- cost-accounting

- Service costing method- definition, objectives, characteristics, applicability,adv and disadvantages

On this Page

- Introduction

- Objectives of Service Costing Method

Characteristics of service costing method

Applicability of service costing method, steps of service costing methods.

Illustration

Advantages of service costing method

Disadvantages of service costing method, service costing method : definition; objectives; characteristics; applicability; unit costing; multiple costing and advantages, 1.1 introduction.

In this article, I have used two key definitions to clarify this concept to you as a learner, or tutor.

Definition-1: Service costing is an operation costing method which entails assigning of cost-on-cost unit which is a standardized service product and not physical good.

Definition-2: Service costing method is a way of ascertaining cost incurred or paid to make it possible to offer services to the end user.

NB: That service costing is an output costing method for the main objective of accumulating costs is to determine the average cost or cost per unit of “service provided” at the end of a certain period. So, the basic activities that the producer or manufacturer undertakes is to do cost ascertainment per unit service of a single service provision. The per unit service cost is computed by dividing total production cost by the number of units manufactured. Examples of service provision are such as railway transport, air transport, hospital service provision and school educational provision. Other domains with such service provision are such hotel accommodation, restaurants, power generation etc.

1.2 Objectives of Service Costing Method

The specific objectives of service costing method which is the universe of output/unit costing, are as follows;

1). To determine the total cost a consumer of a certain service will pay or incur or will pay the service provider.

2). To determine whether a certain service being provided to the client or service user is profitable or not.

3). To classify the cost elements that are consumed in providing a specific service.

4). To control costs associated with the services being provided by an organization. This involves use of comparison of cost elements for different periods.

The main features of service costing are as following:

(1) All completed products are intangible. In service costing methods, the targeted unit cost is not visible.

(2) Cost/expenses are divided in to fixed and variable costs. This is because it is necessary so as to ascertain the cost of service and the unit cost of service.

(3) The cost unit are expressed in a simplified manner for the sake of cost cumulation. For example, one cubic litres of water are $12, cost per meal in school for each student is $7, rent per month is $1,000 and one kilowatt (unit) are $5 etc.

(4) Aggregate or total cost is always divided (average) by the overall service provided.

(5) Total cost is determined on the time or period basis although not always. In other cases, we have alternative ways such as orders made by clients.

(6) Service costing is suitable for both internal or external service provisions.

(7) Data sheets are commonly used to record cost data to aid in determination of the cost value of a service provided or rendered.

Service costing methods are suitable in manifold areas such as;

- Transport service industries.

- Hotel or food industries

- Power supply (electricity) industry

The steps followed in costing each product under service costing method is different. Before, we focus on the steps, let us first understand the concept of unit and multiple costing.

2.1 Unit Costing

Unit costing is a method of costing service rendered is based on the criteria of common or uniform identity of the cost unit. Therefore, the general rule of the thumb is that cost units that are identical should have identical costs. Unit costing is applicable for the cases where a single product is the cost object.

2.2 Multiple Costing

Multiple costing is a service costing method where the cost units produced are not the same. In other words, they do not share identity. In this case, the products (cost unit) are different in so many logistics such as what each product demands as far as materials are concerned, laborer qualification, fixed overheads and even the processes for each product.

Now, with that in mind, the following steps are adhered to when costing products.

Step 1: Assess in which class the service rendered falls into. Is it unit or multiple costing.

From the previous discussion, the way of costing service provided is either on unit cost or multiple cost basis. The reason of undertaking this stage in costing is because each service provided fits in either. Remember if the appropriate cost unit is selected, this fosters the assigning of costs to the cost object in the right manner. In this step, identify the most logical cost unit for each cost object (product).

Step 2: Identify all fixed costs associated with that cost unit/or cost object.

The various costs associated with the service being provided should be sorted out such that all fixed costs are gathered together. Fixed cost are the economic resources that the service provider needs to pay for or incurs whether service is provided or not. It is a periodic cost.

Step 3: Identify all the relevant variable costs associated with that cost unit/or cost object.

The various costs associated with the service being provided should be sorted out such that all variable/relevant costs are gathered together. Variable cost are the economic resources that the service provider needs to pay for or incurs when service is provided. It is cost which change with changes in volume of service offered.

Step 4: Sum up all the costs-both fixed and variable cost.

In step 4, the total cost, both fixed and variable are added together towards achievement of the overall cost for the service provided.

Step 5: Determine the total number of cost units which is the basis of costing the service being provided.

The service provider has to determine the total cost unit (quantity wise) associated with the service provided. For example, the total number of kilometers covered, total litres consumed, total kilograms consumed etc.

Step 6: Compute the per unit cost for the service provided.

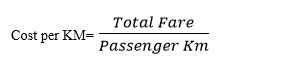

Determination of the cost per cost unit is undertaken at this level. In this stage, the service provider divides the total cost (i.e., both fixed and variable cost) by the total cost unit consumed. For example, if we take the case of transport service. To determine the cost per kilometer,

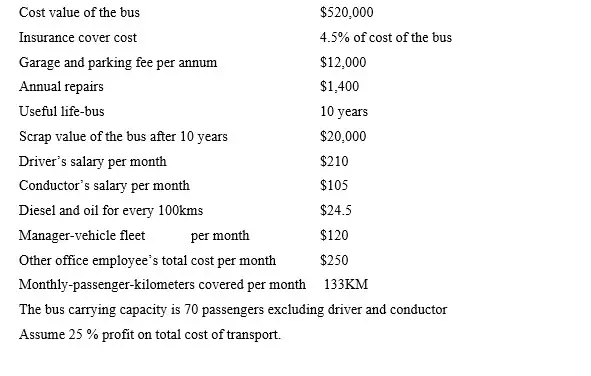

Quick Comfort travelers co. ltd provide transport services to those clients or passengers who go for tourism or special occasions in far places. The following information was provided to you so as to compute the cost per unit of service.

- Determine the total cost of transport service offered for one year.

- Determine the bus fare (cost per service) provided per passenger.

- Determine the total bus fare (income) to be generated by the service provider for the whole year.

The operation costing of service-based product is simple determination of the total cost incurred or paid for the service provided then divided by the total cost units consumed. In this approach, the profit margin dictates how much to charge a client.

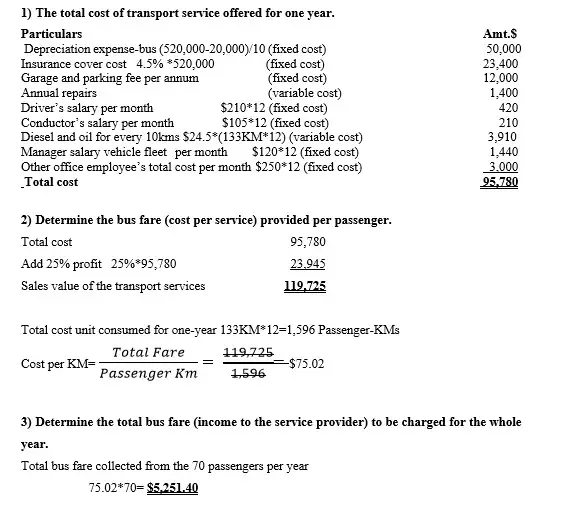

Cost units in service costing is the bottom line and any service provider need to familiarize with the generally accepted metric of measuring that variable in that industry.

