Topics

- Blockchain Technology and Its Impact on Financial Transactions

- The Rise of Cryptocurrencies: Analyzing Market Trends and Investment Strategies

- Exploring the Role of Artificial Intelligence in FinTech Applications

- Evaluating the Regulatory Challenges of Peer-to-Peer Lending Platforms

- Robo-Advisors: Revolutionizing Financial Advisory Services

- Cryptocurrency Adoption in Developing Economies: Opportunities and Challenges

- The Use of Big Data Analytics in Credit Scoring and Risk Assessment

- Security and Privacy Concerns in Mobile Payment Systems

- The Evolution of Digital Banking and Its Effects on Traditional Banking

- Decentralized Finance (DeFi): A Comprehensive Analysis

- Smart Contracts in FinTech: Applications and Implications

- FinTech and Financial Inclusion: Bridging the Gap for the Unbanked

- The Role of FinTech Startups in Shaping the Financial Services Industry

- Digital Wallets and Their Impact on Payment Ecosystems

- Tokenization of Assets: Transforming Traditional Investments

- The Future of Central Bank Digital Currencies (CBDCs)

- Cross-Border Payments and the Role of FinTech in Reducing Transaction Costs

- RegTech (Regulatory Technology): Enhancing Compliance in Financial Institutions

- Biometrics and Identity Verification in FinTech Applications

- Cybersecurity Challenges in the FinTech Sector: Threats and Mitigation Strategies

- The Gig Economy and FinTech: Financial Services for Freelancers

- FinTech and Sustainable Finance: Promoting ESG Investments

- NFTs (Non-Fungible Tokens) and Their Use Cases in FinTech

- Open Banking and API Integration: Facilitating Innovation in Financial Services

- FinTech and InsurTech: Innovations in the Insurance Industry

25 International Finance Project Topics

- Exchange Rate Volatility and Its Impact on International Trade

- Determinants of Exchange Rates: A Comparative Study

- Currency Hedging Strategies in Multinational Corporations

- The Role of Central Banks in Exchange Rate Management

- Effects of Brexit on International Financial Markets

- Global Financial Crisis: Causes, Consequences, and Lessons Learned

- International Investment and Capital Flows

- The Eurozone Crisis : Causes and Implications

- Impact of Trade Wars on Global Financial Markets

- Emerging Markets and Foreign Direct Investment (FDI)

- Sovereign Debt Crises: Case Studies and Analysis

- Exchange Rate Regimes: Fixed vs. Floating

- The Role of International Financial Institutions (IMF, World Bank)

- Globalization and Financial Integration

- The Asian Financial Crisis: Causes and Recovery

- Foreign Exchange Market Manipulation: Scandals and Regulatory Responses

- Comparative Analysis of International Banking Regulations

- The Influence of Political Risk on International Investments

- International Portfolio Diversification Strategies

- The Impact of Global Economic Trends on International Finance

- Cross-Border Mergers and Acquisitions: Challenges and Opportunities

- Financial Contagion: Spillover Effects in Global Markets

- The Role of Multinational Corporations in Global Finance

- Global Capital Markets and Access to Financing for Developing Countries

- Environmental, Social, and Governance (ESG) Factors in International Investment Decisions

How to Craft the Perfect Accounting and Finance Project

To wrap things up, let’s talk about why picking the right project topic in accounting and finance is super important. It’s like choosing the right path for a big adventure. Your project topic sets the direction for your research journey, affecting everything you do.

A good topic isn’t just something you like; it makes your research better. It gives your work meaning, not just for you but also for others who care about accounting and finance.

Plus, your project can boost your career. It makes you an expert in a specific area, which employers love. Having deep knowledge from your project can open doors to exciting job opportunities.

Related Posts

Online gambling is becoming popular with college students.

