- Search 24299

- Search 71936

- Search 28698

Southwest Airlines SWOT 2024 | SWOT Analysis of Southwest Airlines

Company: Southwest Airlines Co. CEO: Gary Kelly Founders: Herb Kelleher & Rollin King Year founded: 1967 ( as Air Southwest), and 1971 (as Southwest Airlines) Headquarter: Dallas, Texas, U.S. Number of Employees (Dec 2019): 60,800 Type: Public Ticker Symbol: LUV Annual Revenue (Dec 2019): $22.4 Billion Profit | Net income (Dec 2019): $2.3 Billion

Products & Services: Business Select Flights | Express Bag Drop | Southwest Airlines Charter | Fly By Priority Lane Access | Early Bird Check-In | Business Travel and Groups | Southwest Airlines Cargo | P.A.W.S. | Southwest Gift Cards Competitors: Delta Airlines | American Airlines | Spirit | United Airlines | JetBlue | Skywest | Alaska | Frontier | Republic

Did you know that Southwest Airlines had to sell one of their four Boeing 737s in 1972 to cover payroll?

Table of Contents

Southwest Airlines’ Strengths

1. luv culture.

Making every customer feel like a part of the family is an effective way to enhance customer loyalty. The airline has mastered the art of bringing the customer into the Southwest family using its enticingly warm LUV culture .

2. Lower Cost

One of the reasons behind Southwest Airlines’ large number of loyal customers is its low-cost flights. Using the airlines’ Low Fare Calendar , passengers can book flight tickets starting as low as $45 for a one-way flight. The airline has held the title of the best low-cost carrier for years.

3. Best Employer

Southwest Airlines has consistently been ranked as one of the best employers in America. According to recent Forbes ranking, Southwest Airlines is ranked #2 America’s Best Employers 2019.

4. World’s Most Admired Company

In 2019, Southwest Airlines was ranked #11 Fortune’s most admired company in the world.

5. Consistently Profitable

Attaining high profits consistently is the main purpose of going into business. It fuels growth by allowing businesses to amass capital for expansion and R&D. In 2019, Southwest Airlines showed profits for 47 years consecutively . Considering airlines is a cutthroat industry, it’s indeed a great accomplishment.

6. Brand Value

Southwest Airlines is the 4 th most valuable airlines brand in the world, with a brand value of $6.6 Billion .

7. Single Aircraft Type (Boeing 737s)

Since its inception, Southwest Airlines has exclusively used Boeing 737s for all its flight operations. As of Dec 2019, it has a total of 747 Boeing 737s Aircraft. Single aircraft type has been an effective, low-cost strategy for Southwest Airlines. It allows for simplified training (pilots, staff and ground crew), maintenance, scheduling, flight operations, and effective aircraft utilization.

8. Effective Service Strategy

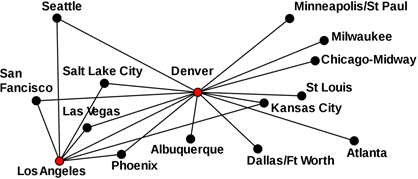

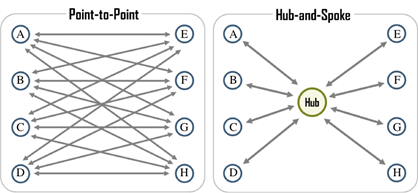

Southwest Airlines provide direct non-stop flights under its point-to-point service , which reduces time-wastage.

9. High Capacity

The capacity of airlines is measured in terms of Available Seat Miles (ASMs). Having a higher ASM means more seats for longer miles, which contributes to the bottom line. From 2011 to 2019, Southwest Airlines’ ASMs grew from 120.58 billion to 157.25 billion , making it one of a few national airlines with ridiculously high capacity.

10. Effective Management

From financial management to HRM, having effective management from top-level down to the mid-level enhances stability and increases the rate of growth. Southwest Airlines’ management is regarded as one of the best in the industry and the airline’s major strength.

11. Market Share Dominance

Being a dominant player in the market is particularly beneficial in industries that are influenced by intense lobbying, such as airlines. Dominant players can leverage their connections, superiority, and resources to lobby successfully for the adoption of legislation that advances their agenda.

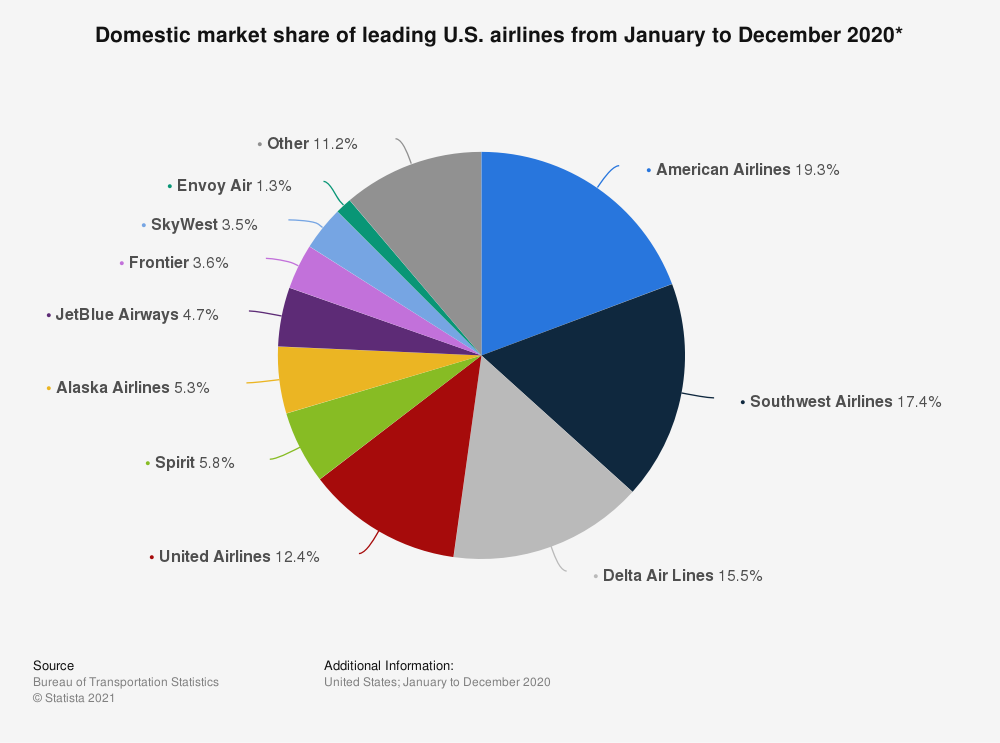

From Feb 2019 to Jan 2020 , Southwest Airlines is ranked 3 rd and has U. S. domestic market share of 16.8% , followed by American (17.6%) and Delta (17.5%).

12. Thousands of Flights

The more an airline flies, the more revenue it can generate. During peak travel season, Southwest operates over 4,000 flights a day. With a large number of flights, Southwest Airlines is undeniably a force to reckon with in the airline industry.

Southwest Airlines’ Weaknesses

1. lack of diversification.

Over dependence on a single revenue source exposes a company to catastrophic loss in case of uncertainty or economic turmoil within that sector.

In FY2019, Southwest Airlines’ reported $22.4 billion total revenues to consist of $20.7 billion as passenger revenue making up 93% of total revenues while freight revenue was $172 million, which is less than 1%.

- Passenger (air ticket) revenue : $20.77 Billion (~93 % of total revenue)

- Other (loyalty points) revenue : $1.48 Billion (~6% of total revenue)

- Freight (cargo and mail) revenue : $172 Million (~1 % of total revenue)

Southwest Airline should diversify its revenue sources. Any issues that impede tourism or travel in these uncertain times can be catastrophic for the airline.

2. Dependent on the US Market

Southwest Airlines does not offer international flights and depends on the domestic US market completely (with the exception of few tropical vacation islands in Mexico, Central America, and The Caribbean).

“Don’t put all your eggs in one basket” comes to mind. Southwest can lose profitability and sustainability in case the US market dries up suddenly.

3. Overdependence on Boeing 737s

Since its founding, Southwest Airlines has depended solely on Boeing 737s.

On Mar 13, 2019, the Federal Aviation Administration (FAA) issued an emergency order to ground all MAX aircraft following two fatal accidents. Southwest Airlines owns 31 Boeing 737 Max out of its total fleet of 747 planes.

The grounding of Boeing 737 MAX resulted in a loss of revenue due to fewer planes. This highlights the issue over depending on only one aircraft model.

Southwest Airlines’ Opportunities

1. expand globally.

Southwest Airlines recently expanded its local flights to Hawaii and can expand further to cater to the increasing air travel in emerging economies due to globalization and improved financial situation.

For starters, South America offers an unsaturated market and can be a perfect steppingstone for Southwest’s global expansion .

2. Improve booking process

In 2019, Southwest added PayPal and Apple Pay to its website, mobile app, and in-flight WiFi purchase page. It’s a great opportunity to expand e-payment options for its customers.

3. Expand on Freight Business

Southwest airlines can expand its freight business to tap into the ever-growing global logistics market with a market size of $6 Trillion in 2019.

4. Exploit New Technologies

The ever-increasing number of use cases for the internet offers Southwest airlines an opportunity to market its services directly to a wide audience. Also, the airline can adopt emerging technology trends such as bio metric boarding kiosks to speed up the security process.

