Artificial Intelligence Applied to Stock Market Trading: A Review

Ieee account.

- Change Username/Password

- Update Address

Purchase Details

- Payment Options

- Order History

- View Purchased Documents

Profile Information

- Communications Preferences

- Profession and Education

- Technical Interests

- US & Canada: +1 800 678 4333

- Worldwide: +1 732 981 0060

- Contact & Support

- About IEEE Xplore

- Accessibility

- Terms of Use

- Nondiscrimination Policy

- Privacy & Opting Out of Cookies

A not-for-profit organization, IEEE is the world's largest technical professional organization dedicated to advancing technology for the benefit of humanity. © Copyright 2024 IEEE - All rights reserved. Use of this web site signifies your agreement to the terms and conditions.

Subscribe to the PwC Newsletter

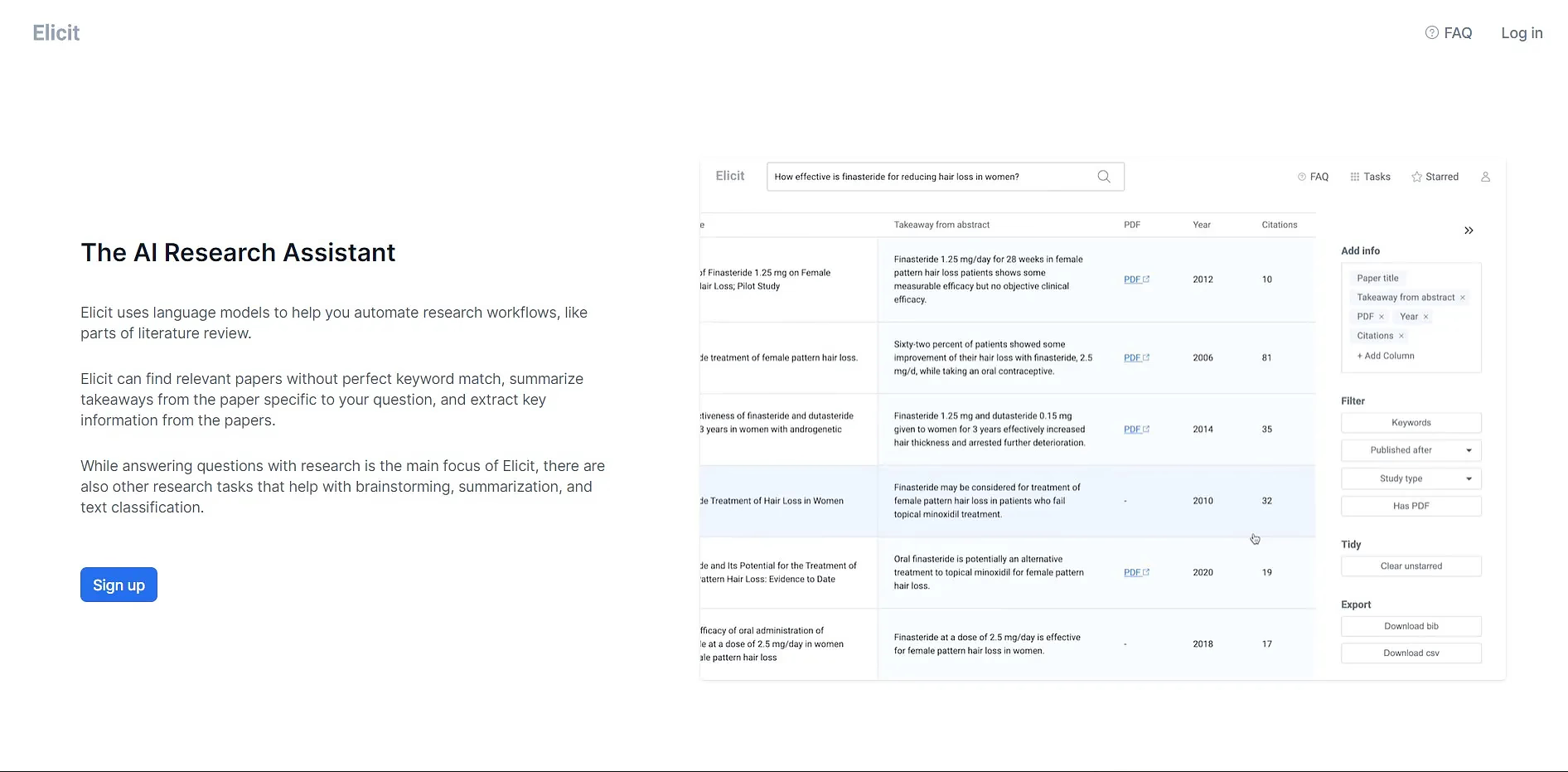

Join the community, add a new evaluation result row, algorithmic trading.

17 papers with code • 0 benchmarks • 1 datasets

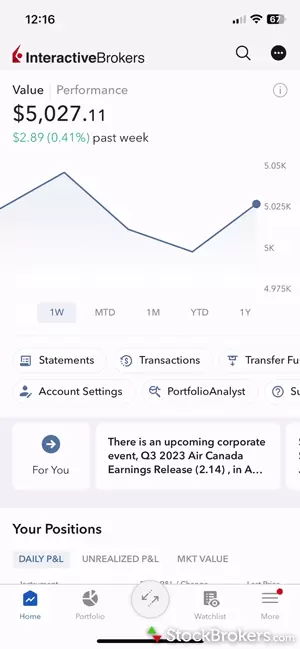

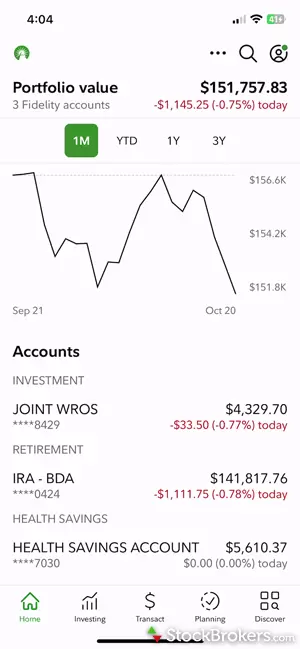

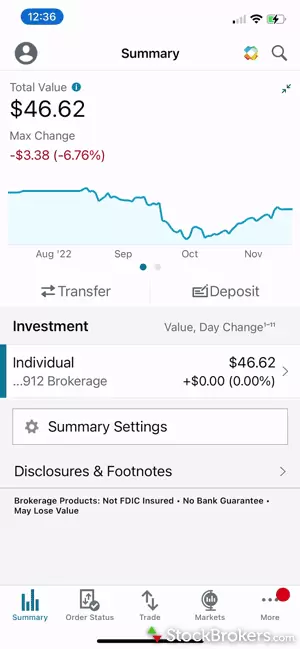

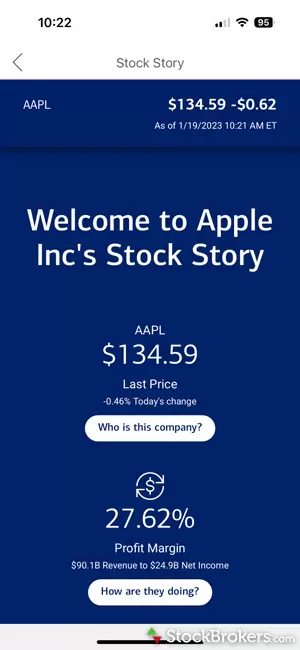

An algorithmic trading system is a software that is used for trading in the stock market.

Benchmarks Add a Result

Most implemented papers, a wavelet method for panel models with jump discontinuities in the parameters.

timmens/sawr • 22 Sep 2021

Our method adapts Haar wavelets to the structure of the observed variables in order to detect the change points of the parameters consistently.

FinGPT: Open-Source Financial Large Language Models

While proprietary models like BloombergGPT have taken advantage of their unique data accumulation, such privileged access calls for an open-source alternative to democratize Internet-scale financial data.

Machine Learning in Asset Management—Part 1: Portfolio Construction—Trading Strategies

firmai/machine-learning-asset-management • Journal of Financial Data Science 2020

This is the first in a series of arti-cles dealing with machine learning in asset management.

Using Reinforcement Learning in the Algorithmic Trading Problem

A system for trading the fixed volume of a financial instrument is proposed and experimentally tested; this is based on the asynchronous advantage actor-critic method with the use of several neural network architectures.

An Application of Deep Reinforcement Learning to Algorithmic Trading

This scientific research paper presents an innovative approach based on deep reinforcement learning (DRL) to solve the algorithmic trading problem of determining the optimal trading position at any point in time during a trading activity in stock markets.

Rise of the Machines? Intraday High-Frequency Trading Patterns of Cryptocurrencies

QuantLet/CCID • 9 Sep 2020

This research analyses high-frequency data of the cryptocurrency market in regards to intraday trading patterns related to algorithmic trading and its impact on the European cryptocurrency market.

Taking Over the Stock Market: Adversarial Perturbations Against Algorithmic Traders

nehemya/Algo-Trade-Adversarial-Examples • 19 Oct 2020

In this study, we present a realistic scenario in which an attacker influences algorithmic trading systems by using adversarial learning techniques to manipulate the input data stream in real time.

