Accounting Equation Problems and Solutions

Click here to download accounting equation problems.

Previous Lesson: Principles of Accounting

Next Lesson: Accounting Variation Proforma Problems and Solutions

Accounting is based on the principle of two-sided. In order to carry out business activities, the company needs funds; these funds must be given to the company by someone. The funds owned by the company are called assets . Part of these assets is provided by the owner, total amount of funds contributed by him is called owner’s equity or capital. If the owner is the only one who contributed, then the equation A = O.E will be fair. (assets equal to capital).

However, the assets may be contributed by someone else who is not the owner. The debt of the enterprise for these assets is called liabilities. Therefore, now the equation will take the following form: A = L + O.E . (Assets equal equity plus liabilities). The left and right sides of the equation always coincide.

Assets= Liabilities + Owner’s Equity

The equality of both parts of the equation is always maintained. For deep understanding of accounting equation, following are important accounting equation questions:

Habib Ullah Sadiq is wholesale trader; following transactions are record in Accounting Equation?

i. Commence business with cash Rs. 200,000 and Land Rs. 50,000.

ii. Bought merchandising for cash Rs. 80,000.

iii. Cash sales of worth Rs. 25,000.

iv. Bought goods on credit from Salman of worth Rs. 50,000.

v. Sales on account to Ali Raza Rs. 12,000.

vi. Purchase furniture of the value of Rs. 5,000 by cash.

vii. Received cash form Ali Raza of Rs. 10,000.

viii. Return defective furniture of worth Rs. 1,500.

xi. Paid wages Rs. 1,000, Rent 2,000 and Electricity Bill Payable Rs. 1,500.

Accounting Equation Format Download

>> Read Accounting Equation explanation.

Video Lecture: Accounting Equation Problems and Solutions

Click here to download worksheet used in video.

Muhammad Faizan Abid had the following transactions. Use accounting equation to show their effect on his Assets, Liabilities and Capital?

a) Invested Rs. 15,000 in cash.

b) Purchased securities for cash Rs. 7,500.

c) Purchased a home for Rs. 15,000: giving Rs. 5,000 in cash and the balance through loan account.

d) Sold securities costing Rs. 1,000 for Rs. 1,500.

e) Purchase an old car for Rs. 2,800 cash.

f) Received cash as salary Rs. 3,600.

g) Paid cash Rs.500 for loan and Rs. 300 for interest.

h) Paid cash for expenses Rs. 300.

i) Received cash for dividend on securities Rs.200.

>> Understand Types of Accounts for Accounting Equation Problems and Solutions .

Selected Transactions from Shah Transport Services began on June 1, 2016 by Zahid Shah as?

a. Zahid Shah invested Rs. 600,000.

b. Truck was Purchase by business for Rs. 430,000.

c. Equipment purchased on credit for Rs. 9,000.

d. A bill of Rs. 7,200 for transporting goods was sent to Mr. Ashraf Abbasi, a customer.

e. Cash of Rs. 6,000 is received from the customer who was billed in d.

f. Received Rs. 22,300 is cash for transporting goods.

g. A payment of Rs. 5,000 was made on the equipment purchased in c.

h. Paid expenses of different types for Rs. 1,700 in cash.

i. Equipment of Rs. 1,200 was withdrawn from business for Zahid Shah’s personal use.

Required: Arrange the Assets, Liabilities and Owner’s Equity accounts in an Accounting Equation, using the following account titles: Cash, Trucks, Equipment, Account Receivables, Account Payable and Owner’s Equity:

>> Further study Golden Rules of Accounting .

Prove that the Accounting Equation is satisfied in all following transactions of Wajeeha Ejaz owner of business enterprises?

I. Started business with cash value of Rs. 500,000.

II. Rent paid in advance for a year Rs. 6,000.

III. Purchased merchandising inventory for cash Rs. 80,000 and on account Rs. 20,000 from Mr. Tahir.

IV. Purchased Marketable securities for cash Rs. 100,000.

V. Cash Sales Rs. 30,000 (cost 20,000).

VI. During the period rent expires Rs. 2,000.

VII. Commission paid during the trading was Rs. 1,000.

VIII. Received cash dividend Rs. 4,000 on marketable securities.

IX. Paid to Rs. 19,500 to Mr. Tahir in full settlement.

X. Withdrew inventory for personal purpose by owner of worth Rs. 6,000.

>> Practice Journal Entry Problems and Solutions .

Show the effect of the following transactions upon the Accounting Equation?

June 2017

>> Read Balance Sheet for better understanding the Balance Sheet Equation .

Related Questions

Accounting Equation

Accounting Equation MCQs

Accounting Equation Examples

Accounting Equation Questions

Accounting Equation Format

Related Problems

Accounting Equation Exam Questions

Accounting Equation Exercises

Accounting Equation Problems PDF

Golden Rule of Accounts

Expanded Accounting Equation

Related Exams

Principles of Accounting

Accounting MCQs

Accounting Problems

Accounting Problems PDF

Accounting Workbook

Mukharji, A., & Hanif, M. (2003). Financial Accounting (Vol. 1). New Delhi: Tata McGraw-Hill Publishing Co.

Narayanswami, R. (2008). Financial Accounting: A Managerial Perspective. (3rd, Ed.) New Delhi: Prentice Hall of India.

Ramchandran, N., & Kakani, R. K. (2007). Financial Accounting for Management. (2nd, Ed.) New Delhi: Tata McGraw Hill.

21 Comments

Plz solve depriciation of class 11 question no 3 Frome numerical problem from asmita publication

Thank you for sharing this information

commenced business with cash 200,000. purchase building for cash 50000. Purchase machine on credit base 70000. purchase goods for cash 100000 and 30000 on credit base. sold goods 60000 on cash . he paid outstanding wages 10000. He sold good 10000 costing Rs 8000 for cash. He deposit 10000 cash into bank. He pay bills by cheque 5000. He withdraw goods for Rs 5000 for his personal use. Kindly Send me the solution of this questio.

In a very wonderful way u teach. Now i m quiet clear about accounting Equation.

Thanku so much . in a very wonderful way u teach . i want to join ur website . plz guide me

TYSM for this blog . Tomorrow is my exam and I studied from this blog and found some challenging questions and other such quality content . Thanks again .

You made a few fine points there. I did a search on the topic and found most persons will consent with your blog.

Yes, this is a Good one

Nice respond in return of this issue with genuine arguments and telling the whole thing concerning that.

Please I want know how prepaid will be treated in accounting equation

I really wanted to appreciate you people for such nice explanation of Accounting system. It was really very helpful. I just to request you that i have a you tube channel so can i mention your site name for my subscribers. Because that will be a great help for them. I will just show your site and details. Is it ok or note . Please share your feedback

yours truly,

Dear Joby Mchael Thank you for nice comments. I will share my feedback…

Thank you so much brother.

I have been browsing online more than 4 hours today, yet I never found any interesting article like yours. It is pretty worth enough for me. Personally, if all website owners and bloggers made good content as you did, the internet will be a lot more useful than ever before.

Heya i am for the first time here. I found this board and I find It really useful & it helped me out a lot. I am hoping to provide one thing again and help others such as you aided me.

It is smart work okay brother thank you so mach

Very Helpful

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Submit Comment

Home » Explanations » Introduction to financial accounting » Accounting equation

Accounting equation

Accounting equation describes that the total value of assets of a business entity is always equal to its liabilities plus owner’s equity. This equation is the foundation of modern double entry system of accounting being used by small proprietors to large multinational corporations. Other names used for this equation are balance sheet equation and fundamental or basic accounting equation.

Definition and explanation

We know that every business holds some properties known as assets. The claims to the assets owned by a business entity are primarily divided into two types – the claims of creditors and the claims of owner of the business. In accounting, the claims of creditors are referred to as liabilities and the claims of owner are referred to as owner’s equity.

Accounting equation is simply an expression of the relationship among assets, liabilities and owner’s equity in a business. The general form of this equation is presented below:

Assets = Liabilities + Owner’s Equity

Notice that the left hand side (also known as assets side) of the equation shows the resources owned by the business and the right hand side (also known as equity side) shows the sources of funds used to acquire these resources. All assets owned by a business are acquired with the funds supplied either by creditors or by owner(s). In other words, we can say that the value of assets in a business is always equal to the sum of the value of liabilities and owner’s equity. The total dollar amounts of two sides of accounting equation are always equal because they represent two different views of the same thing.