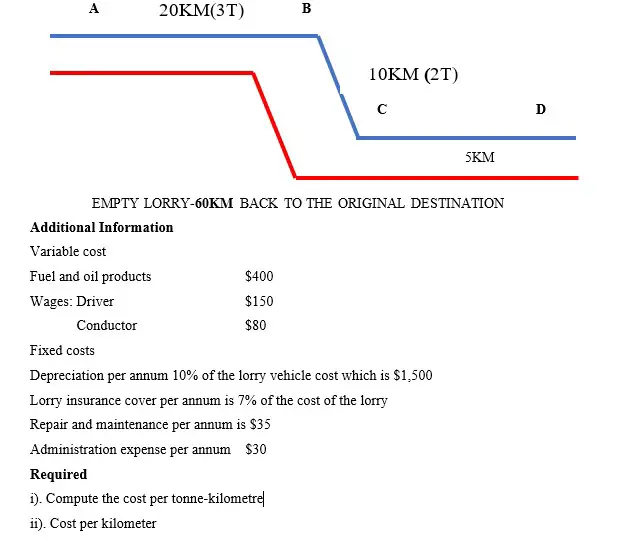

Multiple carriers co. ltd is a national carrier of cargo know in Texas City USA. The company has a routine mandate of distributing cargo to various destinations (A to D and back) in a month as shown in the following diagram

- Simple to compute the total cost for the whole service being provided.

- The method is suitable to a specific sector. This approach targets the invisible products which cannot rely on other methods of costing such as hospital and road transport services.

- Cost effective-this method is not complicated and does not cost the organization to prepare it.

- Flexible-the method is time adjustable such that if the time period covered is less than a year or more than a year, the cost per unit is still deterministic.

- Since service profession demands professionals, the method is worked out by experts who are gurus that area and this improves the quality of work done.

- Time saving. The method of service costing involves cost elements which are straight away understandable and so computation of the final cost is within a short time.

- Only applicable on costing of intangible assets.

- Not common amongst traders. This costing method is not commonly practiced and so it is not of much help to the end users.

- Not easy to identify service costing elements. Sometimes the cost elements are intertwined such that it is hard to separate them.

6.3 Calculate Activity-Based Product Costs

As technology changes the ratio between direct labor and overhead, more overhead costs are linked to drivers other than direct labor and machine hours. This shift in costs gives companies the opportunity to stop using the traditional single predetermined overhead rate applied to all units of production and instead use an overhead allocation approach based on the actual activities that drive overhead. Making this change allows management to obtain more accurate product cost information, which leads to more informed decisions. Activity-based costing (ABC) is the process that assigns overhead to products based on the various activities that drive overhead costs.

Historical Perspective on Determination of Manufacturing Overhead Allocation

All products consist of material, labor, and overhead, and the major cost components have historically been materials and labor. Manufacturing overhead was not a large cost of the product, so an overhead allocation method based on labor or machine hours was logical. For example, as shown in Figure 6.3 , Musicality determined the direct costs and direct labor for their three products: Solo, Band, and Orchestra. Under the traditional method of costing, the predetermined overhead rate of $2 per direct labor hour was computed by dividing the estimated overhead by the estimated direct labor hours. Based on the number of direct labor hours and the number of units produced for each product, the overhead per product is shown in Figure 6.4 .

As technology costs decreased and production methods became more efficient, overhead costs changed and became a much larger component of product costs. For many companies, and in many cases, overhead costs are now significantly larger than labor costs. For example, in the last few years, many industries have increased technology, and the amount of overhead has doubled. 5 Technology has changed the manufacturing labor force, and therefore, the type and cost of labor associated with those jobs have changed. In addition, technology has made it easier to track the various activities and their related overhead costs.

Costs can be gathered on a unit level, batch level, product level, or factory level. The idea behind these various levels is that at each level, there are additional costs that are encountered, so a company must decide at which level or levels it is best for the company to accumulate costs. A unit-level cost is incurred each time a unit of product is produced and includes costs such as materials and labor. A batch-level cost is incurred every time a batch of items is manufactured, for example, costs associated with purchasing and receiving materials. A product-level cost is incurred each time a product is produced and includes costs such as engineering costs, testing costs, or quality control costs. A factory-level cost is incurred because products are being produced and includes costs such as the plant supervisor’s salary and rent on the factory building. By definition, indirect labor is not traced to individual products. However, it is possible to track some indirect labor to several jobs or batches. A similar amount of information can be derived for indirect material. An example of an indirect material in some manufacturing processes is cleaning solution. For example, one type of cleaning solution is used in the manufacturing of pop sockets. It is not practical to measure every ounce of cleaning solution used in the manufacture of an individual pop socket; rather, it makes sense to allocate to a particular batch of pop sockets the cost of the cleaning solution needed to make that batch. Likewise, a manufacturer of frozen french fries uses a different type of solution to clean potatoes prior to making the french fries and would allocate the cost of the solution based on how much is used to make each batch of fries.

Establishing an Activity-Based Costing System

ABC is a five-stage process that allocates overhead more precisely than traditional allocation does by applying it to the products that use those activities. ABC works best in complex processes where the expenses are not driven by a single cost driver. Instead, several cost drivers are used as the overhead costs are analyzed and grouped into activities, and each activity is allocated based on each group’s cost driver. The five stages of the ABC process are:

- Identify the activities performed in the organization

- Determine activity cost pools

- Calculate activity rates for each cost pool

- Allocate activity rates to products (or services)

- Calculate unit product costs

The first step is to identify activities needed for production. An activity is an action or process involved in the production of inventory. There can be many activities that consume resources, and management will need to narrow down the activities to those that have the biggest impact on overhead costs. Examples of these activities include:

- Taking orders

- Setting up machines

- Purchasing material

- Assembling products

- Inspecting products

- Providing customer service

The second step is assigning overhead costs to the identified activities. In this step, overhead costs are assigned to each of the activities to become a cost pool. A cost pool is a list of costs incurred when related activities are performed. Table 6.4 illustrates the various cost pools along with their activities and related costs.

For example, the production cost pool consists of costs such as indirect labor for those accepting the order, verifying the customer has credit to pay for the order, maintenance and depreciation on the machines used to produce the orders, and utilities and rent for operating the machines. Figure 6.8 illustrates how the costs in each pool are allocated to each product in a different proportion.

Once the costs are grouped into similar cost pools, the activities in each pool are analyzed to determine which activity “drives” the costs in that pool, leading to the third step of ABC: identify the cost driver for each cost pool and estimate an annual level of activity for each cost driver. As you’ve learned, the cost driver is the specific activity that drives the costs in the cost pools. Table 6.5 shows some activities and cost drivers for those activities.

The fourth step is to compute the predetermined overhead rate for each of the cost drivers. This portion of the process is similar to finding the traditional predetermined overhead rate, where the overhead rate is divided by direct labor dollars, direct labor hours, or machine hours. Each cost driver will have its own overhead rate, which is why ABC is a more accurate method of allocating overhead.

Finally, step five is to allocate the overhead costs to each product. The predetermined overhead rate found in step four is applied to the actual level of the cost driver used by each product. As with the traditional overhead allocation method, the actual overhead costs are accumulated in an account called manufacturing overhead and then applied to each of the products in this step.

Notice that steps one through three represent the process of allocating overhead costs to activities, and steps four and five represent the process of allocating the overhead costs that have been assigned to activities to the products to which they pertain. Thus, the five steps of ABC involve two major processes: first, allocating overhead costs to the various activities to get a cost per activity, and then allocating the cost per activity to each product based on that product’s usage of the activities.

Now that the steps involved have been detailed, let’s demonstrate the calculations using the Musicality example.

Comparing Estimates to Actual Costs

A company has determined that its estimated 500,000 machine hours is the optimal driver for its estimated $1,000,000 machine overhead cost pool. The $750,000 in the material overhead cost pool should be allocated using the estimated 15,000 material requisition requests. How much is over- or underapplied if there were actually 490,000 machine hours and 15,500 material requisitions that resulted in $950,000 in the machine overhead cost pool, and $780,000 in the material cost pool? What does this difference indicate?

The predetermined overhead rate is $2 per machine hour ($1,000,000/500,000 machine hours) and $50 per material requisition ($750,000/15,000 requisitions). The actual and applied overhead can then be calculated to determine whether it is over- or underapplied:

The difference is a combination of factors. There were fewer machine hours than estimated, but there was also less overhead than estimated. There were more requisitions than estimated, and there was also more overhead.