Multi-Graph Tensor Networks

The irregular and multi-modal nature of numerous modern data sources poses serious challenges for traditional deep learning algorithms.

Deep Reinforcement Learning in Quantitative Algorithmic Trading: A Review

Algorithmic stock trading has become a staple in today's financial market, the majority of trades being now fully automated.

Exploration of Algorithmic Trading Strategies for the Bitcoin Market

Crone1/Bitcoin-Algorithmic-Trading-Paper • 28 Oct 2021

This work brings an algorithmic trading approach to the Bitcoin market to exploit the variability in its price on a day-to-day basis through the classification of its direction.

- Open access

- Published: 25 March 2020

Research on a stock-matching trading strategy based on bi-objective optimization

- Haican Diao 1 ,

- Guoshan Liu 1 &

- Zhuangming Zhu 1

Frontiers of Business Research in China volume 14 , Article number: 8 ( 2020 ) Cite this article

10k Accesses

1 Citations

Metrics details

In recent years, with strict domestic financial supervision and other policy-oriented factors, some products are becoming increasingly restricted, including nonstandard products, bank-guaranteed wealth management products, and other products that can provide investors with a more stable income. Pairs trading, a type of stable strategy that has proved efficient in many financial markets worldwide, has become the focus of investors. Based on the traditional Gatev–Goetzmann–Rouwenhorst (GGR, Gatev et al., 2006) strategy, this paper proposes a stock-matching strategy based on bi-objective quadratic programming with quadratic constraints (BQQ) model. Under the condition of ensuring a long-term equilibrium between paired-stock prices, the volatility of stock spreads is increased as much as possible, improving the profitability of the strategy. To verify the effectiveness of the strategy, we use the natural logs of the daily stock market indices in Shanghai. The GGR model and the BQQ model proposed in this paper are back-tested and compared. The results show that the BQQ model can achieve a higher rate of returns.

Introduction

Since the A-share margin trading system opened in 2010, there has been a gradual improvement in short sales of stock index futures (Wang and Wang 2013 ) and investors are again favoring prudent investment strategies, which include pairs-trading strategies. As a kind of statistical arbitrage strategy (Bondarenko 2003 ), the essence of pairs trading (Gatev et al. 2006 ) is to discover wrongly priced securities in the market, and to correct the pricing through trading means to earn a profit from the spreads. However, with the increase in statistical trading strategies and the gradual improvement of market efficiency (Hu et al. 2017 ), profit opportunities using existing trading strategies have become more scarce, driving investors to seek new trading strategies. At present, academic research on pairs trading has mainly concentrated on the construction of pairing models and the optimization design of trading parameters, with a greater focus on the latter. However, merely improving trading parameters does not guarantee a high return for the strategy, and this drives researchers back to the foundations of the pairs-trading model.

There are three main methods for screening stocks: the minimum distance method, the cointegration pairing method, and the stochastic spread method. The minimum distance method was proposed by Gatev et al. ( 2006 )—hence its common name, the GGR model. Gatev et al. ( 2006 ) used the distance of a price series to measure the correlation between the price movements of two stocks. When making a specific transaction, the strategy user determines the trading signal by observing the magnitude of the change in the Euclidean distance between the normalized price series of two stocks (the sum of the squared deviations, or SSD). Perlin ( 2007 ) promoted GGR as a unitary method rather than a pluralistic one; testing it in the Brazilian financial market, he found that risk can be lessened by increasing the number of pairs and stock. Do and Faff ( 2010 ) found that the length of a trading period can affect strategy returns; their study laid the foundation for later research. Jacobs and Weber ( 2011 ) found that the GGR model’s revenue comes from the difference in the speed of paired-stock information diffusion. Chen et al. ( 2017 ) revised the measurement method of the GGR model, changing the original measure (SSD) to the correlation coefficient, and increased the reliability of the multi-pairing strategy. Wu and Cui ( 2011 ) first applied the GGR model to the A-share market; conducting a back-test on the stock markets in Shanghai, they found that the GGR model can generate considerable returns, and its profits come from a market’s non-validity. Wang and Mai ( 2014 ) measured the return on stock markets in Shanghai, Shenzhen, and Hong Kong respectively, and found that improvements to the original approach can bring portfolio construction strategic benefits but can also increase the risk of exploitation of the GGR model.

The cointegration pairing method was first used by Vidyamurthy ( 2004 ) to find stock pairs with a cointegral relationship. He used cointegrating vectors as the weight of pairs when trading. To solve the problem of single-stock pairing risks, Dunis and Ho ( 2005 ) extended the cointegration method from unitarism to pluralism and proposed an enhanced index strategy based on cointegration. By extracting sparse mean–return portfolios from multiple time series, D’Aspremont ( 2007 ) found that small portfolios had lower transaction costs and higher portfolio interpretability than the original intensive portfolios. Peters et al. ( 2010 ) and Gatarek et al. ( 2014 ) applied the Bayesian process to the cointegration test and found that the pairing method can be applied to high-frequency data.

The stochastic spread method first appeared in a paper by Elliott et al. ( 2005 ), who used the continuous Gauss–Markov model to describe the mean return process of paired-stock spreads, thus theoretically predicting stock spreads. Based on the research by Elliott et al. ( 2005 ) . Do et al. ( 2006 ) first linked the capital asset pricing model (CAPM) with the pairs-trading strategy and achieved a higher strategic benefit than when using the traditional random spread method. Bertram ( 2010 ), assuming that the price differences of stock obey the Ornstein–Uhlenbeck process, derived the expression of the mean and variance of the strategic return on the position and found the parameter value when the expected return was maximized.

Based on above approaches, many scholars have begun to study mixed multistage pairing-trading strategies. Miao ( 2014 ) added a correlation test to the traditional cointegration method and found that screening stock-correlation analysis improved the profitability of the strategy. Xu et al. ( 2012 ) combined cointegration pairing with the stochastic spread model and conducted a back-test on the stock markets in both Shanghai and Shenzhen; they found that higher returns could be obtained. Following Bertram’s ( 2010 ) research, Zhang and Liu ( 2017 ) examined a pairs-trading strategy based on cointegration and the Ornstein–Uhlenbeck process and found the strategy to be robust and profitable.

In recent years, most scholars have focused on improving the long-term equilibrium of paired-stock prices in the stock-matching process continuously. Few studies have considered the short-term fluctuations of paired-stock spreads, which has led to poor profitability of the strategy. Therefore, this paper focuses on the stock matching of pairs trading and constructs a bi-objective optimized stock-matching strategy based on the traditional GGR model. The strategy introduces weight parameters, conducts long-term stock price volatility spreads, and adjusts the equalizer to match investors’ preferences, enhancing the flexibility and practicality of the strategy.

The remainder of this paper is organized as follows. Basic theory and model section provides the basic theories and models of pairs-trading strategies and double bi-objective optimization. Optimized pairing model section establishes an optimized pairing model. Pairing strategy empirical analysis section provides an empirical analysis of the optimal matching strategy proposed in this paper. Finally, Conclusions section presents conclusions and suggests future research direction.

Basic theory and model

Based on theories of pairs trading, stock-pairing rules in the minimum distance method, and multi-objective programming, we propose a strategy to improve profits based on the minimum distance method.

- Pairs trading

Pairs-trading parameters

Using a pairs-trading strategy requires a focus on the following trading parameters:

Formation period : the time interval for stock-pair screening using the stock-matching strategy.

Trading period : the time interval in which selected stock pairs are used for actual trading.

Configuration of opening : the value of the portfolio construction triggered. For example, we can start a transaction by satisfying the following conditions: (1) The user is in the short position state; (2) the degree to which the paired-stock spread deviates from the mean changes; and (3) the degree changes from less than a given standard deviation to more than a given standard deviation.

Closing threshold : the value of the position closing triggered. For example, when the strategy user is in position and the paired-stock spread hits the mean.

Stop-loss threshold : the value of the stop-loss triggered; that is, when the rules are engaged for exiting an investment after reaching a maximum acceptable threshold of loss or for re-entering after achieving a specified level of gains.

- Minimum distance method

When using the minimum distance method to screen stocks, it is necessary to standardize the stock price series first. Suppose the price sequence of stock A in period T is \( {P}_i^A\left(i=1,2,3,\dots, T\right) \) ; \( {r}_t^A \) is the daily rate of return of stock A . By compounding r , we can get the cumulative rate of return of stock A in period T , which is recorded as:

where t = 1, 2, 3, …, T . When we record the standardized stock price series as \( S{P}_t^A \) , the distance SSD of each two-stock normalized price series can be calculated as follows (Krauss 2016 ):

Multi-objective programming

The multi-objective optimization problem was first proposed by economist Vilfredo Pareto (Deb and Sundar 2006 ). It means that in an actual problem, there are several objective functions that need to be optimized, and they often conflict with each other. In general, the multi-objective optimization problem can be written as a plurality of objective functions, and the constraint equation and the inequality can be expressed as follows:

where, x ∈ R u , f i : R n → R ( i = 1, 2, ..., n ) is the objective function; and g i : R n → R and h i : R n → R are constraint functions. The feasible domain is given as follows:

If there is not an x ∈ X , such that

then x ∗ ∈ X is called an effective solution (Bazaraa et al. 2008 ) to the multi-objective optimization problem.