Best Ever Topic for Accounting Research Paper

About Stanford GSB

- The Leadership

- Dean’s Updates

- School News & History

- Commencement

- Business, Government & Society

- Centers & Institutes

- Center for Entrepreneurial Studies

- Center for Social Innovation

- Stanford Seed

About the Experience

- Learning at Stanford GSB

- Experiential Learning

- Guest Speakers

- Entrepreneurship

- Social Innovation

- Communication

- Life at Stanford GSB

- Collaborative Environment

- Activities & Organizations

- Student Services

- Housing Options

- International Students

Full-Time Degree Programs

- Why Stanford MBA

- Academic Experience

- Financial Aid

- Why Stanford MSx

- Research Fellows Program

- See All Programs

Non-Degree & Certificate Programs

- Executive Education

- Stanford Executive Program

- Programs for Organizations

- The Difference

- Online Programs

- Stanford LEAD

- Seed Transformation Program

- Aspire Program

- Seed Spark Program

- Faculty Profiles

- Academic Areas

- Awards & Honors

- Conferences

Faculty Research

- Publications

- Working Papers

- Case Studies

Research Hub

- Research Labs & Initiatives

- Business Library

- Data, Analytics & Research Computing

- Behavioral Lab

Research Labs

- Cities, Housing & Society Lab

- Golub Capital Social Impact Lab

Research Initiatives

- Corporate Governance Research Initiative

- Corporations and Society Initiative

- Policy and Innovation Initiative

- Rapid Decarbonization Initiative

- Stanford Latino Entrepreneurship Initiative

- Value Chain Innovation Initiative

- Venture Capital Initiative

- Career & Success

- Climate & Sustainability

- Corporate Governance

- Culture & Society

- Finance & Investing

- Government & Politics

- Leadership & Management

- Markets & Trade

- Operations & Logistics

- Opportunity & Access

- Organizational Behavior

- Political Economy

- Social Impact

- Technology & AI

- Opinion & Analysis

- Email Newsletter

Welcome, Alumni

- Communities

- Digital Communities & Tools

- Regional Chapters

- Women’s Programs

- Identity Chapters

- Find Your Reunion

- Career Resources

- Job Search Resources

- Career & Life Transitions

- Programs & Services

- Career Video Library

- Alumni Education

- Research Resources

- Volunteering

- Alumni News

- Class Notes

- Alumni Voices

- Contact Alumni Relations

- Upcoming Events

Admission Events & Information Sessions

- MBA Program

- MSx Program

- PhD Program

- Alumni Events

- All Other Events

- Requirements

- Requirements: Behavioral

- Requirements: Quantitative

- Requirements: Macro

- Requirements: Micro

- Annual Evaluations

- Field Examination

- Research Activities

- Research Papers

- Dissertation

- Oral Examination

- Current Students

- Entering Class Profile

- Education & CV

- GMAT & GRE

- International Applicants

- Statement of Purpose

- Letters of Recommendation

- Reapplicants

- Application Fee Waiver

- Deadline & Decisions

- Job Market Candidates

- Academic Placements

- Stay in Touch

- Fields of Study

- Student Life

Our doctoral program in the accounting field offers broadly based, interdisciplinary training that develops the student’s skills in conducting both analytical and empirical research.

Emphasis is placed on developing a conceptual framework and set of skills for addressing questions broadly related to accounting information. While issues of financial reporting, managerial accounting, corporate governance and taxation are the ultimate concern, special emphasis is given to applying basic knowledge of economics, decision theory, and statistical inference to accounting issues.

Spectrum of Interests and Research Methods

Faculty research represents a broad spectrum of interests and research methods:

- Empirical and analytical research on the relation between accounting information and capital market behavior examines the characteristics of accounting amounts, the effect of accounting disclosures on the capital market, the role of analysts as information intermediaries, and the effects of management discretion. Issues examined also include the impact of financial information on stock and option prices, earnings response coefficients, market microstructure, earnings management, voluntary disclosures, and the effect of changes in accounting standards and disclosure requirements.

- Problems of information asymmetries among management, investors, and others are currently under study. This research investigates, analytically and empirically, the structure of incentive systems and monitoring systems under conditions of information asymmetry. Research on moral hazard, adverse selection, risk sharing, and signaling is incorporated into this work.

- Other ongoing projects include research on the economic effects of auditing and regulation of accounting information, and analysis of tax-induced incentive problems in organizations.

- Additional topics of faculty interest include analytical and empirical research on productivity measurement, accounting for quality, activity-based costing for operations and marketing, and strategic costing and pricing.

Preparation and Qualifications

It is desirable for students to have a solid understanding of applied microeconomic theory, econometrics and mathematics (linear algebra, real analysis, optimization, probability theory) prior to the start of the program. Adequate computer programming skills (e.g. Matlab, SAS, STAT, Python) are necessary in coursework. A traditional accounting background such as CPA is not required.

