How Qantas Became An Australian Icon

Table of contents.

The Qantas Group markets its brands - Qantas and Jetstar - mainly in the transport sector, offering regional, domestic, and international flights. From Qantas Freight to Qantas Frequent Flyer, the company has a broad portfolio of subsidiaries. Registered initially as Queensland Aerial Services Limited (QANTAS), its reputation is based on safety, operational reliability, engineering and maintenance, and customer service.

The company's history shows the importance of branding and how it can be used to transform from a local service provider to a globally recognized enterprise.

A few key facts about Qantas Group:

● Founded in the Queensland outback in 1920, Qantas is the world’s second-oldest airline (behind KLM).

● In response to COVID-19 pandemic, capacity was reduced by 94% as a result of the steep decline in passenger traffic in Q4 2020

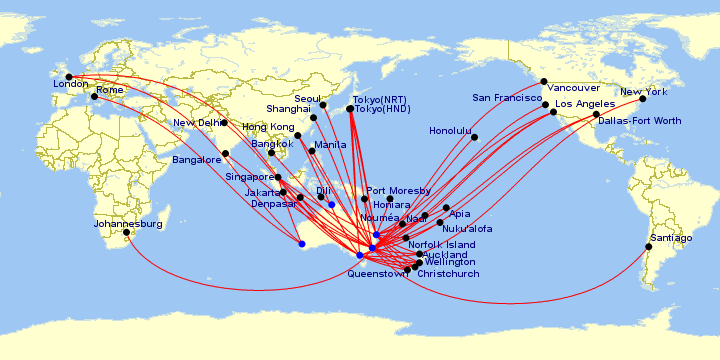

● Qantas International operated more than 750 flights per week before March 2020.

● For its amazing record of firsts in operations and safety, Qantas ranked highest among 385 airlines, beating Qatar Airways, Air New Zealand, Singapore Airlines, and Emirates on the annual list of AirlineRatings.com .

{{cta('eed3a6a3-0c12-4c96-9964-ac5329a94a27')}}

Channeling military flight experience into a business

'The story of Qantas is the story of modern Australia,' the airline's chief executive Alan Joyce said succinctly. Like that of many other flagship airlines, the story began shortly after the First World War when aviation had already proved itself in the hands of the military. It was also logical that a continent of countries would need to connect its far-flung cities by air, as would the fifth continent with the outside world. The importance of the latter is not insignificant: in her anniversary address, Joyce recalls that the first plane once made 31 landings in 12 days from London to Australia and that the first non-stop passenger flights between Europe and Australia were recently made.

During World War I, Gallipoli veterans Paul McGinness and Hudson Fysh met while serving in Palestine with the Australian Flying Corps. A project for the first flight from Britain to Australia was completed by McGinness and Fysh, who carry out a land airfield survey between Longreach and Darwin. Thus, their idea of using military flying experience for civilian use was born.

In November 1920, the two war veterans registered a company, Queensland and Northern Territory Aerial Services Ltd, and drove around Darwin to find possible landing sites. In the first year, they started to introduce people to flying with walking flights and then began to expand the network, initially with Avro 504K biplanes.

Western Queenslanders responded enthusiastically to Qantas' first air routes by purchasing shares and flying frequently using the airline’s services. The founders pioneered a new form of travel, which eventually became much more than an airline. NT in Qantas was their plan of flying overseas via Darwin, which was their primary entry point. A route network was soon developed from joyrides and charter services operated from western Queensland, Australia.

Joyrides: As the name implies, joy ride flights are for pure entertainment. While back in the early 20th century, airplane capabilities were limited compared to today's highly maneuverable aircraft. The scenic views and aerobatics were enjoyed by many at the time.

In 1922 Qantas was already operating with passengers and as a mail distribution service. In 1924 the Australian Prime Minister flew with the airline because a storm had damaged the Winton-Longreach road. To further developed its revenue streams, Qantas operated the first Flying Doctor air ambulance service. The original Qantas became one of the few airlines to build its own aircraft (DH50) in 1926.

DH50, the first Qantas-manufactured aircraft

De Havilland Aircraft Company built this large biplane at Stag Lane, Edgware, in the early 1920s, one of the company's first successful designs. At the rear of the aircraft, the pilot sat in an open cockpit, while three passengers sat in an enclosed cabin in the center of the fuselage. It won praise for its handling characteristics as well as its performance. Passengers and pilots alike loved it.

A slightly enlarged cabin, a larger radiator area, as well as other modifications made to the De Havilland DH50A, marked its first production version. The National Airline QANTAS acquired a production license for the type following the delivery of nine DH50As to Australia. De Havilland modified a British-built Qantas DH50 in Queensland to fulfill the requirements of the Australian Inland Mission and became an aircraft used by the Royal Flying Doctor Service of Australia. A total of 38 planes have been manufactured over the years of this type.

Key Takeaway #1: Building on years of experience

The founders of Qantas built their initial services on years of experience gained in the military. Even the flight zone was the same one they already knew! The duo started small but had the vision to pioneer civil aviation and slowly built their company.

An important lesson from the Qantas story is to leverage your hard-earned experience, market knowledge, and the tools you have access to. Many startup founders make the mistake of venturing into completely new market areas that they have no idea about, rather than using the professional experience they already have.

During and after the Second World War

Qantas Empire Airways went abroad in 1935 and flew the first service between Brisbane and Singapore with DH-86. Later, in the golden age of seaplanes, the company began service between Sydney and Singapore. The prestigious short type, the Empire, with its comfortable main deck and high passenger comfort, was used on this route.

Qantas, mainly based on the founders’ military experience was heavily involved in different scenarios during the Second World War:

● After the declaration of war in 1939, Qantas continued to operate in Singapore and within Australia, despite some aircraft being transferred to the Royal Australian Air Force.

● During the second east-west air crossing of the Pacific Ocean, 19 Catalina flying boats were brought from the United States to Australia by Qantas crews in 1941.

● When Japanese forces occupied most of Southeast Asia in February 1942, Singapore's operations ended.

● The Dutch East Indies were evacuated to Australia via Qantas flying boats.

● Japanese aircraft shot down two Qantas Empire flying boats in early 1942.

● The Qantas hangar and flying boat maintenance facilities were destroyed in the first Japanese air raid on Darwin on 19 February 1942. A flying boat from the Qantas fleet narrowly escapes destruction.

● From Mount Hagen in New Guinea, 78 people were evacuated by a Qantas DH86 aircraft in May 1942.

The first steps in building the company brand

During the Second World War, only a few air routes were left - one of them was Qantas maintaining a link between Perth and Ceylon using Catalina seaplanes. Catalina flying boats covered 5,600 kilometers nonstop in 28 to 33 hours of nonstop flight. The passengers were presented with membership certificates from the "Rare and Secret Order of the Double Sunrise."

"Sublime Order of the Longest Jump" was awarded to passengers of Liberator aircraft in 1945. After the war, the Liberators were the first to carry the Kangaroo silhouette, followed by DC-3s, and 4s flying mainly internal routes. Qantas maintained its military charter flight capacity to Japan in the Korean War to create a revenue stream.

The peak of the radial engine era was the beautiful Lockheed Constellation, which also opened the Kangaroo Line between London and Sydney. At that time, the route network included Hong Kong and Tokyo, and Beirut and Frankfurt in 1952.

Key Takeaway #2: Brand development

The history of Qantas tells us that even in the most desperate of times, during World War II, the company worked doggedly to build a brand and maintain maximum service levels. After the Japanese bombed Qantas' infrastructure system, the company could have closed its doors, but instead, it carried on and maintained some civilian lines. These aircraft featured the company's logo, the iconic kangaroo, and helped build the company's image as a reliable, professional, and safe organization.

Today, there is almost no market where you will not encounter some type of competition. There are national and global, smaller and more agile, and larger, corporate-like players targeting the same audience as your company. You need to stand out somehow, and the best way to do that is to build a brand with characteristics that your audience can identify with.