Optimized pairing model

Previous studies on the GGR model have mostly focused on similarities in stock trends and have cared less about the volatility of stock spreads. Such studies could not present ways to achieve higher returns. This paper, however, is based on the traditional GGR model, and can thus propose a new pairs-trading model, namely bi-objective quadratic programming with quadratic constraints (BQQ) model. By adjusting the weights between maintaining a long-term equilibrium of paired-stock prices and increasing the volatility of stock spreads (Whistler 2004 ), we can achieve equilibrium.

Mean-variance minimization distance model

Assume that there are m stocks in the alternative stock pool, and the formation period of the stock pairing is n days. Take the daily closing price of the stock as the original price series, recorded as P 1 , P 2 , ⋯ , P m . To make the price sequence smoother, we use the average price series over the past 30 days: \( \overline{P_1},\overline{P_2},\cdots, \overline{P_m} \) (instead of the original price series), to eliminate short-term fluctuations in stock prices. Then, in the moment, t can be expressed as follows:

First we consider \( \sum {\alpha}_i\overline{P_i} \) .

Let α be the weight of the stock in the stock pool, and then let

Then, we divide the stock into two groups according to the positive and negative weights. The stock combination with a positive weight is called \( {P}_t^{+} \) , while the stock combination with a negative weight is called \( {P}_t^{-} \) , so

According to the GGR method, as long as we are in the formation period n , we can consider that the groups’ prices have to represent a long-term equilibrium relationship. Therefore, we get the bi-objective optimization model as follows:

The volatility of the paired-stock spread is a source of revenue for the pairs-trading strategy. Variances are used to describe the volatility of a time series. Therefore, we use the formula below to measure the stock spread:

Avoiding the case that α = 0, we increase the regularity constraint; that is, the second-order modulus is 1, so we can obtain the BQQ model as:

This paper uses a linear weighting method by introducing weight λ ( λ > 0), transforming the bi-objective optimization problem into a single-objective optimization problem. The model is denoted as revised quadratic programming with quadratic constraints (RQQ):

Since users of the matching strategy have different risk preferences, λ can be seen as an important indicator of strategic risk. When λ is large, the model magnifies the volatility of the paired-stock spread sequence, and the strategy may obtain higher returns, but it also raises the risk of divergence in the stock spread. Therefore, users can adjust λ to match their risk preferences, which increases the usefulness of the pairing strategy.

Let \( \overline{p}=\frac{1}{n}\sum \limits_{t=1}^n\overline{p_t} \) .

To facilitate the model solution, we perform matrix transformation as follows:

For a given α k , we get the sub-problem of the model as this:

The sequential quadratic programming algorithm

Since the objective and constraints of RQQ are quadratic functions, these are typical nonlinear programming problems. Therefore, the sequential quadratic programming algorithm can solve the original problem by solving a series of quadratic programming sub-problems (Jacobs and Weber 2011 ; Zhang and Liu 2017 ). The solution process is as follows:

Step 1 : Give α 1 ∈ R m , ε > 0, μ > 0, δ > 0, k = 1, B 1 ∈ R m × m .

Step 2 : Solve sub-question sub ( α k ), and we get its solution d k and the Lagrange multiplier μ k in the case of ∣ d k ∣ ≤ ε , terminating the iteration; therefore, let s k ∈ [0, δ ] and μ = max ( μ , μ k ). By solving this:

we get s k , where ε k ( k = 1, 2, ⋯ ) satisfies the non-negative condition and

Equation ( 21 ) is the exact penalty function.

Step 3 : Let α k + 1 = α k + s k d k , and use the Broyden–Fletcher–Goldfarb–Shanno algorithm (BFGS, Zhu et al. 1997 ) to find B k + 1 , then let k = k + 1 and go back to Step 2 .

Thus, we find the optimal sub-solution d k . Make d k the search direction and perform a one-dimensional search in direction d k on the exact penalty function of the original problem; we get the next iteration point of the original problem as α k + 1 . The iteration is terminated when the iteration point satisfies the given accuracy, obtaining the optimal solution of the original problem.

Pairing strategy empirical analysis

To verify the profitability of the BQQ strategy, this paper compares the empirical investment effects of the BQQ strategy and the GGR strategy with the same transaction parameters and applies a profit-risk test for the arbitrage results of the two strategies.

Data selection and preprocessing

We use SSE 50 Index constituent stocks in the Shanghai stock market as the sample set for this study. We choose this sample set for its high circulation market value and large market capitalizations. Since the stock-pairing method proposed in this paper is based on an improvement of the traditional minimum distance method, this is consistent with the GGR model in the time interval selection of the sample: The paired stocks for trading are selected during the formation period of 12 months, and the stocks are traded in the next 6 months. To verify the effectiveness of the strategy, the paper conducts a strategic back-test from January 2016 to December 2018. Within the period, the broader market experienced a complete set of ups and downs.

Due to the existence of share allotments and share issues by listed companies, and because the suspension of stocks will also lead to a lack of market data, the raw data needs to be preprocessed. By reversing the stock price forward, the stock price changes caused by the allotments and stock offerings are eliminated. In addition, we exclude stocks that have been suspended for more than 10 days in the formation period. These missing data are replaced by the closing price of the nearest trading day.

Parameters settings

Transaction parameters setting.

The implementation of a pairs-trading strategy relies on setting trading parameters. To compare this strategy with the traditional minimum distance method and verify the validity of the BQQ strategy, this paper uses the same parameters used in the GGR model for setting the trading parameters. We set the stop-loss threshold to 3 to prevent excessive losses due to excessive strategy losses and transaction costs. We set the number of paired shares to 10. For convenience, we divide the stocks into groups according to their weights, positive and negative.

Portfolio construction

After determining the trading parameters and cost parameters, we also need to determine the stock opening method; assuming that the final selected pair of stocks is \( \left\{{S}_1^{+},{S}_2^{+},\cdots, {S}_5^{+}\right\},\left\{{S}_1^{-},{S}_2^{-},\cdots, {S}_5^{-}\right\} \) (corresponding to two sets of paired stocks), and the corresponding weight is \( \left\{{\alpha}_1^{+},{\alpha}_2^{+},...,{\alpha}_3^{+}\right\} \) and \( \left\{{\alpha}_1^{-},{\alpha}_2^{-},...,{\alpha}_3^{-}\right\} \) . When the trading strategy issues a trading signal for opening, closing, or stop-loss, the trading begins. The user needs to trade α i / α 1 ( i = 2, 3, 4, …, 10) units of stock \( \left\{{S}_1^{-},{S}_2^{-},\cdots, {S}_5^{-}\right\} \) for each unit of \( \left\{{S}_1^{+},{S}_2^{+},\cdots, {S}_5^{+}\right\} \) . Then, the strategy user has a net position, which is the paired-stock spread.

Performance evaluation

To compare the effects of the GGR model and the proposed BQQ model, we verify the effectiveness of the proposed optimization pairing strategy. This paper selects the income coefficient α , risk coefficient β , and the Sharpe ratio as evaluation indicators, and the two strategies are back-tested and compared on the JoinQuant platform.

Stock-matching stage

When adopting the GGR model, we select five groups of stocks with the smallest SSD (two in each group) from each formation period. There is a small distance between these stocks. The stocks are selected from 50 constituent stocks. The matching results are shown in Table 1 . When adopting the BQQ model, since the trend of the stock was screened beforehand, we select two sets of stocks (five in each group) for pairing. To explore the impact of λ on strategy performance, we perform a back-test on the optimal matching strategy under different values (when λ is greater than 0.7, the paired-stock spread is relatively poor, resulting in a strategy failure). Therefore, this paper is limited to a λ range from 0 to 0.7. The pairing results are shown in Table 2 .

As can be seen in Table 2 , when λ changes from 0 to 0.4, the selected stock pairs show a very dramatic change; when λ changes from 0.4 to 0.6, the selected stock pairs are almost identical. At that time, the change of λ cannot significantly affect the return; when λ changes from 0.6 to 0.7, the selected stock pairs change less. However, the positives and negatives of the paired-stock weights have changed. Therefore, compared with the GGR model, the optimized pairing strategy makes better use of stock price information and is more flexible.

Stock trading stage

The GGR model and the BQQ model use the same parameters set in the back-test. The trading period is 2016.01–2016.12. The results obtained are shown in Table 3 . By comparing the back-test performance of the BQQ strategy with the GGR model, we arrive at five findings:

The ability of the BQQ strategy to obtain revenue is significantly stronger than of the GGR model, which shows that the BQQ strategy is effective in increasing the volatility of the spread to improve the profitability of the pairs-trading strategy.