In accounting equation, the liabilities are normally placed before owner’s equity because the rights of creditors are always given a priority over the rights of owners. Because of this preference, the liabilities are sometime transposed to the left side which results in the following form of accounting equation:

Assets – Liabilities = Owner’s Equity

If dollar amounts of any two of the three elements are known, we can solve the equation to find the third one. For example, if a business owns total assets amounting to $400,000 and total liabilities amounting to $120,000, the owners equity must be equal to $280,000 as computed below:

Assets – Liabilities = Owner’s Equity $400,000 – $120,000 = $280,000

Using the concept of accounting equation, compute missing figures from the following:

- Assets = $100,000, Liabilities = $40,000, Owner’s equity = ?

- Assets = ?, Liabilities = $20,000, Owner’s equity = $30,000

- Assets = $120,000, Liabilities = ?, Owner’s equity = $80,000

- Assets = ?, Liabilities + Owner’s equity = $300,000

- Owner’s equity = Assets – Liabilities = $100,000 – $40,000 = $60,000

- Assets = Liabilities + Owner’s equity = $20,000 + $30,000 = $50,000

- Liabilities = Assets – Owner’s equity = $120,000 – $80,000 = $40,000

- The basic accounting equation is: Assets = Liabilities + Owner’s equity. Therefore, If liabilities plus owner’s equity is equal to $300,000, then the total assets must also be equal to $300,000.

Impact of transactions on accounting equation

Valid financial transactions always result in a balanced accounting equation which is the fundamental characteristic of double entry accounting (i.e., every debit has a corresponding credit).

Every transaction impacts accounting equation in terms of dollar amounts but the equation as a whole always remains in balance. Any increase in one side is balanced either by a corresponding decrease in the same side or by a corresponding increase in the other side and any decrease is balanced either by a corresponding increase in the same side or by a corresponding decrease in the other side. For better explanation, consider the impact of twelve transactions included in the following example:

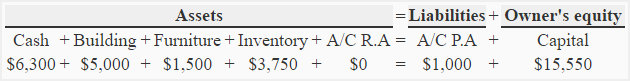

Mr. John started a T-shirts business to be known as “John T-shirts”. He performed following transactions during the first month of operations:

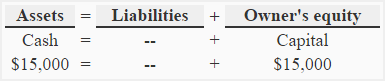

- Mr. John invested a capital of $15,000 into his business.

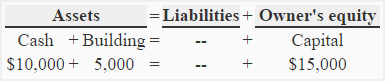

- Acquired a building for $5,000 cash for business use.

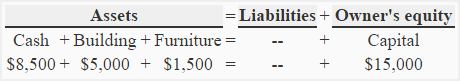

- Bought furniture for $1,500 cash for business use.

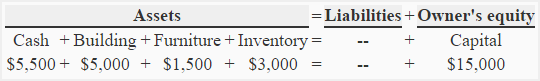

- Purchased T-shirts from a manufacturer for $3,000 cash.

- Sold T- shirts for $1,000 cash, the cost of those T-shirts were $700.

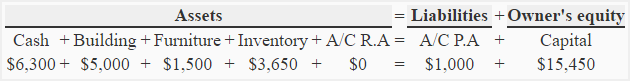

- Purchased T-shirts for $2,000 on credit.

- Sold T-shirts for $800 on credit, the cost of those shirts were $550.

- Paid $1,000 cash to his payables.

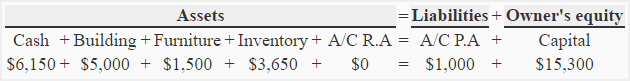

- Collected $800 cash from his receivables.

- The shirts costing $100 were stolen by someone.

- Mr. John paid $150 cash for telephone bill.

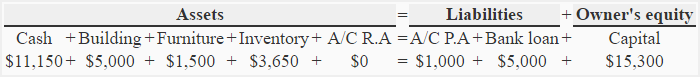

- Borrowed money amounting to $5,000 from City Bank for business purpose.

Required: Explain how each of the above transactions impacts the accounting equation of John T-shirts.

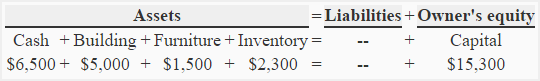

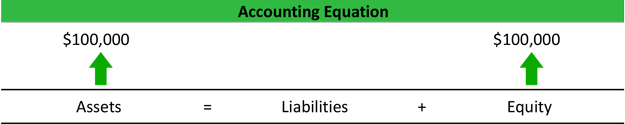

Transaction 1: The investment of capital by John is the first transaction of John T-shirts which creates very initial accounting equation of the business. At this point, the cash is the only asset of business and owner has the sole claim to this asset. Therefore, the equation would look like the following:

Equation element(s) impacted as a result of transaction 1: “Assets” & “Owner’s equity”.

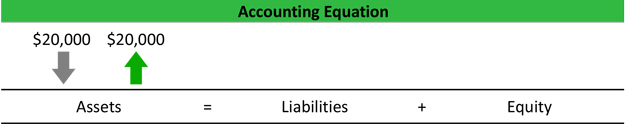

Transaction 2: The second transaction is the purchase of building which brings two changes. First, it reduces cash by $5,000 and second, the building valuing $5,000 comes into the business. In other words, cash amounting to $5,000 is converted into building. The impact of this transaction on accounting equation is shown below:

Equation element(s) impacted as a result of transaction 2: “Assets”

Transaction 3: The impact of this transaction is similar to that of transaction number 2. Cash goes out of and furniture comes in to the business. On asset side, The reduction of $1,500 in cash is balanced by the addition of furniture with a value of $1,500.

Equation element(s) impacted as a result of transaction 3: “Assets”

Transaction 4: The impact of this transaction is similar to transactions 2 and 3. One asset (i.e, cash) goes out and another asset (i.e, inventory) comes in. The cash would decrease by $3,000 and at the same time the inventory valuing $3,000 would be recorded on the asset side.

Equation element(s) impacted as a result of transaction 4: “Assets”

Transaction 5: In this transaction, shirts costing $700 are sold for $1,000 cash. It increases cash by $1,000 and reduces inventory by $700. The difference of $300 is the profit of the business that would be added to the capital. The whole impact of this transaction on accounting equation is shown below:

Equation element(s) impacted as a result of transaction 5: “Assets” & “Owner’s equity”

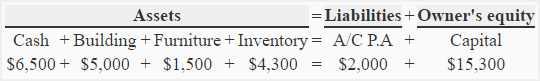

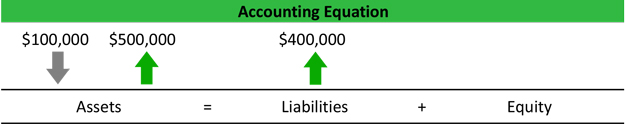

Transaction 6: In this transaction, T-shirts costing $2,000 are purchased on credit. It increases inventory on asset side and creates a liability of $2,000 known as accounts payable (abbreviated as A/C P.A) on the equity side of the equation. Since it is a credit transaction, it has no impact on cash.

Equation element(s) impacted as a result of transaction 6: “Assets” & “liabilities”

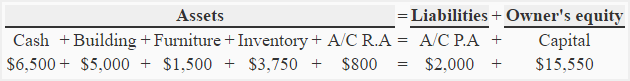

Transaction 7: In this transaction, the business sells T-shirts costing $550 for $800 on credit. It reduces inventory by $550 and creates a new asset known as accounts receivable (abbreviated as A/C R.A) valuing $800. The difference of $250 is profit of the business and would be added to capital under the head owner’s equity.

Equation element(s) impacted as a result of transaction 7: “Assets” & “Owner’s equity”

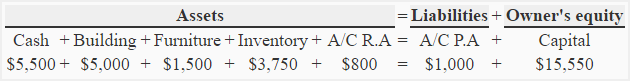

Transaction 8: In this transaction, business pays cash amounting to $1,000 for a previous credit purchase. It will reduce cash and accounts payable liability both with $1,000.