5. Offer Long-distance Flights

The market for longer flights is increasing rapidly as more millennials enter the workforce and dare to work and live further from home than previous generations. Southwest Airlines can expand from short hauls to long flights to exploit growing demand.

Southwest Airlines’ Threats

1. global recession.

From South East Asia to Europe, Africa, America, and Australia, economies across the world are nose-diving into economic turmoil due to uncertain times. With the record rate of unemployment in the US and threat of recession looming , Southwest’s operations are under threat.

2. Boeing 737 Max Issues

Boeing’s Max aircraft are crucial for Southwest Airlines’ growth plans and modernization initiatives . With the grounding of Boeing 737 Max, Southwest’s operations have been immensely affected since its fleet consists primarily of this aircraft model.

If the situation continues, the airline can suffer from:

- lost revenue due to cancellations

- b) negative effects on customer airline choice

3. Negative Publicity

A report by the US government revealed that the airline has been flying jets without confirmed maintenance records for over two years and exposed over 17 million passengers to safety risks.

4. Intense Competition

From Jet Blue to Delta, American, Spirit, United, and Alaska, Southwest Airlines faces intense competition from other players in the US Airline industry.

In addition, Southwest Airlines considers not only the airline industry but also automobiles , buses , and train s as other forms of competition for them.

During an economic downturn, customers cut down on their discretionary expenses and choose less expensive ground transportation alternatives.

5. Increase in Fuel Price

The profitability and sustainability of airlines are heavily dependent on fuel prices. In the event of an increase in fuel prices, Southwest’s profitability and sustainability could be threatened due to increased operating costs.

6. Incidents of Terrorism

The airline industry struggled with the decline in leisure travel due to the 9/11 terror attack. Any terror attack in the future could be devastating not only to Southwest Airlines but also to the entire industry and economy.

7. Stringent Regulations

From FAA inspections to government legal compliance, the operations of Southwest Airlines can be threatened by stringent regulations in the airline industry. For one, the government recently announced that it would be taking action against the airlines’ decision to fly 49 used jets acquired from foreign carriers without proper inspection.

8. Uncertain Times (Economic Shock)

These uncertain times have highlighted the vulnerabilities of the airline sector. Planes have been grounded, and air travel demand is at an all-time low, leading to millions of dollars in losses.

In March 2019, Southwest warned its investors that its first-quarter revenue is projected to drop between $200 and $300 million . If the situation persists, Southwest’s profitability and sustainability can be affected even more.

References & more information

- 11 Little Known Facts About Southwest Airlines | Boldmethod

- 2019 One Report | Southwest Airlines

- Low Fare Calendar | Southwest

- Southwest Airlines SEC Filing

- Teneva, M. (2018). Price Wars: Airline Industry Pains and Gains . Sky Refund.

- Southwest Newsroom. Southwest Corporate Fact Sheet .

- Thomson, J. (2018, December 18). Company Culture Soars at Southwest Airlines . Forbes.

- Cowney, D. A. (2019, September 19). What is Southwest Airlines Low-Cost Strategy? Leadership Strategic Plan. Medium.

- Mazareanu, E. (2020, February 10). Southwest Airlines: Available Seat Miles 2011-2019 . Statista.

- Southwest Airlines. Culture. https://careers.southwestair.com/culture

- Rothman L. A. (2019, Oct 23). Analyzing Southwest Airlines’ Market Share (LUV) . Investopedia.

- Trefis Team. (2016, September 14). Factors That Have Strengthened Southwest’s Domestic Presence . Forbes.

- Booker, B. (2019, December 17). Southwest Airlines Nixes Boeing 737 Max Planes from Its Fleet until April .

- Trefis Team. (2020, February 25). Can Southwest Airlines Overcome Its Capacity Crunch To Grow Revenues In 2020 ?

- Pasztor A. and Alison Sider (2020, January 30). Southwest Flew Millions on Jets with Unconfirmed Maintenance Records, Government Report Says . The Wall Street Journal.

- Gilbertson, D. (2019, March 23). Southwest to cut 1,500 daily flights as passenger levels, bookings hit ‘unimaginable lows.’ USA Today.

- Ballard, J. (2019, August 31). Where Be Will Southwest Airlines in 10 Years? Motley Fool.

- Globe Newswire (2020, February 6). Global Logistics Industry 2020-2023 . Globe Newswire.

- Bogaisky, J. (2019, December 26). What’s Ahead for Airlines and Aviation In 2020 .

- Aditi S. (2018, Dec 13). Why millennial-themed airlines don’t attract millennials .

- Siegel, R. (2020, March 10). Airlines slash routes, outlook, and executive pay . The Washington Post.

- Tsang, A. (2019, July 25). Southwest Airlines to Leave Newark Airport as Toll of Boeing’s 737 Max Grounding Grows. The New York Times.

- Foelber, D. (2020, January 31). Why JetBlue Airways Could Be the Best Airline Stock of 2020 . Motley Fool.

- Gilbertson, D. (2020, March 5). Southwest CEO says bookings down . USA Today.

- Lori Aratani, L. (2019, November 12). Southwest Airlines is operating 49 planes that may not have been properly inspected, top FAA official says . The Washington Post.

- Oliver, D. (2020, January 30). Southwest speaks out about draft government report saying it neglected to prioritize safety . USA Today.

Tell us what you think? Did you find this article interesting? Share your thoughts and experiences in the comments section below.

A management consultant and entrepreneur. S.K. Gupta understands how to create and implement business strategies. He is passionate about analyzing and writing about businesses.

Add comment

Cancel reply, you may also like.

Kroger SWOT Analysis (2024)

Company: Kroger Founder: Bernard Kroger Year founded:1883 CEO: Rodney McMullen Headquarter: Cincinnati, Ohio, United States Employees (2022): 420,000 Type: Public Ticker Symbol: KR AnnualRevenue (FY 2021): $137.9...

HDFC Bank SWOT Analysis (2024)

Company: HDFC CEO: Sashidhar Jagdishan Founder: HT Parekh Year founded: 1994 Headquarter: Mumbai, India Employees (2022): 141,579 Type: Public Ticker Symbol: HDFCBANK Annual Revenue (Mar 2022): 101,519 Crore Rupees...

Verizon SWOT 2024 | SWOT Analysis of Verizon

Company: Verizon Communications Inc. CEO: Hans Erik Vestberg Year founded: October 7, 1983 Headquarters: Hans Erik Vestberg Employees (Dec 2019): 135,400 Ticker Symbol: VZ Type: Public Annual...

BMW SWOT 2024 | SWOT Analysis of BMW

Company: BMW Group Founders: Camillo Castiglioni, Franz Popp, and Karl Rapp Year founded: March 7, 1916 CEO: Oliver Zipse Headquarters: Munich, Bavaria, Germany Employees (FY2019): 133,778 Tpye or Private...

Sears SWOT 2024 | SWOT Analysis of Sears

Company: Sears Holding, Corp. CEO: Mohsin Y. Meghji Founder: Alvah Curtis Roebuck, Richard Warren Sears, Julius Rosenwald Year founded: 1893 Headquarters: Hoffman Estates, Illinois, United States Employees...

Nordstrom SWOT 2024 | SWOT Analysis of Nordstrom

Company: Nordstrom, Inc. Co-Presidents: Erik Nordstrom and Pete Nordstrom Founders: John W. Nordstrom & Carl F. Wallin Year founded: 1901 (as Wallin & Nordstrom), 1971 (Nordstrom Inc...

Ford SWOT 2024 | SWOT Analysis of Ford

Company: Ford Motor Company CEO : James Duncan Farley Jr. Year founded : 1903 Headquarter : Dearborn, Michigan, USA Number of Employees (FY 2022): 173,000 Public or Private: Public Ticker...

Cadbury SWOT Analysis (2024)

Company: Cadbury CEO: Anand Kripalu Founder: John Cadbury Year founded: 1824 Headquarter: Uxbridge, United Kingdom Employees (2022): 140,000 Type: Public Ticker Symbol: Revenue (2021): 572.80 Rupees Profit | Net...

Home Depot SWOT 2024 | SWOT Analysis of Home Depot

Company: Home Depot Inc. Founders: Bernie Marcus and Arthur Blank Year founded: 1978 CEO: Craig Menear Headquarters: Atlanta, Georgia, USA Number of Employees (Dec 2019): 413,000 Ticker Symbol: HD Public or...

McDonald’s SWOT 2024 | SWOT Analysis of McDonald

Company: McDonald’s Corp. CEO: Chris Kempczinski Founders: Richard and Maurice McDonald’s Year founded: 1940 Headquarter: Chicago, Illinois Number of Employees (FY 2023): 150,000 Type: Public...

Recent Posts

- Who Owns Westin Hotels & Resorts?

- Who Owns Truist Bank?

- Who Owns Alfa Romeo?

- Who Owns Burt’s Bees?

- Top 15 Ruggable Competitors and Alternatives

- Top 15 Ticketmaster Competitors and Alternatives

- Who owns Kidz Bop?

- Top 20 Zapier Competitors and Alternatives

- Top 15 Boxabl Competitors and Alternatives

- Who Owns High Noon?

Business Strategy Hub

- A – Z Companies

- Privacy Policy

Subscribe to receive updates from the hub!