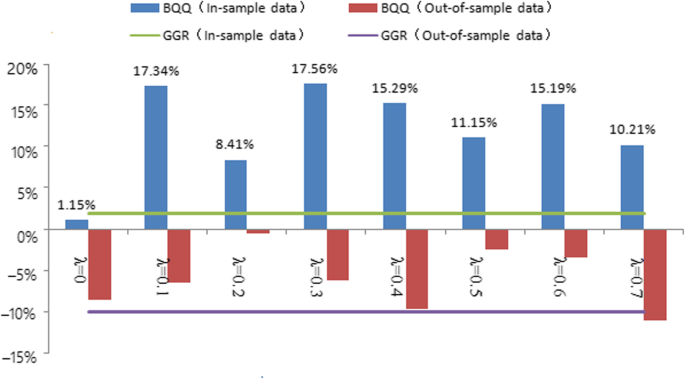

Figure 1 shows the average annualized rate of return of the BQQ strategy and the GGR strategy for different λ values (both in-sample data and out-of-sample data, respectively). For the in-sample rate of return, both strategies were carried out for a total of 32 back-tests, with a total of 31 positive gains. The return of the BQQ strategy is better than that of the GGR strategy in 87.5% of the cases. For the out-of-sample rate of return, the return of the BQQ strategy is better than that of the GGR strategy in 68.8% of the cases. To rule out the deviation of income caused by the different ways of opening a position, we also need to examine the coefficient of the two strategies and the Sharpe ratio.

Average annualized rate of return of the two strategies

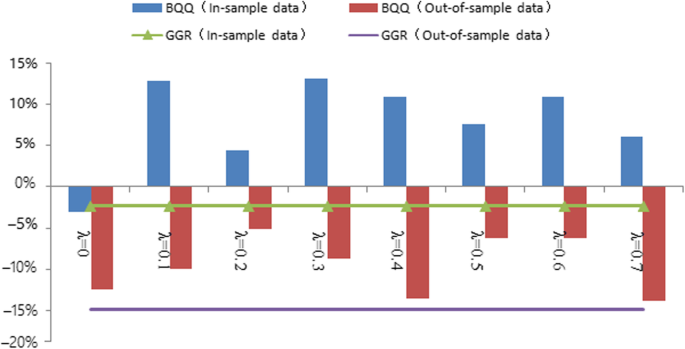

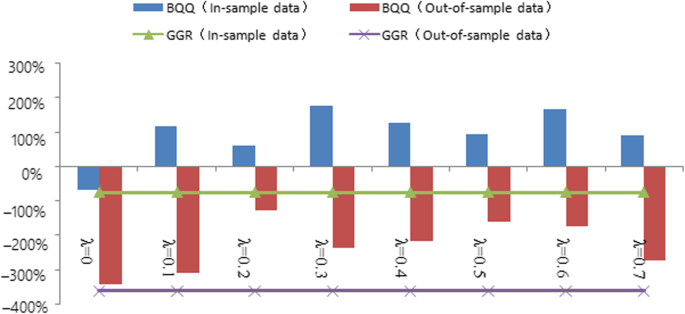

As shown in Figs. 2 and 3 , the BQQ model performs significantly better than the GGR model, both in terms of the coefficient α and the Sharpe ratio. This result indicates that the BQQ model bears the average return of nonmarket risk during the four trading periods, and the average return on unit risk is higher than with the GGR model. Therefore, the better perfomance of the BQQ strategy is not from the strategy taking more market risk; rather, it is independent of the way the strategy is opened.

Coefficient α of the two strategies

Sharpe ratio of the two strategies

The BQQ strategy has a strong ability to hedge the market. Table 4 shows the average value of the coefficient β of the BQQ strategy under different values of λ . It can be seen that the absolute value of β is below 0.1, which indicates and proves that the performance of the strategy is not affected by market fluctuations, which in turn proves that the pairs-trading strategy based on the minimum distance method can hedge market risk well. Compared with the GGR model, the coefficient β of the BQQ strategy is magnified because the GGR model uses a capital-neutral approach when in the opening position, while the BQQ strategy uses a coefficient-neutral approach. Due to the existence of the spread, the BQQ strategy cannot guarantee that the market value of the bought stock will be equal to the market value of the sold stock when the position is opened, which is equivalent to the fact that some net positions follow market ups and downs and the coefficient will increase.

Similar to the GGR model, the BQQ strategy performs poorly in out-of-sample data. In the 32 out-of-sample back-tests, the annualized return of the BQQ strategy was positive only six times, and the coefficient α was positive only eight times. The main reason for this phenomenon is the lack of rationality in the length of the formation period used at the stock-matching stage and the trading parameters used in the stock-trading stage. The yield of the GGR model is affected by trading parameters in many cases, such as the formation period, trading period, and opening threshold. Since this article presents only a methodological improvement for the stock-pairing trading model, it does not provide a more in-depth study of trading parameters.

Performance of the BQQ strategy is very sensitive to the value of λ . Adjustable λ enhances the practicality of the strategy. In the same trading period, the return of the BQQ strategy does not show a monotonous change with λ . When the value of λ is too large, the stock-matching strategy is invalid because when λ increases, the volatility of the paired-stock spread is increasing, which means that the strategy is likely to obtain higher returns. Conversely, the increase of λ raises the risk of divergence in the spread, making it easier for the strategy to trigger a stop-loss signal and cause losses. Therefore, λ is a significant parameter to adjust the risk of the strategy, and the strategy user can adjust λ to match risk preferences, which enhances the usefulness of the strategy.

The optimal λ value is time dependent. The benefit of the BQQ strategy are non-monotonic changes in λ . Excessive λ assembly leads to the invalidation of the stock-matching strategy, which means that for a specific trading period, there is an optimized λ that maximizes the strategy’s return. From the perspective of revenue indicators and risk indicators, there are no obvious rules about the performance of the strategy and the change of λ . That is, the optimal λ value varies with the trading period and is time dependent.

Table 5 shows the values of coefficient α and the Sharpe ratio from four out-of-sample back-tests. When λ is 0.5, coefficient α and the Sharpe ratio take the maximum value at the same time.

The results show that when λ is 0.5, the average matching revenue of the optimized matching strategy for non-market risk in the four trading periods and the average return from unit risk are the largest, but the value needs to be verified by large-scale data.

Conclusions

By introducing multi-objective optimization to the GGR model, this paper considers the long-term equilibrium of stock prices and the volatility of spreads and establishes a BQQ model. This novel pairs-trading model provides a new perspective for pairs-trading strategy research. At the same time, it provides investors with a stock-matching method that effectively improves the profitability of the trading strategy. This paper introduces the weight λ when solving bi-objective optimization problems, and these problems are transformed into single-objective optimization problems and solved by a sequential quadratic programming algorithm. To verify the effectiveness of the optimized pairing strategy, this paper selects the traditional GGR model as model for comparison and conducts back-testing on multiple time intervals on the SSE 50 constituents. We find that the BQQ strategy was able to obtain significantly higher revenue than the GGR model, and the adjustment of the weight λ increases the flexibility and practicality of the strategy.

This paper has some limitations. We used the SSE 50 Index as the research target in our empirical analysis. However, this was subject to the limitation of financing and securities lending; the small number of stocks may have affected the performance of the trading strategy. Additionally, when we performed the validity check of the optimized pairing strategy, there was scarce in-depth research available on the trading parameters and optimal values of the strategy, and this may have affected the profitability of the strategy to some extent. Therefore, subsequent research work should include these aspects. In the future, we will expand the number of stock share pools. In addition, the screening method for the transaction parameter of pairs-trading strategy requires in-depth research to find the right trading parameters for the BQQ strategy. Finally, we will try to establish an optimized pairing strategy by attaining the function of risk indicator λ through extended empirical analysis.

Availability of data and materials

Shanghai Composite Index

Please contact authors for data requests.

Abbreviations

The Broyden–Fletcher–Goldfarb–Shanno algorithm

Bi-objective quadratic programming with quadratic constraints

Capital asset pricing model

The distance approach proposed by Gatev, Goetzmann and Rouwenhorst in 2006

Revised quadratic programming with quadratic constraints

Sum of squared deviations

Shanghai Stock Exchange

Bazaraa, M. S., Sherali, H. D., & Shetty, C. M. (2008). Nonlinear programming: Theory and algorithms (3rd ed.). Hoboken: Wiley.

Google Scholar

Bertram, W. K. (2010). Analytic solutions for optimal statistical arbitrage trading. Physica A: Statistical Mechanics and its Applications, 389 (11), 2234–2243.

Article Google Scholar

Bondarenko, O. (2003). Statistical arbitrage and securities prices. Review of Financial Studies, 16 (3), 875–919.

Chen, H., Chen, S., Chen, Z., & Li, F. (2017). Empirical investigation of an equity pairs trading strategy. Management Science, 65 (1), 370–389.

D’Aspremont, A. (2007). Identifying small mean reverting portfolios. Quantitative Finance, 11 (3), 351–364.

Deb, K., & Sundar, J. (2006). Reference point based multi-objective optimization using evolutionary algorithms. In Proceedings of the 8th annual conference on conference on genetic & evolutionary computation (pp. 635–642).

Do, B., & Faff, R. (2010). Does simple pairs trading still work? Financial Analysts Journal, 66 (4), 83–95.

Do, B., Faff, R., & Hamza, K. (2006). A new approach to modeling and estimation for pairs trading. In Proceedings of 2006 financial management association European conference (pp. 87–99).

Dunis, C. L., & Ho, R. (2005). Cointegration portfolios of European equities for index tracking and market neutral strategies. Journal of Asset Management, 6 (1), 33–52.

Elliott, R. J., van der Hoek, J., & Malcolm, W. P. (2005). Pairs trading. Quantitative Finance, 5 (3), 271–276.

Gatarek, L. T., Hoogerheide, L. F., & van Dijk, H. K. (2014). Return and risk of pairs trading using a simulation-based Bayesian procedure for predicting stable ratios of stock prices. Electronic, 4 (1), 14–32 Tinbergen Institute Discussion Paper 14-039/III.

Gatev, E., Goetzmann, W. N., & Rouwenhorst, K. G. (2006). Pairs trading: Performance of a relative-value arbitrage rule. Social Science Electronic Publishing, 19 (3), 797–827.

Hu, W., Hu, J., Li, Z., & Zhou, J. (2017). Self-adaptive pairs trading model based on reinforcement learning algorithm. Journal of Management Science, 2 (2), 148–160.

Jacobs, H., & Weber, M. (2011). Losing sight of the trees for the forest? Pairs trading and attention shifts. Working paper, October 2011 . University of Mannheim. Available at https://efmaefm.org/0efmsymposium/2012/papers/011.pdf .

Krauss, C. (2016). Statistical arbitrage pairs trading strategies: Review and outlook. Journal of Economic Surveys, 31 (2), 513–545.

Miao, G. J. (2014). High frequency and dynamic pairs trading based on statistical arbitrage using a two-stage correlation and cointegration approach. International Journal of Economics and Finance, 6 (3), 96–110.

Perlin, M. (2007). M of a kind: A multivariate approach at pairs trading (working paper) . University Library of Munich, Germany.

Peters, G. W., Kannan, B., Lasscock, B., Mellen, C., & Godsill, S. (2010). Bayesian cointegrated vector autoregression models incorporating alpha-stable noise for inter-day price movements via approximate Bayesian computation. Bayesian Analysis, 6 (4), 755–792.

Vidyamurthy, G. (2004). Pairs trading: Quantitative methods and analysis . Hoboken: Wiley.

Wang, F., & Wang, X. Y. (2013). An empirical analysis of the influence of short selling mechanism on volatility and liquidity of China’s stock market. Economic Management, 11 (3), 118–127.

Wang, S. S., & Mai, Y. G. (2014). WM-FTBD matching trading improvement strategy and empirical test of Shanghai and Shenzhen ports. Economy and Finance, 26 (1), 30–40.

Whistler, M. (2004). Trading pairs: Capturing profits and hedging risk with statistical arbitrage strategies . Hoboken: Wiley.

Wu, L., & Cui, F. D. (2011). Investment strategy of paired trading. Journal of Statistics and Decision, 23 , 156–159.

Xu, L. L., Cai, Y., & Wang, L. (2012). Research on paired transaction based on stochastic spread method. Financial Theory and Practice, 8 , 30–35.

Zhang, D., & Liu, Y. (2017). Research on paired trading strategy based on cointegration—OU process. Management Review, 29 (9), 28–36.

Zhu, C., Byrd, R. H., Lu, P., & Nocedal, J. (1997). Algorithm 778: L-BFGS-B: Fortran subroutines for large-scale bound-constrained optimization. ACM Transactions on Mathematical Software (TOMS), 23 (4), 550–560.

Download references

Acknowledgements

Not applicable.

The research is supported by the Fundamental Research Funds for the Central Universities, and the Research Funds of Renmin University of China (No. 19XNH089).

Author information

Authors and affiliations.

Business School, Renmin University of China, 59 Zhongguancun Street, Beijing, 100872, China

Haican Diao, Guoshan Liu & Zhuangming Zhu

You can also search for this author in PubMed Google Scholar

Contributions

Diao contributed to the overall writing and the data analysis; Liu conceived the idea; Zhu contributed to the data collection and the data analysis. All authors read and approved the final manuscript.

Corresponding author

Correspondence to Guoshan Liu .

Ethics declarations

Competing interests.

The authors declare that they have no competing interests.

Additional information

Publisher’s note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/ .

Reprints and permissions

About this article

Cite this article.

Diao, H., Liu, G. & Zhu, Z. Research on a stock-matching trading strategy based on bi-objective optimization. Front. Bus. Res. China 14 , 8 (2020). https://doi.org/10.1186/s11782-020-00076-4

Download citation

Received : 09 July 2019

Accepted : 25 February 2020

Published : 25 March 2020

DOI : https://doi.org/10.1186/s11782-020-00076-4

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Bi-objective optimization

- Quadratic programming

Click through the PLOS taxonomy to find articles in your field.

For more information about PLOS Subject Areas, click here .

Loading metrics

Open Access

Peer-reviewed

Research Article

Improving stock trading decisions based on pattern recognition using machine learning technology

Roles Conceptualization, Data curation, Formal analysis, Software, Writing – original draft

Affiliation School of Economics and Management, Beihang University, Beijing, China

Roles Funding acquisition, Writing – review & editing

Affiliations School of Economics and Management, Beihang University, Beijing, China, Key Laboratory of Complex System Analysis, Management and Decision (Beihang University), Ministry of Education, Beijing, China

Roles Conceptualization, Formal analysis, Funding acquisition, Methodology, Writing – review & editing

* E-mail: [email protected]

Affiliations School of Economics and Management, Beihang University, Beijing, China, Beijing Advanced Innovation Center for Big Data and Brain Computing, Beihang University, Beijing, China

Roles Data curation, Validation, Writing – review & editing

Affiliation Strome College of Business, Old Dominion University, Norfolk, Virginia, United States of America

Roles Data curation, Validation

Affiliation Software Engineering Center, Chinese Academy of Sciences, Beijing, China

- Yaohu Lin,

- Shancun Liu,

- Haijun Yang,

- Harris Wu,

- Bingbing Jiang

- Published: August 6, 2021

- https://doi.org/10.1371/journal.pone.0255558

- Reader Comments

PRML, a novel candlestick pattern recognition model using machine learning methods, is proposed to improve stock trading decisions. Four popular machine learning methods and 11 different features types are applied to all possible combinations of daily patterns to start the pattern recognition schedule. Different time windows from one to ten days are used to detect the prediction effect at different periods. An investment strategy is constructed according to the identified candlestick patterns and suitable time window. We deploy PRML for the forecast of all Chinese market stocks from Jan 1, 2000 until Oct 30, 2020. Among them, the data from Jan 1, 2000 to Dec 31, 2014 is used as the training data set, and the data set from Jan 1, 2015 to Oct 30, 2020 is used to verify the forecasting effect. Empirical results show that the two-day candlestick patterns after filtering have the best prediction effect when forecasting one day ahead; these patterns obtain an average annual return, an annual Sharpe ratio, and an information ratio as high as 36.73%, 0.81, and 2.37, respectively. After screening, three-day candlestick patterns also present a beneficial effect when forecasting one day ahead in that these patterns show stable characteristics. Two other popular machine learning methods, multilayer perceptron network and long short-term memory neural networks, are applied to the pattern recognition framework to evaluate the dependency of the prediction model. A transaction cost of 0.2% is considered on the two-day patterns predicting one day ahead, thus confirming the profitability. Empirical results show that applying different machine learning methods to two-day and three-day patterns for one-day-ahead forecasts can be profitable.

Citation: Lin Y, Liu S, Yang H, Wu H, Jiang B (2021) Improving stock trading decisions based on pattern recognition using machine learning technology. PLoS ONE 16(8): e0255558. https://doi.org/10.1371/journal.pone.0255558

Editor: Stefan Cristian Gherghina, The Bucharest University of Economic Studies, ROMANIA

Received: March 19, 2020; Accepted: July 20, 2021; Published: August 6, 2021

Copyright: © 2021 Lin et al. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Data Availability: All relevant data are within paper and its Supporting Information files. Alternatively, the data may be accessed by downloading the files "ThreeDays_sample.zip" and "TwoDays_Sample.zip" at http://semen.buaa.edu.cn/Faculty/Finance/YANG_Haijun/Profile.htm .

Funding: Haijun Yang: Grant No. 71771006 Shangcun Liu: Grant No. 71771008 The authors declare that they have no competing financial interests.This research was partially supported by National Natural Science Foundation of China (Grant No. 71771006 and 71771008). There was no additional external funding received for this study.

Competing interests: The authors have declared that no competing interests exist.

1. Introduction

Analyzing and forecasting the stock market is notoriously tricky due to the high degree of noise [ 1 ] and semi-strong form of market efficiency [ 2 ], which is generally accepted. A reasonably accurate prediction may raise the potential of yielding benefits and hedging against market risks. However, financial economists often question the existence of opportunities for profitable predictions [ 3 ].

Technical analysis, also called candlestick charting, is one of the most common traditional analysis methods to predict the financial market. By utilizing open-high-low-close prices in chronological order, candlestick charting can reflect not only the changing balance between supply and demand [ 4 ] but also the sentiment of the investors in the market [ 5 ]. Bulkowski described the known 103 patterns in natural language [ 6 ], and then comprehensive formal specifications of the known candlestick patterns were proposed [ 7 ]. In recent years, technical analysis has been proven to be effective in stock market analysis. For example, Caginalp and Laurent tested the predictive capability of candlestick patterns and found that applying candlestick trading strategies on daily stock returns in S&P 500 stocks can result in profits [ 8 ]. Goo et al. found that many one-day candlestick and reversal patterns can help investors earn significant returns by following candlestick trading strategies [ 9 ]. Moreover, the profitability of candlestick trading strategies was further confirmed [ 10 , 11 ]. More complex candlestick patterns have been used in the latest research. The predictive power of 5 two-day reversal patterns was examined [ 12 ], and 4 pairs of two-day patterns were studied [ 13 ]. Lu et al. studied the profitability of 8 three-day reversal patterns under trend conditions and different holding strategies [ 11 ].