The Calculation of Product Costs Using the Activity-Based Costing Allocation Method

Musicality is considering switching to an activity-based costing approach for determining overhead and has collected data to help them decide which overhead allocation method they should use. Performing the analysis requires these steps:

- Technological production

Now that Musicality has applied overhead to each product, they can calculate the cost per unit . Management can review its sales price and make necessary decisions regarding its products. The overhead cost per unit is the overhead for each product divided by the number of units of each product:

The overhead per unit can be added to the unit cost for direct material and direct labor to compute the total product cost per unit:

The sales price was set after management reviewed the product cost with traditional allocation along with other factors such as competition and product demand. The current sales price, cost of each product using ABC, and the resulting gross profit are shown in Figure 6.9 .

The loss on each sale of the Solo product was not discovered until the company did the calculations for the ABC method, because the sales of the other products were strong enough for the company to retain a total gross profit.

Additionally, the more accurate gross profit for each product calculated using ABC is shown in Figure 6.10 :

The calculations Musicality did in order to switch to ABC revealed that the Solo product was generating a loss for every unit sold. Knowing this information will allow Musicality to consider whether they should make changes to generate a profit from the Solo product, such as increase the selling price or carefully analyze the costs to identify potential cost reductions. Musicality could also decide to continue selling Solo at a loss, because the other products are generating enough profit for the company to absorb the Solo product loss and still be profitable. Why would a company continue to sell a product that is generating a loss? Sometimes these products are ones for which the company is well known or that draw customers into the store. For example, companies will sometimes offer extreme sales, such as on Black Friday, to attract customers in the hope that the customers will purchase other products. This information shows how valuable ABC can be in many situations for providing a more accurate picture than traditional allocation.

The Service Industries and Their Use of the Activity-Based Costing Allocation Method

ABC costing was developed to help management understand manufacturing costs and how they can be better managed. However, the service industry can apply the same principles to improve its cost management. Direct material and direct labor costs range from nonexistent to minimal in the service industry, which makes the overhead application even more important. The number and types of cost pools may be completely different in the service industry as compared to the manufacturing industry. For example, the health-care industry may have different overhead costs and cost drivers for the treatment of illnesses than they have for injuries. Some of the overhead related to monitoring a patient’s health status may overlap, but most of the overhead related to diagnosis and treatment differ from each other.

Link to Learning

Activity-based costing is not restricted to manufacturing. Service industries also have cost drivers and can benefit from analyzing what drives their costs. See this report on activity-based costing at UPS for an example.

- 5 Mary Ellen Biery. “A Sure-Fire Way to Boost the Bottom Line.” Forbes . January 12, 2014. https://www.forbes.com/sites/sageworks/2014/01/12/control-overhead-compare-industry-data/#47a9ea69d068

As an Amazon Associate we earn from qualifying purchases.

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution-NonCommercial-ShareAlike License and you must attribute OpenStax.

Access for free at https://openstax.org/books/principles-managerial-accounting/pages/1-why-it-matters

- Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper

- Publisher/website: OpenStax

- Book title: Principles of Accounting, Volume 2: Managerial Accounting

- Publication date: Feb 14, 2019

- Location: Houston, Texas

- Book URL: https://openstax.org/books/principles-managerial-accounting/pages/1-why-it-matters

- Section URL: https://openstax.org/books/principles-managerial-accounting/pages/6-3-calculate-activity-based-product-costs

© Dec 13, 2023 OpenStax. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

- Cost Accounting Systems

- Pre-determined Overhead Rate

- Job Order Costing

- Job Cost Sheet

- Process Costing

- Process Costing – Weighted Average Method

- Equivalent Units – Weighted Average Method

- Process Costing – FIFO Method

- Equivalent Units – FIFO Method

- Activity-Based Costing

Activity-based costing is a method of assigning indirect costs to products and services by identifying cost of each activity involved in the production process and assigning these costs to each product based on its consumption of each activity.

Activity-based costing is a more refined approach to costing products and services than the traditional cost allocation methods. It involves the following steps:

- Identification of activities involved in the production process;

- Classification of each activity according to the cost hierarchy (i.e. into unit-level, batch-level, product-level, and facility-level);

- Identification and accumulation of total costs of each activity;

- Identification of the most appropriate cost driver (allocation base) for each activity;

- Calculation of total units of the cost driver relevant to each activity;

- Calculation of the activity rate i.e. the total cost of each activity per unit of its relevant cost driver;

- Application of the cost of each activity to products based on its activity usage by the product.

Cost Hierarchy

The first step in activity-based costing involves identifying activities and classifying them according to the cost hierarchy. Cost hierarchy is a framework that classifies activities based the ease at which they are traceable to a product. The levels are (a) unit level, (b) batch level, (c) product level, and (d) facility level.

Unit level activities are activities that are performed on each unit of product. Batch level activities are activities that are performed whenever a batch of the product is produced. Product level activities are activities that are conducted separately for each product. Facility level activities are activities that are conducted at the plant level. The unit-level activities are most easily traceable to products while facility-level activities are least traceable.

Example: Application of Activity-Based Costing

Alex Erwin started Interwood, a niche furniture brand, 10 years ago. He ran the business as a sole proprietorship. While he has 50 skilled carpenters and 5 salespeople on his payroll, he has been taking care of the accounting by himself. Now, he intends to offer 40% of the ownership to public in next couple years and is willing to make changes and has hired you as the management accountant to organize and improve the accounting systems.

Interwood's total budgeted manufacturing overheads cost for the current year is $5,404,639 and budgeted total labor hours are 20,000. Alex has been applying traditional costing method during the whole 10 years period and based the pre-determined overhead rate on total labor hours.

Interwood's sofa range includes the 2-set, 3-set and 6-set options. Platinum Interiors recently placed an order for 150 units of the 6-set type. The order is expected to be delivered in one-month time. Since it is a customized order, Platinum will be billed at cost plus 25%.

You are not a fan of traditional product costing systems . You believe that the benefits of activity-based costing system exceeds its costs, so you sat down with Aaron Mason, the chief engineer, to identify the activities which the firm undertakes in its sofa division. Next, you calculated the total cost that goes into each activity, identified the cost driver that is most relevant to each activity and calculated the activity rate.

The results are summarized below:

Once the order was ready for packaging, Aaron gave you a summary of total cost incurred, and a statement of activities performed (also called the bill of activities) as shown below:

Part A: Traditional Costing System

Calculate the total cost of the order and the invoice value of the order based on traditional costing system.

In the traditional costing system, cost equals materials cost plus labor cost plus manufacturing overhead costs charged at the pre-determined overhead rate.

The pre-determined overhead rate based on direct labor hours = $5,404,639/20,000 = $270 per labor hour

The actual number of labor hours spent on the order is 250. Once we have this data, we can estimate the manufacturing overheads and the total cost as follows:

Interwood bills Platinum at cost plus 25%, so the amount of sales to be booked would amount to $178,875 (= $143,100 × 1.25).

Part B: Calculating Total Cost under Activity-Based Costing

You know activity-based costing is a more refined approach. Now, since you have all the data needed, calculate the order cost using activity-based costing.

In activity-based costing, direct materials cost, cost of purchased components and labor cost remains the same as in traditional product costing. However, the value of manufacturing overheads assigned is more accurately estimated. The following worksheet estimates the manufacturing overhead costs that should be assigned to the order of Platinum Interiors:

Total cost of the order is hence:

Based on the more accurate estimation of the order cost, the invoice should be raised at $197,150 (=$157,721 × 1.25) instead of $178,875 calculated under traditional product costing system.