- Red Queen Effect

- Blue Ocean Strategy

- Only the paranoid survives

- Co-opetition Strategy

- Mintzberg’s 5 Ps

- Ansoff Matrix

- Target Right Customers

- Product Life Cycle

- Diffusion of Innovation Theory

- Bowman’s Strategic Clock

- Pricing Strategies

- 7S Framework

- Porter’s Five Forces

- Strategy Diamond

- Value Innovation

- PESTLE Analysis

- Gap Analysis

- SWOT Analysis

- Strategy Canvas

- Business Model

- Mission & Vision

- Competitors

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

PESTLE Analysis

Insights and resources on business analysis tools

Southwest Airlines SWOT Analysis: 51 Factors Affecting its Flight Plans

Last Updated: May 15, 2024 by Jim Makos Filed Under: Companies , SWOT Analysis

Southwest Airlines is a low-cost carrier that distinguishes itself from other airline companies through its low-cost fares.

Despite being an airline known for its low cost, Southwest airlines operated profitably from its inception in 1967 to 2019. But when the pandemic hit, Southwest’s profits plummeted, leading the company to its first and only loss in over 50 years of operation.

So, what was behind Southwest’s success streak? What did it do to recover from a 59% drop in profit? And what is Southwest doing to recover from this crisis?

Well, this Southwest Airlines SWOT analysis will clarify everything and fill in the blanks of the PESTLE Analysis of Southwest Airlines .

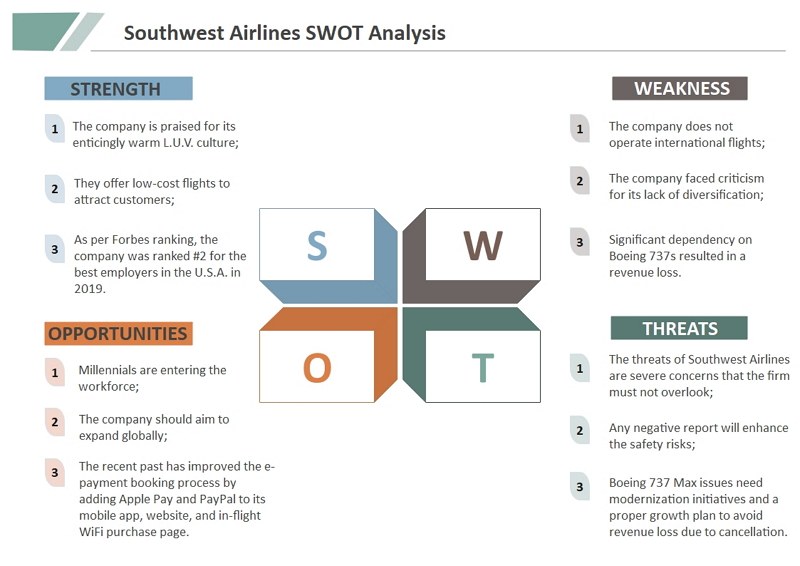

SWOT Analysis of Southwest Airlines

In this SWOT analysis, Ι will explore:

- Strengths – Internal factors supporting Southwest’s growth.

- Weaknesses – Internal factors hindering Southwest’s progress.

- Opportunities – External factors that may help Southwest strengthen its position in the market.

- Threats – External factors that may weaken Southwest’s position in the industry.

For Southwest Airlines, a major U.S. airline known for its unique management style and customer service, we can begin by identifying some key strengths.

Southwest Airlines strengths

The main strengths of Southwest Airlines are its low-cost business model and point-to-point routes. In addition to these, Southwest Airlines has taken aggressive measures to increase its liquidity. As a result, it has added a strong balance sheet to its arsenal of strengths.

Here’s an overview of Southwest’s strengths:

- Low-Cost Structure : One of the lowest-cost operators in the airline industry, which helps in keeping fares low and competitive. Southwest Airlines uses three main measures to reduce its operating costs. The first of these measures includes implementing a point-to-point route structure rather than a hub-spoke route structure. In addition to this, Southwest flies only one type of aircraft. Lastly, Southwest improves operation efficiency by reducing the headcount and increasing the efficiency of employees needed to run operations.

- Customer Service : Known for its friendly service and free checked bags, Southwest often ranks high in customer satisfaction among U.S. airlines. No fee for flight changes and free checked bags are significant benefits that attract customers.

- Point-to-Point Network : Traditionally, airline companies operate the hub-spoke model. In this model, the airline concentrates its resources on major cities – the hubs. Southwest Airlines breaks this model. Instead, it operates scheduled flights between secondary or downtown airports. These airports are less congested, leading to high asset utilization.

- Extensive Domestic Network : It covers a wide network across the United States, offering extensive national connectivity.

- Single Aircraft Fleet: Southwest exclusively flies the Boeing 737. The single aircraft policy simplifies the operation of the fleet and training of the staff. This decision reduces operational expenses and improves efficiency.

- Financial Health : Historically, Southwest has maintained strong profitability and has a robust balance sheet despite some challenges. As of 2024, the company reported a liquidity of $12.5 billion, which comfortably exceeds its total long-term debt of $8.0 billion. For the first quarter of 2024, Southwest experienced a net loss of $231 million, a slight improvement over previous projections. This was accompanied by a record operating revenue for the quarter, demonstrating the airline’s strong revenue-generating capability despite its losses.

- Operational Efficiency : Southwest is known for quick turnaround times and high aircraft utilization, helping to keep costs down. Southwest has also benefitted from its proactive fuel hedging policy, which has protected it against fuel price volatility in the past. The airline routinely adjusts frequencies in its existing routes while adding new routes and itineraries. The company also eliminates less profitable routes. The ongoing optimization of existing routes, adding new routes, and eliminating unprofitable routes create a winning formula for maintaining low operating costs and high operational efficiency.

- Southwest Airlines is well-known for its “ Transfarency ” policy, which promises no hidden fees, a concept that strongly resonates with consumers and sets it apart from competitors. This transparent approach to pricing is a core part of its brand, making it highly recognizable and appreciated among U.S. travelers.

- Southwest is renowned for its positive work culture and strong employee relations. One example is the profit-sharing program , which has been in place since 1974. In February 2020, Southwest announced that it would be sharing $667 million with its employees through this program, which was about 13.2 percent of each eligible employee’s annual salary.

- Loyal Customer Base : The airline has a loyal customer base, thanks to its Rapid Rewards loyalty program . This loyalty program offers benefits such as unlimited reward seats, no blackout dates, and points that do not expire, making it highly attractive to frequent flyers.

- Strong Safety Record : The airline has a strong safety record, which is a critical factor for travelers when choosing an airline.

- Strategic Acquisitions : The acquisition of AirTran Airways expanded its market presence and route network.

- One of its key programs is the “Southwest Airlines Heart of the Community Grants,” which supports the creation of vibrant, community-led public spaces in partnership with Project for Public Spaces. The airline also has a longstanding relationship with the Ronald McDonald House , providing travel assistance to families dealing with serious illnesses.

- A notable campaign was the “Wanna Get Away” ads, which humorously depicted people in embarrassing situations, suggesting that Southwest could offer an escape at a low cost. These ads were not only memorable but also effectively communicated the value proposition of the airline.

Southwest Airlines managed to pull through 2020 during COVID-19 without eliminating any of the destinations it serves. The company also absorbed the impact of the downturn quite well with an adjusted balance sheet leverage of 56% at the end of 2020.

However, the airline industry is hyper-competitive . Therefore, its success in the years to come will not only depend on how well it leverages its strengths but also on how well it addresses its weaknesses.

In the next part of the article, I’ll explain the major weaknesses of Southwest Airlines.

Southwest Airlines weaknesses

The biggest weakness of Southwest Airlines is its inability to remain competitive in the face of other airline companies adopting cost-cutting measures because of the pandemic. In addition to this, Southwest’s destinations and passenger amenities are falling short of those its competitors offer.

Here’s an explanation of Southwest’s weaknesses:

- Limited International Reach : Southwest primarily operates within the United States, with limited international flights, potentially missing out on global market share. Southwest Airlines has a strong network of point-to-point routes in the US. However, its competitors have more extensive routes within the US and in the international markets. At the end of 2020, Southwest served 107 destinations. However, its rival Delta and its alliance partners serve 900 destinations in 140 countries.

- Concentration in the Domestic Market : High exposure to the U.S. market makes Southwest vulnerable to domestic economic downturns.

- No Commercial Alliances : Many of Southwest’s competitors have formed commercial relationships. These relationships allow Southwest’s competitors to provide more destinations to their patrons than Southwest can.

- Dependence on a Single Aircraft Type : Relying mostly on Boeing 737s limits flexibility in capacity management and route customization. Southwest’s single aircraft policy limits passenger amenities to what the Boeing 737 can offer. Other airline companies operate aircrafts that have a larger carrying capacity and better passenger amenities. For instance, Southwest flights don’t offer premium seating facilities such as first class or business class. Southwest’s lack of a business class may deter some higher-paying business travelers.

- No Seat Assignments : The open seating policy can be a deterrent for those who prefer pre-assigned seating.

- Supply Chain : Southwest relies on Boeing for spare parts. The reliance on a single company creates supply chain bottlenecks. The prolonged delays in restoring Southwest’s fleet of grounded Boeing 737 MAX highlights the problems of Southwest’s sole reliance on Boeing.

- Limited Cost-Reduction Possibilities: Prior to the pandemic, Southwest’s low-cost business model gave it an edge in the airline industry. However, after the pandemic, several airline companies resorted to similar measures to remain operational. As a result, Southwest lost its advantage. What’s worse, the company is struggling to find further opportunities for cost reduction.

- Limited Cargo Service : Southwest does not have a significant cargo business, unlike many competitors, missing out on this revenue stream.