Equation element(s) impacted as a result of transaction 8: “Assets” & “Liabilities”

Transaction 9: In this transaction, the business collects cash amounting to $800 for a previous credit sale. On asset side, it increases cash by $800 and reduces accounts receivable by the same amount.

Equation element(s) impacted as a result of transaction 9: “Assets”

Transaction 10: The loss of shirts by theft reduces inventory on asset side and capital on equity side both by $100. All expenses and losses reduce owner’s equity or capital.

Equation element(s) impacted as a result of transaction 10: “Assets” & “Owner’s equity”

Transaction 11: The payment of telephone and electricity bills are business expenses that reduce cash on asset side and capital on equity side both by $150.

Equation element(s) impacted as a result of transaction 11: “Assets” & “Owner’s equity”

Transaction 12: The loan is a liability because the John T-shirts will have to repay it to the City Bank. This transaction increases cash by $5,000 on asset side and creates a “bank loan” liability of $5,000 on equity side.

Equation element(s) impacted as a result of transaction 12: “Assets” & “Liabilities”

In above example, we have observed the impact of twelve different transactions on accounting equation. Notice that each transaction changes the dollar value of at least one of the basic elements of equation (i.e., assets, liabilities and owner’s equity) but the equation as a whole does not lose its balance.

it was bit challenging but knowledge obtained.

This is nasir,please give me more questions and let me practice on it. Topic : accounting equatin

Excellent, I am so thankful for these explainations

It is informative and well presented. I need more examples.

I love this

Good explantions with examples, thanks buddy

Leave a comment Cancel reply

- school Campus Bookshelves

- menu_book Bookshelves

- perm_media Learning Objects

- login Login

- how_to_reg Request Instructor Account

- hub Instructor Commons

Margin Size

- Download Page (PDF)

- Download Full Book (PDF)

- Periodic Table

- Physics Constants

- Scientific Calculator

- Reference & Cite

- Tools expand_more

- Readability

selected template will load here

This action is not available.

2.4: The Basic Accounting Equation

- Last updated

- Save as PDF

- Page ID 26177

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

An accounting transaction is a business activity or event that causes a measurable change in the accounting equation. An exchange of cash for merchandise is a transaction. Merely placing an order for goods is not a recordable transaction because no exchange has taken place. In the coming sections, you will learn more about the different kinds of financial statements accountants generate for businesses.

In the previous section we described specific types of accounts that business activities fall into, namely:

- Assets (what it owns)

- Liabilities (what it owes to others)

- Equity (the difference between assets and liabilities or what it owes to the owners)

These are the building blocks of the basic accounting equation. The accounting equation is:

ASSETS = LIABILITIES + EQUITY

For Example:

A sole proprietorship business owes $12,000 and you, the owner personally invested $100,000 of your own cash into the business. The assets owned by the business will then be calculated as:

$12,000 (what it owes) + $100,000 (what you invested) = $112,000 (what the company has in assets)

In a sole-proprietorship, equity is actually Owner’s Equity. If the business in question is a corporation, equity will be held by stockholders, which uses stockholder’s equity but the basic equation is the same:

A business owes $35,000 and stockholders (investors) have invested $115,000 by buying stock in the company. The assets owned by the business will then be calculated as:

$35, 000 (what it owes) + $115,000 (what stockholders invested) = $150,000 (what the company has in assets)

Since each transaction affecting a business entity must be recorded in the accounting records based on a detailed account (remember, file folders and the chart of accounts from the previous section), analyzing a transaction before actually recording it is an important part of financial accounting. An error in transaction analysis could result in incorrect financial statements.

A YouTube element has been excluded from this version of the text. You can view it online here: pb.libretexts.org/llfinancialaccounting/?p=50

To further illustrate the analysis of transactions and their effects on the basic accounting equation, we will analyze the activities of Metro Courier, Inc., a fictitious corporation. Refer to the chart of accounts illustrated in the previous section.

1. Owners invested cash

Metro Courier, Inc., was organized as a corporation on January 1, the company issued shares (10,000 shares at $3 each) of common stock for $30,000 cash to Ron Chaney, his wife, and their son. The $30,000 cash was deposited in the new business account.

Transaction analysis:

- The new corporation received $30,000 cash in exchange for ownership in common stock (10,000 shares at $3 each).

- We want to increase the asset Cash and increase the equity Common Stock.

Let’s check the accounting equation: Assets $30,000 = Liabilities $0 + Equity $30,000

2. Purchased equipment for cash

Metro paid $ 5,500 cash for equipment (two computers).

- The new corporation purchased new asset (equipment) for $5,500 and paid cash.

- We want to increase the asset Equipment and decrease the asset Cash since we paid cash.

Let’s check the accounting equation: Assets $30,000 (Cash $24,500 + Equipment $5,500) = Liabilities $0 + Equity $30,000

3. Purchased truck for cash

Metro paid $ 8,500 cash for a truck.

- The new corporation purchased new asset (truck) for $8,500 and paid cash.

- We want to increase the asset Truck and decrease the asset cash for $8,500.

Let’s check the accounting equation: Assets $30,000 (Cash $16,000 + Equipment $5,500 + Truck $8,500) = Liabilities $0 + Equity $30,000

4. Purchased supplies on account.

Metro purchased supplies on account from Office Lux for $500.

- The new corporation purchased new asset (supplies) for $500 but will pay for them later.

- We want to increase the asset Supplies and increase what we owe with the liability Accounts Payable.

Let’s check the accounting equation: Assets $30,500 (Cash $16,000+ Supplies $500 + Equipment $5,500 + Truck $8,500) = Liabilities $500 + Equity $30,000

5. Making a payment to creditor.

Metro issued a check to Office Lux for $300 previously purchased supplies on account.

- The corporation paid $300 in cash and reduced what they owe to Office Lux.

- We want to decrease the liability Accounts Payable and decrease the asset cash since we are not buying new supplies but paying for a previous purchase.

Let’s check the accounting equation: Assets $30,200 (Cash $15,700 + Supplies $500 + Equipment $5,500 + Truck $8,500) = Liabilities $200 + Equity $30,000

6. Making a payment in advance.

Metro issued a check to Rent Commerce, Inc. for $1,800 to pay for office rent in advance for the months of February and March.

Transaction analysis (to save space we will look at the effects of each of the remaining transactions only):

- The corporation prepaid the rent for next two months making an advanced payment of $1,800 cash.

- We will increase an asset account called Prepaid Rent (since we are paying in advance of using the rent) and decrease the asset cash.

The only account balances that changed from transaction 5 are Cash and Prepaid Rent. All other account balances remain unchanged. The new accounting equation would be: Assets $30,200 (Cash $13,900 + Supplies $500 + Prepaid Rent $1,800 + Equipment $5,500 + Truck $8,500) = Liabilities $200 + Equity $30,000

7. Selling services for cash.

During the month of February, Metro Corporation earned a total of $50,000 in revenue from clients who paid cash.

- The corporation received $50,000 in cash for services provided to clients.

- We want to increase the asset Cash and increase the revenue account Service Revenue.

Wait a minute…the accounting equation is ASSETS = LIABILITIES + EQUITY and it does not have revenue or expenses…where do they fit in? Revenue – Expenses equals net income . Net Income is added to Equity at the end of the period. Assets $80,200 (Cash $63,900 + Supplies $500 + Prepaid Rent $1,800 + Equipment $5,500 + Truck $8,500)= Liabilities $200)+ Equity $80,000 (Common Stock $30,000 + Net Income $50,000). Note: This does not mean revenue and expenses are equity accounts!

8. Selling services on credit.

Metro Corporation earned a total of $10,000 in service revenue from clients who will pay in 30 days.

- Metro performed work and will receive the money in the future.

- We record this as an increase to the asset account Accounts Receivable and an increase to service revenue.

Remember, all other account balances remain the same. The only changes are the addition of Accounts Receivable and an increase in Revenue. Assets $90,200 (Cash $63,900 + Accounts Receivable $10,000 + Supplies $500 + Prepaid Rent $1,800 + Equipment $5,500 + Truck $8,500)= Liabilities $200 + Equity $90,000 (Common Stock $30,000 + Net Income $60,000).