The age of aviation

The jet age.

Throughout the history of aviation, the Jet Age was defined by the advent of aircraft powered by turbine engines and the resulting changes in society.

Due to the jets' ability to fly longer and faster than older piston-powered propliners. Leaving Australia and flying across the Pacific and Indian Oceans, aircraft were able to travel non-stop to their destinations, making it possible to travel to long-distance destinations within a single day. In addition to carrying more passengers than piston-engined airliners, large jetliners also lower airfares, so people from a broader socioeconomic range could travel across borders.

Qantas was among the pioneers in operating a lower-cost Tourist Class on various routes to bring the experience of flying to new audiences.

In addition to the advantages of the jet stream, the turbine-powered engines provided a smoother ride and better fuel economy compared to their predecessors. Among the exceptions to the jet-powered dominance of large airliners was the contra-rotating propeller turboprop design that powered the Tu-114 (first flight 1957). Although this airliner was able to match or even exceed the speed, range, and capacity of contemporary jets, its use in large aircraft was restricted to the military after 1976.

Qantas is recognized internationally for its engineering quality and safety record. First to offer a business class in 1979, and the first to introduce the slide raft in 1982, which has been a standard feature on all large commercial planes ever since.

The Boeing - Qantas partnership

With the Boeing 707 in 1959 and later the 747 in 1966, the jet age halved flight times. During the 1960s, Qantas entered the jet age when it began flying Boeing 707s from London. The result was a marked improvement in journey times and an expansion of its global network. Two days after its inaugural flight from Sydney to San Francisco, the first flight departed London on 31 July 1959.

By flying from London to Sydney via San Francisco, passengers can save over 25 hours on their journey. In 1961, Boeing introduced a special version of the 707 known as the "V Jet". Equipped with significantly powerful engines, the V jet continued to enhance the experience of the London to Sydney line.

During this time, Qantas ordered airplanes from Boeing to serve on other routes, such as:

● Singapore

● The short-lived Fiesta Route - from the UK to Australia via Bermuda, Nassau, Mexico City, Acapulco, Tahiti, and Fiji

Boeing’s jet engine airplanes empowered Qantas to become a truly global airline offering its flight services to all popular countries of Europe, the Americas, and the APAC region.

Stewards and stewardesses

In Qantas' case, flight hostesses, in particular, became one of the airline's most visible, glamorous marketing symbols. But it wasn’t how it started.

The wife of Qantas' founder, Hudson Fysh, was entrusted with the task of hiring the airline's first intake of hostesses. Patricia Burke was among nine "girls" selected by Mrs Fysh and her team from a field of 1,000 applicants from all over Australia.

They performed clerical duties on board and assisted stewards in serving meals to passengers. The captain personally directed them. As Patricia recalled in an interview with the Sydney Morning Herald : "We were trained very well in safety and loading procedures, shown how to serve passengers properly and we were taken on a familiarisation flight to Singapore in a seaplane. We didn't have to push heavy trolleys of food and drink up the aisles: that was left to the stewards but we did assist them to serve it. I was paid ten pounds a week but the stewards got more and tips as well. Hostesses were never tipped. It was not ladylike."

While the Flight Stewards Association of Australia represented the majority male workforce, as of 1957, the Aviation Hostesses Association was formed to represent local and international flight hostesses. With almost only female members and strong collective bargaining, the AHA was unique at that time.

The Airline Hostesses Association also played a significant role in supporting the Qantas Flight Hostesses' strike for career advancement and equal pay. The Hostesses of past eras were required to ‘retire’ at the age of 35 without having the option of applying for promotions such as Senior Flight Steward, Chief Steward, or Flight Service Director.

After decades of competition, the two representative organizations joined forces in 1992 and became one under the name Flight Attendants Association of Australia.

Key Takeaway #3: Pushing the limits of innovation

Throughout its more than 100-year history, Qantas has been at the forefront of innovation. Of course, one of the main drivers has been the long distance to other countries, which has led the company to look for cheaper solutions. Thanks to its partnership with Boeing, Qantas was one of the first airlines to offer non-stop flights and also invested heavily in research and development to improve safety.

Although being far from the most popular destinations seems to be a significant disadvantage compared to traditional European and American airlines, Qantas turned this into a growth engine.

An alliance and privatization

Founding the oneworld alliance.

Alliances between airlines are now an integral part of travel. Star Alliance, SkyTeam, and OneWorld are three of the major airline alliances. For the airlines, there are benefits in terms of cost savings and operational efficiencies; for passengers, there are facilitations in routing and connections; and, of course, there are loyalty benefits for all airlines.

It hasn't always been like this. Pan American World Airways and Panair de Brasil operated routes to Latin America together as early as the 1930s. In the early 1990s, there were also several African airlines offering services in an alliance. However, it was not until the late 1990s that a truly global alliance began to emerge.

Oneworld was co-founded in 1998 by Qantas, British Airways, Cathay Pacific, and American Airlines. With Iberia Airlines and Finnair joining in the same year, the alliance became operational in February 1999.

Oneworld targets the premium travel market and allows passengers to enjoy a wider route network than would be possible on their own. Airlines work together to keep costs down and achieve operational synergies. In 1998, the alliance carried 181 million passengers annually (to 648 destinations in 139 countries).

As part of the alliance's launch, all industry personnel were involved in extensive communication and training programs. In addition, the slogan "Oneworld revolves around you" was used for a major advertising campaign.

Today, under the OneWorld alliance logo, 14 world-class airlines offer seamless service and connections to more than 1,000 destinations in nearly 170 countries and territories. Member airlines work together to ensure the perfect flying experience - from check-in to boarding. OneWorld also plans to open its own branded airport lounges at major hub airports. Recently, the alliance introduced a new form of membership. Thanks to OneWorld Connect, regional airlines can take advantage of the alliance's benefits. Fiji Airways is the first airline to join this program.

In addition to consumer services, OneWorld Alliance provides services for corporate clients. According to the Alliance’s website, companies enjoy the following benefits:

● With global coverage, OneWorld flies to and from the world's most important markets and has global support centers in those locales.

● There is flexibility with flights, fares, and product options. First Class, Business Class, and Premium Economy come with award-winning fully flat seats.

● The Global Corporate Program gives each member a single, dedicated OneWorld contact, which streamlines communication and contractual implementation.

● Single legal agreement and four-year commitment: Streamlined sign-up that only takes a couple of minutes. All OneWorld airlines share the same expiration dates.

● Corporate clients get perks that give frequent flyers an edge, such as lounge access to top-tier cards, priority check-in, pre-boarding, and preferred seating options.

The privatization process of Qantas

Qantas was first given access to the national domestic market as a result of the Government of Australia's 1992 sale of Australian Airlines. As part of the purchase, the company added the Boeing 737 and Airbus A300 to its fleet, although the latter airplane type was eventually retired.

In March 1993, Qantas was privatized, with British Airways purchasing 25% of its shares for A$665 million. Profits increased by nearly 80% over the first half of 1995, allowing the Australian Government to sell its remaining 75% stake. Across the six months through the end of December, the company reported a net profit of A$129 million ($95 million), while sales was increased by 9.5%.

A 2% increase in yields across the network boosted performance. Despite a 10% increase in capacity, Qantas claimed that it had avoided diluting its load factors. Although earlier concerns about intense competition from privately held Ansett had arisen, the airline’s domestic operations have improved significantly. Operating profit for the domestic sector was $A51 million, as revenues grew by 24%.

During that time, Qantas highlighted that it started to see benefits from its alliance with British Airways, such as joint marketing and purchasing. In the wake of British Airways' purchase of 25% of Qantas, the remaining shares have been sold progressively later as the business has been reorganized and the top management has changed.

Qantas decided to proceed with the rest of its float in 1995. Public share offers were conducted in June and July of that year, earning the government A$1.45 billion. The remaining shares were sold in two phases in 1995–96 and 1996–97.

