AML Analyst Cover Letter Examples & Writing Tips

Use these AML Analyst cover letter examples and writing tips to help you write a powerful cover letter that will separate you from the competition.

Table Of Contents

- AML Analyst Example 1

- AML Analyst Example 2

- AML Analyst Example 3

- Cover Letter Writing Tips

AML analysts are responsible for detecting and preventing money laundering. They work with banks, casinos, and other financial institutions to identify and investigate suspicious activity.

To get a job as an AML analyst, you need to have a strong understanding of financial systems and the ability to identify red flags. Use these examples and tips to write a cover letter that shows hiring managers that you’re the perfect candidate for the job.

AML Analyst Cover Letter Example 1

I am excited to be applying for the AML Analyst position at Topdown Bank. I have more than five years of experience working in the financial industry, and I have a proven track record of success in identifying and investigating money laundering and terrorist financing activities. I am confident that I have the skills and experience to be a valuable asset to your team.

In my previous role at ABC Financial, I was responsible for conducting investigations into high-risk customers and transactions. I utilized my knowledge of financial products and services to identify red flags and potential money laundering activities. I also worked closely with other departments within the company to develop and implement procedures to mitigate the risk of money laundering.

I have a strong understanding of the regulations and compliance requirements related to anti-money laundering. I am proficient in the use of financial investigation tools and software, and I have experience in conducting interviews with individuals and organizations. I am also a certified CFE.

I am confident that I have the skills and experience to be a valuable asset to your team. I look forward to discussing this opportunity further with you and learning more about how I can contribute to Topdown Bank’s success. My resume is enclosed for your reference.

AML Analyst Cover Letter Example 2

I am writing in regards to the open AML Analyst position that I saw on your website. I am confident that I have the skills and qualifications that you are looking for in a candidate.

I have been working in the AML industry for the past three years and have a wealth of experience and knowledge that I can bring to your company. In my previous roles, I have been responsible for conducting risk assessments, reviewing customer files, and developing and implementing compliance programs. I have a deep understanding of the regulations and laws governing the AML industry, and I am well-versed in the latest anti-money laundering techniques and tools.

I am a highly motivated and results-driven individual, and I am confident that I can exceed your expectations in this role. I am passionate about fighting financial crime, and I am confident that I can make a significant contribution to your company.

I have attached my resume for your review, and I would be happy to answer any questions you may have. I look forward to hearing from you soon.

AML Analyst Cover Letter Example 3

I am writing to express my interest in the AML Analyst position that you have posted. I believe that my experience and education make me a strong candidate for this position.

I have been working as an AML Analyst for the past two years at Bank of America, where I have gained extensive experience in all aspects of the job description. My primary responsibilities include monitoring transactions for suspicious activity, analyzing data to identify trends and patterns, and reporting findings to senior management. I also work closely with other departments to ensure that our policies are being followed and that we are meeting regulatory requirements.

My background in statistics has been extremely helpful in my current role. I have used statistical software such as SPSS and R to analyze large datasets and identify anomalies. I have also developed a strong understanding of how to interpret results and communicate them effectively to non-statisticians.

I am confident that my skills and experience would be a valuable addition to your team. I would welcome the opportunity to discuss this position with you further.

AML Analyst Cover Letter Writing Tips

1. highlight your experience.

When writing a cover letter for an AML analyst role, it’s important to highlight your experience and how it will help you in the role. Some great ways to do this include:

- Mentioning specific cases or projects you’ve worked on in the past that involved AML procedures.

- Explaining how you’ve used your experience and knowledge to develop new processes or improve on existing ones.

- Detailing the results of your work, such as how you helped increase the efficiency of the team or reduced the number of false positives.

2. Customize your cover letter

Just as you would for any other job application, it’s important to tailor your cover letter specifically for the AML analyst role. This means highlighting how your skills and experience make you the perfect candidate for the job.

Some ways to do this include:

- Discussing how your experience in risk assessment will help you spot potential money laundering activities.

- Highlighting your experience in data analysis and how you’ll be able to use this to help identify suspicious behavior.

- Mentioning your knowledge of financial regulations and how you’ll be able to ensure compliance with all relevant laws.

3. Show your commitment to the role

AML analysts are responsible for ensuring that their company is compliant with all relevant laws and regulations. As such, hiring managers are looking for candidates who are committed to the role and have a strong understanding of the laws and regulations that apply.

In your cover letter, make sure to discuss your commitment to the role and how you’ve gone above and beyond to learn about the laws that apply. For example, you could mention how you’ve read up on the latest changes to the AML regulations or how you’ve attended seminars and training courses on the subject.

4. Proofread your cover letter

Just as with any other job application, it’s important to proofread your cover letter for mistakes. This is especially important when applying for an AML analyst role, as any mistakes could be seen as a lack of commitment or understanding of the role.

Marketing Graphic Designer Cover Letter Examples & Writing Tips

Ecommerce customer service cover letter examples & writing tips, you may also be interested in..., case manager cover letter examples, airport operations agent cover letter examples & writing tips, medical laboratory technician cover letter examples & writing tips, document manager cover letter examples & writing tips.

AML Analyst Cover Letter Examples

A great aml analyst cover letter can help you stand out from the competition when applying for a job. Be sure to tailor your letter to the specific requirements listed in the job description, and highlight your most relevant or exceptional qualifications. The following aml analyst cover letter example can give you some ideas on how to write your own letter.

or download as PDF

Cover Letter Example (Text)

Dann Branger

(802) 622-5731

Dear Addisan Suhajda,

I am writing to express my interest in the AML Analyst position at HSBC Holdings plc, as advertised. With a solid foundation of five years of experience in anti-money laundering efforts at JPMorgan Chase & Co., I am eager to bring my expertise to your esteemed institution and contribute to the integrity and compliance of your financial services.

During my tenure at JPMorgan Chase & Co., I developed a keen eye for detail and a robust understanding of AML regulations and practices. My role involved actively monitoring transactional data to identify and investigate suspicious activities, ensuring compliance with the Bank Secrecy Act, the USA PATRIOT Act, and other regulatory requirements. I have honed my skills in utilizing advanced analytical tools to dissect complex financial data, which has been instrumental in the timely and accurate reporting of potential money laundering activities.

My ability to work collaboratively within a team, coupled with my capacity for independent decision-making, has allowed me to effectively navigate cross-departmental initiatives and contribute to the development of risk mitigation strategies. I have also participated in the creation and implementation of AML training programs, aimed at enhancing the knowledge and vigilance of staff across various departments.

I am particularly attracted to the opportunity at HSBC Holdings plc because of your global reputation for excellence in compliance and your commitment to preventing financial crime. I am confident that my proactive approach and continuous pursuit of knowledge in the ever-evolving landscape of AML compliance will make a valuable addition to your team.

I am looking forward to the opportunity to discuss how my experience and skills align with the needs of your company. Thank you for considering my application. I am excited about the prospect of contributing to HSBC Holdings plc and am eager to further discuss how I can be an asset to your team.

Warm regards,

Related Cover Letter Examples

- Business Analyst Consultant

- Business Analyst Manager

- CRM Analyst

- Sales Analyst

- Benefits Analyst

Resume Builder

- Resume Experts

- Search Jobs

- Search for Talent

- Employer Branding

- Outplacement

Analyst, AML Cover Letter

15 analyst, aml cover letter templates.

How to Write the Analyst, AML Cover Letter

In response to your job posting for analyst, AML, I am including this letter and my resume for your review.

In my previous role, I was responsible for sME feedback on products used in broker dealer/Capital Markets, SWIFT messages, Checks, ACH etc ;and use the product knowledge to monitor activity for Anti Money Laundering.

I reviewed the requirements of the job opening and I believe my candidacy is an excellent fit for this position. Some of the key requirements that I have extensive experience with include:

- Works independently or oversees the assessment of the Quality Controls in place within AML

- Oversees the assigned portfolio analysis in support of financial, regulatory and risk management requirements

- Provides direction and guidance and assists staff with most complex aspects of work as necessary

- Analyzes the quality of key risk components of assigned portfolios and provides analysis of portfolio risks and makes recommendations to Senior Management regarding the direction of future activities

- Resolves escalated issues and problems by conferring with senior management, staff in other internal departments, outside

- Supports the assigned portfolio analysis in terms of financial, regulatory and risk management requirements considering current economic environments and forecast impact

- Deals with complex analytical initiatives and interact with TDBG businesses

- Works independently with the assessment of the Quality Controls in place within AML

Thank you for taking your time to review my application.

Robin Predovic

- Microsoft Word (.docx) .DOCX

- PDF Document (.pdf) .PDF

- Image File (.png) .PNG

Responsibilities for Analyst, AML Cover Letter

Analyst, AML responsible for thought leadership, high quality advice and communications to internal stakeholders in relation to sanctions, export controls and anti-money laundering.

Analyst, AML Examples

Example of analyst, aml cover letter.

I submit this application to express my sincere interest in the analyst, AML position.

In my previous role, I was responsible for support to Money Laundering Reporting Officer (MLRO) in Seoul Branch on AML & Sanctions queries.

Please consider my qualifications and experience:

- Experience with analyzing customer financial transactions for Title 31 compliance

- A professional AML qualification (ICA Advanced AML Certificate or similar) would be welcomed although not essential

- Experience of the intelligence cycle and/or investigating financial crime preferably through working in an AML role in a regulated industry or for a regulatory body

- Experience of working as part of the retail gambling market would be beneficial especially if in an AML or other risk role

- Anti-Money Laundering (AML) experience preferred

- Proven track record of building effective, collaborative relationships in a highly ma

- Proficient in Excel (e.g., pivot tables, building formulas and macros) and SQL(optional)

- Experience and/or strong knowledge in BSA/AML/OFAC Compliance, providing support to Compliance-related technology applications, or equivalent related experience preferred

Thank you in advance for taking the time to read my cover letter and to review my resume.

Denver Daugherty

I am excited to be applying for the position of analyst, AML. Please accept this letter and the attached resume as my interest in this position.

Previously, I was responsible for independent assessments of AML/ATF/Sanctions/Anti-Bribery, Anti-Corruption (ABAC) control effectiveness and reporting of material issues.

- Maages complex analytical initiatives and interacts with TDBG businesses

- Strong understanding of AML regulations

- Accountable for ensuring compliance with Sections 311, 314, 351, 352, and 356 of the USA PATRIOT Act (USAPA) covering Jurisdictions/Financial Institutions/Transactions of Primary Money Laundering Concern, Cooperation Efforts to Deter Money Laundering, Reporting of Suspicious Activity, Anti-Money Laundering Programs, and Reporting of Suspicious Activities by Securities Brokers and Dealers, respectively

- Research potentially suspicious customer activities

- Conduct comprehensive reviews (following approved processes/guidelines)

- Assess risks and provide recommendations to maintain/demarket client based on assessment and risk of client

- Identify unusual/conflicting information through analysis and assessment

- Work with team members to ensure resolution of problems efficiently

Sutton Grant

Previously, I was responsible for subject matter expertise in the area of AML, BSA, and Economic Sanctions related issues including identifying, assessing and managing the risks associated with money laundering and terrorist financing.

- Fraud Detection and Prevention - Working Experience

- Operational Risk - Working Experience

- Able to work in a fast paced, dynamic environment with little supervision

- The business analyst will work closely with the work stream manager, key business stakeholders and technology to define and implement business requirements, functional specifications, operational process documents, project plans and weekly status update, testing implementations and to record, track and help resolve test issues

- Serve as the conduit between the customer community and the software development team through which requirements flow

- Expert knowledge in several statistical techniques (Generalized linear modeling, Time Series, CART, Decision Trees, Neural Networks, Factor analysis experimental design, hypothesis testing, and/or advance techniques)

- Experience with HP ALM an asset

- Documentation background around compliance or regulatory projects

I really appreciate you taking the time to review my application for the position of analyst, AML.

Tyler Bahringer

Previously, I was responsible for advice and support to other teams within the FCC, including Sanctions and Anti-Bribery & Corruption and the greater AML team.

- Experience in application interface design, modelling, and implementation with SAS programming including PROC SQL interactions with Oracle and SQL Server

- Release management (source control and deployment) best practices for production SAS solutions

- Financial industry and BSA/AML Monitoring Applications experience strongly preferred

- In-depth knowledge of AML product (MANTAS, BAE Detica/NetReveal)

- Certification in ACMS/CAMS is preferred

- Good knowledge of real-time integration technologies (TIBCO) and batch ETL (Teradata)

- Hands-on experience in process documentation, business analysis, consulting in banking

- Understanding of cash management and payment processing in an international banking environment

Thank you for your time and consideration.

Justice Johns

Previously, I was responsible for leadership on a small, hands-on team to execute and/or oversee all aspects of WU’s AML/CTF programs in Australia and other Oceania markets.

- AML related experience in a Large US Bank or related institution

- Skilled in documentation of Technical Requirements

- Experience in triaging business needs\Requirements, documenting Technical Requirements and

- Experience with Actimize products and\or Oracle Mantis products

- Experience with Banking deposit accounts and transaction processing

- Institutional knowledge of products and services business unit policies and objectives

- Written, Reading and Spoken Fluency in German and English is Essential

- Generate user flows, use cases, and workflows

Emery Lueilwitz

Related Cover Letters

Create a Resume in Minutes with Professional Resume Templates

Create a Cover Letter and Resume in Minutes with Professional Templates

Create a resume and cover letter in minutes cover letter copied to your clipboard.

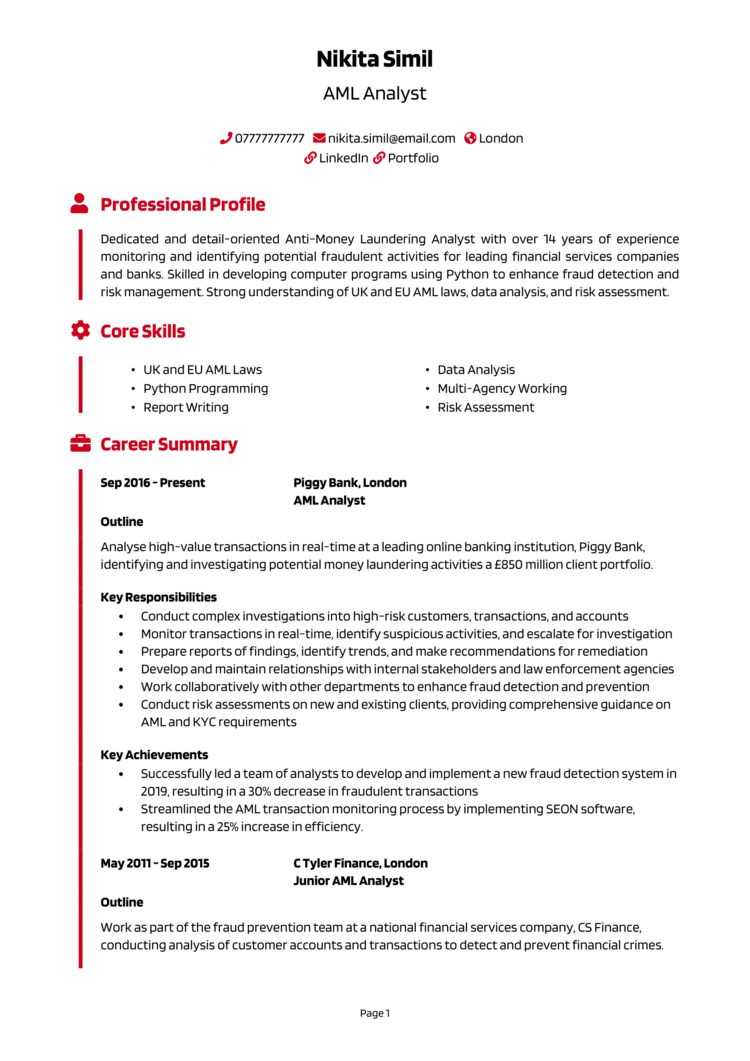

Anti Money Laundering Analyst Cover Letter Example

Your Anti Money Laundering Analyst Cover Letter acts as a Sales Pitch as it is a quick intro document where you get introduced to your hiring employer, and provide details about your strengths, and accomplishments. It offers an insight into your personality, attitude, and how well you would fit with the company. Our Anti Money Laundering Analyst Cover Letter Sample written below is an illustration of it!

An Anti Money Laundering Analyst investigates and monitors suspicious financial activities. The job description is to ensure that the companies comply with AML regulations. Common work activities include – collecting and examining financial statements and documents, assisting in identifying unusual transaction patterns, and creating new case files as needed based on suspicious activities.

- Cover Letters

- Accounting & Finance

What to Include in a Anti Money Laundering Analyst Cover Letter?

Roles and responsibilities.

- Helping the AML team in tracking and completing case files to investigate suspicious activities.

- Preparing and reviewing file documents for AML investigations .

- Coordinating with the AML team to ensure transactions are appropriately documented.

- Conducting periodic reviews of the company’s high-risk customers.

- Investigating and assessing the financial risks posed by the company’s operations.

- Monitoring and regulating high-risk activities.

- Examining data and solutions to verify all AML regulations are met.

Education & Skills

Anti money laundering analyst skills:.

- A complete understanding of the firm’s business.

- Strong comprehension of the data sources.

- Keeping up with new compliance requirements and interpreting them.

- Decent communication skills.

- Staying current with money laundering and terrorist financing behaviors, issues, policies, regulations, criminal typologies, and industry best practices.

Anti Money Laundering Analyst Education Requirements:

- Bachelor’s degree in research, business, accounting, or criminal justice.

- Work experience in banking risk & compliance.

- Familiarity with AML issues and suspicious transaction monitoring systems.

Anti Money Laundering Analyst Cover Letter Example (Text Version)

Dear Hiring Manager,

Upon learning of your requirement for an experienced and professional Anti Money Laundering Analyst for your company, I felt compelled to send my resume for your consideration. As a highly skilled and experienced professional in this field, I am confident that I will be a great contribution to your company, and would prove to make a valuable addition working in this role.

My background spans more than 15 years as an AML Analyst at ***, undertaking responsibility for collecting, evaluating, and reconciling various financial statements and documents. Besides, while on my job, my experience earned me recognition for my well-rounded skill set, including critical thinking and analytical abilities. Moreover, I excel at –

- Excelling in compiling and analyzing data; extensive knowledge of finance and accounting; with a thorough knowledge of the anti-laundering laws and procedures, ensuring that the field conducts all transactions according to the laws.

- Reviewing documents to prevent fraud, money laundering, and identifying theft losses; monitoring and analyzing currency transaction logs, and performing field audits for more than 25 clients.

- Analyzing accounting statements to look for patterns that result in illegal, fraudulent activities.

- Finely honed skills in tracking suspicious money transfers or other transactions, and checking authenticity to determine validity, ability to stay up-to-date on all AML procedures, and standards pertaining to the industry.

Apart from these qualifications, my excellent verbal skills, and the ability to articulate information clearly and concisely, along with my flexibility to travel, positions me well to undertake this role as an Anti Money Laundering Analyst in your company. I have included my completed work profile, history, and reference in my resume for your consideration.

A chance to meet you in person, and discuss further to move things ahead would be appreciated. Thank you for your time and consideration.

Sincerely, [Your Name]

An Anti Money Laundering Analyst should be detail-oriented, efficient, and financially savvy. As you professionals are in charge of fraud detection, your resume should represent this quality of yours. Highlight your strength as an AML analyst, and make employers feel that they can entrust you with their money, customers, and business. And, one best way to win their heart is through your cover letter. In addition to our cover letter samples, be sure to check out our Anti Money Laundering Analyst Resume Samples .

Customize Anti Money Laundering Analyst Cover Letter

Get hired faster with our free cover letter template designed to land you the perfect position.

Related Accounting & Finance Cover Letters

Cover Letter for Anti-Money Laundering (AML) Analyst

[An anti-money laundering (AML) analyst or officer basically investigates monitors and manages suspicious financial activity. Below briefly focus on sample Cover Letter for Anti-Money Laundering (AML) Analyst. These professionals are responsible for detecting and monitoring suspicious transactions in an effort to prevent money laundering. The skills required for these professionals include – research competencies, computer proficiency, analytical skills, and solid financial expertise are paramount. You can make any change to the below application as per your needs.]

Candidate/Your Name…

Full Address…

Contact No…

Mail Address…

Date: DD/MM/YY

Management Authority name…

Job Designation…

Department name…

Sub: Cover Letter for Anti-Money Laundering (AML) Analyst

Dear (Sir/Name),

I am applying for the position of AML Analyst with (Institute/Organization Name) and I have a (degree Name) in business administration. (Describe in your words). With more than (***) years’ experience as an AML Analyst, I am adept in the collection evaluation and reconciliation of a wide range of financial documents and statements.

My present/previous place of work highly values my ability to analyze and monitor various forms of potentially suspicious transactions. I am computer savvy and have the ability to manage databases of all sizes. (Describe all about your job experiences). Reviewing clients’ transaction that may violate anti-money laundering or economic sanctions, monitoring alerts, communications, and workflows is an area that I have cut out a niche for myself. I have experience compiling and analyzing data and I have extensive knowledge of finances and accounting. In addition to my experience and personal qualities I have a solid educational foundation and a passion for transparency in the financial field. (Describe all about your educational qualification). I have a complete understanding of the anti laundering laws and procedures with the ability to ensure that your organization performs all transactions according to these laws.

I have experience analyzing accounting statements to look for any patterns that could be the result of any type of illegal or fraudulent activity, which could be devastating to your business. (Describe all about your job qualifications). I have the skills to track any suspicious money transfers or other transactions and the skills to check their authenticity to determine if they are valid. I have the ability to keep your organization up-to-date on all AML procedures and standards as they relate to this industry.

I possess excellent verbal skills with the ability to convey information in a clear and concise manner. I am dependable, trustworthy and I have the ability to travel when necessary. (Express your confidence and dedication). I have included a complete look at my work history and references in my resume.

You can reach me by calling (*****) and I hope to meet with you soon to discuss the details of this position in more detail. (Cordially describe your greetings and expectation). Thank you for your time and consideration, and I look forward to hearing from you.

Respectfully,

Contact info. and Signature…

Encl: Resume and others….

Cover Letter for Affiliate Manager

Cover Letter for Employment at Filling Station

Cover Letter for Adjudicator Job Position

Cover Letter for External Auditor

Chemical Vapour Deposition Method for Preparation Crystal

Define Fusion, Vaporization and Condensation

How much does Eating Meat influence a Country’s Emissions of Greenhouse Gases?

Mechanism of Action of Thyroid Hormone

Study found Stress and Depression during Pandemic linked with Lower Quality Sleep

Disadvantages of Credit Cards

Latest post.

Nano-oscillator Achieves Record Quality Factor

Not Only Do Opposites Attract: A New Study Demonstrates That Like-Charged Particles Can Come Together

A Breakthrough in Single-photon Integration Shows Promise for Quantum Computing and Cryptography

Could the Sun be Conscious? Enter the Unorthodox World of Panpsychism

The Brains of Conspiracy Theorists Are Different: Here’s How

Baltimore’s Key Bridge Collapses Following Container Ship Collision

- Resume Builder

- Resume Templates

- Resume Formats

- Resume Examples

- Cover Letter Builder

- Cover Letter Templates

- Cover Letter Formats

- Cover Letter Examples

- Career Advice

- Interview Questions

- Resume Skills

- Resume Objectives

- Job Description

- Job Responsibilities

- FAQ’s

AML Analyst Resume Examples

A resume for an AML Analyst position is a critical tool for success in the job search process. It helps employers quickly identify candidates who are qualified for the job. A well-written and formatted AML Analyst resume should highlight the most relevant skills and experiences that you possess that make you the ideal candidate for the job. This comprehensive guide will provide useful tips and examples for crafting an impressive AML Analyst resume. It will also help you understand what employers are looking for in a candidate and how to best position yourself to be selected for a job interview.

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples .

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

AML Analyst

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: [email protected]

A motivated and experienced AML Analyst with a passion for financial compliance and regulations. Highly knowledgeable in both domestic and international banking regulations and laws that govern the financial industry. Excellent track record in the successful identification and resolution of suspicious activity, as well as the implementation of successful compliance measures.

Core Skills

- Strong knowledge of the Bank Secrecy Act (BSA) and its associated regulations

- Proficient in AML/BSA investigative techniques and processes

- Highly detail- oriented and organized

- Excellent problem- solving and analytical skills

- Proficient in multiple financial software applications

- Advanced knowledge of fraud detection and prevention

- Strong understanding of KYC and enhanced due diligence procedures

- Excellent written and verbal communication skills

Professional Experience AML Analyst, ABC Bank, 2018- Present

- Analyze customer transactions to detect suspicious activity and prepare detailed reports

- Monitor customer accounts for any suspicious or unusual activity

- Conduct research on customer backgrounds and activities including KYC checks

- Analyze customer information to accurately assess risk

- Conduct training sessions and educate staff on banking regulations and compliance

- Assist in the development of new AML policies and procedures

- Conduct AML/BSA audits and reviews

- Develop and maintain relationships with law enforcement and regulatory agencies

Education Bachelor of Science in Finance, University of XYZ, 2016- 2018

Create My Resume

Build a professional resume in just minutes for free.

AML Analyst Resume with No Experience

Recent college graduate with a degree in Business Administration and a passion for data analysis and financial operations. Seeking to leverage my analytical skills and knowledge of financial software and systems to help support the AML Analyst team.

- Proficient in Microsoft Office Suite, including Excel, Access and PowerPoint

- Knowledge of financial software and systems

- Strong analytical and problem- solving skills

- Excellent communication and interpersonal skills

- Ability to work effectively in a team environment

Responsibilities :

- Assist in the development and implementation of AML compliance processes and procedures

- Monitor accounts for suspicious activity and investigate any discrepancies

- Conduct audits to ensure compliance with AML regulations

- Provide recommendations for improvement of existing policies and procedures

- Assist with customer onboarding and KYC processes

- Conduct research and analysis of customer data and records

Experience 0 Years

Level Junior

Education Bachelor’s

AML Analyst Resume with 2 Years of Experience

A highly motivated and self- directed analyst with two years of experience in Asset Management and Lending (AML). Demonstrated success in analyzing financial information and identifying compliance risks. Experienced in developing and executing AML compliance policies and procedures. Strong analytical and problem- solving skills, with a commitment to accuracy and excellent customer service.

Core Skills :

- Financial Analysis

- AML Compliance

- Risk Analysis

- Regulatory Compliance

- Process Improvement

- Problem Solving

- Report Writing

- Investigative Analysis

- Conducted financial analysis to identify non- compliance or suspicious activities in accordance with applicable AML regulations.

- Created and implemented AML compliance policies and procedures to ensure compliance with applicable regulations.

- Developed and maintained AML filter parameters and monitoring scenarios to identify suspicious activity.

- Analyzed and reported on regulatory developments to ensure AML compliance.

- Assessed customer risk profiles and monitored customer activities for potential AML compliance issues.

- Investigated suspicious activity and drafted reports outlining the findings.

- Developed and implemented process improvements to enhance operational efficiency and reduce costs.

Experience 2+ Years

AML Analyst Resume with 5 Years of Experience

A highly accomplished and detail- oriented AML Analyst with 5 years of professional experience in conducting financial crime investigations and developing money laundering policies. Possesses expertise in analyzing financial transactions and detecting signs of suspicious activity. Experienced in managing and analyzing high- volume data, identifying potential risks and implementing effective solutions. Possesses excellent research, analytical and problem- solving skills, and the ability to communicate effectively with stakeholders and colleagues.

- Advanced knowledge of KYC, AML, and Fraud Analytics

- Ability to identify, investigate, and report suspicious activity

- Knowledge of financial crime regulations, compliance policies and procedures

- Proficient in using various investigation tools, including Excel

- Excellent communication and writing skills

- Identified and investigated suspicious financial transactions using transaction monitoring and data analysis tools

- Performed KYC (Know Your Customer) reviews to ensure compliance with AML regulations

- Researched and identified activities potentially associated with money laundering

- Developed and implemented policies to detect and prevent money laundering and other financial crimes

- Drafted reports to senior management on suspicious activity, money laundering cases, and risk assessments

- Assisted in developing and maintaining internal control processes and procedures

- Conducted financial crime investigations and analysis to detect money laundering and fraud

- Analyzed large amounts of data to detect anomalies, trends and irregularities

- Reviewed new and existing customer accounts for compliance with AML law and regulations

Experience 5+ Years

Level Senior

AML Analyst Resume with 7 Years of Experience

I am an experienced and professional AML (Anti- Money Laundering) Analyst, with more than 7 years of expertise in the financial industry. My experience includes handling complex client transactions, identifying and investigating suspicious activities, enabling the smooth functioning of financial systems, and ensuring compliance with AML regulations. I possess excellent analytical, technical, and communication skills, which have enabled me to provide complete assistance to financial institutions on various aspects of AML, KYC, and Regulatory Compliance. I also have a deep understanding of the systems and procedures for preventing, detecting, and tracking financial terrorist activities.

- Strong Analytical Skills

- Excellent Knowledge of AML and KYC Regulations

- Highly Experienced in Anti- Money Laundering Investigations

- Proficient in Regulatory Compliance

- In- depth Understanding of Financial Systems

- Good Understanding of Financial Terrorist Activities

- Proficient in Risk Assessment and Risk Analysis

- Monitoring and analyzing financial transactions for suspicious activities

- Ensuring compliance with Anti- Money Laundering (AML) regulations and Know Your Customer (KYC) procedures

- Conducting investigations into suspicious activities and reporting findings to the senior management

- Developing and maintaining a database of customer information and transaction records

- Providing customer support on AML and KYC compliance issues

- Identifying and analyzing financial risks and threats, and developing strategies to mitigate them

- Assisting in the implementation of AML and KYC compliance policies and procedures

- Performing periodic reviews of customer accounts to ensure compliance with AML regulations

- Providing training on financial regulations and fraud prevention to staff members.

Experience 7+ Years

AML Analyst Resume Resume with 10 Years of Experience

Highly experienced AML Analyst with 10 years of experience in the financial services industry. Adept at monitoring customer accounts to detect unusual activity, performing customer risk assessments, and ensuring compliance with all applicable laws and regulations. Possesses excellent analytical skills, a keen eye for detail, and the ability to work well under pressure.

- Experienced in Anti- Money Laundering (AML)

- Able to identify and assess customer risk

- Excellent analytical, problem- solving and organizational skills

- Knowledge of financial instruments and transaction types

- Proficient in using MS Office and AML software

- Strong written and verbal communication skills

- Able to work independently and as part of a team

- Monitor customer accounts to detect any unusual or suspicious activity

- Perform customer risk assessments to identify any potential money laundering or other fraudulent activities

- Analyze customer transactions and make recommendations for further investigation

- Ensure compliance with all applicable laws and regulations, including the Bank Secrecy Act, PATRIOT Act, and OFAC regulations

- Assist with customer due diligence and customer onboarding process

- Review customer documentation for accuracy and completeness

- Generate reports and provide them to senior management

- Maintain detailed records and prepare regular status updates on compliance activities

- Participate in internal and external audits, as required

Experience 10+ Years

Level Senior Manager

Education Master’s

AML Analyst Resume Resume with 15 Years of Experience

A highly experienced AML Analyst with over 15 years of professional experience in the banking and financial services industries, adept at detecting and managing financial crime risks through a range of techniques, including periodic reviews and customer profiling. Experienced with compliance, risk management, and data analysis, with a sound knowledge of relevant regulations and best practices in the banking and financial services sector. Proven track record of success in identifying suspicious activity, conducting timely investigations and collaborating with the relevant stakeholders to mitigate potential risks.

- Extensive knowledge of banking and financial services industry regulations, procedures and best practices

- Experienced in developing and implementing AML compliance standards and procedures

- Proficient in the use of software applications to analyze large sets of data, identify anomalies and detect suspicious activity

- Ability to identify potential risks and take appropriate action

- Highly organized with attention to detail

- Proven track record of success in customer profiling

- Conduct customer due diligence and periodic reviews to identify suspicious activity

- Develop and implement AML compliance strategies and procedures

- Monitor customer accounts for any suspicious activity and escalate as needed

- Collaborate with stakeholders such as law enforcement, regulators, and other financial institutions to ensure compliance with regulations

- Keep abreast of current developments in the banking and financial services industry

- Analyze customer data to identify suspicious activity, including money laundering and terrorist financing

- Prepare reports and documents for internal and external review

- Provide guidance and support to colleagues on AML related topics

Experience 15+ Years

Level Director

In addition to this, be sure to check out our resume templates , resume formats , cover letter examples , job description , and career advice pages for more helpful tips and advice.

What should be included in a AML Analyst Resume resume?

A resume for a AML Analyst should contain information that outlines the individual’s qualifications, experience, and any special training related to the position. When creating a resume for an AML Analyst position, there are certain key elements that should be included.- Education: Be sure to include any degrees, certifications, or educational courses related to the position of AML Analyst. This can include a degree in finance, economics, accounting, or a related field.

- Experience: Include any relevant experience in the financial industry as a AML Analyst. This should include any past roles and responsibilities related to AML compliance.

- Knowledge: This should include any specialized knowledge related to AML compliance that the individual has acquired. This could include an understanding of banking regulations, anti-money laundering legislation, or other AML related topics.

- Technical Skills: Include any technical skills related to AML compliance that the individual possesses. This can include software proficiency, familiarity with databases, or any other technical skills related to the position.

- Communication Skills: Outline any communication skills that the individual possesses that are relevant to the position. This can include abilities to effectively collaborate with colleagues and customers, as well as the ability to present data and information in a clear manner.

By including these elements in an AML Analyst resume, the individual will be able to demonstrate their qualifications for the position and make themselves a more attractive candidate for employment.

What is a good summary for a AML Analyst Resume resume?

A good summary for an Anti-Money Laundering (AML) Analyst Resume should highlight the candidate’s expertise in AML compliance and regulations. It should also mention the candidate’s experience in conducting AML investigations, analyzing suspicious activities, and performing risk assessments. The summary should also include the candidate’s ability to work collaboratively with team members, as well as their knowledge of banking and financial systems. Finally, the summary should emphasize any special qualifications the candidate has, such as certifications and other relevant training.

What is a good objective for a AML Analyst Resume resume?

A well-constructed objective for an AML Analyst Resume should clearly communicate the candidate’s professional goals and qualifications. A good objective for an AML Analyst Resume should focus on the following points:

- Increase proficiency in identifying suspicious financial activities and complying with AML regulations

- Utilize financial software to analyze and monitor financial transactions

- Develop and implement AML procedures and policies

- Monitor customer accounts to detect suspicious activities

- Participate in audits to ensure compliance with AML regulations

- Create and manage financial reports and documents

- Liaise with internal and external stakeholders to ensure timely and accurate completion of AML tasks

- Remain up-to-date with the latest AML regulations

- Enhance AML process efficiency and effectiveness through innovative solutions.

How do you list AML Analyst Resume skills on a resume?

When listing AML Analyst skills on a resume, you should focus not only on the technical capabilities and experience that are directly related to the role, but also the personal qualities that will make you stand out from other applicants. Below are some skills and qualifications that are beneficial to highlight in an AML Analyst resume:

- In-depth understanding and knowledge of AML regulations and laws

- Expertise in AML/KYC systems and applications

- Proficiency in financial analysis and data analysis

- Strong ability to detect suspicious financial transactions and patterns

- Excellent communication and problem-solving skills

- Ability to work independently and in a team

- Experience with AML compliance processes and procedures

- High attention to detail and accuracy

- Ability to identify areas of risk and take decisive action to address them

- Ability to manage multiple projects and prioritize tasks

What skills should I put on my resume for AML Analyst Resume?

When applying for a role as an anti-money laundering (AML) analyst, it’s important to make sure that your qualifications are highlighted on your resume. Your resume should include a combination of skills and experiences that demonstrate your knowledge of banking regulations and financial crime prevention. Here are some of the key skills employers will be looking for when reviewing your AML analyst resume:

- Thorough knowledge of banking regulations and financial crime prevention

- Familiarity with anti-money laundering laws, regulations, and procedures

- Strong analytical and problem-solving skills

- Ability to interpret and analyze financial data

- Excellent interpersonal and communication skills

- Proficient in Microsoft Office Suite (Excel, Word, PowerPoint, etc.)

- Ability to identify suspicious activities

- Ability to develop and maintain relationships with clients

- Strong organizational and time management skills

- Ability to work independently and as part of a team

By showcasing these skills and qualifications on your resume, you’ll demonstrate to employers that you’re the ideal candidate for the role of an AML analyst.

Key takeaways for an AML Analyst Resume resume

An Anti-Money Laundering (AML) Analyst resume is a vital component of an AML Analyst’s job search. While it is important to include information about education, experience, and certifications, it is also important to include certain key takeaways that will help the resume stand out from the competition. Here are the key takeaways for an AML Analyst resume:

- Put your experience in the spotlight. Make sure that you highlight the experience you have with AML compliance and financial crime prevention. Ensure that you include any specific software or systems you have worked with, as well as any specialized roles you have performed.

- Show off your hard skills. As an AML Analyst, you will need to demonstrate your knowledge of various AML regulations, financial instruments, and risk management practices. List any specialized courses or certifications that you have completed that relate to AML and financial crime.

- Demonstrate your aptitude for data analysis. As an AML Analyst, you will need to be able to analyze large amounts of data to identify suspicious activity. Make sure to include any data analysis tools, such as Excel and SQL, that you are proficient in.

- Show off your soft skills. As an AML Analyst, you need to have excellent communication and problem-solving skills. Make sure to include any additional soft skills, such as customer service and collaboration, that are necessary for your role.

By following these key takeaways, you can create an AML Analyst resume that will make you stand out from the competition. Make sure to highlight your experience, knowledge, and skills to give potential employers an accurate representation of how you can contribute to their team.

Let us help you build your Resume!

Make your resume more organized and attractive with our Resume Builder

- ResumeBuild

- Aml Analyst

5 Amazing aml analyst Resume Examples (Updated 2023) + Skills & Job Descriptions

Build your resume in 15 minutes, aml analyst: resume samples & writing guide, employment history.

- Perform customer due diligence and enhanced due diligence

- Provide AML training and guidance to employees

- Analyze customer data and documents for AML compliance

- Monitor changes in AML regulations and ensure compliance

- Prepare reports and presentations on AML compliance

- Maintain and update customer information in the AML database

Do you already have a resume? Use our PDF converter and edit your resume.

Simon Daniels

- Prepare and submit suspicious activity reports to regulatory authorities

- Monitor transactions for suspicious activity and investigate any potential violations of AML regulations

- Liaise with internal and external stakeholders to ensure compliance

- Review customer profiles for potential money laundering

- Develop and maintain AML policies, procedures, and controls

- Develop and implement AML risk assessment programs

- Analyze suspicious activity reports and other financial data

- Conduct internal and external audits of AML processes

Todd Foster

Professional summary.

- Review customer transactions for compliance with AML regulations

Francis Young

Not in love with this template? Browse our full library of resume templates

Table of Content

- Introduction

- Resume Samples & Writing Guide

- Resume Example 1

- Resume Example 2

- Resume Example 3

- Resume Example 4

- Resume Example 5

- Jobs Description

- Jobs Skills

- Technical Skills

- Soft Skills

- How to Improve Your Resume

- How to Optimize Your Resume

- Cover Letter Example

aml analyst Job Descriptions; Explained

If you're applying for an aml analyst position, it's important to tailor your resume to the specific job requirements in order to differentiate yourself from other candidates. Including accurate and relevant information that directly aligns with the job description can greatly increase your chances of securing an interview with potential employers. When crafting your resume, be sure to use action verbs and a clear, concise format to highlight your relevant skills and experience. Remember, the job description is your first opportunity to make an impression on recruiters, so pay close attention to the details and make sure you're presenting yourself in the best possible light.

aml analyst

- Conduct BSA monitoring program which includes exception monitoring, clearing, investigating and reporting in accordance with BSA/AML policies and procedures.

- Assist in the identification, risk assessment and on-going monitoring of high risk accounts for suspicious activity.

- Responsible for identifying and researching the patterns, trends and anomalies in complex transactions and customer data to detect, prevent, mitigate and report suspicious activity related to money laundering, terrorist financing and structuring of funds.

- Cross trained to adverse media cases, and investigates whether the alerted adverse media article is pertaining to the actual customer based on risk-based approach.

- Good knowledge on USA regulations

- Experience on SCC (Special category clients) accounts and investigations.

- Conduct meaningful analysis and assign an appropriate risk rating to clients as well as prepare a concise but comprehensive narrative and recommendation report whether to or not to file a Suspicious Transaction Report with FINTRAC (Financial Transactions and Reports Analysis Centre of Canada).

- Prepare and transmit STR electronically to FINTRAC where an investigation proves the need to file STR on the client/account under review by using provided template and following laid down policies and procedures for STR Filing with FINTRAC

- Scan clients against databases to identify names/entities that relate to money laundering and/or terrorist financing, sanctioned Persons .

- Appointed as a team coach within 4 months which deepened and broadened my leadership skills through training programs and coaching new analyst by providing side-by-side support as well as assisting existing colleagues with inquiries in a professional and responsive manner by giving them appropriate guidance and referring to team lead where necessary.

- Improved the team’s productivity by 30% within 2 months as a Team Coach by documenting procedures and making recommendations to streamline current processes to consolidate them under proceedures that encompassed all programs needed to reach business needs leading to more timely insights.

- Chosen for Special Projects team – Team of seasoned Analyst that reviewed and resolved Tier2 Escalated cases that led to 60% reduction of Tier 2 and which probelled the bank to meeting its regulatory filing requirements in Q3 and Q4of 2018

- Member of Promontory Social Experience team – a committee that supports diversity by improving and fostering positive social environment in the workplace to create a sense of togetherness among co-workers to reflect the IBM brand thereby delivering high employee engagement and motivation.

- Holistic investigations for the alerts generated by the monitoring program and branch.

- Adhered to and complied with the applicable, federal and state laws, regulations and guidelines, including those related to Anti-money laundering.

- Monitor transactions to identify potential suspicious activity or any false positives.

- Investigation on all bank products.

- Identified patterns and trends consistent with money laundering, terrorist financing and flagged any suspicious activities detected. Investigate source and destination of funds to ascertain legitimacy of funds and its use, from account level investigations to customer level investigation and linked counterparts.

- Reporting anomalous customer profile to authorities as per regional standards and requirements.

- Analyzed transactions activity of correspondent banking transactions.Researched, Articulated and reviewed transactions on daily basis.

- Performed detailed analyses to detect patterns,trends,anomalies and schemes in transactions and relationships across multiple business/products.

- Analysed multiple significant cases,red flags and patterns associated with the laundering of illicit funds.Established investigation and make risk-based approach for each situation. Identified anomalies and escalations as they relate to AML initiatives.

- Responsible for identifying and researching the patterns, trends and anomalies in complex transactional and customer data to detect, prevent, mitigate and report suspicious activity related to money laundering, terrorist financing and structuring.

- Identifying the risk based alerts and escalating to the Senior Management for any actions.

- Identifying the duplicate alerts which are already closed under different result ID in order improve the work efficiency.

- Training to the team in closing the alerts if any difficulties occur

- Performing OFAC Sanction watch list testing on Bridger as per regulatory requirement and providing the status on weekly basis.

- Complete MIS management of alerts generated on Bridger.

- Reviewing of alerts raised by Accounts Payable team for new vendor creations.

- Identifying the material alerts which could pose reputational risk to the entity and taking necessary actions on such alerts.

aml analyst Job Skills

For an aml analyst position, your job skills are a key factor in demonstrating your value to the company and showing recruiters that you're the ight fit for the role. It's important to be specific when highlighting your skills and ensure that they are directly aligned with the job requirements, as this can greatly improve your chances of being hired. By showcasing your relevant skills and experience, you can make a compelling case for why you're the best candidate for the job.

How to include technical skills in your resume:

Technical skills are a set of specialized abilities and knowledge required to perform a particular job effectively. Some examples of technical skills are data analysis, project management, software proficiency, and programming languages, to name a few. Add the technical skills that will get hired in your career field with our simple-to-use resume builder. Select your desired resume template, once you reach the skills section of the builder, manually write in the skill or simply click on "Add more skills". This will automatically generate the best skills for your career field, choose your skill level, and hit "Save & Next."

- Data Analysis

- Database Management

- Financial Management

- Risk Management

- Quality Assurance

- Troubleshooting

- Visualization

- Process Improvement

- Business Acumen

- Project Management

- Technical Writing

- Computer Literacy

- Strategic Thinking

- Documentation

- Regulatory Compliance

- Anti-Money Laundering

- Software Development.

How to include soft skills in your resume:

Soft skills are non-technical skills that relate to how you work and that can be used in any job. Including soft skills such as time management, creative thinking, teamwork, and conflict resolution demonstrate your problem-solving abilities and show that you navigate challenges and changes in the workplace efficiently. Add competitive soft skills to make your resume stand-out to recruiters! Simply select your preferred resume template in the skills section, enter the skills manually or use the "Add more skills" option. Our resume builder will generate the most relevant soft skills for your career path. Choose your proficiency level for each skill, and then click "Save & Next" to proceed to the next section.

- Communication

- Interpersonal

- Time Management

- Problem Solving

- Decision Making

- Critical Thinking

- Adaptability

- Organization

- Public Speaking

- Negotiation

- Conflict Resolution

- Attention to Detail

- Self-Motivation

- Stress Management

- Collaboration

- Emotional Intelligence

- Flexibility

- Reliability

- Professionalism

- Customer Service

- Presentation

- Written Communication

- Social Media

- Supervisory

- Relationship Management.

How to Improve Your aml analyst Resume

Navigating resume pitfalls can mean the difference between landing an interview or not. Missing job descriptions or unexplained work history gaps can cause recruiters to hesitate. Let's not even talk about the impact of bad grammar, and forgetting your contact info could leave your potential employer hanging. Aim to be comprehensive, concise, and accurate.

Provide your Contact Information and Address Year Gaps

Always explain any gaps in your work history to your advantage..

- Employers want to know what you've accomplished, so make sure to explain any gaps using a professional summary.

- Adding extra details and context to explain why you have a gap in your work history shows employers you are a good fit for the position.

How to Optimize Your aml analyst Resume

Keep an eye out for these resume traps. Neglecting to detail your job roles or explain gaps in your career can lead to unnecessary doubts. Grammar blunders can reflect negatively on you, and without contact information, how can employers reach you? Be meticulous and complete.

Oscar Wilson

- Prepare and submite suspicious activity report's to regulatory authorities

- Monitor changes in AML regulations, and ensure compliance

- Monitor transaction's for suspicious activity, and investigate any potential violation's of AML regulation's

- Conduct internall and externall audits of AML processes

- Review custmer profiles for potential money laundering

- Monitor changes in AML regulations and ensu compliance.

- "I went to the store and bought some food

- I went to the store an' bought some food.

Include Job Descriptions and Avoid Bad Grammar

Avoid sending a wrong first impression by proofreading your resume..

- Spelling and typos are the most common mistakes recruiters see in resumes and by simply avoiding them you can move ahead on the hiring process.

- Before submitting your resume, double check to avoid typos.

aml analyst Cover Letter Example

A cover letter can be a valuable addition to your job application when applying for an aml analyst position. Cover letters provide a concise summary of your qualifications, skills, and experience, also it also gives you an opportunity to explain why you're the best fit for the job. Crafting a cover letter that showcases your relevant experience and enthusiasm for the Accounts Payable role can significantly improve your chances of securing an interview.

Deloitte Recruitment Team

I am writing to express my interest in the Lead Aml Analyst role at Deloitte. As an Aml Analyst with 4 years of experience in Accounting & Auditing, I am confident that I have the necessary skills and expertise to succeed in this position.

Throughout my life, I have been passionate about Financial Statement Analysis and have pursued opportunities to make a difference in this field. My experience in various areas, not just in Accounting & Auditing, has given me the opportunity to develop my skills in Negotiation and Conflict Resolution, which I am excited to apply to the role at Deloitte. I am eager to work with a team that shares my values and to help your organization achieve its well determined goals.

Thank you for considering my application for the Lead Aml Analyst role. I am very passionate about this field and possess a deep understanding of the industry so, I am thrilled about the opportunity to contribute to your organization's success.

Showcase your most significant accomplishments and qualifications with this cover letter. Personalize this cover letter in just few minutes with our user-friendly tool!

Related Resumes & Cover Letters

Contemporary

Professional

Looking to explore other career options within the Accounting & Auditing field?

Check out our other resume of resume examples.

- Accounting Resume

- Payroll Resume

- Internal Audit Resume

- Accounts Receivable Resume

- Accounts Payable Resume

- Staff Auditor Resume

- Staff Accountant Resume

- Senior Account Manager Resume

- Payroll Admin Resume

- Fund Accountant Resume

- Accounts Receivable Analyst Resume

- Accounting Manager Resume

- Tax Accountant Resume

- Senior Accountant Resume

- Accounting Supervisor Resume

- Accounting Assistant Resume

- Accounting Analyst Resume

- Controller Resume

- Bookkeeper Resume

- Auditor Resume

- Audit Manager Resume

FIND EVERYTHING YOU NEED HERE.

IF YOU HAVE QUESTIONS, WE HAVE ANSWERS.

4 Ways a Career Test Can Jump-Start Your Future (and Help Your Resume)

If you’re looking for a fresh path or a new passion, a career test could help you find it. You can take these tests online, in the comfort of your...

Avoid These 3 Resume Mistakes at All Costs

Your resume is your first impression for a prospective employer. The way you present yourself in that little document can make or break you – it can clinch you an...

Resume Design Tips and Tricks

Creating a resume that stands out from the rest doesn’t have to be rocket science. With just a few tips and tricks, you can make your professional resume a shining...

Build your Resume in 15 minutes

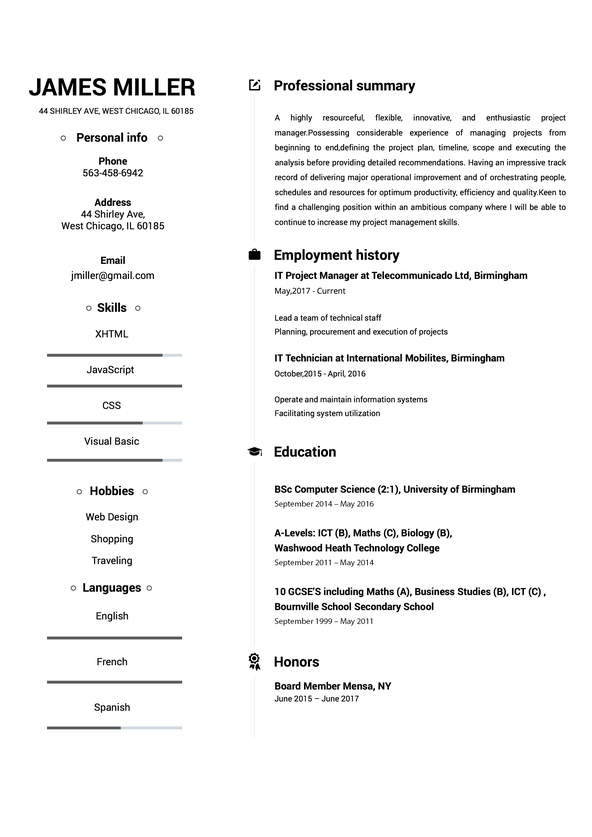

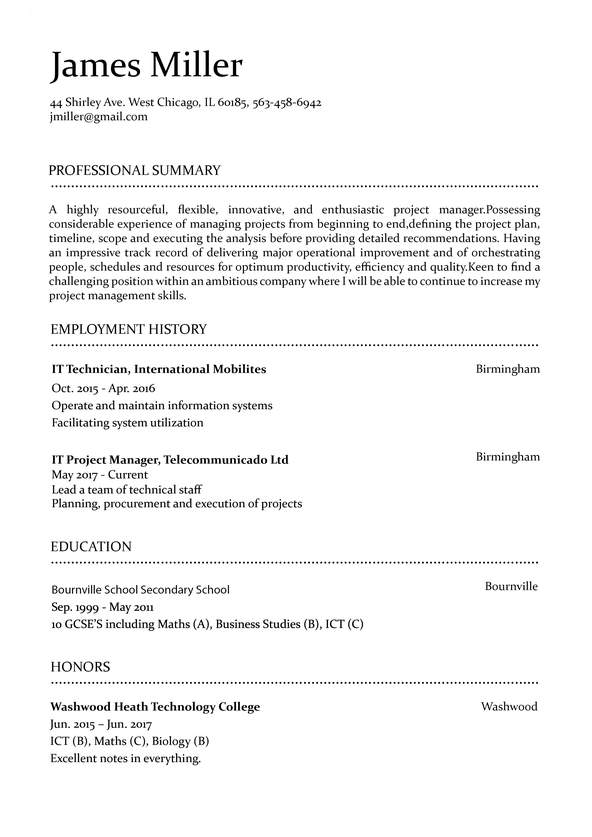

AML Analyst CV example

Can you spot suspicious financial activity from a mile away?

If so, you need to demonstrate your keen eye, attention to detail and analysis skills on your CV.

Find out how to write an attention-grabbing application, bursting with impressive statistics, using our detailed guide and anti-money laundering analyst CV example below.

CV templates

AML Analyst CV example

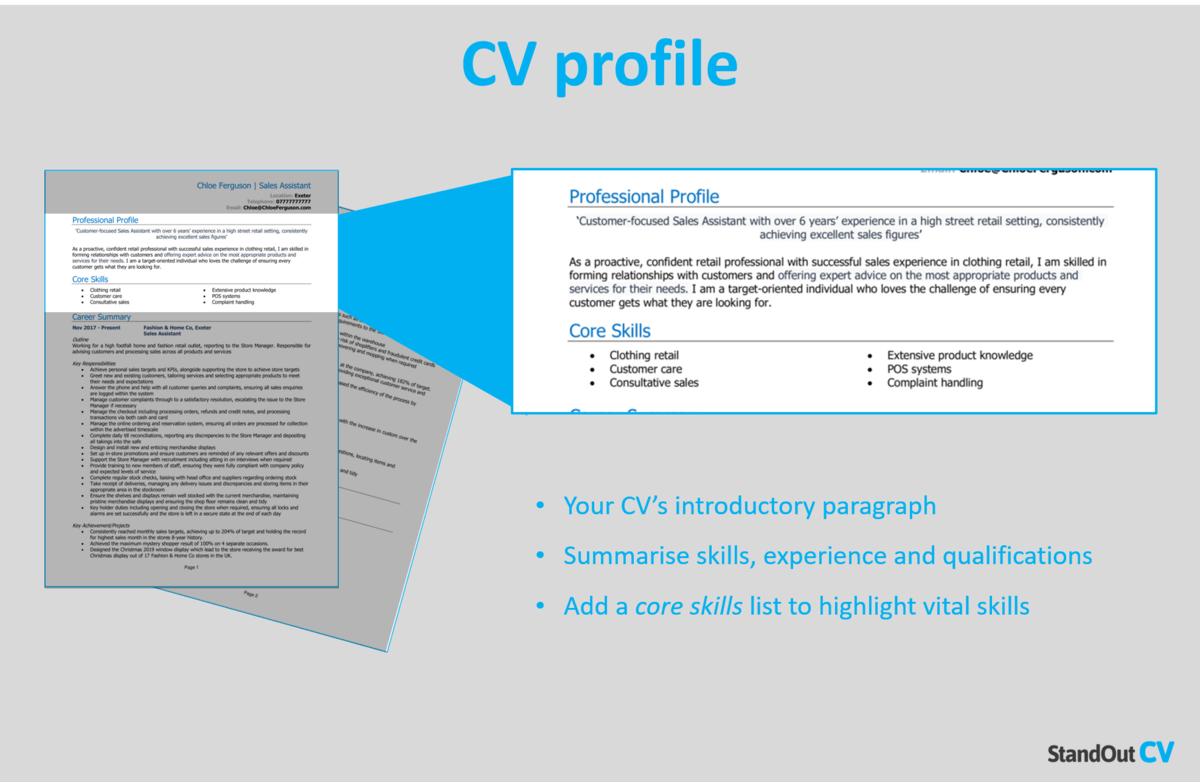

Before you start writing your CV, take a look at the example AML Analyst CV above to give yourself a good idea of the style and format that works best in today’s job market.

Also, take note of the type of content that is included to impress recruiters, and how the most relevant information is made prominent, to ensure it gets noticed.

AML Analyst CV format and structure

The format and structure of your CV is important because it will determine how easy it is for recruiters and employers to read your CV.

If they can find the information they need quickly, they’ll be happy; but if they struggle, your application could be overlooked.

A simple and logical structure will always create a better reading experience than a complex structure, and with a few simple formatting tricks, you’ll be good to go.

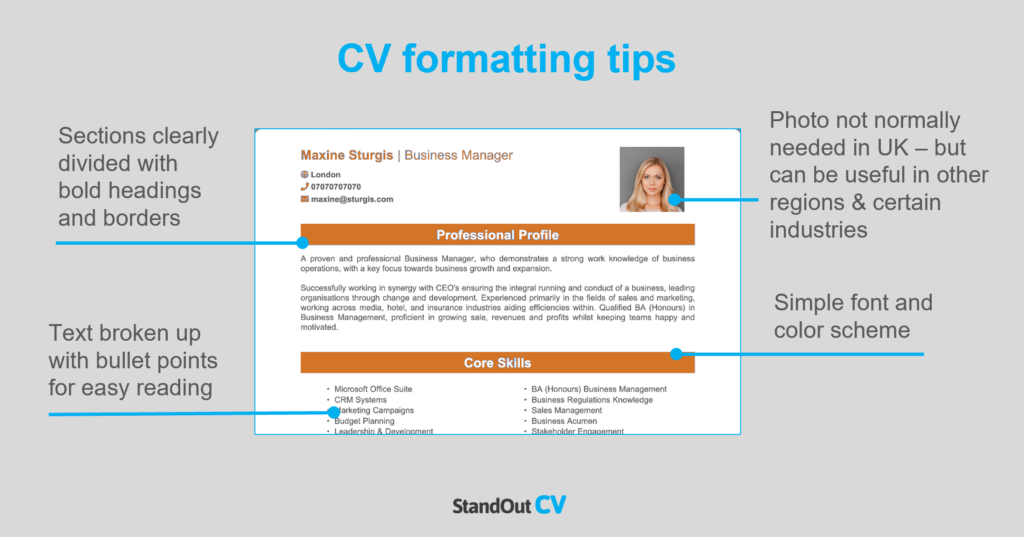

Tips for formatting your AML Analyst CV

- Length: It’s essential to keep your CV concise, regardless of whether you have one year or thirty years of experience. Recruiters are frequently managing multiple roles and responsibilities and do not have the luxury of reading lengthy CVs. Therefore, limit your CV to two sides of A4. If you have little industry experience, one page is sufficient.

- Readability : To help busy recruiters scan through your CV, make sure your section headings stand out – bold or coloured text works well. Additionally, try to use bullet points wherever you can, as they’re far easier to skim through than huge paragraphs. Lastly, don’t be afraid of white space on your CV – a little breathing space is great for readability.

- Design & format: When it comes to CV design, it’s best to keep things simple and sleek. While elaborate designs certainly command attention, it’s not always for the right reasons! Readability is key, so whatever you choose to do, make sure you prioritise readability above everything.

- Photos: Don’t add profile photos to your CV unless you work in an industry or region which prefers to see them. Most employers in the UK will not need to see one.

Quick tip: Creating a professional CV style can be difficult and time-consuming when using Microsoft Word or Google Docs. To create a winning CV quickly, try our quick-and-easy CV Builder and use one of their eye-catching professional CV templates.

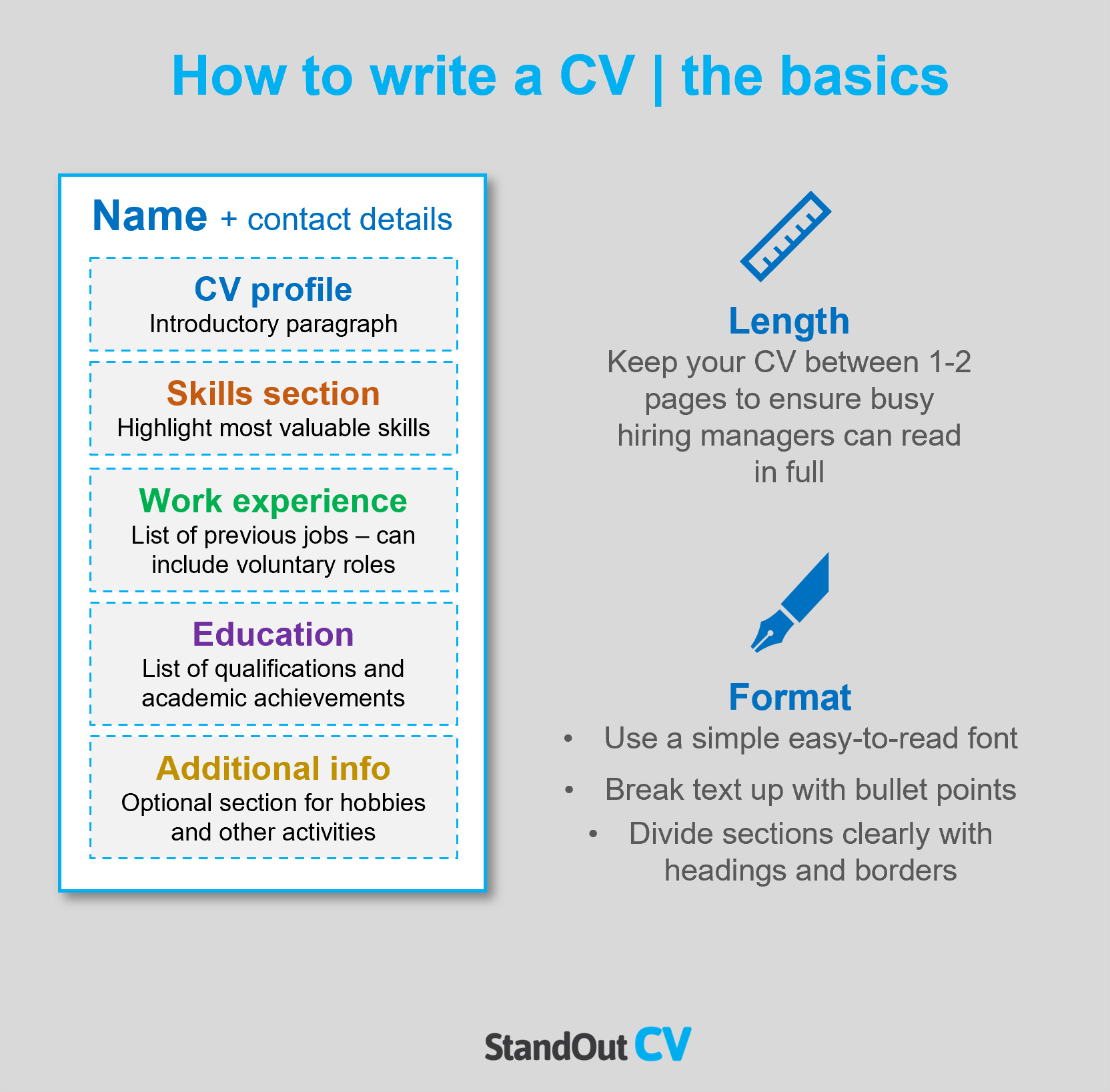

CV structure

To make it easy for busy recruiters and hiring managers to digest your CV, divide the content into several key sections when writing it:

- Contact details: Always list your contact details at the very top to avoid them being missed.

- Profile: Start with an introductory paragraph that catches recruiters’ attention and summarises your offerings.

- Work experience/career history: List your relevant work experience in reverse chronological order, starting with your current position.

- Education: Provide a concise summary of your education and qualifications.

- Interests and hobbies: You can include an optional section to showcase any hobbies that demonstrate transferable skills.

Now you understand the basic layout of a CV, here’s what you should include in each section of yours.

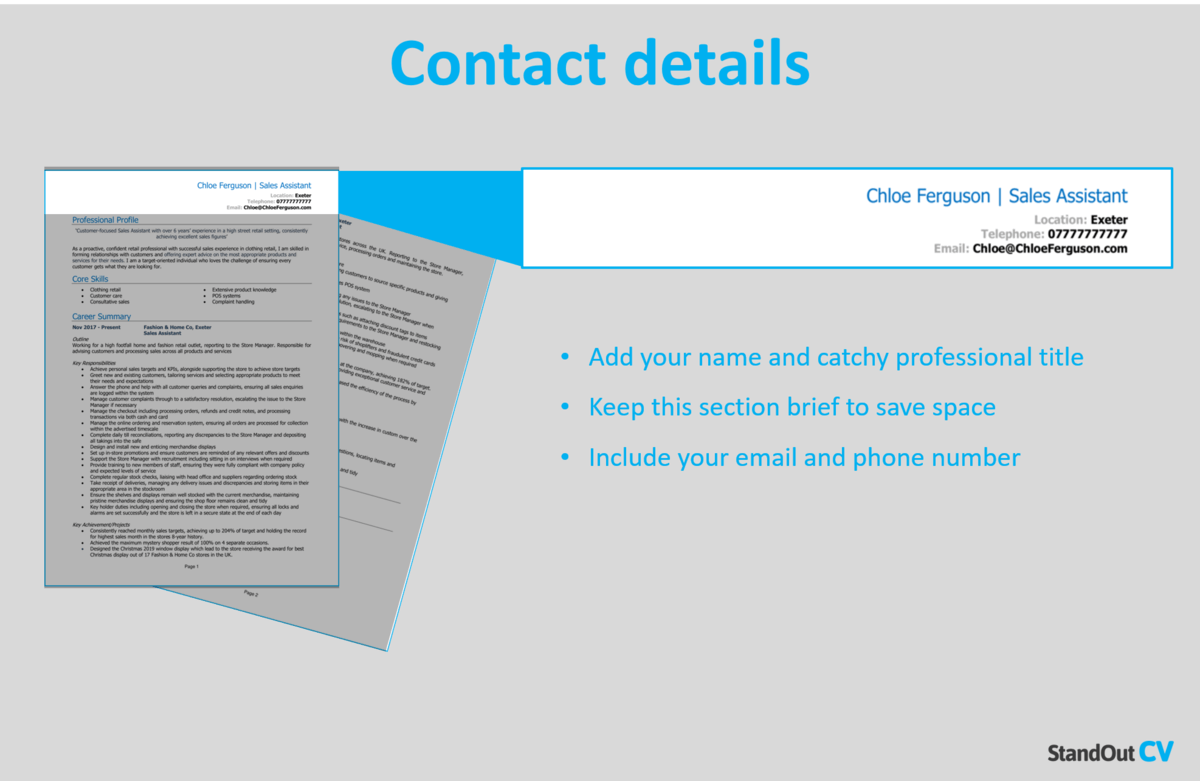

Contact Details

Kick-start your CV with your contact details, so recruiters can get in touch easily. Here’s what you should include:

- Mobile number

- Email address – Make sure it’s professional, with no silly nicknames.

- Location – Your town or city is sufficient, rather than a full address.

- LinkedIn profile or portfolio URL – Ensure they’ve been updated and are looking slick and professional.

Quick tip: Avoid listing your date of birth, marital status or other irrelevant details – they’re unnecessary at this stage.

AML Analyst CV Profile

Your CV profile (or personal statement , if you’re an entry-level applicant) provides a brief overview of your skills, abilities and suitability for a position.

It’s ideal for busy recruiters and hiring managers, who don’t want to waste time reading unsuitable applications.

Think of it as your personal sales pitch. You’ve got just a few lines to sell yourself and prove you’re a great match for the job – make it count!

How to write a good CV profile:

- Make it short and sharp: Recruiters have piles of CVs to read through and limited time to dedicate to each, so it pays to showcase your abilities in as few words as possible. 3-4 lines is ideal.

- Tailor it: No matter how much time you put into your CV profile, it won’t impress if it’s irrelevant to the role you’re applying for. Before you start writing, make a list of the skills, knowledge and experience your target employer is looking for. Then, make sure to mention them in your CV profile and throughout the rest of your application.

- Don’t add an objective: If you want to discuss your career objectives, save them for your cover letter , rather than wasting valuable CV profile space.

- Avoid generic phrases: If your CV is riddled with clichès like “Dynamic thought-leader”, hit that delete button. Phrases like these are like a broken record to recruiters, who read them countless times per day. Hard facts, skills, knowledge and results are sure to yield far better results.

Example CV profile for AML Analyst

What to include in your aml analyst cv profile.

- Experience overview: Start with a brief summary of your relevant experience so far. How many years experience do you have? What type of companies have you worked for? What industries/sectors have you worked in? What are your specialisms?

- Targeted skills: Ensure that your profile highlights your key skills that are most relevant to anti-money laundering, and tailor them to match the specific job you are applying for. To do this, refer to the job description to closely align your skills with their requirements.

- Important qualifications: If the job postings require specific qualifications, it is essential to incorporate them in your profile to ensure visibility to hiring managers.

Quick tip: If you are finding it difficult to write an attention-grabbing CV profile, choose from hundreds of pre-written profiles across all industries, and add one to your CV with one click in our quick-and-easy CV Builder . All profiles are written by recruitment experts and easily tailored to suit your unique skillset.

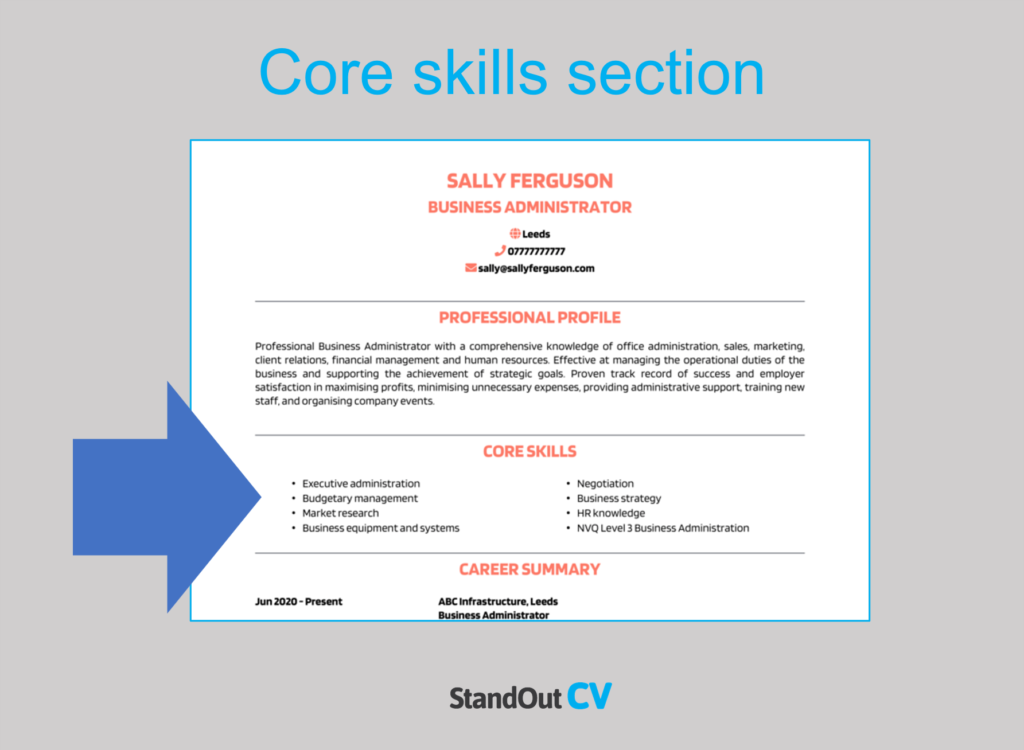

Core skills section

In addition to your CV profile, your core skills section provides an easily digestible snapshot of your skills – perfect for grabbing the attention of busy hiring managers.

As AML Analyst jobs might receive a huge pile of applications, this is a great way to stand out and show off your suitability for the role.

It should be made up of 2-3 columns of bullet points and be made up of skills that are highly relevant to the jobs you are targeting.

Important skills for your AML Analyst CV

Regulatory Knowledge – Utilising an in-depth understanding of UK anti-money laundering (AML) regulations, including laws, guidelines, and reporting requirements.

Risk Assessment – Conducting thorough risk assessments to identify potential money laundering activities, assessing the level of risk, and implementing appropriate controls.

Due Diligence – Conducting customer due diligence (CDD) and enhanced due diligence (EDD) processes to verify customer identities, assess their risk profiles, and detect suspicious transactions.

Transaction Monitoring – Monitoring and analysing financial transactions, identifying patterns, anomalies, and red flags that may indicate money laundering or other illicit activities.

Investigation and Reporting – Conducting detailed investigations into suspicious activities, gathering evidence, and preparing comprehensive reports for submission to relevant authorities.