- In early 2023, Southwest’s mechanics disputed contract terms , highlighting ongoing union negotiation challenges.

- The massive flight cancellations during winter 2023 , which were partly blamed on outdated technology, seriously impacted Southwest’s operations and reputation.

- Aging Aircraft Fleet : Maintenance costs and efficiency losses from an aging aircraft fleet.

- Market Share Limitation : As a low-cost carrier, competing for market share with full-service airlines can be challenging without diversifying the service offerings.

While it may take a decade for the airline industry to return to normal, airline companies must face intense competition on the road to recovery. However, the future isn’t bleak. These turbulent times present several opportunities for Southwest. Capitalizing on these opportunities could give Southwest a significant edge in the industry. I will discuss these opportunities next.

Southwest Airlines Opportunities

Some of the major opportunities for Southwest Airlines are expanding its routes and upgrading its fleets. In addition to this, Southwest can also re-think its cost structure so that they offer more amenities and compete with ultra-low-cost airlines.

Here’s an overview of Southwest’s opportunities:

- According to the International Air Transport Association (IATA) , global air travel demand in February 2024 saw a substantial increase of 21.5% compared to the same month in 2023, demonstrating a strong start to the year across all markets except North America.

- Further analysis by Airports Council International (ACI) supports these findings, predicting that global passenger volume will reach 9.4 billion by 2024 , surpassing pre-pandemic levels from 2019. This marks a significant recovery, with the global passenger volume in 2023 reaching 94.2% of the 2019 level, setting the stage for further growth

- IATA has outlined a progressive increase in mandatory SAF blending rates, which will require significant adoption across the industry. Starting in 2025 with a 2% minimum blend, the requirement will rise to 70% by 2050, reflecting a strong institutional commitment to reducing aviation’s climate impact

- Advancements in Aviation Technology : Innovations such as more efficient aircraft engines, improvements in air traffic management, and developments in digital and automation technologies can help Southwest reduce operational costs and enhance customer experience.

- Technological Innovations : Investing in newer technologies for booking, boarding, and customer service could improve efficiency and customer satisfaction.

- The digital nomad community has been expanding rapidly, with estimates in 2023 showing that there are about 35 million digital nomads globally, with a significant portion, approximately 47%, coming from the United States. Digital nomads tend to prefer locations that are not only inspirational but also cost-effective, which could influence the development of targeted travel packages or routes by airlines to popular nomad hubs. Moreover, the financial aspect of being a digital nomad is quite favorable, with a substantial number of them earning between $75,000 to over $100,000 annually, which may enhance their ability to travel frequently. This financial independence, combined with their flexible lifestyle, means that digital nomads are a unique customer segment that could potentially prefer the budget-friendly and flexible travel options that Southwest Airlines offers.

- Technology in Customer Service : AI and machine learning developments offer airlines like Southwest new ways to enhance customer service, from personalized booking experiences to automated updates and handling customer inquiries.

- Mobile Technology Integration : Developing a more robust mobile app that offers everything from ticket booking to in-flight services could improve customer engagement.

- Economic Recovery Programs : Governmental economic stimulus measures aimed at boosting travel and tourism can create a more favorable environment for expanding airline operations.

- Ultra-Low-Cost Airlines : Ultra-low-cost airline routes are becoming increasingly popular. Ultra-low-cost carriers, or ULCC, unbundle the fare. In other words, the whole fare is broken into components that the passengers can choose to eliminate. Unbundling leaves anything over the base fare optional. Although Southwest offers low fares, it is a low-cost carrier and not an ultra-low-cost carrier. Therefore, Southwest can explore opportunities in the ULCC niche.

- Partnerships and Alliances : Emerging trends towards strategic partnerships within the industry, such as codeshare agreements or joint ventures, could allow Southwest to expand its network reach without significant capital expenditure.

- Health and Safety Innovations : In a world still aware of pandemic risks, innovations in health and safety, like touchless technologies and improved air filtration systems, can be a market differentiator for airlines prioritizing passenger well-being.

The biggest opportunity for Southwest is the dip in competition the pandemic has created. COVID-19 essentially put the airline industry on time-out. Southwest can use this time to re-imagine its role and re-create itself to face the heavy competition that is on its way.

Southwest Airlines Threats

Traditionally, the biggest threats to Southwest airlines are fluctuating fuel prices, heavy regulation, and intense competition. In addition to these threats, Southwest airlines are also facing new threats such as COVID-19 restrictions and growth of remote work.

Let’s look at Southwest’s threats in more detail:

- Health Pandemics : Outbreaks like COVID-19 can drastically reduce travel demand and disrupt operations. After nearly 50 years of profitable operation, the pandemic led Southwest to its first loss. Southwest’s operating revenue fell from $22.4 billion in 2019 to $9 billion in 2020 . As a result of this 59% drop, the company had to take aggressive measures to stay relevant.

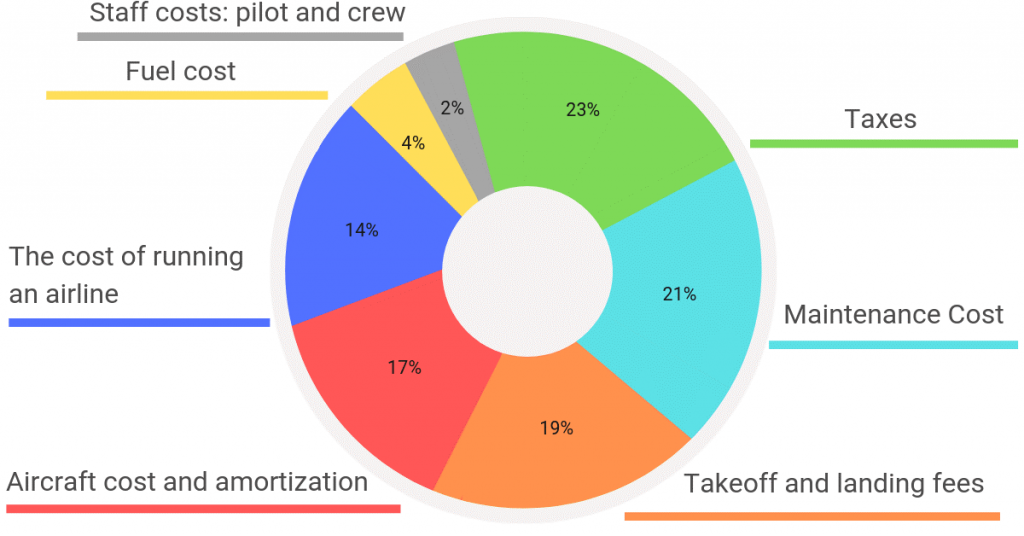

- Fuel Price Volatility : Fluctuations in oil prices can significantly impact operating costs. In 2020, Southwest spent $1.8 billion on fuel. This expense is 14% of the total operating costs. So, fluctuations in fuel prices have a big impact on Southwest’s operating costs and profit.

- Regulatory Changes : New aviation regulations could introduce costly compliance requirements. The airline industry must satisfy the requirements of many operational and economic regulatory bodies such as the FAA and DOT. In addition to this, the company must also comply with many operational, health, and safety regulations. With the emergence of online commerce, the company must also address informational technology and data privacy regulations.

- Intense Competition : The pool of fliers shrank because of the global health crisis. As a result, the competition to acquire patronage has increased. In 2020, American Airlines, Southwest Airlines, Delta Airlines, and United Airlines accounted for nearly 66% of the market share in the United States. However, the individual market share of these companies was close.

- Growth of Remote Work : Lockdowns and social-distancing norms has accelerated work-from-home culture. Online video conferencing platforms such as Zoom has reduced the need for travel. The increase in online collaborative tools has also reduced the need for people to work under one roof. As a result, the segment of income from business travel has been severely hit. Airline companies fear that this behavior shift would be permanent.

- Economic Downturns : Recessions or economic slowdowns can lead to reduced consumer spending on travel.

- Terrorism and Security Concerns : Acts of terrorism could lead to tighter security measures and reduced demand for air travel.

- Environmental Regulations : Stricter emissions regulations could increase operational costs.

- Labor Strikes : Disputes with unions could lead to strikes, disrupting flight operations.

- Data Breaches : Cybersecurity threats that compromise customer data could lead to financial loss and damage to reputation.

- Climate Change Impacts : Extreme weather conditions could disrupt travel schedules and damage infrastructure.

- Currency Fluctuations : Can affect international revenue and costs.

- Political Instability : In regions where the airline operates, political unrest could affect travel patterns.

- Accidents or Safety Incidents : Can lead to a loss of consumer confidence and potential legal liabilities.

In today’s scenario, Southwest’s biggest threats are the competition to acquire patrons and the decline in business travel. The silver lining for Southwest in this scenario is that it has been able to raise cash rapidly. It has also survived the pandemic without canceling any of its destinations.

Recommendations based on today’s Southwest Airlines SWOT Table

The SWOT table summarizes SWOT analysis for Southwest airlines in an easy-to-read grid. Here are my recommendations for Southwest Airlines based on today’s SWOT table .

- Expansion into International Markets : Targeting new international destinations could diversify revenue streams and reduce dependency on the U.S. domestic market. The pandemic has disturbed the existing order of flight routes. In the emerging new order, Southwest can find many gaps for under-serviced routes and expand its network.

