Tax codes in SAP Business One

The creation and use of tax codes in SAP Business One plays a central role in the area of VAT administration. These codes are decisive for the calculation of VAT amounts, both for the advance VAT return and for the VAT return. Other than ledger accounts tax codes are used specifically for the calculation of tax amounts for deliveries and other services to other EU countries.

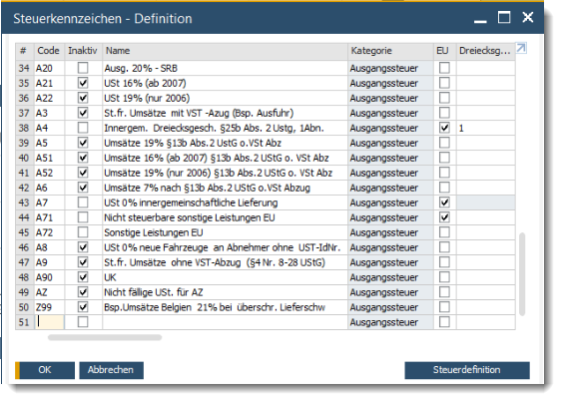

Creation of tax codes in SAP Business One

These tax codes are created in the "Administration" module under "Definition", "Financial accounting" and "Tax". In the "Tax codes" window, you can create the codes required for the company. For example, a typical SAP Business One client requires ten tax codes:

- Five input tax codes for the purchasing area

- five output tax codes for the sales area.

Setting options for tax codes

There are various setting options for creating tax codes. The coding of the tax codes is freely selectable. Inactive codes cannot be used when entering documents. The category also determines whether a tax code is used in purchase or sales documents. The "EU" characteristic determines whether documents with this tax code are relevant for the recapitulative statement. Further specifications relate to the type of service, such as intra-Community deliveries, other services or triangular transactions, as well as the definition as acquisition tax or reverse charge tax.

Reverse charge procedure

A special case is the so-called reverse charge procedure, in which the VAT liability is transferred to the recipient of the service. This applies to intra-Community acquisitions from other EU countries and certain situations under § 13b UStG. If an input tax code with this feature is used, the purchase tax is also posted in addition to the input tax. For special sales transactions, such as tax-free EU deliveries or services that are subject to the reverse charge procedure, certain mandatory information is required on invoices. These can be defined in the "Text for tax code on invoice" column.

Budgets in SAP Business One

Manage SAP Business One access rights

Keyboard shortcuts for SAP Business One documents

Customise SAP Business One user interface (UI)

New training programme for SAP Business One

Updates for SAP Business One 10.0 SP 2311

How to Assign Company Code to Company in SAP

Assign company code to company in sap.

The following SAP tutorials guide you on how to assign company code to the company in SAP step by step with screenshots.

Before assigning of company code to a company , you need to configure the following organizational units in SAP system

- Company code

After configuration of company and company code, all the company codes must be assigned to a company. So the integration between company code companies is established through this assignment.

- Menu Path: – SPRO –> IMG Reference –> Enterprise Structure –> Assignment –> Financial Accounting –> Assign Company Code To Company

- Transaction Code:- OX16

The following are the steps to Assign the Company Code to Company in SAP FICO

Step 1 :- Enter the T-Code SPRO in the commend field and enter to continue

Step 2 :- Click SAP Reference IMG

Step 3 :- Follow the SAP IMG menu Path as per the below screenshot

Step 4 :- Click Position

Update company code for which you wants to assign and Enter

Step 5 :- Update Company ID in Company field and click on save icon

Thus company code AD06 was assigned to Company ADARSH.

Learn how to assign company to company code in SAP S4 Hana system.

Watch Video for how to assign company code to the company in SAP step by step.

/support/notes/service/sap_logo.png)

1893984 - ALE intercompany : FD008, incorrect tax code

EDI invoice or in the case of a vendor posting of the intercompany billing in FI or in the MR01 invoice verification,the system uses an incorrect tax code or issues error message FD 008: "Assigning a new tax key for & and VAT 0.000 not possible".

SAPLIEDI, intercompany transaction, INVF, IDOC_INPUT_INVOIC_FI, T076M, OBCD, E1EDP04, E1EDK04 FD008, FD 008, tax code , KBA , FI-AP-AP-M , Ext. Interfaces/BAPIs/ALE , Problem

About this page

Search for additional results.

Visit SAP Support Portal's SAP Notes and KBA Search .

Privacy | Terms of use | Legal Disclosure | Copyright | Trademark

IMAGES

VIDEO

COMMENTS

You have the same minimum authorization as delivered with the Configuration Expert - Business Process Configuration (SAP_BR_BPC_EXPERT) business role template. Procedure In your configuration environment, use the search function to open the following activity: Assign Tax Code to Company Codes (ID: 101320).

Assign Tax Code To Company CodeFor SAP freelancing and Online SAP training contact on https://www.linkedin.com/in/hrushikes... or [email protected]

Tax Procedure To Company Code AssignmentFor SAP freelancing and Online SAP training contact on https://www.linkedin.com/in/hrushikes... or Hrushikesh.kaule@g...

Use. The company code is the central organizational unit of external accounting within the SAP System. You must define at least one company code before implementing the Financial Accounting component. The business transactions relevant for Financial Accounting are entered, saved, and evaluated at company code level. You usually create a legally independent company in the SAP System with one ...

new tax code is created by copying existing one and through the pricing conditions the validity is changed to old condition as 31.03.2011 and for the code it is maintained from 01.04.2011. how to assign this new code to company code? pl help. rgds, parijatha

These tax codes are created in the "Administration" module under "Definition", "Financial accounting" and "Tax". In the "Tax codes" window, you can create the codes required for the company. For example, a typical SAP Business One client requires ten tax codes: Five input tax codes for the purchasing area. five output tax codes for the sales area.

In a domestic business scenario which has tax jurisdiction active, when you try to release a billing document to accounting, you receive message "Company code & requires you to enter a tax jurisdiction code" (FF775).

Assignment of Assets to Company Code. You have to enter a company code when you create an asset. This ensures that each asset is always uniquely assigned to a company code. Status. An Asset Accounting company code can have one of the following statuses: Production status: Transfer of legacy asset data from your previous system is finished.

For this I went to spro-lg-basic settings-determination of excise etc and maintained new tax code by copying a similar one ( FTXP with Tax type V). Then I assigned the tax code to company code. The tax code is VE and description is ED 8%, Cess 2%, ECess 1%, CST 2%. Then I went to FV12 and maintained record for the condition types as follows ...

Menu Path:- SPRO -> IMG Reference -> Enterprise Structure -> Assignment -> Financial Accounting -> Assign Company Code To Company. Transaction Code:- OX16. The following are the steps to Assign the Company Code to Company in SAP FICO. Step 1:- Enter the T-Code SPRO in the commend field and enter to continue. Step 2:- Click SAP ...

This is a preview of a SAP Knowledge Base Article. Click more to access the full version on SAP for Me (Login required). Search for additional results. Visit SAP Support Portal's SAP Notes and KBA Search.

Enter Incoming Invoices. FI - Financial Accounting. 9. SM30. Call View Maintenance. Basis - Table Maintenance Tool. 10. FS00. G/L acct master record maintenance.