Although these studies have shown that using the candlestick pattern strategy can be profitable, dissenting voices have emerged in academia. Fock et al. found no evidence of the predictive ability of candlestick patterns alone or in combination with other common technical indicators in the DAX stock index contract and the Bund interest rate future [ 14 ]. Duvingage et al. tested the intraday predictive power of Japanese candlesticks at the 5-minute interval on the 30 constituents of the DJIA index and concluded that candlestick trading strategies do not improve investment performance [ 15 ]. These conflicting conclusions about candlestick patterns prompt us to investigate further.

Artificial intelligence has recently been applied to address the chaotic and randomness time series data [ 16 , 17 ]. The intense computational use of intelligent predictive models has commonly been studied under machine learning [ 18 ]. Compared to the more traditional models, machine learning models provide more flexibility [ 19 ], do not require distributional assumptions, and can easily combine individual classifiers to reduce variance [ 20 ]. Many machine techniques have already been applied to forecast the stock market [ 20 – 36 ]. For example, logistic regression (LR) and neural networks (NNs) [ 27 , 29 , 30 , 36 ], deep neural networks (DNNs) [ 22 ], decision trees (DTs) [ 22 , 25 ], support vector machines (SVMs) [ 24 , 26 , 28 ] or support vector regression (SVR) [ 21 ], k-nearest neighbors (KNN) [ 23 , 33 ], random forests (RFs) [ 22 ], long short-term memory networks (LSTMs) [ 1 , 31 , 34 ] and restricted Boltzmann machines (RBMs) [ 32 ] have been used to predict stock market movements. In comparing multiple machine learning methods, Fischer et al. (2018) deploy LSTM networks for predicting out-of-sample directional movements for the constituent stocks of the S&P 500 from 1992 until 2015. They find LSTM networks to outperform RF, DNN and LR. Patel et al. (2015) compare the performance of four models (namely, ANN, SVM, RF, and naïve-Bayes) with respect to the following indexes and companies on the Indian stock market: CNX Nifty, S&P BSE Sensex, Infosys Ltd. and Reliance Industries [ 35 ]. Brownstone (1996) used a neural network to predict daily closing prices for five days and twenty-five days of the FTSE 100 Share Index in the UK and used multiple linear regression to compare the prediction results [ 30 ]. Krauss et al. (2017) implemented and analyzed the one-day effectiveness of deep neural networks (DNNs), gradient-boosted-trees (GBTs), and random forests (RFs) on all stocks of the S&P 500 from 1992 to 2015, and then the trading signals were generated based on the forecast probability. These techniques sort all stocks over the cross-section k probability in descending order. Five different investment strategies are generated by going long the top k stocks and short the bottom K stocks, with k∈{10,50,100,150,200}. These techniques achieve the best performance when k = 10, and RF outperforms GBT and DNN [ 22 ]. Profitable patterns may be discovered based on more recent returns and daily data. Qiu et al. (2020) established an LSTM with a wavelet forecasting framework to predict the opening prices of stocks [ 34 ].

The existing research shows that machine learning methods can effectively predict the direction of the financial market. However, the use of machine learning technology for candlestick pattern recognition is still less prevalent. Moreover, traditional research on candlestick patterns focuses mainly on a limited number of patterns [ 9 – 15 ]. The latest artificial intelligence technology prompts us to consider applying pattern recognition to decision-making in the stock market. Since different machine learning methods perform differently in different scenarios [ 1 , 22 , 30 , 35 ], a prediction framework that can adapt to different machine learning methods will greatly improve the usability of the model.

The remainder of this paper is organized as follows: Section 2 outlines the design of this paper. A pattern recognition prediction framework with four popular machine learning methods is designed. Then two other popular machine learning methods are used to replace the four machine learning methods to evaluate the dependency of the prediction framework. Section 3 presents the empirical results. Section 4 concludes the paper.

2. Methodology

This paper attempts to develop PRML, a Pattern Recognition method based on Machine Learning methods, to improve stock trading decisions, as shown in Fig 1 . First, 13 forms of one-day patterns are constructed and classified, and then the corresponding technical indicators and location information are calculated. Then, the pattern-building phase starts; this phase generates all possible combinations of candlestick patterns. For example, the two-day patterns are composed of two consecutive one-day patterns; therefore, there are 13*13 possible combinations. All the pattern information, including the technical indicators and location information, is put into the machine learning models, which test the prediction accuracy of each pattern during different periods. The pattern recognition stage retains only those patterns whose accuracy exceeds the threshold value. Finally, the adaptive recommendation schedule gives corresponding stock prediction actions based on the evaluated results.

- PPT PowerPoint slide

- PNG larger image

- TIFF original image

https://doi.org/10.1371/journal.pone.0255558.g001

Based on the identified patterns, the daily portfolio is dynamically built. The main pattern recognition process is shown in Fig 2 .

https://doi.org/10.1371/journal.pone.0255558.g002

2.1 Candlestick patterns

A candlestick, also called a K-line, consists of four basic elements: the opening price, high price, low price and closing price, as shown in Fig 3 . For simplicity, these elements are often denoted as open, high, low, and close. According to the different values of open, high, low and close, one-day patterns can have 13 different forms, as shown in Fig 3 .

https://doi.org/10.1371/journal.pone.0255558.g003

2.1.1 Definitions.

The definitions and functions used to describe the rules for classifying daily candlestick patterns are listed as follows:

2 . 1 . 1 . 1 Definition 1 (Candlestick) . A candlestick k = ( o t , h t , l t , c t ) is a tuple that consists of four basic prices of a stock at time t . A candlestick k is a basic element in identifying the candlestick pattern recognition. The o t , h t , l t and c t represent the opening price, high price, low price and closing price at time t , respectively. Additionally, k i = ( o it , h it , l it , c it ) denotes the i th candlestick at time t .

2 . 1 . 1 . 2 Definition 2 (Candlestick time series) . A candlestick time series T n = { k 1 , k 2 , …, k n } is a sequence of candlesticks of a stock; the sequence consists of n candlesticks from day 1 to day n. Additionally, T in = { k i 1 , k i 2 , …, k in } denotes the i th stock sequence.

2 . 1 . 1 . 4 Definition 4 (Candlestick relative position series) . LOC n = { loc 1 , loc 2 ,…, loc n } is a sequence of relative position information of a stock; the sequence consists of n relative position information from day 1 to day n.

2 . 1 . 1 . 5 Definition 5 (Candlestick pattern) . A candlestick pattern or K-line pattern p j = { T j , Loc j } is a subsequence of consecutive candlesticks; this subsequence consists of two parts: a sequence of candlesticks and a corresponding location sequence. For example, a two-day pattern can be defined as p 2 = { T 2 , Loc 2 } and T 2 = { k 1 , k 2 }, Loc 2 = { loc 1 , loc 2 }.

2.2 Technical indicators

Technical indicators are mathematical calculations based on price and volume. By analyzing historical data, technical analysts use indicators to predict the future trend of the financial market [ 37 , 38 ], and these indicators can potentially affect stock price prediction [ 39 , 40 ]. Following Zhou et al. (2019) and Bao et al. (2017), we use feature sets containing several indicators that are commonly used in the technical analysis [ 3 , 31 ]. The most prevalent indicators are defined below:

- A moving average (MA) is a calculation to analyze data points by creating a series of averages of different subsets of the full data set. The calculation formula is:

where m refers to the time interval and c is the closing price.

2.3 Pattern generation & generation of training and testing sets

We begin to extract more complex N-day daily patterns based on the one-day candlestick patterns. First, the one-day candlestick pattern classification is generated on the basis price of open, high, low, and close. A total of 13 one-day patterns are obtained after considering all the circumstances. Second, the values of nine technical indicators, shape and relative location information are calculated. The research in this paper focuses on short-term effects; 5 days or 10 days as the parameters of indicators are choosen. The parameters of 5 days for MA and 10 days for EMA , CCI and ATR are used for testing. All the characteristics of the one-day patterns are obtained through these two processes. Finally, the one-day candlestick patterns are combined into more complex patterns for each stock according to different time windows. A total of 169 two-day candlestick patterns are combined based on the 13 one-day candlestick patterns. Time must be continuous in this pattern combination process.

After all the patterns and features are ready, we begin to prepare the training sets and testing sets. The entire data set are divided into two parts: the machine learning data set from Jan 1, 2000 to Dec 31, 2014 and the forecasting set from Jan 1, 2015 to Oct 30, 2020. Of the machine learning data set, 80% is used as training subsets, and 20% is used as testing subsets. First of all, the data of the training subset is used to fit the parameters in the machine learning model. Next, the machine learning model that fits the parameters is predicted in the testing subset, and the predicted result is compared with the real value to get the accuracy rate. The testing subset is the validation set. The corresponding result is the next N-day’s direction of the close price; N is from 1 to 10.