The example highlights the importance of correct estimation of the product cost and the usefulness of activity-based costing in achieving that goal. It is because accurate allocation of cost is critical for identification of profitable products and allocating resources.

by Obaidullah Jan, ACA, CFA and last modified on Apr 3, 2019

Related Topics

- Direct Costs and Indirect Costs

- Cost Allocation

- Manufacturing Overhead Costs

All Chapters in Accounting

- Intl. Financial Reporting Standards

- Introduction

- Accounting Principles

- Business Combinations

- Accounting Cycle

- Financial Statements

- Non-Current Assets

- Fixed Assets

- Investments

- Revenue Recognition

- Current Assets

- Receivables

- Inventories

- Shareholders' Equity

- Liability Accounts

- Accounting for Taxes

- Employee Benefits

- Accounting for Partnerships

- Financial Ratios

- Cost Classifications

- Cost Behavior

- CVP Analysis

- Relevant Costing

- Capital Budgeting

- Master Budget

- Inventory Management

- Cash Management

- Standard Costing

Current Chapter

XPLAIND.com is a free educational website; of students, by students, and for students. You are welcome to learn a range of topics from accounting, economics, finance and more. We hope you like the work that has been done, and if you have any suggestions, your feedback is highly valuable. Let's connect!

Copyright © 2010-2024 XPLAIND.com

Module 6: Process Costing

Introduction to accumulating and assigning costs, what you will learn to do: assign costs to various stages of production.

Here is an overview of what you will learn in detail in this section:

You can view the transcript for “Process Costing” here (opens in new window) .

There are two methods for using process costs: Weighted Average and FIFO (First In, First Out). Each method uses equivalent units and cost per equivalent units but calculates them just a little differently.

When you are done with this section, you will be able to:

- Prepare a production cost report for the first stage of a multi-step process using the weighted-average method

- Prepare a production cost report for a second or subsequent stage of a multi-step process using the weighted-average method

- Prepare a production cost report using the FIFO method

Learning Activities

The learning activities for this section include the following:

- Reading: First-stage production report

- Self Check: First-stage production report

- Reading: Subsequent-stage production report

- Self Check: Subsequent-stage production report

- Reading: Production report using FIFO

- Self Check: Production report using FIFO

- Introduction to Accumulating and Assigning Costs. Authored by : Joseph Cooke. Provided by : Lumen Learning. License : CC BY: Attribution

- Process Costing. Authored by : Edspira. Located at : https://youtu.be/guZc84c5HNI. . License : All Rights Reserved . License Terms : Standard YouTube License

Privacy Policy

- Top Courses

- Online Degrees

- Find your New Career

- Join for Free

Basics of Cost Accounting: Product Costing

This course is part of Cost Accounting Specialization

Taught in English

Some content may not be translated

Instructors: Gunther Friedl +3 more

Instructors

Instructor ratings

We asked all learners to give feedback on our instructors based on the quality of their teaching style.

Financial aid available

9,864 already enrolled

(109 reviews)

Recommended experience

Beginner level

No prior experience required.

What you'll learn

You will learn how to make your company's cost structure transparent and how to record and calculate costs.

You will learn methods of product costing, i.e., how companies calculate costs of their products and services.

You will learn to decide which product costing system is most suitable for your company’s production program and production type.

You will learn how to determine overhead rates for the allocation of overhead costs to products.

Skills you'll gain

Cost-type accounting.

- Service costing

Cost-center accounting

Details to know.

Add to your LinkedIn profile

See how employees at top companies are mastering in-demand skills

Build your subject-matter expertise

- Learn new concepts from industry experts

- Gain a foundational understanding of a subject or tool

- Develop job-relevant skills with hands-on projects

- Earn a shareable career certificate

Earn a career certificate

Add this credential to your LinkedIn profile, resume, or CV

Share it on social media and in your performance review

There are 4 modules in this course

The core of the first course is to learn how companies record total costs and calculate unit costs for their individual products or services. For example, how can a car manufacturer figure out the costs of an individual car series? During the first weeks, participants learn what costs are and how to distinguish them from expenses or cash flows. Participants will understand how companies record total costs and distinguish important cost types such as material costs, personnel costs, or depreciation. At the core of their cost-accounting system, companies allocate overhead costs to individual products. We show participants how to allocate the costs incurred to the company's products and introduce them to the most important methods and challenges of product costing.

Introduction to cost accounting

Welcome to Cost Accounting! In this module, we will introduce you to the basic concepts of cost accounting. You will learn what cost accounting is and how cost accounting relates to corporate accounting. Thereafter, you will get familiar with some basic cost terms that are essential for cost accountants. Finally, we will introduce you to a framework that distinguishes three sub-systems of cost accounting. This framework will guide us through the following modules.

What's included

8 videos 6 readings 3 quizzes 1 discussion prompt 1 plugin

8 videos • Total 35 minutes

- Introduction • 1 minute • Preview module

- Cost accounting and corporate management • 3 minutes

- Cost accounting, management accounting, and financial accounting • 6 minutes

- Definition of costs • 5 minutes

- Cost terms and their meaning: Total and unit costs, direct and indirect costs, fixed and variable costs • 5 minutes

- Cost terms and their meaning: Inventoriable and period costs, opportunity and sunk costs • 4 minutes

- Three sub-systems of cost accounting • 3 minutes

- Absorption costing vs variable costing • 5 minutes

6 readings • Total 39 minutes

- Course Overview • 2 minutes

- Introduce yourself! • 10 minutes

- Lecture slides for this course • 2 minutes

- Harmonization of management and financial accounting • 5 minutes

- Average unit costs: an example from the automotive industry in the COVID crisis • 10 minutes

- Practical example: Sunk costs when Robert Bosch GmbH exited the solar sector • 10 minutes

3 quizzes • Total 13 minutes

- Cost accounting as a part of corporate accounting • 4 minutes

- Basic concepts of cost accounting • 4 minutes

1 discussion prompt • Total 10 minutes

- How can cost accounting support the management? • 10 minutes

1 plugin • Total 10 minutes

- Direct, indirect, variable, and fixed costs • 10 minutes

In this module, we will introduce you to cost-type accounting - the first of the three cost accounting sub-systems. Cost-type accounting helps companies to make their cost structure transparent. It gives companies an overview of which costs have been incurred. We will take a closer look at three important cost items namely material costs, personnel costs, and machine costs. You will learn how companies record and calculate them.

8 videos 5 readings 7 quizzes

8 videos • Total 53 minutes

- Tasks of cost-type accounting, linkage to financial accounting, and important cost types • 4 minutes • Preview module

- Introduction to material costs • 3 minutes

- Recording material consumption • 5 minutes

- Valuing material consumption • 12 minutes

- Personnel costs • 4 minutes

- Types of machine costs • 4 minutes

- Depreciation • 9 minutes

- Interest costs • 9 minutes

5 readings • Total 40 minutes

- Cost types in business practice • 5 minutes

- Comparing the methods for recording material consumption • 5 minutes

- Excursus: What crypto taxpayers need to know about FIFO, LIFO, HIFO & specific ID • 10 minutes

- Deep dive: Personnel costs • 10 minutes

- Deep dive: Imputed interest costs at BASF • 10 minutes

7 quizzes • Total 45 minutes

- Introduction to cost-type accounting • 3 minutes

- Material costs • 4 minutes

- Depreciation • 4 minutes

- Machine costs • 4 minutes

- Material costs: Valuing material consumption • 10 minutes

- Machine costs: Depreciation • 10 minutes

- Interest costs • 10 minutes

In this module, we will dive into cost-center accounting. Cost-center accounting creates transparency about where, i.e. in which cost center, the overhead costs of a company have been incurred. It connects cost-type accounting with product costing by performing three allocation steps: First, overhead costs from cost-type accounting are assigned to cost centers. However, ultimately cost accountants want to assign the costs to cost objects. Because this is easier for costs of production-related cost centers ("direct cost centers") than for costs of "indirect cost centers" such as the IT or the canteen, companies allocate overhead costs from indirect to direct cost centers first. Finally, they determine overhead rates for the allocation of overhead costs from direct cost centers to cost objects. In this module, we will introduce you to each of these steps.

10 videos 2 readings 11 quizzes

10 videos • Total 56 minutes

- Tasks of cost-center accounting and structure of cost centers • 6 minutes • Preview module

- The three steps of cost-center accounting • 4 minutes

- Primary cost allocation • 6 minutes

- Overview of the methods for the allocation of service-department costs • 3 minutes

- Reciprocal method based on equations • 11 minutes

- Reciprocal method based on iterations • 7 minutes

- Method of credits and debits • 3 minutes

- Step-ladder method • 6 minutes

- Direct method • 2 minutes

- Determining overhead rates • 4 minutes

2 readings • Total 10 minutes

- Practical example: Cost-center plan of the Federation of German Industry • 5 minutes

- Methods for the allocation of service-department costs: Practices in Germany and Austria • 5 minutes

11 quizzes • Total 96 minutes

- Introduction to cost-center accounting • 8 minutes

- Assignment of overhead costs to cost centers • 4 minutes

- Reciprocal method based on equations • 9 minutes

- Reciprocal method based on iterations • 6 minutes

- Method of credits and debits • 6 minutes

- Step-ladder method • 12 minutes

- Direct method • 6 minutes

- Methods for the allocation of service-department costs • 4 minutes

- Determining overhead rates for costing • 6 minutes

- Allocation of service department costs: Reciprocal method based on equations, direct method, method of credits and debits • 20 minutes

- Allocation of service department costs: Step ladder method, reciprocal method based on iterations • 15 minutes

Product and service costing

In this module, we introduce you to product and service costing. Product and service costing provides companies with information about the costs of individual products or services. It is the final of the three cost accounting sub-systems. We will sometimes just refer to product and service costing as "product costing", but of course some companies offer physical products while others offer services. We explain how companies design product costing systems and we make you familiar with important methods of product costing. We also discuss how well the costing methods are suited for different production processes and program types. To this end, we will distinguish "job shop production" and "mass and batch production".

12 videos 2 readings 13 quizzes 1 discussion prompt 3 plugins

12 videos • Total 67 minutes

- Tasks of product and service costing • 6 minutes • Preview module

- Classification of cost objects • 2 minutes

- The relationship between program type, product characteristics, and costing method • 4 minutes

- The general approach to job costing • 8 minutes

- Job costing with multiple overhead rates • 8 minutes

- Machine-hour costing • 9 minutes

- Actual costing, interim costing, and normal costing • 6 minutes

- Book keeping for job shop production • 1 minute

- Single-stage process costing • 1 minute

- Multi-stage process costing • 8 minutes

- Equivalence number method • 5 minutes

- Cost allocation for joint products and byproducts • 3 minutes

2 readings • Total 20 minutes

- Practical example: Cost cutting in the energy industry • 10 minutes

- What do I learn in the remaining two courses of the Specialization? • 10 minutes

13 quizzes • Total 106 minutes

- Tasks and design of product and service costing • 8 minutes

- Allocating overhead costs with single rates • 10 minutes

- Schematic structure of an overhead calculation • 8 minutes

- Allocating overhead costs with multiple rates • 6 minutes

- Machine-hour costing • 4 minutes

- Product costing for job shop production • 8 minutes

- Single-stage process costing • 4 minutes

- Multi-stage process costing • 5 minutes

- Product and service costing for mass and variant production • 5 minutes

- Job costing with multiple overhead rates • 12 minutes

- Equivalence number method • 10 minutes

- Cost allocation for joint products and by-products • 20 minutes

- Reduced material costs in car manufacturing • 10 minutes

3 plugins • Total 45 minutes

- Which products are produced by which program type? • 15 minutes

- Job costing with multiple overhead rates • 15 minutes

- Summary exercise: Overview of product and service costing • 15 minutes

Technical University of Munich (TUM) is one of Europe’s top universities. It is committed to excellence in research and teaching, interdisciplinary education and the active promotion of promising young scientists. The university forges strong links with companies and scientific institutions across the world. TUM was one of the first universities in Germany to be named a University of Excellence. TUM does not pass any personal data to the platform providers. If you take part in one of our MOOCs, please refer to the data protection guidelines in the terms and conditions of the provider.

Recommended if you're interested in Finance

Technical University of Munich (TUM)

Cost Accounting

Specialization

Cost Accounting: Profit and Loss Calculation

Cost Accounting: Decision Making

Queen Mary University of London

Cloud Computing Law: Data Protection and Cybersecurity

Why people choose coursera for their career.

Learner reviews

Showing 3 of 109

109 reviews

Reviewed on Mar 25, 2024

Excellent Course with specific detailed information, really thank you

Reviewed on Mar 5, 2022

Perfect Course.. with very good examples.. you will earn a lot of knowledge the instructor is great. also, they are very responsive in the forum, Thanks to all the instructor's team!

Reviewed on Aug 15, 2023

Thank you for the instructors and Coursera for offering this course.

New to Finance? Start here.

Open new doors with Coursera Plus

Unlimited access to 7,000+ world-class courses, hands-on projects, and job-ready certificate programs - all included in your subscription

Advance your career with an online degree

Earn a degree from world-class universities - 100% online

Join over 3,400 global companies that choose Coursera for Business

Upskill your employees to excel in the digital economy

Frequently asked questions

When will i have access to the lectures and assignments.

Access to lectures and assignments depends on your type of enrollment. If you take a course in audit mode, you will be able to see most course materials for free. To access graded assignments and to earn a Certificate, you will need to purchase the Certificate experience, during or after your audit. If you don't see the audit option:

The course may not offer an audit option. You can try a Free Trial instead, or apply for Financial Aid.

The course may offer 'Full Course, No Certificate' instead. This option lets you see all course materials, submit required assessments, and get a final grade. This also means that you will not be able to purchase a Certificate experience.

What will I get if I subscribe to this Specialization?

When you enroll in the course, you get access to all of the courses in the Specialization, and you earn a certificate when you complete the work. Your electronic Certificate will be added to your Accomplishments page - from there, you can print your Certificate or add it to your LinkedIn profile. If you only want to read and view the course content, you can audit the course for free.

What is the refund policy?

If you subscribed, you get a 7-day free trial during which you can cancel at no penalty. After that, we don’t give refunds, but you can cancel your subscription at any time. See our full refund policy Opens in a new tab .

Is financial aid available?

Yes. In select learning programs, you can apply for financial aid or a scholarship if you can’t afford the enrollment fee. If fin aid or scholarship is available for your learning program selection, you’ll find a link to apply on the description page.

More questions

- school Campus Bookshelves

- menu_book Bookshelves

- perm_media Learning Objects

- login Login

- how_to_reg Request Instructor Account

- hub Instructor Commons

- Download Page (PDF)

- Download Full Book (PDF)

- Periodic Table

- Physics Constants

- Scientific Calculator

- Reference & Cite

- Tools expand_more

- Readability

selected template will load here

This action is not available.

7.12: Assignment- Costing Methods

- Last updated

- Save as PDF

- Page ID 45881

For this assignment, you will download and complete the following worksheet:

- Assignment: Costing Methods (.docx)

- Assignment: Costing Methods. Authored by : Linda Williams. Provided by : Lumen Learning. License : CC BY: Attribution

What is Cost Assignment?

Share This...

Cost assignment.

Cost assignment is the process of associating costs with cost objects, such as products, services, departments, or projects. It encompasses the identification, measurement, and allocation of both direct and indirect costs to ensure a comprehensive understanding of the resources consumed by various cost objects within an organization. Cost assignment is a crucial aspect of cost accounting and management accounting, as it helps organizations make informed decisions about pricing, resource allocation, budgeting, and performance evaluation.

There are two main components of cost assignment:

- Direct cost assignment: Direct costs are those costs that can be specifically traced or identified with a particular cost object. Examples of direct costs include direct materials, such as raw materials used in manufacturing a product, and direct labor, such as the wages paid to workers directly involved in producing a product or providing a service. Direct cost assignment involves linking these costs directly to the relevant cost objects, typically through invoices, timesheets, or other documentation.