The stock float attracted significant interest from investors outside Australia, who bought 20 percent, while British Airways purchased 25 percent. This meant Qantas became 55% Australian-owned and 45% foreign-owned once listed on the stock exchange. By law, at least 51% of the company must be owned by Australians, so foreign ownership is constantly monitored. However, the tense situation changed when British Airways sold its 18.5% stake in Qantas in September 2004 for £425 million, though keeping its close ties with the Australian carrier intact.

Key Takeaway #4: Offering services with your competitors

Of course, Qantas did not enter into an alliance with its closest competitors but saw the opportunity to join forces with similar airlines covering long distances. The ultimate goal was to create a network that would reach all parts of the world and generate contacts with members through consumer and corporate agreements. Under a single brand umbrella, member companies provide services that they could not provide without each other, resulting in an increase in revenue.

The present and future of Qantas

Airplanes, the most important assets of any airline.

The most vital asset of any airline is its fleet. Qantas has been a pioneer in implementing new technologies and integrating the newest airplane types into its fleet for more than 100 years. Let's take a look at Qantas' current aircraft!

In contrast to 1970, when the company had 28 airplanes (mainly Boeing 707s), Qantas and its subsidiaries operated 297 aircraft as of November 2018. Qantas subsidiaries operate the majority: Jetstar Airways aircraft made up 71 of the fleet, 90 were operated by various QantasLink airlines, and six by Express Freighters Australia. Over the years, Qantas has always favored Boeing aircraft over products from other suppliers, but the other major civil aircraft manufacturer, Airbus, is also represented in the fleet.

Airbus A320

The Airbus A320 is a twin-engine, single-aisle, narrow-body, medium-range passenger aircraft developed by Airbus in the late 1980s, primarily to compete with the Boeing 737 and its various successors, the McDonnell Douglas DC-9. Digital electronic steering was used for the first time on a passenger aircraft. To date, over 4,400 aircraft have been delivered, making it the second-largest passenger aircraft ever built.

Airbus A330

The Airbus A330 is a wide-body, high-capacity passenger aircraft for medium- and long-haul flights made by the European airline Airbus, competing mainly with the Boeing 777. It was developed in the 1990s in parallel with the Airbus A340, which is why the two aircraft share many systems: They have the same wings (two engines on the A330 and four on the A340), the same fuselage structure, and the same avionics.

The main motivation for the development was the airlines' desire to use a twin-engine aircraft for certain long-haul routes, which was not much smaller than the three- and four-engine aircraft used until then. Twin-engine aircraft did not exist for ocean-going flights. It was not until the 1980s that engines were developed that were reliable enough to meet the safety requirements on transcontinental routes.

Airbus A380

The Airbus A380 is a twin-engine, four-engine wide-body passenger aircraft manufactured by the European company Airbus. The A380 is currently the largest passenger aircraft in the world. It first took off from Toulouse, France on April 27, 2005, and made its first scheduled flight on October 25, 2007, between Singapore and Sydney on behalf of Singapore Airlines. Its size quickly earned it the nickname "Superjumbo".

The Boeing 717 is a narrow-body twin-engine aircraft developed by McDonnell Douglas under the designation MD -95 as a successor to the third-generation DC-9. The first Boeing 717 entered service in 1999, and production of the series was completed in 2006. The aircraft has a maximum capacity of 117 passengers, a range of 3,820 km, and is powered by two Rolls-Royce gas turbine engines.

The Boeing 737 is the world's most popular medium-range narrow-body aircraft. By December 2011, it had more than 7,000 orders (6,000 were delivered in April 2009). By November 2019, it was the most ordered and most produced commercial airliner ever, with 15,156 orders and 10,565 deliveries.

Boeing announced the B737 on February 19, 1965, a twin-engine jet-powered turboprop aircraft for short-haul routes to complete the family of passenger aircraft. The 800, which Qantas also used, could carry 160 passengers in a typical two-class configuration and 184 in a single-class configuration.

B787-9 Dreamliner

The Boeing 787 Dreamliner (development designation 7E7 or Y2) is Boeing Commercial Airplanes' latest twin-engine, long-range, mid-size, wide-body aircraft designed and manufactured in the United States. Its various versions can accommodate 242to 335 passengers in three classes. It is the first passenger aircraft to have a large portion of its fuselage made of composite materials. It is designed to consume 20% less fuel than the Boeing 767.

The main focus in the development of the 787 was to reduce the weight of the aircraft. The aircraft is made of 80% composite materials. In the 787's onboard systems, the most striking feature is the new efficient electronic architecture, which replaces the previous compressed air and hydraulic components with electric compressors and pumps and eliminates pneumatics and hydraulics in some subsystems (e.g. engine starters or brakes). Another new feature of the 787 is the electronic wing heating system, which heats the wing surface electrothermally, replacing the previous hot air heating system.

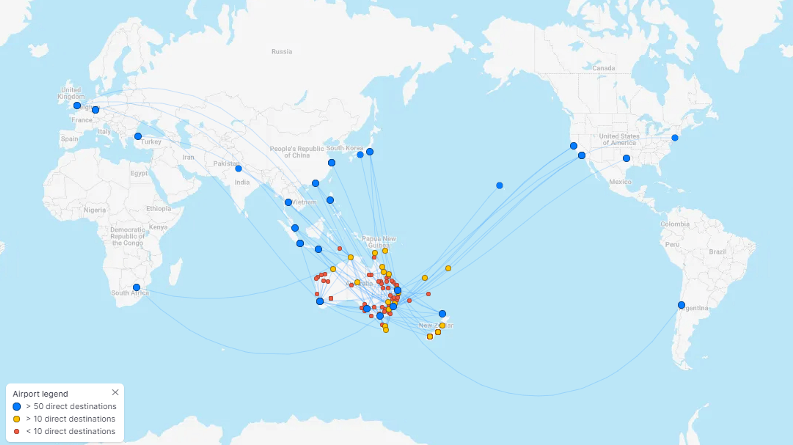

En route around the world - Qantas’ currently available flights

Subsidiaries

The company is also engaged in a broad range of subsidiaries and related businesses, including holiday and travel operations, in addition to the business of transporting passengers and cargo.

● QantasLink: A network of 56 metropolitan and regional destinations across Australia are served by it on over 2000 flights each week.

● Qantas Loyalty: Through its Qantas Frequent Flyer and Qantas Business Rewards programs, Qantas Loyalty is an innovative data-driven business that drives customer and partner loyalty.

● Qantas Freight: Every day, Qantas Freight flies more than 4,000 air freight items to more than 500 destinations around the world.

● Jetstar: Is a low-cost airline network with destinations within Australia, and also New Zealand (both completely operated by Qantas Group), and multiple co-operated companies, including Jetstar Asia, Jetstar Pacific, and Jetstar Japan.

● Jetconnect: Is a New Zealand-based subsidiary of the Qantas Group that offers trans-Tasman services. The company also provides cabin crew to Qantas for flights to Australia and around the world.

Qantas and COVID-19

A 3-year plan was outlined in June 2020 to guide Qantas Airlines through the COVID-19 crisis.

The recovery plan focused on three immediate actions:

● Reinforce the financial resilience of the company through a $1.4 billion equity raise.

● With the ability to scale up as demand grows, the proper workforce size, fleet size, and other costs should be considered.

● Streamline all operations to reduce costs and improve efficiencies.

The grounding of some 200 Qantas and Jetstar aircraft means the loss of at least 6,000 jobs and extended stand-downs for thousands of employees.

Key Takeaway #5: How to cope with crisis

The history of Qantas teaches us that the more successful a company is and the longer it has been operating, the more crises it has to deal with. COVID-19 hit all airlines around the world hard, forcing them to cease operations completely. Qantas was also forced to cease operations, but it has created a plan that reflects the present and considers the future.

Marketing above the clouds

How qantas’ logo changed over time.

During more than 100 years of operation, between 1920 and today, Qantas’ logo and name were changed several times.

