Loan Application Letter For School Fees: How To Make Yours Stand Out!

Key takeaways:.

- Understanding Loan Application Letters : Gain insights into the purpose and importance of loan application letters for school fees.

- Personal Experience : Discover how my extensive experience in writing various types of loan application letters can guide you.

- Step-by-Step Guide : Follow a detailed, easy-to-understand guide on writing an effective loan application letter for school fees, including a template.

- Real-Life Examples : Learn from actual examples that illustrate the do’s and don’ts of loan application letter writing.

- SEO Optimization : This article is crafted for optimal SEO performance to reach a wide audience seeking advice on loan application letters for school fees.

As someone who has written numerous loan application letters for various purposes, including school fees, I’ve come to understand the nuanced art of persuasive and effective writing in this domain.

My journey began a few years ago when I first encountered the need to craft a loan application for my education. This experience sparked my interest, leading me to assist others in similar situations.

Understanding the Purpose of Loan Application Letters

A loan application letter is a formal request for financial assistance, specifically aimed at covering educational expenses.

It’s not just about asking for money; it’s about presenting a compelling case that convinces the lender of your need and your ability to repay the loan.

Table 1: Components of a Loan Application Letter

My Approach to Writing Effective Loan Application Letters

Trending now: find out why.

My approach centers around three key principles: clarity, conciseness, and honesty. Clarity ensures that the purpose of the letter is immediately apparent. Conciseness respects the reader’s time, and honesty builds trust.

List of Principles for Effective Loan Application Letters:

- Clarity : Be clear about your needs and goals.

- Conciseness : Keep it brief yet comprehensive.

- Honesty : Be truthful about your financial situation.

Real-Life Example: A Success Story

One of my most memorable experiences was helping a student, Sarah, write a loan application letter for her university fees. Sarah was from a low-income family and aspired to study engineering.

We focused on her passion for engineering, her academic achievements, and her clear plan for repayment. The result? Sarah secured the loan and is now a successful engineer.

Step-by-Step Guide: How to Write a Loan Application Letter for School Fees

- Start with a Formal Salutation : Address the lender respectfully.

- Introduce Yourself : Briefly state who you are and your educational background.

- State the Purpose of the Letter : Clearly mention that the letter is a request for a school fee loan.

- Explain Your Financial Situation : Give details of your financial need without oversharing.

- Describe Your Educational Goals : Link how the loan will help in achieving your academic aspirations.

- Outline Your Repayment Plan : Indicate your plan for repaying the loan.

- Conclude Politely : End with a note of thanks and a polite request for a favorable response.

- Provide Contact Information : Include your contact details for further communication.

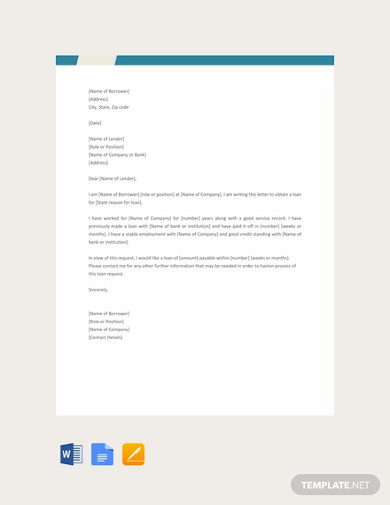

Loan Application Letter Template:

[Your Name] [Your Address] [City, State, Zip] [Email Address] [Phone Number] [Date]

[Lender’s Name] [Lender’s Institution] [Lender’s Address] [City, State, Zip]

Dear [Lender’s Name],

I am writing to request a loan for my school fees for [Name of Your Course/Program] at [Your School/University]. I am currently facing financial challenges…

[Include Personal Story and Educational Goals]

…Therefore, I kindly request a loan of [Amount] to cover my tuition and related expenses. I plan to repay this loan by [Your Repayment Plan].

Thank you for considering my request. I am looking forward to a favorable response.

Sincerely, [Your Name]

Final Thoughts and Your Input

Crafting an effective loan application letter for school fees is about striking the right balance between personal storytelling and professional appeal. Through my experience, I’ve learned that a well-written letter can open doors to educational opportunities that might otherwise remain closed.

I’d love to hear about your experiences or any questions you might have about writing loan application letters for school fees. Please share your thoughts and queries in the comments below!

Frequently Asked Questions (FAQs)

Q: What is the Most Important Aspect of a Loan Application Letter for School Fees?

Answer: In my experience, the most important aspect is clearly articulating your financial needs and educational goals. It’s essential to explain why you need the loan and how it will help you achieve your academic aspirations.

Being honest and detailed about your financial situation while tying it to your commitment to education can significantly impact the lender’s decision.

Q: How Detailed Should I Be About My Financial Situation?

Answer: You should be transparent enough to establish credibility, but there’s no need to overshare. I’ve found that providing a clear overview of your financial status, such as your family’s income, expenses, and any hardships, is sufficient.

The key is to make the lender understand your need without delving into excessive personal details.

Q: Can Personal Stories Improve the Chances of Loan Approval?

Answer: Absolutely! From my experience, personal stories can make your application stand out. When I helped students with their letters, we included personal anecdotes that highlighted their determination and academic goals.

This human element often helps the lender connect with your situation on a more empathetic level.

Q: Should the Loan Application Letter Be Formal or Informal?

Answer: It should always be formal. Despite sharing personal stories, the overall tone of your letter should be professional. Address the lender respectfully, use formal language, and maintain a structured format. This approach shows the lender that you take the request seriously.

Q: Is It Necessary to Mention a Repayment Plan in the Letter?

Answer: Yes, mentioning a repayment plan is crucial. In my writings, I always emphasize how the applicant plans to repay the loan. It demonstrates responsibility and foresight.

Outline a realistic plan, whether it’s through part-time employment, future earnings, or other means. This assures the lender of your commitment to repay the debt.

Q: How Long Should the Loan Application Letter Be?

Answer: It should be concise yet comprehensive. Ideally, keep it to one page. In my practice, I ensure that the letter includes all necessary information without being overly lengthy. Lenders appreciate brevity and clarity, so stick to the essential points and avoid unnecessary details.

Related Articles

Sample request letter for air conditioner replacement: free & effective, goodbye email to coworkers after resignation: the simple way, sample absence excuse letter for work: free & effective, salary negotiation counter offer letter sample: free & effective, formal complaint letter sample against a person: free & effective, medical reimbursement letter to employer sample: free & effective, 1 thought on “loan application letter for school fees: how to make yours stand out”.

An excellent resource for anyone looking to write a persuasive loan application letter. The combination of real-life examples and clear, step-by-step guidance makes it incredibly helpful and easy to follow.

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Start typing and press enter to search

How to Write a Cover Letter for Student Finance

In University by Think Student Editor December 22, 2022 Leave a Comment

Sorting out your finances and funding can be difficult at any point. However, due to the rather complex systems and there often being a lack of information, it can be even worse for university students when applying for student finance. The problems especially arise when it comes to the more nitty-gritty parts of sorting out student finance, such as with your actual application for it and cover letters.

Continue reading to learn more about writing a cover letter to secure your student finance. This article will answer your burning questions about what this cover letter is all about, whether you need one and a step-by-step guide for writing your own.

Table of Contents

What is a student finance cover letter?

In general terms, a cover letter is normally used for a job application. It is a short letter, only about 5 paragraphs long, that is meant to essentially convince a potential employer to hire you. For more information about this, check out this guide by the National Careers Service.

However, for student finance, this cover letter can be pretty different and is at times less clear. While it may be in reference to the general student finance application, your student finance form. To learn more about these, check out this governmental guide .

A cover letter for student finance is more likely to be in reference to applying for additional finance for compelling personal reasons . This may also be known as discretionary funding.