2.4 Prediction models

The inference engine is introduced in this phase. We use four machine learning models, logistic regression (LR), k-nearest neighbors (KNN), random forest (RF), and restricted Boltzmann machine (RBM), to predict the direction of the close price. The parameters used in the four machine learning methods are shown as Table 1 .

https://doi.org/10.1371/journal.pone.0255558.t001

2.4.1 Logistic regression (LR).

Logistic regression is the most basic machine learning algorithm. The logistic regression model returns an equation that determines the relationship between the independent variables and the dependent variable. The model calculates linear functions and then converts the result into a probability. Finally, the model converts the probability into a label.

In the empirical stage, we use L2 as a regularized parameter and specify warn as the solver parameter that determines our optimization method for the logistic regression loss function. In terms of the termination parameters of the algorithm, we set the maximum number of iterations that are taken for the solvers to converge to 100 and set the tolerance for the stopping criteria parameter to 0 . 0001 .

2.4.2 K-nearest neighbors (KNN).

K-nearest neighbors (KNN) is another machine learning algorithm. The k-NN algorithm looks for ‘k’ nearest records within the training data set and uses most of the classes of the identified neighbors for classifying. Subha used k-NN to classify the stock index movement [ 23 ], and Zhang et al. used ensemble empirical mode decomposition (EEMD) and a multidimensional k-nearest neighbor model (MKNN) to forecast the closing price and high price of the stocks [ 33 ].

In the experimental stage, we obtain the best performance from the grid search algorithm, which sets different neighbors, leaves, and weights. Different parameter combinations produce different clustering effects.

2.4.3 Restricted Boltzmann machine (RBM).

A restricted Boltzmann machine (RBM) is a generative stochastic artificial neural network that can learn a probability distribution over its input sets. Recently, due to their powerful representation, RBMs have been used as generative models of many types of data, including text, images and speech. Liang et al. used an RBM to predict short-term stock market trends [ 32 ].

In the empirical stage, we connected a logistic regression to the output of the RBM for classification. Different parameter combinations may produce different classification effects; therefore, we set 10 iterations and 100 components to improve training results.

2.4.4 Random forest (RF).

The following brief description of random forests follows Breiman (2001). Random forests are a combination of tree predictors such that each tree depends on the values of a random vector sampled independently and with the same distribution for all trees in the forest. Random forests (RFs) are nonparametric and nonlinear classification and regression algorithms [ 41 ]. Random forests not only use a subset of the training set but also select only a subset of the feature set when the tree is established in the decision tree. In the training stage, RF repeats n times to select a random sample with replacement of the training set and selects k features randomly to build a decision tree. Then repeat the above steps T num times to build T num decision trees. After each tree decision, the final result is confirmed by voting. Booth (2014) used RFs to construct an automated trading mechanism [ 42 ].

2.5 Two other testing machine learning models

2.5.1 multilayer perceptron network (mlp)..

A multilayer perceptron (MLP) is a class of feedforward artificial neural network (ANN). A MLP consists of an input layer, one or more hidden layers and an output layer. The following brief description of MLP follows Moghaddam et al. (2016) [ 36 ]. The input layer matches the feature space, and the output layer matches the output space, which may be a classification or regression layer. In the network, each neuron in the previous layer is fully connected with all neurons in the subsequent layer and represents a certain weight. Each non-output layer of the net has a bias unit, serving as an activation threshold for the neurons in the subsequent layer. In this study, the most common three-layer MLP model is constructed based on experience. In order to improve the generalization of the model, the number of inputs is set to 64, which is greater than the number of features. Finally, a three-layer MLP network, including an input layer with 64 nodes, a hidden layer with 64 neurons and an output layer with 1 neuron is developed. The ReLU activation, 0.1 leaning rate, 20 epochs, 128 batch sizes and an RMSProp optimizer for the objective function of binary_crossentropy are used in the learning phase.

2.5.2 Long short-term memory neural networks (LSTMs).

Long short-term memory neural networks (LSTMs) are one of the most common forms of recurrent neural networks (RNNs), which are a type of deep neural network architecture. This description of LSTMs follows the description of Fischer et al. (2018), Bao et al. (2017) and Qiu et al. (2020) [ 1 , 31 , 34 ]. The LSTM consists of a set of memory cells that replace the hidden layer neurons of the RNN. The memory cell consists of three components: the input gate, the output gate, and the forget gate. The gates control the interactions between neighboring memory cells and the memory cell itself. The input gate controls the input state, while the output gate controls the output state, which is the input of other memory cells. The forget gate can choose to remember or forget its previous state. In this study, a common three-layer LSTM model is constructed based on experience. The number of inputs is set to 64 to improve the generalization. Finally, a three-layer LSTM network that includes 64 neurons input and an Adam optimizer for the objective function of binary_crossentropy , a middle layer with 64 neurons and an output layer with 1 neuron is developed; 10 epochs are constructed to increase the stability. A total of 56,129 parameters are generated by the LSTM in the prediction process.

2.6 Model evaluation

The Sharpe Ratio depicts the risk-adjusted return, the Maximum Drawdown denotes the largest cumulative loss over the period of investment and the Information Ratio measures the portfolio returns beyond the returns of a benchmark.

2.7 Investment strategy

Based on the above evaluation criteria, the investment strategy is constructed. According to the actual situation of the Chinese stock market, short selling is limited to some stocks with securities margin trading. Therefore, we consider only long selling and build the corresponding investment strategy with different time windows from 1 day to 10 days. This article assumes that we will invest at the close price at time t and will be clear at the close price at time t+N , where N is from1 to 10. Suppose that we have initial capital M and the current stock can be bought without affecting price fluctuations; then, the specific construction steps of the equal-weight investment strategy are as follows:

First, all the possible two-day and three-day candlestick patterns of all stocks traded on the Chinese stock market are checked at time t . Next, the machine learning methods are used to predict the rise or fall of t+N based on the above evaluation model. Only the best-performing of the machine learning methods and forecasting results will be saved after comparing the prediction results of these machine learning models. If the predicted result is long and consistent with the real result, the t+ N profit is recorded. If the prediction is wrong, the negative profit of t+N is recorded as a loss value. Furthermore, it would do nothing if the predicted result is short. Then, the above steps are repeated to calculate t+1 , t+2 , etc. Finally, the recommendation stage for investment is carried out. The specific patterns where accuracy exceeds the threshold are screened out in the training and testing stage. The daily investment portfolio is adaptively built according to the filtered patterns pools. Five different strategy pools are used to form 5 comparable strategies: the All , Adjust , TOP10 , TOP5 and TOP3 candlestick pattern pool. The All baseline candlestick pattern pool contains all the candlestick patterns whose accuracy is greater than 55% in the testing stage. After excluding from the rule pool the patterns that appear fewer than 1000 times in the machine learning set, from the All candlestick pattern pool, we obtain the Adjust patterns pool. The 10 most accurate patterns in the adjust pool were used to form the TOP10 candlestick patterns pool; the 5 most accurate patterns in the adjust pool were used to form the TOP5 candlestick patterns pool; and the 3 most accurate patterns in the adjust pool were used to form the TOP3 candlestick patterns pool. The investment flowchart is shown as Fig 4 .

https://doi.org/10.1371/journal.pone.0255558.g004

3. Empirical results

3.1 data and training environment.

In this study, we use the daily data on the Chinese stock market from the period of Jan 1, 2000 to Oct 30, 2020; a list of 9,745,597 rows of original data is used in our study.

Stock data are collected from CCER, a local data provider in China. First, a data cleaning phase schedule is carried out to guarantee the validity of the training data. We remove the daily data for a given stock if the trading volume is zero, which is a sign of stopped trading due to, e.g., company reorganization. Rows that contain one or more missing values out of range are removed from the database.

Then, feature information for each stock is generated on each day t . According to the definition of the candlestick chart, the feature of Shape is labeled. The feature of Loc is generated by using the definition of candlestick relative position. The other 9 feature values are calculated by indicator formulas (1)-(12). Therefore, the daily data contains these 11 features for each stock. To ensure effectiveness, three rounds of training are carried out. We randomly choose 5,000 rows of daily stock data for each of the patterns from the database. To ensure the balance of classification during training, for each intraday pattern, we choose half of the training data with rising prices (closing price lower than next N-day’s) and half of the training data with falling prices. Finally, the average accuracy is obtained based on the three rounds of results.

As a result, a list of 5,445,915 rows of the two-day patterns data with 26 data columns and 5,420,650 rows of the three-day patterns data with 38 data columns is generated. The Date and Result return information used for investment return calculation will not be used in machine training. Therefore, 22 distinct features will be used as input data for two-day candlestick patterns recognition and 33 distinct features will be used as input data for three-day candlestick patterns recognition. Regardless of the two-day or three-day patterns, the Result direction data is used for training and evaluation of machine learning results. The features of the two-day patterns are composed of the features of the first day, the next day, and the result features. In addition to the features of the two-day patterns, the three-day patterns also include the features of the third day. The data sample which used in the machine learning models is shown as Table 2 .

https://doi.org/10.1371/journal.pone.0255558.t002

3.2 Model comparison and evaluation

Four complete predictions are made in this study. First, all two-day candlestick patterns and three-day candlestick patterns data are put into the four machine models for prediction without distinguishing patterns. The histograms in Fig 5 show the forecast accuracy in the training sets for 1, 2, 3, 5, 7, and 10 days ahead. Then, a prediction method for a basic segmentation pattern is performed. All possible combinations of different patterns for two-day and three-day patterns are put into four machine learning models to make predictions and record the best machine learning method and accuracy rate for each pattern. During training, patterns that appear fewer than 100 times are discarded. Three full-round calculating works have been done and the error bars are calculated based on the standard deviation of the three groups of calculation results. In the forecasts 2, 3, 5, 7 and 10 days ahead, the pure ML methods forecast two-day patterns have lower accuracy than forecasting 1 day ahead, which means that there is a greater risk, leading to greater uncertainty. Similarly, in the forecast 3, 5, 7 and 10 days ahead, the pure ML methods forecast three-day patterns have lower accuracy than forecasting 1 day and 2 days ahead, which means that it may suffer continuous losses in the future. The line chart in Fig 5 shows the predicted averages for all the segment patterns.

https://doi.org/10.1371/journal.pone.0255558.g005

For different candlestick patterns, four machine models have different prediction effects. Four machine learning models are used to make predictions separately for each pattern. The machine learning model with the highest prediction accuracy corresponding to each pattern will be recorded. Fig 6 shows the number of machine learning methods whose prediction accuracy exceeds the threshold. Taking the two-day candlestick patterns which have 169 combinations in theory to predict one day ahead as an example, 159 patterns have a prediction accuracy rate that exceeds our threshold, thus supporting 1,299,028 rows of data. From the bottom half of Fig 6 , we can see that 14 patterns perform well using the KNN prediction method, 10 patterns make the best predictions by using the LR method, 39 patterns are supported by the RBM model, and 96 models make the best predictions by using the RF method. Taking the three-day candlestick patterns which have 2,197 combinations in theory to predict one day ahead as an example, the prediction accuracy of 451 patterns exceeded our threshold and supported 665,243 rows of data. From the upper half of Fig 6 , we can see that 51 patterns perform well using the KNN prediction method, LR supports 96 models, 120 patterns make the best predictions by using the RBM method, and RF supports 184 patterns. RF outperforms LR, KNN and RBM in two-day and three-day-pattern forecasting. Except for forecasting 5 days ahead, the number of patterns that exceeds the accuracy threshold value decreases significantly as the forecast period becomes longer based on two-days pattern forecasting. The number of patterns to meet the conditions for forecasting 1, 2, 3, 5, 7, and 10 days ahead are 159, 123, 98, 142, 95, and 99 respectively. In terms of the three-day patterns, the number of patterns in forecasting 1 day ahead is significantly higher than in forecasting other periods. The number of three-day patterns to meet the conditions for forecasting 1, 2, 3, 5, 7, and 10 days ahead are 451, 363, 389, 370, 369, and 348 respectively. Regardless of two-day patterns or three-day patterns, the number of selecting patterns for forecasting 1 day ahead is significantly higher than forecasting other periods, which means that it is possible to obtain better performance in forecasting 1 day than in other periods.

https://doi.org/10.1371/journal.pone.0255558.g006

3.3 Investment strategy result

Based on the PRML prediction framework of this paper, we conducted an investment validation in the forecasting sets. The cumulative return performance of PRML and pure ML, including forecasting 1, 2, 3, 5, 7, and 10 days ahead, is shown as Fig 7 . The Shanghai Composite Index during the same period was used as a benchmark, as shown by the blue line in the figure. The performance of PRML with respect to two-day patterns and three-day patterns is better than pure ML when forecasting 1 day ahead and shows more stability when forecasting 2, 3,5,7 and 10 days ahead. For the two-day patterns, the pure ML models predict and give investment recommendations for 13*13 patterns every day. For the three-day patterns, the pure ML models predict 13*13*13 patterns and give investment recommendations every day. However, PRML only gives investment recommendations for the patterns whose prediction accuracy exceeds the threshold. Pure ML methods predict and give investment recommendations for each stock every day, while PRML invests according to the performance of different patterns, and the average number of stocks invested per day is relatively small. This can be seen from the number of selected patterns in Fig 6 and the number of theoretical combinations. Lower forecast accuracy and frequent transactions may lead to a significant decline in earnings, as we can see from the forecast results of 3 and 7 days ahead in Fig 7 . Pure ML methods have a better effect in predicting two days in the three-day patterns, which is consistent with the higher accuracy in Fig 5 .

https://doi.org/10.1371/journal.pone.0255558.g007

The finance performance of PRML and ML when predicting one day ahead is shown as Table 3 . The average annual return of ML3, PRML2 and PRML3 show that the previous patterns are profitable. For both the two-day patterns and the three-day patterns, the financial performance of PRML is better than that of ML. With a maximum of 10.75% annual returns, the two-day patterns based on the PRML model are more profitable than the market. During the same period, two-day patterns using pure ML have a large drawdown of 75.45%, and our portfolio drawdown using PRML is smaller, thus indicating that the proposed model has less risk. In the one-day forecasting scenario, the two-day patterns are better than the three-day patterns.

https://doi.org/10.1371/journal.pone.0255558.t003

Then, 5 more detailed investment strategies are constructed based on PRML. First, 5 different strategy pools are generated based on machine learning results and investment strategy. Next, the prediction effects of different periods from 1 day to 10 days are examined. For each day of data in the prediction set, we use the corresponding machine learning method according to the pattern rule pool to forecast. If the prediction result is long, a buy operation is performed. Then, the result with the actual situation is compared and the average daily return is calculated with equal weight.

Fig 8 shows the average portfolio return of two-day candlestick patterns, including forecasting 1, 2, 3, 5, 7, and 10 days ahead. All patterns indicate that we construct the portfolio according to all the patterns in the pattern rule pool. Adjust patterns show that we exclude the patterns in the baseline candlestick pattern pool that appear fewer than 1000 times in the machine learning set. The TOP10 patterns indicate that we use the 10 most accurate candlestick patterns, TOP5 means that we use only the 5 most accurate candlestick patterns, and TOP3 indicates that we use the top 3 most accurate patterns to invest. It seems that the two-day combination patterns have a certain prediction effect for 1 and 5 days. This is consistent with the higher number of selected patterns in forecasting 1 day and 5 days ahead than 2, 3, 7 and 10 days ahead in Fig 6 . In the case of two-day patterns forecasting 5 days ahead, the performance difference among TOP3 , TOP5 and TOP10 is obvious, indicating that its return is significantly affected by a certain pattern. Of the two-day pattern’s prediction effect for six different periods, the 1-day prediction effect is the best. The very short-term forecasts may be related to China’s emerging stock markets.

https://doi.org/10.1371/journal.pone.0255558.g008

The finance performance of two-day candlestick patterns in predicting one day ahead is shown in Table 4 . The average annual return of TOP3, TOP5 and TOP10 shows that the previous patterns are profitable. With a maximum annual return of 36.73% returns, five different portfolios based on the PRML model are more profitable than the market. During the same period, the market has a large drawdown of 52.28%, and our portfolio drawdown is smaller, thus indicating that the proposed model has less risk. The All and Adjust patterns show that using many patterns can reduce risk, but the corresponding profit will be reduced.

https://doi.org/10.1371/journal.pone.0255558.t004

The portfolio average return of three-day patterns for forecasting 1, 2, 3, 5, 7, and 10 days ahead is shown as Fig 9 . It shows that the three-day combination patterns have certain prediction effects only for 1 day. Among the prediction effect for six different periods, the one-day prediction effect is the best. This effect may be related to short-term market volatility.

https://doi.org/10.1371/journal.pone.0255558.g009

Table 5 shows the finance performance of three-day patterns to predict one day ahead. The average annual returns of the five strategies show that the previous patterns are profitable when they predict one day ahead. With a maximum annual return of 8.29%, five different portfolios based on the PRML model are more profitable than the market. During the same period, the market has a large drawdown of 52.28%, and our portfolio drawdown is smaller, thus indicating that the proposed model has less risk. The All and Adjust patterns show that using many patterns can reduce risk, but the corresponding profit will be reduced.

https://doi.org/10.1371/journal.pone.0255558.t005

In the All strategy, although the three-day candlestick combination patterns have a lower return than do the two-day candlestick combination patterns, the max drawdown of the three-day candlestick combination patterns has also decreased and has greater stability. Portfolios constructed by the top 10 three-day candlestick patterns have not obtained a return larger than the return obtained by the top 5 portfolios; however, more patterns can bring greater benefits in the two-day candlestick patterns because there is a fewer supporting number of three-day patterns in the training set and the machine learning model is prone to overfitting. However, adding more three-day combination patterns can effectively increase stability.

Although we have used all the stock data of Chinese listed companies for 15 years, the training data corresponding to each pattern of the two-day patterns and the three-day patterns are different. Especially the three-day patterns which have as many as 2,197 combinations, the data of each pattern of the three-day patterns is still relatively small, which will easily cause the over-fitting of machine learning, leading to obvious differences in the prediction effects which are shown in Tables 4 and 5 .

3.4 Prediction model dependence testing