The brand today

Qantas strives to emphasize reliability, safety, quality customer service, operational efficiency, and innovation as part of all its marketing efforts. Globally, the brand is strong and represents Australian culture. As the slogan says, "The spirit of Australia" captures exactly what the company’s brand is about.

Pricing strategy

In its pricing strategy, Qantas can utilize its diverse portfolio of subsidiaries, and offer wide price ranges for a vast amount of destinations. Most of Qantas' passengers are frequent business travelers . Qantas charges a premium price for its flights because of the aircraft's comfort and contemporary entertainment facilities. Its marketing mix has a premium pricing strategy that incorporates cost, benefits, and quality service value additions. In offering 'refunds', Qantas develops trust and loyalty in its target market.

Qantas advertisements

To market itself, Qantas uses several media channels such as TV, print, and online. The Qantas frequent flyer program is regarded as one of the best loyalty options because it offers a wide range of facilities to Qantas' frequent flyers and maintains the balance between retaining and acquiring customers.

Through its Aboriginal and Torres Strait islander initiative, Qantas promotes the arts and culture of Australia, showcasing its 'spirit of Australia'. Qantas has developed into a premium brand around the world for its sophisticated, hi-tech facilities and safe production standards. Qantas services and touring options are trusted by millions, who remain loyal to their brand name. One of Australia's national sports is rugby, which is sponsored by Qantas and helps with brand recognition.

The LGBTQIA community is openly supported in its campaigns, which earned the organization a positive image. These activities are aimed at developing a brand personality that the customers can relate to, especially since they are geared toward well-qualified and open-minded customers.

Most notable Qantas advertisements:

● I hate Qantas : From 1962- 1992, Qantas advertised with a gruff koala who lived by the slogan "I Hate Qantas".

● The Flying Kangaroo: In the 80s, no great advertisement worked without a theme song.

● Standing up: A recent commercial with actor Hugh Jackman, who became a Qantas Ambassador.

Key Takeaway #6: Pricing with a strategy in mind

Qantas has always strived to offer a diversified service portfolio complemented by a diverse pricing strategy to ensure maximum profit. The service provider uses subsidiaries to offer low-cost flights for shorter routes, while Qantas' mainline services have been created with a luxury image in mind to enable higher fares.

Final thoughts and key takeaways of Qantas Group’s story

Growth by numbers, key takeaways from qantas' story.

● Building on years of experience: Stories like AirBnB's are hard to follow - most successful founders leverage their existing experience and market knowledge rather than venturing into uncharted territory. The founders of Qantas used their experience gained as military pilots to launch a new airline in Australia.

● The importance of brand development: A company can only sell products and services if customers resonate with its brand. Quality, safety, and professionalism have been part of the Qantas brand for more than 100 years. The team at Qantas did not even stop building the brand when the company was forced to participate in World War II.

● Pushing the limits of innovation: Qantas pioneered aviation technology and safety. The company always spent a significant portion of its budget on manufacturing, innovation, and R&D activities.

● Offering services with your competitors: The Australian company partnered with similar companies around the world to offer complementary services and gain access to new markets and customers. Use partnerships to develop business and increase profits.

● How to cope with a crisis: Qantas created a plan that ensured the integrity of the company and prepared it for future expansion. One of the key takeaways from this story is that you should always prepare for the future while dealing with current challenges.

● Pricing with a strategy in mind: Qantas is a master at using different pricing strategies that complement each other. Embrace the Qantas mindset in your market and consider how you can offer different packages and how you can target customers that you can do more business.

Throughout more than 100 years, Qantas Group has made an extraordinary journey that holds many takeaways for present entrepreneurs. Although the company is not at its peak due to the global pandemic situation, the team already has plans on how to ensure the future growth of the airline group. Alan Joyce, CEO of Qantas, is already eyeing the newest aircraft types from both industry-leading manufacturers that will ensure a quicker-than-ever connection between Australia and even the most distant places on the globe.

Welcome to Bright Education - Specialists in Educational Posters and Books

Bundle & Save! Buy 2 or more books from any subject collection and automatically receive 15% off your order 📚🎉

Item added to your cart

Get Smart Education

Qantas 2022: A Business Case Study Book

SKU: BKECON01914

Couldn't load pickup availability

'Qantas 2022: A Business Case Study Book' - your ultimate Business Studies resource!

Are you in search of an engaging and educationally rewarding resource to enhance your Business Studies curriculum? Look no further than 'Qantas 2022: A Business Case Study Book '. This exceptional case study is meticulously designed to align perfectly with the NSW Syllabus, making it an ideal choice for both teachers and students.

Why 'Qantas 2022: A Business Case Study Book ' ?

Syllabus Excellence: When it comes to matching the NSW Syllabus seamlessly, no other Australian business case study can compare to Qantas. It thoroughly covers all the essential aspects mandated by the syllabus, ensuring your students receive the most relevant and up-to-date information.

Student Appeal: Qantas is a well-known and iconic brand among students, making it highly relatable. This familiarity can significantly enhance their engagement and comprehension of the case study, leading to a more effective and enjoyable learning experience.

Integrated Learning: The 'Qantas 2022: A Business Case Study Book ' adopts an integrated 'across topic' approach. It applies a wide range of business concepts and methodologies to a real-world business with both domestic and international operations. This comprehensive approach not only enriches students' understanding but also equips them to apply theoretical knowledge to practical business scenarios.

Enhance Your Business Studies Program with 'Qantas 2022: A Business Case Study Book '

Introduce your students to a case study that not only aligns perfectly with the NSW Syllabus but also captures their interest and imagination. 'Qantas 2022: A Business Case Study Book ' offers a wholistic view of business operations, making it an invaluable resource for teachers and students alike.

Rates calculated at checkout.

Standard and Express delivery available.

All orders placed via Express Post before 12pm Monday to Friday will be shipped the same day.

Orders placed with Standard delivery will be processed and sent within 1-3 business days.

Return policy

We have a 30-day return policy, which means you have 30 days after receiving your item to request a return. To be eligible for a return, your item must be in the same condition that you received it, unused and in its original packaging. To start a return, you can contact us at [email protected] .

Please note that returns will need to be sent to the following address: Bright Education Australia Pty Ltd, PO Box 261, Sandringham VIC 3191, Australia at your own cost. If your return is accepted, we will refund you the agreed amount upon return of the item. Items sent back to us without first requesting a return will not be accepted. You can always contact us for any return question at [email protected] .

Damages and issues Please inspect your order upon delivery and contact us immediately if the item is defective, damaged or if you receive the wrong item, so that we can evaluate the issue and make it right.

Subscribe to our emails

Join our email list for exclusive offers and the latest news.

- Choosing a selection results in a full page refresh.

- Opens in a new window.

Digital Travel Summit APAC 2024

August 14 - 15, 2024

Equarius Hotel, Sentosa, Singapore

*NEW* How Qantas used digital transformation to “punch above its weight” on customer and product experience

Increasingly sophisticated and with numerous options available to them through the digital transformation of commerce itself, today’s travellers expect stellar service and personalised experiences, tailored just for them. As new technologies make data storage cheaper and easier, airlines have a greater opportunity to store and analyse vast amounts of customer information, using the insights gained to create customised offers, and to personalise the customer journey.

Many airlines still look upon "Digital" as an end in itself, usually as a means of modernising isolated business functions. But true digital transformation is a process that can fundamentally change how airlines operate - one that enables new levels of collaboration across all airline functions collectively. It’s a process that uses information as the basis for connecting people, processes, technology, and culture, to deliver a more seamless customer experience.

In a recent study by Frost & Sullivan on digital transformation in the airline industry, the world’s third oldest airline and the safest airline in the world - Qantas - was also revealed to be the world’s most digitally ready airline. As we’ll see, Qantas has been using digital transformation to redefine its internal operating models, allowing the organisation to “punch above its weight” on customer and product experience.