- Indirect cost assignment (Cost allocation): Indirect costs, also known as overhead or shared costs, are those costs that cannot be directly traced to a specific cost object or are not economically feasible to trace directly. Examples of indirect costs include rent, utilities, depreciation, insurance, and administrative expenses. Since indirect costs cannot be assigned directly to cost objects, organizations use various cost allocation methods to distribute these costs in a systematic and rational manner. Some common cost allocation methods include direct allocation, step-down allocation, reciprocal allocation, and activity-based costing (ABC).

In summary, cost assignment is the process of associating both direct and indirect costs with cost objects, such as products, services, departments, or projects. It plays a critical role in cost accounting and management accounting by providing organizations with the necessary information to make informed decisions about pricing, resource allocation, budgeting, and performance evaluation.

Example of Cost Assignment

Let’s consider an example of cost assignment at a bakery called “BreadHeaven” that produces two types of bread: white bread and whole wheat bread.

BreadHeaven incurs various direct and indirect costs to produce the bread. Here’s how the company would assign these costs to the two types of bread:

- Direct cost assignment:

Direct costs can be specifically traced to each type of bread. In this case, the direct costs include:

- Direct materials: BreadHeaven purchases flour, yeast, salt, and other ingredients required to make the bread. The cost of these ingredients can be directly traced to each type of bread.

- Direct labor: BreadHeaven employs bakers who are directly involved in making the bread. The wages paid to these bakers can be directly traced to each type of bread based on the time spent working on each bread type.

For example, if BreadHeaven spent $2,000 on direct materials and $1,500 on direct labor for white bread, and $3,000 on direct materials and $2,500 on direct labor for whole wheat bread, these costs would be directly assigned to each bread type.

- Indirect cost assignment (Cost allocation):

Indirect costs, such as rent, utilities, equipment maintenance, and administrative expenses, cannot be directly traced to each type of bread. BreadHeaven uses a cost allocation method to assign these costs to the two types of bread.

Suppose the total indirect costs for the month are $6,000. BreadHeaven decides to use the number of loaves produced as the allocation base , as it believes that indirect costs are driven by the production volume. During the month, the bakery produces 3,000 loaves of white bread and 2,000 loaves of whole wheat bread, totaling 5,000 loaves.

The allocation rate per loaf is:

Allocation Rate = Total Indirect Costs / Total Loaves Allocation Rate = $6,000 / 5,000 loaves = $1.20 per loaf

BreadHeaven allocates the indirect costs to each type of bread using the allocation rate and the number of loaves produced:

- White bread: 3,000 loaves × $1.20 per loaf = $3,600

- Whole wheat bread: 2,000 loaves × $1.20 per loaf = $2,400

After completing the cost assignment, BreadHeaven can determine the total costs for each type of bread:

- White bread: $2,000 (direct materials) + $1,500 (direct labor) + $3,600 (indirect costs) = $7,100

- Whole wheat bread: $3,000 (direct materials) + $2,500 (direct labor) + $2,400 (indirect costs) = $7,900

By assigning both direct and indirect costs to each type of bread, BreadHeaven gains a better understanding of the full cost of producing each bread type, which can inform pricing decisions, resource allocation, and performance evaluation.

Other Posts You'll Like...

What are Items 7, 7A, and 8 in Part II of Form 10-K?

What are Items 1-3 of Part 1 of Form 10-Q?

2024 CPA Exams F.A.Q.s Answered

REG CPA Practice Questions Explained: How to Calculate Partnership Ordinary Business Income and Separately Stated Items

REG CPA Practice Questions Explained: How to Calculate S Corp Shareholder Debt Basis

REG CPA Practice Questions Explained: How to Calculate the S Corporation AAA (Accumulated Adjustments Account)

Helpful links.

- Learn to Study "Strategically"

- How to Pass a Failed CPA Exam

- Samples of SFCPA Study Tools

- SuperfastCPA Podcast

How Jackie Got Re-Motivated by Simplifying Her CPA Study

The Study Tweaks That Turned Kevin’s CPA Journey Around

Helicopter Pilot to CPA: How Chase Passed His CPA Exams

How Josh Passed His CPA Exams Using Shorter Study Sessions

The Changes That Helped Marc Pass His CPA Exams After Failing 6 Times

Want to pass as fast as possible, ( and avoid failing sections ), watch one of our free "study hacks" trainings for a free walkthrough of the superfastcpa study methods that have helped so many candidates pass their sections faster and avoid failing scores....

Make Your Study Process Easier and more effective with SuperfastCPA

Take Your CPA Exams with Confidence

- Free "Study Hacks" Training

- SuperfastCPA PRO Course

- SuperfastCPA Review Notes

- SuperfastCPA Audio Notes

- SuperfastCPA Quizzes

Get Started

- Free "Study Hacks Training"

- Read Reviews of SuperfastCPA

- Busy Candidate's Guide to Passing

- Subscribe to the Podcast

- Purchase Now

- Nate's Story

- Interviews with SFCPA Customers

- Our Study Methods

- SuperfastCPA Reviews

- CPA Score Release Dates

- The "Best" CPA Review Course

- Do You Really Need the CPA License?

- 7 Habits of Successful Candidates

- "Deep Work" & CPA Study

- Search Search Please fill out this field.

What Is Activity-Based Costing (ABC)?

How activity-based costing (abc) works, requirements for activity-based costing (abc), benefits of activity-based costing (abc).

- Corporate Finance

Activity-Based Costing (ABC): Method and Advantages Defined with Example

:max_bytes(150000):strip_icc():format(webp)/wk_headshot_aug_2018_02__william_kenton-5bfc261446e0fb005118afc9.jpg)

Activity-based costing (ABC) is a costing method that assigns overhead and indirect costs to related products and services. This accounting method of costing recognizes the relationship between costs, overhead activities, and manufactured products, assigning indirect costs to products less arbitrarily than traditional costing methods. However, some indirect costs, such as management and office staff salaries, are difficult to assign to a product.

Key Takeaways

- Activity-based costing (ABC) is a method of assigning overhead and indirect costs—such as salaries and utilities—to products and services.

- The ABC system of cost accounting is based on activities, which are considered any event, unit of work, or task with a specific goal.

- An activity is a cost driver , such as purchase orders or machine setups.

- The cost driver rate, which is the cost pool total divided by cost driver, is used to calculate the amount of overhead and indirect costs related to a particular activity.

ABC is used to get a better grasp on costs, allowing companies to form a more appropriate pricing strategy.

Investopedia / Theresa Chiechi

Activity-based costing (ABC) is mostly used in the manufacturing industry since it enhances the reliability of cost data, hence producing nearly true costs and better classifying the costs incurred by the company during its production process.

This costing system is used in target costing, product costing, product line profitability analysis, customer profitability analysis, and service pricing. Activity-based costing is used to get a better grasp on costs, allowing companies to form a more appropriate pricing strategy.

The formula for activity-based costing is the cost pool total divided by cost driver, which yields the cost driver rate. The cost driver rate is used in activity-based costing to calculate the amount of overhead and indirect costs related to a particular activity.

The ABC calculation is as follows:

- Identify all the activities required to create the product.

- Divide the activities into cost pools, which includes all the individual costs related to an activity—such as manufacturing. Calculate the total overhead of each cost pool.

- Assign each cost pool activity cost drivers, such as hours or units.

- Calculate the cost driver rate by dividing the total overhead in each cost pool by the total cost drivers.

- Divide the total overhead of each cost pool by the total cost drivers to get the cost driver rate.

- Multiply the cost driver rate by the number of cost drivers.

As an activity-based costing example, consider Company ABC that has a $50,000 per year electricity bill. The number of labor hours has a direct impact on the electric bill. For the year, there were 2,500 labor hours worked, which in this example is the cost driver. Calculating the cost driver rate is done by dividing the $50,000 a year electric bill by the 2,500 hours, yielding a cost driver rate of $20. For Product XYZ, the company uses electricity for 10 hours. The overhead costs for the product are $200, or $20 times 10.