- Upgrade Fleet : The airline industry (check out its PEST analysis here ) is not the only victim of the economic recession. Aircraft manufacturers such as Boeing and Airbus have been hit hard as well. These companies are looking to increase their liquidity. Given Southwest’s financial position, now is the best time for Southwest to acquire new aircrafts for relatively low costs.

- Re-Think Cost Structure : At this time, the airline industry as a whole is recovering from a severe setback. Since Southwest got back on its feet more quickly than other airlines did, this recovery window is the perfect time for the company to make bold moves such as re-thinking its cost structure to compete with emerging ultra-low-cost airline companies.

- Revamping In-flight Experience : Upgrading in-flight amenities and entertainment options to enhance passenger satisfaction and compete with larger carriers. The tight competition and rigid operation locked Southwest into offering limited amenities for its passengers. In the years to come, the company anticipates the competition to increase. Before the race picks up and intensifies, Southwest can upgrade its fleet to offer more passenger amenities.

- Introduction of Premium Services : Developing a premium economy or business class service could attract business travelers and increase revenue per flight.

- Enhanced Cargo Operations : Expanding cargo services could capitalize on the growing demand for air freight, especially e-commerce shipments.

- Hub Expansion in Key Cities : Expanding presence in strategic cities could improve network efficiency and capture more passenger traffic.

If you want to learn how to make a SWOT table for another company or SWOT analysis in general, I have a lot of SWOT analysis examples for you to learn and increase your critical thinking skills. And for a step-by-step explanation, you can read everything you need to know about SWOT analysis here .

Southwest Airlines SWOT Analysis 2024 With Key Insights

The moment you started reading this, more than 10 Southwest flights have landed and flown to the sky, serving thousands of people each hour. With consistency and the goal of providing affordable pricing, the company has become one of the largest, favorite, and go-to airlines for thousands of Americans.

It took them four decades to reach where they are now, and in that way, their strengths helped them while weaknesses and threats tried to bring them down. But, by utilizing and capturing opportunities, the company has survived this far, and we will get to know more in this Southwest Airlines swot analysis.

Table of Contents

Southwest Airlines: Company Overview

With just three aircraft serving three cities in Texas, Southwest founded in 1967 by Herb Kelleher and Rollin King and began operating in 1971. And now, the company is the world’s largest operator of the Boeing 737, with a fleet of over 700 aircraft.

The company reported total revenue of $23.8 B, with over 66,656 employees, and operates flights to 121 destinations in the United States, Mexico, and the Caribbean. Southwest Airlines aims to provide high-quality air travel at an affordable price, focusing on customer satisfaction and operational efficiency.

Product & Services of Southwest Airlines Passenger Airline

Southwest Airlines Competitors American Airlines | Delta Air Lines | United Airlines | JetBlue | Virgin America | US Airways Group | AirTran Holdings | Continental Airlines

Did You Know? The company has around 3K flights daily, which goes through the roof with about 5K during peak seasons.

Strengths – Southwest Airlines SWOT Analysis

High Brand Value: Focusing on low fares, friendly customer service, and unique company culture has helped build a strong brand that resonates with customers. In 2022, the airline’s brand value was estimated at $7.3 B, a massive increase from the previous year and ranking as the world’s 4th most valuable airline brand.

Economical Pricing: By offering low fares for its flights compared to its competitors, Southwest Airlines has made a name for its economical pricing strategy. Southwest’s average domestic fare was $142 in 2022, lower than the average $397 for all U.S. airlines, which helped Southwest to remain a popular choice for budget-conscious travelers.

Steady Finance: The airline reported revenue of $23.8 B and a net income of $723 M in 2022. And the data shows this stable performance in the last few years, which is why it has maintained a positive cash flow , with $$11.049 B in operating cash flow, and the balance sheet remains strong.

Effective Customer Service: With a focus on providing passengers with a positive and friendly experience, Southwest Airlines is known for its excellent customer service. According to the various customer satisfaction Indexes, Southwest Airlines had a customer satisfaction score of 77 out of 100 in 2022, the second highest in the US airline industry.

Operational Excellence: The airline’s point-to-point system and efficient turnaround times have contributed to its success in providing customers with reliable and affordable air travel. According to the J.D. Power North America Airline Satisfaction Study, the airline ranked first in economy class with the lowest customer complaint rate.

Weaknesses – Southwest Airlines SWOT Analysis

Unbalanced Revenue: The company is highly dependent on a single segment for revenue, the passenger, which covered over 80% of the total revenue in the last eight years. Besides, its niche-based offerings and focus on economical pricing have made it almost impossible for the company to keep a balanced revenue stream.

Single Market Overdependency: Southwest generated over 90% of its revenue from domestic operations in the USA, making it vulnerable to domestic economic and consumer behavior changes. It creates an overdependency on the market, limits the airline’s growth opportunities, and increases its exposure to domestic financial risks.

Lower International Options: Most of Southwest’s flights are domestic, with limited international destinations , making it hard to target a mass market. As a result, the overdependency on a single market, unbalanced revenue, and various threats and weaknesses are taking away many opportunities for the company.

Weak Supply Chain: Southwest Airlines has recently faced some supply chain challenges, particularly concerning its maintenance operations. The Federal Aviation Administration fined the company $325,000 for improperly maintained Boeing 737 aircraft, and recently, in 2022, the company had a severe SCM meltdown.

Lack of Offerings: The company has emphasized its commitment to providing affordable and reliable air travel, which comes at a cost. Because of that, the airline does not offer first-class seating, and its aircraft doesn’t have in-flight entertainment systems.

Opportunities – Southwest Airlines SWOT Analysis

Multidomestic Strategy: As mentioned, international flights accounted for approximately 7.7% of Southwest airline’s total revenue in 2022, so there are opportunities to expand internationally to more countries, focusing on a multi-domestic strategy. Finding new international routes and starting with them would be an excellent start.

Tech Adaptation: In recent years, the tech has disrupted and efficiently brought operational excellence and better customer experience. The company can implement self-service kiosks, mobile boarding passes, and other digital tools to streamline check-in and reduce customer wait times, and launching a new reservation system is part of the process.

Diversify Offerings: One opportunity for Southwest Airlines to continue to grow and expand its business is to diversify its offerings. As only a limited number of service offerings are available in the portfolio, the company can offer new services with different price sets. That will help to bring new consumer bases and increase revenue.

Sustainability Practices: To become a part of the sustainability practitioners, the company can recognize the importance of environmental responsibility and social impact. The airline has set a goal to reach carbon neutrality by 2050. It has implemented several initiatives, such as investing in more fuel-efficient aircraft and using sustainable aviation fuel .

Effective Partnerships: To expand the company’s reach and offer new services to customers, it has always tried to bring in new partnerships. The airline announced a partnership with Expedia in 2021. And recently, in 2022, the company partnered with a giant like Amazon to give the consumer a better experience.

Threats – Southwest Airlines SWOT Analysis

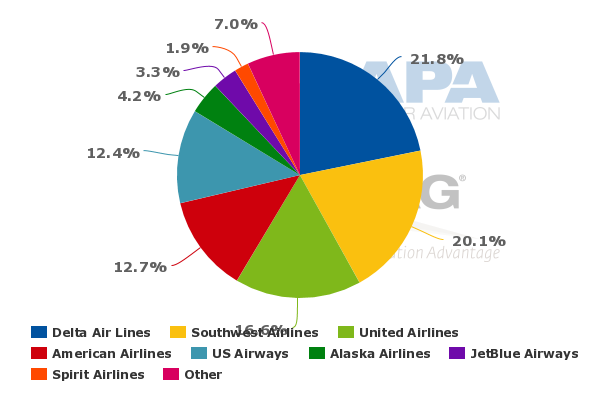

Competitive Market: Southwest Airlines faces intense competition in the U.S. airline industry with giant competitors such as Delta Air Lines, Spirit Airlines, American Airlines, and Frontier Airlines, etc. It had a market share of 17.1%, behind American Airlines (17.6%%), and a similar market share with Delta Air Lines (17.1%) in 2022.

Rising Fuel Price: Fuel is one of the most significant expenses for airlines, and rising prices can lead to increased operating costs and lower profitability. In 2022, the airline’s fuel costs were up 85% compared to 2021 and still increasing, a significant threat to Southwest Airlines.

Economic Downfall: Inflations and recessions or downturns can lead to decreased demand for air travel, as it did during the pandemic or 2008 recession, impacting Southwest Airlines’ revenue and profitability. As inflation already affects the airlines, the recession will make it difficult for Southwest Airlines to keep a stable cash flow in 2023.

Strict Regulations: Changes in government regulations or policies can significantly impact Southwest Airlines. The FAA grounded the Boeing 737 MAX aircraft following two fatal crashes, which affected Southwest Airlines’ operations in 2019. The grounding resulted in the cancellation of thousands of flights and negatively impacted the airline’s revenue.

Labor Shortage: As the recession hit the economy, many industries are on a streak of letting go of labor, which also impacted the airline industry. In December 2022, the company had to cancel 60% of the flights, a total of 2600 flights, because of labor shortage, including pilots to field workers, including staff in the headquarters.

[Bonus Infographic] SWOT Analysis of Southwest Airlines

Recommendations for Southwest Airlines

Every company has to overcome all its weaknesses and mitigate threats to survive in the market long-term, and Southwest is no different. Here are some recommendations for them.

- Expanding its international offerings could help the company reach new customers, increase its revenue, reduce one market dependency, and balance the revenue stream.

- The company should continue to invest in employee retention and satisfaction.

- Exploring new partnerships and offerings that could help it to reach new customers.