Faculty in Accounting

Christopher s. armstrong, jung ho choi, george foster, brandon gipper, ron kasznik, john d. kepler, jinhwan kim, rebecca lester, iván marinovic, maureen mcnichols, joseph d. piotroski, kevin smith, emeriti faculty, mary e. barth, william h. beaver, david f. larcker, charles m. c. lee, stefan j. reichelstein, recent publications in accounting, elpr: a new measure of capital adequacy for commercial banks, fraudulent financial reporting and the consequences for employees, rank-and-file accounting employee compensation and financial reporting quality, recent insights by stanford business, nine stories to get you through tax season, tax cuts in the uk gave an unexpected boost to african economies, the hidden costs of clicking the “buy now, pay later” button.

- Priorities for the GSB's Future

- See the Current DEI Report

- Supporting Data

- Research & Insights

- Share Your Thoughts

- Search Fund Primer

- Teaching & Curriculum

- Affiliated Faculty

- Faculty Advisors

- Louis W. Foster Resource Center

- Defining Social Innovation

- Impact Compass

- Global Health Innovation Insights

- Faculty Affiliates

- Student Awards & Certificates

- Changemakers

- Dean Jonathan Levin

- Dean Garth Saloner

- Dean Robert Joss

- Dean Michael Spence

- Dean Robert Jaedicke

- Dean Rene McPherson

- Dean Arjay Miller

- Dean Ernest Arbuckle

- Dean Jacob Hugh Jackson

- Dean Willard Hotchkiss

- Faculty in Memoriam

- Stanford GSB Firsts

- Certificate & Award Recipients

- Teaching Approach

- Analysis and Measurement of Impact

- The Corporate Entrepreneur: Startup in a Grown-Up Enterprise

- Data-Driven Impact

- Designing Experiments for Impact

- Digital Business Transformation

- The Founder’s Right Hand

- Marketing for Measurable Change

- Product Management

- Public Policy Lab: Financial Challenges Facing US Cities

- Public Policy Lab: Homelessness in California

- Lab Features

- Curricular Integration

- View From The Top

- Formation of New Ventures

- Managing Growing Enterprises

- Startup Garage

- Explore Beyond the Classroom

- Stanford Venture Studio

- Summer Program

- Workshops & Events

- The Five Lenses of Entrepreneurship

- Leadership Labs

- Executive Challenge

- Arbuckle Leadership Fellows Program

- Selection Process

- Training Schedule

- Time Commitment

- Learning Expectations

- Post-Training Opportunities

- Who Should Apply

- Introductory T-Groups

- Leadership for Society Program

- Certificate

- 2023 Awardees

- 2022 Awardees

- 2021 Awardees

- 2020 Awardees

- 2019 Awardees

- 2018 Awardees

- Social Management Immersion Fund

- Stanford Impact Founder Fellowships and Prizes

- Stanford Impact Leader Prizes

- Social Entrepreneurship

- Stanford GSB Impact Fund

- Economic Development

- Energy & Environment

- Stanford GSB Residences

- Environmental Leadership

- Stanford GSB Artwork

- A Closer Look

- California & the Bay Area

- Voices of Stanford GSB

- Business & Beneficial Technology

- Business & Sustainability

- Business & Free Markets

- Business, Government, and Society Forum

- Get Involved

- Second Year

- Global Experiences

- JD/MBA Joint Degree

- MA Education/MBA Joint Degree

- MD/MBA Dual Degree

- MPP/MBA Joint Degree

- MS Computer Science/MBA Joint Degree

- MS Electrical Engineering/MBA Joint Degree

- MS Environment and Resources (E-IPER)/MBA Joint Degree

- Academic Calendar

- Clubs & Activities

- LGBTQ+ Students

- Military Veterans

- Minorities & People of Color

- Partners & Families

- Students with Disabilities

- Student Support

- Residential Life

- Student Voices

- MBA Alumni Voices

- A Week in the Life

- Career Support

- Employment Outcomes

- Cost of Attendance

- Knight-Hennessy Scholars Program

- Yellow Ribbon Program

- BOLD Fellows Fund

- Application Process

- Loan Forgiveness

- Contact the Financial Aid Office

- Evaluation Criteria

- English Language Proficiency

- Personal Information, Activities & Awards

- Professional Experience

- Optional Short Answer Questions

- Application Fee

- Reapplication

- Deferred Enrollment

- Joint & Dual Degrees

- Event Schedule

- Ambassadors

- New & Noteworthy

- Ask a Question

- See Why Stanford MSx

- Is MSx Right for You?