This is where you are applying for additional funding from student finance to support you in your studies after having put on hold or withdrawn from your previous studies . This pause or withdrawal from your studies will need to have been unavoidable for it to come under the bracket of compelling personal reasons.

The idea of this cover letter is that you will need to explain your situation and why this means that you need more funding to study . You will also need to provide some form of evidence of your situation. For more information about this, check out this guide by the University of Manchester.

Do you need a cover letter for your student finance application?

Whether you need a cover letter for your student finance application will depend on what kind of application it is . For example, if this is just the regular student finance application, you will generally be able to apply online and so you won’t need a cover letter . To learn more about applying for funding, check out this UCAS guide .

However, if this application is for additional finance for compelling personal reasons, you will need a cover letter in order to explain your situation . Compelling personal reasons is an overarching term for a range of reasons for why someone may have had to stop or pause their studies. These can include but are not limited to mental or physical health issues, bereavement, pregnancy, or caring responsibilities.

The cover letter is important for discretionary funding as your application for this funding is much more of an appeal that the regular student finance application. In this way, your application for discretionary funding due to compelling personal reasons may not be accepted. To learn more about this, check out this guide by the Sheffield Hallam Students’ Union.

How long should your cover letter be for student finance?

While there’s not particularly an exact word count for how long your student finance compelling personal reasons cover letter should be, it mostly like will only need to fit about one side of A4 . In fact, considering how it is in some ways structurally similar to the cover letter of a job application, it is likely that once again you may only need about 5 or so paragraphs, as mentioned above.

While it is unlikely to be very long, you will need to make sure that you include everything . Included in your student finance cover letter will need to be:

- Your personal details – This is including your name, address, ways of contacting you such as email or phone number and your student finance reference number.

- An explanation of what you are requesting – This is essentially to explain what type of funding you need, whether this is a reinstatement of funding from the year you couldn’t complete or if it is the continuation of your maintenance loan during your suspension of studies.

- An explanation of your situation – This is where you would explain what your compelling personal reasons for pausing or suspending your studies are and how they have affected you.

- An explanation of the timeframe – This is where you would explain when the problem(s) began and how long they have been an issue for.

- An explanation of how your situation has changed – This is for you to explain why the same situation that suspended your studies is unlikely to happen again.

For more information about all of this, check out this guide by Northumbria University.

How do you write a cover letter for student finance? (step-by-step guide)

Writing your cover letter for compelling personal reasons to student finance is no easy feat. However, it is such an important part of your application that it is important that know how to do it.

The following steps will take you through a step-by-step guide on how to write your cover letter to student finance. The information included in the following sections is taken from this guide by Aberystwyth University and this guide by Northumbria University. To find a template of a compelling personal reasons cover letter, you can check out this guide by Nottingham Trent University.

Step 1: Set up your student finance cover letter

The first thing you need to do when writing your compelling personal reasons cover letter is to properly set it up. By this, I mean that you need to essentially get your personal details section written and then plan what you’re going to put in the rest of the cover letter.

Your personal details section is essentially the part where you are actually setting it up as a formal letter. As mentioned above, this section is going to need to include your name, your student finance number, your address, your email/ phone number as well as the date of the letter .

Then, I would suggest planning your other sections to make it easier to write them up when it comes to it. To learn more about what the key points of each of these sections are, continue reading the following steps.

Step 2: Explain what you a requesting from student finance

For student finance to be able to help you, they will need to know what you need help with. This is why it is so important that you explain what you are requesting from them in your cover letter. It can also help to put it at the start to get it out of the way before your other sections.

However, you may also feel that it fits best at the end to wrap up your cover letter. The choice on how to structure your cover letter is up to you. To get you started, you may wish to use phrases, such as “I am writing to request…”.

Step 3: Explain what your situation was to student finance

For student finance to be able to properly consider your application, they will need to know what the circumstances that led you to suspend your studies were. In this part of your cover letter, you will need to explain your compelling personal reasons. This will need to be done in some depth so make sure you put enough focus on it .

This is the part where you would explain what the situation was, how it affected you and when your problems started and ended. You will also want to write about the emotional and/or physical effects it has had on your wellbeing, which have made you unable to carry on with your studies. To do this, you may want to use phrases, such as “I experienced…” or “I suffered with…”.

You will also need to include evidence of your situation, such as a medical note for health issues or a death certificate for bereavement. While this will not be in the cover letter itself, you will likely need to refer to where this evidence comes from and what type of evidence it is .

Step 4: Explain how your situation has now improved to student finance

In order to convince student finance that the funding will go to good use, you have to explain to them how your situation has changed so that you suspending your studies again is unlikely to happen . To do this, you may wish to describe any treatment you have had and explain how it has improved your situation or describe how your situation has otherwise improved.

Published In: Applications

How to Write a Loan Application Letter (with Samples)

Sometimes we need financial assistance to push through with our business idea, education, medical emergencies, or any other personal project or goals that require a huge amount of money for its realization. Basically, it is for this reason that banks and other money lending institutions exist.

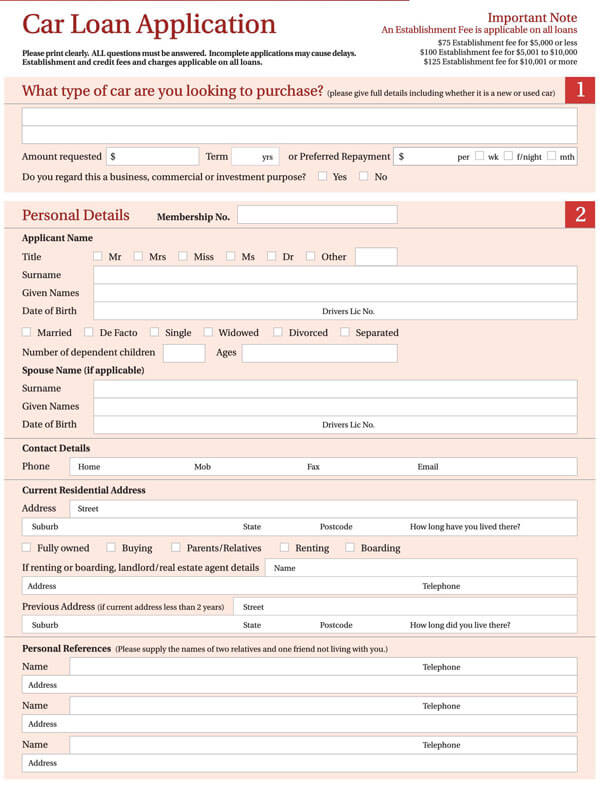

Applying for a loan from any lending institution requires the applicant to first fill out a form. Along with this form, the applicant can attach a loan application letter that provides more details on what he/she intends to do with the money and an overview of how the loan will be paid.

As a loan applicant, you need to learn how to write the loan request letter in a polite and convincing tone to appeal to your lender for your loan to be granted successfully.

What is a Loan Application Letter?

A Loan application letter is a document that informs the financial lending institution of the amount of money you are asking for, a clear outline of what you intend to do with the money, and convinces the bank why you are a good investment risk. Because it is a request, a loan application letter should be written in a polite tone, short and to the point.

The Loan Application Process

Based on the financial institution you choose, the process and time it takes for you to receive funding may vary. However, the typical loan application process may take on the following critical stages:

Pre-qualification stage

Prior to the loan contract, the potential borrower receives a list of items that they need to submit to the lender for them to get a loan. This may include Identification proof, credit score, current employment information, bank statements as well as previous loan statements.

Immediately this information is submitted, the lender reviews the documents and makes a pre-approval- meaning the borrower can move on to the next phase of the loan application process.

Loan application

In the second phase of the loan origination process, the borrower fills-in the loan application form either electronically- through mobile apps, websites, or paper-based. The data collected is then tailored to specific loan products.

The aspects that are included in the loan application form include the following;

The payment method- if it will be personal, through a check, or via online banking.

The payment frequency- There are several payment frequency methods, for example, Monthly installments, annually, or if the loan will be paid once.

The amount of interest accumulated on the loaned amount. This is the amount of money charged by the lender to the borrower on top of the amount which he/she has loaned.

The assets in the form of properties of the borrower will serve as collateral damage/guarantees in case the borrower defaults loan repayment or is unable to make his payments as per the agreed time.

Application processing

Once the application is received by the credit department, it is reviewed for accuracy, genuineness, and completeness. Lenders then use Loan Originating Systems to determine an applicant’s creditworthiness.

Underwriting process

This process only begins after an application is totally completed. In this stage, the lender checks the application in consideration of various accounts, such as an applicant’s credit score, risk scores, and other industry-based criteria. Today, this process is fully automated using Rule Engines and API integrations with credit scoring engines.

Credit Decision

Based on the results from the underwriting phase, the lender makes a credit decision. The loan is either approved, denied, or sent back to the originator for additional information. If the criteria used do not match with what is set in the engine system, there is an automatic change in the loan parameters, for instance, reduced loan amount or a different interest rate on the loaned amount.

Quality Check

Quality check of the loan application process is very critical since lending is highly regulated. The loan application is then sent to the Quality Control Team to analyze critical variables of the loan against internal and external regulations on loans. This is often the last step of the application process before funding is approved.

Loan funding

Once the loan documents are signed by both the borrower and the lender, funds are released shortly after. Nevertheless, business loans, loans on properties, and second mortgage loans may comparatively take more time to be approved due to legal and compliance reasons.

Essential Elements of a Loan Application Letter

Now that you have already understood the complex loan application process, it is important that you know the critical points to include in your loan request letter to convince your lender to give you a business loan.

Here is how to effectively write a loan application letter:

Header and greetings

The first and most important element of your business or personal loan application letter should be a header and an appropriate greeting.

In your header, include the following details:

- Your business names

- The physical address of your business

- Business telephone and cell phone numbers

- Lender’s contact details

- Lender’s or Loan Agent’s Name and Title

- A subject line stating the loan amount you are requesting for.

Once you have written your header, include a friendly but professional greeting to start off your loan application letter in a cordial tone.

Business Loan Request Summary

The body of your business or personal loan request letter should start with a brief summary of your loan request amount, why you need the loan, your basic business information, and why you are an ideal risk investment for the lender. This section should be brief and concise. Only include the relevant information to capture your loan agent’s interest and keep them reading the body of your loan application letter.

Basic Details about your Business

Ideally, this is the third paragraph of your loan application letter. Use a few short and concise sentences to give a clear outline of your business.

Be sure to include the details below:

- The legal name of your business and any DBA that your business uses

- Your business structure- if it is a corporation- partnership, individually owned, etc.

- A summary of what your business does.

- How long your business has been operational

- Total number of employees

- A brief description of your current annual revenue

Once you have provided your basic business information, it is time to write the meat of your business loan request letter- clearly explaining why you need the business loan and how you intend to recuperate the investment.

The purpose of the business loan

In the fourth paragraph of your loan application letter, explain succinctly how you will use the business loan. Additionally, tell the lender why your intended use of the business loan will be a wise business investment.

While detailing this section, be as specific as possible and demonstrate to the lender that you have carefully considered the kind of revenue generation this new debt will accomplish for your business. for instance, don’t just say that you intend to use the loan for working capital. Rather, say that you plan to increase your inventory by 45% or that you need to increase your Human Resources to 4 to generate more income by 6%.

In the same paragraph, inform the lender exactly how the loaned amount will help generate more profits necessary to cover repayment plus the interest accumulated on loan.

Proof that you’ll be able to fully repay the loan

In this section, you need to demonstrate to the lender that you can pay back the loaned amount together with interest as per the agreed repayment period. You will want to use any figures from your latest income statements or balance sheets to prove your business is financially healthy and that it is a low-risk investment decision for your lender. In case you have other existing debts, be sure to mention them and include a business debt schedule if possible. If your business is profitable, highlight that in your letter since it something that most lenders pretty much look for in successful loan applicants.

In addition to that, consider including specific cash flow projections to demonstrate to your lender how you plan to fit repayment of the loaned amount plus interest into your budget.

Sample: Loan Application Letter

Sample 1: business loan application letter.

Samira Mitchell,

Mitchell Face Masks Limited,

4680 Forest Road

939, New York.

January 17, 2021

Mr. Wesley Kingston

Guarantor Trust Bank

679, New York State

Ref: Loan Request for $10,000

Exactly two years ago, I started my small face mask vending business in our local market. Over the last two years, my business has picked up really well to an extent where I need to expand to a bigger face mask vending company.

It is for this reason that I am writing this letter. I am confident that there is a great market niche for face masks, especially due to the current worldwide Novel Covid-19 Pandemic. Thus far, I have had many repeat customers, new customer links through referrals, and my client base has grown rapidly. Generally, there is an increase in demand for my products; therefore, I am requesting for a loan amounting to $10,000 to be able to supply more and satisfy all my clients.

This money, along with the amount that I have saved up from my profits, will enable me to lease a large, modern storefront and to import supplies that will help me launch my business plan.

I have attached my business plan, my latest business balance sheets, current business schedules, as well as my credit history statements for your perusal and review. If you have any questions or need any further clarifications, please contact me directly on (111) 345 679 or email me at Mitchel.facemasksltd.co.ke. Thank you for your consideration.

Samira Mitchel.

Sample 2: Personal Loan Application Letter

Dear Michael,

It is common for everyone to face difficult situations and bitter realities in life. I am currently facing a situation where everything seems bleak, and there seems to be no way out of this difficult situation. I am in debt, and I need to pay at least 30% of my house’s mortgage will be taken over by the bank, and I am currently ailing and weak, I’ll not be able to survive such a nervewrecking situation.

The only way I can avoid such a fate is by paying the full amount that is needed by the bank. I can be able to do so if I am allowed to take out a loan from the office, which is a privilege that the company has granted to all the employees. I would be thankful if the company allows me to borrow the money against my monthly pay.

Mr Brandon Brown

Do’s and Don’ts of Writing a Loan Request Letter

A loan application letter may increase or break your chances of receiving funding from any lending institution. This is because it is the first thing that lenders look for in the underwriting process when you submit an application. That said, you must know the dos and don’ts of writing a winning loan request letter to help you receive the funding that you really need.

- Check your personal and business credit scores before sending a loan request letter and take the necessary steps to improve them.

- Have all your financial statements ready, including cash flow statements, business balance sheets, P$L statements, etc

- Make sure to submit all your relevant credentials along with your loan application request letter.

- Always provide the correct and factual information to avoid fraudulent consequences.

- Don’t make your letter too long and unnecessarily wordy

- Don’t use an informal format while writing the loan application letter. Instead, follow the proper rules on writing formal letters

- Don’t include any false information in your loan request letter- be it your business’s current financial health, assets, and liabilities that may be used as collateral damage in case you default payment or why you need the money.

Things to Remember When Writing a Loan Application Letter

Generally, you should always consider the following essential tips if you want to write a winning loan application letter:

- The loan application letter is a formal document. Therefore, observe the proper rules of writing a formal letter.

- Clearly state your intent to borrow a given amount of money

- Provide a vivid but brief description of why you need the money. Your explanation should be concise, genuine, and transparent. While at it, explain how you plan to use the loaned amount and be very sincere about it.

- Explain why your business is a low-risk investment decision for the lender.

- Enumerate your assets and liabilities

- Include the time, date, manner, and method that you will use to make your payment.

Free Loan Application Letter Templates

Are you looking to get some financing for your business or personal emergency? Download our free, well-crafted Loan application letter templates to help you customize your loan request letter. Our Templates includes all the critical elements of a winning loan request letter that will successfully help convince your lender to grant you the funding you need. Download our templates today to help you get started!

Collateral is defined as something that helps secure a loan. Generally, based on the type of lending institution you pick, the lender will give you less than your pledged asset value. Lenders every so often quote an acceptable loan to value ratio, meaning that if you borrow against your house, for example, and it worth $400,000, you will be given a loan amounting to $380,000. Again, this depends on the bank.

The prepayment penalty is a fee that some lenders charge if you pay off all or part of your loan before the loan’s maturity date. These do not usually apply if you pay extra principal on your loaned amount in small amounts at a time. However, it is good that you counter check with your lender.

Every lender follows a different criterion to approve a business or personal loan. The application process depends on several factors; therefore, the time taken to receive funding in your account may take anywhere from a few minutes to several days. This depends on the type of institution you choose and the type of loan you are asking for.

Acquiring a loan is sometimes a necessity in one’s business or personal life. Nonetheless, it is not always easy to get a loan as lenders are wary of granting loans due to loan repayment defaults and fraudulent borrowers. This article has provided you with great insight on loan application letters, the loan application process, essential tips for writing a winning loan application letter, and the dos and don’ts of writing a convincing loan request letter. If you keep these things in mind every time you are thinking of applying for a loan, you are sure to get the funds you need to ensure the smooth running of your business and sort any personal emergency that may come your way.

Related Documents

Student Loans

Internationals

Refinancing & Consolidation

Juno In Our Words

Juno in Your Words

Talk to Juno

Student Loan Guides

Calculators & Scholarships

Financial Literacy Hub

Other Resources

Have existing federal student loans? Calculate potential forgiveness here.

How to Write a Student Loan Goodwill Letter to Save Your Credit: Sample Included

Late or missing student loan payments can cause your credit score to tank. Read on for a sample letter to remove a student loan from your credit report.

Sarah Li Cain

Nov 11, 2021

Not making on-time payments on your student loans will negatively impact your credit score . On the upside, you may be able to rescue your damaged credit score by writing a student loan goodwill letter.

It’s not a guarantee, but sending one might be worth the effort. The worst thing that could happen is that your loan servicer could deny your request. But you could get lucky, and the lender could ask the credit bureaus to take your late payments off your credit history.

Let’s g over what you need to know, including a sample letter you can use to remove a late student loan payment from your credit report.

What Is a Student Loan Goodwill Letter?

A goodwill letter is a letter you send to your loan servicer to request that, in an act of goodwill, it remove any late or missed student loan payments from your credit report. Since late payments are a major red flag, your credit score could tank if you don’t make on-time payments .

One possible consequence of having a low credit score is being denied a loan. And even if you do qualify for a car loan, mortgage or personal loan, you could be charged high fees and interest rates.

Writing a goodwill letter is your best bet if you were the one who caused the late or missed payment and you want to explain why it happened. If a reported late payment was because of your loan servicer’s mistake, then you’ll need to dispute it with the credit bureau directly.

If you can successfully convince your lender you’re still a reliable borrower, you may have these negative remarks on your credit report removed. If so, your credit score could see a sharp improvement reasonably quickly.

Will My Goodwill Letter Work?

No matter how well written your goodwill letter is, there is no guarantee that the lender will agree to your request. The decision is totally up to the lender, which may not accept or care about the circumstances that resulted in your missed or late payment.

But you may get a sympathetic reader who understands why you made a late student loan payment, especially if it was due to an illness, a sudden job loss or other unexpected circumstances.

If you explain what happened in a polite and appreciative tone, your lender might be receptive to your request.

When you write your letter, carefully explain what happened that got you into a financial pickle — aka what resulted in your late or missed payment. Admit your mistake and conclude by assuring the loan servicer that it won’t happen again and that missing a payment is rare for you.

Sample Letter to Remove Student Loan From Credit Report

Each borrower’s goodwill letter will be unique, but this sample can give you a good start for how to structure yours. Remember: You should write your letter with a friendly and appreciative tone while being clear in your request. All letters should include the loan account number, the borrower’s contact information, and details about the late or missed payment.

Dear [loan servicer name],

My name is [your name], and my student loan account number is [your account number]. I discovered there was a late payment reported on Jan. 1, 2021, on my credit report. I understand that my actions resulted in this late payment.

I want to let you know that I am willing to do everything I can to pay back my student loans in full and on time. Sadly, I recently underwent major surgery and have been negotiating with my health insurance company for months about my five-figure medical bill. Due to this unexpected expense, my budget was stretched too thin. I also had to take unpaid time off work and could not keep up with payments.

I assure you that missing payments is rare for me. You can check my payment history to see that I’ve always made on-time payments (and sometimes more than the minimum amount) other than this one time. Once I went back to work, I was able to balance my budget and resumed making my loan payments on time.

I am concerned that my low credit score may result in me having to pay a higher interest rate for a home equity loan I plan to take out. I don’t feel as though my credit report reflects the kind of responsible borrower I truly am.

I request that you remove the late payment as a goodwill gesture. I appreciate and thank you for your consideration and hope that my request will be granted.

How long does it take to get a response to a goodwill letter?

It may take a few weeks to get a response from your lender. You can follow up by calling your lender if you haven’t heard anything after a few weeks.

If Your Request Is Denied

There’s a chance your lender won’t approve your request. If your credit score is negatively affected, you’ll have to take steps to rebuild your credit. The best way to do so is to keep making on-time payments, to be careful about closing old accounts, and to avoid maxing out your credit cards, among other steps.

If you’re still struggling with making your student loan payments, contact your lender to see what can be done, such as adjusting your monthly payments or exploring your options for loan deferment or forbearance. You may be able to reach an agreement and prevent further damage to your credit.

Also consider refinancing through an organization such as Juno , which could help you save tens of thousands of dollars throughout the life of your loan. Juno negotiates with partner lenders on behalf of borrowers to help each student qualify for the best refinance rates they can given their financial situation.

Juno's Exclusive Student Loan Refinance Deals

Can’t be refinanced with a cosigner

Fixed starting at 5.09% APR, Variable starting at 5.89% APR including the .25% autopay discount and the .25% Juno discount.

Juno benefit:

Rate reduction of 0.25%

Soft Credit Check to get rates; Hard Credit Check to refinance

May be able to refinance with a cosigner

Fixed starting at 4.96% APR, Variable starting at 4.99% APR. May include autopay discount.

Up to $1,000 cash back based on loan amount

Fixed starting at 5.74% APR, Variable starting at 5.49% APR *

Rate reduction of 0.25% *

Soft Credit Check to get rates * ; Hard Credit Check to refinance

Sarah Li Cain is a finance writer and a candidate for the Accredited Financial Counselor designation whose work has appeared in places like Bankrate, Business Insider, Financial Planning Association, Investopedia, Kiplinger, and Redbook. She’s the host of Beyond The Dollar, where she and her guests have deep and honest conversations about money affects their well-being.

Related Articles

All categories:.

Enter our scholarship in two minutes

Awards Monthly

All Formats

Table of Contents

5 steps to make a loan letter, 1. free loan guarantee letter, 2. free loan request letter template, 3. free loan sanction letter, 4. bank loan application letter template, 5. personal loan letter format, 6. request for loan letter template, 7. education loan letter format, 8. student loan letter template, 9. bank loan application letter example, 10. sample loan application letter template, 11. student loan letter format, 12. loan application letter template, 13. loan letter example, 14. sample student loan letter, 13+ loan letter templates.

A loan letter is a letter issued by a bank or any other financial institution to a borrower or an applicant who has applied for the loan. The loan letters are very necessary these days. Because you need to apply for the loan in a particular procedure. But do you keep on writing the loan letter every time you need one? If yes, you need not do that from now. Because we have the letter templates designed for you, to make you design the loan letter in minutes. With the templates , you can very easily make the letters.

Step 1: The Subject

Step 2: the language, step 3: know the procedure, step 4: the reason, step 5: check.

- Google Docs

More in Letters

Loan requisition letter, loan letter template, loan application letter to bank manager template, sample follow up letter after interview template, simple loan application letter template, personal loan letter to company template, loan reschedule letter template, loan repayment letter to employee template, request for education loan letter template, loan agreement letter template.

- FREE 26+ Covid-19 Letter Templates in PDF | MS Word | Google Docs

- Thank You Letter for Appreciation – 19+ Free Word, Excel, PDF Format Download!

- 69+ Resignation Letter Templates – Word, PDF, IPages

- 12+ Letter of Introduction Templates – PDF, DOC

- 14+ Nurse Resignation Letter Templates – Word, PDF

- 16+ Sample Adoption Reference Letter Templates

- 10+ Sample Work Reference Letters

- 28+ Invitation Letter Templates

- 19+ Rental Termination Letter Templates – Free Sample, Example Format Download!

- 23+ Retirement Letter Templates – Word, PDF

- 12+ Thank You Letters for Your Service – PDF, DOC

- 12+ Job Appointment Letter Templates – Google DOC, PDF, Apple Pages

- 21+ Professional Resignation Letter Templates – PDF, DOC

- 14+ Training Acknowledgement Letter Templates

- 49+ Job Application Form Templates

File Formats

Word templates, google docs templates, excel templates, powerpoint templates, google sheets templates, google slides templates, pdf templates, publisher templates, psd templates, indesign templates, illustrator templates, pages templates, keynote templates, numbers templates, outlook templates.

SemiOffice.Com

Your Office Partner

Application for Loan From School By Teacher or Other Staff Member

Want to write a requesting application for a loan from school to fulfill your needs? We are giving you sample loan applications for schools to be submitted by teachers and other staff members working for a school, branch, or academy. if you need a new or different letter, please let us know in the comments at the bottom.

We regularly publish letters and applications for our visitors. You can write your requirement in the comments if you need any type of letter or application.

Sample Application for Loan by Teacher for School (format 1)

The Principal, School Name, Address/Branch

Subject: Application for Loan

Respected (Sir/Madam or Name or the Person),

I need an urgent loan of 5000 to meet (a personal requirement or you mention any of your reason here). You are requested to give me this amount and deduct 1000 per month from my salary starting from the following month. I will be very grateful to you.

Sincerely Yours,

Teacher Name, Designation, Subject, Class,

Sample Application for Loan by Teacher for School (format 2)

I am “your name” teaching (subject name) at your prestigious school for two years. Due to some urgency, I need an urgent loan of 10,000/- to meet (a personal requirement or you mention any of your reason here).

You are requested to give me this amount and deduct 1000 per month from my salary starting from the following month. I will be very grateful to you.

Teacher Name, Designation, Subject, Class

Application By Staff Member for Loan from School

Subject: Request for Salary Loan

I am “your name,” working as (designation) at your prestigious school for two years. Due to some urgency, I need an urgent loan of 10,000/- to meet (a personal requirement or you mention any of your reason here).

Your Name, Designation, Subject, Class

Share this:

Author: david beckham.

I am a content creator and entrepreneur. I am a university graduate with a business degree, and I started writing content for students first and later for working professionals. Now we are adding a lot more content for businesses. We provide free content for our visitors, and your support is a smile for us. View all posts by David Beckham

Please Ask Questions? Cancel reply

Get the Tata Capital App to apply for Loans & manage your account. Download Now

- Personal Loan

- Business Loan

- Vehicle Loan

- Loan Against Securities

- Loan Against Property

- Education Loan New

- Credit Cards

- Microfinance

- Rural Individual Loan New

Personal loan starting @ 10.99% p.a

- Instant approval

- Overdraft Facility

All you need to know

- Rates & Charges

- Documents Required

Personal loan for all your needs

Overdraft Loan

Personal Loan for Travel

Personal Loan for Medical

Personal Loan for Marriage

Personal Loan for Home Renovation

- Personal Loan EMI Calculator

Pre-payment Calculator

Eligibility Calculator

Check Your Credit Score

Higher credit score increases the chances of loan approval. Check your CIBIL score today and get free insights on how to be credit-worthy.

Home Loan with instant approval starting @ 8.75% p.a

- Easy repayment

- Home Loan Online

- Approved Housing Projects

Home Loan for all your needs

- Home Extension Loan

Affordable Housing Loan

Plot & Construction Loan

- Balance Transfer

Home Loan Top Up

- Calculators

- Home Loan EMI Calculator

- PMAY Calculator

Balance Transfer & Top-up Calculator

- Area Conversion Calculator

- Stamp Duty Calculator

Register as a Selling Agent. Join our Loan Mitra Program

Business loan to suit your growth plan

- Collateral-free loans

- Customized EMI options

Business loan for all your needs

- Machinery Loan

Small Business Loan

EMI Calculator

- GST Calculator

- Foreclosure Calculator

Looking for Secured Business Loans?

Get secured business loans with affordable interest rates with Tata Capital. Verify eligibility criteria and apply today

Accelerate your dreams with our Vehicle Loans

- Flexible Tenures

- Competitive interest rates

Explore Used Car Loans

- Used Car Loan

Loan On Used Car

Explore Two Wheeler Loans

- Two Wheeler Loan

Used Car EMI Calculator

Two Wheeler EMI Calculator

Get upto 95% of your car value and book your dream car

A loan upto ₹5,00,000 to own the bike of your choice

Avail Loan Against Securities up to ₹40 crores

- Quick access to finance

- Zero foreclosure charges

Explore Loan Against Securities

Loan against Shares

Loan against mutual funds

- Loan Against Securities Calculator

Avail Loan Against Property up to ₹3 crores

- Loan against property

- Business loan against property

- Mortgage loan against property

- EMI Options

Loans for all your needs

Secured Micro LAP

Empowering Rural India with Microfinance loans

- Quick processing

Want To Know More?

Avail a Rural Individual Loan

- Working Capital Loans

- Cleantech Finance

Structured Products

- Equipment Financing & Leasing

Construction Financing

Commercial Vehicle Loan

- Explore all Business Loans

Digital financial solutions to aid your growth

- Simple standard documentation process

- Quick disbursal

Most Popular products

Channel Financing

Invoice Discounting

Purchase Order Funding

Working Capital Demand Loan

Sub Dealer Loan

Pioneering Climate Finance through innovative solutions

Most popular products

Project & structured design

Debt Syndication

Financial Advisory

Cleantech Advisory

Financing solutions tailored to your business needs

- Quick approvals

- Flexible payment options

Our Bestselling Products

Structured Investment

Letter of Credit

Lease Rental Discounting

Avail Term Loans up to Rs. 1 Crore

- Customise loan tenures as per your needs

- Get your loan processed, sanctioned and funds disbursed digitally

- Equipment Finance

Avail Digital Equipment Loans up to Rs. 1 Crore

- Attractive ROIs

- Customizable Loan tenure

Equipment Leasing

Avail Leasing solutions for all asset classes

- Up to 100% financing

- No additional collateral required

Ensure your business’ operational effeciency with ease

- Wide range of equipments covered

- Minimum paperwork

- Construction Finance

- Construction Equipment Finance

Moneyfy by Tata Capital

A personal finance app, your one-stop shop for comprehensive financial needs - SIP, Mutual Funds, Loans, Insurance, Credit Cards and many more

- 100% digital journey

- Start investing in SIP as low as Rs 500

SIP Calculator

Investment Calculator

- Mutual Funds

- Fixed Deposit

Wealth Services by Tata Capital

Personalised Wealth Services for exclusive customers delivered by a team of experts from a suite of product offerings

- Inhouse research & reports

- Exclusive Privileges & Offers

Financial Goal Calculator

Retirement Calculator

- Download forms

Protect your family against unforeseen risks

Avail any of the Insurance policies online in just a few clicks

Bestselling insurance solutions

Motor Insurance

Life Insurance

Health Insurance

Home & Travel Insurance

Wellness Insurance

Protection Plan & other solutions

Retirement Solutions & Child Plan

Quick Links for loans

- Used Car Loans

- Loan against Property

Loan Against securities

Quick Links for insurance

- Car Insurance

- Bike Insurance

Saving & Investments

Medical Insurance

Cardiac Insurance

Cancer care Insurance

Other Insurance

- Wellness solutions

- Retirement Solution Plans

- Child Plans

- Home Insurance

- Travel Insurance

- Mutual Fund

Choose from our list of insurance solutions

Retirement Solutions & Child Plans

Quick Links for Loans

Cancer Care Insurance

Offers & Updates

Download the moneyfy app.