- Adapting new techs will make the overall operations more effective and efficient.

- Practicing sustainability will create a positive impact on the consumer.

Frequently Asked Questions (FAQs)

What day is cheapest to fly on southwest airlines.

Tuesday is the cheapest day to fly on Southwest Airlines.

Is Southwest a Budget Airline?

Yes, Southwest is a budget airline.

Is Southwest an International Airline?

Yes, Southwest is an international airline.

Final Words on Southwest Airlines SWOT Analysis

Southwest Airlines is a significant player in the aviation industry, known for its commitment to affordable and reliable air travel. The company’s focus on operational efficiency and employee satisfaction has helped it to maintain low costs and a unique company culture that sets it apart from its competitors. While Southwest Airlines faces threats such as competitive pressure, regulations, rising fuel price, and a labor shortage, it has a track record of adapting and innovating to maintain its success.

- Wikipedia contributors. (n.d.). Southwest Airlines . Wikipedia.

- Second Quarter 2022 Average Air Fare Increases 22% from Second Quarter 2021 . (2022, October 18). Bureau of Transportation Statistics.

- O’Marah, K. (2022, December 30). Southwest Airlines Meltdown: A Supply Chain Management Perspective . Forbes.

- Banker, S. (2022, May 2). Southwest Airlines’ Flight Path To Carbon Neutrality . Forbes.

- Gabriele, A. (2023, March 9). Southwest Airlines Partners With Amazon After the Colossal Mess That Was Late 2022 . InsideHook.

- Pande, P. (2022, April 24). How Rising Jet Fuel Prices Will Hurt Airlines and Travelers . Simple Flying.

- Kulisch, E. (2022, June 1). Airline industry economist sees recession risk in 2023 . FreightWaves.

- Isidore, C. (2020, January 23). The 737 Max grounding cost Southwest $828 million in 2019 . CNN.

- Zilber, A. (2022, December 29). Southwest scrambles to fill key staff shortages with HQ workers, memo reveals . New York Post.

About The Author

Ahsanul Hauqe

Explore more swot analysis.

Apple SWOT Analysis 2024 : In-Depth Report With Infographics

Johnson and Johnson SWOT Analysis 2024 With Key Insights

Patagonia SWOT Analysis 2023: Explore Its Competitive Edge

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Presentations made painless

- Get Premium

Southwest Airlines: Business Model, SWOT Analysis, and Competitors 2023

Inside This Article

Southwest Airlines is a renowned American low-cost carrier that has revolutionized the airline industry with its unique business model and customer-centric approach. In this blog article, we will delve into the intricacies of Southwest's business model, highlighting its key strengths, weaknesses, opportunities, and threats through a SWOT analysis. Additionally, we will explore the competitive landscape, identifying the major players that pose a challenge to Southwest's market dominance. Join us as we analyze Southwest Airlines' strategies and anticipate its position in the aviation industry in 2023.

What You Will Learn:

- Who owns Southwest Airlines and how its ownership structure may influence the company's decision-making process.

- The mission statement of Southwest Airlines and how it guides the company's strategic direction and customer service approach.

- How Southwest Airlines generates revenue and the key factors that contribute to its financial success.

- An explanation of the Southwest Airlines Business Model Canvas, which highlights the various components of the company's business model and how they work together.

- An overview of the main competitors of Southwest Airlines and how they compare in terms of market share, routes, and customer base.

- A SWOT analysis of Southwest Airlines, examining its strengths, weaknesses, opportunities, and threats in the competitive aviation industry.

Who owns Southwest Airlines?

Ownership structure of southwest airlines.

Southwest Airlines, one of the largest low-cost carriers in the world, has a unique ownership structure that sets it apart from many other airlines. The company operates under a publicly traded model, which means that its ownership is distributed among a diverse group of individual and institutional investors.

At present, the largest shareholders of Southwest Airlines are primarily institutional investors such as mutual funds, pension funds, and other financial institutions. These investors hold significant stakes in the company, often owning thousands or even millions of shares. Some of the major institutional shareholders of Southwest Airlines include The Vanguard Group, BlackRock, and State Street Corporation.

In addition to institutional investors, individual shareholders also play a crucial role in owning Southwest Airlines. Many individual investors, including employees of the company, hold shares of Southwest Airlines either directly or through retirement plans like 401(k)s. This broad base of individual ownership is a testament to the company's commitment to employee ownership and engagement.

It is worth noting that Southwest Airlines has a dual-class stock structure, with two different classes of shares: Class A and Class B. Class A shares are publicly traded and have voting rights, while Class B shares are mostly owned by Southwest Airlines' employees and have limited or no voting rights. This structure reflects the company's emphasis on employee participation and aligning their interests with those of the company.

Overall, Southwest Airlines' ownership is a balanced mix of institutional and individual investors, with both groups having a significant influence on the company's operations and decision-making. This diverse ownership structure helps ensure stability and fosters a long-term perspective, allowing Southwest Airlines to focus on delivering value to its shareholders while maintaining its reputation as a customer-centric airline.

What is the mission statement of Southwest Airlines?

Southwest airlines' mission statement.

Southwest Airlines is renowned for its unique mission statement, which is deeply ingrained in the company's culture and operations. The airline's mission statement can be summarized as follows:

"To connect people to what's important in their lives through friendly, reliable, and low-cost air travel."

Southwest Airlines places a strong emphasis on creating meaningful connections and providing exceptional customer service. By offering affordable air travel options, the company aims to enable individuals to reach their desired destinations while staying within their budget. Southwest strives to establish a warm and welcoming environment for its passengers, ensuring that their travel experience is not only hassle-free but also enjoyable.

The Core Values of Southwest Airlines

To fulfill its mission statement, Southwest Airlines upholds a set of core values that guide its actions and decision-making processes. These core values include:

Warrior Spirit: Southwest Airlines encourages its employees to have a warrior spirit, fostering a determination to overcome challenges and go above and beyond to serve customers. This value reflects the airline's commitment to excellence and continuous improvement.

Servant's Heart: Southwest Airlines believes in the importance of having a servant's heart, prioritizing the needs of others before its own. This value is reflected in the company's dedication to providing exceptional customer service and treating passengers with kindness and respect.

Fun-LUVing Attitude: Southwest Airlines promotes a fun-LUVing attitude among its employees, encouraging them to bring their authentic selves to work. This value fosters a positive and inclusive work environment, contributing to a vibrant and friendly atmosphere that passengers can sense during their journey.

Work the Southwest Way: Southwest Airlines emphasizes the significance of working the Southwest way, which means following established procedures while being open to innovation and creativity. This value ensures consistency and efficiency in operations while allowing for flexibility and adaptability to meet customer needs.

By adhering to these core values, Southwest Airlines strives to create a unique and exceptional travel experience for its passengers, setting itself apart from other airlines in the industry.

How does Southwest Airlines make money?

Ticket sales.

The primary source of revenue for Southwest Airlines is ticket sales. Passengers purchase tickets for flights, which generate income for the company. Southwest offers a variety of fare options, including Business Select, Anytime, and Wanna Get Away, allowing customers to choose the level of service and flexibility that best suits their needs. By offering competitive prices, Southwest attracts a large customer base, ensuring steady revenue from ticket sales.

Ancillary Revenue

In addition to ticket sales, Southwest Airlines generates significant income from ancillary revenue. Ancillary revenue refers to the revenue earned from services and products that are not directly related to the core air travel experience. Southwest offers several ancillary services, such as EarlyBird Check-In, which allows passengers to secure a better boarding position for an additional fee. The airline also earns revenue from the sale of in-flight snacks, beverages, and merchandise. These additional revenue streams contribute to Southwest's overall profitability.

Rapid Rewards Program

Southwest Airlines' Rapid Rewards Program plays a crucial role in generating revenue for the company. This loyalty program incentivizes customers to fly with Southwest by offering points for each flight. Accumulated points can be redeemed for free flights, hotel stays, rental cars, and other rewards. The Rapid Rewards Program encourages repeat business and fosters customer loyalty, ultimately leading to increased ticket sales and revenue for Southwest Airlines.

Cargo and Freight Services

Beyond passenger transportation, Southwest Airlines offers cargo and freight services to generate additional income. The company leverages its extensive network of flights and destinations to transport goods and packages efficiently. Southwest Cargo provides reliable and cost-effective shipping solutions for businesses and individuals alike. By tapping into the demand for cargo transportation, Southwest expands its revenue streams and diversifies its income sources.

Partnerships and Codeshare Agreements

Southwest Airlines also generates revenue through partnerships and codeshare agreements with other airlines. These agreements allow Southwest to extend its reach and offer customers a wider range of travel options. By collaborating with partner airlines, Southwest can sell tickets on routes not served by its own fleet. In return, Southwest earns a portion of the revenue from these codeshare flights. This strategic partnership approach helps Southwest Airlines increase its market share and boost its revenue.

In conclusion, Southwest Airlines generates revenue primarily through ticket sales, supplemented by ancillary services, the Rapid Rewards Program, cargo and freight services, as well as partnerships and codeshare agreements. These diverse income streams contribute to the company's financial success and enable Southwest to remain competitive in the aviation industry.

Southwest Airlines Business Model Canvas Explained

Introduction to the southwest airlines business model canvas.

The Southwest Airlines Business Model Canvas serves as a comprehensive framework for understanding the key components of the airline's business model. Developed by Alexander Osterwalder, this tool provides a visual representation of an organization's strategy, value proposition, customer segments, revenue streams, and more.

