🇺🇦 make metadata, not war

CEO International Assignment Experience and Corporate Social Performance

- Daniel Slater

- Heather Dixon-Fowler

Similar works

Research Papers in Economics

This paper was published in Research Papers in Economics .

Having an issue?

Is data on this page outdated, violates copyrights or anything else? Report the problem now and we will take corresponding actions after reviewing your request.

Index Theologicus

Ceo international assignment experience and corporate social performance.

Research suggests that international assignment experience enhances awareness of societal stakeholders, influences personal values, and provides rare and valuable resources. Based on these arguments, we hypothesize that CEO international assignment experience will lead to increased corporate social...

Full description

- Description

- Search Full Text

Similar Items

- The Impact of CEO Characteristics on Corporate Social Performance by: Manner, Mikko H. Published: (2010)

- CEOs' poverty experience and corporate social responsibility: are CEOs who have experienced poverty more generous? by: Xu, Shan, et al. Published: (2022)

- Trends in the dynamic evolution of corporate social responsibility and leadership: a literature review and bibliometric analysis by: Zhao, Liming, et al. Published: (2023)

- Unpacking Functional Experience Complementarities in Senior Leaders’ Influences on CSR Strategy: A CEO–Top Management Team Approach by: Reimer, Marko, et al. Published: (2018)

- Boardroom Diversity and its Effect on Social Performance: Conceptualization and Empirical Evidence by: Hafsi, Taïeb, et al. Published: (2013)

- Driven to Be Good: A Stakeholder Theory Perspective on the Drivers of Corporate Social Performance by: Brower, Jacob, et al. Published: (2013)

- CEO Incentives and Corporate Social Performance by: McGuire, Jean, et al. Published: (2003)

- Do returnee executives value corporate philanthropy?: evidence from China by: Zhang, Lin, et al. Published: (2022)

- Managerial Efficiency, Corporate Social Performance, and Corporate Financial Performance by: Cho, Seong Y., et al. Published: (2019)

- The Relationship Between Corporate Social Responsibility and Earnings Management: An Exploratory Study by: Hong, Yongtao, et al. Published: (2011)

- The Relationship Between Corporate Social Performance and Corporate Financial Performance in the Banking Sector by: Soana, Maria-Gaia Published: (2011)

- The effects of top management team national diversity and institutional uncertainty on subsidiary CSR focus by: Dahms, Sven, et al. Published: (2022)

- Corporate Social Performance and Economic Cycles by: Harrison, Jeffrey S., et al. Published: (2016)

- Opening the Black Box of CSR Decision Making: A Policy-Capturing Study of Charitable Donation Decisions in China by: Wang, Shuo, et al. Published: (2015)

- Do Chief Sustainability Officers Make Companies Greener? The Moderating Role of Regulatory Pressures by: Kanashiro, Patricia, et al. Published: (2019)

- Corporate Social Performance and Attractiveness as an Employer to Different Job Seeking Populations by: Albinger, Heather Schmidt, et al. Published: (2000)

- Changes in corporate social responsibility and stock performance by: Tsai, Hui-Ju, et al. Published: (2022)

- Do Suppliers Applaud Corporate Social Performance? by: Zhang, Min, et al. Published: (2014)

- The Worth of Values – A Literature Review on the Relation Between Corporate Social and Financial Performance by: van Beurden, Pieter, et al. Published: (2008)

- Corporate Social and Financial Performance: An Investigation in the U.K. Supermarket Industry by: Moore, Geoff Published: (2001)

- Author By Last Name

- Departments

Theses & Dissertations

- Advisor By Last Name

- Degrees By Discipline

- Degrees By Level

- Degrees By Type

Submissions

- Articles, Chapters, & other finished products

CEO International Assignment Experience and Corporate Social Performance

Abstract: Research suggests that international assignment experience enhances awareness ofsocietal stakeholders, influences personal values, and provides rare and valuableresources. Based on these arguments, we hypothesize that CEO international assignmentexperience will lead to increased corporate social performance (CSP) and will bemoderated by the CEO's functional background. Using a sample of 393 CEOs of S&P 500companies and three independent data sources, we find that CEO internationalassignment experience is positively related to CSP and is significantly moderated by theCEO's functional background. Specifically, CEOs with international assignmentexperience and an output functional background (e.g., marketing and sales) arepositively associated with greater CSP.

CEO International Assignment Experience and Corporate Social Performance PDF (Portable Document Format) 507 KB Created on 6/27/2016 Views: 3757

Additional Information

Email this document to

Maintained by ERIT , University Libraries , UNCG

Marketing experience of CEOs and corporate social performance

- Original Empirical Research

- Published: 05 January 2022

- Volume 50 , pages 460–481, ( 2022 )

Cite this article

- Saeed Janani 1 ,

- Ranjit M. Christopher 2 ,

- Atanas Nik Nikolov 3 &

- Michael A. Wiles ORCID: orcid.org/0000-0003-3680-9912 4

3929 Accesses

19 Citations

4 Altmetric

Explore all metrics

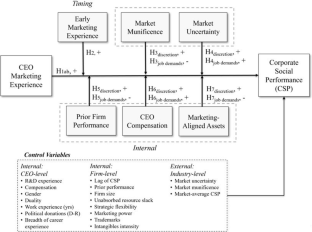

Corporate social performance (CSP) is increasingly becoming an important firm performance dimension in its own right. Since the CEO plays a pivotal role in setting the firm’s strategic actions, the examination of CSP’s antecedents has often focused on how CEO characteristics may impact CSP. According to upper echelons theory, one such key characteristic is the CEO’s functional background. As CEO experience in marketing may instill a CSP-supportive mindset in line with stakeholder theory, we examine how such CEO marketing experience may promote CSP and how situational factors may moderate this. Analyses of 3,569 CEOs from 1,999 firms from 2001 to 2016 reveal that CEO prior experience in marketing positively relates to CSP. This finding is robust to multiple analytical methods and endogeneity checks. Further, marketing experience’s effect is stronger than that of other functional experiences. Moderation results indicate this effect is associated more with executive discretion than job demands.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

Corporate social responsibility and firm performance: the mediating role of marketing competence and the moderating role of market environment, reexamining corporate social responsibility and shareholder value: the inverted-u-shaped relationship and the moderation of marketing capability.