Be investment ready in minutes

Take a Tata Capital Home Loan

Lowest interest rates starting at 8.75%*

Apply for a Tata Card

Get benefits worth Rs. 18,000*

Sign in to unlock special offers!

You are signed in to unlock special offers.

- Retail Customer Login

- Corporate Customer Login

- My Wealth Account

- Dropline Overdraft Loan

- Two wheeler Loan

Quick Links for Insurance

- Term insurance

- Savings & investments

- Medical insurance

- Cardiac care

- Cancer care

Personal loan

- Rate & Charges

Loan Against Shares

Loan Against Mutual Funds

Avail a Rural Individual Loan

EMI Calculators

Compound Interest Calculator

Home Insurance & Travel Insurance

Menu

- Loan for Home

- Loan for Business

- Loan for Education

- Loan for Vehicle

- Personal Use Loan

- Loan for Travel

- Loan for Wedding

- Capital Goods Loan

- Home Repair Loan

- Medical Loan

- Loan on Property

- Loan on Securities

- Wealth Services

- What’s Trending

- RBI Regulations

- Equipment Lease

- Circulating Capital Loan

- Construction Loan

- Leadership Talks

- Dealer Finance

- Shubh Chintak

- Coronavirus

- Government Updates

- Lockdown News

- Finance Solutions

Tata Capital > Blog > Loan for Education > How to Write a Letter for Education Loan Application in India

How to Write a Letter for Education Loan Application in India

Congratulations on receiving an acceptance letter from your dream university! Now, to finance your tuition fee, living costs, and other expenses, you can consider opting for education finance. It is a ray of hope for students who aspire to study in premier institutes and are looking to manage their educational expenses.

Loans for education come with a pretty simple application process. But, first things first, you must write a loan application letter to the lender requesting them to sanction your loan. Read on to understand how to write an application for education loan.

How to write application for loan

After you have selected a lender, you must write a loan application letter to them explaining your academic and financial situation. Here’s what you should include in your letter.

- Recipient’s address

First, you must mention the Manager’s name you are writing the letter to, the name of the lending institution, branch details, and the branch address.

- Applicant address

Next, include your name and address.

Once you have mentioned the address details, write the date. This doubles up as the date of application when the lender approves your letter.

After the date, write the subject line or the purpose of the letter. So, make sure it is to the point and conveys the intent of writing the letter.

Once you mention the email subject, address the authority directly in the salutation.

Now comes the meat of the application. This section must include all the details required by the lender to grant you a loan. So, introduce yourself, talk about the institute you have been accepted into and the degree you wish to pursue and mention why you need the loan. Make sure to include your academic records, entrance/foreign exam scorecard, acceptance letter, and other relevant documents to make a convincing case for why you deserve the opportunity. Lastly, assure the lender that you will complete your studies and fetch a good job and close the letter.

Here’s a sample letter to make things clear for you.

Sample letter for education finance

The Bank Manager

Date: XX/X/20XX

Subject: Application for the education loan

I am writing this letter to apply for a student loan to pursue higher education in English Literature. I recently completed my Bachelor’s in English Literature from the University of Delhi with a 9.7 CGPA. Besides, I scored 85% marks in the All India Senior School Certificate Examination (AISSCE) with a Science background.

I applied to the University of Pennsylvania for a full-time Master’s degree in English and have been selected for the programme. The total hostel fee, cost of education accessories, tuition fee, and boarding expenses in the United States is approximately Rs. 20 lakhs.

Due to my humble family background, I’m unable to afford the cost and require financial assistance. I request you to grant me a personal loan for higher education at this prestigious university. I will repay the loan amount on time.

I have attached my academic records, credentials, acceptance letter and other relevant documents with the letter. I am looking forward to your response.

Thank you. Yours sincerely, Anita

After formally putting your request forward with aletter for education loan, you must wait for the lender to approve and sanction your loan.

Additional Read: Recent Changes Happening in Higher Educations in The New Normal World

Need help financing your education? We can help!

Getting a solid education is a stepping stone toward a promising career. Therefore, you shouldn’t have to compromise your dreams due to a shortage of funds. At Tata Capital, we offer customisable loans with competitive personal loan interest rates to help you pursue your education in India and abroad. You can avail of an amount depending on your needs and loan eligibility.

What’s more, with Tata Capital, you can apply for a student loan online and get a hassle-free experience with minimal documentation and fast approval. So, without further ado, visit our website and apply for education finance today!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Most Viewed Blogs

5 Pro Tips To Pay Off Your Education Loan Faster

Can I get Education Loan for Pursuing CFA in India?

Know All About Education Loan – CSIS Subsidy Scheme in India

A Guide To Education Loan Eligibility

Here’s the List of MS in US Scholarships for Indian Students

Education Loan Options for Borrowers with Low Credit Score

Things to Look Out for While Signing Education Loan Documents

5 Last Minute Strategies Helping to Pay For your College Tuition Fees

Tips To Apply For Scholarships

Trending Blogs

- Business Loan EMI Calculator

Used Car Loan EMI Calculator

Two Wheeler Loan EMI Calculator

Loan Against Property Calculator

- Media Center

- Branch Locator

- Tata Capital Housing Finance Limited

- Tata Securities Limited

Tata Mutual Fund

Tata Pension Fund

Important Information

- Tata Code of Conduct

- Master T&Cs’ Tata Capital Limited

- Master T&Cs' Tata Capital Financial Services Limited - Pre 31st December, 2023

- Master T&Cs' Tata Capital Housing Finance Limited - Pre 31st December, 2023

- Master T&Cs' Tata Capital Housing Finance Limited

- Vendor Feedback Form

- Rate History

- Ways to Service

- Our Partners

- Partnership APIs

- SARFAESI – Regulatory Display - Tata Capital Limited

- SARFAESI – Regulatory Display - Tata Capital Housing Finance Limited

Investor Information

- Tata Capital Limited

Our Private Equity Funds

- Tata Capital Healthcare Fund

- Tata Opportunities Fund

- Tata Capital Growth Fund

Amalgamated Companies

- Archived Documents of Tata Capital Financial Services Limited

- Archived Documents of Tata Cleantech Capital Limited

Top Branches

Most important terms & conditions - home loans.