Key Partnerships

One of the fundamental elements of Southwest Airlines' business model is its strategic partnerships. By collaborating with various stakeholders, the airline is able to enhance its services and expand its reach. Southwest has built strong relationships with aircraft manufacturers, such as Boeing, to ensure a reliable and efficient fleet. Additionally, the airline has formed partnerships with hotels, car rental companies, and other travel service providers to offer bundled packages and increase customer convenience.

Key Activities

Southwest Airlines' key activities revolve around providing reliable and low-cost air travel. These activities include flight operations, maintenance and servicing of aircraft, customer service, and marketing. The airline focuses on operational efficiency, quick turnaround times, and streamlined processes to reduce costs and deliver high-quality services to its customers.

Key Resources

To support its key activities, Southwest Airlines relies on several key resources. The most critical resource is its fleet of aircraft, which enables the airline to operate its flights. Additionally, Southwest invests in highly skilled pilots, flight attendants, and ground staff who contribute to the smooth functioning of the airline. The company's extensive network of airports, maintenance facilities, and reservation systems also play a crucial role in its operations.

Value Proposition

Southwest Airlines' value proposition centers around its commitment to providing low-cost, reliable, and customer-centric air travel. The airline differentiates itself by offering low fares, no baggage fees, and a hassle-free experience. Southwest's open seating policy and friendly customer service contribute to a unique and enjoyable flying experience. By focusing on these elements, the airline aims to attract price-sensitive customers and build long-term relationships with loyal passengers.

Customer Segments

Southwest Airlines primarily targets leisure and business travelers who prioritize affordability and convenience. The airline caters to a broad customer base, including families, solo travelers, small businesses, and frequent flyers. By understanding the needs and preferences of these customer segments, Southwest tailors its services and marketing efforts to deliver maximum value and create customer loyalty.

Revenue Streams

The main revenue stream for Southwest Airlines is ticket sales. The airline generates income by selling flight tickets directly to customers through its website, mobile app, and customer service centers. In addition to ticket sales, Southwest also earns revenue through ancillary services such as onboard food and beverage sales, Wi-Fi access, and early boarding options. By diversifying its revenue streams, Southwest minimizes its dependence on a single source of income.

The Southwest Airlines Business Model Canvas provides a comprehensive overview of the key components that drive the airline's success. By focusing on strategic partnerships, delivering a unique value proposition, targeting specific customer segments, and diversifying its revenue streams, Southwest has established itself as a leading low-cost carrier in the industry. Understanding and leveraging these elements within the Business Model Canvas framework can help other businesses analyze and optimize their own strategies for success.

Which companies are the competitors of Southwest Airlines?

Introduction.

Southwest Airlines, known for its low-cost model and exceptional customer service, operates in a highly competitive industry. While Southwest has managed to carve out a niche for itself, it faces fierce competition from various companies within the airline industry. In this section, we will explore some of the major competitors of Southwest Airlines.

Delta Air Lines

Delta Air Lines is one of the largest airlines globally and a significant competitor of Southwest Airlines. With a wide network of domestic and international routes, Delta offers a range of services catering to different customer segments. Delta Air Lines focuses on providing premium services, including extensive in-flight entertainment options, comfortable seating arrangements, and a broad range of travel classes. This emphasis on luxury and comfort sets Delta apart from Southwest, which primarily focuses on no-frills, budget-oriented travel.

American Airlines

American Airlines, another major competitor of Southwest Airlines, offers an extensive network of domestic and international flights. American Airlines targets a wide range of customer segments, including both leisure and business travelers. With a broader range of travel classes, including first-class and business-class options, American Airlines caters to passengers seeking a more luxurious travel experience. This differentiation allows American Airlines to compete with Southwest Airlines, appealing to customers who prioritize comfort and amenities over cost.

United Airlines

United Airlines is a leading global airline and a formidable competitor for Southwest Airlines. Operating an extensive network of domestic and international routes, United Airlines offers a range of services catering to both leisure and business travelers. With a focus on providing a premium travel experience, United Airlines offers various travel classes, including first-class and business-class options. Additionally, United Airlines has a strong presence in major hub airports, allowing them to offer a wider range of connecting flights. This strategic advantage enables United Airlines to compete directly with Southwest Airlines, especially on routes where nonstop flights are not available.

JetBlue Airways

JetBlue Airways, while not as large as some of the other competitors mentioned, is a notable low-cost airline that competes directly with Southwest Airlines. Similar to Southwest, JetBlue focuses on offering affordable fares and exceptional customer service. Both airlines have a similar no-frills approach, providing a simplified travel experience without charging extra fees for services like checked bags. JetBlue Airways primarily operates in the domestic market but offers a limited number of international flights. This overlap in target market and business model makes JetBlue a direct competitor of Southwest Airlines.

In the fiercely competitive airline industry, Southwest Airlines faces significant competition from various companies. Delta Air Lines, American Airlines, United Airlines, and JetBlue Airways are among the major competitors that challenge Southwest's market position. Each of these airlines differentiates itself by offering varying levels of luxury, a broader network of routes, or a combination of both. Despite the competition, Southwest Airlines continues to thrive by focusing on its core strengths of low-cost fares, excellent customer service, and efficient operations.

Southwest Airlines SWOT Analysis

Strong brand reputation: Southwest Airlines has built a strong brand reputation over the years, known for its customer-friendly policies, low fares, and excellent customer service. The company has consistently ranked high in customer satisfaction surveys, leading to customer loyalty and repeat business.

Extensive domestic network: Southwest Airlines operates an extensive domestic network, serving more than 100 destinations across the United States. This wide coverage allows the airline to attract a large customer base and capture a significant market share.

Cost leadership: Southwest Airlines has a reputation for offering low fares compared to its competitors. The airline has implemented cost-saving measures, such as using a single aircraft type (Boeing 737) to simplify operations and reduce maintenance costs. This cost leadership strategy enables Southwest Airlines to attract price-sensitive customers and maintain a competitive edge in the market.

Limited international presence: Unlike some of its competitors, Southwest Airlines has a limited international presence. The airline primarily focuses on domestic flights, which could be a strategic disadvantage in an increasingly globalized market. This limitation may result in missed opportunities to tap into the growing international travel market.

No first-class or business-class seating: Southwest Airlines operates with a single-class configuration, offering no first-class or business-class seating options. While this helps in maintaining simplicity and reducing operational costs, it may deter high-end business travelers who prefer premium seating and services. This could limit the airline's potential to attract a certain segment of customers.

Dependency on the US economy: Southwest Airlines' performance is closely tied to the health of the US economy. Economic downturns, such as recessions, can lead to reduced air travel demand, affecting the airline's profitability. This dependency on a single market makes Southwest Airlines vulnerable to economic fluctuations.

Opportunities

International expansion: Southwest Airlines has the opportunity to expand its international presence and tap into the growing global travel market. By adding more international routes and partnerships with foreign airlines, the company can attract a wider customer base and increase revenue streams.

Technological advancements: The airline industry is constantly evolving with technological advancements. Southwest Airlines can leverage technology to enhance its operational efficiency, improve customer experiences, and streamline processes. For example, implementing self-service kiosks, mobile apps for booking and check-in, and utilizing data analytics for personalized marketing can give Southwest Airlines a competitive advantage.

Growing demand for sustainable travel: With increasing awareness of environmental issues, there is a growing demand for sustainable travel options. Southwest Airlines can seize this opportunity by implementing eco-friendly practices, such as investing in fuel-efficient aircraft, adopting sustainable fuel alternatives, and reducing carbon emissions. This can attract environmentally conscious travelers and enhance the airline's reputation.

Intense competition: The airline industry is highly competitive, with numerous airlines vying for market share. Southwest Airlines faces competition from both legacy carriers and low-cost carriers, which may lead to price wars and reduced profitability. The intense competition can also result in decreased customer loyalty, as customers have a wide range of options to choose from.

Fluctuating fuel prices: Fuel prices are a significant cost component for airlines. Fluctuations in fuel prices can significantly impact Southwest Airlines' operating expenses and profitability. Volatile fuel prices make it challenging for the airline to accurately forecast and plan its financials, posing a constant threat to its bottom line.

Regulatory challenges: The airline industry is subject to various regulations, including safety, security, and labor regulations. Compliance with these regulations can be costly and time-consuming. Changes in regulations or the introduction of new regulations can pose challenges for Southwest Airlines' operations and increase compliance costs.

By conducting a SWOT analysis, Southwest Airlines can identify its strengths, weaknesses, opportunities, and threats, enabling the company to formulate effective strategies to leverage its strengths, mitigate weaknesses, seize opportunities, and manage threats in the ever-changing airline industry.

Key Takeaways

- Southwest Airlines is owned by its shareholders, with no single majority owner. The largest shareholders include institutional investors and mutual funds.

- The mission statement of Southwest Airlines is to "dedicate ourselves to the highest quality of customer service delivered with a sense of warmth, friendliness, individual pride, and company spirit."

- Southwest Airlines primarily makes money through ticket sales, as well as various ancillary sources such as baggage fees, in-flight services, and partnerships with other companies.

- The Southwest Airlines Business Model Canvas is a strategic management tool that outlines the key elements of Southwest's business model, including its customer segments, value proposition, channels, revenue streams, key activities, resources, and partnerships.

- The main competitors of Southwest Airlines include other major US airlines such as Delta Air Lines, American Airlines, and United Airlines. However, Southwest differentiates itself through its low-cost, point-to-point, and customer-centric approach.

- Southwest Airlines SWOT Analysis reveals its strengths (strong brand reputation, low-cost structure), weaknesses (limited international presence, dependence on US market), opportunities (expansion into new markets, partnerships), and threats (competition, fuel prices, economic downturns).

In conclusion, Southwest Airlines is owned by a diverse group of shareholders, including institutional investors and individual stakeholders. The mission statement of the airline is to provide the highest quality of customer service, while maintaining a focus on employee welfare and profitability.

Southwest Airlines generates revenue through various sources, such as ticket sales, additional services, and partnerships. Their business model canvas is built upon key elements like low-cost operations, customer-centricity, and a strong corporate culture.

As for competitors, Southwest Airlines faces competition from major carriers like Delta, American Airlines, and United Airlines. However, its unique positioning as a low-cost airline with a strong focus on customer satisfaction sets it apart from the competition.

A SWOT analysis of Southwest Airlines reveals its strengths, including a robust brand image, efficient operations, and a loyal customer base. However, it also faces challenges such as increasing competition, fluctuating fuel prices, and potential labor disputes. By leveraging its strengths and addressing its weaknesses, Southwest Airlines aims to remain a leading player in the airline industry.

In summary, Southwest Airlines is a well-established airline with a strong mission statement and a successful business model. While facing competition from major carriers, it continues to thrive by delivering exceptional customer service, maintaining cost-effective operations, and adapting to the ever-changing industry landscape.

Want to create a presentation now?

Instantly Create A Deck

Let PitchGrade do this for me

Hassle Free

We will create your text and designs for you. Sit back and relax while we do the work.

Explore More Content

- Privacy Policy

- Terms of Service

© 2023 Pitchgrade

Southwest Airlines SWOT: Financial strength is mainstay, but cost and culture challenges loom large

At 43 years of age, Southwest Airlines is firmly entrenched in middle age within a mature US market place. During its more than four decades the airline has largely retained its appeal and perpetuated its renegade image, even if that perception is now more legend than reality. As its merger integration with AirTran comes to a close, Southwest continues to exploit its domestic strength by forging a presence in key US markets while laying the groundwork to bolster its international offerings in 2015 with service from a new international terminal at its sixth largest base measured by seats deployed, Houston Hobby . But even as it still engenders positive customer sentiment, Southwest faces numerous challenges. These include preserving its culture and finding new ways to generate revenue. At the same time it is becoming more difficult for Southwest to brandish its low fare image with the rise of ultra low-cost airlines that are fulfilling Southwest 's traditional role - traffic stimulation through rock bottom fares.

- Southwest Airlines has sustained profitability and has a strong balance sheet, making it financially stable.

- The airline has a well-known and recognized brand, which provides differentiation in a competitive market.

- Southwest has a robust domestic network and a strong presence in key US markets.

- The airline faces challenges in generating revenue and maintaining its low fare image in the face of competition from ultra low-cost carriers.

- Opportunities for Southwest include the repeal of the Wright Amendment, allowing for direct flights from its Dallas Love Field base, and the expansion of international operations.

- Threats to Southwest include the rise of ultra low-cost carriers and increasing costs due to labor negotiations, which could erode the airline's unique culture.

Southwest Airlines Strengths

1. financial wherewithal.

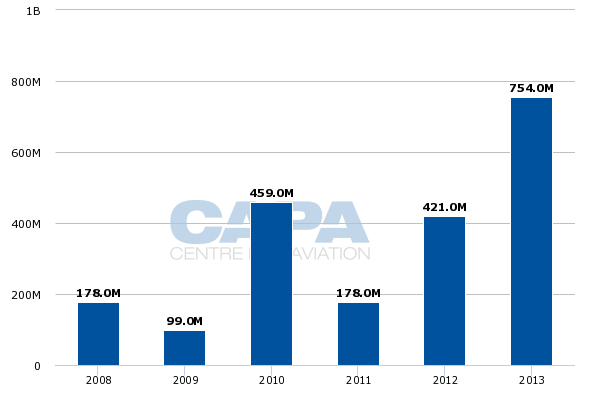

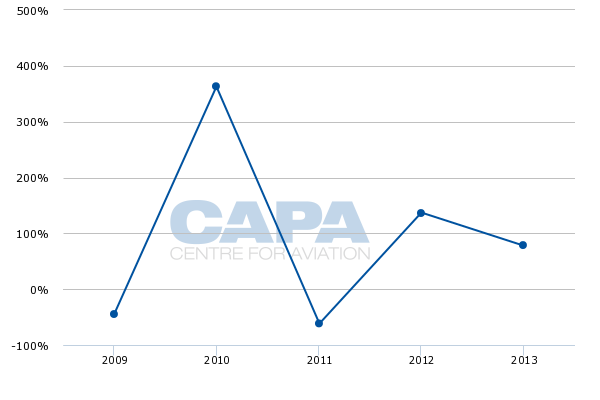

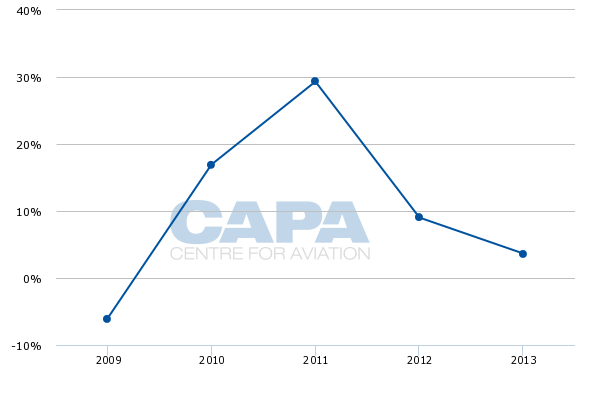

During 2Q2014 Southwest recorded its fifth consecutive quarter of record profits. Its consistent profitability and balance sheet strength have resulted in the airline holding the position of the only US airline to achieve investment grade status until Alaska Air Group secured that coveted position earlier in 2014. Southwest managed to remain profitable during the financial downturn of 2008 and 2009, and its CY2013 profits of USD754 million were the highest recorded by the airline since 2008.

Southwest Airlines Co . annual net profit (loss): 2008 to 2013

Source: CAPA - Centre for Aviation and airline reports

Growth of Southwest Airlines Co . annual net profit (loss): 2009 to 2013

At the same time Southwest has sustained a measurably strong balance sheet. Its leverage at the end of 2Q2014 was 37%, and its cash in hand was USD4 billion. During 1H2014 it generated USD1.6 billion of free cash flow, and as of 30-Jun-2014 Southwest had reduced its debt and capital lease obligations by USD1.5 billion.

2. Southwest has an iconic brand

Southwest is one of the most recognised brands in the US , and it consistently works to exploit its heritage through advertising during high profile sporting events and in social media. It has been deemed the top travel brand and fifth overall brand by The Business Journals in the American Brand Excellence Awards.

This provides important differentiation in a commoditised industry. Standing out by not going along with the crowd and forgoing the revenue is arguably a net gain, albeit perhaps not easily accountable.

3. It maintains a robust domestic network

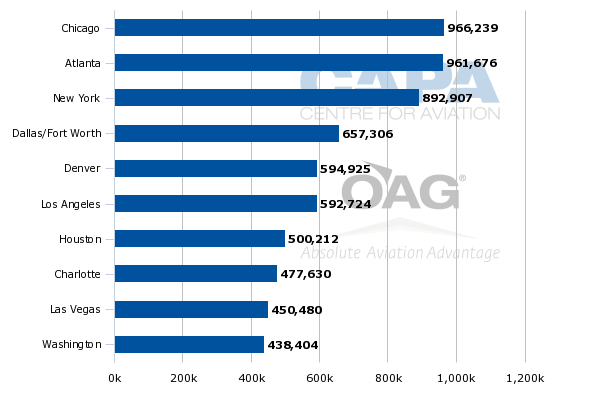

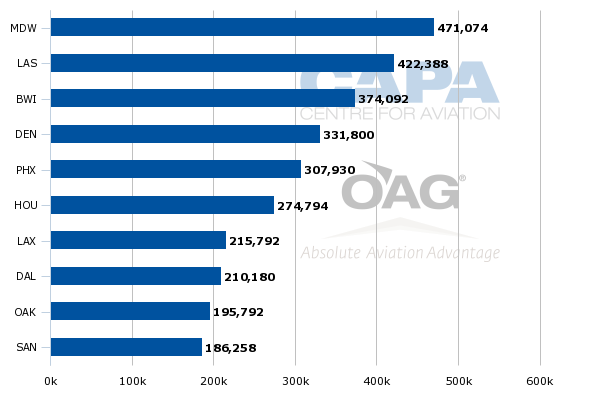

Presently Southwest is benefitting from strong demand within the US market place, reflected in its 8% passenger unit revenue growth in 2Q2014, the largest gain of any US airline. Based on data from CAPA and OAG for the week of 15-Sep-2014 to 21-Sep-2014 Southwest is the second largest airline in the US domestic market measured by seat deployment. Its share is approximately 20% behind Delta 's nearly 22% share.

United States of America capacity by airline (% of seats): 15-Sep-2014 to 21-Sep-2014

Source: CAPA - Centre for Aviation and OAG

Through its acquisition of AirTran and seizing on required slot divestitures by American and US Airways in order for those airlines to move forward with their merger, Southwest has made inroads in the key US markets of Washington National and New York LaGuardia .