Corporate Social Responsibility (CSR) and Marketing Performance: Role of Commitment to the Customer Relationship (An Extended Abstract)

The term CSR is often used to describe the conceptual social responsibilities of companies, the programs and initiatives the firm engages in, and the measurement or assessment of the organization’s visible performance related to CSR (Manner, 2010 ). Similar to others, we refer to this latter aspect as corporate social performance (CSP) (Brower & Mahajan, 2013 ; Luo & Bhattacharya, 2009 ; Manner, 2010 ; Wood, 1991 ). As we are interested in explaining the variations in socially responsible behaviors across firms, we utilize CSP to refer to such behavior (e.g., Brower & Mahajan, 2013 ; Manner, 2010 ; Waddock & Graves, 1997 ).

This is due to the hierarchical governance mechanisms in existence which place CEOs on top of the corporate structure (e.g., Kashmiri et al., 2017 ) and because CEOs influence what information others in the firm attend and respond to (Yadav et al., 2007 ).

For readability, we use the term ‘CEO marketing experience’ interchangeably with CEO prior functional experience in marketing (i.e., gained in a marketing position, degree, or role before assuming the CEO role).

Managerial discretion, as used in the strategic management literature, refers to latitude of action, and we follow this conceptualization. In economics, managerial discretion describes the extent to which managers are free to pursue their own interests over shareholders (i.e., latitude of objectives).

Thus, for market munificence (H3), prior performance (H5), and marketing-aligned assets (H7), a positive moderating effect indicates support for the discretion pathway, while a negative moderating effect indicates support for the job demands pathway (see also Fig. 1 ). For market uncertainty (H4) and CEO compensation (H6), the job demands and discretion perspectives do not offer competing predictions.

This database has been widely used in the marketing and management literature (e.g., Chin et al., 2013 ; Mishra & Modi, 2016 ). There are several advantages to using KLD scores over other rank order ratings like Fortune 1,000 or primary survey-based ratings to assess firm CSP. First, the ratings align well with the theoretical stakeholder perspective of CSP considered in this paper. Second, the ratings are widely used by both the investor community and academic researchers. Third, despite a few weaknesses owing to the inherent subjectivity of raters and the masking of industry effects, KLD’s advantages over other available metrics are well-documented (Harrison & Freeman, 1999 ).

We also use these keywords to identify the percentage of board members with finance and operations experience.

Further, we use short-term and long-term compensation (Manner, 2010 ) but did not find any difference in results. We also use the relative total compensation to the average compensation of the board as well as to the compensation of the CFO, and we find consistent interaction results. However, due to significant number of missing values, we do not use those in our main analysis.

Similar to marketing power, we calculate finance and operations power as the percentage of board members with finance and operations experience, excluding the CEO, as this captures their influence at the strategic levels of the firm (McNulty & Pettigrew, 1999 ; Whitler et al., 2018 ).

The lag of the dependent variable is not included in the first three models because it is correlated with the error term and thereby leads to inconsistent results.

By excluding general management CEOs who also have marketing experience from the DID analysis, the effect for general management is smaller (treatment effect = .104; p < .001).

We also considered the possibility of lagged effects. Looking at the effect of marketing CEO appointments within the three years after the appointment, we find similar results (treatment effect = .109; p = .000). Further, as we expand (limit) our analysis to more (fewer) number of years after CEO appointment, we notice that the effect strengthens (weakens). This finding suggests that CEOs with marketing experience become increasingly more effective in enhancing CSP as time goes by. When we look at the effect of CEO appointments with general management and legal experience within the three years after the appointment, we also find a similar pattern of results as what we observe for marketing CEOs (general management treatment effect = .030; p = .034; legal experience treatment effect = -.159; p = .027). We thank a reviewer for this insightful suggestion.

Alternate specifications of the first-stage model with different controls provide similar results.

The effect size is calculated as the coefficient of marketing experience intensity times its standard deviation, divided by the mean of CSP.

Abadie, A., & Imbens, G. W. (2006). Large sample properties of matching estimators for average treatment effects. Econometrica, 74 , 235–267.

Article Google Scholar

Agle, B. R., Mitchell, R. K., & Sonnenfeld, J. A. (1999). Who matters to CEOs? An investigation of stakeholder attributes and salience, corporate performance and CEO values. Academy of Management Journal, 42 , 507–525.

Aiken, L. S., West, S. G., & Reno, R. R. (1991). Multiple Regression: Testing and Interpreting Interactions . Sage Publications Inc.

Google Scholar

Alba, J. W., & Hasher, L. (1983). Is memory schematic? Psychological Bulletin, 93 , 203–231.

Angrist, J. (2014). The perils of peer effects. Labor Economics, 30 , 98–108.

Basu, K., & Palazzo, G. (2008). Corporate social responsibility: A process model of sense making. Academy of Management Review, 33 , 122–136.

Baum, C. F., Schaffer, M. E., & Stillman, S. (2003). Instrumental variables and GMM: Estimation and testing. The Stata Journal, 3 (1), 1–31.

Black, J. S., & Gregersen, H. (2002). Leading Strategic Change: Breaking through the Brain Barrier . FT Press.

Brickson, S. L. (2007). Organizational identity orientation: The genesis of the role of the firm and distinct forms of social value. Academy of Management Review, 32 , 864–888.

Brower, J., & Dacin, P. A. (2020). An institutional theory approach to the evolution of the corporate social performance-corporate financial performance relationship. Journal of Management Studies, 57 , 805–836.

Brower, J., & Mahajan, V. (2013). Driven to be good: A stakeholder theory perspective on the drivers of corporate social performance. Journal of Business Ethics, 117 , 313–331.

Business Roundtable. (2019). Business roundtable redefines the purpose of a corporation to promote ‘An economy that serves all Americans’ . Retrieved May 19, 2020 from https://www.businessroundtable.org/business-roundtable-redefines-the-purpose-of-a-corporation-to-promote-an-economy-that-serves-all-americans .

Cha, W., Abede, M., & Dadanlar, H. (2019). The effect of CEO civic engagement on corporate social and environmental performance. Social Responsibility Journal, 15 , 1054–1107.

Chabowski, B. R., Mena, J. A., & Gonzalez-Padron, T. L. (2011). The structure of sustainability research in marketing, 1958–2008: A basis for future research opportunities. Journal of the Academy of Marketing Science, 39 , 55–57.

Chernev, A., & Blair, S. (2015). Doing well by doing good: The benevolent halo of corporate social responsibility. Journal of Consumer Research, 41 , 1412–1425.

Chin, M. K., Hambrick, D. C., & Treviño, L. K. (2013). Political ideologies of CEOs: The influence of executives’ values on corporate social responsibility. Administrative Science Quarterly, 58 , 197–232.

Clarkson, M. E. (1995). A stakeholder framework for analyzing and evaluating corporate social performance. Academy of Management Review, 20 , 92–117.

Cohn, M. (2020). Big four firms release ESG reporting metrics with World Economic Forum. Accounting Today (Sepember 23, accessed at https://www.accountingtoday.com/news/big-four-firms-release-esg-reporting-metrics-with-world-economic-forum .

Connelly, B. L., Ketchen, D. L., Jr., & Slater, S. F. (2011). Toward a “theoretical toolbox” for sustainability research in marketing. Journal of the Academy of Marketing Science, 39 , 86–10.

Crittenden, V. L., Crittenden, W. F., Ferrell, L. K., Ferrell, O. C., & Pinney, C. C. (2011). Market-oriented sustainability: A conceptual framework and propositions. Journal of the Academy of Marketing Science, 39 , 71–85.

Cron, W. L. (1984). Industrial salesperson development: A career stages perspective. Journal of Marketing, 48 , 41–52.

Cyert, R. M., & March, J. G. (1963). A Behavioral Theory of the Firm . Prentice Hall.

David, P., Bloom, M., & Hillman, A. J. (2007). Investor activism, managerial responsiveness, and corporate social performance. Strategic Management Journal, 28, 91–100.

Day, G. S., & Nedungadi, P. (1994). Managerial representations of competitive advantage. Journal of Marketing, 58 , 31–44.

Dearborn, D. C., & Simon, H. A. (1958). Selective perception: A note on the departmental identifications of executives. Sociometry, 21 , 140–144.

Deckop, J. R., Merriman, K. K., & Gupta, S. (2006). The effects of CEO pay structure on corporate social performance. Journal of Management, 32 , 329–342.

Dess, G. G., & Beard, D. W. (1984). Dimensions of organizational task environments. Administrative Science Quarterly, 29 , 52–73.

Dunham, L., Freeman, R. E., & Liedtka, J. (2006). Enhancing stakeholder practice: A particularized exploration of community. Business Ethics Quarterly, 16 , 23–42.

Feng, H., Morgan, N. A., & Rego, L. L. (2015). Marketing department power and firm performance. Journal of Marketing, 79 , 1–20.

Feng, H., Morgan, N. A., & Rego, L. L. (2017). Firm capabilities and growth: The moderating role of market conditions. Journal of the Academy of Marketing Science, 45 , 76–92.

Finkelstein, S., & Hambrick, D. C. (1990). Top management team tenure and organizational outcomes: The moderating role of managerial discretion. Administrative Science Quarterly, 35 , 484–503.

Finkelstein, S., Hambrick, D. C., & Cannella, A. A., Jr. (2009). Strategic Leadership: Theory and Research on Executives, Top Management Teams, and Boards . Oxford University Press.

Fombrun, C. J., Van Riel, C. B., & Van Riel, C. (2004). Fame & fortune: How successful companies build winning reputations . FT press.

Freeman, R. E. (1984). Strategic Management: A Stakeholder Approach . Pitman.

Germann, F., Ebbes, P., & Grewal, R. (2015). The chief marketing officer matters! Journal of Marketing, 79 , 1–22.

Graham, J. R., Harvey, C. R., & Puri, M. (2013). Managerial attitudes and corporate actions. Journal of Financial Economics, 109 , 103–121.

Greve, H. R. (2003). A behavioral theory of R&D expenditures and innovations: Evidence from shipbuilding. Academy of Management Journal, 46 , 685–702.

Grayson, K., Johnson, D., & Chen, D.-F.R. (2008). Is firm trust essential in a trusted environment? How trust in the business context influences customers. Journal of Marketing Research, 45 , 241–256.

Groening, C., & Kanuri, V. K. (2018). Investor reactions to concurrent positive and negative stakeholder news. Journal of Business Ethics, 149 , 833–856.

Guadalupe, M., Li, H., & Wulf, J. (2014). Who lives in the C-Suite? Organizational structure and the division of labor in top management. Management Science, 60 , 824–844.

Hambrick, D. C. (1982). Environmental scanning and organizational strategy. Strategic Management Journal, 3 , 159–174.

Hambrick, D. C. (2007). Upper echelons theory: An update. Academy of Management Review, 32 , 334–343.

Hambrick, D. C., & Finkelstein, S. (1987). Managerial discretion: A bridge between polar views of organizational outcomes. Research in Organizational Behavior, 9 , 369–406.

Hambrick, D. C., Finkelstein, S., & Mooney, A. C. (2005). Executive job demands: New insights for explaining strategic decisions and leader behaviors. Academy of Management Review, 30 , 472–491.

Hambrick, D. C., Geletkanycz, M. A., & Fredrickson, J. W. (1993). Top executive commitment to the status quo: Some tests of its determinants. Strategic Management Journal, 14 , 401–418.

Hambrick, D. C., & Mason, P. A. (1984). Upper echelons: The organization as a reflection of its top managers. Academy of Management Review, 9 , 193–206.

Harrison, J. S., & Freeman, R. E. (1999). Stakeholders, social responsibility, and performance: Empirical evidence and theoretical perspectives. Academy of Management Journal, 42 , 479–485.

Hillebrand, B., Driessen, P. H., & Koll, O. (2015). Stakeholder marketing: Theoretical foundations and required capabilities. Journal of the Academy of Marketing Science, 43 , 411–428.

Hitt, M. A., & Tyler, B. B. (1991). Strategic decision models: Integrating different perspectives. Strategic Management Journal, 12 , 327–351.

Hoeffler, S., Bloom, P. N., & Keller, K. L. (2010). Understanding stakeholder response to corporate citizenship initiatives: Managerial guidelines and research directions. Journal of Public Policy and Marketing, 29 , 78–88.

Hult, G. T. M., Mena, J. A., Ferrell, O. C., & Ferrell, L. (2011). Stakeholder marketing: A definition and conceptual framework. AMS Review, 1 , 44–65.

Ikram, A., Li, Z. F., & Minor, D. (2019). CSR-contingent executive compensation contracts. Journal of Banking & Finance, 105655.

Ioannou, I., & Serafeim, G. (2015). The impact of corporate social responsibility on investment recommendations: Analysts’ perceptions and shifting institutional logics. Strategic Management Journal, 36 , 1053–1081.

Kang, C., Germann, F., & Grewal, R. (2016). Washing away your sins? Corporate social responsibility, corporate social irresponsibility, and firm performance. Journal of Marketing, 80 , 59–79.

Kahneman, D., Fredrickson, B. L., Schreiber, C. A., & Redelmeier, D. A. (1993). When more pain is preferred to less: Adding a better end. Psychological Science, 4 , 401–405.

Kashmiri, S., Nicol, C. D., & Arora, S. (2017). Me, myself, and I: Influence of CEO narcissism on firms’ innovation strategy and the likelihood of product-harm crises. Journal of the Academy of Marketing Science, 45 , 633–656.

Keats, B. W., & Hitt, M. A. (1988). A causal model of linkages among environmental dimensions, macro organizational characteristics, and performance. Academy of Management Journal, 31 , 570–598.

Kim, M., Boyd, D. E., Kim, N., & Yi, C. H. (2016). CMO equity incentive and shareholder value: Moderating role of CMO managerial discretion. International Journal of Research in Marketing, 33 , 725–738.

Kotchen, M., & Moon, J. J. (2012). Corporate social responsibility for irresponsibility. The BE Journal of Economic Analysis & Policy, 12 , 1–21.

Krasnikov, A., Mishra, S., & Orozco, D. (2009). Evaluating the financial impact of branding using trademarks: A framework and empirical evidence. Journal of Marketing, 73 , 154–166.

Kurt, D., & Hulland, J. (2013). Aggressive marketing strategy following equity offerings and firm value: The role of relative strategic flexibility. Journal of Marketing, 77 , 57–74.

Lacey, R., Kennett-Hensel, P. A., & Manolis, C. (2015). Is corporate social responsibility a motivator or a hygiene factor? Insights into its bivalent nature. Journal of the Academy of Marketing Science, 43 , 315–332.

Lenz, I., Wetzel, H. A., & Hammerschmidt, M. (2017). Can doing good lead to doing poorly? Firm value implications of CSR in the face of CSI. Journal of the Academy of Marketing Science, 45 , 677–697.

Lim, L. G., Tuli, K. R., & Grewal, R. (2020). Customer satisfaction and its impact on the future costs of selling. Journal of Marketing, 84 , 23–44.

Luo, X., & Bhattacharya, C. B. (2009). The debate over doing good: Corporate social performance, Strategic marketing levers, and firm-idiosyncratic risk. Journal of Marketing, 73 , 198–213.

Luo, X., Wieseke, J., & Homburg, C. (2012). Incentivizing CEOs to build customer- and employee-firm relations for higher customer satisfaction and firm value. Journal of the Academy of Marketing Science, 40 , 745–758.

Maignan, I., & Ferrell, O. C. (2004). Corporate social responsibility and marketing: An integrative framework. Journal of the Academy of Marketing Science, 32 , 3–19.

Mallin, C., Michelon, G., & Raggi, D. (2013). Monitoring intensity and stakeholders’ orientation: How does governance affect social and environmental disclosure. Journal of Business Ethics, 114 , 29–43.

Maltz, E., & Kohli, A. (2000). Reducing marketing’s conflict with other functions: The differential effects of integrating mechanisms. Journal of the Academy of Marketing Science, 28 , 479–492.

Manner, M. H. (2010). The impact of CEO characteristics on corporate social performance. Journal of Business Ethics, 93 , 53–72.

McGuire, J. B., Oehmichen, J., Wolff, M., & Hilgers, R. (2019). Do contracts make them care? The impact of CEO compensation design on corporate social performance. Journal of Business Ethics, 157 , 375–439.

McLymont, R. (2018). CSR reporting: The expanding field of corporate citizenship. https://tnj.com/csr-reporting-the-expanding-field-of-corporate-citizenship/ , accessed March 25, 2021.

McNulty, T., & Pettigrew, A. (1999). Strategists on the board. Organization Studies, 20 (1), 47–74.

McWilliams, A., & Siegel, D. (2001). Corporate social responsibility: A theory of the firm perspective. Academy of Management Review, 26 , 117–127.

Mena, J. A., & Chabowski, B. R. (2015). The role of organizational learning in stakeholder marketing. Journal of the Academy of Marketing Science, 43 , 429–452.

Minsky, M. A. (1975). A framework for representing knowledge. In P. H. Winston (Ed.), The Psychology of Computer Vision (pp. 211–267). McGraw-Hill.

Mitchell, R. K., Agle, B. R., & Wood, D. J. (1997). Toward a theory of stakeholder identification and salience: Defining the principle of who and what really counts. Academy of Management Review, 22 , 853–886.

Mishra, S., & Modi, S. B. (2016). Corporate social responsibility and shareholder wealth: The role of marketing capability. Journal of Marketing, 80 , 26–46.

Morgan, N. A. (2012). Marketing and business performance. Journal of the Academy of Marketing Science, 40 , 102–119.

Muller, A., & Kolk, A. (2010). Extrinsic and intrinsic drivers of corporate social performance: Evidence from foreign and domestic firms in Mexico. Journal of Management Studies, 47 , 1–26.

Narver, J. C., & Slater, S. F. (1990). The effect of a market orientation on business profitability. Journal of Marketing, 54 , 20–35.

Nath, P., & Bharadwaj, N. (2020). Chief marketing officer presence and firm performance: Assessing conditions under which the presence of other C-level functional executives matters. Journal of the Academy of Marketing Science, 48 , 670–694.

Nath, P., & Mahajan, V. (2008). Chief Marketing Officers: A study of their presence in firms’ top management teams. Journal of Marketing, 72 , 65–81.

Neubaum, D. O., & Zahra, S. A. (2006). Institutional ownership and corporate social performance: The moderating effects of investment horizon, activism, and coordination. Journal of Management, 32 , 108–131.

Nikolaeva, R., & Bicho, M. (2011). The role of institutional and reputational factors in the voluntary adoption of corporate social responsibility reporting standards. Journal of the Academy of Marketing Science, 39 , 136–157.

Padgett, R. C., & Galan, J. I. (2010). The effect of R&D intensity on corporate social responsibility. Journal of Business Ethics, 93 , 407–418.

Park, S., & Gupta, S. (2012). Handling endogenous regressors by joint estimation using copulas. Marketing Science, 31 , 567–586.

Palmatier, R. W., Dant, R. P., Grewal, D., & Evans, K. R. (2006). Factors influencing the effectiveness of relationship marketing: A meta-analysis. Journal of Marketing, 70 , 136–153.

Petrin, A., & Train, K. (2010). A control function approach to endogeneity in consumer choice models. Journal of Marketing Research, 47 , 3–13.

Pfeffer, J., & Salancik, G. (1978). The External Control of Organizations: A Resource Dependence Perspective . Harper & Row.

Rajagopalan, N., & Finkelstein, S. (1992). Effects of strategic orientation and environmental change on senior management reward systems. Strategic Management Journal, 13 , 127–141.

Roodman, D. (2009). How to do xtabond2: An introduction to difference and system GMM in Stata. The Stata Journal, 9 , 86–136.

Sen, S., Bhattacharya, C. B., & Korschun, D. (2006). The role of corporate social responsibility in strengthening multiple stakeholder relationships: A field experiment. Journal of the Academy of Marketing Science, 34 , 158–166.

Slater, D. J., & Dixon-Fowler, H. R. (2009). CEO international assignment experience and corporate social performance. Journal of Business Ethics, 89 , 473–489.

Smith, N. C. (2009). Bounded goodness: Marketing implications of Drucker on corporate responsibility. Journal of the Academy of Marketing Science, 37 , 73–84.

Smith, N. C., Drumwright, M. E., & Gentile, M. C. (2010). The new marketing myopia. Journal of Public Policy & Marketing, 29 , 4–11.

Spencer, S. J., Zanna, M. P., & Fong, G. T. (2005). Establishing a causal chain: Why experiments are often more effective than mediational analyses in examining psychological processes. Journal of Personality and Social Psychology, 89 , 845–851.

Spender, J. C. (1989). Industry Recipes: An Enquiry into the Nature and Sources of Managerial Budget . Blackwell.

Srinivasan, R., & Ramani, N. (2019). With power comes responsibility: How powerful marketing departments can help prevent myopic management. Journal of Marketing, 83 , 108–125.

Tang, Y., Qian, C., Chen, G., & Shen, R. (2015). How CEO hubris affects corporate social (ir) responsibility. Strategic Management Journal, 36 , 1338–1357.

Thomas, A. S., & Simerly, R. L. (1994). The chief executive officer and corporate social performance: An interdisciplinary examination. Journal of Business Ethics, 13 , 959–968.

Tuli, K. R., Bharadwaj, S. G., & Kohli, A. K. (2010). Ties that bind: The impact of multiple types of ties with a customer on sales growth and sales volatility. Journal of Marketing Research, 47 , 36–50.

Tushman, M. L., & Anderson, P. (1986). Technological discontinuities and organizational environments. Administrative Science Quarterly, 31 , 439–465.

Vakkayil, J. D. (2014). Contradictions and identity work: Insights from early-career experiences. Journal of Management Development, 33 , 906–918.

Verhoef, P. C., & Leeflang, P. S. H. (2009). Understanding the marketing’s department’s influence within the firm. Journal of Marketing, 73 , 14–37.

Waddock, S. A., & Graves, S. B. (1997). The corporate social performance. Strategic Management Journal, 8 , 303–319.

Wiles, M. A., Morgan, N. A., & Rego, L. L. (2012). The effect of brand acquisition and disposal on stock returns. Journal of Marketing, 76 , 38–58.

Whitler, K. A., Krause, R., & Lehmann, D. R. (2018). When and how board members with marketing experience facilitate firm growth. Journal of Marketing, 82 , 86–105.

Whitler, K. A., Lee, B., Krause, R., & Morgan, N. A. (2021). Upper echelons research in marketing. Journal of the Academy of Marketing Science, 49 , 198–219.

Wickert, C., Scherer, A. G., & Spence, L. J. (2016). Walking and talking corporate social responsibility: Implications of firm size and organizational cost. Journal of Management Studies, 53 , 1169–1196.

Wong, E. M., Ormiston, M., & Tetlock, P. E. (2011). The effects of top management team integrative complexity and decentralized decision making on corporate social performance. Academy of Management Journal, 54 , 1207–1228.

Wood, D. (1991). Corporate social performance revisited. Academy of Management Review, 16 , 691–718.

Wooldridge, J. M. (2015). Introductory Econometrics: A Modern Approach (6th ed.). Cengage.

Yadav, M. S., Prabhu, J. C., & Chandy, R. K. (2007). Managing the future: CEO attention and innovation outcomes. Journal of Marketing, 71 , 84–101.

Zuo, L., Fisher, G., & Yang, Z. (2019). Organizational learning and technological innovation: The distinct dimensions of novelty and meaningfulness that impact firm performance. Journal of the Academy of Marketing Science, 47 , 1166–1183.

Download references

Author information

Authors and affiliations.

University of Houston, Victoria, 3007 N. Ben Wilson St., Victoria, TX, 77901, USA

Saeed Janani

Henry W. Bloch School of Management, University of Missouri – Kansas City, 5110, Cherry St, Kansas City, MO, 64110, USA

Ranjit M. Christopher

Walker College of Business, Appalachian State University, 4111 Peacock Hall, Boone, NC, 28608, USA

Atanas Nik Nikolov

W. P. Carey School of Business, Arizona State University, Mail code 4106, Tempe, AZ, 85287-4106, USA

Michael A. Wiles

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Saeed Janani .

Ethics declarations

Conflict of interest.

The authors declare that they have no conflict of interest.

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Mark Houston served as Editor for this article.

Supplementary Information

Below is the link to the electronic supplementary material.

Supplementary file1 (DOCX 95 kb)

Rights and permissions.

Reprints and permissions

About this article

Janani, S., Christopher, R.M., Nikolov, A.N. et al. Marketing experience of CEOs and corporate social performance. J. of the Acad. Mark. Sci. 50 , 460–481 (2022). https://doi.org/10.1007/s11747-021-00824-9

Download citation

Received : 26 June 2020

Accepted : 01 November 2021

Published : 05 January 2022

Issue Date : May 2022

DOI : https://doi.org/10.1007/s11747-021-00824-9

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Corporate social responsibility

- Corporate social performance

- Upper echelons

- Functional background

- Stakeholder theory

- Job demands

- Find a journal

- Publish with us

- Track your research

Browse Econ Literature

- Working papers

- Software components

- Book chapters

- JEL classification

More features

- Subscribe to new research

RePEc Biblio

Author registration.

- Economics Virtual Seminar Calendar NEW!

CEOs’ International Work Experience and Compensation

- Author & abstract

- 122 References

- Most related

- Related works & more

Corrections

(ESCP Business School Berlin)

Suggested Citation

Download full text from publisher, references listed on ideas.

Follow serials, authors, keywords & more

Public profiles for Economics researchers

Various research rankings in Economics

RePEc Genealogy

Who was a student of whom, using RePEc

Curated articles & papers on economics topics

Upload your paper to be listed on RePEc and IDEAS

New papers by email

Subscribe to new additions to RePEc

EconAcademics

Blog aggregator for economics research

Cases of plagiarism in Economics

About RePEc

Initiative for open bibliographies in Economics

News about RePEc

Questions about IDEAS and RePEc

RePEc volunteers

Participating archives

Publishers indexing in RePEc

Privacy statement

Found an error or omission?

Opportunities to help RePEc

Get papers listed

Have your research listed on RePEc

Open a RePEc archive

Have your institution's/publisher's output listed on RePEc

Get RePEc data

Use data assembled by RePEc

Asking the better questions that unlock new answers to the working world's most complex issues.

Trending topics

AI insights

EY Center for Board Matters

EY podcasts

EY webcasts

Operations leaders

Technology leaders

EY helps clients create long-term value for all stakeholders. Enabled by data and technology, our services and solutions provide trust through assurance and help clients transform, grow and operate.

EY.ai - A unifying platform

Strategy, transaction and transformation consulting

Technology transformation

Tax function operations

Climate change and sustainability services

EY Ecosystems

EY Nexus: business transformation platform

Discover how EY insights and services are helping to reframe the future of your industry.

Case studies

How Mojo Fertility is helping more men conceive

26-Sep-2023 Lisa Lindström

Strategy and Transactions

How a cosmetics giant’s transformation strategy is unlocking value

13-Sep-2023 Nobuko Kobayashi

How a global biopharma became a leader in ethical AI

15-Aug-2023 Catriona Campbell

We bring together extraordinary people, like you, to build a better working world.

Experienced professionals

EY-Parthenon careers

Student and entry level programs

Talent community

At EY, our purpose is building a better working world. The insights and services we provide help to create long-term value for clients, people and society, and to build trust in the capital markets.

Press release

Extreme E and EY publish Season 3 report, recording 8.2% carbon footprint reduction as female-male performance gap continues to narrow

09-Apr-2024 Michael Curtis

EY announces acceleration of client AI Business Model adoption with NVIDIA AI

20-Mar-2024 Barbara Dimajo

EY announces launch of artificial intelligence platform EY.ai following US$1.4b investment

13-Sep-2023 Rachel Lloyd

No results have been found

Recent Searches

How do you steady the course of your IPO journey in a changing landscape?

EY Global IPO Trends Q1 2024 provides insights, facts and figures on the IPO market and implications for companies planning to go public. Learn more.

How can the moments that threaten your transformation define its success?

Leaders that put humans at the center to navigate turning points are 12 times more likely to significantly improve transformation performance. Learn More.

Artificial Intelligence

EY.ai - a unifying platform

Select your location

close expand_more

Three in four businesses failing to manage talent mobility effectively, as demand for international work experience soars

Press contact

EY Global Media Relations and Social Media Associate Director – Tax and Assurance

- Send e-mail to Emile Abu-Shakra

- Open LinkedIn profile of Emile Abu-Shakra

Related topics

- EY survey shows 75% of employers do not have fully developed mobility functions vital for meeting modern business and talent demands.

- Companies could be neglecting a crucial opportunity to retain key talent – 64% say international assignments would encourage them to consider staying in current job.

- 71% of firms say mobility risks and scope have increased over past two years, but many don’t have policies in place to manage them.

Companies around the world could be at risk of losing out in the race for talent and driving business resilience because they are failing to mobilize their workforce effectively and create opportunities for flexible work experiences, according to the EY 2024 Mobility Reimagined Survey .

The survey canvassed the views of 1,059 mobility professionals across 21 countries on the benefits and challenges organizations can face when developing and building mobility strategies and functions.

It found that only one in four employers surveyed (25%) have a fully developed mobility function, with three-quarters (75%) failing to take advantage of a truly mobile and agile workforce.

Mobility strategy now central to talent attraction and retention

This is despite the fact that almost two-thirds (64%) of employee respondents around the world say they’re more likely to stay with their current employer after a long-term cross-border assignment, while (92%) believe such experiences can be “life-changing” and 89% say international mobility is essential for business continuity and resilience, edging up from 74% last year.

Gerard Osei-Bonsu , EY Global People Advisory Services Tax Leader, says:

“From economic volatility and geopolitical crises to talent shortages and rapidly changing employee demands, companies are having to navigate an unprecedented number of complex challenges.

“If organizations want to survive and thrive in this new working environment, they need to attract and retain top talent. Having an effective international mobility function and program in place is critical to creating a dynamic and empowered workforce.”

Organizations ill-prepared to deal with cross-border risks

Despite the significant benefits that mobility programs bring to companies, many are facing a growing number of risks and challenges when establishing international mobility functions. Seven in ten respondents (71%) say cross-border mobility risks – including tax/regulatory and data privacy risks – have increased over the last two years, mostly due to the pandemic and ongoing geopolitical and economic challenges, which saw employees move around the world and work in separate jurisdictions, heightening corporate exposure to tax, regulatory issues and diverse employment laws.

Worryingly, many organizations are not fully prepared to manage all the risks they face. For example, while 84% of employer respondents recognize data privacy risks from hybrid mobility arrangements, just 55% have policies in place to mitigate them — a moderate improvement from last year’s 47%. Similarly, although 87% of employer respondents are aware of cybersecurity risks, just 46% have policies to address them – down from 51% last year.

In addition, 46% of companies responding use a centralized mobility operating model, which is often siloed from the rest of the business, creating a raft of communication, collaboration, and technology-related challenges.

Successful organizations accelerate mobility with five key drivers

Nevertheless, many companies are taking action where it is needed. More than eight in 10 employer respondents (82%) have developed a policy or approach for hybrid mobility, up from 76% in 2023.

There is also clear recognition that mobility is growing in importance. Eight in 10 employer respondents (80%) say they plan to increase investment in mobility technology over the next five years, up from 67% in 2023. Two-thirds (66%) of respondents believe the scope of the mobility function will grow over the next three years.

The survey identifies five key drivers that are crucial to the development of a successful mobility function:

- Strategic alignment: Organizations should align their mobility strategy to broader organizational strategy.

- Talent linkage: An organization’s mobility strategy should be used for talent acquisition and development.

- Digital focus: Organizations should have investment and maturity in the automation and digitization of mobility processes.

- Flexibility: Organizations should be embedding flexibility in the selection of program benefits.

- External expertise: Organizations should be co-sourcing or outsourcing selected mobility processes for greater efficiency.

Maureen Flood , EY Global Mobility Reimagined Leader, says:

“It’s clear that businesses do understand the value of international mobility, not least for the impact it can have on the workforce and wider business resilience. With robust polices in place to address risks, the right level of investment, and by ensuring that the function isn’t siloed, mobility can propel businesses forward and help them face the many challenges that the future surely holds. When organizations adopt an evolved mobility approach, they reap much greater rewards.”

EY exists to build a better working world, helping create long-term value for clients, people and society and build trust in the capital markets.

Enabled by data and technology, diverse EY teams in over 150 countries provide trust through assurance and help clients grow, transform and operate.

Working across assurance, consulting, law, strategy, tax and transactions, EY teams ask better questions to find new answers for the complex issues facing our world today.

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. Information about how EY collects and uses personal data and a description of the rights individuals have under data protection legislation are available via ey.com/privacy. EY member firms do not practice law where prohibited by local laws. For more information about our organization, please visit ey.com.

This news release has been issued by EYGM Limited, a member of the global EY organization that also does not provide any services to clients.

About the survey

The EY 2024 Mobility Reimagined Survey was conducted in January 2024 and received responses from 1,059 employees and employers from 21 countries.

To take a, CPE accredited, deeper dive into the survey results, please visit and register here: Welcome - EY 2024 Mobility Reimagined Conference (cvent.com)

Related news

EY launches OpsChain Contract Manager solution to support secure private business agreements on public Ethereum

LONDON, April 17, 2024 – The EY organization today announces the launch of EY OpsChain Contract Manager (OCM), a transformative blockchain-enabled solution for contract management. EY OCM helps enterprises to execute complex business agreements, supporting confidentiality, helping improve time efficiency, and achieving cost reduction, with automatic adherence to the agreed terms.

EY and Saïd Business School study reveals that leaders prioritizing a human-centered approach to transformation turning points are up to 12x more successful

LONDON,16 April 2024. The EY organization’s latest research with Saïd Business School, at the University of Oxford, reveals new insights into what happens when a transformation program’s leadership believes a transformation has or will go off-course and intervenes with the intent of improving its performance (turning points).

LONDON, 9 APRIL 2024. Extreme E has published its third Sustainability Report, compiled, and produced in collaboration with EY. Continuing to race the series’ ODYSSEY 21 off-road electric vehicles and leveraging solar and green hydrogen energy, the report reveals that the racing series maintained its carbon-neutral status and reduced its overall carbon footprint by 8.2%.

Major shift in global IPO market share from the past five years

London, 28 March 2024. The year kicked off on a cautiously optimistic note, marked by a selective thaw following a quieter period. The Americas and EMEIA IPO markets had a bright start in 2024, increasing global proceeds. However, the Asia-Pacific region started on a weak note, weighing down the overall global volume.

EY announces 18 women entrepreneurs selected for the EY Entrepreneurial Winning Women™ Asia-Pacific class of 2024

HONG KONG, 27 MARCH 2024 — The EY organization today announces the details of 18 female entrepreneurs selected for the EY Entrepreneurial Winning Women™ Asia-Pacific class of 2024 — a bespoke executive program that identifies and champions a select group of high-potential entrepreneurs who have built profitable companies and provides them with connections and resources needed to unlock their potential and sustainably scale their companies.

LONDON, 20 March 2024. The EY organization today announces Ernst & Young LLP (EY US) will help clients implement and accelerate their artificial intelligence (AI) journeys using NVIDIA’s industry-leading technology and solutions.

- Connect with us

- Our locations

- Legal and privacy

- Open Facebook profile

- Open X profile

- Open LinkedIn profile

- Open Youtube profile

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

IMAGES

VIDEO

COMMENTS

assignment experience enhances awareness of societal stakeholders, influences personal values, and provides rare and valuable resources. Based on these arguments, we hypothesize that CEO international assignment experi- ence will lead to increased corporate social performance. (CSP) and will be moderated by the CEO's functional background.

Research suggests that international assignment experience enhances awareness of societal stakeholders, influences personal values, and provides rare and valuable resources. Based on these arguments, we hypothesize that CEO international assignment experience will lead to increased corporate social performance (CSP) and will be moderated by the CEO's functional background. Using a sample of ...

Specifically, CEOs with international assignment experience and an output functional background (e.g., marketing and sales) are positively associated with greater CSP. KEY WORDS: corporate social performance, corporate social responsibility, international experience, upper echelons, KLD. Corporate social performance (CSP) represents a firm's ...

Slater and Dixon-Fowler (2009) found that CEO international assignment experience is a significant positive (job experience) predictor of corporate social performance. H5 was accepted as the study ...

Based on these arguments, we hypothesize that CEO international assignment experience will lead to increased corporate social performance (CSP) and will be moderated by the CEO's functional background. Using a sample of 393 CEOs of S&P 500 companies and three independent data sources, we find that CEO international assignment experience is ...

Daniel Slater & Heather Dixon-Fowler, 2009. "CEO International Assignment Experience and Corporate Social Performance," Journal of Business Ethics, Springer, vol. 89(3), ... Analyzing corporate financial performance for industrial corporate social performance leaders and laggards," Journal of Business Research, Elsevier, vol. 155(PB).

Samuel Adomako & Mai Dong Tran, 2022. "Local embeddedness, and corporate social performance: The mediating role of social innovation orientation," Corporate Social Responsibility and Environmental Management, John Wiley & Sons, vol. 29(2), pages 329-338, March. Lu, Yun & Ntim, Collins G. & Zhang, Qingjing & Li, Pingli, 2022.

CEO International Assignment Experience and Corporate Social Performance. Daniel Slater and Heather Dixon-Fowler () . Journal of Business Ethics, 2009, vol. 89, issue 3, 473-489 . Keywords: corporate social performance; corporate social responsibility; international experience; upper echelons; KLD (search for similar items in EconPapers) Date: 2009

"CEO International Assignment Experience and Corporate Social Performance," Journal of Business Ethics ... Michael Y., 2002. "An analysis of determinants of entry mode and its impact on performance," International Business Review, Elsevier, vol. 11(2 ... "Corporate Social Irresponsibility and Executive Succession: An Empirical Examination ...

CEO International Assignment Experience and Corporate Social Performance. Authors. Daniel Slater; Heather Dixon-Fowler; Publication date. Publisher. Doi. Cite. Abstract corporate social performance, corporate social responsibility, international experience, upper echelons, KLD, article; Similar works. Full text. Research Papers in Economics. Go ...

Research suggests that international assignment experience enhances awareness of societal stakeholders, influences personal values, and provides rare and valuable resources. Based on these arguments, we hypothesize that CEO international assignment experience will lead to increased corporate social performance (CSP) and will be moderated by the ...

Experience and Corporate Social Performance Daniel J. Slater Heather R. Dixon-Fowler ABSTRACT. Research suggests that international assignment experience enhances awareness of societal stakeholders, influences personal values, and provides rare and valuable resources. Based on these arguments, we hypothesize that CEO international assignment ...

CEO International Assignment Experience and Corporate Social Performance. Research suggests that international assignment experience enhances awareness of societal stakeholders, influences personal values, and provides rare and valuable resources.

Research suggests that international assignment experience enhances awareness of societal stakeholders, influences personal values, and provides rare and valuable resources. Based on these arguments, we hypothesize that CEO international assignment experience will lead to increased corporate social performance (CSP) and will be moderated by the CEO's functional background. Using a sample of ...

Using manually collected data of CEOs' foreign experience and corporate ESG data from the Bloomberg database for Chinese listed firms from 2011 to 2020, we observe that CEOs with foreign imprinting tend to improve their corporate ESG performance in China.

Research suggests that international assignment experience enhances awareness ofsocietal stakeholders, influences personal values, and provides rare and valuableresources. Based on these arguments, we hypothesize that CEO international assignmentexperience will lead to increased corporate social performance (CSP) and will bemoderated by the CEO's functional background.

Corporate social performance (CSP) is increasingly becoming an important firm performance dimension in its own right. Since the CEO plays a pivotal role in setting the firm's strategic actions, the examination of CSP's antecedents has often focused on how CEO characteristics may impact CSP. According to upper echelons theory, one such key characteristic is the CEO's functional background ...

CEO international assignment experience and corporate social performance. Journal of Business Ethics, 89(3): 473-489. Google Scholar; Turban D. , Greening D. 1996. Corporate social performance and organizational attractiveness to prospective employees. Academy of Management Journal, 40(3): 658-672. Google Scholar; Waddock S. A. , Graves S ...

The results further reveal that the effect of CEO social capital on stakeholder integration is moderated by CEO tenure, such that the relationship is more significant for long-tenured CEOs than short-tenured CEOs. These findings extend the social capital and corporate social responsibility research and practice.

The positive relationship between CEO foreign experience and green innovation (including green invention patents and green utility model patents) is more significant when the firm is state owned, when the firm has better corporate governance, and when the firm is subject to a better institutional environment.

This article reviews empirical research of corporate social performance (CSP) using Kinder, Lydenberg, Domini (KLD) social ratings data through 2011. ... Simerly R. L., Bass K. E. (1998). The impact of equity position on corporate social performance. International Journal of Management, 15(1), 130-135. Google Scholar. Slater D. J., Dixon-Fowler ...

Abstract. In this paper, we study the effect a CEO's international work experience has on his or her compensation. By combining human capital theory with a resource dependence and a resource-based perspective, we argue that international work experience translates into higher pay. We also suggest that international work experience comprises ...

CEO international assignment experience: Corporate social performance: Slater and Dixon-Fowler (2009) CEO experiencing depression: Corporate financing decisions ... The effects of corporate governance and institutional ownership types on corporate social performance. Academy of Management Journal, 42 (5) (1999), pp. 564-576. View in Scopus ...

LONDON, April 23, 2024 - Companies around the world could be at risk of losing out in the race for talent and driving business resilience because they are failing to mobilize their workforce effectively and create opportunities for flexible work experiences, according to the EY 2024 Mobility Reimagined Survey.

Join us at 6 PM (WAT) this Thursday May 9, 2024, as our distinguish guest will be discussing the topic: GEN-Z ACCOUNTANTS: Redefining Traditional...