Download in your preferred language

Policies, Codes & Other Documents

- Tata Code Of Conduct

- Audit Committee Charter

- Affirmative Action Policy

- Whistleblower Policy

- Code of Conduct for Non-Executive Directors

- Remuneration Policy

- Board Diversity Policy

- Code of Corporate Disclosure Practices and Policy on determination of legitimate purpose for communication of UPSI

- Anti-Bribery and Anti-Corruption Policy

- Vigil Mechanism

- Composition Of Committees

- Notice Of Hours Of Work, Rest-Interval, Weekly Holiday

- Fit & Proper Policy

- Policy For Appointment Of Statutory Auditor

- Policy On Related Party Transactions

- Policy For Determining Material Subsidiaries

- Policy On Archival Of Documents

- Familiarisation Programme

- Compensation Policy for Key Management Personnel and Senior Management

- Fair Practice Code - Micro Finance

- Fair Practice Code

- Internal Guidelines on Corporate Governance

- Grievance Redressal Policy

- Privacy Policy on protecting personal data of Aadhaar Number holders

- Dividend Distribution Policy

- List of Terminated Vendors

- Policy for determining Interest Rates, Processing and Other Charges

- Policy specifying the process to be followed by the Investors for claiming their Unclaimed Amounts

- NHB registration certificate

- KYC pamphlet

- Fair Practices Code

- Most Important Terms & Conditions - Home Equity

- Most Important Terms & Conditions - Offline Quick Cash

- Most Important Terms & Conditions - Digital Quick Cash

- Most Important Terms & Conditions - GECL

- Most Important Terms & Conditions - Dropline Overdraft

- GST Details

- Customer Grievance Redressal Policy

- Recovery Agents List

- Legal Disclaimer

- Privacy Commitment

- Investor Information And Financials

- Guidelines On Corporate Governance

- Anti-Bribery & Anti-Corruption Policy

- Whistle Blower Policy

- Policy Board Diversity Policy and Director Attributes

- TCHFL audit committee Charter

- Code of Conduct For Non-Executive Directors

- Code of Corporate Disclosure Pracrtices and policy On determination of Legitimate purpose

- List of Terminated Channel Partners

- Policy On Resolution Framework 2.0

- RBI Circular On Provisioning

- Policy for Use of Unparliamentary Language by Customers

- Policy for Determining Interest Rates and Other Charges

- Additional Facility

- Compensation Policy For Key Management Personnel And Senior Management

- Guidelines for release of property documents in the event of demise of Property Owners who is a sole or joint borrower

- Prevention Of Money Laundering Policy

- Policy For Accounting Of Tax In Respect Of The Tax Position Under Litigation

- Cyber Security Policy

- Conflict Of Interest Policy

- Policy For Outsourcing Of Activities

- Surveillance Policy

- Anti-Bribery And Anti-Corruption Policy

- Code Of Conduct For Prevention Of Insider Trading

Tata Capital Solutions & Services

- Loans for You

- Loans for Business

- Overdraft Personal Loan

- Wedding Loan

- Travel Loan

- Home Renovation Loan

- Personal Loan for Govt employee

- Personal Loan for Salaried

- Personal Loan for Women

- Small Personal Loan

- Required Documents

- Application Process

- Affordable Housing

- Business Loan for Women

- MSME/SME Loan

Vehicle Loans

More Products

- Emergency Credit Line Guarantee Scheme (ECLGS)

- Credit Score

- Education Loan

- Rural Individual Loans

- Structured Loans

- Commercial Vehicle Finance

- Personal Loan Pre Payment Calculator

- Personal Loan Eligibility Calculator

- Balance Transfer & Top-Up Calculator

- Home Loan Eligibility Calculator

- Business Loan Pre Payment Calculator

- Loan Against Property EMI Calculator

- Used car Loan EMI Calculator

- Two wheeler Loan EMI Calculator

- APR Calculator

- Personal Loan Rates And Charges

- Home Loan Rates And Charges

- Business Loan Rates And Charges

- Loan Against Property Rates And Charges

- Used Car Loan Rates And Charges

- Two Wheeler Loan Rates and Charges

- Loan Against Securities Rates And Charges

Uh oh, something went wrong

Please try again later.

Watch CBS News

Student loan forgiveness approval letters are going out. Here's what they mean.

By Aimee Picchi

November 23, 2022 / 10:38 AM EST / MoneyWatch

About 16 million borrowers who had applied for the Biden administration's student loan forgiveness program received letters starting last weekend letting them know that they've been approved for debt relief.

However, the letter states that a number of lawsuits "have blocked our ability to discharge your debt at present." The approvals come after two courts blocked the plan, placing legal barriers before a federal program that had promised to forgive up to $20,000 in student debt for about 40 million eligible Americans.

"Your application is complete and approved, and we will discharge your approved debt if and when we prevail in court," Secretary of Education Miguel Cardona said in the letter.

About 26 million people had applied for the loan relief effort prior to the court rulings, which have effectively stopped the Biden administration's ability to accept new applications. The Biden administration is appealing those decisions, but it's unclear whether the cases will be decided.

On Tuesday, the Biden administration said it is extending the pause on student debt repayments. That freeze had been slated to expire on December 31, which meant borrowers would have started repayments in January. With the latest extension, the pause will now be pushed back until no later than June 30, 2023.

"I'm confident that our student debt relief plan is legal. But it's on hold because Republican officials want to block it," President Biden wrote on Twitter. "That's why [Education Secretary Miguel Cardona] is extending the payment pause to no later than June 30, 2023, giving the Supreme Court time to hear the case in its current term."

The letter from the Education Department said it will update applicants "when there are new developments."

Loan payments

The letters are helping "folks understand a bit better why they haven't had their debts forgiven yet," noted Mike Pierce, executive director of the advocacy group Student Borrower Protection Center. "That doesn't completely do away with the very real economic anxiety that people with student loans feel at this moment."

The irony of getting approval for loan forgiveness while also being told that the plan might not move forward due to legal challenges wasn't lost on recipients, who took to social media to comment on the mixed messages.

"Getting the student loan forgiveness approval letter, but saying we really can't forgive your loans at this time is peak 2022," one person wrote on Twitter.

Getting the student loan forgiveness approval letter, but saying we really can’t forgive your loans at this time is peak 2022 😏 #ExtendThePause #CancelStudentDebt pic.twitter.com/yKdY4xORIn — Skye Devonshire (@skyedevonshire) November 21, 2022

What is getting approved for relief?

The Department of Education sent the letter to 16 million people who applied to have up to $20,000 in student debt forgiven, telling them they received a green light — at least from the Biden administration. The letters don't inform the borrowers how much of their loans had been erased, however.

But because of the court rulings, debt forgiveness can't move forward unless the Biden administration is victorious with its legal challenges. The Education Department will "quickly process their relief once we prevail in court," White House Press Secretary Karine Jean-Pierre has said.

I applied for forgiveness but haven't gotten a letter. Why?

The Biden administration had approved 16 million applications prior to the court rulings, and those people are receiving alerts about that now. Some of those applicants may not have received the emails in the initial alert, but could receive an alert in their inbox soon, according to a November 19 tweet from Cardona.

"Beginning today, applicants and others seeking relief through the Biden-Harris Administration's Student Debt Relief Plan will begin receiving updates. Don't worry if you don't get an email today — more are coming," Cardona said in a tweet.

But the other 10 million people who applied but hadn't been approved prior to the court rulings may be in for a longer wait. "The Biden administration is in a tough spot right now — they aren't allowed to approve applications until something changes in the court," Pierce noted.

And the roughly 14 million eligible borrowers who have yet to apply are no longer able to do so via the Education Department's online application, which has been shut down in response to the court rulings.

When could I see debt relief?

It's unclear because that depends on the timing of the Biden administration's appeals, Pierce noted.

Advocacy groups for student debt relief on Tuesday applauded the White House's decision to extend the repayment pause until June 2023, which will give eligible borrowers financial breathing room over the next few months as the legal challenges move forward.

"This extension means that struggling borrowers will be able to keep food on their tables during the holiday season — and the coming months — as the Administration does everything it can to beat back the baseless and backward attacks on working families with student debt," Pierce said in a Tuesday statement.

- Student Debt

Aimee Picchi is the associate managing editor for CBS MoneyWatch, where she covers business and personal finance. She previously worked at Bloomberg News and has written for national news outlets including USA Today and Consumer Reports.

More from CBS News

Supreme Court lets Louisiana use congressional map with new majority-Black district

Victims of Think Finance loan repayment scam to get $384 million

U.S. announces effort to expedite cases of migrants who cross border illegally

Mercedes-Benz workers in Alabama vote against joining the UAW

Student Loan Cancellation Update: Borrowers Get New Chance to Apply

The Biden administration has extended the deadline for student loan borrowers to apply for a loan consolidation .

With the rising costs of higher education, more students are turning to loans to finance their degrees. However, many students struggle to repay these loans after college, which has become a significant issue for Democrats . So far, President Joe Biden 's administration has approved nearly $160 billion in student loan forgiveness for almost 4.6 million borrowers, according to the U.S. Department of Education (DOE).

Read more: Federal PLUS Student Loans 2024 Review

Student loan borrowers can consolidate, or combine, one or more federal education loans into a new Direct Consolidation Loan, which helps them gain access to federal forgiveness programs, among other benefits.

Initially, the deadline to apply was April 30, but now borrowers have until June 30 to request the loan consolidation.

By consolidating their loans, borrowers can get a payment count adjustment, which gives them credit for past loan periods that previously wouldn't have counted toward loan forgiveness under income-driven repayment (IDR) plans or Public Service Loan Forgiveness (PSLF).

Direct Loans or Federal Family Education Loan (FFEL) Program loans held by the DOE "will see a full and accurate count of their progress toward loan forgiveness" in September 2024, according to a press release from the DOE on Wednesday.

"Because of this updated timeline, borrowers with non-federally held FFEL loans who apply to consolidate by June 30 can still benefit from the payment count adjustment," the release said.

Read more: When Is the FAFSA Deadline?

U.S. Under Secretary of Education James Kvaal said in the release, "The Department is working swiftly to ensure borrowers get credit for every month they've rightfully earned toward forgiveness. FFEL borrowers should consolidate as soon as possible in order to receive this benefit that has already provided forgiveness to nearly 1 million borrowers."

Newsweek reached out to the White House via email for comment.

How do I Apply for Loan Consolidation?

According to the Federal Student Aid website, it takes less than 30 minutes to apply for a direct consolidation loan online. There is also an option to submit an application via mail.

If you decide to apply online, go to studentaid.gov/loan-consolidation . You will have to confirm your personal information, select your loan servicer and which loans you want to consolidate, choose a repayment plan, confirm your references and add any new references you have, agree to the terms and conditions of the loan consolidation, and then review the information you have provided before signing and submitting your application.

You will need a verified FSA ID; personal details such as your mailing address, telephone number, and email address; financial information and additional loan information to complete the application.

After submitting your application, a loan servicer will manage the consolidation process in which they will be your point of contact for any questions you may have.

Start your unlimited Newsweek trial

Home » Letters » Bank Letters » Student Loan Application Cancellation Letter – Sample Letter for Cancelling Student Loan Application

Student Loan Application Cancellation Letter – Sample Letter for Cancelling Student Loan Application

To, The Branch Manager _____________(Name of the bank) _____________(Address)

Date: __/___/_______(Date)

Subject: Cancellation of loan application

Respected Sir/Madam,

I am writing this letter in reference to the student loan application_____________(loan application number). I submitted the loan application to Mr./ Mrs. _____________ (name) on __/__/_____(date). I would like to cancel my request for the loan application as ____________________ (it is no longer required/personal reasons/ mention your reason). I am ready to pay the cancellation fees. I have already enclosed a cheque for the amount __________ (mentioned amount) to pay the cancellation fees.

Kindly, accept my request and cancel my student loan application so that I can collect my original documents from the branch which I have submitted during the process of my loan application. If you have any issues regarding this matter, please let me know at the earliest. I can be contacted as per the details provided below.

Yours faithfully, _____________(Signature) _____________(Name) _____________(Contact details)

By Rahul Sharma

Related post, loan application letter | sample application letter to bank manager for loan.

Complaint Letter to Bank for Amount Deduction as Processing Charge – Sample Complaint Letter Regarding Unexplained Deduction from Bank Account

Letter to bank for non-payment of loan – sample explanation letter for delay in loan payment, congratulations letter to colleague on promotion – sample letter to congratulate colleague on promotion, food diet chart request letter – sample letter requesting food diet chart, letter to embassy for visa refusal reason – sample letter requesting reason for visa refusal, holiday request letter – sample letter requesting leave, privacy overview.

IMAGES

VIDEO

COMMENTS

Begin your letter with a personal introduction. Mention your name, current educational status, and the program you wish to enroll in. This sets the context for your request. Example: "My name is [Your Name], a recent graduate from [Your School], and I am writing to request a loan for my upcoming Master's program in [Program Name] at ...

Template for a Student Finance Cover Letter. Dear [Recipient's Name or "Sir/Madam"], I am writing to apply for [specific student finance package], as advertised [mention where you found the listing, if applicable]. As a [your year in school] student at [your school], pursuing a degree in [your field of study], I am earnestly seeking ...

Name of Loan Officer. Name of Financial Institution or Bank. Address of Financial Institution or Bank. City, State, Zip Code. RE: Loan Application for $100,000. Dear [Loan Officer's Name], I am writing to formally request a loan of $100,000. As a loyal customer for the past 20 years, I have always trusted this institution with my financial ...

Step 6: Provide a Clear Call to Action. End your letter with a clear request for the financial assistance and provide a way for the reader to contact you. Also, mention any documents you've attached, like your academic transcript or recommendation letters. Real-Life Example: "I respectfully request your support to help me complete my degree ...

Key Takeaways: Understanding Loan Application Letters: Gain insights into the purpose and importance of loan application letters for school fees.; Personal Experience: Discover how my extensive experience in writing various types of loan application letters can guide you.; Step-by-Step Guide: Follow a detailed, easy-to-understand guide on writing an effective loan application letter for school ...

20 Best Loan Application Letter Samples (Guide and Format) An application letter for a loan is a formal letter written to a financial institution by a borrower requesting a loan, payable in a specified amount of time. The letter helps lenders get acquainted with the borrowers better to determine if they qualify for the loan based on the ...

Write a Conclusion. In a final paragraph, restate the amount you need and thank the school or lender for considering your request. You will then close your letter with "Sincerely," or another appropriate ending. Include your name and contact information at the end of the letter. When applying for a private student loan or for additional ...

Here is an example of a student loan hardship letter. It should be sent by certified mail, so the sender has proof of the time it was sent and received. Only copies of documents should be included. No original documents should be sent. The sender should keep a record of this and any other communication in this matter.

Step 2: Explain what you a requesting from student finance. For student finance to be able to help you, they will need to know what you need help with. This is why it is so important that you explain what you are requesting from them in your cover letter. It can also help to put it at the start to get it out of the way before your other sections.

When writing a letter to a bank manager for a student loan, clarity and politeness are key. Start with a clear introduction stating your purpose for the loan and your academic background. Include details about the course or degree you wish to pursue and the institution you plan to attend. ... Loan Application Letter | Sample Application Letter ...

Sample application letter for loan by students due to financial problems, father unemployment, loss of family member, or any other reason. Sample application for educational loan, study loan, student loan from a bank on urgent basis. Education Loan Request Letter Sample Howard School of SciencesUnited States of America Respected Dean of student, My name is Charlie, and have recently…

Header and greetings. The first and most important element of your business or personal loan application letter should be a header and an appropriate greeting. In your header, include the following details: Your name. Your business names. The physical address of your business. Business telephone and cell phone numbers.

7070 Worthington Galena Rd. Westerville, Ohio 43081. Attn: Student Loans/Lending Department. Dear Lending Department, I have been a customer of Huntington National Bank for 3 years and my family has done business with your bank for more than 30 years. I have decided to peruse my education at the Ohio State University.