KYC Compliance – Utilising knowledge of Know Your Customer (KYC) procedures and performing thorough customer screenings and ongoing monitoring to ensure compliance with AML regulations.

Data Analysis – Utilising data analysis tools and techniques to analyse large volumes of financial data, detect patterns, trends, and anomalies, and identify potential money laundering risks.

Stakeholder Communication – Effectively communicating AML findings, raising concerns, and providing recommendations to senior management, colleagues, and external stakeholders.

Cross-functional Collaboration – Working collaboratively with cross-functional teams, including compliance officers, legal counsel, and law enforcement agencies, to ensure effective AML controls and investigations.

Continuous Learning – Staying updated on the latest AML regulations, industry trends, and emerging money laundering techniques, and continuously enhance knowledge and skills through professional development.

Quick tip: Our quick-and-easy CV Builder has thousands of in-demand skills for all industries and professions, that can be added to your CV in seconds – This will save you time and ensure you get noticed by recruiters.

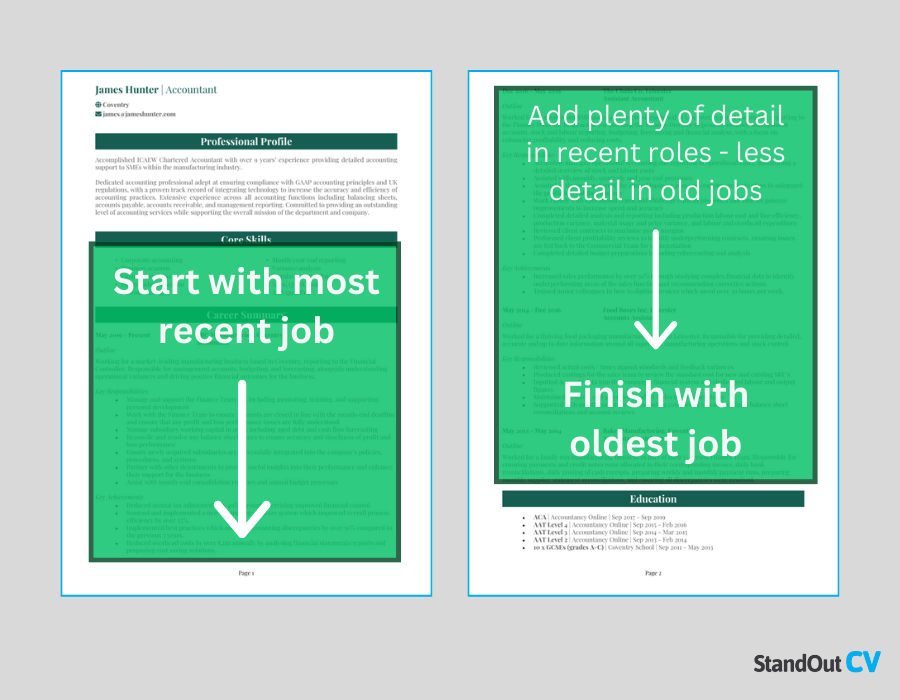

Work experience

By now, you’ll have hooked the reader’s attention and need to show them how you apply your skills and knowledge in the workplace, to benefit your employers.

So, starting with your most recent role and working backwards to your older roles, create a thorough summary of your career history to date.

If you’ve held several roles and are struggling for space, cut down the descriptions for your oldest jobs.

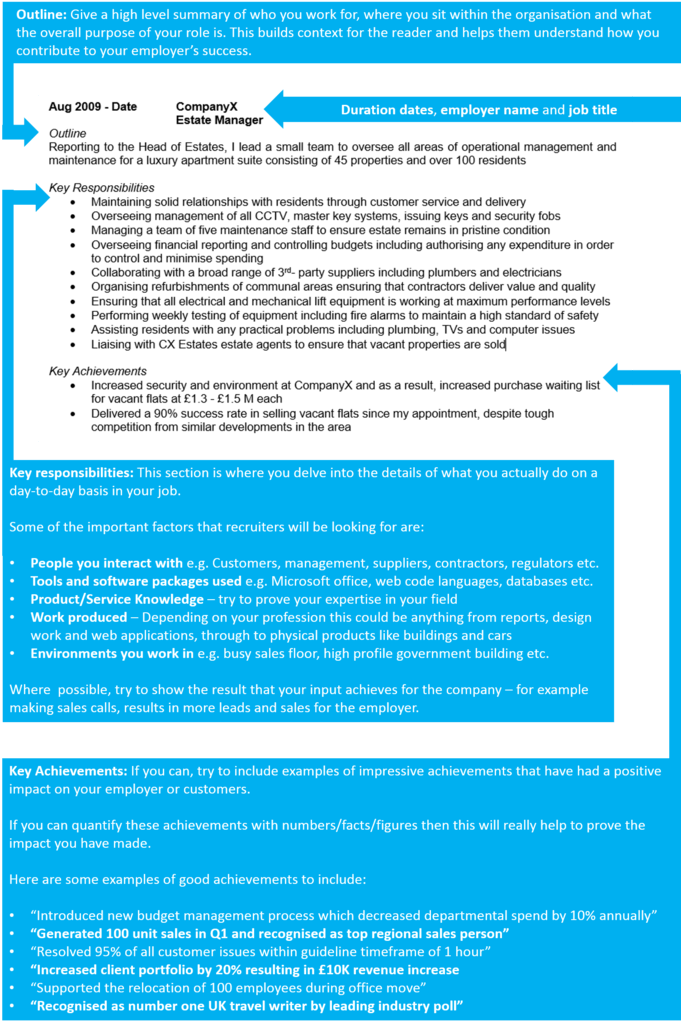

Structuring each job

The structure of your work experience section can seriously affect its impact.

This is generally the biggest section of a CV, and with no thought to structure, it can look bulky and important information can get lost.

Use my 3-step structure below to allow for easy navigation, so employers can find what they are looking for:

Start with a solid introduction to your role as a whole, in order to build some context.

Explain the nature of the organisation you worked for, the size of the team you were part of, who you reported to and what the overarching purpose of your job was.

Key responsibilities

Next up, you should write a short list of your day-to-day duties within the job.

Recruiters are most interested in your sector-specific skills and knowledge, so highlight these wherever possible.

Key achievements

Lastly, add impact by highlight 1-3 key achievements that you made within the role.

Struggling to think of an achievement? If it had a positive impact on your company, it counts.

For example, you might increased company profits, improved processes, or something simpler, such as going above and beyond to solve a customer’s problem.

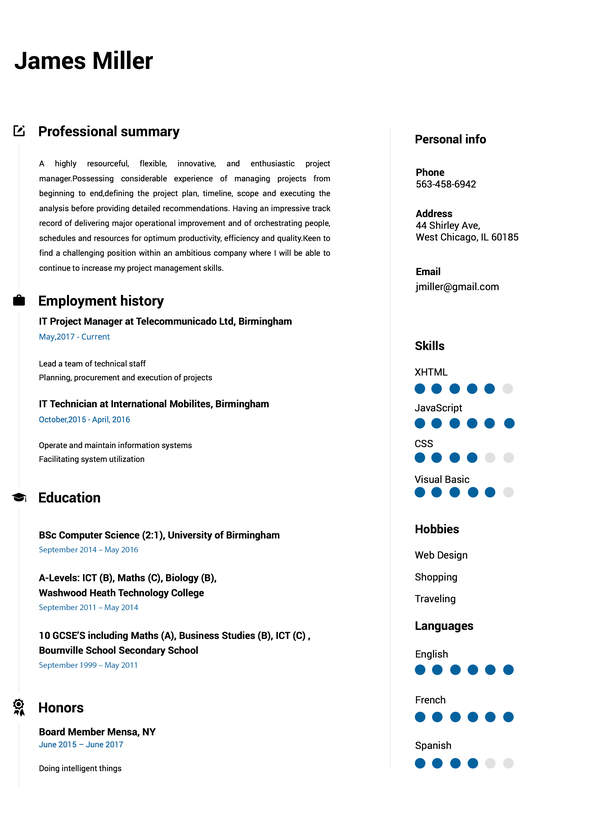

Sample job description for AML Analyst CV

Analyse high-value transactions in real-time at a leading online banking institution, Piggy Bank, identifying and investigating potential money laundering activities a £850 million client portfolio.

Key Responsibilities

- Conduct complex investigations into high-risk customers, transactions, and accounts

- Monitor transactions in real-time, identify suspicious activities, and escalate for investigation

- Prepare reports of findings, identify trends, and make recommendations for remediation

- Develop and maintain relationships with internal stakeholders and law enforcement agencies

Quick tip: Create impressive job descriptions easily in our quick-and-easy CV Builder by adding pre-written job phrases for every industry and career stage.

Education section

At the bottom of your CV is your full education section. You can list your formal academic qualifications, such as:

- GCSE’s

As well as any specific AML Analyst qualifications that are essential to the jobs you are applying for. Note down the name of the qualification, the organisation at which you studied, and the date of completion.

Hobbies and interests

The hobbies and interests CV section isn’t mandatory, so don’t worry if you’re out of room by this point.

However, if you have an interesting hobby , or an interest that could make you seem more suitable for the role, then certainly think about adding.

Be careful what you include though… Only consider hobbies that exhibit skills that are required for roles as a AML Analyst, or transferable workplace skills.

There is never any need to tell employers that you like to watch TV and eat out.

When putting together your Anti-Money Laundering Analyst CV, there are a few key points to remember

Always tailor your CV to the target role, even if it means creating several versions for different roles.

Additionally, remember that the structure and format of your CV needs just as much attention as the content.

Good luck with your job search!

Clinical psychology

- Anxiety disorders

- Feeding and eating disorders

- Mood disorders

- Neuro-developmental disorders

- Personality disorders

- Affirmations

- Cover Letters

- Relationships

- Resignation & Leave letters

Psychotherapy

Personality.

Table of Contents

Cover letter for KYC analyst(5 samples)

As a BetterHelp affiliate, we may receive compensation from BetterHelp if you purchase products or services through the links provided.

The Optimistminds editorial team is made up of psychologists, psychiatrists and mental health professionals. Each article is written by a team member with exposure to and experience in the subject matter. The article then gets reviewed by a more senior editorial member. This is someone with extensive knowledge of the subject matter and highly cited published material.

This article will list samples of “cover letters for a KYC analyst.”

Samples of KYC analyst cover letter

When applying for aKYC analyst position, your cover letter is an opportunity for you to tell your story, without being stuck in the formatting constraints of the resume. The best format for writing a cover letter is as follows:

- Address the employer with a formal salutation. For example, “Dear/Hello (name of the recipient).” If you do not know the recipient’s name, you can refer to them as the hiring manager.