9. Collecting accounts receivable.

Metro Corporation collected a total of $5,000 on account from clients who owned money for services previously billed.

- Metro received $5,000 from customers for work we have already billed (not any new work).

- We want to increase the asset Cash and decrease (what we will receive later from customers) the asset Accounts Receivable.

Assets $90,200 (Cash $68,900 + Accounts Receivable $5,000 + Supplies $500 + Prepaid Rent $1,800 + Equipment $5,500 + Truck $8,500)= Liabilities $200 + Equity $90,000 (Common Stock $30,000 + Net Income $60,000).

10. Paying office salaries.

Metro Corporation paid a total of $900 for office salaries.

- The corporation paid $900 to its employees.

- We will increase the expense account Salaries Expense and decrease the asset account Cash.

Remember, net income is calculated as Revenue – Expenses and is added to Equity. The new accounting equation would show: Assets $89,300 (Cash $68,000 + Accounts Receivable $5,000 + Supplies $500 + Prepaid Rent $1,800 + Equipment $5,500 + Truck $8,500)= Liabilities $200 + Equity $89,100 (Common Stock $30,000 + Net Income $59,100 from revenue of $60,000 – expenses $900).

11. Paying utility bill.

Metro Corporation paid a total of $1,200 for utility bill.

- The corporation paid $1,200 in cash for utilities.

- We will increase the expense account Utility Expense and decrease the asset Cash.

Click Transaction analysis to see the full chart with all transactions. The final accounting equation would be: Assets $88,100 (Cash $66,800 + Accounts Receivable $5,000 + Supplies $500 + Prepaid Rent $1,800 + Equipment $5,500 + Truck $8,500) = Liabilities $200 + Equity $87, 900 (Common Stock $30,000 + Net Income $57,900 from revenue of $60,000 – salary expense $900 – utility expense $1,200).

Answer the following questions about the accounting equation. Remember to rate your confidence to check your answer: Maybe? Probably. Definitely!

A Open Assessments element has been excluded from this version of the text. You can view it online here: pb.libretexts.org/llfinancialaccounting/?p=50

- Accounting Principles: A Business Perspective. Authored by : James Don Edwards, University of Georgia & Roger H. Hermanson, Georgia State University. Provided by : Endeavour International Corporation. Project : The Global Text Project . License : CC BY: Attribution

- Transaction Analysis - Basic Example. Authored by : AccountingWITT. Located at : youtu.be/E_Kw_pFHY2w. License : All Rights Reserved . License Terms : Standard YouTube License

- Accounting Equation

Home › Accounting › Accounting Basics › Accounting Equation

- What is the Accounting Equation?

Basic Accounting Equation Formula

Liabilities, how to use the accounting equation.

The accounting equation, also called the basic accounting equation, forms the foundation for all accounting systems. In fact, the entire double entry accounting concept is based on the basic accounting equation. This simple equation illustrates two facts about a company: what it owns and what it owes.

The accounting equation equates a company’s assets to its liabilities and equity. This shows all company assets are acquired by either debt or equity financing. For example, when a company is started, its assets are first purchased with either cash the company received from loans or cash the company received from investors. Thus, all of the company’s assets stem from either creditors or investors i.e. liabilities and equity.

Here is the basic accounting equation.

As you can see, assets equal the sum of liabilities and owner’s equity. This makes sense when you think about it because liabilities and equity are essentially just sources of funding for companies to purchase assets.

The equation is generally written with liabilities appearing before owner’s equity because creditors usually have to be repaid before investors in a bankruptcy. In this sense, the liabilities are considered more current than the equity. This is consistent with financial reporting where current assets and liabilities are always reported before long-term assets and liabilities.

This equation holds true for all business activities and transactions. Assets will always equal liabilities and owner’s equity. If assets increase, either liabilities or owner’s equity must increase to balance out the equation. The opposite is true if liabilities or equity increase.

Now that we have a basic understanding of the equation, let’s take a look at each accounting equation component starting with the assets.

Accounting Equation Components

An asset is a resource that is owned or controlled by the company to be used for future benefits. Some assets are tangible like cash while others are theoretical or intangible like goodwill or copyrights.

Another common asset is a receivable. This is a promise to be paid from another party. Receivables arise when a company provides a service or sells a product to someone on credit.

All of these assets are resources that a company can use for future benefits. Here are some common examples of assets:

- Accounts Receivable

- Prepaid Expense

A liability, in its simplest terms, is an amount of money owed to another person or organization. Said a different way, liabilities are creditors’ claims on company assets because this is the amount of assets creditors would own if the company liquidated.

A common form of liability is a payable. Payables are the opposite of receivables. When a company purchases goods or services from other companies on credit, a payable is recorded to show that the company promises to pay the other companies for their assets.

Here are some examples of some of the most common liabilities:

- Accounts payable

- Lines of Credit

- Personal Loans

- Officer Loans

- Unearned income

Equity represents the portion of company assets that shareholders or partners own. In other words, the shareholders or partners own the remainder of assets once all of the liabilities are paid off.

Owners can increase their ownership share by contributing money to the company or decrease equity by withdrawing company funds. Likewise, revenues increase equity while expenses decrease equity.

Here are some common equity accounts:

- Owner’s Capital

- Owner’s Withdrawals

- Common stock

- Paid-In Capital

Let’s take a look at the formation of a company to illustrate how the accounting equation works in a business situation.

Ted is an entrepreneur who wants to start a company selling speakers for car stereo systems. After saving up money for a year, Ted decides it is time to officially start his business. He forms Speakers, Inc. and contributes $100,000 to the company in exchange for all of its newly issued shares. This business transaction increases company cash and increases equity by the same amount.

After the company formation, Speakers, Inc. needs to buy some equipment for installing speakers, so it purchases $20,000 of installation equipment from a manufacturer for cash. In this case, Speakers, Inc. uses its cash to buy another asset, so the asset account is decreased from the disbursement of cash and increased by the addition of installation equipment.

After six months, Speakers, Inc. is growing rapidly and needs to find a new place of business. Ted decides it makes the most financial sense for Speakers, Inc. to buy a building. Since Speakers, Inc. doesn’t have $500,000 in cash to pay for a building, it must take out a loan. Speakers, Inc. purchases a $500,000 building by paying $100,000 in cash and taking out a $400,000 mortgage. This business transaction decreases assets by the $100,000 of cash disbursed, increases assets by the new $500,000 building, and increases liabilities by the new $400,000 mortgage.

As you can see, all of these transactions always balance out the accounting equation. This is one of the fundamental rules of accounting. The accounting equation can never be out of balance. Assets will always equal liabilities and owner’s equity.

Accounting & CPA Exam Expert

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

Accounting Basics

- Financial Accounting Basics

- Financial Accounting

- Expanded Accounting Equation

- Account Format

- Chart of Accounts

- Asset Accounts

- Liability Accounts

- Equity Accounts

- Contra Account

- Revenue Accounts

- Expense Account

- General Ledger

- Debits and Credits

- Double Entry Accounting

- Business Events

- General Journal

- Trial Balance

- Accounting Principles

- Accounting Cycle

- Financial Statements

- Financial Ratios

- Search Search Please fill out this field.

- Corporate Finance

- Financial Ratios

What Is the Accounting Equation, and How Do You Calculate It?

:max_bytes(150000):strip_icc():format(webp)/jason_mugshot__jason_fernando-5bfc261946e0fb00260a1cea.jpg)

What Is the Accounting Equation?

The accounting equation states that a company’s total assets are equal to the sum of its liabilities and its shareholders’ equity .

This straightforward relationship between assets, liabilities, and equity is considered to be the foundation of the double-entry accounting system. The accounting equation ensures that the balance sheet remains balanced. That is, each entry made on the debit side has a corresponding entry (or coverage) on the credit side.

The accounting equation is also called the basic accounting equation or the balance sheet equation.

Key Takeaways

- The accounting equation is considered to be the foundation of the double-entry accounting system.

- The accounting equation shows on a company’s balance sheet that a company’s total assets are equal to the sum of the company’s liabilities and shareholders’ equity.

- Assets represent the valuable resources controlled by a company. The liabilities represent its obligations.

- Both liabilities and shareholders’ equity represent how the assets of a company are financed.

- Financing through debt shows as a liability, while financing through issuing equity shares appears in shareholders’ equity.

Daniel Fishel / Investopedia

What Are the Key Components in the Accounting Equation?

The financial position of any business, large or small, is based on two key components of the balance sheet : assets and liabilities. Owners’ equity, or shareholders’ equity, is the third section of the balance sheet.

The accounting equation is a representation of how these three important components are associated with each other.

Assets represent the valuable resources controlled by a company, while liabilities represent its obligations. Both liabilities and shareholders’ equity represent how the assets of a company are financed. If it’s financed through debt, it’ll show as a liability, but if it’s financed through issuing equity shares to investors, it’ll show in shareholders’ equity.

The accounting equation helps to assess whether the business transactions carried out by the company are being accurately reflected in its books and accounts. Below are examples of items listed on the balance sheet.

Assets include cash and cash equivalents or liquid assets, which may include Treasury bills and certificates of deposit (CDs).

Accounts receivable list the amounts of money owed to the company by its customers for the sale of its products. Inventory is also considered an asset.

The major and often largest value assets of most companies are that company’s machinery, buildings, and property. These are fixed assets that are usually held for many years.

Liabilities

Liabilities are debts that a company owes and costs that it needs to pay in order to keep the company running.

Debt is a liability, whether it is a long-term loan or a bill that is due to be paid.

Costs include rent, taxes, utilities, salaries, wages, and dividends payable.

Shareholders’ Equity

The shareholders’ equity number is a company’s total assets minus its total liabilities.

It can be defined as the total number of dollars that a company would have left if it liquidated all of its assets and paid off all of its liabilities. This would then be distributed to the shareholders.

Retained earnings are part of shareholders’ equity. This number is the sum of total earnings that were not paid to shareholders as dividends.

Think of retained earnings as savings, since it represents the total profits that have been saved and put aside (or “retained”) for future use.

Accounting Equation Formula and Calculation

Assets = ( Liabilities + Owner’s Equity ) \text{Assets}=(\text{Liabilities}+\text{Owner's Equity}) Assets = ( Liabilities + Owner’s Equity )

The balance sheet holds the elements that contribute to the accounting equation:

- Locate the company’s total assets on the balance sheet for the period.

- Total all liabilities, which should be a separate listing on the balance sheet.

- Locate total shareholders’ equity and add the number to total liabilities.

- Total assets will equal the sum of liabilities and total equity.

As an example, say leading retailer XYZ Corp. reported the following on its balance sheet for its latest full fiscal year :

- Total assets: $170 billion

- Total liabilities: $120 billion

- Total shareholders’ equity: $50 billion

If we calculate the right-hand side of the accounting equation (equity + liabilities), we arrive at ($50 billion + $120 billion) = $170 billion, which matches the value of the assets reported by the company.

What Is the Purpose of the Double-Entry System?

The accounting equation is a concise expression of the complex, expanded , and multi-item display of a balance sheet.

Essentially, the representation equates all uses of capital (assets) to all sources of capital, where debt capital leads to liabilities and equity capital leads to shareholders’ equity.

For a company keeping accurate accounts, every business transaction will be represented in at least two of its accounts. For instance, if a business takes a loan from a bank, the borrowed money will be reflected in its balance sheet as both an increase in the company’s assets and an increase in its loan liability.

If a business buys raw materials and pays in cash, it will result in an increase in the company’s inventory (an asset) while reducing cash capital (another asset). Because there are two or more accounts affected by every transaction carried out by a company, the accounting system is referred to as double-entry accounting.

The double-entry practice ensures that the accounting equation always remains balanced, meaning that the left-side value of the equation will always match the right-side value.

In other words, the total amount of all assets will always equal the sum of liabilities and shareholders’ equity.

The global adherence to the double-entry accounting system makes the account-keeping and -tallying processes more standardized and foolproof.

The accounting equation ensures that all entries in the books and records are vetted, and a verifiable relationship exists between each liability (or expense) and its corresponding source; or between each item of income (or asset) and its source.

Limits of the Accounting Equation

Although the balance sheet always balances out, the accounting equation can’t tell investors how well a company is performing. Investors must interpret the numbers and decide for themselves whether the company has too many or too few liabilities, not enough assets, or perhaps too many assets, or whether its financing is sufficient to ensure its long-term growth.

What Is a Real-World Example of the Accounting Equation?

Below is a portion of Exxon Mobil Corp.’s ( XOM ) balance sheet in millions as of Sept. 30, 2023:

- Total assets were $372,259

- Total liabilities were $164,726

- Total equity was $207,533

The accounting equation is calculated as follows:

- Accounting equation : $164,726 (total liabilities) + $207,533 (equity) = $372,259 (which equals the total assets for the period)

Why Is the Accounting Equation Important?

The accounting equation captures the relationship between the three components of a balance sheet: assets, liabilities, and equity. All else being equal, a company’s equity will increase when its assets increase, and vice versa. Adding liabilities will decrease equity, while reducing liabilities—such as by paying off debt—will increase equity. These basic concepts are essential to modern accounting methods.

What Are the Three Elements of the Accounting Equation?

The three elements of the accounting equation are assets, liabilities, and shareholders’ equity. The formula is straightforward: A company’s total assets are equal to its liabilities plus its shareholders’ equity. The double-entry bookkeeping system, which has been adopted globally, is designed to accurately reflect a company’s total assets.

What Is an Asset in the Accounting Equation?

An asset is anything with economic value that a company controls that can be used to benefit the business now or in the future. They include fixed assets, such as machinery and buildings. They may include financial assets, such as investments in stocks and bonds. They also may be intangible assets, like patents, trademarks, and goodwill.

What Is a Liability in the Accounting Equation?

A company’s liabilities include every debt it has incurred. These may include loans, accounts payable, mortgages, deferred revenues, bond issues, warranties, and accrued expenses.

What Is Shareholders’ Equity in the Accounting Equation?

Shareholders’ equity is the total value of the company expressed in dollars. Put another way, it is the amount that would remain if the company liquidated all of its assets and paid off all of its debts. The remainder is the shareholders’ equity, which would be returned to them.

The Bottom Line

The accounting equation is based on the premise that the sum of a company’s assets is equal to its total liabilities and shareholders’ equity. As a core concept in modern accounting, this provides the basis for keeping a company’s books balanced across a given accounting cycle.

ExxonMobil Investor Relations. “ Balance Sheet .”

- Accounting Explained With Brief History and Modern Job Requirements 1 of 51

- What Is the Accounting Equation, and How Do You Calculate It? 2 of 51

- What Is an Asset? Definition, Types, and Examples 3 of 51

- Liability: Definition, Types, Example, and Assets vs. Liabilities 4 of 51

- Equity Meaning: How It Works and How to Calculate It 5 of 51

- Revenue Definition, Formula, Calculation, and Examples 6 of 51

- Expense: Definition, Types, and How Expenses Are Recorded 7 of 51

- Current Assets vs. Noncurrent Assets: What's the Difference? 8 of 51

- What Is Accounting Theory in Financial Reporting? 9 of 51

- Accounting Principles Explained: How They Work, GAAP, IFRS 10 of 51

- Accounting Standard Definition: How It Works 11 of 51

- Accounting Convention: Definition, Methods, and Applications 12 of 51

- What Are Accounting Policies and How Are They Used? With Examples 13 of 51

- How Are Principles-Based and Rules-Based Accounting Different? 14 of 51

- What Are Accounting Methods? Definition, Types, and Example 15 of 51

- What Is Accrual Accounting, and How Does It Work? 16 of 51

- Cash Accounting Definition, Example & Limitations 17 of 51

- Accrual Accounting vs. Cash Basis Accounting: What's the Difference? 18 of 51

- Financial Accounting Standards Board (FASB): Definition and How It Works 19 of 51

- Generally Accepted Accounting Principles (GAAP): Definition, Standards and Rules 20 of 51

- What Are International Financial Reporting Standards (IFRS)? 21 of 51

- IFRS vs. GAAP: What's the Difference? 22 of 51

- How Does US Accounting Differ From International Accounting? 23 of 51

- Cash Flow Statement: What It Is and Examples 24 of 51

- Breaking Down The Balance Sheet 25 of 51

- Income Statement: How to Read and Use It 26 of 51

- What Does an Accountant Do? 27 of 51

- Financial Accounting Meaning, Principles, and Why It Matters 28 of 51

- How Does Financial Accounting Help Decision-Making? 29 of 51

- Corporate Finance Definition and Activities 30 of 51

- How Financial Accounting Differs From Managerial Accounting 31 of 51

- Cost Accounting: Definition and Types With Examples 32 of 51

- Certified Public Accountant: What the CPA Credential Means 33 of 51

- What Is a Chartered Accountant (CA) and What Do They Do? 34 of 51

- Accountant vs. Financial Planner: What's the Difference? 35 of 51

- Auditor: What It Is, 4 Types, and Qualifications 36 of 51

- Audit: What It Means in Finance and Accounting, and 3 Main Types 37 of 51

- Tax Accounting: Definition, Types, vs. Financial Accounting 38 of 51

- Forensic Accounting: What It Is, How It's Used 39 of 51

- Chart of Accounts (COA) Definition, How It Works, and Example 40 of 51

- What Is a Journal in Accounting, Investing, and Trading? 41 of 51

- Double Entry: What It Means in Accounting and How It's Used 42 of 51

- Debit: Definition and Relationship to Credit 43 of 51

- Credit: What It Is and How It Works 44 of 51

- Closing Entry 45 of 51

- What Is an Invoice? It's Parts and Why They Are Important 46 of 51

- 6 Components of an Accounting Information System (AIS) 47 of 51

- Inventory Accounting: Definition, How It Works, Advantages 48 of 51

- Last In, First Out (LIFO): The Inventory Cost Method Explained 49 of 51

- The FIFO Method: First In, First Out 50 of 51

- Average Cost Method: Definition and Formula with Example 51 of 51

:max_bytes(150000):strip_icc():format(webp)/_equity_final-a71099b17173432f813b15202e64459d.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- 101 Accounting Basics Strong foundation on fundamental concepts and the accounting process

- FIN Financial Accounting Financial accounting and reporting, financial statements, IFRS and GAAP

- MNG Managerial Accounting Managerial/management accounting topics to aid in decision-making

- DIC Accounting Dictionary Accounting terms defined and carefully explained

- MIS Misc Articles Miscellaneous topics about anything accounting

- References +

- 1 Basic accounting principles

- 2 Elements of accounting

- 3 Exercises on elements of accounting

- 4 Accounting equation

- 5 Accounting equation: More examples

- 6 Expanded accounting equation

- 7 Double-entry accounting

- 8 Accounting cycle

Accounting equation: More examples and explanation

Accounting equation.

As we've learned previously, the accounting equation is a mathematical expression that shows the relationship among the different elements of accounting, i.e. assets, liabilities, and capital (or "equity").

The basic accounting equation is: Assets = Liabilities + Capital

Sample Business Transactions

Here are more examples to further illustrate how the accounting equation works. Below are additional transactions following example 1, 2 and 3 in the previous lesson :

- Rendered services and received the full amount in cash, $500

- Rendered services on account, i.e., receivable from customer , $750

- Purchased office supplies on account, i.e., payable to supplier , $200

- Had some equipment repaired for $400, to be paid after 15 days

- Mr. Alex, the owner, withdrew $5,000 cash for personal use

- Paid one-third of the loan obtained in transaction #2

- Received customer payment from services in transaction #5

Now let's take a look at how each transaction affects the accounting equation:

Examples Explained

- The company received cash for services rendered. Cash increased thereby increasing assets. At the same time, capital is increased as a result of the income (Service Revenue) . As we've mentioned in the Accounting Elements lesson, income increases capital.

- The company rendered services on account. The services have been rendered, hence, already earned. Thus, the $750 worth of services rendered is considered income even if the amount has not yet been collected. Since the amount is still to be collected, it is recorded as Accounts Receivable , an asset account.

- Office supplies worth $200 were acquired. This increases the company's Office Supplies , part of the company's assets. The purchase results in an obligation to pay the supplier; thus a $200 increase in liability (Accounts Payable) .

- The company incurred in $400 Repairs Expense . Expenses decrease capital. The amount has not yet been paid. Thus, it results in an increase in total liabilities.

- The owner withdrew $5,000 cash. Cash is decreased thereby decreasing total assets. Withdrawals or drawings decrease capital.

- One-third of the $30,000 loan was paid. Therefore, Cash is decreased by $10,000 as a result of the payment. And, liabilities are decreased because part of the obligation has been settled.

- The $750 account in a previous transaction has been collected. Therefore, the Accounts Receivable account is decreased and Cash is increased.

Notice that every transaction results in an equal effect to assets and liabilities plus capital. The beginning balances are equal. The changes arising from the transactions are equal. Therefore, the ending balances would still be equal.

The balance of the total assets after considering all of the above transactions amounts to $36,450. It is equal to the combined balance of total liabilities of $20,600 and capital of $15,850 (a total of $36,450) .

Assets = Liabilities + Capital is a mathematical equation. Using simple transposition, the formula can be rewritten to get other versions of the equation.

- Liabilities = Assets - Capital

- Capital = Assets - Liabilities

The basic accounting equation is:

Assets = Liabilities + Capital

Because of the two-fold effect of business transactions, the equation always stays in balance.

More under Fundamental Accounting Concepts

- 1 Basic Accounting Principles

- 2 Elements of Accounting

- 3 Exercises on Elements of Accounting

- 4 Accounting Equation

- 5 More Examples of the Accounting Equation

- 6 Expanded Accounting Equation

- 7 Double-Entry Accounting

- 8 Accounting Cycle

- Recently Active

- Top Discussions

- Best Content

By Industry

- Investment Banking

- Private Equity

- Hedge Funds

- Real Estate

- Venture Capital

- Asset Management

- Equity Research

- Investing, Markets Forum

- Business School

- Fashion Advice

- Technical Skills

- Accounting Articles

Accounting Equation

It is an essential accounting formula that shows a company’s assets, liabilities, and equity at a specific snapshot in time.

Matthew started his finance career working as an investment banking analyst for Falcon Capital Partners, a healthcare IT boutique, before moving on to work for Raymond James Financial, Inc in their specialty finance coverage group in Atlanta. Matthew then started in a role in corporate development at Babcock & Wilcox before moving to a corporate development associate role with Caesars Entertainment Corporation where he currently is. Matthew provides support to Caesars' M&A processes including evaluating inbound teasers/ CIMs to identify possible acquisition targets, due diligence, constructing financial models , corporate valuation, and interacting with potential acquisition targets.

Matthew has a Bachelor of Science in Accounting and Business Administration and a Bachelor of Arts in German from University of North Carolina.

- What Is The Accounting Equation?

- Equity Component Of The Accounting Equation

Economic Entity Assumption

- Classification Of Assets And Liabilities

- Accounting Transactions

- Examples Of Accounting Transactions

What Is the Accounting Equation?

The accounting equation, an essential accounting formula, shows a company’s assets, liabilities, and equity at a specific snapshot in time.

The accounting equation is also known as the balance sheet equation. Furthermore, the equation serves as the building block for the double-entry bookkeeping system in accounting.

The accounting equation is fundamental in analyzing business transactions, the first step in the accounting cycle .

There are three primary financial statements ,

- the income statement (IS),

- balance sheet (BS), and

- cash flow statement ( CFS ).

While we mainly discuss only the BS in this article, the IS shows a company’s revenue and expenses and goes down to net income as the final line on the statement.

The CFS shows money going into (cash inflow) and out of (cash outflow) a business; furthermore, the CFS is separated into operating, investing, and financing activities.

It’s called the Balance Sheet (BS) because assets must equal liabilities plus shareholders’ equity .

There are no exceptions to this rule, except if you are ever dealing with the BS and do not have both sides as the same number, you know you did something wrong and should go back and check your numbers.

We can break down the accounting equation into two essential elements –

- what the business owns (its assets) and

- how it pays for those assets (the liabilities and equity portion of the accounting equation).

While there is no universal definition for liabilities and equity, liabilities are typically external claims (e.g., creditors and suppliers), and equity is internal claims (e.g., owners and shareholders of the business).

The formula is:

Assets = Liabilities + Equity

Key Takeaways

- Assets = Liabilities + Shareholders’ Equity

- A business's assets are resources, and liabilities are the creditors’ claims on total assets. Whereas shareholders’ equity is the owners’ claim on total assets

- Assets = Liabilities + Common Stock + Revenues - Expenses - Dividends,

- So that you can walk someone through the fundamental transaction analysis of economic events in a company’s lifecycle

- Common stock is increased when the company issues new shares of stock in exchange for cash

- Revenue is affected as a result of business operations that aim to earn money for the corporation

- Expenses are the costs of generating revenue

- Dividends are (annual) payments the company will make to stockholders assuming that revenue exceeds expenses (net income). It has nothing better to do with all that cash sitting on hand.

- Remember, to get to net income, subtract the total amount of expenses from the total revenue earned for the period.

Equity Component of the Accounting Equation

Under the equity component of the formula, we can expand the equity component into common stock and retained earnings .

The common stock section is the money invested/paid-in into the company by investors that purchase stock. Under the retained earnings section, we can divide that component into “revenues - expenses - dividends.”

- Revenue is the money that we generate from the direct sale of a product or delivery of a service.

- Expenses are the direct costs generated during generating revenue.

- Net income is a fancy accounting term for profit – the money the business gets to “take home” after everything is paid off.

- Dividends are the distribution of cash (i.e., cash dividend) or other assets (i.e., stock dividend) to shareholders of a company when the company decides that there is no better use for that residual income .

While dividends DO reduce retained earnings, dividends are not an expense for the company.

Increases from investments by stockholders or increases in revenue will cause an increase in shareholders’ equity. It is crucial to note that the formula for net income is as follows:

Net Income= Revenue - Expenses

You have likely heard of the word entity in your life in some shape or form. We think of economic entities as any organization or business in the financial world.

In some situations, accounts may use the terms

- shareholders’ equity

about the same component of the accounting equation.

We use owner’s equity in a sole proprietorship , a business with only one owner, and they are legally liable for anything on a personal level.

Owners’ equity typically refers to partnerships (a business owned by two or more individuals).

Similar to a sole proprietorship, partnerships separate their accounting activities from their activities (hence owners’ equity).

However, each partner generally has unlimited personal liability for any kind of obligation for the business (for example, debts and accidents). Some common partnerships include doctor’s offices, boutique investment banks , and small legal firms.

Shareholders’ equity comes from corporations dividing their ownership into stock shares.

Shareholders, or owners of the stock, benefit from limited liability because they are not personally liable for any kind of debts or obligations the corporate entity may have as a business.

Stockholders can transfer their ownership of shares to any other investor at any time.

While there is no notable difference in each term, if you wanted to be technical and saw it come up in a question, you should probably be familiar with the economic entity assumption.

The economic entity assumption states that all of the financial activities associated with the business are kept separate from its owners. For example, the CEO of Apple , Tim Cook, must keep his living expenses separate from Apple’s operating expenses (OpEx).

Operating expenses (or OpEx) are any daily costs that a business or large corporation incurs. OpEx is commonly confused with CapEx – these two accounts are NOT the same!

Classification of Assets and Liabilities

In accounting, we have different classifications of assets and liabilities because we need to determine how we report them on the balance sheet. The first classification we should introduce is current vs. non-current assets or liabilities.

Current assets and liabilities can be converted into cash within one year.

- Examples of current assets include cash, accounts receivable , and in many instances, inventory.

- Examples of current liabilities typically include short-term debt and accounts payable .

Non-current assets or liabilities are those that cannot be converted easily into cash, typically within a year, that is.

Non-current assets could include accounts receivable greater than a year or PP&E.

Furthermore, another common way to classify assets is based on their “physical existence.”

Assets based on “physical existence” are tangible.

Tangible assets can be touched, felt, and seen. Some common examples of tangibles include property, plant and equipment (PP&E), and supplies found in the office.

An intangible asset is an identifiable non-monetary asset without physical substance . Such an asset is identifiable when it is separable or arises from contractual or other legal rights.

For example, goodwill , patents, copyrights, and trademarks are all common examples of intangibles : patents, copyrights, and trademarks best suit inventors, authors, and brands.

Furthermore, patents protect the original designs/workings of the machine or invention, copyrights protect any form of art (i.e., music, literature, etc.), and trademarks protect any catchphrases, designs, symbols, or slogans.

Assets are resources the company owns and can be used for future benefit. Liabilities are anything that the company owes to external parties, such as lenders and suppliers.

Everything You Need To Master Financial Statement Modeling

To Help you Thrive in the Most Prestigious Jobs on Wall Street.

Accounting Transactions

Business transactions are economic events recorded by accountants based heavily on the accounting equation (A = L + E). Algebra can be used to find stockholders’ equity (E = A - L).

There are two types of transactions,

- internal, i.e., within a company, and

- external, i.e., outside the company transactions.

Any event that does not affect the business's accounting equation is considered a non-business transaction. Responding to emails, hiring employees, or talking with clients are all examples of non-business transactions.

Under all circumstances, each transaction must have a dual effect on the accounting transaction. For instance, if an asset increases, there must be a corresponding decrease in another asset or an increase in a specific liability or stockholders’ equity item.

Examples of Accounting Transactions

Now that you are familiar with some basic concepts of the accounting equation and balance sheet let’s jump into some practice examples you can try for yourself.

1. Example Transaction #1: Investment of Cash by Stockholders

Nabil invests $10,000 cash in Apple in exchange for $10,000 of common stock.

Solution: The asset, cash, increases by $10,000, and shareholders’ equity increases by $10,000; therefore, it is a balanced equation.

2. Example Transaction #2: Purchase of Equipment for Cash

Apple purchased equipment for its computer for $5,500 cash.

Solution: The asset cash decreases by $5,500, and the asset equipment increases by $5,500 to compensate; therefore, It is a balanced equation.

3. Example Transaction #3: Purchase of Supplies on Credit

Apple buys packages for iPhones and semiconductors from suppliers such as TSMC for $1,500 on the account.

Solution: Supplies, an asset, increase by $1,600, and to compensate, accounts payable also increase by $1,600; therefore,

4. Example Transaction #4: Services Performed for Cash

Apple receives $1,300 cash from Harvard for app development services that it has performed.

Solution: Service revenue, a component of shareholders’ equity, increases by $1,300, and so does the asset cash; therefore, we’re in balance.

5. Example Transaction #5: Purchase of Advertising on Credit

Apple receives a bill for $290 from Google for advertising rights but asks to postpone the payment.

Solution: Accounts Payable, a liability, increases by $290, but the shareholders’ equity item, advertising expense, decreases by $290; therefore, we’re in balance.

6. Example Transaction #6: Services Performed for Cash and Credit

Apple performs $3,500 of app development services for iPhone 13 users, receives $1,500 from customers, and bills the remaining balance on the account ($2,000).

Solution: Service revenue, an item under retained earnings and stockholders’ equity, increases by $3,500, and to compensate, cash increases by $1,500, and accounts receivable also increase by $2,000; therefore, we’re in balance.

7. Example Transaction #7: Payment of Expenses

Apple pays for rent ($600) and utilities ($200) expenses for a total of $800 in cash.

Solution: Rent expense , an item under retained earnings and stockholders’ equity, goes down by $600, and utility expense decreases by $200. To compensate, cash is reduced by $800; therefore, we’re in balance.

8. Example Transaction #8: Payment of Accounts Payable

Apple pays the $290 in cash to Google that it previously had on account in transaction #5.

Solution: Cash, an asset, goes down by $290, and to compensate, so do the accounts payable, the liability; therefore, we’re in balance.

9. Example Transaction #9: Receipt of Cash on Account

Apple receives $600 from customers billed for annual iOS services.

Solution: Cash, an asset, increases by $600, and to compensate, accounts receivable (another asset) decrease by $600; therefore, we’re in balance.

10. Example Transaction #10: Issue of Dividends

Apple pays a $1,300 cash dividend to shareholders.

Solution: Cash, an asset, is decreased by $1,300, and dividends under stockholders’ equity go down by $1,300; therefore, we’re in balance.

It’s important to note that although dividends reduce retained earnings, they are not expenses . Therefore, dividends are excluded when determining net income (revenue - expenses), just like stockholder investments (common and preferred).

Everything You Need To Build Your Accounting Skills

To Help you Thrive in the Most Flexible Job in the World.

Researched and Authored by Joshua Tobias | LinkedIn

Reviewed & Edited by Ankit Sinha | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

- Accounting Method

- Amortization

- Balance Sheet

- Income Statement

Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling.

or Want to Sign up with your social account?

Accounting Equation Problems and Solutions with Examples

What is the Accounting Equation?

The Accounting Equation is based on the double entry accounting, which says that every transaction has two aspects, debit and credit, and for every debit there is equal and opposite credit. It helps to prepare a balance sheet, so it is also called the Balance Sheet Equation.

Accounting Equation Formula

We already know what the words “Asset” and “Liability” mean from the previous lesson. Let’s quickly define this new term, “Owners Equity”.

What is Owner’s Equity?

We can define Owners Equity as “the amount of money that you (the owner) have invested in the business.”

Whenever you contribute any personal assets to your business your owner’s equity will increase. These contributions can be any asset, such as cash, vehicles or equipment. For example, if you put your car worth $5,000 into the business, your owner’s equity will increase by $5,000. If you invest $10,000 of your savings into the business, your owner’s equity will increase by $10,000.

Likewise, if you take money out of business, your owner’s equity will decrease. For example, you go into your store and take $100 from the cashier to buy yourself a shirt. Because you are taking $100 out of business, your owner’s equity will decrease by $100.

Let’s see if you can identify which of the following transactions will result in a change in owner’s equity:

Problems and Solutions: For each of these transactions we could simply have a “yes” and “no” button. I’ll write the correct answer below for you to code.

Transaction 1:

You invest $1,000 of your personal savings into the business.

Change in owner’s equity?

Incorrect Correct

In this scenario you are investing your own personal funds into the business. Any personal investment will increase your owner’s equity.

Transaction 2:

Your new oven breaks. You hire a repairman $50 to fix it.

Correct Incorrect

Again, you are introducing a personal asset into your business and using it as a business asset. Any investment of personal assets will increase your owner’s equity.

Transaction 3:

You purchase a computer for the business using the business bank account.

You are not making any personal investment here. You are using business funds to purchase a business asset. Therefore there was no new investment by you. Your owner’s equity will remain unchanged.

How does the Accounting Equation Works?

Every single transaction that occurs in your bakery will be recorded using the accounting equation .

Before we go any further, there are three very important things to remember about the equation:

- The left side is referred to as “The Debit Side”

- The right side is referred to as “The Credit Side”

- The equation must always be in balance.

The two sides of the equation:

The Debit Side: The left side of the equation is known as the debit side. As you can see, the left side of the equation consists of Assets.

The Credit Side: The right side of the equation is known as the credit side. As you can see, the right side of the equation consists of Liabilities and Owners Equity.

Remember, the equation must ALWAYS balance.

Note : Throughout this lesson, you will also notice that we refer to different “accounts”. An account can be thought of as a collection of related entries. For example, every entry that relates to our loan will be recorded in the “loan account”. Every transaction that relates to our oven will be recorded in the “oven account”. It Might be part of the reason this subject is called “ accounting ”!

Examples of the Accounting Equation

Let’s look at some examples to see the accounting/bookkeeping equation in action.

Transaction 1

After making cupcakes in your Grandma’s kitchen your whole life, you decide to open a bakery. You use your $10,000 in savings to start your business.

Now let’s look at how this fits into the accounting equation.

Accounts affected:

You have just put $10,000 into the bank, which is an asset. This goes on the debit side. Now that the debit side has gone up, we need to balance this with $10,000 on our credit side.

We know that our $10,000 investment represents an increase in owner’s equity, and owner’s equity will go on the credit side.

With these two entries, the equation is now balanced.

Let’s fit this into the accounting equation.

We started off with $0 = $0 + $0. Doesn’t get much easier than that!

Now it’s changed a little.

As you can see, we have +$10,000 on the left side (the debit side), and we have +$10,000 on the right side (the credit side). Because both sides went up by $10,000, we’re still in the balance. Phew!

Still don’t get it? Don’t worry, it’ll click soon enough. Let’s look at another example.

Transaction 2

You need an iPhone to take delivery calls from all your crazy customers. You buy one off eBay for $500.

Remember in the first example we put money into the bank? Well, this time we’ll be using the bank again, only now we’ll be spending money. That means our bank account, an asset, is going to decrease .

Now that we know the Debit side has decreased, we need to record the second side of the transaction that will keep the equation in balance.

We’re going to create a new asset account called iPhone, because we need to record the new phone as an asset . Remember, it cost $500, so the two sides of the transaction are:

BANK -$500 (Debit side decrease) iPhone+$500 (Debit side increase)

Our bank caused the debit side to decrease, but then our new phone caused it to increase. That means our debit side had no change in the end, and our equation still balances.

You may be wondering, why didn’t the credit side change in this example like it did in the previous example?

Remember, the credit side is only involved in transactions that relate to liabilities and owner’s equity. In this particular transaction, only assets were involved: we used an asset (bank) to purchase another asset (iPhone).

We saw above that owner’s equity only relates to investments made personally by the owner. In this example, we used the business bank account to purchase a business asset. Therefore the owner was not involved. If we had used the owner’s personal bank account to buy the iPhone, then our owner’s equity on the credit side would have increased.

Still not getting it? Let’s do a few more examples.

Accounting Equation Problems and Solutions

Have a go at working out the two sides of each transaction. Remember, it needs to balance!

Problem: It’s time to go oven shopping, but first, you need some cash. You visit Anne, the loan officer, and she gives you a loan of $10,000.

Drag & Drop the blocks into correct positions in the table

Transaction 4:

Problem: It’s your lucky day. You just won a lottery prize of $5,000. You decide to invest your $5,000 into the business.

Drag & Drop the blocks into correct positions in table

- Owner’s Equity

Transaction 5:

Problem: We don’t want Anne to get angry. You better pay back some of the loans. You decide to pay back $1,000.

Transaction 6:

Problem: You need a computer to start taking internet orders and also to watch funny Youtube videos after work. You purchase a computer for $1,500.

Transaction 7:

Problem: Your oven got stolen! Time to purchase the new Bakemaster X Series! It costs you $2,000

After recording these seven transactions, our accounts now look like this. We have all our assets listed on the debit side and all our liabilities and owner’s equity listed on the credit side.

Take a quick look back and see if you can follow how the numbers have changed.

Still in balance. Perfect!

In case you haven’t figured out how we got to these figures, we’ve broken it down step by step for you below.

Let’s use our Bank account as an example.

Our bank account started at $0. Then the following happened:

As you can see, we added all transactions that related to the bank to arrive at our ending balance of $20,000. This is the same approach we took for all the accounts.

- Accounting Tutorial for Beginners: Learn Bookkeeping in 7 Days

- Purpose of Accounting (It’s Need and Importance)

- Top 134 Accounting Interview Questions and Answers (PDF)

- 11 BEST Accounting Books for Beginners (2024 Update)

- Accounting Book PDF: Basic Principles & Bookkeeping Tutorial

- 10 BEST Free POS Systems for Small Business (2024)

- 7 BEST Accounts Payable Software for Small Business (2024)

- 8 BEST Expense Management Software (2024)

- Accounting Equation

An Accounting Equation is also called the Balance Sheet Equation. We all know that we record all the business transactions using the Dual Aspect concept. This means that each debit has an equal credit and vice-versa.

Suggested Videos

There are two approaches to record the transactions in financial accounting. One is the Traditional approach or the British Approach and another is the Modern Approach or the American Approach. Under the Modern Approach , we do not debit and credit the accounts. Here, we use the Accounting Equation to debit or credit an account. Thus, it is also called the Accounting Equation Approach. Now let us study the Accounting Equation in detail.

This approach classifies the accounts as follows: