Complete Guide to Bill of Exchange

Every business wants speed and convenience. It is the mantra In the contemporary world of commerce, and cash transactions have naturally taken a backseat. Even outside the capital markets, we see the reign where credit and trust are a currency. Transactions of all sizes are hinging on a fundamental pledge—the buyer commits to settling the bill later.

Today, physical currency only changes hands with this financial choreography, the bill of exchange.

Understanding Bill of Exchange

A bill of exchange is a written, unconditional commitment by one party, known as the drawer, to another party, the drawee, to pay a certain sum of money to a third party, the payee, either on demand or at a specific future date. This financial instrument serves as a guarantee of payment for goods or services provided.

The bill of exchange has been a fundamental legal instrument in global trade, binding the exporter and the importer and enabling smooth transactions between parties across international borders.

Key Terminology

- Drawer: The drawer is the party that issues the bill of exchange, directing the drawee to make a specified payment to the payee. This is usually the seller/ creditor entitled to receive the payment.

- Drawee: The drawee is the entity that must make the payment to the payee. The drawee is the buyer/ debtor.

- Payee: The payee is the payment recipient. The party is entitled to receive the amount mentioned in the bill and is often the seller/ creditor. It may also be a third party.

How Bill of Exchange Works

- Creating a Bill of Exchange: The process begins with the drawer signing the bill, filling in essential details such as the date, amount, and parties involved, and ensuring the inclusion of specific payment instructions and references to the underlying transaction.

- Presentation to the Drawee: The payee presents the bill to the drawee for payment on the due date or upon demand, as per the terms outlined in the bill.

- Acceptance or Rejection: The drawee acknowledges the bill by accepting it, thereby confirming the commitment to make the payment, or rejects it, indicating the refusal to honor the payment obligation.

- Negotiation and Endorsement: The payee can transfer the bill to a third party through negotiation and endorsement, enabling the bill to change hands in the secondary market.

- Payment Process: Upon acceptance, the drawee pays the payee on the due date or demand, ensuring the fulfillment of the financial obligation.

- Dishonour of a Bill: If the drawee fails to honor the bill, it is dishonored, potentially leading to legal repercussions and affecting the parties' creditworthiness.

In case of dishonor, the payee can seek legal recourse to enforce payment, utilizing the legal provisions outlined in the governing framework to ensure the settlement of the outstanding amount and any associated damages or penalties.

Let's consider a scenario where a Bengaluru-based software company (Exporter) is providing software services to a Silicon Valley company (Importer). The Bengaluru company, acting as the exporter, creates a Bill of Exchange. This document includes details such as the total amount due, the due date, and other relevant terms.

The Bengaluru company is the drawer, the Silicon Valley company is the drawee, and the bank may be involved as a financial intermediary. The Silicon Valley company reviews the document and, if satisfied, accepts the Bill of Exchange, acknowledging its commitment to pay the specified amount on the due date.

On the due date specified in the Bill of Exchange, the Silicon Valley company makes the payment to the Bengaluru company or through the bank. The transaction is considered complete, and the Bengaluru company delivers the software services as agreed.

Advantages of Bill of Exchange

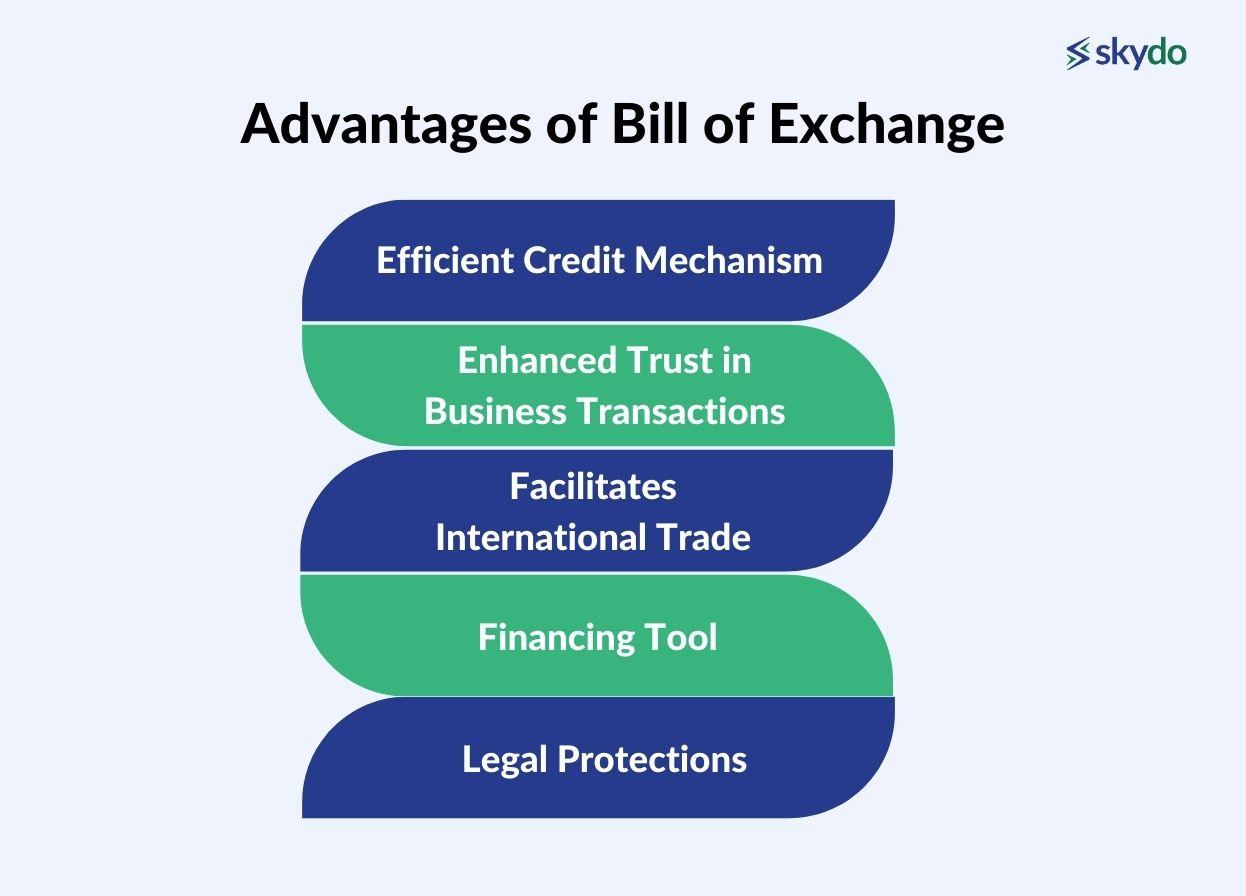

A bill of exchange offers several key advantages, making it a valuable tool in commercial transactions and international trade.

- Efficient Credit Mechanism: An effective credit instrument allows parties to defer payment obligations, thereby managing cash flows and improving financial flexibility.

- Enhanced Trust in Business Transactions: The bill of exchange fosters trust between transacting parties by providing a written commitment to payment, reducing the risk of non-payment and disputes.

- Facilitates International Trade: Its standardized format and recognition in international trade practices make it an indispensable tool for conducting cross-border transactions, minimizing the complexities.

- Financing Tool: It can be used as collateral or security for obtaining financing from banks and financial institutions, enabling businesses to access capital for operational and expansion needs.

- Legal Protections: It offers legal protections to parties involved, providing a formal recourse in case of non-payment, ensuring that contractual obligations are enforceable, and protecting the stakeholders' interests in the transaction.

Components of a Bill of Exchange

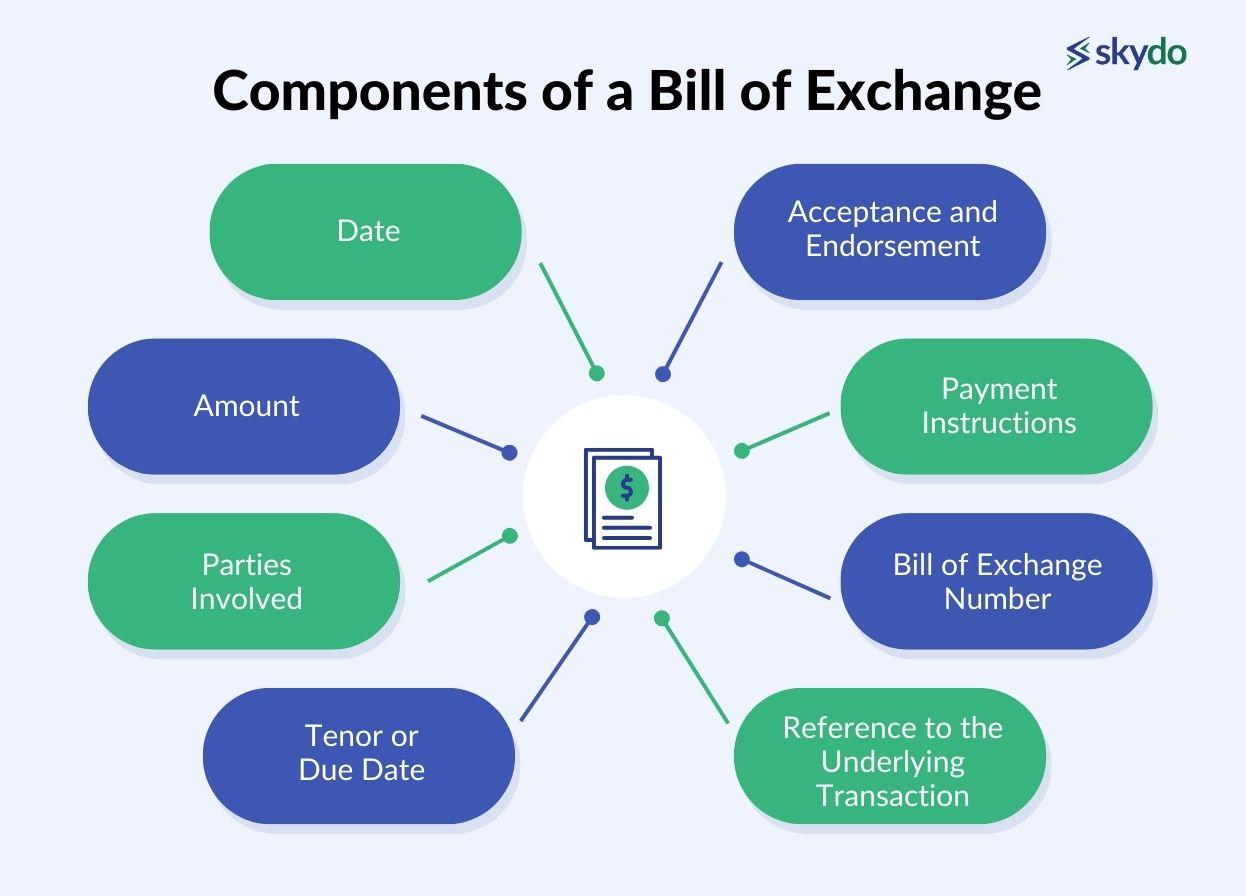

A bill of exchange comprises several key components that define its structure and functionality, ensuring clarity and enforceability within commercial transactions.

- Date: The bill must include a specified date indicating its issuance date. It provides a reference point for payment timelines and legal validity.

- Amount: The bill clearly states the exact monetary value the drawee must pay the payee upon its maturity, ensuring transparency in financial obligations.

- Parties Involved: It identifies the three primary parties - the drawer, the drawee, and the payee - specifying their roles and responsibilities in the transaction.

- Tenor or Due Date: This indicates the maturity date or the specific period within which the drawee must honor the bill, ensuring a clear understanding of the payment timeline.

- Acceptance and Endorsement: The bill may require the drawee's acceptance, demonstrating their commitment to fulfilling the payment obligation, while endorsement signifies the transfer of the bill's ownership, enabling its negotiation in the secondary market.

- Payment Instructions: It outlines the specific conditions and instructions for payment, ensuring that the transaction proceeds smoothly and without ambiguity.

- Bill of Exchange Number: Each bill is assigned a unique identification number, facilitating easy tracking, referencing, and record-keeping for accounting and auditing purposes.

- Reference to the Underlying Transaction: The bill includes a reference to the underlying transaction, providing context and ensuring that the bill is linked to the goods or services exchanged, reinforcing the bill's legitimacy and purpose.

Types of Bills of Exchange

- Promissory Note: This is a two-party instrument where one party makes an unconditional promise in writing to pay a determined sum of money to the other party.

- Sight Bill: A sight bill is payable immediately upon presentation to the drawee for payment or acceptance. The payee can demand payment on bill presentation.

- Time Bill: A time bill specifies a definite period after it becomes payable. It allows the drawee a specific period, usually from days to months, to make the payment.

Bill of Exchange vs. Promissory Note

A bill of exchange involves three parties: the drawer, drawee, and payee, where the drawee must pay the payee. In contrast, a promissory note is a two-party instrument in which one party unconditionally promises to pay a specified sum to the other party.

A bill of exchange is suitable for commercial transactions involving the sale of goods or services on credit, providing a structured framework for payment and trade. On the other hand, a promissory note is more appropriate for individual lending arrangements, personal loans, or informal credit agreements, facilitating clear repayment terms between the lender and the borrower.

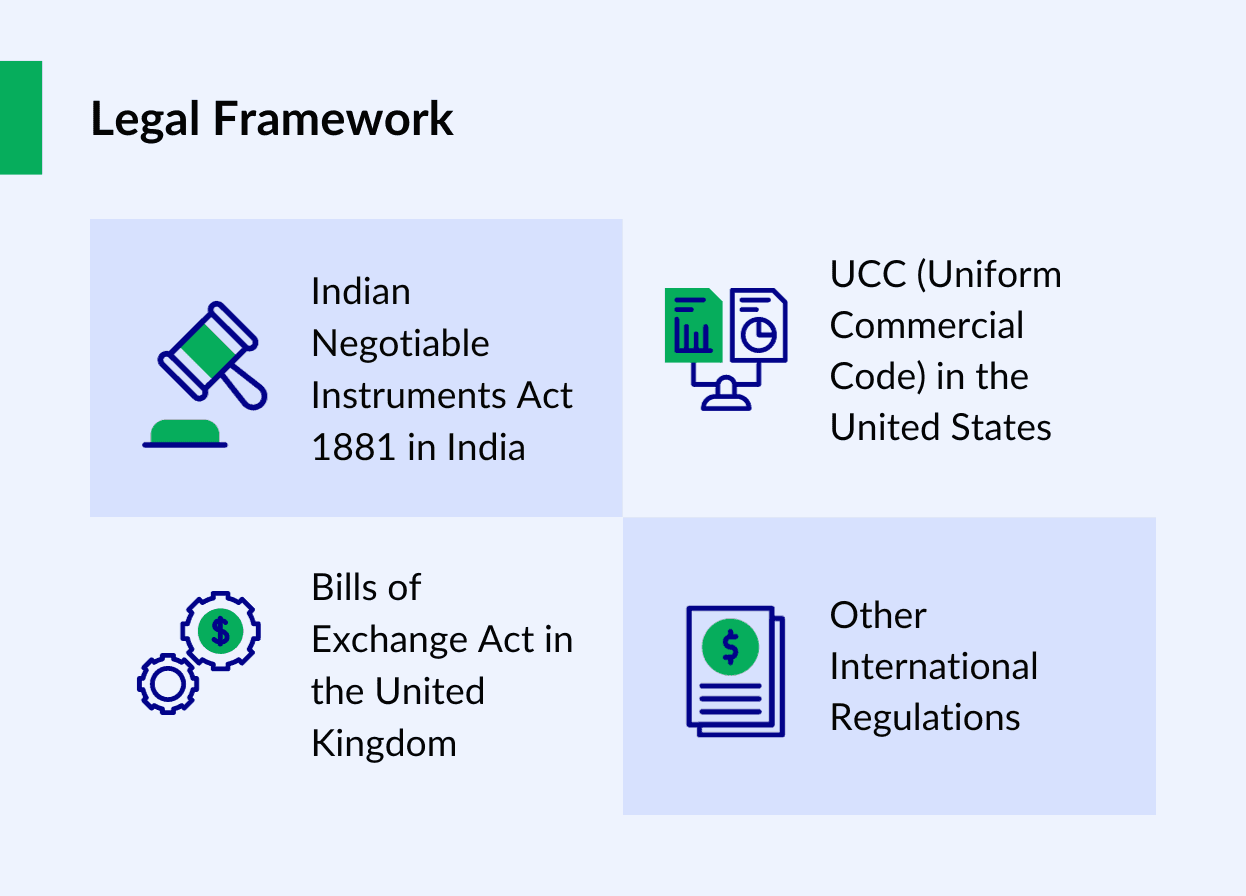

Legal Framework

- Indian Negotiable Instruments Act 1881 in India: Negotiable instruments can be anything that has a monetary value and is transferable. It enlists cheques, exchange bills, and promissory notes but excludes hundis, the original bill of exchange used in ancient India.

- UCC (Uniform Commercial Code) in the United States: The UCC, established in the 1950s, governs commercial transactions and trade practices across all U.S. states. It provides regulations for using bills of exchange, ensuring uniformity in business dealings, including rules on issuance, negotiation, and enforcement of these financial instruments.

- Bills of Exchange Act in the United Kingdom: The Bills of Exchange Act 1882, along with subsequent amendments, provides the legal framework for using bills of exchange in the UK. It outlines the rights and obligations of parties involved in the exchange, governing aspects such as presentment, acceptance, and dishonor, and ensuring the smooth functioning of these financial instruments within the British legal system.

- Other International Regulations: Apart from country-specific regulations, international bodies like the International Chamber of Commerce (ICC) and the United Nations Commission on International Trade Law (UNCITRAL) have developed frameworks and guidelines for international trade, including provisions for bills of exchange. These frameworks aim to harmonize laws and practices concerning bills of exchange across different jurisdictions, facilitating smoother global trade transactions.

Regulatory Compliance

Regulatory compliance is essential when handling bills of exchange formats involving stringent legal requirements and documentation practices.

- Legal Requirements: Comply with the legal provisions outlined in the relevant bills of exchange acts and international trade regulations, ensuring the validity and enforceability of the financial instrument.

- Documentation and Record-Keeping: Accurate records of all bill-related transactions, including issuance, acceptance, and payments, are important to maintain to facilitate transparency and audit trails.

- Reporting Obligations: Fulfill reporting obligations as mandated by regulatory authorities, providing timely and accurate information related to bill transactions and financial dealings.

- Non-Compliance: Non-compliance can lead to legal penalties, financial liabilities, and reputational damage, jeopardizing business relationships and impeding future transactions.

The bill of exchange is crucial for managing credit, fostering trust, facilitating international trade, providing financing opportunities, and offering legal protections. Thus, it streamlines complex financial transactions and contributes to the smooth functioning of global trade networks.

By integrating a bill of exchange into their operations, businesses can enhance their financial flexibility, minimize risks, and foster stronger relationships with their trade partners, thereby ensuring a seamless and secure exchange of goods and services on a global scale.

Frequently Asked Questions

Q1. what do you mean by a bill of exchange.

Ans: A bill of exchange is a written order from one party to another, directing the second party to pay a specific sum of money to a third party on a specific date or demand.

Q2. What are the legal provisions regarding bills of exchange?

Ans: The negotiable instruments law of a specific country typically governs the legal provisions for bills of exchange.

Q3. Who is an acceptor of a bill of exchange?

Ans: An acceptor of a bill of exchange is the individual or entity formally agreeing to honour the obligation stated in the bill. The acceptor assumes the primary liability for paying the specified amount indicated in the bill, either on a fixed date or upon demand.

We have a better idea! Find high quality visuals in our press kit section.

Bill of Exchange: Understanding the Basics (Types and Uses)

Understanding bills of exchange is crucial as they play a vital role in enabling secure and regulated financial transactions, particularly in commercial and international trade scenarios.

Their nature as negotiable instruments adds to their significance in facilitating business and financial operations.

In this article, we will cover the following topics:

What is a Bill of Exchange?

The Bill of Exchange process

Bill of Exchange types

What information is required on a Bill of Exchange document?

This article will provide you with a comprehensive understanding of the Bill of Exchange and how you can use it in your business transactions.

A Bill of Exchange is a written, unconditional order drawn by one party (the drawer) to another (the drawee), directing the drawee to pay a specified sum of money to a third party (the payee) either immediately (sight) or at a fixed or determinable future time (usance). It is essentially a formal written promise to pay a certain amount to someone else.

Below are key components of a Bill of Exchange

1. Parties involved:

Drawer – The party that creates the bill and is owed the payment.

Drawee – The party is directed to pay the specified sum.

Payee – The party entitled to receive the payment.

2. Elements:

Amount – The specified sum of money to be paid.

Date and place – When and where the payment is due.

Unconditional order – Clear instruction to pay.

The main function of the Bill of Exchange includes;

1. Negotiability – Bills of Exchange are transferable instruments, allowing the payee to transfer their rights to receive payment to another party.

2. Endorsement – Parties can endorse bills, further facilitating their transfer and ensuring their validity.

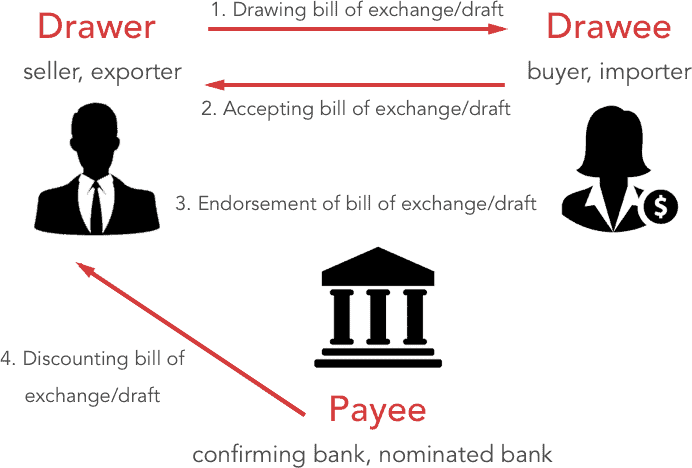

Bill of Exchange process

Traditionally, the bill of exchange process involves several steps, including issuance, acceptance, negotiation, and settlement. Each step requires meticulous handling of physical documents, leading to delays and potential risks of fraud or errors.

Here's an overview of each step:

1. Creation or Issuance:

The process initiates when the exporter drafts the Bill of Exchange, outlining the payment terms, amount, due date, and other relevant details. This document serves as an order from the exporter (drawer) to the importer (drawee) for payment.

2. Presentation to the Drawee:

The exporter presents the Bill of Exchange to the importer who examines the document for accuracy and validity. If the terms align with the agreed-upon transaction, the drawee can accept the bill.

3. Acceptance:

The drawee's acceptance signifies their commitment to pay the specified amount within the stipulated time frame. They might indicate acceptance by signing the bill and acknowledging the obligation to honour it upon maturity.

4. Negotiation:

At times, the exporter may transfer the Bill of Exchange to a third party (holder) to obtain funds or facilitate the movement of goods. This transfer, known as negotiation, can occur through endorsement, transferring ownership to another party.

5. Settlement:

Upon maturity, the drawee settles the bill by making the payment to the holder or the entity specified in the bill. Payment can occur at sight (immediately upon presentation) or at a specified future date (time draft).

Each step in the process involves careful documentation, verification, and adherence to legal and financial standards to ensure a smooth and secure transaction. The Bill of Exchange serves as a critical instrument in facilitating international trade, providing a structured framework for payment and ensuring trust between parties involved.

Types of Bills of Exchange

The Bill of Exchange, a versatile instrument in global trade, manifests in various types, each tailored to specific trade scenarios and financial agreements.

Here are some of the key types:

Sight Draft : This type of bill requires the drawee (the party obligated to pay) to make payment immediately upon presentation or "sight" of the bill. It ensures rapid settlement and is often used in transactions where prompt payment is preferred.

Time Draft : In contrast to a sight draft, a time draft specifies a future date for payment. It allows the drawee a set period, usually a specific number of days after the draft's presentation, to settle the bill. This type provides flexibility in managing cash flows and obligations.

Clean Bill : A clean bill of exchange does not involve any accompanying shipping documents or trade goods. It represents a straightforward financial transaction without the need for additional documentation related to goods being transported.

Documentary Bill : Contrary to a clean bill, a documentary bill of exchange is accompanied by shipping documents (like bills of lading or invoices) representing the underlying goods being traded. This type offers security to the drawee and often serves as proof of ownership or receipt of goods.

Banker's Acceptance : This type involves a draft drawn by a seller on a buyer, with the buyer accepting the obligation to pay at a future date. It is then endorsed and guaranteed by a bank, transforming it into a tradable financial instrument.

The obligatory details typically include:

Parties involved : Identification and contact details of the drawer (seller/exporter), drawee (buyer/importer), and any other relevant parties involved in the transaction.

Amount : The specific monetary value or amount owed, expressed in the relevant currency, that the drawee is obligated to pay upon maturity.

Date : The date when the bill is issued, providing a reference point for maturity and payment timelines.

Payment terms : Clear stipulations outlining the terms and conditions of payment, including the maturity date (when payment is due), payment method (sight or time draft), and any applicable interest or discounts.

Place of payment : The designated location or entity where the payment must be made. This could be a specific bank, financial institution, or any agreed-upon location.

Reference numbers : Unique identification numbers or references that link the bill to other relevant documents or transactions, ensuring proper traceability and record-keeping.

Endorsements : If the bill is transferred or negotiated to a third party, endorsements serve as declarations of transfer, indicating the new beneficiary or holder of the bill.

Terms and conditions : Any additional clauses or specific conditions governing the transaction, such as clauses related to warranties, shipping, insurance, or other contractual obligations.

Here is a bill of exchange template:

Bill of Exchange

Date: [Insert Date]

Pay [Insert Drawee's Name] or Order the Sum of [Insert Amount in Words] [Insert Amount in Numbers]

[Insert Drawer's Name and Address]

[City, State, Zip Code]

At [Insert Place of Payment]

On [Insert Date of Payment or Maturity Date]

For value received, I/we promise to pay [Insert Drawee's Name] the sum mentioned above, at the designated place, on the specified date. This bill is subject to the terms and conditions agreed upon between the parties.

Drawer's Signature: ___________________ _

(Insert Drawer's Signature and Date)

Accepted: ___________________ _

(Insert Drawee's Signature and Date)

Endorsements: [If Applicable]

This template serves as a starting point and should be adapted to meet specific legal and financial requirements, including additional clauses or details pertinent to the trade transaction and compliance with applicable laws and regulations.

The challenges and risks associated with Bills of Exchange

Challenges and risks associated with bills of exchange include:

Fraud and forgery : Bills of Exchange, particularly paper-based ones, are susceptible to fraud and forgery. Alteration or unauthorised creation of documents poses a significant risk, leading to financial losses and legal disputes.

Document handling and delays : The manual handling of paper-based bills of exchange often leads to delays in processing and settlement. Documents can get lost or delayed in transit, causing disruptions in payment timelines and impacting trade relationships.

Compliance and legal challenges : Meeting legal and compliance standards across different jurisdictions can be complex. Varying regulations, documentation requirements, and differing legal interpretations can lead to challenges in drafting and executing bills of exchange accurately.

Payment and credit risks : Non-payment or delayed payment by the drawee presents a financial risk to the drawer. If the drawee fails to honour the bill upon maturity, it can strain business relationships and impact cash flow for the exporter.

Currency and exchange rate fluctuations : Bills of exchange involving multiple currencies are vulnerable to exchange rate fluctuations. Variations in currency values between issuance and payment dates can impact the actual value received, leading to financial discrepancies.

Operational costs : The traditional paper-based process incurs costs related to printing, handling, courier services, and storage of documents, adding to operational expenses.

Lack of transparency : Traditional methods lack real-time transparency, making it challenging for parties involved to track the status of bills of exchange. Lack of visibility can lead to uncertainties and potential disputes.

Addressing these challenges requires innovative solutions that enhance security, efficiency, and transparency in bill of exchange processes, such as the integration of technology like blockchain to mitigate fraud, improve traceability, and streamline documentation handling in international trade transactions.

How to overcome challenges and risks associated with handling Bills of Exchange

Accurate and comprehensive documentation of these details on the Bill of Exchange is critical for ensuring transparency, legal compliance, and smooth execution of trade transactions.

At CargoX, our technology harnesses the power of blockchain to streamline and enhance various aspects of bills of exchange and trade documentation processes.

Here's how our platform facilitates these processes:

Digitisation and secure storage : CargoX's Platform for Blockchain Data Transfer digitises bills of exchange, transforming them from traditional paper-based documents into secure, tamper-proof digital records. These digitised documents are stored on a decentralised blockchain ledger, ensuring immutability and eliminating the risk of physical document loss or alteration.

Real-time accessibility and transparency : Utilising blockchain, our platform offers stakeholders instantaneous access to bills of exchange. Parties involved in trade transactions can view, validate, and track these documents in real-time, reducing delays associated with traditional document handling.

Enhanced security and fraud prevention : The CargoX Platform for Blockchain Data Transfer ensures encrypted and secure storage of sensitive information within bills of exchange. The immutable nature of blockchain technology fortifies security measures, significantly mitigating risks associated with document forgery, tampering, or unauthorised access.

Smart contracts for automated execution : Smart contracts, powered by blockchain, enable automated execution of predefined conditions within bills of exchange. These contracts self-execute when specific conditions (such as the maturity date) are met, facilitating prompt payment and reducing the need for manual intervention.

Traceability and auditability : The decentralised nature of the blockchain ensures a transparent and auditable trail of transactions. The CargoX Platform for BDT provides an immutable history of changes made to Bills of Exchange, allowing stakeholders to trace and verify the authenticity of each transaction or alteration.

Integration with trade ecosystems : Our platform can be seamlessly integrated with existing trade ecosystems through APIs, allowing for interoperability among various stakeholders, including exporters, importers, banks, insurers, and logistics providers. This integration fosters a collaborative and efficient trade environment.

By leveraging blockchain technology, we established a new baseline for the management and handling of Bills of Exchange, offering a secure, transparent, and effective solution that significantly enhances trust, transparency, and efficiency within the global supply chain.

The future of transactions is dynamic and multifaceted, driven by innovation, adaptability, and a focus on customer-centric solutions.

Our use of blockchain technology redefines the landscape of Bills of Exchange, bringing international trade processes to a whole new level. Our platform's digitization, real-time accessibility, and fortified security measures elevate the efficiency and transparency of trade documentation.

Embracing these changes offers businesses and consumers opportunities to streamline transactions, enhance experiences, and drive economic growth while navigating the challenges that come with rapid transformation.

bill of exchange

Primary tabs.

A bill of exchange, a short-term negotiable instrument , is a signed, unconditional, written order binding one party to pay a fixed sum of money to another party on demand or at a predetermined date. A bill of exchange is sometimes called draft or draught , but draft usually applies to domestic transactions only. The term bill of exchange may also be applied broadly to other instruments of foreign exchange.

For example, a check is a type of bill of exchange.

[Last updated in February of 2022 by the Wex Definitions Team ]

- commercial activities

- financial services

- business law

- business sectors

- commercial transactions

- money and financial problems

- wex definitions

Bill of Exchange: The Key Payment Instrument in International Trade Finance

In international trade finance, sellers rely on various payment instruments to ensure secure and efficient transactions. One such instrument that plays a vital role in trade operations is the “bill of exchange.” This article aims to provide an in-depth understanding of bill of exchange, including their significance, working mechanism, types, and practical applications in the world of international trade finance.

The Need for Bill of Exchange in Export Finance

When engaging in export finance, sellers often encounter two primary challenges:

- Ensuring a Promise of Payment: Sellers need a separate promise of payment that is independent of the underlying transaction. This promise should provide reassurance that payment will be made, regardless of any unforeseen circumstances or disputes that may arise between the buyer and seller.

- Access to Immediate Cash: In some cases, sellers may require immediate cash instead of waiting for the payment to be made at a future date. This liquidity can be crucial for their business operations, such as fulfilling additional orders or managing cash flow effectively.

Bill of exchange serves as an effective solution to address these challenges. By obtaining acceptance (signature) on a bill of exchange, the seller receives a distinct promise of payment. This promise is not contingent on the transaction itself but stands as an independent commitment from the buyer or the buyer’s bank. Furthermore, depending on the party that accepts the bill of exchange, it can be discounted with a finance house, allowing the seller to trade the promise of payment for immediate cash.

Understanding Bill of Exchange

A bill of exchange is an unconditional, written order issued by one person (the drawer) to another person (the drawee). The bill is signed by the drawer and directs the drawee to pay a certain sum of money either on demand or at a fixed or determined future time to a specified person or to the bearer of the bill. In simpler terms, it is a legally binding document that ensures the payment of a specified amount by a specific date.

Bills of exchange are classified as negotiable instruments, making them an integral part of documentary credit or documentary collection operations. A clear understanding of bills of exchange is essential to comprehending other trade finance instruments commonly employed in international trade transactions.

The Role of Banks and Creditworthiness

Banks play a significant role in the world of bills of exchange. They are often referred to as the custodians of “paper” because their involvement adds credibility and security to the payment instrument. The creditworthiness of the drawee, i.e., the party responsible for making the payment, is a crucial factor that affects the value of the bill of exchange. Drawing the bill of exchange on a reputable bank provides an added layer of security for sellers, as banks are generally considered reliable in meeting their financial obligations.

Working Mechanism of Bill of Exchange

To understand the working mechanism of bills of exchange, let’s break down the process into several steps:

- Issuance: The bill of exchange is issued by the drawer, who can be either the seller or the seller’s bank. The drawer registers the bill as a legal tender by paying the necessary stamp duties. The bill of exchange is then presented to the drawee, who is typically the buyer or the buyer’s bank. The bill of exchange contains an order for the drawee to pay a specific sum of money to the beneficiary (the seller) or the bearer of the bill at a designated future date.

- Acceptance: Once the drawee accepts the bill of exchange, it becomes proof of their indebtedness. This acceptance is independent of the underlying contract or documentary credit, meaning the drawee is legally obligated to fulfill the payment specified in the bill of exchange, regardless of any issues that may arise between the buyer and seller.

- Payment: On the maturity date specified in the bill of exchange, the seller presents the bill to the drawee for payment. The drawee is legally bound to honor the bill and make the payment as agreed.

Types of Bills of Exchange

Several types of bills of exchange cater to different requirements in international trade finance. Some common types include:

- Sight Bills of Exchange: These bills require immediate payment upon presentation. The drawee must make the payment as soon as the bill is presented.

- Term Bills of Exchange: These bills specify a future date for payment. The buyer accepts the bill, committing to pay the specified amount in the indicated currency on the stated date. The bill is held by the seller’s bank or returned to the seller for safekeeping until maturity, when it is presented to the buyer for payment.

- Bill of Exchange Guarantee (“Aval”): In situations where sellers have concerns about the buyer’s ability to fulfill the payment obligation, or when dealing with new clients without an international track record, buyers may request their bank to act as a guarantor. The guaranteed bill of exchange is generally payable at the counters of the guarantor bank, providing additional reassurance to the seller.

- Negotiable Instruments: Term bills of exchange are negotiable payment order instruments, allowing transfer to another party through endorsement. Sellers can discount term bills of exchange by trading them for immediate payment from a bank or other willing purchasers.

Practical Applications of Bills of Exchange

Bills of exchange find practical applications in various scenarios within international trade finance. They are commonly used in Letter of Credit or Cash Against Documents operations to facilitate secure and efficient payment processes. By leveraging bills of exchange, sellers can ensure timely and reliable payment, even in complex cross-border transactions.

In a Nutshell

Bills of exchange serve as a crucial payment instrument in international trade finance. They provide sellers with a separate promise of payment, independent of the underlying transaction, ensuring security and peace of mind. Additionally, the possibility of discounting bills of exchange for immediate cash offers liquidity benefits to sellers. By understanding the intricacies of bills of exchange, exporters can navigate the complexities of trade operations and foster successful international business transactions. These instruments contribute to the seamless functioning of the global trade ecosystem, enabling sellers to optimize their financial operations and mitigate risks effectively.

- Bill of Exchange

- Payment Terms

Helping businesses grow for over 10 years. Visit services page below to find out how I can help.

- Happy Labour Day! The Importance of the Organized Working Class in Türkiye

Why Cultural Intelligence Is Your Business Passport in the Global Marketplace

- Exporting in 2024: How B2B Companies Can Go Global with Digital Marketing

- Shifting Alliances in an Era of Intertwined Blocs

Leave a Reply Cancel reply

Your email address will not be published.

Save my name, email, and website in this browser for the next time I comment.

Related Posts

Unlock the Potential of Your International Business with Trade Finance

Letter of Credit | Payment Terms in International Trade

Open Account | Payment Terms in International Trade

Cash Against Documents (CAD) | Payment Terms In International Trade

Global Trade in Flux

Latest from payment terms.

Cash in Advance | Payment Terms in International Trade

How An Ideal Website That Converts Should Be

- Privacy Overview

- Strictly Necessary Cookies

- 3rd Party Cookies

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

This website uses Google Analytics to collect anonymous information such as the number of visitors to the site, and the most popular pages.

Keeping this cookie enabled helps us to improve our website.

Please enable Strictly Necessary Cookies first so that we can save your preferences!

- Search Search Please fill out this field.

- Checking Accounts

Bill Presentment: What It is, How It Works

:max_bytes(150000):strip_icc():format(webp)/wk_headshot_aug_2018_02__william_kenton-5bfc261446e0fb005118afc9.jpg)

What Is Bill Presentment?

Bill presentment refers to a set of instructions that directs a third party (e.g., a customer) to pay the recipient a specified amount of money. Bill presentment, simply put, is when a service provider bills a customer and demands payment. This can be in paper form or done electronically.

Key Takeaways

- Bill presentment is an instruction for a third party to pay a specified sum to the recipient in return for services rendered.

- Traditionally, this has relied on mailing paper bills and accepting payment by mail in return.

- Electronic bill presentment and payment (EBPP) has essentially replaced paper-based bill presentment.

- EBPP improves customer service and streamlines the reconciliation process.

Understanding Bill Presentment

Bill presentment represents a financial claim along with instructions to carry out the payment. Bill presentment is often used by vendors such as utilities (e.g. phone companies, electricity & gas providers), lenders, insurers, and other service companies to demand payment by check or credit card, or else directly from their customers' bank accounts.

Bill presentment involves generating an invoice (i.e., a bill) and sending it to the customer for payment. In the past, this was done via paper bills sent and returned through the mail. Today, a large amount of bill presentment has moved online. Bills generally must be paid in a timely fashion, with a due date printed on the bill itself. Late fees or surcharges may be added if payment of the bill is delinquent.

Change of Address

Bill presentment relies upon being able to deliver the bill to the customer. A change of address section is usually included on a bill to notify the service provider and inform them where to send future bills.

Electronic Bill Presentment and Payment (EBPP)

Electronic bill presentment and payment (EBPP) is an online system that allows invoices to be created, processed, and paid over the internet, and has functionally replaced paper-based bill presentment. EBPP services are a core feature of online banking , allowing customers to pay their mortgages, insurance, utilities, and other bills online directly from their bank account at regular intervals or on a specified date or dates.

EBPP has been widely adopted in business-to-business (B2B) eCommerce because it saves on postage fees and transaction processing costs, and it can be used in cash management systems and on mobile devices. EBPP improves customer service and streamlines the reconciliation process, as well as enables customers to pay faster, which also improves cash flows. It is also increasingly popular for business-to-consumer (B2C) payments.

Take Advantage of the Latest Features

Many banks today now provide automatic bill pay services, which can be set up on their websites or mobile apps. These bill payments may be done electronically or through the generation of a paper bank check mailed to the recipient. Some newer EBPP products also include security features like encrypted or password-protected email delivery, stored payment data, two-factor authentication (2FA), and autopay.

:max_bytes(150000):strip_icc():format(webp)/147323400-5bfc2b8c4cedfd0026c11901.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Double Entry Bookkeeping

learn bookkeeping online for free

Home > Bills Payable > Bills of Exchange in Accounting

Bills of Exchange in Accounting

During the course of trade a seller supplies goods or services to a buyer. If the transaction is carried out on credit terms, in which the seller gives the buyer a term of credit in which to settle their outstanding account, bills of exchange can be used to signify that the buyer has agreed to make a payment to the seller on a predetermined date.

Bills of exchange are simply documents which signify the agreement between the seller and the buyer. The seller draws up the bill of exchange requiring the buyer to pay the amount outstanding to the seller, or to a person nominated by the seller, on a particular date. The bill of exchange is sent to the buyer, and the buyer signs and accepts the bill, and returns it to the seller. The seller now has a transferable document which is legal proof that the buyer has agreed to pay the amount on a particular date.

Bills of Exchange Terminology

Drawer The drawer is the person who draws up the bills of exchange. (Seller) Drawee The drawee is the person on who the bills of exchange are drawn. (Buyer) Acceptor The acceptor is the person who accepts the bill of exchange. (Buyer) Payee The payee is the person to who the bill of exchange is to be paid at the maturity date. (Seller) Maturity Date The maturity date is the date on which the bill of exchange matures. (Payment date or due date)

Bills Receivable Bills receivable represent amounts receivable under bills of exchange. The bills receivable are an asset shown in the accounting records of the person entitled to payment under the bills of exchange. In the above case the seller has bills receivable for the amount due from the buyer.

Bills Payable Bills payable represent amounts payable under bills of exchange. The bills payable are a liability shown in the accounting records of the person responsible for making payment under the bills of exchange. In the above case the buyer has bills payable for the amount due to the seller.

Using Bills of Exchange

Bills of exchange can be transferred between different parties. In the above discussion there was a simply arrangement between a drawer (seller) and a drawee (buyer). The drawer however is under no obligation to retain the bills of exchange, they have a number of options.

1. Hold Until Maturity

The drawer (seller) can hold the bill of exchange until its maturity date, and simply present the bill to the acceptor (buyer) for payment to be made. This process is shown in the diagram below.

2. Discounting Bills of Exchange

Alternatively, the drawer (seller) can discount the bill of exchange with a bank (discounter). The drawer transfers the right to collect payment on the bill to the bank in return for a cash payment less a discount representing the banks fee. The discount charged by the bank is the interest on the amount of the bill for the period from the date of discounting until the date of maturity.

The bank who is now the payee, holds the bill of exchange until the maturity date at which point it presents the bill to the acceptor (buyer) for payment. This process is shown in the diagram below.

3. Negotiation of Bills of Exchange

Finally, the drawer (seller) can negotiate the bill of exchange with a third party in return for a payment. The drawer endorses the bill to the third party (endorsee and payee) who then holds the bill until maturity and presents it to the acceptor (buyer) for payment. Alternatively, the third party could further negotiate the bill with another third party and so on until the person who holds the bill at its maturity date presents it to the acceptor (buyer) for payment. This process is shown in the diagram below.

Dishonored Bills of Exchange

If the acceptor (buyer) fails to make the payment required under the bill of exchange on the maturity date, the bill is said to have been dishonored.

When a discounted or negotiated bill is dishonored, the drawer of the bill (seller) becomes liable to compensate the bank, or in the case of a negotiated bill the endorsee, for the amount due. The drawer has legal recourse to the acceptor of the bill.

About the Author

Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

You May Also Like

- CROSS-BORDER PAYMENTS

- CREDIT TRANSFERS

- DIRECT DEBITS

- LIST OF ALL SWIFT MESSAGES TYPES

- PAYMENT COURSES

The Four Corner Model for bills of exchange

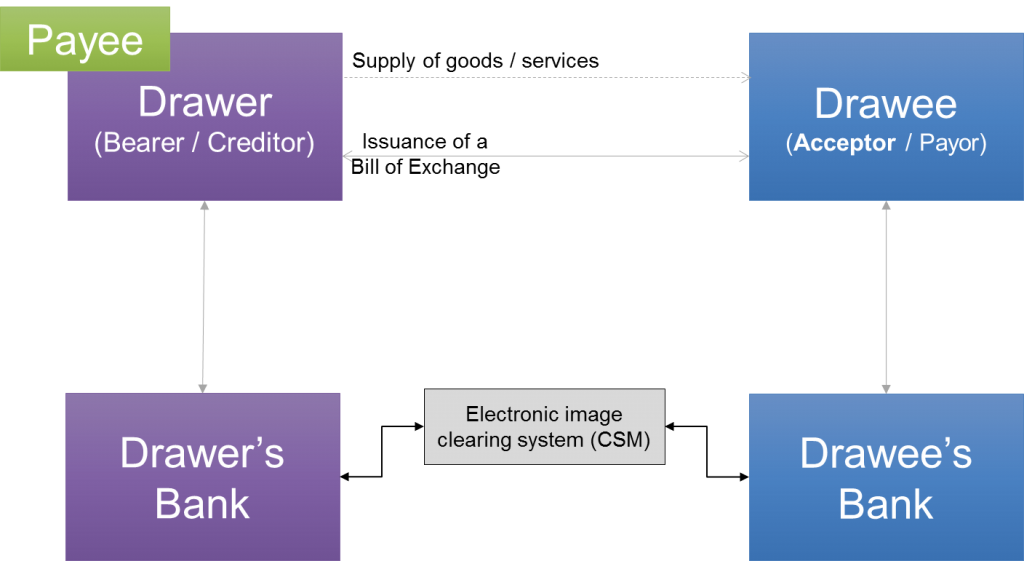

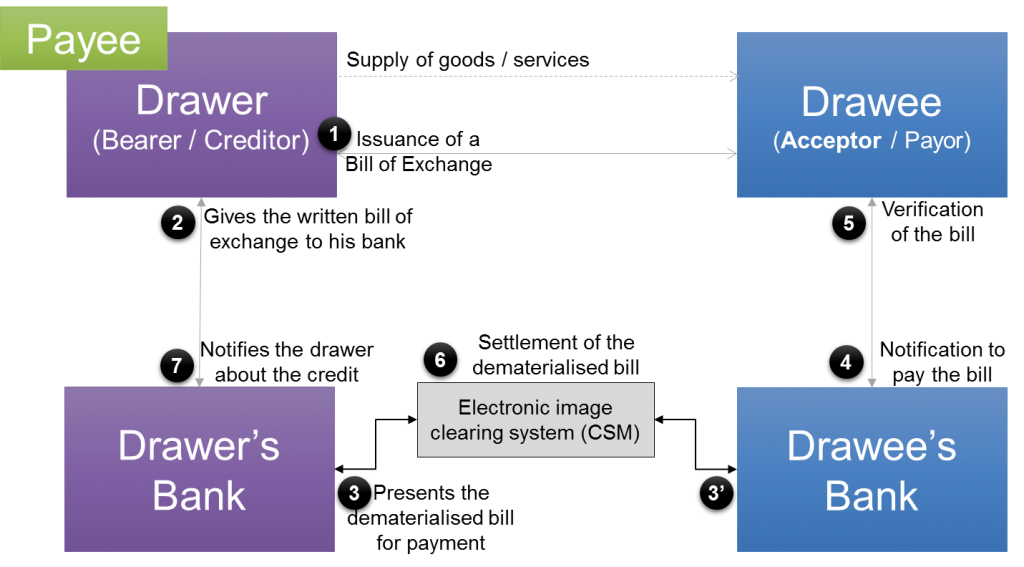

The different parties involved in bills of exchange as well as their roles were presented in the previous article . In this article we consider two other parties that play an important role in bills of exchange: the drawer’s bank and the drawee’s bank. Banks are involved in the settlement of bills of exchange since they manage payment instruments. In certain countries, the payment must be carried out through banks if the amount of the bill is above a regulatory threshold. Since bills are used in commercial transactions, the amounts are usually pretty high and payments cannot be in cash.

The different parties involved in bills of exchange as well as their roles were presented in the previous article. In this article we consider two other parties that play an important role in bills of exchange: the drawer’s bank and the drawee’s bank.

Banks are involved in the settlement of bills of exchange since they manage payment instruments . In certain countries, the payment must be carried out through banks if the amount of the bill is above a regulatory threshold. Since bills are used in commercial transactions, the amounts are usually pretty high and payments cannot be in cash.

Banks as account holders therefore take part in the payment process and this brings us to the Four Corner Model of bills of exchange which involves four parties (“the four corners”): the drawer, the drawer’s bank, the drawee and the drawee’s bank. As we will see below, banks do not only come into play when the bill is settled. They can intervene before too.

[box type=”info”]The Four Corner Model is one the most powerful tool to analyze almost any mean of payment. [/box]

Dematerialisation of bills of exchange

Before we explain how the bills of exchange are exchanged and settled between banks, it is important to say something about dematerialisation of paper-based instruments in general and bills of exchange in particular.

A bill of exchange is a written document. Working with such paper documents is cumbersome and costly. That is why many countries all over the world have made the choice of dematerialisation. Dematerialisation is the process through which physical documents are converted into electronic format: the electronic image of the document and the electronic payment records (For bills of exchange, they include bank account details of both drawer and drawee). And the electronic format is the legal equivalent of the original document. Documents in electronic formats are called Image Replacement Documents or Substitute documents. To collect the funds for example, it is sufficient to use the electronic format, no need to present the paper documents. The purpose of dematerialisation is therefore to facilitate the processing and settlement of bills of exchange and negotiable instruments in general.

Many countries have set up electronic image clearing systems allowing interconnected banks to exchange electronic images and related payment records. In certain countries, it is enough to exchange the electronic payment records only.

The dematerialisation of bills of exchange can happen at different stages in the process:

- The drawer can directly create the note electronically (with electronic signature of course).

- The drawer can take the written and accepted document to his bank. And the bank will dematerialise it.

In any case, the bill of exchange is always settled as a pull payment . It is initiated by the drawer who instructs his bank to collect the funds from the drawee’s account.

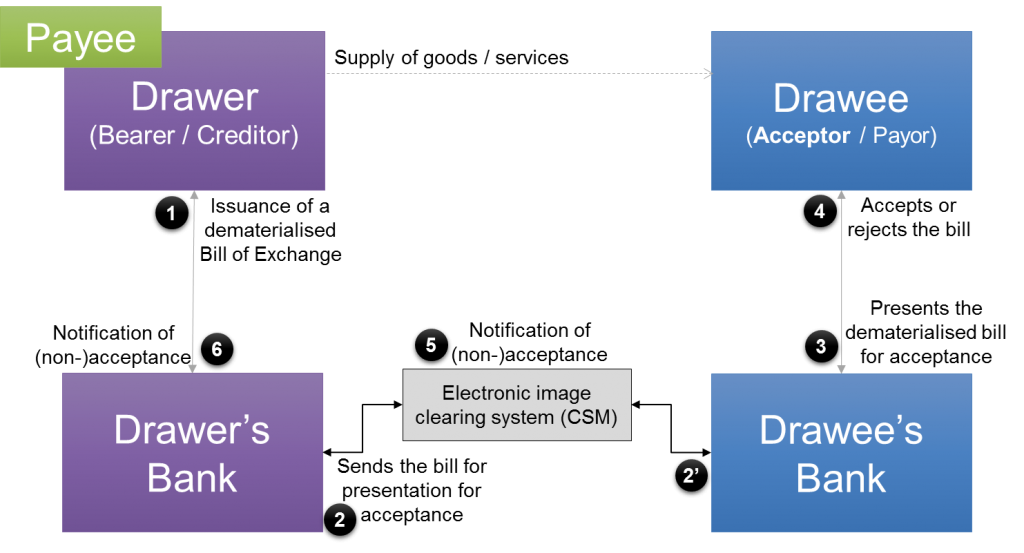

Acceptance of Bill of exchange created electronically

If the drawer directly creates a bill of exchange electronically and sends it to his bank, the bank must first present the bill for acceptance.

The drawer issues and signs the bill electronically. The drawer’s bank receives the dematerialised bill of exchange and performs the format checks to ensure that all the mandatory information is provided. The bill is sent to the drawee’s bank through the interbank exchange network. The BoE message contains specific information indicating that it is for the presentation for acceptance.

The drawee’s bank presents the dematerialised bill to its customer (the drawee) for acceptance. This generally happens through an e-banking portal provided by the bank. The drawee views and checks the bill information and decides to accept or rejects. Electronic signature is needed for acceptance and the date is recorded. After that, the notification of (non-)acceptance is sent to the drawer’s bank through the Interbank clearing system. The drawer’s bank informs its customer, the drawer. If the bill was accepted, everything is fine. The drawer will wait until the term to receive the payment collected by his bank. But if the bill was refused, then the drawer can fix it and sends another dematerialised bill or he can issue a paper bill and requests the drawee to accept it. The paper bill is necessary in order to take legal action (See paragraph dishonour of a bill of exchange in the previous article).

When the bill is issued electronically, the drawer cannot negotiate it to another party. After acceptance, he can perform the discounting or the factoring that were explained in detail in the previous article. We assume that none of this is done. The drawer’s waits until the term for the payment of the bill. If it is a sight bill, the drawer can obviously request the payment right after acceptance.

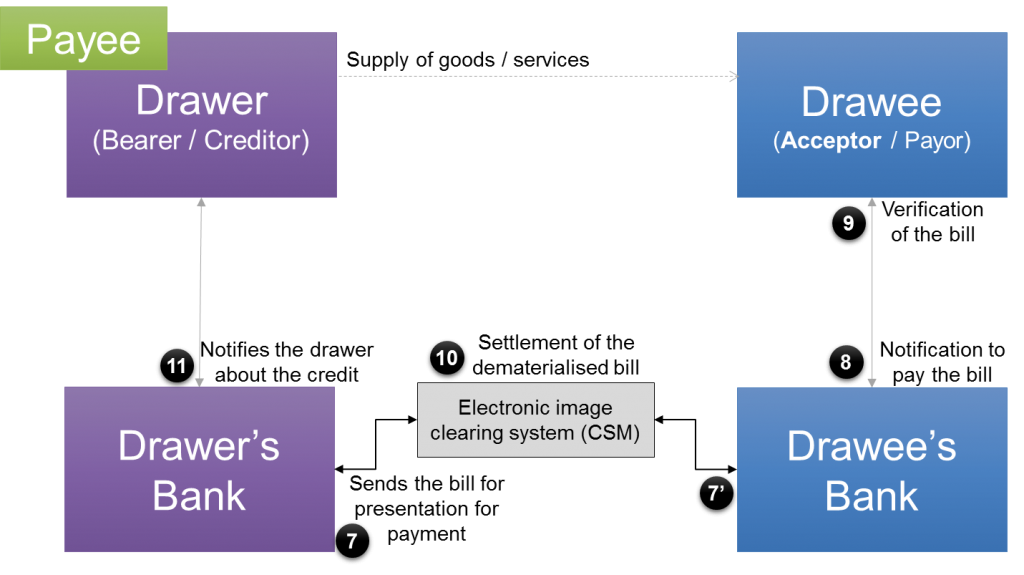

Settlement of Bill of exchange created electronically

The settlement of the bill of exchange is initiated by the drawer’s bank.

At due date or few days before due date, the drawer’s bank sends the instruction to collect the funds from the drawee account. This is also referred to as presentation for payment. The drawee’s bank informs its customer that the bill is to be paid. The drawee checks the bill to ensure that there is no mistake and gives his approval to pay. Usually, the approval to pay is implicit. The drawee does not do anything to accept the payment. However, if he wants to refuse the payment, he must clearly provide that information to his bank. We assume that everything is fine and the drawee is willing to pay.

Here we have 2 options: either the drawee has sufficient balance on his account or not. If he does not have enough money, the payment may be made partially in certain countries. In other countries, the bill is treated as rejected in case of non-sufficient balance. If a payment is done, the drawee’s account will be debited and the amount will be settled in the interbank space between the two banks. The drawer’s account will be credited and he will be notified about the credit. If the payment was made only partially, he will connect with the drawee and undertake legal actions to get the rest of the amount.

[box type=”info”]In certains countries, the drawer’s bank pays an interchange fee to the drawee’s bank. [/box]

Acceptance and settlement of a paper bill of exchange

When the bill of exchange is issued in paper form, the drawer presents it to the drawee for acceptance. If the bill of exchange is not accepted, the drawer can immediately undertake legal actions. But let’s assume the bill was accepted.

A drawer can endorse and delivers the bill to someone else if he wants and this can happen as many times as necessary. There is no limit to the number of negotiations that can be performed. Any drawer can choose to perform the discounting or the factoring of the bill if he wants. We assume below that it is not the case.

The drawer (or the final endorsee) will then hand over the paper bill to his bank usually few days before the term. The bank will perform the dematerialisation of the bill and sends it directly for payment.

At reception, the drawee’s bank will notify his customer, the drawee and requests him to pay. This can happen through many channels (e-bank portal, mail, SMS). The drawee is the supposed to connect to the bank portal and verifies the bill. This step is important because mistakes are not totally excluded. A bill can be sent to the wrong drawee or the amount of the bill may be incorrect. A for the drawee’s bank it is a way to ensure that its customer really accepted the bill and wants to pay.

If everything is OK, the account of the drawee will be debited for the full amount and settled at due date. As already stated above, only a partial payment may be carried out if the drawee does not have sufficient balance on his account. In any case, when the drawer’s bank receives the funds, the account of the drawer is credited and the drawer is informed about the credit.

This ends our analysis of the Four Corner Model for Bills of exchange. Bills of exchange are used in trade finance. We will take a closer look at this topic in next articles.

RELATED ARTICLES

Simple collection or payment against invoice, bill of exchange – definition and parties involved, the four corner model for promissory notes, leave a reply cancel reply.

Save my name, email, and website in this browser for the next time I comment.

MOST POPULAR

Psd2 and the new generation of third-party providers, differences between sepa, swift and uk faster payments, sepa payments schemes, instruments, initiatives and messages standards, how corporations use the swift mt101 request for transfer, swift serial and cover payments.

Phone : +33 6 42 23 96 63 Email : [email protected] Address : 350 Rue Lecourbe , 75015 Paris

Useful Links

- Online courses

- Training calendar

Copyright ©2022 - Paymerix - All rights reserved | Privacy Policy | Terms and Conditions

Privacy Overview

- Trade Finance

- Letters of Credit

- Trade Insurance & Risk

- Shipping & Logistics

- Sustainable Trade Finance

- Incoterms® Rules 2020

- Research & Data

- Conferences

- Purchase Order Finance

- Stock Finance

- Structured Commodity Finance

- Receivables Finance

- Supply Chain Finance

- Bonds and Guarantees

- Find Finance Products

- Get Trade Finance

- Incoterms® 2020

- Letters of Credit (LCs)

Promissory Notes and Bills of Exchange

What is promissory notes and bills of exchange.

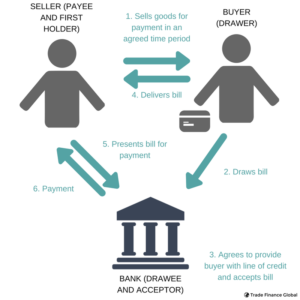

Bills of Exchange and Promissory Notes are independent payment undertakings (debt obligations) from one person to another. They are codified under the Bills of Exchange Act 1882, which were developed and interpreted by courts

Is a promissory note the same as a bill of exchange?

Historically, both financial instruments were used as a method of financing and to support financing, both domestically and for international (cross-border) trade, although nowadays, Bills of Exchange and Promissory Notes are mainly used for cross-border financing.

Bills of Exchange and Promissory notes are totally independent. This is an important characteristic of these financial instruments. If they are contingent on other instruments such as Purchase Agreements or other underlying transactions, they are generally not accepted.

As an example, in the case of a buyer wanting to buy goods from a seller, with the intention of paying in 6 months, the purchase agreement will lie between the buyer and the seller.

- The buyer will agree to payment through a bill of exchange, which can be guaranteed by a bank.

- In this case, a seller would arrange for the goods to be delivered to the buyer, and the buyer would draw a bill on its bank to accept

- By doing so, the bank will incur primary liability of that exchange, which is in favour of the seller

- The bank can also provide the buyer with a line of credit. Alternatively, the seller can agree to have extended payment terms for its buyer (e.g. 6months) knowing that the bank has a better credit rating than the buyer

Example of a promissory note

Yes, both instruments could be transferred or negotiable. Parties involved may be able to transfer the rights or title of these instruments to other parties. A holder can receive a bill, providing they become a holder before it’s overdue, if in good faith, and has no idea of defect in the title of that bill. This includes the acceptor (bank), drawer (buyer) or indorser.

In order to complete the contract under a Bill of Exchange or Promissory note, delivery must take place. Delivery can mean actual or constructive. An acceptor must accept liability and indorsement of the goods once delivered in order for the contract to remain. Indorsements must be in writing and signed by the indorser, written on the instrument, to the full amount of the product. Indorsement can be with or without recourse (see our article on recourse and non-recourse payments around forfeiting here).

Generally the acceptor / maker of Bills of Exchange or Promissory notes respectively are liable to make payment to the seller once presentation of the instrument occurs. Payment can be made to a person acting on behalf of the holder (e.g. a collecting bank) providing the holder treats such payment as discharging the payer’s liability.

Access trade, receivables and supply chain finance

Contact the trade team, speak to our trade finance team, want to learn more about trade finance download our free guides.

Learn more about Receivables Finance

2015 | TFG Excellence Awards

2016 | TFG Currency Awards

2016 | TFG Product Awards

2016 | tfg recruitment awards, 2016 | tfg shipping awards.

2017 | TFG International Trade Awards

2018 | TFG International Trade Awards

2019 | TFG International Trade Awards

2020 | TFG International Trade Awards

2022 | TFG International Trade Awards

2023 | TFG Trade, Treasury & Payments Awards

2023 export finance guide, 2024 trade finance research.

A complete guide to the Incoterms® 2020 Rules (International Commerce Terms)

AB Svensk Exportkredit (SEK) | Export Credit Agency (ECA) in Sweden

Accelerate – Apply | Trade Finance Global

About the Author

Mark heads up the trade finance offering at TFG where his team focuses on bringing in alternative structured finance to international trading companies. Prior to joining TFG (tradefinanceglobal.com), Mark qualified as a lawyer with a top ranked global trade and structured commodity finance team.

Mark has previously advised commodity trading firms, banks and alternative capital providers on international structured trade financings, pre-export, prepayment and limited recourse structures – notably in the oil, soft commodities and metals sectors. This has included mining finance projects, structured letter of credit facilities, receivables discounting and forfaiting agreements.

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Search ITA Search

Documentary Collections

The Documentary Collections payment method is an approach used for merchandise and commodity exports. Generally recommended in situations where there is an established and ongoing trade relationship with a trusted buyer, this method can simplify your export transaction, offer faster payment, and reduce costs when compared to Letters of Credits.

In a Documentary Collections transaction, the exporter’s and the importer’s banks facilitate the export sale by exchanging shipping documents for payment. However, the banks do not verify that the documents are accurate and do not guarantee payment as they do with Letters of Credit. As a result, Documentary Collections are only recommended for established trade relationships in economically and politically stable markets.

While there are several benefits to the Documentary Collections payment method, each export transaction is unique. We recommend you consult with your bank before moving forward.

Ask your bank

- How a documentary collection is different from a letter of credit.

- What type or size of transaction is suitable.

- How disputes are resolved between the importer and exporter.

How the Documentary Collections Payment Method Works

- Both the exporter and importer agree to a documentary collection for payment in the sales agreement

- The exporter prepared a Bill of Exchange and sends it to their banks for forwarding to the importer’s bank

- The Bill of Exchange - also known as a draft - provides instructions to the bank about the required documents, payment amount due, the terms of payment, and when title transfers for the goods

- The importer’s bank releases the documents according to one of two options specified in the bill of exchange, outlined below: + Release of documents upon receipt from the importer of full payment + Release of documents upon receipt of the importer’s signed acceptance of the terms that commit to future payment

- The importer uses the documents to clear the goods through the foreign customs agency

- The importer’s bank forwards the importer’s payment back to the exporter’s bank account

What if they don’t pay?

If the importer does not pay, the exporter typically needs to find another buyer, pay for return transportation, or abandon the merchandise.

Bill of Exchange

A bill of exchange is a specialized type of international draft used to expedite foreign money payments in many types of international transactions. In addition, a draft is commonly used in the U.S. while a bill of exchange is primarily used outside the U.S.

A negotiable instrument is a signed writing, containing an unconditional promise or order to pay a fixed sum of money, to order or bearer, on demand at a definite time. Examples of negotiable instruments include promissory includes which are two party instruments and drafts which are three party instruments.

Thus, a negotiable instrument is a document guaranteeing the payment of a specific amount of money, either on demand or at a set time.

Bill of Exchange Transaction Example

After shipping the goods, the documents for import along with the bill of exchange are submitted to the exporter’s bank. Then, the exporter’s bank then send it to the foreign buyer through the buyer’s bank. The said bill of exchange draws in duplicate as per the specified format. The bill of exchange contains the reference details of shipment, amount of invoice to be receivable from the overseas buyer, the time of payment to be effected, bank details, etc.

A draft is the signed order of the drawer , given to a drawee who in possession of money to which the drawer is entitled, to pay a sum of money to a third party, the payee , on demand or at a definite time. A check is an example of a draft, which is drawn on a bank and payable on demand. The three parties include the drawer, the drawee bank, and the payee.

A documentary draft is used to expire payment in a documentary sale.

These negotiable instruments can serve two purposes:

- They act as a substitute for money

- They act as a financing or credit service

What are the Requirements of a Bill of Exchange?

A bill of exchange should be:

- An unconditional order in writing

- Addressed by one person to another

- Signed by the person giving it

- It requires that the person pay the amount on demand or at a fixed or determinable future time

- A sum certain in money

- To or to the order of a specified person or to bearer

Similar Posts:

- Trade Finance

- Letter of Credit

- Price Elasticity of Demand (PED)

- Top 100 Economics Blogs of 2023

- Financial Instruments

Leave a Comment Cancel reply

Save my name and email in this browser for the next time I comment.

Talk to our experts

1800-120-456-456

- Negotiable Instruments - Presentment for Acceptance

Introduction to Presentment for Acceptance

Presentment is a type of demand by which a negotiable instrument’s holder can do something based on the directives of the same. It is a form of showing the instrument to the drawee, maker, or acceptor for acceptance and sight or payment. The Negotiable Instrument Act 1881– presentment for acceptance can help you understand this concept with proper elaboration and discernment. The entire procedure of the presentation of negotiable instruments has been outlined for ease of understanding of presentment for acceptance.

After sight, if a bill of exchange is payable and there is no time or place specified for presentment, make sure to be presented to the drawee for further acceptance. After a relevant and reasonable search, if possible, the person who is entitled to the demand acceptance can appear within a reasonable time only after it is drawn. In general, in such a presentment, no parties stand liable to the person making a claim. If the drawee in case of need cannot be found after reasonable search, the bill stands dishonoured.

When a bill is directed to a drawee at a particular location, the same must be presented only in that location, however, in terms of the due date of presentment, if the person fails after reasonable search, the bill is considered as dishonoured. Therefore, the presentment for acceptance is presenting a bill of exchange to the drawee mentioned in the bill. He or she has to agree to pay the bill at any time in the future. It is an act through which we can understand the notification of holding a bill of exchange for the request of acceptance accompanied by the bill.

Also, a promissory note is applicable in terms of the acceptor for the honour. It is payable after a specific period of sight and hence, must be presented to the maker for sight. This is possible only if he or she is found after a reasonable search, by the person who is entitled to the demand payment. Cheques, promissory notes, and bills of exchange must be presented for payment.

Acceptance for Honour

When a bill of exchange has been protested or noted for non-acceptance due to various reasons, and on the other hand, a person accepts it with supra protest for honour on behalf of the drawer or even a person endorsed, he or she is known as the acceptor for the honour. To make it simpler, when a third party like a bank, releases payment for a bill of exchange due to the nonpayment from a buyer (because the buyer refused the acceptance of delivery or simply didn’t want to pay the money), this is known as acceptance for the honour.

This means when a holder of a particular bill presents the same to a drawee for accepting the bill, and the person denies receiving the bill, it is known as a dishonoured bill, and the drawee in case of need should deal with a protested bill for dishonour. In the same situation, if a third person wishes to accept the bill for honour of the indorser or drawee, he or she becomes the acceptor for the honour.

Presentment for Acceptance

There are only some types of bills of exchange that require the terms of acceptance. A bill is only accepted when the drawee signifies his or her consent with an authorized signature on the instrument over the order of the drawer and wishes to pay the due bills. Under the law of the presentment of negotiable instruments, the drawee in case of need has no liability until the bill is accepted. Therefore, the person has to signify the acceptance by providing a valid signature on the bill.

As per section 15, the presentation for acceptance shall be submitted to the payer or its duly authorized agent, in case if the payer dies, its legal representative or its legal receiver or assignee at the time of bankruptcy.

The Bill Should be Presented to the Following Persons:

Drawee or its duly authorized agent.

If there is more than one drawee, to all drawers. In the case of the death of the drawee, to his legal representative.

If the payer is insolvent, it shall be handed over to its formal receiver.

When the original payer refuses to accept the bill of exchange, it shall be raised to the payer when necessary.

The acceptance of honor.

The acceptance presentation shall be made at the payer’s business place or residence during the business hours of the business day before the due date, within a reasonable time after the issuance of the invoice.

The Essentials of Valid Acceptance

The drawee should sign the bill through an authorized agent or on his own. The person becomes liable only after the acceptance of the bill and not before it. The prevention of liability is imposed as the person is yet not a party of the instrument.

When a bill is drawn in a set, the acceptance too must be done part wise. If the third person puts the acceptance over one or more parts, he or she becomes liable to all the parts.

A bill is treated as dishonoured when the drawee is declared bankrupt or dies. It may also be treated as the same when the drawee is fictitious or can't contract by the bill.

FAQs on Negotiable Instruments - Presentment for Acceptance

1. What is the presentment of Negotiable Instruments?

When a buyer (called drawee) in the process of a negotiable act accepts the bill of exchange provided by the seller, it is known as the presentment of the negotiable instrument. The drawee has to sign on the face of the bill under the words “accepted”. This act illustrates that the drawee is now an acceptor and thus, becomes liable for further payments on or before the maturity date. When a bill becomes payable after sight, the presentment of acceptance is important for fixing the instrument’s maturity.

2. Define acceptor for Honour.

When a bill holder presents the same to a drawee for acceptance, and the person denies it, the bill becomes dishonoured. It is then noted or protested for dishonour. Now, if a third person wants to accept the bill for acceptance on behalf of the drawee or indorser, the person becomes an acceptor for the honour. The person, who is willing to accept the bill, must provide in writing on the bill about the declaration of the acceptance under the protest bill to pay the sum on behalf of the drawee.

3. What is General and Qualified Acceptance?

There are different types of acceptance, and among them, general acceptance and qualified acceptance are common. A general acceptance or absolute acceptance is applicable when the drawee accepts the bill, however, without any attachment of condition or qualification. If it is not an absolute acceptance, the holder can regard the bill as dishonored.

In terms of qualified acceptance, when a condition is imposed for accepting the presentment, it is called a qualified acceptance. The terms and clauses of qualified acceptance vary on the bill, and thus, the holder has the right to refuse the acceptance of the condition and regards the bill as dishonored through the terms of non-acceptance.

4. What is the presentment of acceptance?

Presentment of acceptance refers to presenting the bill of exchange to the payer specified on the bill of exchange, asking him to accept and agree to pay the bill, usually at a certain time in the future. This is an act, which is equivalent to notifying the holder of a bill of exchange and requesting an acceptance of the bill, with the bill of exchange attached.

If the bill of exchange is accepted in writing, the words "accepted", "seen", "presented" on the bill of exchange or any other documents related to the transaction will constitute an acceptance of the bill of exchange.

5. When is the presentment for acceptance excused?

In some circumstances, the compulsory presentment of acceptance is excused, and the bill is treated as dishonoured. Here are a few examples:

When we are unable to find the drawee after a thorough search.

When a drawee is a fictitious person.

The drawee cannot contract.

Even though the presentment is irregular, he refuses to accept it for some other reason.

6. What are the Rules for presenting for acceptance?

A bill is presented for acceptance following the following rules:

The presentation must be made by the holder or on behalf of the holder to the drawee or a person authorized to accept or refuse to accept on his behalf within a reasonable time on a business day and before the bill is overdue;

If a bill of exchange is issued to two or more non-partner drawers, it must be presented to all drawers, unless one person has the right to accept it for everyone, in which case presentment may be made to him only.

If the drawee is dead, the bill may be presented to his personal representation.

A presentation through the post office is sufficient if authorized by agreement or usage.

- Constitutional Law

- Election and Public Officers

- Public International Law

- Labor Standards

- Labor Relations

- Persons and Family

- Obligations and Contracts

- Partnership

- Torts and Damages

- Land Titles And Deeds

- Case Digests

- General Taxation

- Income Taxation

- Local Taxation

- Real Property

- Estate and Donor's

- Documentrary Stamp

- Tax Remedies

- Value Added Tax

- Banking Laws

- Intellectual Property

- Negotiable Instruments

- Corporation Law

- Transportation Laws

- Credit Transactions

- General Provisions

- Crimes and Penalties

- Civil Procedure

- Criminal Procedure

- Special Proceedings

- Legal Ethics

- Lawyer's Oath

- Text of Laws and Statutes

- Jurisprudence Full Text

- Talk to a Lawyer

- Pro Bono Services

- Bar Exam Results and News

- Bar Exam Coverage

- Bar Questions

- Free Legal Advice

- Jurisprudence

- Legal E-Consultation

PRESENTATION FOR PAYMENT OF NEGOTIABLE INSTRUMENTS

Meaning of presentment for payment, presentment for payment not necessary to charge persons primarily liable, payable at a special place, necessary steps to charge persons secondarily liable in bills of exchange.

1. In the three steps required by law, presentment for acceptance to the drawee or negotiation within reasonable time after acquisition unless excused 2. If the bill is dishonored by non-acceptance, notice of dishonor by non-acceptance must be given to persons secondarily liable unless excused and in case of foreign bills, protest for dishonor by non-acceptance must be made unless excused

3. But if the bill is accepted, or if the bill isn’t required to be presented for acceptance, it must be presented for payment to the persons primarily liable unless excused 4. If the bill is dishonored by non-payment, notice of dishonor by non-payment must be also be given to person secondarily liable unless excused, and in case of foreign bills, protest for dishonor by non-pay7ment must be made unless excused

NECESSARY STEPS TO CHARGE PERSONS SECONDARILY LIABLE

• Presentment for payment must be made within the period required to the person primarily liable unless excused • If the note is dishonored by non-payment, notice of dishonor by non-payment must be given to the person secondarily liable unless excused

- Holder in Due Course with Incomplete and Undelivered Instrument

- Persons Liable on a Negotiable Instrument

- Negotiable Instruments With a Term

- Construction in Case of Ambiguities in a Negotiable Instrument

- Conditional or Special Delivery of Negotiable Instruments

- Undelivered Instrument

- Incomplete and Undelivered Instrument

- Incomplete But Delivered Instrument

- Importance of Dates in Negotiable Instruments

- LAW in General

The Next LIVE Free Legal Advice Episode

WE ARE EVERYDAY AT 8PM

Visit our Youtube Channel for Details

Facebook Page | YouTube Channel

Negotiable Instruments Act 05 Of Presentment

Free full course available on lawmint's youtube channel.

How to Land Your Dream LLB Internship in a Top Law Firm

- Part 1 - Introduction

- Part 2 - Internship Planning

- Part 3 - Internship Research

- Part 4 - Building Your Profile

- Part 5 - The Email

- Part 6 - The Resume

- Part 7 - The Cover Letter

- Part 8 - The Interview

- Part 9 - Self Development

Practical and comprehensive course, with real examples and step-by-step analysis of the complete internship application process. Check out LawMint's YouTube channel now!

Negotiable Instruments Act, 1881

Chapter v – of presentment, section 61 – presentment for acceptance.

A bill of exchange payable after sight must, if no time or place is specified therein for presentment, be presented to the drawee thereof for acceptance, if he can, after reasonable search, be found, by a person entitled to demand acceptance, within a reasonable time after it is drawn, and in business hours on a business day. In default of such presentment, no party thereto is liable thereon to the person making such default. If the drawee cannot, after reasonable search, be found, the bill is dishonoured. If the bill is directed to the drawee at a particular place, it must be presented at that place; and if at the due date for presentment he cannot, after reasonable search, be found there, the bill is dishonoured. Where authorized by agreement or usage, a presentment through the post office by means of a registered letter is sufficient.

Section 62 – Presentment of promissory note for sight

A promissory note, payable at a certain period after sight, must be presented to the maker thereof for sight (if he can after reasonable search be found) by a person entitled to demand payment, within a reasonable time after it is made and in business hours on a business day. In default of such presentment, no party thereto is liable thereon to the person making such default.

Section 63 – Drawee’s time for deliberation

The holder must, if so required by the drawee of a bill of exchange presented to him for acceptance, allow the drawee forty – eight hours (exclusive of public holidays) to consider whether he will accept it.

Section 64 – Presentment for payment

- Promissory notes, bills of exchange and cheques must be presented for payment to the maker, acceptor or drawee thereof respectively, by or on behalf of the holder as hereinafter provided. In default of such presentment, the other parties thereto are not liable thereon to such holder. Where authorized by agreement or usage, a presentment through the post office by means of a registered letter is sufficient.

- Notwithstanding anything contained in section 6, where an electronic image of a truncated cheque is presented for payment, the drawee bank is entitled to demand any further information regarding the truncated cheque from the bank holding the truncated cheque in case of any reasonable suspicion about the genuineness of the apparent tenor of instrument, and if the suspicion is that of any fraud, forgery, tampering or destruction of the instrument, it is entitled to further demand the presentment of the truncated cheque itself for verification: Provided that the truncated cheque so demanded by the drawee bank shall be retained by it, if the payment is made accordingly.