Activity-based costing benefits the costing process by expanding the number of cost pools that can be used to analyze overhead costs and by making indirect costs traceable to certain activities.

The ABC system of cost accounting is based on activities, which are any events, units of work, or tasks with a specific goal, such as setting up machines for production, designing products, distributing finished goods, or operating machines. Activities consume overhead resources and are considered cost objects.

Under the ABC system, an activity can also be considered as any transaction or event that is a cost driver. A cost driver, also known as an activity driver, is used to refer to an allocation base. Examples of cost drivers include machine setups, maintenance requests, consumed power, purchase orders, quality inspections, or production orders.

There are two categories of activity measures: transaction drivers, which involve counting how many times an activity occurs, and duration drivers, which measure how long an activity takes to complete.

Unlike traditional cost measurement systems that depend on volume count, such as machine hours and/or direct labor hours, to allocate indirect or overhead costs to products, the ABC system classifies five broad levels of activity that are, to a certain extent, unrelated to how many units are produced. These levels include batch-level activity , unit-level activity, customer-level activity, organization-sustaining activity, and product-level activity.

Activity-based costing (ABC) enhances the costing process in three ways. First, it expands the number of cost pools that can be used to assemble overhead costs. Instead of accumulating all costs in one company-wide pool, it pools costs by activity.

Second, it creates new bases for assigning overhead costs to items such that costs are allocated based on the activities that generate costs instead of on volume measures, such as machine hours or direct labor costs.

Finally, ABC alters the nature of several indirect costs, making costs previously considered indirect—such as depreciation , utilities, or salaries—traceable to certain activities. Alternatively, ABC transfers overhead costs from high-volume products to low-volume products, raising the unit cost of low-volume products.

Chartered Global Management Accountant. " Activity-Based Costing (ABC) ."

:max_bytes(150000):strip_icc():format(webp)/Activity-driver-analysis-4202077-FINAL-0a7e89ba2d5649e1ba480c9af08a9c89.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- A Deep Dive into Activity-Based Costing (ABC) in Cost accounting Assignments

Activity-Based Costing in Practice: Tackling Assignments with Real-World Scenarios

Are you struggling to solve your Cost Accounting assignment ? If so, you're not alone. Cost accounting assignments often pose challenges, especially when dealing with complex cost structures. One effective approach to address these challenges is the implementation of Activity-Based Costing (ABC). In this blog, we will delve into the practical application of Activity-Based Costing, providing real-world scenarios, example questions, and solutions that can significantly enhance your ability to solve cost accounting assignments.

Understanding Activity-Based Costing (ABC):

In the realm of cost accounting assignments, grasping the intricacies of Activity-Based Costing (ABC) is akin to unlocking a strategic tool for precision and accuracy. Unlike traditional costing methods, ABC provides a nuanced approach to cost allocation, acknowledging the diverse activities that contribute to a product or service's creation. For students tackling cost accounting assignments, mastering ABC is a game-changer.

Assignments often simulate real-world scenarios where organizations grapple with complex cost structures. ABC, with its emphasis on identifying and allocating costs based on actual activities, offers a practical solution. Through ABC, students learn to discern the direct and indirect costs associated with each activity, unraveling the true cost drivers. This understanding is crucial in decision-making, pricing strategies, and resource allocation — all pivotal aspects of cost accounting. As students navigate through ABC in their assignments, they not only solve problems but also develop a skill set essential for strategic financial management in the professional landscape.

Real-World Scenario 1: Manufacturing Company X

Let's consider a manufacturing company, X, that produces customized machinery. Company X has three major activities: designing, machining, and assembly. Each of these activities incurs different overhead costs. To determine the true cost of each product, Company X decides to implement Activity-Based Costing.

Example Question 1: Calculate the Overhead Cost for Each Activity

Given the following information:

- Designing Activity Costs: $50,000

- Machining Activity Costs: $80,000

- Assembly Activity Costs: $70,000

Calculate the overhead cost for each activity using Activity-Based Costing.

Solution 1:

Overhead Rate for Designing= Designing Activity Costs/Total Units of Designing Activity

Overhead Rate for Machining= Machining Activity Costs/Total Units of Machining Activity

Overhead Rate for Assembly= Assembly Activity Costs/Total Units of Assembly Activity

Once you have calculated the overhead rates for each activity, you can then allocate the overhead costs to individual products based on the actual units of each activity consumed during production.

Real-World Scenario 2: Service Company Y

Now, let's shift our focus to a service-based company, Y, that provides consulting services. Company Y identifies two primary activities: client meetings and research. Each activity incurs different costs, and Company Y aims to use Activity-Based Costing to better understand the cost structure.

Example Question 2: Allocate Overhead Costs to Clients

- Client Meetings Activity Costs: $40,000

- Research Activity Costs: $60,000

Determine the overhead cost per client for each activity.

Solution 2:

Overhead Rate for Client Meetings= Client Meetings Activity Costs/Total Client Meetings

Overhead Rate for Research= Research Activity Costs/Total Research Hours

Once you have calculated the overhead rates, you can allocate the costs to individual clients based on the actual number of meetings and research hours dedicated to each.

Expanding the Horizon of Activity-Based Costing: Real-Life Applications and Advanced Problem-Solving Techniques

In our exploration of Activity-Based Costing (ABC) for cost accounting assignments, it's imperative to delve deeper into real-life applications and more advanced problem-solving techniques. By examining diverse scenarios and employing sophisticated ABC methodologies, you can elevate your understanding and prowess in solving complex cost accounting challenges.

Advanced ABC Techniques:

Resource Driver Analysis:

Resource Driver Analysis represents a sophisticated facet of Activity-Based Costing (ABC), taking the precision of cost allocation to a whole new level. While traditional ABC relies on identifiable cost drivers such as machine hours or labor hours, resource driver analysis delves into the core resources fueling various activities, providing a more nuanced understanding of cost dynamics.

In essence, a resource driver is a factor that directly influences the consumption of resources in an activity. By identifying and aligning costs with these resource drivers, organizations gain a granular perspective on how resources are utilized, enabling more accurate cost allocations.

Example Question 3:Resource Driver Analysis for Company X

Suppose Company X identifies the resource driver for the designing activity as the number of unique design elements. Calculate the overhead cost for designing based on this resource driver.

Solution 3:

Overhead Rate for Designing=Designing Activity Costs/Total Unique Design Elements

This advanced approach allows for a more nuanced understanding of the cost structure, especially in scenarios where traditional cost drivers may not accurately capture the complexity of activities.

Activity-Based Budgeting:

In the realm of cost accounting, Activity-Based Budgeting (ABB) emerges as a strategic extension of Activity-Based Costing (ABC). Unlike traditional budgeting approaches, ABB aligns financial planning with the intricacies of specific activities, ensuring a more granular and accurate representation of costs. This method fosters a dynamic budgeting process that adapts to the evolving needs of an organization, providing a comprehensive view of resource utilization.

By integrating cost information with budgetary planning, companies can make informed decisions about resource allocation, prioritize activities that drive value, and enhance overall financial performance. Activity-Based Budgeting transcends the limitations of conventional budgeting, offering a forward-looking perspective that resonates with the dynamic nature of modern business environments.

Example Question 4: Activity-Based Budgeting for Company Y

Consider a manufacturing company specializing in custom furniture production. Traditional budgeting may allocate a fixed budget to the manufacturing department without considering the diverse activities within it. However, by implementing Activity-Based Budgeting (ABB), the company gains a more nuanced understanding of its costs.

- Identify Key Activities:

- Materials Procurement

- Manufacturing

- Quality Control

- Packaging and Shipping

- Assign Budgets to Activities: Allocate budgets to each activity based on their anticipated costs. For instance, the designing activity may require funds for design software licenses, while manufacturing may need budgetary allocations for machinery maintenance and upgrades.

- Determine Cost Drivers: Identify the factors influencing costs within each activity. Designing costs could be driven by the number of unique design elements, while manufacturing costs may be influenced by machine hours.

- Allocate Resources Based on Activity Demands: If a surge in custom design requests is anticipated, allocate a proportionally higher budget to the designing activity. Likewise, if an increase in production volume is expected, allocate additional resources to the manufacturing activity.

- Regularly Review and Adjust: ABB is dynamic. Regularly review actual expenditures and compare them to the budgeted amounts. If there are significant variances, adjust future budgets accordingly. For instance, if the designing activity consistently requires more resources than initially budgeted, allocate a higher budget for design in subsequent periods.

By adopting Activity-Based Budgeting, the manufacturing company gains a more accurate reflection of its cost structure, allowing for strategic resource allocation, improved decision-making, and heightened financial control. This example illustrates how ABB provides a forward-looking, activity-centric approach to budgeting, enhancing the company's ability to adapt to changing market demands and internal dynamics.

Real-Life Applications of ABC:

In practical terms, Activity-Based Costing (ABC) transcends theory, finding robust applications across industries. From healthcare, where it dissects complex medical service costs, to technology, where it refines R&D expenditure, ABC is a versatile tool. Its real-life impact extends beyond textbooks, optimizing resource allocation, pricing strategies, and informed decision-making in diverse business scenarios.

Healthcare Industry:

The healthcare sector often grapples with complex cost structures due to the diverse range of services provided. ABC proves invaluable in determining the actual costs associated with different medical procedures, patient care units, or diagnostic services. For instance, a hospital implementing ABC may identify the cost drivers for emergency room services as patient visits and intensity of care required.

Example Question 5: ABC in Healthcare

A hospital wants to implement ABC to understand the costs associated with its surgical department. Identify potential cost drivers for activities such as pre-operation preparation, surgery, and post-operation care.

Solution 5:

Conduct a thorough analysis of the surgical department activities and identify relevant cost drivers. For pre-operation preparation, the number of required tests or consultations could be a key driver, while the surgery itself might be driven by factors like complexity or duration.

Technology Company:

In the technology industry, where research and development are pivotal, ABC can shed light on the true costs of innovation. By identifying and allocating costs based on the specific R&D activities undertaken, a technology company can make more informed decisions regarding product pricing and investment in future projects.

Example Question 6: ABC in a Technology Company

A technology company is considering implementing ABC to understand the costs associated with its software development process. Identify potential cost drivers for activities like coding, testing, and debugging.

Solution 6:

For coding, the number of lines of code or the complexity of the code could be identified as relevant cost drivers. Testing might be driven by the number of test cases, and debugging could be driven by the number of reported issues.

Solving Your Cost accounting Assignment with Precision:

As you navigate the intricacies of Activity-Based Costing in real-world scenarios, it's crucial to recognize the broader implications for solving cost accounting assignments. The examples and techniques presented in this blog are not mere exercises; they represent a paradigm shift in how organizations approach cost management.

Example Question 7: Comprehensive ABC Implementation

Imagine you are tasked with implementing ABC in a manufacturing company that produces custom-designed furniture. Outline the step-by-step process, from identifying activities to calculating overhead rates and allocating costs to individual products.

To achieve a holistic understanding of Activity-Based Costing (ABC) in cost accounting, let's delve into a step-by-step guide for a comprehensive implementation:

- Identify Activities: Clearly define all activities relevant to your business. In a manufacturing context, this could encompass designing, procurement, production, quality control, and distribution.

- Assign Costs to Activities: Attribute direct and indirect costs to each activity. This involves scrutinizing expenses associated with personnel, facilities, equipment, and any other resources involved in each activity.

- Identify Cost Drivers: Pinpoint the factors influencing the costs within each activity. For instance, the designing activity's cost driver might be the number of unique design elements, while production costs could be influenced by machine hours.

- Calculate Overhead Rates: Develop overhead rates for each activity by dividing the total cost of the activity by the associated cost driver. This establishes a clear relationship between the cost and the activity's driving factor.

Overhead Rate= Total Activity Costs/ Total Cost Driver Units

Allocated Cost=Overhead Rate×Quantity of Cost Driver

- Regularly Update and Refine: ABC is an iterative process. Regularly update cost data and refine cost drivers based on evolving business dynamics and market conditions. This ensures that ABC remains relevant and reflective of the organization's operational reality.

- Integrate ABC with Decision-Making: Leverage the insights gained from ABC in strategic decision-making. Whether setting prices, optimizing resource allocation, or identifying areas for cost reduction, the comprehensive implementation of ABC equips organizations with a powerful tool for informed decision-making.

Conclusion:

In the fast-paced world of cost accounting, accurately assigning costs is crucial for informed decision-making. Activity-Based Costing provides a practical solution to this challenge by offering a more precise method of cost allocation. By solving your cost accounting assignment problems through real-world scenarios like those presented in this blog, you can gain a deeper understanding of how ABC works and its significance in optimizing cost management.

In conclusion, whether you are dealing with manufacturing or service-oriented scenarios, Activity-Based Costing is a powerful tool that can enhance the accuracy of your cost calculations. So, the next time you find yourself grappling with your cost accounting assignment, consider the real-world scenarios and examples provided here to guide you toward a more comprehensive and precise solution. Solving your cost accounting assignment becomes much more manageable when armed with the practical insights of Activity-Based Costing.

Post a comment...

A deep dive into activity-based costing (abc) in cost accounting assignments submit your assignment, attached files.

Shared Service Costing Assignment

Helps In Identifying correct adoption of costing method which facilitates a transparent cost chargeable to Business Units (recipient of shared services) with granular Insight of the cost constituents. Introduction: In today’s highly cost conscious environment, enterprise wide cost savings can be achieved by consolidating common work and infrastructure by using Shared Services units.

But Business units often complain that Shared Services end up costing more than they targeted to save and also have the below questions:- “What are my Shared services costs made up off? ” “Shared services costs are too high and affecting my product profitability’ Shared services are unable to answer these questions due to lack of cost transparency in their cost models.

Don’t waste your time! Order your assignment!

Typical reasons for lack of cost transparency in shared services cost models are:- using complex costing methodology which makes measurement, chargeable and report to Business units difficult Lack of standardization of allocation logic Inability to completely automate the cross charging process Shared Service oodles ” Our Shared services models enable cost transparency for multi-functional and reciprocal services rendered by Shared Services units.

Cost transparency in context of Shared Services is to show the Business Services it consumes Cost of delivering these services Breaking the cost down to activities and resources involved in producing these services Allocation logic for cross charging On demand “what – with respect to demonstrate how costs change due to change In demand for services ,resource drivers and allocation logic Various automated cross charging models which reflect reciprocal services among Shared Services and eventually charge out to the Business are as follows:- Reciprocal costing model This costing model makes one time assignment of cost between Shared Services and eventually charges out Business for the Shared Services cost. This method Is easy to understand, fairly accurate and facilitates In tracing cost to the origin. It also differentiates the rate at which Shared service unit Is charged with that charged to Business. Recursive costing model Services and Business. This method is accurate and reflects simultaneous charging at the same rate to Shared service and Business.

Business benefits of the models: – (Positive Business Outcomes) Substantial reduction in lead time of calculating cross charging rates by eliminating manual and Increase in frequency of variance reporting which leads to repetitive interventions improved control of costs Detailed breakdown of cost of each service by the activities ensured and resources utilized Facilitates root cause analysis by tracing costs to origin for each service provided by Shared Services Availability of accurate and timely actionable cost data to analyze performance of Shared Services units and impact of its cost on Business Business benefits delivered.

How to cite this assignment

Related assignments:.

- Traditional Volume-Based Product Costing Assignment

- Unit Level and Multiple Level Costing Assignment

- Shared Leadership Assignment