Digital Transformation And The Customer Experience Are Key

In a highly competitive market, both traditional and low-cost carriers require new strategies to differentiate themselves from their competitors. Over the past decade, the growth of the Internet, eCommerce, and the development of multiple digital channels have had a profound effect on the travel industry. Digital transformation and data-driven business models have emerged as key enablers, in allowing players to distinguish themselves from others in the pack.

Airlines in particular have traditionally had access to huge reserves of transactional data about their consumers. Digital customer interactions now provide new data points about customer behaviour, which airlines can combine with insights gleaned both from internal sources such as reservation systems, and external sources like social media.

Information and technology now empower consumers more than ever before. Prospective travellers once had to rely on professional consultants, to find and compare all of the best airfares, schedules, and travel itineraries. But with the resources now available through online platforms and mobile apps, travellers can be their own travel agent.

At the top of any list of priorities for the intending passenger is a safe, smooth journey, which begins and ends on time. Any efforts on the part of the airline to personalise the process or enhance the customer experience will of course be welcome - but it’s fundamentally important to first get the basics right. So in digitally transforming, airlines must not neglect the operational aspect, which is the foundation for guaranteeing customer satisfaction. Airlines should also recognise the potential for improved efficiency that digital technology can bring.

Benefits Of Digital Transformation For The Airline Industry

Increased efficiency and streamlining of operations are just two of the benefits that digital transformation has to offer to the airline. Transformation is typically a multi-faceted initiative which, if successfully implemented, can increase revenue per customer, improve services, reduce costs, and produce other favourable outcomes.

A recent survey of 100 airline executives conducted by Sabre and Forbes revealed that 61% of those surveyed consider customer experience to be their primary brand promise. Personalisation and the custom-tailored travel experience are key elements in delivering on this promise.

Digital transformation provides a medium for delivery, by enabling multi-channel analytics on behavioural data. Such personalisation can extend beyond outreach and marketing channels, to include processes like the check-in at an airport kiosk, to create an integrated experience for the traveller at all touch points.

At the heart of any digital transformation initiative is a reserve of available data. The information typically on hand for airlines provides a pool of instantly available market intelligence, which may be used to increase ancillary sales. Data stores and insights from analytics can also enable airlines to enhance their revenue streams by identifying new opportunities for cross-selling and up-selling.

IATA reckons that globally, the number of air travel passengers is set to double from its level in 2016, to around 7.2 billion flyers by 2035. Any investment that an airline makes in digital transformation today will lay the foundation for building the data repository and analytics capability required to meet the demands of tomorrow’s market.

In terms of customer lifetime value, airlines can use the insights gleaned from digital transformation to generate new ways of segmenting their customers, and interacting with them. By analysing the lifetime value of passengers, airlines are also empowered to make more strategic marketing decisions, and customised support plans.

Using multiple data sources and the real-time processing of customer information, digital transformation enables airlines to create smarter, more meaningful segmentations and communications. This in turn allows them to establish and sustain more personalised, one-to-one conversations with consumers. For example, automated processes can give passengers notifications and updates which are directly relevant to their current destination, flight history, and previous interactions with the airline.

Automating service excellence

Automated response mechanisms and communications can also improve customer service, while reducing the burden on an airline’s human front-line staff when there is a disruption. For instance, configuring rule-based responses on an agile software platform can power automated responses to flight delays or cancellations.

The way in which these automated responses are crafted and delivered also gives airlines an opportunity to establish and communicate their unique brand personality. So for instance, an organisation might choose to emphasise certain kinds of notification to their passengers such as flight status, baggage status, waiting times for baggage delivery, or waiting times at security / border control.

The shift to a digital medium enables airlines to take advantage of commonly available resources such as the application programming interface or API, which can be used to create software solutions to an enormous range of issues. Digital transformation can give airlines real-time access to multiple customer and flight databases, and to the APIs used by other organisations. This in turn can provide opportunities for the airlines to expand their range of product and service offerings.

The digital ecosystem also enables airlines to present travellers with simple and accessible flight options across different service routes, when booking multiple flights to get to their destination – without the need for establishing formal partnerships between the various carriers.

Data and analytics lie at the heart of most digital transformation endeavours. With predictive analytics, customer insights can enable an airline to predict the likelihood of sales at an individual level, and to project likely income at a corporate level. Multi-channel analytics allow organisations to track customers through their entire experience via multiple touch points, including call centres, corporate websites, mobile apps, and value chain partners.

Other types of analysis can yield benefits for airlines at the operational level. For example, weather analytics can provide real-time insights that allow carriers to alter their flight paths in response to varying conditions. Big data analytics can enable airlines to predict potential traffic, and the revenue from new routes.

With online platforms and third-party apps offering instant price comparisons or bundling flights into a total travelling experience for passengers, travellers can afford to pay little attention to a particular airline’s brand, and treat it as a simple commodity. Projects like IATA’s NDC initiative can empower airlines to seize back some of the control and relevance of their brand. Digitally transformed airlines can also use social channels, integrated data sources, and analytics to help promote their brand more effectively to customers, and to encourage repeat business.

More generally, a report by Accenture estimates that digital transformation in aviation will create an additional $305 billion of value for the industry, over the next decade. Benefits to consumers are valued at $700 billion. In addition, digital initiatives will play a role in reducing the environmental impact of travel and improving safety, security, and cost.

The Challenges Of Digital Transformation For Airlines

Continue reading this article plus many more.

Download The Age of Digital Travel Guide

Related Posts

*NEW* Case Study: Reaching new heights of advertising through Multi-Layer Optimisation over Facebook - Fiji Airways

*NEW* 5G; Not just a technology revolution, but a customer experience revolution

*NEW* Destination Marketing 2.0 – How can you put agility and personalisation to work to know your customers better, predict what they want, and delight them to take away friction?

UniSuper private cloud, secondary systems taken out by "rare" Google Cloud "issues"

Anz finds savings and security benefits in technology estate simplification, the rise of collaboration platforms have created a new threat surface organisations must protect, westpac begins tech consolidation under $2bn unite program, defence readies a three-year technology roadmap, qantas outlines tech transformation targets for next two years, covering cloud migration, digital optimisation and operational efficiency..

Qantas has set a clear path for the next two years as part of an ongoing transformation, covering its transition to cloud and optimising the digital customer experience.

In its full-year 2023 results, the airline said data and digitalisation will occupy 35 percent of its targeted $300 million cost and revenue transformation efforts over the next financial year.

Qantas plans to complete its IT cloud transition, add baggage tracking to its app amongst other features and boost functionality for charter and group bookings

It also intends to improve its revenue management system, digital-enabled additional revenue, and data-driven decision-making, including for aircraft maintenance.

The remaining parts of the transformation involve fleet renewals and network improvements (25 percent) and ways of working (40 percent), which it said will include virtual reality for cabin crew.

As the airline heads to FY25, it plans to build out its digital customer experience, drive operational efficiencies and continue enhancing its data-driven management capability.

Over the FY23 period its spending across technology and digital reached $89 million.

Qantas CEO Alan Joyce told investors it is “recruiting a significant amount of cabin crew and engineers”, but has no issue with finding enough pilots.

He also noted that customers had "stuck with" the airline, "even when we were a long way from delivering the service that they expected”.

He said issues impacting customer service had been resolved, and that the airline's "return to profit also means we can make some important investments in their experience.”

“There's a steady stream of short and long term projects happening across the group, all with a simple aim of making people's journey a lot better.”

Qantas reported an underlying profit before tax of $2.47 billion and a statutory profit after tax of $1.74 billion.

Partner Content

Sponsored Whitepapers

Most Read Articles

IBM wins reversal of US$1.6 billion judgment to BMC

Victorian IT projects cost twice their budgets

Digital Nation

Most popular tech stories

State of Security 2023

Cover story: sustainability and ai, a promising partnership or an environmental grey area, fyai: what is an ai hallucination and how does it impact business leaders, case study: warren and mahoney adopts digital tools to reduce its carbon footprint, cricket australia automates experiences for fans and players, unix co-creator dennis ritchie passes away, broadcom issues update on partner program, vmware portfolio changes, photos: see who was at beyondtrust's sydney partner conference, avocado consulting's journey: from a mcdonald's to beating multinationals for contracts, hcltech wins $127 million transport for nsw contract.

Right to repair: Large scale IT buyers can influence product design... and they should

Shivering in summer sweating in winter your building is living a lie, building a modern workplace for a remote workforce, venom blackbook zero 15 phantom, how long will a ups keep your computers on if the lights go out.

Photos: The 2019 IoT Festival in Melbourne

Photos: the 2023 iot awards winners, meet the environmental monitoring award finalists in the iot awards, meet the data smart transformation award finalists in the iot awards, photos: 2023 iot impact exhibitors.

ACCC takes court action alleging Qantas advertised flights it had already cancelled

The ACCC today launched action in the Federal Court of Australia alleging Qantas Airways (QAN) engaged in false, misleading or deceptive conduct, by advertising tickets for more than 8,000 flights that it had already cancelled but not removed from sale.

The ACCC alleges that for more than 8,000 flights scheduled to depart between May and July 2022, Qantas kept selling tickets on its website for an average of more than two weeks, and in some cases for up to 47 days, after the cancellation of the flights.

It is also alleged that, for more than 10,000 flights scheduled to depart in May to July 2022, Qantas did not notify existing ticketholders that their flights had been cancelled for an average of about 18 days, and in some cases for up to 48 days. The ACCC alleges that Qantas did not update its “Manage Booking” web page for ticketholders to reflect the cancellation.

This conduct affected a substantial proportion of flights cancelled by Qantas between May to July 2022. The ACCC alleges that for about 70 per cent of cancelled flights, Qantas either continued to sell tickets for the flight on its website for two days or more, or delayed informing existing ticketholders that their flight was cancelled for two days or more, or both.

“The ACCC has conducted a detailed investigation into Qantas’ flight cancellation practices. As a result, we have commenced these proceedings alleging that Qantas continued selling tickets for thousands of cancelled flights, likely affecting the travel plans of tens of thousands of people,” ACCC Chair Gina Cass-Gottlieb said.

“We allege that Qantas’ conduct in continuing to sell tickets to cancelled flights, and not updating ticketholders about cancelled flights, left customers with less time to make alternative arrangements and may have led to them paying higher prices to fly at a particular time not knowing that flight had already been cancelled.”

“There are vast distances between Australia’s major cities. Reliable air travel is essential for many consumers in Australia who are seeking to visit loved ones, take holidays, grow their businesses or connect with colleagues. Cancelled flights can result in significant financial, logistical and emotional impacts for consumers,” Ms Cass-Gottlieb said.

The ACCC’s investigation included engagement with impacted consumers and the serving of compulsory information notices on Qantas. The investigation, which included detailed data analysis by ACCC specialist data analysts, identified that Qantas cancelled almost 1 in 4 flights in the period from May to July 2022, with about 15,000 out of 66,000 domestic and international flights from airports in all states and mainland territories in Qantas’ published schedule being cancelled. These proceedings relate to more than 10,000 of those cancelled flights.

As an example of the conduct, ticketholders scheduled to fly on Qantas flight QF93 from Melbourne to Los Angeles on 6 May 2022 were first notified of the cancellation on 4 May, two days before the scheduled departure and four days after Qantas had cancelled the flight.

One consumer was provided with a replacement flight a day before their original departure date, which was communicated only by the Qantas app. As a result, the consumer had to change connecting flights and had a 15-hour layover in Los Angeles, which had a significant impact on the consumer and left them $600 out of pocket.

In another example, Qantas sold 21 tickets for QF73 from Sydney to San Francisco scheduled to depart on 29 July 2022 after it had cancelled the flight, with the last ticket being sold 40 days after cancellation.

Airlines may cancel flights in the short term due to a range of unforeseeable reasons including bad weather, aircraft defects and delays from previous flights. Flight cancellation can also happen due to a range of factors that are within the control of an airline.

“We allege that Qantas made many of these cancellations for reasons that were within its control, such as network optimisation including in response to shifts in consumer demand, route withdrawals or retention of take-off and landing slots at certain airports,” Ms Cass-Gottlieb said.

“However, this case does not involve any alleged breach in relation to the actual cancellation of flights, but rather relates to Qantas’ conduct after it had cancelled the flights.”

The ACCC is seeking orders including penalties, injunctions, declarations, and costs.

Some examples of flights allegedly affected:

- Qantas flight QF93 was scheduled to depart from Melbourne to Los Angeles on 6 May 2022. On 28 April 2022, Qantas made the decision to cancel the flight. Despite this, Qantas did not remove the flight from sale until 2 May 2022, and did not inform existing ticketholders of the cancellation until 4 May 2022 (two days before the flight).

- Qantas flight QF81 was scheduled to depart from Sydney to Singapore on 4 June 2022. On 8 February 2022, Qantas made the decision to cancel the flight. Despite this, Qantas did not remove the flight from sale until 27 March 2022, and did not inform existing ticketholders of the cancellation until 28 March 2022.

- Qantas flight QF63 was scheduled to depart from Sydney to Johannesburg on 31 July 2022. On 8 February 2022, Qantas made the decision to cancel the flight. Despite this, Qantas did not remove the flight from sale until 27 March 2022, and did not inform existing ticketholders of the cancellation until 28 March 2022.

- Qantas flight QF486 was scheduled to depart from Melbourne to Sydney on 1 May 2022. On 18 February 2022, Qantas made the decision to cancel the flight. Despite this, Qantas did not remove the flight from sale until 15 March 2022, and did not inform existing ticketholders of the cancellation until 16 March 2022.

- Qantas flight QF1785 was scheduled to depart from Gold Coast to Sydney on 1 May 2022. On 17 February 2022, Qantas made the decision to cancel the flight. Despite this, Qantas did not remove the flight from sale until 15 March 2022, and did not inform existing ticketholders of the cancellation until 16 March 2022.

- Qantas flight QF696 was scheduled to depart from Adelaide to Melbourne on 23 July 2022. On 18 June 2022, Qantas made the decision to cancel the flight. Despite this, Qantas did not remove the flight from sale until 26 June 2022, and did not inform existing ticketholders of the cancellation until 27 June 2022.

- Qantas flight QF1764 was scheduled to depart from Canberra to Gold Coast on 27 June 2022. On 16 June 2022, Qantas made the decision to cancel the flight. Despite this, Qantas did not remove the flight from sale until 19 June 2022, and did not inform existing ticketholders of the cancellation until 20 June 2022.

- Qantas flight QF513 was scheduled to depart from Brisbane to Sydney on 8 June 2022. On 27 May 2022, Qantas made the decision to cancel the flight. Despite this, Qantas did not remove the flight from sale until 30 May 2022, and did not inform existing ticketholders of the cancellation until 31 May 2022.

- Qantas flight QF45 was scheduled to depart from Melbourne to Denpasar on 1 May 2022. On 8 February 2022, Qantas made the decision to cancel the flight. Despite this, Qantas did not remove the flight from sale until 24 February 2022, and did not inform existing ticketholders of the cancellation until 23 March 2022.

- Qantas flight QF649 was scheduled to depart from Sydney to Perth on 30 July 2022. On 18 February 2022, Qantas made the decision to cancel the flight. Despite this, Qantas did not remove the flight from sale until 7 March 2022, and did not inform existing ticketholders of the cancellation until 8 March 2022.

Qantas is Australia’s largest domestic airline operator. It is a publicly listed company which operates domestic and international passenger flights under its mainline brand, Qantas, and through its subsidiary Jetstar. It offers flights for sale through direct channels, such as its website and app, and indirect channels, such as travel agents and third-party online booking websites.

ACCC’s other work in the airline industry

During the pandemic and in the industry’s recovery period, from June 2020 to June 2023, the ACCC monitored prices, costs and profits of Australia’s major domestic airlines under a direction from the Federal Government.

The ACCC has investigated various aspects of Qantas’ conduct over the past three years. It has been engaging with Qantas directly on aspects of its customer service in an effort to get quick and equitable outcomes for consumers, however the ACCC considers that Qantas needs to do more.

The ACCC continues to receive more complaints about Qantas than about any other business. Last year alone the ACCC received more than 1,300 complaints about Qantas cancellations, accounting for half of all complaints about Qantas reported to the ACCC.

The ACCC notes Qantas’ public statements that most consumers holding COVID flight credits are eligible for, and still able to seek, refunds. The ACCC strongly encourages consumers holding these flight credits to seek refunds directly from Qantas.

Qantas has suggested that these COVID credits will expire at the end of December 2023, and that customers with expired COVID credits where Qantas cancelled the original flight may not be able to seek a refund. The ACCC has written to Qantas strongly objecting to this proposed position and will continue to monitor the situation to ensure Qantas continues to make available refunds to consumers.

The ACCC also notes there is a current class action which has been launched in relation to flight credits, and affected consumers may be able to seek remedies against Qantas as part of this class action.

Maximum penalties

For corporations, the maximum penalties for each breach of the Australian Consumer Law before 9 November 2022 is the greater of:

- $10 million,

- three times the total benefits that have been obtained and are reasonably attributable, or

- if the total value of the benefits cannot be determined, 10 per cent of the corporation's annual turnover.

Concise statement

ACCC v Qantas Concise Statement 31 August 2023 ( PDF 577.52 KB )

The document contains the ACCC’s initiating court documents in relation to this matter. We will not be uploading further documents in the event these initial documents are subsequently amended.

Correction: This media release was amended on 31 August 2023 to correct the date of the example for flight QF73 to 29 July 2022, and not 28 July 2023 as originally stated.

Release number

General enquiries.

Contact us to report an issue or make an enquiry.

Media enquiries

Milan Pintar E-Portfolio

Strategic management – group report: qantas case study analysis.

1 Executive Summary…………………………………………………………………. 3

2 Introduction…………………………………………………………………………….. 6

3 Strategic Management and Strategic Competitiveness…………………. 8

4 Business-level strategy……………………………………………………………. 10

4.1 Current……………………………………………………………………………. 10

4.1.1 Qantas and Porter’s Five Forces…………………………………… 11

4.1.2 Current Geographical External Environment…………………. 14

4.2 Recommendations……………………………………………………………. 15

4.2.1 Recommended Geographical External Environment………. 15

5 Corporate-level Strategy – Diversification………………………………… 17

5.1 Current……………………………………………………………………………. 17

5.2 Recommendations……………………………………………………………. 20

6 Corporate-level Strategy – Mergers and Acquisitions…………………. 23

6.1 Current……………………………………………………………………………. 23

6.2 Recommendations……………………………………………………………. 25

7 Corporate-level Strategy – International…………………………………… 27

7.1 Current……………………………………………………………………………. 27

7.2 Recommendations……………………………………………………………. 29

8 Conclusion…………………………………………………………………………….. 32

1 Executive Summary

This report examines Qantas’ strategic management and how these strategies increase Qantas’ ability to sustain competitive advantage and achieve above average returns. The Qantas group strategy is to deliver sustainable returns to shareholders with safety always being their first priority (Qantas Airways Ltd, 2015c).

At a competitive strategy and business level Qantas’ unique position as Australia’s largest and longest established airline has not been sufficient alone to sustain competitive advantage. With the pressures of the post Global Financial Crisis economy and increasing new entrant competition in its external environment Qantas has had to establish new competitive strategies including development of a cost lead airline JetStar alongside its value oriented premium service in Qantas. In addition the internal resource based environment as focused on rationalising core competences and developing an approach that resists the competitive forces of the market (Porter 1979) fending off the rivalry of existing competitors through price wars, reducing costs by engaging suppliers, building their loyalty program strength to combat threat of new entrants and develop clear differentiation that is difficult to imitate to ward off product substitutes. Business level recommendations include further stabilisation of relations with unions to contain personnel costs along with a focus on the continued distinction between its cost lead strategy and the value differentiation of premium services.

Corporate strategy has seen Qantas focus on the development of its 5 segment diversification with further development of secondary subsidiaries to smooth revenue and profit generation and limit risks and dependencies on any single business unit. This has been effective stable growth in profits generated by the Loyalty and Freight segments have successfully supported Qantas through recent challenging industry and economic conditions restoring returns to stakeholders. Corporate strategy recommendations include capacity and resource distribution to maximise profitability in the five business segments, evolution and alignment with corporate vision and core brand values to ensure realisation of strategic synergies and consideration of the vertical integration of a travel insurance business line leveraging Qantas’ 10.8 million market reach and travel buying cycle relationship with its customers. Caution is recommended in over diversification of areas such as Loyalty where Qantas may be at risk of crating unnecessary risk and complexity expanding outside its core competences.

As with most companies, Qantas has had limited success in its mergers and acquisitions, with the majority in the last ten years not achieving above average returns and creating greater stakeholder value. This includes expansions in their freight interests, extended travel booking services and even more diverse analytical consulting services in the Red Planet business. Failures can generally be attributed to poor due diligence, a lack of realisation of synergies and limited integration success. With the limited success Qantas must consider several divestments in order to return to core value creation for its stakeholders. There are growth opportunities in leveraging resources for the vertical expansion of air based freight services through acquisition along with international opportunities to grow through acquisition into developing regions such as Asia.

Qantas’ international strategy is supporting growth into new markets, in particular reducing barriers to entry in Asia in the form of foreign ownership limitations by leveraging partnership and alliances. These entities, while minority owned, form the basis of a home office lead global strategy building growth in the rapidly expanding Asian middle class market. To ensure this regionalisation is successful Qantas should consider a transitional strategy to increase local responsiveness and address the cultural and political complexities that will increase rapidly as they increase scale and market power in these regions.

2 Introduction

Qantas Airways Ltd is the third oldest airline in the world and was established in 1920. The Qantas group has grown to comprise five major segments generating over $15.8 billion in revenue that include Qantas Domestic, Qantas International, Jetstar Group Qantas Loyalty and Qantas Freight. Their group strategy is to deliver sustainable returns to shareholders with safety always being their first priority (Qantas Airways Ltd, 2015c). The airline has had to adapt too many changes in the external environment following the global financial crisis (GFC) in 2008. These changes have had a very drastic impact on the company’s internal operational environment as will be explained. To address these changes Alan Joyce, Qantas CEO, focused the airline on core business competences to help them sustain their competitive advantage and restore returns to profitable levels.

Under the burden of large capital commitments having ordered 115 new aircraft in 2005 (Hanson 2010), Qantas rationalised many of its resources and capabilities outsourcing 7000 jobs overseas in an effort to reduce costs and offshoring engineering and maintenance work to third parties that have an excellent safety record that limited the risk of damaging Qantas’ reputation as the safest airline in the world. The rationalisation of operations and focus on core competences restored profitability as the broader industry began to recover and Qantas now operate profitably across the group after several years of losses in their three airline segments.

This report examines Qantas competitive, business-level, corporate-level and international strategies to establishing the theoretical strategic management foundations to Qantas current situation. The report provides recommendations based on Qantas current context identifying appropriate strategic management principles that can be applied to sustain competitive advantage and achieve above average returns.

3 Strategic Management and Strategic Competitiveness

The essence of strategic management is to establish a unique market position that addresses the five forces of competition (Porter, 1980) minimising threats and capitalising on opportunities. To do so companies need to scan the external environment and identifying signals to changes in the environment, monitor identified trends and generate projections. The application of the I/O model pursues above average returns through targeting an attractive industry and implementing a strategy that is determined by that industry.

In turn the company’s internal environment must be aligned to address external opportunities and threats. Applying a resource based model internal analysis examines what is valuable, rare, costly to imitate and non-substitutable (VRIN) (Barney, 1991) to make strategic decisions in respect to its resources, capabilities and focus on core competences in an effort to create sustainable competitive advantage. The company can then assess its value chain (Porter, 1985) and make decisions on what competences create the greatest value for its customers and its ultimately stakeholders. As resource can often be imitated or substituted over time however it is difficult to sustain competitive advantage based on resources alone thus the importance of strategy to address the external environment. This leads to decisions on mergers and acquisitions then need be made to take advantage of economies of scale and earn above average returns on its products and services. International strategies also can help the company like Qantas take advantage of locations nearer to high demand and high growth markets (Hitt, et al., 2015).

Qantas unique position in the market has not been adequate to sustain competitive advantage alone. Its well establish and valuable position in the market has attracted competitors who have sort to imitate and provide substitute products, that seek to emulate Qantas products and services and also undercut them through cost lead strategies. Following the Global Financial Crisis where Low Cost Carriers (LCC) addressed changes in the external environment of customer price sensitivity and Qantas was forced to respond through establishment of it’s JetStar Group creating its own LCC imitation. Qantas do have substantial resources that address the four VRIN criteria, the most significant of which is their intangible brand asset and associated loyalty being Australia’s long-standing national carrier. Qantas focus attention on core competence surrounding this resource and leverage its capacity to sustain competitive advantage.

4 Business-level strategy

Qantas must understand its strengths, weaknesses, opportunities and threats, as well as its resources and capabilities from its internal conditions where competitive advantage can be achieved (Nandakumar et al 2010). The below reviews Qantas’ ability and success at deploying its resources to achieve a sustainable competitive advantage over their competitors and earn above-average returns by integrating and coordinating a set of commitments and actions.

4.1 Current

Firms have to develop their business level strategy based on how they will deploy their resources to compete in a specific industry or market section (Raphael 1986). This helps form the core strategy that the firm chooses to achieve its competitive advantage. Another important factor in the foundation of a successful business level strategy requires understanding the customer value proposition. To create customer value firms have to satisfy three aspects:

- What will be the proposition, in terms of product and service about customers’ needs and satisfaction

- To which customer segment will the product be served

- How will the firm use its core competencies to satisfy the costumers needs

(Lecocq 2015).

Qantas use the NPS (Net Promoter Score) program to understand whether passengers will advocate for them. The feedback is passed on to frontline employees in order to improve service delivery and is used by the business to inform strategic decisions and to improve travel experiences.

To create competitive advantage, firms can evaluate different business-level strategies that can match with the course of action pursued by the company. The strategies are:

- Cost leadership: the production of the low per-unit cost from a product.

- Differentiation: the production of goods or services within an acceptable cost which produce unique products in the industry.

- Focus strategy: the production of goods and service that is determined to satisfy a specific customer segment.

Competitive advantage growth occurs when firms create value for its products that exceed the firm’s cost to creating it (Porter 1985). Value is what buyers are willing to pay, and superior value stems from offering lower prices than competitors, with equivalent benefits or providing unique benefits that more than offset a higher price. There are two basic types of competitive advantage: cost leadership and differentiation.

Qantas has achieved competitive advantage using the integrated cost leadership/ differentiation strategy. This is evident due to Qantas’ longevity and unique position (in global terms) in being able to cover a diverse (business and leisure) national market with a diversity of products and services that reflect different services levels. This strategy is driven by its route segmentation, where Qantas differentiate the service provided by the type of traffic to reduce operational cost. The results are the business outcomes of increasing revenue and (return to) profit, route growth and continued, sustained cost reduction (Whyte and Lohmann 2015).

4.1.1 Qantas and Porter’s Five Forces

Qantas addressed each of Porter’s Five Forces (Porter, 1979) it faced to achieve its dominant market position and deliver upon its business level strategy.

Rivalry within Existing Competitors

The high volume of competitors in the aviation industry produces a fierce competition between them, in which the rivalry is strong due to the crowded marketplace. Rivalry is manifested through price wars, regular and long discount cycles, regularly adding new products, large marketing campaigns and service improvement. Qantas has achieved a competitive advantage against competitors as they have developed and maintained a larger diverse market with a diverse range of unique products.

Bargaining Power of Buyers

Most buyers tend to be price sensitive and will shop around for better prices or better value (Porter 2008). The primary buyers in the aviation industry are middle class individuals or business professionals. They command significant buyer power because they are able to move freely between airlines. Buyers can easily hold a number of frequent flyer loyalty accounts, so this is no longer as effective in keeping buyers loyal to the product or service. Because of this, Qantas has its two major brands; Qantas (for product differentiation) and Jetstar (for best value). Qantas’ strategy has to be mindful as to not cannibalise its own market, leading to customer confusion and a loss in revenue opportunity in customers choosing to fly with the wrong brand.

Bargaining Power of Suppliers

Qantas is a highly recognized brand around the world which makes it a trusted company in the eyes of the suppliers. During the last year, Qantas worked with many of its suppliers to reduce operational cost and preserve their current margins. As many suppliers are dependant on Qantas, most begrudgingly complied. Where supplies hold key strategic assets (eg. jet fuel, airliner construction), airlines have little bargaining power over prices, however, the industry can negotiate contractual outcomes over a number of years. Most other airline industry suppliers are not critical and operate in a competitive environment where the industry players can switch suppliers with little effort and recourse. Unlike other competitors, Qantas relies heavily on unionised labour to run its operations. Unions have significant influence and power over Qantas as key resource suppliers.

Potential New Entrants

The barriers to entry in the aviation industry are high due to the need for large capital outlays to enter and compete in the market. There are many airlines in the market (ranging from large national carriers to small regional carriers), the industry operates on fairly low margins (due to constant price competition and price reporting), and experiences volatility with jet fuel. This makes the industry quite unattractive for new entrants to successfully enter and compete against existing operators. Furthermore, Qantas has developed a highly successful loyalty program, through brand development, which helps them preserve their customer base and complicates the task of new entrants even further.

Product Substitutes

Train and road travel are the main substitutes locally, however, with heavily reduced prices (where a domestic air ticket can cost less than the taxi ride to the airport), the airline industry will be able to demonstrate significant value (time saving, convenience, comfort) over road or rail based travel. Qantas’ integrated cost leadership/differentiation strategy helps to reduce the possibility of customers switching to substitutes.

4.1.2 Current Geographical External Environment

Qantas needs to develop core competence in integrating horizontal acquisitions and building a business outside of Australia. External market trends show growth in Asia and Africa and Qantas needs to be closer to those markets in order to offer new customers its safety record core competence.

Air New Zealand and Qantas, have several times claimed that Emirates is dumping capacity in the trans-Tasman market, seeking only to cover its marginal costs and in the process driving down fares to levels unprofitable for competitors (Mullins 2014). Another problem in aeronautical relations with Australia involves the imbalance in benefits from the air service agreement, with the benefits heavily slanted in Emirate’s favour (Mullins 2014). Qantas has complained that the operations of sixth freedom carriers – SIA as well as Emirates – have been responsible for a sharp fall in its market share of international traffic to / from Australia. Emirates is seeking to double flights into Australia in the future which will threaten Qantas’ geographical advantage. The UAE maintains an open skies policy and so it could offer Qantas the opportunity to set up a hub in Dubai (Mullins 2014). But this might well be something of an empty gesture given that Qantas would still need fifth freedom rights to operate beyond Dubai. As a third / fourth freedom carrier Qantas also complains that Emirates simply diverts traffic, but more than 80 per cent of the passengers Emirates currently carries in and out of Australia are flying to / from cities not served by Qantas, for example Paris, Zurich, and Vienna ( Airline Business 2006). But because a third / fourth freedom carrier cannot match the sixth freedom carrier’s economies of route traffic density, it is bound to be at a competitive disadvantage, due to the geographical accident of its home country’s location (Mullins, 2014).

The argument of location and Emirates dumping capacity is a serious concern especially, even with the hub location and the brand image of Qantas safety record.

4.2 Recommendations