- Screen Reader

- Skip to main content

- Text Size A

- Language: English

- Case Studies

- EXIM Procedure

Media & Events

- Image Gallery

- Media Coverage

Other Links

- GI of India

- Experience India

- Indian Trend Fair 2022

- India Organic Biofach 2022

- Gulfood Dubai 2023

Indian Economy Overview

About indian economy growth rate & statistics, introduction.

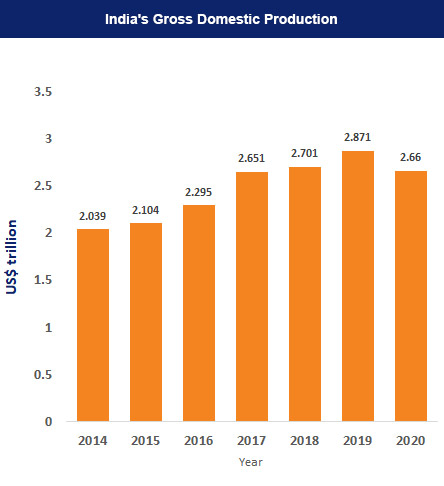

Strong economic growth in the first quarter of FY23 helped India overcome the UK to become the fifth-largest economy after it recovered from the COVID-19 pandemic shock. India's gross domestic product (GDP) at current prices in the second quarter (Q2) of 2023-24 is estimated to be Rs. 71.66 trillion (US$ 861.2 billion), as against Rs. 65.67 trillion (US$ 789.2 billion) in Q2 of 2022-23, showing a growth rate of 9.1%. Strong domestic demand for consumption and investment, along with Government’s continued emphasis on capital expenditure are seen as among the key driver of the GDP in the first half of FY24. In 2023-24 (April-December), India’s service exports stood at US$ 247.92 billion. Furthermore, India’s overall exports (services and merchandise) in 2023-24 (April-December) were estimated at US$ 565.04 billion. Rising employment and substantially increasing private consumption, supported by rising consumer sentiment, will support GDP growth in the coming months.

Future capital spending of the government in the economy is expected to be supported by factors such as tax buoyancy, the streamlined tax system with low rates, a thorough assessment and rationalisation of the tariff structure, and the digitization of tax filing. In the medium run, increased capital spending on infrastructure and asset-building projects is set to increase growth multipliers. The contact-based services sector has largely demonstrated promise to boost growth by unleashing the pent-up demand. The sector's success is being captured by a number of HFIs (High-Frequency Indicators) that are performing well, indicating the beginnings of a comeback.

India has emerged as the fastest-growing major economy in the world and is expected to be one of the top three economic powers in the world over the next 10-15 years, backed by its robust democracy and strong partnerships.

India's appeal as a destination for investments has grown stronger and more sustainable as a result of the current period of global unpredictability and volatility, and the record amounts of money raised by India-focused funds in 2022 are evidence of investor faith in the "Invest in India" narrative.

Market size

India’s nominal gross domestic product (GDP) at current prices is estimated to be at Rs. 296.58 trillion (US$ 3.56 trillion) in 2023-24. Additionally, the Nominal GDP at current prices in Q2 of 2023-24 was Rs. 71.66 trillion (US$ 861.2 billion), as against Rs. 65.67 trillion (US$ 789.2 billion) in 2022-23, estimating a growth of 9.1%. As of 03rd October 2023, India is home to 111 unicorns with a total valuation of US$ 349.67 Billion. Out of the total number of unicorns, 45 unicorns with a total valuation of US$ 102.30 Billion were born in 2021 and 22 unicorns with a total valuation of $ 29.20 Billion were born in 2022. India presently has the third-largest unicorn base in the world. The government is also focusing on renewable sources by achieving 40% of its energy from non-fossil sources by 2030. India is committed to achieving the country's ambition of Net Zero Emissions by 2070 through a five-pronged strategy, ‘Panchamrit’. Moreover, India ranked 3rd in the renewable energy country attractive index.

According to the McKinsey Global Institute, India needs to boost its rate of employment growth and create 90 million non-farm jobs between 2023 to 2030 in order to increase productivity and economic growth. The net employment rate needs to grow by 1.5% per annum from 2023 to 2030 to achieve 8-8.5% GDP growth between same time period. The current account deficit stood at US$ 8.3 billion, or 1% of GDP, in the second quarter of fiscal 2023-24 as compared to US$ 9.2 billion or 1.1% of GDP in the preceding quarter.

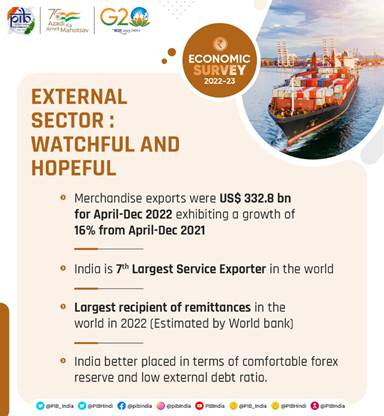

Exports fared remarkably well during the pandemic and aided recovery when all other growth engines were losing steam in terms of their contribution to GDP. Going forward, the contribution of merchandise exports may waver as several of India’s trade partners witness an economic slowdown. According to Minister of Commerce and Industry, Consumer Affairs, Food and Public Distribution and Textiles Mr. Piyush Goyal, Indian exports are expected to reach US$ 1 trillion by 2030.

Recent Developments

India is primarily a domestic demand-driven economy, with consumption and investments contributing to 70% of the economic activity. With an improvement in the economic scenario and the Indian economy recovering from the Covid-19 pandemic shock, several investments and developments have been made across various sectors of the economy. According to World Bank, India must continue to prioritise lowering inequality while also putting growth-oriented policies into place to boost the economy. In view of this, there have been some developments that have taken place in the recent past. Some of them are mentioned below.

- As of January 19, 2024, India’s foreign exchange reserves stood at US$ 616.14 billion.

- In 2023, India saw a total of US$ 49.8 billion in PE-VC investments.

- Merchandise exports in December 2023 stood at US$ 38.45 billion, with total merchandise exports of US$ 505.15 billion during the period of April-December (2023-24).

- India was also named as the 48th most innovative country among the top 50 countries, securing 40th position out of 132 economies in the Global Innovation Index 2023. India rose from 81st position in 2015 to 40th position in 2023. India ranks 3rd position in the global number of scientific publications.

- At the beginning of January 2024, the PMI Services comfortably remained in the expansionary zone, registering a value of 61.2.

- In December 2023, the gross Goods and Services Tax (GST) revenue collection stood at Rs.1,64,882 crore (US$ 19.80 billion), of which CGST is Rs. 30,443 crore (US$ 3.65 billion), SGST is Rs. 37,935 crore (US$ 4.55 billion).

- Between April 2000–September 2023, cumulative FDI equity inflows to India stood at US$ 953.14 billion.

- In November 2023, the overall IIP (Index of Industrial Production) stood at 141. The Indices of Industrial Production for the mining, manufacturing and electricity sectors stood at 131.1, 139.2 and 176.3, respectively, in November 2023.

- According to data released by the Ministry of Statistics & Programme Implementation (MoSPI), India’s Consumer Price Index (CPI) based retail inflation reached 5.55% in November 2023.

- Foreign Institutional Investors (FII) inflows between April-July (2023-24) were close to Rs. 80,500 crore (US$ 9.67 billion), while Domestic Institutional Investors (DII) sold Rs. 4,500 crore (US$ 540.56 million) in the same period. As per depository data, Foreign Portfolio Investors (FPIs) invested Rs. 261,856 crore (US$ 31.5 billion) in India during Aril-December (2023-24).

- The wheat procurement during RMS 2023-24 (till May) was estimated to be 262 lakh metric tonnes (LMT) and the rice procured in KMS 2023-24 was 385 LMT. The combined stock position of wheat and rice in the Central Pool is over 579 LMT (Wheat 312 LMT and Rice 267 LMT).

Government Initiatives

Over the years, the Indian government has introduced many initiatives to strengthen the nation's economy. The Indian government has been effective in developing policies and programmes that are not only beneficial for citizens to improve their financial stability but also for the overall growth of the economy. Over recent decades, India's rapid economic growth has led to a substantial increase in its demand for exports. Besides this, a number of the government's flagship programmes, including Make in India, Start-up India, Digital India, the Smart City Mission, and the Atal Mission for Rejuvenation and Urban Transformation, is aimed at creating immense opportunities in India. In this regard, some of the initiatives taken by the government to improve the economic condition of the country are mentioned below:

- On January 22, 2024, Prime Minister Mr. Narendra Modi announced the 'Pradhan Mantri Suryodaya Yojana'. Under this scheme, 1 crore households will receive rooftop solar installations.

- On September 17th, 2023, Prime Minister Mr. Narendra Modi launched the Central Sector Scheme PM-VISHWAKARMA in New Delhi. The new scheme aims to provide recognition and comprehensive support to traditional artisans & craftsmen who work with their hands and basic tools. This initiative is designed to enhance the quality, scale, and reach of their products, as well as to integrate them with MSME value chains.

- On August 6th, 2023, Amrit Bharat Station Scheme was launched to transform and revitalize 1309 railway stations across the nation. This scheme envisages development of stations on a continuous basis with a long-term vision.

- On June 28th, 2023, the Ministry of Environment, Forests, and Climate Change introduced the ‘Draft Carbon Credit Trading Scheme, 2023’.

- From April 1st, 2023, Foreign Trade Policy 2023 was unveiled to create an enabling ecosystem to support the philosophy of ‘AtmaNirbhar Bharat’ and ‘Local goes Global’.

- In order to enhance India’s manufacturing capabilities by increasing investment and production in the sector, the government of India has introduced the Production Linked Incentive Scheme (PLI) for Pharmaceuticals.

- Prime Minister’s Development Initiative for North-East Region (PM-DevINE) was announced in the Union Budget 2022-23 with a financial outlay of Rs. 1,500 crore (US$ 182.35 million).

- Prime Minister Mr Narendra Modi has inaugurated a new food security scheme for providing free food grains to Antodaya Ann Yojna (AAY) & Primary Household (PHH) beneficiaries, called Pradhan Mantri Garib Kalyan Ann Yojana (PMGKAY) from January 1st, 2023.

- The Amrit Bharat Station scheme for Indian Railways envisages the development of stations on a continuous basis with a long-term vision, formulated on December 29th, 2022, by the Ministry of Railways.

- On October 7th, 2022, the Department for Promotion of Industry and Internal Trade (DPIIT) launched Credit Guarantee Scheme for Start-ups (CGSS) aiming to provide credit guarantees up to a specified limit by start-ups, facilitated by Scheduled Commercial Banks, Non-Banking Financial Companies and Securities and Exchange Board of India (SEBI) registered Alternative Investment Funds (AIFs).

- Telecom Technology Development Fund (TTDF) Scheme was launched in October 2022 by the Universal Service Obligation Fund (USOF), a body under the Department of Telecommunications. The objective is to fund R&D in rural-specific communication technology applications and form synergies among academia, start-ups, research institutes, and the industry to build and develop the telecom ecosystem.

- Home & Cooperation Minister Mr. Amit Shah laid the foundation stone and performed Bhoomi Pujan of Tanot Mandir Complex Project under Border Tourism Development Programme in Jaisalmer in September 2022.

- In August 2022, Mr. Narendra Singh Tomar, Minister of Agriculture and Farmers Welfare inaugurated four new facilities at the Central Arid Zone Research Institute (CAZRI), which has been rendering excellent services for more than 60 years under the Indian Council of Agricultural Research (ICAR).

- In August 2022, a Special Food Processing Fund of Rs. 2,000 crore (US$ 242.72 million) was set up with National Bank for Agriculture and Rural Development (NABARD) to provide affordable credit for investments in setting up Mega Food Parks (MFP) as well as processing units in the MFPs.

- In July 2022, Deendayal Port Authority (DPA) announced plans to develop two Mega Cargo Handling Terminals on a Build-Operate-Transfer (BOT) basis under Public-Private Partnership (PPP) Mode at an estimated cost of Rs. 5,963 crore (US$ 747.64 million).

- In July 2022, the Union Cabinet chaired by Prime Minister Mr. Narendra Modi, approved the signing of the Memorandum of Understanding (MoU) between India & Maldives. This MoU will provide a platform to tap the benefits of information technology for court digitization and can be a potential growth area for IT companies and start-ups in both countries.

- India and Namibia entered a Memorandum of Understanding (MoU) on wildlife conservation and sustainable biodiversity utilization on July 20th, 2022, for establishing the cheetah into the historical range in India.

- In July 2022, the Reserve Bank of India (RBI) approved international trade settlements in Indian rupees (Rs.) in order to promote the growth of global trade with emphasis on exports from India and to support the increasing interest of the global trading community.

- The Agnipath Scheme aims to develop a young and skilled armed force backed by an advanced warfare technology scheme by providing youth with an opportunity to serve Indian Army for a 4-year period. It is introduced by the Government of India on June 14th, 2022.

- In June 2022, Prime Minister Mr. Narendra Modi inaugurated and laid the foundation stone of development projects worth Rs. 21,000 crore (US$ 2.63 billion) at Gujarat Gaurav Abhiyan at Vadodara.

- Mr. Rajnath Singh, Minister of Defence, launched 75 newly developed Artificial Intelligence (AI) products/technologies during the first-ever ‘AI in Defence’ (AIDef) symposium and exhibition organized by the Ministry of Defence in New Delhi on July 11th, 2022.

- In June 2022, Prime Minister Mr. Narendra Modi laid the foundation stone of 1,406 projects worth more than Rs. 80,000 crore (US$ 10.01 billion) at the ground-breaking ceremony of the UP Investors Summit in Lucknow. The Projects encompass diverse sectors like Agriculture and Allied industries, IT and Electronics, MSME, Manufacturing, Renewable Energy, Pharma, Tourism, Defence & Aerospace, and Handloom & Textiles.

- The Indian Institute of Spices Research (IISR) under the Indian Council for Agricultural Research (ICAR) inked a Memorandum of Understanding (MoU) with Lysterra LLC, a Russia-based company for the commercialization of bio capsule, an encapsulation technology for bio-fertilization on June 30th, 2022.

- As of April 2022, India signed 13 Free Trade Agreements (FTAs) with its trading partners including major trade agreements like the India-UAE Comprehensive Partnership Agreement (CEPA) and the India-Australia Economic Cooperation and Trade Agreement (IndAus ECTA).

- 'Mission Shakti' was applicable with effect from April 1st, 2022, aimed at strengthening interventions for women’s safety, security, and empowerment.

- The Union Budget of 2022-23 was presented on February 1st, 2022, by the Minister for Finance & Corporate Affairs, Ms. Nirmala Sitharaman. The budget had four priorities PM GatiShakti, Inclusive Development, Productivity Enhancement and Investment, and Financing of Investments. In the Union Budget 2022-23, effective capital expenditure is expected to increase by 27% at Rs. 10.68 trillion (US$ 142.93 billion) to boost the economy. This will be 4.1% of the total Gross Domestic Production (GDP).

- Strengthening of Pharmaceutical Industry (SPI) was launched in March 2022 by the Ministry of Chemicals & Fertilisers to provide credit linked capital and interest subsidy for Technology Upgradation of MSME units in pharmaceutical sector, as well as support of up to Rs. 20 crore (US$ 2.4 million) each for common facilities including Research centre, testing labs and ETPs (Effluent Treatment Plant) in Pharma Clusters, to enhance the role of MSMEs.

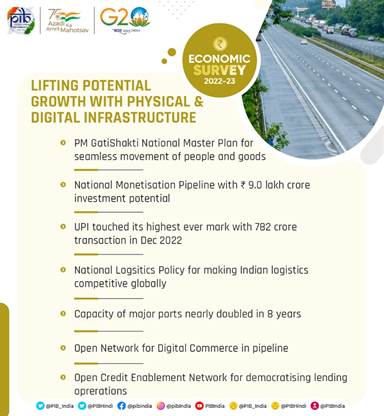

- Under PM GatiShakti Master Plan, the National Highway Network will develop 25,000 km of new highways network, which will be worth Rs. 20,000 crore (US$ 2.67 billion). In 2022-23. Increased government expenditure is expected to attract private investments, with a production-linked incentive scheme providing excellent opportunities. Consistently proactive, graded, and measured policy support is anticipated to boost the Indian economy.

- In February 2022, The Ministry of Social Justice & Empowerment launched the Scheme for Economic Empowerment of Denotified/Nomadic/SemiNomadic tribal communities (DNTs) (SEED) to provide basic facilities like good quality coaching, and health insurance. livelihoods initiative at a community level and financial assistance for the construction of houses.

- In February 2022, Minister for Finance and Corporate Affairs Ms. Nirmala Sitharaman said that productivity linked incentive (PLI) schemes would be extended to 14 sectors to achieve the mission of AtmaNirbhar Bharat and create 60 lakh jobs with an additional production capacity of Rs. 30 trillion (US$ 401.49 billion) in the next five years.

- In the Union Budget of 2022-23, the government announced funding for the production-linked incentive (PLI) scheme for domestic solar cells and module manufacturing of Rs. 24,000 crore (US$ 3.21 billion).

- In the Union Budget of 2022-23, the government announced a production-linked incentive (PLI) scheme for Bulk Drugs which was an investment of Rs. 2,500 crore (US$ 334.60 million).

- In the Union Budget of 2022, Minister for Finance & Corporate Affairs Ms. Nirmala Sitharaman announced that a scheme for design-led manufacturing in 5G would be launched as part of the PLI scheme.

- In September 2021, Union Cabinet approved major reforms in the telecom sector, which are expected to boost employment, growth, competition, and consumer interests. Key reforms include rationalization of adjusted gross revenue, rationalization of bank guarantees (BGs), and encouragement of spectrum sharing.

- In the Union Budget of 2022-23, the government has allocated Rs. 44,720 crore (US$ 5.98 billion) to Bharat Sanchar Nigam Limited (BSNL) for capital investments in the 4G spectrum.

- Minister for Finance & Corporate Affairs Ms. Nirmala Sitharaman allocated Rs. 650 crore (US$ 86.69 million) for the Deep Ocean mission that seeks to explore vast marine living and non-living resources. Department of Space (DoS) has got Rs. 13,700 crore (US$ 1.83 billion) in 2022-23 for several key space missions like Gaganyaan, Chandrayaan-3, and Aditya L-1 (sun).

- In May 2021, the government approved the production-linked incentive (PLI) scheme for manufacturing advanced chemistry cell (ACC) batteries at an estimated outlay of Rs. 18,100 crore (US$ 2.44 billion); this move is expected to attract domestic and foreign investments worth Rs. 45,000 crore (US$ 6.07 billion).

- Minister for Finance & Corporate Affairs Ms. Nirmala Sitharaman announced in the Union Budget of 2022-23 that the Reserve Bank of India (RBI) would issue Digital Rupee using blockchain and other technologies.

- In the Union Budget of 2022-23, Railway got an investment of Rs. 2.38 trillion (US$ 31.88 billion) and over 400 new high-speed trains were announced. The concept of "One Station, One Product" was also introduced.

- To boost competitiveness, Budget 2022-23 has announced reforming the 16-year-old Special Economic Zone (SEZ) act.

- In June 2021, the RBI (Reserve Bank of India) announced that the investment limit for FPI (foreign portfolio investors) in the State Development Loans (SDLs) and government securities (G-secs) would persist unaffected at 2% and 6%, respectively, in FY22.

- In November 2020, the Government of India announced Rs. 2.65 trillion (US$ 36 billion) stimulus package to generate job opportunities and provide liquidity support to various sectors such as tourism, aviation, construction, and housing. Also, India's cabinet approved the production-linked incentives (PLI) scheme to provide ~Rs. 2 trillion (US$ 27 billion) over five years to create jobs and boost production in the country.

- Numerous foreign companies are setting up their facilities in India on account of various Government initiatives like Make in India and Digital India. Prime Minister of India Mr. Narendra Modi launched the Make in India initiative with an aim to boost the country's manufacturing sector and increase the purchasing power of the average Indian consumer, which would further drive demand and spur development, thus benefiting investors. The Government of India, under its Make in India initiative, is trying to boost the contribution made by the manufacturing sector with an aim to take it to 25% of the GDP from the current 17%. Besides, the government has also come up with the Digital India initiative, which focuses on three core components: the creation of digital infrastructure, delivering services digitally, and increasing digital literacy.

- On January 29th, 2022, the National Asset Reconstruction Company Ltd (NARCL) will acquire bad loans worth up to Rs. 50,000 crore (US$ 6.69 billion) about 15 accounts by March 31st, 2022. India Debt Resolution Co. Ltd (IDRCL) will control the resolution process. This will clean up India's financial system and help fuel liquidity and boost the Indian economy.

- National Bank for Financing Infrastructure and Development (NaBFID) is a bank that will provide non-recourse infrastructure financing and is expected to support projects from the first quarter of FY23; it is expected to raise Rs. 4 trillion (US$ 53.58 billion) in the next three years.

- By November 1st, 2021, India, and the United Kingdom hope to begin negotiations on a free trade agreement. The proposed FTA between these two countries is likely to unlock business opportunities and generate jobs. Both sides have renewed their commitment to boost trade in a manner that benefits all.

- In August 2021, Prime Minister Mr. Narendra Modi announced an initiative to start a national mission to reach the US$ 400 billion merchandise export target by FY22.

- In August 2021, Prime Minister Mr. Narendra Modi launched a digital payment solution, e-RUPI, a contactless and cashless instrument for digital payments.

- In April 2021, Dr. Ahmed Abdul Rahman AlBanna, Ambassador of the UAE to India and Founding Patron of IFIICC, stated that trilateral trade between India, the UAE and Israel is expected to reach US$ 110 billion by 2030.

- India is expected to attract investment of around US$ 100 billion in developing the oil and gas infrastructure during 2019-23.

- The Government of India is expected to increase public health spending to 2.5% of the GDP by 2025.

In the second quarter of FY24, the growth momentum of the first quarter was sustained, and high-frequency indicators (HFIs) performed well in July and August of 2023. India's comparatively strong position in the external sector reflects the country's generally positive outlook for economic growth and rising employment rates. India ranked 5th in foreign direct investment inflows among the developed and developing nations listed for the first quarter of 2022.

India's economic story during the first half of the current financial year highlighted the unwavering support the government gave to its capital expenditure, which, in 2023-24, stood 37.4% higher than the same period last year. In the budget of 2023-24, capital expenditure took lead by steeply increasing the capital expenditure outlay by 37.4 % in BE 2023-24 to Rs.10 lakh crore (US$ 120.12 billion) over Rs. 7.28 lakh crore (US$ 87.45 billion) in RE 2022-23. The ratio of revenue expenditure to capital outlay increased by 1.2% in the current year, signalling a clear change in favour of higher-quality spending. Stronger revenue generation because of improved tax compliance, increased profitability of the company, and increasing economic activity also contributed to rising capital spending levels. Further, In the interim budget for FY24, Government increased FY25 Capex outlay to record Rs.11.11 lakh crore (US$ 133.5 billion).

Since India’s resilient growth despite the global pandemic, India's exports climbed at the second-highest rate with a year-over-year (YoY) growth of 8.39% in merchandise exports and a 29.82% growth in service exports till April 2023. With a reduction in port congestion, supply networks are being restored. The CPI-C inflation reduction from June 2022 already reflects the impact. In September 2023 (Provisional), CPI-C inflation was 5.02%, down from 7.01% in June 2022. With a proactive set of administrative actions by the government, flexible monetary policy, and a softening of global commodity prices and supply-chain bottlenecks, inflationary pressures in India look to be on the decline overall.

Note: Conversion rate used for January 2024 is Rs.1 = US$ 0.012

Not a member

India Better Positioned to Navigate Global Headwinds Than Other Major Emerging Economies: New World Bank Report

NEW DELHI, 06 December 2022 – India’s economy has demonstrated resilience despite a challenging external environment , says the World Bank in its latest India Development Update, a World Bank flagship publication. The report titled “ Navigating the Storm ”, finds that while the deteriorating external environment will weigh on India’s growth prospects, the economy is relatively well positioned to weather global spillovers compared to most other emerging markets.

Impact of a tightening global monetary policy cycle, slowing global growth and elevated commodity prices will mean that the Indian economy will experience lower growth in 2022-23 financial year compared to 2021-22. Despite these challenges, the update expects India to register a strong GDP growth and remain one of the fasted growing major economies in the world, due to robust domestic demand.

The World Bank has revised its 2022-23 GDP forecast upward to 6.9 percent from 6.5 percent (in October 2022), considering a strong outturn in India in the second quarter (July-September) of the 2022-23 financial year.

"India’s economy has been remarkably resilient to the deteriorating external environment, and strong macroeconomic fundamentals have placed it in good stead compared to other emerging market economies," said Auguste Tano Kouame, World Bank's Country Director in India. “ However, continued vigilance is required as adverse global developments persist. ”

The report forecasts that the India economy will grow at slightly lower rate of 6.6 percent in the 2023-24 fiscal year. A challenging external environment will affect India’s economic outlook through different channels. The report states that rapid monetary policy tightening in advanced economies has already resulted in large portfolio outflows and depreciation of the Indian Rupee while high global commodity prices have led to a widening of the current account deficit.

However, it argues that India’s economy is relatively insulated from global spillovers compared to other emerging markets. This is partly because India has a large domestic market and is relatively less exposed to international trade flows. The report finds that while a 1 percentage point decline in growth in the US is associated with a 0.4 percentage point decline in India’s growth, the effect is around 1.5 times larger for other emerging economies. Analysis for growth spillovers from the EU and China also yields similar results.

India’s external position has also improved considerably over the past decade. The current-account deficit is adequately financed by improving foreign direct investment inflows and a solid cushion of foreign exchange reserves (India has one of the largest holdings of international reserves in the world).

Policy reforms and prudent regulatory measures have also played a key role in developing resilience in the economy . Increased reliance on market borrowings has improved the transparency and credibility of fiscal policy and the government has diversified the investor base for government securities. The introduction of a formal inflation targeting framework during the past decade was an important step in lending credibility to monetary policy decisions. While there are still some challenges in the financial sector, the adoption of several regulatory and policy measures— including the introduction of a new Insolvency and Bankruptcy Code and the creation of the new National Reconstruction Company Limited— facilitated an improvement in financial sector metrics over the past five years; these policy interventions are also expected to help alleviate pressures related to non-performing loans.

“A well-crafted and prudent policy response to global spillovers is helping India navigate global and domestic challenges,” said Dhruv Sharma, Senior Economist, World Bank, and lead author of the report .

The report notes that both levers of macroeconomic policy – fiscal and monetary – have played a role in managing the challenges that have emerged over the past year. The report notes that the RBI withdrew accommodative monetary policy settings in a measured approach as it balanced the need to rein in inflation while continuing to support economic growth. Fiscal policy supported the central bank’s rate actions by cutting excise duty and other taxes on fuel to moderate the impact of higher global oil prices on inflation. However, the report also cautions that there is a trade-off between trying to limit the adverse impact of global spillovers on India’s growth and available policy space.

- World Bank India Website

- Website World Bank India on Facebook

- World Bank India on Twitter

This site uses cookies to optimize functionality and give you the best possible experience. If you continue to navigate this website beyond this page, cookies will be placed on your browser. To learn more about cookies, click here .

The Economic Times daily newspaper is available online now.

The state of the indian economy: 2022 roundup.

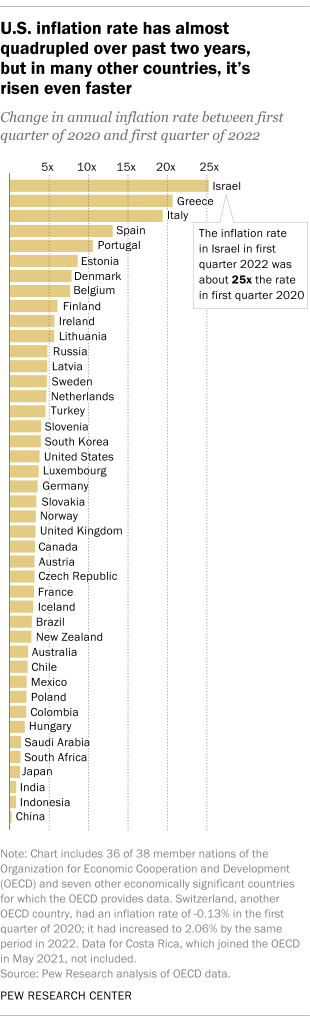

Retail inflation, as reflected by the Consumer Price Index, remained above the RBI’s upper tolerability level of 6% for 10 consecutive months to November, when it eased slightly to 5.88%. Retail inflation recorded an eight-year high in April, with rural inflation rising to 8.4% and urban inflation being recorded at 7.1%.

Dhiraj Relli

With a career spanning over two decades, Relli brings to the table a wealth of experience in banking... Show more »

Read More News on

Download The Economic Times News App to get Daily Market Updates & Live Business News.

Subscribe to The Economic Times Prime and read the Economic Times ePaper Online.and Sensex Today .

Top Trending Stocks: SBI Share Price , Axis Bank Share Price , HDFC Bank Share Price , Infosys Share Price , Wipro Share Price , NTPC Share Price

- View More Stories

Find this comment offensive?

Choose your reason below and click on the Report button. This will alert our moderators to take action

Reason for reporting:

Your Reason has been Reported to the admin.

To post this comment you must

Log In/Connect with:

Fill in your details:

Will be displayed

Will not be displayed

Share this Comment:

Uh-oh this is an exclusive story available for selected readers only..

Worry not. You’re just a step away.

Prime Account Detected!

It seems like you're already an ETPrime member with

Login using your ET Prime credentials to enjoy all member benefits

Log out of your current logged-in account and log in again using your ET Prime credentials to enjoy all member benefits.

To read full story, subscribe to ET Prime

₹34 per week

Billed annually at ₹2499 ₹1749

Super Saver Sale - Flat 30% Off

On ET Prime Membership

Unlock this story and enjoy all members-only benefits.

Offer Exclusively For You

Save up to Rs. 700/-

ON ET PRIME MEMBERSHIP

Get 1 Year Free

With 1 and 2-Year ET prime membership

Get Flat 40% Off

Then ₹ 1749 for 1 year

ET Prime at ₹ 49 for 1 month

Stay Ahead in the New Financial Year

Get flat 20% off on ETPrime

90 Days Prime access worth Rs999 unlocked for you

Exclusive Economic Times Stories, Editorials & Expert opinion across 20+ sectors

Stock analysis. Market Research. Industry Trends on 4000+ Stocks

Get 1 Year Complimentary Subscription of TOI+ worth Rs.799/-

Stories you might be interested in

SUMMARY OF THE ECONOMIC SURVEY 2022-23

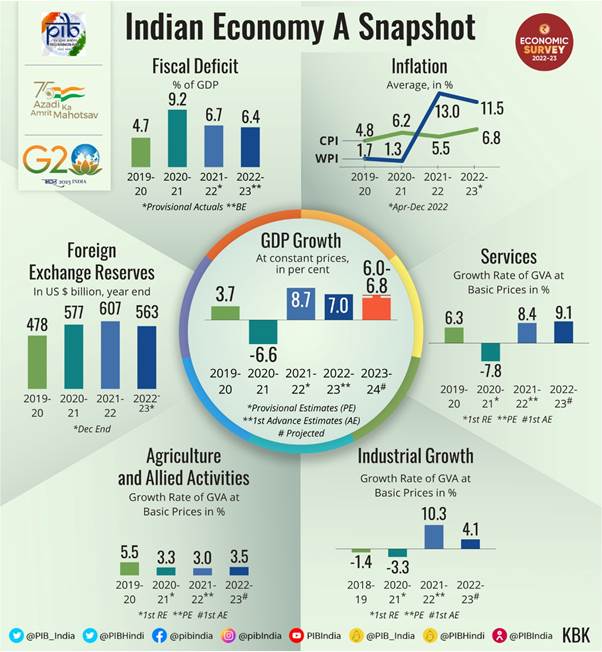

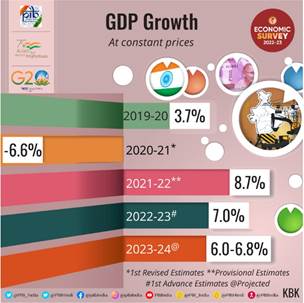

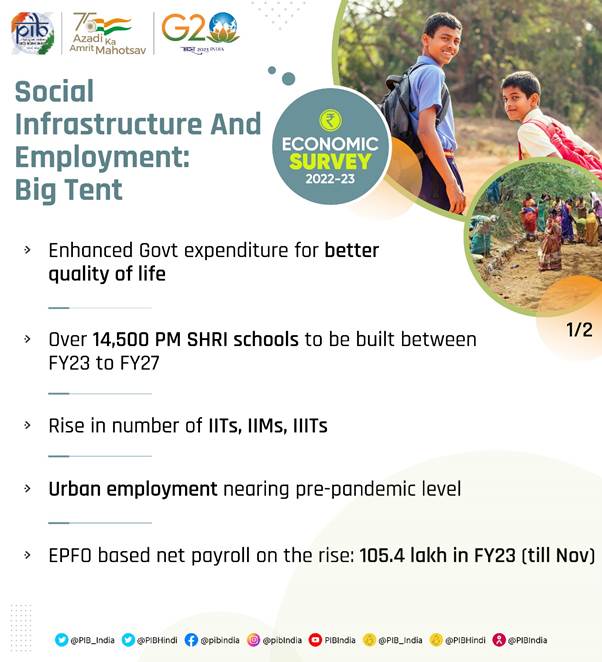

India to witness gdp growth of 6.0 per cent to 6.8 per cent in 2023-24, depending on the trajectory of economic and political developments globally economic survey 2022-23 projects a baseline gdp growth of 6.5 per cent in real terms in fy24 economy is expected to grow at 7 per cent (in real terms) for the year ending march 2023, this follows an 8.7 per cent growth in the previous financial year credit growth to the micro, small, and medium enterprises (msme) sector has been remarkably high, over 30.5 per cent, on average during jan-nov 2022 capital expenditure (capex) of the central government, which increased by 63.4 per cent in the first eight months of fy23, was another growth driver of the indian economy in the current year rbi projects headline inflation at 6.8 per cent in fy23, which is outside its target range return of migrant workers to construction activities helped housing market witnessing a significant decline in inventory overhang to 33 months in q3 of fy23 from 42 months last year surge in growth of exports in fy22 and the first half of fy23 induced a shift in the gears of the production processes from mild acceleration to cruise mode private consumption as a percentage of gdp stood at 58.4 per cent in q2 of fy23, the highest among the second quarters of all the years since 2013-14, supported by a rebound in contact-intensive services such as trade, hotel and transport survey points to the lower forecast for growth in global trade by the world trade organisation, from 3.5 per cent in 2022 to 1.0 per cent in 2023.

India to witness GDP growth of 6.0 per cent to 6.8 per cent in 2023-24, depending on the trajectory of economic and political developments globally.

The optimistic growth forecasts stem from a number of positives like the rebound of private consumption given a boost to production activity, higher Capital Expenditure (Capex), near-universal vaccination coverage enabling people to spend on contact-based services, such as restaurants, hotels, shopping malls, and cinemas, as well as the return of migrant workers to cities to work in construction sites leading to a significant decline in housing market inventory, the strengthening of the balance sheets of the Corporates, a well-capitalised public sector banks ready to increase the credit supply and the credit growth to the Micro, Small, and Medium Enterprises (MSME) sector to name the major ones.

The Union Minister for Finance & Corporate Affairs Smt. Nirmala Sitharaman tabled the Economic Survey 2022-23 in Parliament today, which projects a baseline GDP growth of 6.5 per cent in real terms in FY24. The projection is broadly comparable to the estimates provided by multilateral agencies such as the World Bank, the IMF, and the ADB and by RBI, domestically.

It says, growth is expected to be brisk in FY24 as a vigorous credit disbursal, and capital investment cycle is expected to unfold in India with the strengthening of the balance sheets of the corporate and banking sectors. Further support to economic growth will come from the expansion of public digital platforms and path-breaking measures such as PM GatiShakti, the National Logistics Policy, and the Production-Linked Incentive schemes to boost manufacturing output.

The Survey says, in real terms, the economy is expected to grow at 7 per cent for the year ending March 2023. This follows an 8.7 per cent growth in the previous financial year.

Despite the three shocks of COVID-19, Russian-Ukraine conflict and the Central Banks across economies led by Federal Reserve responding with synchronised policy rate hikes to curb inflation, leading to appreciation of US Dollar and the widening of the Current Account Deficits (CAD) in net importing economies, agencies worldwide continue to project India as the fastest-growing major economy at 6.5-7.0 per cent in FY23.

According to Survey, India’s economic growth in FY23 has been principally led by private consumption and capital formation and they have helped generate employment as seen in the declining urban unemployment rate and in the faster net registration in Employee Provident Fund. Moreover, World’s second-largest vaccination drive involving more than 2 billion doses also served to lift consumer sentiments that may prolong the rebound in consumption. Still, private capex soon needs to take up the leadership role to put job creation on a fast track.

It also points out that the upside to India’s growth outlook arises from (i) limited health and economic fallout for the rest of the world from the current surge in Covid-19 infections in China and, therefore, continued normalisation of supply chains; (ii) inflationary impulses from the reopening of China’s economy turning out to be neither significant nor persistent; (iii) recessionary tendencies in major Advanced Economies (AEs) triggering a cessation of monetary tightening and a return of capital flows to India amidst a stable domestic inflation rate below 6 per cent; and (iv) this leading to an improvement in animal spirits and providing further impetus to private sector investment.

The Survey says, the credit growth to the Micro, Small, and Medium Enterprises (MSME) sector has been remarkably high, over 30.6 per cent, on average during Jan-Nov 2022, supported by the extended Emergency Credit Linked Guarantee Scheme (ECLGS) of the Union government. It adds that the recovery of MSMEs is proceeding apace, as is evident in the amounts of Goods and Services Tax (GST) they pay, while the Emergency Credit Linked Guarantee Scheme (ECGLS) is easing their debt servicing concerns.

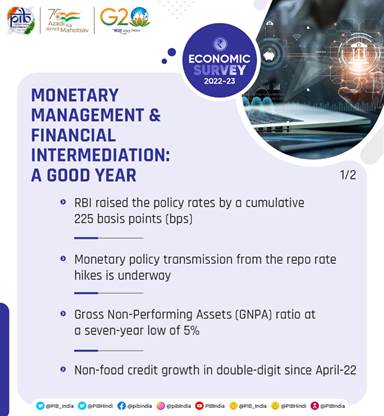

Apart from this, increase in the overall bank credit has also been influenced by the shift in borrower’s funding choices from volatile bond markets, where yields have increased, and external commercial borrowings, where interest and hedging costs have increased, towards banks. If inflation declines in FY24 and if real cost of credit does not rise, then credit growth is likely to be brisk in FY24.

The Capital Expenditure (Capex) of the central government, which increased by 63.4 per cent in the first eight months of FY23, was another growth driver of the Indian economy in the current year, crowding in the private Capex since the January-March quarter of 2022. On current trend, it appears that the full year’s capital expenditure budget will be met. A sustained increase in private Capex is also imminent with the strengthening of the balance sheets of the Corporates and the consequent increase in credit financing it has been able to generate.

Dwelling on halt in construction activities during the Pandemic, the Survey underscores that vaccinations have facilitated the return of migrant workers to cities to work in construction sites as the rebound in consumption spilled over into the housing market. This is evident in the housing market witnessing a significant decline in inventory overhang to 33 months in Q3 of FY23 from 42 months last year.

It also says that the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS) has been directly providing jobs in rural areas and indirectly creating opportunities for rural households to diversify their sources of income generation. Schemes like PM-Kisan and PM Garib Kalyan Yojana have helped in ensuring food security in the country, and their impact was also endorsed by the United Nations Development Programme (UNDP). The results of the National Family Health Survey (NFHS) also show improvement in rural welfare indicators from FY16 to FY20, covering aspects like gender, fertility rate, household amenities, and women empowerment.

The Survey notes with optimism that Indian economy appears to have moved on after its encounter with the pandemic, staging a full recovery in FY22 ahead of many nations and positioning itself to ascend to the pre-pandemic growth path in FY23. Yet in the current year, India has also faced the challenge of reining in inflation that the European strife accentuated. Measures taken by the government and RBI, along with the easing of global commodity prices, have finally managed to bring retail inflation below the RBI upper tolerance target in November 2022.

It, however, cautions that the challenge of the depreciating rupee, although better performing than most other currencies, persists with the likelihood of further increases in policy rates by the US Fed. The widening of the CAD may also continue as global commodity prices remain elevated and the growth momentum of the Indian economy remains strong. The loss of export stimulus is further possible as the slowing world growth and trade shrinks the global market size in the second half of the current year.

Therefore, the Global growth has been projected to decline in 2023 and is expected to remain generally subdued in the following years as well. The slowing demand will likely push down global commodity prices and improve India’s CAD in FY24. However, a downside risk to the Current Account Balance stems from a swift recovery driven mainly by domestic demand, and to a lesser extent, by exports. It also adds that the CAD needs to be closely monitored as the growth momentum of the current year spills over into the next.

The Survey brings to the fore an interesting fact that in general, global economic shocks in the past were severe but spaced out in time, but this changed in the third decade of this millennium, as at least three shocks have hit the global economy since 2020.

It all started with the pandemic-induced contraction of the global output, followed by the Russian-Ukraine conflict leading to a worldwide surge in inflation. Then, the central banks across economies led by the Federal Reserve responded with synchronised policy rate hikes to curb inflation. The rate hike by the US Fed drove capital into the US markets causing the US Dollar to appreciate against most currencies. This led to the widening of the Current Account Deficits (CAD) and increased inflationary pressures in net importing economies.

The rate hike and persistent inflation also led to a lowering of the global growth forecasts for 2022 and 2023 by the IMF in its October 2022 update of the World Economic Outlook. The frailties of the Chinese economy further contributed to weakening the growth forecasts. Slowing global growth apart from monetary tightening may also lead to a financial contagion emanating from the advanced economies where the debt of the non-financial sector has risen the most since the global financial crisis. With inflation persisting in the advanced economies and the central banks hinting at further rate hikes, downside risks to the global economic outlook appear elevated.

India’s Economic Resilience and Growth Drivers

The Survey points out that factors like monetary tightening by the RBI, the widening of the CAD, and the plateauing growth of exports have essentially been the outcome of geopolitical strife in Europe. As these developments posed downside risks to the growth of the Indian economy in FY23, many agencies worldwide have been revising their growth forecast of the Indian economy downwards. These forecasts, including the advance estimates released by the NSO, now broadly lie in the range of 6.5-7.0 per cent.

Despite the downward revision, the growth estimate for FY23 is higher than for almost all major economies and even slightly above the average growth of the Indian economy in the decade leading up to the pandemic.

IMF estimates India to be one of the top two fast-growing significant economies in 2022. Despite strong global headwinds and tighter domestic monetary policy, if India is still expected to grow between 6.5 and 7.0 per cent, and that too without the advantage of a base effect, it is a reflection of India’s underlying economic resilience; of its ability to recoup, renew and re-energise the growth drivers of the economy. India’s economic resilience can be seen in the domestic stimulus to growth seamlessly replacing the external stimuli. The growth of exports may have moderated in the second half of FY23. However, their surge in FY22 and the first half of FY23 induced a shift in the gears of the production processes from mild acceleration to cruise mode.

Manufacturing and investment activities consequently gained traction. By the time the growth of exports moderated, the rebound in domestic consumption had sufficiently matured to take forward the growth of India’s economy. Private Consumption as a percentage of GDP stood at 58.4 per cent in Q2 of FY23, the highest among the second quarters of all the years since 2013-14, supported by a rebound in contact-intensive services such as trade, hotel and transport, which registered sequential growth of 16 per cent in real terms in Q2 of FY23 compared to the previous quarter.

Although domestic consumption rebounded in many economies, the rebound in India was impressive for its scale. It contributed to a rise in domestic capacity utilisation. Domestic private consumption remains buoyant in November 2022. Moreover, RBI’s most recent survey of consumer confidence released in December 2022 pointed to improving sentiment with respect to current and prospective employment and income conditions.

The Survey also points to another recovery and adds that the “release of pent-up demand” was reflected in the housing market too as demand for housing loans picked up. Consequently, housing inventories have declined, prices are firming up, and construction of new dwellings is picking up pace and this has stimulated innumerable backward and forward linkages that the construction sector is known to carry. The universalisation of vaccination coverage also has a significant role in lifting the housing market as, in its absence, the migrant workforce could not have returned to construct new dwellings.

Apart from housing, construction activity, in general, has significantly risen in FY23 as the much-enlarged capital budget (Capex) of the central government and its public sector enterprises is rapidly being deployed.

Going by the Capex multiplier estimated for the country, the economic output of the country is set to increase by at least four times the amount of Capex. States, in aggregate, are also performing well with their Capex plans. Like the central government, states also have a larger capital budget supported by the centre’s grant-in-aid for capital works and an interest-free loan repayable over 50 years.

Also, a capex thrust in the last two budgets of the Government of India was not an isolated initiative meant only to address the infrastructure gaps in the country. It was part of a strategic package aimed at crowding-in private investment into an economic landscape broadened by the vacation of non-strategic PSEs (disinvestment) and idling public sector assets.

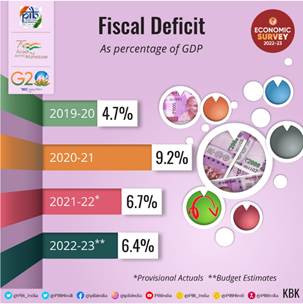

Here, three developments support this firstly the significant increase in the Capex budget in FY23, as well as its high rate of spending, secondly direct tax revenue collections have been highly buoyant, and so have GST collections, which should ensure the full expending of the Capex budget within the budgeted fiscal deficit. The growth in revenue expenditure has also been limited to pave the way for higher growth in Capex and thirdly the pick-up in private sector investment since the January-March quarter of 2022. Evidence shows an increasing trend in announced projects and capex spending by the private players.

While an increase in export demand, rebound in consumption, and public capex have contributed to a recovery in the investment/manufacturing activities of the corporates, their stronger balance sheets have also played a big part equal measure to realising their spending plans. As per the data on non-financial debt from the Bank for International Settlements, in the course of the last decade, Indian non-financial private sector debt and non-financial corporate debt as a share of GDP declined by nearly thirty percentage points.

The banking sector in India has also responded in equal measure to the demand for credit as the Year-on-Year growth in credit since the January-March quarter of 2022 has moved into double-digits and is rising across most sectors.

The finances of the public sector banks have seen a significant turnaround, with profits being booked at regular intervals and their Non-Performing Assets (NPAs) being fast-tracked for quicker resolution/liquidation by the Insolvency and Bankruptcy Board of India (IBBI). At the same time, the government has been providing adequate budgetary support for keeping the PSBs well-capitalized, ensuring that their Capital Risk-Weighted Adjusted Ratio (CRAR) remains comfortably above the threshold levels of adequacy. Nonetheless, financial strength has helped banks make up for lower debt financing provided by corporate bonds and External Commercial Borrowings (ECBs) so far in FY23. Rising yields on corporate bonds and higher interest/hedging costs on ECBs have made these instruments less attractive than the previous year.

RBI has projected headline inflation at 6.8 per cent in FY23, which is outside its target range. At the same time, it is not high enough to deter private consumption and also not so low as to weaken the inducement to invest.

Macroeconomic and Growth Challenges in the Indian Economy

After the impact of the two waves of the pandemic seen in a significant GDP contraction in FY21, the quick recovery from the virus in third wave of Omicron contributed to minimising the loss of economic output in the January-March quarter of 2022. Consequently, output in FY22 went past its pre-pandemic level in FY20, with the Indian economy staging a full recovery ahead of many nations. However, the conflict in Europe necessitated a revision in expectations for economic growth and inflation in FY23. The country’s retail inflation had crept above the RBI’s tolerance range in January 2022 and it remained above the target range for ten months before returning to below the upper end of the target range of 6 per cent in November 2022.

It says that the Global commodity prices may have eased but are still higher compared to pre-conflict levels and they have further widened the CAD, already enlarged by India's growth momentum. For FY23, India has sufficient forex reserves to finance the CAD and intervene in the forex market to manage volatility in the Indian rupee.

Outlook: 2023-24

Dwelling on the Outlook for 2023-24, the Survey says, India’s recovery from the pandemic was relatively quick, and growth in the upcoming year will be supported by solid domestic demand and a pickup in capital investment. It says that aided by healthy financials, incipient signs of a new private sector capital formation cycle are visible and more importantly, compensating for the private sector’s caution in capital expenditure, the government raised capital expenditure substantially.

Budgeted capital expenditure rose 2.7 times in the last seven years, from FY16 to FY23, re-invigorating the Capex cycle. Structural reforms such as the introduction of the Goods and Services Tax and the Insolvency and Bankruptcy Code enhanced the efficiency and transparency of the economy and ensured financial discipline and better compliance, the Survey added.

Global growth is forecasted to slow from 3.2 per cent in 2022 to 2.7 per cent in 2023 as per IMF’s World Economic Outlook, October 2022. A slower growth in economic output coupled with increased uncertainty will dampen trade growth. This is seen in the lower forecast for growth in global trade by the World Trade Organisation, from 3.5 per cent in 2022 to 1.0 per cent in 2023.

On the external front, risks to the current account balance stem from multiple sources. While commodity prices have retreated from record highs, they are still above pre-conflict levels. Strong domestic demand amidst high commodity prices will raise India’s total import bill and contribute to unfavourable developments in the current account balance. These may be exacerbated by plateauing export growth on account of slackening global demand. Should the current account deficit widen further, the currency may come under depreciation pressure.

Entrenched inflation may prolong the tightening cycle, and therefore, borrowing costs may stay ‘higher for longer’. In such a scenario, global economy may be characterised by low growth in FY24. However, the scenario of subdued global growth presents two silver linings – oil prices will stay low, and India’s CAD will be better than currently projected. The overall external situation will remain manageable.

India’s Inclusive Growth

The Survey emphasises that growth is inclusive when it creates jobs. Both official and unofficial sources confirm that employment levels have risen in the current financial year, as the Periodic Labour Force Survey (PLFS) shows that the urban unemployment rate for people aged 15 years and above declined from 9.8 per cent in the quarter ending September 2021 to 7.2 per cent one year later (quarter ending September 2022). This is accompanied by an improvement in the labour force participation rate (LFPR) as well, confirming the emergence of the economy out of the pandemic-induced slowdown early in FY23.

In FY21, the Government announced the Emergency Credit Line Guarantee Scheme, which succeeded in shielding micro, small and medium enterprises from financial distress. A recent CIBIL report (ECLGS Insights, August 2022) showed that the scheme has supported MSMEs in facing the COVID shock, with 83 per cent of the borrowers that availed of the ECLGS being micro-enterprises. Among these micro units, more than half had an overall exposure of less than Rs10 lakh.

Furthermore, the CIBIL data also shows that ECLGS borrowers had lower non-performing asset rates than enterprises that were eligible for ECLGS but did not avail of it. Further, the GST paid by MSMEs after declining in FY21 has been rising since and now has crossed the pre-pandemic level of FY20, reflecting the financial resilience of small businesses and the effectiveness of the pre-emptive government intervention targeted towards MSMEs.

Moreover, the scheme implemented by the government under the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) has been rapidly creating more assets in respect of “Works on individual’s land” than in any other category. In addition, schemes like PM-KISAN, which benefits households covering half the rural population, and PM Garib Kalyan Anna Yojana have significantly contributed to lessening impoverishment in the country.

The UNDP Report of July 2022 stated that the recent inflationary episode in India would have a low poverty impact due to well-targeted support. In addition, the National Family Health Survey (NFHS) in India shows improved rural welfare indicators from FY16 to FY20, covering aspects like gender, fertility rate, household amenities, and women empowerment.

So far, India has reinforced the country’s belief in its economic resilience as it has withstood the challenge of mitigating external imbalances caused by the Russian-Ukraine conflict without losing growth momentum in the process. India’s stock markets had a positive return in CY22, unfazed by withdrawals by foreign portfolio investors. India’s inflation rate did not creep too far above its tolerance range compared to several advanced nations and regions.

India is the third-largest economy in the world in PPP terms and the fifth-largest in market exchange rates. As expected of a nation of this size, the Indian economy in FY23 has nearly “recouped” what was lost, “renewed” what had paused, and “re-energised” what had slowed during the pandemic and since the conflict in Europe.

The global economy battles through a unique set of challenges

The Survey narrates about six challenges faced by the Global Economy. The three challenges like COVID-19 related disruptions in economies, Russian-Ukraine conflict and its adverse impact along with disruption in supply chain, mainly of food, fuel and fertilizer and the Central Banks across economies led by Federal Reserve responding with synchronised policy rate hikes to curb inflation, leading to appreciation of US Dollar and the widening of the Current Account Deficits (CAD) in net importing economies. The fourth challenge emerged as faced with the prospects of global stagflation, nations, feeling compelled to protect their respective economic space, thus slowing cross-border trade affecting overall growth. It adds that all along, the fifth challenge was festering as China experienced a considerable slowdown induced by its policies. The sixth medium-term challenge to growth was seen in the scarring from the pandemic brought in by the loss of education and income-earning opportunities.

The Survey notes that like the rest of the world, India, too, faced this extraordinary set of challenges but withstood them better than most economies.

In the last eleven months, the world economy has faced almost as many disruptions as caused by the pandemic in two years. The conflict caused the prices of critical commodities such as crude oil, natural gas, fertilisers, and wheat to soar. This strengthened the inflationary pressures that the global economic recovery had triggered, backed by massive fiscal stimuli and ultra-accommodative monetary policies undertaken to limit the output contraction in 2020. Inflation in Advanced Economies (AEs), which accounted for most of the global fiscal expansion and monetary easing, breached historical highs. Rising commodity prices also led to higher inflation in the Emerging Market Economies (EMEs), which otherwise were in the lower inflation zone by virtue of their governments undertaking a calibrated fiscal stimulus to address output contraction in 2020.

The Survey underlines that Inflation and monetary tightening led to a hardening of bond yields across economies and resulted in an outflow of equity capital from most of the economies around the world into the traditionally safe-haven market of the US. The capital flight subsequently led to the strengthening of the US Dollar against other currencies – the US Dollar index strengthened by 16.1 per cent between January and September 2022. The consequent depreciation of other currencies has been widening the CAD and increasing inflationary pressures in the net importing economies.

- International

- Today’s Paper

- Premium Stories

- Express Shorts

- Health & Wellness

- Board Exam Results

Explained: Expected economic recovery, and factors it will depend on

India’s gdp is expected to return to pre-covid levels by the end of 2021-22. but some sectors are struggling more than others, the number of unemployed remains high, and private consumption is low..

By October 2020, official data confirmed that the Indian economy had gone into a technical recession. But since then, the gross domestic product (GDP) has been clawing its way back. As such, at the start of 2021 , it was hoped that India’s growth recovery would start to gather momentum. At that time, the concerns about Covid-19 had also taken a back seat. But a second Covid wave upset all calculations.

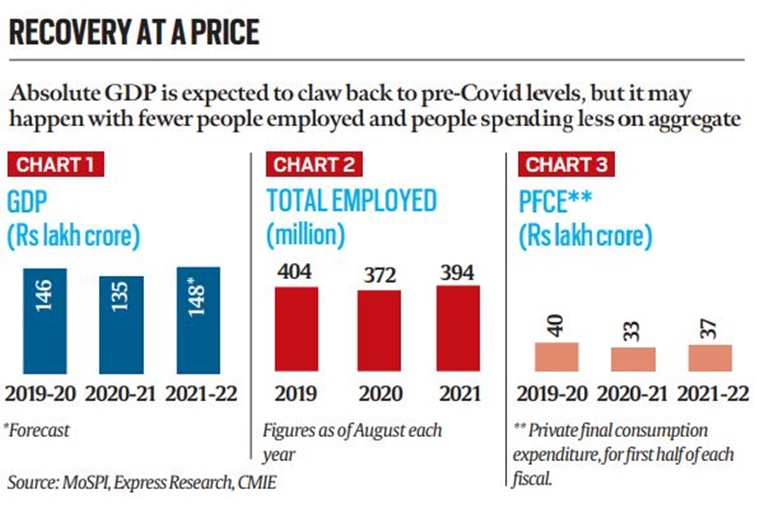

Still, by the end of the financial year 2021-22 , India’s GDP is expected to come back to the pre-Covid level (see the chart below). Given the severity of the second Covid wave, that is a matter of relief.

- Why some student visa hopefuls are attempting to go to Canada on visitor visas

- Explained: The legislations that BJP, Congress, DMK and others have promised in manifestos

- Russia-Ukraine war: Have tanks become obsolete in modern warfare?

K-shaped recovery

The recovery has, however, altered the shape and fabric of the Indian economy. In technical jargon, this is because of a K-shaped recovery. In simple terms, it means that while some sectors/ sections of the economy have registered a very fast recovery, many are still struggling.

The entities that have done well are firms that were already in the formal sector and had the financial wherewithal to survive the repeated lockdowns and disruptions. In fact, many big firms in the formal economy have actually increased their market share during the Covid-19 pandemic and this has come at the cost of smaller, weaker firms that were mostly in the informal sector.

On the face of it, this might appear to be a minor detail. But in India’s case, this shift has massive ramifications. That’s because almost 90% of all employment in India happens in the informal sector. When the medium, small and micro enterprises (MSMEs) lose out to their counterparts in the formal economy, it results in the same GDP being produced with fewer people in jobs.

Unemployment concerns

That is what explains the odd nature of the challenge facing the Indian economy in 2022. While the GDP is expected to recover back to pre-Covid levels — which in itself implies two full years wasted in terms of jobs that would have otherwise been created, incomes that would have been earned, and expenditures that would have been made — the same cannot be said about total employment in the country (see the chart above).

Not only was the total number of employed people as of August 2021 lower than the August 2019 level, the August 2019 level itself was lower than the August 2016 level — pointing to a stagnant employment situation over the past many years.

For one, this means that even an easing of the situation will require time, because we are talking about tens of millions of unemployed people. Two, it requires the government to actively act in a manner that tries to address the change of shift introduced by Covid.

Three, in the interim, such persistently high levels of unemployment can pose a challenge for social cohesion. As we witnessed in Haryana and Jharkhand, locals may demand laws to bar migrants from other states.

Private consumption slump

Private consumption expenditure is the biggest engine of GDP growth in India. It accounts for over 55% of all GDP. If this component remains weak, sustained recovery in GDP will not be possible. To a great extent, it is down because of job and income losses. But in part, it also has to do with people wanting to hold back for a rainy day. What if there is another equally severe third wave?

Widening inequalities

The year started with an Oxfam India report that detailed how Covid was widening existing inequalities and it ended with the World Inequality Report pegging India as one of the worst performers. “India stands out as a poor and very unequal country, with an affluent elite,” stated the WIR. While the top 10% and top 1% held respectively 57% and 22% of total national income, the bottom 50% share had gone down to 13%.

What makes this trend even more worrisome is that higher inequalities now also come with rising poverty levels. A study by Santosh Mehrotra and Jajati Parida has found that between 2012 and 2020, India witnessed an increase in the absolute number of poor — the first such reversal in poverty alleviation since Independence.

Persistently high inflation

Typically, there tends to be silver lining in phases when an economy is failing to create many jobs: The inflation rate stays low. But 2021 brought disappointment on that front as well. Between fast GDP growth in developed countries, higher crude oil prices and high domestic taxation, not to mention supply bottlenecks in different commodities, both retail and wholesale inflation stayed too high for comfort.

Indian economy: What lies ahead in 2022

If 2020 was the year when Covid hit India and 2021 was the year when India’s economy recovered from that shock, then 2022 should be the year that will provide a snapshot of the economy as it is coming out of the Covid impact. It can then be compared with how the economy was in 2019 to figure out what has changed and what needs policy attention. Five factors that are likely to play a crucial role in how the economy shapes up in 2022:

OMICRON : The expectation that 2022 will be the first normal year after 2019 completely depends on the assumption that the Omicron variant, which is considered to be far more infectious than the deadly Delta, does not lead to any substantial loss of life and/or economic disruption. But if it does, or if there are other variants that emerge just like they did in April and May 2021, then all bets are off. If that happens, concerns about lives will yet again dominate those about livelihoods. A lot may depend again on the pace of vaccination — including the booster doses.

UNION BUDGET : Presuming no new Covid surges, the focus would shift to the Union Budget, which will be announced on February 1. In times of such upheaval, the Budget is more than just an accounting exercise. The government would be expected to lay out its plan to tackle high unemployment, high inflation, widening inequalities and rising poverty levels. But a lot depends on how the government sees the economic situation. Last year, for example, the government cut its Budget allocation for health by 10%. Former Chief Statistician of India Pronab Sen said, ”The government doesn’t seem to be recognising that (K-shaped recovery) at all in its pronouncements.” Sen said the government has been misdiagnosing the economy for the past five years, especially since demonetisation. “That is what has resulted in formal sector firms increasing the market share at the cost of MSMEs.” This, in turn, gets reflected in both higher tax collections and lower employment levels, he said.

ELECTIONS: The repeal of the three contentious farm laws was another example of how policymaking can be impacted by electoral pressures. In that regard, 2022 is a critical year. Not only does it have seven state Assembly elections, there is also the fact that the BJP is in power in six of them. Consider two polar opposites — one where BJP wins all seven and another where it loses in all — to understand how these elections may impact the central government’s policy choices, especially with general elections due in early 2024.

Newsletter | Click to get the day’s best explainers in your inbox

NPAs: Before Covid disrupted India’s economy, high levels of non-performing assets (NPAs) were one of the biggest stumbling blocks. During Covid, mandatory asset quality reviews have been suspended. But when they are re-started in 2022, Sen said, it is anybody’s guess how high they may jump.

EXTERNAL FACTORS: Several key central banks, especially the US Fed , have started tightening their monetary policy in light of the high inflation in the developed countries. This, in turn, will force India’s RBI to raise interest rates as well. “To a great extent monetary tightening has already happened in India. It is just that no one is talking about it. Look at the 10-year government bond yields. They have gone from 5.7% to 6.4% (since May 2020),” he points out. For Indians, the silver lining is that as monetary tightening happens in the West, crude oil prices may simmer down.

Calendar 2022

- January 7: First Advance Estimates of GDP for the current financial year. These would be crucial because they will form the basis for all calculations in the Union Budget

- January 31: First Revised Estimates (FRE) of GDP for the previous financial year (2020-21). Provisional estimates, announced in May 2021, pegged the GDP to contract by 7.3% in FY21. The FRE will provide greater clarity.

- February 1: Union Budget.

- February 28: Second Advance Estimates of the GDP for the current financial year. This will be an update on the FRE announced on January 7 because it would have the GDP growth estimates of Q3 of the current financial year.

- May 31: The government will announce (i) GDP estimates of Q4 of 2021-22; (ii) Provisional Estimates of GDP for the full financial year of 2021-22.

- August 31: Release of GDP estimates for Q1 of 2022-23.

- November 30: GDP estimates for Q2 of 2022-23.

- Monthly releases: Between the 10th and 15th of each month, the government releases updates of the Index of Industrial Production, Retail Inflation and Wholesale Inflation

I met nobody in rural India who saw Modi as Subscriber Only

How Bengaluru’s lakes disappeared Subscriber Only

Vidya Balan & Pratik Gandhi talk about marriage, infidelity & Subscriber Only

Buoyed by Modi factor, Tejasvi Surya sits pretty in Bangalore Subscriber Only

To survive as an artist today, be a megalomaniac Subscriber Only

How FN Souza's art was perplexing yet arresting Subscriber Only

Lakshya Sen & Priyanshu Rajawat hold the key to India's Subscriber Only

Why Shobhaa De says hunger is underrated

‘High growth not possible if we don’t do our own Subscriber Only

Udit Misra is Deputy Associate Editor. Follow him on Twitter @ieuditmisra ... Read More

- Explained Economics

- Express Explained

The BSEAP is set to announce the AP SSC results 2024 today at 11 M. Over 6.3 lakh students appeared for the exam this year, which was conducted from March 8 to 30. Students can check their scorecards on the official websites or through the direct link provided. Last year, the overall passing percentage was 72.26%.

More Explained

Best of Express

EXPRESS OPINION

Apr 22: Latest News

- 01 Iveco chief Marx quits to become CEO at CNH Industrial

- 02 PBKS vs GT, what caught our eye: Prabhsimran fills in at the start, Harpreet never gets going; Punjab flounder as Ashutosh-Shashank can’t rescue one more time

- 03 SI returning from kin’s funeral dies after his car rams road divider

- 04 Ecuadorians head to polls to toughen fight against gangs behind wave of violence

- 05 Chess Candidates 2024 Live Updates: Gukesh makes history by becoming youngest-ever World Championship contender

- Elections 2024

- Political Pulse

- Entertainment

- Movie Review

- Newsletters

- Gold Rate Today

- Silver Rate Today

- Petrol Rate Today

- Diesel Rate Today

- Web Stories

India could become the world’s 3rd largest economy in the next 5 years. Here's how

India is poised to play defining role in shaping the future of the global economy in 2024 and beyond. Image: Getty Images/iStockphoto

.chakra .wef-1c7l3mo{-webkit-transition:all 0.15s ease-out;transition:all 0.15s ease-out;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;outline:none;color:inherit;}.chakra .wef-1c7l3mo:hover,.chakra .wef-1c7l3mo[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.chakra .wef-1c7l3mo:focus,.chakra .wef-1c7l3mo[data-focus]{box-shadow:0 0 0 3px rgba(168,203,251,0.5);} Sriram Gutta

Suchi kedia.

.chakra .wef-9dduvl{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-9dduvl{font-size:1.125rem;}} Explore and monitor how .chakra .wef-15eoq1r{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;color:#F7DB5E;}@media screen and (min-width:56.5rem){.chakra .wef-15eoq1r{font-size:1.125rem;}} India is affecting economies, industries and global issues

.chakra .wef-1nk5u5d{margin-top:16px;margin-bottom:16px;line-height:1.388;color:#2846F8;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-1nk5u5d{font-size:1.125rem;}} Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:.

- Amidst a challenging global scenario, India has emerged as a significant economic and geopolitical power.

- 2023 was a landmark year for India as it assumed the presidency of the G20, marked by some notable achievements.

- India is poised to play a defining role in shaping the future of the global economy in 2024 and beyond.

This article has been published in CNBC .

2024 begins at a critical and delicate juncture. While the global economy has managed to stave off recession, albeit narrowly, it has suffered significant volatility and unpredictability during the past year. Devastating conflicts have stoked geopolitical fractures, economic fragmentation and financial turbulence.

With new global challenges emerging, urgent progress is needed to address existing vulnerabilities, including fragile energy and food security, inclusive growth, and the intensifying climate emergency. Effective multilateral cooperation is key for the world to come to a common understanding to tackle these interlinked issues.

Have you read?

Davos 2024: who's coming and what to expect, how india’s climate leadership is building a better future for all, here are 4 ways ai is streamlining banking in india.

Amidst a challenging global scenario, India has emerged as a significant economic and geopolitical power. Its actions in the coming year could lay the groundwork for the country to become the world’s third largest economy in the next five years and a developed nation by 2047, setting an example on inclusive, sustainable economic growth, digital development and climate action.

A landmark year

2023 marked a landmark year for India as it assumed presidency of the world’s highest profile global economic assembly, the G20, and showcased its economic prowess and diplomatic finesse to the world.

India’s emphasis on a rule-based international order, advocacy for collaboration to solve common issues, and commitment to upholding democratic values positions makes it a stabilizing force in an increasingly complex global geopolitical landscape. Importantly, India also helped herald a new dawn of multilateralism where developing countries take their rightful place in shaping the global narrative by mainstreaming the Global South's concerns in international discourse.

The notable achievements during India’s tenure – the inclusion of the African Union into the G20; the launch of critical multistakeholder partnerships such as the Global Biofuel Alliance and the Global Initiative on Digital Health; the progress on United Nations Sustainable Development Goals (SDGs); the reform of multilateral development banks; and the scaling of digital public infrastructure – demonstrate its ability to build consensus to address global challenges collectively and effectively.

The World Economic Forum, through its centres and initiatives, actively supported India’s G20 agenda and contributed to key thematic areas including energy and health.

On the economic front, India has been a key growth engine for the world, contributing 16% to the global growth in 2023 . The country’s growth rate of 7.2% in fiscal 2022-2023 was the second-highest among the G20 countries and almost twice the average for emerging market economies that year.

India’s efforts to maintain stability and enact structural reforms have contributed to its economic resilience in the face of global challenges. Investments in upgrading infrastructure and connectivity, including projects like the Bharatmala highway programme, the Sagarmala project for port-led development and the Smart Cities Mission, are transforming the country's landscape and playing a pivotal role in the country’s economic advancement.

India began laying a solid foundation for a more digital economy over a decade ago with the launch of its national identification programme, Aadhaar, which uses biometric IDs to establish proof of residence. Today, with a burgeoning tech industry, the country has become a key centre for innovation and technology services, not only boosting economic growth but also positioning India as a key player in shaping the future of the digital economy.

In the face of escalating climate-related concerns, India also plays a key leadership role in the global fight against climate change. Through the launch of the Mission LiFE of Lifestyle for Environment, coupled with a concerted push for Green Hydrogen, India has demonstrated a firm commitment to a growth trajectory that balances economic advancement with ecological responsibility.

India has also launched the International Solar Alliance and the Coalition for Disaster Resilient Infrastructure, and proposed a global grid for renewables. A major announcement made by Prime Minister Modi at COP28 in Dubai was the introduction of the Green Credit Initiative as a substitute for carbon credits.

According to our Future of Jobs 2018 report, more than one-half of India’s workforce will need to be re-skilled by 2022 to meet the demands of the Fourth Industrial Revolution.

With the world’s largest youth population and more than half of the population of working age, skills development is critical for India to sustain inclusive growth and development.

In late 2018, the World Economic Forum, in collaboration with India's oil and skills development minister as well as the head of business consulting company Infosys, launched a Task Force for Closing the Skills Gap in India .

The task force brings together leaders from business, government, civil society and the education and training sectors to help future-proof India’s education and training systems. Find out more about our Closing the Skills Gap 2020 initiative.

A focus on inclusive growth

Moving forward, fulfilling India’s national and global ambitions will require strategic policymaking to tread the delicate balance between economic growth, social development and environmental sustainability. India’s demographics will be advantageous to its growth story only if coupled with broad labour market reforms and human development measures to skill one of the world’s largest workforces and address youth unemployment.

Continued broad-based policy initiatives and structural changes focused on inclusive growth, sustained revival in domestic consumption demand, and rapid adoption of new and emerging technologies to enhance the productivity will be critical. Additionally, India must continue to engage in multilateral forums to address global issues such as health crises, economic disparities and geopolitical tensions.

The world is now witnessing a nation on the rise, with a booming economy, and a commitment to inclusivity, sustainability, and international collaboration. India is poised to play defining role in shaping the future of the global economy in 2024 and beyond.

This article was published as part of the World Economic Forum Annual Meeting 2024 discussions.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing